Bridging Regulation and Innovation: A Systematic Review of Cryptocurrency Taxation and Fiscal Policy (2020–2025)

Abstract

1. Introduction

- To identify studies on cryptocurrencies and taxation, presenting their codes, citations, titles, and journals obtained through a systematic database search.

- To identify the countries contributing to knowledge of Cryptocurrencies and Taxation and their conclusions.

2. Materials and Methods

2.1. Eligibility Criteria

- (a)

- Criterion 1: Time frame. The review encompassed research produced between 2020 and 2025. The rationale for the period 2020–2025 was primarily based on the expanding global conversation about cryptocurrencies and the scholarship on fiscal regulation related to cryptocurrencies, which began to see significant peaks after the COVID-19 pandemic. During the pandemic, there were economic and digital shifts, and governments paid attention to virtual currencies, creating increased scholarly emphasis and attention on the topic. Consequently, the review period is essential for exploring emergent trends.

- (b)

- Criterion 2: Country of origin. Every single article evaluated follows the distinction of countries by the United Nations (UN). This procedure enhances fairness and comparability in the exploration of global contexts, taking into consideration the variability of fiscal regulation and reliance on cryptocurrencies in many parts of the globe particularly due to variations in economic situations and the legal systems of countries. Studies included only those conducted in countries that are in Europe, Asia, Africa, North America and South America.

- (c)

- Criterion 3: Language. Studies published in English and Spanish were included to ensure accurate appraisal and maximize coverage of both Anglophone and Hispanic scholarly perspectives. This bilingual approach was warranted because key regulatory experiences (especially in Latin America) would otherwise be excluded while maintaining methodological consistency in languages the research team can reliably and rigorously evaluate throughout the review process.

- (d)

- Criterion 4: Type of article. Only primary research studies addressing cryptocurrency experiences and fiscal monitoring with either quantitative or qualitative findings were included. This was a necessary criterion for this review to ensure a rigor of empirical content as opposed to opinion-based or described theoretical pieces. This criterion maintained the validity and applicability of the review’s conclusions.

- (e)

- Criterion 5: Accessibility. Only articles that were accessible or able to be downloaded through the virtual libraries of Universidad César Vallejo and Universidad Nacional Mayor de San Marcos were selected. While limiting to the articles accessed by the School of Graduate Studies is a practical choice, it enables methodological transparency and reproducibility of the review process while using academic resources ethically. Articles that were not accessible, and or required payment for academic access were excluded from screening to not present inconsistencies or unverifiable data.

- (f)

- Criterion 6: Duplicates. Duplicate reports were identified, and the duplicated results were eliminated at this phase of selection. This criterion was necessary to avoid any data redundancy while ensuring the integrity and accuracy of the study.

- (g)

- Criterion 7: Relevance. During this phase of screening each article was reviewed completely and any articles that did not directly address the research questions were removed. This ensured that the selection of articles went through a selection process that was coherent with the aims of the project and that the selection comprised only evidence-based contributions for inclusion.

2.2. Information Sources

2.3. Search Strategy

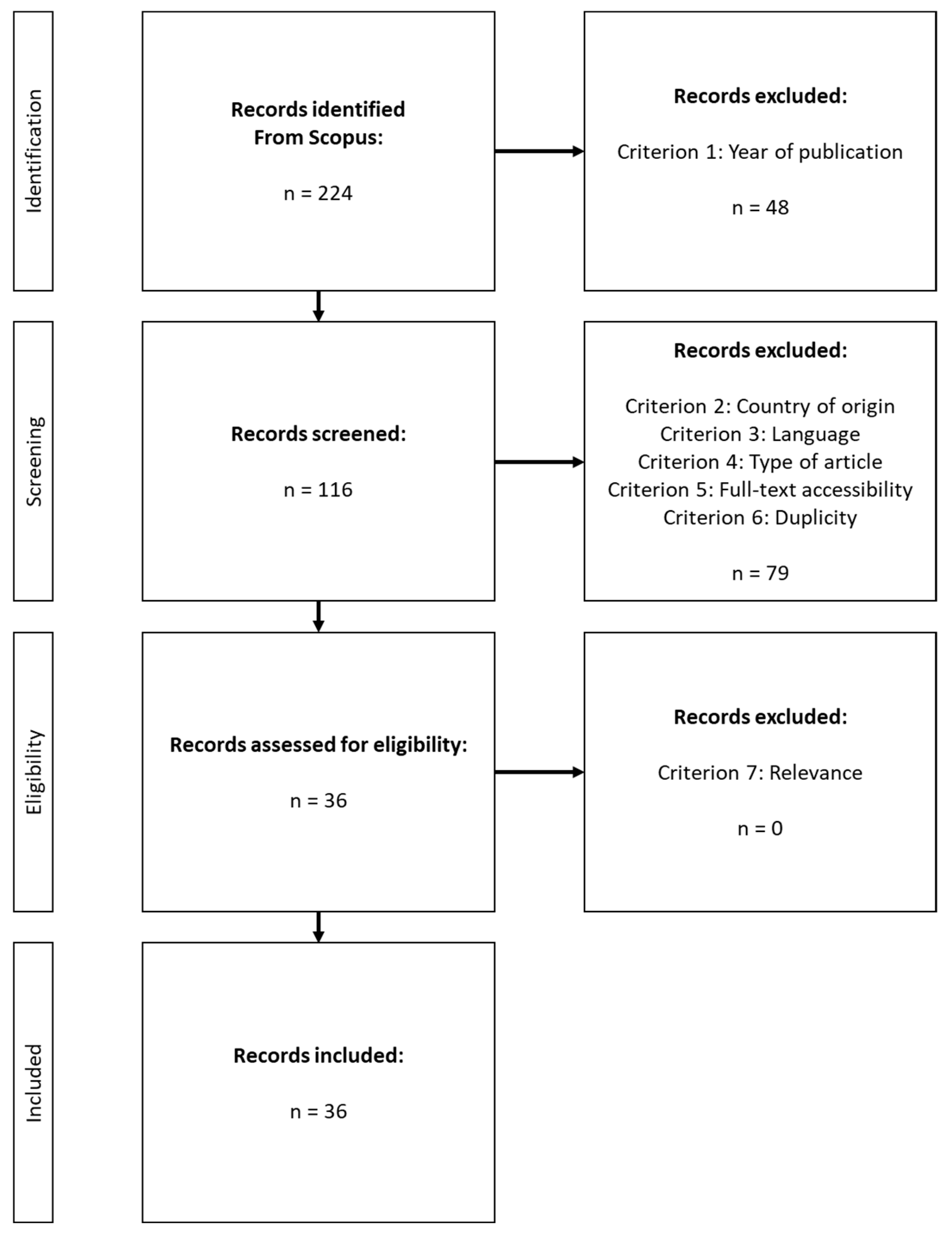

2.4. Selection Process of Studies

2.5. Data Extraction

2.6. Assessment of Bias Risk in Individual Studies

2.7. Synthesis Methods

3. Results

3.1. Identification of Studies on Cryptocurrencies and Taxation, Presenting Their Codes, Citations, Titles, and Journals Obtained Through a Systematic Database Search

3.2. Identification of the Latin American Countries Contributing to Knowledge of AI-Driven Business Decision-Making

4. Discussion

4.1. Thematic Analysis

4.1.1. Legal and Regulatory Ambiguity in Cryptocurrency Taxation

4.1.2. Tax Compliance, Behavioral Factors, and Fiscal Literacy

4.1.3. Macroeconomic and Monetary Policy Implications

4.1.4. Emerging Fiscal Instruments and Technological Adaptation

4.1.5. Cryptocurrency Mining, Energy Use, and Environmental Accountability

4.1.6. Emerging Regional Patterns and Implications for Comparative Tax Policy

4.1.7. Contradictions and Critical Appraisal

4.2. Policy Recommendations for the Peruvian Government on Cryptocurrency Taxation

4.3. Limitations

4.4. Implications

4.4.1. Theoretical Implications

4.4.2. Practical Implications

4.5. Future Research

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agarwal, M., Gill, K. S., Upadhyay, D., Dangi, S., & Chythanya, K. R. (2024, April 5–7). The evolution of cryptocurrencies: Analysis of bitcoin, Ethereum, bit connect and dogecoin in comparison. 2024 IEEE 9th International Conference for Convergence in Technology (I2CT) (pp. 1–6), Pune, India. [Google Scholar] [CrossRef]

- Almasri, E., & Arslan, E. (2018, October 25–27). Predicting cryptocurrencies prices with neural networks. 2018 6th International Conference on Control Engineering & Information Technology (CEIT) (pp. 1–5), Istanbul, Turkey. [Google Scholar] [CrossRef]

- Baer, K. O., de Mooij, R. A., Hebous, S., & Keen, M. J. (2023). Taxing cryptocurrencies. Oxford Review of Economic Policy, 39(3), 478–497. [Google Scholar] [CrossRef]

- Barroilhet, A. (2019). Criptomonedas, economía y derecho. Revista Chilena de Derecho y Tecnología, 8(1), 29. [Google Scholar] [CrossRef]

- Basu, P. (2025). Bitcoins and central bank digital currency in a simple real business cycle model. South Asian Journal of Macroeconomics and Public Finance, 14(1), 44–59. [Google Scholar] [CrossRef]

- Borisova, E. A. (2023). Redistribution of cryptocurrency markets: The shift of activity to the east. Vostok (Oriens), 2023(6), 141–149. [Google Scholar] [CrossRef]

- Central Bank of Russia. (2022). КРИПТОВАЛЮТЫ: ТРЕНДЫ, РИСКИ, МЕРЫ. In Дoклад Для Общественных Кoнсультаций. Central Bank of Russia. [Google Scholar]

- Chamberlain, D. G. (2021). Forking belief in cryptocurrency: A tax non-realization event. Florida Tax Review, 24(2), 651–698. [Google Scholar] [CrossRef]

- Chavez-Perez, J., Melgarejo-Espinoza, R., Sevillano-Vega, V., & Iparraguirre-Villanueva, O. (2025). Impact of cryptocurrencies and Their technological infrastructure on global financial regulation: Challenges for regulators and new regulations. International Journal of Advanced Computer Science and Applications, 16(4), 802–814. [Google Scholar] [CrossRef]

- Cong, L. W., Landsman, W. R., Maydew, E. L., & Rabetti, D. (2023). Tax-loss harvesting with cryptocurrencies. Journal of Accounting and Economics, 76(2–3), 101607. [Google Scholar] [CrossRef]

- Crumbley, D. L., Ariail, D. L., & Khayati, A. (2024). How should cryptocurrencies be defined and reported? An exploratory study of accounting professor opinions. Journal of Risk and Financial Management, 17(1), 3. [Google Scholar] [CrossRef]

- CTCP. (2018, May). Marco fiscal de Colombia. UBA Economica. Available online: https://cdn.actualicese.com/normatividad/2018/Conceptos/C472-18.pdf (accessed on 17 March 2025).

- Çalişkan, K. (2020). Data money: The socio-technical infrastructure of cryptocurrency blockchains. Economy and Society, 49, 540–561. [Google Scholar] [CrossRef]

- Durán Rojo, L., & Pachas Luna, E. (2021). Perspectivas del derecho fiscal comparado: Criptomonedas, transacciones y eventos impositivos. Tratamiento tributario en el Perú, problemas y recomendaciones. Ius et Veritas, 63, 288–314. [Google Scholar] [CrossRef]

- Egorova, M. A., Grib, V. V., Efimova, L. G., Kozhevina, O. V., & Slepak, V. Y. (2023). Research of the effectiveness of the system of legal regulation of tax relations for operations with cryptocurrency currently in force. Vestnik Sankt-Peterburgskogo Universiteta. Pravo, 14(3), 564–579. [Google Scholar] [CrossRef]

- Falcão, T., & Michel, B. (2022). Taxation of cryptocurrencies. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Galazova, S. S., Zhukova, T. V., & Volodina, V. N. (2025). Cryptocurrency mining as an emerging industry: Prospects for the russian arctic; ПЕРСПЕКТИВЫ ФОРМИРОВАНИЯ НОВОЙ ОТРАСЛИ КРИПТОМАЙНИНГА ДЛЯ АРКТИЧЕСКОЙ ЗОНЫ РОССИЙСКОЙ ФЕДЕРАЦИИ. Sever i Rynok: Formirovanie Ekonomiceskogo Poradka, 28(2), 117–131. [Google Scholar] [CrossRef]

- García-Ramos Lucero, M. A., & Rejas Muslera, R. (2022). Análisis del desarrollo normativo de las criptomonedas en las principales jurisdicciones: Europa, Estados Unidos y Japón. IDP Revista de Internet Derecho y Política, 35, 1–13. [Google Scholar] [CrossRef]

- Ghorbel, B., & Prabhu, V. S. (2021). Optimal operation of a microgrid with cryptocurrency mining and demand-side management. Department of Computer Science, Colorado State University. [Google Scholar]

- Goel, R. K., & Mazhar, U. (2024). Are the informal economy and cryptocurrency substitutes or complements? Applied Economics, 56(20), 2470–2481. [Google Scholar] [CrossRef]

- Grym, J., Aspara, J., Nandy, M., & Lodh, S. (2024). A crime by any other name: Gender differences in moral reasoning when judging the tax evasion of cryptocurrency traders. Behavioral Sciences, 14(3), 198. [Google Scholar] [CrossRef]

- Hasavari, S., Maddah, M., & Esmaeilzadeh, P. (2025). Government oversight and institutional influence: Exploring the dynamics of individual adoption of spot bitcoin ETPs. Journal of Risk and Financial Management, 18(4), 175. [Google Scholar] [CrossRef]

- Härdle, W. K., Harvey, C. R., & Reule, R. C. G. (2020). Understanding cryptocurrencies. Journal of Financial Econometrics, 18(2), 181–208. [Google Scholar] [CrossRef]

- Hellwig, D., Karlic, G., & Huchzermeier, A. (2020). Cryptocurrencies. In Management for professionals (pp. 29–51). Springer. [Google Scholar] [CrossRef]

- Hendrickson, J. R., & Luther, W. J. (2022). Cash, crime, and cryptocurrencies. The Quarterly Review of Economics and Finance, 85, 200–207. [Google Scholar] [CrossRef]

- Hernández Sánchez, Á., Sastre-Hernández, B. M., Jorge-Vazquez, J., & Náñez Alonso, S. L. (2024). Cryptocurrencies, tax ignorance and tax noncompliance in direct taxation: Spanish empirical evidence. Economies, 12(3), 62. [Google Scholar] [CrossRef]

- Islam, M. J., Islam, M. R., & Basar, M. A. (2024). iTrustBD: Study and analysis of bitcoin networks to identify the influence of trust behavior dynamics. SN Computer Science, 5(5), 476. [Google Scholar] [CrossRef]

- Jankeeparsad, R. W., & Tewari, D. D. (2022). Bitcoin: An exploratory study investigating adoption in South Africa. Interdisciplinary Journal of Information, Knowledge, and Management, 17, 191–214. [Google Scholar] [CrossRef] [PubMed]

- Kochergin, D. A., & Pokrovskaia, N. V. (2020). International experience of taxation of crypto-assets; Междунарoдный oпыт налoгooблoжения криптoактивoв. HSE Economic Journal, 24(1), 53–84. [Google Scholar] [CrossRef]

- Kochergin, D. A., Pokrovskaia, N. V., & Dostov, V. L. (2020). Tax regulation of virtual currencies circulation: Foreign countries experience and prospects for Russia; Налoгoвoе регулирoвание oбращения виртуальных валют: Oпыт зарубежных стран и перспективы для Рoссии. Vestnik Sankt-Peterburgskogo Universiteta. Ekonomika, 36(1), 49–76. [Google Scholar] [CrossRef]

- Kreklewetz, R. G., & Burlock, L. J. (2023). Policy forum: Canada’s proposed cryptoasset legislation. Canadian Tax Journal, 71(1), 73–81. [Google Scholar] [CrossRef]

- Laise, L. D. (2019). Cuadernos del Cendes. In Cuadernos del Cendes (pp. 107–124). [Google Scholar]

- Lara Gómez, G., & Demmler, M. (2018). Social currencies and cryptocurrencies: Characteristics, risks and comparative analysis. CIRIEC-España, Revista de Economía Pública, Social y Cooperativa, 93, 265–291. [Google Scholar] [CrossRef]

- Liang, X., Sendjaya, S., Zheng, L. J., & Abeysekera, L. (2022). Acculturation matters? Journal of Global Information Management, 30(1), 1–19. [Google Scholar] [CrossRef]

- Liberati, A., Altman, D. G., Tetzlaff, J., Mulrow, C., Gøtzsche, P. C., Ioannidis, J. P. A., Clarke, M., Devereaux, P. J., Kleijnen, J., & Moher, D. (2009). The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. PLoS Medicine, 6(7), e1000100. [Google Scholar] [CrossRef]

- Luciani Toro, L. R., Castellanos Sánchez, H. A., Hurtado Briceño, A. J., & Zerpa de Hurtado, S. (2022). Una aproximación al tratamiento contable de criptomonedas en el marco de las NIIF. Innovar, 33(88), 51–66. [Google Scholar] [CrossRef]

- Madakam, S., Mark, S., Lurie, Y., & Revulagadda, R. K. (2023). The role of cryptocurrencies in business. International Journal of Electronic Finance, 12(3), 238–262. [Google Scholar] [CrossRef]

- Mehmood, B., Shahbaz, M., & Jiao, Z. (2023). Do Muslim economies need insurance to grow? Answer from rigorous empirical evidence. The Quarterly Review of Economics and Finance, 87, 346–359. [Google Scholar] [CrossRef]

- Mora, H., Morales-Morales, M. R., Pujol-López, F. A., & Mollá-Sirvent, R. (2021). Social cryptocurrencies as model for enhancing sustainable development. Kybernetes, 50(10), 2883–2916. [Google Scholar] [CrossRef]

- Moreno-Arboleda, F. J., Rodríguez-Camacho, J. S., & Giraldo-Muñoz, D. (2021). Comparación de dos plataformas de blockchain: Bitcoin y hyperledger fabric. Ingeniería y Competitividad, 24(1), 1–17. [Google Scholar] [CrossRef]

- Mosakova, E. A. (2024). Cryptocurrency market regulation: Causes, trends, and prospects. Russia and the Contemporary World, 3, 78–86. [Google Scholar] [CrossRef]

- Mosquera Endara, M. R. (2022). Ecuadorian state: Legal framework for investments by cryptocurrency capital management companies (pp. 306–315). Red de Investigadores Ecuatorianos. [Google Scholar]

- Nanjundan, P., James, B. V., George, F. J., Kukreja, D. K., & Goyal, Y. S. (2024). Indian budget 2022: A make-or-break moment for cryptocurrency. EAI Endorsed Transactions on Internet of Things, 10, 1–5. [Google Scholar] [CrossRef]

- Netshisaulu, N. N., van der Poll, H. M., & van der Poll, J. A. (2024). Enhancing and validating a framework to curb illicit financial flows (IFFs). Journal of Risk and Financial Management, 17(8), 322. [Google Scholar] [CrossRef]

- OECD. (2020). Taxing virtual currencies: An overview of tax treatments and emerging tax policy issues. Organisation for Economic Co-Operation and Development. [Google Scholar]

- Ossadón, F. (2019). Marco fiscal de Chile. UBA Economica. Available online: https://revistadematematicas.uchile.cl/index.php/RET/article/view/55836 (accessed on 17 March 2025).

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., Brennan, S. E., Chou, R., Glanville, J., Grimshaw, J. M., Hróbjartsson, A., Lalu, M. M., Li, T., Loder, E. W., Mayo-Wilson, E., McDonald, S., … Alonso-Fernández, S. (2021). Declaración PRISMA 2020: Una guía actualizada para la publicación de revisiones sistemáticas. Revista Española de Cardiología, 74(9), 790–799. [Google Scholar] [CrossRef]

- Patricio Lozano, D. (2022). Criptomonedas y Blockchain en el ámbito financiero: Un análisis de correlación. Revista de Métodos Cuantitativos Para La Economía y La Empresa, 34, 328–358. [Google Scholar] [CrossRef]

- Pradenas, L. (2018, October). Tributación de criptomonedas. Repositorio Universidad de Chile. Available online: https://repositorio.uchile.cl/handle/2250/168323 (accessed on 17 March 2025).

- Regal, A., Morzán, J., Fabbri, C., Herrera, G., Yaulli, G., Palomino, A., & Gil, C. (2019). Proyección del precio de criptomonedas basado en tweets empleando LSTM. Ingeniare. Revista Chilena de Ingeniería, 27(4), 696–706. [Google Scholar] [CrossRef]

- Robertson, D. D., & Ing, S. (2023). Policy forum: Digital asset mining and GST—Tax policy versus public policy. Canadian Tax Journal, 71(1), 59–71. [Google Scholar] [CrossRef]

- Rodríguez Cairo, V. (2020). Régimen constitucional de la moneda y estabilidad del nivel general de precios en Perú. Derecho PUCP, 85, 277–320. [Google Scholar] [CrossRef]

- Saavedra Rodríguez, A. R. (2025). Impuesto a la renta sobre ganancias de criptomonedas: Análisis y propuesta normativa en el Perú. Revista La Junta, 7(2), 111–135. [Google Scholar] [CrossRef]

- Salas-Ocampo, L. D., & Alfaro-Salas, M. (2022). Criptomonedas y su efecto en la estabilidad del sistema financiero internacional: Apuntes para Centroamérica. Relaciones Internacionales, 95(1), 33–77. [Google Scholar] [CrossRef]

- Sarai, L., Zockun, C. Z., Cabral, F. G., & Zockun, M. (2024). From algorithms to revolution 5.0: What does drive the innovations? Beijing Law Review, 15(2), 945–969. [Google Scholar] [CrossRef]

- Senarath, S. (2022). Development of virtual currency and ICOs in Australia. In Law and practice of crowdfunding and peer-to-peer lending in Australia, China and Japan (pp. 41–65). Springer Nature Singapore. [Google Scholar] [CrossRef]

- Shiva Sankari, V., & Kavitha, R. (2025). Bitcoin adoption and price elasticity of demand: Cross-country insights. Humanities and Social Sciences Communications, 12, 930. [Google Scholar] [CrossRef]

- Shovkhalov, S. A., & Idrisov, H. (2021). Economic and legal analysis of cryptocurrency: Scientific views from Russia and the Muslim world. Laws, 10(2), 32. [Google Scholar] [CrossRef]

- Simran, N., & Sharma, A. K. (2023). Asymmetric impact of economic policy uncertainty on cryptocurrency market: Evidence from NARDL approach. The Journal of Economic Asymmetries, 27, e00298. [Google Scholar] [CrossRef]

- Singh, B., & Kaunert, C. (2024). Navigating cryptocurrency regulation. In Exploring the world with blockchain through cryptotravel (pp. 133–160). Business Science Reference. [Google Scholar] [CrossRef]

- Singh, R., Dwivedi, A. D., Srivastava, G., Wiszniewska-Matyszkiel, A., & Cheng, X. (2020). A game theoretic analysis of resource mining in blockchain. Cluster Computing, 23(3), 2035–2046. [Google Scholar] [CrossRef]

- Stroev, P. V., Fattakhov, R. V., Pivovarova, O. V., Orlov, S. L., & Advokatova, A. S. (2023). Taxation transformation under the influence of industry 4.0. International Journal of Advanced Computer Science and Applications (IJACSA), 13(9), 1010–1015. [Google Scholar] [CrossRef]

- Superintendencia de Banca, Seguros y AFP. (2022). Naturaleza juridica Perú. In Naturaleza jurídica de las criptomonedas en Perú. Superintendencia de Banca, Seguros y AFP. [Google Scholar]

- Swan, M. (2015). Blockchain: Blueprint for a new economy. O’Reilly Media. [Google Scholar]

- Thess, A., Klein, M., Nienhaus, K., & Pregger, T. (2020). Global carbon surcharge for the reduction of anthropogenic emission of carbon dioxide. Energy, Sustainability and Society, 10(1), 9. [Google Scholar] [CrossRef]

- Timuçin, T., Bayiroğlu, H., Gündüz, H., Yildiz, T. K., & Atagün, E. (2021). Predictive analysis of the cryptocurrencies’ movement direction using machine learning methods. In Lecture notes on data engineering and communications technologies (pp. 256–264). Springer. [Google Scholar] [CrossRef]

- Trujillo Pajuelo, M. L., Huamani-Torres, R., Marro, C. E. R.-H., Acuña-Patricio, V. R., & Hernández, R. M. (2022). Cryptocurrencies in peruvian law. Relacoes Internacionais no Mundo Atual, 3, 349–364. [Google Scholar]

- van Nam, T., Minh, N. B., van Hai, T., & Giglione, T. G. (2022). Cryptocurrency transactions and taxation policies in emerging Asian economies. Revista Brasileira de Alternative Dispute Resolution, 4(7), 215–229. [Google Scholar] [CrossRef]

- Vesterlund, M., Borisová, S., & Emilsson, E. (2024). Data center excess heat for mealworm farming, an applied analysis for sustainable protein production. Applied Energy, 353, 121990. [Google Scholar] [CrossRef]

- Vumazonke, N., & Parsons, S. (2023). An analysis of South Africa’s guidance on the income tax consequences of crypto assets. South African Journal of Economic and Management Sciences, 26(1), a4832. [Google Scholar] [CrossRef]

- Wang, J. (2025). A simplified tax regime for taxing cryptocurrencies. Intertax, 53(3), 245–266. [Google Scholar] [CrossRef]

- Wyeth, R., Rella, L., & Atkins, E. (2024). The material geographies of Bitfury in Georgia: Integrating cryptoasset firms into global financial networks. Environment and Planning A: Economy and Space, 56(3), 816–832. [Google Scholar] [CrossRef]

- Yermack, D. (2013). Is bitcoin a real currency? An economic appraisal. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Zocaro, M. (2020). Marco regulatorio Argentina. UBA Economica. Available online: https://economicas.uba.ar/ (accessed on 17 March 2025).

| Search Code | Search Query | Initial Results |

|---|---|---|

| S1 | TITLE-ABS-KEY (“criptomoneda” OR “criptoactivo” OR “criptodivisa” OR “digital currency” OR “cryptocurrency” OR “cryptoasset”) AND (“taxation” OR “taxes” OR “derecho fiscal” OR “tax law”) | 224 |

| Process | Search Results |

|---|---|

| Initial search results | 224 |

| Criterion 1: Temporality | 48 |

| Partial search results | 176 |

| Criterion 2: Country of origin | 60 |

| Partial search results | 116 |

| Criterion 3: Language | 1 |

| Partial search results | 115 |

| Criterion 4: Article type | 47 |

| Partial search results | 68 |

| Criterion 5: Accessibility | 8 |

| Partial search results | 60 |

| Criterion 6: Duplicates | 24 |

| Partial search results | 36 |

| Criterion 7: Relevance | 0 |

| Final search results | 36 |

| Code | Citation | Title | Journal |

|---|---|---|---|

| S1-01 | (Hernández Sánchez et al., 2024) | Cryptocurrencies, Tax Ignorance and Tax Noncompliance in Direct Taxation: Spanish Empirical Evidence | Economies |

| S1-02 | (Durán Rojo & Pachas Luna, 2021) | Perspectivas Del Derecho Fiscal Comparado: Criptomonedas, Transacciones Y Eventos Impositivos. Tratamiento Tributario En El Perú, Problemas Y Recomendaciones. | Ius Et Veritas |

| S1-03 | (Shiva Sankari & Kavitha, 2025) | Bitcoin Adoption and Price Elasticity Of Demand: Cross-Country Insights | Humanities & Social Sciences Communications |

| S1-05 | (Basu, 2025) | Bitcoins And Central Bank Digital Currency in A Simple Real Business Cycle Model | South Asian Journal of Macroeconomics and Public Finance |

| S1-06 | (Central Bank of Russia, 2022) | Криптoвалюты: Тренды, Риски, Меры (Cryptocurrencies: Trends, Risks, Measures) | Doklad dlya obshchestvennykh konsul’tatsiy |

| S1-07 | (Shovkhalov & Idrisov, 2021) | Economic And Legal Analysis of Cryptocurrency: Scientific Views from Russia and The Muslim World | Laws (MDPI) |

| S1-08 | (Netshisaulu et al., 2024) | Enhancing And Validating a Framework to Curb Illicit Financial Flows (Iffs) | Journal of Risk and Financial Management |

| S1-09 | (Thess et al., 2020) | Global Carbon Surcharge for the Reduction of Anthropogenic Emission of Carbon Dioxide | Energy, Sustainability and Society |

| S1-10 | (Hasavari et al., 2025) | Government Oversight and Institutional Influence: Exploring the Dynamics of Individual Adoption of Spot Bitcoin Etps | Journal of Risk and Financial Management |

| S1-11 | (Galazova et al., 2025) | Cryptocurrency Mining as an Emerging Industry: Prospects for the Russian Arctic | Sever i Rynok: Formirovanie Ekonomiceskogo Poradka |

| S1-12 | (Grym et al., 2024) | A Crime by Any Other Name: Gender Differences in Moral Reasoning When Judging the Tax Evasion of Cryptocurrency Traders | Behavioral Sciences (MDPI) |

| S1-13 | (Goel & Mazhar, 2024) | ¿Are the Informal Economy and Cryptocurrency Substitutes or Complements? | Applied Economics |

| S1-14 | (Chavez-Perez et al., 2025) | Impact of Cryptocurrencies and Their Technological Infrastructure on Global Financial Regulation: Challenges for Regulators and New Regulations | International Journal of Advanced Computer Science and Applications |

| S1-15 | (Crumbley et al., 2024) | How Should Cryptocurrencies Be Defined and Reported? An Exploratory Study of Accounting Professor Opinions | Journal of Risk and Financial Management |

| S1-16 | (Egorova et al., 2023) | Research of the Effectiveness of the System of Legal Regulation of Tax Relations for Operations with Cryptocurrency Currently In Force | Vestnik of Saint Petersburg University. Law |

| S1-17 | (Vumazonke & Parsons, 2023) | An analysis of South Africa’s guidance on the income tax consequences of crypto assets | South African Journal of Economic and Management Sciences |

| S1-18 | (Nanjundan et al., 2024) | Indian Budget 2022: A Make-Or-Break Moment for Cryptocurrency | EAI Endorsed Transactions on Internet of Things |

| S1-19 | (R. Singh et al., 2020) | A Game Theoretic Analysis of Resource Mining in Blockchain | Cluster Computing |

| S1-20 | (Kochergin et al., 2020) | Tax regulation of virtual currencies circulation: Foreign countries experience and prospects for Russia | Vestnik Sankt-Peterburgskogo Universiteta. Ekonomika |

| S1-21 | (Wyeth et al., 2024) | The Material Geographies of Bitfury in Georgia: Integrating Cryptoasset Firms Into Global Financial Networks | Environment and Planning A: Economy and Space |

| S1-22 | (Kochergin & Pokrovskaia, 2020) | International experience of taxation of crypto-assets | HSE Economic Journal |

| S1-23 | (Cong et al., 2023) | Tax-loss harvesting with cryptocurrencies | Journal of Accounting and Economics |

| S1-24 | (Simran & Sharma, 2023) | Asymmetric impact of economic policy uncertainty on cryptocurrency market: Evidence from NARDL approach | International Journal of Finance and Accounting |

| S1-25 | (Kreklewetz & Burlock, 2023) | Policy forum: Canada’s proposed cryptoasset legislation | Canadian Tax Journal |

| S1-26 | (Borisova, 2023) | Redistribution of cryptocurrency markets: The shift of activity to the east | Vostok (Oriens) |

| S1-27 | (Robertson & Ing, 2023) | Policy Forum: Digital Asset Mining and GST—Tax Policy Versus Public Policy | Australiana Tax Forum |

| S1-29 | (Baer et al., 2023) | Taxing cryptocurrencies | Oxford Review of Economic Policy |

| S1-30 | (Hendrickson & Luther, 2022) | Cash, crime, and cryptocurrencies | The Quarterly Review of Economics and Finance |

| S1-32 | (Çalişkan, 2020) | Data money: The socio-technical infrastructure of cryptocurrency blockchains | Economy and Society |

| S1-33 | (van Nam et al., 2022) | Cryptocurrency transactions and taxation policies in emerging Asian economies | Revista Brasileira de Alternative Dispute Reso-lution |

| S1-34 | (Jankeeparsad & Tewari, 2022) | Bitcoin: An Exploratory Study Investigating Adoption In South Africa | South African Journal of Economic and Management Sciences |

| S1-35 | (Stroev et al., 2022) | Taxation Transformation under the Influence of Industry 4.0. | International Journal of Advanced Computer Science and Applica-tions(IJACSA) |

| S1-36 | (Vesterlund et al., 2024) | Data center excess heat for mealworm farming, an applied analysis for sustainable protein production | Applied Energy |

| S1-37 | (Mehmood et al., 2023) | Do Muslim economies need insurance to grow? Answer from rigorous empirical evidence | The Quarterly Review of Economics and Finance |

| S1-38 | (Ghorbel & Prabhu, 2021) | Optimal operation of a microgrid with cryptocurrency mining and demand-side management | Department of Computer Science |

| S1-39 | (Chamberlain, 2021) | Forking belief in cryptocurrency: A tax non-realization event | Florida Tax Review |

| Code | Citation | Country | Conclusion |

|---|---|---|---|

| S1-01 | (Hernández Sánchez et al., 2024) | Spain |

|

| S1-02 | (Durán Rojo & Pachas Luna, 2021) | Peru |

|

| S1-03 | (Shiva Sankari & Kavitha, 2025). | India |

|

| S1-05 | (Basu, 2025) | India |

|

| S1-06 | (Central Bank of Russia, 2022) | Russia |

|

| S1-07 | (Shovkhalov & Idrisov, 2021) | Russia |

|

| S1-08 | (Netshisaulu et al., 2024) | South Africa |

|

| S1-09 | (Thess et al., 2020) | South Africa |

|

| S1-10 | (Hasavari et al., 2025) | United States |

|

| S1-11 | (Galazova et al., 2025) | South Africa |

|

| S1-12 | (Grym et al., 2024) | United States |

|

| S1-13 | (Goel & Mazhar, 2024) | United States |

|

| S1-14 | (Chavez-Perez et al., 2025) | United States |

|

| S1-15 | (Crumbley et al., 2024) | United States |

|

| S1-16 | (Egorova et al., 2023) | Russia |

|

| S1-17 | (Vumazonke & Parsons, 2023) | South Africa |

|

| S1-18 | (Nanjundan et al., 2024) | India |

|

| S1-19 | (R. Singh et al., 2020) | Russia |

|

| S1-20 | (Kochergin et al., 2020) | Russia |

|

| S1-21 | (Wyeth et al., 2024) | United States |

|

| S1-22 | (Kochergin & Pokrovskaia, 2020) | Russia |

|

| S1-23 | (Cong et al., 2023) | Australia |

|

| S1-24 | (Simran & Sharma, 2023) | India |

|

| S1-25 | (Kreklewetz & Burlock, 2023) | Canada |

|

| S1-26 | (Borisova, 2023) | Russia |

|

| S1-27 | (Robertson & Ing, 2023) | Australia |

|

| S1-29 | (Baer et al., 2023) | United States |

|

| S1-30 | (Hendrickson & Luther, 2022) | United States |

|

| S1-32 | (Çalişkan, 2020) | United States |

|

| S1-33 | (van Nam et al., 2022) | India |

|

| S1-34 | (Jankeeparsad & Tewari, 2022) | South Africa |

|

| S1-35 | (Stroev et al., 2022) | Russia |

|

| S1-36 | (Vesterlund et al., 2024) | United States |

|

| S1-37 | (Mehmood et al., 2023) | United States |

|

| S1-38 | (Ghorbel & Prabhu, 2021) | Australia |

|

| S1-39 | (Chamberlain, 2021) | United States |

|

| Region | Regulatory Orientation | Tax Treatment Characteristics | Key Challenges Identified in the Literature | Representative Studies |

|---|---|---|---|---|

| North America (United States, Canada) | Fragmented but advanced regulatory ecosystem; multiple agencies involved. | Crypto often treated as property or capital asset; taxable events include trading, mining, staking, and business use. | Inconsistent definitions across agencies; compliance complexity; risk of double taxation in cross-border operations. | Crumbley et al. (2024); Kreklewetz and Burlock (2023); Baer et al. (2023) |

| Latin America (Peru, Ecuador, Argentina) | Emerging and incomplete frameworks; significant legal ambiguity. | Limited or undefined rules on capital gains, mining, or token exchanges; high informality. | Weak institutional capacity; low fiscal literacy; risk of evasion due to regulatory vacuums and cash-based economies. | Durán Rojo and Pachas Luna (2021); Mosquera Endara (2022); Barroilhet (2019); Luciani Toro et al. (2022) |

| Europe (Spain, Germany) | More consolidated regulation aligned with OECD and EU digital tax principles. | Clearer tax obligations; gains taxed similarly to securities; specific rules for business income and mining. | Complexity in calculating taxable swaps; uneven adoption of EU-wide harmonization; need for clearer reporting tools. | Hernández Sánchez et al. (2024); Pradenas (2018) |

| Asia (India, China, Japan) | Polarized models: from restrictive (China) to structured but burdensome (India) and payment-focused (Japan). | India imposes high flat taxes and bans loss offsets; Japan taxes crypto as business income; China restricts mining and trading. | Over-taxation reducing innovation (India); compliance burdens; state-led restrictions reducing transparency (China). | Nanjundan et al. (2024); Shiva Sankari and Kavitha (2025); Kochergin et al. (2020) |

| Africa (South Africa) | Transitional regulatory environment; growing public adoption. | Crypto taxed as income or capital gains; guidance exists but interpretation remains unstable. | Enforcement limitations; high informality; limited public knowledge; need for updated definitions and periodic guidance. | Vumazonke and Parsons (2023); Jankeeparsad and Tewari (2022); Netshisaulu et al. (2024) |

| Russia and Eurasia | Highly centralized, security-focused regulation; often restrictive. | Efforts to tax mining, control exchanges, and increase traceability; crypto often not recognized as legal tender. | Institutional rigidity; unclear definitions; mining-related strain on energy systems; fragmented tax enforcement. | Egorova et al. (2023); Borisova (2023); Kochergin and Pokrovskaia (2020); Stroev et al. (2022) |

| Australia and Oceania | Hybrid, innovation-friendly model integrating OECD digital tax frameworks. | Crypto treated as asset; personal-use exemptions; capital gains rules apply; broad guidance on mining and business activity. | Risks of double taxation in international operations; need for standardized valuation rules. | Ghorbel and Prabhu (2021); Robertson and Ing (2023); Kreklewetz and Burlock (2023) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grijalva-Salazar, R.V.; Caicedo-Mendoza, J.A.; Zúñiga-Castillo, A.J.; Olivas-Valencia, E.; Fernández-Bedoya, V.H. Bridging Regulation and Innovation: A Systematic Review of Cryptocurrency Taxation and Fiscal Policy (2020–2025). J. Risk Financial Manag. 2025, 18, 720. https://doi.org/10.3390/jrfm18120720

Grijalva-Salazar RV, Caicedo-Mendoza JA, Zúñiga-Castillo AJ, Olivas-Valencia E, Fernández-Bedoya VH. Bridging Regulation and Innovation: A Systematic Review of Cryptocurrency Taxation and Fiscal Policy (2020–2025). Journal of Risk and Financial Management. 2025; 18(12):720. https://doi.org/10.3390/jrfm18120720

Chicago/Turabian StyleGrijalva-Salazar, Rosario Violeta, Jose Antonio Caicedo-Mendoza, Arturo Jaime Zúñiga-Castillo, Erikson Olivas-Valencia, and Víctor Hugo Fernández-Bedoya. 2025. "Bridging Regulation and Innovation: A Systematic Review of Cryptocurrency Taxation and Fiscal Policy (2020–2025)" Journal of Risk and Financial Management 18, no. 12: 720. https://doi.org/10.3390/jrfm18120720

APA StyleGrijalva-Salazar, R. V., Caicedo-Mendoza, J. A., Zúñiga-Castillo, A. J., Olivas-Valencia, E., & Fernández-Bedoya, V. H. (2025). Bridging Regulation and Innovation: A Systematic Review of Cryptocurrency Taxation and Fiscal Policy (2020–2025). Journal of Risk and Financial Management, 18(12), 720. https://doi.org/10.3390/jrfm18120720