From Compliance to Strategic Partnerships: The Role of Internal Audit in Enterprise Risk Management and Opportunities for Future Research

Abstract

1. Introduction

2. Background

2.1. Committee of Sponsoring Organizations (COSO) and Enterprise Risk Management (ERM)

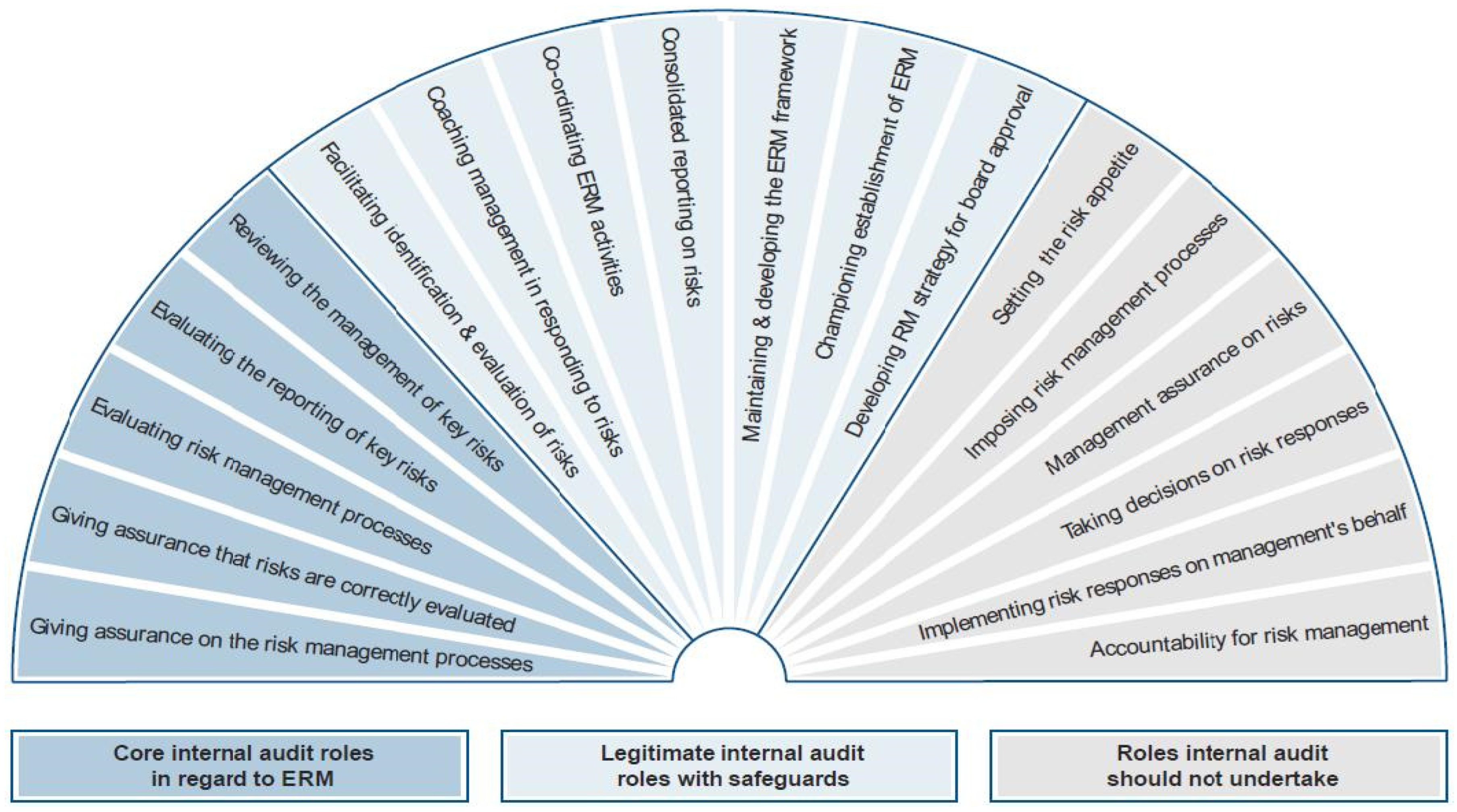

2.2. The Role of the Internal Audit Function (IAF) in the ERM Framework

3. Methodology

3.1. Identification Process

3.2. The Difference from Prior Internal Audit Literature Reviews

4. Literature Review & Synthesis

4.1. Category 1: Core Internal Audit Roles—Assurance Activities

4.1.1. What Have We Learned?

Theme 1—Risk Management Processes, the IAF and External Auditors’ Reliance Decisions

Theme 2—Risk Management Processes, the IAF and Risk Management Effectiveness

Theme 3—Management of Key Risks, the IAF and Financial Reporting Risk

Theme 4—Management of Key Risks, the IAF’s Use of Technology and Continuous Monitoring

4.1.2. What Do We Still Need to Learn?

4.2. Category 2: Legitimate Internal Audit Roles with Safeguards—Consulting Activities

4.2.1. What Have We Learned?

Theme 1—Facilitating Identification and Evaluation of Risks

- Financial Statement Risk

- Fraud Risk

- Internal Control Risk

- Other Risks

Theme 2—Coordinating ERM Activities

Theme 3—Consolidated Reporting on Risks

- Financial Statement Risk

- Information Technology and Information Systems Risk

- Other Risks

Theme 4—Maintaining and Developing the ERM Framework

4.2.2. What Do We Still Need to Learn?

4.3. Category 3: Roles Internal Audit Should Not Take—Role Duality

4.3.1. What Have We Learned?

Theme 1—Internal Audit’s General Involvement in ERM

Theme 2—The Internal Audit Function’s Dual Role, Assurance and Consulting Related to ERM

Theme 3—Use of the Internal Audit Function as a MTG, Implications for ERM

- Hire externally but directly into the IAF. This approach focuses on new college graduates and or experienced hires with the implicit intent of promoting these individuals into management positions outside the IAF after a predetermined amount of time (Oxner & Kusel, 1996). These cycles range between two and five years

- Rotate existing non-IAF employees of the company into the IAF as a path to senior management positions after the IAF rotation (Chadwick, 1995)

- Cycle “career” auditors within the IAF into the operations of the company for a specified amount of time to increase domain or task-specific experience (Christ et al., 2015; Burton et al., 2015).

4.3.2. What Do We Still Need to Learn?

5. Concluding Comments

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| COSO | Committee of Sponsoring Organizations of the Treadway Commission |

| ERM | Enterprise risk management |

| ESG | Environmental, social and governance |

| IA | Internal audit |

| IAF | Internal audit function |

| IIA | Institute of Internal Auditors |

| MTG | Management training ground |

| PCAOB | Public Company Accounting Oversight Board |

| SOX | Sarbanes-Oxley Act |

| TLoD | Three lines of defense (model) |

| U.S. | United States |

| 1 | The IIA conducts surveys of its practitioners through its research foundation and practitioners such as Protiviti. The Global Audit Information Network (GAIN) survey is a comprehensive annual benchmarking study with chief audit executives (CAEs) in 17 industries and 44 countries. It helps CAEs benchmark their organizations based on several qualitative and quantitative dimensions. The Common Body of Knowledge (CBOK) is a broad and the world’s largest ongoing study of the profession and includes a practitioner and a stakeholder survey. Data are proprietary. |

| 2 | Of the 77 studies, we identified 20 mixed-method studies employing experimental and survey methods. |

| 3 | The Three Lines Model is a governance framework endorsed by the IIA. The framework describes the roles and responsibilities for an organization’s management to effectively manage risk (IIA, 2020). |

| 4 | This assertion applies to the set of research journals included in our review. We acknowledge that other journals, especially international journals, may contain studies that examine the MTG phenomenon. |

| 5 | Throughout this paper, we use the terms independence and objectivity interchangeably. |

References

- Abbott, L. J., Daugherty, B., Parker, S., & Peters, G. F. (2016). Internal audit quality and financial reporting quality: The joint importance of independence and competence. Journal of Accounting Research, 54(1), 3–40. [Google Scholar] [CrossRef]

- Abbott, L. J., Parker, S., & Peters, G. F. (2010). Serving two masters: The association between audit committee internal audit oversight and internal audit activities. Accounting Horizons, 24(1), 1–24. [Google Scholar] [CrossRef]

- Abbott, L. J., Parker, S., & Peters, G. F. (2012). Internal audit assistance and external audit timeliness. Auditing: A Journal of Practice & Theory, 31(4), 3–20. [Google Scholar] [CrossRef]

- Ahlawat, S. S., & Lowe, D. J. (2004). An examination of internal auditor objectivity: In-house versus outsourcing. Auditing: A Journal of Practice & Theory, 23(2), 147–158. [Google Scholar] [CrossRef]

- Ahmad, Z., & Taylor, D. (2009). Commitment to independence by internal auditors: The effects of role ambiguity and role conflict. Managerial Auditing Journal, 24(9), 899–925. [Google Scholar] [CrossRef]

- Archambeault, D. S., DeZoort, F. T., & Holt, T. P. (2008). The need for an internal auditor report to external stakeholders to improve governance transparency. Accounting Horizons, 22(4), 375–388. [Google Scholar] [CrossRef]

- Axén, L. (2018). Exploring the association between the content of internal audit disclosures and external audit fees: Evidence from Sweden. International Journal of Auditing, 22(2), 285–297. [Google Scholar] [CrossRef]

- Bame-Aldred, C. W., Brandon, D. M., Messier, W. F., Rittenberg, L. E., & Stefaniak, C. M. (2013). A summary of research on external auditor reliance on the internal audit function. Auditing: A Journal of Practice & Theory, 32(Suppl. S1), 251–286. [Google Scholar] [CrossRef]

- Banham, R. (2004). Enterprising views of risk management. Journal of Accountancy, 197(6), 65–71. [Google Scholar]

- Bantleon, U., d’Arcy, A., Eulerich, M., Hucke, A., Pedell, B., & Ratzinger-Sakel, N. V. (2021). Coordination challenges in implementing the three lines of defense model. International Journal of Auditing, 25(1), 59–74. [Google Scholar] [CrossRef]

- Barr-Pulliam, D. (2019). The effect of continuous auditing and role duality on the incidence and likelihood of reporting management opportunism. Management Accounting Research, 44, 44–56. [Google Scholar] [CrossRef]

- Barr-Pulliam, D., Eulerich, M., & Ratzinger-Sakel, N. (2024). The effect of the internal audit function’s perceived assurance versus advisory purpose on the external auditor’s reliance decision. Managerial Auditing Journal, 39(2), 138–165. [Google Scholar] [CrossRef]

- Beasley, M. S., Clune, R., & Hermanson, D. (2006). The impact of enterprise risk management on the internal audit function. Journal of Forensic Accounting, 1–26. [Google Scholar]

- Bhattacharjee, S., Maletta, M. J., & Moreno, K. K. (2016). The role of account subjectivity and risk of material misstatement on auditors’ internal audit reliance judgments. Accounting Horizons, 30(2), 225–238. [Google Scholar] [CrossRef]

- Bierstaker, J. L., Brody, R. G., & Pacini, C. (2006). Accountants’ perceptions regarding fraud detection and prevention methods. Managerial Auditing Journal, 21(5), 520–535. [Google Scholar] [CrossRef]

- Bou-Raad, G. (2000). Internal auditors and a value-added approach: The new business regime. Managerial Auditing Journal, 15(4), 182–187. [Google Scholar] [CrossRef]

- Bowlin, K. O., Hales, J., & Kachelmeier, S. J. (2009). Empirical evidence of how prior experience as an auditor influences managers’ strategic reporting decisions. Review of Accounting Studies, 14(1), 63–87. [Google Scholar] [CrossRef]

- Boyle, D. M., DeZoort, F. T., & Hermanson, D. R. (2015). The effects of internal audit report type and reporting relationship on internal auditors’ risk judgments. Accounting Horizons, 29(3), 695–718. [Google Scholar] [CrossRef]

- Brown, C. E., Wong, J. A., & Baldwin, A. A. (2007). A review and analysis of the existing research streams in continuous auditing. Journal of Emerging Technologies in Accounting, 4, 1–28. [Google Scholar] [CrossRef]

- Brown-Liburd, H., Issa, H., & Lombardi, D. (2015). Behavioral implications of big data’s impact on audit judgment and decision making and future research directions. Accounting Horizons, 29(2), 451–468. [Google Scholar] [CrossRef]

- Burton, F. G., Emett, S. A., Simon, C. A., & Wood, D. A. (2012). Corporate managers’ reliance on internal auditor recommendations. Auditing: A Journal of Practice & Theory, 31(2), 151–166. [Google Scholar] [CrossRef]

- Burton, F. G., Starliper, M. W., Summers, S. L., & Wood, D. A. (2015). The effects of using the internal audit function as a management training ground or as a consulting services provider in enhancing the recruitment of internal auditors. Accounting Horizons, 29(1), 115–140. [Google Scholar] [CrossRef]

- Carcello, J. V., Eulerich, M., Masli, A., & Wood, D. A. (2018). The value to management of using the internal audit function as a management training ground. Accounting Horizons, 32(2), 121–140. [Google Scholar] [CrossRef]

- Carcello, J. V., Eulerich, M., Masli, A., & Wood, D. A. (2020). Are internal audits associated with reductions in perceived risk? Auditing: A Journal of Practice & Theory, 39(3), 55–73. [Google Scholar] [CrossRef]

- Carcello, J. V., Hermanson, D. R., & Raghunandan, K. (2005). Factors associated with U.S. public companies’ investment in internal auditing. Accounting Horizons, 19(2), 69–84. [Google Scholar] [CrossRef]

- Carpenter, T. D., Reimers, J. L., & Fretwell, P. Z. (2011). Internal auditors’ fraud judgments: The benefits of brainstorming in groups. Auditing: A Journal of Practice & Theory, 30(3), 211–224. [Google Scholar] [CrossRef]

- Center for Audit Quality (CAQ). (2016). Audit quality indicators: Journey and path ahead. Available online: https://www.thecaq.org/audit-quality-indicators-journey-and-path-ahead (accessed on 2 January 2019).

- Chadwick, W. E. (1995). Tough questions, tougher answers. Internal Auditor, 52(6), 63–65. [Google Scholar]

- Christ, M. H., Masli, A., Sharp, N. Y., & Wood, D. A. (2015). Rotational internal audit programs and financial reporting quality: Do compensating controls help? Accounting, Organizations and Society, 44, 37–59. [Google Scholar] [CrossRef]

- Christopher, J., Sarens, G., & Leung, P. (2009). A critical analysis of the independence of the internal audit function: Evidence from Australia. Accounting, Auditing & Accountability Journal, 22(2), 200–220. [Google Scholar] [CrossRef]

- Church, B. K., & Schneider, A. (1992). Internal auditor involvement in internal control system design: Is objectivity impaired? Journal of Applied Business Research, 8(4), 15–24. [Google Scholar] [CrossRef]

- Coderre, D., Verver, J. G., & Warren, J. D., Jr. (2005). Continuous auditing: Implications for assurance, monitoring, and risk assessment. In Global technology audit guide (pp. 1–34). The Institute of Internal Auditors. [Google Scholar]

- Codesso, M., de Freitas, M. M., Wang, X., de Carvalho, A., & da Silva Filho, A. A. (2020). Continuous audit implementation at Cia. Hering in Brazil. Journal of Emerging Technologies in Accounting, 17(2), 103–118. [Google Scholar] [CrossRef]

- Cohen, J. R., Krishnamoorthy, G., & Wright, A. (2004). The corporate governance mosaic and financial reporting quality. Journal of Accounting Literature, 23, 87–152. Available online: https://ssrn.com/abstract=1086743 (accessed on 1 December 2016).

- Committee of Sponsoring Organizations (COSO) of the Treadway Commission. (2004). Enterprise risk management: Integrated framework. Available online: https://www.coso.org/guidance-erm (accessed on 1 December 2016).

- Committee of Sponsoring Organizations (COSO) of the Treadway Commission. (2011). Embracing enterprise risk management: Practical approaches for getting started. Available online: https://www.coso.org/guidance-erm (accessed on 20 April 2017).

- Committee of Sponsoring Organizations (COSO) of the Treadway Commission. (2013). Internal control: Integrated framework. Available online: https://home.kpmg.com/content/dam/kpmg/pdf/2016/05/2750-New-COSO-2013-Framework-WHITEPAPER-V4.pdf (accessed on 1 December 2016).

- Committee of Sponsoring Organizations (COSO) of the Treadway Commission. (2017). Enterprise risk management: Integrating strategy and performance. Available online: https://www.coso.org/guidance-erm (accessed on 28 March 2018).

- Coram, P., Ferguson, C., & Moroney, R. (2008). Internal audit, alternative internal audit structures and the level of misappropriation of assets fraud. Accounting & Finance, 48, 543–559. [Google Scholar] [CrossRef]

- DeAngelo, L. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183–199. [Google Scholar] [CrossRef]

- Demek, K. C., Raschke, R. L., Janvrin, D. J., & Dilla, W. N. (2018). Do organizations use a formalized risk management process to address social media risk? International Journal of Accounting Information Systems, 28, 31–44. [Google Scholar] [CrossRef]

- DeZoort, F. T., & Harrison, P. D. (2018). Understanding auditors’ sense of responsibility for detecting fraud within organizations. Journal of Business Ethics, 149, 857–874. [Google Scholar] [CrossRef]

- De Zwaan, L., Stewart, J., & Subramaniam, N. (2011). Internal audit involvement in enterprise risk management. Managerial Auditing Journal, 26(7), 586–604. [Google Scholar] [CrossRef]

- D’Onza, G., Sarens, G., & DeSimone, S. (2020). Factors that influence the internal audit function’s maturity. Accounting Horizons, 34(4), 57–74. [Google Scholar] [CrossRef]

- Ege, M. S. (2015). Does internal audit function quality deter management misconduct? The Accounting Review, 90(2), 495–527. [Google Scholar] [CrossRef]

- Eulerich, M., Georgi, C., & Schmidt, A. (2020). Continuous auditing and risk-based audit planning–An empirical analysis. Journal of Emerging Technologies in Accounting, 17(2), 141–155. [Google Scholar] [CrossRef]

- Eulerich, M., & Kalinichenko, A. (2018). The current state and future directions of continuous auditing research: An analysis of the existing literature. Journal of Information Systems, 32(3), 31–51. [Google Scholar] [CrossRef]

- Eulerich, M., Masli, A., Pickerd, J., & Wood, D. A. (2023). The impact of audit technology on audit task outcomes: Evidence for technology-based audit techniques. Contemporary Accounting Research, 40(2), 981–1012. [Google Scholar] [CrossRef]

- Farkas, M. J., & Hirsch, R. M. (2016). The effect of frequency and automation of internal control testing on external auditor reliance on the internal audit function. Journal of Information Systems, 30(1), 21–40. [Google Scholar] [CrossRef]

- Garven, S. A., & Scarlata, A. N. (2021). An examination of internal audit function size: Evidence from U.S. government and nonprofit sectors. Current Issues in Auditing, 15(1), A38–A56. [Google Scholar] [CrossRef]

- Gebrayel, E., Jarrar, H., Salloum, C., & Lefebvre, Q. (2018). Effective association between audit committees and the internal audit function and its impact on financial reporting quality: Empirical evidence from Omani listed firms. International Journal of Auditing, 22(2), 197–213. [Google Scholar] [CrossRef]

- Glover, S. M., Prawitt, D. F., & Wood, D. A. (2008). Internal audit sourcing arrangement and the external auditor’s reliance decision. Contemporary Accounting Research, 25(1), 193–213. [Google Scholar] [CrossRef]

- Gonzalez, G. C., Sharma, P. N., & Galletta, D. (2012a). Factors influencing the planned adoption of continuous monitoring technology. Journal of Information Systems, 26(2), 53–69. [Google Scholar] [CrossRef]

- Gonzalez, G. C., Sharma, P. N., & Galletta, D. F. (2012b). The antecedents of the use of continuous auditing in the internal auditing context. International Journal of Accounting Information Systems, 13(3), 248–262. [Google Scholar] [CrossRef]

- Graham, L., & Bedard, J. C. (2015). Internal control deficiencies in tax reporting: A detailed view. Accounting Horizons, 29(4), 917–942. [Google Scholar] [CrossRef]

- Gramling, A. A., Jenkins, J. G., & Taylor, M. H. (2010). Policy and research implications of evolving independence rules for public company auditors. Accounting Horizons, 24(4), 547–566. [Google Scholar] [CrossRef]

- Gramling, A. A., Maletta, M. J., Schneider, A., & Church, B. K. (2004). The role of the internal audit function in corporate governance: A synthesis of the extant internal auditing literature and directions for future research. Journal of Accounting Literature, 23, 94–244. [Google Scholar]

- Gramling, A. A., & Myers, P. M. (2006). Internal auditing’s role in ERM: As organizations lay their enterprise risk groundwork, many auditors are taking on management’s oversight responsibilities, new research finds. Internal Auditor, 63(2), 52–58. [Google Scholar]

- Grebe, G. P. M., & Marx, J. (2023). The perceived relationship between risk culture and operational risk management practices of Ghanaian banks. Journal of Risk and Financial Management, 16(9), 407. [Google Scholar] [CrossRef]

- Grima, S., Baldacchino, P. J., Grima, S., Kizilkaya, M., Tabone, N., & Ellul, L. (2023). Designing a characteristics effectiveness model for internal audit. Journal of Risk and Financial Management, 16(2), 56. [Google Scholar] [CrossRef]

- Héroux, S., & Fortin, A. (2013). The internal audit function in information technology governance: A holistic perspective. Journal of Information Systems, 27(1), 189–217. [Google Scholar] [CrossRef]

- Hoos, F., Messier, W. F., Jr., Smith, J. L., & Tandy, P. R. (2018). An experimental investigation of the interaction effect of management training ground and reporting lines on internal auditors’ objectivity. International Journal of Auditing, 22(2), 150–163. [Google Scholar] [CrossRef]

- Institute of Internal Auditors (IIA). (2000). Internal auditing: Adding value across the board. IIA. [Google Scholar]

- Institute of Internal Auditors (IIA). (2009). IIA position paper: The role of internal auditing in enterprise-wide risk management. IIA. [Google Scholar]

- Institute of Internal Auditors (IIA). (2017). International standards for the professional practice of internal auditing. IIA. [Google Scholar]

- Institute of Internal Auditors (IIA). (2020). The IIA’s three lines model. IIA. [Google Scholar]

- Islam, M. S., Farah, N., & Stafford, T. F. (2018). Factors associated with security/cybersecurity audit by internal audit function. Managerial Auditing Journal, 33(4), 377–409. [Google Scholar] [CrossRef]

- Islam, S., & Stafford, T. (2022). Factors associated with the adoption of data analytics by internal audit function. Managerial Auditing Journal, 37(2), 193–223. [Google Scholar] [CrossRef]

- Ismael, H. R., & Roberts, C. (2018). Factors affecting the voluntary use of internal audit: Evidence from the UK. Managerial Auditing Journal, 33(3), 288–317. [Google Scholar] [CrossRef]

- Jemaa, F. (2022). Recoupling work beyond COSO: A longitudinal case study of enterprise-wide risk management. Accounting, Organizations and Society, 103, 101369. [Google Scholar] [CrossRef]

- Kaplan, S. E., & Schultz, J. J. (2007). Intentions to report questionable acts: An examination of the influence of anonymous reporting channel, internal audit quality, and setting. Journal of Business Ethics, 71(2), 109–124. [Google Scholar] [CrossRef]

- Kleffner, A. E., Lee, R. B., & McGannon, B. (2003). The effect of corporate governance on the use of enterprise risk management: Evidence from Canada. Risk Management and Insurance Review, 6(1), 53–73. [Google Scholar] [CrossRef]

- Kotb, A., Elbardan, H., & Halabi, H. (2020). Mapping of internal audit research: A post-Enron structured literature review. Accounting, Auditing & Accountability Journal, 33(8), 1969–1996. [Google Scholar] [CrossRef]

- Krogstad, J. L., Anthony, J. R., & Rittenberg, L. E. (1999). Where we’re going. Internal Auditor, 56(6), 28–33. [Google Scholar]

- Liebenberg, A. P., & Hoyt, R. E. (2003). The determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Management and Insurance Review, 6(1), 37–52. [Google Scholar] [CrossRef]

- Malaescu, I., & Sutton, S. G. (2015). The reliance of external auditors on internal audit’s use of continuous audit. Journal of Information Systems, 29(1), 95–114. [Google Scholar] [CrossRef]

- Mat Ludin, K. R., Mohamed, Z. M., & Mohd-Saleh, N. (2017). The association between CEO characteristics, internal audit quality, and risk-management implementation in the public sector. Risk Management, 19(4), 281–300. [Google Scholar] [CrossRef]

- Messier, W. F., Reynolds, J. K., Simon, C. A., & Wood, D. A. (2011). The effect of using the internal audit function as a management training ground on the external auditor’s reliance decision. The Accounting Review, 86, 2131–2154. [Google Scholar] [CrossRef]

- Moffitt, K. C. (2018). A framework for legacy source code audit analytics. Journal of Emerging Technologies in Accounting, 15(2), 67–75. [Google Scholar] [CrossRef]

- Munro, L., & Stewart, J. (2010). External auditors’ reliance on internal audit: The impact of sourcing arrangements and consulting activities. Accounting & Finance, 50(2), 371–387. [Google Scholar] [CrossRef]

- Mutschmann, M., Hasso, T., & Pelster, M. (2022). Dark triad managerial personality and financial reporting manipulation. Journal of Business Ethics, 181, 763–788. [Google Scholar] [CrossRef]

- Nagy, A. L., & Cenker, W. J. (2002). An assessment of the newly defined internal audit function. Managerial Auditing Journal, 17(3), 130–137. [Google Scholar] [CrossRef]

- Nagy, A. L., & Cenker, W. J. (2007). Internal audit professionalism and Section 404 compliance: The view of chief audit executives from Northeast Ohio. International Journal of Auditing, 11(1), 41–49. [Google Scholar] [CrossRef]

- Nair, A. S., Nair, P., & Agrawal, A. (2024). Examining the synergy between enterprise risk management and internal auditing. New Challenges in Accounting and Finance, 12, 1–13. [Google Scholar] [CrossRef]

- Nkansa, P. (2024). Does external auditor coordination influence internal auditor effort? Advances in Accounting, 65, 100684. [Google Scholar] [CrossRef]

- North Carolina State University’s ERM Initiative and Protiviti. (2017). Executive perspectives on top risks 2018. North Carolina State University and Protiviti. [Google Scholar]

- Nuijten, A., Keil, M., Sarens, G., & Van Twist, M. (2019). Partners or opponents: Auditor-manager relationship dynamics following the deaf effect in information system projects. Managerial Auditing Journal, 34(9), 1073–1100. [Google Scholar] [CrossRef]

- Nuijten, A. L., Keil, M., & Zwiers, B. (2023). Internal auditors’ perceptions of information technology-related risks: A comparison between general auditors and information technology auditors. Journal of Information Systems, 37(1), 67–83. [Google Scholar] [CrossRef]

- Oxner, T. H., & Kusel, J. (1996). Trends in the job market. Internal Auditor, 53(3), 20–28. [Google Scholar]

- Petherbridge, J., & Messier, W. F., Jr. (2016). The impact of PCAOB regulatory actions and engagement risk on auditors’ internal audit reliance decisions. Journal of Accounting and Public Policy, 35(1), 3–18. [Google Scholar] [CrossRef]

- Pickett, K. S. (2010). The internal auditing handbook. John Wiley & Sons, Inc. [Google Scholar]

- Plumlee, R. D. (1985). The standard of objectivity for internal auditors: Memory and bias effects. Journal of Accounting Research, 23(2), 683–699. [Google Scholar] [CrossRef]

- Prawitt, D. F., Sharp, N. Y., & Wood, D. A. (2011). Reconciling archival and experimental research: Does internal audit contribution affect the external audit fee. Behavioral Research in Accounting, 23(2), 187–206. [Google Scholar] [CrossRef]

- Prawitt, D. F., Sharp, N. Y., & Wood, D. A. (2012). Internal audit outsourcing and the risk of misleading or fraudulent financial reporting: Did Sarbanes-Oxley get it wrong? Contemporary Accounting Research, 29(4), 1109–1136. [Google Scholar] [CrossRef]

- Prawitt, D. F., Smith, J. L., & Wood, D. A. (2009). Internal audit quality and earnings management. The Accounting Review, 84(4), 1255–1280. [Google Scholar] [CrossRef]

- PricewaterhouseCoopers (PwC). (2000). PricewaterhouseCoopers 2000 state of the internal audit profession study: Continuous auditing gains momentum. PricewaterhouseCoopers. [Google Scholar]

- Reeve, J. T. (1990). Internal audit in the year 2000. Internal Auditor, 47(1), 15–22. [Google Scholar]

- Ridley, A. J. (1997, June). The underutilized internal auditor. IIA Issues and Answers. Director’s Monthly. [Google Scholar]

- Rose, A. M., Rose, J. M., & Norman, C. S. (2013). Is the objectivity of internal audit compromised when the internal audit function is a management training ground? Accounting & Finance, 53(4), 1001–1019. [Google Scholar] [CrossRef]

- Roussy, M. (2015). Welcome to the day-to-day of internal auditors: How do they cope with conflicts? Auditing: A Journal of Practice & Theory, 34(2), 237–264. [Google Scholar] [CrossRef]

- Roussy, M., & Perron, A. (2018). New perspectives in internal audit research: A structured literature review. Accounting Perspectives, 17(3), 345–385. [Google Scholar] [CrossRef]

- Roussy, M., & Rodrigue, M. (2018). Internal audit: Is the ‘third line of defense’ effective as a form of governance? An exploratory study of the impression management techniques chief audit executives use in their annual accountability to the audit committee. Journal of Business Ethics, 151, 853–869. [Google Scholar] [CrossRef]

- Roychowdhury, S., & Srinivasan, S. (2019). The role of gatekeepers in capital markets. Journal of Accounting Research, 57(2), 295–322. [Google Scholar] [CrossRef]

- Sarens, G., & De Beelde, I. (2006a). Internal auditors’ perception about their role in risk management: A comparison between US and Belgian companies. Managerial Auditing Journal, 21(1), 63–80. [Google Scholar] [CrossRef]

- Sarens, G., & De Beelde, I. (2006b). The relationship between internal audit and senior management: A qualitative analysis of expectations and perceptions. International Journal of Auditing, 10(3), 219–241. [Google Scholar] [CrossRef]

- Sawyer, L. B. (1996). The practice of modern internal auditing (4th ed.). The Institute of Internal Auditors. [Google Scholar]

- Slapničar, S., Vuko, T., Čular, M., & Drašček, M. (2022). Effectiveness of cybersecurity audit. International Journal of Accounting Information Systems, 44, 100548. [Google Scholar] [CrossRef]

- Stefaniak, C. M., Houston, R. W., & Cornell, R. M. (2012). The effects of employer and client identification on internal and external auditors’ evaluations of internal control deficiencies. Auditing: A Journal of Practice & Theory, 31(1), 39–56. [Google Scholar] [CrossRef]

- Steinbart, P. J., Raschke, R. L., Gal, G., & Dilla, W. N. (2012). The relationship between internal audit and information security: An exploratory investigation. International Journal of Accounting Information Systems, 13(3), 228–243. [Google Scholar] [CrossRef]

- Steinbart, P. J., Raschke, R. L., Gal, G., & Dilla, W. N. (2013). Information security professionals’ perceptions about the relationship between the information security and internal audit functions. Journal of Information Systems, 27(2), 65–86. [Google Scholar] [CrossRef]

- Steinbart, P. J., Raschke, R. L., Gal, G., & Dilla, W. N. (2018). The influence of a good relationship between the internal audit and information security functions on information security outcomes. Accounting, Organizations and Society, 71, 15–29. [Google Scholar] [CrossRef]

- Stewart, J., & Subramaniam, N. (2010). Internal audit independence and objectivity: Emerging research opportunities. Managerial Auditing Journal, 25(4), 328–360. [Google Scholar] [CrossRef]

- Szabo, S., & Webster, J. (2021). Perceived greenwashing: The effects of green marketing on environmental and product perceptions. Journal of Business Ethics, 171(4), 719–739. [Google Scholar] [CrossRef]

- Tapestry Networks. (2004, July 6). The internal auditor’s perspective. InSights. [Google Scholar]

- Tawfik, O. I., Durrah, O., & Aljawhar, K. A. (2023). The role of the internal auditor in strengthening the governance of economic organizations using the three lines of defense model. Journal of Risk and Financial Management, 16(7), 341. [Google Scholar] [CrossRef]

- Trudell, C. (2014). Internal audit’s role in the risk assessment process at KeyCorp. Journal of Risk Management in Financial Institutions, 7(4), 370–374. [Google Scholar] [CrossRef]

- Walker, K., Brown-Liburd, H., & Lewis, A. (2019). The emergence of data analytics in auditing: Perspectives from internal and external auditors through the lens of institutional theory. Working paper. Virginia Tech and Rutgers University. [Google Scholar]

- Weidenmier, M. L., & Ramamoorti, S. (2006). Research opportunities in information technology and internal auditing. Journal of Information Systems, 20(1), 205–219. [Google Scholar] [CrossRef]

- Wood, D. J., & Wilson, J. A. (1989). Roles and relationships in internal auditing. The Institute of Internal Auditors Research Foundation. [Google Scholar]

| Panel A: Journal Citation Count by Category | |||||

| Journal | Abbreviation | Core IA Roles | Legitimate IA Roles | Prohibited Roles | Total |

| Accounting Horizons | AH | 3 | 4 | 3 | 10 |

| Accounting & Finance | A&F | - | 1 | 2 | 3 |

| Accounting, Auditing & Accountability Journal | AAAJ | - | - | 1 | 1 |

| Accounting, Organizations, and Society | AOS | 1 | 2 | 1 | 4 |

| Advances in Accounting | AIA | - | 1 | - | 1 |

| Auditing: A Journal of Practice & Theory | AJPT | 1 | 5 | 1 | 7 |

| Behavioral Research in Auditing | BRIA | - | 1 | - | 1 |

| Contemporary Accounting Research | CAR | 3 | - | - | 3 |

| Current Issues in Auditing | CIIA | 1 | - | - | 1 |

| International Journal of Accounting Information Systems | IJAIS | 2 | 2 | - | 4 |

| International Journal of Auditing | IJA | 2 | 2 | 1 | 5 |

| Journal of Accounting and Public Policy | JAPP | 1 | - | - | 1 |

| Journal of Accounting Research | JAR | - | 1 | - | 1 |

| Journal of Business Ethics | JBE | 1 | 2 | 1 | 4 |

| Journal of Emerging Technologies in Accounting | JETA | 3 | - | - | 3 |

| Journal of Information Systems | JIS | 2 | 4 | - | 6 |

| Journal of Risk and Financial Management | JRFM | 3 | - | - | 3 |

| Journal of Risk Management in Financial Institutions | JRMFI | 2 | - | - | 2 |

| Management Accounting Research | MAR | 1 | 1 | - | 2 |

| Managerial Auditing Journal | MAJ | 5 | 2 | 3 | 10 |

| New Challenges in Accounting and Finance | NCAF | - | - | 1 | 1 |

| Risk Management | RM | 1 | - | - | 1 |

| The Accounting Review | TAR | 2 | - | 1 | 3 |

| TOTAL | 34 | 28 | 15 | 77 | |

| Panel A reports paper counts by journal and ERM category based on the IIA’s 2009 framework (IIA, 2009). | |||||

| Panel B: Paper Count by Methodology and Category | |||||

| Methodology | Core IA Roles | Legitimate IA Roles | Prohibited Roles | Total | |

| Archival | 6 | - | - | 6 | |

| Case study | 3 | 2 | - | 5 | |

| Experimental | 7 | 9 | 5 | 20 | |

| Exploratory | 1 | - | - | 1 | |

| Mixed | 4 | 8 | 4 | 16 | |

| Qualitative | 1 | 5 | 1 | 7 | |

| Survey | 12 | 4 | 5 | 18 | |

| TOTAL | 34 | 28 | 15 | 77 | |

| Panel B reports paper counts by methodology and ERM category based on the IIA’s 2009 framework (IIA, 2009). Mixed and experimental methodologies also include surveys and qualitative approaches, where applicable. | |||||

| Panel A—Research Themes and Subthemes | |||||

Themes

| |||||

| Subthemes related to Judgment and Decision-Making Research in Auditing | |||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| Panel B—Research Summary | |||||

| ERM Activity—Risk Management Processes | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| Accountants’ Perceptions Regarding Fraud Detection and Prevention Methods | Bierstaker, Brody, and Pacini | Managerial Auditing Journal | 2006 | Survey | Firewalls, virus protection, password protection and internal control review were usually used to combat fraud. Specifically, using forensic accountants and digital analysis were used less than any other anti-fraud method but had the highest effectiveness ratings. |

| Research Opportunities in Information Technology and Internal Auditing | Weidenmier and Ramamoorti | Journal of Information Systems | 2006 | Exploratory | The IAF should be more involved in organizations’ security and privacy activities. |

| Internal Audit Sourcing Arrangement and the External Auditor’s Reliance Decision | Glover, Prawitt, and Wood | Contemporary Accounting Research | 2008 | Experimental | External auditors are more likely to rely on the work of outsourced rather than in-house internal auditors when inherent risk is high. Further, external auditors rely more on internal auditors’ work for objective tasks when inherent risk is high than subjective tasks. |

| Internal Audit Outsourcing and the Risk of Misleading or Fraudulent Financial Reporting: Did Sarbanes-Oxley Get It Wrong? | Prawitt, Sharp, and Wood | Contemporary Accounting Research | 2012 | Mixed | Companies that outsourced a portion of their IAF to external auditors were associated with lower accounting risk compared to companies that did not outsource their IAF. |

| The Effects of Employer and Client Identification on Internal and External Auditors’ Evaluations of Internal Control Deficiencies | Stefaniak, Houston, and Cornell | Auditing: A Journal of Practice & Theory | 2012 | Experimental | Internal auditors are less lenient than external auditors when evaluating internal control deficiencies. For example, internal auditors are more likely to support management’s preferred position to a lesser extent. |

| Information Security Professionals’ Perceptions about the Relationship between the Information Security and Internal Audit Functions | Steinbart, Raschke, Gal, and Dilla | Journal of Information Systems | 2013 | Qualitative | Information security professionals’ (ISP) perceptions about internal auditors’ technical expertise and the scope of internal auditors’ review of information security are positively associated with ISP assessment. |

| Internal Control Deficiencies in Tax Reporting: A Detailed View | Graham and Bedard | Accounting Horizons | 2015 | Archival | Internal control deficiencies in tax reporting are less likely to be remedied between discovery and fiscal year-end. They are more likely to be severe and to have caused a financial misstatement. |

| The Role of Account Subjectivity and Risk of Material Misstatement on Auditors’ Internal Audit Reliance Judgments | Bhattacharjee, Maletta, and Moreno | Accounting Horizons | 2016 | Experimental | There is a positive (negative) relationship between internal audit reliance and account subjectivity when misstatement risk is moderate (high). |

| The Impact of PCAOB Regulatory Actions and Engagement Risk on Auditors’ Internal Audit Reliance Decisions | Petherbridge and Messier | Journal of Accounting and Public Policy | 2016 | Experimental | When PCAOB inspections focus on both effectiveness and efficiency, external auditors’ reliance on the IAF is not influenced by engagement risk. However, when PCAOB inspections focus solely on effectiveness, the external auditors are more likely to rely more on the IAF when engagement risk is low compared to when engagement risk is high. |

| Exploring the Association between the Content of Internal Audit Disclosures and External Audit Fees: Evidence from Sweden | Axén | International Journal of Auditing | 2018 | Archival | The use of an IAF for companies that disclose firm-specific information related to internal audit pay lower external audit fees than companies that do not provide firm-specific internal audit disclosures. |

| The Influence of a Good Relationship between the Internal Audit and Information Security Functions on Information Security Outcomes | Steinbart, Raschke, Gal and Dilla | Accounting, Organizations and Society | 2018 | Survey | The quality of the relationship between the IAF and information security functions is positively related to reporting internal control weaknesses, reporting incidents of noncompliance, and information security incidents detections. |

| Factors that Influence the Internal Audit Function’s Maturity | D’Onza, Sarens and DeSimone | Accounting Horizons | 2020 | Survey | Organizations’ risk management maturity is positively associated with IAF maturity. |

| Effectiveness of Cybersecurity Audit | Slapničar, Vuko, Čular and Drašček | International Journal of Accounting Information Systems | 2022 | Survey | Cybersecurity risk management (including IAF audit engagements) is positively associated with cybersecurity audit effectiveness. |

| Designing a Characteristics Effectiveness Model for Internal Audit | S. Grima, Baldacchino, S. Grima, Kizilkaya, Tabone and Ellul | Journal of Risk and Financial Management | 2023 | Mixed | There is a positive relationship between the IAF incorporating risk management into the internal audit approach and internal audit effectiveness. |

| The Role of the Internal Auditor in Strengthening the Governance of Economic Organizations Using the Three Lines of Defense Model | Tawfik, Durrah and Aljawhar | Journal of Risk and Financial Management | 2023 | Survey | There is a positive association between the IAF, its assurance of risk management effectiveness and strengthening companies’ corporate governance. |

| The Perceived Relationship between Risk Culture and Operational Risk Management Practices of Ghanaian Banks | Grebe and Marx | Journal of Risk and Financial Management | 2023 | Survey | There is a significant relationship between banks’ risk culture and the IAF’s assessment of the effectiveness and efficiency of operational risk management. |

| The Effect of the Internal Audit Function’s Perceived Assurance vs. Advisory Purpose on the External Auditor’s Reliance Decision | Barr-Pulliam, Eulerich, and Ratzinger-Sakel | Managerial Auditing Journal | 2024 | Experiment | When the IAF is viewed as assurance-oriented, external auditors are more likely to rely on its work. When the IAF is perceived as advisory-oriented, external auditors reduce reliance due to concerns about independence and objectivity. |

| ERM Activity—Management of Key Risks | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| Internal Audit Quality and Earnings Management | Prawitt, Smith, and Wood | The Accounting Review | 2009 | Archival | There is a moderate relationship between IAF quality and earnings management. The authors measure IAF by experience, certification, objectivity, time on financial audits, training and size. |

| The Antecedents of the Use of Continuous Auditing in the Internal Auditing Context | Gonzalez, Sharma and Galletta | International Journal of Accounting Information Systems | 2012 | Experimental | A survey of 210 global internal auditors suggests that internal auditors’ perceptions of effort expectancy and social influence drive intent to use continuous auditing. |

| Internal Audit’s Role in the Risk Assessment Process at KeyCorp | Trudell | Journal of Risk Management in Financial Institutions | 2014 | Case study | The study provides an example of the IAF’s use of a company’s governance, risk and compliance software to implement three lines of defense risk convergence for risk assessments. |

| Does Internal Audit Function Quality Deter Management Misconduct? | Ege | The Accounting Review | 2015 | Archival | The relationship between IAF quality and the likelihood of management misconduct is negative. |

| The Association between CEO Characteristics, Internal Audit Quality and Risk-Management Implementation in the Public Sector | Ludin, Mohamed and Mohd-Saleh | Risk Management | 2017 | Survey | Internal audit quality moderates the relationship between CEOs’ locus of control and the implementation of risk management in public sector organizations. |

| Effective Association between Audit Committees and the Internal Audit Function and its Impact on Financial Reporting Quality: Empirical Evidence from Omani Listed Firms | Gebrayel, Jarrar, Salloum and Lefebvre | International Journal of Auditing | 2018 | Archival | An IAF presence is positively associated with companies’ financial reporting quality. |

| Factors Associated with Security/ Cybersecurity Audit by Internal Audit Function: An International Study | Islam, Farah and Stafford | Managerial Auditing Journal | 2018 | Survey | The IAF’s comprehensive risk assessment is positively related to security/cybersecurity audits. |

| Factors Affecting the Voluntary Use of Internal Audit: Evidence from the UK | Ismael and Roberts | Managerial Auditing Journal | 2018 | Archival | There is a significant relationship between IAF existence and companies’ level of internal risks. |

| A Framework for Legacy Source Code Audit Analytics | Moffitt | Journal of Emerging Technologies in Accounting | 2018 | Case study | Provides an audit analytic tool that helps internal auditors uncover malicious software code that affects organizational risk. |

| The Effect of Continuous Auditing and Role Duality on the Incidence and Likelihood of Reporting Management Opportunism | Barr-Pulliam | Management Accounting Research | 2019 | Experimental | Managers are less likely to manipulate earnings when the IAF uses continuous auditing. |

| Continuous Audit Implementation at Cia. Hering in Brazil | Codesso, Freitas, Wang, de Carvalho and de Silva Filho | Journal of Emerging Technologies in Accounting | 2020 | Case study | Internal auditors use continuous auditing to provide continuous control monitoring and continuous data assurance that decreases tax compliance risk. |

| Continuous Auditing and Risk-Based Audit Planning—An Empirical Analysis | Eulerich, Georgi and Schmidt | Journal of Emerging Technologies in Accounting | 2020 | Survey | Data analytics has a favorable influence on the use of continuous auditing information in the IAF’s risk-based audit planning. |

| An Examination of Internal Audit Function Size: Evidence from U.S. Government and Nonprofit Sectors | Garven and Scarlata | Current Issues in Auditing | 2021 | Survey | There is a positive relationship between IAF size and the extent of use of sophisticated audit technologies in a governmental and nonprofit setting. |

| Factors Associated with the Adoption of Data Analytics by Internal Audit Function | Islam and Stafford | Managerial Auditing Journal | 2022 | Mixed | Factors that are associated with the IAF’s adoption of data analytics are: data-specific information technology knowledge, critical thinking skills, CAE business knowledge, fraud detection responsibility and technologically advanced cultures. |

| Dark Triad Managerial Personality and Financial Reporting Manipulation | Mutschmann, Hasso and Pelster | Journal of Business Ethics | 2022 | Survey | Outsourced internal audits reduce the financial reporting manipulation of managers who possess dark triad personality traits which positively affects financial reporting quality. |

| The Impact of Audit Technology on Audit Task Outcomes: Evidence for Technology-Based Audit Techniques | Eulerich, Masli, Pickerd and Wood | Contemporary Accounting Research | 2023 | Mixed | Internal auditors utilize technology-based audit techniques to identify more significant audit risk factors. |

| Panel C—Future Research Directions | |||||

| The IAF Collaboration with Management | |||||

| |||||

| Information Technology | |||||

| |||||

| Reporting | |||||

| |||||

| Panel A—Research Themes and Subthemes | |||||

Themes

| |||||

| Subthemes related to Judgment and Decision-Making Research in Auditing | |||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| Panel B—Research Summary | |||||

| ERM Activity—Facilitating Identification and Evaluation of Risks | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| An Examination of Internal Auditor Objectivity: In-house versus Outsourcing | Ahlawat and Lowe | Auditing: A Journal of Practice & Theory | 2004 | Experimental | Significant advocacy exists in in-house and outsourced internal auditors’ judgements. |

| Internal Auditors’ Fraud Judgments: The Benefits of Brainstorming in Groups | Carpenter, Reimers, and Fretwell | Auditing: A Journal of Practice & Theory | 2011 | Experimental | Internal auditors who brainstorm in groups identify more quality fraud risks. |

| Serving Two Masters: The Association Between Audit Committee Internal Audit Oversight and Internal Audit Activities | Abbott, Parker, and Peters | Accounting Horizons | 2010 | Mixed | This study suggests the idea of internal auditors assisting external auditors in identifying financial statement risk. |

| Corporate Managers’ Reliance on Internal Auditor Recommendations | Burton, Emmett, Simon, and Wood | Auditing: A Journal of Practice & Theory | 2012 | Experimental | Managers are more likely to rely on the preference-inconsistent recommendations of in-house internal auditors. |

| The Effects of Internal Audit Report Type and Reporting Relationship on Internal Auditors’ Risk Judgments | Boyle, DeZoort, and Harrison | Accounting Horizons | 2015 | Experimental | Internal auditors report higher fraud risk assessments in an internal audit report and to the audit committee. |

| The Reliance of External Auditors on Internal Audit’s Use of Continuous Audit | Malaescu and Sutton | Journal of Information Systems | 2015 | Experimental | External auditors are willing to rely more on internal audit work in a continuous audit environment. |

| The Effect of Frequency and Automation of Internal Control Testing on External Auditor Reliance on the IAF | Frakas and Hirsch | Journal of Information Systems | 2016 | Experimental | External auditors perceive IAF’s failure to detect a significant deficiency as poor work performance. |

| Do Organizations Use a Formalized Risk Management Process to Address Social Media Risk? | Demek, Raschke, Janvrin and Dilla | International Journal of Accounting Information Systems | 2018 | Survey | Social media risk management is influenced by organizations’ social media use, the perceived risk of use, social media policy implementation, and social media training and technical controls. |

| Understanding Auditors’ Sense of Responsibility for Detecting Fraud Within Organizations | DeZoort and Harrison | Journal of Business Ethics | 2018 | Experimental | Accountable internal auditors report higher responsibility for fraud detection. |

| Internal Auditors’ Perceptions of Information Technology-Related Risks: A Comparison Between General Auditors and Information Technology Auditors | Nuijten, Keil and Zweirs | Journal of Information Systems | 2023 | Experimental | Poor risk management results in IT failures. |

| Does External Auditor Coordination Influence Internal Auditor Effort? | Nkansa | Advances in Accounting | 2024 | Survey | The levels of external auditor coordination and fraud risk affect internal auditor effort. |

| ERM Activity—Coordinating ERM Activities | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| Welcome to the Day-to-Day of Internal Auditors: How Do They Cope with Conflicts? | Roussy | Auditing: A Journal of Practice & Theory | 2015 | Qualitative | Internal auditors experience role conflicts. |

| Coordination Challenges in Implementing the Three Lines of Defense Model | Bantleon, d’Arcy, Eulerich, Hucke, Pedell and Ratzinger-Sakel | International Journal of Auditing | 2021 | Survey | Companies that do not have three lines of defense implementation challenges are those where: (1) the IAF has a good relationship with chief executives and the supervisory board and (2) the IAF has an increased focus on assurance activities. |

| ERM Activity—Consolidated Reporting on Risks | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| Factors Associated with U.S. Public Companies’ Investment in Internal Auditing | Carcello, Hermanson, and Raghunandan | Accounting Horizons | 2005 | Mixed | Total internal audit budgets are related to several company factors. |

| Internal Audit, Alternative Internal Audit Structures and the Level of Misappropriation of Assets Fraud | Coram, Ferguson, and Moroney | Accounting & Finance | 2008 | Mixed | Organizations with IAFs are more likely to detect and self-report fraud. |

| Serving Two Masters: The Association Between Audit Committee Internal Audit Oversight and Internal Audit Activities | Abbott, Parker, and Peters | Accounting Horizons | 2010 | Mixed | There is a positive relationship between audit committee oversight and the IAF budget. |

| Reconciling Archival and Experimental Research: Does Internal Audit Contribution Affect the External Audit Fee | Prawitt, Sharp, and Wood | Behavioral Research in Auditing | 2011 | Mixed | There is a negative relationship between archival proxies for internal audit contribution and external audit fees. |

| Internal Audit Assistance and External Audit Timeliness | Abbott, Parker, and Peters | Auditing: A Journal of Practice & Theory | 2012 | Mixed | Internal audit assistance may result in audit cost savings and greater audit efficiency. |

| The Relationship Between Internal Audit and Information Security: An Exploratory Investigation | Steinbart, Raschke, Gal, and Dilla | International Journal of Accounting Information Systems | 2012 | Qualitative | A good relationship between internal auditors and information systems professionals is perceived to improve risk management. |

| The Internal Audit Function in Information Technology Governance: A Holistic Perspective | Héroux and Fortin | Journal of Information Systems | 2013 | Survey | Internal audit involvement in IT governance is still evolving. |

| Rotational Internal Audit Programs and Financial Reporting Quality: Do Compensating Controls Help? | Christ, Masli, Sharp, and Wood | Accounting, Organizations and Society | 2015 | Mixed | The rotation of internal auditors may harm the IAF’s ability to monitor financial reporting quality. |

| Internal Audit Quality and Financial Reporting Quality: The Joint Importance of Independence and Competence | Abbott, Daugherty, Parker, and Peters | Journal of Accounting Research | 2016 | Mixed | The presence of competence and independence is essential for effective IAF monitoring of financial reporting. |

| Internal Audit: Is the ‘Third Line of Defense’ Effective as a Form of Governance? An Exploratory Study of the Impression Management Techniques Chief Audit Executives Use in Their Annual Accountability to the Audit Committee | Roussy and Rodrigue | Journal of Business Ethics | 2018 | Qualitative | CAEs use impression management techniques in annual accountability reports (about IT systems risks) to the audit committee. |

| The Effect of Continuous Auditing and Role Duality on the Incidence and Likelihood of Reporting Management Opportunism | Barr-Pulliam | Management Accounting Research | 2019 | Experimental | Internal auditors perceive that earnings manipulation is less likely to occur when the IAF uses continuous auditing. |

| Partners or Opponents Auditor-Manager Relationship Dynamics following the Deaf Effect in Information System Projects | Nuijten, Keil, Sarens and van Twist | Managerial Auditing Journal | 2019 | Case study | When internal auditors report risks for risk monitoring systems and risk governance systems to managers, the internal auditors experience the deaf effect from the managers. |

| ERM Activity—Maintaining and Developing the ERM Framework | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| Internal Auditors’ Perception about Their Role in Risk Management: A Comparison Between US and Belgian Companies | Sarens and De Beelde | Managerial Auditing Journal | 2006a | Qualitative | Internal auditors’ consulting role in risk management focuses on transparency and documentation. |

| The Relationship Between Internal Audit and Senior Management: A Qualitative Analysis of Expectations and Perceptions | Sarens and De Beelde | International Journal of Auditing | 2006b | Qualitative | Internal auditors are aware of their pioneering role in formalizing risk management. |

| Recoupling Work Beyond COSO: A Longitudinal Case Study of Enterprise-wide Risk Management | Jemaa | Accounting, Organizations and Society | 2022 | Case study | Internal auditors’ introduction of ERM through risk mapping leads to organizational inefficiency and internal auditors suggest improving the risk management system. |

| Panel C—Future Research Directions | |||||

| Coaching Management in Responding to Risks | |||||

| |||||

| Championing Establishment of ERM | |||||

| |||||

| Developing Risk Management (RM) Strategy for Board Approval | |||||

| |||||

| Panel A—Research Themes and Subthemes | |||||

Themes

| |||||

| Subthemes related to Judgment and Decision-Making Research in Auditing | |||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| |||||

| Panel B—Research Summary | |||||

| Internal Audit’s General Involvement in ERM | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| Intentions to Report Questionable Acts: An Examination of the Influence of Anonymous Reporting Channel, Internal Audit Quality, and Setting | Kaplan and Schultz | Journal of Business Ethics | 2007 | Experimental | IAF quality does not affect the likelihood of reporting fraud to non-anonymous channels. |

| Internal Audit Involvement in Enterprise Risk Management | de Zwaan, Stewart, and Subramaniam | Managerial Auditing Journal | 2011 | Experimental | High involvement in ERM impacts the perceptions of internal auditors’ willingness to report a breakdown in risk procedures to the audit committee, whereas a strong relationship with the audit committee does not. Lastly, some IAFs engage in ERM activity that could compromise objectivity. |

| Examining the Synergy Between Enterprise Risk Management and Internal Audit Functions | A. Nair, P. Nair, and Agrawal | New Challenges in Accounting and Finance | 2024 | Survey | When internal audit is restricted to an advisory role, internal auditors’ involvement in ERM does not threaten their independence or objectivity. |

| The Internal Audit Function’s Dual Role, Assurance and Consulting Related to ERM | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| An Assessment of the Newly Defined Internal Audit Function | Nagy and Cenker | Managerial Auditing Journal | 2007 | Qualitative | 11 IAF directors describe vast differences in viewpoints and objectives. However, a theme among them is that there has been a definite shift in the overall scope of internal audit towards operational activities. |

| Commitment to Independence by Internal Auditors: The Effects of Role Ambiguity and Role Conflict | Ahmad and Taylor | Managerial Auditing Journal | 2009 | Survey | Internal audit commitment to independence is affected by: (1) ambiguity in the exercise of authority by the IAF and time pressure and (2) conflict between internal auditors’ values and expectations from management and their profession. |

| External Auditors’ Reliance on Internal Audit: The Impact of Sourcing Arrangements and Consulting Activities | Munro and Stewart | Accounting & Finance | 2010 | Experimental | Involvement in consulting impacts reliance on work already undertaken and the use of internal auditors as assistants for control evaluation. |

| Use of the Internal Audit Function as a Management Training Ground, Implications for ERM | |||||

| Title | Author(s) | Publication | Year | Methodology | Main Findings |

| A Critical Analysis of the Independence of the Internal Audit Function: Evidence from Australia | Christopher, Sarens, and Leung | Accounting, Auditing & Accountability Journal | 2009 | Survey | The threats to IAF independence from management include: using the IAF as an MTG, having the CEO or CFO approve the IAF budget and audit plan, and considering the IAF as a “partner.” The threats to IAF independence from the audit committee include: CAEs not reporting functionally to the audit committee; the audit committee not having sole responsibility for appointing, dismissing and evaluating the CAE; and not having all or at least one accounting expert on the audit committee. |

| Serving Two Masters: The Association Between Audit Committee Internal Audit Oversight and Internal Audit Activities | Abbott, Parker, and Peters | Accounting Horizons | 2010 | Mixed | There is a strong, positive association between a measure of audit committee oversight and the amount of IAF budget allocated to internal-controls-based activities. |

| The Effect of Using the Internal Audit Function as a Management Training Ground on the External Auditor’s Reliance Decision | Messier, Reynolds, Simon, and Wood | The Accounting Review | 2011 | Mixed | The study uses archival data, which suggests that external auditors charge higher fees to companies that use the IAF as an MTG. The study conducts an experiment, and findings suggest that external auditors perceive internal auditors employed in an IAF that is an MTG to be less objective but not less competent than internal auditors employed in an IAF not used as an MTG. |

| Is the Objectivity of Internal Audit Compromised When the Internal Audit Function is a Management Training Ground? | A. Rose, J. Rose, and Norman | Accounting & Finance | 2013 | Experimental | Internal auditors are less objective in an MTG versus a non-MTG. Further, empowering the audit committee further decreases the objectivity of internal auditors because the board’s power can have unintended consequences on internal auditors’ behavior. |

| The Effects of Using the Internal Audit Function as a Management Training Ground or as a Consulting Services Provider in Enhancing the Recruitment of Internal Auditors | Burton, Starliper, Summers, and Wood | Accounting Horizons | 2015 | Survey | Job applicants with business experience are less likely to apply for IA positions. Interest increases when the position advertises the combination of (1) participation in an MTG and (2) work mostly related to consulting services rather than assurance services. Participants in the study believe that other business professionals have negative stereotypes of internal audit. |

| Rotational Internal Audit Programs and Financial Reporting Quality: Do Compensating Controls Help? | Christ, Masli, Sharp, and Wood | Accounting, Organizations and Society | 2015 | Mixed | Companies using the IAF as an MTG have significantly lower financial reporting quality than companies that do not. However, compensating controls such as consistency of IAF leadership or supervision, audit committee oversight, and management oversight and direction can reduce this adverse financial reporting effect. |

| The Value to Management of Using the Internal Audit Function as a Management Training Ground | Carcello, Eulerich, Masli, and Wood | Accounting Horizons | 2018 | Mixed | Surveys of 355 CAEs who perceive senior management to be more likely to use recommendations from MTG internal auditors than non-MTG internal auditors. Experimental results suggest this greater reliance is due to perceptions that MTG internal auditors have more natural ability. |

| An Experimental Investigation of the Interaction Effect of Management Training Ground and Reporting Lines on Internal Auditors’ Objectivity | Hoos, Messier, Smith, and Tandy | International Journal of Auditing | 2018 | Experimental | The study suggests (1) when the IAF is not (is) an MTG, IAs’ risks assessments are not different by reporting line (align with management’s preferences); (2) when the IAF is a MTG, internal auditors provide investment recommendations consistent with management’s preferences; (3) internal auditors provide more favorable recommendations to the audit committee than to management. |

| Are Internal Audits Associated with Reductions in Perceived Risk? | Carcello, Eulerich, Masli and Wood | Auditing: A Journal of Practice & Theory | 2020 | Survey | Companies that are used as MTGs are associated with larger reductions in risk and more advanced operating performance. |

| Panel C—Future Research Directions | |||||

| Inter- and Intra-Personal Implications of a MTG | |||||

| |||||

| Firm Benefits | |||||

| |||||

| Category/Area | Examples of Internal Audit Activities | Recommended Practical Actions for Practitioners |

|---|---|---|

| ERM—Value-enhancing/Good Practice |

|

|

| ERM—Independence Risks/Caution Areas |

|

|

| ESG—Environmental (E) |

|

|

| ESG—Social (S) |

|

|

| ESG—Governance (G) |

|

|

| ESG—Cross-Cutting Integration |

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nkansa, P.; Barr-Pulliam, D.; Walker, K. From Compliance to Strategic Partnerships: The Role of Internal Audit in Enterprise Risk Management and Opportunities for Future Research. J. Risk Financial Manag. 2025, 18, 707. https://doi.org/10.3390/jrfm18120707

Nkansa P, Barr-Pulliam D, Walker K. From Compliance to Strategic Partnerships: The Role of Internal Audit in Enterprise Risk Management and Opportunities for Future Research. Journal of Risk and Financial Management. 2025; 18(12):707. https://doi.org/10.3390/jrfm18120707

Chicago/Turabian StyleNkansa, Porschia, Dereck Barr-Pulliam, and Kimberly Walker. 2025. "From Compliance to Strategic Partnerships: The Role of Internal Audit in Enterprise Risk Management and Opportunities for Future Research" Journal of Risk and Financial Management 18, no. 12: 707. https://doi.org/10.3390/jrfm18120707

APA StyleNkansa, P., Barr-Pulliam, D., & Walker, K. (2025). From Compliance to Strategic Partnerships: The Role of Internal Audit in Enterprise Risk Management and Opportunities for Future Research. Journal of Risk and Financial Management, 18(12), 707. https://doi.org/10.3390/jrfm18120707