Perspectives on Audit Opinions and Key Audit Matters in the Global Airline Industry and the COVID-19 Pandemic

Abstract

1. Introduction

- (1)

- The airline industry started to operate at a low capacity as of 28 October 2020, compared to 2019. For instance, departure/arrival traffic in Norway, Turkey, France, Germany, and Italy declined by 39%, 52%, 55%, 62%, and 64%, respectively (Dube et al., 2021).

- (2)

- Revenue generation in the airline industry was negatively affected. For instance, the realized revenue in Europe was as much as 88% lower than the expected revenue in April 2020, and as of June 2020, in Europe, the realized revenue was less than 20% of the expected revenue (Dube et al., 2021).

- (3)

- Airlines considered restructuring and resizing to prevent cash burns (Dube et al., 2021). In this context, job layoffs, and the retiring of old and large aircraft were considered to increase operational efficiency in the most cost-effective way. For instance, British Airways retired its 31 Boeing B747-400 models in mid-July 2020, four years earlier than the planned retirement date of 2024.

- (4)

- Mass grounding of aircraft occurred (Dube et al., 2021), and this was mostly observed from March 2020 to June 2020. To find space to park aircrafts at airports became difficult, and this mass grounding led to increased parking fees, mandatory maintenance expenses, and a significant loss of revenue for airlines.

- (5)

- Several rescue packages for the aviation industry were announced by governments, amounting to USD 123.1 billion in the global context (Dube et al., 2021). These packages include loans, equity financing, ticket taxes, corporate taxes, and fuel taxes. However, 55% of government aid—USD 67 billion out of USD 123.1 billion—consisted of loans, leading to the accumulation of additional debt in the industry. Therefore, the industry’s huge debt structure increased.

2. Literature Review

2.1. Literature Review on Audit Opinion and the COVID-19 Pandemic in General

2.2. Literature Review on KAMs and the COVID-19 Pandemic in General

2.3. Literature Review on Audit Opinion, KAMs, and the COVID-19 Pandemic in the Airline Industry

3. Methodology

3.1. Research Sample

3.2. Research Period

3.3. Research Objective

3.4. Research Methodology

4. Results

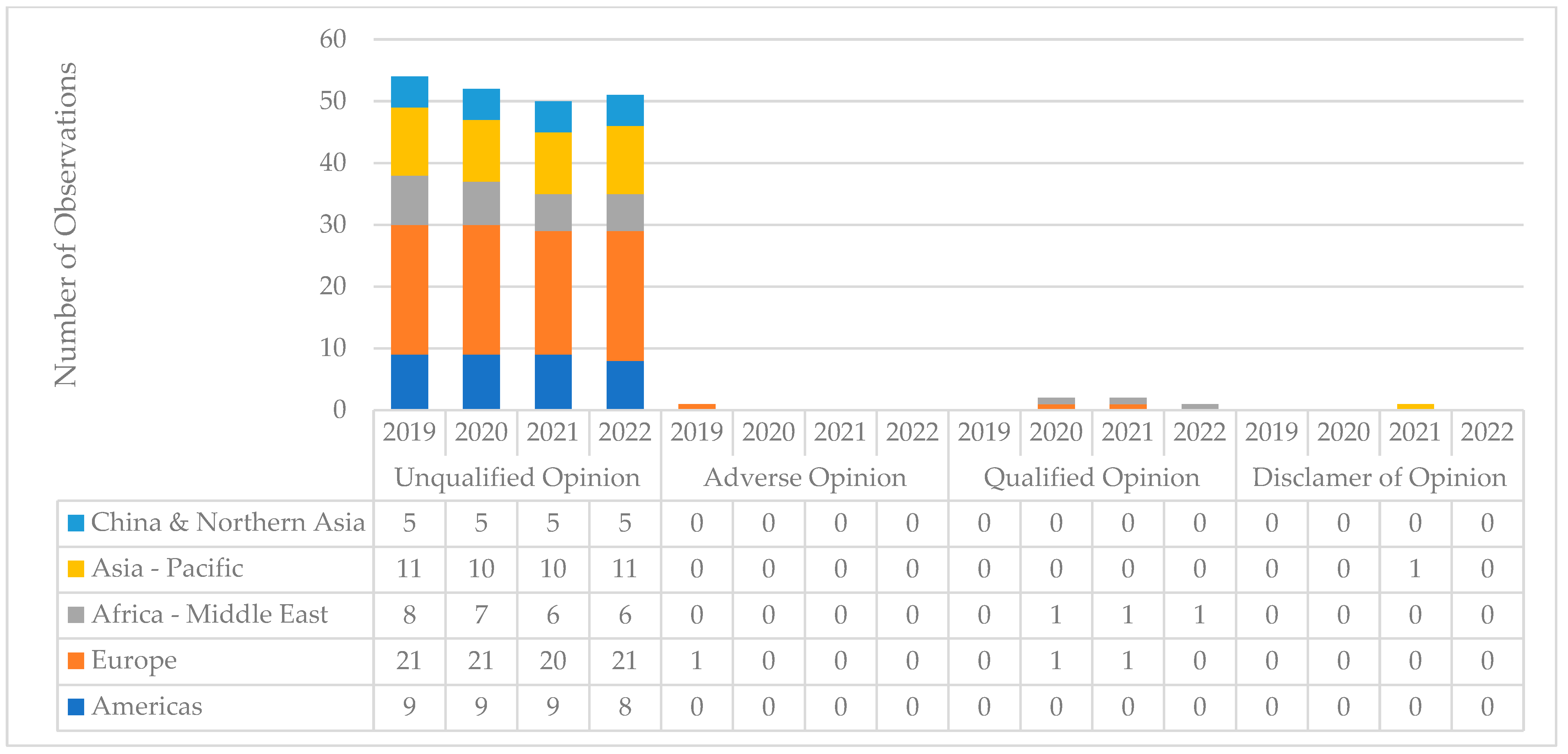

4.1. Audit Opinions in Airline Audit Reports

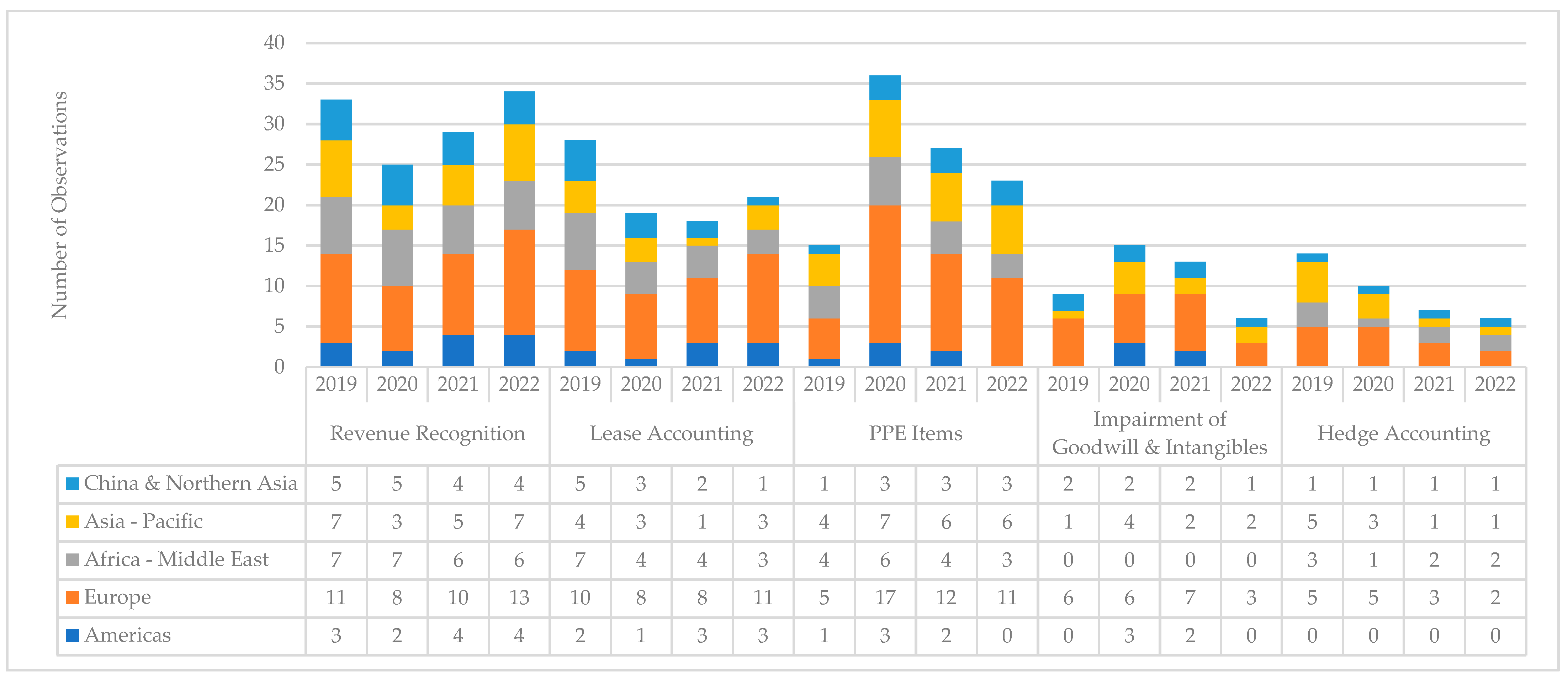

4.2. Analysis of Main KAMs in Airline Audit Reports

4.2.1. Main KAMs in Airline Audit Reports in the Pre-COVID-19 Pandemic Period

4.2.2. Main KAMs in Airline Audit Reports During the COVID-19 Pandemic

4.2.3. Main KAMs in Airline Audit Reports in Post-COVID-19 Pandemic Period

4.2.4. Overall Analysis of Main KAMs in Airline Audit Reports

4.3. Subject-Specific Content Analysis of Main KAMs

4.3.1. Revenue Recognition

4.3.2. Lease Accounting

4.3.3. PPE Items

4.3.4. Hedge Accounting

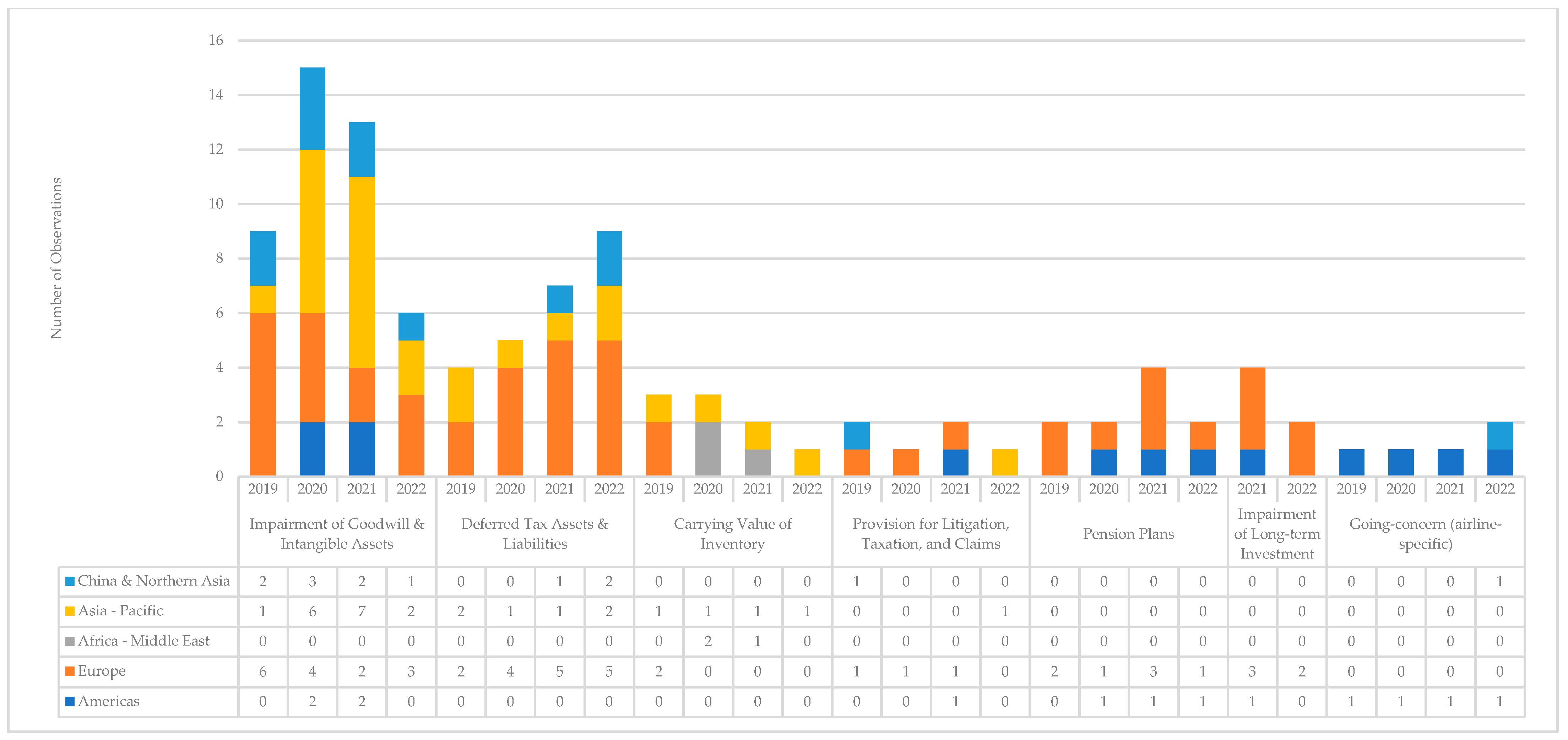

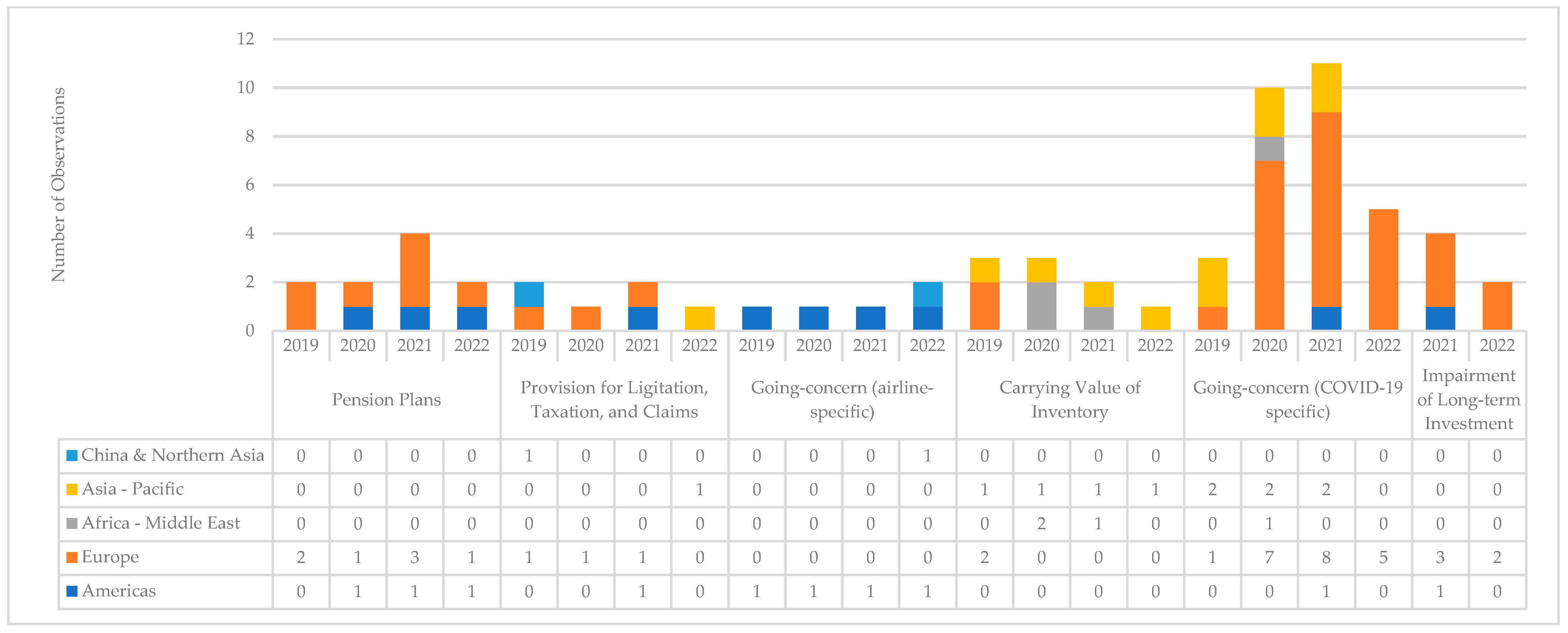

4.4. Rare KAMs in the Airline Industry

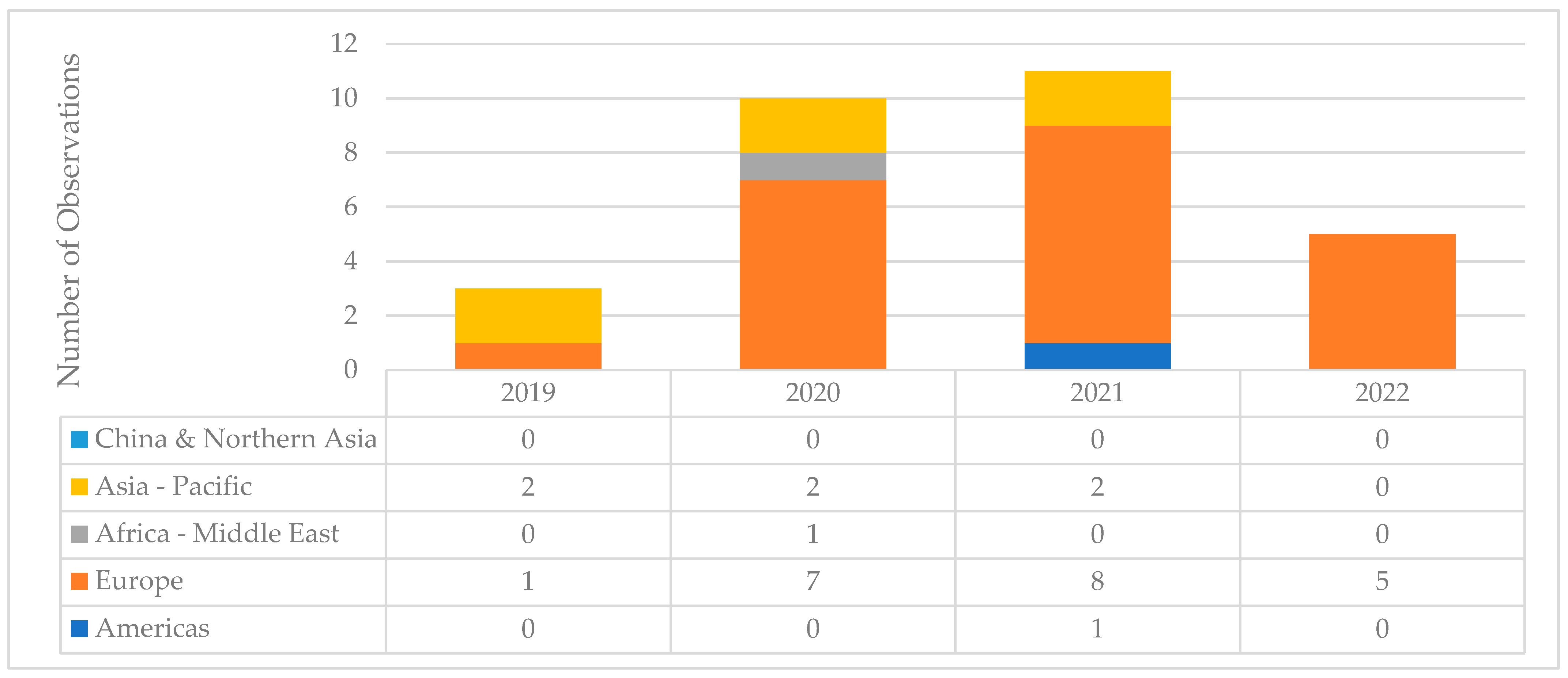

4.5. Very Rare KAMs in the Airline Industry

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Air Asia X Berhad. (2021). 2020/2021 annual report. Available online: https://www.airasiax.com/misc/ar/ar2021.pdf (accessed on 10 January 2025).

- Albitar, K., Gerged, A. M., Kikhia, H., & Hussainey, K. (2020). Auditing in times of social distancing: The effect of COVID-19 on auditing quality. International Journal of Accounting and Information Management, 29(1), 169–178. [Google Scholar] [CrossRef]

- Alharasis, E. E., Alkhwaldi, A. F., & Hussainey, K. (2024). Key audit matters and auditing quality in the era of COVID-19 pandemic: The case of Jordan. International Journal of Law and Management, 66(4), 417–446. [Google Scholar] [CrossRef]

- Alshdaifat, S. M., Abdul-Hamid, M. A., Alhadab, M., Saidin, S. F., & Ab Aziz, N. H. (2025). Key audit matters and earnings management practice pre and during COVID-19: Evidence from Jordan. Asian Journal of Accounting Research, 10(3), 277–293. [Google Scholar] [CrossRef]

- Brown, R. S., & Kline, W. A. (2020). Exogenous shocks and managerial preparedness: A study of US airlines’ environmental scanning before the onset of the COVID-19 pandemic. Journal of Air Transport Management, 89, 101899. [Google Scholar] [CrossRef]

- Çelik, D. S. (2017). Havayolu taşımacılığı endüstrisi ve ekonomik etkileri. The Journal of International Scientific Researches, 2(8), 82–89. [Google Scholar]

- Deb, R., & Chakraborty, S. (2020). COVID-19: Potential financial auditing challenges and turnaround strategies. Available online: https://www.researchgate.net/publication/342513901_COVID-19-Potential_Financial_Auditing_Challenges (accessed on 9 November 2025).

- Diab, A. A. (2021). The implications of the COVID-19 pandemic for the auditing and assurance processes. Journal of Legal, Ethical and Regulatory Issues, 24, 1–8. [Google Scholar]

- Dube, K., Nhamo, G., & Chikodzi, D. (2021). COVID-19 pandemic and prospects for recovery of the global aviation industry. Journal of Air Transport Management, 92, 102022. [Google Scholar] [CrossRef]

- Ecim, D., Maroun, W., & Duboisee de Ricquebourg, A. (2023). An analysis of key audit matter disclosures in South African audit reports from 2017 to 2020. South African Journal of Business Management, 54(1), a3669. [Google Scholar] [CrossRef]

- Fastjet. (2019). Fastjet plc and its subsidiary undertakings annual report and financial statements for the year ended 31 December 2019. Available online: https://www.fastjet.com/app/uploads/2022/11/fastjet-Annual-Report-and-Financial-Statements-2019.pdf (accessed on 10 January 2025).

- Fastjet. (2020). Fastjet plc and its subsidiary undertakings annual report and financial statements for the year ended 31 December 2020. Available online: https://www.fastjet.com/app/uploads/2022/11/fastjet-Annual-Report-and-Financial-Statements-2020.pdf (accessed on 10 January 2025).

- Fastjet. (2021). Fastjet plc and its subsidiary undertakings annual report and financial statements for the year ended 31 December 2021. Available online: https://www.fastjet.com/app/uploads/2022/11/fastjet-Annual-Report-and-Financial-Statements-2021.pdf (accessed on 10 January 2025).

- FRC. (2022). ISA 200 Overall objectives of the independent auditor and the conduct of an audit in accordance with international standards on auditing (UK). Available online: https://media.frc.org.uk/documents/ISA_UK_200_Updated_May_2022_V8vTA3V.pdf (accessed on 10 January 2025).

- Hategan, C. D., Pitorac, R. I., & Crucean, A. C. (2022). Impact of COVID-19 pandemic on auditors’ responsibility: Evidence from European listed companies on key audit matters. Managerial Auditing Journal, 37(7), 886–907. [Google Scholar] [CrossRef]

- Hay, D., Shires, K., & Van Dyk, D. (2021). Auditing in the time of COVID–the impact of COVID-19 on auditing in New Zealand and subsequent reforms. Pacific Accounting Review, 33(2), 179–188. [Google Scholar] [CrossRef]

- Hegazy, M. A. A., El-Haddad, R., & Kamareldawla, N. M. (2022). Impact of auditor characteristics and COVID-19 Pandemic on KAMs reporting. Managerial Auditing Journal, 37(7), 908–933. [Google Scholar] [CrossRef]

- IAASB. (2015a). ISA 700 (Revised) Forming an opinion and reporting on financial statements. Available online: https://www.iaasb.org/publications/international-standard-auditing-isa-700-revised-forming-opinion-and-reporting-financial-statements (accessed on 22 January 2025).

- IAASB. (2015b). ISA 705 (Revised) Modifications to the opinion in the independent auditor’s report. Available online: https://www.iaasb.org/publications/international-standard-auditing-isa-705-revised-modifications-opinion-independent-auditor-s-report-3 (accessed on 22 January 2025).

- IAASB. (2015c). ISA 701 (New) Communicating key audit matters in the independent auditor’s report. Available online: https://www.iaasb.org/publications/international-standard-auditing-isa-701-new-communicating-key-audit-matters-independent-auditor-s-3 (accessed on 22 January 2025).

- IASB. (2016). Effects analysis: International financial reporting standard 16 leases. Available online: https://www.ifrs.org/content/dam/ifrs/project/leases/ifrs/published-documents/ifrs16-effects-analysis.pdf (accessed on 22 January 2025).

- IASB. (2024a). IFRS 15 Revenue from contracts with customers. IFRS Foundation. [Google Scholar]

- IASB. (2024b). IFRS 16 Leases. IFRS Foundation. [Google Scholar]

- IASB. (2024c). IAS 36 Impairment of assets. IFRS Foundation. [Google Scholar]

- IASB. (2024d). IAS 38 Intangible assets. IFRS Foundation. [Google Scholar]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [Google Scholar] [CrossRef]

- Kend, M., & Nguyen, L. A. (2022). Key audit risks and audit procedures during the initial year of the COVID-19 pandemic: An analysis of audit reports 2019–2020. Managerial Auditing Journal, 37(7), 798–818. [Google Scholar] [CrossRef]

- Lavi, M. R. (2016). The impact of IFRS on industry. John Wiley & Sons. [Google Scholar]

- Linden, E. (2021). Pandemics and environmental shocks: What aviation managers should learn from COVID-19 for long-term planning. Journal of Air Transport Management, 90, 101944. [Google Scholar] [CrossRef] [PubMed]

- Luo, Y., & Malsch, B. (2023). Re-examining auditability through auditors’ responses to COVID-19: Roles and limitations of improvisation on the production of auditing knowledge. Auditing: A Journal of Practice & Theory, 42(3), 155–175. [Google Scholar]

- Mashayekhi, B., Dolatzarei, E., Faraji, O., & Rezaee, Z. (2024). Mapping the state of expanded audit reporting: A bibliometric view. Meditari Accountancy Research, 32(2), 579–612. [Google Scholar] [CrossRef]

- Miani, P., Kille, T., Lee, S. Y., Zhang, Y., & Bates, P. R. (2021). The impact of the COVID-19 pandemic on current tertiary aviation education and future careers: Students’ perspective. Journal of Air Transport Management, 94, 102081. [Google Scholar] [CrossRef] [PubMed]

- Özçelik, H. (2020). BDS 701 Kilit denetim konuları: Uluslararası havayolu işletmeleri üzerine bir araştırma. In G. Kurt, & C. Y. Özbek (Eds.), Denetimde seçme konular 3 (pp. 149–173). Gazi Kitabevi. [Google Scholar]

- Öztürk, C. (2022). Some observations on international auditing: The case of the airline industry. In Perspectives on international financial reporting and auditing in the airline industry (Vol. 35, pp. 127–157). Emerald Publishing Limited. [Google Scholar] [CrossRef]

- Qatar Airways. (2021). Qatar airways group Q.C.S.C. consolidated financial statements 31 March 2021. Available online: https://d21buns5ku92am.cloudfront.net/69647/documents/53714-1704626325-Qatar%20Airways%20Annual%20Report%202021-3ee8c0.pdf (accessed on 10 January 2025).

- Qatar Airways. (2022). Qatar airways group Q.C.S.C. consolidated financial statements 31 March 2022. Available online: https://d21buns5ku92am.cloudfront.net/69647/documents/53715-1704626413-Qatar%20Airways%20Annual%20Report%202022-1ec70b.pdf (accessed on 10 January 2025).

- Qatar Airways. (2023). Qatar airways group Q.C.S.C. consolidated financial statements 31 March 2023. Available online: https://d21buns5ku92am.cloudfront.net/69647/documents/53716-1704627090-Qatar%20Airways%20Consolidated%20Financial%20Statements%202023-b4bd7c.pdf (accessed on 10 January 2025).

- Rainsbury, E., Bandara, S., & Perera, A. (2023). Auditors’ response to regulators during COVID-19: Disclosures of key audit matters. Asian Review of Accounting, 31(1), 42–56. [Google Scholar] [CrossRef]

- Renold, M., Vollenweider, J., Mijović, N., Kuljanin, J., & Kalić, M. (2023). Methodological framework for a deeper understanding of airline profit cycles in the context of disruptive exogenous impacts. Journal of Air Transport Management, 106, 102305. [Google Scholar] [CrossRef]

- Tay, D., Du, K., Ho, J., Liu, F., Chan, C., & Cao, C. (2020). The Aviation Industry: Tackling the turbulence caused by COVID-19. IETI Transport Economics and Management, 1, 44–56. [Google Scholar] [CrossRef]

- Xiang, W., & Ma, C. (2025). How do auditors respond to major emergencies? Empirical evidence from the COVID-19 pandemic. Managerial Auditing Journal, 40(5), 483–519. [Google Scholar] [CrossRef]

- Zhang, S., Zhang, A., Lei, Z., & Cai, Y. (2024). Call for papers: Journal of Air Transport Management: Special issue: The financial stability of airlines: Turbulence or tranquility ahead? Journal of Air Transport Management. Available online: https://www.sciencedirect.com/special-issue/297577/the-financial-stability-of-airlines-turbulence-or-tranquillity-ahead (accessed on 10 January 2025).

| Region/Year | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Americas | 9 | 9 | 9 | 8 |

| Europe | 22 | 22 | 21 | 21 |

| Middle East and Africa | 8 | 8 | 7 | 7 |

| Asia-Pacific | 11 | 10 | 11 | 11 |

| China and Northern Asia | 5 | 5 | 5 | 5 |

| Total | 55 | 54 | 53 | 52 |

| Region/Year | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Americas | 3 | 6 | 7 | 6 |

| Europe | 17 | 17 | 16 | 16 |

| Middle East and Africa | 7 | 7 | 6 | 6 |

| Asia-Pacific | 10 | 9 | 9 | 9 |

| China and Northern Asia | 5 | 5 | 5 | 5 |

| Total | 42 | 44 | 43 | 42 |

| Statistic | Value |

|---|---|

| Chi-square (χ2) | 0.454 |

| Degrees of freedom (df) | 12 |

| p-value | 0.9999998 |

| Year | 2017 and 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Period | Pre-COVID-19 | Pre-COVID-19 | During COVID-19 | During COVID-19 | Post-COVID-19 |

| Ranking | Özçelik (2020); Öztürk (2022) | ||||

| 1 | Revenue recognition | Revenue recognition | PPE items | Revenue recognition | Revenue recognition |

| 2 | Lease accounting | Lease accounting | Revenue recognition | PPE items | PPE items |

| 3 | PPE items | PPE items | Lease accounting | Lease accounting | Lease accounting |

| 4 | Hedge accounting | Hedge accounting | Impairment of goodwill and intangible assets | Impairment of goodwill and intangible assets | Hedge accounting |

| 5 | Hedge accounting | Hedge accounting |

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Öztürk (2022) | |||||

| Aircraft maintenance provisions | 62% | 46% | 76% | 85% | 87% |

| Aircraft maintenance deposits | 10% | 2% | 5% | 5% | - |

| Lease classification | 17% | - | - | - | - |

| Early adoption of IFRS 16 | 7% | - | - | - | - |

| Expected impact of IFRS 16 | 4% | - | - | - | - |

| First-time adoption of IFRS 16 | - | 50% | - | - | - |

| Compliance with IFRS 16 | - | - | 19% | 10% | 9% |

| Discount rate | - | 2% | - | - | - |

| Accounting for withdrawn funds from letter of credit | - | - | - | - | 4% |

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Öztürk (2022) | |||||

| Residual values | 35% | 21% | 14% | 15% | 19% |

| Useful lives | 31% | 24% | 18% | 20% | 25% |

| Impairment | 35% | 55% | 67% | 66% | 56% |

| 2018 Öztürk (2022) | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| - | Going-concern (COVID-19-specific) | Going-concern (COVID-19-specific) | Going-concern (COVID-19-specific) | - |

| Provisions for taxation, litigation, and claims | Provision for litigation, taxation, and claims | - | Provision for litigation, taxation, and claims | - |

| Deferred tax assets and liabilities | Deferred tax assets and liabilities | Deferred tax assets and liabilities | Deferred tax assets and liabilities | Deferred tax assets and liabilities |

| Pension plans | Pension plans | Pension plans | - | Pension plans |

| Impairment of goodwill and intangible assets | Impairment of goodwill and intangible assets | - | - | Impairment of goodwill and intangible assets |

| Carrying value of inventory | Carrying value of inventory | Carrying value of inventory | Carrying value of inventory | - |

| Defined benefit plan obligations | - | - | - | - |

| First adoption of IFRS 9 | - | - | Impairment of long-term investment | - |

| New aircraft purchases | - | - | - | Going-concern (airline-specific) |

| 2018 Öztürk (2022) | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| - | Impact of the COVID-19 pandemic (in general) | Impact of the COVID-19 pandemic (in general) | Impact of the COVID-19 pandemic (in general) | - |

| - | Pension plans | - | - | - |

| Acquisition accounting | Acquisition accounting | - | - | - |

| - | Recapitalization | - | - | - |

| - | French tax investigation | French tax investigation | - | - |

| - | Classification of investments | - | - | - |

| - | Classification of exceptional and other items | Classification of exceptional and other items | - | - |

| - | Cyberattacks and cybersecurity | - | - | Cyberattacks and cybersecurity |

| Convertible bond | Convertible bonds | Convertible notes | - | - |

| - | Restructuring provision | Restructuring provision | - | - |

| - | Government grants | Government grants | - | - |

| Going-concern | Going-concern (airline-specific) | Going-concern (airline-specific) | Going-concern (airline-specific) | - |

| Change in accounting policy | - | Defined employee benefit plans | - | - |

| Accuracy of opening balances | - | Accounting for ST working allowances | - | - |

| - | - | Valuation of investment properties | Valuation of investment properties | Valuation of investment properties |

| - | - | Stock warrant obligations | Stock warrant obligations | Stock warrant obligations |

| EU 261 provision | - | Risk of material misstatement | - | - |

| Disposal of trade operations | - | Assets, liabilities held for sale | - | - |

| Functional currency | - | - | SAS Forward Business Transformation Plan | SAS Forward Business Transformation Plan |

| Accounting for one-off items | - | - | Non-recurring expenses | - |

| Carrying value of receivables | - | - | - | Restructuring plan on going-concern |

| Loan classification | - | - | - | Loans and receivables due (intercompany) |

| Asset retirement obligation | - | - | - | New financial reporting system |

| Accounting for cash-generating unit | - | - | - | Accounting for joint-ventures |

| - | - | Provision for litigation, taxation, and claims | - | Provision for litigation, taxation, and claims |

| - | - | - | - | Carrying value of inventory |

| - | - | - | - | Going-concern (recovery from the COVID-19 pandemic and the war in Ukraine) |

| Impairment of LT investment |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dansık, U.; Öztürk, C. Perspectives on Audit Opinions and Key Audit Matters in the Global Airline Industry and the COVID-19 Pandemic. J. Risk Financial Manag. 2025, 18, 702. https://doi.org/10.3390/jrfm18120702

Dansık U, Öztürk C. Perspectives on Audit Opinions and Key Audit Matters in the Global Airline Industry and the COVID-19 Pandemic. Journal of Risk and Financial Management. 2025; 18(12):702. https://doi.org/10.3390/jrfm18120702

Chicago/Turabian StyleDansık, Umutcan, and Can Öztürk. 2025. "Perspectives on Audit Opinions and Key Audit Matters in the Global Airline Industry and the COVID-19 Pandemic" Journal of Risk and Financial Management 18, no. 12: 702. https://doi.org/10.3390/jrfm18120702

APA StyleDansık, U., & Öztürk, C. (2025). Perspectives on Audit Opinions and Key Audit Matters in the Global Airline Industry and the COVID-19 Pandemic. Journal of Risk and Financial Management, 18(12), 702. https://doi.org/10.3390/jrfm18120702