Author Contributions

P.C.: Writing—review & editing, Software, Methodology, Writing—original draft, Validation, Supervision, Methodology, Investigation, Data curation, Conceptualization. A.J.-D.: Writing—review & editing, Writing—original draft, Investigation, Formal analysis. G.Z.: Writing—review & editing, Funding, Writing—original draft, Validation, Supervision, Methodology, Investigation, Data curation, Conceptualization. All authors have read and agreed to the published version of the manuscript.

Figure 1.

Corn—Spot and Future Monthly Prices. The figure shows the monthly time series of corn spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 1.

Corn—Spot and Future Monthly Prices. The figure shows the monthly time series of corn spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 2.

Oats—Spot and Future Monthly Prices. The figure shows the monthly time series of oats spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

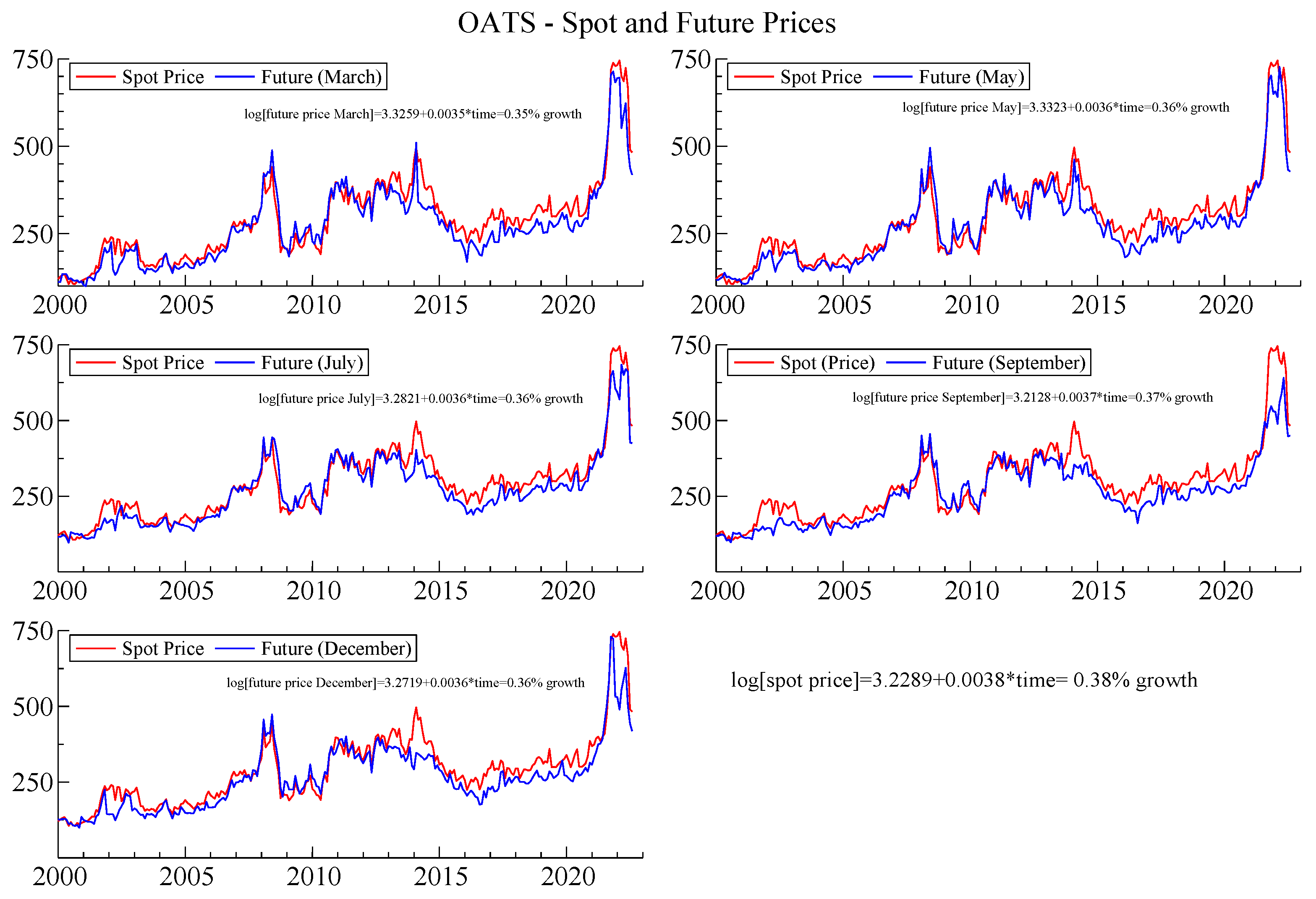

Figure 2.

Oats—Spot and Future Monthly Prices. The figure shows the monthly time series of oats spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 3.

Soybeans—Spot and Future Monthly Prices. The figure shows the monthly time series of soybeans spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and September), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

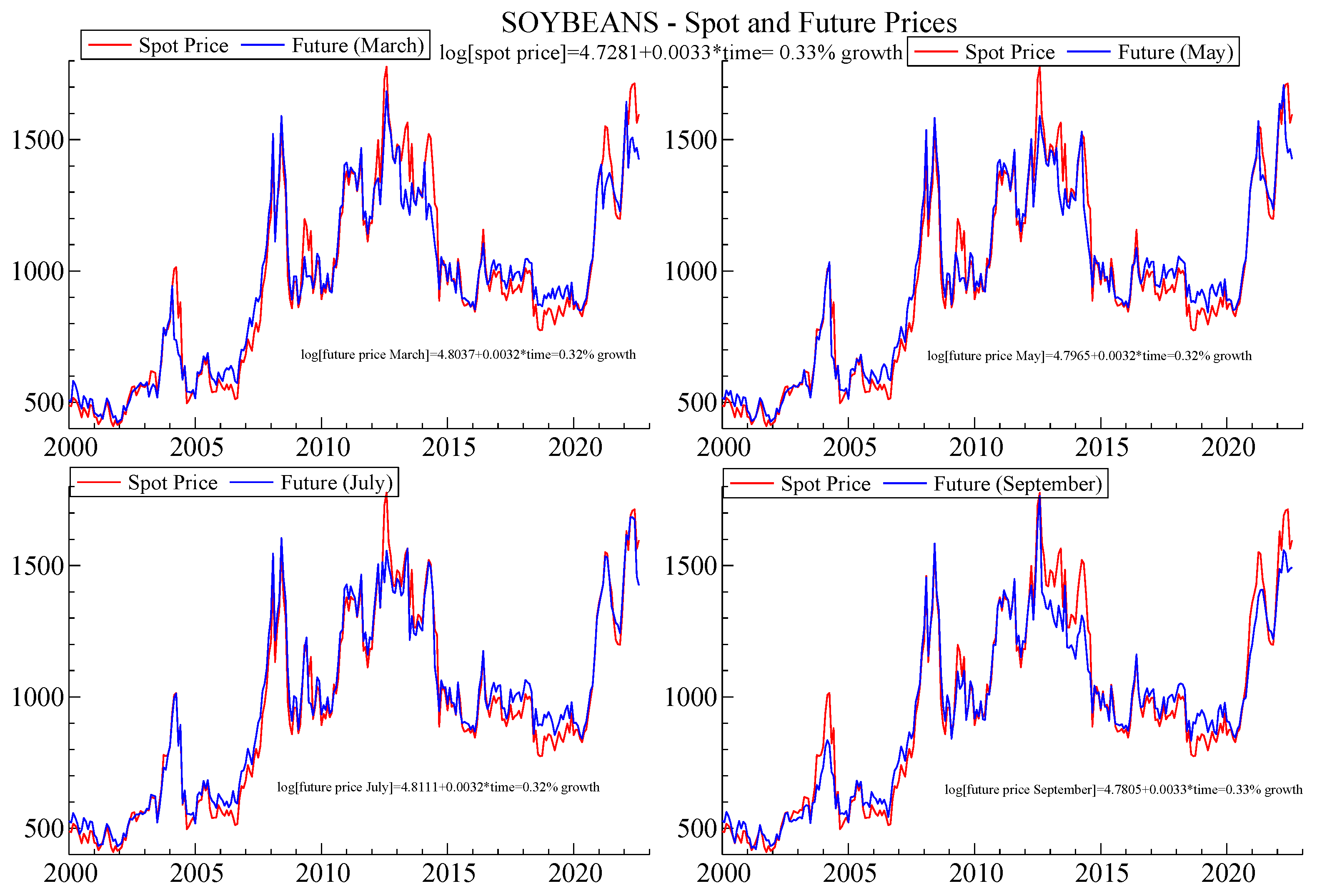

Figure 3.

Soybeans—Spot and Future Monthly Prices. The figure shows the monthly time series of soybeans spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and September), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 4.

Soybean Oil—Spot and Future Monthly Prices. The figure shows the monthly time series of soybean oil spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

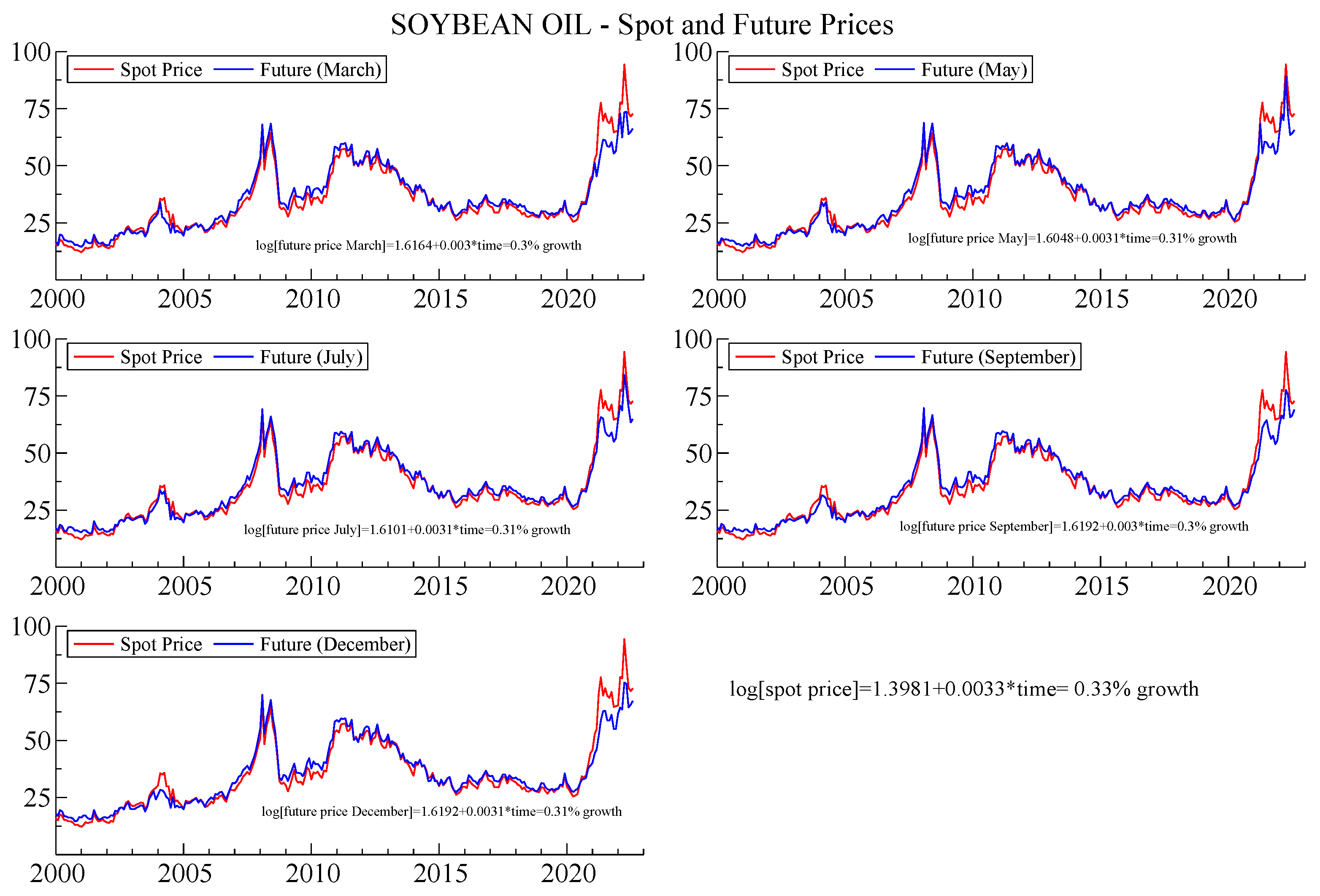

Figure 4.

Soybean Oil—Spot and Future Monthly Prices. The figure shows the monthly time series of soybean oil spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 5.

Wheat—Spot and Future Monthly Prices. The figure shows the monthly time series of wheat spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 5.

Wheat—Spot and Future Monthly Prices. The figure shows the monthly time series of wheat spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 6.

Hard Red Wheat—Spot and Future Monthly Prices. The figure shows the monthly time series of hard red wheat spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 6.

Hard Red Wheat—Spot and Future Monthly Prices. The figure shows the monthly time series of hard red wheat spot prices (red lines) and futures prices (blue lines) across five contract maturities (March, May, July, September, and December), and the estimation of growth equations for each contract to analyze price dynamics. Source: Authors’ elaboration from BarChart database.

Figure 7.

Corn—Area under the ROC curve. Source: Authors elaboration from BarChart database.

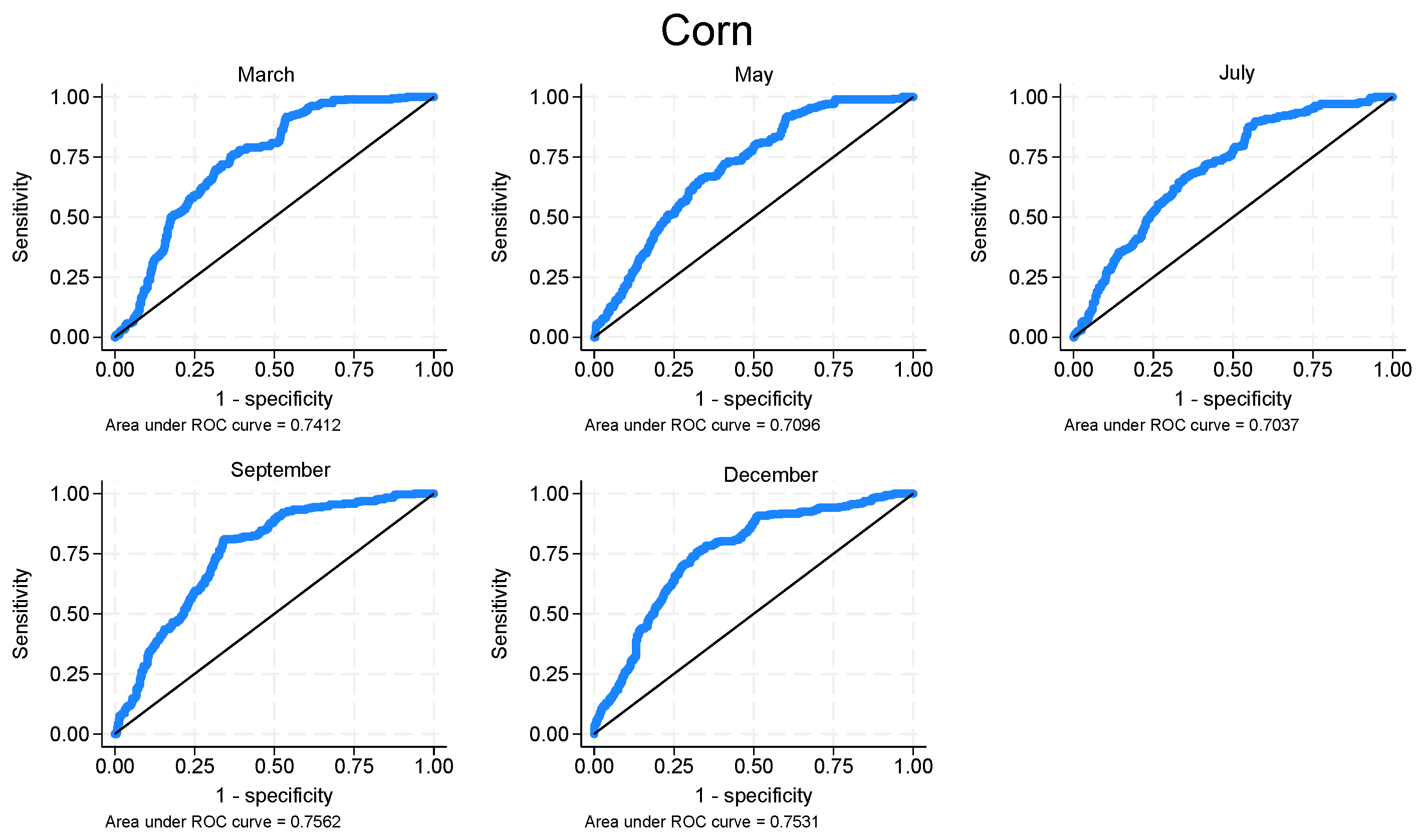

Figure 7.

Corn—Area under the ROC curve. Source: Authors elaboration from BarChart database.

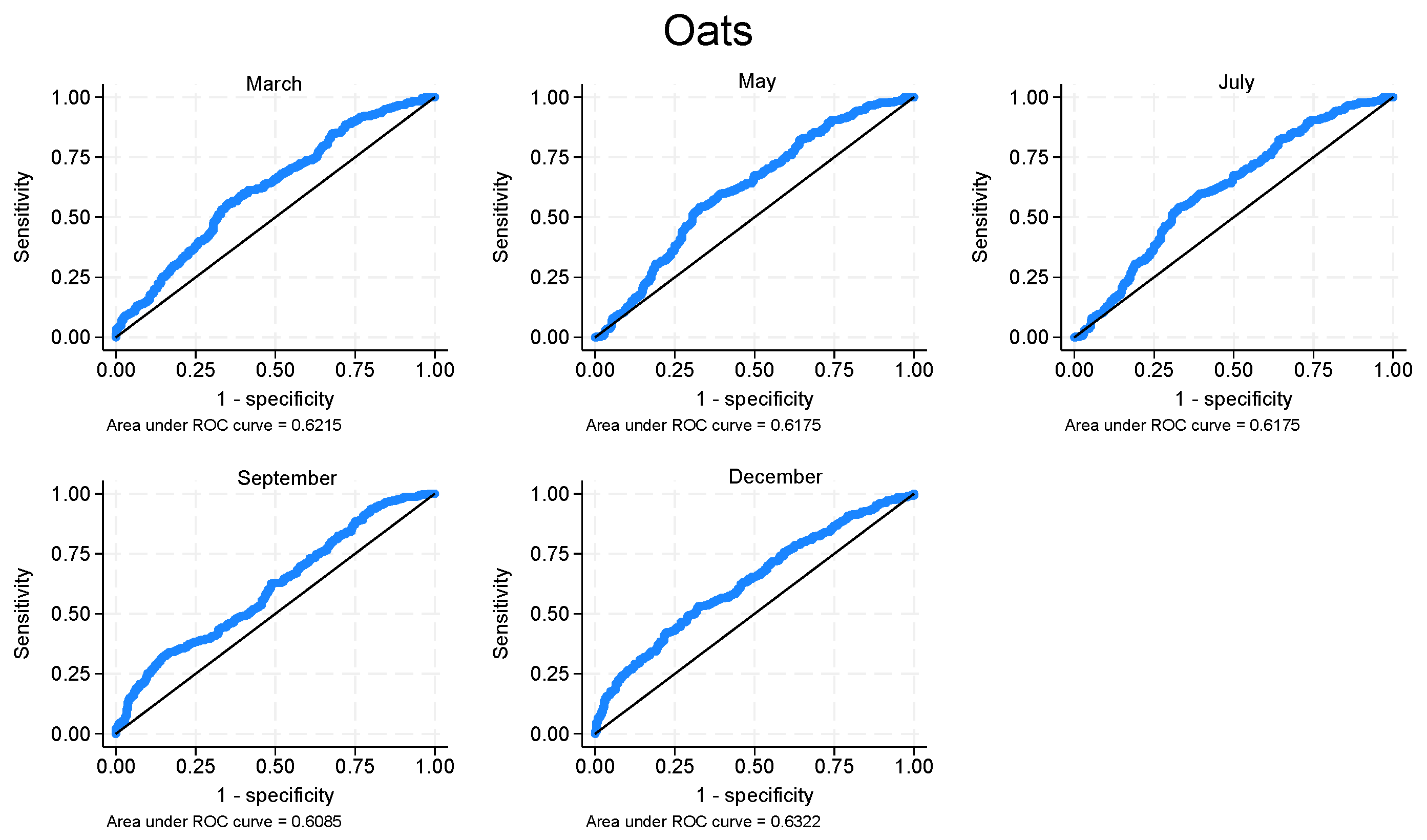

Figure 8.

Oats—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 8.

Oats—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 9.

Soybeans—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 9.

Soybeans—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 10.

Soybean Oil—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 10.

Soybean Oil—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

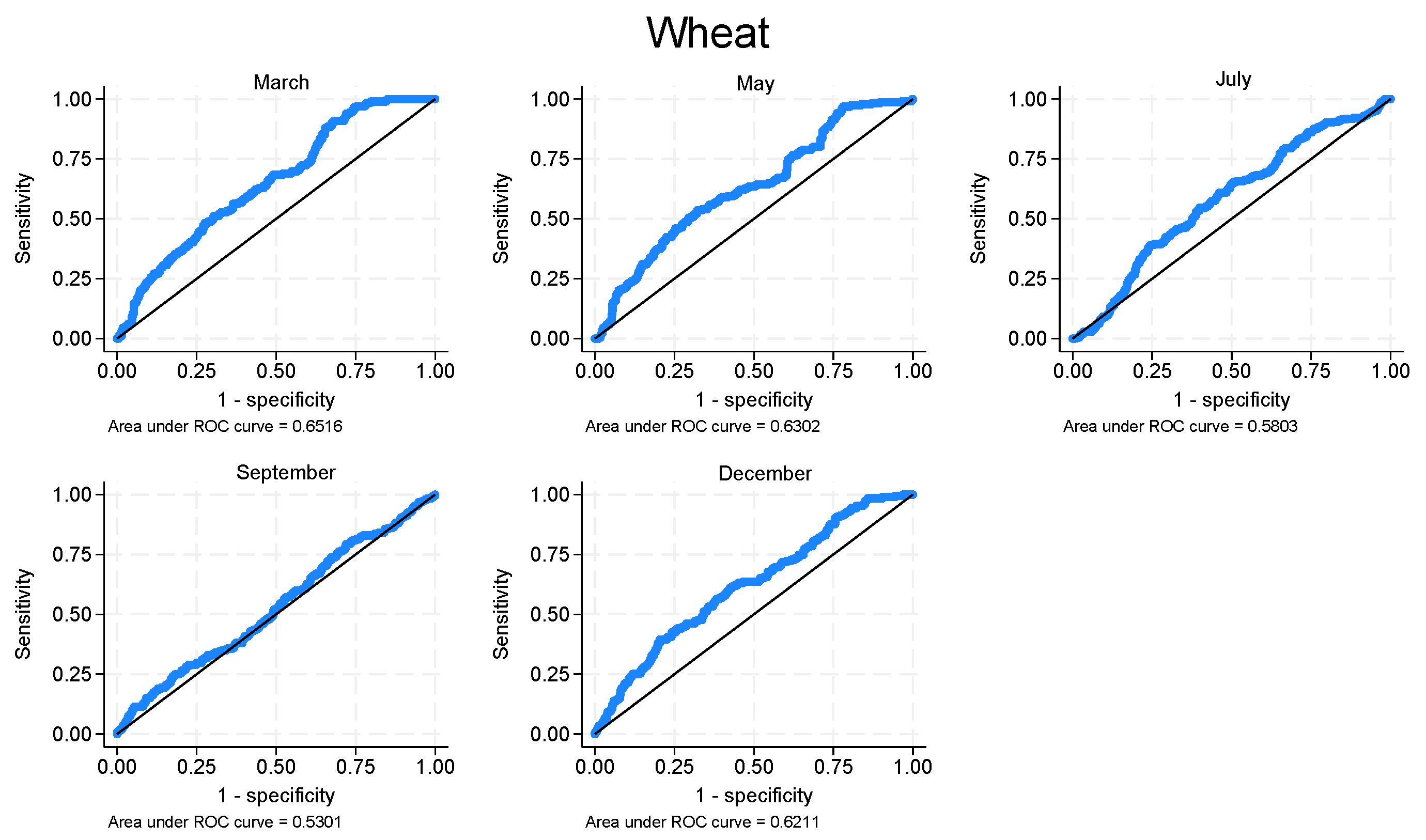

Figure 11.

Wheat—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 11.

Wheat—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

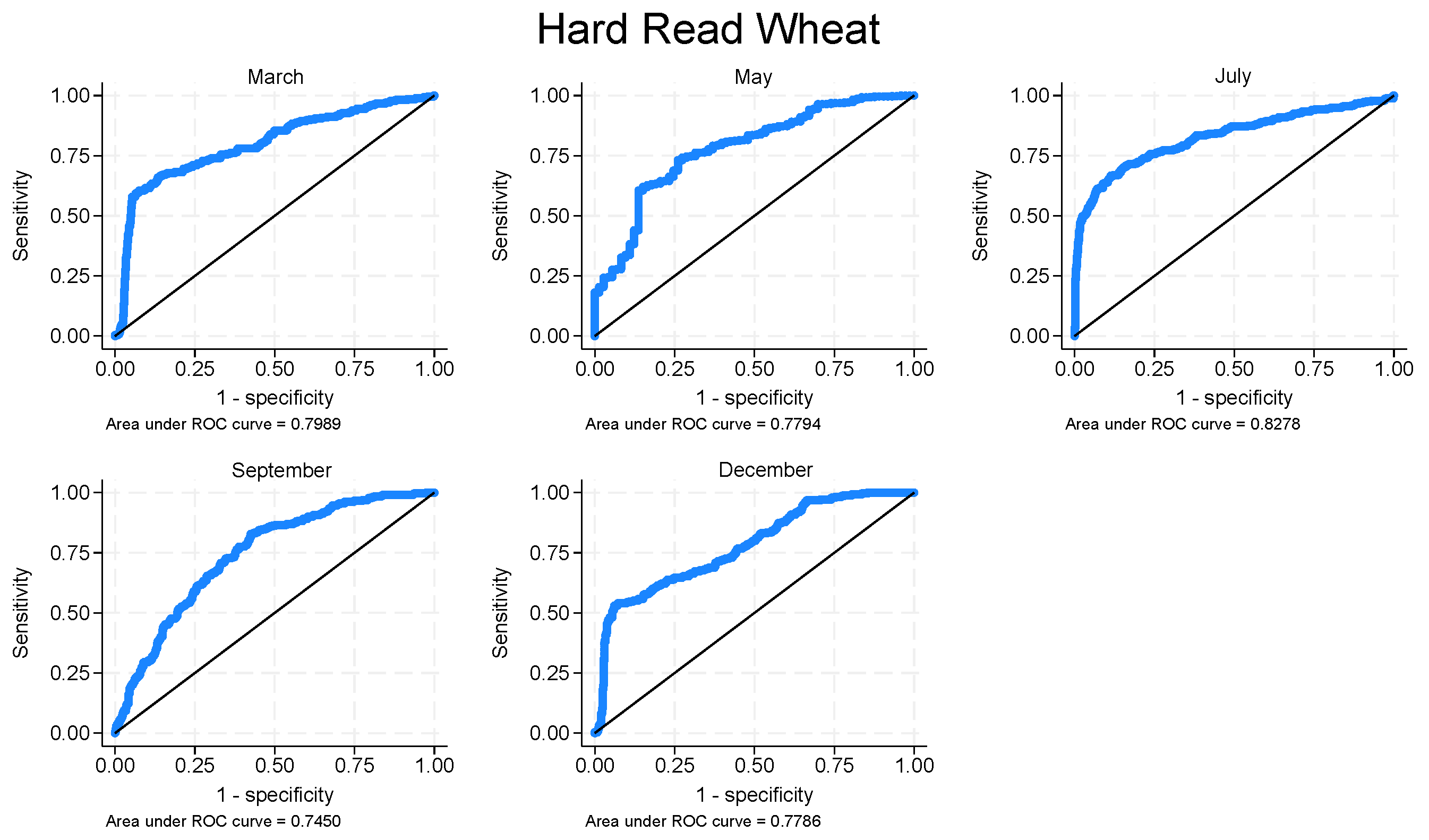

Figure 12.

Hard Read Wheat—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Figure 12.

Hard Read Wheat—Area under the ROC curve. Source: Authors’ elaboration from BarChart database.

Table 1.

Stickiness persistence in backwardation. Future Prices—March contracts.

Table 1.

Stickiness persistence in backwardation. Future Prices—March contracts.

| Dep. Variable: Spot Price | Corn | Oats | Soybeans | Soybean Oil | Wheat | Har Red Wheat |

|---|

| [i] | [ii] | [iii] | [iv] | [v] | [vi] |

|---|

| ln Future Pricest−2 | 0.9196 *** | 0.7737 *** | 0.9157 *** | 0.9752 *** | 0.8270 *** | 0.9421 *** |

| | (0.0451) | (0.0599) | (0.0465) | (0.0327) | (0.0486) | (0.0388) |

| Backwardation dummyt | −0.3794 | 0.1768 | −0.1754 | 0.0875 | −0.1276 | 0.7097 * |

| | (0.2399) | (0.3183) | (0.2764) | (0.1591) | (0.2688) | (0.3843) |

| (Backwardation dummy × log Future Prices)t−2 | 0.0782 * | −0.0114 | 0.0376 | 0.0188 | 0.0418 | −0.0902 |

| | (0.0411) | (0.0583) | (0.0405) | (0.0457) | (0.0435) | (0.0625) |

| VIXt−2 | 0.001 | −0.0014 | 0.0016 ** | 0.0008 | −0.0022 ** | 0.0021 ** |

| | (0.0009) | (0.0011) | (0.0008) | (0.0008) | (0.0010) | (0.0009) |

| CPIt−2 | 0.0008 ** | 0.0023 *** | 0.0002 | 0.0008 ** | 0.0016 *** | 0.0006 |

| | (0.0003) | (0.0004) | (0.0004) | (0.0003) | (0.0004) | (0.0004) |

| T-billt−2 | −0.0081 | −0.0058 | −0.0202 *** | −0.0007 | −0.0005 | 0.0139 ** |

| | (0.0059) | (0.0055) | (0.0059) | (0.0060) | (0.0072) | (0.0068) |

| Constant | 0.2537 | 0.7800 ** | 0.5061 * | −0.1626 | 0.6573 ** | 0.0782 |

| | (0.2327) | (0.3267) | (0.2877) | (0.1395) | (0.2672) | (0.2720) |

| N. Obs. | 270 | 270 | 270 | 270 | 270 | 270 |

| R2 Adj. | 0.92 | 0.89 | 0.93 | 0.93 | 0.83 | 0.84 |

| F-Test | 198.84 *** | 173.33 *** | 235.74 *** | 216.42 *** | 131.59 *** | 174.10 *** |

Table 2.

Stickiness persistence in backwardation. Future Prices—September contracts.

Table 2.

Stickiness persistence in backwardation. Future Prices—September contracts.

| Dep. Variable: Spot Price | Corn | Oats | Soybeans | Soybean Oil | Wheat | Hard Red Wheat |

|---|

| [i] | [ii] | [iii] | [iv] | [v] | [vi] |

|---|

| ln Future Pricest−2 (September) | 0.9201 *** | 0.8228 *** | 0.9127 *** | 0.9822 *** | 0.8458 *** | 0.9786 *** |

| | (0.0461) | (0.0606) | (0.0491) | (0.0331) | (0.0505) | (0.0419) |

| Backwardation dummyt | −0.5291 * | 0.3846 | 0.0727 | 0.1642 | 0.3395 | 0.5697 |

| | (0.2758) | (0.3306) | (0.2710) | (0.1668) | (0.3524) | (0.4781) |

| (Backwardation dummy × log Future Prices)t−2 | 0.1048 ** | −0.0384 | 0.0088 | −0.0028 | −0.0338 | −0.0635 |

| | (0.0465) | (0.0606) | (0.0398) | (0.0484) | (0.0575) | (0.0772) |

| VIXt−2 | 0.0008 | −0.0006 | 0.0009 | 0.0012 | −0.0028 ** | 0.0016 |

| | (0.0009) | (0.0012) | (0.0009) | (0.0009) | (0.0010) | (0.0011) |

| CPIt−2 | 0.0008 ** | 0.0018 *** | 0.0006 | 0.0009 ** | 0.0013 ** | 0.0002 |

| | (0.0004) | (0.0005) | (0.0003) | (0.0004) | (0.0005) | (0.0006) |

| T-billt−2 | −0.0072 | −0.0081 | −0.0089 | 0.001 | −0.0036 | 0.0162 ** |

| | (0.0058) | (0.0062) | (0.0055) | (0.0062) | (0.0071) | (0.0068) |

| Constant | 0.2388 | 0.5728 * | 0.4199 | −0.2275 | 0.6299 ** | −0.0598 |

| | (0.2358) | (0.3366) | (0.2935) | (0.1492) | (0.2841) | (0.3262) |

| N. Obs. | 270 | 270 | 270 | 270 | 270 | 270 |

| R2 Adj. | 0.92 | 0.87 | 0.93 | 0.93 | 0.83 | 0.84 |

| F-Test | 196.95 *** | 146.38 *** | 239.90 *** | 210.74 *** | 132.92 *** | 176.79 *** |

Table 3.

Stickiness persistence in backwardation. Future Prices—December contracts.

Table 3.

Stickiness persistence in backwardation. Future Prices—December contracts.

| Dep. Variable: Spot Price | Corn | Oats | Soybean Oil | Wheat | Hard Red Wheat |

|---|

| [i] | [ii] | [iii] | [iv] | [v] |

|---|

| ln Future Pricest−2 | 0.9122 *** | 0.8229 *** | 0.9821 *** | 0.8451 *** | 0.9721 *** |

| | (0.0507) | (0.0634) | (0.0338) | (0.0470) | (0.0425) |

| Backwardation dummyt | −0.4566 * | 0.5923 * | 0.2951 * | 0.1097 | 1.0496** |

| | (0.2758) | (0.3460) | (0.1645) | (0.3545) | (0.4253) |

| (Backwardation dummy × log Future Prices)t−2 | 0.0946 ** | −0.0889 | −0.0383 | 0.0031 | −0.1449 ** |

| | (0.0473) | (0.0636) | (0.0478) | (0.0577) | (0.0686) |

| VIXt−2 | 0.001 | −0.0016 | 0.0011 | −0.0032 ** | 0.0026 ** |

| | (0.0009) | (0.0011) | (0.0009) | (0.0011) | (0.0012) |

| CPIt−2 | 0.0010 ** | 0.0025 *** | 0.0012 ** | 0.0015 *** | 0.0009 * |

| | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0005) |

| T-billt−2 | −0.0071 | −0.0066 | 0.0024 | −0.0039 | 0.0209 ** |

| | (0.0062) | (0.0060) | (0.0061) | (0.0073) | (0.0072) |

| Constant | 0.2414 | 0.4802 | −0.2931 * | 0.6100 ** | −0.2004 |

| | (0.2647) | (0.3553) | (0.1517) | (0.2660) | (0.3225) |

| N. Obs. | 270 | 270 | 270 | 270 | 270 |

| R2 Adj. | 0.91 | 0.87 | 0.93 | 0.82 | 0.84 |

| F-Test | 185.26 *** | 152.35 *** | 208.7 *** | 129.58 *** | 169.71 *** |

Table 4.

Stickiness persistence in backwardation. Future Prices—May contracts.

Table 4.

Stickiness persistence in backwardation. Future Prices—May contracts.

| Dep. Variable: Spot Price | Corn | Oats | Soybeans | Soybean Oil | Wheat | Hard Red Wheat |

|---|

| [i] | [ii] | [iii] | [iv] | [v] | [vi] |

|---|

| ln Future Pricest−2 | 0.9315 *** | 0.8349 *** | 0.9469 *** | 0.9700 *** | 0.8009 *** | 0.9271 *** |

| | (0.0409) | (0.0599) | (0.0448) | (0.0339) | (0.0524) | (0.0385) |

| Backwardation dummyt | −0.2567 | 0.5208 * | 0.394 | 0.2074 | 0.0873 | 0.6422 |

| | (0.2163) | (0.2889) | (0.2566) | (0.1760) | (0.2607) | (0.3981) |

| (Backwardation dummy × log Future Prices)t−2 | 0.0515 | −0.0748 | −0.0466 | −0.0167 | 0.0059 | −0.0789 |

| | (0.0370) | (0.0527) | (0.0374) | (0.0510) | (0.0425) | (0.0645) |

| VIXt−2 | 0.0016 * | −0.0014 | 0.0018 ** | 0.0009 | −0.0012 | 0.0020 ** |

| | (0.0009) | (0.0009) | (0.0007) | (0.0008) | (0.0010) | (0.0010) |

| CPIt−2 | 0.0008 ** | 0.0022 *** | 0.0003 | 0.0010 ** | 0.0020 *** | 0.0006 |

| | (0.0003) | (0.0004) | (0.0004) | (0.0003) | (0.0004) | (0.0005) |

| T-billt−2 | −0.0091 | −0.0057 | −0.0151 ** | 0.0007 | 0.0009 | 0.0112 * |

| | (0.0056) | (0.0051) | (0.0051) | (0.0061) | (0.0076) | (0.0066) |

| Constant | 0.1633 | 0.4551 | 0.2496 | −0.195 | 0.7256 ** | 0.1858 |

| | (0.2191) | (0.3105) | (0.2613) | (0.1463) | (0.2817) | (0.2723) |

| N. Obs. | 270 | 270 | 270 | 270 | 270 | 270 |

| R2 Adj. | 0.92 | 0.89 | 0.93 | 0.93 | 0.81 | 0.83 |

| F-Test | 199.38 *** | 174.80 *** | 242.14 *** | 220.45 *** | 121.84 *** | 164.34 *** |

Table 5.

Stickiness persistence in backwardation. Future Prices—July contracts.

Table 5.

Stickiness persistence in backwardation. Future Prices—July contracts.

| Dep. Variable: Spot Price | Corn | Oats | Soybeans | Soybean Oil | Wheat | Hard Red Wheat |

|---|

| [i] | [ii] | [iii] | [iv] | [v] | [vi] |

|---|

| ln Future Pricest−2 | 0.9421 *** | 0.8049 *** | 0.9108 *** | 0.9670 *** | 0.8227 *** | 0.9484 *** |

| | (0.0391) | (0.0657) | (0.0414) | (0.0343) | (0.0586) | (0.0419) |

| Backwardation dummyt | −0.0774 | 0.2764 | 0.223 | 0.095 | 0.1093 | 0.4554 |

| | (0.2299) | (0.3387) | (0.3090) | (0.1787) | (0.3189) | (0.4498) |

| (Backwardation dummy × log Future Prices)t−2 | 0.0236 | −0.0298 | −0.0201 | 0.0136 | 0.0084 | −0.0434 |

| | (0.0388) | (0.0615) | (0.0442) | (0.0517) | (0.0519) | (0.0729) |

| VIXt−2 | 0.0013 * | −0.0018 * | 0.0016 ** | 0.0008 | −0.0013 | 0.0005 |

| | (0.0008) | (0.0011) | (0.0008) | (0.0008) | (0.0010) | (0.0010) |

| CPIt−2 | 0.0007 ** | 0.0018 *** | 0.0004 | 0.0008 ** | 0.0017 *** | 0.0002 |

| | (0.0003) | (0.0004) | (0.0004) | (0.0003) | (0.0004) | (0.0005) |

| T-billt−2 | −0.008 | −0.0102 * | −0.0155 ** | −0.0026 | 0.0018 | 0.0106 |

| | (0.0050) | (0.0059) | (0.0053) | (0.0063) | (0.0076) | (0.0070) |

| Constant | 0.1287 | 0.7198 ** | 0.4692 * | −0.1219 | 0.6401 * | 0.1631 |

| | (0.2092) | (0.3577) | (0.2491) | (0.1531) | (0.3251) | (0.3159) |

| N. Obs. | 270 | 270 | 270 | 270 | 270 | 270 |

| R2 Adj. | 0.92 | 0.89 | 0.93 | 0.93 | 0.82 | 0.83 |

| F-Test | 212.84 *** | 159.53 *** | 236.37 *** | 213.32 *** | 128.64 *** | 167.81 *** |

Table 6.

Determinant of stickiness persistence—Commodity: Corn.

Table 6.

Determinant of stickiness persistence—Commodity: Corn.

| Corn | March | May | July | September | December |

|---|

| [i] | [ii] | [iii] | [iv] | [v] |

|---|

| March Convenience Yieldt−1 | −0.4499 *** | | | | |

| | (0.0477) | | | | |

| May Convenience Yieldt−1 | | −0.3619 *** | | | |

| | | (0.0418) | | | |

| July Convenience Yieldt−1 | | | −0.3090 *** | | |

| | | | (0.0397) | | |

| September Convenience Yieldt−1 | | | | −0.3731 *** | |

| | | | | (0.0398) | |

| December Convenience Yieldt−1 | | | | | −0.3381 *** |

| | | | | | (0.0363) |

| Interest Riskt−1 | 0.2005 | 0.194 | −0.061 | −0.8848 *** | −0.8951 *** |

| | (0.2180) | (0.2045) | (0.2193) | (0.2435) | (0.2400) |

| S&P 500 returnst−1 | −3.5524 * | 0.0576 | −2.1853 | 1.2933 | 2.4126 |

| | (2.0078) | (1.9425) | (1.9670) | (1.9847) | (2.0098) |

| Baltic Dry Indext−1 | −0.0002 | −0.0001 | 0.0000 | 0.0000 | 0.0000 |

| | (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0002) |

| VIXt−1 | −0.0191 ** | −0.0024 | −0.0140 ** | 0.0101 | −0.0001 |

| | (0.0061) | (0.0065) | (0.0062) | (0.0063) | (0.0060) |

| Constant | 0.4818 *** | −0.0344 | 0.1764 | 0.2637 ** | 0.4396 *** |

| | (0.1231) | (0.1239) | (0.1214) | (0.1232) | (0.1227) |

| N. Obs. | 907 | 907 | 907 | 907 | 907 |

| Pseudo R2 | 0.15 | 0.10 | 0.09 | 0.16 | 0.14 |

| Log-Likelihood | −499.06 *** | −505.05 *** | −505.26 *** | −510.94 *** | −522.38 *** |

Table 7.

Determinant of stickiness persistence—Commodity: Wheat.

Table 7.

Determinant of stickiness persistence—Commodity: Wheat.

| Wheat | March | May | July | September | December |

|---|

| [i] | [ii] | [iii] | [iv] | [v] |

|---|

| March Convenience Yieldt−1 | −0.3165 *** | | | | |

| | (0.0538) | | | | |

| March Convenience Yieldt−1 | | −0.2091 *** | | | |

| | | (0.0429) | | | |

| March Convenience Yieldt−1 | | | −0.0614** | | |

| | | | (0.0298) | | |

| March Convenience Yieldt−1 | | | | −0.0008 | |

| | | | | (0.0312) | |

| March Convenience Yieldt−1 | | | | | −0.1114 ** |

| | | | | | (0.0412) |

| Interest Riskt−1 | −0.0524 | 0.1592 | −0.5842 ** | −0.6469 ** | −0.5398 ** |

| | (0.2215) | (0.2194) | (0.1997) | (0.2179) | (0.2161) |

| S&P500 returnst−1 | 0.8114 | −0.4302 | 0.4742 | 3.3523 * | 5.4663 ** |

| | (2.2273) | (2.2142) | (1.9174) | (2.0369) | (2.0799) |

| Dry Indext−1 | −0.0005 ** | 0 | −0.0001 | −0.0001 | −0.0004 * |

| | (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0002) |

| VIXt−1 | −0.0098 | −0.0189 ** | −0.0037 | −0.0036 | 0.0085 |

| | (0.0071) | (0.0077) | (0.0062) | (0.0065) | (0.0067) |

| VSRt | 1.1937 *** | 0.9975 *** | 0.8395 *** | 1.2960 *** | 1.4901 *** |

| | (0.1109) | (0.1035) | (0.0997) | (0.1036) | (0.1095) |

| Kraft squeezet | 1.2024 ** | 0.0000 | 0.0000 | 0.0000 | −0.1018 |

| | (0.4107) | (0.0000) | (0.0000) | (0.0000) | (0.5379) |

| Constant | −0.6118 *** | −0.4068 ** | −0.2999 ** | −0.7607 *** | −1.2026 *** |

| | (0.1486) | (0.1525) | (0.1327) | (0.1492) | (0.1533) |

| N. Obs. | 907 | 898 | 898 | 898 | 907 |

| Pseudo R2 | 0.19 | 0.13 | 0.08 | 0.16 | 0.24 |

| Log-Likelihood | −388.73 *** | −437.84 *** | −538.67 *** | −448.74 *** | −358.39 *** |

Table 8.

Determinant of stickiness persistence—Commodity: Soybeans.

Table 8.

Determinant of stickiness persistence—Commodity: Soybeans.

| Soybeans | March | May | July | September |

|---|

| [i] | [ii] | [iii] | [iv] |

|---|

| March Convenience Yieldt−1 | −0.7675 *** | | | |

| | (0.1195) | | | |

| May Convenience Yieldt−1 | | −0.7178 *** | | |

| | | (0.1073) | | |

| July Convenience Yieldt−1 | | | −0.9161 *** | |

| | | | (0.1688) | |

| September Convenience Yieldt−1 | | | | −0.9098 *** |

| | | | | (0.1549) |

| Interest Riskt−1 | 1.3574 *** | 1.3670 *** | 1.6402 *** | 0.9730 ** |

| | (0.4048) | (0.3178) | (0.4119) | (0.3631) |

| S&P 500 returnst−1 | −1.4573 | −1.416 | −0.7643 | 1.2038 |

| | (2.4700) | (2.5313) | (2.5907) | (2.1176) |

| Baltic Dry Indext−1 | 0.0003 | −0.0003 | 0.0000 | 0.0002 |

| | (0.0003) | (0.0003) | (0.0003) | (0.0003) |

| VIXt−1 | −0.0266 ** | −0.0532 *** | −0.0598 *** | −0.0083 |

| | (0.0106) | (0.0087) | (0.0096) | (0.0079) |

| Constant | 0.3086 * | 0.6477 *** | 0.7333 *** | 0.4470 ** |

| | (0.1790) | (0.1604) | (0.1778) | (0.1563) |

| N. Obs. | 907 | 907 | 907 | 907 |

| Pseudo R2 | 0.20 | 0.19 | 0.22 | 0.27 |

| Log-Likelihood | −426.38 *** | −401.24 *** | −367.96 *** | −433.31 *** |

Table 9.

Determinant of stickiness persistence—Commodity: Soybean Oil.

Table 9.

Determinant of stickiness persistence—Commodity: Soybean Oil.

| Soybean Oil | March | May | July | September | December |

|---|

| [i] | [ii] | [iii] | [iv] | [v] |

|---|

| March Convenience Yieldt−1 | −0.2023 *** | | | | |

| | (0.0326) | | | | |

| May Convenience Yieldt−1 | | −0.2454 *** | | | |

| | | (0.0363) | | | |

| July Convenience Yieldt−1 | | | −0.2395 *** | | |

| | | | (0.0349) | | |

| September Convenience Yieldt−1 | | | | −0.2292 *** | |

| | | | | (0.0328) | |

| December Convenience Yieldt−1 | | | | | −0.2030 *** |

| | | | | | (0.0315) |

| Interest Riskt−1 | −0.1983 | −0.0909 | −0.1089 | −0.118 | −0.2235 |

| | (0.2148) | (0.2175) | (0.2243) | (0.2220) | (0.2034) |

| S&P 500 returnst−1 | −0.866 | −0.681 | 0.6677 | −0.601 | 0.9485 |

| | (2.0878) | (2.1068) | (2.0692) | (2.0873) | (1.9863) |

| Baltic Dry Indext−1 | −0.0002 | −0.0002 | −0.0002 | −0.0001 | −0.0001 |

| | (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0002) |

| VIXt−1 | −0.0048 | −0.0022 | −0.0026 | −0.0084 | −0.0031 |

| | (0.0059) | (0.0060) | (0.0059) | (0.0059) | (0.0059) |

| Constant | −0.3990 *** | −0.5154 *** | −0.5212 *** | −0.3296 ** | −0.3307 ** |

| | (0.1163) | (0.1156) | (0.1157) | (0.1177) | (0.1155) |

| N. Obs. | 907 | 907 | 907 | 907 | 907 |

| Pseudo R2 | 0.05 | 0.06 | 0.06 | 0.05 | 0.05 |

| Log-Likelihood | −442.23 *** | −410.48 *** | −408.35 *** | −436.17 *** | −471.20 *** |

Table 10.

Determinant of stickiness persistence—Commodity: Oats.

Table 10.

Determinant of stickiness persistence—Commodity: Oats.

| Oats | March | May | July | September | December |

|---|

| [i] | [ii] | [iii] | [iv] | [v] |

|---|

| March Convenience Yieldt−1 | −0.1370 *** | | | | |

| | (0.0275) | | | | |

| May Convenience Yieldt−1 | | −0.1320 *** | | | |

| | | (0.0263) | | | |

| July Convenience Yieldt−1 | | | −0.1320 *** | | |

| | | | (0.0263) | | |

| September Convenience Yieldt−1 | | | | 0.0857 ** | |

| | | | | (0.0277) | |

| December Convenience Yieldt−1 | | | | | 0.1919 *** |

| | | | | | (0.0323) |

| Interest Riskt−1 | 0.1921 | 0.2325 | 0.2325 | −0.6145 *** | −0.4700 ** |

| | (0.2070) | (0.1854) | (0.1854) | (0.1824) | (0.2039) |

| S&P 500 returnst−1 | −1.0095 | −2.4191 | −2.4191 | 1.1896 | 3.6814 * |

| | (2.0738) | (1.9216) | (1.9216) | (1.8786) | (1.8959) |

| Baltic Dry Indext−1 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0003 |

| | (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0002) |

| VIXt−1 | −0.0303 *** | −0.0323 *** | −0.0323 *** | −0.0150 ** | 0.0134 ** |

| | (0.0069) | (0.0065) | (0.0065) | (0.0063) | (0.0066) |

| Constant | 0.3010 ** | 0.5798 *** | 0.5798 *** | 0.6083 *** | 0.1951 |

| | (0.1321) | (0.1256) | (0.1256) | (0.1250) | (0.1265) |

| N. Obs. | 907 | 907 | 907 | 907 | 907 |

| Pseudo R2 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 |

| Log-Likelihood | −557.88 *** | −596.49 *** | −596.49 *** | −580.91 *** | −512.60 *** |

Table 11.

Determinant of stickiness persistence—Commodity: Hard Red Wheat.

Table 11.

Determinant of stickiness persistence—Commodity: Hard Red Wheat.

| Hard Red Wheat | March | May | July | September | December |

|---|

| [i] | [ii] | [iii] | [iv] | [v] |

|---|

| March Convenience Yieldt−1 | 0.5076 *** | | | | |

| | (0.0316) | | | | |

| May Convenience Yieldt−1 | | 0.3104 *** | | | |

| | | (0.0485) | | | |

| July Convenience Yieldt−1 | | | 0.6177 *** | | |

| | | | (0.0332) | | |

| September Convenience Yieldt−1 | | | | 0.6321 *** | |

| | | | | (0.0335) | |

| December Convenience Yieldt−1 | | | | | 0.4984 *** |

| | | | | | (0.0308) |

| Interest Riskt−1 | −0.4781 ** | −1.7962 *** | −0.8412 *** | −1.4887 *** | −0.8477 *** |

| | (0.2230) | (0.4080) | (0.2185) | (0.2513) | (0.2407) |

| S&P 500 returnst−1 | 1.6068 | 4.4602 | 5.2117 ** | 5.4718 ** | 3.5737 |

| | (2.2213) | (4.1082) | (2.3375) | (2.4057) | (2.2235) |

| Delta Baltic Dry Indext−1 | 0.0002 | −0.0004 | 0.0006 ** | 0.0004 * | 0.0000 |

| | (0.0002) | (0.0003) | (0.0002) | (0.0002) | (0.0002) |

| VIXt−1 | 0.0313 *** | 0.0780 *** | 0.0528 *** | 0.0357 *** | 0.0256 ** |

| | (0.0080) | (0.0154) | (0.0081) | (0.0089) | (0.0080) |

| VSRt | 1.0216 *** | 0.5922 ** | 0.8617 *** | 1.1162 *** | 1.2574 *** |

| | (0.1052) | (0.2088) | (0.1127) | (0.1162) | (0.1089) |

| Constant | −2.2853 *** | 0.0399 | −2.4454 *** | −2.0907 *** | −2.0948 *** |

| | (0.1560) | (0.2151) | (0.1798) | (0.1710) | (0.1530) |

| N. Obs. | 907 | 907 | 907 | 907 | 907 |

| Pseudo R2 | 0.31 | 0.16 | 0.36 | 0.39 | 0.32 |

| Log-Likelihood | −384.20 *** | −213.73 *** | −378.69 *** | −357.86 *** | −382.38 *** |

Table 12.

Area under the ROC curves—Commodity and contracts.

Table 12.

Area under the ROC curves—Commodity and contracts.

| Commodity | Contracts | |

|---|

| March | May | July | September | December | Mean for

Each Commodity |

|---|

| Corn | 74.12% | 70.96% | 70.37% | 75.62% | 75.31% | 73.28% |

| Oats | 62.15% | 61.75% | 61.75% | 60.85% | 63.22% | 61.94% |

| Soybeans | 83.35% | 80.64% | 83.35% | 59.91% | n.a. | 76.81% |

| Soybean Oil | 68.29% | 70.57% | 68.94% | 58.81% | 69.48% | 67.22% |

| Wheat | 65.16% | 63.02% | 58.03% | 53.01% | 62.11% | 60.27% |

| Hard Red Wheat | 79.89% | 77.94% | 82.78% | 74.50% | 77.86% | 78.59% |

Mean for

each contract | 72.16% | 70.81% | 70.87% | 63.78% | 69.60% | |