1. Introduction

The rapid digitalization of financial services has fundamentally transformed the manner in which individuals and businesses engage with monetary transactions, delivering unprecedented convenience, efficiency, and accessibility. Globally, the widespread adoption of mobile banking, e-wallets, and online payment platforms has significantly advanced financial inclusion, particularly in developing economies where conventional banking infrastructure remains underdeveloped or geographically inaccessible. These digital financial innovations reduce barriers to entry, lower transaction costs, and enable broader participation in formal financial systems, thereby contributing to economic development and social inclusion (

Kandpal et al., 2025;

Ly & Ly, 2024;

Nwoke, 2024). Thailand exemplifies this trend, having undergone a remarkable digital transformation within its financial sector. This progress has been catalyzed by strategic government policies such as the National e-Payment Master Plan and the implementation of the PromptPay system, which enable real-time interbank transfers and facilitate seamless digital payments across diverse population segments. The rapid proliferation of smartphones and improved internet penetration has further accelerated the uptake of digital financial services. Concurrently, the emergence of fintech enterprises and collaborations between traditional financial institutions and technology firms have diversified the financial ecosystem, expanding access to innovative products ranging from microfinance to automated investment platforms (

Teerapunyachai & Bawornkitchaikul, 2024;

Ungratwar et al., 2025;

Warokka et al., 2025).

Despite these advancements, the proliferation of digital financial services has been accompanied by an alarming increase in digital fraud (

Yoganandham & Govindaraj, 2024). Digital fraud encompasses a wide range of illicit activities conducted via digital channels, including phishing, identity theft, fraudulent investment schemes, unauthorized transactions, and social engineering attacks. These frauds exploit inherent vulnerabilities in digital ecosystems, leveraging deceptive techniques that manipulate users’ trust and behavioral patterns to gain unauthorized access to financial assets. The rapid pace of digital adoption has often outstripped the development of comprehensive cybersecurity infrastructure and user education, particularly in contexts where regulatory frameworks are still evolving and enforcement mechanisms are nascent. This gap creates an environment conducive to cybercriminal activities, which are further complicated by the increasing sophistication of fraud techniques, including the use of artificial intelligence (AI) for deepfake communications and automated scam campaigns. This dynamic has resulted in rising incidents of digital financial fraud, with significant implications for consumer confidence, financial stability, and the overall sustainability of digital financial inclusion efforts (

Alex-Omiogbemi et al., 2024;

Chayanon et al., 2025;

Odufisan et al., 2025;

Oroșanu & Alexandru, 2024;

D. Sharma et al., 2025;

Udeh et al., 2024).

In the context of Thailand, recent reports and case studies have highlighted an alarming rise in digital fraud cases, affecting not only individual consumers but also contributing to broader economic losses (

Dangpisan, 2025;

The Nation, 2025). However, empirical investigations into the root causes of digital fraud victimization in Thailand—and similar developing economies—remain scarce. While international research (e.g.,

Choi et al., 2016;

Marttila et al., 2021;

Padyab et al., 2024) has identified key demographic and psychological traits associated with cybercrime exposure, these insights may not fully translate to the Southeast Asian context, where cultural, technological, and socioeconomic conditions differ significantly. There is a pressing need for localized, data-driven research that captures the lived experiences, behaviors, and perceptions of users in digitally maturing environments like Thailand. Specifically, few studies have systematically analyzed how individuals’ demographic profiles (e.g., age, income, education), digital habits (e.g., device usage, time online, preferred social media), and perceived digital security features (e.g., password protocols, identity verification, alerts) intersect to influence fraud risk in developing nations. This study seeks to fill this critical research gap by conducting a comprehensive, empirical investigation into the predictors of digital fraud victimization in Thailand. By leveraging a large-scale dataset of 1200 respondents and applying binary logistic regression analysis, the research identifies statistically significant factors contributing to fraud susceptibility. Furthermore, the study estimates the national economic impact of digital fraud, offering policy-relevant insights that extend beyond academic theory to inform public awareness campaigns, consumer protection strategies, and digital literacy initiatives. In doing so, this research contributes to a nuanced understanding of the interplay between individual behavior, perception, and technology in shaping fraud vulnerability. It also provides one of the few large-scale, quantitative assessments of digital fraud victimization within a Southeast Asian developing economy, thereby addressing a notable void in the literature and reinforcing the importance of context-specific cybersecurity research in the digital age.

4. Results

The g 0.743(AAA) + gital behavior characteristics of the survey participants were carefully examined using data obtained from online questionnaires. This assessment served as a vital foundation for interpreting the study’s overall results.

Table 1 presents the general demographic and digital behavior characteristics of the 1200 respondents who participated in the study. The sample was composed of 59.6% female and 40.4% male participants, reflecting a slightly higher representation of women in the dataset. In terms of age distribution, the largest group of respondents (27.0%) were between 21 and 30 years old, followed closely by those over 50 years (26.8%) and those under 21 years (21.8%). Educational attainment was relatively high, with 56.8% of participants holding a bachelor’s degree, while 22.1% had education below the undergraduate level, and 21.1% had attained a postgraduate degree. Occupation-wise, students represented the largest group (34.8%), followed by government officers (28.7%), private company employees (15.7%), and business owners (18.5%). In terms of income, 39.3% of respondents reported earning more than 40,000 Baht per month, suggesting that the sample included a substantial proportion of individuals with higher income levels. Regarding mobile operating systems, users were nearly evenly split between iOS (49.4%) and Android (47.2%), with only a small proportion (3.4%) using other systems. Internet usage behavior revealed that a majority (66.3%) of participants reported spending more than two hours online per session, indicating high digital engagement. The most commonly used device for accessing digital platforms was the smartphone (83.2%), followed by computers (12.7%) and tablets (4.1%). In terms of social media usage, Facebook emerged as the dominant platform (61.1%), followed by Line (16.0%), X (formerly Twitter) (13.6%), TikTok (6.0%), and Instagram (3.3%). These findings provide a comprehensive overview of the respondents’ demographic profiles and digital behaviors, offering a contextual foundation for analyzing their vulnerability to digital fraud in subsequent sections of the study.

Table 2 summarizes participants’ awareness and perceptions of digital transaction practices, as measured by mean scores and standard deviations. Overall, the findings indicate a high level of perceived benefit and security associated with digital financial activities among Thai users. The item with the highest mean score was “Convenient money transfers, top-ups, and payments” (CMP), with a mean of 4.54 and a standard deviation of 0.660, suggesting that most respondents strongly agree that digital platforms offer practical advantages for financial transactions. Similarly, high mean values were observed for “No travel costs, no queues, no transaction fees” (NTF) (M = 4.51), “Faster financial transactions” (FFT) (M = 4.43), and “Anytime, anywhere access to financial services” (AAA) (M = 4.43), all indicating broad recognition of digital convenience and efficiency. In terms of perceived security, the results were also positive. The items “Password required for every login” (PRL) and “Identity verification for first-time transactions” (IVT) both had mean scores of 4.26, while “Alerts for every online transaction” (AOT) followed closely with a mean of 4.25. Notably, the item “Strong security system” (SSS) received a slightly lower but still favorable mean of 3.92, implying that while users generally trust the security infrastructure, there may still be some residual concerns or variability in perceived robustness. The relatively low standard deviations across all items suggest consistency in user perceptions. Collectively, these results highlight that respondents are well aware of both the functional and protective features of digital transactions, which may influence their digital behavior and exposure to fraud-related risks in meaningful ways.

Table 3 presents the distribution of fraud experience among the 1200 respondents and reveals a strikingly high prevalence of digital fraud victimization. A substantial majority—843 respondents, or 70.3%—reported having experienced digital fraud, while only 29.8% (357 respondents) indicated that they had never encountered such incidents. This finding underscores the widespread nature of digital fraud in the Thai context and highlights the growing urgency of addressing cybersecurity risks as digital financial transactions become more common. The high rate of fraud experience suggests that despite widespread awareness of digital transaction benefits and security features (as seen in

Table 2), a significant portion of the population remains vulnerable to fraud attempts. This pattern may reflect gaps between perceived safety and actual protective behavior, or it may indicate that current digital security measures are insufficient to deter increasingly sophisticated fraud tactics. These results provide a critical foundation for deeper analysis of the variables that predict fraud victimization, particularly within the context of individual characteristics and digital engagement patterns explored in subsequent sections of the study.

Subsequently, the dataset was refined through a data-cleaning process, focusing on 843 respondents who reported experiencing fraud. This targeted subset enabled a more precise analysis of influencing factors and an in-depth examination of individuals within the fraud experience context.

Table 4 presents the average monetary loss incurred by respondents who reported experiencing digital fraud. Among the 843 individuals who indicated they had been victims of digital fraud, the mean financial damage was 3236.69 Baht, with a standard deviation of 7294.31. This wide standard deviation suggests considerable variability in the extent of financial loss, indicating that while some victims may have suffered minor losses, others experienced significantly higher levels of financial damage. To estimate the broader economic impact of digital fraud at the national level, the study extrapolated these findings using demographic data from Thailand’s 2025 national statistics. With 70.3% of respondents having experienced digital fraud, and the adult population aged 21 and over in Thailand estimated at 55,667,452 individuals, it was projected that approximately 39,127,707 people had encountered digital fraud. Multiplying this number by the average loss yielded an estimated total economic damage of approximately 126.63 billion Baht (39,127,707 × 3236.69) nationwide. These findings highlight not only the individual financial consequences of digital fraud but also its substantial macroeconomic implications, reinforcing the need for targeted digital security interventions and consumer protection policies within Thailand’s rapidly evolving digital economy.

Table 5 presents the results of the Omnibus Test of Model Coefficients, assessing the overall significance of the logistic regression model predicting digital fraud victimization. The chi-square value is 575.152 with 18 degrees of freedom and a

p-value of 0.000, indicating statistical significance at the 0.05 level. This confirms that the independent variables collectively enhance the prediction of whether an individual has experienced digital fraud compared to a model without predictors.

Table 6 provides the model summary statistics for the logistic regression analysis, offering insights into the model’s explanatory power in predicting digital fraud victimization. The reported −2 Log Likelihood value is 885.803, indicating the goodness-of-fit of the model; lower values generally suggest a better-fitting model. Two pseudo R-square statistics are also presented: Cox & Snell R

2 = 0.381 and Nagelkerke R

2 = 0.541. While Cox & Snell R

2 gives a conservative estimate of the explained variance, Nagelkerke R

2 adjusts the value to range from 0 to 1, allowing for clearer interpretation. In addition, the model yielded a Nagelkerke R

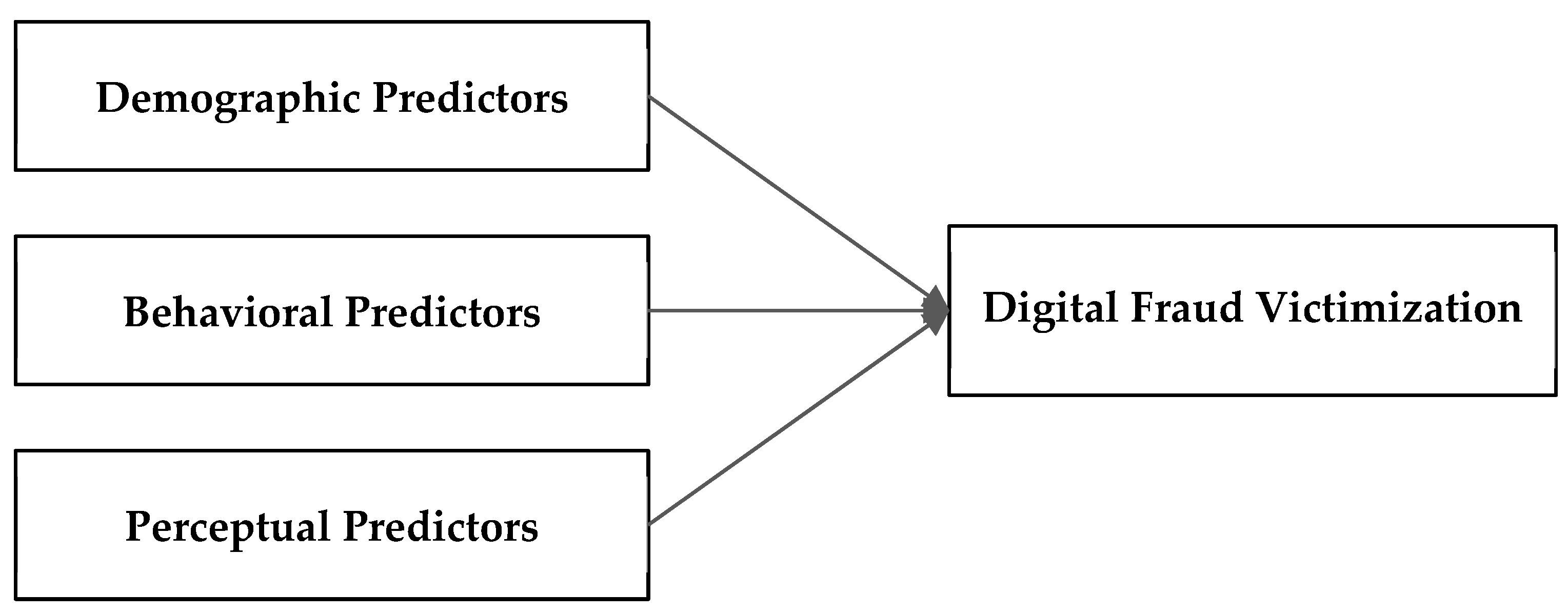

2 value of 0.541, indicating that approximately 54.1% of the variance in digital fraud victimization is explained by the combined demographic, behavioral, and perceptual predictors. Within social science research, where complex human behavior is influenced by multiple unobserved or latent factors, a value above 0.50 is considered notably strong. This suggests that the model not only fits the data well but also captures key mechanisms underlying fraud vulnerability in Thailand’s digital environment.

Table 7 presents the classification results of the logistic regression model, which assesses its ability to accurately predict whether an individual has experienced digital fraud. The classification table compares observed outcomes with predicted classifications, using a cut-off value of 0.50 to distinguish between predicted cases of fraud victimization (Yes) and non-victimization (No). According to the results, the model correctly predicted 64.4% of non-victims and 87.7% of victims, resulting in an overall prediction accuracy of 80.8%. This high level of classification accuracy demonstrates the model’s effectiveness in distinguishing between individuals who have and have not experienced digital fraud based on the selected independent variables. The relatively higher accuracy in predicting fraud victims suggests that the model is particularly sensitive to identifying risk factors associated with vulnerability to digital fraud. These results confirm the practical utility of the model for predictive purposes and support its robustness in capturing the dynamics of fraud victimization within the surveyed population.

The predictive regression equation of Model (1) using the coefficients from

Table 8 can be described by the following equation:

where

P is the digital fraud victimization in Thailand, and

Z = −21.876 + 0.671(age) + 0.740(being a student) + 1.305(income) − 0.673(using iOS) + 0.788(portable devices) + 0.761(social media) + 1.054(FFT) + 0.743(AAA) + 0.468(SSS) + 0.687(PRL) + 1.070(IVT).

Table 8 summarizes the logistic regression results, highlighting both significant and non-significant predictors of digital fraud victimization among the respondents. Several variables showed statistically significant effects at the 0.05 level, indicating a meaningful influence on the likelihood of experiencing fraud, while others did not demonstrate significant associations and therefore do not reliably predict fraud victimization.

Among demographic factors, gender (H1: B = −0.048, Sig. = 0.806, Exp(B) = 0.953) and education level (H3: B = 0.297, Sig. = 0.058, Exp(B) = 1.346) were not significant predictors of fraud victimization, indicating that being male or female, or holding higher educational qualifications, does not meaningfully influence the likelihood of experiencing digital fraud. In contrast, age (H2: B = 0.670, Sig. = 0.000, Exp(B) = 1.956), student status (H4: B = 0.739, Sig. = 0.021, Exp(B) = 2.095), and income (H5: B = 1.305, Sig. = 0.000, Exp(B) = 3.687) emerged as significant predictors. Older individuals were found to have nearly double the odds of victimization, while students were over twice as likely to be targeted compared to non-students. Higher-income individuals were almost 3.7 times more likely to experience fraud, suggesting both increased exposure to digital financial activities and greater financial attractiveness to scammers.

Within behavioral factors of technological usage, iOS usage (H6: B = −0.673, Sig. = 0.001, Exp(B) = 0.510), reliance on portable devices (H9: B = 0.787, Sig. = 0.000, Exp(B) = 2.198), and social media engagement (H10: B = 0.761, Sig. = 0.000, Exp(B) = 2.141) significantly influenced fraud risk. iOS users were less likely to be victimized, reflecting the platform’s stronger security architecture, whereas individuals relying on portable devices or engaging intensively with social media were more than twice as likely to experience fraud. Conversely, internet usage time (H7: B = 0.165, Sig. = 0.086, Exp(B) = 1.179) and home internet access (H8: B = 0.135, Sig. = 0.498, Exp(B) = 1.145) were not significant predictors, suggesting that general levels of online connectivity do not inherently elevate the risk of fraud.

In terms of user perceptions, faster financial transactions (H11: B = 1.054, Sig. = 0.000, Exp(B) = 2.870), anytime–anywhere access (H12: B = 0.744, Sig. = 0.019, Exp(B) = 2.103), confidence in strong security systems (H15: B = 0.468, Sig. = 0.012, Exp(B) = 1.596), reliance on password-based login (H16: B = 0.687, Sig. = 0.002, Exp(B) = 1.989), and trust in identity verification for first-time transactions (H17: B = 1.070, Sig. = 0.000, Exp(B) = 2.915) were all significant predictors. These findings suggest that individuals who strongly prioritize convenience or who exhibit high confidence in platform security features may unintentionally expose themselves to greater risk, reflecting tendencies toward overconfidence and risk-compensating behaviors. Meanwhile, perceptions of no travel cost, queues, or fees (H13: B = 0.264, Sig. = 0.300, Exp(B) = 1.303), convenience in payments (H14: B = 0.284, Sig. = 0.327, Exp(B) = 1.329), and transaction alerts (H18: B = 0.222, Sig. = 0.222, Exp(B) = 1.248) were not statistically significant, indicating that these convenience- and alert-related features alone do not meaningfully influence the probability of becoming a fraud victim.

Overall, the combined findings indicate that fraud victimization is shaped less by general demographics or routine digital access and more by specific behavioral, perceptual, and technological risk factors. Significant predictors such as age, student status, income, portable device use, social media activity, and convenience-driven attitudes all substantially heighten vulnerability, while strong confidence in security features further amplifies risk through overconfidence. In contrast, factors such as gender, education, internet usage time, and basic convenience perceptions show no meaningful impact. The protective effect of iOS highlights the role of secure ecosystems in reducing exposure. Taken together, the results suggest that fraud risk is primarily driven by targeted behaviors and perceptions rather than broad user characteristics, emphasizing the need for improved digital literacy, cautious transaction practices, and awareness of social-engineering threats.

5. Discussion

This study explored the demographic, behavioral, and perceptual factors associated with digital fraud victimization in the context of a developing economy, using Thailand as a case study. The results offer several important insights into the profiles and experiences of individuals who fall victim to digital fraud and highlight broader implications for public policy, consumer protection, and digital literacy initiatives.

First, the finding that 70.3% of respondents had experienced digital fraud underscores the alarming prevalence of this issue in Thailand’s digital economy. This high rate is especially notable considering the strong awareness levels reported regarding digital transaction benefits and security features. While respondents widely acknowledged the convenience, speed, and accessibility of digital financial platforms, these advantages have not necessarily translated into safety. This disconnect between perceived protection and actual vulnerability suggests that user confidence in digital systems may lead to underestimating fraud risks—a phenomenon that aligns with previous literature on overconfidence bias in cybersecurity behaviors. Aligned with

Lunn (

2024), the implementation of advanced security measures—such as encryption, Multi-Factor Authentication (MFA), and secure payment gateways—plays a critical role in safeguarding sensitive information. However, despite their importance, these security protocols can introduce complexity that may negatively affect the user experience. Specifically, the additional steps required for authentication and transaction verification can create friction, leading to user frustration or abandonment of the process. Balancing robust security with seamless usability thus remains a key challenge in digital transaction design. Furthermore, as indicated by

Chayanon et al. (

2025) and

P. Sharma (

2024), inadequate user training in identifying and reporting suspicious activity can allow fraudsters to exploit the convenience of a system. Striking an effective balance between security and user convenience is therefore essential. Insufficient user awareness creates critical vulnerabilities, highlighting the need for clear guidance and user-oriented security practices as integral components of effective fraud prevention strategies (

Tripathi & Tripathi, 2024).

The logistic regression analysis identified several significant predictors of fraud victimization. Demographic factors, including age, income, and student status, were positively associated with an increased likelihood of experiencing fraud. Older adults and individuals with higher income levels may be targeted more frequently due to greater digital exposure or their perceived financial worth. Consistent with

Lazarus et al. (

2025), digital fraudsters often exploit age as a vulnerability, thereby reinforcing ageist practices. In this context, ageism in cybercrime can be understood as the deliberate targeting or prioritization of older adults as potential victims. This demographic is particularly susceptible due to a combination of physiological factors, such as cognitive decline; psychological factors, including heightened fear of cybercrime; familial risks, such as insider fraud; and sociocultural conditions, including social isolation. Cybercrimes against senior citizens are predominantly socioeconomic in nature and typically motivated by financial gain. Similarly,

Wang et al. (

2025) confirmed that older adults with higher socioeconomic status are more likely to be targeted by digital fraud, although this does not necessarily result in actual financial loss. Furthermore, students also emerged as a high-risk group, likely due to limited financial resources, lack of digital security experience, and inadequate understanding of the legal consequences of cybercrime. In line with

Abah and Agada (

2025), many students remain unaware of the potential repercussions of their actions, which can lead to risky behaviors and further increase their vulnerability to both perpetrating and falling victim to cyber-related offenses. These findings highlight the importance of implementing targeted digital safety campaigns and interventions that address the specific needs and vulnerabilities of different demographic groups.

Behavioral factors also played a significant role in cybercrime victimization. Frequent use of portable devices and social media platforms was associated with a higher likelihood of victimization, likely because these technologies create multiple points of entry for fraudulent actors. Notably, iOS users were significantly less likely to experience fraud compared to Android users, potentially due to stricter security protocols or differing usage patterns. These findings indicate that both device-level features and individual usage habits can tangibly affect exposure to cyber threats. Consistent with

Parmar et al. (

2024), increased daily mobile use, a preference for social media as the primary mobile activity, and social media addiction were linked to a heightened risk of cyberbullying. Similarly,

Griffith et al. (

2023) reported that greater engagement in online activities correlates with a higher likelihood of cybercrime victimization. Risky online behavior and inadequate security measures further compound this vulnerability.

Marttila et al. (

2021) also found a strong association between problematic social media use and increased risk of cybercrime, with within-subjects analysis revealing that higher levels of problematic use were significantly linked to a greater chance of being victimized. These findings underscore the cumulative impact of excessive and irresponsible online behavior on cybercrime vulnerability, emphasizing the importance of mindful digital engagement. Moreover,

Ahmad et al. (

2013) highlighted that Android devices are more susceptible to viruses and other security threats, primarily due to their open-source architecture and less rigorous app review process. In comparison,

Kollnig et al. (

2022) noted that the iOS ecosystem is generally more privacy-protective, offering tighter restrictions on data sharing and third-party access. Apple’s strict control over its App Store reduces the risk of malware, thereby enhancing the overall security of iOS devices relative to Android.

Moreover, perceptions related to security features—such as identity verification protocols, password requirements, and alert systems—were paradoxically associated with a higher likelihood of fraud victimization. Although this may initially appear counterintuitive, such heightened security awareness often arises from prior negative experiences, such as having been previously targeted by fraud. This post-experience learning effect suggests that security consciousness may function more as a reactive measure than a preventive one. Additionally, awareness of phishing and other digital scams typically increases following exposure or victimization. Another plausible explanation is that the presence of perceived security features may foster a false sense of safety, prompting users to engage in riskier online behaviors—a phenomenon known as “risk compensation.” This is further supported by

Arenas et al. (

2024) and

Kellner et al. (

2019), who argue that security tools can create an “illusion of control,” giving users a false sense of security and thereby encouraging riskier online activity that may ultimately lead to security incidents. This underscores the importance of designing security systems that not only incorporate robust technical safeguards but also provide behavioral guidance and user education. Consistent with the findings of

Li and Liu (

2021) and

Malik et al. (

2024), fear of data breaches, unauthorized access, and misuse of personal information can lead to heightened anxiety and mistrust. Individuals may become increasingly concerned about the safety of their digital identities, financial data, and personal communications. As a result, they may be reluctant to engage in online activities—such as e-commerce or social networking—that require the disclosure of personal information. These widespread concerns about data privacy in the digital era contribute to a sense of vulnerability and can adversely affect overall well-being.

A notable and counterintuitive finding of this study is the positive association between perceived digital security and fraud victimization. Individuals who expressed strong confidence in password requirements, identity verification mechanisms, and overall platform security were significantly more likely to have experienced digital fraud. This paradox may be driven by risk-compensation behavior, where users relax vigilance when they believe security systems are robust, or by cognitive biases such as the illusion of control. It may also reflect post-victimization learning, as individuals who have already been scammed become more aware of security features afterward. This dynamic underscores the importance of designing security systems that promote not only technical protection but also continuous user vigilance (

Brandimarte et al., 2013;

Datta et al., 2022;

Maini & Sindhi, 2025;

Whitty, 2025).

Interestingly, several demographic and behavioral variables—such as gender, education level, daily internet usage time, and perceived benefits like transaction alerts and cost savings—were not statistically significant predictors of fraud. These findings contradict earlier assumptions that linked demographic characteristics with differential vulnerability to cybercrime (e.g.,

Buse et al., 2024;

Dadà et al., 2025;

Kavvadias & Kotsilieris, 2025). Consistent with this,

Mwiraria et al. (

2024) found no statistically significant difference in the rates of cybercrime victimization between males and females, suggesting that both sexes are equally at risk. Nonetheless, their research also showed that age and education level were significantly associated with cybercrime victimization, indicating the importance of developmental and cognitive maturity in digital risk assessment. Taken together, these findings emphasize the complexity of cybercrime exposure and the necessity of moving beyond oversimplified demographic generalizations. Context-specific, data-driven insights are vital for shaping effective and equitable fraud prevention strategies.

The discussion highlights the multifaceted nature of digital fraud risk, driven by a complex interplay of demographics, technology use, and psychological perceptions. Addressing these risks requires a combination of technical safeguards, user education, and behaviorally informed policy interventions. As digital transactions continue to grow in popularity, especially in developing economies, building public resilience to fraud must become a national priority.

6. Conclusions

This study investigated the demographic, behavioral, and technological determinants of digital fraud victimization in a developing economy, using empirical data from Thailand. The results revealed that digital fraud is highly prevalent, with more than 70% of respondents reporting personal experience with online scams. Logistic regression analysis identified age, income, student status, device usage, social media engagement, and perceived digital security features as significant predictors of fraud vulnerability. Notably, individuals who believed in the strength of digital security measures—such as identity verification and login protocols—were paradoxically more likely to experience fraud, suggesting a possible overconfidence effect or reactive security awareness following prior victimization. This paradox underscores the need for policies and digital literacy initiatives that address user overconfidence and emphasize careful, informed online behavior, even when security mechanisms appear robust. Furthermore, iOS users were found to be significantly less likely to fall victim, pointing to potential differences in operating-system-level security. These findings underscore the need for a multidimensional approach to digital fraud prevention, one that incorporates technological safeguards, behavioral education, and user-centric design.

6.1. Research Contribution

This study contributes to the understanding of digital fraud victimization in developing economies by examining how demographic characteristics, behavioral patterns, and technological factors collectively shape exposure to fraud. Drawing on a large dataset from Thailand, the findings identify key predictors—including age, income, student status, mobile-device dependence, and social media engagement—that help explain why certain population groups are more vulnerable. A distinctive contribution is the identification of a paradoxical effect in which stronger perceived digital security corresponds with greater fraud victimization, underscoring the influence of cognitive biases and overconfidence in digital environments. This insight enriches current discussions on cybersecurity by highlighting the importance of user psychology and behavioral tendencies in shaping actual risk.

6.2. Policy Implication

The findings underscore the urgent need for coordinated national action to reduce digital fraud vulnerability. Public agencies should prioritize continuous digital literacy and fraud-awareness programs, with targeted interventions for high-risk groups such as students, young adults, and lower-income users. These initiatives should incorporate behavioral-science principles to address cognitive biases, including the illusion of control and risk-compensation tendencies, which can inflate confidence in platform security. Communication strategies must correct misconceptions about digital safeguards by emphasizing that technical features alone do not eliminate fraud risks. Stronger collaboration among regulators, digital platforms, telecom operators, and financial institutions is essential to enhance real-time detection, reporting, and coordinated responses. Financial institutions and fintech developers should adopt secure-by-design approaches that prioritize user comprehension, integrate behavioral cues, and minimize opportunities for error. Additionally, policymakers should update legal frameworks to address evolving scam tactics and invest in specialized cyber-investigation capacity. Collectively, these actions can mitigate behavioral vulnerabilities, bridge the gap between perceived and actual digital security, and strengthen national digital resilience.

6.3. Limitations and Future Research

This study has limitations that suggest directions for future research. First, the use of convenience sampling may limit generalizability, particularly for underrepresented groups such as rural residents or those with limited internet access; future studies should employ more diverse and probabilistic sampling and consider cross-country comparisons in Southeast Asia to enhance external validity. Second, reliance on self-reported data may introduce recall and social desirability biases; integrating objective measures, such as transaction or platform-reported data, could improve reliability. Third, the cross-sectional design limits causal inference; longitudinal studies are needed to examine how security perceptions, behaviors, and fraud experiences evolve over time. Finally, the absence of interaction terms highlights the importance of exploring moderating effects between demographic, behavioral, and perceptual variables—for example, how age or income influences the link between perceived security and fraud risk. Addressing these limitations can provide more nuanced, robust, and generalizable insights into digital fraud vulnerability, informing both theory and practice in cybersecurity.