News vs. Social Media: Sentiment Impact on Stock Performance of Big Tech Companies

Abstract

1. Introduction

2. Literature Review

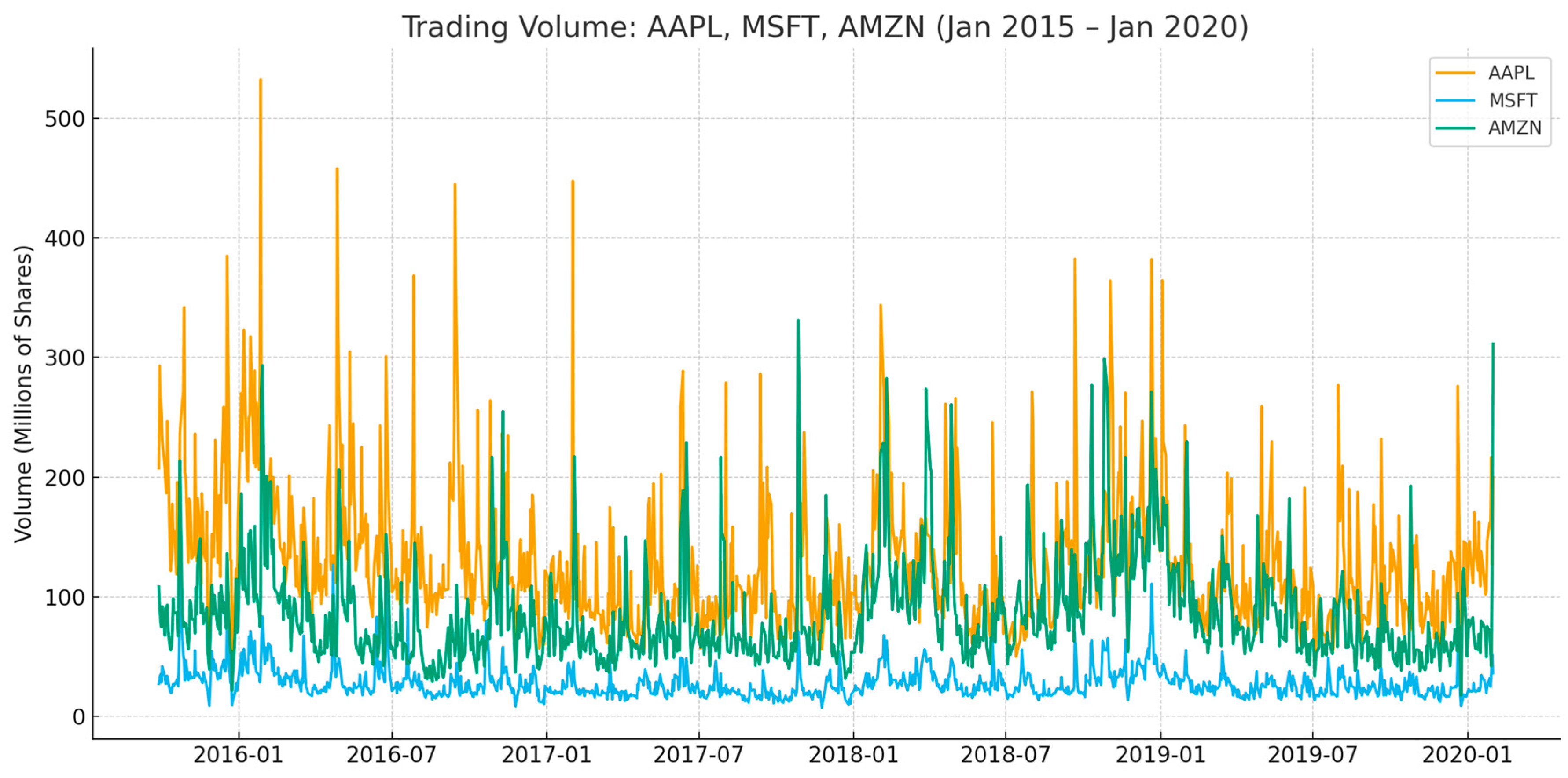

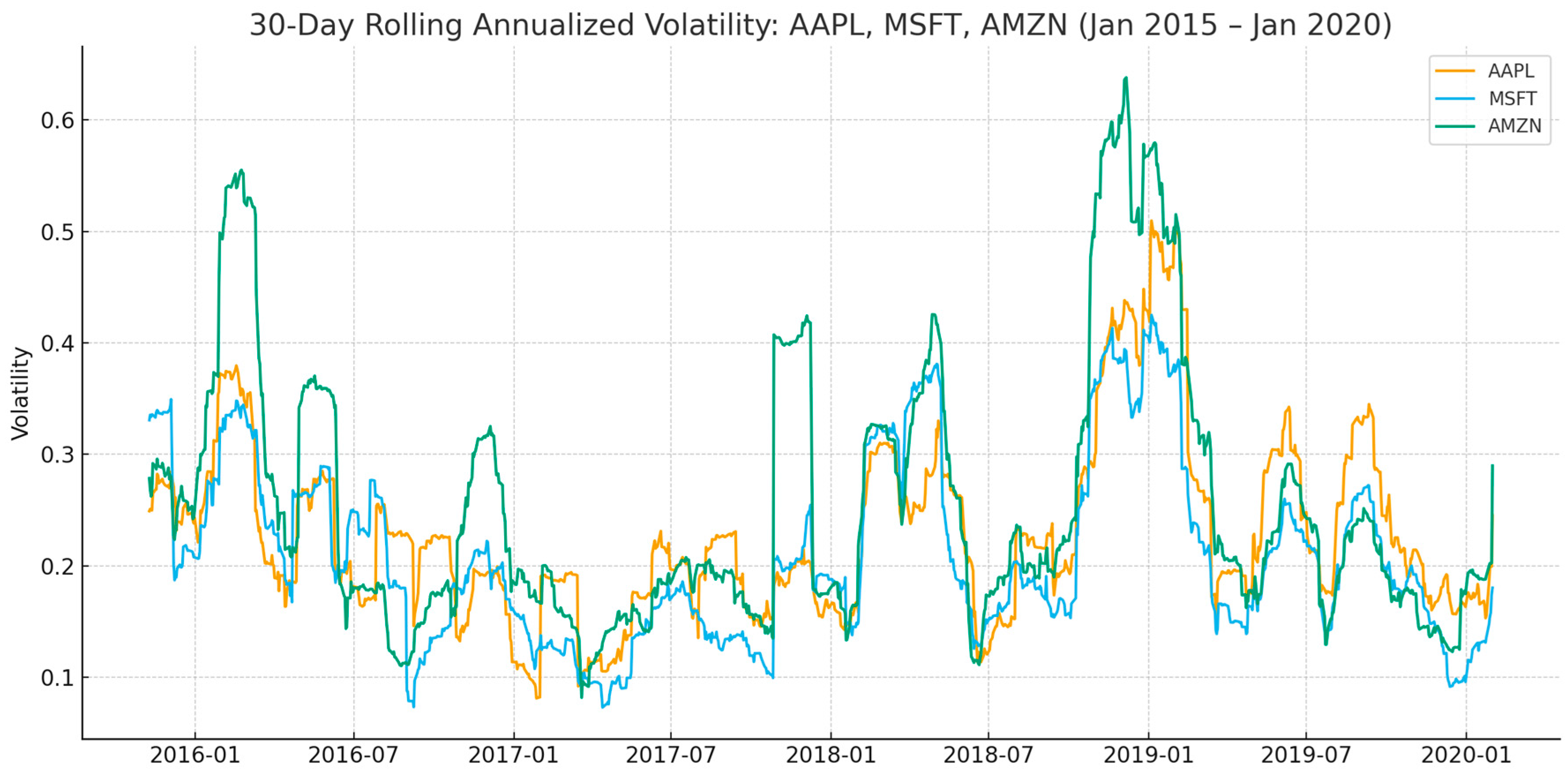

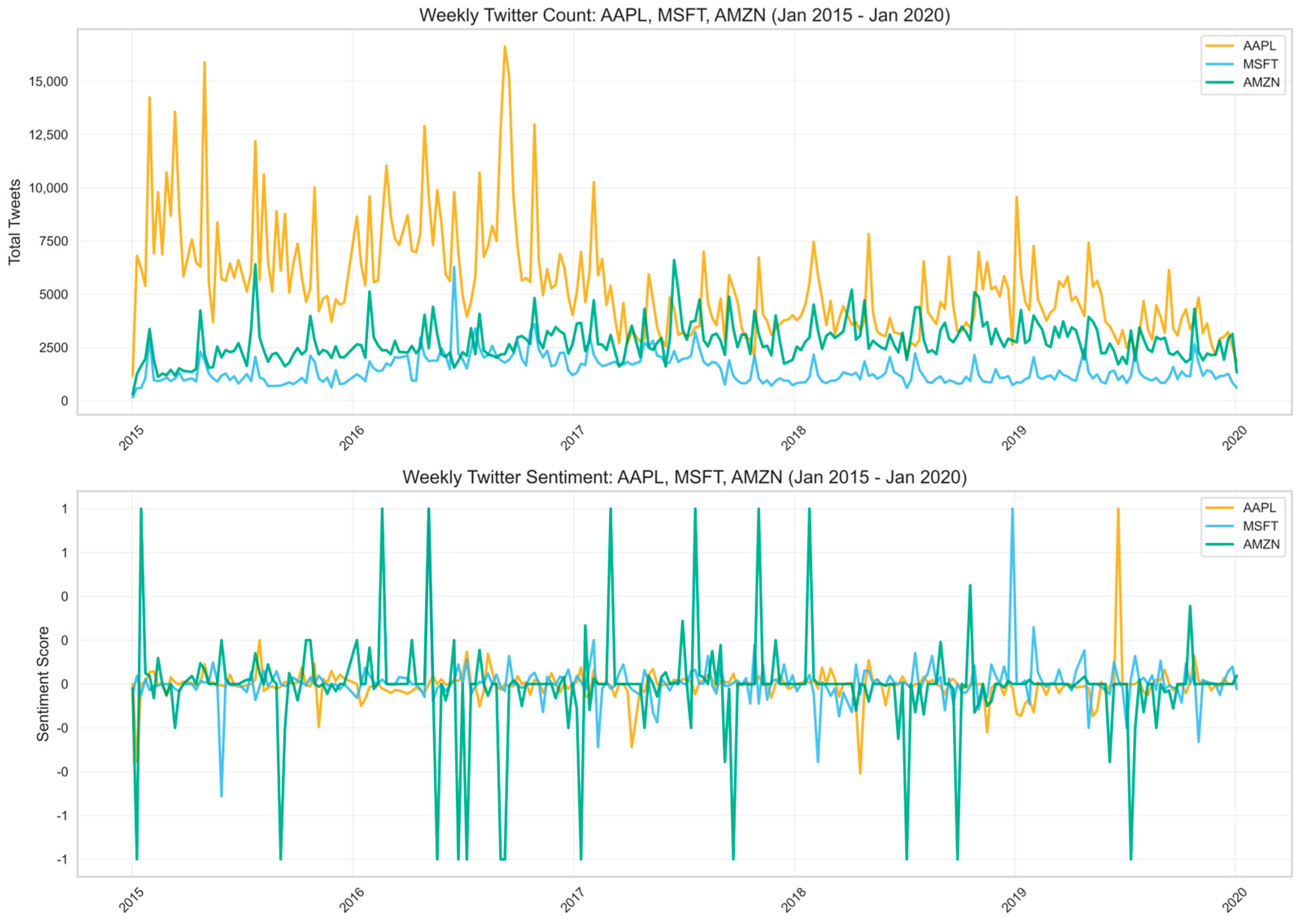

3. Stock Performance of the Three Big-Tech (Jan 2015–Jan 2020)

4. Methodology

4.1. LLM-Based Sentiment Analysis

4.2. Model Specification

- : weekly stock return for firm , calculated as the percentage change in adjusted closing price.

- : weekly trading volume, measured as the total number of shares traded (scaled by 1000).

- : the absolute value of weekly stock returns, approximating realized variability

- is a vector that captures traditional media coverage derived from The New York Times via the LexisNexis database. Articles were identified by searching for each company name in the “Company” field, ensuring they were a central topic. To reduce the noise common in article-level sentiment analysis, where multiple entities are often discussed together, we tested several levels of granularity: full article, title, paragraph, and company-specific sentences. Our final model used paragraph-level sentiment, which gave the strongest results. Sentence-level analysis produced similar outcomes, while article- and title-level analysis were more ambiguous.

- Paragraph Counts: the weekly number of paragraphs mentioning firm , which represents the weekly number of paragraphs from news articles that mention the firm. This serves as a proxy for the volume of traditional media coverage, capturing news-related investor attention.

- News Sentiment: a composite sentiment score reflecting the overall tone of coverage, or polarity (positive/negative) of news media content. JF coefficient 100 (to scale)

- is a vector that represents real-time discourse on Twitter (X). Data was sourced from the existing dataset published by Doğan et al. (2020), which comprises posts from X (formerly Twitter) that mention the three companies. This corpus provides insight into real-time public discourse and reaction on a major social media platform during the study’s timeframe.

- Tweet Counts: the total number of tweets mentioning firm in week , regardless of the content. It measures online visibility, public attention, and social buzz, and not necessarily have any financial relevance.

- Twitter Sentiment: a sentiment score capturing the polarity of tweets, scaled similarly to news sentiment. JF coefficient 100

- is a Google Trends Index that measures the weekly normalized search intensity for each firm. This data provides a normalized index (0–100) of search volume, as it tracks Google search interest in the firm over time. It serves as a measure of real-time public interest and retail investor attention.

- is a vector that contains firm-specific financial fundamentals interpolated from quarterly to weekly frequency. All financial variables were obtained from CRSP or Compustat via WRDS, or calculated from data provided by these sources.

- Return on Assets (ROA): profitability relative to total assets. It indicates how efficiently a firm is using its assets to generate earnings.

- Revenue Growth: quarter-over-quarter sales expansion. This reflects the firm’s ability to expand operations and market share.

- Free Cash Flow: cash generated after capital expenditure. This reflects the firm’s ability to expand operations and market share.

- Price-to-Book Ratio: market value relative to book value. It is often used to assess valuation, particularly in asset-heavy firms.

- Earnings Surprise: difference between reported EPS and analyst expectations. Positive surprises often drive short-term stock price increases, while negative ones can lead to declines.

5. Results and Discussion

5.1. Impact on Trading Volume

5.2. Impact on Stock Volatility

5.3. Impact on Stock Returns

6. Robustness Check

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| FinBERT | Financial BERT(Bidirectional Encoder Representations from Transformers) |

| LLM | large language model |

| NLP | natural language processing |

| JF | Janis-Fadner |

| ROA | Return on Assets |

Appendix A. Alternative Specifications

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | −7.6 | −3.1 | 5.6 | 1.1 | 6.8 | 7.2 | 42.9 * | 5.8 | - |

| (23.7) | (25.0) | (24.4) | (26.0) | (24.2) | (24.2) | (22.9) | (24.2) | - | |

| News Sentiment | 53.5 | 96.0 | 40.4 | −16.7 | 54.2 | 48.5 | 64.0 | - | 55.8 |

| (102.4) | (104.5) | (101.6) | (108.1) | (101.3) | (100.9) | (104.3) | - | (101.3) | |

| Twitter Counts (Thousands) | 2401.8 *** | 2254.0 *** | 1937.0 *** | 2497.5 *** | 1813.8 *** | 1793.2 *** | - | 1828.0 *** | 1872.2 *** |

| (409.9) | (483.6) | (476.7) | (499.9) | (478.0) | (477.1) | - | (478.3) | (439.0) | |

| Twitter Sentiment | −2159.6 | −423.8 | −1280.2 | −652.0 | −1322.1 | - | −726.7 | −1128.5 | −1244.5 |

| (1565.2) | (1647.0) | (1611.7) | (1718.1) | (1591.8) | - | (1643.3) | (1593.5) | (1600.2) | |

| Google Trends index | 15.7 | 138.4 | −25.1 | −108.1 | - | 68.3 | 42.8 | 55.3 | 59.7 |

| (111.1) | (113.8) | (101.7) | (116.3) | - | (110.9) | (114.7) | (111.5) | (111.5) | |

| Return On Assets | 7904.0 *** | 7583.6 *** | 7078.6 *** | - | 8525.4 *** | 8642.7 *** | 9948.7 *** | 8611.9 *** | 8693.0 *** |

| (1388.7) | (1442.4) | (1085.7) | - | (1376.3) | (1417.4) | (1420.7) | (1409.1) | (1417.4) | |

| Revenue Growth | −83.4 | −123.7 ** | - | 124.9 *** | −87.2 * | −100.5 * | −128.6 ** | −96.8 * | −99.4 * |

| (56.5) | (58.1) | - | (46.1) | (51.1) | (56.4) | (57.5) | (56.2) | (56.4) | |

| Free Cash Flow | 0.4 *** | - | 0.4 *** | 0.3 *** | 0.4 *** | 0.4 *** | 0.5 *** | 0.4 *** | 0.4 *** |

| (0.1) | - | (0.1) | (0.1) | (0.1) | (0.1) | (0.1) | (0.1) | (0.1) | |

| Price-To-Book Ratio | - | −719.4 | −1158.8 ** | −431.5 | −1234.5 ** | −1393.3 ** | −2417.1 *** | −1279.3 ** | −1247.2 ** |

| - | (564.5) | (560.5) | (584.4) | (553.8) | (543.4) | (490.2) | (561.7) | (543.6) | |

| Constant | −20,053.6 ** | −4297.6 | −10,089.9 | 17,723.3 *** | −14,679.5 ** | −17,068.3 ** | −9151.0 | −16,832.0 ** | −17,047.4 ** |

| (8467.9) | (8222.7) | (7605.3) | (6813.2) | (7326.8) | (8497.5) | (8482.7) | (8493.1) | (8478.1) | |

| Observations | 252 | 252 | 252 | 252 | 252 | 252 | 252 | 252 | 252 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 26.7 * | 24.3 | 25.1 * | 23.7 | 29.6 * | 30.7 ** | 49.5 *** | 23.7 | - |

| (15.0) | (15.0) | (15.1) | (15.1) | (15.3) | (15.4) | (17.1) | (15.1) | - | |

| News Sentiment | 1.0 | 0.6 | 0.9 | 0.7 | 1.8 | 2.9 | 2.9 | - | 0.7 |

| (5.5) | (5.5) | (5.5) | (5.5) | (5.5) | (5.6) | (6.4) | - | (5.5) | |

| Twitter Counts (Thousands) | 1698.2 *** | 1727.8 *** | 1725.2 *** | 1736.6 *** | 1798.7 *** | 1893.6 *** | - | 1736.3 *** | 1796.5 *** |

| (198.4) | (198.1) | (200.0) | (198.1) | (197.2) | (200.2) | - | (198.6) | (196.0) | |

| Twitter Sentiment | 931.7 *** | 945.2 *** | 913.4 *** | 952.8 *** | 788.5 *** | - | 1424.1 *** | 955.3 *** | 1001.6 *** |

| (255.2) | (253.8) | (254.8) | (254.0) | (254.3) | - | (287.4) | (252.8) | (253.6) | |

| Google Trends index | −2.1 | −10.2 | −6.3 | −9.1 | - | −7.5 | −22.1 * | −9.5 | −9.3 |

| (9.2) | (10.1) | (10.2) | (9.7) | - | (10.6) | (11.8) | (10.2) | (10.3) | |

| Return On Assets | −361.2 | −61.6 | −354.1 | - | −18.1 | 100.3 | 327.6 | 33.4 | 35.4 |

| (318.2) | (333.8) | (339.1) | - | (393.0) | (421.3) | (471.8) | (409.0) | (411.4) | |

| Revenue Growth | 16.9 | 27.2 * | - | 31.9 ** | 20.5 | 26.2 | 27.7 | 32.9 * | 34.5 * |

| (16.7) | (13.9) | - | (16.2) | (19.5) | (20.1) | (22.7) | (19.6) | (19.7) | |

| Free Cash Flow | 0.0 | - | 0.1 | −0.0 | 0.0 | −0.0 | 0.0 | −0.0 | −0.0 |

| (0.1) | - | (0.0) | (0.1) | (0.1) | (0.1) | (0.1) | (0.1) | (0.1) | |

| Price-To-Book Ratio | - | −133.3 | −63.6 | −147.5 * | −73.4 | −133.3 | −46.5 | −153.4 | −173.6 * |

| - | (87.7) | (85.2) | (77.4) | (86.6) | (103.0) | (114.9) | (100.0) | (99.7) | |

| Constant | −1099.5 * | 1310.8 | 263.5 | 1477.3 | −130.2 | 1807.2 | 3530.8 | 1566.0 | 1879.9 |

| (661.3) | (1757.7) | (1703.5) | (1579.8) | (1475.8) | (1917.5) | (2137.8) | (1861.2) | (1860.7) | |

| Observations | 234 | 234 | 234 | 234 | 253 | 234 | 234 | 234 | 234 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 2.7 | 2.1 | 2.2 | 7.9 | 15.7 | 45.5 | 71.5 | 2.2 | - |

| (56.6) | (56.8) | (56.6) | (56.0) | (55.7) | (54.9) | (55.4) | (56.6) | - | |

| News Sentiment | 5.8 | 11.4 | 7.0 | 11.3 | −3.5 | 12.1 | 28.2 | - | 6.9 |

| (91.8) | (92.2) | (91.7) | (91.8) | (91.9) | (93.2) | (94.6) | - | (91.9) | |

| Twitter Counts (Thousands) | 7410.0 *** | 7073.0 *** | 7535.0 *** | 7605.5 *** | 6522.3 *** | 6739.8 *** | - | 7543.3 *** | 7558.7 *** |

| (1879.3) | (1908.0) | (1931.6) | (1931.1) | (1891.6) | (1935.0) | - | (1928.7) | (1834.4) | |

| Twitter Sentiment | 2450.2 *** | 2371.5 ** | 2395.8 *** | 2197.8 ** | 2943.0 *** | - | 1828.7 * | 2397.2 *** | 2406.4 *** |

| (899.0) | (923.4) | (920.0) | (873.4) | (907.3) | - | (937.4) | (919.9) | (879.6) | |

| Google Trends index | 149.7 *** | 169.7 *** | 162.0 *** | 170.0 *** | - | 186.4 *** | 123.0 ** | 161.9 *** | 162.4 *** |

| (40.9) | (60.7) | (60.3) | (59.7) | - | (60.9) | (61.8) | (60.7) | (60.3) | |

| Return On Assets | 828.4 | 648.4 | 695.0 | - | 1123.1 | −151.9 | 913.2 | 701.9 | 702.5 |

| (910.3) | (1030.4) | (1014.7) | - | (1010.8) | (988.0) | (1058.2) | (1024.6) | (1015.8) | |

| Revenue Growth | 13.7 | 40.8 | - | −19.6 | −159.2 | 10.7 | 18.7 | 2.8 | 1.8 |

| (199.4) | (202.5) | - | (201.6) | (191.5) | (206.7) | (210.3) | (203.5) | (203.9) | |

| Free Cash Flow | −0.2 | - | −0.3 | −0.2 | −0.3 | −0.2 | −0.1 | −0.3 | −0.3 |

| (0.2) | - | (0.2) | (0.2) | (0.2) | (0.2) | (0.2) | (0.2) | (0.2) | |

| Price-To-Book Ratio | - | 87.4 | 317.1 | 671.9 | −1788.4 ** | 946.4 | −715.8 | 311.1 | 316.2 |

| - | (1127.3) | (1110.9) | (1007.6) | (764.1) | (1125.6) | (1139.8) | (1134.8) | (1135.5) | |

| Constant | 15,651.7 *** | 10,790.4 | 13,374.0 | 12,340.5 | 33,377.1 *** | 14,616.0 | 29,170.7 *** | 13,395.5 | 13,345.6 |

| (5670.9) | (9821.6) | (9971.3) | (9866.9) | (5887.2) | (10,105.8) | (9405.0) | (9972.0) | (9944.4) | |

| Observations | 245 | 245 | 245 | 245 | 253 | 245 | 245 | 245 | 245 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 0.001 | 0.001 | 0.000 | 0.000 | 0.000 | −0.000 | 0.007 * | 0.000 | - |

| (0.003) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.003) | (0.004) | - | |

| News Sentiment | −0.001 | −0.003 | −0.002 | −0.002 | −0.002 | 0.002 | 0.000 | - | −0.001 |

| (0.015) | (0.015) | (0.015) | (0.015) | (0.015) | (0.015) | (0.015) | - | (0.015) | |

| Twitter Counts (Thousands) | 0.280 *** | 0.302 *** | 0.329 *** | 0.331 *** | 0.322 *** | 0.336 *** | - | 0.326 *** | 0.327 *** |

| (0.059) | (0.069) | (0.070) | (0.068) | (0.070) | (0.071) | - | (0.070) | (0.065) | |

| Twitter Sentiment | 0.480 ** | 0.366 | 0.407 * | 0.413 * | 0.378 | - | 0.495 ** | 0.407 * | 0.408 * |

| (0.226) | (0.232) | (0.233) | (0.232) | (0.232) | - | (0.242) | (0.231) | (0.232) | |

| Google Trends index | 0.021 | 0.014 | 0.016 | 0.017 | - | 0.015 | 0.015 | 0.018 | 0.018 |

| (0.016) | (0.016) | (0.015) | (0.016) | - | (0.016) | (0.017) | (0.016) | (0.016) | |

| Return On Assets | 0.131 | 0.126 | 0.014 | - | 0.011 | 0.086 | 0.301 | 0.067 | 0.065 |

| (0.201) | (0.205) | (0.160) | - | (0.203) | (0.209) | (0.210) | (0.206) | (0.208) | |

| Revenue Growth | −0.004 | −0.002 | - | −0.002 | 0.001 | −0.003 | −0.008 | −0.003 | −0.003 |

| (0.008) | (0.008) | - | (0.006) | (0.007) | (0.008) | (0.008) | (0.008) | (0.008) | |

| Free Cash Flow | −0.000 | - | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | - | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Price-To-Book Ratio | - | 0.070 | 0.104 | 0.107 | 0.115 | 0.136 * | −0.105 | 0.100 | 0.101 |

| - | (0.080) | (0.082) | (0.079) | (0.081) | (0.080) | (0.072) | (0.082) | (0.080) | |

| Constant | 0.073 | −0.833 | 0.046 | 0.084 | 0.530 | −0.124 | 1.204 | −0.172 | −0.174 |

| (1.221) | (1.160) | (1.098) | (0.931) | (1.067) | (1.241) | (1.249) | (1.234) | (1.232) | |

| Observations | 252 | 252 | 252 | 252 | 252 | 252 | 252 | 252 | 252 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 0.004 | 0.003 | 0.003 | 0.004 | 0.009 | 0.011 | 0.011 | 0.003 | - |

| (0.015) | (0.015) | (0.015) | (0.015) | (0.016) | (0.016) | (0.015) | (0.015) | - | |

| News Sentiment | 0.002 | 0.002 | 0.002 | 0.002 | 0.002 | 0.004 | 0.003 | - | 0.002 |

| (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | - | (0.006) | |

| Twitter Counts (Thousands) | 0.488 ** | 0.494 ** | 0.497 ** | 0.473 ** | 0.564 *** | 0.616 *** | - | 0.500 ** | 0.505 ** |

| (0.201) | (0.201) | (0.202) | (0.201) | (0.203) | (0.204) | - | (0.201) | (0.197) | |

| Twitter Sentiment | 0.932 *** | 0.929 *** | 0.930 *** | 0.896 *** | 0.833 *** | - | 1.041 *** | 0.940 *** | 0.937 *** |

| (0.268) | (0.268) | (0.269) | (0.267) | (0.273) | - | (0.267) | (0.266) | (0.264) | |

| Google Trends index | −0.002 | −0.004 | −0.001 | −0.008 | - | −0.004 | −0.008 | −0.004 | −0.004 |

| (0.009) | (0.010) | (0.010) | (0.010) | - | (0.011) | (0.010) | (0.010) | (0.010) | |

| Return On Assets | −0.589 * | −0.504 | −0.744 ** | - | −0.503 | −0.299 | −0.352 | −0.469 | −0.466 |

| (0.320) | (0.340) | (0.342) | - | (0.412) | (0.434) | (0.428) | (0.425) | (0.425) | |

| Revenue Growth | 0.018 | 0.020 | - | 0.036 ** | 0.011 | 0.023 | 0.023 | 0.023 | 0.023 |

| (0.017) | (0.014) | - | (0.017) | (0.021) | (0.021) | (0.021) | (0.021) | (0.021) | |

| Free Cash Flow | 0.000 | - | 0.000 | −0.000 | 0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | - | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Price-To-Book Ratio | - | −0.039 | 0.019 | −0.122 | 0.027 | −0.059 | −0.025 | −0.049 | −0.049 |

| - | (0.090) | (0.086) | (0.079) | (0.091) | (0.107) | (0.106) | (0.105) | (0.104) | |

| Constant | 0.706 | 1.428 | 0.514 | 2.765 * | −0.023 | 2.415 | 2.275 | 1.557 | 1.572 |

| (0.677) | (1.838) | (1.751) | (1.639) | (1.581) | (2.017) | (1.985) | (1.981) | (1.977) | |

| Observations | 233 | 233 | 233 | 233 | 252 | 233 | 233 | 233 | 233 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 0.011 * | 0.011 * | 0.011 * | 0.012 * | 0.013 ** | 0.016 *** | 0.014 ** | 0.011 * | - |

| (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | - | |

| News Sentiment | 0.007 | 0.007 | 0.007 | 0.008 | 0.007 | 0.008 | 0.008 | - | 0.007 |

| (0.010) | (0.010) | (0.010) | (0.010) | (0.010) | (0.010) | (0.010) | - | (0.010) | |

| Twitter Counts (Thousands) | 0.384 * | 0.377 * | 0.394 * | 0.416 * | 0.321 | 0.314 | - | 0.404 * | 0.508 ** |

| (0.208) | (0.212) | (0.215) | (0.215) | (0.208) | (0.217) | - | (0.215) | (0.206) | |

| Twitter Sentiment | 0.304 *** | 0.298 *** | 0.299 *** | 0.255 *** | 0.325 *** | - | 0.274 *** | 0.301 *** | 0.352 *** |

| (0.100) | (0.104) | (0.104) | (0.098) | (0.101) | - | (0.103) | (0.104) | (0.099) | |

| Google Trends index | 0.010 ** | 0.011 * | 0.011 * | 0.013 * | - | 0.014 ** | 0.009 | 0.011 | 0.012 * |

| (0.005) | (0.007) | (0.007) | (0.007) | - | (0.007) | (0.007) | (0.007) | (0.007) | |

| Return On Assets | 0.155 | 0.141 | 0.146 | - | 0.173 | 0.028 | 0.159 | 0.150 | 0.174 |

| (0.101) | (0.116) | (0.114) | - | (0.112) | (0.111) | (0.116) | (0.116) | (0.115) | |

| Revenue Growth | −0.002 | −0.002 | - | −0.009 | −0.011 | −0.005 | −0.002 | −0.002 | −0.003 |

| (0.022) | (0.023) | - | (0.023) | (0.021) | (0.023) | (0.023) | (0.023) | (0.023) | |

| Free Cash Flow | −0.000 | - | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | - | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Price-To-Book Ratio | - | 0.018 | 0.023 | 0.104 | −0.120 | 0.117 | −0.032 | 0.022 | 0.031 |

| - | (0.127) | (0.124) | (0.112) | (0.086) | (0.126) | (0.125) | (0.128) | (0.129) | |

| Constant | 0.187 | −0.115 | 0.000 | −0.251 | 1.396 ** | 0.056 | 0.842 | 0.016 | −0.143 |

| (0.627) | (1.092) | (1.111) | (1.098) | (0.650) | (1.131) | (1.019) | (1.113) | (1.116) | |

| Observations | 244 | 244 | 244 | 244 | 252 | 244 | 244 | 244 | 244 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 0.011 ** | 0.013 *** | 0.012 ** | 0.012 ** | 0.012 ** | 0.010 * | 0.010 ** | 0.012 ** | |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | (0.006) | (0.005) | (0.005) | ||

| News Sentiment | 0.021 | 0.019 | 0.022 | 0.025 | 0.022 | 0.041 * | 0.021 | 0.020 | |

| (0.020) | (0.020) | (0.020) | (0.020) | (0.020) | (0.023) | (0.020) | (0.021) | ||

| Twitter Counts (Thousands) | −0.058 | −0.139 | −0.106 | −0.135 | −0.101 | −0.035 | −0.101 | −0.009 | |

| (0.082) | (0.096) | (0.097) | (0.095) | (0.098) | (0.111) | (0.098) | (0.091) | ||

| Twitter Sentiment | 2.720 *** | 2.724 *** | 2.790 *** | 2.763 *** | 2.804 *** | 2.761 *** | 2.826 *** | 2.751 *** | |

| (0.313) | (0.323) | (0.323) | (0.324) | (0.321) | (0.323) | (0.322) | (0.327) | ||

| Google Trends index | −0.012 | −0.016 | −0.007 | −0.002 | −0.032 | −0.008 | −0.010 | −0.007 | |

| (0.022) | (0.022) | (0.020) | (0.022) | (0.026) | (0.023) | (0.023) | (0.023) | ||

| Return On Assets | −0.456 | −0.299 | −0.345 | −0.366 | −0.249 | −0.467 * | −0.430 | −0.418 | |

| (0.279) | (0.285) | (0.223) | (0.281) | (0.329) | (0.280) | (0.287) | (0.292) | ||

| Revenue Growth | 0.004 | 0.005 | −0.007 | 0.001 | 0.005 | 0.004 | 0.004 | 0.003 | |

| (0.011) | (0.011) | (0.009) | (0.010) | (0.013) | (0.011) | (0.011) | (0.012) | ||

| Free Cash Flow | −0.000 * | −0.000 * | −0.000 | −0.000 * | −0.000 | −0.000 ** | −0.000 | −0.000 * | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Price-To-Book Ratio | −0.143 | −0.100 | −0.137 | −0.104 | 0.153 | −0.032 | −0.094 | −0.027 | |

| (0.111) | (0.113) | (0.111) | (0.113) | (0.126) | (0.096) | (0.114) | (0.112) | ||

| Constant | 1.374 | 0.583 | 1.406 | 0.077 | 1.263 | 1.927 | 1.174 | 1.645 | 1.381 |

| (1.693) | (1.613) | (1.525) | (1.297) | (1.478) | (1.958) | (1.667) | (1.717) | (1.732) | |

| Observations | 252 | 252 | 252 | 252 | 252 | 252 | 252 | 252 | 252 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | −0.008 | −0.008 | −0.010 | −0.010 | −0.019 | 0.013 | −0.010 | −0.010 | - |

| (0.020) | (0.020) | (0.020) | (0.020) | (0.021) | (0.022) | (0.020) | (0.020) | - | |

| News Sentiment | 0.007 | 0.007 | 0.007 | 0.007 | 0.005 | 0.013 | 0.007 | - | 0.007 |

| (0.007) | (0.007) | (0.007) | (0.007) | (0.007) | (0.008) | (0.007) | - | (0.007) | |

| Twitter Counts (Thousands) | 0.001 | 0.008 | 0.034 | 0.034 | 0.020 | 0.368 | - | 0.046 | 0.006 |

| (0.268) | (0.269) | (0.268) | (0.267) | (0.270) | (0.294) | - | (0.268) | (0.262) | |

| Twitter Sentiment | 2.619 *** | 2.603 *** | 2.605 *** | 2.604 *** | 2.873 *** | - | 2.611 *** | 2.640 *** | 2.575 *** |

| (0.358) | (0.358) | (0.357) | (0.354) | (0.362) | - | (0.351) | (0.355) | (0.352) | |

| Google Trends index | 0.006 | −0.006 | −0.001 | −0.003 | - | −0.003 | −0.003 | −0.004 | −0.003 |

| (0.012) | (0.014) | (0.014) | (0.013) | - | (0.015) | (0.014) | (0.014) | (0.014) | |

| Return On Assets | −0.496 | −0.472 | −0.262 | - | −0.093 | 0.475 | 0.024 | −0.002 | 0.025 |

| (0.428) | (0.455) | (0.454) | - | (0.548) | (0.625) | (0.562) | (0.566) | (0.566) | |

| Revenue Growth | 0.001 | −0.006 | - | 0.022 | 0.026 | 0.024 | 0.023 | 0.023 | 0.023 |

| (0.023) | (0.019) | - | (0.022) | (0.028) | (0.031) | (0.028) | (0.028) | (0.028) | |

| Free Cash Flow | −0.000 | - | −0.000 | −0.000 * | −0.000 * | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | - | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Price-To-Book Ratio | - | −0.090 | −0.127 | −0.189 * | −0.192 | −0.224 | −0.191 | −0.196 | −0.186 |

| - | (0.120) | (0.115) | (0.105) | (0.121) | (0.155) | (0.139) | (0.140) | (0.139) | |

| Constant | −1.911 ** | 0.087 | 0.479 | 1.460 | 1.271 | 3.932 | 1.551 | 1.528 | 1.427 |

| (0.904) | (2.457) | (2.327) | (2.176) | (2.101) | (2.909) | (2.606) | (2.641) | (2.633) | |

| Observations | 233 | 233 | 233 | 233 | 252 | 233 | 233 | 233 | 233 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| News Paragraph Counts | 0.013 | 0.013 | 0.013 | 0.013 | 0.012 | 0.021 ** | 0.013 | 0.013 | - |

| (0.009) | (0.009) | (0.009) | (0.009) | (0.009) | (0.009) | (0.008) | (0.009) | - | |

| News Sentiment | 0.029 ** | 0.029 ** | 0.029 ** | 0.030 ** | 0.030 ** | 0.031 ** | 0.029 ** | - | 0.029 ** |

| (0.014) | (0.014) | (0.014) | (0.014) | (0.014) | (0.015) | (0.014) | - | (0.015) | |

| Twitter Counts (Thousands) | 0.087 | 0.057 | 0.044 | 0.065 | 0.142 | −0.076 | - | 0.085 | 0.184 |

| (0.296) | (0.301) | (0.306) | (0.305) | (0.296) | (0.310) | - | (0.308) | (0.293) | |

| Twitter Sentiment | 0.453 *** | 0.470 *** | 0.471 *** | 0.441 *** | 0.435 *** | - | 0.466 *** | 0.478 *** | 0.531 *** |

| (0.143) | (0.148) | (0.148) | (0.139) | (0.144) | - | (0.146) | (0.149) | (0.141) | |

| Google Trends index | −0.007 | −0.010 | −0.009 | −0.009 | - | −0.005 | −0.010 | −0.011 | −0.008 |

| (0.006) | (0.010) | (0.010) | (0.009) | - | (0.010) | (0.009) | (0.010) | (0.010) | |

| Return On Assets | 0.054 | 0.091 | 0.109 | - | 0.067 | −0.090 | 0.093 | 0.116 | 0.127 |

| (0.144) | (0.165) | (0.162) | - | (0.160) | (0.158) | (0.165) | (0.166) | (0.164) | |

| Revenue Growth | −0.024 | −0.021 | - | −0.023 | −0.007 | −0.022 | −0.020 | −0.016 | −0.020 |

| (0.032) | (0.032) | - | (0.032) | (0.030) | (0.033) | (0.033) | (0.033) | (0.033) | |

| Free Cash Flow | 0.000 | - | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.000) | - | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Price-To-Book Ratio | - | −0.080 | −0.109 | −0.034 | 0.045 | 0.059 | −0.090 | −0.102 | −0.078 |

| - | (0.181) | (0.177) | (0.160) | (0.122) | (0.181) | (0.177) | (0.184) | (0.183) | |

| Constant | −0.731 | −0.111 | −0.092 | −0.294 | −1.377 | −0.040 | −0.029 | −0.041 | −0.298 |

| (0.894) | (1.554) | (1.584) | (1.561) | (0.925) | (1.618) | (1.442) | (1.597) | (1.587) | |

| Observations | 244 | 244 | 244 | 244 | 252 | 244 | 244 | 244 | 244 |

Appendix B. Supplementary Discussion on Data Time Frame Selection

References

- Andersen, T. G., Bollerslev, T., Diebold, F. X., & Labys, P. (2003). Modeling and forecasting realized volatility. Econometrica, 71(2), 579–625. [Google Scholar] [CrossRef]

- Antweiler, W., & Frank, M. Z. (2004). Is all that talk just noise? The information content of Internet stock message boards. The Journal of Finance, 59(3), 1259–1294. [Google Scholar] [CrossRef]

- Araci, D. (2019). FinBERT: Financial sentiment analysis with pre-trained language models. arXiv. [Google Scholar] [CrossRef]

- Audrino, F., & Hu, Y. (2016). Volatility forecasting: Downside risk, jumps and leverage effect. Econometrics, 4(1), 8. [Google Scholar] [CrossRef]

- Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. (2020). COVID-induced economic uncertainty. Working Paper No. 26983. National Bureau of Economic Research (NBER). [CrossRef]

- Barber, B. M., & Odean, T. (2008). All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies, 21(2), 785–818. [Google Scholar] [CrossRef]

- Bhargava, N., Radaideh, M. I., Kwon, O. H., Verma, A., & Radaideh, M. I. (2025). On the impact of language nuances on sentiment analysis with large language models: Paraphrasing, sarcasm, and emojis. arXiv. [Google Scholar] [CrossRef]

- Bloomberg Intelligence. (2024). Here comes T+1 and the US buy-side has questions. Bloomberg Intelligence. [Google Scholar]

- Bollen, J., Mao, H., & Zeng, X. (2011). Twitter mood predicts the stock market. Journal of Computational Science, 2(1), 1–8. [Google Scholar] [CrossRef]

- Cevik, E., Kirci Altinkeski, B., Cevik, E. I., & Dibooglu, S. (2022). Investor sentiments and stock markets during the COVID-19 pandemic. Financial Innovation, 8, 69. [Google Scholar] [CrossRef]

- Chatterjee, U., & French, J. J. (2022). A note on tweeting and equity markets before and during the COVID-19 pandemic. Finance Research Letters, 46, 102224. [Google Scholar] [CrossRef]

- Chen, H., De, P., Hu, Y. J., & Hwang, B.-H. (2014). Wisdom of crowds: The value of stock opinions transmitted through social media. The Review of Financial Studies, 27(5), 1367–1403. [Google Scholar] [CrossRef]

- Chordia, T., Roll, R., & Subrahmanyam, A. (2011). Recent trends in trading activity and market quality. Journal of Financial Economics, 101(2), 243–263. [Google Scholar] [CrossRef]

- Costola, M., Hinz, O., Nofer, M., & Pelizzon, L. (2023). Machine learning sentiment analysis, COVID-19 news and stock market reactions. Research in International Business and Finance, 64, 101881. [Google Scholar] [CrossRef] [PubMed]

- Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461–1499. [Google Scholar] [CrossRef]

- Deephouse, D. L. (2000). Media reputation as a strategic resource: An integration of mass communication and resource-based theories. Journal of Management, 26(6), 1091–1112. [Google Scholar] [CrossRef]

- De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703–738. [Google Scholar] [CrossRef]

- Devlin, J., Chang, M.-W., Lee, K., & Toutanova, K. (2019). BERT: Pre-training of deep bidirectional transformers for language understanding. In Proceedings of the 2019 conference of the North American chapter of the association for computational linguistics: Human language technologies (pp. 4171–4186). Association for Computational Linguistics. [Google Scholar] [CrossRef]

- di Tollo, G., Andria, J., & Filograsso, G. (2023). The predictive power of social media sentiment: Evidence from cryptocurrencies and stock markets using NLP and stochastic ANNs. Mathematics, 11(16), 3441. [Google Scholar] [CrossRef]

- Divernois, M.-A., & Filipović, D. (2024). StockTwits classified sentiment and stock returns. Digital Finance, 6, 249–281. [Google Scholar] [CrossRef]

- Doğan, M., Metin, O., Tek, E., Yumuşak, S., & Oztoprak, K. (2020, December 10–13). Speculator and influencer evaluation in stock market by using social media. 2020 IEEE International Conference on Big Data (Big Data) (pp. 4559–4566), Atlanta, GA, USA. [Google Scholar] [CrossRef]

- Engelberg, J. E., & Parsons, C. A. (2011). The causal impact of media in financial markets. The Journal of Finance, 66(1), 67–97. [Google Scholar] [CrossRef]

- Fama, E. F., & French, K. R. (2021). The value premium: Fundamentals and stock returns in Japan. The Review of Asset Pricing Studies, 11(1), 105–121. [Google Scholar] [CrossRef]

- Henriques, I., & Sadorsky, P. (2025). Connectedness and systemic risk between FinTech and traditional financial stocks: Implications for portfolio diversification. Research in International Business and Finance, 73, 102629. [Google Scholar] [CrossRef]

- Huang, A. H., Wang, H., & Yang, Y. (2023). FinBERT: A large language model for extracting information from financial text. Contemporary Accounting Research, 40(2), 806–841. [Google Scholar] [CrossRef]

- International Monetary Fund [IMF]. (2023). Global financial stability report: Financial and climate policies for a high-interest-rate era. IMF. [Google Scholar]

- Janis, I. L., & Fadner, R. (1965). The coefficient of imbalance. In H. D. Lasswell, N. Leites, & Associates (Eds.), Language of politics: Studies in quantitative semantics (pp. 153–169). MIT Press. [Google Scholar]

- Jiang, T., & Zeng, A. (2023). Financial sentiment analysis using FinBERT with application in predicting stock movement. arXiv, arXiv:2306.02136. [Google Scholar] [CrossRef]

- Jiao, P., Veiga, A., & Walther, A. (2020). Social media, news media and the stock market. Journal of Economic Behavior & Organization, 176, 63–90. [Google Scholar] [CrossRef]

- Ke, Z., Kelly, B. T., & Xiu, D. (2020). Predicting returns with text data. Working Paper No. 2019-69, Yale ICF Working Paper No. 2019-10, Chicago Booth Research Paper No. 20-37. University of Chicago, Becker Friedman Institute for Economics. Available online: https://ssrn.com/abstract=3389884 (accessed on 1 September 2025).

- Kolajo, T., Daramola, O., & Adebiyi, A. A. (2022). Real-time event detection in social media streams through semantic analysis of noisy terms. Journal of Big Data, 9, 90. [Google Scholar] [CrossRef]

- Li, Q., Chao, Y., Li, D., Lu, Y., & Zhang, C. (2023). Event detection from social media stream: Methods, datasets and opportunities. arXiv, arXiv:2306.16495. [Google Scholar] [CrossRef]

- Malo, P., Sinha, A., Takala, P., Korhonen, P., Wallenius, J., & Gabbouj, M. (2014). Good debt or bad debt: Detecting semantic orientations in economic texts. Journal of the Association for Information Science and Technology, 65(4), 782–796. [Google Scholar] [CrossRef]

- Medhat, W., Hassan, A., & Korashy, H. (2014). Sentiment analysis algorithms and applications: A survey. Ain Shams Engineering Journal, 5(4), 1093–1113. [Google Scholar] [CrossRef]

- Nasdaq. (2025). Historical data for Apple Inc., Microsoft Corp., and Amazon.com Inc. Available online: https://www.nasdaq.com/market-activity/stocks (accessed on 1 October 2025).

- Nyakurukwa, K., & Seetharam, Y. (2024). Sentimental showdown: News media vs. social media in stock markets. Heliyon, 10(9), e30211. [Google Scholar] [CrossRef]

- Pfarrer, M. D., Pollock, T. G., & Rindova, V. P. (2010). A tale of two assets: The effects of firm reputation and celebrity on earnings surprises and investors’ reactions. Academy of Management Journal, 53(5), 1131–1152. [Google Scholar] [CrossRef]

- Preis, T., Moat, H. S., & Stanley, H. E. (2013). Quantifying trading behavior in financial markets using Google Trends. Scientific Reports, 3, 1684. [Google Scholar] [CrossRef]

- ProsusAI. (2020). FinBERT-tone [Data set]. Hugging Face. Available online: https://huggingface.co/ProsusAI/finbert (accessed on 1 June 2025).

- Ranco, G., Aleksovski, D., Caldarelli, G., Grčar, M., & Mozetič, I. (2015). The effects of Twitter sentiment on stock price returns. PLoS ONE, 10(9), e0138441. [Google Scholar] [CrossRef] [PubMed]

- Rao, T., & Srivastava, S. (2012). Analyzing stock market movements using Twitter sentiment analysis. In Proceedings of the 2012 international conference on advances in social networks analysis and mining (pp. 119–123). IEEE. [Google Scholar]

- Roy, P. K., Saumya, S., Singh, J. P., Banerjee, S., & Gutub, A. (2023). Analysis of community question-answering issues via machine learning and deep learning: State-of-the-art review. CAAI Transactions on Intelligence Technology, 8(1), 95–117. [Google Scholar] [CrossRef]

- Ruan, L., & Jiang, H. (2025). Stock price prediction using FinBERT-Enhanced sentiment with SHAP explainability and differential privacy. Mathematics, 13(17), 2747. [Google Scholar] [CrossRef]

- Shobayo, O., Adeyemi-Longe, S., Popoola, O., & Ogunleye, B. (2024). Innovative sentiment analysis and prediction of stock price using FinBERT, GPT-4 and logistic regression: A data-driven approach. Big Data and Cognitive Computing, 8(11), 143. [Google Scholar] [CrossRef]

- Simply Wall Street. (2025, October 3). Can Microsoft’s valuation still climb after folding AI into Office? Simply Wall St. Available online: https://simplywall.st/stocks/us/software/nasdaq-msft/microsoft/news/can-microsofts-valuation-still-climb-after-folding-ai-into-o (accessed on 1 September 2025).

- Sprenger, T. O., Tumasjan, A., Sandner, P. G., & Welpe, I. M. (2014). Tweets and trades: The information content of stock microblogs. European Financial Management, 20(5), 926–957. [Google Scholar] [CrossRef]

- Sun, A., Najand, M., & Shen, J. (2016). Stock return predictability and investor sentiment: A high-frequency perspective. Journal of Banking & Finance, 73, 147–164. [Google Scholar] [CrossRef]

- Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. The Journal of Finance, 62(3), 1139–1168. [Google Scholar] [CrossRef]

- Verma, R., & Verma, P. (2025). Economic news, social media sentiments, and stock returns: Which is a bigger driver? Journal of Risk and Financial Management, 18(1), 16. [Google Scholar] [CrossRef]

- WallStreetZen. (2025). Microsoft Corp (MSFT) ownership structure. WallStreetZen. Available online: https://www.wallstreetzen.com/stocks/us/nasdaq/msft/ownership (accessed on 1 September 2025).

- Wlodarczak, P. (2017). Exploring the value of big data analysis of Twitter tweets and share prices [Ph.D. dissertation, University of Southern Queensland]. [Google Scholar]

- Wolf, T., Debut, L., Sanh, V., Chaumond, J., Delangue, C., Moi, A., Cistac, P., Rault, T., Louf, R., Funtowicz, M., Davison, J., Shleifer, S., von Platen, P., Ma, C., Jernite, Y., Plu, J., Xu, C., Le Scao, T., Gugger, S., … Rush, A. M. (2020). Transformers: State-of-the-art natural language processing. In Proceedings of the 2020 conference on empirical methods in natural language processing: System demonstrations (pp. 38–45). Association for Computational Linguistics. [Google Scholar] [CrossRef]

- Wu, S., & Gu, F. (2023). Lightweight scheme to capture stock market sentiment on social media using sparse attention mechanism: A case study on Twitter. Journal of Risk and Financial Management, 16(10), 440. [Google Scholar] [CrossRef]

- Xiao, Q., & Ihnaini, B. (2023). Stock trend prediction using sentiment analysis. PeerJ Computer Science, 9, e1293. [Google Scholar] [CrossRef]

- Yoon, J., & Oh, G. (2022). Investor herding behavior in social media sentiment. Frontiers in Physics, 10, 1023071. [Google Scholar] [CrossRef]

- Yue, L., Chen, W., Li, X., Zuo, W., & Yin, M. (2019). A survey of sentiment analysis in social media. Knowledge and Information Systems, 60(2), 617–663. [Google Scholar] [CrossRef]

- Zeitun, R., Rehman, M. U., Ahmad, N., & Vo, X. V. (2023). The impact of Twitter-based sentiment on US sectoral returns. North American Journal of Economics and Finance, 64, 101847. [Google Scholar] [CrossRef]

- Zhang, W., Deng, S., & Li, J. (2022). A survey on aspect-based sentiment analysis: Tasks, methods, and challenges. IEEE Transactions on Knowledge and Data Engineering, 34(11), 5109–5129. [Google Scholar] [CrossRef]

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Trading volume (Thousands) | 25,088.480 | 21,192.420 | |||||||||||

| 2 | Stock Volatility (%) | 2.572 | 2.411 | 0.22 | ||||||||||

| 3 | Stock Return (%) | 0.591 | 3.477 | −0.10 | 0.18 | |||||||||

| 4 | News Paragraph Counts | 24.947 | 32.792 | 0.37 | 0.10 | 0.07 | ||||||||

| 5 | News Sentiment | −0.512 | 19.307 | 0.04 | 0.04 | 0.09 | 0.02 | |||||||

| 6 | Twitter Counts (Thousands) | 3.219 | 2.329 | 0.30 | 0.20 | −0.01 | 0.38 | 0.00 | ||||||

| 7 | Twitter Sentiment | 1.403 | 1.053 | 0.11 | 0.11 | 0.28 | 0.05 | 0.06 | −0.24 | |||||

| 8 | Google Trends index | 32.999 | 25.190 | 0.19 | 0.06 | −0.04 | 0.10 | −0.03 | 0.04 | 0.02 | ||||

| 9 | Return on Assets | 2.506 | 1.620 | 0.52 | −0.00 | −0.04 | 0.38 | 0.01 | 0.39 | −0.12 | 0.02 | |||

| 10 | Revenue Growth | 5.828 | 16.927 | −0.03 | 0.05 | −0.02 | −0.01 | 0.00 | 0.02 | −0.05 | 0.08 | 0.17 | ||

| 11 | Free Cash Flow | 21,088.190 | 18,121.530 | 0.55 | −0.02 | −0.05 | 0.41 | 0.03 | 0.49 | −0.09 | 0.13 | 0.68 | −0.03 | |

| 12 | Price-To-Book Ratio | 11.130 | 6.314 | −0.68 | 0.07 | 0.04 | −0.39 | −0.05 | −0.21 | −0.05 | −0.28 | −0.57 | 0.11 | −0.69 |

| Trading Volume | Stock Volatility | Stock Return | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | Apple | Amazon | Microsoft | Apple | Amazon | Microsoft | Apple | Amazon | Microsoft |

| News Paragraph Counts | 6.3 | 23.7 | 2.2 | 0.000 | 0.003 | 0.011 * | 0.012 ** | −0.010 | 0.013 |

| (24.3) | (15.1) | (56.7) | (0.004) | (0.015) | (0.006) | (0.005) | (0.020) | (0.009) | |

| News Sentiment | 56.8 | 0.7 | 6.9 | −0.001 | 0.002 | 0.007 | 0.022 | 0.007 | 0.029 ** |

| (101.6) | (5.5) | (92.1) | (0.015) | (0.006) | (0.010) | (0.020) | (0.007) | (0.015) | |

| Twitter Counts (Thousands) | 1823.0 *** | 1735.2 *** | 7534.6 *** | 0.326 *** | 0.496 ** | 0.396 * | −0.103 | 0.033 | 0.052 |

| (479.1) | (199.3) | (1936.2) | (0.070) | (0.202) | (0.215) | (0.098) | (0.269) | (0.307) | |

| Twitter Sentiment | −1224.8 | 951.9 *** | 2395.7 *** | 0.408 * | 0.929 *** | 0.299 *** | 2.789 *** | 2.603 *** | 0.469 *** |

| (1605.0) | (254.8) | (922.1) | (0.233) | (0.268) | (0.104) | (0.324) | (0.357) | (0.148) | |

| Google Trends index | 58.4 | −9.4 | 162.1 *** | 0.018 | −0.004 | 0.011 | −0.009 | −0.003 | −0.010 |

| (111.8) | (10.3) | (60.9) | (0.016) | (0.010) | (0.007) | (0.023) | (0.014) | (0.010) | |

| Return on Assets | 8705.9 *** | 34.8 | 696.5 | 0.065 | −0.463 | 0.143 | −0.393 | 0.016 | 0.090 |

| (1421.0) | (410.1) | (1029.3) | (0.208) | (0.426) | (0.116) | (0.289) | (0.567) | (0.165) | |

| Revenue Growth | −99.7 * | 32.9 * | 1.9 | −0.003 | 0.023 | −0.003 | 0.003 | 0.023 | −0.020 |

| (56.5) | (19.7) | (204.3) | (0.008) | (0.021) | (0.023) | (0.011) | (0.028) | (0.033) | |

| Free Cash Flow | 0.4 *** | −0.0 | −0.3 | −0.000 | −0.000 | −0.000 | −0.000 * | −0.000 | 0.000 |

| (0.1) | (0.1) | (0.2) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Price-To-Book Ratio | −1283.7 ** | −152.9 | 314.9 | 0.100 | −0.047 | 0.027 | −0.096 | −0.192 | −0.082 |

| (562.5) | (100.3) | (1138.4) | (0.082) | (0.105) | (0.128) | (0.114) | (0.140) | (0.183) | |

| Constant | −12,671.7 | 9065.3 *** | 41,001.6 *** | 1.456 | 4.527 ** | 1.948 * | 5.496 *** | 5.022 * | 0.987 |

| (8515.8) | (1856.4) | (9423.2) | (1.237) | (1.938) | (1.045) | (1.718) | (2.580) | (1.489) | |

| Observations | 253 | 234 | 245 | 252 | 233 | 244 | 252 | 233 | 244 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim-Hahm, H.; Abou-Zaid, A.S.; Mohd, A. News vs. Social Media: Sentiment Impact on Stock Performance of Big Tech Companies. J. Risk Financial Manag. 2025, 18, 660. https://doi.org/10.3390/jrfm18120660

Kim-Hahm H, Abou-Zaid AS, Mohd A. News vs. Social Media: Sentiment Impact on Stock Performance of Big Tech Companies. Journal of Risk and Financial Management. 2025; 18(12):660. https://doi.org/10.3390/jrfm18120660

Chicago/Turabian StyleKim-Hahm, Hyunsun, Ahmed S. Abou-Zaid, and Abidalrahman Mohd. 2025. "News vs. Social Media: Sentiment Impact on Stock Performance of Big Tech Companies" Journal of Risk and Financial Management 18, no. 12: 660. https://doi.org/10.3390/jrfm18120660

APA StyleKim-Hahm, H., Abou-Zaid, A. S., & Mohd, A. (2025). News vs. Social Media: Sentiment Impact on Stock Performance of Big Tech Companies. Journal of Risk and Financial Management, 18(12), 660. https://doi.org/10.3390/jrfm18120660