Adoption of Digital Technology and Financial Knowledge: Strategies for Achieving Sustainable Performance of MSMEs

Abstract

1. Introduction

2. Literature Review

2.1. Resource-Based View (RBV) Theory

2.2. Micro, Small and Medium Enterprises (MSMEs)

3. Research Method

3.1. Hypothesis Development

3.1.1. Digital Payments and MSME Performance

3.1.2. Business Automation and MSME Performance

3.1.3. Financial Inclusion and MSME Performance

3.1.4. Financial Literacy and MSME Performance

4. Results & Discussions

4.1. Digital Payment and MSME Performance

4.2. Business Automation and MSME Performance

4.3. Financial Inclusion and MSME Performance

4.4. Financial Literacy and MSME Performance

5. Conclusions

5.1. Implications

5.2. Limitations and Suggestions for Future Studies

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Al-Qudah, A. A., Al-Okaily, M., Shiyyab, F. S., Taha, A. A. D., Almajali, D. A., Masa’deh, R., & Warrad, L. H. (2024). Determinants of digital payment adoption among Generation Z: An empirical study. Journal of Risk and Financial Management, 17(11), 521. [Google Scholar] [CrossRef]

- Amnas, M. B., Selvam, M., & Parayitam, S. (2024). FinTech and financial inclusion: Exploring the mediating role of digital financial literacy and the moderating influence of perceived regulatory support. Journal of Risk and Financial Management, 17(3), 108. [Google Scholar] [CrossRef]

- Ariyanti, L. (2023). Kebijakan pemerintah dalam pemberdayaan UMKM [Government policy on empowering MSMEs]. Available online: https://djpb.kemenkeu.go.id/kppn/cirebon/id/data-publikasi/berita-terbaru/2852-kebijakan-pemerintah-dalam-pemberdayaan-umkm.html (accessed on 16 June 2025).

- Baker, H., Kaddumi, T. A., Nassar, M. D., & Muqattash, R. S. (2023). Impact of financial technology on improvement of banks’ financial performance. Journal of Risk and Financial Management, 16(4), 230. [Google Scholar] [CrossRef]

- Bakrie, R. R., Atikah Suri, S., Nabila, Sahara, A., Pratama, V. H., & Firmansyah. (2024). Pengaruh kreativitas UMKM serta kontribusinya di era digitalisasi terhadap perekonomian Indonesia [The influence of MSME creativity and its contribution in the digital age to the Indonesian economy]. Jurnal Ekonomi Dan Bisnis, 16(2), 82–88. [Google Scholar] [CrossRef]

- Banerjee, A., Duflo, E., Glennerster, R., & Kinnan, C. (2015). The miracle of microfinance? Evidence from a randomized evaluation. American Economic Journal: Applied Economics, 7(1), 22–53. [Google Scholar] [CrossRef]

- Bapat, G., Mahindru, R., Kumar, A., Rroy, A. D., Bhoyar, S., & Vaz, S. (2023). Leveraging ChatGPT for empowering MSMEs: A paradigm shift in problem solving. Engineering Proceedings, 59(1), 197. [Google Scholar] [CrossRef]

- Bhattarai, B., Shrestha, R., Maharjan, S., Malla, S., & Shakya, S. (2023). Effectiveness of digital payments in the performance of nepalese micro, small and medium enterprises (MSME). New Perspective Journal of Business and Economics, 6(1), 9–22. [Google Scholar] [CrossRef]

- Cohen, M., & Nelson, C. (2011). Financial literacy: A step for clients towards financial inclusion. Global Microcredit Summit, 14(17), 1–34. [Google Scholar]

- Damane, M., & Ho, S. Y. (2024). The impact of financial inclusion on financial stability: Review of theories and international evidence. Development Studies Research, 11(1), 2373459. [Google Scholar] [CrossRef]

- Darcy, C., Hill, J., Mccabe, T. J., & Mcgovern, P. (2014). A consideration of organisational sustainability in the SME context: A resource-based view and composite model. European Journal of Training and Development, 38(5), 398–414. [Google Scholar] [CrossRef]

- Darma, E. S., & Handoyo, S. F. L. (2022). The role of Baitul Maal Wat Tamwil financing and business coaching on business development and welfare improvement of micro traders in traditional markets. Journal of Accounting and Investment, 23(2), 379–397. [Google Scholar] [CrossRef]

- Daud, I., Nurjannah, D., Mohyi, A., Ambarwati, T., Cahyono, Y., Haryoko, A. D. E., Handoko, A. L., Putra, R. S., Wijoyo, H., Ari-Yanto, A., & Jihadi, M. (2022). The effect of digital marketing, digital finance and digital payment on finance performance of Indonesian SMEs. International Journal of Data and Network Science, 6(1), 37–44. [Google Scholar] [CrossRef]

- Espeña, G. D., Libao, F. J. D., Comedia, V. J. G., De Luna, N. A. P. U., Nardo, G. J., & Dizon, R. O. (2022, December 1–4). Assessment of Philippine MSMEs’ shop floor automation level and barriers to their technology upgrading. 2022 IEEE 14th International Conference on Humanoid, Nanotechnology, Information Technology, Communication and Control, Environment, and Management, HNICEM 2022, Boracay Island, Philippines. [Google Scholar] [CrossRef]

- Febriansyah, A., Syafei, M. Y., Narimawati, U., Chochole, T., & Stakic, A. J. (2024). How important is financial inclusion for the performance of MSMEs? Australasian Accounting, Business and Finance Journal, 18(5), 53–66. [Google Scholar] [CrossRef]

- Fomum, T. A., & Opperman, P. (2023). Financial inclusion and performance of MSMEs in Eswatini. International Journal of Social Economics, 50(11), 1551–1567. [Google Scholar] [CrossRef]

- Frimpong, S. E., Agyapong, G., & Agyapong, D. (2022). Financial literacy, access to digital finance and performance of SMEs: Evidence from central region of Ghana. Cogent Economics and Finance, 10(1), 2121356. [Google Scholar] [CrossRef]

- Gameti, D., & Morrish, S. (2025). Entrepreneurial orientation and SME growth: The mediating effect of product, process, and business model innovations. Journal of Research in Marketing and Entrepreneurship, 27(2), 232–254. [Google Scholar] [CrossRef]

- Giang, N. T. P., Tan, T. D., Hung, L. H., & Duy, N. B. P. (2024). The adoption of electronic payments in online shopping: The mediating role of customer trust. International Journal of Advanced Computer Science and Applications, 15(9), 876–886. [Google Scholar] [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Hasan, M., Jannah, M., Supatminingsih, T., Ahmad, M. I. S., Sangkala, M., Najib, M., & Elpisah. (2024). Understanding the role of financial literacy, entrepreneurial literacy, and digital economic literacy on entrepreneurial creativity and MSMEs success: A knowledge-based view perspective. Cogent Business and Management, 11(1), 2433708. [Google Scholar] [CrossRef]

- Hidranto, F. (2024). Transaksi digital tumbuh pesat [Digital transactions are growing rapidly. Indonesia.Go.Id. [Google Scholar]

- Ilham, B. U. (2025). UMKM outlook 2025. Portal Bisnis KUMKM. Available online: https://bisniskumkm.com/umkm-outlook-2024/ (accessed on 9 April 2025).

- Kaddumi, T. A., Baker, H., Nassar, M. D., & A-Kilani, Q. (2023). Does financial technology adoption influence bank’s financial performance: The case of Jordan. Journal of Risk and Financial Management, 16(9), 413. [Google Scholar] [CrossRef]

- Kemenkeu. (2023). Kontribusi UMKM dalam perekonomian Indonesia [Contribution of MSMEs in the Indonesian economy]. Available online: https://djpb.kemenkeu.go.id/kppn/lubuksikaping/id/data-publikasi/artikel/3134-kontribusi-umkm-dalam-perekonomian-indonesia.html (accessed on 31 March 2024).

- Kemenko Perekonomian. (2025). Pemerintah dorong UMKM naik kelas tingkatkan kontribusi terhadap ekspor Indonesia [Government encourages MSMEs to upgrade and increase contribution to Indonesian exports]. Available online: https://www.ekon.go.id/publikasi/detail/6152/pemerintah-dorong-umkm-naik-kelas-tingkatkan-kontribusi-terhadap-ekspor-indonesia (accessed on 9 April 2025).

- komdigi.go.id. (2024, December). Menggalakkan literasi digital dan literasi keuangan untuk tekan pengaruh judi online [Promoting digital literacy and financial literacy to reduce the influence of online gambling]. Indonesia.Go.Id. Available online: https://www.komdigi.go.id/berita/masyarakat-digital/detail/menggalakkan-literasi-digital-dan-literasi-keuangan-untuk-tekan-pengaruh-judi-online (accessed on 9 April 2025).

- Ledi, K. K., Ameza-Xemalordzo, E., Amoako, G. K., & Asamoah, B. (2023). Effect of QR code and mobile money on performance of SMEs in developing countries. The role of dynamic capabilities. Cogent Business and Management, 10(2), 2238977. [Google Scholar] [CrossRef]

- Lontchi, C. B., Yang, B., & Shuaib, K. M. (2023). Effect of financial technology on SMEs performance in Cameroon amid COVID-19 recovery: The mediating effect of financial literacy. Sustainability, 15(3), 2171. [Google Scholar] [CrossRef]

- Mariska. (2024). % Penyebab UMKM gulung tikar, salah satunya legalitas [Causes of MSME closures, one of which is legality]. Available online: https://kontrakhukum.com/article/umkm-gulung-tikar/ (accessed on 9 April 2025).

- Maskuri, M. F., Febriyanto, A., Baroroh, H., & Nurullaily, S. (2024). Factors affecting the sustainability of halal MSMEs in Yogyakarta: A study on literacy, digitalization, and fintech. Diponegoro Journal of Economics, 13(4), 37–56. [Google Scholar] [CrossRef]

- Miran, M., Evinita, L., & Pesak, P. J. (2025). Financial literacy as mediating factors affecting the financial performance of MSMEs in digital cities and special economic zones in 3T regions. Edelweiss Applied Science and Technology, 9(3), 801–816. [Google Scholar] [CrossRef]

- Moreira, S., Mamede, H. S., & Santos, A. (2023). Business process automation in SMEs. Lecture Notes in Business Information Processing, 464 LNBIP, 426–437. [Google Scholar] [CrossRef]

- Moreira, S., Mamede, H. S., & Santos, A. (2024). Business process automation in SMEs: A systematic literature review. IEEE Access, 12, 75832–75864. [Google Scholar] [CrossRef]

- Musyaffi, A. M., Baxtishodovich, B. S., Johari, R. J., Wolor, C. W., Afriadi, B., & Muna, A. (2024). Can financial advantages and digital payments adoption provide effective solutions to improve SMEs’ performance? Montenegrin Journal of Economics, 20(2), 75–89. [Google Scholar] [CrossRef]

- Musyaffi, A. M., Gurendrawati, E., Afriadi, B., Oli, M. C., Widawati, Y., & Oktavia, R. (2022). Resistance of traditional SMEs in using digital payments: Development of innovation resistance theory. Human Behavior and Emerging Technologies, 2022, 7538042. [Google Scholar] [CrossRef]

- Nugraheni, P., & Muhammad, R. (2024). The optimisation of Qardhul Hasan management in Islamic banking: Enhancing its role in empowering the community. Journal of Enterprising Communities, 18(3), 469–486. [Google Scholar] [CrossRef]

- OECD. (2024). Financing SMEs and entrepreneurs 2024: An OECD scoreboard. Available online: https://www.oecd.org/en/publications/financing-smes-and-entrepreneurs-2024_fa521246-en.html (accessed on 9 April 2025).

- OJK. (2023). Peningkatan literasi dan inklusi keuangan di sektor jasa keuangan bagi konsumen dan masyarakat [Improving financial literacy and inclusion in the financial services sector for consumers and the community]. Otoritas Jasa Keuangan (OJK). [Google Scholar]

- Oussouadi, K., & Cherkaoui, K. (2024). Survival dynamics of SMEs supported by credit guarantee schemes: Insights from Morocco. Banks and Bank Systems, 19(1), 86–98. [Google Scholar] [CrossRef]

- Pratama, D., Nurwani, N., & Nasution, Y. S. J. (2023). The effect of understanding of financial literacy and ease of digital payment of the continuity of MSMEs in the digitalization era. Indonesian Interdisciplinary Journal of Sharia Economics (IIJSE), 6(2), 618–638. [Google Scholar]

- Purba, F. A., Nasution, H. M., Siregar, N. H., Lubis, S. N. T., & Wulandari, S. (2024). Peran sistem pembayaran digital dalam meningkatkan produktivitas Usaha Mikro, Kecil, dan Menengah (UMKM) di Kecamatan Medan Perjuangan [The Role of Digital Payment Systems in Increasing the Productivity of Micro, Small, and Medium Enterprises (MSMEs) in Medan Perjuangan District]. Jurnal Ekonomi Dan Bisnis (EK&BI), 7(2), 425. [Google Scholar] [CrossRef]

- Rahadjeng, E. R., Pratikto, H., Mukhlis, I., Restuningdiah, N., & Mala, I. K. (2023). The impact of financial literacy, financial technology, and financial inclusion on SME business performance in Malang Raya, Indonesia. Journal of Social Economics Research, 10(4), 146–160. [Google Scholar] [CrossRef]

- Saputri, N. A. (2021). Readiness of SMEs on digital payment for business sustainbility. Ekonomi, Keuangan, Investasi Dan Syariah (EKUITAS), 3(2), 140–144. [Google Scholar] [CrossRef]

- Sari, Y. W., Nugroho, M., & Rahmiyati, N. (2023). The effect of financial knowledge, financial behavior and digital financial capabilities on financial inclusion, financial concern and performance in MSMEs in East Java. Uncertain Supply Chain Management, 11(4), 1745–1758. [Google Scholar] [CrossRef]

- Saskia, W., Ainil Putri, A., & Razak, L. (2023). The influence of financial inclusion, financial literacy and financial behavior on company performance in MSMEs in Makassar City. International Journal of Economic Research and Financial Accounting (IJERFA), 1(4), 146–156. [Google Scholar] [CrossRef]

- Thathsarani, U. S., & Jianguo, W. (2022). Do digital finance and the technology acceptance model strengthen financial inclusion and SME performance? Information, 13(8), 390. [Google Scholar] [CrossRef]

- Wiranatakusuma, D. B., & Latief, N. (2024). Analysis of switching behavior for using digital payment financial technology in Tumenggungan market Kebumen, Central Java. Journal of Economics Research and Social Sciences, 8(1), 53–69. [Google Scholar] [CrossRef]

- Yaya, R., Nugraheni, P., Nurpaizah, S., Putra, A. Z., Razak, D. B. A., Suib, F. H., & Suki, A. A. (2023). Improving entrepreneur skills for micro business nearby Al Syakirin Gombak Mosque Malaysia to achieve sustainable development goals. Proceeding International Conference of Community Service, 1(1), 440–445. [Google Scholar] [CrossRef]

| No. | Sex | Number | Percentage (%) |

| 1 | Male | 134 | 48.20 |

| 2 | Female | 144 | 51.80 |

| Total | 278 | 100 | |

| No. | Age | Number | Percentage (%) |

| 1 | 15–20 Years old | 5 | 1.80 |

| 2 | 21–30 Years old | 122 | 43.88 |

| 3 | 31–40 Years old | 123 | 44.24 |

| 4 | 41–50 Years old | 25 | 8.99 |

| 5 | >50 Years old | 3 | 1.08 |

| Total | 278 | 100 | |

| No. | Position | Number | Percentage (%) |

| 1 | Manager | 39 | 14.03 |

| 2 | Owner | 239 | 85.97 |

| Total | 278 | 100 | |

| No. | Education Level | Number | Percentage (%) |

| 1 | Primary School | 2 | 0.72 |

| 2 | Lower Secondary School | 9 | 3.24 |

| 3 | Upper Secondary School | 141 | 50.72 |

| 4 | Diploma | 29 | 10.43 |

| 5 | Bachelor’s Degree | 94 | 33.81 |

| 6 | Master’s Degree | 3 | 1.08 |

| Total | 278 | 100 | |

| No. | Years in Business | Number | Percentage (%) |

| 1 | <1 Year | 26 | 9.35 |

| 2 | 1–3 Years | 124 | 44.60 |

| 3 | 3–5 Years | 89 | 32.01 |

| 4 | 5–10 Years | 28 | 10.07 |

| 5 | >10 Years | 11 | 3.96 |

| Total | 278 | 100 | |

| No. | Employee | Number | Percentage (%) |

| 1 | None | 59 | 21.22 |

| 2 | 1–5 employees | 138 | 49.64 |

| 3 | 6–10 employees | 43 | 15.47 |

| 4 | 11–20 employees | 30 | 10.79 |

| 5 | >20 employees | 8 | 2.88 |

| Total | 278 | 100 | |

| No. | Profit | Number | Percentage (%) |

| 1 | <Rp 5,000,000 | 73 | 26.26 |

| 2 | Rp 5,000,000–Rp 10,000,000 | 86 | 30.94 |

| 3 | Rp 10,000,000–Rp 50,000,000 | 82 | 29.50 |

| 4 | Rp 50,000,000–Rp 100,000,000 | 32 | 11.51 |

| 5 | >Rp 100,000,000 | 5 | 1.80 |

| Total | 278 | 100 | |

| No. | Business Type | Number | Percentage (%) |

| 1 | Fashion/Clothing | 39 | 14.03 |

| 2 | Service (Salon, laundry, dll) | 20 | 7.19 |

| 3 | Culinary | 151 | 54.32 |

| 4 | Craft | 17 | 6.12 |

| 5 | Automotive | 12 | 4.32 |

| 6 | Others | 14 | 5.04 |

| 7 | More than 1 Business | 25 | 8.99 |

| Total | 278 | 100 |

| Descriptive Statistics | ||||

|---|---|---|---|---|

| Minimum | Maximum | Mean | Std. Dev. | |

| Digital Payment | 4 | 20 | 17.43 | 2.944 |

| Business Automation | 5 | 25 | 20.92 | 3.792 |

| Financial Inclusion | 8 | 25 | 18.88 | 3.309 |

| Financial Literation | 4 | 20 | 17.17 | 2.713 |

| Performance in MSME | 11 | 55 | 46.45 | 7.559 |

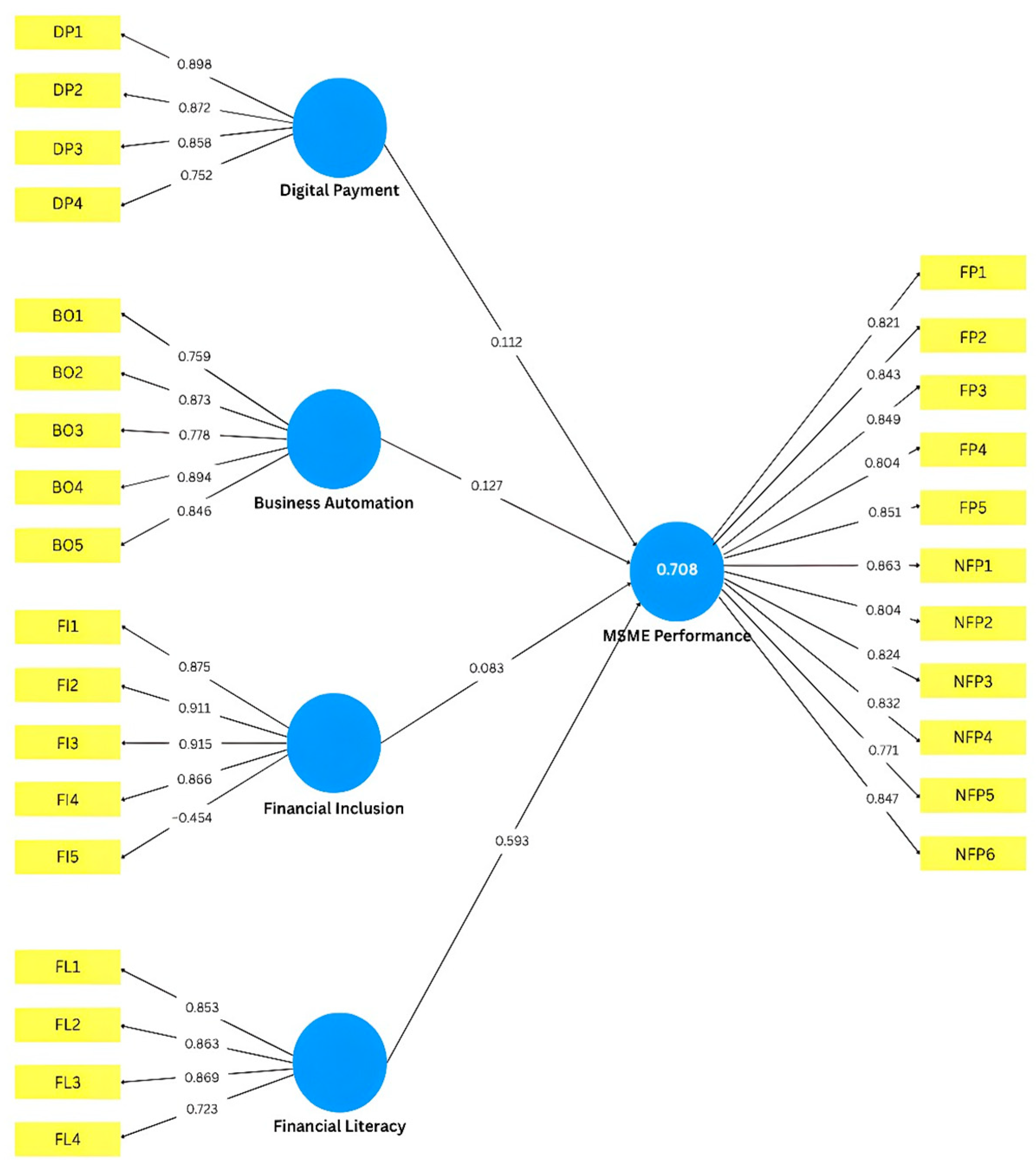

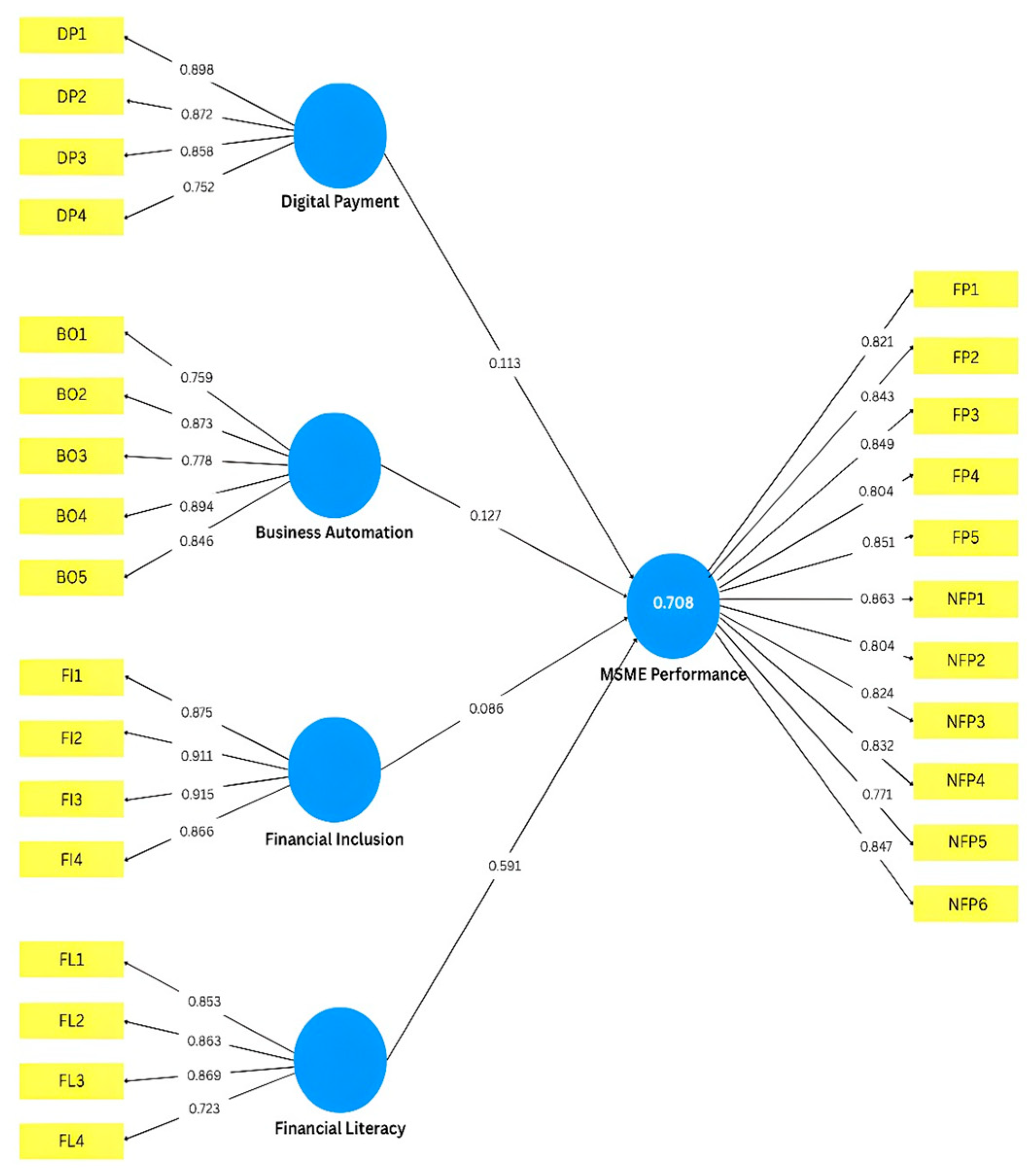

| Latent Variables | Code | Before Treatment Loading Factor | Before AVE | After Treatment Loading Factor | After AVE |

|---|---|---|---|---|---|

| Business Automation | BO1 | 0.759 | 0.692 | 0.759 | 0.692 |

| BO2 | 0.873 | 0.873 | |||

| BO3 | 0.778 | 0.778 | |||

| BO4 | 0.894 | 0.894 | |||

| BO5 | 0.846 | 0.846 | |||

| Digital Payment | DP1 | 0.898 | 0.717 | 0.898 | 0.717 |

| DP2 | 0.872 | 0.872 | |||

| DP3 | 0.858 | 0.858 | |||

| DP4 | 0.752 | 0.752 | |||

| Financial Inclusion | FI1 | 0.875 | 0.678 | 0.875 | 0.796 |

| FI2 | 0.911 | 0.911 | |||

| FI3 | 0.915 | 0.915 | |||

| FI4 | 0.866 | 0.866 | |||

| FI5 | −0.454 | ||||

| Financial Literacy | FL1 | 0.853 | 0.688 | 0.853 | 0.688 |

| FL2 | 0.863 | 0.863 | |||

| FL3 | 0.869 | 0.869 | |||

| FL4 | 0.723 | 0.723 | |||

| MSMEs Performance | FP1 | 0.821 | 0.686 | 0.821 | 0.686 |

| FP2 | 0.843 | 0.843 | |||

| FP3 | 0.849 | 0.849 | |||

| FP4 | 0.804 | 0.804 | |||

| FP5 | 0.851 | 0.851 | |||

| NFP1 | 0.863 | 0.863 | |||

| NFP2 | 0.804 | 0.804 | |||

| NFP3 | 0.824 | 0.824 | |||

| NFP4 | 0.832 | 0.832 | |||

| NFP5 | 0.771 | 0.771 | |||

| NFP6 | 0.847 | 0.847 |

| Business Automation | Digital Payment | Financial Inclusion | Financial Literacy | MSMEs Performance | |

|---|---|---|---|---|---|

| Business Automation | 0.832 | ||||

| Digital Payment | 0.661 | 0.847 | |||

| Financial Inclusion | 0.673 | 0.541 | 0.892 | ||

| Financial Literacy | 0.765 | 0.722 | 0.67 | 0.829 | |

| MSMEs Performance | 0.711 | 0.67 | 0.626 | 0.827 | 0.828 |

| Cronbach’s Alpha | Composite Reliability | |

|---|---|---|

| Business Automation | 0.887 | 0.918 |

| Digital Payment | 0.868 | 0.910 |

| Financial Inclusion | 0.914 | 0.940 |

| Financial Literacy | 0.847 | 0.898 |

| MSMEs Performance | 0.954 | 0.960 |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p Values | |

|---|---|---|---|---|---|

| Digital Payment -> MSMEs Performance | 0.112 | 0.116 | 0.074 | 1.516 | 0.065 |

| Business Automation -> MSMEs Performance | 0.127 | 0.125 | 0.062 | 2.05 | 0.020 |

| Financial Inclusion -> MSMEs Performance | 0.086 | 0.09 | 0.059 | 1.442 | 0.075 |

| Financial Literacy -> MSMEs Performance | 0.591 | 0.586 | 0.069 | 8.527 | 0.000 |

| VIF | 2.044–3.270 | ||||

| Adjusted R-Square | 0.704 | ||||

| SRMR | <0.10 | ||||

| NFI | 0.809 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nugraheni, P.; Darma, E.S.; Muhammad, R. Adoption of Digital Technology and Financial Knowledge: Strategies for Achieving Sustainable Performance of MSMEs. J. Risk Financial Manag. 2025, 18, 646. https://doi.org/10.3390/jrfm18110646

Nugraheni P, Darma ES, Muhammad R. Adoption of Digital Technology and Financial Knowledge: Strategies for Achieving Sustainable Performance of MSMEs. Journal of Risk and Financial Management. 2025; 18(11):646. https://doi.org/10.3390/jrfm18110646

Chicago/Turabian StyleNugraheni, Peni, Emile Satia Darma, and Rifqi Muhammad. 2025. "Adoption of Digital Technology and Financial Knowledge: Strategies for Achieving Sustainable Performance of MSMEs" Journal of Risk and Financial Management 18, no. 11: 646. https://doi.org/10.3390/jrfm18110646

APA StyleNugraheni, P., Darma, E. S., & Muhammad, R. (2025). Adoption of Digital Technology and Financial Knowledge: Strategies for Achieving Sustainable Performance of MSMEs. Journal of Risk and Financial Management, 18(11), 646. https://doi.org/10.3390/jrfm18110646