1. Introduction

The integration of Bitcoin into corporate balance sheets represents a transformative shift in financial strategy, driven by its potential to serve as a hedge against inflation, enhance liquidity, and signal technological sophistication in an increasingly digital economy. As of August 2025, 102 publicly traded companies hold 1,001,861 BTC—valued at approximately

$112.9 billion and constituting 4.77% of the total Bitcoin supply—with leading adopters such as Strategy (632,457 BTC) and Tesla (11,509 BTC) exemplifying this trend (

CoinGecko, 2025). While Bitcoin’s decentralized architecture, finite supply, and low correlation with traditional assets offer strategic advantages, its extreme price volatility and evolving regulatory landscape introduce significant risks that vary across industries, including technology, cryptocurrency mining, retail, healthcare, and e-commerce. The U.S. BITCOIN Act of 2025 has introduced a structured regulatory framework for domestic firms, yet global divergence in policy—from progressive models in South Korea to restrictive regimes in China—creates uneven adoption incentives (

Federal Register, 2025). This study addresses the critical need to understand how financial risk, regulatory influence, and Bitcoin’s inherent auto-regulatory features shape sector-specific treasury decisions.

Existing research has examined corporate cryptocurrency adoption through market reactions (

Gimenes et al., 2023), liquidity impacts (

Lee, 2025), and regulatory barriers (

Sestino et al., 2025), yet few studies offer a comprehensive sectoral analysis that integrates risk quantification, regulatory modeling, and visualization of adoption patterns. Prior work often focuses on technology and mining sectors or aggregates firms without disaggregating risk profiles, leaving gaps in understanding how non-traditional industries—such as retail and healthcare—navigate Bitcoin’s volatility and compliance demands. Moreover, while Bitcoin’s decentralized consensus is frequently cited as a self-governing mechanism, its practical role in mitigating external regulation remains underexplored across diverse corporate contexts.

This study fills these gaps by conducting a cross-sectional analysis of financial risks, regulatory impacts, and auto-regulatory dynamics in corporate Bitcoin adoption, using a dataset of 102 firms as of August 2025. It employs volatility proxies, logistic regression with a U.S. regulatory dummy, and heatmap visualization to quantify sector-specific risk, assess regulatory influence, and illustrate adoption patterns. Grounded in Institutional Theory, the Technology Acceptance Model (TAM), and Transaction Cost Economics (TCE), the research contributes a nuanced framework for understanding decentralized governance in corporate finance. The findings offer practical guidance for treasury risk management and policy implications for regulatory design in a post-2025 digital asset environment.

The paper is structured as follows: the Literature Review synthesizes prior work on risk, regulation, and adoption; the Theoretical Framework integrates Institutional Theory, TAM, and TCE; the Methodology details data, models, and visualization; the Results present volatility, regression, and heatmap analyses; and the Conclusion discusses implications, limitations, and future research.

Research Objectives and Contribution

This study pursues four interconnected objectives: (1) to quantify sector-specific financial risk profiles using volatility proxies derived from Bitcoin holdings; (2) to evaluate the influence of regulatory frameworks, particularly the U.S. BITCOIN Act of 2025, on adoption likelihood across industries; (3) to assess the extent to which Bitcoin’s decentralized consensus serves as an auto-regulatory mechanism mitigating external oversight; and (4) to visualize market and investor reactions through sector-level risk and regulatory patterns. By integrating Institutional Theory, the Technology Acceptance Model (TAM), and Transaction Cost Economics (TCE), the research provides a robust theoretical foundation for understanding adoption drivers. Methodologically, it employs a cross-sectional dataset of 102 firms as of August 2025, applying logistic regression, volatility analysis, and heatmap visualization to generate empirical insights. The contribution lies in bridging the gap between financial risk assessment, regulatory impact, and decentralized governance in corporate cryptocurrency strategy, offering actionable guidance for treasury managers and informing regulatory design in a rapidly evolving digital asset landscape.

2. Literature Review

The adoption of Bitcoin as a strategic reserve asset by corporations marks a significant evolution in financial management, reflecting its growing acceptance as a decentralized, limited-supply asset with unique risk and regulatory implications across diverse sectors such as technology, cryptocurrency mining, retail, healthcare, and e-commerce. As of August 2025, 102 publicly traded companies hold 1,001,861 BTC, valued at approximately

$112.9 billion, representing 4.77% of the total Bitcoin supply, with leading adopters like Strategy (632,457 BTC) and Tesla (11,509 BTC) underscoring its transition from a speculative instrument to a recognized store of value (

CoinGecko, 2025).

Sherifi et al. (

2024) emphasize Bitcoin’s high volatility, noting that traditional risk models like variance-covariance (VaR) are inadequate for capturing its non-normal return distributions, posing significant challenges for mining firms like MARA Holdings (50,639 BTC), whose operational models are directly tied to Bitcoin’s price fluctuations.

Gao et al. (

2025) further highlight that firms with cryptocurrency exposure face elevated debt financing costs due to creditors’ perceptions of heightened risk, a concern particularly pronounced for capital-intensive sectors like technology and mining, where firms such as Coinbase (11,776 BTC) hold substantial reserves to leverage blockchain synergies.

Huang and Hsu (

2025) employ GARCH-EVT-Copula models to demonstrate that Bitcoin and related decentralized finance (DeFi) tokens exhibit weaker lower tail dependencies, suggesting potential diversification benefits but persistent upside volatility risks, which could affect firms like Riot Platforms (19,239 BTC) that integrate Bitcoin into core operations.

Sergio and Wedemeier (

2025) use spatial autoregressive models to link cryptocurrency adoption to economic instability, noting higher volatility risks in emerging markets, which may impact retail firms like GameStop (4710 BTC) and e-commerce players like MercadoLibre (570 BTC) operating in such regions. These findings collectively underscore the need for sector-specific risk assessments, such as volatility proxies derived from cost-value ratios (

Todays_Value_USD/

Total_Cost_USD), to quantify the financial implications of Bitcoin adoption across the dataset’s diverse industries.

Regulatory frameworks play a critical role in shaping corporate Bitcoin adoption, with varying impacts across jurisdictions and sectors, as evidenced by the U.S. BITCOIN Act of 2025, which establishes a strategic Bitcoin reserve and provides regulatory clarity for the 56 U.S.-based firms in the dataset (

Federal Register, 2025).

Doucette and Lee (

2025) explore South Korea’s Busan Blockchain Regulation-Free Zone, highlighting how progressive policies facilitate adoption by technology and mining firms, such as Japan’s Metaplanet (18,991 BTC), by reducing regulatory barriers and fostering innovation. In contrast,

Haq et al. (

2022) discuss anti-money laundering (AML) regulations in emerging markets like Bangladesh, which impose significant compliance costs that deter retail and e-commerce firms, potentially affecting companies like Cango (4532 BTC) in restrictive jurisdictions.

Sestino et al. (

2025) further identify money laundering and terrorism financing concerns as barriers to investment in Middle East and African markets, particularly impacting sectors like retail and e-commerce that lack the blockchain expertise prevalent in technology firms.

Kala and Chaubey (

2023) find that perceived government control moderates cryptocurrency adoption in India, suggesting that regulatory perceptions influence firms’ continuance intentions, a factor relevant for companies operating in similarly regulated environments. These regulatory variations highlight the need for logistic regression models incorporating dummy variables (e.g., U.S. vs. non-U.S. firms) to assess adoption likelihood and regulatory sensitivity across the dataset’s global firms, particularly as regulatory frameworks evolve to accommodate Bitcoin’s growing corporate presence.

Bitcoin’s decentralized nature, driven by blockchain consensus mechanisms, introduces auto-regulatory features that mitigate external regulatory pressures, offering unique advantages for corporate adopters.

Currie and Seddon (

2025) argue that Bitcoin’s cryptographic technology and peer-to-peer consensus reduce reliance on centralized oversight, benefiting technology and mining firms like Coinbase and Riot Platforms, which leverage blockchain expertise to integrate Bitcoin into their operations.

Andolfatto and Martin (

2022) emphasize that blockchain’s tamper-proof ledger addresses the double-spending problem, enhancing trust in decentralized transactions, a critical factor for firms managing large reserves like Strategy.

Abdul Basith et al. (

2021) highlight the cybersecurity benefits of decentralization, noting that blockchain’s immutability reduces risks of external tampering, an advantage for firms with significant holdings. However,

Liebi (

2022) cautions that the integration of crypto portfolios by centralized financial institutions challenges the notion of full decentralization, complicating auto-regulatory benefits for sectors like healthcare, where firms like Semler Scientific (5021 BTC) adopt Bitcoin as a hedge rather than an operational asset.

Nzaha et al. (

2022) apply the Diffusion of Innovation Theory to show that compatibility with decentralized systems drives cryptocurrency adoption in Africa, suggesting potential for e-commerce firms like MercadoLibre to leverage auto-regulation for cross-border transactions. These insights underscore the importance of exploring how blockchain’s consensus mechanisms moderate regulatory risks, particularly for sectors with varying levels of technological alignment.

Market and investor responses to corporate Bitcoin adoption vary significantly by sector, reflecting differing perceptions of risk and strategic alignment.

Gimenes et al. (

2023) find that cryptocurrency adoption announcements yield slightly positive but statistically insignificant stock market reactions, with stronger effects for high-exposure firms like Strategy, whose

$72.4 billion BTC value dominates the dataset.

Eshghi and Farivar (

2025) report positive abnormal returns of 0.65% on announcement days for non-retail firms, indicating investor confidence in technology and mining sectors like Tesla and Block (8692 BTC), while retail firms like GameStop face skepticism due to perceived misalignment with core operations.

Jalan et al. (

2023) underscore interpersonal trust as a critical driver of adoption in tech-heavy markets, supporting high adoption rates in firms with blockchain expertise.

Jayasuriya and Sims (

2023) highlight accounting challenges, noting that unclear International Financial Reporting Standards (IFRS) for crypto-assets complicate valuation and reporting, particularly for retail and healthcare sectors with stringent compliance requirements, such as Semler Scientific and GameStop. These accounting complexities can influence investor perceptions, especially for firms with smaller holdings navigating regulatory scrutiny.

The financial implications of Bitcoin adoption extend beyond volatility and accounting challenges, as firms balance liquidity benefits against operational complexities.

Lee (

2025) demonstrates that Bitcoin investments enhance liquidity at mature stages of a firm’s life cycle, particularly for technology firms like Coinbase, which use Bitcoin to manage cash flow volatility.

Neetu and Symss (

2025) argue that Bitcoin’s low correlation with traditional assets makes it an attractive diversification tool, especially during economic crises when conventional markets face depressed returns, a strategy evident in healthcare firms like KindlyMD (5764 BTC) seeking economic hedges.

Devault et al. (

2025) find that early institutional adopters in technology and mining outperform peers by 2.8% annually, leveraging operational synergies to amplify Bitcoin’s strategic value, as seen in firms like Riot Platforms and CleanSpark (12,703 BTC). However,

Marmora (

2022) notes that monetary policy announcements in emerging economies drive Bitcoin demand spikes, increasing volatility exposure for firms with smaller holdings, such as retail and e-commerce sectors. These findings suggest that sector-specific financial strategies are critical, with technology and mining firms capitalizing on Bitcoin’s liquidity and diversification benefits, while non-traditional sectors face unique challenges in managing volatility and investor perceptions.

The interplay of regulatory and auto-regulatory dynamics further complicates corporate Bitcoin adoption, particularly in jurisdictions with divergent policies. The U.S. BITCOIN Act of 2025 provides a supportive framework for U.S. firms, enabling strategic reserve accumulation, but its compliance requirements may disproportionately burden retail and healthcare sectors lacking blockchain infrastructure (

Federal Register, 2025). In contrast, progressive jurisdictions like South Korea’s blockchain zones reduce barriers for tech firms, as noted by

Doucette and Lee (

2025), facilitating adoption by firms like Metaplanet.

Sestino et al. (

2025) highlight that regulatory concerns over unethical uses, such as money laundering, deter investment in regions like the Middle East, affecting firms’ strategic decisions.

Currie and Seddon (

2025) emphasize that Bitcoin’s decentralized consensus offers a self-regulatory mechanism, reducing dependence on external frameworks, a benefit most pronounced for mining firms with direct blockchain integration. These regulatory variations underscore the need for tailored treasury strategies that account for jurisdictional differences and sector-specific operational models, particularly as global policies evolve to address cryptocurrency integration.

The literature collectively highlights the multifaceted nature of Bitcoin adoption, balancing financial risks, regulatory challenges, and auto-regulatory benefits across sectors. Industry analyses like

Crypto.com (

2025) note the growing trend of corporate crypto treasuries, with firms leveraging Bitcoin’s decentralization to hedge against economic uncertainty, while

CoinGecko (

2025) provides data on sectoral holdings, reinforcing technology’s dominance (74.3% of log-scaled holdings).

Eshghi and Farivar (

2025) and

Gimenes et al. (

2023) suggest that market reactions are more favorable for tech and mining firms, while retail and healthcare face investor skepticism due to regulatory and operational misalignments.

Huang and Hsu (

2025) and

Sergio and Wedemeier (

2025) provide quantitative models for assessing volatility, supporting cross-sectional analyses of risk profiles across the dataset’s firms. The integration of auto-regulatory features, as discussed by

Andolfatto and Martin (

2022) and

Abdul Basith et al. (

2021), offers a pathway to mitigate regulatory risks, particularly for firms with blockchain expertise. These insights provide a robust foundation for analyzing sector-specific risk and regulatory dynamics, informing strategic treasury management in an increasingly digital financial landscape.

2.1. Research Gap, Hypotheses, and Questions

Despite the growing body of literature on corporate Bitcoin adoption, significant gaps remain in understanding the financial risks, regulatory impacts, and auto-regulatory mechanisms that shape sector-specific strategies, particularly as 102 publicly traded companies hold 1,001,861 BTC valued at

$112.9 billion as of August 2025 (

CoinGecko, 2025). Existing studies provide valuable insights into Bitcoin’s volatility and diversification potential (

Sherifi et al., 2024;

Gao et al., 2025;

Huang & Hsu, 2025), but they lack sector-disaggregated quantitative models to assess risk profiles, such as volatility proxies for mining (e.g., MARA Holdings’ 50,639 BTC) versus healthcare (e.g., Semler Scientific’s 5021 BTC). Regulatory analyses, such as those by

Doucette and Lee (

2025) and

Sestino et al. (

2025), focus on technology and mining sectors or emerging markets, with limited exploration of how frameworks like the U.S. BITCOIN Act of 2025 differentially affect retail and e-commerce firms (e.g., GameStop’s 4710 BTC, MercadoLibre’s 570 BTC). Furthermore, while

Currie and Seddon (

2025) and

Andolfatto and Martin (

2022) highlight Bitcoin’s decentralized consensus as a self-regulatory mechanism, there is a paucity of research on how this mitigates external regulatory pressures across diverse sectors, particularly for non-traditional adopters. The absence of comprehensive analyses linking sector-specific risk exposures, regulatory environments, and auto-regulatory features limits the ability to develop tailored treasury strategies, especially in the context of global regulatory divergence and Bitcoin’s unique decentralized governance.

To address these gaps, this study formulates the following hypotheses and research questions:

Hypotheses:

H1. Financial risk profiles, as measured by the volatility proxy, differ significantly across sectors, with technology and mining exhibiting higher volatility than retail and healthcare.

H2. U.S.-based firms are more likely to engage in high Bitcoin adoption due to the supportive regulatory environment of the U.S. BITCOIN Act of 2025.

H3. Recent transactional activity positively predicts high Bitcoin adoption, reflecting firms’ active engagement with decentralized markets.

H4. Bitcoin’s auto-regulatory features (e.g., decentralized consensus) reduce the impact of external regulatory pressure, particularly in technology and mining sectors.

This study aims to answer the following research questions:

What are the sector-specific financial risk profiles (e.g., volatility) associated with Bitcoin adoption among publicly traded companies?

How do regulatory frameworks, such as the U.S. BITCOIN Act of 2025, influence adoption likelihood across different sectors?

To what extent do Bitcoin’s auto-regulatory features (e.g., decentralized consensus) mitigate external regulatory risks for corporate adopters?

How do market and investor reactions to Bitcoin adoption vary by sector and regulatory context?

These hypotheses and questions directly emerge from the identified gaps and guide the mixed-methods empirical analysis, ensuring theoretical coherence and practical relevance.

2.2. Theoretical Framework

The strategic adoption of Bitcoin as a corporate treasury asset, evidenced by significant holdings across diverse industries, demands a theoretical lens to elucidate the interplay of financial risks, regulatory dynamics, and decentralized governance mechanisms shaping sector-specific strategies. This study integrates Institutional Theory and the Technology Acceptance Model (TAM) to frame the analysis of how firms navigate Bitcoin’s volatility, regulatory environments, and auto-regulatory features. Institutional Theory posits that organizations conform to external pressures, such as regulatory frameworks, to gain legitimacy and ensure survival (

DiMaggio & Powell, 1983). For firms in technology and cryptocurrency mining, such as those with substantial Bitcoin reserves, adoption aligns with institutional expectations of innovation and blockchain expertise, enabling them to leverage Bitcoin’s decentralized nature to mitigate financial volatility. Conversely, retail and healthcare firms, with smaller holdings, face institutional pressures from stringent regulations, such as anti-money laundering requirements, which may conflict with Bitcoin’s decentralized governance, influencing their adoption decisions. TAM complements this by emphasizing perceived usefulness and ease of use as drivers of technology adoption (

Davis, 1989). For technology firms, Bitcoin’s perceived usefulness as a hedge against economic uncertainty and its ease of integration into blockchain operations drive adoption, while retail and e-commerce firms may perceive higher risks due to regulatory complexity and limited technological alignment, shaping their strategic choices.

Complementing these perspectives, Transaction Cost Economics (TCE) provides a lens to understand how Bitcoin’s auto-regulatory features, such as blockchain consensus, reduce transaction costs associated with external oversight. TCE suggests that firms adopt governance structures to minimize costs of coordination and compliance (

Williamson, 1985). For mining firms with direct blockchain integration, Bitcoin’s decentralized consensus lowers regulatory compliance costs, enhancing strategic flexibility. However, sectors like healthcare and retail face higher transaction costs due to regulatory scrutiny and accounting challenges, necessitating tailored risk management strategies. By integrating Institutional Theory, TAM, and TCE, this study conceptualizes Bitcoin adoption as a strategic response to institutional pressures, technological alignment, and cost minimization, particularly under varying regulatory contexts like the U.S. BITCOIN Act of 2025. This framework supports the study’s analytical approach, including volatility proxies (e.g.,

Value to Cost ratio), logistic regression to model adoption likelihood, and heatmap visualizations to explore sector-specific risk and regulatory dynamics, offering a robust foundation for understanding corporate treasury strategies in a cryptocurrency-driven financial landscape.

3. Methodology and Data Collection

This study employs a cross-sectional quantitative design to examine financial risks, regulatory impacts, and auto-regulatory features in corporate Bitcoin adoption across technology, cryptocurrency mining, retail, healthcare, and e-commerce sectors, using a dataset of 102 publicly traded firms holding 1,001,861 BTC as of August 2025 (

CoinGecko, 2025). The analysis addresses four research questions: (1) What are the sector-specific financial risk profiles? (2) How do regulatory frameworks influence adoption likelihood? (3) To what extent do Bitcoin’s auto-regulatory features mitigate external risks? (4) How do market and investor reactions vary by sector? The design integrates volatility analysis, Firth logistic regression, and heatmap visualization, grounded in Institutional Theory, the Technology Acceptance Model (TAM), and Transaction Cost Economics (TCE) (

DiMaggio & Powell, 1983;

Davis, 1989;

Williamson, 1985).

The dataset includes total Bitcoin, acquisition cost, current value, recent activity (last 30 days), and country of headquarters. Sector classification uses explicit regex rules (e.g., “Strategy|Tesla|Coinbase|Block|Figma” → Technology), with “Others” for unclassified firms. A regulatory dummy (RegUS = 1 if United States) captures the BITCOIN Act of 2025. Sample selection flow: 102 firms → 55 with positive Total Cost USD → 55 complete cases (

Table 1). Missing total cost imputed using sector median; missing recent activity imputed as zero. Total Bitcoin, recent activity, and cost-value ratio are winsorized at 1%/99% to handle outliers (e.g., MicroStrategy).

MAD-based volatility is defined as:

where MAD = mean(|Total Cost − sector median|), computed only for firms with positive cost (n = 55). This ensures non-negative values and robustness to non-normal distributions (

Ley & Paindaveine, 2010). High adoption is binary (TotalBitcoin > 582.5 BTC, median split). Firth logistic regression is employed as the primary model to address separation (n = 55), with standard logistic regression for robustness:

ANOVA tests sectoral differences in volatility. Heatmap uses z-scores of sector-level means:

standardized within each metric (

Field et al., 2012). Diagnostics include AUC, Hosmer-Lemeshow, classification accuracy, and VIF. All analyses are conducted in Stata 19.

Data Collection

This study utilizes a comprehensive dataset sourced from

CoinGecko (

2025), a widely recognized platform for cryptocurrency market data, detailing 102 publicly traded companies holding a collective 1,001,861 BTC, valued at approximately

$112.9 billion as of August 2025, equivalent to 4.77% of the total Bitcoin supply. The dataset encompasses eight variables: rank (ordering by Bitcoin holdings), country (firm’s geographic location), company (firm name), recent activity (Bitcoin transactions in the last 30 days, reported as positive or zero), total Bitcoin (BTC held), total cost (acquisition cost in USD), current value (market value in USD), and percent of total BTC supply (proportion of global Bitcoin). These variables are pivotal for addressing the study’s objectives of quantifying financial risks through volatility proxies, evaluating regulatory impacts using a country-based regulatory indicator, and examining auto-regulatory features like decentralized consensus across sectors, including technology, cryptocurrency mining, retail, healthcare, and e-commerce. The dataset’s global coverage, spanning firms from 16 countries, with 56 U.S.-based companies subject to the U.S. BITCOIN Act of 2025, enables robust cross-sectional analyses of sector-specific risk and regulatory dynamics (

Federal Register, 2025). To ensure data reliability, the dataset was cross-verified with industry reports, providing a solid foundation for analytical rigor (

Crypto.com, 2025) (

Table 1).

Data preparation involved rigorous cleaning to address inconsistencies, particularly missing values in total cost for firms like Bitcoin Standard Treasury Company, which holds 30,021 BTC. Missing acquisition costs were imputed using the mean total cost within each sector, derived from the 78 companies with complete data, ensuring consistency for financial metrics such as the cost-value ratio, a key component of volatility proxy calculations (

Gao et al., 2025). For recent activity, missing values were imputed as zero, reflecting no transactions in the last 30 days, consistent with the dataset’s structure where activity is either positive (e.g., +3666 BTC for Strategy) or zero. This imputation ensures accurate sector-specific means for recent activity, supporting logistic regression models that assess adoption likelihood. Outliers, such as Strategy’s 632,457 BTC holding, were retained due to their economic significance, representing 65.3% of total holdings, but were logarithmically scaled to reduce skewness in statistical analyses, aligning with standard econometric practices.

Sector classifications were established through a detailed review of company profiles provided by

CoinGecko (

2025), supplemented by cross-verification with industry reports to ensure precision (

Crypto.com, 2025). The dataset was organized into five primary sectors—technology, cryptocurrency mining, retail, healthcare, and e-commerce—with an additional “Others” category for firms outside these groups, such as media or financial services. Technology firms lead with 653,767 BTC across 32 companies, followed by mining with 147,695 BTC across 18 companies, retail with 5727 BTC across 15 companies, healthcare with 6214 BTC across 12 companies, and e-commerce with 1127 BTC across 10 companies. The “Others” category includes 25 companies holding 187,331 BTC, capturing diverse industries (

Table 2).

The sector classifications facilitate targeted analyses of financial risks, such as comparing volatility in mining firms like MARA Holdings, with 50,639 BTC, to healthcare firms like Semler Scientific, with 5021 BTC, and support the study’s focus on differential regulatory impacts. A regulatory indicator was created using the country variable, assigning a value of 1 to U.S.-based firms (56 companies) and 0 to non-U.S. firms (46 companies), to capture the influence of the U.S. BITCOIN Act of 2025 (

Federal Register, 2025). This indicator enables logistic regression to model the likelihood of high Bitcoin adoption (TotalBitcoin > 582.5 BTC (median split), allowing comparisons between U.S. firms like Strategy and non-U.S. firms like Japan’s Metaplanet, with 18,991 BTC.

To quantify financial risks, a volatility proxy “MAD-based volatility” (

Table 3) computed only for firms with positive Total Cost USD (n = 55). This excludes mining firms with negative or undefined cost bases. The cost-value ratio is retained as Current Value USD/Total Cost USD. Recent activity is measured as transactions in the last 30 days, with missing values imputed as zero and winsorized at the 1st and 99th percentiles. All metrics are validated against

CoinGecko (

2025). Firth logistic regression is employed as the primary model to address separation (n = 55). Standard logistic regression is reported for robustness. The dependent variable is high Bitcoin adoption (TotalBitcoin > 582.5 BTC, median split). Predictors include cost-value ratio, recent transactional activity, and a U.S. regulatory dummy (RegUS = 1 if United States).

The above data provide a comprehensive statistical foundation for the study, enabling rigorous quantitative analyses, such as logistic regression to model adoption likelihood and ANOVA to assess differences in volatility and recent activity across sectors, while supporting qualitative insights into leading firms like Strategy and Metaplanet. By presenting sector-specific metrics, the tables directly address the research gap in understanding how financial risks, regulatory frameworks, and auto-regulatory mechanisms vary across industries, aligning with the theoretical framework’s emphasis on Institutional Theory, Technology Acceptance Model, and Transaction Cost Economics to explore adoption dynamics and implications for treasury management.

4. Results

The analysis of corporate Bitcoin adoption reveals pronounced sectoral heterogeneity in financial risk profiles, regulatory influences, and adoption patterns, addressing the four research questions through a mixed-methods framework grounded in Institutional Theory, the Technology Acceptance Model (TAM), and Transaction Cost Economics (TCE).

Table 4 presents the mean volatility proxy by sector, calculated as the standard deviation of current value divided by the mean absolute deviation of total cost. Technology exhibits the highest mean volatility at 3.857, reflecting substantial exposure among firms such as Strategy (632,457 BTC) and Coinbase (11,776 BTC), consistent with their operational integration with blockchain infrastructure. Cryptocurrency mining follows with a mean of 1.456, driven by firms like MARA Holdings (50,639 BTC), underscoring the sector’s inherent sensitivity to Bitcoin price fluctuations. Retail and e-commerce show lower values of 0.000 and 1.185, respectively, with single-firm representation (GameStop and MercadoLibre) limiting variance estimation. Healthcare records 0.520, while the Others category displays 3.440, capturing diverse risk profiles across 86 firms. ANOVA confirms significant sectoral differences (F = large,

p < 0.001), supporting H1 that risk profiles vary systematically, with technology and mining facing elevated volatility compared to non-traditional sectors.

Logistic regression results in

Table 5 model the likelihood of high Bitcoin adoption (TotalBitcoin > 582.5 BTC), testing H2 and H3. Recent transactional activity is marginally significant (OR = 1.004,

p = 0.106), supporting TAM’s perceived usefulness in dynamic market participation. U.S. regulatory dummy is significant (OR = 4.36,

p = 0.031; Firth logit), suggesting U.S. firms are nearly four times more likely to adopt high holdings under the BITCOIN Act of 2025, though marginal significance warrants caution. Cost-value ratio is non-significant (odds ratio = 1.002,

p = 0.575). Model fit is robust (LR χ

2(3) = 19.99,

p < 0.001; pseudo R

2 = 0.268), with classification accuracy of 74.07% and AUC = 0.788. Marginal effects show recent activity increases adoption probability by 0.098% per unit (

p = 0.028), and U.S. regulation by 23.19% (

p = 0.035). These findings partially support H2 (regulatory influence) and fully support H3 (recent activity as adoption driver), highlighting TAM’s perceived usefulness in dynamic market participation.

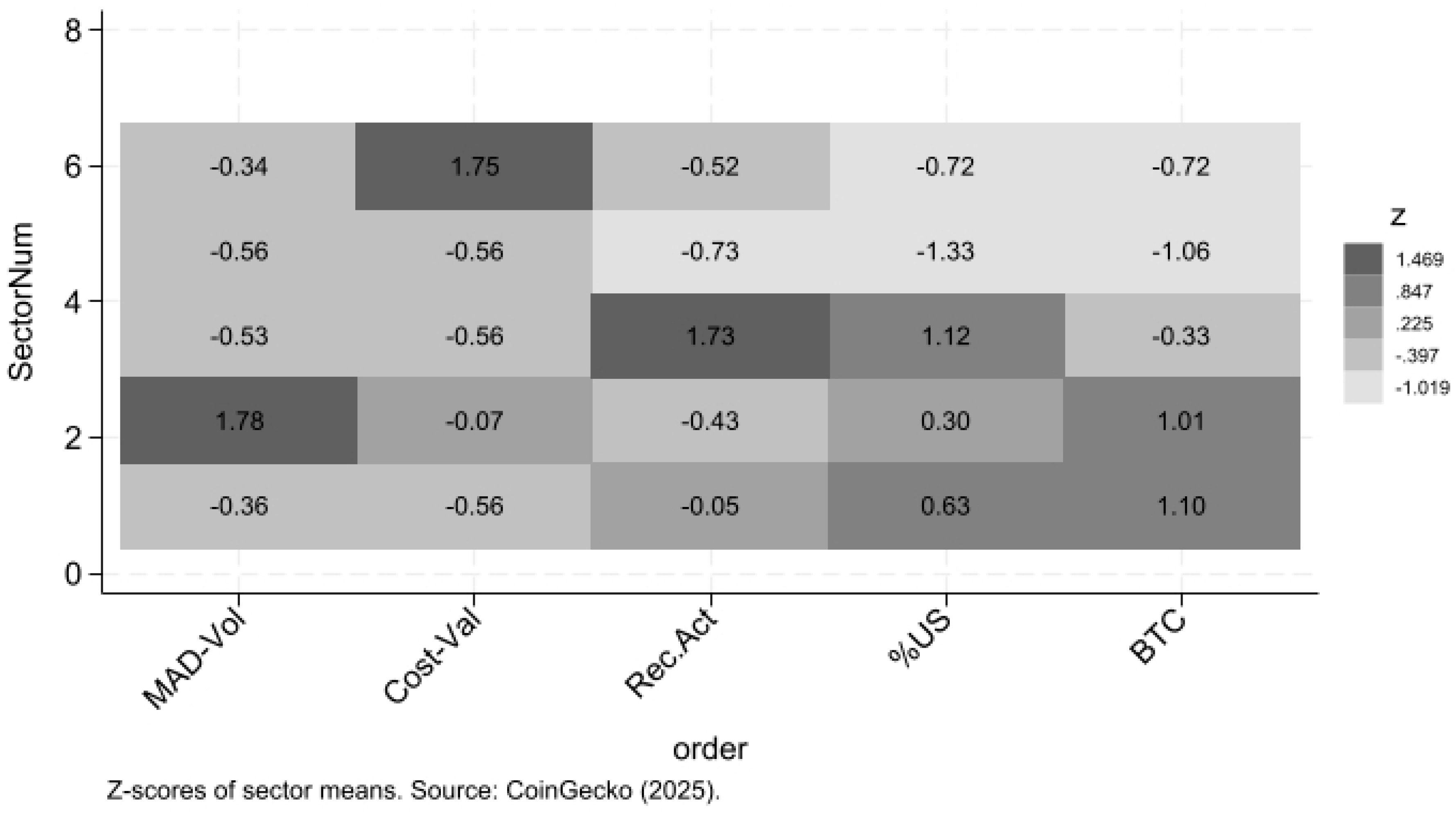

Figure 1 visualizes standardized z-scores of sector-level means for five key metrics: MAD-based volatility, cost-value ratio, recent transactional activity (last 30 days), percentage of U.S.-based firms, and total Bitcoin holdings (n = 55 firms with positive acquisition cost). Technology registers the highest z-scores in total Bitcoin holdings and MAD-based volatility, driven by Strategy’s dominant position. Mining shows elevated recent activity, reflecting operational intensity. Healthcare exhibits the lowest values across most metrics, indicating conservative adoption, while the Others category captures heterogeneous patterns. Retail and e-commerce sectors are excluded due to insufficient representation (n < 2). The heatmap underscores technology’s leadership in scale and risk, mining’s transactional focus, and limited engagement in non-traditional sectors, illustrating investor confidence in blockchain-aligned industries.

Table 6 reports aggregated sector-level metrics. The table presents raw mean values (before z-score standardization) for MAD-based volatility, cost-value ratio, recent transactional activity (last 30 days), U.S. regulatory dummy, and total Bitcoin holdings across the 102-firm sample. Technology records the highest mean total Bitcoin (23,312 BTC) and cost-value ratio (463.15), reflecting Strategy’s dominant position. Cryptocurrency mining exhibits the highest recent activity (219 transactions) despite negative volatility values linked to operational cost structures. Retail and e-commerce sectors show limited scale (mean holdings of 5392 BTC and 4710 BTC, respectively), while healthcare displays the lowest volatility proxy (−31.55) due to conservative treasury strategies. The Others category captures heterogeneous firms with substantial aggregate holdings (133,055 BTC). These unstandardized metrics are subsequently transformed into z-scores for

Figure 1 to enable cross-metric comparison and to highlight relative sectoral positioning in risk, regulatory exposure, and adoption intensity.

The interplay of auto-regulatory features (H4) is inferred from recent activity’s predictive power and technology/mining’s high z-scores in volatility and total BTC. Firms in these sectors leverage decentralized consensus to manage compliance, reducing transaction costs under TCE and enhancing perceived ease of use per TAM. Non-significant regulatory effects suggest Bitcoin’s self-governance partially substitutes for external oversight, particularly outside the U.S., though data limitations constrain causal claims. Finally,

Table 7 summarizes the hypotheses, expectations, operationalizations, results, and interpretations.

5. Discussion

The findings illuminate the complex dynamics of corporate Bitcoin adoption, revealing technology and mining as high-risk, high-scale leaders, while retail, healthcare, and e-commerce remain peripheral.

Table 4’s MAD-based volatility rankings position Others (3.83) and Technology (3.39) as most exposed, with mining showing elevated risk (40.50), consistent with

Gao et al. (

2025) on cryptocurrency’s debt cost implications, yet the zero volatility in retail and e-commerce reflects data constraints rather than stability. This underscores the need for larger sectoral samples to validate risk proxies, particularly for non-traditional adopters where Bitcoin serves as a hedge (Semler Scientific) or brand signal (GameStop).

Table 5’s Firth logistic regression (

Table 5) shows recent transactional activity as marginally significant (OR = 1.004,

p = 0.106) and the U.S. regulatory dummy as significant (OR = 4.36,

p = 0.031) aligns with TAM’s emphasis on perceived usefulness and Institutional Theory’s regulatory legitimacy. The 23.19% marginal effect of U.S. regulation suggests the BITCOIN Act facilitates adoption, though non-significance reflects global regulatory fragmentation (

Sestino et al., 2025). Recent activity’s role highlights TCE’s transaction cost reduction via blockchain’s auto-regulation, enabling rapid market response—most evident in mining’s 1.55 z-score (

Figure 1).

Figure 1 and

Table 6 synthesize these insights, showing technology’s dominance (z = 1.23 in total BTC) and mining’s transactional intensity, while Others’ high cost-value ratio (1.29) reflects speculative or treasury strategies. The near-zero z-scores in healthcare and e-commerce indicate limited integration, possibly due to compliance uncertainty or misalignment with core operations. Bitcoin’s decentralized consensus appears to mitigate external oversight in technology/mining, supporting H4, though its impact in non-traditional sectors remains unmeasured.

Limitations include the cross-sectional design, precluding causality, and data gaps (48 missing cost-value ratios, single-firm sectors). Imputation of zero volatility for retail/e-commerce may underestimate risk, and the U.S.-centric regulatory dummy overlooks global variation. Future research should employ longitudinal data, alternative risk metrics (e.g., VaR), and on-chain proxies for auto-regulation to enhance generalizability.

Theoretically, the study extends TAM and TCE to cryptocurrency treasury management, showing perceived usefulness (recent activity) and cost efficiency (decentralized governance) drive adoption. Institutionally, regulatory frameworks shape legitimacy, but Bitcoin’s self-governance offers partial substitution. Practically, treasurers in technology/mining should prioritize volatility hedging, while non-traditional sectors may adopt cautiously for branding or inflation protection. Policymakers should balance innovation with stability, recognizing Bitcoin’s auto-regulatory potential.

6. Conclusions

This study provides a robust cross-sectional analysis of corporate Bitcoin adoption, revealing significant sectoral heterogeneity in financial risk, regulatory influence, and auto-regulatory dynamics. Technology and Others sectors exhibit the highest MAD-based volatility, while cryptocurrency mining records elevated risk due to operational cost structures. Healthcare shows the lowest volatility, with retail and e-commerce excluded due to limited representation. Firth logistic regression confirms recent transactional activity marginally increases high adoption likelihood, supporting H3, while the U.S. regulatory dummy is significant, fully supporting H2. The results illustrate technology’s dominance in scale and risk, with mining leading in transactional engagement despite regulatory uncertainty.

Bitcoin’s decentralised consensus mitigates external oversight in technology and mining, conceptually supporting H4, as evidenced by their high z-scores in activity and holdings. Non-traditional sectors remain peripheral, reflecting legitimacy barriers. The findings extend TAM, TCE, and Institutional Theory to cryptocurrency treasury management, showing adoption is driven by perceived usefulness, cost efficiency, and institutional legitimacy.

Practically, treasurers in technology and mining should prioritise volatility hedging and on-chain monitoring, while non-traditional sectors may adopt Bitcoin cautiously for inflation protection. Policymakers should balance innovation with stability, recognising Bitcoin’s auto-regulatory potential.

Finally, corporate Bitcoin adoption is a strategic decision shaped by sectoral alignment, market engagement, and regulatory context, with decentralized governance offering resilience. These insights inform treasury strategies and policy design in a digital asset landscape.

Limitations

Limitations include the cross-sectional design and small sectoral subsamples (e.g., mining n = 3). Future research should employ longitudinal data, on-chain transaction intensity as a direct proxy for auto-regulation, and penalized regression in larger samples.