The Impact of Cash Holding Decisions on Firm Performance in the IT Industry

Abstract

1. Introduction

2. Hypothesis Development

3. Empirical Models

3.1. Regression Model

3.2. Machine Learning Techniques

4. Empirical Results

4.1. Data and Descriptive Statistics

4.2. Multivariate Results

5. Additional Tests

5.1. One-Year-Forward Dependent Variable

5.2. Subsample Analysis: Big IT Firms

5.3. Effect of Recessionary Periods

5.4. Principal Component Analysis

5.5. Cash Holdings and Profitability Using Master Proxies

5.6. Machine Learning Model Results

6. Discussion

7. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Hyperparameter Configurations

| Random Forest batchSize = 100—The number of samples processed before updating model parameters during training. numTrees = 100—Number of trees to generate in the forest. maxDepth = 0—Unlimited depth (nodes expand until pure or minimum size). numFeatures = 0—Uses the default: for regression. .seed = 1—Random seed for reproducibility. breakTiesRandomly = false—Ties not broken randomly. minNum = 1.0—Minimum number of instances per leaf. computeAttributeImportances = false—Variable importance not computed unless specified. Decision Tree batchSize = 100—The number of samples processed before updating model parameters during training. minNum = 2.0—Minimum total weight of instances per leaf. maxDepth = −1—Unlimited tree depth. numFolds = 3—Folds used for reduced-error pruning. seed = 1—Random seed for cross-validation pruning. noPruning = false—Pruning enabled (i.e., reduced-error pruning). maxOptimizationRuns = 5—Optimization iterations for pruning. Support Vector Machine batchSize = 100—The number of samples processed before updating model parameters during training. Kernel = PolyKernel—Polynomial kernel function. filterType = Normalize training data—Preprocessing method for input features. C = 1.0—Regularization parameter controlling margin/penalty tradeoff. seed = 1—Random seed. regOptimizer = RegSMOImproved—Optimization algorithm for SVM regression. Multilayer Perceptron batchSize = 100—The number of samples processed before updating model parameters during training. hiddenLayers = “a”—One hidden layer with (attributes + classes)/2 neurons. learningRate = 0.3—Step size for weight updates. momentum = 0.2—Momentum for smoothing weight changes. trainingTime = 500—Number of epochs (iterations). validationSetSize = 0—No internal validation set. seed = 0—Random seed for weight initialization. normalizeAttributes = true—Input attributes normalized. normalizeNumericClass = true—Output class normalized (for regression). validationThreshold = 20—Number of epochs with no improvement before early stopping. |

Appendix B. Proxies of Variables

| Variables | Proxies | Sources |

| Profitability | EBIT (Earnings Before Interest and Taxes)/Total Assets | Benaroch and Chernobai (2017) |

| Net Income/Total Assets | N. Li (2010) | |

| Operating income/Total Assets | Park and Wu (2009) | |

| EBIT/the sum of Equity and Long-term Liabilities | Gu and Gao (2000) | |

| Cost of Goods Sold/Total Assets | Abuzayed (2012) | |

| Cost of Goods Sold/Sales | Singhania et al. (2014) | |

| EBIT/Sales | Silva (2025) | |

| Net Income/Sales | Demers et al. (2024) | |

| Net Income/Equity | Elayan et al. (2008) | |

| EBIT/Capital Employed | Afrifa (2016) | |

| Liquidity | Current Assets/Current liabilities | Y. Chen et al. (2014) |

| Current Assets/Sales | Nwude et al. (2021) | |

| Investment | Tangible Fixed Assets/Total Assets | Baños-Caballero et al. (2010) |

| The difference in Fixed Assets | S. Chen et al. (2023) | |

| Growth | Sales Growth | Murthy et al. (2020) |

| Operating Profit Growth | Xie (2020) | |

| Fixed Assets Growth | Menike et al. (2015) | |

| Size | Total Assets | Afrifa (2016) |

| Logarithm of Total Assets | Lim (2023) | |

| Logarithm of Sales | Beasley et al. (2009) | |

| Logarithm of Sales/Total Assets | Mahmood et al. (2025) | |

| Logarithm of Fixed Assets | Liu et al. (2023) | |

| Leverage | Total Debts/Total Assets | Gholampoor and Asadi (2024) |

| Long-term Debts/Total Assets | Danso et al. (2019) | |

| Total Debts/Capital Employed | Afrifa (2016) | |

| Note: All variables defined above are based on book values. | ||

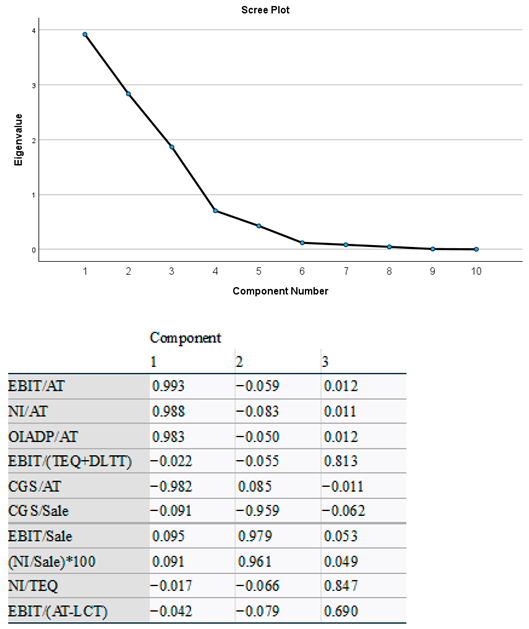

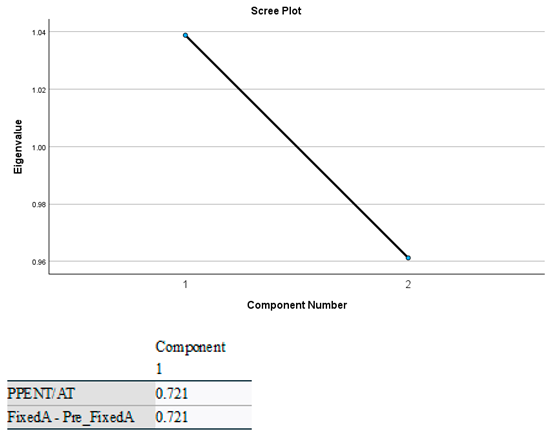

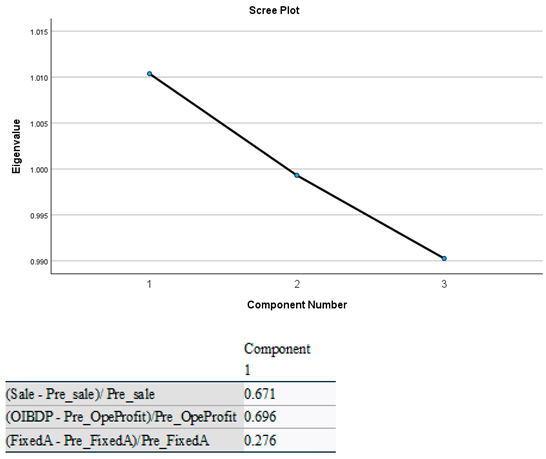

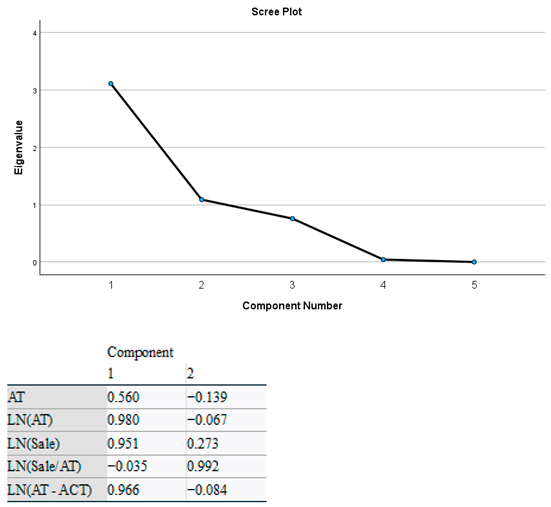

Appendix C. Scree Plots and PCA Loadings

- Profitability

- Liquidity

- Investment

- Growth

- Size

- Leverage

Appendix D. Variable Definitions

| Variables | Definitions |

| PROFIT_M | Master proxy for ten profitability variables. |

| CASH | Cash ratio, calculated as cash and marketable securities divided by the book value of total assets. |

| CASH_SQUARED | Squared value of cash ratio, equal to cash ratio × cash ratio. |

| LIQUIDITY_M | Master proxy for two liquidity variables. |

| INVESTMENT_M | Master proxy for two fixed asset investment variables. |

| GROWTH_M | Master proxy for three growth variables. |

| SIZE_M | Master proxy for five size variables. |

| LEVERAGE_M | Master proxy for three financial leverage variables. |

| R&D INTENSITY | Research and Development (R&D) intensity, calculated as R&D expenditure divided by total sales. |

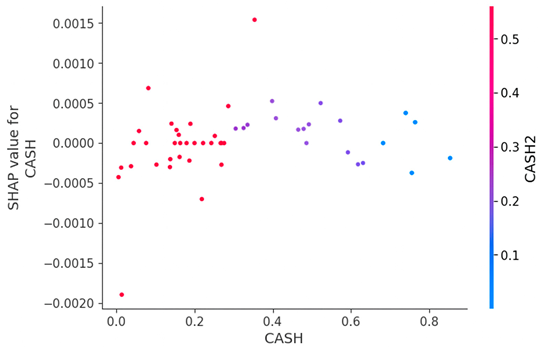

Appendix E. SHAP Dependency Plot

References

- Abedin, M. Z., Guotai, C., Moula, F. E., Azad, A. S. M. S., & Khan, M. S. U. (2019). Topological applications of multilayer perceptrons and support vector machines in financial decision support systems. International Journal of Finance & Economics, 24(1), 474–507. [Google Scholar]

- Abel, A. B. (2018). Optimal debt and profitability in the trade-off theory. The Journal of Finance, 73(1), 95–143. [Google Scholar] [CrossRef]

- Abuzayed, B. (2012). Working capital management and firms’ performance in emerging markets: The case of Jordan. International Journal of Managerial Finance, 8(2), 155–179. [Google Scholar] [CrossRef]

- Acosta-Jiménez, S., Mendoza-Mendoza, M. M., Galván-Tejada, C. E., Galván-Tejada, J. I., Celaya-Padilla, J. M., García-Domínguez, A., Gamboa-Rosales, H., & Solís-Robles, R. (2024). Detection of ovarian cancer using a methodology with feature extraction and selection with genetic algorithms and machine learning. Network Modeling Analysis in Health Informatics and Bioinformatics, 14(1), 3. [Google Scholar] [CrossRef]

- Afrifa, G. A. (2016). Net working capital, cash flow and performance of UK SMEs. Review of Accounting and Finance, 15(1), 21–44. [Google Scholar] [CrossRef]

- Amir, M., Azhar, Z., Kishan, A., & Krishnen, L. (2024). From the implementation of environmental management accounting to organizational sustainability: Does stakeholder integration strengthen it? Pakistan Journal of Commerce and Social Sciences, 18(4), 1065–1089. [Google Scholar] [CrossRef]

- Baños-Caballero, S., García-Teruel, P. J., & Martínez-Solano, P. (2010). Working capital management in SMEs. Accounting & Finance, 50(3), 511–527. [Google Scholar] [CrossRef]

- Beasley, M., Bradford, M., & Dehning, B. (2009). The value impact of strategic intent on firms engaged in information systems outsourcing. International Journal of Accounting Information Systems, 10(2), 79–96. [Google Scholar] [CrossRef]

- Benaroch, M., & Chernobai, A. (2017). Operational IT failures, IT value destruction, and board-level IT governance changes. MIS Quarterly, 41(3), 729–762. [Google Scholar] [CrossRef]

- Boot, A., & Vladimirov, V. (2019). (Non-)Precautionary cash hoarding and the evolution of growth firms. Management Science, 65(11), 5290–5307. [Google Scholar] [CrossRef]

- Chambers, N., & Cifter, A. (2022). Working capital management and firm performance in the hospitality and tourism industry. International Journal of Hospitality Management, 102, 103144. [Google Scholar] [CrossRef]

- Chan, T., Tan, C.-E., & Tagkopoulos, I. (2022). Audit lead selection and yield prediction from historical tax data using artificial neural networks. PLoS ONE, 17(11), e0278121. [Google Scholar] [CrossRef]

- Chang, C.-C., Kao, L.-H., & Chen, H.-Y. (2018). How does real earnings management affect the value of cash holdings? Comparisons between information and agency perspectives. Pacific-Basin Finance Journal, 51, 47–64. [Google Scholar] [CrossRef]

- Chen, S., De Simone, L., Hanlon, M., & Lester, R. (2023). The effect of innovation box regimes on investment and employment activity. The Accounting Review, 98(5), 187–214. [Google Scholar] [CrossRef]

- Chen, Y., Smith, A. L., Cao, J., & Xia, W. (2014). Information technology capability, internal control effectiveness, and audit fees and delays. Journal of Information Systems, 28(2), 149–180. [Google Scholar] [CrossRef]

- Chen, Y.-R., & Chuang, W.-T. (2009). Alignment or entrenchment? Corporate governance and cash holdings in growing firms. Journal of Business Research, 62(11), 1200–1206. [Google Scholar] [CrossRef]

- Danso, A., Lartey, T., Fosu, S., Owusu-Agyei, S., & Uddin, M. (2019). Leverage and firm investment: The role of information asymmetry and growth. International Journal of Accounting and Information Management, 27(1), 56–73. [Google Scholar] [CrossRef]

- Das, S. (2015). Cash management in IT sector—A study. Journal of Commerce and Accounting Research, 4, 27–39. [Google Scholar] [CrossRef]

- Deb, P., David, P., & O’Brien, J. (2017). When is cash good or bad for firm performance? Strategic Management Journal, 38(2), 436–454. [Google Scholar] [CrossRef]

- Demers, E., Gaertner, F. B., Kausar, A., Li, H., & Steele, L. B. (2024). Aggregate tone and gross domestic product. Contemporary Accounting Research, 41(4), 2574–2599. [Google Scholar] [CrossRef]

- Dewan, S., & Ren, F. (2011). Information technology and firm boundaries: Impact on firm risk and return performance. Information Systems Research, 22(2), 369–388. [Google Scholar] [CrossRef]

- Dittmar, A., Mahrt-Smith, J., & Servaes, H. (2003). International corporate governance and corporate cash holdings. The Journal of Financial and Quantitative Analysis, 38(1), 111–133. [Google Scholar] [CrossRef]

- Doshi, H., Kumar, P., & Yerramilli, V. (2018). Uncertainty, capital investment, and risk management. Management Science, 64(12), 5769–5786. [Google Scholar] [CrossRef]

- Eger, R. J., III, & Hermis, J. M. (2025). Capital structure of special-purpose governments. Journal of Public Budgeting, Accounting & Financial Management, 37(3), 393–414. [Google Scholar]

- Elayan, F. A., Li, J., & Meyer, T. O. (2008). Accounting irregularities, management compensation structure and information asymmetry. Accounting & Finance, 48(5), 741–760. [Google Scholar] [CrossRef]

- Farinha, J., Mateus, C., & Soares, N. (2018). Cash holdings and earnings quality: Evidence from the main and alternative UK markets. International Review of Financial Analysis, 56, 238–252. [Google Scholar] [CrossRef]

- Faysal, S. (2024). The analysis of capital structure theories in emerging markets. International Journal of Management, Accounting & Economics, 11(2), 148–160. [Google Scholar]

- Frésard, L., & Salva, C. (2010). The value of excess cash and corporate governance: Evidence from US cross-listings. Journal of Financial Economics, 98(2), 359–384. [Google Scholar] [CrossRef]

- García-Teruel, P. J., Martínez-Solano, P., & Sánchez-Ballesta, J. P. (2009). Accruals quality and corporate cash holdings. Accounting & Finance, 49(1), 95–115. [Google Scholar] [CrossRef]

- Gholampoor, H., & Asadi, M. (2024). Risk analysis of bankruptcy in the U.S. healthcare industries based on financial ratios: A Machine learning analysis. Journal of Theoretical and Applied Electronic Commerce Research, 19(2), 1303–1320. [Google Scholar] [CrossRef]

- Gow, I. D., Larcker, D. F., & Zakolyukina, A. A. (2023). How important is corporate governance? Evidence from machine learning. Chicago booth research paper no. 22-16, no. 2022-137. University of Chicago. [Google Scholar]

- Greiner, A. J. (2017). An examination of real activities management and corporate cash holdings. Advances in Accounting, 39, 79–90. [Google Scholar] [CrossRef]

- Gu, Z., & Gao, L. (2000). A multivariate model for predicting business failures of hospitality firms. Tourism and Hospitality Research, 2(1), 37–49. [Google Scholar] [CrossRef]

- Habib, A., Monzur Hasan, M., & Al-Hadi, A. (2017). Financial statement comparability and corporate cash holdings. Journal of Contemporary Accounting & Economics, 13(3), 304–321. [Google Scholar] [CrossRef]

- Harford, J., Mansi, S. A., & Maxwell, W. F. (2008). Corporate governance and firm cash holdings in the US. Journal of Financial Economics, 87(3), 535–555. [Google Scholar] [CrossRef]

- Hennessy, C. A., & Whited, T. M. (2007). How costly is external financing? Evidence from a structural estimation. The Journal of Finance, 62(4), 1705–1745. [Google Scholar] [CrossRef]

- Hirth, S., & Uhrig-Homburg, M. (2010). Investment timing when external financing is costly. Journal of Business Finance & Accounting, 37(7–8), 929–949. [Google Scholar] [CrossRef]

- Howe, J. S., & Jain, R. (2010). Testing the trade-off theory of capital structure. Review of Business, 31(1), 54–67. [Google Scholar]

- Hunt, J. O., Myers, J. N., & Myers, L. A. (2022). Improving earnings predictions and abnormal returns with machine learning. Accounting Horizons, 36(1), 131–149. [Google Scholar] [CrossRef]

- Iliyas, M., & Barca, M. (2025). A chronological review of resource-based theory and future research directions. Journal of Management, 4, 41–53. [Google Scholar] [CrossRef]

- Jolliffe, I. T., & Cadima, J. (2016). Principal component analysis: A review and recent developments. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 374(2065), 20150202. [Google Scholar] [CrossRef]

- Jones, S., Johnstone, D., & Wilson, R. (2017). Predicting corporate bankruptcy: An evaluation of alternative statistical frameworks. Journal of Business Finance & Accounting, 44(1–2), 3–34. [Google Scholar]

- Kayakus, M., Tutcu, B., Terzioglu, M., Talaş, H., & Ünal Uyar, G. F. (2023). ROA and ROE forecasting in iron and steel industry using machine learning techniques for sustainable profitability. Sustainability, 15(9), 7389. [Google Scholar] [CrossRef]

- Kim, C., & Bettis, R. A. (2014). Cash is surprisingly valuable as a strategic asset. Strategic Management Journal, 35(13), 2053–2063. [Google Scholar] [CrossRef]

- Kim, J. H., Lim, J., Ahn, J. S., & Kim, Y. (2023). Cash holdings and firm performance in the restaurant industry. Journal of Applied Business and Economics, 25(3), 193–202. [Google Scholar] [CrossRef]

- Kori, A., & Gadagin, N. (2024). Interpretable financial risk models: Leveraging gradient boosting and feature importance analysis. International Research Journal of Modernization in Engineering Technology and Science, 6(11), 3347–3366. [Google Scholar]

- La Rocca, M., & Cambrea, D. R. (2019). The effect of cash holdings on firm performance in large Italian companies. Journal of International Financial Management & Accounting, 30(1), 30–59. [Google Scholar]

- Lee, E., & Powell, R. (2011). Excess cash holdings and shareholder value. Accounting & Finance, 51(2), 549–574. [Google Scholar] [CrossRef]

- Li, M., Sun, H., Huang, Y., & Chen, H. (2024). Shapley value: From cooperative game to explainable artificial intelligence. Autonomous Intelligent Systems, 4(1), 2. [Google Scholar] [CrossRef]

- Li, N. (2010). Negotiated measurement rules in debt contracts. Journal of Accounting Research, 48(5), 1103–1144. [Google Scholar] [CrossRef]

- Lim, J. (2023). Organization capital and corporate governance. Journal of Risk and Financial Management, 16(9), 384. [Google Scholar] [CrossRef]

- Liu, J., Xiong, X., Gao, Y., & Zhang, J. (2023). The impact of institutional investors on ESG: Evidence from China. Accounting & Finance, 63(S2), 2801–2826. [Google Scholar]

- Louis, H., Sun, A. X., & Urcan, O. (2012). Value of cash holdings and accounting conservatism. Contemporary Accounting Research, 29(4), 1249–1271. [Google Scholar] [CrossRef]

- Lozano, M. B., & Yaman, S. (2020). The European financial crisis and firms’ cash holding policy: An analysis of the precautionary motive. Global Policy, 11(S1), 84–94. [Google Scholar] [CrossRef]

- Lundberg, S. M., & Lee, S.-I. (2017, December 4–9). A unified approach to interpreting model predictions. The 31st International Conference on Neural Information Processing Systems, Long Beach, CA, USA. [Google Scholar]

- Mahmood, F., Ahmed, Z., Hussain, N., & Ben-Zaied, Y. (2025). Working capital financing and firm performance: A machine learning approach. Review of Quantitative Finance and Accounting, 65, 71–106. [Google Scholar] [CrossRef]

- Melo, M. C., Bernardi, R. C., De La Fuente-Nunez, C., & Luthey-Schulten, Z. (2020). Generalized correlation-based dynamical network analysis: A new high-performance approach for identifying allosteric communications in molecular dynamics trajectories. The Journal of Chemical Physics, 153(13), 134104. [Google Scholar] [CrossRef] [PubMed]

- Meng, Y., Yang, N., Qian, Z., & Zhang, G. (2021). What makes an online review more helpful: An interpretation framework using XGBoost and SHAP values. Journal of Theoretical and Applied Electronic Commerce Research, 16(3), 466–490. [Google Scholar] [CrossRef]

- MengYun, W., Um-e-Habiba, Husnain, M., Sarwar, B., & Ali, W. (2021). Board financial expertise and corporate cash holdings: Moderating role of multiple large shareholders in emerging family firms. Complexity, 2021(1), 6397515. [Google Scholar] [CrossRef]

- Menike, L., Dunusinghe, P., & Ranasinghe, A. (2015). Macroeconomic and firm specific determinants of stock returns: A comparative analysis of stock markets in Sri Lanka and in the United Kingdom. Journal of Finance and Accounting, 3(4), 86–96. [Google Scholar] [CrossRef]

- Merrick, L., & Taly, A. (2020, August 25–28). The explanation game: Explaining machine learning models using shapley values. International Cross-Domain Conference for Machine Learning and Knowledge Extraction, Dublin, Ireland. [Google Scholar]

- Mitchell, R. K., Van Buren, H. J., III, Greenwood, M., & Freeman, R. E. (2015). Stakeholder inclusion and accounting for stakeholders. Journal of Management Studies, 52(7), 851–877. [Google Scholar] [CrossRef]

- Mohamed, W. N. H. W., Salleh, M. N. M., & Omar, A. H. (2012, November 23–25). A comparative study of reduced error pruning method in decision tree algorithms. 2012 IEEE International Conference on Control System, Computing and Engineering, Penang, Malaysia. [Google Scholar]

- Mousa, G. A., Elamir, E. A. H., & Hussainey, K. (2022). Using machine learning methods to predict financial performance: Does disclosure tone matter? International Journal of Disclosure and Governance, 19(1), 93–112. [Google Scholar] [CrossRef]

- Mubarek, A. M., & Adalı, E. (2017, October 5–8). Multilayer perceptron neural network technique for fraud detection. 2017 International Conference on Computer Science and Engineering (UBMK), Antalya, Turkey. [Google Scholar]

- Murthy, U. S., Smith, T. J., Whitworth, J. D., & Zhang, Y. (2020). The effects of information systems compatibility on firm performance following mergers and acquisitions. Journal of Information Systems, 34(2), 211–233. [Google Scholar] [CrossRef]

- Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221. [Google Scholar] [CrossRef]

- Myers, S. C., & Rajan, R. G. (1998). The paradox of liquidity. The Quarterly Journal of Economics, 113(3), 733–771. [Google Scholar] [CrossRef]

- Najem, R., Bahnasse, A., Fakhouri Amr, M., & Talea, M. (2025). Advanced AI and big data techniques in E-finance: A comprehensive survey. Discover Artificial Intelligence, 5(1), 102. [Google Scholar] [CrossRef]

- Nguyen Thanh, C., & Phan Huy, T. (2025). Predicting financial reports fraud by machine learning: The proxy of auditor opinions. Cogent Business & Management, 12(1), 2510556. [Google Scholar] [CrossRef]

- Nohara, Y., Matsumoto, K., Soejima, H., & Nakashima, N. (2022). Explanation of machine learning models using shapley additive explanation and application for real data in hospital. Computer Methods and Programs in Biomedicine, 214, 106584. [Google Scholar] [CrossRef]

- Nwude, E. C., Allison, P. U., & Nwude, C. A. (2021). The relationship between working capital management and corporate returns of cement industry of emerging market. International Journal of Finance & Economics, 26(3), 3222–3235. [Google Scholar]

- Opler, T., Pinkowitz, L., Stulz, R., & Williamson, R. (1999). The determinants and implications of corporate cash holdings. Journal of Financial Economics, 52(1), 3–46. [Google Scholar] [CrossRef]

- Ozkan, A., & Ozkan, N. (2004). Corporate cash holdings: An empirical investigation of UK companies. Journal of Banking & Finance, 28(9), 2103–2134. [Google Scholar] [CrossRef]

- Ozlem, S., & Tan, O. F. (2022). Predicting cash holdings using supervised machine learning algorithms. Financial Innovation, 8(1), 44. [Google Scholar] [CrossRef]

- Park, J. C., & Wu, Q. (2009). Financial restatements, cost of debt and information spillover: Evidence From the secondary loan market. Journal of Business Finance & Accounting, 36(9–10), 1117–1147. [Google Scholar] [CrossRef]

- Pinillos, J., Macías, H., Castrillon, L., Eslava, R., & De la Cruz, S. (2025). Analysis of the capital structure of Latin American companies in light of trade-off and pecking order theories. Journal of Risk and Financial Management, 18(7), 399. [Google Scholar] [CrossRef]

- Rozemberczki, B., Watson, L., Bayer, P., Yang, H.-T., Kiss, O., Nilsson, S., & Sarkar, R. (2022, July 23–29). The shapley value in machine learning. The 31st International Joint Conference on Artificial Intelligence and the 25th European Conference on Artificial Intelligence, Vienna, Austria. [Google Scholar]

- Saldanha, T. J. V., Andrade-Rojas, M. G., Kathuria, A., Khuntia, J., & Krishnan, M. S. (2024). How the locus of uncertainty shapes the influence of CEO long-term compensation of information technology capital investments. MIS Quarterly, 48(2), 459–490. [Google Scholar] [CrossRef]

- Shubho, S. A., Razib, M. R. H., Rudro, N. K., Saha, A. K., Khan, M. S. U., & Ahmed, S. (2019, December 18–20). Performance analysis of NB Tree, REP tree and random tree classifiers for credit card fraud data. 2019 22nd International Conference on Computer and Information Technology (ICCIT), Dhaka, Bangladesh. [Google Scholar]

- Silva, S. (2025). Trade credit and corporate profitability: Evidence from EU-based SMEs. Journal of Corporate Accounting & Finance, 36(1), 81–92. [Google Scholar]

- Singhania, M., Sharma, N., & Yagnesh Rohit, J. (2014). Working capital management and profitability: Evidence from Indian manufacturing companies. Decision, 41(3), 313–326. [Google Scholar] [CrossRef]

- Situmeang, F. B. I., Gemser, G., Wijnberg, N. M., & Leenders, M. A. A. M. (2016). Risk-taking behavior of technology firms: The role of performance feedback in the video game industry. Technovation, 54, 22–34. [Google Scholar] [CrossRef]

- Sun, Q., Yung, K., & Rahman, H. (2012). Earnings quality and corporate cash holdings. Accounting & Finance, 52(2), 543–571. [Google Scholar]

- Tan, J., & Peng, M. W. (2003). Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strategic Management Journal, 24(13), 1249–1263. [Google Scholar] [CrossRef]

- Tellez Gaytan, J. C., Ateeq, K., Rafiuddin, A., Alzoubi, H. M., Ghazal, T. M., Ahanger, T. A., Chaudhary, S., & Viju, G. K. (2022). AI-based prediction of capital structure: Performance comparison of ANN SVM and LR models. Computational Intelligence and Neuroscience, 2022(1), 8334927. [Google Scholar] [CrossRef]

- Theissen, M. H., Jung, C., Theissen, H. H., & Graf-Vlachy, L. (2023). Cash holdings and firm value: Evidence for increasing marginal returns. Journal of Management Scientific Reports, 1(3–4), 260–300. [Google Scholar] [CrossRef]

- The United States Census Bureau. (2025). North American industry classification system. Available online: https://www.census.gov/naics/ (accessed on 11 October 2025).

- Toms, S. (2010). Value, profit and risk: Accounting and the resource–based view of the firm. Accounting, Auditing & Accountability Journal, 23(5), 647–670. [Google Scholar]

- Trustorff, J.-H., Konrad, P. M., & Leker, J. (2011). Credit risk prediction using support vector machines. Review of Quantitative Finance and Accounting, 36(4), 565–581. [Google Scholar] [CrossRef]

- Weigel, C., & Hiebl, M. R. (2023). Accountants and small businesses: Toward a resource-based view. Journal of Accounting & Organizational Change, 19(5), 642–666. [Google Scholar]

- Wernerfelt, B. (1984). A resource--based view of the firm. Strategic Management Journal, 5(2), 171–180. [Google Scholar] [CrossRef]

- Wu, D., Ma, X., & Olson, D. L. (2022). Financial distress prediction using integrated Z-score and multilayer perceptron neural networks. Decision Support Systems, 159, 113814. [Google Scholar] [CrossRef]

- Xie, X.-T. (2020). Technology enterprise value assessment based on BP neural network. International Journal of Computing Science and Mathematics, 12(2), 192–203. [Google Scholar] [CrossRef]

- Xin, M., & Choudhary, V. (2019). IT investment under competition: The role of implementation failure. Management Science, 65(4), 1909–1925. [Google Scholar] [CrossRef]

- Yin, Y., & Yin, H. (2025, April 25–27). Optimization of the relationship between cash holding and corporate performance through digital technology. The 2025 International Conference on Digital Economy and Information Systems, Guangzhou, China. [Google Scholar]

- Zahariev, A., Angelov, P., & Zarkova, S. (2022). Estimation of bank profitability using vector error correction model and support vector regression. Economic Alternatives, 28(2), 157–170. [Google Scholar] [CrossRef]

- Zakaria, N., Sulaiman, A., Min, F. S., & Feizollah, A. (2023). Machine learning in the financial industry: A bibliometric approach to evidencing applications. Cogent Social Sciences, 9(2), 2276609. [Google Scholar] [CrossRef]

- Zhang, C., Zhang, H., & Liu, D. (2019). A contrastive study of machine learning on energy firm value prediction. IEEE Access, 8, 11635–11643. [Google Scholar] [CrossRef]

- Zhang, S. (2024, December 4–5). Application of random forest algorithm in accounting data analysis and prediction. 2024 4th International Conference on Mobile Networks and Wireless Communications (ICMNWC), Tumakuru, India. [Google Scholar]

| NAICS Codes | Industries |

|---|---|

| 334 | Computer and Electronic Product Manufacturing |

| 51121 | Software Publishers |

| 51321 | Software Publishers |

| 517 | Telecommunications |

| 518 | Data Processing, Hosting, and Related Services |

| 519 | Other Information Services |

| 54151 | Computer Systems Design and Related Services |

| N | 25th Percentile | Mean | Median | 75th Percentile | Standard Deviation | |

|---|---|---|---|---|---|---|

| PROFIT | 21,051 | −0.115 | −0.311 | 0.027 | 0.088 | 4.105 |

| CASH | 21,051 | 0.097 | 0.291 | 0.237 | 0.443 | 0.229 |

| CASH_SQUARED | 21,051 | 0.009 | 0.137 | 0.056 | 0.196 | 0.182 |

| LIQUIDITY | 21,051 | 1.169 | 3.043 | 1.969 | 3.460 | 5.412 |

| INVESTMENT | 21,051 | 0.037 | 0.140 | 0.082 | 0.175 | 0.158 |

| GROWTH | 21,051 | −0.046 | 1.421 | 0.080 | 0.257 | 70.821 |

| SIZE | 21,051 | 37.573 | 5684.242 | 270.810 | 1727.153 | 25,421.916 |

| LEVERAGE | 21,051 | 0.003 | 0.552 | 0.131 | 0.335 | 9.241 |

| R&D INTENSITY | 21,051 | 0.011 | 1.234 | 0.094 | 0.195 | 28.665 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| PROFIT (1) | 1.000 | ||||||||

| CASH (2) | 0.017 | 1.000 | |||||||

| CASH_SQUARED (3) | 0.004 | 0.952 * | 1.000 | ||||||

| LIQUIDITY (4) | 0.034 * | 0.337 * | 0.354 * | 1.000 | |||||

| INVESTMENT (5) | −0.022 * | −0.317 * | −0.286 * | −0.119 * | 1.000 | ||||

| GROWTH (6) | −0.002 | −0.012 | −0.008 | −0.006 | −0.008 | 1.000 | |||

| SIZE (7) | 0.022 * | −0.127 * | −0.106 * | −0.058 * | 0.150 * | −0.004 | 1.000 | ||

| LEVERAGE (8) | −0.525 * | −0.029 * | −0.022 * | −0.026 * | 0.033 * | 0.000 | −0.007 | 1.000 | |

| R&D INTENSITY (9) | −0.030 * | 0.061 * | 0.078 * | 0.043 * | −0.006 | −0.001 | −0.009 | 0.014 | 1.000 |

| PROFIT | ||

|---|---|---|

| Coef. | t-Value | |

| CASH | 1.7240 | 2.270 ** |

| CASH_SQUARED | −2.4247 | −2.995 *** |

| LIQUIDITY | 0.0208 | 3.103 *** |

| INVESTMENT | −0.1179 | −0.370 |

| GROWTH | −0.0001 | −0.433 |

| SIZE | 0.0001 | 5.100 *** |

| LEVERAGE | −0.2322 | −7.630 *** |

| R&D INTENSITY | −0.0030 | −3.760 *** |

| Year fixed effects | Yes | |

| N | 21,051 | |

| Adj. R-sq | 0.277 | |

| One-Year-Forward PROFIT | ||

|---|---|---|

| Coef. | t-Value | |

| CASH | 2.0576 | 2.173 ** |

| CASH_SQUARED | −3.2437 | −2.459 ** |

| LIQUIDITY | 0.0161 | 2.151 ** |

| INVESTMENT | −0.0132 | −0.029 |

| GROWTH | −0.0001 | −0.612 |

| SIZE | 0.0001 | 2.968 *** |

| LEVERAGE | −0.2763 | −4.164 *** |

| R&D INTENSITY | −0.0051 | −2.143 ** |

| Year fixed effects | Yes | |

| N | 18,281 | |

| Adj. R-sq | 0.090 | |

| One-Year-Forward PROFIT | ||

|---|---|---|

| Coef. | t-Value | |

| CASH | 0.1207 | 2.903 *** |

| CASH_SQUARED | −0.1284 | −1.776 * |

| LIQUIDITY | −0.0013 | −1.065 |

| INVESTMENT | 0.0324 | 1.146 |

| GROWTH | 0.0014 | 0.962 |

| SIZE | −0.0001 | −1.810 * |

| LEVERAGE | 0.0216 | 0.911 |

| R&D INTENSITY | −0.3007 | −4.909 *** |

| Year fixed effects | Yes | |

| Firm fixed effects | Yes | |

| N | 5258 | |

| Adj. R-sq | 0.040 | |

| PROFIT | ||

|---|---|---|

| Coef. | t-Value | |

| CASH | 1.6279 | 2.587 *** |

| CASH_SQUARED | −2.7366 | −2.565 ** |

| LIQUIDITY | 0.0248 | 1.928 * |

| INVESTMENT | −0.9977 | −1.463 |

| GROWTH | −0.0002 | −1.907 * |

| SIZE | 0.0001 | 3.480 *** |

| LEVERAGE | −0.2260 | −6.207 *** |

| R&D INTENSITY | −0.0006 | −1.326 |

| Year fixed effects | Yes | |

| N | 5479 | |

| Adj. R-sq | 0.613 | |

| Variables | Number of Proxies | Variance Explained by PC1 |

|---|---|---|

| Profitability | 10 | 39.7% |

| Liquidity | 2 | 57.7% |

| Investment | 2 | 51.1% |

| Growth | 3 | 36.4% |

| Size | 5 | 67.6% |

| Leverage | 3 | 48.8% |

| PROFIT_M | ||

|---|---|---|

| Coef. | t-Value | |

| CASH | 0.0502 | 2.438 ** |

| CASH_SQUARED | −0.0460 | −2.380 ** |

| LIQUIDITY_M | 0.0068 | 2.363 ** |

| INVESTMENT_M | −0.0047 | −3.574 *** |

| GROWTH_M | 0.0013 | 2.184 ** |

| SIZE_M | 0.0210 | 6.512 *** |

| LEVERAGE_M | −0.2958 | −2.423 ** |

| R&D INTENSITY | 0.0001 | 2.101 ** |

| Year fixed effects | Yes | |

| N | 21,051 | |

| Adj. R-sq | 0.136 | |

| Models | MAE | RMSE | R2 |

|---|---|---|---|

| Random Forest | 0.0084 | 0.0723 | 0.6090 |

| Neural Network | 0.0128 | 0.0989 | 0.4293 |

| Decision Tree | 0.0140 | 0.1010 | 0.2174 |

| Support Vector Machine | 0.0128 | 0.1101 | 0.1207 |

| OLS Regression | 0.0824 | 1.0098 | 0.1360 |

| Mean SHAP Value | |

|---|---|

| CASH | 0.000140 |

| CASH_SQUARED | −0.000222 |

| LIQUIDITY_M | −0.000064 |

| INVESTMENT_M | −0.000367 |

| GROWTH_M | 0.000479 |

| SIZE_M | 0.003200 |

| LEVERAGE_M | −0.000068 |

| R&D INTENSITY | 0.001593 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lim, J.; Jeong, B.K. The Impact of Cash Holding Decisions on Firm Performance in the IT Industry. J. Risk Financial Manag. 2025, 18, 625. https://doi.org/10.3390/jrfm18110625

Lim J, Jeong BK. The Impact of Cash Holding Decisions on Firm Performance in the IT Industry. Journal of Risk and Financial Management. 2025; 18(11):625. https://doi.org/10.3390/jrfm18110625

Chicago/Turabian StyleLim, Jaeseong, and Bong Keun Jeong. 2025. "The Impact of Cash Holding Decisions on Firm Performance in the IT Industry" Journal of Risk and Financial Management 18, no. 11: 625. https://doi.org/10.3390/jrfm18110625

APA StyleLim, J., & Jeong, B. K. (2025). The Impact of Cash Holding Decisions on Firm Performance in the IT Industry. Journal of Risk and Financial Management, 18(11), 625. https://doi.org/10.3390/jrfm18110625