Systematic Review of Financial Distress Prediction Models for Municipalities: Key Evaluation Criteria and a Framework for Model Selection

Abstract

1. Introduction

2. Literature Review

2.1. Understanding Financial Distress in Municipalities

2.2. Financial Distress Prediction and Measurement of Financial Condition

2.3. Existing FDP Models for Financial Distress Prediction

2.4. Importance of Selecting the Suitable FDP Tools

2.5. Criteria for Selecting Financial Distress Prediction Tools

2.6. Gaps in Existing Literature

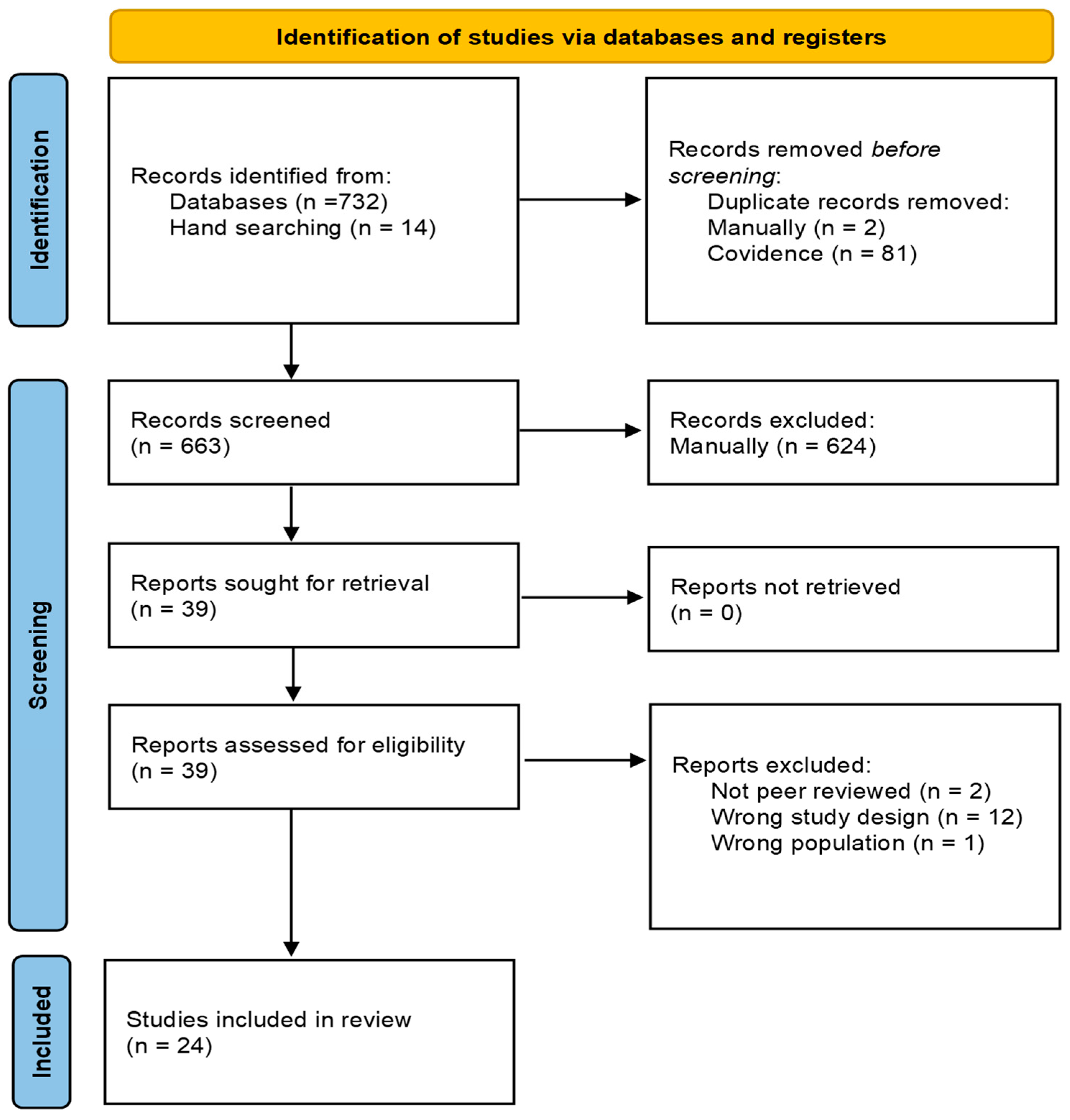

3. Methodology

3.1. Defining the Research Question

3.2. Developing a Search Strategy

3.3. Developing Eligibility Criteria for Study Selection

3.4. Screening and the Selection of Studies

3.5. Assessing the Quality of the Included Studies

3.6. Extraction of the Relevant Data

3.7. Synthesis and Reporting of Findings

4. Results

4.1. Characteristics of the Included Studies

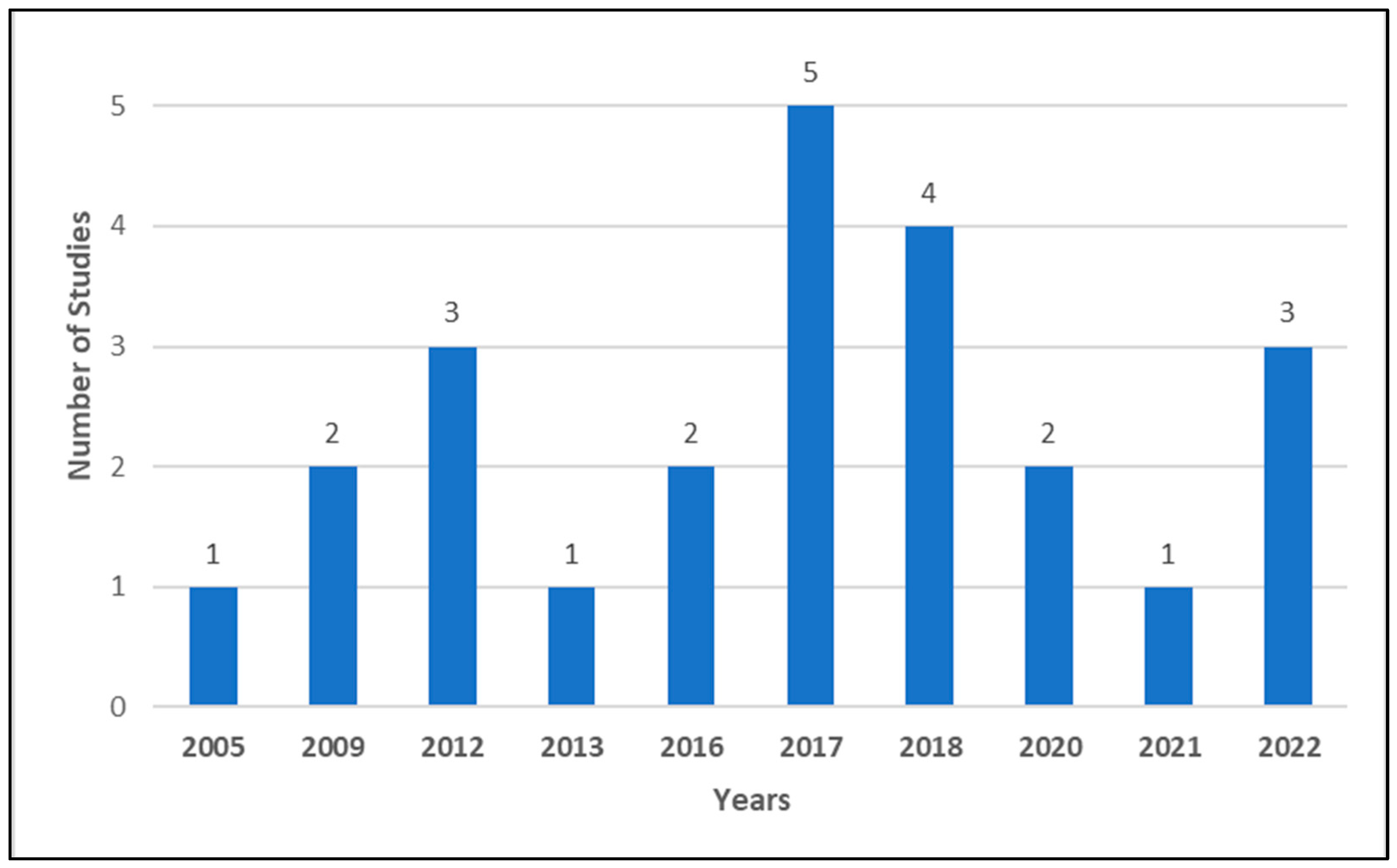

4.1.1. Publication Trends

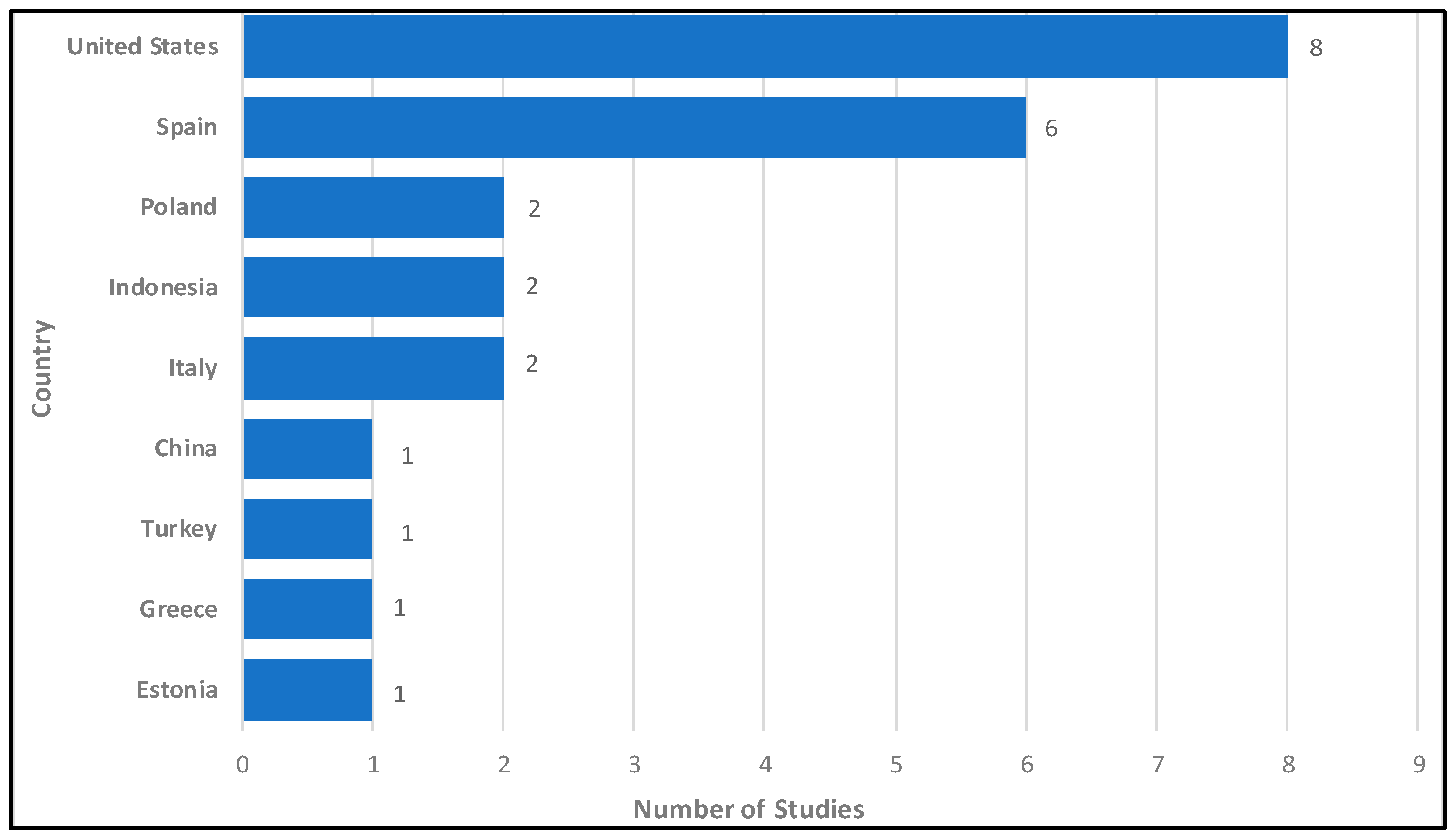

4.1.2. Geographic Distribution of the Selected Studies

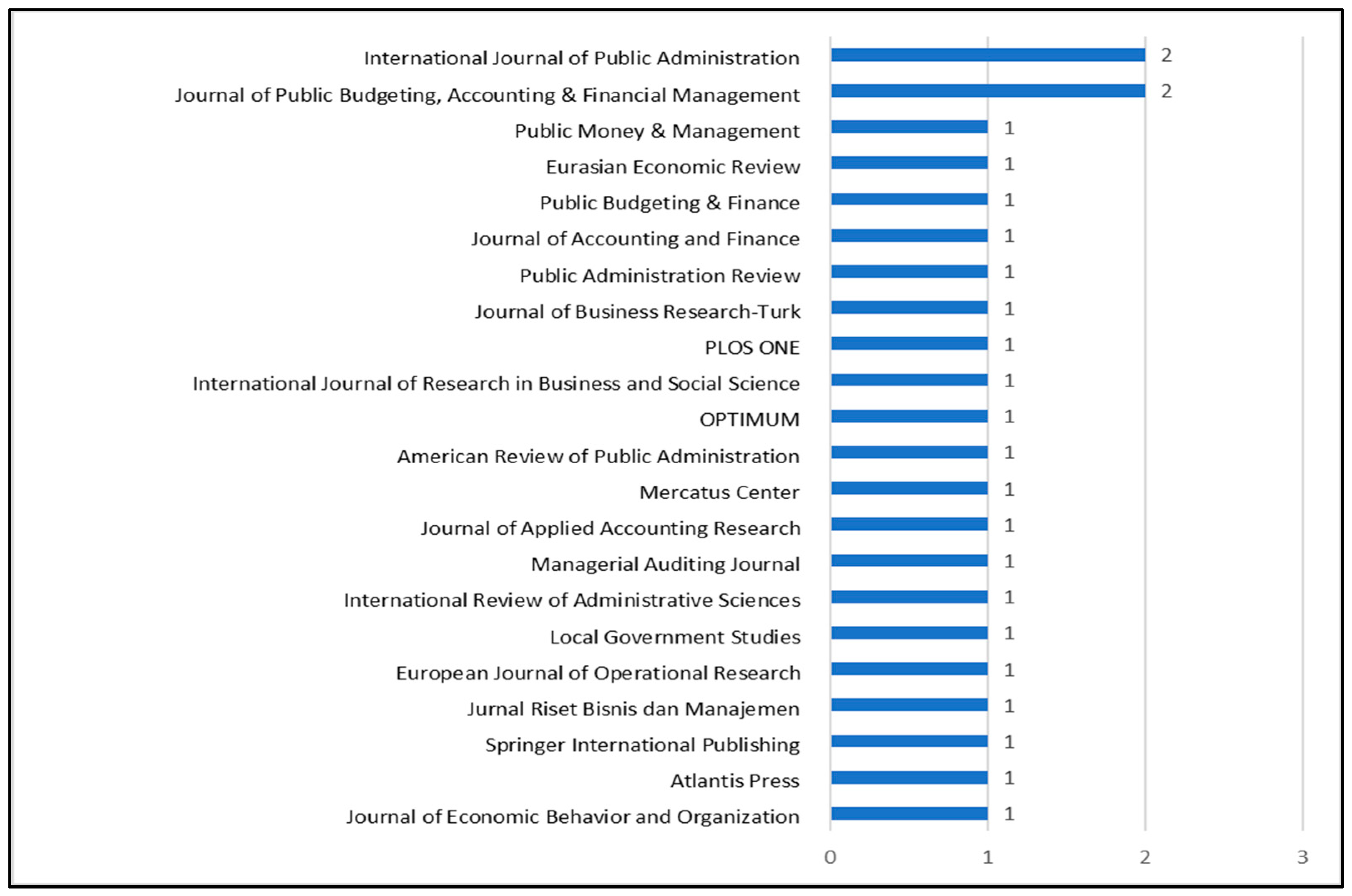

4.1.3. Publication Outlets of the Included Studies

4.1.4. Summary of the Included Studies

4.1.5. Thematic Classification of Variable Indicators

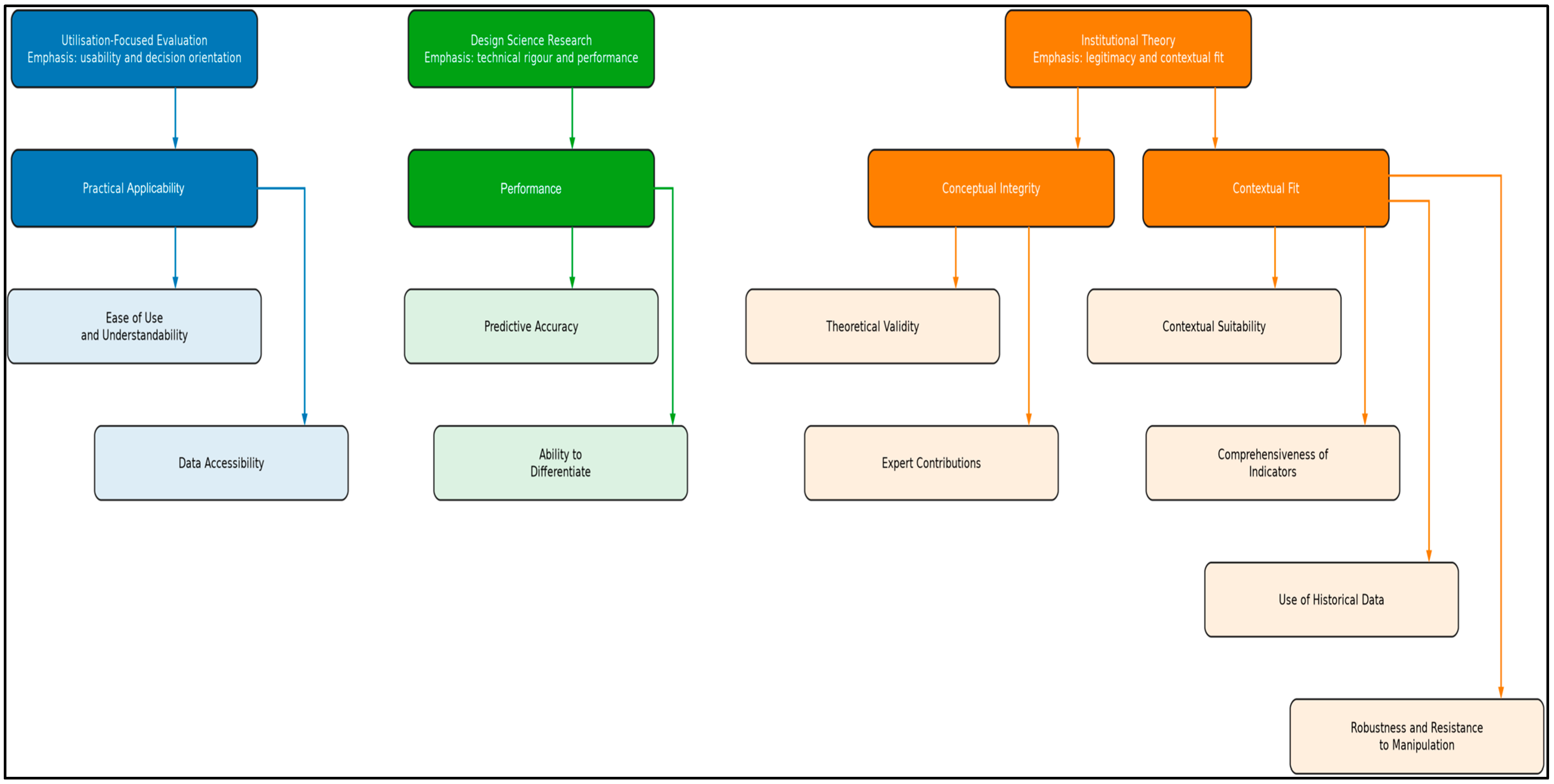

4.2. Evaluation Criteria Identified Across Studies

4.3. Model Performance of the Included Studies

4.3.1. Performance

Prediction Success Rates

Ability to Differentiate (False Positives and Negatives)

4.3.2. Conceptual Integrity

Theoretical Frameworks

Expert Contributions

4.3.3. Practical Ability

Data Sources and Accessibility Challenges

Use of Historical Data

Ease of Use and Understandability

4.3.4. Contextual Fit

Contextual Suitability and Relevance

Robustness and Resistance to Manipulation

Comprehensiveness of Indicators

5. Discussion: Towards a Framework for the Evaluation and Selection of Municipal FDP Models

5.1. Reconciling Predictive Accuracy with Broader Model Quality

5.2. Theoretical Validity and Conceptual Gaps

5.3. Contextual Fit: Geographic and Institutional Relevance

5.4. Operational Considerations: Usability, Data, and Manipulation Risk

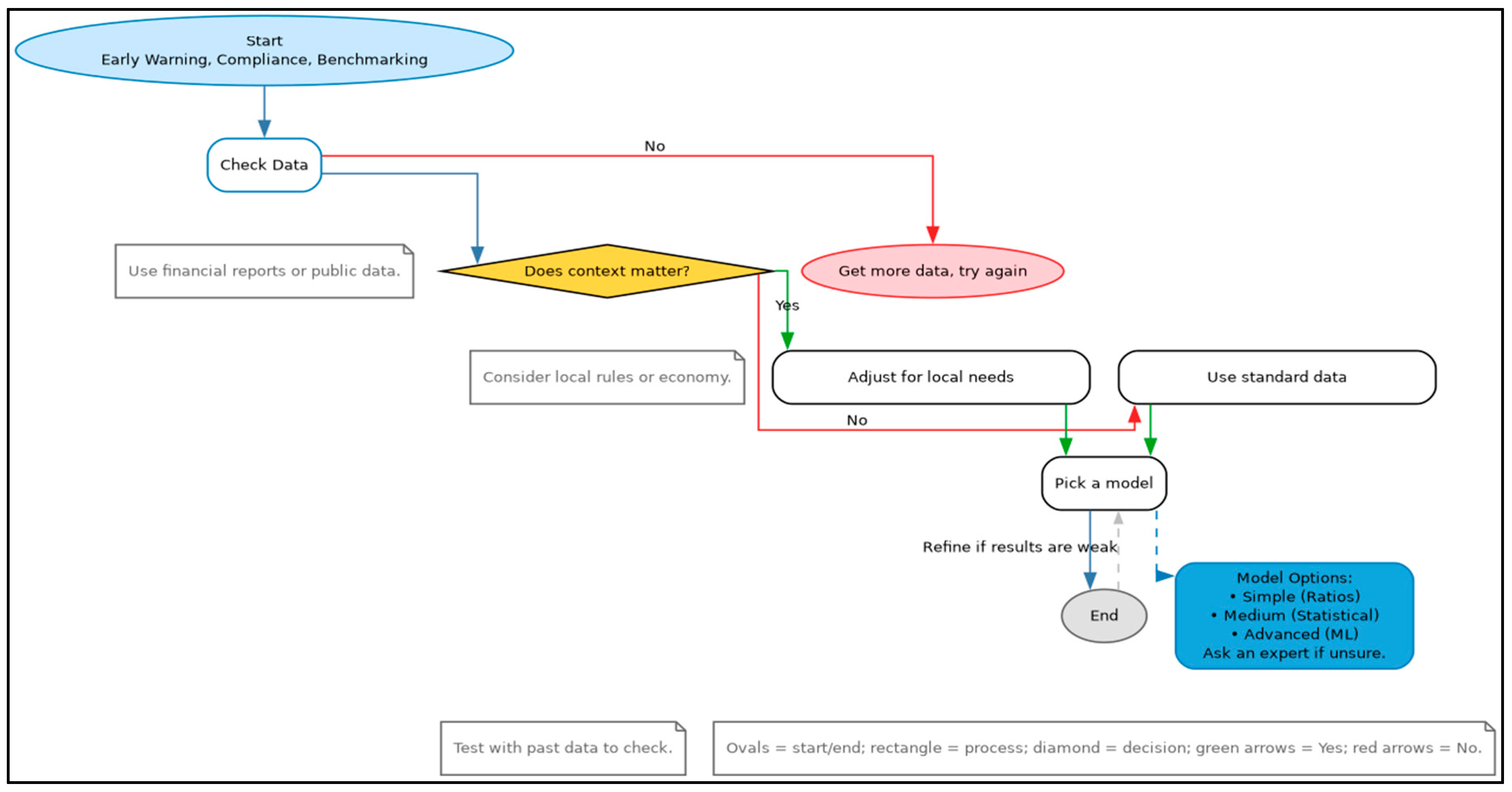

5.5. Towards a Multi-Criteria Evaluation Paradigm

5.5.1. Assessment Checklist for Model Evaluation

- Gather model details and evidence. Collect information on predictive performance, theoretical grounding, and contextual features from published studies or pilot applications.

- Assign scores using the rubric. Rate each criterion on the 0–2 scale. Evidence examples include validation tests (e.g., AUC > 0.8, cross-validation), government adoption, or expert endorsement.

- Determine weights. Conduct a small Delphi round (3–5 experts) to align weights with municipal capacity. Round 1: independent ranking; Round 2: group discussion; Round 3: consensus.

- Calculate composite score. Multiply each criterion score by its assigned weight and sum across all ten criteria. Apply the tie-break rule where needed.

5.5.2. Design Guide for Model Development

- If audited years < 3 or data completeness < 80%: adopt a transparent baseline model using a small indicator set and simple thresholds, documenting assumptions and handling of missing data.

- If audited years ≥ 3 and completeness ≥ 80% but technical capacity is limited: use logistic regression with appropriate constraints, ensuring diagnostics and calibration are reported.

- If audited years ≥ 3, completeness ≥ 85% and capacity is adequate: apply more advanced techniques such as gradient boosting or support vector machines, with calibration and explainability tools, while retaining a logistic regression benchmark.

5.5.3. Application of the Framework in Practice

- Small developing municipality: Prioritises data accessibility and ease of use (PA1, PA3). The decision tree guides the user to ratio-based models, with Table 5 showing examples such as Kloha et al. (2005).

- Medium-sized municipality: Balances predictive accuracy and robustness (P1, CF1). The decision tree points to medium-complexity statistical approaches, with Table 5 indicating logistic regression as a suitable option (see, Trussel & Patrick, 2018; Gorina et al., 2018b).

- Large developed: Emphasises predictive accuracy and comprehensiveness (P1, CF3). The decision tree directs towards advanced techniques, while Table 5 highlights machine learning hybrids (see, X. Li et al., 2022; Antulov-Fantulin et al., 2021).

5.6. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Search Strategy

| Database | Search String | Initial Search | Initial Results | Follow-Up Search | Follow-Up Results |

|---|---|---|---|---|---|

| Google Scholar | (“Municipality” OR “municipal” OR “local governments” OR “councils”) AND (“Financial distress” OR “Financial crisis” OR “Financial strain” OR “Financial condition”) AND (“Prediction” OR “Forecasting” OR “Assessment” OR “Modelling” OR “Estimation” OR “Measurement”) | 10 October 2024 | 106 papers | 10 March 2025 | 91 papers |

| Web of Science | (“Municipalities” OR “local governments” OR “councils”) AND (“Financial distress” OR “Fiscal strain” OR “Financial condition”) AND (“Prediction” OR “Modelling” OR “Measurement”) | 10 October 2024 | 14 papers | 10 March 2025 | 0 papers |

| ScienceDirect | (“Municipalities” OR “local governments” OR “councils”) AND (“Financial distress” OR “Fiscal strain” OR “Financial condition”) AND (“Prediction” OR “Modelling” OR “Measurement”) | 10 October 2024 | 34 papers | 10 March 2025 | 45 papers |

| Scopus | (“Municipality” OR “municipal” OR “local governments” OR “councils”) AND (“Financial distress” OR “Financial crisis” OR “Financial strain” OR “Financial condition”) AND (“Prediction” OR “Forecasting” OR “Assessment” OR “Modelling” OR “Estimation” OR “Measurement”) | 10 October 2024 | 112 papers | 10 March 2025 | 16 papers |

| EBSCOHOST | (“Municipalities” OR “local governments” OR “councils”) AND (“Financial distress” OR “Fiscal strain” OR “Financial condition”) AND (“Prediction” OR “Modelling” OR “Measurement”) | 10 October 2024 | 12 Papers | 10 March 2025 | 0 papers |

| ProQuest | (“Municipalities” OR “local governments” OR “councils”) AND (“Financial distress” OR “Fiscal strain” OR “Financial condition”) AND (“Prediction” OR “Modelling” OR “Measurement”) | 10 October 2024 | 209 papers | 10 March 2025 | 93 papers |

Appendix B. An Overview Summary of the Reviewed Studies

| No. | Authors | Country | FDP Tool Type | Summary |

|---|---|---|---|---|

| 1 | Kloha et al. (2005) | United States | Composite Fiscal Distress Scale | Developed a 10-point fiscal distress scale using demographic and financial indicators. Validated with historical distress cases. |

| 2 | Trussel and Patrick (2009) | United States | Logistic Regression | Used municipal data to predict fiscal distress from sustained operating deficits. Achieved up to 91% accuracy. |

| 3 | Zafra-Gómez et al. (2009) | Spain | Financial Ratio Analysis, Cluster Analysis | Combined financial ratio and cluster analysis to develop a financial condition index and classify municipalities by distress risk. |

| 4 | Cohen et al. (2012) | Greece | Multicriteria Decision Analysis | Applied SMAA with disaggregation to assess viability in Greek municipalities using accrual financial data. Validated with ROC and AUROC. |

| 5 | García-Sánchez et al. (2012) | Spain | Logistic Regression | Used panel data and logistic regression to classify municipalities over 20 years. Tested predictive accuracy using Wilcoxon test. |

| 6 | Trussel and Patrick (2012) | United States | Survival Analysis (Cox Regression) | Used Cox regression to model fiscal distress likelihood. Evaluated via hazard ratios and baseline hazard on over 25,000 observations. |

| 7 | Trussel and Patrick (2013) | United States | Survival Analysis (Cox Regression) | Extended Cox regression to special district governments. Model achieved up to 93.4% accuracy and was validated with a holdout sample. |

| 8 | Lohk and Siimann (2016) | Estonia | Discriminant Analysis, Logit Regression | Developed predictive models for Estonian municipalities. Achieved 88% (Discriminant) and 87% (Logit) classification accuracy. |

| 9 | Rodríguez-Bolívar et al. (2016) | Spain | Panel Data Regression | Used pooled OLS and fixed-effects to assess financial sustainability. Validated with R2, significance levels, and Wald tests. |

| 10 | Cohen et al. (2017) | Italy | Logistic Regression | Used financial ratios and logistic regression to classify municipalities pre-bankruptcy. Achieved 77% predictive power. |

| 11 | Gorina et al. (2018b) | United States | Logistic Regression | Developed action-based model of fiscal distress using financial and socio-economic factors. Validated using pseudo R2 and parameter estimates. |

| 12 | Kluza (2017) | Poland | Ratio Analysis, DEA | Combined corporate finance ratios with DEA to evaluate fiscal efficiency. Validated using DEA scores and debt limit correlations. |

| 13 | López-Hernández et al. (2018) | Spain | Survival Analysis, Hazard Modeling | Used dynamic survival analysis to study effects of fiscal stress on contracting out. Identified key hazard ratios. |

| 14 | Navarro-Galera et al. (2017) | Spain | Logistic Regression | Used random-effects logistic regression to predict default risk. Assessed via odds ratios, Wald tests, and ROC curves. |

| 15 | Alaminos et al. (2018) | Spain | Machine Learning | Used classifiers like Decision Trees and Deep Belief Networks to predict fiscal distress. Evaluated with classification accuracy and RMSE. |

| 16 | Gorina et al. (2018a) | United States | Logistic Regression | Applied relogit model to national sample predicting defaults. Validated with pseudo R2, likelihood ratios, and robust errors. |

| 17 | Malinowska-Misiąg (2018) | Poland | Ratio Analysis, Relative Ranking | Assessed applicability of foreign models to Polish municipalities using ranking models and quartile classification. |

| 18 | Trussel and Patrick (2018) | United States | Logistic Regression | Ranked financial risk using logistic regression. Achieved up to 99% accuracy across 10,248 municipality-years. |

| 19 | Kablan (2020) | Turkey | Altman’s Z-Score | Applied Altman Z-Score model to Turkish municipalities, creating risk maps and categorising municipalities into distress zones. |

| 20 | Trussel (2020) | United States | Logistic Regression | Used logistic regression with financial and socio-economic data to predict operating deficits. Validated using pseudo R2. |

| 21 | Antulov-Fantulin et al. (2021) | Italy | Machine learning | Used GBM, RF, LASSO, and Neural Networks to predict bankruptcy. Validated with ROC, PRC, and AUC metrics. |

| 22 | Islamiyah et al. (2022) | Indonesia | Logistic Regression | Analysed financial independence and decentralisation effects using logistic regression. Evaluated with Hosmer-Lemeshow test. |

| 23 | X. Li et al. (2022) | China | Machine Learning | Developed EWS using Markov-switching, SVM, GBM, RF, and network analysis. Assessed with ROC-AUC and switching probabilities. |

| 24 | Shiddiqy and Prihatiningtias (2022) | Indonesia | Logistic Regression | Used binary logistic regression on financial ratios to classify distress in East Java. Achieved 93.6% classification accuracy. |

Appendix C. Scoring Rubric and Application

| Criterion | Short Code | Scoring (0–2) | Example Weighting | Illustrative Scenario |

|---|---|---|---|---|

| Predictive Accuracy | P1 | 0 = absent; 1 = descriptive only; 2 = predictive tests reported | 0.15–0.25 | Weighted higher in data-rich municipalities with technical expertise. |

| Ability to Differentiate (False Positives & Negatives) | P2 | 0 = absent; 1 = implied only; 2 = clear false positive/negative rates | 0.10 | Ensures the model can distinguish distressed vs. healthy municipalities. |

| Theoretical Validity | CI 1 | 0 = absent; 1 = weak/implicit; 2 = grounded in theory | 0.10 | Adds credibility by linking to established financial/economic theories. |

| Expert Involvement | CI 2 | 0 = absent; 1 = ad hoc; 2 = systematic inclusion | 0.10 | Higher weight in politically sensitive contexts to secure legitimacy. |

| Data Accessibility | PA 1 | 0 = absent; 1 = present, limited; 2 = present, open/easy | 0.20 | Prioritised where financial/operational data are scarce or fragmented. |

| Use of Historical Data | PA 2 | 0 = absent; 1 = short series (<5 years); 2 = long series (≥10 years) | 0.10 | Weighted more in contexts where past fiscal trends are critical. |

| Ease of Use/Understandability | PA 3 | 0 = absent; 1 = present, unclear; 2 = present with clear steps | 0.20 | Favoured in low-capacity municipalities with limited staff skills. |

| Robustness/Resistance to Manipulation | CF 1 | 0 = absent; 1 = claimed only; 2 = tested/validated | 0.15 | Weighted higher where manipulation risk or poor data quality is high. |

| Comprehensiveness of Indicators | CF 2 | 0 = financial ratios only; 1 = some socio-economic; 2 = broad (financial, socio-economic, governance) | 0.10–0.15 | Prioritised in municipalities with diverse socio-economic pressures. |

| Contextual Suitability/Relevance | CF 3 | 0 = absent; 1 = partially adapted; 2 = fully adapted to local context | 0.10–0.20 | Especially important when applying models developed in other countries. |

References

- Ainan, U. H., Por, L. Y., Chen, Y., Yang, J., & Ku, C. S. (2024). Advancing bankruptcy forecasting with hybrid machine learning techniques: Insights from an unbalanced Polish dataset. IEEE Access, 12, 9369–9381. [Google Scholar] [CrossRef]

- Alaka, H. A., Oyedele, L. O., Owolabi, H. A., Kumar, V., Ajayi, S. O., Akinade, O. O., & Bilal, M. (2018). Systematic review of bankruptcy prediction models: Towards a framework for tool selection. Expert Systems with Applications, 94, 164–184. [Google Scholar] [CrossRef]

- Alaminos, D., Fernández, S., García, F., & Fernández, M. (2018). Data mining for municipal financial distress prediction. In P. Perner (Ed.), Advances in data mining: Applications and theoretical aspects (Vol. 10933, pp. 296–308). Springer. Lecture Notes in Computer Science. [Google Scholar] [CrossRef]

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal of Finance, 23(4), 589–609. [Google Scholar] [CrossRef]

- Antulov-Fantulin, N., Lagravinese, R., & Resce, G. (2021). Predicting bankruptcy of local government: A machine learning approach. Journal of Economic Behavior & Organization, 183, 681–699. [Google Scholar] [CrossRef]

- Aoki, N., Tatsumi, T., Naruse, G., & Maeda, K. (2024). Explainable AI for government: Does the type of explanation matter to the accuracy, fairness, and trustworthiness of an algorithmic decision as perceived by those who are affected? Government Information Quarterly, 41(4), 101965. [Google Scholar] [CrossRef]

- Belton, V., & Stewart, T. (2012). Multiple criteria decision analysis: An integrated approach. Springer Science & Business Media. [Google Scholar]

- Brown, K. W. (1993). The 10 point test of financial condition: Toward an easy to use assessment tool for smaller cities. Government Finance Review, 9(6), 21–26. [Google Scholar]

- Brusca, I., Rossi, F. M., & Aversano, N. (2015). Drivers for the financial condition of local government: A comparative study between Italy and Spain. Lex Localis, 13(2), 161–184. [Google Scholar] [CrossRef] [PubMed]

- Chan, T. K., & Abdul Aziz, A. R. S. (2017). Financial performance and operating strategies of Malaysian property development companies during the global financial crisis. Journal of Financial Management of Property and Construction, 22(2), 174–191. [Google Scholar] [CrossRef]

- Chen, C., Chen, C., & Lien, D. (2020). Financial distress prediction model: The effects of corporate governance indicators. Journal of Forecasting, 39(8), 1238–1252. [Google Scholar] [CrossRef]

- Chen, W., Yang, K., Yu, Z., Shi, Y., & Chen, C. L. P. (2024). A survey on imbalanced learning: Latest research, applications and future directions. Artificial Intelligence Review, 57, 137. [Google Scholar] [CrossRef]

- Chung, I. H., & Williams, D. (2020). Local governments’ responses to the fiscal stress label: The case of New York. Local Government Studies, 47(5), 808–835. [Google Scholar] [CrossRef]

- Clark, W. R., Clark, L. A., Raffo, D. M., & Williams, R. I. (2021). Extending Fisch and Block’s tips for a systematic review in management and business literature. Management Review Quarterly, 71, 215–231. [Google Scholar] [CrossRef]

- Cohen, S., Costanzo, A., & Manes Rossi, F. (2017). Auditors and early signals of financial distress in local governments. Managerial Auditing Journal, 32(3), 234–250. [Google Scholar] [CrossRef]

- Cohen, S., Doumpos, M., Neofytou, E., & Zopounidis, C. (2012). Assessing financial distress where bankruptcy is not an option: An alternative approach for local municipalities. European Journal of Operational Research, 218(1), 270–279. [Google Scholar] [CrossRef]

- Darmawati, D., Mediawati, E., & Rasyid, S. (2024). New trends and directions in local government finance research: A bibliometric analysis. Public and Municipal Finance, 13(1), 137–149. [Google Scholar] [CrossRef]

- Dasilas, A., & Rigani, A. (2024). Machine learning techniques in bankruptcy prediction: A systematic literature review. Expert Systems with Applications, 255, 124761. [Google Scholar] [CrossRef]

- Delfos, J., Zuiderwijk, A. M. G., & Van Cranenburgh, S. (2024). Integral system safety for machine learning in the public sector: An empirical account. Government Information Quarterly, 41(3), 101963. [Google Scholar] [CrossRef]

- DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160. [Google Scholar] [CrossRef]

- Elhoseny, M., Metawa, N., Sztano, G., & El-Hasnony, I. M. (2022). Deep learning-based model for financial distress prediction. Annals of Operations Research, 345(2), 885–907. [Google Scholar] [CrossRef]

- Galán, J. (2021). CREWS: A CAMELS-based early warning system of systemic risk in the banking sector (Occasional Paper No. 2132). Banco de España. [Google Scholar]

- Galiński, P. (2023). Determinants of the financial liquidity of local governments: Empirical evidence from Poland. Argumenta Oeconomica, 2(51), 329–351. [Google Scholar] [CrossRef]

- García-Sánchez, I. M., Cuadrado Ballesteros, B., Frías Aceituno, J. V., & Mordan, N. (2012). A new predictor of local financial distress. International Journal of Public Administration, 35(11), 739–748. [Google Scholar] [CrossRef]

- Gorina, E., Joffe, M., & Maher, C. (2018a). Using fiscal ratios to predict local fiscal distress. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Gorina, E., Maher, C., & Joffe, M. (2018b). Local fiscal distress: Measurement and prediction. Public Budgeting & Finance, 38(1), 72–94. [Google Scholar] [CrossRef]

- Groves, S. M., Godsey, W. M., & Shulman, M. A. (1981). Financial indicators for local government. Public Budgeting & Finance, 1(2), 5–19. [Google Scholar] [CrossRef]

- Gusenbauer, M., & Haddaway, N. R. (2020). Which academic search systems are suitable for systematic reviews or meta-analyses? Evaluating retrieval qualities of Google Scholar, PubMed, and 26 other resources. Research Synthesis Methods, 11(2), 181–217. [Google Scholar] [CrossRef]

- Hevner, A. R., March, S. T., Park, J., & Ram, S. (2004). Design science in information systems research. MIS Quarterly, 28(1), 75–105. [Google Scholar] [CrossRef]

- Iacuzzi, S. (2022). An appraisal of financial indicators for local government: A structured literature review. Journal of Public Budgeting, Accounting & Financial Management, 34(6), 69–94. [Google Scholar] [CrossRef]

- Islamiyah, M. T., Ratifah, I., & Firdaus, F. (2022). Do financial ratio predicting financial distress in local government? Jurnal Riset Bisnis dan Manajemen, 15(1), 56–60. [Google Scholar] [CrossRef]

- Jones, S., & Walker, R. G. (2007). Explanators of local government distress. Abacus, 43(3), 396–418. [Google Scholar] [CrossRef]

- Kablan, A. (2020). Altman’s Z”-score to predict accounting-based financial distress of municipalities: Bankruptcy risk map for metropolitan municipalities in Turkey. İşletme Araştırmaları Dergisi, 12(1), 498–509. [Google Scholar] [CrossRef]

- Kadkhoda, S. (2024). A hybrid network analysis and machine learning model for enhanced financial distress prediction. IEEE Access, 12, 52759–52777. [Google Scholar] [CrossRef]

- Kloha, P., Weissert, C. S., & Kleine, R. (2005). Developing and testing a composite model to predict local fiscal distress. Public Administration Review, 65(3), 313–323. [Google Scholar] [CrossRef]

- Kluza, K. (2017). Risk assessment of the local government sector based on the ratio analysis and the DEA method: Evidence from Poland. Eurasian Economic Review, 7(3), 329–351. [Google Scholar] [CrossRef]

- Kolaski, K., Romeiser Logan, L., & Ioannidis, J. P. A. (2023). Guidance to best tools and practices for systematic reviews. Journal of Pediatric Rehabilitation Medicine, 16(2), 241–273. [Google Scholar] [CrossRef]

- Kooij, J., & Groot, T. (2021). Towards a comprehensive assessment system of local government fiscal health. Maandblad voor Accountancy en Bedrijfseconomie, 95(7/8), 233–244. [Google Scholar] [CrossRef]

- Leiser, S., & Mills, S. (2019). Local government fiscal health: Comparing self-assessments to conventional measures. Public Budgeting & Finance, 39(3), 75–96. [Google Scholar] [CrossRef]

- Li, H., Sun, T., & Zhang, J. (2024). Prediction of corporate financial distress based on corporate social responsibility: New evidence from DANP, VWP and MEOWA weights methodologies. Accounting & Finance, 64(5), 4537–4565. [Google Scholar] [CrossRef]

- Li, X., Ge, X., & Chen, C. (2022). Several explorations on how to construct an early warning system for local government debt risk in China. PLoS ONE, 17(2), e0263391. [Google Scholar] [CrossRef]

- Liu, L., Chen, C., & Wang, B. (2022). Predicting financial crises with machine learning methods. Journal of Forecasting, 41(5), 871–910. [Google Scholar] [CrossRef]

- Lohk, P., & Siimann, P. (2016, December 8–9). Predicting the risk of encountering financial difficulties by the example of Estonian municipalities [Paper presentation]. 5th International Conference on Accounting, Auditing, and Taxation (ICAAT) (pp. 297–306), Tallinn, Estonia. [Google Scholar] [CrossRef]

- López-Hernández, A. M., Zafra-Gómez, J. L., Plata-Díaz, A. M., & de la Higuera-Molina, E. J. (2018). Modeling fiscal stress and contracting out in local government: The influence of time, financial condition, and the Great Recession. American Review of Public Administration, 48(6), 565–583. [Google Scholar] [CrossRef]

- Lukáč, J., Teplická, K., Čulková, K., & Hrehová, D. (2021). Evaluation of the financial performance of the municipalities in slovakia in the context of multidimensional statistics. Journal of Risk and Financial Management, 14(12), 570. [Google Scholar] [CrossRef]

- Lunny, C., Brennan, S. E., McDonald, S., & McKenzie, J. E. (2018). Toward a comprehensive evidence map of overview of systematic review methods: Paper 2—Risk of bias assessment; synthesis, presentation and summary of the findings; and assessment of the certainty of the evidence. Systematic Reviews, 7, 159. [Google Scholar] [CrossRef]

- Maher, C. S., Oh, J. W., & Liao, W. J. (2020). Assessing fiscal distress in small county governments. Journal of Public Budgeting, Accounting & Financial Management, 32(4), 691–711. [Google Scholar] [CrossRef]

- Malinowska-Misiąg, E. (2018). Possibilities of using in Poland the foreign models of predicting the fiscal distress in local government units. Optimum Economic Studies, 93(3), 115–125. [Google Scholar] [CrossRef]

- Matenda, F. R., Sibanda, M., Chikodza, E., & Gumbo, V. (2021). Bankruptcy prediction for private firms in developing economies: A scoping review and guidance for future research. Management Review Quarterly, 72(4), 927–966. [Google Scholar] [CrossRef]

- McDonald, B. D., III, & Maher, C. S. (2020). Do we really need another municipal fiscal health analysis? Assessing the effectiveness of fiscal health systems. Public Finance Management, 19(4), 270–296. [Google Scholar] [CrossRef]

- Mishra, N., Ashok, S., & Tandon, D. (2021). Predicting financial distress in the Indian banking sector: A comparative study between the logistic regression, LDA and ANN models. Global Business Review, 25(6), 1540–1558. [Google Scholar] [CrossRef]

- Munn, Z., Dias, M., Tufanaru, C., Porritt, K., Stern, C., Jordan, Z., Aromataris, E., & Pearson, A. (2021). The “quality” of JBI qualitative research synthesis: A methodological investigation into adherence of meta-aggregative systematic reviews to reporting standards and methodological guidance. JBI Evidence Synthesis, 19(5), 1119–1139. [Google Scholar] [CrossRef]

- Munn, Z., Stone, J. C., Aromataris, E., Klugar, M., Sears, K., Leonardi Bee, J., & Barker, T. H. (2023). Assessing the risk of bias of quantitative analytical studies: Introducing the vision for critical appraisal within JBI systematic reviews. JBI Evidence Synthesis, 21(3), 467–471. [Google Scholar] [CrossRef]

- Navarro-Galera, A., Lara Rubio, J., Buendía Carrillo, D., & Rayo Cantón, S. (2017). What can increase the default risk in local governments? International Review of Administrative Sciences, 83(2), 397–419. [Google Scholar] [CrossRef]

- Padovani, E., Iacuzzi, S., Jorge, S., & Pimentel, L. (2021). Municipal financial vulnerability in pandemic crises: A framework for analysis. Journal of Public Budgeting, Accounting & Financial Management, 33(4), 387–408. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., Brennan, S. E., Chou, R., Glanville, J., Grimshaw, J. M., Hróbjartsson, A., Lalu, M. M., Li, T., Loder, E. W., Mayo-Wilson, E., McDonald, S., … Moher, D. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ, 372, n71. [Google Scholar] [CrossRef]

- Park, S., Maher, C. S., & Liao, W. J. (2023). Revisiting the (lack of) association between objective and subjective measures of local fiscal condition. Public Budgeting & Finance, 43(3), 39–54. [Google Scholar] [CrossRef]

- Patton, M. Q. (2008). Utilisation-focused evaluation (4th ed.). Sage Publications. [Google Scholar]

- Rahayu, S., Yudi, Y., & Rahayu, R. (2023). Local government performance: Financial condition perspective. Jurnal Perspektif Pembiayaan Pembangunan Daerah, 10(6), 395–408. [Google Scholar] [CrossRef]

- Reilly, T., Coordes, L. N., Reinisch, E., & Schlinkert, D. (2023). Uncovering municipal fiscal distress in the United States. Public Finance Management, 21(2), 86–113. [Google Scholar] [CrossRef]

- Ritonga, I. T., & Buanaputra, V. G. (2022). Developing rules of thumb for the financial conditions of city livability: A study of municipal governments in Indonesia. Cogent Business & Management, 9(1), 2101327. [Google Scholar] [CrossRef]

- Ríos, A. M., Guillamón, M. D., & Benito, B. (2024). The influence of local government transparency on the implementation of the Sustainable Development Goals in municipalities. Journal of Public Budgeting, Accounting & Financial Management, 36(4), 417–444. [Google Scholar] [CrossRef]

- Robbins, G., Turley, G., & McNena, S. (2016). Benchmarking the financial performance of local councils in Ireland. Administration, 64(1), 1–27. [Google Scholar] [CrossRef]

- Rodríguez-Bolívar, M. P., Navarro Galera, A., Alcaide Muñoz, L., & López Subirés, M. D. (2016). Risk factors and drivers of financial sustainability in local government: An empirical study. Local Government Studies, 42(1), 29–51. [Google Scholar] [CrossRef]

- Rudin, C. (2019). Stop explaining black box machine learning models for high-stakes decisions and use interpretable models instead. Nature Machine Intelligence, 1(5), 206–215. [Google Scholar] [CrossRef]

- Sauer, P. C., & Seuring, S. (2023). How to conduct systematic literature reviews in management research: A guide in 6 steps and 14 decisions. Review of Managerial Science, 17(5), 1899–1933. [Google Scholar] [CrossRef]

- Shiddiqy, R. A., & Prihatiningtias, Y. W. (2022). The prediction of financial distress probability in East Java province governments. International Journal of Research in Business and Social Science, 11(1), 152–160. [Google Scholar] [CrossRef]

- Skica, T., Rodzinka, J., & Zaremba, U. (2020). The application of a synthetic measure in the assessment of the financial condition of LGUs in Poland using the TOPSIS method approach. Economics and Sociology, 13(4), 297–317. [Google Scholar] [CrossRef]

- Song, Y., Jiang, M., Li, S., & Zhao, S. (2024). Class imbalanced financial distress prediction with machine learning: Incorporating financial, management, textual, and social responsibility features into an index system. Journal of Forecasting, 43(3), 593–614. [Google Scholar] [CrossRef]

- Sun, J., Li, H., Huang, Q.-H., & He, K.-Y. (2014). Predicting financial distress and corporate failure: A review from the state of the art definitions, modeling, sampling, and featuring approaches. Knowledge-Based Systems, 57, 41–56. [Google Scholar] [CrossRef]

- Tran, C. D. T. T., & Dollery, B. (2021). All in the mind: Citizen satisfaction and financial performance in the Victorian local government system. Australian Accounting Review, 31(1), 51–64. [Google Scholar] [CrossRef]

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207–222. [Google Scholar] [CrossRef]

- Trussel, J. M. (2020). Predicting significant operating deficits in municipalities using economic indicators. Journal of Accounting and Finance, 20(8), 65–76. [Google Scholar] [CrossRef]

- Trussel, J. M., & Patrick, P. A. (2009). A predictive model of fiscal distress in local governments. Journal of Public Budgeting, Accounting & Financial Management, 21(4), 578–616. [Google Scholar] [CrossRef]

- Trussel, J. M., & Patrick, P. A. (2012). A survival analysis of U.S. municipalities in fiscal distress. International Journal of Public Administration, 35(9), 620–633. [Google Scholar] [CrossRef]

- Trussel, J. M., & Patrick, P. A. (2013). Predicting fiscal distress in special district governments. Journal of Public Budgeting, Accounting & Financial Management, 25(4), 589–616. [Google Scholar] [CrossRef]

- Trussel, J. M., & Patrick, P. A. (2018). Assessing and ranking the financial risk of municipal governments: The case of Pennsylvania. Journal of Applied Accounting Research, 19(1), 81–101. [Google Scholar] [CrossRef]

- Wang, X., Dennis, L., & Tu, Y. S. (2007). Measuring financial condition: A study of US states. Public Budgeting & Finance, 27(2), 1–21. [Google Scholar] [CrossRef]

- Zafra-Gómez, J. L., López Hernández, A. M., & Hernández Bastida, A. (2009). Developing an alert system for local governments in financial crisis. Public Money & Management, 29(3), 175–181. [Google Scholar] [CrossRef]

- Zhuang, Y., & Wei, H. (2023). Early warning model and prevention of regional financial risk integrated into legal system. PLoS ONE, 18(6), e0286685. [Google Scholar] [CrossRef] [PubMed]

| Component | Description |

|---|---|

| P (Population) | Municipalities |

| I (Intervention) | Financial distress prediction tools |

| C (Comparison) | Different prediction tools |

| O (Outcome) | Framework for selecting appropriate financial distress prediction tools |

| Criteria Category | Inclusion Criteria | Exclusion Criteria |

|---|---|---|

| Study Type | Peer-reviewed journal articles, conference proceedings, and systematic reviews | Opinion pieces, editorials, non-peer-reviewed reports, and studies that do not propose predictive models |

| Publication Date | 2000–2025 | Publications outside the 2000–2025 range |

| Scope | Studies focusing on financial distress prediction models applicable to municipalities and local governments | Studies focusing solely on corporate or private-sector financial distress models without municipal relevance |

| Methodology | Empirical, theoretical, or review Studies that propose, or test financial distress prediction models (not mere measurement of financial distress) | Studies focused only on the measurement of financial distress without predictive intent |

| Geographic Coverage | No geographic restriction. | None specifically (as long as other criteria are met) |

| Language | English (or with high-quality translations available) | Literature written in languages other than English without available translations |

| Criterion | Description | Number of Studies | Percentage of Studies (%) |

|---|---|---|---|

| Predictive Accuracy | Ability of a model to correctly classify distressed vs. non-distressed municipalities. | 17 | 70.8 |

| Comprehensiveness of Indicators | Inclusion of diverse dimensions (e.g., financial, economic, political, demographic) to ensure multidimensional assessment. | 16 | 66.7 |

| Contextual Suitability | Ability of a model to account for country-specific fiscal, legal, and institutional conditions. | 10 | 41.7 |

| Use of Historical Data | The extent to which models incorporate longitudinal or time-series data to identify financial distress patterns. | 10 | 41.7 |

| Ease of Use/ Understandability | The model’s practical usability by government officials, auditors, or policymakers. | 9 | 37.5 |

| Robustness/Resistance to Manipulation | The model’s capacity to withstand reporting bias or accounting manipulation. | 8 | 33.3 |

| Data Accessibility | Availability of required data inputs in practical or real-world municipal settings. | 4 | 16.7 |

| Ability to Differentiate | Precision in distinguishing distressed from non-distressed cases (Type I and Type II error handling). | 4 | 16.7 |

| Theoretical Validity | Degree to which the model aligns with or is grounded in relevant theoretical frameworks. | 3 | 12.5 |

| Expert Contributions | Whether domain experts were involved in model development or validation. | 2 | 8.3 |

| Performance | Conceptual Integrity | Practical Applicability | Contextual Fit | Composite Low Capacity | Composite High Capacity | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| P1 | P2 | C1 | C2 | PA1 | PA2 | PA3 | CF1 | CF2 | CF3 | |||

| Model A | 1 | 1 | 2 | 1 | 2 | 2 | 2 | 1 | 1 | 1 | 1.60 | 1.25 |

| Model B | 2 | 2 | 1 | 2 | 1 | 1 | 1 | 2 | 2 | 2 | 1.40 | 1.75 |

| Criterion | Logistic Regression (e.g., Trussel & Patrick, 2018) | Machine Learning Hybrid (e.g., X. Li et al., 2022) | Ratio-Based (e.g., Kloha et al., 2005) |

|---|---|---|---|

| Predictive Accuracy | High (90%+ in stable data) | Very High (>90%+ with large datasets) | Moderate (80–85%, transparent) |

| Comprehensiveness | Moderate (financial ratios focus) | High (adds socio-economic indicators) | Moderate (limited ratios) |

| Contextual Suitability | Good for developed countries | Adaptable but data-intensive | Excellent for data-scarce settings |

| Use of Historical Data | Strong (10+ years) | Strong (large datasets) | Moderate (5–8 years) |

| Ease of Use | Moderate (statistical software) | Low (requires data science) | High (simple calculations) |

| Robustness | High (audited data) | Moderate (sensitive to quality) | High (transparent metrics) |

| Data Accessibility | Moderate (standardised reports) | Low (diverse sources needed) | High (basic financial data) |

| Ability to Differentiate | High (low false positives) | High (AUC metrics) | Moderate (simpler classification) |

| Theoretical Validity | Strong (fiscal distress theory) | Moderate (less theory-driven) | Strong (policy-aligned) |

| Expert Contributions | Moderate (auditors, officials) | Moderate (technical experts) | High (simple calculations) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Radebe, N.E.; Nomlala, B.C.; Matenda, F.R. Systematic Review of Financial Distress Prediction Models for Municipalities: Key Evaluation Criteria and a Framework for Model Selection. J. Risk Financial Manag. 2025, 18, 624. https://doi.org/10.3390/jrfm18110624

Radebe NE, Nomlala BC, Matenda FR. Systematic Review of Financial Distress Prediction Models for Municipalities: Key Evaluation Criteria and a Framework for Model Selection. Journal of Risk and Financial Management. 2025; 18(11):624. https://doi.org/10.3390/jrfm18110624

Chicago/Turabian StyleRadebe, Nkosinathi Emmanuel, Bomi Cyril Nomlala, and Frank Ranganai Matenda. 2025. "Systematic Review of Financial Distress Prediction Models for Municipalities: Key Evaluation Criteria and a Framework for Model Selection" Journal of Risk and Financial Management 18, no. 11: 624. https://doi.org/10.3390/jrfm18110624

APA StyleRadebe, N. E., Nomlala, B. C., & Matenda, F. R. (2025). Systematic Review of Financial Distress Prediction Models for Municipalities: Key Evaluation Criteria and a Framework for Model Selection. Journal of Risk and Financial Management, 18(11), 624. https://doi.org/10.3390/jrfm18110624