Abstract

Against China’s innovation-driven strategy, this study explores the impact of R&D investment on firm innovation performance and the mediating role of the wage gap between high- and low-skilled labor (HLWG) using data from Chinese A-share non-financial listed firms spanning 2010–2022. Employing static panel regression, Bootstrap test, and instrumental variables (R&D investment deduction, college enrollment expansion), the study finds three key results. First, R&D investment positively affects both firm innovation performance and HLWG. Second, HLWG exerts a positive impact on firm innovation performance. Third, HLWG plays a partial mediating role in the relationship between R&D investment and firm innovation performance. Robustness tests and instrumental variable regression confirm the stability of these conclusions. This finding enriches the theoretical understanding of the R&D-innovation transmission mechanism, offers insights into enterprises to coordinate R&D investment and wage structure optimization, and provides policy references for refining innovation incentives and labor market policies.

1. Introduction

In the context of the global economy transitioning toward an innovation-driven paradigm, R&D investment has evolved into the core determinant of sustained competitive advantage, particularly for emerging economies striving to upgrade their industrial structures. As the backbone of China’s real economy, A-share non-financial listed companies contribute a substantial proportion of the nation’s total R&D investment and innovation output. However, extant empirical observations reveal a persistent “black box” in the R&D input-innovation output conversion mechanism: while a growing number of enterprises have scaled up R&D investment, the efficiency of translating these resource inputs into tangible innovation performance exhibits significant heterogeneity across firms. This discrepancy underscores the existence of intermediate variables that mediate the relationship between R&D investment and innovation outcomes, yet the identification and validation of such key mediating factors remain insufficiently addressed in existing research.

The wage gap between high-skilled and low-skilled labor (HLWG) has emerged as a pivotal yet understudied intermediary in the R&D-innovation nexus, particularly against the backdrop of China’s evolving labor market dynamics. On the one hand, R&D investment inherently entails a heightened demand for high-skilled talent individuals proficient in specialized technical domains, capable of solving complex engineering problems, and adept at frontier technological exploration. This skewed demand structure tends to reshape enterprises’ internal wage distribution, as firms compete to attract and retain high-skilled human capital through differentiated compensation packages. On the other hand, HLWG may exert dual effects on innovation: in line with the “tournament theory” (Lazear & Rosen, 1981), a moderate gap can incentivize high-skilled employees to dedicate greater effort to innovative tasks by linking skill contributions to monetary rewards; concurrently, it may influence the skill upgrading trajectory of low-skilled employees and the efficiency of inter-skill collaboration within R&D teams. Notably, China’s unique policy context—marked by the 2010–2021 higher education enrollment expansion, which drastically altered the supply structure of high-skilled labor and the iterative adjustment of R&D investment additional deduction policies—adds layers of complexity to the RD-HLWG-innovation performance relationship, rendering its systematic investigation both theoretically imperative and practically relevant.

Despite existing research on R&D investment, wage gaps, and corporate innovation, three critical gaps remain. First, most prior studies on the R&D-innovation link (Gkypali et al., 2017) like Czarnitzki and Thorwarth (2020) focus solely on direct correlations, neglecting intermediate transmission pathways in the “input–output” chain. As a result, the micro-mechanisms through which R&D investment influences innovation via labor market adjustments remain under-theorized and unvalidated. Second, research on wage gaps and corporate behavior primarily centers on executive–employee pay differentials or overall internal income inequality, with limited attention to skill-based wage gaps (specifically HLWG delineated by educational attainment) and their heterogeneous impacts on R&D and innovation—activities inherently dependent on skill differentiation. Third, studies on Chinese corporate innovation rarely integrate exogenous macro-policy shocks into analytical frameworks, leading to potential endogeneity issues that weaken causal inferences. Recent studies (Feng et al., 2023; Zhang, 2023) have begun to explore skill-biased wage effects in innovation, but they still lack systematic analysis of HLWG’s mediating role and policy-driven exogenous identification.

This study makes three key contributions to literature. First, it enriches the R&D-innovation transmission mechanism by identifying HLWG as a partial mediator, filling the gap in existing research that overlooks labor market intermediaries. Second, it uses exogenous policy shocks (R&D investment additional deduction, college enrollment expansion) as instrumental variables, effectively addressing endogeneity issues (reverse causality between HLWG and innovation) and enhancing the credibility of causal inferences—an improvement over prior studies that lack rigorous identification strategies. Third, it provides targeted practical insights: for enterprises, it offers guidance for coordinating R&D investment and wage structure optimization; for policymakers, it informs the refinement of innovation incentives and labor market policies, especially in the context of China’s innovation-driven development strategy.

Based on the above background and gaps, this study proposes the following research question: Does the wage gap between high- and low-skilled labor (HLWG) mediate the relationship between R&D investment and firm innovation performance in Chinese A-share non-financial listed firms, and how do exogenous policy shocks (R&D tax incentives, college enrollment expansion) affect this mechanism?

Correspondingly, the research objectives are: (1) Verify the direct impact of R&D investment on firm innovation performance and HLWG. (2) Examine the direct impact of HLWG on firm innovation performance. (3) Test the mediating role of HLWG in the R&D investment-innovation performance relationship. (4) Address endogeneity and ensure conclusion robustness using instrumental variables and policy shocks.

The remainder of the paper is organized as follows. Section 2 reviews relevant literature and develops research hypotheses while also presenting the theoretical and conceptual frameworks. Section 3 details the methodology, including data sources, variable definitions and measurements, model specifications, and diagnostic tests. Section 4 reports and discusses empirical results, including descriptive statistics, correlation analysis, mediation analysis, robustness tests, and endogeneity treatment. Section 5 discusses the theoretical and practical implications, as well as study limitations. Section 6 concludes the study.

2. Literature Review, Hypothesis Development, and Theoretical Framework

2.1. Literature Review

While existing studies have yielded extensive findings around these three core topics, it is necessary to systematically organize the theoretical foundations, empirical conclusions, and differences in research perspectives under each topic. This organization aims to clarify the boundaries of current research and identify areas requiring further exploration. Therefore, this section will conduct a classified review of relevant literature following the logical sequence of “R&D Investment and Firm innovation performance,” “R&D Investment and Internal Wage Gap,” and “Wage Gap and Firm innovation performance.” The ultimate goal is to provide theoretical support for the formulation of subsequent research hypotheses and the design of empirical analyses.

2.1.1. R&D Investment and Firm Innovation Performance

According to the new growth theory, the direct source of technological progress is the investment in R&D by the firms (Romer, 1990). Based on this pretext, many scholars have studied this. Rogers (2010) using Cobb–Douglas’s production function, verified that American manufacturing firms can improve their productivity by increasing internal R&D investment.

Gkypali et al. (2017) establishing a theoretical framework found that there is a significant interaction between the R&D efforts made within the firm and various forms, and contents of R&D cooperation outside the firm, and the feedback between them forms a virtuous circle, which improves the R&D efficiency of the firm. Among the efforts made within the firm, it is more important to increase R&D investment.

These findings have been validated across diverse contexts. Czarnitzki and Thorwarth (2020) extended the analysis to industry heterogeneity, revealing that R&D investment exerts a more pronounced impact on productivity in high-tech sectors, where technological breakthroughs are the primary source of competitive advantage, compared to low-tech industries. Matricano (2020) further emphasized the complementary role of human capital, showing that R&D investment in Italian innovative startups translates to higher performance only when paired with a skilled workforce, hinting at the indirect pathways through which R&D influences innovation.

2.1.2. R&D Investment and Internal Wage Gap

Most scholars start from the perspective of supply and demand of skilled workers. They believe that R&D investment will lead to biased technological progress. If the supply of skilled labor increases at a slower rate than the demand for skilled labor, the skill premium will continue to rise, thereby exacerbating wage inequality (Liu, 2013). This leads to a widening of wage gap.

As early as more than 20 years ago, some scholars conducted preliminary research on the impact of R&D investment and wage. Regev (1998) conducted a study on Israeli industrial firms and proposed that, compared with other types of firms, the average salary of employees in technology-intensive firms is higher.

In recent years, more scholars have continued to conduct further research on the impact of R&D investment on wages. Aghion et al. (2019) matched employee–employer data from the UK, analyzing that more R&D intensive firms pay higher wages on average. Matricano (2020), based on the unbalanced panel of Italian innovative startups, found that R&D investments influence the total amount of highly skilled employees and the effect on firm performance. Osório and Pinto (2020) found that public R&D incentives and the increasing horizontal integration have biased the income distribution towards the top income group. In particular, the high-skilled workers involved in the R&D process have benefited enormously from this process. Similarly, capital owners have seen an increase in their profits because of the reduction in product market competition and technological improvements in the production process.

(Wang et al., 2024) believed that the imbalance between the supply and demand of skilled labor leads to a rise in the skill premium, which in turn exacerbates wage inequality. An excessively large salary gap may trigger a sense of unfairness and dissatisfaction among employees, causing them to lose enthusiasm and motivation for work.

Some scholars have proposed other explanations. They believe that employee turnover will lead to company information leakage, and R&D investment information is very important. Companies will be more inclined to increase the salaries of executives or key employees, or grant them stock options to increase employee stability, to avoid leakage of company R&D information (Erkens, 2011). This will also lead to a widening of the wage gap.

2.1.3. The Wage Gap and Firm Innovation Performance

Many of the research documents regarded the wage gap of firms as a hidden incentive for job promotion, that is, tournament incentive (Haß et al., 2015). This indirectly implies that it may also influence the innovation of firms, especially those in product innovation.

Few studies touch on the influence of the wage gap on innovation, and such topic is more recent in terms of research. Nevertheless, this section will review the research on the influence of wage gaps on firm innovation that is available.

Using the data of listed firms in China’s A-share manufacturing industry, Kong and Xu (2017) have found that the internal wage gap has a promoting effect on technological innovation and can improve the innovation efficiency of inventors. Pan et al. (2020) select data from Chinese A-share listed manufacturing enterprises spanning 2012 to 2016 and employ a multiple regression model to analyze the relationship between salary gap and corporate innovation efficiency. The results indicate a positive correlation between ordinary employees’ salaries and corporate innovation efficiency, suggesting that enterprises should also consider optimizing the salary structure at the ordinary employee level to promote innovation.

Yang and Ji (2025) take Chinese A-share listed companies during the 2017–2021 period as the research sample, revealing that both internal and external types of compensation gaps exert a significant positive effect on innovation quality. Furthermore, the study also finds that an optimal compensation gap is most effective in promoting the upgrading of corporate innovation quality, rather than a simply larger gap yielding better outcomes.

Cheng et al. (2020) thought that the narrowing of the internal wage gap caused by salary control would reduce the innovation level of firms. The other studies also found that the internal wage gap is one of the necessary conditions to promote firm innovation (Firth et al., 2015; Huo & Cheng, 2021; Yang & Zhu, 2020).

2.2. Theoretical and Conceptual Frameworks

2.2.1. Theoretical Foundation

This study is theoretically anchored in two core theories: the SBTC Theory and the Tournament Theory. Both theories have been widely applied in the fields related to this research, laying a solid basis for the subsequent analysis.

Skill-Biased Technological Change (SBTC) Theory (Acemoglu & Autor, 2011): R&D-driven technological progress increases the marginal productivity of high-skilled labor, leading to higher demand for and compensation of high-skilled talent, thereby widening HLWG.

Tournament Theory (Lazear & Rosen, 1981): A moderate wage gap acts as an incentive, motivating high-skilled employees to invest more effort in innovative tasks to obtain higher compensation, ultimately improving firm innovation performance.

2.2.2. Conceptual Framework

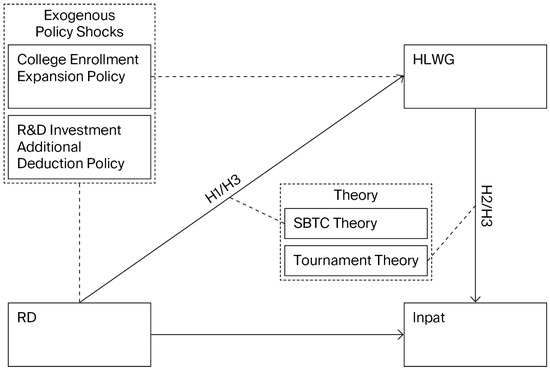

The conceptual framework (Figure 1) illustrates the transmission mechanism: R&D investment first affects HLWG (driven by SBTC theory), and then HLWG influences firm innovation performance (driven by tournament theory). HLWG plays a partial mediating role, while firm size, debt level, and other factors act as control variables. Exogenous policy shocks (R&D additional deduction, college enrollment expansion) are used to address endogeneity.

Figure 1.

Conceptual Framework.

2.3. Hypothesis Development

Based on the theoretical framework and literature gaps outlined above, this study proposes three core hypotheses to examine the relationships between R&D investment (RD), the wage gap between high-skilled and low-skilled labor (HLWG), and firm innovation performance (lnpat).

H1:

R&D investment has a significantly positive impact on the wage gap between high-skilled and low-skilled labor (HLWG).

According to SBTC theory (Acemoglu & Autor, 2011), R&D activities drive technological progress that disproportionately increases the marginal productivity of high-skilled labor—individuals proficient in specialized technical domains, capable of solving complex R&D problems, and adapting to new technologies. To attract and retain such talent, firms must offer higher compensation than for low-skilled labor, widening HLWG. Empirically, Osório and Pinto (2020) found that R&D incentives expand demand for high-skilled labor, leading to higher relative wages. In China, the scarcity of high-skilled R&D talent (exacerbated by firms’ growing innovation needs) further amplifies this effect: as firms increase R&D investment, their demand for high-skilled labor outpaces that for low-skilled labor, pushing up high-skilled wages relative to low-skilled wages. Thus, we hypothesize that R&D investment positively influences HLWG.

H2:

The wage gap between high-skilled and low-skilled labor (HLWG) has a significantly positive impact on firm innovation performance (lnpat).

Tournament theory (Lazear & Rosen, 1981) suggests that a moderate wage gap acts as a competitive incentive: high-skilled employees, motivated by the prospect of higher compensation, dedicate more effort to innovative tasks (e.g., developing new technologies, optimizing processes). For firms, this translates to higher innovation output (patents). Firth et al. (2015) further noted that skill-based wage gaps—tied to observable technical contributions—enhance firm efficiency by aligning compensation with innovation value. In the context of R&D-intensive activities, HLWG also signals the firm’s commitment to reward technical expertise, reducing high-skilled talent turnover and fostering long-term innovation engagement. While equity theory warns of excessive gaps, existing literature (Huang & Wang, 2023) suggests that skill-based gaps (rather than arbitrary ones) are perceived as fair and do not harm collaboration. Thus, we hypothesize that HLWG positively influences firm innovation performance.

H3:

The wage gap between high-skilled and low-skilled labor (HLWG) plays a partial mediating role in the relationship between R&D investment and firm innovation performance.

In accordance with the mediating effect framework proposed by Baron and Kenny (1986), a variable assumes a partial mediating role when the independent variable (RD) exerts dual influences on the dependent variable (lnpat): a direct effect (enhancing operational efficiency through the allocation of R&D resources, thereby directly boosting innovation outputs) and an indirect effect transmitted via the mediating variable (HLWG). On the one hand, R&D investment can directly foster innovation outputs, a finding that is consonant with empirical observations in technology-intensive enterprise contexts. On the other hand, the heightened demand for high-skilled labor precipitated by increased R&D investment necessitates adjustments to HLWG to align with the value of high-skilled human capital, which in turn catalyzes innovation-related efforts. This proposition is corroborated by empirical evidence from Osório and Pinto (2020), whose findings confirm that the absence of commensurate HLWG adjustments attenuates the incremental contribution of R&D investment to innovation outcomes.

Within the Chinese institutional context, the endemic scarcity of high-skilled talent—whose proportion in the overall labor force stands at a mere 31.2%—renders the expansion of HLWG a necessary measure to retain such talent. Concurrently, policy initiatives that endorse skill-based wage differentiation further facilitate the unimpeded functioning of the transmission pathway. In synthesis, R&D investment impacts firm innovation performance through a dual-pathway mechanism: a direct pathway independent of HLWG and an indirect pathway mediated by HLWG.

3. Methodology

3.1. Data Source

This study investigates China’s A-share and non-financial publicly listed companies from 2010 to 2022. Previous research indicates that the data are handled in the following manners: (1) the “Guidelines for Industry Classification of Listed Companies” published by the China Securities Regulatory Commission in 2012, listed firms in the monetary financial services, money market services, insurance, and financial sectors have been excluded; (2) listed companies with *ST, ST, and PT are eliminated; (3) data such as corporate governance structure and financial analysis indicators that are not included in the database and cannot be manually searched and obtained are eliminated. To avoid outliers affecting the empirical results, the regression data will be winsorized at the upper and lower 1% quantiles. The main source of data is the CSMAR database.

3.2. Data Analysis Method

3.2.1. Multicollinearity Test (VIF)

The variance inflation factor (VIF) is used to test multicollinearity. Montgomery et al. (2021) note that a VIF > 5 indicates severe multicollinearity. This study calculates VIF for all independent variables, with the average VIF used to judge overall collinearity. Pearson correlation analysis is not used as a standalone test, as VIF inherently incorporates correlation information (VIF = 1/(1 − R2)), making it a more formal and comprehensive measure (Montgomery et al., 2021).

3.2.2. Heteroskedasticity Test (Breusch–Pagan/Cook–Weisberg)

To address heteroskedasticity (a common issue in panel data), we use the Breusch–Pagan/Cook–Weisberg test (Greene, 2018). The null hypothesis is “no heteroskedasticity”; if the p-value < 0.05, heteroskedasticity exists, and robust standard errors are used in regressions to correct for it.

3.2.3. Model Specification Test (RESET Test)

The RESET test (Ramsey, 1969) is used to check for omitted variables or incorrect functional forms. The null hypothesis is “no specification error”; if the p-value > 0.05, the model specification is valid.

3.2.4. Bootstrap Test

The Bootstrap test is used to verify the mediating effect’s significance, especially when a or b is not significant. By repeatedly sampling (5000 times) from the original sample with replacement, we construct a confidence interval for the product a × b (Preacher & Hayes, 2008). If the interval excludes 0, the mediating effect is significant. For this study, the Bootstrap test is particularly useful because: (1) it does not rely on the normality assumption of the sampling distribution, making it more suitable for non-normal panel data; (2) it directly tests the mediating effect (a × b), avoiding the limitations of stepwise regression (Preacher et al., 2007); (3) it provides a more precise estimate of the mediating effect size, which is critical for interpreting HLWG’s practical role.

3.2.5. Instrumental Variable (IV) Method

To address endogeneity (omitted variables, reverse causality, measurement errors), we use two instrumental variables.

The first IV corresponds to R&D investment (RD) and is constructed using the R&D investment additional deduction policy, measured by the interaction term of a policy eligibility dummy variable (Treatrdit) and a policy intensity variable (Intentrd). The eligibility dummy identifies whether a firm qualifies for the policy in a given year, while the intensity variable differentiates policy strength across phases based on key revisions (e.g., expanded deductible expense scope in 2016, increased deduction ratio in 2018). This IV is exogenous as it is a government-formulated policy independent of firm behavior and relevant as it directly incentivizes corporate R&D investment by reducing tax burdens (Yao & Lei, 2018).

The second IV targets the high-low skilled wage gap (HLWG) and leverages the college enrollment expansion policy, quantified via the interaction term of a regional policy impact dummy (Treatwgit) and a policy intensity variable (Intentwg). The regional dummy indicates whether a firm is in an area significantly affected by enrollment growth, and the intensity variable reflects heterogeneous policy impacts (e.g., the 2019 “one million additional vocational college enrollments” reform). This IV is exogenous as it is a national macro-education strategy unrelated to firm-level wage decisions and relevant as it adjusts HLWG by altering the supply of high-skilled labor (Xing & Yan, 2018; Li, 2020).

3.3. Model Specification

Examine the effect of the independent variable RD on the dependent variable lnpat. If RD influences lnpat through variable HLWG, then HLWG is designated as a mediating variable. This study will use stepwise methods to empirically investigate the hypotheses. The following models are developed from Model (1) to Model (3).

- Direct effect of R&D investment on innovation performance:where c is the coefficient of RD (total effect)lnpatit = β0 + c × RDit + β1 × Controlsit + Σindustry + Σyear + εit

- Effect of R&D investment on HLWG:where a is the coefficient of RD (effect of R&D on mediator).HLWGit = β0 + a × RDit + β1 × Controlsit + Σindustry + Σyear + εit

- Joint effect of R&D investment and HLWG on innovation performance:where b is the coefficient of HLWG (effect of mediator on innovation). c′ is the coefficient of RD (direct effect after controlling for mediator).lnpatit = β0 + c′ × RDit + b × HLWGit + β1 × Controlsit + Σindustry + Σyear + εit

- Mediation effect judgment criteria (Wen & Ye, 2014):

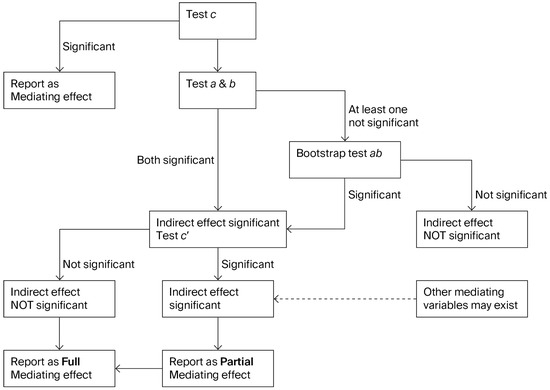

To test the mediation effect, the process is shown in Figure 2.

Figure 2.

The process of the mediation effect test. Source: (Wen & Ye, 2014).

The specific steps are as follows:

Step 1: Test c in Model (1); if significant, proceed.

Step 2: Test a in Model (2) and b in Model (3); if both are significant, test c′ in Model (3).

Step 3: If c′ is significant, HLWG has a partial mediating effect; if c′ is not significant, it has a full mediating effect.

If either a or b is not significant, use the Bootstrap test to verify the significance of the product a × b. Even if both a and b are significant, the Bootstrap test remains employed to verify the significance of a × b and enhance the robustness of the mediating effect conclusion.

3.4. Description of Variables

This study aims to determine whether the wage gap between High-skilled labor and Low-skilled labor wage gap (HLWG) can mediate R&D investment (RD) and firm innovation performance (lnpat). All data employed in this investigation are derived from the CSMAR database. The variables are shown in Table 1.

Table 1.

Measurement of variables.

Independent Variable: R&D investment (RD) refers to a series of activities carried out by enterprises through scientific and systematic approaches to fulfill the goals of innovation and development (Zhang, 2023).

Dependent Variable: lnpat. Firm innovation performance constitutes the augmentation of business volume resultant from a firm’s adoption of novel technologies, ultimately contributing to the elevation of the firm’s overall value. This performance can be delineated into process innovation and product innovation, and it stands as a pivotal primary indicator within the framework of the enterprise innovation evaluation system (Zhang & Li, 2016).

Mediating Variable: HLWG refers to the wage gap between High-skilled labor and Low-skilled labor (Feng et al., 2023). Low-skilled personnel refer to those who lack relevant skills and knowledge in a certain field and are not competent for advanced work. High-skilled talents refer to those who are proficient in specialized knowledge and technology, possess superb operational skills, and can solve key technical and process operational problems in their work practice, working on the front line in the fields of production, transportation, and service. This study adopts Feng et al. (2023) classification method of high- and low-skilled employees, defining employees with a college degree or above as high-skilled employees, and employees with a high school degree or below as low-skilled employees. This study also refers to the research of Chen and He (2013) and uses the average wage of rural residents at the urban level to replace the wage level of low-skilled labor. Based on , is the proportion of high-skilled labor in enterprises measured by educational background data, which is calculated as WHLt, and then this study gets HLWGit.

Control variables will be incorporated into the analysis, as outlined in Table 1. These variables are essential to mitigate potential biases and ensure the robustness of the findings. By including these control variables, the study seeks to isolate the specific effect of R&D investment and evaluate the mediating role of TLWG in shaping the dynamic between R&D investment and firm performance.

4. Results

4.1. Descriptive Statistical Analysis

This section offers a comprehensive overview of the sample size, mean, standard deviation, variance, minimum, median, and maximum values for each variable to facilitate an initial understanding of their features.

Table 2 displays the descriptive statistics for the complete sample. The findings reveal that the majority of companies’ R&D investments fall below average, although most companies exceed the average in financial performance, exhibiting robust asset conditions and profitability. The statistical properties of the variables are within acceptable ranges, establishing a robust basis for subsequent analysis.

Table 2.

Descriptive Statistics.

4.2. VIF Test

The variance inflation factor (VIF) is a statistical measure employed to identify multicollinearity. It quantifies the intensity of the linear correlation between each independent variable and the others. A high VIF number signifies a pronounced multicollinearity problem, indicating substantial linear correlations among the independent variables (Montgomery et al., 2021). This study presents the VIF values and their respective 1/VIF values for each variable in Table 3.

Table 3.

VIF Test Result.

Generally, VIF value of more than 5 signals the presence of highly collinear variable (Montgomery et al., 2021), which suggests that the estimates of regression coefficients may be unreliable. Therefore, with an average VIF of 1.34, it basically eliminates the problem of multicollinearity. Therefore, subsequent analysis and testing can be performed.

4.3. Heteroskedasticity and RESET Tests

Breusch–Pagan/Cook–Weisberg Test: Chi2 = 28.69, Prob > chi2 = 0.0001 < 0.05, indicating heteroskedasticity. Robust standard errors are used in all regressions to correct for this (Greene, 2018).

RESET Test: F = 1.58, Prob > F = 0.1932 > 0.05, indicating no specification error. The model functional form is valid (Ramsey, 1969).

4.4. Mediation Analysis

4.4.1. Definition of Instrumental Variables

Endogeneity issues primarily stem from three sources: omitted variables, reverse causality, and measurement errors. To ensure the robustness of the results, this study employs instrumental variables to mitigate the impact of endogeneity issues caused by the aforementioned factors.

- (1)

- Instrumental Variable for HLWG

From 2010 to 2021, the enrollment scale of regular institutions of higher education in China achieved leapfrog growth. The number of enrolled students increased steadily from 6.618 million in 2010 to 7.9099 million (approximately 7.91 million) in 2018, and in 2021, it exceeded the 10-million mark for the first time, reaching 10.012 million.

This surge on the supply side directly reshaped the pay gap between high-skilled and low-skilled employees, which is categorized by educational background. On one hand, the continuous inflow of young, highly educated workers has diluted the scarcity of academic qualifications, leading to a significant narrowing of the “educational premium” for new college graduates entering the workplace (Li, 2020). On the other hand, the labor market’s demand for compound talents with “academic qualifications + experience” has continued to rise, resulting in new characteristics in the pay differentiation between senior highly educated employees and low-educated employees. This forms a clear transmission chain of “policy-driven supply changes → reconstruction of educational premium → adjustment of pay gap” (Acemoglu & Autor, 2011).

Treating the intensity of the college enrollment expansion policy during this period as an instrumental variable for the pay gap is supported by sufficient theoretical and empirical feasibility:

In terms of relevance, the stepwise growth in the scale of enrollment expansion from 2010 to 2021 directly determined the increment in the supply of highly educated labor. There is a strong correlation between changes in supply, fluctuations in the educational premium, and adjustments in the pay gap (Xing & Yan, 2018). For instance, the 26.6% increase in the number of enrollments from 2018 to 2021 is highly consistent with the changes in the wage differentiation of new employees during the same period, satisfying the correlation requirement between the instrumental variable and the endogenous explanatory variable.

In terms of exogeneity, the round of enrollment expansion was driven by the national macro-strategy. The enrollment expansion in higher vocational colleges in 2019 aimed to alleviate structural employment contradictions, and the continuation of the scale from 2020 to 2021 served the needs of the supply-side reform of talents (Qian, 2018). The implementation rhythm and intensity of the policy are completely independent of the micro-level corporate pay decisions, and there is no reverse causality problem where “the wage gap affects the policy intensity”.

In terms of exclusivity, the intensity of the enrollment expansion policy only exerts an indirect impact on the pay gap by changing the supply structure of educational backgrounds in the labor market. Its influence is concentrated on the changes in the supply-demand relationship of highly educated labor, rather than directly interfering with pay distribution through other channels such as technological progress or industry prosperity. This complies with the core criterion of instrumental variables, “affecting the explained variable only through the endogenous explanatory variable” (Yao & Lei, 2018).

The design of this instrumental variable accurately leverages the exogenous nature of policy shocks, effectively avoiding common omitted variables (such as unobserved individual capabilities) and bidirectional causality issues in pay gap research, and provides a reliable solution for identifying the real effect of the pay gap from the perspective of educational background.

Treatwgit is a policy variable, indicating whether enterprise i falls within the scope of application of the policy at time t (coded as 1 if yes, and 0 if no). Intentwg is a policy intensity variable, representing the policy intensity at different time points. The period from 2019 to 2022 was the peak of college enrollment expansion; therefore, the period from 2010 to 2018 is set to 1, and the period from 2019 to 2022 is set to 4.

- (2)

- Instrumental Variable for RD

To alleviate the endogeneity issue of the independent variable, this study selects the policy of additional deduction for R&D investment as the instrumental variable for corporate innovation, for the following reasons:

In terms of the relevance of the instrumental variable, the policy of additional deduction for R&D investment has a significant incentive effect. Firm R&D and innovation activities are characterized by high costs, high risks, and positive externalities, which lead to a lack of enthusiasm for innovation among some enterprises. However, this policy provides compensation and tax incentives for corporate R&D investment. For example, the Notice on Issues Concerning the Pre-tax Additional Deduction of Research and Development Expenses (Ministry of Finance and State Taxation Administration, 2013, Cai Shui [2013] No. 70) stipulates that, if R&D investment are included in current profits and losses and do not form intangible assets, 50% of the actual R&D investment incurred in the current year are allowed to be directly deducted from the current taxable income; if intangible assets are formed, amortization is conducted at 150% of the cost of the intangible assets before tax. Such provisions have effectively enhanced enterprises’ enthusiasm for carrying out innovation activities, promoted enterprises to engage in innovation, and thus satisfied the relevance assumption of an effective instrumental variable.

Regarding the exogeneity of the instrumental variable, this policy is issued by the government. The timing of its issuance, policy intensity, and selected applicable entities exhibit a certain degree of randomness, which can well avoid the problem of reverse causality and meet the exogeneity assumption of an effective instrumental variable.

Using the relatively exogenous policy of additional deduction for R&D investment as an instrumental variable can effectively reduce the measurement error of the corporate innovation level.

Treatrdit is a policy variable, indicating whether enterprise i falls within the scope of application of the policy at time t (coded as 1 if yes, and 0 if no). Intentrd is a policy intensity variable, representing the policy intensity at different time points. The policy of additional deduction for R&D investment underwent two important adjustments in 2016 and 2018, which expanded the types of R&D investment and increased the proportion of additional deduction. Therefore, the period from 2008 to 2016 is set to 1, the period of 2016–2017 is set to 2, and the period from 2018 to 2019 is set to 4.

4.4.2. Mediation Analysis Results

Table 4 shows the path analysis results of RD on lnpat with HLWG as the mediating variable, and displays the stepwise methods regression results for Model (1) to Model (3). With robust standard errors in parentheses (to correct for heteroskedasticity) and adjusted R2 (to reflect the model’s explanatory power for multiple independent variables). The table clearly presents the direct and indirect effects of R&D investment on firm innovation performance through HLWG.

Table 4.

Regression Results of Mediating Effect Test for HLWG between RD and lnpat.

Model (1) (Direct effect of RD on lnpat): The coefficient of RD is 5.704 *** (p < 0.01), indicating R&D investment significantly promotes firm innovation performance. Adjusted R2 = 0.258, meaning the model explains 25.8% of lnpat’s variation.

Model (2) (Effect of RD on HLWG): The coefficient of RD is 2.095 *** (p < 0.01), supporting H1—R&D investment significantly widens HLWG. Adjusted R2 = 0.432, indicating strong model fit.

Model (3) (Joint effect of RD and HLWG on lnpat): The coefficient of HLWG is 0.160 *** (p < 0.01), supporting H2, that HLWG significantly promotes firm innovation performance. The coefficient of RD is 5.399 *** (p < 0.01), indicating a significant direct effect of RD on lnpat after controlling for HLWG. The mediating effect size is a × b = 2.095 × 0.160 = 0.335, accounting for (0.335/5.704) × 100% ≈ 5.8% of the total effect. Adjusted R2 = 0.259, slightly higher than Model (1), confirming HLWG’s incremental explanatory power.

Bootstrap Test Result: For 5000 samples, the 95% confidence interval of a × b is [0.082, 0.591], which excludes 0, further confirming the significance of the partial mediating effect. Thus, H3 is supported.

4.5. Robustness Test

To validate the scientific rigor and robustness of the conclusions, this study conducts robustness checks from the following two perspectives:

Alternative measurement of key explanatory variables. With respect to the measurement of firm innovation performance (lnpat1), this study adopts an alternative approach inspired by Zhou et al. (2012). Specifically, instead of employing the original weighted sum method—where invention patents, utility model patents, and design patents are assigned weights of 0.5, 0.3, and 0.2 respectively, followed by taking the natural logarithm after adding 1 to the weighted sum. This study replaces it with a more straightforward proxy: the natural logarithm of the total annual count of patent applications, with one added to avoid taking the logarithm of zero.

Shortening the temporal window of the sample. Given that the initial sample period includes the years 2021 and 2022, when the global COVID-19 pandemic may have introduced substantial external shocks, this study performs a time-window robustness test by excluding data from these two years. The revised sample period is thus restricted to 2010–2020, and the core regressions are re-estimated accordingly.

Table 5 shows the path analysis results of RD on lnpat1 with HLWG as the mediating variable, showing the regression results for Model (1) to Model (3). This indicates that the core findings remain substantively unchanged, confirming the robustness of the results.

Table 5.

Robustness Test Results of Mediating Effect Test for HLWG Between RD and lnpat1.

4.6. Endogeneity Stepwise Inspection

Table 6 and Table 7 report IV regression results, with standard errors in parentheses and adjusted R2.

Table 6.

Results of the Endogeneity Test for RD.

Table 7.

Results of the Endogeneity Test for HLWG.

4.6.1. Endogeneity Test of the Independent Variable (RD)

To investigate the relationship between the additional deduction policy for R&D investment, wage gap, and firm innovation performance, the regression results are presented in Table 6.

This section conducts an analysis based on the regression results. First, regarding the validity of the instrumental variable, the interaction term Treatrdit * Intentrd (“scope of application × intensity” of the additional deduction policy for R&D investment) exerts a significantly positive impact on lnpat (firm innovation performance) (Column 1) while exerting a significantly negative effect on the wage gap between high-skilled and low-skilled employees (HLWG) (Column 2). This indicates that the additional deduction policy for R&D investment demonstrates sound exogeneity and relevance, laying a solid foundation for subsequent causal inference.

From the perspective of the mediating effect, after controlling for other variables, when both the policy interaction term and the wage gap variable are incorporated simultaneously (Column 3), the positive impact of the policy interaction term on firm innovation performance remains significant, and HLWG exhibits a significantly positive effect on firm innovation performance. Combined with the total impact of the policy interaction term on firm innovation performance shown in Column 1, it can be concluded that the wage gap plays a partial mediating role in the functional path of “additional deduction policy for R&D investment → firm innovation performance”. Specifically, the policy not only directly promotes corporate innovation but also indirectly affects innovation performance by adjusting the wage gap between high-skilled and low-skilled employees.

In addition, the control variables also reflect the role of corporate characteristics in innovation performance. Size and debt are significantly positively correlated with innovation performance, which reflects the support of scale advantages and debt financing for R&D investment. Growth is significantly negatively correlated with innovation performance, which may be attributed to the fact that growing enterprises focus more on short-term expansion and invest relatively less in long-term R&D. Age has no significant direct impact on innovation performance, while the effect of ibal is partially covered by other factors.

4.6.2. Endogeneity Test of the Mediating Variable (HLWG)

To investigate the relationship between the additional deduction policy for wage gap between high- and low-skilled labor, R&D investment, and firm innovation performance, the regression results are presented in Table 7.

The regression results presented in Table 7 reveal the transmission mechanism between R&D investment (RD), the wage gap between high-skilled and low-skilled employees (HLWG), and firm innovation performance (lnpat). From the perspective of the direct effects of core variables, Column (1) shows that R&D investment (RD) exerts a significantly positive impact on firm innovation performance (lnpat), indicating that an increase in R&D investment can directly drive the improvement of firm innovation outputs. Meanwhile, the results in Column (2) demonstrate that RD has a significantly negative effect on HLWG, which implies that higher R&D investment by enterprises tends to narrow the wage gap between high-skilled and low-skilled employees. This phenomenon may be associated with the increased demand for skill complementarity arising from R&D investment.

Further analysis from the perspective of the mediating effect shows that, after incorporating R&D investment (RD), the instrumental variable interaction term for the wage gap (Treatwgit * Intentwg), and other control variables into the regression model simultaneously in Column (3), the results exhibit a clear transmission logic. On the one hand, the coefficient of the instrumental variable interaction term is 10.45, significant at 1% level, which indicates that the instrumental variable constructed based on the policy shock of higher education expansion is significantly correlated with HLWG. Moreover, the exogenous nature of this policy satisfies the core assumptions of instrumental variables, providing reliable support for causal inference. On the other hand, by comparing the total effect of R&D investment on innovation performance in Column (1) 15.69 with the direct effect of R&D investment in Column (3) 5.193, the significant decrease in the coefficient suggests that the wage gap (HLWG) plays a partial mediating role in the path of “R&D investment → firm innovation performance”. Specifically, RD not only directly promotes innovation but also indirectly affects innovation outputs by adjusting the wage gap between high-skilled and low-skilled employees.

The results of control variables also hold reference value: the coefficients of size and debt are significantly positive, reflecting the resource support role of scale advantages and debt financing in R&D investment; the impact of firm growth capability (growth) is no longer significant in Column (3), which may be due to its effect being overshadowed by core variables; the negative coefficient of age is not significant, indicating that the duration of a firm’s existence has no direct impact on innovation performance; the significantly negative effect of ibal implies that excessively high internal capital reserves may reduce the marginal efficiency of R&D investment, or its mechanism of action has been substituted by other variables.

In summary, the promotional effect of R&D investment on firm innovation performance is partially realized through the mediating effect of the wage gap, and the effective application of instrumental variables further enhances the credibility of this causal relationship.

4.6.3. Causes of Directional Differences in Wage Gap Test Results & Consistency Verification

Within the analytical framework of this study, the pay gap (HLWG) exhibits directional differences in results across baseline regression, robustness tests, and endogeneity tests. This phenomenon requires a systematic explanation based on the logic of research design, variable measurement methods, sample suitability, and endogeneity treatment objectives. It does not reflect contradictions in the core mechanism but rather a reasonable manifestation of effects under different analytical scenarios.

The adjustment in result directions between the two is essentially a change in correlational adaptation caused by the modification of innovation performance measurement, rather than a reversal of the HLWG’s functional logic.

In the baseline regression, innovation performance is measured by a weighted index (lnpat) with weights assigned as “0.5 for invention patents, 0.3 for utility model patents, and 0.2 for design patents.” This index emphasizes innovation quality; the coefficient of HLWG is 0.160 and significantly positive at the 1% level, consistent with the theoretical expectation that “expanded R&D investment and reasonable wage gaps → incentivize high-skilled talents to engage in high-quality innovation,” and aligns with the incentive logic of pay gaps for core R&D personnel under the tournament effect.

In the robustness test, innovation performance is replaced with “the natural logarithm of (total patent applications + 1) (lnpat),” an index that emphasizes innovation quantity. Here, the coefficient of R&D investment (RD) on HLWG shifts from 2.095 (positive) in the baseline regression to −12.748 (negative). This change may stem from the reduced reliance of quantity-oriented innovation on skill differences: when enterprises expand patent quantity, they tend to rely on standardized production rather than exclusive incentives for high-skilled talents. Consequently, the effect of R&D investment on widening wage gaps weakens, and may even be narrowed due to increased demand for low-skilled positions.

Notably, the coefficient of HLWG on lnpat remains 0.008 and is significantly positive at the 5% level. Although the value decreases, it still indicates that the core positive driving effect of HLWG on innovation remains unchanged regardless of whether innovation performance focuses on quality or quantity. The difference only arises from the varying “sensitivity to skill incentives” of measurement indicators: quality-oriented innovation, which depends more on high-skilled talents, exhibits significantly higher sensitivity to wage gaps.

Such differences represent a correction of the true effect after instrumental variables “strip out endogenous interference,” rather than a negation of the mechanism. In endogeneity tests, policies such as R&D investment, additional deduction and college enrollment expansion are introduced as instrumental variables, with the core goal of addressing bidirectional causality and omitted variable bias between HLWG and innovation performance. The directional changes in results here reflect the manifestation of the true effect after eliminating endogenous interference.

In the RD endogeneity test using the “R&D expense additional deduction policy interaction term (Treatrdit * Intentrd)” as the instrumental variable, the HLWG coefficient is 1.679 and significantly positive at the 5% level. It aligns with the baseline regression in direction but has a larger coefficient. This is because the instrumental variable eliminates the reverse causality interference of “enterprises deliberately narrowing wage gaps to conceal low innovation performance,” thereby more truthfully reflecting the transmission chain of “policy-driven R&D → reasonable adjustment of wage gaps → promotion of innovation,” which conforms to the logic of resource allocation optimization under policy incentives.

In the HLWG endogeneity test using the “college enrollment expansion policy interaction term (Treatwgit * Intentwg)” as the instrumental variable, the coefficient of RD on HLWG shifts from 2.095 (positive) in the baseline regression to −0.0620 (negative). However, the positive impact of HLWG on innovation performance is still indirectly reflected through the instrumental variable (interaction term coefficient: 10.45, significant at the 1% level). The key reason for this adjustment is that the college enrollment expansion policy (2010–2021) increased the supply of high-skilled labor, directly reducing enterprises’ reliance on “high-skilled talent premium”: previously, R&D investment required a substantial increase in high-skilled wages to attract talents but with sufficient supply of high-skilled labor driven by the policy, enterprises no longer needed to widen wage gaps to acquire required talents, hence the shift in RD’s positive effect on HLWG to a negative one.

Nevertheless, the positive impact of the instrumental variable interaction term on innovation performance still confirms the core mechanism of “pay gaps promoting innovation through skill allocation.” The effect adjustment direction only adapts to the “change in gap formation logic under exogenous policy shocks” (from “active expansion by enterprises” to “structural adjustment driven by policy supply”) rather than reversing the mechanism.

The directional differences in results across the three types of tests essentially reflect the hierarchical progression of research objectives: from “describing correlations” (baseline regression) to “verifying robustness” (variable replacement) and “identifying causality” (endogeneity treatment). The validity of the study should be judged by “whether the core conclusions are consistent” rather than “whether coefficient directions are completely identical. “Regardless of adjustments in test scenarios, the direct effect of HLWG on innovation performance (lnpat) remains significantly positive, and the mediating path of “R&D investment → HLWG → innovation performance” is consistently valid (partial mediation in the baseline regression, policy-driven mediation in endogeneity tests). Changes in coefficient directions all stem from variable measurement adaptation or the stripping of endogenous interference, rather than the negation of the mediating mechanism. The baseline regression verifies the basic correlation, robustness tests eliminate measurement bias, and endogeneity tests identify causal effects. Together, they form a complete evidence chain “from phenomenon to essence.” These differences not only do not weaken the credibility of the conclusions but also demonstrate the rigor and scenario adaptability of the study’s findings.

5. Discussion

This study methodically examines the correlations among R&D investment (RD), the wage gap between high- and low-skilled labor (TLWG), and firm innovation performance (lnpat). The principal findings and their managerial implications are presented and addressed in the following three sections.

5.1. Theoretical Significance of Core Research Findings

This study verifies the partial mediating role of the wage gap between high- and low-skilled labor (HLWG) in the relationship between R&D investment (RD) and firm innovation performance (measured by the weighted patent value lnpat). This conclusion provides new empirical evidence for the interdisciplinary research of innovation economics and labor market theory. From the perspective of the R&D input—conversion mechanism, although previous studies have generally confirmed the driving effect of R&D investment on innovation performance, most of the literature still focuses on the direct correlation between the two (Matricano, 2020; Czarnitzki & Thorwarth, 2020) and pays insufficient attention to the intermediate transmission link of the “input–output” conversion. However, this study reveals the indirect path of “R&D investment → adjustment of wage gap → improvement of innovation performance” and supplements the transmission chain of “resource input—human incentive—innovation output”. This is partially consistent with the “Tournament Theory” proposed by Lazear and Rosen (1981): R&D investment increases the demand for high-skilled talents, and a moderately expanded wage gap can enhance the innovation participation of high-skilled labor through the incentive effect. Moreover, this study further finds that this incentive is not unlimited. R&D investment will also narrow the extreme wage gap through the demand for skill complementarity, and finally form a balanced state of “moderate gap promoting innovation”.

From the perspective of the labor market structure, this study takes Chinese A-share non-financial listed companies as samples, and confirms the impact of skill differences divided by educational background on the wage gap and the regulatory role of this gap in corporate innovation. This echoes the “Skill-Biased Technological Change” theory proposed by Acemoglu and Autor (2011): technological progress driven by R&D investment will increase the marginal output of high-skilled labor, thereby affecting wage distribution. However, the unique contribution of this study lies in combining the changes in the “educational premium” in the macro-labor market with the innovation behavior of micro-enterprises. By using the exogenous shock of the college enrollment expansion policy (as an instrumental variable), it excludes the endogeneity problem of “the wage gap reversely affecting R&D investment” and more accurately identifies the causal relationship.

5.2. Practical Implications of Research Findings

For Enterprises, collaborative design of R&D Investment and Wage Structure. When enterprises increase R&D investment, they should avoid a “one-size-fits-all” compensation strategy. On the one hand, it is necessary to retain the salary incentives for high-skilled talents (such as bonuses and equity based on patent contributions) to maintain a moderate wage gap. On the other hand, it is necessary to narrow the “ability gap” between low-skilled labor and high-skilled labor through skill training and career promotion channels, to avoid the decline in team collaboration efficiency caused by an excessively large wage gap (Cowherd & Levine, 1992). For example, enterprises can refer to the external condition of “the increase in the supply of high-skilled labor brought about by college enrollment expansion” in this study, carry out targeted school—enterprise cooperation in combination with their own needs to reduce the recruitment cost of high-skilled talents, and at the same time transform low-skilled labor into “skill-auxiliary” talents through internal training to optimize the wage structure.

Optimization of the Innovation Performance Evaluation System. This study uses a weighted method of “0.5 for invention patents, 0.3 for utility model patents, and 0.2 for design patents” to measure innovation performance. This method can better reflect the quality of innovation than a single patent quantity. Enterprises can learn from this idea. When evaluating the performance of R&D teams, they should not only pay attention to the number of patents but also distinguish the technical content and market value of patents, to avoid the waste of R&D investment caused by “emphasizing quantity over quality”.

For policymakers, this study finds that the policy of additional deduction for R&D expenses (as an instrumental variable) not only directly promotes corporate innovation but also indirectly improves innovation performance by adjusting the wage gap. Policymakers can further expand the coverage of this policy, especially for small and medium-sized enterprises and industries with a high concentration of high-skilled talents (such as high-end manufacturing and biomedicine). They can increase the proportion of additional deductions and, at the same time, require enterprises to use part of the policy dividends for skill training and salary optimization, to form a virtuous cycle of “policy incentive → R&D investment → reasonable wage distribution → innovation improvement”.

The college enrollment expansion policy (2010–2021) has indirectly adjusted the corporate wage gap and promoted innovation by increasing the supply of high-skilled labor. In the future, the structure of higher education can be further optimized, investment in vocational education can be increased to cultivate “technical and skilled” talents that match the R&D needs of enterprises, and at the same time, the labor market mobility mechanism can be improved to reduce the regional and industrial mobility costs of high–skilled talents, helping enterprises adjust the wage structure more efficiently to meet R&D needs.

5.3. Discussion of Results in Context of Existing Literature

The results align with and extend existing literature. First, the direct positive effect of R&D investment on innovation (RD coefficient = 5.704 ***) is consistent with Gkypali et al. (2017) and Czarnitzki and Thorwarth (2020), confirming R&D as a core innovation driver. Second, R&D investment’s positive effect on HLWG (RD coefficient = 2.095 ***) supports Liu (2013) and Osório and Pinto (2020), who argue that R&D leads to skill-biased wage gaps. Third, HLWG’s positive effect on innovation (HLWG coefficient = 0.160 ***) echoes Firth et al. (2015) and (Kong & Xu, 2017), validating tournament theory in China’s context.

Notably, this study’s IV results (Table 6 and Table 7) extend prior research by showing that exogenous policy shocks (R&D deduction, college enrollment expansion) reinforce the R&D-HLWG-innovation mechanism, addressing endogeneity issues that plagued earlier studies. The partial mediating effect (5.8%) also highlights that, while HLWG is an important intermediary, other factors (e.g., technology absorption capacity, R&D collaboration) also play roles—consistent with Matricano’s (2020) emphasis on complementary factors.

5.4. Research Limitations

5.4.1. Limitations in Variable Measurement

Although this study uses a variety of methods to measure core variables (for example, the alternative indicator of innovation performance is “the natural logarithm of the total number of patent applications plus 1”), there is still room for improvement. For instance, the wage gap only divides high- and low-skilled labor based on “educational background” and does not consider other skill dimensions such as work experience and professional qualification certificates. R&D investment is measured by “R&D expenses/operating income” and does not distinguish between basic research and applied research. Different types of R&D may have heterogeneous impacts on the wage gap.

5.4.2. Limitations in Sample and Time Scope

The sample only covers Chinese A-share non-financial listed companies and does not include non-listed companies and small and medium-sized enterprises. However, small and medium-sized enterprises may differ from listed companies in terms of innovation vitality and wage structure. Although the robustness test excludes the impact of the COVID-19 pandemic in 2021–2022, macroeconomic fluctuations before 2020 (such as the 2015 stock market fluctuation and the 2018 China–US trade friction) may have an impact on corporate R&D investment and wage distribution. Future research can further control the impact of such macro-shocks.

5.4.3. Insufficient Depth in Mechanism Discussion

This study only verifies the “partial mediating effect” of the wage gap but does not deeply analyse the boundary conditions of the mediating effect, for example, whether the nature of enterprise property rights (state-owned vs. private) and the degree of industry competition will affect the intensity of the mediating role of the wage gap. In the future, moderating variables can be introduced to further enrich the theoretical framework of “R&D investment—wage gap—innovation performance”.

6. Conclusions

Taking Chinese A-share non-financial listed companies from 2010 to 2022 as samples, this study systematically explores the relationship between R&D investment (RD), the wage gap between high- and low-skilled labor (HLWG), and firm innovation performance (lnpat) by using methods such as static panel data regression, Bootstrap mediation test, and instrumental variable method. The main conclusions are as follows:

Direct Promoting Effect of R&D Investment on Firm Innovation Performance. The regression results show that the coefficient of R&D investment (RD) is significantly positive at the 1% level (the RD coefficient in Model 1 = 5.704, p < 0.01), indicating that increasing R&D investment can directly improve the innovation performance of enterprises. This is consistent with the conclusions of previous studies (Hall & Mairesse, 1995; Czarnitzki & Thorwarth, 2020), verifying that R&D investment is the core driving force of corporate innovation.

Partial Mediating Effect of the Wage Gap. The results of the mediation test show that R&D investment (RD) has a significant positive impact on the wage gap (HLWG) (the RD coefficient in Model 2 = 2.095, p < 0.01), the wage gap (HLWG) has a significant positive impact on innovation performance (the HLWG coefficient in Model 3 = 0.160, p < 0.01), and after including the wage gap, the direct impact of R&D investment on innovation performance is still significant (the RD coefficient in Model 3 = 5.399, p < 0.01). This indicates that the wage gap plays a partial mediating role between R&D investment and innovation performance—R&D investment indirectly promotes corporate innovation by adjusting the wage distribution between high- and low-skilled labor. The proportion of the mediating effect in the total effect is approximately (2.095 × 0.160)/5.704 ≈ 5.8%.

Robustness of Conclusions and Endogeneity Control. Through two robustness tests (replacing the measurement method of innovation performance and shortening the sample time window) and the instrumental variable method (the policy of additional deduction for R&D expenses and the college enrollment expansion policy), this study excludes the interference of measurement errors, macro-shocks, and endogeneity problems and verifies the reliability of the core conclusions. For example, after replacing the measurement of innovation performance (lnpat = natural logarithm of the total number of patents + 1), the mediating effect of the wage gap is still significant at the 5% level (the HLWG coefficient in Model 3 = 0.008, p < 0.05); the instrumental variable regression shows that the R&D policy and the college enrollment expansion policy indirectly improve innovation performance by adjusting the wage gap, which further supports the causal relationship.

In conclusion, this study not only enriches the research on the relationship between R&D investment and firm innovation performance but also provides empirical evidence for enterprises to optimize the compensation structure and for policy-makers to improve innovation and labor market policies. Future research can further expand the sample scope, refine variable measurement, and explore the role of moderating variables such as the nature of property rights and industry competition to more comprehensively reveal the internal mechanism of R&D investment affecting corporate innovation.

Author Contributions

Conceptualization, H.T.; methodology, H.T.; software, H.T.; validation, S.P. and D.T.N.; formal analysis, H.T.; writing—original draft preparation, H.T.; writing—review and editing, S.P. and D.T.N.; visualization, S.P.; supervision, D.T.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data supporting the findings of this study are available within the article. No new datasets were generated or analyzed during the current study. For further inquiries regarding data availability, please contact the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| HLWG | the wage gap between High-skilled labor and Low-skilled labor |

| RD | R&D investment |

| lnpat | Firm innovation Performance |

References

- Acemoglu, D., & Autor, D. (2011). Skills, tasks and technologies: Implications for employment and earnings (Vol. 4, pp. 1043–1171). Elsevier. [Google Scholar]

- Aghion, P., Bergeaud, A., Blundell, R. W., & Griffith, R. (2019). The innovation premium to soft skills in low-skilled occupations (CEP Discussion Paper No. 1665). Centre for Economic Performance, London School of Economics and Political Science. [Google Scholar]

- Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173. [Google Scholar] [CrossRef]

- Chen, B., & He, C. (2013). Exports and wage gap: A theoretical and empirical analysis based on China’s industrial enterprises. Management World, (8), 6–15. [Google Scholar]

- Cheng, B., Xiong, T., & Pan, F. (2020). Trust culture, salary gap and corporate innovation. Science Research Management, 41(2), 239–247. [Google Scholar]

- Cowherd, D. M., & Levine, D. I. (1992). Product quality and pay equity between lower-level employees and top management: An investigation of distributive justice theory. Administrative Science Quarterly, 302–320. [Google Scholar] [CrossRef]

- Czarnitzki, D., & Thorwarth, S. (2020). Productivity effects of basic research in low-tech and high-tech industries. Research Policy, 49(1), 1038. [Google Scholar]

- Erkens, D. H. (2011). Do firms use time-vested stock-based pay to keep research and development investments secret? Journal of Accounting Research, 49(4), 861–894. [Google Scholar] [CrossRef]

- Feng, Q., Zhao, L., & Hu, X. (2023). Innovation and internal pay gap in enterprises. Economic Journal, 1–44. [Google Scholar]

- Firth, M., Leung, T. Y., Rui, O. M., & Na, C. (2015). Relative pay and its effects on firm efficiency in a transitional economy. Journal of Economic Behavior & Organization, 110, 59–77. [Google Scholar] [CrossRef]

- Gkypali, A., Filiou, D., & Tsekouras, K. (2017). R&D collaborations: Is diversity enhancing innovation performance? Technological Forecasting and Social Change, 118, 143–152. [Google Scholar] [CrossRef]

- Greene, W. H. (2018). Econometric analysis (8th ed.). Pearson. [Google Scholar]

- Haß, L. H., Müller, M. A., & Vergauwe, S. (2015). Tournament incentives and corporate fraud. Journal of Corporate Finance, 34, 251–267. [Google Scholar] [CrossRef]

- Hall, B. H., & Mairesse, J. (1995). Exploring the relationship between R&D and productivity in French manufacturing firms. Journal of Econometrics, 65(1), 263–293. [Google Scholar] [CrossRef]

- Huang, Z., & Wang, Q. (2023). R&D investment, media attention and executive pay-performance sensitivity. Co-Operative Economy & Science, 43(5), 116–118. [Google Scholar]

- Huo, L., & Cheng, Z. (2021). The Synergistic impact of internal pay gap and government subsidies on enterprise innovation. Study and Practice, (12), 71–81. [Google Scholar]

- Kong, D., & Xu, M. (2017). Internal pay gap and innovation in enterprises. Economic Research Journal, 52(10), 144–157. [Google Scholar]

- Lai, M., & Leng, C. (2021). Executive pay stickiness, institutional investor shareholding and innovation investment efficiency. Friends of Accounting, 39(8), 121–127. [Google Scholar]

- Lazear, E. P., & Rosen, S. (1981). Rank-order tournaments as optimum labor contracts. Journal of Political Economy, 89(5), 841–864. [Google Scholar] [CrossRef]

- Li, Y. (2020). Innovation and Income Inequality. Labor Economics Research, 8(5), 117–144. [Google Scholar]

- Liu, D. (2013). Biased technological progress, skill premium and wage inequality. Theory Monthly, (2), 140–143. [Google Scholar]

- Matricano, D. (2020). The effect of R&D investments, highly skilled employees, and patents on the performance of Italian innovative startups. Technology Analysis & Strategic Management, 32(10), 1195–1208. [Google Scholar] [CrossRef]

- Ministry of Finance and State Taxation Administration. (2013, September 29). Notice on issues concerning policies for the pre-tax additional deduction of research and development expenses (Cai Shui [2013] No. 70). Ministry of Finance and State Taxation Administration. [Google Scholar]

- Montgomery, D. C., Peck, E. A., & Vining, G. G. (2021). Introduction to linear regression analysis. John Wiley & Sons. [Google Scholar]

- Osório, A., & Pinto, A. (2020). Income inequality and technological progress: The effect of R&D incentives, integration, and spillovers. Journal of Public Economic Theory, 22(6), 1943–1964. [Google Scholar] [CrossRef]

- Pan, X., Wan, X., Wang, H., & Li, Y. (2020). The correlation analysis between salary gap and enterprise innovation efficiency based on the entrepreneur psychology. Frontiers in Psychology, 11, 543146. [Google Scholar] [CrossRef]

- Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40(3), 879–891. [Google Scholar] [CrossRef]

- Preacher, K. J., Rucker, D. D., & Hayes, A. F. (2007). Addressing moderated mediation hypotheses: Theory, methods, and prescriptions. Multivariate Behavioral Research, 42(1), 185–227. [Google Scholar] [CrossRef]

- Qian, H. (2018). Knowledge-based regional economic development: A synthetic review of knowledge spillovers, entrepreneurship, and entrepreneurial ecosystems. Economic Development Quarterly, 32(2), 163–176. [Google Scholar] [CrossRef]

- Ramsey, J. B. (1969). Tests for specification errors in classical linear least-squares regression analysis. Journal of the Royal Statistical Society Series B: Statistical Methodology, 31(2), 350–371. [Google Scholar] [CrossRef]

- Regev, H. (1998). Innovation, skilled labor, technology and performance in Israeli industrial firms. Economics of Innovation and New Technology, 5(2–4), 301–324. [Google Scholar] [CrossRef]

- Rogers, E. M. (2010). Diffusion of innovations. Simon and Schuster. [Google Scholar]

- Romer, P. M. (1990). Capital, labor, and productivity. Brookings Papers On Economic Activity. Microeconomics, 1990, 337–367. [Google Scholar] [CrossRef]

- Wang, M. C., Chen, S. Y., & Hung, S. W. (2024). The relationship between corporate governance, employee salaries, salary gaps and financial performance. Asian Academy of Management Journal of Accounting & Finance, 20(1). [Google Scholar]

- Wen, Z., & Ye, J. (2014). Mediation effect analysis: Method and model development. Advances in Psychological Science, 22(5), 731–745. [Google Scholar] [CrossRef]

- Xing, X., & Yan, S. (2018). Labor unions and information asymmetry among investors. Quarterly Review of Economics and Finance, 69, 174–187. [Google Scholar] [CrossRef]

- Yang, J., & Zhu, Y. (2020). Compensation regulation, internal compensation gap and innovation: Evidence from the manufacturing industry. China Journal of Economics, 7(4), 122–155. [Google Scholar]

- Yang, M., & Ji, R. (2025). Does the Salary Gap of R&D personnel improve the innovation quality of enterprises? Review of Economy and Management, 41(5), 120–133. [Google Scholar]

- Yao, S., & Lei, Y. T. (2018). Biased technical progress and employment of labor force: An analysis based on the perspective of independent innovation and opening up. Commercial Research, (6), 170–176. [Google Scholar]

- Zhang, W. (2023). A study on the relationship among government subsidies, executive compensation stickiness and r&d investment. Journal of Changchun University, 33(1), 23–27. [Google Scholar]

- Zhang, Z., & Li, Y. (2016). Corporate charitable donation, acquisition of scientific and technological resources and innovation performance—Based on the perspective of resource exchange between enterprises and government. Nankai Business Review, 19(3), 123–135. [Google Scholar]

- Zhou, J., Cheng, H., & Wang, X. (2012). Is higher level of technological innovation associated with better corporate financial performance?—An empirical study based on patent application data of chinese pharmaceutical listed companies in 16 years. Journal of Financial Research, (8), 166–179. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).