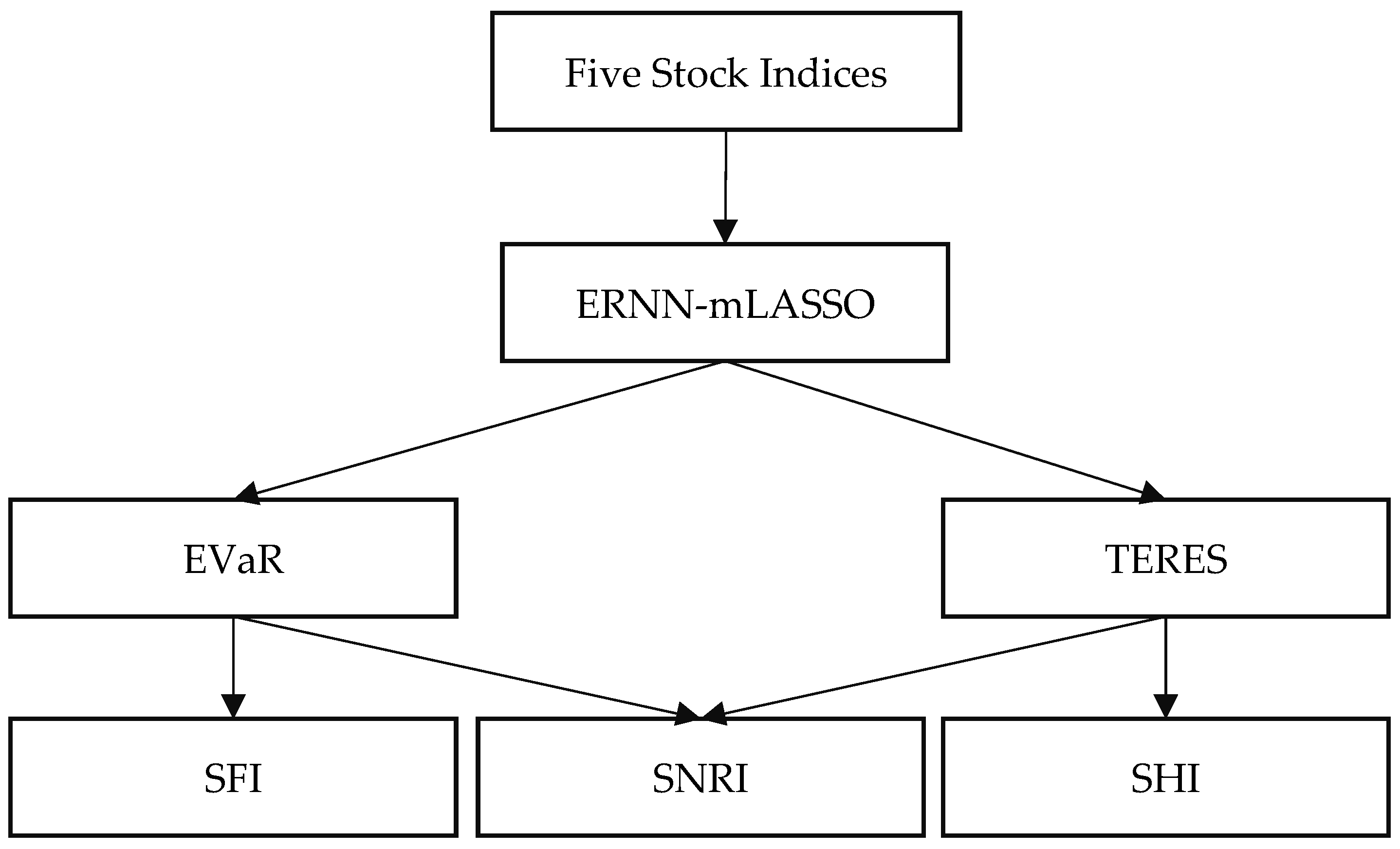

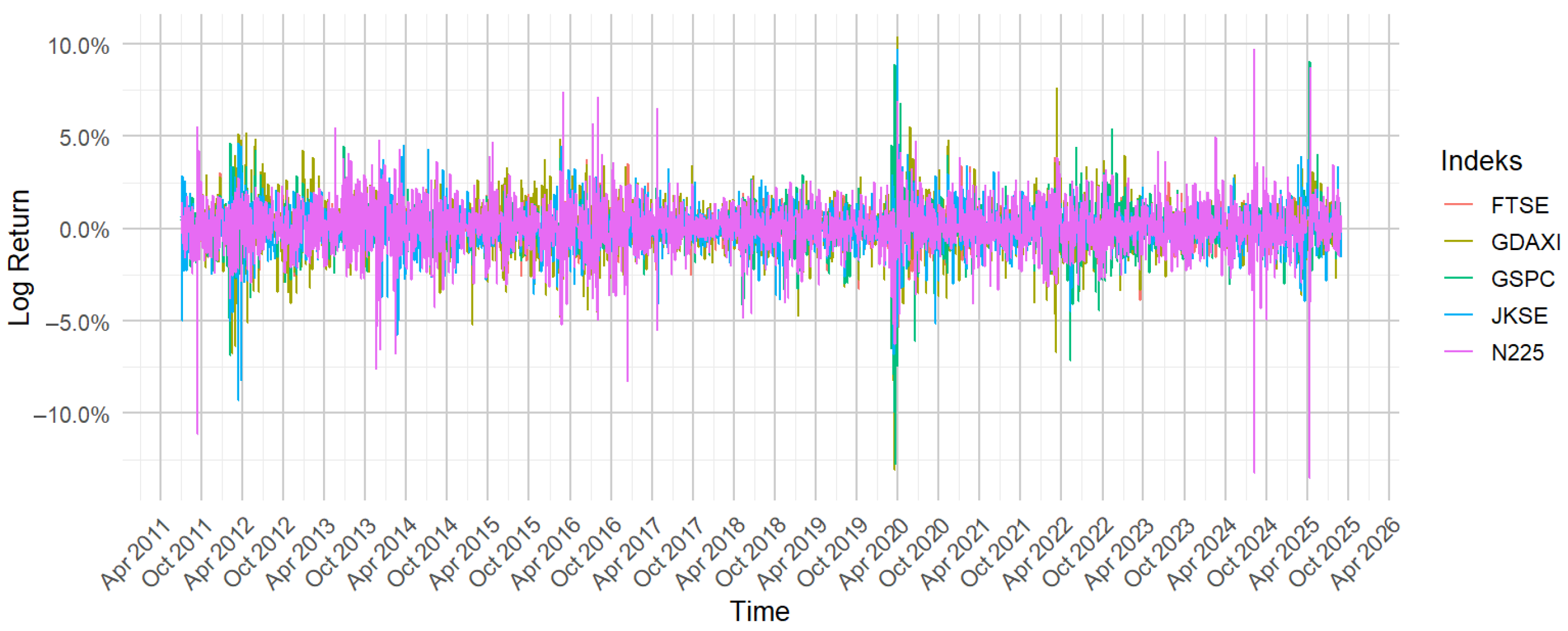

This section specifically analyzes and discusses the research results. It begins with the presentation and selection of more stable Expectile-based Value at Risk (EVaR) and Tail Event Risk Expectile Shortfall (TERES) estimates, using either the ERNN or ERNN-mLASSO models. This is followed by the estimation of systemic risk indices based on the SFI and SHI measures. Finally, the section concludes with a comprehensive interpretation of systemic risk through the estimated SNRI movements.

4.3.1. EVaR and TERES

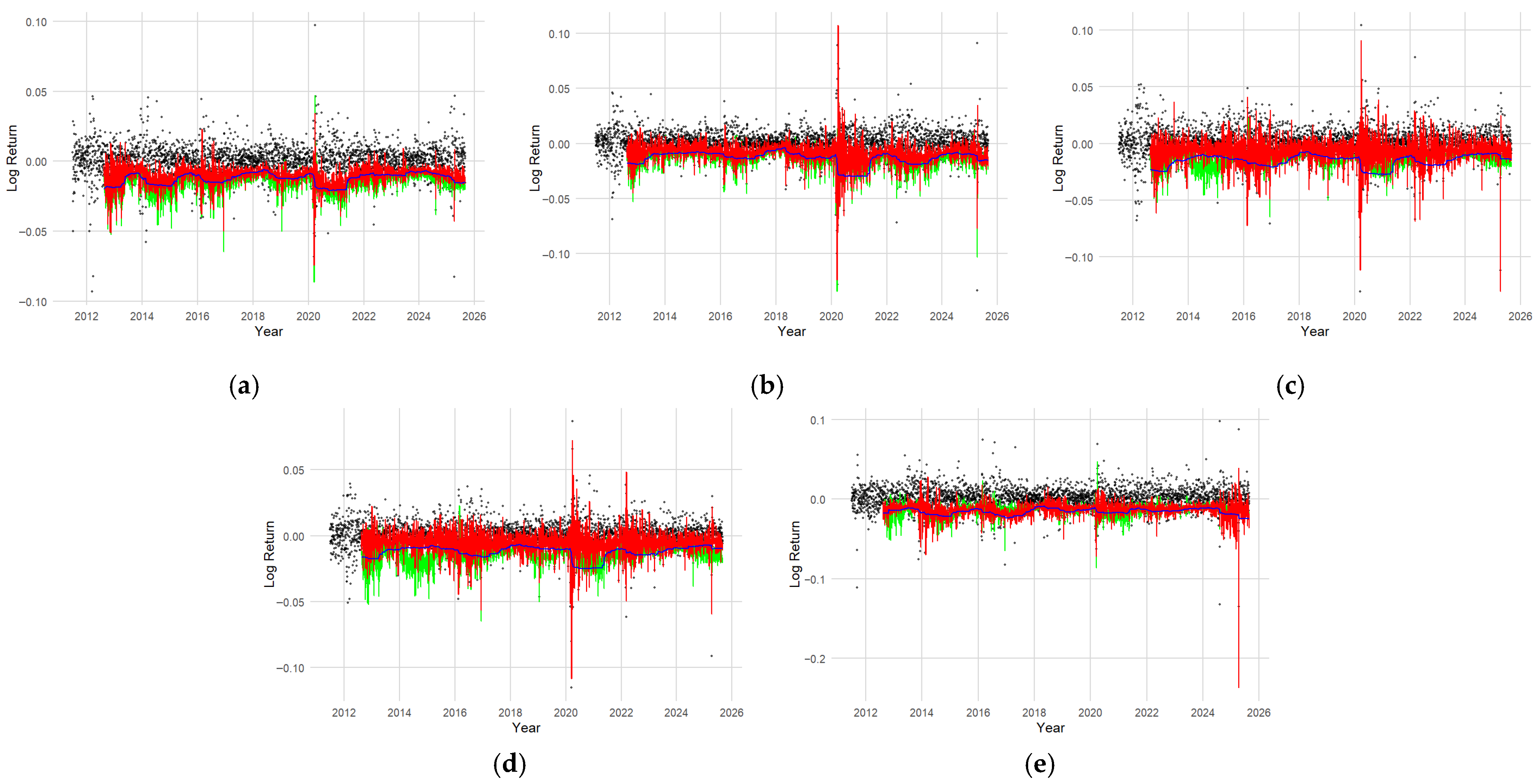

Systemic risk is a measure calculated from the EVaR and TERES functions. A 10% expectile level was chosen as the extreme expectile sample analyzed. The EVaR and TERES estimation results for each stock index are illustrated in

Figure 7.

Figure 7 displays the daily log-return, EVaR, and TERES for five global stock market indices. The black dots represent the daily log-return, while the blue line shows the dynamic estimate of EVaR at a 10% expectancy level, which serves as a threshold for extreme losses. The green and red lines show the TERES based on the ERNN and ERNN-mLASSO models, respectively. These two lines measure the expected loss when the EVaR threshold is exceeded.

Overall, all indices fluctuate around zero, but volatility increases sharply during periods of global crises. The EVaR line provides a lower bound marking the threshold for extreme risk, while TERES indicates the severity of losses when this threshold is exceeded. It is important to note the comparison between the green line (TERES from the ERNN model) and the red line (TERES from the ERNN-mLASSO model). The ERNN-mLASSO model, which uses regularization, tends to produce more stable and robust TERES estimates, as evidenced by the smoother and less volatile red line compared to the green line. This suggests that ERNN-mLASSO is more effective at addressing overfitting, where the standard ERNN model (green line) may be too sensitive to noise in the data, resulting in more volatile and less reliable estimates, especially during periods of market volatility. In other words, the ERNN-mLASSO model exhibits better resilience to data anomalies, providing a clearer picture of the true tail risk.

For the JKSE, significant spikes in TERES (both green and red) occurred in early 2020 during the COVID-19 pandemic, and again in 2022 following Russia’s invasion of Ukraine, highlighting the vulnerability of the domestic market to external shocks. A similar pattern is observed in the GSPC, with a sharp decline in March 2020 reflecting US market panic, as well as increased risk during periods of high inflation and monetary policy tightening in 2022–2023. Here, the red line (ERNN-mLASSO) often shows better stability than the green line (ERNN) in estimating these risk peaks. European markets, represented by the GDAXI and FTSE, also exhibit high sensitivity to crises, particularly the 2011–2012 European debt crisis and the Russian invasion of Ukraine in 2022. The red line in the GDAXI indicates a more measured risk severity than the green line, which may be overly reactive. Although the FTSE appears more stable than the GDAXI due to its broader UK market diversification, the volatility difference between the green and red TERES estimates remains noticeable, with the red being more consistent. Meanwhile, the N225 index exhibits a sharp response to the global crisis, with significant spikes in TERES in 2020 and 2022, followed by a sharp decline in 2025. This latest decline is a result of a combination of risk factors, including a slowdown in the Japanese domestic economy, pressure from the strengthening US dollar against the yen, and investor concerns about prolonged global uncertainty, underscoring the Japanese market’s high sensitivity to external shocks. Again, the red line provides a more restrained and likely more accurate estimate of the magnitude of this risk.

Overall, the consistent pattern across these five indices confirms that EVaR serves effectively as a threshold indicator for extreme risk, while TERES provides a more in-depth view of loss severity. A comparison of TERES estimates from the ERNN (green) and ERNN-mLASSO (red) models highlights the advantage of the regularized model in producing more stable and robust risk estimates, reducing the potential for overfitting, and providing a more reliable view of systemic risk in global markets. In complex tail risk measures such as TERES, selecting a robust model is crucial. The ERNN-mLASSO model, with its adaptive regularization and feature selection capabilities, has been shown to provide more stable, less volatile, and more reliable TERES estimates than standard ERNN models. This stability is crucial in risk analysis, where models that are too sensitive to short-term fluctuations or data noise can lead to misleading risk interpretations. Therefore, the TERES generated by the ERNN-mLASSO model (red line) is a superior choice for measuring and understanding the severity of losses in financial markets, due to its ability to distinguish between true risk signals and irrelevant random variability. Therefore, the TERES generated by the ERNN-mLASSO model (red line) will be selected for further risk analysis in a systemic context.

4.3.2. Position and Role of Index in the Context of Systemic Risk

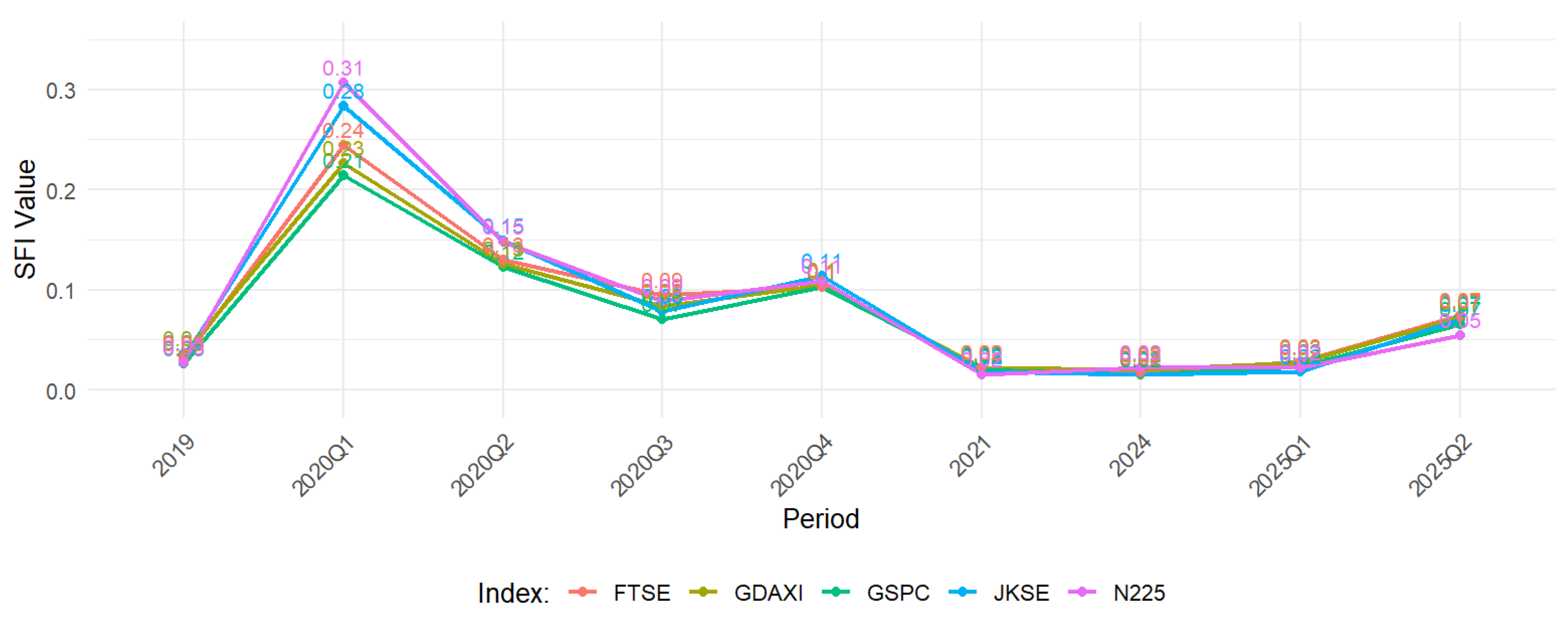

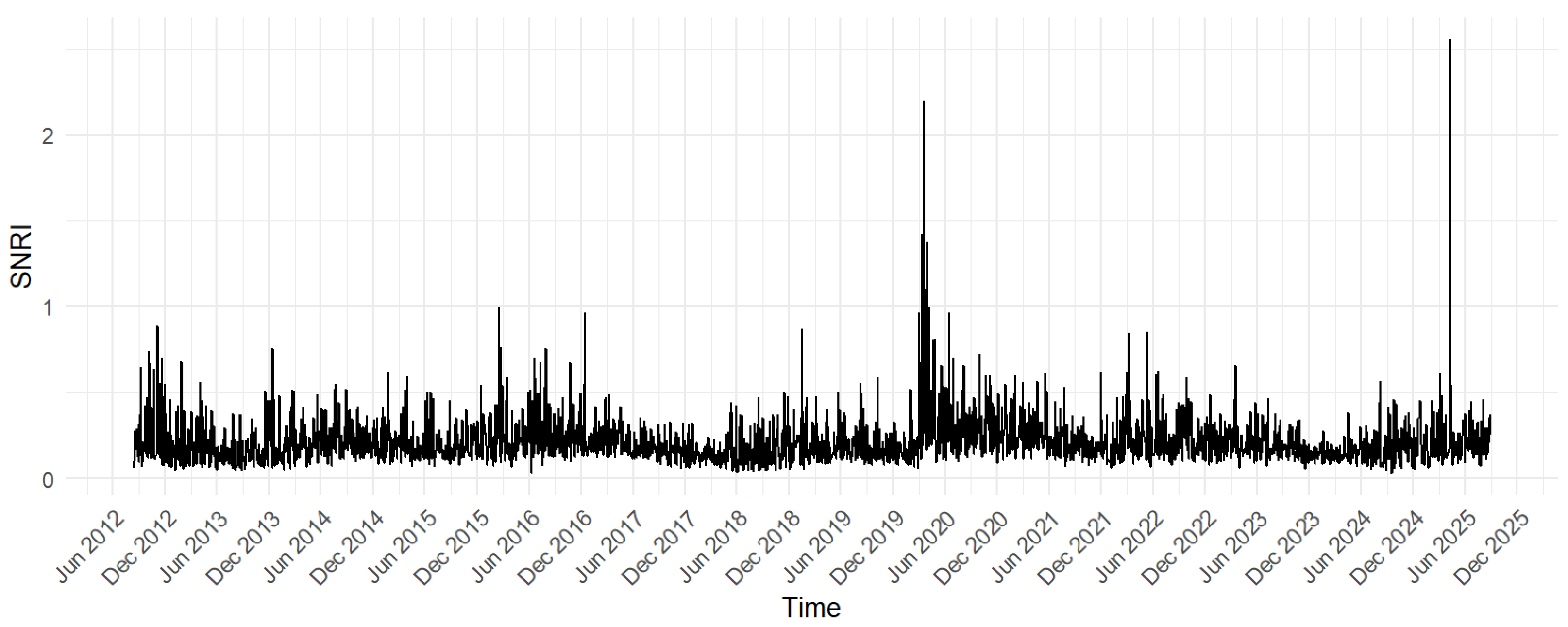

This section is the most important part of this research. It discusses the position and role of each stock index within the context of systemic risk. The analysis begins with estimating the SFI value, which is considered capable of describing the relative position and role of each index within the context of systemic vulnerability. A high SFI value reflects increased exposure to global shocks and the potential for risk transmission between markets. The visualization of the SFI movement is shown in

Figure 8, which serves as the basis for identifying the dynamics of systemic fragility before, during, and after the COVID-19 crisis, including the impact of geopolitical uncertainty in 2025.

Figure 8 illustrates the dynamics of five global stock indices based on their respective SFI values from 2019 to 2025Q2. The observation focuses on the phases before, during, and after the global crisis caused by the COVID-19 pandemic. The SFI reflects the level of market vulnerability to systemic turmoil, with higher values indicating greater vulnerability of an index when global financial markets experience collective stress. In other words, a high SFI indicates that an index is more susceptible to contagion effects from other stressed markets, significantly contributes to global financial system instability, and reflects a decline in market resilience in the face of external and internal shocks. Conversely, a low SFI value indicates relatively low systemic vulnerability and greater market stability. The results show that the largest spike occurred in the first quarter of 2020 (2020Q1), coinciding with the peak of the pandemic crisis. During this period, all indices experienced significant increases in SFI values. The N225 and JKSE indices reached their highest levels, indicating greater systemic vulnerability, likely due to their relatively smaller market structures and lower liquidity compared to major global indices. Conversely, indices such as the GSPC and GDAXI tended to have lower SFI values, although they remained elevated during the crisis. This can be attributed to their large market capitalization, market depth, and high liquidity, which enable them to absorb shocks better. After the peak of the crisis, the SFI values across all indices gradually declined, with a sharp decline from 2020Q3 to 2021, in line with the easing of global pressures and the introduction of economic stabilization policies in various countries. Throughout 2021 and 2024, the SFI values remained relatively low and stable, indicating a post-pandemic market resilience phase. However, in early 2025, particularly in the second quarter, a slight increase in SFI values across all indices was observed. Although not as large as the spike during the pandemic, this condition remains significant because it is linked to increasing geopolitical uncertainties affecting the global economy, such as trade tensions, regional geopolitical conflicts, and changes in monetary policy direction in several major countries, all of which increase the potential for cross-market risk transmission. Overall, this pattern confirms that systemic vulnerability is dynamic, strongly influenced by global shocks, and moves in unison across indices due to market interconnectedness. Furthermore, differences in SFI values across indices also reflect the influence of market capitalization and liquidity: large-cap markets, such as the GSPC and GDAXI, tend to be more resilient to shocks, while smaller-cap markets, like the JKSE, are more vulnerable to systemic risk propagation. Thus, the SFI is an important measure in understanding how global shocks and geopolitical uncertainty affect the level of systemic fragility in international stock markets.

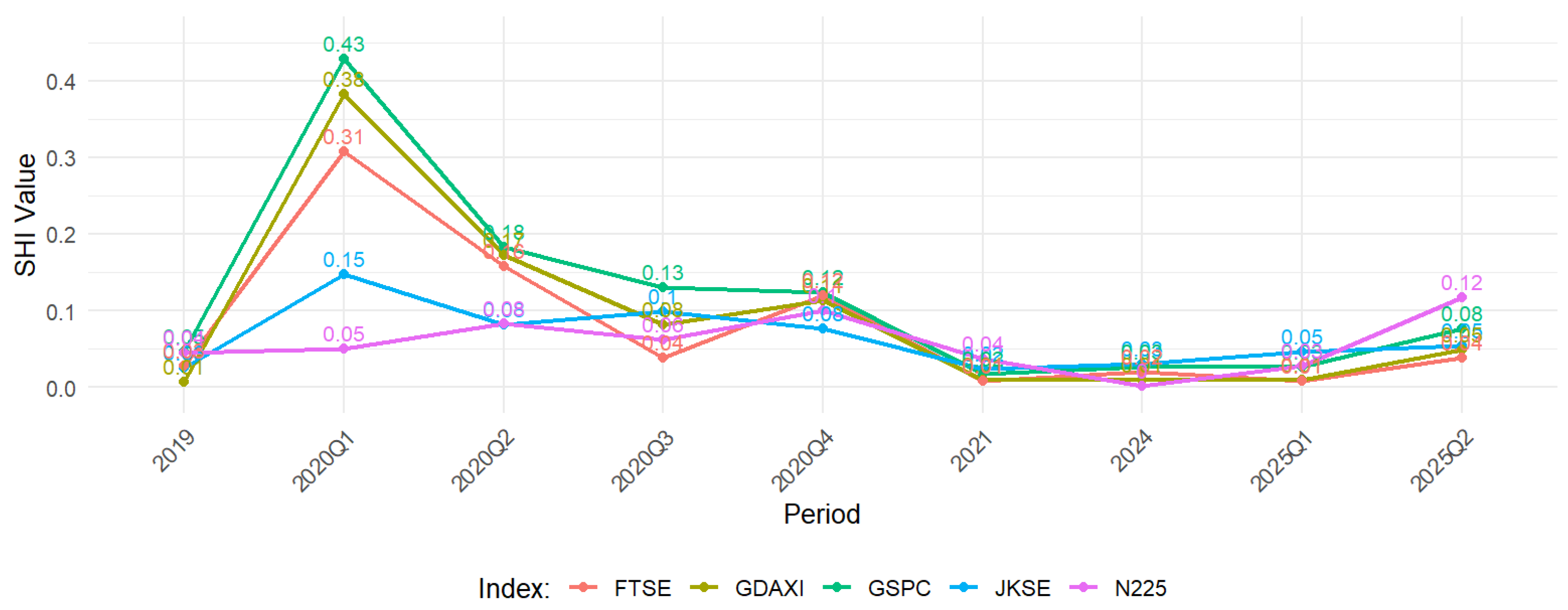

After discussing the SFI, which represents the level of market vulnerability to the propagation of systemic shocks, the next analysis focuses on the SHI. Unlike the SFI, which emphasizes vulnerability, the SHI focuses more on the risk contribution of an index to the overall global financial system. Thus, the SHI provides a complementary perspective on how an index is not only affected by external shocks but also has the potential to become a source of systemic risk transmission to other markets. Visually, the movement of the SHI values for each index is presented in

Figure 9.

Figure 9 shows that the peak SHI value occurred in the first quarter of 2020 (2020Q1), which coincided with the initial phase of the COVID-19 pandemic crisis. During this period, the GDAXI (DAX) and FTSE indices recorded the highest SHI values, around 0.43 and 0.31, respectively, indicating that these two indices were major contributors to the spread of systemic risk in global markets. This aligns with their position as representatives of the European market, which has large capitalization and close links to international financial markets. Conversely, indices such as the N225 exhibited relatively low SHI values during the crisis period, indicating a more limited role in spreading systemic turmoil, despite remaining impacted by the global crisis. After the peak crisis phase, SHI values generally trended downward until the period 2021–2024, during which all indices remained at relatively low levels. This reflects the market’s declining ability to transmit systemic risk, alongside the recovery of global economic activity and the implementation of various financial stabilization policies. However, in early 2025, particularly in the second quarter, a slight increase in SHI values was observed in several indices, including the N225, which saw a spike of up to 0.12. While this increase was not as sharp as during the pandemic, the phenomenon remains significant as it is associated with increasing geopolitical uncertainties, such as regional geopolitical tensions, global monetary policy dynamics, and the potential fragmentation of international trade, which again increases the potential for cross-market risk transmission. Thus, this pattern confirms the dynamic nature of the SHI, with large-cap indices, such as the DAX and FTSE, tending to play a dominant role as sources of systemic risk during crises, while smaller-cap indices, like the JKSE, have a more limited contribution. Thus, the SHI complements the SFI analysis by highlighting another dimension of systemic risk: the active role of an index in spreading turmoil to global financial markets.

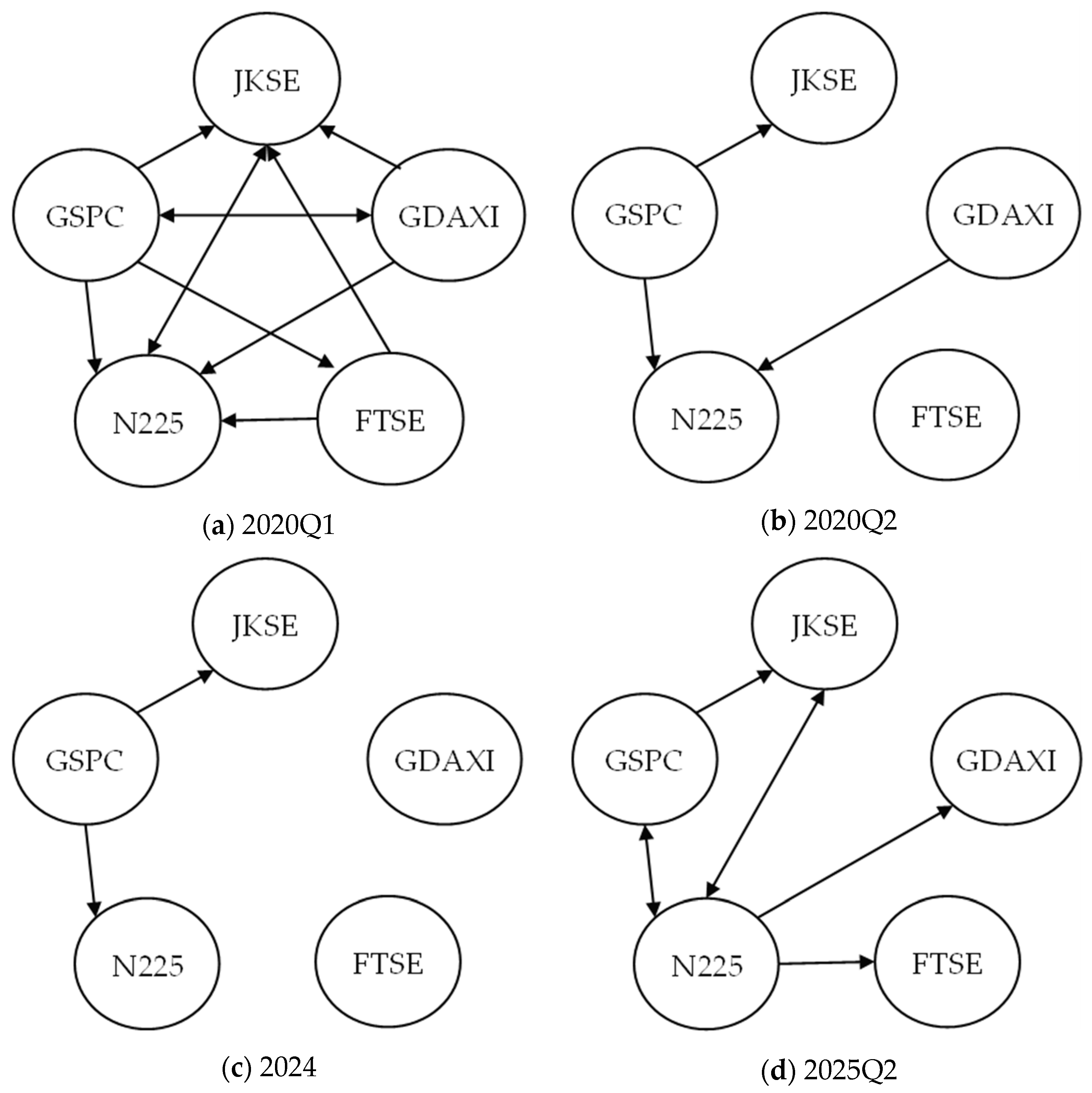

Beyond analyzing the SFI, which provides an aggregate picture of market vulnerability to systemic risk, and the SHI, which measures the contribution of individual indices to the spread of systemic risk, it is important to understand the specific mechanisms by which these risks are transmitted between markets. While the SFI and SHI offer perspectives on the magnitude and source of risk, the dynamics of interconnectivity between markets reveal the pathways and direction of spillovers. Therefore, to gain a comprehensive understanding of systemic risk, analyzing these spillover relationships is crucial. Illustrations of interconnectivity between markets are presented in

Figure 10 across several key periods, including the COVID-19 pandemic.

Figure 10 visually depicts the dynamics of risk spillovers across major stock markets—the JKSE, GSPC, GDAXI, FTSE, and N225—showing significant evolution reflecting responses to global economic events. In Q1 2020, which coincided with the escalation of the COVID-19 pandemic, a highly dense and interconnected spillover network was observed. Nearly all markets exhibited bidirectional or unidirectional relationships, indicating rapid and widespread risk transmission amidst global systemic uncertainty. GSPC, in particular, acted as a key trigger, spreading risk to the JKSE, N225, and GDAXI, while N225 also played a central role due to its extensive connectivity. This network density strongly underscores the characteristics of a global crisis, where shocks in one market immediately ripple across others, highlighting the interconnectedness of the global economy.

Moving into Q2 2020, there was a significant de-escalation in the intensity of risk spillovers. The network became sparser, indicating that markets were beginning to adapt or that the initial shock had subsided. The GSPC remains a key hub for risk transmission to the JKSE and N225, but markets like the FTSE appear isolated, indicating potential decoupling or resistance to risk transmission from other hubs. In 2024, the spillover network reached a point of extreme minimalism, maintaining only two unidirectional connections: the GSPC to N225, and the N225 to the JKSE. The GDAXI and FTSE markets were completely disconnected from the network, which could be interpreted as a period of relative stability or increased resilience in these markets. This pattern highlights specific regional risk transmission pathways, with the dominant influence from the US market (GSPC) then channeled through the Asian market (N225) to the Southeast Asian market (JKSE). However, in Q2 2025, spillover connectivity re-emerged, although it has not yet reached the density seen at the start of the pandemic. The GSPC again exerted influence on the N225, and the bidirectional relationship between the JKSE and N225 indicates increasing interdependence. N225 also became a hub for widespread risk transmission, channeling its impact to GDAXI and FTSE, previously isolated markets. This increased connectivity suggests the possibility of a resurgence of global uncertainty or broader market stress, reactivating previously dormant risk transmission channels. The analysis clearly demonstrates the dynamic nature of risk spillovers between stock markets. Crisis periods are characterized by high interconnectivity, while stable periods exhibit network fragmentation. This shift highlights the importance of continuously monitoring the structure of spillover networks to understand and mitigate systemic risk in the evolving global financial markets.

To provide a more comprehensive understanding of the position and role of each global stock index in the context of systemic risk, the SFI and SHI estimation results are integrated. The SFI reflects an index’s vulnerability to systemic shocks, while the SHI indicates an index’s capacity to transmit risk to global markets.

Table 7 presents objective results based on several crisis periods that draw particular attention to the position and role of each index in the context of systemic risk.

Table 7 summarizes the position and role of each global stock index based on its Systemic Fragility Index (SFI) and Systemic Hazard Index (SHI) values. The results indicate heterogeneity in systemic function across indices, which can be categorized as risk takers and risk transmitters.

The JKSE Index is positioned as a more vulnerable index to shocks (high SFI), but its contribution to spreading systemic risk is relatively limited (low SHI). This is understandable given the JKSE’s smaller market size and capitalization compared to major global indices. Thus, the JKSE is more representative of a market that is sensitive to external pressures but does not act as a center for global risk transmission. Conversely, the GSPC and GDAXI demonstrate a dominant role as risk transmitters. A low SFI indicates relative resilience to shocks, but a high SHI reflects their capacity to channel risk to global markets, particularly during the 2020 crisis. This can be explained by their large market capitalization and the degree of integration of both in the international financial network. Shocks to the GSPC and GDAXI have the potential to cause significant spillover effects on other indices. The FTSE exhibits a moderate profile, both in terms of its SFI and SHI. Its large market capitalization makes it relatively stable against shocks, while still maintaining the ability to transmit moderate levels of risk. This position positions the FTSE as an index with a balancing role in the global financial system, neither dominantly acting as a risk taker nor as a risk transmitter. Meanwhile, the N225 (Nikkei 225) exhibits dual characteristics: it is vulnerable to shocks (high SFI), but its contribution to global risk transmission is initially limited (low SHI). However, since 2025, the N225’s role has increased, as evidenced by the rise in SHI. This increase aligns with increasing geopolitical uncertainty in the Asian region, which has pushed the Japanese market to become more influential in transmitting systemic risk. Overall, this mapping confirms that indices with large market capitalization and high global integration (such as the GSPC and GDAXI) tend to act as risk transmission hubs, while indices with relatively small market capitalizations (such as the JKSE) function more as risk recipients. However, the dynamics of economic and geopolitical conditions, as reflected in the N225, can change the role of an index over time, making continuous monitoring important in systemic risk analysis.

The finding that developed markets like the GSPC and GDAXI serve as primary risk disseminators, while emerging markets like the Jakarta Composite Index (JKSE) act as receivers, provides strong empirical confirmation of the core-periphery model of the global financial network structure. This implies that the stability of peripheral markets, such as Indonesia, is fundamentally dependent on conditions in core financial centers. The implication is that shocks that appear to originate in the US or Europe are not isolated events; they systematically propagate and are amplified in smaller, less liquid markets. This highlights the asymmetry of vulnerability in the global financial system, where geographic diversification may offer less protection for investors in emerging markets than previously thought. Another interesting finding is the projected shift in the role of Nikkei 225 (N225), which begins to exhibit characteristics of a more significant risk disseminator toward 2025. This likely reflects changing macroeconomic dynamics in the Asian region, including increasing geopolitical uncertainty and shifting capital flows. This suggests that a country’s role in the global risk network is not static; These roles can evolve with changing economic and political conditions. This challenges the simplistic view that only the US and European markets are sources of risk, highlighting the importance of dynamically monitoring all major players in the system. The results of this mapping of the roles of spreaders and takers align with the spillover index framework pioneered by

Diebold and Yilmaz (

2012), which also found that shocks tend to originate in the US market. However, our contribution extends their work by using a nonlinear, machine learning-based approach. Our ERNN-mLASSO model specifically quantifies risk transmission during tail events, which are the most crucial moments for systemic stability. This shows that the ‘core-periphery’ relationship becomes much more pronounced and dangerous precisely during times of extreme market stress, a nuance that linear models may miss.