From Toxic to Transparent: The Effect of Greenpeace’s Detox Campaign on Market Volatility

Abstract

1. Introduction

- Firstly, the information boom enabled these organisations to collect, analyse, and disseminate information effectively, allowing them to contest the market and the state.

- Secondly, the position they held in Society led most NGOs to concentrate on legitimacy due to the moral authority that prevails in Western Societies (Chandhoke, 2002).

2. Data

3. Methodology

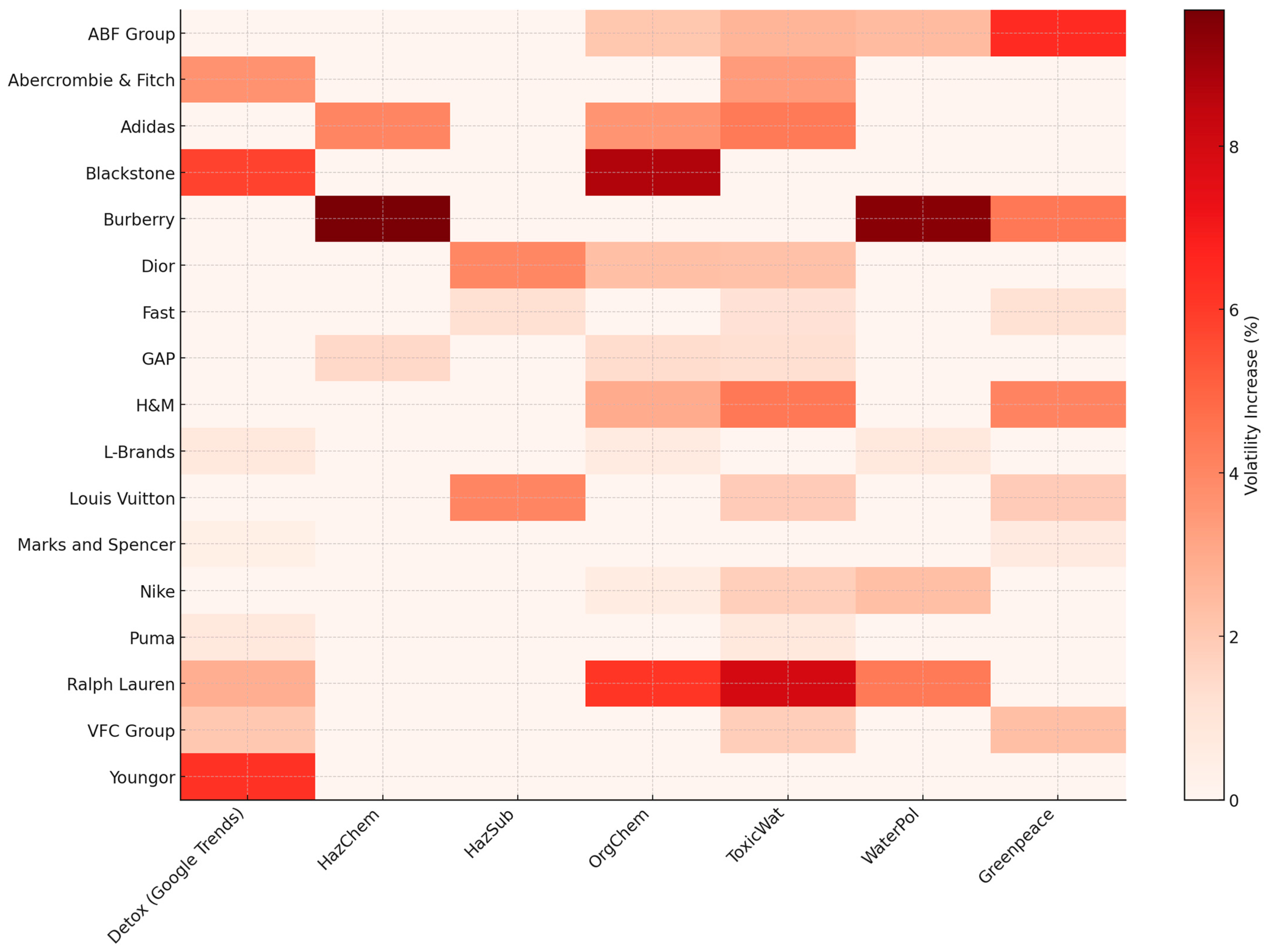

4. Empirical Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | We will not present the correlations in the paper; the correlation results are available from the authors upon request. |

References

- Angrist, J. D., & Pischke. (2008). Mostly harmless econometrics: An empiricist’s companion. Princeton University Press. [Google Scholar]

- Arora, S. (2001). Voluntary abatement and market value: An event study approach (Discussion Paper No. 30). Stanford Institute for Economic Policy Research. [Google Scholar]

- Beck, T. (2003). Financial dependence and international trade. Review of International Economics, 11, 296–316. [Google Scholar] [CrossRef]

- Bollerslev, T. (1986). Generalised autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307–327. [Google Scholar] [CrossRef]

- Brendel, A., Chen, L., Keusch, T., & Sautner, Z. (2024). The value of NGOs in ESG. Swiss Finance Institute Research Paper Series No. 24–35. Swiss Finance Institute. [Google Scholar]

- Brunnermeier, M., Dong, G., & Palia, D. (2012). Banks’ non-interest income and systemic risk (Working Paper). Princeton University. [Google Scholar]

- Card, D., & Krueger, A. B. (1994). Minimum wages and employment: A case study of the fast-food industry in New Jersey and Pennsylvania. American Economic Review, 84(4), 772–793. [Google Scholar]

- Cetorelli, N., & Gambera, M. (2001). Banking market structure, financial dependence and growth: International evidence from industry data. The Journal of Finance, 56(2), 617–648. [Google Scholar] [CrossRef]

- Chandhoke, N. (2002). The limits of global civil society. In M. Glasius, M. Kaldor, & H. Anheier (Eds.), Global civil society 2002. Oxford University Press. [Google Scholar]

- Chiu, W., & Kolstad, I. (2024). NGO campaign responses to corporate environmental policies and practices. Corporate Social Responsibility and Environmental Management, 32(2), 2271–2294. [Google Scholar] [CrossRef]

- Choi, H., & Varian, H. (2012). Predicting the present with Google trends. Economic Record, 88, 2–9. [Google Scholar] [CrossRef]

- Coombs, W. T., & Holladay, S. J. (2015). How activists shape CSR: Insights from internet contagion and contingency theories. In Corporate social responsibility in the digital age. Emerald, U.K. [Google Scholar]

- Coussement, K., & Van Den Poel, D. (2008). Integrating the voice of customers through call center emails into a decision support system for churn prediction. Information and Management, 45(3), 164–174. [Google Scholar] [CrossRef]

- David, P., Bloom, M., & Hillman, A. J. (2007). Investor activism, managerial responsiveness, and corporate social performance. Strategic Management Journal, 28(1), 91–100. [Google Scholar] [CrossRef]

- Draca, M., Machin, S., & Witt, S. (2011). Panic on the streets of London: Police, crime, and the July 2005 terror attacks. American Economic Review, 101(5), 2157–2181. [Google Scholar] [CrossRef]

- Dupire, M., M’Zali, B., & Hossain, T. (2022). NGO tweets: Do large NGOs’ messages on Twitter affect companies’ stock prices? Business & Society, 61(4), 893–926. [Google Scholar]

- Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50(4), 987–1007. [Google Scholar] [CrossRef]

- Epstein, M. J., & Schnietz, K. E. (2002). Measuring the cost of environmental and labour protests to globalisation: An event study of the failed 1999 Seattle WTO talks. The International Trade Journal, 16(2), 129–160. [Google Scholar] [CrossRef]

- Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383–417. [Google Scholar] [CrossRef]

- Ferguson, Y. H. (2012). NGOs’ role in constructing global governance. Global Governance, 18(3), 383–386. [Google Scholar] [CrossRef]

- Fukuyama, F. (1995). Trust: The social virtues and the creation of prosperity. The Free Press. [Google Scholar]

- Grappi, S., Romani, S., & Barbarossa, C. (2017). Fashion without pollution: How consumers evaluate brands after an NGO campaign aimed at reducing toxic chemicals in the fashion industry. Journal of Cleaner Production, 149, 1164–1173. [Google Scholar] [CrossRef]

- Greenpeace. (2018). Destination zero: Seven years of detoxing the clothing industry. Greenpeace International. Available online: https://www.greenpeace.org/international/publication/17612/destination-zero/ (accessed on 24 September 2025).

- Griffin, J. J., & Mahon, J. F. (1997). The corporate social performance and corporate financial performance debate twenty-five years of incomparable research. Business & Society, 36(1), 5–31. [Google Scholar]

- Gupta, S., & Goldar, B. (2005). Do stock markets penalise environment-unfriendly behaviour? Evidence from India. Ecological Economics, 52(1), 81–95. [Google Scholar] [CrossRef]

- Hamilton, J. T. (1995). Pollution as news: Media and stock market reactions to the toxics release inventory data. Journal of Environmental Economics and Management, 28(1), 98–113. [Google Scholar] [CrossRef]

- Hamilton, J. T. (1999). Exercising property rights to pollute: Do cancer risks and politics affect plant emission reductions? Journal of Risk and Uncertainty, 18(2), 105–124. [Google Scholar] [CrossRef]

- Henry, A. L., & McIntosh Sundstrom, L. (2021). Theorising NGO mediation in global governance, Bringing global governance home: NGO mediation in the BRICS states. Oxford Academic. [Google Scholar]

- Huang, A. (2011). Volatility forecasting in emerging markets with application of stochastic volatility model. Applied Financial Economics, 21, 665–681. [Google Scholar] [CrossRef]

- Jones, K., & Rubin, P. H. (2001). Effects of harmful environmental events on reputations of firms. Advances in Financial Economics, 6, 161–182. [Google Scholar]

- Karunanayake, I., Valadkhani, A., & O’Brien, M. (2010). An empirical analysis of international stock market volatility transmission. Economics Working Papers wp10-09. School of Economics, University of Wollongong, NSW, Australia. [Google Scholar]

- Klassen, R. D., & McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Management Science, 42(8), 1199–1214. [Google Scholar] [CrossRef]

- Koku, P. S., Akhigbe, A., & Springer, T. M. (1997). The financial impact of boycotts and threats of boycott. Journal of Business Research, 40(1), 15–20. [Google Scholar] [CrossRef]

- Konar, S., & Cohen, M. A. (2001). Does the market value environmental performance? Review of Economics and Statistics, 83(2), 281–289. [Google Scholar] [CrossRef]

- Kruse, J., & Martens, K. (2015). NGOs as actors in global social governance. In A. Kaasch, & K. Martens (Eds.), Actors and agency in global social governance. Oxford Academic. [Google Scholar]

- Laplante, B., & Lanoie, P. (1994). The market response to environmental incidents in Canada: A theoretical and empirical analysis. Southern Economic Journal, 60(3), 657–672. [Google Scholar] [CrossRef]

- Ma, C., & Cheok, M. Y. (2023). Relationship among Covid-19, stock price and green finance markets pragmatic evidence from volatility dynamics. Economic Change and Restructuring, 56, 265–295. [Google Scholar] [CrossRef]

- Mahapatra, S. (1984). Investor reaction to a corporate social accounting. Journal of Business Finance & Accounting, 11(1), 29–40. [Google Scholar] [CrossRef]

- Mu, Y. (2025). Linear empirical analysis of the impact of market volatility on investment return. Finance & Economics, 1(2), 2. [Google Scholar] [CrossRef]

- Muoghalu, M. I., Robison, H. D., & Glascock, J. L. (1990). Hazardous waste lawsuits, stockholder returns, and deterrence. Southern Economic Journal, 57(2), 357–370, ISSN 0038-4038; ISSN SECJA. [Google Scholar] [CrossRef]

- Murazzani, M. L. (2009). NGOs, global governance and the UN: NGOs as “guardians of the reform of the international system”. Transition Studies Review, 16, 501–509. [Google Scholar] [CrossRef]

- Oberndorfer, U., & Ziegler, A. (2006). Environmentally oriented energy policy and stock returns: An empirical analysis. ZEW Discussion Papers 06-079. ZEW—Leibniz Centre for European Economic Research. [Google Scholar]

- Pruit, S. W., & Friedman, M. (1986). Determining the effectiveness of consumer boycotts: A stock price analysis of their impact on corporate targets. Journal of Consumer Policy, 9(4), 375–387. [Google Scholar] [CrossRef]

- Rajan, G. R., & Zingales, L. (1998). Financial dependence and growth. The American Economic Review, 88(3), 559–586. [Google Scholar]

- Ramelli, S. (2021). Stock price effects of climate activism: Evidence from the first global climate strike. Finance Research Letters, 39, 101620. [Google Scholar] [CrossRef]

- Schuster, C. (2023). Stock price reactions to the climate activism by Fridays for Future. Journal of Environmental Management, 338, 117773. [Google Scholar]

- Shadish, W. R., Cook, T. D., & Campbell, D. T. (2002). Experimental and quasi-experimental designs for generalised causal inference. Houghton Mifflin. [Google Scholar]

- Shiller, R. J. (1981). Do stock prices move too much to be justified by subsequent changes in dividends? The American Economic Review, 71(3), 421–436. [Google Scholar]

- Soule, S. (2009). Contention and corporate social responsibility. Cambridge University Press. [Google Scholar]

- Spicer, B. H. (1978). Investors, corporate social performance and information disclosure: An empirical study. Accounting Review, 53(1), 94–111. [Google Scholar]

- Tang, Y., Liu, M., Xia, F., & Zhang, B. (2023). Informal regulation by nongovernmental organisations enhances corporate compliance: Evidence from a nationwide randomised controlled trial in China. Journal of Policy Analysis and Management, 43, 234–257. [Google Scholar] [CrossRef]

- Taylor, S. J. (1986). Modelling financial time series. Wiley. [Google Scholar]

- Teoh, S. H., Ivo, W., & Wazzan, C. P. (1999). The effect of socially activist investment policies on the financial markets: Evidence from the South African boycott. The Journal of Business, 72(1), 35–89. [Google Scholar] [CrossRef]

- Wang, Y. (2024). Overview of NGO strategies and practices in addressing global challenges. Journal of Education, Humanities and Social Sciences, 46, 194–201. [Google Scholar] [CrossRef]

| Variable Description | Source | Sample Period | Detox Duration |

|---|---|---|---|

| S&P500 | Thomson Reuters Datastream | 2011w01–2015w07 | |

| Abercrombie & Fitch | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| Adidas | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2014w25 |

| ABF Group | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| Blackstone | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| Burberry | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2014w04 |

| Dior | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| FAST | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2013w01 |

| GAP | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| H&M | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2011w36 |

| Inditex | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2012w48 |

| L-Brands | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2013w03 |

| Louis Vuitton | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| Marks & Spencer | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2012w40 |

| Nike | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2011w30 |

| Puma | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2011w28 |

| PVH Group | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| Ralph Lauren | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| VFC Group | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2013w06 |

| Youngor | Thomson Reuters Datastream | 2011w01–2015w07 | 2011w26–2015w07 |

| Detox | Google Trends | 2011w01–2015w07 | |

| Hazardous Chemicals | Google Trends | 2011w01–2015w07 | |

| Hazardous Substances | Google Trends | 2011w01–2015w07 | |

| Organic Chemicals | Google Trends | 2011w01–2015w07 | |

| Toxic Water | Google Trends | 2011w01–2015w07 | |

| Water Pollution | Google Trends | 2011w01–2015w07 | |

| Greenpeace | Google Trends | 2011w01–2015w07 |

| Variable | Count | Mean | Std | Min | Median | Max |

|---|---|---|---|---|---|---|

| A&F | 215 | 0.33 | 6.51 | −25.96 | −0.44 | 27.72 |

| Adidas | 215 | −0.19 | 3.43 | −8.18 | −0.35 | 19.97 |

| Burberry | 215 | −0.25 | 4.54 | −12.22 | −0.59 | 22.18 |

| Nike | 215 | −0.41 | 3.12 | −12.31 | −0.36 | 12.43 |

| Gap | 215 | −0.35 | 4.02 | −13.70 | −0.33 | 18.14 |

| H&M | 215 | −0.21 | 3.55 | −11.45 | −0.30 | 12.03 |

| Blackstone | 215 | −0.52 | 4.80 | −17.16 | −0.23 | 19.96 |

| L-Brands | 215 | −0.65 | 3.69 | −11.92 | −0.61 | 9.75 |

| LouiV | 215 | −0.19 | 3.35 | −7.98 | 0.04 | 10.49 |

| M&S | 215 | −0.21 | 3.17 | −13.65 | −0.10 | 6.97 |

| VFC group | 215 | −0.67 | 3.11 | −11.31 | −0.82 | 7.55 |

| ABF group | 215 | −0.49 | 2.75 | −7.75 | −0.60 | 10.42 |

| PUMA | 215 | 0.12 | 3.08 | −9.86 | 0.06 | 10.59 |

| PVH group | 215 | −0.29 | 4.65 | −19.42 | −0.71 | 22.62 |

| Ralph Lauren | 215 | −0.11 | 3.92 | −11.96 | −0.16 | 18.38 |

| Fast | 215 | −0.41 | 4.43 | −19.29 | −0.46 | 15.08 |

| Youngor | 215 | −0.15 | 4.13 | −18.50 | −0.17 | 11.18 |

| Inditex | 215 | −0.60 | 15.63 | −156.79 | −0.62 | 159.53 |

| Dior | 215 | −0.28 | 3.41 | −8.73 | −0.46 | 10.71 |

| S&P500 | 215 | 0.23 | 1.99 | −7.46 | 0.33 | 7.12 |

| Detox | 215 | 0.59 | 0.26 | 0.00 | 0.64 | 1.00 |

| HazChem | 215 | 0.65 | 0.19 | 0.00 | 0.65 | 1.00 |

| HazSub | 215 | 0.69 | 0.19 | 0.00 | 0.71 | 1.00 |

| OrgChem | 215 | 0.57 | 0.25 | 0.00 | 0.56 | 1.00 |

| ToxicWat | 215 | 0.64 | 0.22 | 0.00 | 0.67 | 1.00 |

| WaterPol | 215 | 0.63 | 0.24 | 0.00 | 0.67 | 1.00 |

| Greenpeace | 215 | 0.61 | 0.25 | 0.00 | 0.64 | 1.00 |

| Abercrombie & Fitch | GAP | Blackstone | Louis Vuitton | ABF Group | PVH Group | Ralph Lauren | Youngor | DIOR | |

|---|---|---|---|---|---|---|---|---|---|

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| D_All | 3.22 * | 1.49 | 2.72 | 2.32 ** | 0.66 | 2.18 | −1.79 | 1.34 | −0.38 |

| (2.54) | (1.63) | (1.25) | (4.63) | (1.02) | (0.72) | (−1.08) | (1.44) | (−0.55) | |

| Detox | 3.63 + | 0.03 | 5.80 * | −0.21 | 0.53 | 4.04 | 2.85 + | 6.23 ** | −0.28 |

| (1.65) | (0.06) | (2.20) | (−0.29) | (0.67) | (1.03) | (1.85) | (2.95) | (−0.33) | |

| Hazchem | −0.02 | 1.47 + | 4.97 | 1.5901 | 0.47 | 2.03 | 5.31 | 0.74 | −1.46 |

| (−0.01) | (1.78) | (0.93) | (1.38) | (0.43) | (0.20) | (1.20) | (0.35) | (−1.07) | |

| Hazsub | −3.00 | −1.50 | −8.69 | 4.01 ** | 1.80 | −12.49 | 1.29 | 0.46 | 3.97 * |

| (−1.20) | (−1.29) | (−1.43) | (2.79) | (1.38) | (−1.22) | (0.32) | (0.23) | (2.29) | |

| Orgchem | −1.38 | 1.33 * | 8.72 * | −1.04 | 2.04 ** | −3.87 | 6.11 ** | 0.81 | 2.28 * |

| (−0.63) | (2.17) | (2.50) | (−1.06) | (2.65) | (−0.81) | (2.81) | (0.53) | (1.98) | |

| Toxicwat | 3.37 + | 1.23 * | 3.79 | 1.89 * | 2.63 ** | 6.45 | 7.95 ** | 0,13 | 2.22 * |

| (1.86) | (2.35) | (1.25) | (2.06) | (3.45) | (1.64) | (3.56) | (0.10) | (2.01) | |

| Waterpol | 2.11 | 0.53 | 1.74 | 0.84 | 2.41 ** | 4.79 | 4.35 * | 0.96 | 1.73 |

| (0.89) | (0.78) | (0.44) | (0.91) | (2.73) | (0.93) | (2.20) | (0.57) | (1.53) | |

| Greenpeace | −0.47 | 0.20 | 0.76 | 1.91 ** | 6.48 ** | 0.66 | −2.52 | −0.97 | 1.41 |

| (−0.25) | (0.22) | (0.25) | (2.76) | (5.83) | (0.19) | (−1.42) | (−0.41) | (1.48) | |

| Constant | 36.98 ** | 16.96 ** | 20.82 ** | 10.65 ** | 8.26 ** | 19.87 ** | 15.15 ** | 19.44 ** | 13.54 ** |

| (12.29) | (19.37) | (4.16) | (7.02) | (6.10) | (2.78) | (5.03) | (6.64) | (8.00) | |

| Observations | 215 | 215 | 215 | 215 | 215 | 215 | 215 | 215 | 215 |

| R-squared | 0.04 | 0.11 | 0.08 | 0.13 | 0.30 | 0.03 | 0.13 | 0.09 | 0.08 |

| ADIDAS | Burberry | NIKE | H&M | L-Brands | Marks & Spencer | VFC Group | PUMA | FAST | INDITEX | |

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| D_Adidas | 4.53 ** | |||||||||

| (3.1) | ||||||||||

| D_Burberry | 14.94 ** | |||||||||

| (10.24) | ||||||||||

| D_Nike | 1.74 + | |||||||||

| (1.93) | ||||||||||

| D_H&M | 1.21 | |||||||||

| (1.01) | ||||||||||

| D_L-Brands | 1.44 ** | |||||||||

| (7.09) | ||||||||||

| D_M&S | −0.03 | |||||||||

| (−0.28) | ||||||||||

| D_VFC Group | 6.99 ** | |||||||||

| (12.95) | ||||||||||

| D_PUMA | 0.79 + | |||||||||

| (1.83) | ||||||||||

| D_FAST | 0.30 | |||||||||

| (1.12) | ||||||||||

| D_Inditex | −56.40 | |||||||||

| (−1.32) | ||||||||||

| Detox | 0.95 | −2.59 | 0.48 | −0.87 | 0.82 * | 0.34 * | 2.02 ** | 0.75 + | 0.05 | 43.98 |

| (0.98) | (−0.90) | (1.52) | (−0.77) | (2.39) | (2.00) | (3.04) | (1.90) | (0.19) | (0.85) | |

| Hazchem | 4.02 * | 9.67 ** | 0.30 | −2.12 | 0.23 | −0.42 | −0.21 | 1.09 | −0.87 | 98.23 |

| (2.06) | −2.67 | (0.41) | (−1.15) | (0.55) | (−1.44) | (−0.17) | (1.39) | (−1.29) | (1.08) | |

| Hazsub | 0.85 | −5.16 | 0.26 | −2.56 | −0.52 | 0.01 | 0.21 | 0.04 | 1.18 * | −152.28 |

| (0.36) | (−1.23) | (0.34) | (−1.19) | (−1.04) | (0.06) | (0.14) | (0.04) | (2.08) | (−1.21) | |

| Orgchem | 3.56 * | −3.73 | 0.60 + | 2.92 * | 0.63 * | −0.09 | −0.09 | −0.66 | −0.07 | 118.23 |

| (2.43) | (−1.30) | (1.71) | (2.06) | (2.09) | (−0.48) | (−0.11) | (−1.37) | (−0.13) | (1.19) | |

| Toxicwat | 4.40 + | 1.77 | 1.81 ** | 4.43 ** | 0.25 | −0.14 | 1.83 * | 0.71 + | 1.12 ** | −350.97 |

| (1.68) | (0.76) | (4.71) | (3.50) | (0.85) | (−0.85) | (2.29) | (1.76) | (3.28) | (−1.37) | |

| Waterpol | −1.38 | 9.39 ** | 2.32 ** | −1.15 | 0.71 + | −0.09 | 0.87 | −0.57 | 0.34 | −132.49 |

| (−0.86) | (2.96) | (4.33) | (−0.74) | (1.94) | (−0.39) | (0.82) | (−1.16) | (0.68) | (−1.19) | |

| Greenpeace | −0.77 | 4.41 + | 0.27 | 4.07 ** | 0.12 | 0.64 * | 2.33 * | 0.62 | 1.14 * | 98.45 |

| (−0.49) | (1.71) | (0.61) | (3.23) | (0.37) | (2.06) | (2.46) | (0.85) | (2.44) | (1.17) | |

| Constant | 18.04 ** | 15.18 ** | 9.54 ** | 13.04 ** | 12.05 ** | 10.32 ** | 5.42 ** | 9.83 ** | 20.42 ** | 395.57 * |

| (6.77) | (3.61) | (20.00) | (6.56) | (26.98) | (38.68) | (5.20) | (17.78) | (46.84) | (1.99) | |

| Observations | 215 | 215 | 215 | 215 | 215 | 215 | 215 | 215 | 215 | 215 |

| R-squared | 0.17 | 0.44 | 0.25 | 0.12 | 0.35 | 0.05 | 0.56 | 0.06 | 0.07 | 0.05 |

| ADIDAS | Burberry | FAST | INDITEX | H&M | L-Brands | Marks & Spencer | NIKE | PUMA | VFC Group | |

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Stock_V | 12.32 ** | 8.29 ** | 16.75 ** | 199.58 ** | 8.67 ** | 9.89 ** | 7.17 ** | 5.88 ** | 5.61 ** | 4.22 ** |

| (10.42) | (15.72) | (112.15) | (4.10) | (21.18) | (102.08) | (73.06) | (25.09) | (23.57) | (19.37) | |

| D_Adidas | 1.12 ** | |||||||||

| (3.75) | ||||||||||

| D_Burberry | 1.50 ** | |||||||||

| (4.68) | ||||||||||

| D_FAST | 2.92 ** | |||||||||

| (6.36) | ||||||||||

| D_Inditex | 3.05 ** | |||||||||

| (6.32) | ||||||||||

| D_HM | 6.24 ** | |||||||||

| (4.92) | ||||||||||

| D_L-Brands | 2.90 ** | |||||||||

| (6.42) | ||||||||||

| D_MS | 3.30 ** | |||||||||

| (6.32) | ||||||||||

| D_Nike | 2.28 ** | |||||||||

| (3.95) | ||||||||||

| D_PUMA | 2.27 ** | |||||||||

| (3.66) | ||||||||||

| D_VFC Group | 2.79 ** | |||||||||

| (6.36) | ||||||||||

| DID | 5.39 ** | 13.70 ** | 2.86 ** | 70.00 | 3.47 * | 1.44 ** | 3.26 ** | 0.6723 | 1.31 + | 3.96 ** |

| (4.36) | (11.76) | (5.68) | (1.44) | (2.17) | (2.99) | (6.16) | (0.63) | (1.76) | (6.06) | |

| Constant | 3.05 ** | 2.92 ** | 2.78 ** | 2.80 ** | 3.55 ** | 2.76 ** | 2.84 ** | 3.81 ** | 3.84 ** | 2.76 ** |

| (23.29) | (28.09) | (38.77) | (39.49) | (20.35) | (39.21) | (40.77) | (18.60) | (18.83) | (37.92) | |

| Observations | 430 | 430 | 430 | 430 | 430 | 430 | 430 | 430 | 430 | 430 |

| R-squared | 0.50 | 0.67 | 0.93 | 0.07 | 0.55 | 0.85 | 0.75 | 0.62 | 0.57 | 0.64 |

| ADIDAS | Burberry | FAST | INDITEX | H&M | L-Brands | Marks & Spencer | NIKE | PUMA | VFC Group | |

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Cap_V | 6.92 ** | 21.99 ** | 13.88 ** | 129.58 ** | 5.19 ** | 8.42 ** | 3.90 ** | 8.40 ** | 4.30 ** | 8.38 ** |

| (18.47) | (21.37) | (27.72) | (162.28) | (3.33) | (17.43) | (7.07) | (8.37) | (6.19) | (13.39) | |

| D_AdidasCap | −0.90 ** | |||||||||

| (−2.66) | ||||||||||

| D_BurberryCap | −1.42 ** | |||||||||

| (−4.15) | ||||||||||

| D_FASTCap | −2.91 ** | |||||||||

| (−6.08) | ||||||||||

| D_InditexCap | −3.04 ** | |||||||||

| (−6.02) | ||||||||||

| D_HMCap | −6.13 ** | |||||||||

| (−4.62) | ||||||||||

| D_L-BrandsCap | −2.91 ** | |||||||||

| (−6.25) | ||||||||||

| D_MSCap | −3.28 ** | |||||||||

| (−5.98) | ||||||||||

| D_NikeCap | −0.24 | |||||||||

| (−0.46) | ||||||||||

| D_PUMACap | −2.12 ** | |||||||||

| (−3.32) | ||||||||||

| D_VFC GroupCap | −2.91 ** | |||||||||

| (−6.08) | ||||||||||

| DID | 8.29 ** | −16.83 ** | −2.91 ** | 84.69 | −3.43 * | −1.31 ** | −3.23 ** | −2.71 ** | −1.30 + | −4.88 ** |

| (4.29) | (−15.94) | (−5.56) | (1.44) | (−2.11) | (−2.67) | (−5.77) | (−2.62) | (−1.76) | (−7.52) | |

| Constant | 4.18 ** | 4.43 ** | 5.70 ** | 5.86 ** | 3.66 ** | 5.70 ** | 6.14 ** | 4.26 ** | 6.11 ** | 5.70 ** |

| (15.05) | (14.07) | (12.03) | (11.72) | (18.24) | (12.47) | (11.27) | (8.77) | (10.26) | (12.03) | |

| Observations | 380 | 380 | 380 | 380 | 380 | 380 | 380 | 380 | 380 | 380 |

| R-squared | 0.52 | 0.68 | 0.93 | 0.07 | 0.52 | 0.84 | 0.72 | 0.59 | 0.55 | 0.68 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sarantidis, A.; Bougioukos, V.; Mitropoulos, F.; Kollias, K. From Toxic to Transparent: The Effect of Greenpeace’s Detox Campaign on Market Volatility. J. Risk Financial Manag. 2025, 18, 569. https://doi.org/10.3390/jrfm18100569

Sarantidis A, Bougioukos V, Mitropoulos F, Kollias K. From Toxic to Transparent: The Effect of Greenpeace’s Detox Campaign on Market Volatility. Journal of Risk and Financial Management. 2025; 18(10):569. https://doi.org/10.3390/jrfm18100569

Chicago/Turabian StyleSarantidis, Antonios, Vasileios Bougioukos, Fotios Mitropoulos, and Konstantinos Kollias. 2025. "From Toxic to Transparent: The Effect of Greenpeace’s Detox Campaign on Market Volatility" Journal of Risk and Financial Management 18, no. 10: 569. https://doi.org/10.3390/jrfm18100569

APA StyleSarantidis, A., Bougioukos, V., Mitropoulos, F., & Kollias, K. (2025). From Toxic to Transparent: The Effect of Greenpeace’s Detox Campaign on Market Volatility. Journal of Risk and Financial Management, 18(10), 569. https://doi.org/10.3390/jrfm18100569