1. Introduction

Sustainable finance has emerged as one of the central paradigms for aligning capital markets with broader societal goals (

Agârbiceanu & Păun, 2021;

Jones, 2024). It integrates environmental, social, and governance (ESG) considerations into investment and financing decisions (

Gao et al., 2024), thereby directing resources toward long-term objectives consistent with sustainable development (

Migliorelli, 2021;

Sharma et al., 2024). Although initially framed as an ethical choice, sustainable finance is now deeply embedded in regulatory frameworks and fiduciary duties. Institutional investors, once bound exclusively to maximize financial returns, are increasingly expected to incorporate ESG risks and opportunities to safeguard the long-term interests of beneficiaries (

Busch et al., 2021). This regulatory and institutional evolution explains the rapid mainstreaming of ESG integration across global capital markets (

Busch et al., 2015;

Haas & Popov, 2019).

Beyond regulatory pressure, investor demand and technological change have accelerated this transformation. The growth of sustainable instruments such as green bonds, sustainability-linked loans, and blended finance has provided diverse channels for financing renewable energy, pollution control, and social inclusion (

Anderson, 2016;

Agliardi & Chechulin, 2020;

Anis et al., 2023;

Kottas, 2025;

International Capital Market Association, 2023a,

2023b). Yet markets remain vulnerable to instability. Sudden disruptions, here conceptualized as financial swings, describe short-term nonlinear deviations that reorganize fiscal and financial interrelationships (

D’Orlando, 2010;

García-Medina & Aguayo-Moreno, 2023;

Manta et al., 2025;

Mayer, 2007). Unlike volatility, which represents noise, or long-term trends, which trace gradual change, swings embody abrupt structural shifts that can alter liquidity, investment behavior, and fiscal outcomes (

Wu et al., 2023;

Arı et al., 2025). They are shaped not only by macroeconomic variables such as GDP and interest rates, but also by globalization, regulation, technological and Greentech innovation (

Srivastava & Bhattacharya, 2018;

Botunac et al., 2024;

Asongu, 2013;

Ma & Li, 2024;

Koemtzopoulos et al., 2025;

Scaffidi, 2022).

To make sense of such complexity, metaphors can be analytically valuable. The concept of the Jazz Economy is particularly apt. Jazz as a musical form privileges improvisation, adaptability, and interaction, characteristics that resonate with the dynamics of modern financial systems operating under uncertainty (

Hatch, 1999;

Gold & Hirshfeld, 2005). In this study, we define the Jazz Economy as a perspective that interprets financial systems as improvisational ensembles where coordination is flexible, harmony emerges from diversity, and resilience depends on the capacity to adapt to sudden changes (

Engelen et al., 2010;

Prouty, 2013;

Laver, 2013). Rather than serving as mere metaphorical flourish, this lens underscores how financial and fiscal “improvisations” can generate either harmony, measured in terms of life satisfaction, or dissonance when fiscal and market elements fail to align.

Quality of life, understood as a multidimensional construct, extends beyond GDP to include both objective indicators (e.g., life expectancy, income, health) and subjective measures (e.g., life satisfaction) (

Felce & Perry, 1995;

Muldoon et al., 1998;

Govorova et al., 2020;

Estoque & Wu, 2023). Recent literature highlights that well-being outcomes are shaped not only by economic growth but also by environmental investments, fiscal stability, and social protection systems (

Joshanloo et al., 2019;

Niekerk, 2024;

Zakaria et al., 2024;

Nobre et al., 2019). The challenge, however, lies in identifying the nonlinear and sometimes paradoxical ways in which these variables interact. For example, higher GDP or longer life expectancy do not automatically translate into greater happiness, especially when fiscal or financial fragilities undermine stability (

García et al., 2019;

Frydman & Camerer, 2016).

Another important challenge concerns how the social and developmental impacts of financial decisions are assessed (

Awais et al., 2023). Scholars have long debated how to value outcomes such as inclusion, health, or environmental quality in ways that go beyond monetary returns (

Romero, 2011;

Gargani, 2017;

Reeder et al., 2015;

Grazier et al., 2013). Some authors stress the difficulty of operationalizing intangible benefits (

Doloi, 2012), while others point to innovative approaches that combine quantitative data with qualitative evaluation (

Malevskaia-Malevich et al., 2023;

García et al., 2019). These debates highlight the persistent tension between the measurability of social outcomes and the broader ambition of sustainable finance to serve the public good (

Udeagha & Muchapondwa, 2023).

Methodologically, evaluating these interactions requires moving beyond linear frameworks. Tools such as hierarchical clustering and neuro-fuzzy modelling enable the detection of latent patterns and nonlinearities that traditional regression often overlooks (

Eisen et al., 1998;

Ward, 1963;

Tibshirani et al., 2001;

Brlečić Valčić et al., 2021). Combining these methods with robustness checks, such as rolling windows, leave-one-out tests, or alternative distance metrics, helps mitigate biases from short panels and structural shocks (

Stekhoven & Bühlmann, 2012;

Ferreira et al., 2021;

Sheraz & Imran, 2021).

This paper builds on these debates by empirically modelling how sustainable finance affects quality of life in the EU. Drawing on EUROSTAT data for 27 member states (2019–2022), it explores whether distinct clusters of fiscal, financial, and social indicators, interpreted as financial swings, predict both objective and subjective dimensions of well-being. Two hypotheses are tested: first, whether increases in public environmental spending and external financial resilience jointly support life satisfaction (H1); and second, whether financial swings can be clustered into meaningful patterns that nonlinearly predict well-being (H2). By integrating the concepts of financial swings and the Jazz Economy with advanced modelling techniques such as ANFIS, this study aims to move beyond conventional approaches and contribute to a deeper understanding of how sustainable finance can generate tangible improvements in societal well-being (

Niekerk, 2024;

Jovović & Vuković, 2024;

Ercegovac et al., 2024).

2. Materials and Methods

The analysis uses a balanced panel of EUROSTAT indicators covering the 27 EU member states for the period 2019–2022. Selected variables reflect both financial dynamics and societal outcomes: green bond issuance, market capitalization, environmental taxation, social spending, net international investment position, life expectancy, and subjective life satisfaction. This combination enables the construction of a composite quality-of-life index that integrates objective and subjective dimensions of well-being (

Felce & Perry, 1995;

Joshanloo et al., 2019).

To address potential limitations of short time series, the dataset is complemented with robustness checks excluding pandemic years and with sensitivity tests using rolling windows. Missing values are imputed using the MissForest algorithm, which has proven effective in handling mixed-type data (

Stekhoven & Bühlmann, 2012). Diagnostics and sensitivity analyses were performed by comparing MissForest outputs with complete-case estimations, confirming the stability of results.

The indicators, their Eurostat codes, thematic roles, and units of measure are summarized in

Table 1.

Data preparation has been presented in

Table 2.

Hierarchical clustering is applied to variables (financial and social indicators), not to the countries. The objective was to identify groups of indicators that move together and form coherent structures, thereby revealing underlying “financial swing” patterns. Ward’s linkage and Euclidean distance are used to minimize within-group variance. The resulting clusters provide an interpretative framework in which sets of financial indicators (e.g., environmental spending and external balances) are directly linked with societal outcomes such as life expectancy and life satisfaction. This approach highlights interdependencies among indicators and supports the development of hypotheses about how specific financial configurations generate improvements in quality of life.

Clustering Component, specification and purpose has been presented in

Table 3.

For each such cluster (analogous to a “section” in the jazz-economy metaphor), a cluster score was obtained by taking the first principal component (PC1) of the variables that constituted the cluster.

In all instances, the explained variance was greater than 70 percent. These scores serve as a compressed, independent input to the predictive model.

To model nonlinear relationships between the clustered financial indicators and the composite quality-of-life index, we employ an ANFIS (

Brlečić Valčić et al., 2021). Gaussian membership functions are used to represent input variables, and a rule base of 81 fuzzy rules is constructed. Model training follows a hybrid approach combining least-squares and backpropagation algorithms.

To ensure methodological transparency, model performance is evaluated through k-fold cross-validation. Out-of-sample metrics include root mean squared error (RMSE), coefficient of determination (R2), and mean absolute percentage error (MAPE). Results are reported as averages with standard deviations across folds.

ANFIS Modelling Framework has been presented in

Table 4.

Sensitivity and Robustness Checks has been presented in

Table 5.

All analyses were carried out in MATLAB 2021a (The MathWorks, Natick, MA, USA).

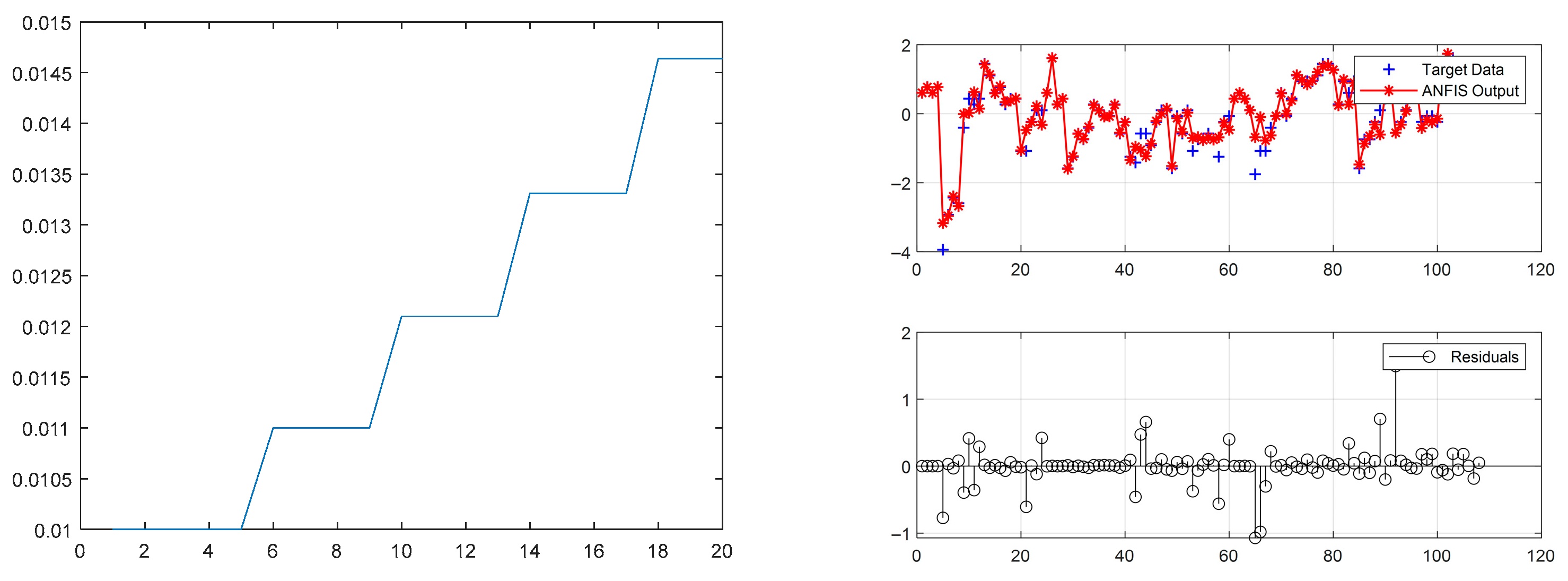

Training characteristics of the ANFIS model:

Number of nonlinear parameters: 36

Total number of parameters: 441

Number of training data pairs: 108

Number of checking data pairs: 0

Number of fuzzy rules: 81

Minimal training RMSE = 0.283876.

The training characteristics of the ANFIS model are shown in

Figure 1.

To assess whether ANFIS provides additional explanatory power, results are compared with benchmark models: linear regression, random forests, and generalized additive models. These models provide a reference for both linear and nonlinear dynamics, allowing for clearer interpretation of the relative contribution of the neuro-fuzzy approach.

Endogeneity and reverse correlation are addressed in two ways. First, the model specification includes lagged independent variables where available, reducing simultaneity bias. Second, sensitivity tests with instrumental variables (IV) are conducted using fiscal indicators (e.g., environmental taxation) as instruments for financial swings. These steps minimize the risk that improvements in life satisfaction merely reflect reverse causality from stronger fiscal and financial positions.

In line with the conceptual framing introduced in the Introduction, we explicitly connect the analytical design to the two guiding notions of this study. First, financial swings are operationalized through hierarchical clustering of the selected EUROSTAT indicators. Rather than treating indicators in isolation, clustering identifies coherent groups of variables whose joint dynamics represent abrupt but structured shifts in fiscal and financial conditions. In this way, swings are not defined as random volatility, but as meaningful configurations that reshape how indicators interact.

Second, the Jazz Economy metaphor provides the interpretive lens through which these nonlinear relationships are examined. Just as jazz ensembles generate harmony through improvisation and adaptive interaction, financial systems may create either coherence or dissonance depending on how fiscal, financial, and social variables align. The application of ANFIS allows these improvisational dynamics to be modelled explicitly: fuzzy rules capture the flexibility of interactions, while the neuro-adaptive component accounts for structural learning. Together, clustering and ANFIS translate the abstract notions of swings and improvisation into measurable patterns, thereby bridging metaphorical insight with empirical modelling.

3. Results

3.1. Hierarchical-Cluster Analysis

Based on the hierarchical-cluster analysis, the dendrogram in

Figure 2 shows that two major clusters predominate.

Hierarchical clustering produced two main clusters of indicators:

Cluster 1 is driven by Environmental protection investments of general government (7), which is strongly related to Expenditure on social protection as % of GDP (6). This group further connects to Green bonds issued (3), which in turn link to Environmental taxes (4) and Greenhouse-gas emissions (5). This cluster therefore captures the interaction of fiscal environmental policy, social expenditure, and market-based sustainability instruments.

Cluster 2 is organized around the Net international investment position (1), which is directly connected to Overall life satisfaction (8). The latter depends on Real GDP per capita (2) and Life expectancy at birth (9). This cluster reflects the importance of macro-financial resilience and economic performance for both objective and subjective well-being.

The two clusters are correlated through the link between Environmental protection investments of general government (7) and the Net international investment position (1). This interconnection suggests that fiscal commitment to environmental protection and macro-financial strength are not independent, but rather mutually reinforcing dimensions of sustainable development.

Taken together, these results confirm H2, as the indicators do not act in isolation but form distinct, interpretable patterns of “financial swings”. However, H1 is not confirmed at this stage, since clustering alone does not establish whether joint increases in environmental spending and external balance-sheet strength causally predict higher life satisfaction. This hypothesis is tested in subsequent nonlinear modelling.

3.2. ANFIS Analysis

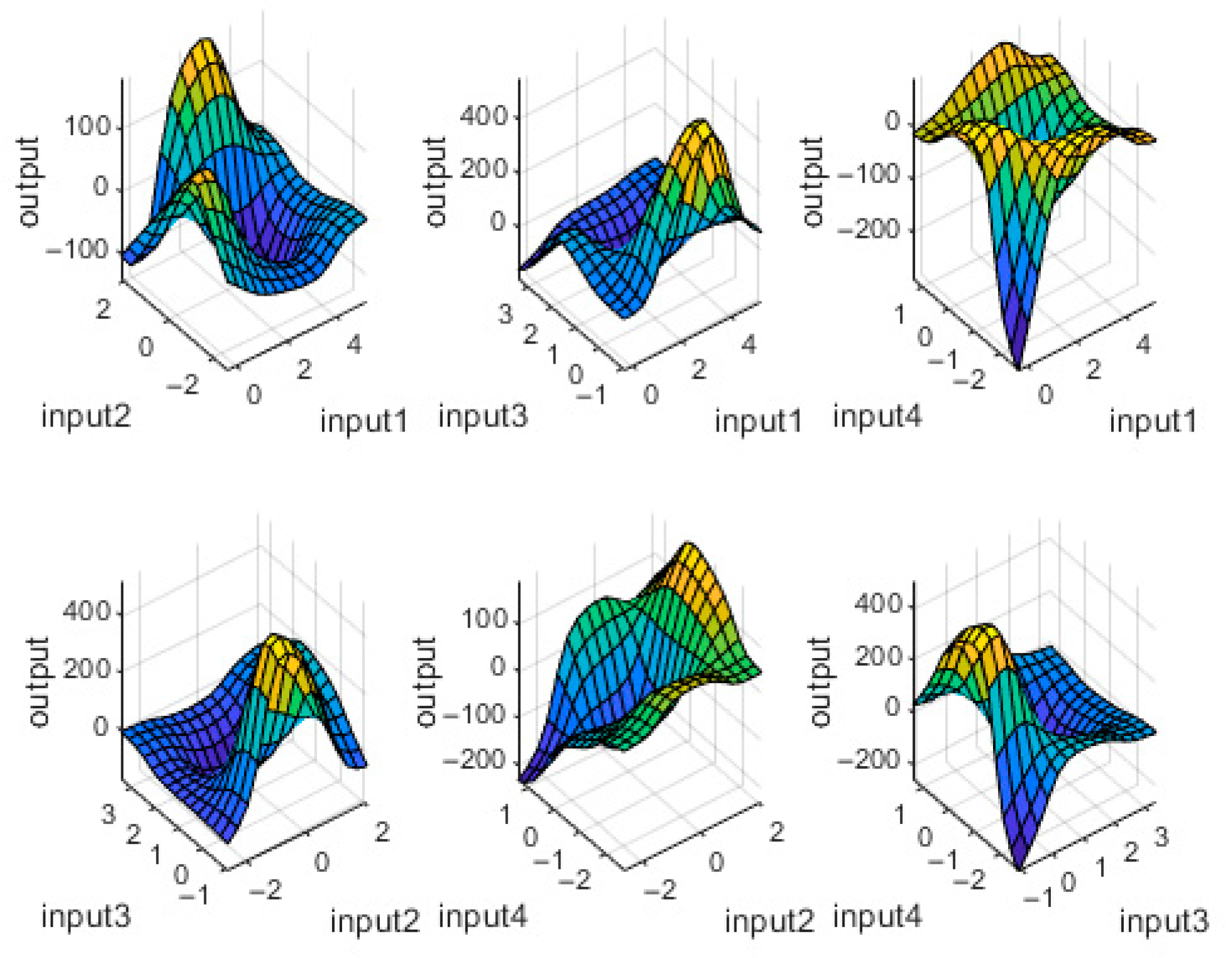

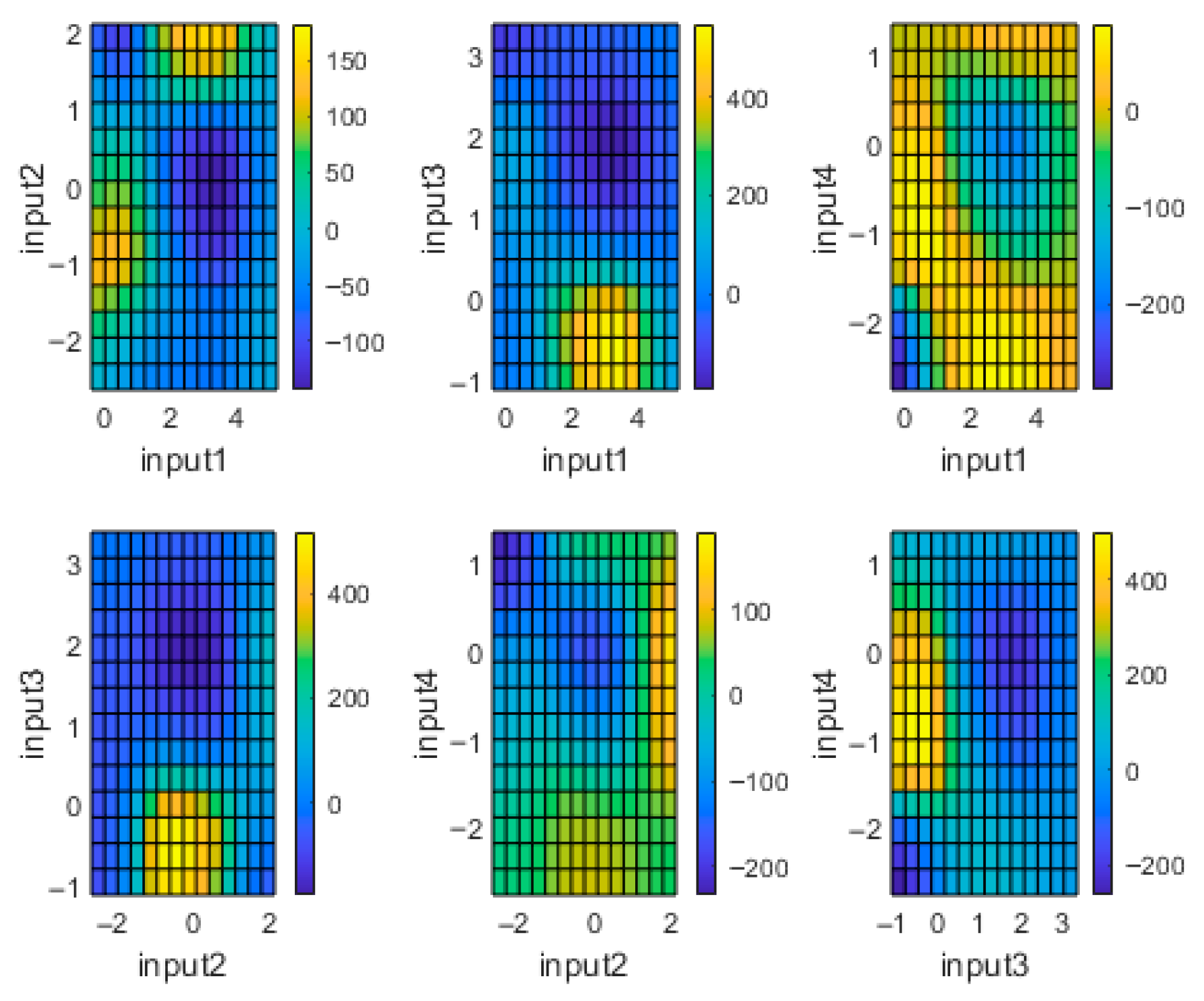

The ANFIS model tested nonlinear interactions between Environmental protection investments of general government (Input 1), Net international investment position (Input 2), Real GDP per capita (Input 3), and Life expectancy at birth (Input 4), with Overall life satisfaction as the output.

Figure 3 and

Figure 4 illustrate the main results.

For easier interpretation of the results,

Table 6 displays the rank values of each selected variable used in the ANFIS analysis.

- (a)

Environmental protection investments and net international investment position.

Life satisfaction reaches its highest values when environmental protection investments are either very low or medium-to-high, combined with a strong net international investment position. Conversely, medium environmental investments together with very high external balances yield very low life satisfaction. These findings highlight the nonlinear role of fiscal–financial interactions in shaping societal well-being and provide empirical support for H1.

- (b)

Environmental protection investments and GDP per capita.

Unexpectedly, combinations of medium-to-high environmental protection spending with medium GDP per capita are associated with very low life satisfaction, while medium-to-high environmental spending paired with low GDP per capita corresponds to very high life satisfaction. This suggests that growth in output alone does not guarantee higher well-being and that fiscal environmental policy may offset limitations in income levels.

- (c)

Environmental protection investments and life expectancy.

High-medium environmental spending with low life expectancy, or low spending with high life expectancy, both correspond to higher life satisfaction. However, when both indicators are simultaneously medium-to-high, life satisfaction decreases. Extremely low environmental investments coupled with extremely low life expectancy predict extremely low life satisfaction, confirming their joint critical role.

- (d)

Net international investment position and GDP per capita.

Medium external balances combined with low GDP per capita yield high life satisfaction, while median values of both indicators predict very low life satisfaction. These results suggest that resilience in external accounts can compensate for weaker income levels, but only under certain thresholds.

- (e)

Net international investment position and life expectancy.

High external balances combined with medium life expectancy correspond to high life satisfaction, while extremely low external balances with extremely high life expectancy result in extremely low life satisfaction. Moderate balances combined with high life expectancy produce only low life satisfaction, again underscoring the nonlinear character of these relationships.

- (f)

GDP per capita and life expectancy.

Low GDP per capita combined with moderate life expectancy predicts very high life satisfaction. By contrast, very low GDP with very low life expectancy, or medium-to-high GDP with medium-to-high life expectancy, correspond to very low life satisfaction. These paradoxical outcomes are consistent with research suggesting that beyond certain thresholds, objective indicators of prosperity and longevity do not translate directly into higher subjective well-being.

Taken together, these findings confirm H1 by demonstrating that the joint dynamics of environmental protection spending and macro-financial strength are the most consistent drivers of societal well-being. At the same time, they reveal complex nonlinearities in how GDP and life expectancy interact with fiscal and financial variables to shape life satisfaction.

4. Discussion

The analysis demonstrates that environmental protection investments combined with a favorable net international investment position consistently drive higher life satisfaction. This finding directly confirms H1 and underscores the role of fiscal commitment and macro-financial resilience as complementary forces. It aligns with research emphasizing that social well-being depends not only on growth but also on the stability of fiscal and external accounts. By integrating environmental priorities into public budgets, governments provide conditions for sustained improvements in quality of life, provided that external balances remain stable.

The ANFIS results also highlight several nonlinearities. Medium-to-high environmental spending with medium GDP per capita is associated with low life satisfaction, while the same level of spending with low GDP predicts high satisfaction. Similarly, life expectancy yields unexpected patterns: in some cases, higher longevity coincides with lower subjective satisfaction. These paradoxes echo findings from well-being literature, which stresses that beyond a certain threshold, increases in income or life expectancy do not automatically translate into greater happiness. Instead, the context in which fiscal and financial dynamics interact determines whether objective gains produce subjective improvements.

The Jazz Economy metaphor remains valuable as an interpretive lens. Just as jazz combines improvisation and harmony, sustainable finance must integrate diverse policy instruments and market mechanisms under uncertainty. The clustering of indicators into two distinct but interlinked structures reflect this improvisational order. However, the metaphor is meaningful only when connected to analytical findings. Here, it helps illustrate how fiscal and financial “improvisations” can either create harmony in the form of high satisfaction or dissonance reflected in low satisfaction.

The evolution of fiduciary duty further strengthens the practical relevance of these findings. Institutional investors are now expected to account for ESG considerations as part of their legal obligations. In this light, the demonstrated importance of environmental investments and external balance sheets provides evidence for expanding fiduciary responsibility beyond short-term returns. At the same time, FinTech and GreenTech offer enabling mechanisms to operationalize this transition (

Puschmann et al., 2020;

Srivastava & Bhattacharya, 2018;

Awais et al., 2023). Blockchain, AI, and digital reporting tools reduce information asymmetry, enhance ESG disclosure, and improve allocation efficiency. Integrating such innovations into fiscal and external balance monitoring can reinforce the positive link between sustainable finance and life satisfaction.

The results also carry important implications for policy. Balanced fiscal–financial strategies that prioritize environmental spending and maintain external stability yield measurable well-being gains. Quantifying these effects provides policymakers with actionable levers: for example, a one-percentage-point increase in environmental protection spending or improvements in net investment position could be directly tied to changes in life satisfaction. At the same time, the risk of greenwashing must be addressed. Our results suggest that without structural fiscal and financial foundations, market instruments such as green bonds alone are insufficient to drive well-being. Ensuring integrity in sustainable finance is therefore a prerequisite for translating capital flows into social outcomes.

Placing EU findings in a global context further enriches the analysis. Recent studies highlight the urgency of linking financial policies with ecological tipping points. Similarly, renewable energy access is strongly correlated with health and life expectancy, while fiscal–environmental reforms demonstrate how policy coordination improves social outcomes. Incorporating these perspectives situates the EU within a wider debate on how sustainable finance can simultaneously support ecological and social resilience.

5. Conclusions

This study sets out to examine how shifts in sustainable capital markets influence societal well-being, focusing on the interplay between environmental protection investments, external balance-sheet resilience, economic performance, and life expectancy. By combining hierarchical clustering with an Adaptive Neuro-Fuzzy Inference System, the analysis demonstrated that these indicators form distinct but interconnected patterns, and that their nonlinear dynamics are critical in explaining variations in life satisfaction across EU member states. The results confirm that environmental protection spending, and a strong net international investment position jointly provide the most stable pathway to improved well-being, while also revealing paradoxical relationships in which higher income or longevity do not always translate into greater subjective satisfaction.

The originality of this research lies in its attempt to move beyond linear models and one-dimensional explanations, instead recognizing that the relationship between finance and quality of life resembles an improvisational process rather than a predictable sequence. In this regard, the Jazz Economy metaphor proved useful as a narrative lens, though its value ultimately depends on how well it aligns with empirical evidence. By grounding the metaphor in measurable outcomes, the study shows that fiscal and financial “improvisations” can produce either harmony or dissonance in social welfare.

Several limitations must be acknowledged. The short time frame of the dataset, covering only four years and including the extraordinary circumstances of the pandemic, restricts the scope of conclusions. The absence of firm-level ESG data, digital finance adoption measures, and governance indicators further narrows the analysis, potentially overlooking mechanisms that operate within enterprises and financial institutions. Despite robustness checks, endogeneity and reverse causality remain methodological challenges that require more extensive datasets to address fully.

Nevertheless, the findings offer clear policy implications. Governments seeking to enhance societal well-being should combine environmental fiscal measures with strategies that strengthen external financial positions, rather than relying solely on market-based instruments such as green bonds or carbon taxes. Institutional investors, bound by an evolving fiduciary duty that now explicitly encompasses ESG considerations, also have a responsibility to align long-term portfolio strategies with these structural drivers of well-being. The enabling role of FinTech and GreenTech, from improving ESG disclosure to enhancing allocation efficiency, represents a further avenue for translating sustainable finance into tangible improvements in quality of life.

Looking ahead, future research should expand the empirical base, incorporating longer time spans, cross-regional comparisons, and corporate-level data to better capture how financial innovation interacts with social outcomes. Comparative perspectives from outside Europe, for instance, renewable energy and health linkages in Sub-Saharan Africa or fiscal–environmental reforms in Latin America, can provide valuable benchmarks for the EU. By embracing this broader and more integrative approach, scholars and policymakers alike can better understand how sustainable finance can serve not just as a mechanism for growth, but as a foundation for a more resilient and meaningful form of societal well-being.