The Impact of Green Banking Activities on Environmental Performance: A Youth-Driven Perception Study in Indonesian Financial Institutions

Abstract

1. Introduction

2. Materials and Method

3. Results

3.1. Demographic Attributes of Participants and Descriptive Variable

3.2. Validity and Reliability Results

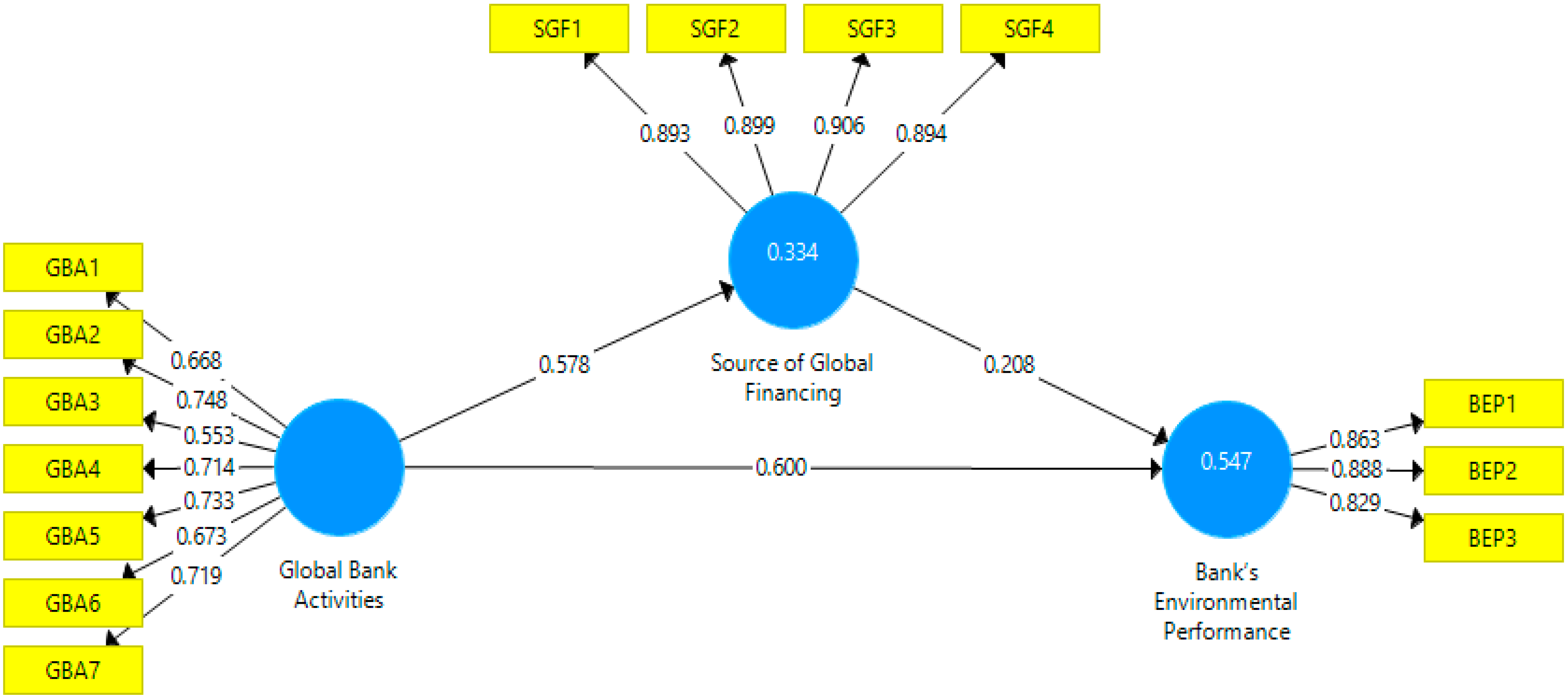

3.3. Hypothesis Testing

3.4. Major Challenges Affecting the Implementation of Green Banking

3.5. Major Benefits Affecting the Implementation of Green Banking

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Akter, N., Siddik, A. B., Saheb, M., & Mondal, A. (2018). Sustainability reporting on green financing: A study of listed private commercial banks in Bangladesh. Journal of Business and Technology, XII, 14–28. Available online: https://www.researchgate.net/publication/326623584 (accessed on 5 April 2025).

- Atif Nawaz, M., Seshadri, U., Kumar, P., Aqdas, R., Patwary, K. A., & Riaz, M. (2020). Nexus between green finance and climate change mitigation in N-11 and BRICS countries: Empirical estimation through difference in differences (DID) approach. Available online: https://link.springer.com/article/10.1007/s11356-020-10920-y (accessed on 5 April 2025).

- Bank for International Settlements (BIS). (2020). The green swan: Central banking and financial stability in the age of climate change. Bank for International Settlements. [Google Scholar]

- Bose, S., Khan, H. Z., Rashid, A., & Islam, S. (2018). What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pacific Journal of Management, 35(2), 501–527. [Google Scholar] [CrossRef]

- Chen, J., Siddik, A. B., Zheng, G. W., Masukujjaman, M., & Bekhzod, S. (2022). The effect of green banking practices on banks’ environmental performance and green financing: An empirical study. Energies, 15(4), 1292. [Google Scholar] [CrossRef]

- de Mariz, F., Aristizábal, L., & Andrade Álvarez, D. (2024). Fiduciary duty for directors and managers in the light of anti-ESG sentiment: An analysis of Delaware Law. Applied Economics, 57(30), 4309–4320. [Google Scholar] [CrossRef]

- Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499–516. [Google Scholar] [CrossRef]

- Guang-Wen, Z., & Siddik, A. B. (2023). The effect of fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: The role of green innovation. Environmental Science and Pollution Research, 30(10), 25959–25971. [Google Scholar] [CrossRef]

- Gutiérrez-Ponce, H., & Wibowo, S. A. (2023). Do sustainability activities affect the financial performance of banks? The case of Indonesian banks. Sustainability, 15(8), 6892. [Google Scholar] [CrossRef]

- Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2019). A primer on partial least squares structural equation modeling (PLS-SEM) (2nd ed.). Sage. [Google Scholar]

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. [Google Scholar] [CrossRef]

- Hakam, D. F., & Hakam, L. I. (2024). Sustainability in small and medium sized enterprises (SME) financing. Development and Sustainabaility in Economics and Finances, 2, 100031. Available online: https://www.sciencedirect.com/science/article/abs/pii/S2950524024000313 (accessed on 5 April 2025). [CrossRef]

- Hakam, D. F., Haryadi, F. N., Indrawan, H., Hanri, M., Hakam, L. I., Kurniawan, O., & Purnomoadi, A. P. (2024). Analyzing current trends in career choices and employer branding from the perspective of millenials within the indonesian energy sector. Energies, 17(11), 2570. [Google Scholar] [CrossRef]

- Hakam, D. F., Nuzula, N. A., Aprianingsih, A., & Utama, A. A. (2025). Youth persepectives on induction stoves: Advancing sustainable energy transitions in Indonesian cities. Frontiers in Sustainable Cities, 7, 1554457. Available online: https://www.frontiersin.org/journals/sustainable-cities/articles/10.3389/frsc.2025.1554457/full (accessed on 5 April 2025). [CrossRef]

- Hakam, L. I., Hakam, D. F., Wiryono, S. K., & Rahadi, R. A. (2025). The impact of sustainability literacy, social support, and attitudes towards innovation on sustainable energy consumption among Indonesian youth. Frontiers in Sustainable Cities, 7, 1606031. Available online: https://www.frontiersin.org/journals/sustainable-cities/articles/10.3389/frsc.2025.1606031/full (accessed on 5 April 2025). [CrossRef]

- He, L., Liu, R., Zhong, Z., Wang, D., & Xia, Y. (2019a). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renewable Energy, 143, 974–984. [Google Scholar] [CrossRef]

- He, L., Zhang, L., Zhong, Z., Wang, D., & Wang, F. (2019b). Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. Journal of Cleaner Production, 208, 363–372. [Google Scholar] [CrossRef]

- Hoque, N., Mowla, M. M., Uddin, M. S., Mamun, A., & Uddin, M. R. (2019). Green banking practices in Bangladesh: A critical investigation. International Journal of Economics and Finance, 11(3), 58. [Google Scholar] [CrossRef]

- Hossain, A., Rahman, M., Sazzad, H., & Karim, R. (2020). The effects of green banking practices on financial performance of listed banking companies in Bangladesh. Canadian Journal of Business and Information Studies, 2(6), 120–128. [Google Scholar] [CrossRef]

- Huang, Y., Chen, C., Lei, L., & Zhang, Y. (2022). Impacts of green finance on green innovation: A spatial and nonlinear perspective. Journal of Cleaner Production, 365, 132548. [Google Scholar] [CrossRef]

- Islam, M. S., Rubel, M. R. B., & Hasan, M. M. (2023). Environmental and social performance of the banking industry in Bangladesh: Effect of stakeholders’ pressure and green practice adoption. Sustainability, 15(11), 8665. [Google Scholar] [CrossRef]

- Jillani, H., Chaudhry, M. N., Zahid, H., & Iqbal, M. N. (2024). The mediating role of stakeholders on green banking practices and bank’s performance: The case of a developing nation. PLoS ONE, 19(5), e0300585. [Google Scholar] [CrossRef]

- Kala, K. N. (2020). A study on the impact of green banking practices on bank’s environmental performance with special reference to Coimbatore city. African Journal of Business and Economic Research, 15, 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3699973 (accessed on 5 April 2025).

- Khairunnessa, F., Vazquez-Brust, D. A., & Yakovleva, N. (2021). A review of the recent developments of green banking in Bangladesh. Sustainability, 13(4), 1904. [Google Scholar] [CrossRef]

- Khan, I. U., Hameed, Z., Khan, S. U., & Khan, M. A. (2024). Green banking practices, bank reputation, and environmental awareness: Evidence from Islamic banks in a developing economy. Environment, Development and Sustainability, 26(6), 16073–16093. [Google Scholar] [CrossRef]

- Miah, M. D., Rahman, S. M., & Haque, M. (2018). Factors affecting environmental performance: Evidence from banking sector in Bangladesh. International Journal of Financial Services Management, 9(1), 22. [Google Scholar] [CrossRef]

- Otoritas Jasa Keuangan. (2018). Pedoman teknis bagi bank terkait implementasi POJK nomor 51/POJK.03/2017 tentang penerapan keuangan berkelanjutan bagi lembaga jasa keuangan (LJK), emiten, dan perusahaan publik. Available online: https://ojk.go.id/id/regulasi/Pages/Penerapan-Keuangan-Berkelanjutan-bagi-Lembaga-Jasa-Keuangan,-Emiten,-dan-Perusahaan-Publik.aspx (accessed on 5 April 2025).

- Qureshi, M. H., & Hussain, T. (2020). Green banking products: Challenges and issues in Islamic and traditional banks of Pakistan. Journal of Accounting and Finance in Emerging Economies, 6(3), 703–712. [Google Scholar] [CrossRef]

- Rahmatullah, M., & Hakam, D. F. (2025). Unveiling the Nexus: ESG reporting, financial performance, and IPO underpricing in the Indonesian stock market. Development and Sustainability in Economics and Finance, 7, 100064. Available online: https://www.sciencedirect.com/science/article/abs/pii/S2950524025000241 (accessed on 5 April 2025).

- Raihan, M. Z. (2007). Sustainable finance for growth and development of banking industry in Bangladesh: An equity perspective. MIST International Journal of Science and Technology, 7(1), 41–51. [Google Scholar] [CrossRef]

- Rehman, A., Ullah, I., Afridi, F. E. A., Ullah, Z., Zeeshan, M., Hussain, A., & Rahman, H. U. (2021). Adoption of green banking practices and environmental performance in Pakistan: A demonstration of structural equation modelling. Environment, Development and Sustainability, 23(9), 13200–13220. [Google Scholar] [CrossRef]

- Rohman, I. K. (2024). Indonesia’s millennials and gen zs: Are they financially (il)literate? In Understanding the role of Indonesian millennials in shaping the nation’s future. ISEAS—Yusof Ishak Institute. [Google Scholar]

- RRI. (2024). Apa itu generasi milenial, baby boomers, gen X, gen Z, dan gen alpha. Available online: https://www.rri.co.id/iptek/509842/apa-itu-generasi-milenial-baby-boomers-gen-x-gen-z-dan-gen-alpha (accessed on 5 April 2025).

- Salim, M. A. (2018). Kesiapan pemerintah menerapkan green banking melalui PJOK dalam mewujudkan pembangunan berkelanjutan berdasarkan hukum positif di Indonesia. Yustitia, 4(2), 119–141. [Google Scholar] [CrossRef]

- Setyo, B. (2014). Mengawal green banking di Indonesia dalam rangka pembangunan berkelanjutan. Edu Elektrika Journal, 3(2). [Google Scholar]

- Sharma, M., & Choubey, A. (2021). A qualitative study on role of information technology in Indian banking sector. AIMA Journal of Management & Research, 15, 1–24. [Google Scholar]

- Sharma, M., & Choubey, A. (2022). Green banking initiatives: A qualitative study on Indian banking sector. Environment, Development and Sustainability, 24(1), 293–319. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F., & Yoshino, N. (2020). Sustainable solutions for green financing and investment in renewable energy projects. Energies, 13(4), 788. [Google Scholar] [CrossRef]

- UNEP FI. (2024). 2024 annual overview. UN Environment Programme Finance Initiative. [Google Scholar]

- Van Hoa, N., Van Hien, P., Tiep, N. C., Huong, N. T. X., Mai, T. T. H., & Phuong, P. T. L. (2022). The role of financial inclusion, green investment and green credit on sustainable economic development: Evidence from Vietnam. Cuadernos de Economia, 45(127), 1–10. Available online: https://cude.es/submit-a-manuscript/index.php/CUDE/article/view/210 (accessed on 5 April 2025).

- Wu, X., Sadiq, M., Chien, F., Ngo, Q.-T., & Nguyen, A.-T. (2021). Testing role of green financing on climate change mitigation: Evidences from G7 and E7 countries The-Truyen Trinh 8. Available online: https://link.springer.com/article/10.1007/s11356-021-15023-w (accessed on 5 April 2025).

- Xing, C., Zhang, Y., & Wang, Y. (2020). Do banks value green management in China? The perspective of the green credit policy. Finance Research Letters, 35, 101601. [Google Scholar] [CrossRef]

- Ye, J., & Dela, E. (2023). The effect of green investment and green financing on sustainable business performance of foreign chemical industries operating in Indonesia: The mediating role of corporate social responsibility. Sustainability, 15(14), 11218. [Google Scholar] [CrossRef]

- Yu, C. H., Wu, X., Zhang, D., Chen, S., & Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy, 153, 112255. [Google Scholar] [CrossRef]

- Zhang, S., Wu, Z., Wang, Y., & Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. Journal of Environmental Management, 296, 113159. [Google Scholar] [CrossRef] [PubMed]

- Zhang, X., Wang, Z., Zhong, X., Yang, S., & Siddik, A. B. (2022). Do green banking activities improve the banks’ environmental performance? The mediating effect of green financing. Sustainability, 14(2), 989. [Google Scholar] [CrossRef]

- Zheng, G. W., Siddik, A. B., Masukujjaman, M., & Fatema, N. (2021). Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability, 13(18), 10165. [Google Scholar] [CrossRef]

| Country | Quantity of Samples | Sector | Methods | Focus | Dependent Variable | Independent Variable | Source |

|---|---|---|---|---|---|---|---|

| Bangladesh | 352 Bankers | Private Commercial Banking | Partial Least Squares-based Structural Equation Modelling (PLS-SEM) | Green financing is considered a mediator between green banking and environmental performance. | Bank’s Environmental Performance | Independent Variable: Green Banking Activities. Intervening/Mediating Variable: Source of Green Financing | (X. Zhang et al., 2022) |

| Pakistan | 250 Bankers | Banking | Mixed Methods (Survey and In-depth Interviews), PLS-SEM | Examines how stakeholders mediate green banking practices and environmental performance. | Bank’s Performance | Independent Variable: Green Banking Practices, Intervening/Mediating Variable: Stakeholders’ Influence | (Jillani et al., 2024) |

| Bangladesh | 14 Listed Banks | Banking from 2011 to 2020 | Two-stage least square (2SLS) regression analysis | The relationship between green banking and banks’ financial performance | Financial Performance: Return on Assets (ROA), Return on Equity (ROE), Market Value (MV) | Independent Variable: Green Banking Practice Variable: Green Cost (GCOS): Volume of Risk Management Committee (VRMC). Control Variable: Operating Cost Ratio (OCR), Bank Size (BSIZE) | (Hossain et al., 2020) |

| Bangladesh | 322 Bankers | Private Commercial Banking | Structural Equation Model (SEM) | Examines how green banking affects banks’ environmental performance. | Banks’ Environmental Performance: Environmental sustainability metrics reported by banks | Independent Variable: green Banking Practices: Banks Employee Related Practices (BERP), Operation (BORP, Customer (BCRP), and Policy (BPRP) Intervening/Mediating Variable: Green Financing | (Chen et al., 2022) |

| Indonesia | 5 Banks | Banking from 2010 to 2020 | Panel data (ESG data from Thomson Reuters), statistical correlations, and regression models | Assesses how sustainability actions affect bank finances. | Financial Performance: Measures like Return on Assets (ROA), Return on Equity (ROE), and other profitability metrics | Independent Variable: Sustainability Activities: environmental, social, and governance. Control Variable: Size and Leverage | (Gutiérrez-Ponce & Wibowo, 2023) |

| India | 36 Bankers from 12 banks | Public and Private Banking | Qualitative Study (Interviews): Content Analysis | Examines how green product innovation, CSR, and internal processes affect brand image and confidence in green banking. | Environmental Performance: Improvement in environmental practices and reduction in carbon footprint | Green Banking Initiatives: Implementation of eco-friendly practices and policies | (Sharma & Choubey, 2022) |

| Bangladesh | 302 Bankers | Banking | PLS-SEM | Examines how Fintech adoption affects green finance and environmental performance during COVID-19. | Environmental Performance: Metrics related to sustainability and green practices | Independent Variable: Fintech adoption and Green Finance Intervening/Mediating Variable: Green Innovation | (Guang-Wen & Siddik, 2023) |

| Bangladesh | 540 Bankers from 30 Banks | Private Commercial Banking | PLS-SEM | Examines Bangladesh’s financial performance and green banking. | Environmental Performance and Social Performance | Independent Variable: Stakeholders’ Pressure: Customer, Competitors, Employee, Government, Senior Managers Intervening/Mediating Variable: Green Practice Innovation | (Islam et al., 2023) |

| Pakistan | 390 Bankers | Islamic Banking | PLS-SEM | Examines how workers’ environmental knowledge affects Pakistani Islamic banks’ green banking operations and reputation. | Bank Reputation | Independent Variable: Employees, Daily operations, Customers, and Bank Policy Moderating Variable: Environmental Awareness | (Khan et al., 2024) |

| Indonesia | 238 foreign chemical companies | Chemical Industry | PLS-SEM | Examines how green funds and investment affect CSR and sustainable enterprise performance. | Sustainable Business Performance | Independent Variable: Green Investment and Green Financing Intervening/Mediating Variable: Corporate Social Responsibility | (Ye & Dela, 2023) |

| Vietnam | 35 observations over the period from 1986 to 2020 | Sustainable Economic Development | Regression Analysis | Examines how financial inclusion, green investment, and green loans affect Vietnam’s SED. | Sustainable Economic Development | Assess to Outstanding Deposits, Assess to Outstanding Loans, Green Investment, Green Credit, Foreign Direct Investment | (Van Hoa et al., 2022) |

| China | 1.699 listed industrial firms | Industrial | Quantitative (Survey) | Examines how funding restrictions affect green innovation. | Sustainability Performance: Overall sustainability metrics | Financial Inclusion: Access to financial services; Green Investment: Investment in sustainable projects; Green Credit: Loans for eco-friendly projects | (Yu et al., 2021) |

| Bangladesh | 302 bankers | Financial | PLS-SEM | In underdeveloped economies like Bangladesh, examine how green finance affects the sustainability of financial institutions. | Sustainability Performance: Environmental and social performance metrics | Factors: Green finance, regulatory policies, stakeholder engagement | (Zheng et al., 2021) |

| China | 141 listed renewable energy enterprises | Renewable Energy | Quantitative Analysis (Panel Data Regression) | Examines whether green finance boosts renewable energy investment efficiency. | Investment Efficiency: Metrics related to renewable energy investment returns | Green Financial Development: Financial policies and products promoting green investments | (He et al., 2019a) |

| Japan | case studies and examples of solutions for green financing | Renewable Energy | Qualitative Analysis | Examines green financial alternatives and their environmental impact. | Environmental Sustainability: Impact metrics related to sustainability practices | Green Financing Solutions: Policies and practices promoting green finance | (Taghizadeh-Hesary & Yoshino, 2020) |

| G7 and E7 countries | 14 countries | Economic and Environmental | Structural Equation Modeling (SEM) | Estimates how a cleaner environment will boost E7 and G7 GDP over time. | Climate Change Mitigation: Reduction in greenhouse gas emissions | Green Financing: Investments in green projects and technologies | (Wu et al., 2021) |

| China | 19.630 firm-year observations from listed companies | Banking and Corporate Finance | Quantitative Analysis (Regression) | Examines China’s green credit policy’s impact on green management and bank lending. | Bank Loans | Independent Variable: Green Management Moderating Variable: Disclosure Choice & Quality, Government Pressure A & B Control Variable: State-Owned Enterprise, Age, Ownership Concentration, etc. | (Xing et al., 2020) |

| China | 30 provinces | Green Finance and Innovation | Quantitative Analysis (Regression Analysis) | Explores the geographical and non-linear effects of green funding on green innovation. | Green Innovation: Number of green patents and eco-friendly technologies developed | Green Finance: Availability and amount of green financial products | (Huang et al., 2022) |

| China | 945 listed companies and 30 provinces | Environmental and Financial | Mixed Methods | GCP may promote sustainability. Little research exists on its policy effects on “two high” (high energy consumption and pollution) enterprises’ micro and macro investment and financing and environmental quality. | Sustainable Development: Metrics related to environmental, social, and economic sustainability | Green Finance: Investments, policies, and financial products supporting sustainability | (S. Zhang et al., 2021) |

| China | 150 listed renewable energy companies | Renewable Energy | Quantitative Analysis | Develop a threshold effect model to examine the non-linear relationship between renewable energy investment and the green economy development index from a green credit perspective. | Green Economy: Growth in the green sector | Green Credit: Loans and credits supporting green projects; Renewable Energy Investment: Amount invested in renewable energy projects | (He et al., 2019b) |

| Latent Variable | Indicators | Definition | Items |

|---|---|---|---|

| Green banking activities (GBA) | Independent Variable | An emerging concept that has a crucial impact on the fields of climatic phenomena, financial market activities, and the sustainable economic progress of a nation |

|

| The bank’s Environmental performance (BEP) | Dependent Variable | The impact of a company’s activities on the ecological system |

|

| Source of Green Financing (SGF) | Intervening Variable | This phrase has many interpretations in both academic and business contexts |

|

| Variable and Indicators | Mean | S.D. | |

|---|---|---|---|

| Green Banking Activities | |||

| 1. | Introducing energy-efficient systems, solutions, and practices (GBA1) | 4.07 | 0.695 |

| 2. | Introducing online banking facilities (GBA2) | 4.03 | 0.734 |

| 3. | Providing loans for eco-friendly projects (GBA3) | 4.21 | 0.757 |

| 4. | Convening seminars and conferences to advocate for environmentally sustainable behavior (GBA4) | 3.94 | 0.776 |

| 5. | Establishment of more green branches (GBA5) | 3.91 | 0.843 |

| 6. | Reduction in paper consumption (GBA6) | 4.23 | 0.899 |

| 7. | Promoting customers’ engagement in environmentally sustainable banking practices, including bill payment via the Internet, online deposit, and e-statements (GBA7) | 4.39 | 0.743 |

| Average Green Banking Activities | 4.11 | 0.535 | |

| Variable and Indicators | Mean | S.D. | |

|---|---|---|---|

| Source of Green Financing | |||

| 1. | Financial institutions have invested more on renewable energy sectors (SGF1) | 3.42 | 0.969 |

| 2. | Financial institutions have invested more on energy efficiency projects (SGF2) | 3.46 | 0.922 |

| 3. | Financial institutions have made more investments in recycling and items that can be recycled (SGF3) | 3.53 | 0.876 |

| 4. | Financial institutions have allocated additional resources for waste collection and other environmentally sustainable initiatives (SGF4) | 3.47 | 0.922 |

| Average Source of Green Financing | 3.47 | 0.828 | |

| Variable and Indicators | Mean | S.D. | |

|---|---|---|---|

| Bank’s Environmental Performance | |||

| 1. | Reducing energy consumption (BEP1) | 4.02 | 0.823 |

| 2. | Reducing carbon emissions (BEP2) | 3.82 | 0.916 |

| 3. | Delivering environmental education to employees on energy and paper conservation (BEP3) | 3.99 | 0.883 |

| Average Bank’s Environmental Performance | 3.94 | 0.752 | |

| Variables | Item | CA | KMO | FL | Result |

|---|---|---|---|---|---|

| Green banking activities (GBA) | GBA1 | 0.813 | 0.801 | 0.844 | Valid and Reliable |

| GBA2 | 0.813 | ||||

| GBA3 | 0.784 | ||||

| GBA4 | 0.825 | ||||

| GBA5 | 0.824 | ||||

| GBA6 | 0.733 | ||||

| GBA7 | 0.781 | ||||

| Source of Green Financing (SGF) | SGF1 | 0.919 | 0.799 | 0.805 | Valid and Reliable |

| SGF2 | 0.797 | ||||

| SGF3 | 0.794 | ||||

| SGF4 | 0.802 | ||||

| Bank’s Environmental Performance | BEP1 | 0.823 | 0.704 | 0.695 | Valid and Reliable |

| BEP2 | 0.664 | ||||

| BEP3 | 0.774 |

| Hypothesis | Path | Estimate | t-Stat | p-Value | Result |

|---|---|---|---|---|---|

| H1 | GBA → BEP | 0.600 | 10.795 | 0.000 | Ha1 accepted |

| H2 | GBA → SGF | 0.578 | 13.515 | 0.000 | Ha2 accepted |

| H3 | SGF → BEP | 0.208 | 3.813 | 0.000 | Ha3 accepted |

| H4 | GBA → SGF → BEP | 0.120 | 3.562 | 0.000 | Ha4 accepted |

| No. | Challenges | Freq. | Percent |

|---|---|---|---|

| 1 | Lack of awareness regarding green financing | 74 | 23.6 |

| 2 | High investment costs | 55 | 17.5 |

| 3 | Low demand for Green Financing | 42 | 13.4 |

| 4 | Difficulties and complexities in assessing green projects | 36 | 11.5 |

| 5 | Technical barriers (knowledge, personally driven) | 34 | 10.8 |

| 6 | Diversification issues (diversity of types of credit and green projects) | 23 | 7.3 |

| 7 | Credit Risk in Green Financing | 22 | 7 |

| 8 | Operational inadequacy | 13 | 4.1 |

| 9 | Lack of competent and trained staff in assessing green financing | 10 | 3.2 |

| 10 | Reduction in bank competitiveness in the short-term | 5 | 1.6 |

| Total | 314 | 100.0 | |

| No. | Benefits | Freq. | Percent |

|---|---|---|---|

| 1 | Contribution to the achievement of sustainable national economic development | 76 | 24.2 |

| 2 | Provision of environmental benefits | 74 | 23.6 |

| 3 | Long-term cost and expense reduction | 39 | 12.4 |

| 4 | Carbon footprint reduction | 32 | 10.2 |

| 5 | Providing environmentally friendly products | 24 | 7.6 |

| 6 | Increasing Bank competitiveness | 17 | 5.4 |

| 7 | Reputation promotion | 16 | 5.1 |

| 8 | Energy conservation | 11 | 3.5 |

| 9 | Higher profits for Banks in the long term | 9 | 2.9 |

| 10 | Provision of online banking facilities | 8 | 2.5 |

| 11 | Savings in paper consumption | 5 | 1.6 |

| 12 | Tax benefits | 1 | 0.3 |

| 13 | Contribution to the achievement of sustainable national economic development | 1 | 0.3 |

| 14 | Increased customer goodwill | 1 | 0.3 |

| Total | 314 | 100.0 | |

| Study | Independent Variable | Mediator Variable | Dependent Variable | Significant Variables |

|---|---|---|---|---|

| Current Study | Green Banking Activities | Green Financing | Environmental Performance | All variables significant |

| X. Zhang et al. (2022) | Green Banking Activities | Green Financing | Environmental Performance | All variables significant |

| Jillani et al. (2024) | Green Banking Practices | Stakeholders’ Influence | Bank’s Performance | Green banking practices significant |

| Chen et al. (2022) | Green Banking Policies | Green Financing | Environmental Sustainability | All variables significant |

| Gutiérrez-Ponce and Wibowo (2023) | Sustainability Activities | None | Financial Performance (ROA, ROE) | Sustainability activities significant |

| Sharma and Choubey (2022) | Green Banking Initiatives | None | Environmental Practices | Green CSR significant |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Setyorini, M.; Hakam, D.F. The Impact of Green Banking Activities on Environmental Performance: A Youth-Driven Perception Study in Indonesian Financial Institutions. J. Risk Financial Manag. 2025, 18, 558. https://doi.org/10.3390/jrfm18100558

Setyorini M, Hakam DF. The Impact of Green Banking Activities on Environmental Performance: A Youth-Driven Perception Study in Indonesian Financial Institutions. Journal of Risk and Financial Management. 2025; 18(10):558. https://doi.org/10.3390/jrfm18100558

Chicago/Turabian StyleSetyorini, Maharestu, and Dzikri Firmansyah Hakam. 2025. "The Impact of Green Banking Activities on Environmental Performance: A Youth-Driven Perception Study in Indonesian Financial Institutions" Journal of Risk and Financial Management 18, no. 10: 558. https://doi.org/10.3390/jrfm18100558

APA StyleSetyorini, M., & Hakam, D. F. (2025). The Impact of Green Banking Activities on Environmental Performance: A Youth-Driven Perception Study in Indonesian Financial Institutions. Journal of Risk and Financial Management, 18(10), 558. https://doi.org/10.3390/jrfm18100558