Navigating the Green Frontier: Dynamic Risk and Return Transmission Between Clean Energy ETFs and ESG Indexes in Emerging Markets

Abstract

1. Introduction

- To what extent are ESG and Clean Energy indexes dynamically connected in BRICS markets?

- How do these connections influence portfolio diversification and risk management?

- What are the implications for investors seeking to balance risk and return amid global uncertainty?

2. Literature Review

3. Data and Methodology

3.1. Data

3.2. Adopted Methodology

3.2.1. Time-Varying Connectedness via TVP-VAR Modeling

3.2.2. Portfolio Implications

The Minimum Variance Approach

The Minimum Connectedness Approach

3.2.3. Portfolio Back Testing

4. Results and Discussion

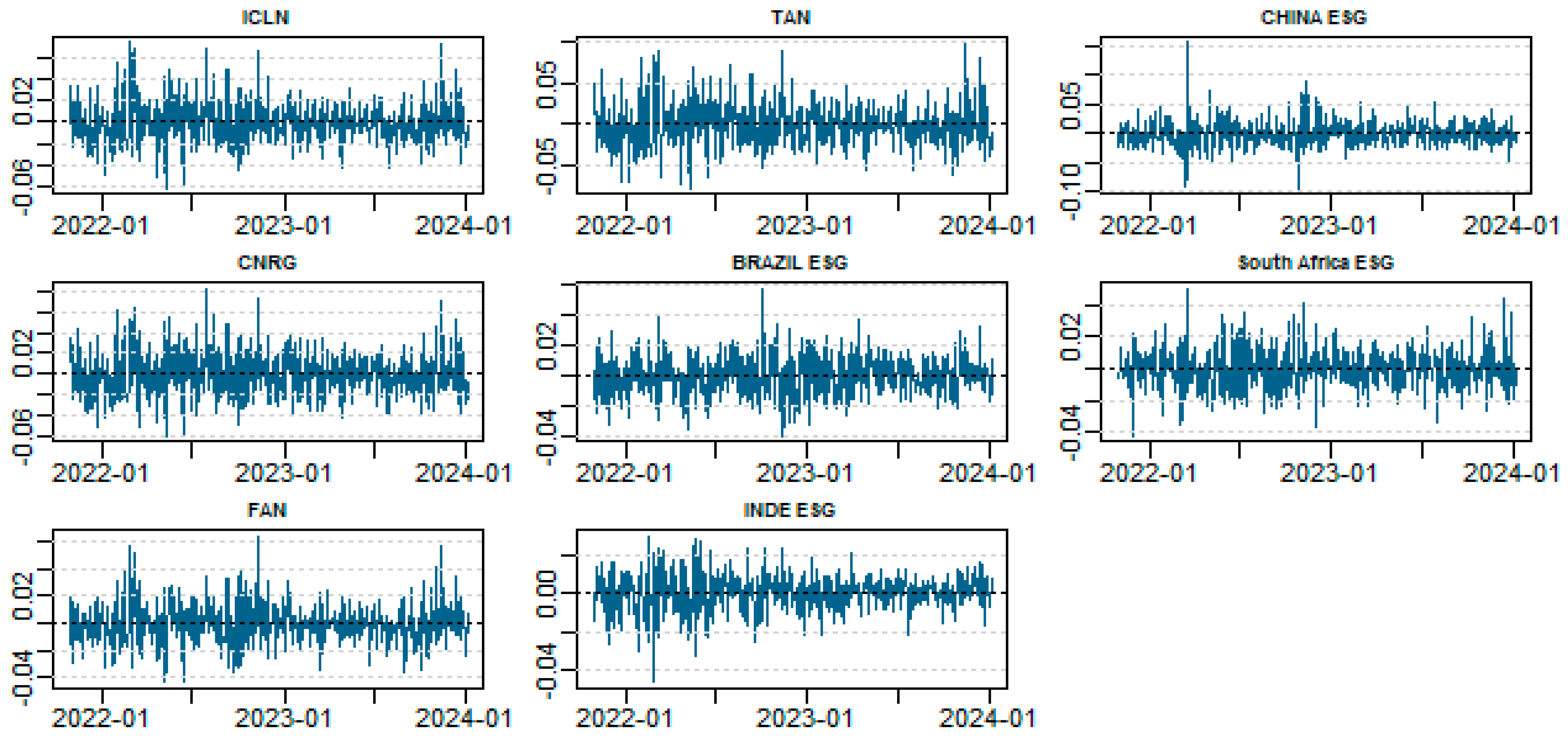

4.1. Descriptive Statistics

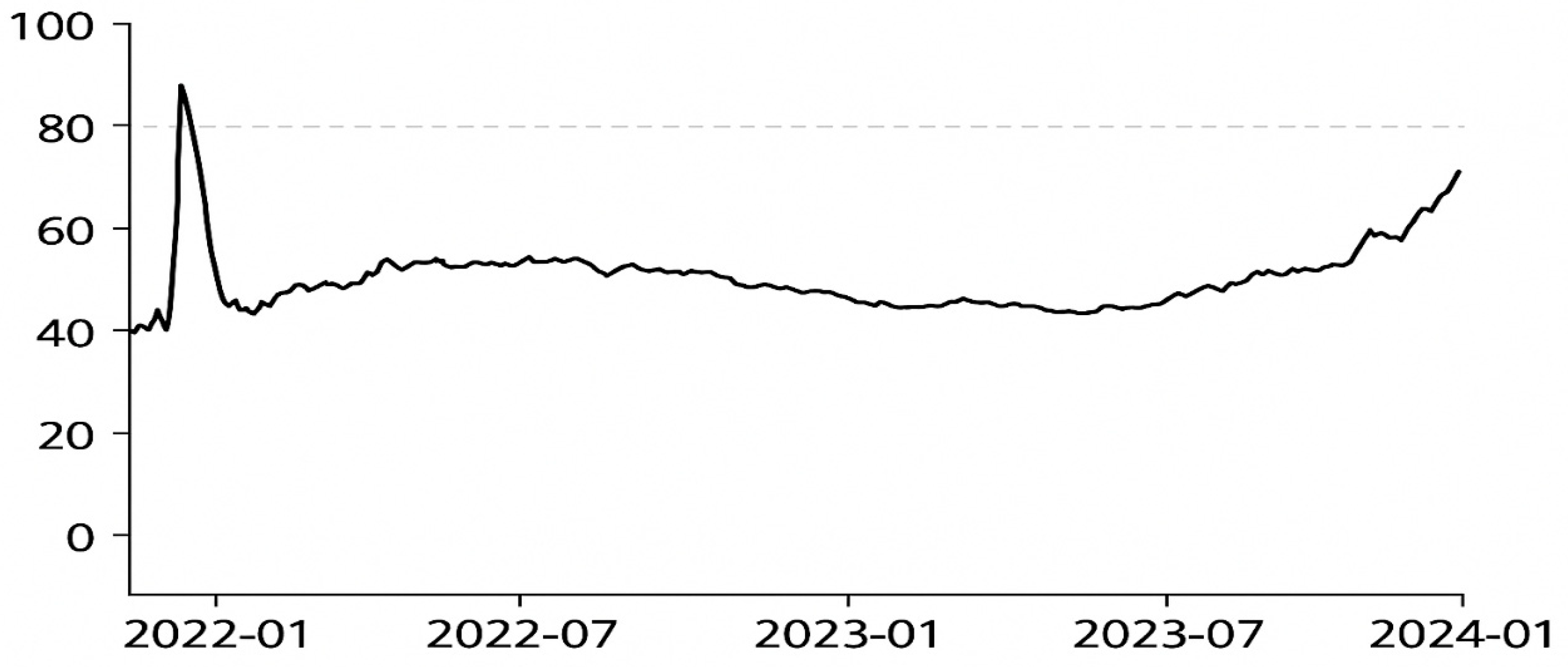

4.2. Dynamic Total Connectedness Analysis

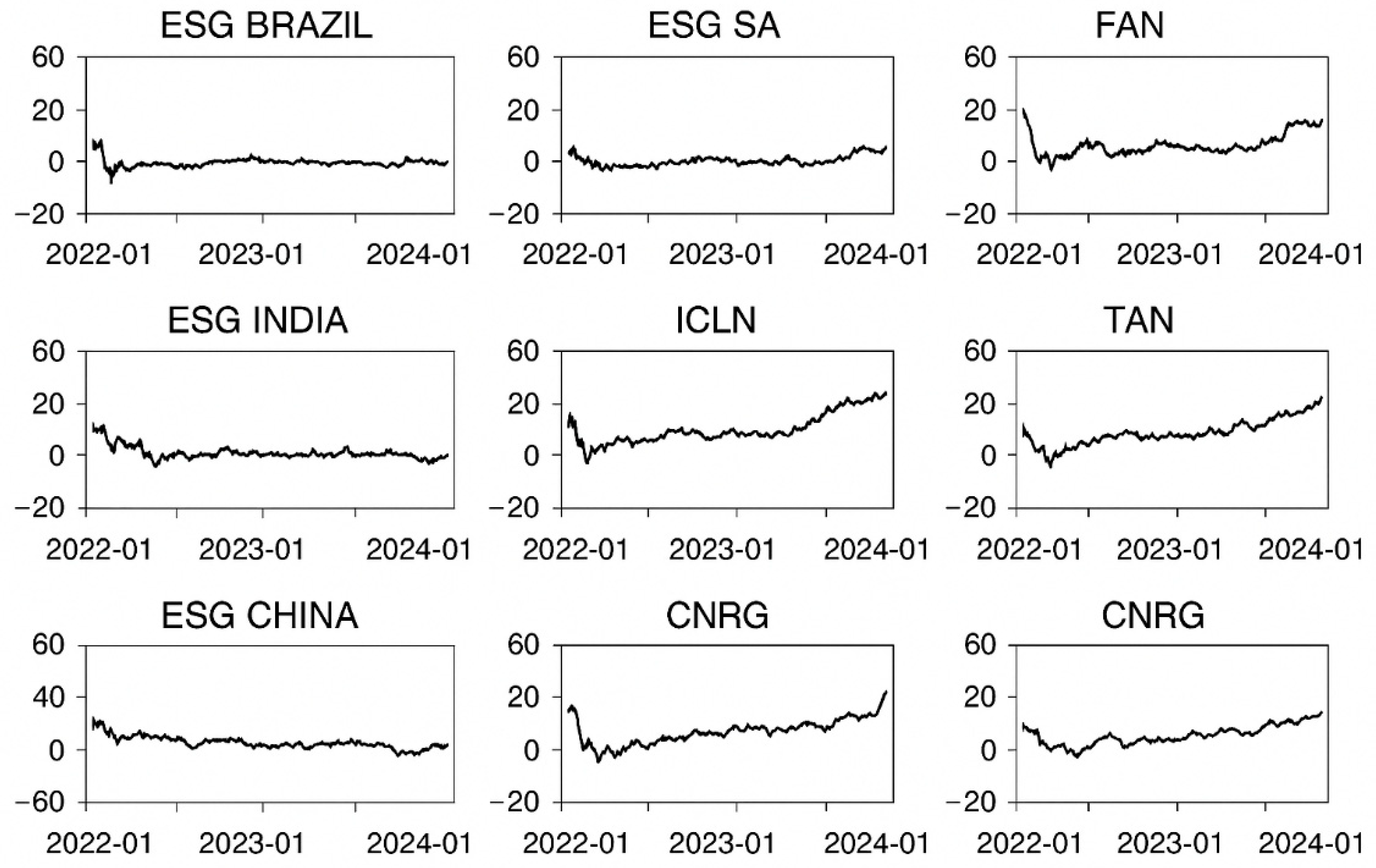

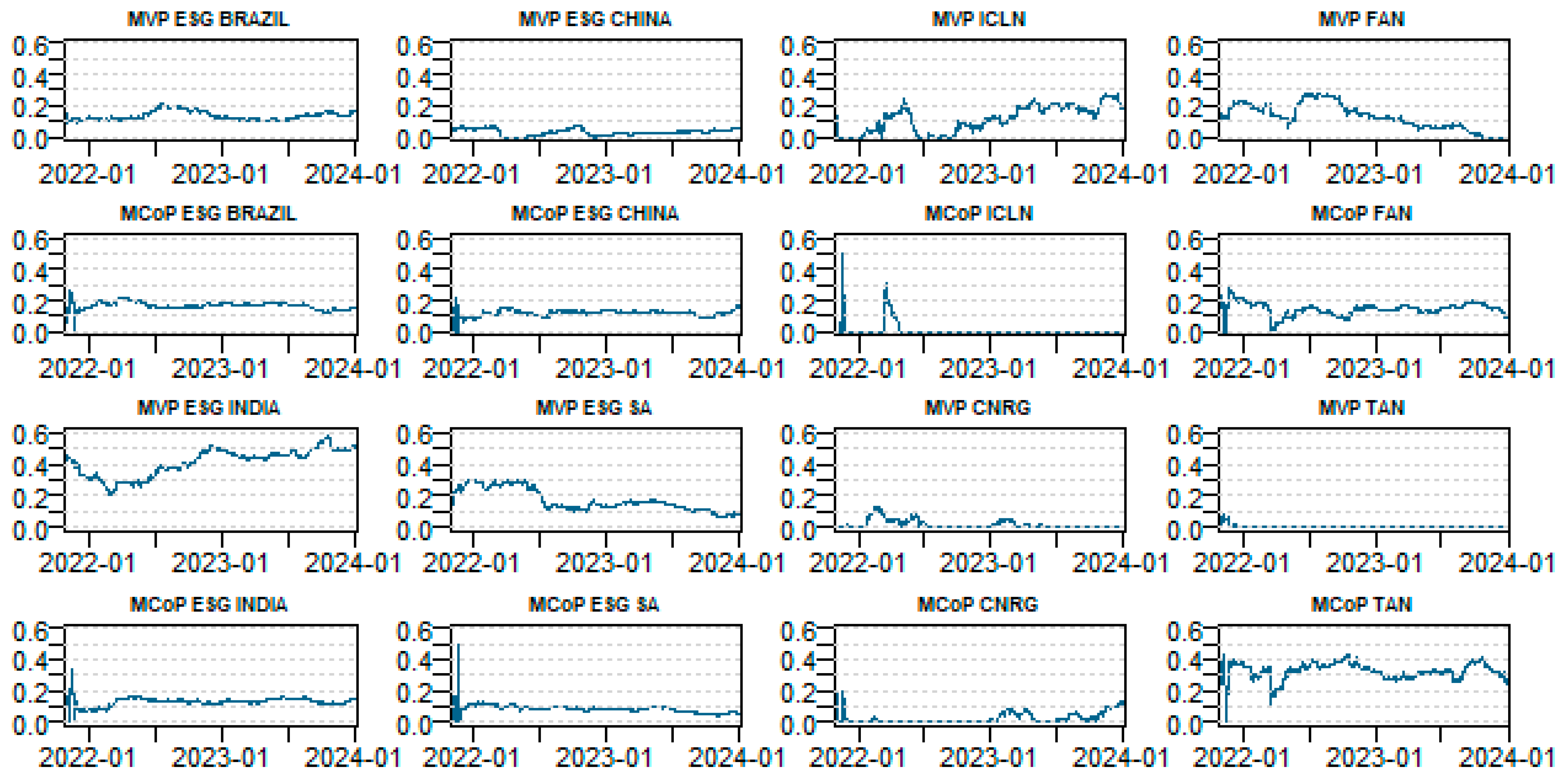

4.3. Dynamic Portfolios

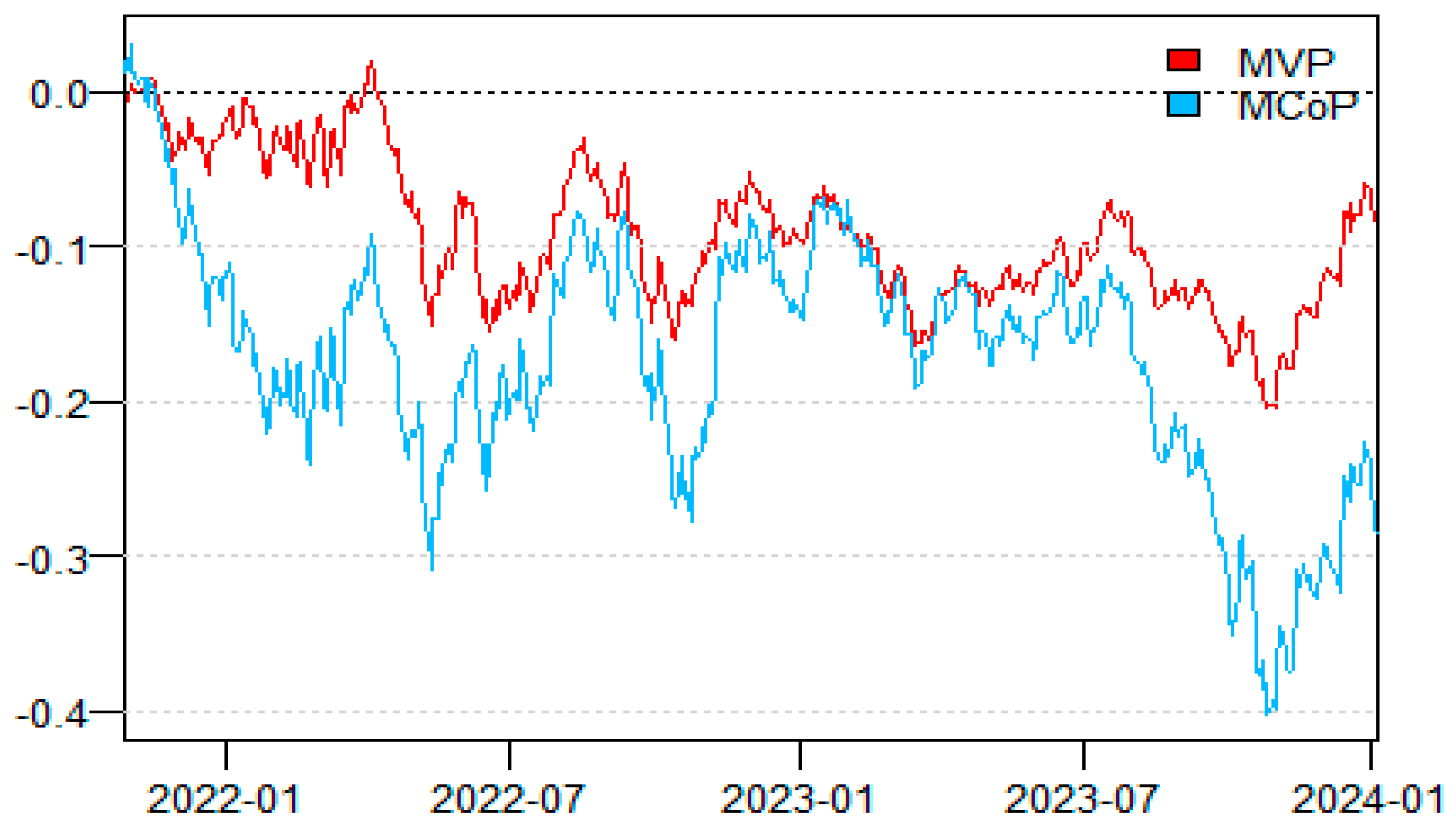

4.4. Back-Testing Portfolios

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | The time span t denotes daily observations. |

| 2 | GFED: It is a key measure in the Diebold and Yilmaz connectedness framework. It quantifies the proportion of the forecast error variance of variable i attributable to shocks from variable j at a given horizon H. Its generalized version (GFEVD) is robust to the ordering of variables in the VAR system. |

| 3 | TCI (Total Connectedness Index): The system-wide total connectedness index, measuring the overall degree of interdependence among all variables. It is calculated as the normalized sum of directional spillovers between all pairs of variables. |

| 4 | The pairwise connectedness index matrix at time t, where each element (PCIt)ij measures the directed connectedness from variable j to variable i. |

| 5 | The HE ratio did not prove to be statistically significant. |

References

- Agyei, S. K., Owusu Junior, P., Bossman, A., Asafo-Adjei, E., Asiamah, O., & Adam, A. M. (2022). Spillovers and contagion between BRIC and G7 markets: New evidence from time-frequency analysis. PLoS ONE, 17(7), e0271088. [Google Scholar] [CrossRef]

- Alharbi, S. S., Naveed, M., Ali, S., & Moussa, F. (2025). Sailing towards sustainability: Connectedness between ESG stocks and green cryptocurrencies. International Review of Economics & Finance, 98, 103848. [Google Scholar] [CrossRef]

- Almansour, B. Y., Elkrghli, S., Gaytan, J. C. T., & Mohnot, R. (2023). Interconnectedness dynamic spillover among US, Russian, and Ukrainian equity indices during the COVID-19 pandemic and the Russian–Ukrainian war. Heliyon, 9(12), e22974. [Google Scholar] [CrossRef]

- Antonakakis, N., & Gabauer, D. (2017). Refined measures of dynamic connectedness based on TVP-VAR. Journal of Risk and Financial Management, 10(4), 1–19. [Google Scholar]

- Antonakakis, N., & Gabauer, D. (2020). A New methodology for measuring time-varying connectedness and its application to global economic uncertainty. Journal of Business & Economic Statistics, 38(1), 181–195. [Google Scholar] [CrossRef]

- Anvekar, R., & Patil, S. (2024). Circular economy goals, large capitalisation, and ESG funds: An investment perspective. Φинaнcы: тeopия и пpaктикa, 28(2), 206–218. [Google Scholar] [CrossRef]

- Arouri, M., Mhadhbi, M., & Shahrour, M. H. (2025). Dynamic connectedness and hedging effectiveness between green bonds, ESG indices, and traditional assets. European Financial Management. [Google Scholar] [CrossRef]

- Bangur, P., Bangur, R., Jain, P., & Shukla, A. (2022). Investment certainty in ESG investing due to COVID-19: Evidence from India. International Journal of Sustainable Economy, 14(4), 429–440. [Google Scholar] [CrossRef]

- Baruník, J., & Křehlík, T. (2018). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296. [Google Scholar] [CrossRef]

- Baykut, E., & Gökgöz, H. (2024). Volatility connectedness of MOVE index and bond returns. Etikonomi, 23(1), 27–46. [Google Scholar]

- Belkhir, N., Masmoudi, W. K., Loukil, S., & Belguith, R. (2025). Portfolio diversification and dynamic interactions between clean and dirty energy assets. International Journal of Energy Economics and Policy, 15(1), 519. [Google Scholar] [CrossRef]

- Beloskar, V. D., & Nageswara Rao, S. V. D. (2024). Screening activity matters: Evidence from ESG portfolio performance from an emerging market. International Journal of Finance & Economics, 29(3), 2593–2619. [Google Scholar] [CrossRef]

- Beloskar, V. D., & Rao, S. N. (2023). Did ESG save the day? Evidence from India during the COVID-19 crisis. Asia-Pacific Financial Markets, 30(1), 73–107. [Google Scholar] [CrossRef]

- Bhattacherjee, P., Mishra, S., Bouri, E., & Wee, J. B. (2024). ESG, clean energy, and petroleum futures markets: Asymmetric return connectedness and hedging effectiveness. International Review of Economics & Finance, 94, 103375. [Google Scholar] [CrossRef]

- Bolognesi, E. (2023). New trends in asset management. Springer books. Palgrave Macmillan Cham. [Google Scholar] [CrossRef]

- Bouzguenda, M., & Jarboui, A. (2025). Unravelling interconnectedness and dynamic behaviour in financial networks: Insights from asset analysis. Global Business Review. [Google Scholar] [CrossRef]

- Chen, S., & Fan, M. (2024). ESG ratings and corporate success: Analyzing the environmental governance impact on Chinese companies’ performance. Frontiers in Energy Research, 12, 1371616. [Google Scholar] [CrossRef]

- Dai, Y. (2021). Can ESG investing beat the market and improve portfolio diversification? Evidence from China. The Chinese Economy, 54(4), 272–285. [Google Scholar] [CrossRef]

- de Boyrie, M. E., & Pavlova, I. (2024). Connectedness with commodities in emerging markets: ESG Leaders vs. conventional indexes. Research in International Business and Finance, 71, 102456. [Google Scholar] [CrossRef]

- Deng, X., & Cheng, X. (2019). Can ESG indices improve the enterprises’ stock market performance?—An empirical study from China. Sustainability, 11(17), 4765. [Google Scholar] [CrossRef]

- Desai, R., & Das, L. (2024). Investor reaction to the mandatory reporting of corporate ESG practices in the Indian stock market: An event study approach (2020–2021). International Journal of Green Economics, 18(1), 45–60. [Google Scholar] [CrossRef]

- Dhasmana, S., Ghosh, S., & Kanjilal, K. (2023). Does investor sentiment influence ESG stock performance? Evidence from India. Journal of Behavioral and Experimental Finance, 37, 100789. [Google Scholar] [CrossRef]

- Dias, R., Galvão, R., Cruz, S., Irfan, M., Teixeira, N., & Gonçalves, S. (2024). Exploring the relationship between clean energy indices and oil prices: A ten-day window approach. Journal of Ecohumanism, 3(4), 1462–1472. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yılmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal, 119(534), 158–171. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yılmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134. [Google Scholar] [CrossRef]

- Ederington, L. H. (1979). The hedging performance of the new futures markets. The journal of finance, 34(1), 157–170. [Google Scholar] [CrossRef]

- Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. [Google Scholar] [CrossRef]

- Fu, Y., Qi, H., Chen, Y., & Wang, Y. (2024). Short-term impacts vs. long-term contributions: The role of clean energy and ESG investments in China. Renewable Energy, 233, 121131. [Google Scholar] [CrossRef]

- Gheorghe, C., Panazan, O., Alnafisah, H., & Jeribi, A. (2025). ETF resilience to uncertainty shocks: A cross-asset nonlinear analysis of AI and ESG strategies. Risks, 13(9), 161. [Google Scholar] [CrossRef]

- Gidage, M., Bhide, S., Pahurkar, R., & Kolte, A. (2024). ESG performance and systemic risk nexus: Role of firm-specific factors in Indian companies. Journal of Risk and Financial Management, 17(9), 381. [Google Scholar] [CrossRef]

- Gökgöz, H., Ben Salem, S., Bejaoui, A., & Jeribi, A. (2025). Connectedness structure and volatility dynamics between BRICS markets and international volatility indices: An investigation. International Journal of Finance & Economics, 30(3), 2981–3002. [Google Scholar] [CrossRef]

- Harris, R. D., & Shen, J. (2006). Hedging and value at risk. Journal of Futures Markets: Futures, Options, and Other Derivative Products, 26(4), 369–390. [Google Scholar] [CrossRef]

- Hiremath, G. S., & Kattuman, P. (2017). Foreign portfolio flows and emerging stock market: Is the midnight bell ringing in India? Research in International Business and Finance, 42, 544–558. [Google Scholar] [CrossRef]

- Höl, A. Ö. (2024). Long memory in clean energy exchange traded funds. Politická ekonomie, 72(3), 478–500. [Google Scholar] [CrossRef]

- Jain, M., Sharma, G. D., & Srivastava, M. (2019). Can sustainable investment yield better financial returns: A comparative study of ESG indices and MSCI indices. Risks, 7(1), 15. [Google Scholar] [CrossRef]

- Jeribi, A., & Béjaoui, A. (2025). Time-frequency volatility transmission and connectedness across gold, bitcoin, green and blue ETFs: A revisit. Development and Sustainability in Economics and Finance, 7, 100070. [Google Scholar] [CrossRef]

- Ji, H., Naeem, M., Zhang, J., & Tiwari, A. K. (2024). Dynamic dependence and spillover among the energy related ETFs: From the hedging effectiveness perspective. Energy Economics, 136, 107681. [Google Scholar] [CrossRef]

- Jlassi, N. B., Lahiani, A., Mefteh-Wali, S., & Mselmi, N. (2025). ESG and sustainable development: Evidence from DCC-GARCH R2 decomposed connectedness measures. Finance Research Letters, 79, 107222. [Google Scholar] [CrossRef]

- Kanamura, T. (2023). Clean energy and (E) SG investing from energy and environmental linkages. Environment, Development and Sustainability, 25(9), 9779–9819. [Google Scholar] [CrossRef] [PubMed]

- Karniol-Tambour, K., Stendevad, C., Hochman, D., Davidson, J., & Kreiter, B. (2020). Building a balanced and scalable strategic asset allocation to meet financial and ESG impact goals 1. In Sustainable investing (pp. 303–328). Routledge. [Google Scholar] [CrossRef]

- Kharbanda, V., & Singh, A. (2018). Futures market efficiency and effectiveness of hedge in Indian currency market. International Journal of Emerging Markets, 13(6), 2001–2027. [Google Scholar] [CrossRef]

- Kocmanová, A., Dočekalová, M. P., Meluzín, T., & Škapa, S. (2020). Sustainable investing model for decision makers (based on research of manufacturing industry in the czech republic). Sustainability, 12(20), 8342. [Google Scholar] [CrossRef]

- Li, X., Xu, F., & Jing, K. (2022). Robust enhanced indexation with ESG: An empirical study in the Chinese Stock Market. Economic Modelling, 107, 105711. [Google Scholar] [CrossRef]

- Liu, G., & Hamori, S. (2020). Can one reinforce investments in renewable energy stock indices with the ESG index? Energies, 13(5), 1179. [Google Scholar] [CrossRef]

- Liu, W. P., Lo, L. Y., & Huang, W. C. (2024). Market reactions to firms’ inclusion in the sustainability index: Further evidence of TCFD framework adoption. Journal of Information Science & Engineering, 40(4), 799–811. [Google Scholar]

- Liu, X., Liang, W., Fu, Y., & Huang, G. Q. (2024). Dual environmental, social, and governance (ESG) index for corporate sustainability assessment using blockchain technology. Sustainability, 16(10), 4272. [Google Scholar] [CrossRef]

- Lopez-Penabad, M. C., Iglesias-Casal, A., Maside-Sanfiz, J. M., & Larbi, O. B. (2025). Clean energy and fintech: A scientometric study on spillovers and hedging in investment portfolios. Energy Strategy Reviews, 59, 101703. [Google Scholar] [CrossRef]

- Lu, J. R., Hwang, C. C., Liu, M. L., & Lin, C. Y. (2016). An incentive problem of risk balancing in portfolio choices. The Quarterly Review of Economics and Finance, 61, 192–200. [Google Scholar] [CrossRef]

- Markowitz, H. M. (2008). Portfolio selection: Efficient diversification of investments. Yale University Press. [Google Scholar]

- Martí-Ballester, C. P. (2022). Do renewable energy mutual funds advance towards clean energy-related sustainable development goals? Renewable Energy, 195, 1155–1164. [Google Scholar] [CrossRef]

- Mats, V. (2024). Hedge performance of different asset classes in varying economic conditions. Radioelectronic and Computer Systems, 2024(1), 217–234. [Google Scholar] [CrossRef]

- Mellouli, D., Bejaoui, A., & Jeribi, A. (2025). Analyzing quantile and frequency connectedness between natural gas and stock markets amid turbulent times: Evidence from G7, BRICS, and Gulf countries. Journal of Chinese Economic and Business Studies, 1–41. [Google Scholar] [CrossRef]

- Muhammad, S., & Huang, X. (2025). Dynamic dependence and network analysis between renewable energy tokens, sustainability-driven investments and equity markets: Portfolio implications. Renewable Energy, 251, 123256. [Google Scholar] [CrossRef]

- Nalam, H., & Kamble, K. (2023). Global wind turbines market. Tribology & Lubrication Technology, 79(3), 20–22. [Google Scholar]

- Natasha, P., & Rajitha, K. S. (2023). Volatility of returns in stock market investments: A study of BRICS Nations. Φинaнcы: тeopия и пpaктикa, 27(2), 87–98. [Google Scholar] [CrossRef]

- Özkan, O., Meo, M. S., & Younus, M. (2024). Unearthing the hedge and safe-haven potential of green investment funds for energy commodities. Energy Economics, 138, 107814. [Google Scholar] [CrossRef]

- Pástor, Ľ., Stambaugh, R. F., & Taylor, L. A. (2021). Sustainable investing in equilibrium. Journal of Financial Economics, 142(2), 550–571. [Google Scholar] [CrossRef]

- Peng, H., Tan, X., & Chen, Y. (2016). Discretion of dynamic position adjustment in hedging strategy. Romanian Journal of Economic Forecasting, 19(2), 86. [Google Scholar]

- Piserà, S., & Chiappini, H. (2022). Are ESG indexes a safe-haven or hedging asset? Evidence from the COVID-19 pandemic in China. International Journal of Emerging Markets, 19(1), 56–75. [Google Scholar] [CrossRef]

- Porteu de la Morandière, A., Vaucher, B., & Bouchet, V. (2025). Do ESG exclusions have an effect on portfolio risk and diversification? Journal of Impact & ESG Investing, 5(4), 159. [Google Scholar]

- Pradhan, K. (2011). The hedging effectiveness of stock index futures: Evidence for the S&P CNX nifty index traded in India. South East European Journal of Economics and Business, 6(1), 111–123. [Google Scholar] [CrossRef]

- Rao, A., Dagar, V., Sohag, K., Dagher, L., & Tanin, T. I. (2023). Good for the planet, good for the wallet: The ESG impact on financial performance in India. Finance Research Letters, 56, 104093. [Google Scholar] [CrossRef]

- Rout, B. S., & Das, N. M. (2024). BRICS stock markets performances during COVID-19: Comparison with other economic crises. Vikalpa, 49(3), 230–243. [Google Scholar] [CrossRef]

- Sajith, S., Aswani, R. S., Bhatt, M. Y., & Kumar, A. (2024). Challenges and opportunities for offshore wind energy from global to Indian context: Directing future research. International Journal of Energy Sector Management, 19(1), 117–145. [Google Scholar] [CrossRef]

- Sharma, G. D., Sarker, T., Rao, A., Talan, G., & Jain, M. (2022). Revisiting conventional and green finance spillover in post-COVID world: Evidence from robust econometric models. Global Finance Journal, 51, 100691. [Google Scholar] [CrossRef]

- Sharpe, W. F. (1966). Mutual fund performance. The Journal of Business, 39(1), 119–138. [Google Scholar] [CrossRef]

- Siche, J. R., Agostinho, F., Ortega, E., & Romeiro, A. (2008). Sustainability of nations by indices: Comparative study between environmental sustainability index, ecological footprint and the emergy performance indices. Ecological Economics, 66(4), 628–637. [Google Scholar] [CrossRef]

- Sinha Ray, R., & Goel, S. (2023). Impact of ESG score on financial performance of Indian firms: Static and dynamic panel regression analyses. Applied Economics, 55(15), 1742–1755. [Google Scholar] [CrossRef]

- Strezov, V., Evans, A., & Evans, T. J. (2017). Assessment of the economic, social and environmental dimensions of the indicators for sustainable development. Sustainable Development, 25(3), 242–253. [Google Scholar] [CrossRef]

- Suresha, B., Srinidhi, V. R., Verma, D., Manu, K. S., & Krishna, T. A. (2022). The impact of ESG inclusion on price, liquidity and financial performance of Indian stocks: Evidence from stocks listed in BSE and NSE ESG indices. Investment Management & Financial Innovations, 19(4), 40. [Google Scholar] [CrossRef]

- Šević, A., Nerantzidis, M., Tampakoudis, I., & Tzeremes, P. (2024). Sustainability indices nexus: Green economy, ESG, environment and clean energy. International Review of Financial Analysis, 96, 103615. [Google Scholar] [CrossRef]

- Tripathi, V., & Jham, J. (2020). Corporate environmental performance and stock market performance: Indian evidence on disaggregated measure of sustainability. Journal of Corporate Accounting & Finance, 31(3), 76–97. [Google Scholar] [CrossRef]

- Umar, Z., Usman, M., Umar, M., & Ktaish, F. (2024). Interdependencies and risk management strategies between green cryptocurrencies and traditional energy sources. Energy Economics, 136, 107742. [Google Scholar] [CrossRef]

- Wan, J., Yin, L., & Wu, Y. (2024). Return and volatility connectedness across global ESG stock indexes: Evidence from the time-frequency domain analysis. International Review of Economics & Finance, 89, 397–428. [Google Scholar] [CrossRef]

- Wang, Y., Xie, B., & Wen, F. (2020). Measuring dynamic connectedness in financial markets: Time-varying evidence from the stock markets and commodities. Energy Economics, 86, 104642. [Google Scholar] [CrossRef]

- Wang, Z. P., Tao, C. Q., & Shen, P. Y. (2014). Regional green technical efficiency with its influencing factors analysis based on ecological footprint. Population Resources and Environment in China, 24, 35–40. [Google Scholar]

- Xiao, Z., Ma, S., Zhang, Z., & Xiang, L. (2024). Shaping sustainable future: The role of central bank in galvanizing corporate ESG performance. Finance Research Letters, 67, 105787. [Google Scholar] [CrossRef]

- Yang, J., Agyei, S. K., Bossman, A., Gubareva, M., & Marfo-Yiadom, E. (2024). Energy, metals, market uncertainties, and ESG stocks: Analysing predictability and safe havens. The North American Journal of Economics and Finance, 69, 102030. [Google Scholar] [CrossRef]

- Yoshino, N., Yuyama, T., & Taghizadeh-Hesary, F. (2023). Diversified ESG evaluation by rating agencies and net carbon tax to regain optimal portfolio allocation. Asian Economic Papers, 22(3), 81–96. [Google Scholar] [CrossRef]

- Zhang, S., Li, F., Zhou, Y., Hu, Z., Zhang, R., Xiang, X., & Zhang, Y. (2022). Using net primary productivity to characterize the spatio-temporal dynamics of ecological footprint for a resource-based city, Panzhihua in China. Sustainability, 14(5), 3067. [Google Scholar] [CrossRef]

- Zhu, L., Zhang, H., Liao, H., & Peng, R. (2020). Evaluation of ecological sustainability in Chongqing, China based on 3D ecological footprint model. International Journal of Design & Nature and Ecodynamics, 15, 89–96. [Google Scholar] [CrossRef]

- Zou, B., & Yang, G. X. (2008). Optimal hedging strategy of futures. Journal of Beijing Institute of Technology (English Edition), 17(Suppl.), 167–170. [Google Scholar]

| ICLN | CNRG | FAN | TAN | ESG BRAZIL | ESG INDIA | ESG CHINA | ESG SOUTH | |

|---|---|---|---|---|---|---|---|---|

| Mean | −0.001 | 0.000 | 0.000 | −0.001 | 0.000 | 0.000 | −0.001 | 0.000 |

| (0.412) | (0.581) | (0.495) | (0.419) | (0.983) | (0.649) | (0.207) | (0.969) | |

| Variance | 0 | 0 | 0 | 0.001 | 0 | 0 | 0 | |

| Skewness | 0.571 * | 0.403 * | 0.525 * | 0.498 * | 0.065 | −0.384 * | 0.886 * | 0.203 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.520) | (0.000) | (0.000) | (0.046) | |

| Ex.Kurtosis | 1.434 * | 0.636 * | 1.932 * | 1.037 * | 0.648 * | 1.766 * | 6.399 * | 1.367 * |

| (0.000) | (0.009) | (0.000) | (0.000) | (0.009) | (0.000) | (0.000) | (0.000) | |

| JB | 80.234 * | 25.184 * | 115.404 * | 49.338 * | 10.431 * | 88.585 * | 1052.623 * | 48.528 * |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.005) | (0.000) | (0.000) | (0.000) | |

| ERS | −3.242 | −5.069 | −9.639 | −2.588 | −9.203 | −9.528 | −4.398 | −9.452 |

| (0.001) | (0.000) | (0.000) | (0.010) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Q(20) | 20.230 | 10.671 | 23.062 * | 15.152 | 6.993 | 14.330 | 27.906 * | 24.149 * |

| (0.016) | (0.434) | (0.004) | (0.115) | (0.824) | (0.152) | (0.000) | (0.003) | |

| Q2(20) | 27.994 * | 14.791 | 48.936 * | 24.054 * | 21.874 * | 89.643 * | 90.732 * | 11.009 |

| (0.000) | (0.130) | (0.000) | (0.003) | (0.008) | (0.000) | (0.000) | (0.400) | |

| kendall | ICLN | CNRG | FAN | TAN | ESG BRAZIL | ESG INDIA | ESG CHINA | ESG SOUTH |

| ICLN | 1.000 * | 0.783 * | 0.629 * | 0.816 * | 0.205 * | 0.137 * | 0.140 * | 0.200 * |

| CNRG | 0.783 * | 1.000 * | 0.525 * | 0.785 * | 0.219 * | 0.131 * | 0.129 * | 0.200 * |

| FAN | 0.629 * | 0.525 * | 1.000 * | 0.521 * | 0.188 * | 0.175 * | 0.132 * | 0.219 * |

| TAN | 0.816 * | 0.785 * | 0.521 * | 1.000 * | 0.167 * | 0.113 * | 0.165 * | 0.205 * |

| ESG BRAZIL | 0.205 * | 0.219 * | 0.188 * | 0.167 * | 1.000 * | 0.092 * | 0.031 | 0.131 * |

| ESG INDIA | 0.137 * | 0.131 * | 0.175 * | 0.113 * | 0.092 * | 1.000 * | 0.197 * | 0.214 * |

| ESG CHINA | 0.140 * | 0.129 * | 0.132 * | 0.165 * | 0.031 | 0.197 * | 1.000 * | 0.282 * |

| ESG SOUTH | 0.200 * | 0.200 * | 0.219 * | 0.205 * | 0.131 * | 0.214 * | 0.282 * | 1.000 * |

| ESG BRAZIL | ESG INDIA | ESG CHINA | ESG SA | ICLN | CNRG | FAN | TAN | FROM | |

|---|---|---|---|---|---|---|---|---|---|

| ESG BRAZIL | 69.04 | 3.24 | 0.78 | 3.80 | 6.19 | 7.05 | 6.01 | 3.88 | 30.96 |

| ESG INDIA | 5.13 | 52.10 | 3.09 | 6.91 | 8.62 | 8.79 | 8.23 | 7.13 | 47.90 |

| ESG CHINA | 2.40 | 2.90 | 56.77 | 12.05 | 6.17 | 6.25 | 6.14 | 7.32 | 43.23 |

| ESG SA | 3.29 | 5.44 | 9.61 | 53.55 | 6.95 | 6.55 | 7.93 | 6.69 | 46.45 |

| ICLN | 2.37 | 1.36 | 1.34 | 2.76 | 26.31 | 23.09 | 18.90 | 23.88 | 73.69 |

| CNRG | 2.82 | 1.49 | 1.53 | 2.94 | 24.23 | 27.31 | 15.40 | 24.27 | 72.69 |

| FAN | 2.86 | 1.74 | 1.32 | 3.95 | 23.01 | 17.81 | 31.75 | 17.57 | 68.25 |

| TAN | 1.59 | 1.20 | 2.11 | 3.15 | 25.06 | 24.31 | 15.14 | 27.46 | 72.54 |

| TO | 20.45 | 17.36 | 19.76 | 35.57 | 100.23 | 93.84 | 77.75 | 90.73 | 455.70 |

| Inc.Own | 89.50 | 69.47 | 76.54 | 89.12 | 126.54 | 121.16 | 109.51 | 118.18 | cTCI/TCI |

| NET | −10.50 | −30.53 | −23.46 | −10.88 | 26.54 | 21.16 | 9.51 | 18.18 | 65.10/56.96 2 |

| NPT | 2.00 | 0.00 | 1.00 | 3.00 | 7.00 | 6.00 | 4.00 | 5.00 |

| Mean | Std.Dev. | 5% | 95% | HE | p-Value | |

|---|---|---|---|---|---|---|

| ESG BRAZIL | 0.13 | 0.03 | 0.10 | 0.19 | 0.61 | 0.00 |

| ESG INDIA | 0.41 | 0.09 | 0.27 | 0.52 | 0.22 | 0.00 |

| ESG CHINA | 0.03 | 0.02 | 0.00 | 0.06 | 0.86 | 0.00 |

| ESG SA | 0.17 | 0.07 | 0.07 | 0.29 | 0.55 | 0.00 |

| ICLN | 0.11 | 0.08 | 0.00 | 0.25 | 0.83 | 0.00 |

| CNRG | 0.01 | 0.03 | 0.00 | 0.07 | 0.86 | 0.00 |

| FAN | 0.13 | 0.08 | 0.00 | 0.27 | 0.70 | 0.00 |

| TAN | 0.00 | 0.01 | 0.00 | 0.00 | 0.91 | 0.00 1 |

| Mean | Std. Dev. | 5% | 95% | HE | p-Value | |

|---|---|---|---|---|---|---|

| ESG BRAZIL | 0.17 | 0.02 | 0.13 | 0.21 | −0.06 | 0.46 |

| ESG INDIA | 0.13 | 0.03 | 0.08 | 0.16 | −1.15 | 0.00 |

| ESG CHINA | 0.12 | 0.02 | 0.09 | 0.15 | 0.62 | 0.00 |

| ESG SA | 0.08 | 0.03 | 0.05 | 0.12 | −0.23 | 0.01 |

| ICLN | 0.01 | 0.04 | 0.00 | 0.05 | 0.52 | 0.00 |

| CNRG | 0.02 | 0.04 | 0.00 | 0.10 | 0.62 | 0.00 |

| FAN | 0.14 | 0.04 | 0.07 | 0.21 | 0.17 | 0.03 |

| TAN | 0.32 | 0.05 | 0.22 | 0.40 | 0.74 | 0.00 1 |

| Mean | Std.Dev. | 5% | 95% | HE | p-Value | Return | Std.Dev. | |

|---|---|---|---|---|---|---|---|---|

| ESG BRAZIL/ICLN | 0.20 | 0.04 | 0.14 | 0.29 | 0.10 | 0.00 | 0.02 | 0.20 |

| ESG BRAZIL/CNRG | 0.19 | 0.04 | 0.13 | 0.25 | 0.12 | 0.00 | 0.01 | 0.19 |

| ESG BRAZIL/FAN | 0.25 | 0.08 | 0.14 | 0.36 | 0.10 | 0.00 | 0.02 | 0.20 |

| ESG BRAZIL/TAN | 0.11 | 0.04 | 0.05 | 0.18 | 0.08 | 0.00 | 0.00 | 0.20 |

| ESG INDIA/ICLN | 0.09 | 0.03 | 0.05 | 0.16 | 0.05 | 0.00 | 0.06 | 0.14 |

| ESG INDIA/CNRG | 0.08 | 0.03 | 0.04 | 0.14 | 0.06 | 0.00 | 0.05 | 0.14 |

| ESG INDIA/FAN | 0.13 | 0.05 | 0.08 | 0.24 | 0.05 | 0.00 | 0.06 | 0.14 |

| ESG INDIA/TAN | 0.05 | 0.02 | 0.03 | 0.09 | 0.04 | 0.00 | 0.05 | 0.14 |

| ESG CHINA/ICLN | 0.21 | 0.06 | 0.11 | 0.29 | 0.05 | 0.00 | −0.26 | 0.34 |

| ESG CHINA/CNRG | 0.20 | 0.06 | 0.12 | 0.33 | 0.06 | 0.00 | −0.27 | 0.33 |

| ESG CHINA/FAN | 0.24 | 0.06 | 0.13 | 0.34 | 0.04 | 0.00 | −0.27 | 0.34 |

| ESG CHINA/TAN | 0.20 | 0.05 | 0.12 | 0.30 | 0.08 | 0.00 | −0.26 | 0.33 |

| ESG SA/ICLN | 0.18 | 0.07 | 0.10 | 0.32 | 0.13 | 0.00 | 0.02 | 0.18 |

| ESG SA/CNRG | 0.16 | 0.05 | 0.11 | 0.27 | 0.13 | 0.00 | 0.01 | 0.18 |

| ESG SA/FAN | 0.26 | 0.08 | 0.14 | 0.40 | 0.15 | 0.00 | 0.00 | 0.18 |

| ESG SA/TAN | 0.14 | 0.05 | 0.08 | 0.22 | 0.13 | 0.00 | 0.02 | 0.18 |

| ICLN/ESG BRAZIL | 0.40 | 0.14 | 0.26 | 0.67 | 0.11 | 0.35 | −0.21 | 0.29 |

| ICLN/ESG INDIA | 0.41 | 0.11 | 0.24 | 0.60 | 0.05 | 0.59 | −0.21 | 0.30 |

| ICLN/ESG CHINA | 0.17 | 0.05 | 0.11 | 0.26 | 0.05 | 0.35 | −0.13 | 0.30 |

| ICLN/ESG SA | 0.47 | 0.12 | 0.31 | 0.77 | 0.12 | 0.09 | −0.20 | 0.29 |

| CNRG/ESG BRAZIL | 0.48 | 0.16 | 0.31 | 0.79 | 0.12 | 0.35 | −0.18 | 0.32 |

| CNRG/ESG INDIA | 0.45 | 0.12 | 0.28 | 0.66 | 0.05 | 0.59 | −0.19 | 0.33 |

| CNRG/ESG CHINA | 0.21 | 0.06 | 0.12 | 0.33 | 0.05 | 0.35 | −0.09 | 0.33 |

| CNRG/ESG SA | 0.53 | 0.11 | 0.37 | 0.82 | 0.12 | 0.09 | −0.17 | 0.32 |

| FAN/ESG BRAZIL | 0.30 | 0.13 | 0.15 | 0.50 | 0.10 | 0.35 | −0.13 | 0.22 |

| FAN/ESG INDIA | 0.34 | 0.10 | 0.24 | 0.53 | 0.05 | 0.59 | −0.14 | 0.23 |

| FAN/ESG CHINA | 0.12 | 0.03 | 0.08 | 0.17 | 0.04 | 0.35 | −0.09 | 0.23 |

| FAN/ESG SA | 0.40 | 0.11 | 0.23 | 0.65 | 0.15 | 0.09 | −0.13 | 0.22 |

| TAN/ESG BRAZIL | 0.40 | 0.20 | 0.16 | 0.76 | 0.08 | 0.35 | −0.29 | 0.40 |

| TAN/ESG INDIA | 0.46 | 0.14 | 0.25 | 0.71 | 0.05 | 0.59 | −0.29 | 0.41 |

| TAN/ESG CHINA | 0.31 | 0.08 | 0.20 | 0.47 | 0.07 | 0.35 | −0.16 | 0.41 |

| TAN/ESG SA | 0.66 | 0.16 | 0.41 | 1.03 | 0.13 | 0.09 | −0.27 | 0.39 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bouzguenda, M.; Jarboui, A. Navigating the Green Frontier: Dynamic Risk and Return Transmission Between Clean Energy ETFs and ESG Indexes in Emerging Markets. J. Risk Financial Manag. 2025, 18, 557. https://doi.org/10.3390/jrfm18100557

Bouzguenda M, Jarboui A. Navigating the Green Frontier: Dynamic Risk and Return Transmission Between Clean Energy ETFs and ESG Indexes in Emerging Markets. Journal of Risk and Financial Management. 2025; 18(10):557. https://doi.org/10.3390/jrfm18100557

Chicago/Turabian StyleBouzguenda, Mariem, and Anis Jarboui. 2025. "Navigating the Green Frontier: Dynamic Risk and Return Transmission Between Clean Energy ETFs and ESG Indexes in Emerging Markets" Journal of Risk and Financial Management 18, no. 10: 557. https://doi.org/10.3390/jrfm18100557

APA StyleBouzguenda, M., & Jarboui, A. (2025). Navigating the Green Frontier: Dynamic Risk and Return Transmission Between Clean Energy ETFs and ESG Indexes in Emerging Markets. Journal of Risk and Financial Management, 18(10), 557. https://doi.org/10.3390/jrfm18100557