1. Introduction

Value relevance is an empirical measure of the usefulness of financial reporting to market participants. It is defined as the ability of information disclosed in financial statements to capture and summarize a firm’s value. From an investor’s perspective, this concept represents the extent to which accounting figures are considered when making common share investment decisions. It is the degree to which changes in a company’s financial figures, such as earnings per share or book value, are reflected in corresponding changes in its stock price. This statistical association is the primary method for empirically measuring value relevance.

The Stock Exchange of Thailand (SET), founded in 1975, is a growing market that serves as a major platform for capital raising to assist corporate progress in Thailand. The period from 2021 to 2023 was vital as businesses attempted to recover from the COVID-19 epidemic, with corporate earnings and investor confidence gradually recovering. To attract investors, listed businesses increased their emphasis on clear and trustworthy financial reporting, while regulatory measures reinforced corporate governance and audit monitoring. This scenario provides an excellent setting for investigating the function of audit quality in increasing the value relevance of earnings and book value to the market price of common stock.

Audit quality plays a vital role in maintaining capital market integrity and enhancing investor confidence. This is especially crucial in emerging economies, where transparency and governance structures are developing. Financial statements serve as a key source of information for investors, and the credibility of these reports largely depends on audit assurance. Recent studies have increasingly examined the impact of audit quality on stock price movements, particularly during periods of heightened uncertainty. High-quality audits are regarded as mechanisms that reduce information asymmetry, improve disclosure reliability, and support market stability (

Almaharmeh et al., 2021;

Salehi et al., 2022). Drawing on agency theory, audit quality helps mitigate the conflict of interest between managers (agents) and shareholders (principals) by curbing managerial opportunism and ensuring that reported financial information accurately reflects the firm’s performance (

Dang et al., 2023). By providing credible verification of financial statements, auditors strengthen investor trust, reduce the potential for earnings manipulation, and facilitate more efficient capital allocation. Consequently, in emerging markets with lower liquidity and higher economic volatility, high-quality audits act as a safeguard against market disruptions and enhance the value relevance of accounting information in share pricing.

The market price of common shares reflects investors’ forward-looking assessments of firms’ financial performance, risk exposure, and growth potential. While extensive research in developed economies has established the value relevance of accounting information, particularly earnings and book value, evidence from emerging markets remains limited, where transparency and regulatory enforcement are often weaker. This gap is particularly salient during periods of macroeconomic uncertainty, when the credibility of financial reporting becomes increasingly consequential. Therefore, this study pursues three objectives: (1) to investigate the value relevance of earnings per share (EPS) and book value of equity per share (BV) for firms listed on the Stock Exchange of Thailand (SET); (2) to examine the extent to which audit quality—proxied by audit firm size, audit fees, and the Beneish M-score—enhances this value relevance; and (3) to evaluate the influence of audit quality on share prices in the Thai capital market context. By strengthening the credibility of financial disclosures, audit quality is expected to improve the informativeness of accounting information, thereby facilitating more accurate investor valuations and contributing to capital market efficiency.

2. Literature Review

Agency Theory (

Jensen & Meckling, 1976) explains the conflict of interest between shareholders (principals) and managers (agents), arising from information asymmetry and the potential for managerial opportunism. High-quality audits act as an effective monitoring mechanism that mitigates agency problems by ensuring the reliability and credibility of financial statements. By reducing information asymmetry and constraining opportunistic behavior, audit quality enhances investor confidence and supports more efficient capital allocation. Consequently, in the context of emerging markets, audit quality serves a critical role in aligning managerial actions with shareholder interests.

Signaling Theory suggests that managers use credible signals to convey private information about a firm’s quality to external stakeholders, reducing information asymmetry between the firm and investors (

Spence, 1973). In the context of financial reporting, high-quality audits serve as a reliable signal that the company’s earnings and book value are fairly presented and free from material misstatements. By engaging reputable auditors or incurring higher audit fees, firms communicate their commitment to transparency and robust governance, which can enhance investor confidence and positively influence stock prices. Therefore, audit quality functions not only as an assurance mechanism but also as a strategic signal that reduces uncertainty and strengthens the market’s perception of financial statement reliability.

Previous studies have examined audit quality, and their findings can be summarized that audit quality is commonly conceptualized through two key lenses: input-based and outcome-based approaches. Input-based measures such as audit firm size, auditor industry expertise, tenure, and audit fees are frequently used as proxies for auditor independence and technical competence (

Chow & Wong-Boren, 1986). These structural attributes are widely accepted in empirical literature as core indicators of audit quality. Emerging evidence suggests that when financial opacity coincides with low audit quality, it enables the concealment of critical information. Such withholding of material details often triggers sharp stock price declines once the information is eventually disclosed (

Al-Hiyari et al., 2022). This effect is particularly pronounced in markets with limited regulatory enforcement and concentrated ownership conditions that are common in many emerging economies (

Dzik-Walczak & Ociepa, 2025;

Galloppo & Paimanova, 2018).

In contrast, outcome-based indicators assess audit quality by evaluating the actual results of the audit process. These include the incidence of financial restatements, the timeliness of disclosures, and the use of forensic tools such as the Beneish M-score, which detects earnings manipulation (

Beneish et al., 2012,

2013). Within this framework, audit quality is defined by the auditor’s effectiveness in identifying and reporting material misstatements. This capability directly impacts the reliability of corporate disclosures, the credibility of reported earnings, and investor perceptions of financial integrity (

Saleeb Agaiby Bakhiet, 2024). Empirical evidence further suggests that high-quality audits reduce the risk of stock market crashes by constraining managerial opportunism and promoting the timely disclosure of adverse information (

Salehi et al., 2022). These findings highlight the systemic importance of audit quality in capital markets particularly in emerging economies, where transparency and investor protections are often weaker.

Audit quality influences firm valuation through both direct and indirect mechanisms. Directly, high-quality audits enhance the credibility of earnings and book value, thereby increasing their value relevance in capital markets (

Kordlouie et al., 2018;

Wu & Wilson, 2016). This improvement in the reliability of financial information contributes to more efficient market pricing and informed investment decisions (

Khaldi & Hamama, 2024;

Lee & Lee, 2013). By ensuring that financial statements fairly represent a firm’s economic reality, credible audits strengthen the association between accounting figures and market value (

Mahdi Sahi et al., 2022).

Indirectly, audit quality plays a governance role by constraining earnings management and limiting information-hoarding behaviors that can distort investor perceptions and lead to asset mispricing. High-quality audits promote the timely disclosure of negative information, reducing the likelihood of abrupt stock price declines triggered by unexpected revelations (

Saleeb Agaiby Bakhiet, 2024). Additionally, rigorous audit oversight supports corporate governance by reinforcing managerial accountability and deterring financial misreporting. This reduces information asymmetry between insiders and external investors, thereby enhancing investor trust and market stability. In emerging markets like Thailand, where ownership concentration and regulatory gaps are prevalent, audit quality serves as a vital safeguard against inefficiencies and stock price crashes, contributing to the broader resilience of capital markets (

Khan et al., 2016).

3. Research Method

This study investigates the relationship between earnings per share (EPS), book value per share (BV), and audit quality on the market price of common shares of firms listed on the Stock Exchange of Thailand (SET). Grounded in value relevance theory and the Feltham and Ohlson (1995) valuation framework, financial statements are posited to provide information relevant to firm valuation (

Stoykova & Paskaleva, 2024). Recent research highlights that audit quality enhances the credibility and informativeness of financial statements, strengthening the association between accounting variables and stock prices (

Salehi et al., 2022;

Wu & Wilson, 2016), particularly in emerging markets where contextual factors such as audit environment, investor protection, and market development influence the strength of this relationship (

Saleeb Agaiby Bakhiet, 2024). Given the institutional characteristics of the Thai capital market—relatively weaker regulatory enforcement, diverse corporate governance practices, and lower liquidity—this study employs audit firm size, audit fees, and the Beneish M-score as proxies for audit quality. By accounting for these country-specific factors, the research design evaluates whether audit quality enhances the value relevance of EPS and BV, providing contextually meaningful evidence on how accounting information translates into market prices in Thailand.Based on the theoretical basis and literature review, the theoretical model is proposed as follows:

where

β1, β2 is the regression coefficient, β0 is the intercept coefficient, ε is the residual.

Dependent Variable:

Market prices of common share (SP): The market prices of common stock as of the date the auditor signs the audit report. At this specific date, investors have access to the audited financial statements, which reduces information asymmetry and enhances the reliability of financial reporting. Using the stock price at this point allows researchers to capture the immediate market reaction to the financial information verified by external auditors, making it a precise proxy for market valuation in studies examining the value relevance of accounting information and audit quality.

Independent Variables:

Earnings Per Share (EPS): reported in the important company’s financial information. It reflects the firm’s performance and is one of the primary inputs in valuation model (

Kordlouie et al., 2018).

Book Value Per Share (BV): reported in the important company’s financial information. It represents the residual value of a company per share (

Khaldi & Hamama, 2024).

Audit quality (AQ) using three proxy variables: audit fees, audit firm size, and financial statement irregularities (M-Score): These measures reflect both input-based and outcome-based dimensions of audit quality, consistent with prior research (

Al-Hiyari et al., 2022;

Tiron-Tudor & Achim, 2019)

Audit Firm Size (AFS): A dummy variable coded as 1 if the auditor is a Big 4 audit firm (i.e., Deloitte, PwC, EY, or KPMG), and 0 otherwise. Big 4 auditors are generally associated with higher audit quality due to superior technical expertise, global resources, and higher reputational risk (

Al-Hiyari et al., 2022).

Audit Fees (AF): as the statutory audit fees disclosed in the company’s annual report (in Thai Baht). Higher audit fees may indicate greater audit effort, complexity, or risk, and are often used as a proxy for higher audit quality (

Krishnan & Tanyi, 2024).

Financial Statement Irregularities (M-Score): The Beneish M-Score is used to detect the likelihood of earnings manipulation. A higher M-Score suggests a higher probability of financial statement irregularities, which may indicate lower audit quality. An M-Score greater than −2.22 is considered a threshold, indicating a higher probability of earnings manipulation and thus potentially lower audit quality (Beneish et al., 2013). (The original formula includes 8 indicators as of revenue inflation (DSRI, SGI), profit margin erosion (GMI), asset reclassification (AQI), expense manipulation (DEPI, SGAI), accrual-based earnings management (TATA), and leverage-related incentives (LVGI). The formula is M-score = −4.84 + 0.92 × DSRI + 0.528 × GMI + 0.404 × AQI + 0.892 × SGI + 0.115 × DEPI − 0.172 × SGAI + 4.679 × TATA − 0.327 × LVGI).

Interaction Terms (for Moderation Analysis):

AQ × EPS: An interaction term between audit quality and earnings per share to test whether audit quality strengthens the value relevance of earnings.

AQ × BV: An interaction term between audit quality and book value per share to test whether audit quality strengthens the value relevance of book value of equity information.

Control variables:

To empirically test the proposed hypotheses, this study defines and measures each variable using established proxies grounded in prior literature.

Table 1 summarizes the variables, their proxies, measurement scales, and key references supporting each construct.

3.1. Hypothesis Rationale

This study draws on the Feltham and Ohlson (1995) valuation model, which posits that a firm’s market value reflects its accounting fundamentals, particularly earnings and book value. Accordingly, H1 and H2 examine the value relevance of earnings per share (EPS) and book value per share (BV). To extend this model, we integrate agency theory and signaling theory to explain how audit quality may influence or reinforce the relationship between accounting information and market price. From an agency perspective, higher audit quality indicated by audit firm size (H3.1), audit fees (H3.2), and low M-scores (H3.3) reduces information asymmetry and enhances investor trust. In line with signaling theory, audit quality serves as a signal of financial reporting credibility. Therefore, it is expected to moderate the value relevance of EPS and BVPS (H4.1–H5.3). These theoretical foundations support the following hypotheses.

H1. Earnings per share have a positive effect on the market price of common shares.

H2. Book value per share has a positive effect on the market price of common shares.

H3.1. Audit firm size has a significant effect on the market price of common shares.

H3.2. Audit fees have a significant effect on the market price of common shares.

H3.3. Financial statement irregularities, as measured by M-scores, have a significant effect on the market price of common shares.

H4.1. The interaction between earnings per share and audit firm size has a significant effect on the market price of common shares.

H4.2. The interaction between earnings per share and audit fees has a significant effect on the market price of common shares.

H4.3. The interaction between earnings per share and financial statement irregularities (M-scores) has a significant effect on the market price of common shares.

H5.1. The interaction between book values per share and audit firm size has a significant effect on the market price of common shares.

H5.2. The interaction between book values per share and audit fees has a significant effect on the market price of common shares.

H5.3. The interaction between book values per share and financial statement irregularities (M-scores) has a significant effect on the market price of common shares.

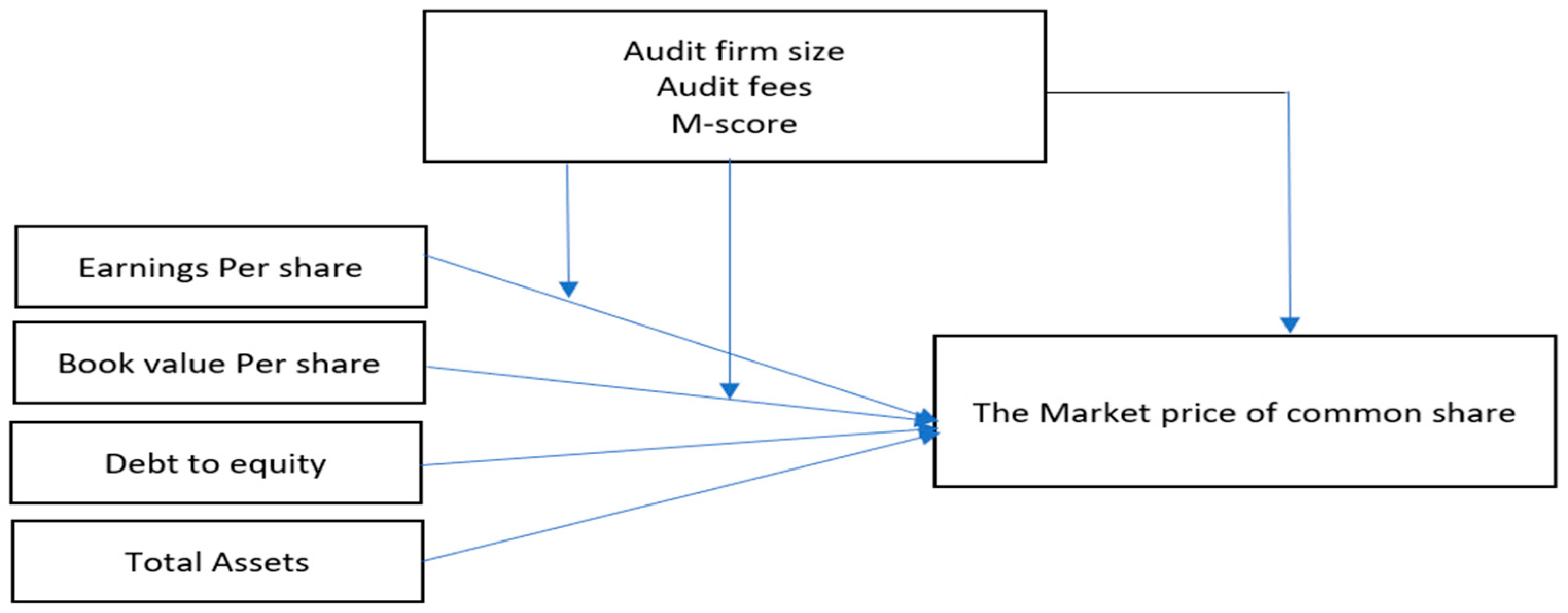

Drawing on the proposed hypotheses, the research framework as shown in

Figure 1 illustrates the relationships among the study’s key variables, including the moderating role of audit quality on the value relevance of accounting information.

3.2. Data Collection and Data Processing

This study employs secondary data from companies listed on the Thai Stock Exchange (SET) that released detailed important financial information and stock prices between 2021 and 2023, a period following the COVID-19 pandemic when firms actively sought to recover and stabilize their operations amid the broader economic rebound. Data were primarily obtained from the Bloomberg database and company annual reports. A purposive sample strategy was used to select 401 companies based on the criteria listed below.

Companies with a fiscal year ending on 31 December, excluding financial groups and companies delisted or under Rehabilitation.

Companies with comprehensive data from 2021 to 2023 over all three years of the study period (Source: The Stock Exchange of Thailand, as of 30 June 2024).

To address potential heteroskedasticity arising from the characteristics of panel data, robustness checks were conducted using fixed-effect and random-effect model tests. Descriptive statistics were used to examine the distribution of the data, while correlation analysis was conducted to explore the direction and strength of relationships among the variables. To reduce the influence of extreme values, all continuous variables were winsorized at the 5% threshold. All statistical analyses were performed using STATA 17 software at a 95% confidence level.

4. Research Results

Descriptive analysis:

Table 2 summarizes audit firm usage across 1203 firm-year observations, showing that 65.92% of firms engaged Big 4 auditors, while 34.08% used non-Big 4 firms. This distribution reflects a strong reliance on auditors with higher perceived expertise and reputation, consistent with input-based measures of audit quality. Aligned with agency theory, this suggests that firms prioritize audit credibility to reduce information asymmetry and bolster investor trust. The notable share of non-Big 4 audits, however, indicates a competitive audit environment, possibly shaped by cost sensitivity or lower emphasis on auditor reputation.

The descriptive statistics in

Table 3 indicate that after using a 5% threshold for winsorization to limit the influence of extreme observations.The market price of common share (SP) has a mean of 13.73 (SD = 18.12), earnings per share (EPS) 0.71 (SD = 1.19), and book value per share (BV) 10.87 (SD = 17.15). The audit fees (AF) has a mean of 4.05 (SD = 3.31). The M-score records a mean of −2.14 (SD = 1.07), debts-to-equity (DE) 1.08 (SD = 0.94) while the total assets (TA) shows a mean of 24.34 (SD = 43.98).

Table 4 shows the Pearson correlations among common share

market price (SP), earnings per share (EPS), book value per share (BV), audit fees (AF), audit firm size (AFS), M-score, debt-to-equity ratio (DE), and total assets (TA). SP is

positively and significantly correlated with EPS (r = 0.716*) and BV (r = 0.751*), indicating that both earnings and book value are key drivers of common share valuation. SP also has

weaker positive correlations with AF, AFS, and TA, and a

slightly negative correlation with DE. EPS and BV are positively associated and show

modest links with audit quality measures, while M-score exhibits negligible or negative correlations with SP, EPS, and BV, suggesting earnings management may reduce financial informativeness. AF and AFS are moderately correlated with firm size (TA), reflecting that larger firms tend to engage bigger audit firms and incur higher audit fees. Overall, the results highlight that accounting information is value-relevant, and audit quality enhances its credibility for investors.

Based on the results presented in

Table 5, the seven multiple regression models (

Appendix A) provide important insights into how audit quality interacts with accounting information to influence the market price of common share.

The regression results indicate that both earnings per share (EPS) and book value per share (BV) are significantly and positively associated with the market price of common shares (SP). Across all model specifications, EPS ranges from β = 5.58 to 6.32 (p < 0.01), while BV ranges from β = 0.465 to 0.552 (p < 0.01). These findings confirm the fundamental value relevance of accounting information in the Thai capital market.

Audit quality proxies also demonstrate notable effects. Audit firm size (AFS) is positively and significantly related to share price in most models (β = 1.27 to 2.04, p < 0.10 to p < 0.01). Audit fees (AF) likewise show a positive and statistically significant effect on share price (β ≈ 2.39 × 10−7 to 3.59 × 10−7, p < 0.05 to p < 0.01). By contrast, earnings manipulation risk (Mscore) is generally negative and insignificant, except in Model 5 where it reaches significance (β = −0.506, p < 0.10). These results suggest that higher audit quality, as measured by audit firm size and audit fees, enhances investor confidence and market valuation.

Among the control variables, firm size (TA) consistently exhibits a positive and significant association with SP (β ≈ 3.43 × 10−5 to 4.64 × 10−5, p < 0.01). Conversely, the debt-to-equity ratio (DE) is negative but not statistically significant in any specification.

Interaction effects were introduced to assess whether audit quality strengthens the value relevance of earnings and book value. The findings show mixed results:

EPS × AFS is negative and significant (β = −0.349, p < 0.01), suggesting that the incremental value relevance of earnings is reduced when audited by Big 4.

EPS × AF is negative and significant (β = −4.61 × 10−8, p < 0.01), indicating that higher audit fees weaken the market’s responsiveness to earnings.

EPS × Mscore is positive and significant (β = 0.152, p < 0.01), implying that in the presence of earnings manipulation risk, reported earnings retain stronger value relevance.

For book value, only BV × AF is negative and significant (β = −1.41 × 10−8, p < 0.01), while BV1 × AFS and BV × Mscore1 are insignificant.

5. Discussions

The findings demonstrate that earnings per share and book value per share are significantly related to the market price of a common share. This is consistent with previous global evidence that accounting information plays an important role in corporate valuation (

Ohlson, 1995;

Collins et al., 1997;

Stoykova & Paskaleva, 2024), as well as more recent Thai research. For example,

Indraprasit and Tantikul (

2024) show that accounting measures, such as earnings and book value, continue to have strong value relevance after the implementation of TFRS 16 in 2020, whereas

Arunrungsirilert et al. (

2022) discover that earnings and other profitability measures are significantly associated with common share prices. These data support the concept that Thai investors continue to use financial statements as main inputs in equity valuation.

Audit quality, proxied by audit firm size and audit fees, positively influences market valuation. Firms audited by larger auditors or paying higher fees tend to have higher share prices, consistent with the view that reputable auditors enhance reporting credibility (

DeAngelo, 1981;

Francis, 2004). Accordingly, Big 4 audits and higher audit fees reduce information asymmetry, strengthen investor confidence, and increase share valuation, in line with

Krishnan and Tanyi (

2024), and

Pham et al. (

2025), who found that higher audit quality improves the credibility and informativeness of financial reporting. Conversely, financial statement irregularities negatively affect the relevance of earnings per share, supporting

Dang et al. (

2023), who argued that such irregularities undermine investor confidence and reduce earnings informativeness.

This finding aligns with regional evidence that audit quality enhances investor confidence in financial reporting across ASEAN countries, including Thailand (Value Relevance of Accounting Information in ASEAN Banking Industry, 2023). The M-score, which captures earnings manipulation risk, shows a negative association with share prices but is statistically significant only in Model 4. This indicates that while concerns about earnings management exist, they may not materially affect market valuation unless manipulation risk is severe. Consistent with

Beneish et al. (

2013) and more recent studies (

Dang et al., 2023;

Lee & Lee, 2013;

Prihatni et al., 2023), accounting manipulations—often measured through the M-score or accrual-based metrics—undermine investor trust and reduce share valuation. Moderating Role of Audit Quality: The interaction results reveal a nuanced relationship. Contrary to the expectation that audit quality would strengthen the association between accounting metrics and common share prices, the interaction of earnings with audit firm size and audit fees showed a reduction in incremental value relevance. One possible explanation is that when audit credibility is perceived as high, investors may focus on the overall assurance provided by auditors rather than relying excessively on individual accounting measures. Conversely, the positive interaction between earnings and the M-score suggests that, in the presence of potential manipulation, higher audit quality sustains the credibility and value relevance of earnings (see also

Becker et al., 1998).

These results have important implications for emerging capital markets. While earnings and book value remain central to share valuation (H1, H2), audit quality plays a dual role: it strengthens investor confidence and reshapes how accounting information is weighted (H3.1–H3.3, H4.1–H4.3, H5.2). This aligns with recent evidence from Thailand showing that both regulatory reforms (

Indraprasit & Tantikul, 2024) and profitability measures (

Arunrungsirilert et al., 2022) affect value relevance. Overall, the findings underscore the critical role of audit quality in maintaining the decision usefulness of financial statements in the evolving context of emerging markets.

6. Conclusions

This study provides evidence on the value relevance of accounting information and the role of audit quality in the Thai stock exchange, particularly during the post-COVID-19 period (2022–2023). The results confirm that earnings per share (EPS) and book value per share (BV) remain fundamental drivers of share valuation, underscoring the continued importance of financial statements for investors. Audit quality, measured by audit firm size and audit fees, further enhances market valuation by improving the credibility and informativeness of financial reporting, reducing information asymmetry, and strengthening investor confidence, consistent with agency theory, which posits that effective auditing mitigates conflicts of interest between managers and shareholders. From the perspective of signaling theory, high-quality audits serve as credible signals to the market, conveying the reliability of financial information and guiding investor decision-making. However, the interaction results reveal a nuanced pattern: while higher audit quality reduces the incremental relevance of EPS and BV, it sustains their credibility in the presence of potential earnings manipulation. The negative impact of financial statement irregularities, as reflected in the M-score, highlights the risk that accounting manipulations undermine investor trust and diminish the usefulness of reported earnings. Taken together, these findings suggest that audit quality plays a dual role in emerging markets—both directly influencing share valuation and shaping how investors interpret accounting information, thereby ensuring that financial statements remain decision-useful in a rapidly evolving market environment.

To further validate these conclusions, robustness checks were conducted using fixed-effect and random-effect models. The results, presented in

Appendix A, confirm the consistency of the main findings and reinforce the reliability of the evidence provided in this study. The Hausman test yielded a Prob > Chi

2 score of 0.000, indicating that the fixed effects model is the most appropriate specification. So the findings demonstrate that earnings per share (EPS) and book value per share (BV) have a favorable impact on the market price of common shares. Furthermore, audit fees (AF) are observed to interact positively with EPS, resulting in an increase in the market price of common shares.

Collectively, these results suggest that audit quality plays a dual role in emerging markets by directly influencing share valuation and shaping investors’ interpretation of accounting information. While the study focuses on Thailand, the findings carry broader implications for other emerging and transitional economies, illustrating how high-quality auditing can strengthen financial reporting credibility and market valuation under conditions of regulatory and economic uncertainty.

6.1. Research Limitations

While this study provides valuable insights, it has several limitations that may affect the interpretation and generalizability of the findings. First, the sample is limited to firms listed on the Stock Exchange of Thailand over a three-year period (2021–2023), which may constrain the applicability of the results to other economic or regulatory contexts. Second, audit quality is measured using observable proxies—audit firm size, audit fees, and the M-score for financial statement irregularities—which may not fully capture its multidimensional nature, potentially underestimating its true impact on market valuation. Third, although control variables were included, other relevant factors such as industry-specific characteristics and corporate governance mechanisms may have been omitted, which could bias the estimated relationships with stock prices. Finally, the use of linear regression models does not account for potential nonlinear relationships or dynamic effects over time, limiting the ability to capture more complex interactions. Collectively, these limitations suggest that the findings should be interpreted with caution, particularly when generalizing to other markets or periods, and highlight avenues for further research to enhance robustness and contextual relevance.

6.2. Recommendations

Practically, the results offer meaningful insights for investors, regulators, and corporate managers. Investors can interpret audit quality proxies as indicators of financial statement credibility. Regulation should be strengthened by promoting mandatory disclosures of audit quality indicators, rather than relying solely on voluntary transparency, to enhance the credibility and comparability of financial reporting across firms. Meanwhile, firms aiming to restore investor confidence especially in post-crisis periods like the aftermath of COVID-19, should view investment in high-quality audits as a strategic decision. Building on the limitations of this study, future research could expand the sample to other countries or longer periods to enhance generalizability and allow cross-market comparisons. More comprehensive measures of audit quality, including audit committee effectiveness, auditor tenure, or methodology, could capture its full impact on market valuation. Incorporating additional controls such as industry-specific factors, corporate governance mechanisms, and macroeconomic indicators may improve understanding of stock price determinants. Finally, employing advanced modeling techniques, such as nonlinear regression or dynamic panel methods, could better capture complex and temporal interactions. Addressing these aspects would provide more robust and contextually relevant evidence on the role of audit quality in enhancing the value relevance of accounting information.