1. Introduction

The environmental, social/sustainable, and governance (ESG) rating and performance of a company affect its market value (

Ward and Wu 2019). On the supply side, a company may obtain government subsidies and/or reductions in levies by improving the firm’s ESG scores, while on the demand side, stocks with high ESG performance attract ESG-conscious individuals and norm-constrained institutional investors. Moreover, investors whose focus is on risk-adjusted returns can further fuel demand for stocks with high ESG ratings should the scores be priced in the market. All the above factors combine to produce a positive feedback loop, which in effect can create a win–win situation for the high-ESG-rated companies and their shareholders, which include ESG advocates, profit-oriented agents, and ESG norm-constrained and -unconstrained institutional investors. Consequently, firms with high ESG ratings have a lower cost of equity capital and a higher valuation than those at the other end of the measure. The existence of the ESG premium in firm values can propel both financial and real production activities to align economic goals with social welfare objectives.

Zhang et al. (

2023) propose three channels through which fund ESG performance could affect fund downside risk: the firm channel in which the risk-mitigation effect of ESG is reflected at the firm level, the diversification channel in which the portfolio concentration of high-ESG funds can aggravate downside risk, and the flow channel in which high-ESG funds can attract investor flows and, consequently, reduce downside risk. The relationship between ESG ratings and downside risk depends on the relative force of these three channels.

We postulate that firms with high ESG ratings are more resilient to market volatility than those with low ESG ratings. Particularly, the preference for high-ESG firms makes them less susceptible to selling pressure in stressful market situations, as the ESG-conscious clientele (investors) are less prone to speculative trading; in addition, the speculative value of such firms is limited since they are already priced at a premium and less attractive to speculators.

Our main contribution is a direct test of the above hypothesis, leveraging the first ESG-enhanced stock market index (the ESG weight-tilted Hang Seng Index HSIESG) derived directly from the Hang Seng Index (HSI). We examine the performance of the HSIESG relative to its parent (HSI) under extreme market volatility conditions. A finding that HSIESG outperforms the parent index under extremely volatile market conditions will indicate the significance of the preference buffer.

The value-weighted free-float-adjusted HSI is the gauge of the blue-chip stocks listed on the Stock Exchange of Hong Kong (SEHK). The index is also the underlying asset of the first Hong Kong index exchange-traded fund (ETF)—that is, the Tracker Fund. The HSIESG is constructed by shifting the original HSI portfolio weights from the lower to higher ESG-rated firms while maintaining the set of constituent stocks of the parent index. The tilts are based on the ESG scores provided by the Hong Kong Quality Assurance Agency (HKQAA). This new setting that we identify allows a direct test of ESG’s marginal impact in terms of the tilted weights’ effect on the performance and volatility–return characteristics of the ESG-infused index relative to its parent.

However, unlike the highly distinguishable ESG-driven performance differential of a best-in-class index compared to its broad-based parent index, such as the S&P 500 (

Giese et al. 2019a), we expect it would be difficult to discern how the tilted weights affect the performance of the narrow-based HSI because the ESG-infused index and parent index are highly correlated. Moreover,

Friede et al. (

2015), in their comprehensive meta-analysis, document a weak correlation between ESG and the performance of equities investments, a finding that further lowers the expectation that the HSIESG can significantly outperform the parent index. Indeed, our study finds that the returns of the weight-tilted HSIESG and the parent index have a correlation of over 99%, which explains why only minor improvements in the performance metrics (mean and volatility of returns) are found in the weight-tilted index. Nevertheless, the paper shows a subtle but significant negative and asymmetrical relationship between the average returns of the two indexes and the change in index option–implied market volatility. The asymmetrical volatility–return relationship is defined by an observation that the positive return associated with a drop in volatility is less than the magnitude of the negative return triggered by an equal rise in volatility.

We want to determine the performance of the ESG-enhanced index relative to its parent index. If the HSIESG underperforms the parent index, companies may not pursue ESG practices. The study is guided by (1) what we believe is crucial for driving companies to improve ESG ratings—that is, the return to shareholders (particularly during market downturns) from investing in high ESG firms, and (2) to explore whether the differential asymmetrical volatility–return relationships between the two indexes can explain the difference in the holding period return.

We report the performance comparisons between the HSIESG and HSI for different volatility conditions. We use both regression and non-parametric analyses to examine the asymmetrical relationships between the index returns and option-implied market volatility. We use the VHSI because the option-implied volatility index is a better measure for ex ante uncertainty than the standard deviation of stock returns. We also analyze the sensitivity of HSIESG and HSI returns to different systematic risk factors. We find that the returns in both indexes have a negative relationship with changes in the VHSI. Most importantly, this study finds that the response to the volatility of the ESG-infused index return is significantly weaker than that of the parent index during volatile periods, a crucial phenomenon that led to the substantially higher holding period return of the HSIESG than that of the HSI. This result supports the proposition that firms with high ESG ratings are less susceptible to trading pressures triggered by volatility-induced turnovers. The evidence also shows that the ESG weight-tilted index is more resilient to volatility spikes than the parent index, indicating that stocks with high ESG ratings can be a hedge against market downside risks. In particular, our results suggest that the firm-level channel and the flow channel are more important than the diversification channel postulated in

Zhang et al. (

2023). This paper also contributes to the literature by providing significant incremental information on the emerging market for ESG-related equity products.

The rest of the paper is organized as follows.

Section 2 reviews related studies.

Section 3 describes the data and methodology for the empirical analysis.

Section 4 summarizes and interprets the findings.

Section 5 concludes the paper.

4. Empirical Results and Interpretations of the HSI and HSIESG

Table 1 shows the summary statistics of daily returns on the ESG weight-tilted HSIESG, the parent HSI, and daily closing levels of and returns on the option-implied volatility index derived from options written on the HSI. The mean and standard deviation of daily returns of the two indexes are not statistically significantly different for the overall period and the two subperiods.

Table 2 shows the correlations among daily returns of the HSIESG and HSI, and the levels and returns of the VHSI. All correlation coefficients are statistically significant at the 1% level. The high return correlation (>99%) between the two indexes suggests that finding any significant differences in the risk and return profiles between the weight-tilted index and the parent index is highly unlikely. The negative and over 60% correlation between the two measures of volatility change and index returns are consistent with the widely documented negative volatility–return relationship in the equity markets. The negative volatility–return relationships have strengthened in the recent period for both indexes, and the change in correlations is qualitatively identical for both indexes. It is useful to mention here that the subperiod results do not reveal significantly different correlation patterns between the prelaunch and postlaunch periods.

Table 3 summarizes the key performance and risk metrics between the HSIESG and HSI. In general, the HSIESG has a higher return and a lower return standard deviation than those of the HSI, but, again, the differences are not statistically and economically significant. Specifically, the average (standard deviation of) daily returns are 0.0088% (0.0115) and 0.0084% (0.0119) for the HSIESG and HSI, respectively. The two subperiod results are qualitatively similar to those of the overall period. However, despite the insignificant differences in the arithmetic mean returns and return standard deviations between the two indexes, the holding period return of the HSIESG is substantially higher than its parent index by over 67% (i.e., 3.9657% vs. 2.369%), an important result that we will further explore in the subsequent sections.

Table 4 summarizes the test results on the negative and asymmetrical relationships between the index returns and the change in option-implied market volatility. The regression results in Panel A show a highly significant negative relationship between index returns and the two measures in volatility changes. The slope coefficients for both measures of volatility change are negative at the 1% significance level, but the intercepts are mostly insignificant. Panel B shows that the intercept dummy and the slope coefficients are significantly negative at the 1% significance level concerning volatility change (Δ

VHSI), an indication of the asymmetrical volatility–return relationship between the returns of the two indexes and the volatility change. Conversely, the slope coefficient has fully captured the volatility–return relationship for both indexes concerning volatility return (Δ

lnVHSI). The regression test results further confirm the asymmetrical negative volatility–return relationship concerning the raw change in volatility. However, concerning the rate of volatility change, we find a highly significant negative volatility–return relationship in the slope coefficient but not in the intercept term. Furthermore, the subperiod results show no significant difference in the volatility–return relationship between the prelaunch and postlaunch periods.

Table 5 summarizes the mean daily returns for the HSIESG and HSI within each of the 10 bins defined by the deciles of the rate of implied volatility change. Decile 1 (the bottom volatility change bin) shows the mean index returns on days with the steepest drop in market volatility, while decile 10 (the top volatility change bin) shows the mean index returns on days with the sharpest rise in market volatility. Consistent with the regression results, the mean returns for both indexes are significantly positive in the bins with an average negative change in volatility and vice versa. The above findings are qualitatively similar for the two subperiods. We use the HAC standard errors of

Newey and West (

1984) to test the statistical significance of the results.

Table A1 in

Appendix A reports our robustness test via a bootstrapping method. The results from both tests are qualitatively identical. Most importantly, the asymmetrical response to the volatility of the ESG-infused index is significantly weaker than the parent index. For the overall period, the HSIESG has a lower mean return than the parent index (1.0496% vs. 1.1261%) for days with the highest drops in volatility. The opposite is true for days with the greatest spikes in volatility, where the HSIESG has a less negative mean return than the parent index (−1.6255% vs. −1.7235%).

Table 6 shows that the above-mentioned mean return differentials particularly for the top and bottom decile bins are statistically significant at the 1% level. Moreover, the results from the two subperiods are consistent with those found in the overall period. We also consider whether the market cap is the main driver of the differential asymmetrical risk–return relationship and the significant holding return gap between the two indexes. By examining a sample of snapshots (since the portfolio weights are changing over time) of the two sets of portfolio weights, we find that the tilted weights have generally migrated downward for the largest stocks. The reason is that because the weights of the largest stocks have already reached the cap rate in the parent index, the ESG tilts can shift their weights only downward. Hence, it is unclear whether the ESG performance is related to the market cap of the largest stocks. The table also shows the difference between the mean returns between the HSIESG and HSI (ΔlnHSIESG − ΔlnHSI) within each bin defined according to the volatility change decile. We test the differences using a

t-test with the HAC standard errors of

Newey and West (

1984). The results show that the parent index HSI generally outperforms the ESG-infused HSIESG for days with the steepest volatility drop (within the volatility change decile 1 bin), while the opposite is true for days with the sharpest rise in volatility (within the volatility change decile 10 bin). The above findings are similar for the two subperiods.

Table A2 in

Appendix A reports the robustness test results via a bootstrapping method. The results from both tests are qualitatively the same.

Results reported in

Table 6 also shed some light as to why the ESG-infused index has a higher return than the parent index. Negative returns have a greater impact than positive returns on the holding period return. As noted in

Table 6, we find that the ESG-infused index has a significantly less negative mean return than the parent index on days with the highest volatility spikes (i.e., the decile 10 bin) while the positive mean return differential (ΔlnHSIESG − ΔlnHSI > 0) in bin 10 is greater than the magnitude of the negative mean return differential (ΔlnHSIESG − ΔlnHSI < 0) in bin 1. Hence, the higher holding period return of the ESG-infused parent index is a result of the observed asymmetrical differential response to volatility shocks between the two indexes.

As noted in

Table 3, the less negative mean return of the ESG-infused index on days with the sharpest rise in volatility produces a substantially higher holding period return than the parent index (i.e., 3.966% vs. 2.369%) despite the seemingly minor and statistically insignificant difference in the standard deviation of daily returns (i.e., 0.0115% vs. 0.0119%). Although the maximum drawdown of the ESG-tilted index is slightly higher than the parent index by 31 basis points for the overall period, the 95% VaR and the CVaRs of the HSIESG for both confidence intervals are lower than those of the parent index. Moreover, the holding period return difference is mainly attributed to the differences in mean returns between the two indexes on days with the greatest drop and the sharpest rise in market volatility (see the interpretation of results for

Table 5 and

Table 6).

To understand the large difference in the overall holding period return between the two indexes, we calculate the cumulative returns for days included in volatility change decile 1, decile 10, and the rest of the sample period. We find the following: (1) the cumulative return for days in decile 1 (the top 10% volatility change) is −380% and −399% for the HSIESG and HSI, respectively; (2) the cumulative return for days in decile 10 (the bottom 10% volatility change) is 343% and 355% for the HSIESG and HSI, respectively; (3) the cumulative returns for all other days (deciles 2–9, both deciles included) are 41.74% and 46.01% for the HSIESG and HSI, respectively. This result leads to the conclusion that the HSIESG has a substantially higher holding period return than the parent index because the ESG-infused index has significantly less negative returns than the parent index during days with the highest volatility spikes.

Table 7 and

Table 8 summarize the test results on the sensitivity of the HSIESG and HSI returns to systematic risk measures via the Fama–French multifactor capital asset pricing model.

Table 7 summarizes the results using market factors of the developed international markets, while

Table 8 shows the results using the systematic risk factors of the Asia–Pacific markets excluding Japan. Both factors of SMB and HML for developed international markets (

Table 7) and Asia–Pacific markets excluding Japan (

Table 8) are used. The analysis is extended to examine whether the official launch (vis-à-vis the prelaunch period) of the ESG-tilted weights has a material impact on the performance of the HSIESG compared to the parent index. The overall results of

Table 7 and

Table 8 show that the HSI and HSIESG have similar sensitivities to the Fama–French five factors and the momentum factor, indicating that our results are not driven by the different sensitivities of these two indexes to the conventional factors. The results from the two subperiods are similar to those for the overall sample period. The two subperiods are the prelaunch and postlaunch periods as shown in

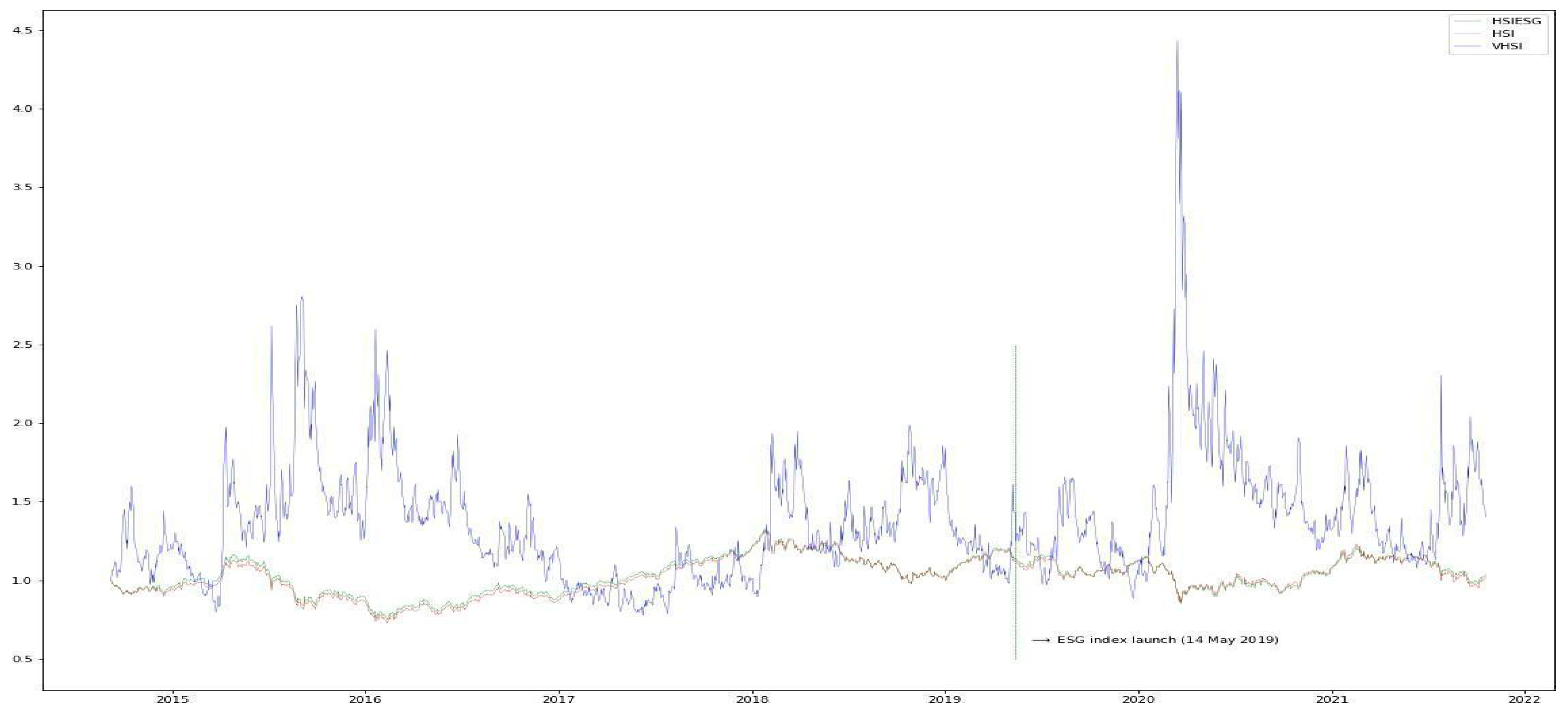

Figure 1.

5. Conclusions

This study examines whether and to what extent the ESG-tilted weights change the performance of the index portfolio (HSIESG) relative to the parent index HSI. The paper shows that the daily returns of the two indexes are very highly correlated. However, the holding period return of the ESG-infused index is surprisingly higher than that of the parent index by over 67%. The unexpected result can be attributed to the difference in the strength of the asymmetrical volatility–return relationships between the two indexes for days with the highest and lowest volatility change, supporting our proposition that stocks with high ESG ratings are less susceptible to market volatility-induced trading pressures than firms with low ratings. The results also confirm our conjecture that ESG ratings are priced in the market, making high ESG companies less attractive to speculators, which increases these stocks’ tolerance against panic selling under market stress. Although our findings show that high-ESG stocks outperform their counterparts in market downturns, whether these companies can buffer against financial crises can be a theme for future studies by factoring in the implications of the volatility paradox discussed in

Deghi et al. (

2018).

These findings suggest that ESG information can play a role as a financial factor in the valuation process in financial management. Moreover, by improving a company’s ESG performance, the board and management may enhance the stock’s resilience to market volatility. The findings also have implications for the prospects of financial market development. Although our results are primarily based on the newly introduced HSIESG, it sheds light on the potential economic benefits of incorporating ESG information into the construction of stock market indexes. ESG indexes may support the development of relevant index products, such as ESG-linked equity ETFs, derivatives, other exchange-traded products, and mutual funds. Currently, there are 36 and 34 investment products linked to the parent indexes, i.e., the HSI and Hang Seng China Enterprises Index, respectively. These products include local ETFs, ETFs listed around the world, leveraged and inverse products in Hong Kong, classification funds and listed open-end funds in China, mandatory provident funds in Hong Kong, and index funds worldwide. Growth in such markets may help promote Hong Kong as a major sustainability and green financial hub and reinforce its status as a global financial center.