Evaluating Financial Inclusion in Peru: A Cluster Analysis Using Self-Organizing Maps

Abstract

1. Introduction

2. Literature Review

2.1. Financial Inclusion

2.2. Machine Learning Clustering in Financial Inclusion

3. Materials and Methods

Self-Organizing Maps

4. Results

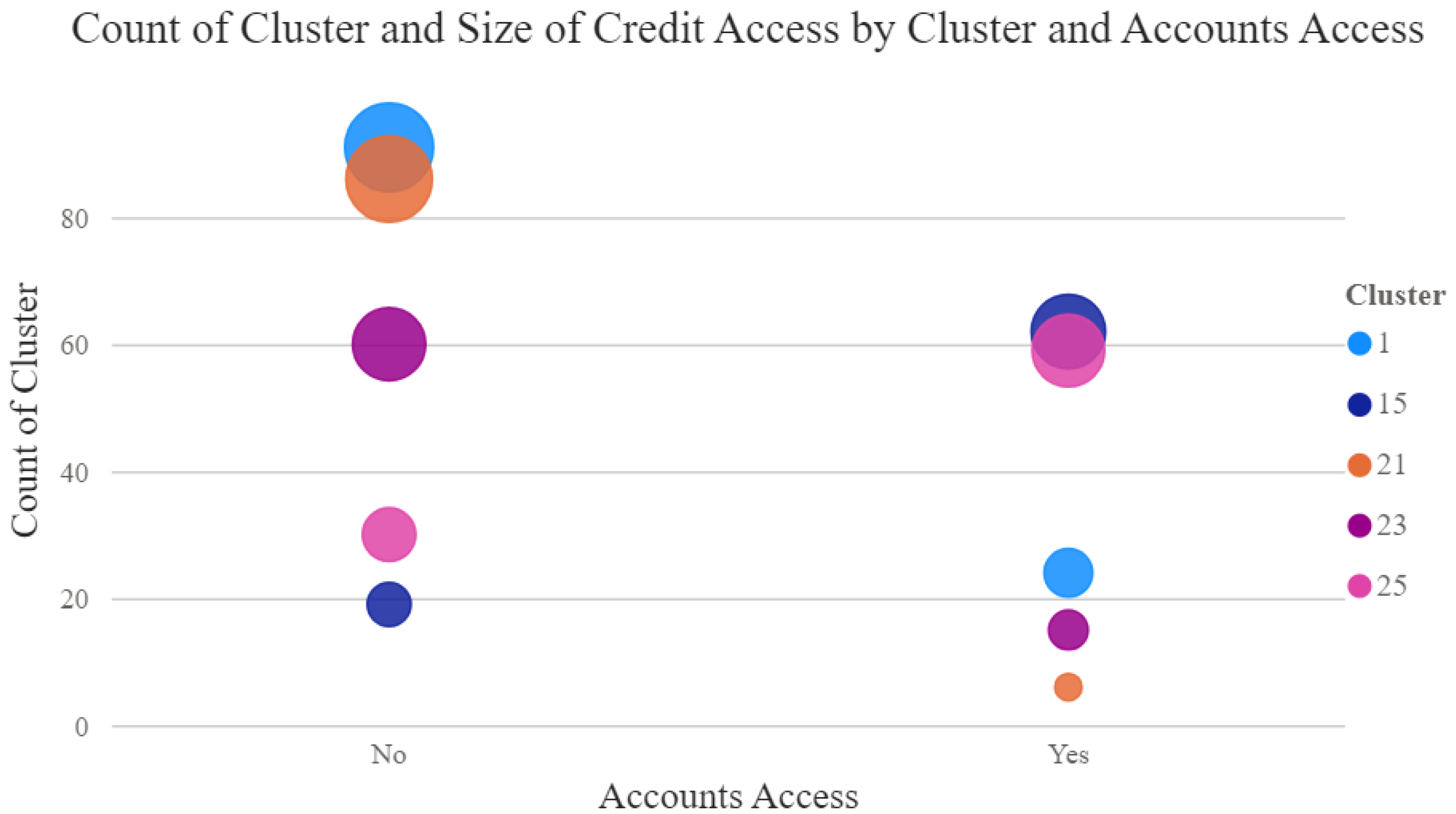

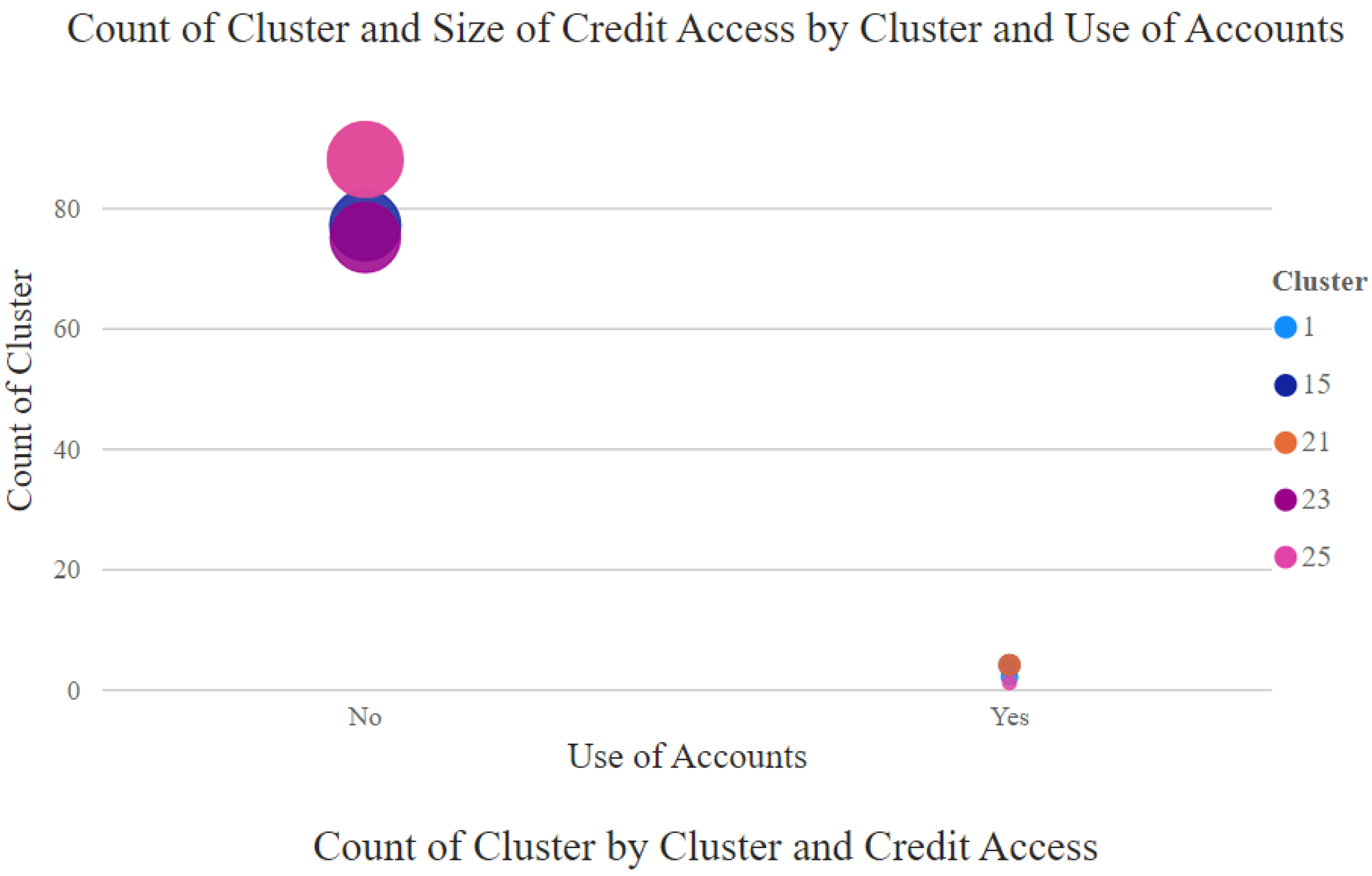

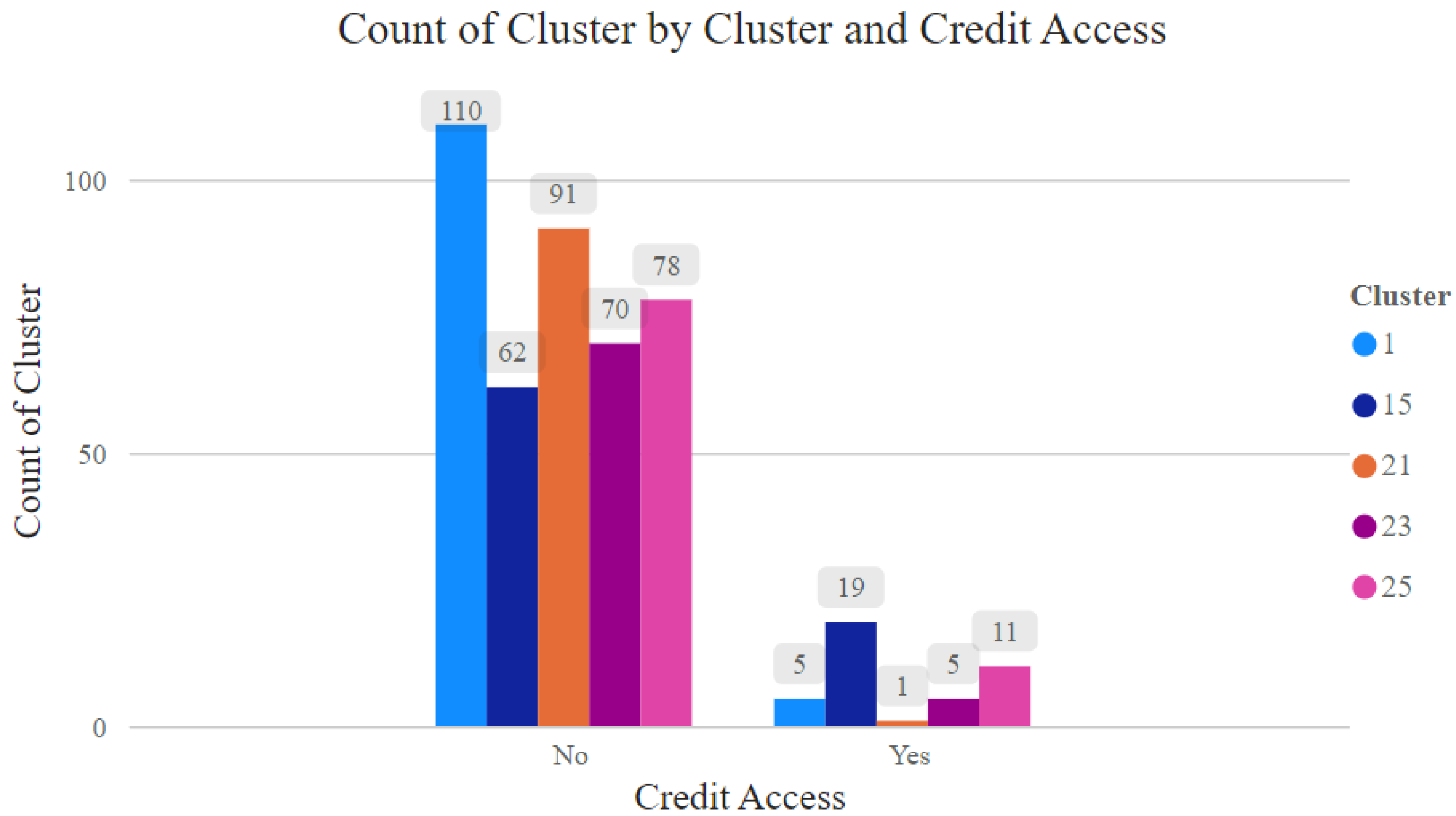

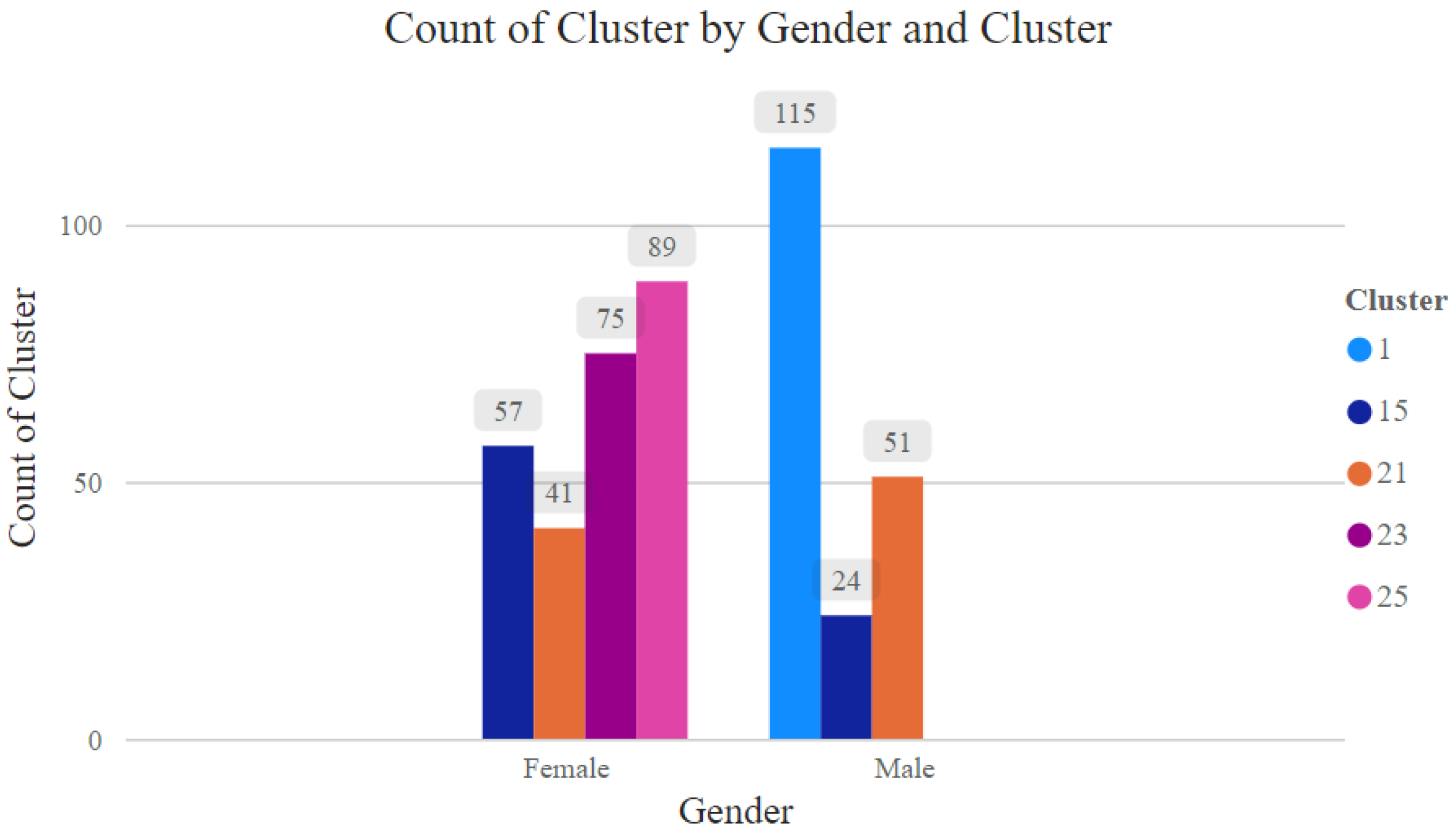

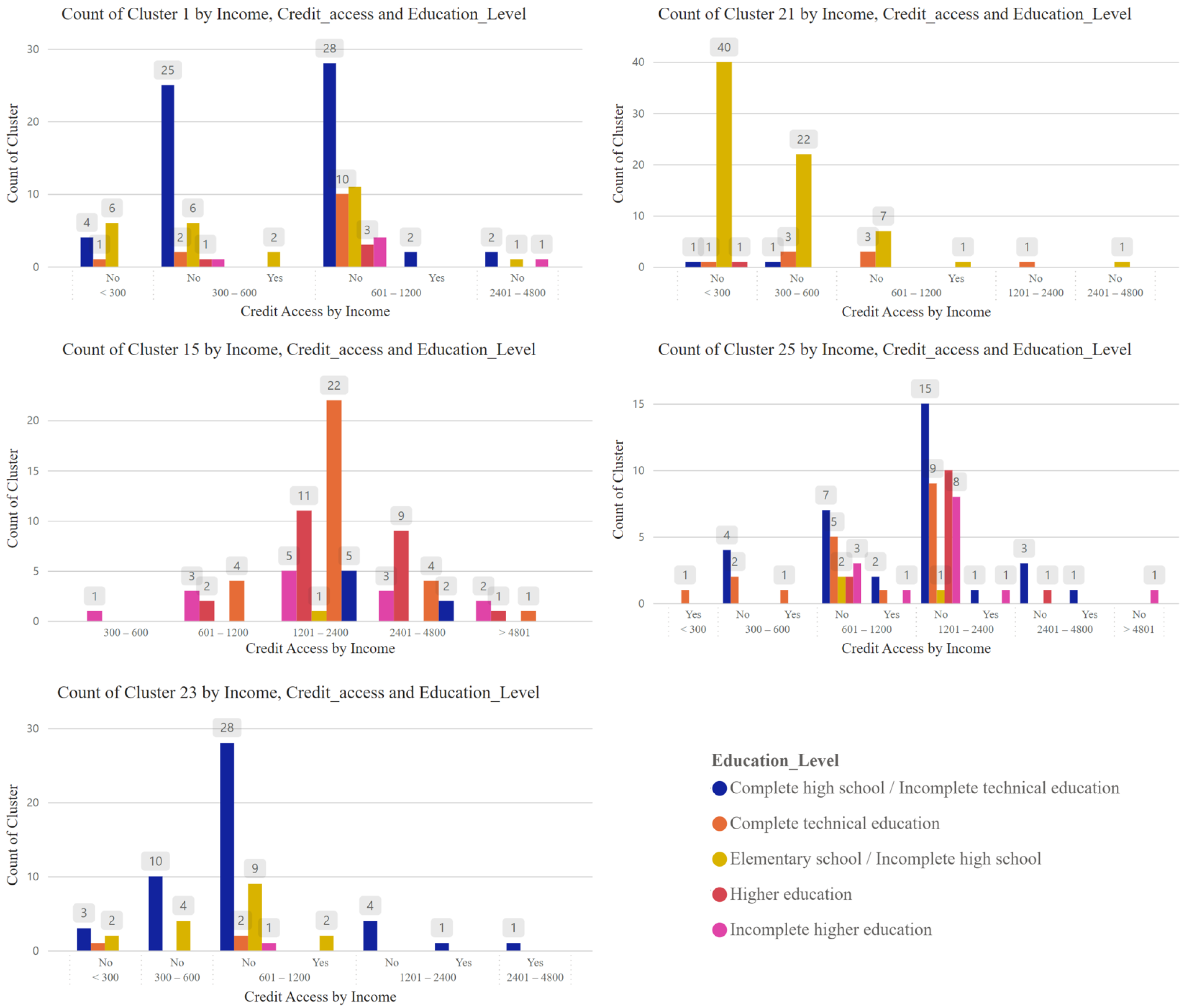

Profiles

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Aurazo, Jose, and Farid Gasmi. 2023. Financial Inclusion Transitions in Peru: The Role of Labor Informality. Technical Report. Available online: https://www.bcrp.gob.pe/docs/Publicaciones/Documentos-de-Trabajo/2023/documento-de-trabajo-007-2023.pdf (accessed on 21 March 2024).

- Bação, Fernando, Victor Lobo, and Marco Painho. 2005. Self-organizing maps as substitutes for k-means clustering. In Computational Science—ICCS 2005: Proceedings of the 5th International Conference on Computational Science (ICCS 2005), Atlanta, GA, USA, 22–25 May 2005. Berlin/Heidelberg: Springer, pp. 476–83. [Google Scholar]

- Bester, Tristan, and Benjamin Rosman. 2024. Towards financially inclusive credit products through financial time series clustering. arXiv arXiv:2402.11066v1. [Google Scholar] [CrossRef]

- Boitano, Guillermo, and Deyvi Franco Abanto. 2020. Challenges of financial inclusion policies in Peru. Revista finanzas y política económica 12: 89–117. [Google Scholar] [CrossRef]

- Clamara, Noelia, Ximena Peña, and David Tuesta. 2014. Factors That Matter for Financial Inclusion: Evidence from Peru—Working Paper no. 14/09 (BBVA Research). Available online: https://www.bbvaresearch.com/wp-content/uploads/mult/WP_1409_tcm348-426338.pdf (accessed on 14 April 2024).

- Cosma, Simona, and Giuseppe Rimo. 2023. Fintech, Financial Inclusion, and Social Challenges: The Role of Financial Technology in Social Inequality. London: Palgrave Mac, pp. 123–45. [Google Scholar]

- De Bodt, Eric, Marie Cottrell, and Michel Verleysen. 2002. Statistical tools to assess the reliability of self-organizing maps. Neural Networks 15: 967–78. [Google Scholar] [CrossRef] [PubMed]

- Guthikonda, Shyam. 2005. Kohonen Self-Organizing Maps. Available online: https://www.researchgate.net/profile/Nurettin-Yorek/publication/312552873_kohonen-self-organizing-maps-shyam-guthikonda/links/5881cf0992851c21ff420b4c/kohonen-self-organizing-maps-shyam-guthikonda.pdf (accessed on 20 December 2023).

- Hammad Naeem, Mohd, Mohammad Subhan, Md Shabbir Alam, Mamdouh Abdulaziz Saleh Al-Faryan, and Mohammad Yameen. 2023. Examining the role of financial innovation on economic growth: Fresh empirical evidence from developing and developed countries. Cogent Economics & Finance 11: 2170000. [Google Scholar] [CrossRef]

- Haykin, Simon. 2009. Self-Organizing Maps. New York: Pearson Education, pp. 425–74. [Google Scholar]

- Jejeniwa, Temitayo Oluwaseun, Noluthando Zamanjomane Mhlongo, and Titilola Olaide Jejeniwa. 2024. AI solutions for developmental economics: Opportunities and challenges in financial inclusion and poverty alleviation. International Journal of Advanced Economics 6: 108–23. [Google Scholar] [CrossRef]

- Jiménez, Jose Luis, Elio Villaseñor, Nieves Castells, Nicandro Cruz-Ramírez, and Humberto Carrillo-Calvet. 2007. Una herramienta computacional para el análisis de mapas autoorganizados. Paper presented at the 2007 IEEE 5º Congreso Internacional en Innovación y Desarrollo Tecnológico, Cuernavaca, Mexico, October 10–12; New York: IEEE, pp. 1–6. [Google Scholar]

- Kaski, Samuel, and Teuvo Kohonen. 1996. Exploratory data analysis by the self-organizing map: Structures of welfare and poverty in the world. Paper presented at the 3rd International Conference on Neural Networks in the Capital Markets-Neuronal Networks in Financial Engineering, London, UK, October 11–13; Singapore: World Scientific, pp. 498–507. [Google Scholar]

- Kohonen, Teuvo. 1998. The self-organizing map. Neurocomputing 21: 1–6. [Google Scholar] [CrossRef]

- Kohonen, Teuvo. 2013. Essentials of the self-organizing map. Neural Networks 37: 52–65. [Google Scholar] [CrossRef] [PubMed]

- Kumar, Sandeep, Snehashish Chakraverty, and Narayan Sethi. 2023. Multidimensional poverty: CMPI development, spatial analysis and clustering. Social Indicators Research 169: 647–70. [Google Scholar] [CrossRef]

- Lee, Youngjin. 2019. Using self-organizing map and clustering to investigate problem-solving patterns in the massive open online course: An exploratory study. Journal of Educational Computing Research 57: 471–90. [Google Scholar] [CrossRef]

- Luo, Lei. 2024. Digital financial inclusion, educational attainment and household consumption. Finance Research Letters 68: 105976. [Google Scholar] [CrossRef]

- Maehara, Rocío, Luis Benites, Alvaro Talavera, Alejandro Aybar-Flores, and Miguel Muñoz. 2024. Predicting financial inclusion in peru: Application of machine learning algorithms. Journal of Risk and Financial Management 17: 34. [Google Scholar] [CrossRef]

- Merzouki, Aziza, Janne Estill, Erol Orel, Kali Tal, and Olivia Keiser. 2021. Clusters of sub-saharan african countries based on sociobehavioural characteristics and associated HIV incidence. PeerJ 9: e10660. [Google Scholar] [CrossRef] [PubMed]

- Orazi, Sofía, Lisana Belén Martinez, and Hernan Pedro Vigier. 2023. Determinants and Evolution of Financial Inclusion in Latin America: A Demand Side Analysis. (American Institute of Mathematical Sciences). Available online: https://www.aimspress.com/data/article/preview/pdf/64427565ba35de3de31bb30f.pdf (accessed on 15 April 2024).

- Quispe Mamani, Julio Cesar, Santotomas Licimaco Aguilar Pinto, Dominga Asunción Calcina Álvarez, Marleny Quispe Layme, Guino Percy Gutierrez Toledo, Gina Tamara Condori Condori, Luis Vargas Espinoza, Wilian Quispe Layme, Hugo Rubén Marca Maquera, and Charles Arturo Rosado Chávez. 2024. Determinants of financial inclusion in households in Peru. Frontiers in Sociology 9: 1196651. [Google Scholar] [CrossRef] [PubMed]

- Saha, Sumanta Kumar, and Jie Qin. 2023. Financial inclusion and poverty alleviation: An empirical examination. Economic Change and Restructuring 56: 409–40. [Google Scholar] [CrossRef]

- Saraswati, Dewi, and Dian Kusumaningrum. 2019. Cluster analysis of financial behaviors and preferences among the bottom of the pyramid group. Jurnal Manajemen dan Kewirausahaan 21: 51–63. [Google Scholar] [CrossRef]

- Senyo, P., Daniel Gozman, Stan Karanasios, Nicholas Dacre, and Melissa Baba. 2023. Moving away from trading on the margins: Economic empowerment of informal businesses through fintech. Information Systems Journal 33: 154–84. [Google Scholar] [CrossRef]

- Sha’ban, Mais, Rym Ayadi, Yeganeh Forouheshfar, Sandra Challita, and Serena Sandri. 2024. Digital and traditional financial inclusion: Trends and drivers. Research in International Business and Finance 72: 02528. [Google Scholar] [CrossRef]

- Song, Xiaoling, Jiaqi Li, and Xueke Wu. 2024. Financial inclusion, education, and employment: Empirical evidence from 101 countries. Humanities and Social Sciences Communications 11: 1–11. [Google Scholar] [CrossRef]

- Sotomayor, Narda, Jacqueline Talledo, and Sara Wong. 2018. Determinants of Financial Inclusion in Peru: Recent Evidence from the Demand Side. Working Paper. Lima: Superintendencia de Banca, Seguros y Administradoras Privadas de Fondo de Pensiones. [Google Scholar]

- Super Superintendencia de Banca Seguros y AFP (SBS). 2022. Encuesta Nacional de Capacidades Financieras 2022. Available online: https://www.sbs.gob.pe/inclusion-financiera-principal/cifras-de-inclusion-financiera/encuestas (accessed on 18 December 2023).

- Toledo Concha, Emerson, and Víctor León Reyes. 2023. Inclusión financiera en el perú: Evaluación y perspectivas. Quipukamayoc 31: 73–84. [Google Scholar] [CrossRef]

- Vesanto, Juha, and Esa Alhoniemi. 2000. Clustering of the self-organizing map. IEEE Transactions on Neural Networks 11: 586–600. [Google Scholar] [CrossRef] [PubMed]

| Variable | Definition | Scale | Categories |

|---|---|---|---|

| Accounts access (AA) | Individual has a savings account or a checking account or a time deposit account or savings in cooperatives | Nominal | 1 = Yes 0 = No |

| Use of accounts in operations (UAO) | Conducted operations involving funds entering the account or funds exiting the account once a week or once a month over the past year | Nominal | 1 = Yes 0 = No |

| Education Level (EL) | The highest level of education that the respondent has | Ordinal | 1 = No education/Preschool 2 = Elementary school/Incomplete high school 3 = Complete high school/Incomplete technical education 4 = Complete technical education 5 = Incomplete higher education 6 = Higher education 7 = Postgraduate studies |

| Work or Occupation (W/O) | Occupation of the respondent | Nominal | 1 = Employer 2 = Self-employed 3 = Technical/professional employee 4 = Laborer 5 = Domestic worker without salary 6 = Domestic worker with salary 7 = Member of the Armed and Police Forces 8 = Farmer/Countryman 9 = Dedicated to household 10 = Incapacitated for work due to illness or ill health 11 = Not working and not looking for it 12 = Student 0 = Other |

| Income (I) | Household’s monthly income of the respondent | Nominal | 1 = <300 2 = 300–600 3 = 601–1200 4 = 1201–2400 5 = 2401–4800 6 = >4801 |

| Gender (G) | Gender of the respondent | Nominal | 1 = Male 2 = Female |

| Zone (Z) | Area of residence of the respondent | Nominal | 1 = Rural 2 = Urban |

| Socioeconomic Level Response (SLR) | Socioeconomic status of the respondent | Ordinal | 1 = SEL E 2 = SEL D 3 = SEL C 4 = SEL B 5 = SEL A |

| Socioeconomic Level Calculated (SLC) | Socioeconomic status of the respondent calculated by the interviewer | Ordinal | 1 = SEL E 2 = SELC D 3 = SELC C2 4 = SELC C1 5 = SELC B2 6 = SELC B1 7 = SELC A2 8 = SELC A1 |

| Use of Electronic Devices (UED) | The individual payments made for services once a week or once a month during the last year using smartphones or computers | Nominal | 1 = Yes 0 = No |

| Age (A) | Age of the respondent | Ordinal | 1 = 18–25 2 = 26–39 3 = 40–49 4 = 50+ |

| Variable | Category | Accounts Access | Use of Credit | Accounts Use | |||

|---|---|---|---|---|---|---|---|

| No | Yes | No | Yes | No | Yes | ||

| EL | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 26 (22.61%) | 2 (1.8%) | 26 (22.61%) | 2 (1.74%) | 28 (24.35%) | 0 (0%) | |

| 3 | 48 (41.74%) | 16 (14.41%) | 61 (53.04%) | 3 (2.61%) | 63 (54.78%) | 1 (0.87%) | |

| 4 | 11 (9.57%) | 2 (1.8%) | 13 (11.3%) | 0 (0%) | 12 (10.43%) | 1 (0.87%) | |

| 5 | 3 (2.61%) | 3 (2.7%) | 6 (5.22%) | 0 (0%) | 6 (5.22%) | 0 (0%) | |

| 6 | 3 (2.61%) | 1 (0.9%) | 4 (3.48%) | 0 (0%) | 4 (3.48%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| WO | 0 | 3 (2.61%) | 1 (0.87%) | 4 (3.48%) | 0 (0%) | 4 (3.48%) | 0 (0%) |

| 1 | 4 (3.48%) | 2 (1.74%) | 6 (5.22%) | 0 (0%) | 6 (5.22%) | 0 (0%) | |

| 2 | 60 (52.17%) | 13 (11.3%) | 70 (60.87%) | 3 (2.61%) | 71 (61.74%) | 2 (1.74%) | |

| 3 | 0 (0%) | 2 (1.74%) | 1 (0.87%) | 1 (0.87%) | 2 (1.74%) | 0 (0%) | |

| 4 | 8 (6.96%) | 3 (2.61%) | 10 (8.7%) | 1 (0.87%) | 11 (9.57%) | 0 (0%) | |

| 5 | 0 (0%) | 1 (0.87%) | 1 (0.87%) | 0 (0%) | 1 (0.87%) | 0 (0%) | |

| 6 | 2 (1.74%) | 0 (0%) | 2 (1.74%) | 0 (0%) | 2 (1.74%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 5 (4.35%) | 1 (0.87%) | 6 (5.22%) | 0 (0%) | 6 (5.22%) | 0 (0%) | |

| 9 | 1 (0.87%) | 0 (0%) | 1 (0.87%) | 0 (0%) | 1 (0.87%) | 0 (0%) | |

| 10 | 1 (0.87%) | 0 (0%) | 1 (0.87%) | 0 (0%) | 1 (0.87%) | 0 (0%) | |

| 11 | 3 (2.61%) | 1 (0.87%) | 4 (3.48%) | 0 (0%) | 4 (3.48%) | 0 (0%) | |

| 12 | 3 (0.87%) | 0 (0%) | 3 (0.87%) | 0 (0%) | 3 (0.87%) | 0 (0%) | |

| I | 1 | 10 (8.7%) | 1 (0.87%) | 11 (9.57%) | 0 (0%) | 11 (9.57%) | 0 (0%) |

| 2 | 26 (22.61%) | 11 (9.57%) | 35 (30.43%) | 2 (1.74%) | 36 (31.3%) | 1 (0.87%) | |

| 3 | 48 (41.74%) | 10 (8.7%) | 56 (48.7%) | 2 (1.74%) | 57 (49.57%) | 1 (0.87%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 3 (2.61%) | 1 (0.87%) | 4 (3.48%) | 0 (0%) | 4 (3.48%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| G | 1 | 91 (79.13%) | 24 (20.87%) | 110 (95.65%) | 5 (4.35%) | 113 (98.26%) | 2 (1.74%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| Z | 1 | 70 (60.87%) | 20 (17.39%) | 87 (75.65%) | 3 (2.61%) | 88 (76.52%) | 2 (1.74%) |

| 2 | 21 (18.26%) | 4 (3.48%) | 23 (20%) | 2 (1.74%) | 25 (21.74%) | 0 (0%) | |

| A | 1 | 15 (13.04%) | 5 (4.35%) | 19 (16.52%) | 1 (0.87%) | 20 (17.39%) | 0 (0%) |

| 2 | 22 (19.13%) | 12 (10.43%) | 33 (28.7%) | 1 (0.87%) | 33 (28.7%) | 1 (0.87%) | |

| 3 | 22 (19.13%) | 3 (2.61%) | 24 (20.87%) | 1 (0.87%) | 24 (20.87%) | 1 (0.87%) | |

| 4 | 32 (27.83%) | 4 (3.48%) | 34 (29.57%) | 2 (1.74%) | 36 (31.3%) | 0 (0%) | |

| SLC | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 7 | 91 (79.13%) | 24 (20.87%) | 110 (95.65%) | 5 (4.35%) | 113 (98.26%) | 2 (1.74%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| SLR | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 91 (79.13%) | 24 (20.87%) | 110 (95.65%) | 5 (4.35%) | 113 (98.26%) | 2 (1.74%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| UED | 1 | 6 (5.22%) | 7 (6.09%) | 10 (8.7%) | 3 (2.61%) | 11 (9.57%) | 2 (1.74%) |

| 0 | 85 (73.91%) | 17 (14.78%) | 100 (86.96%) | 2 (1.74%) | 102 (88.7%) | 0 (0%) | |

| Variable | Category | Accounts Access | Use of Credit | Accounts Use | |||

|---|---|---|---|---|---|---|---|

| No | Yes | No | Yes | No | Yes | ||

| EL | 1 | 2 (2.17%) | 0 (0%) | 2 (2.17%) | 0 (0%) | 2 (2.17%) | 0 (0%) |

| 2 | 74 (80.43%) | 5 (5.43%) | 78 (84.78%) | 1 (1.09%) | 76 (82.61%) | 3 (3.26%) | |

| 3 | 2 (2.17%) | 0 (0%) | 2 (2.17%) | 0 (0%) | 1 (1.09%) | 1 (1.09%) | |

| 4 | 7 (7.61%) | 1 (1.09%) | 8 (8.7%) | 0 (0%) | 8 (8.7%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 6 | 1 (1.09%) | 0 (0%) | 1 (1.09%) | 0 (0%) | 1 (1.09%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| WO | 0 | 6 (6.52%) | 0 (0%) | 6 (6.52%) | 0 (0%) | 6 (6.52%) | 0 (0%) |

| 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 2 | 34 (36.96%) | 3 (3.26%) | 36 (39.13%) | 1 (1.09%) | 35 (38.04%) | 2 (2.17%) | |

| 3 | 1 (1.09%) | 1 (1.09%) | 2 (2.17%) | 0 (0%) | 2 (2.17%) | 0 (0%) | |

| 4 | 4 (4.35%) | 0 (0%) | 4 (4.35%) | 0 (0%) | 4 (4.35%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 6 | 3 (3.26%) | 1 (1.09%) | 4 (4.35%) | 0 (0%) | 3 (3.26%) | 1 (1.09%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 12 (13.04%) | 1 (1.09%) | 13 (14.13%) | 0 (0%) | 13 (14.13%) | 0 (0%) | |

| 9 | 18 (19.57%) | 0 (0%) | 18 (19.57%) | 0 (0%) | 18 (19.57%) | 0 (0%) | |

| 10 | 4 (4.35%) | 0 (0%) | 4 (4.35%) | 0 (0%) | 3 (3.26%) | 1 (1.09%) | |

| 11 | 2 (2.17%) | 0 (0%) | 2 (2.17%) | 0 (0%) | 2 (2.17%) | 0 (0%) | |

| 12 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| I | 1 | 42 (45.65%) | 3 (3.26%) | 45 (48.91%) | 0 (0%) | 42 (45.65%) | 3 (3.26%) |

| 2 | 25 (27.17%) | 1 (1.09%) | 26 (28.26%) | 0 (0%) | 25 (27.17%) | 1 (1.09%) | |

| 3 | 9 (9.78%) | 2 (2.17%) | 10 (10.87%) | 1 (1.09%) | 11 (11.96%) | 0 (0%) | |

| 4 | 1 (1.09%) | 0 (0%) | 1 (1.09%) | 0 (0%) | 1 (1.09%) | 0 (0%) | |

| 5 | 1 (1.09%) | 0 (0%) | 1 (1.09%) | 0 (0%) | 1 (1.09%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| G | 1 | 47 (51.09%) | 4 (4.35%) | 50 (54.35%) | 1 (1.09%) | 48 (52.17%) | 3 (3.26%) |

| 2 | 39 (42.39%) | 2 (2.17%) | 41 (44.57%) | 0 (0%) | 40 (43.48%) | 1 (1.09%) | |

| Z | 1 | 27 (29.35%) | 3 (3.26%) | 29 (31.52%) | 1 (1.09%) | 29 (31.52%) | 1 (1.09%) |

| 2 | 59 (64.13%) | 3 (3.26%) | 62 (67.39%) | 0 (0%) | 59 (64.13%) | 3 (3.26%) | |

| A | 1 | 6 (6.52%) | 1 (1.09%) | 7 (7.61%) | 0 (0%) | 7 (7.61%) | 0 (0%) |

| 2 | 14 (15.22%) | 1 (1.09%) | 15 (16.3%) | 0 (0%) | 15 (16.3%) | 0 (0%) | |

| 3 | 19 (20.65%) | 3 (3.26%) | 21 (22.83%) | 1 (1.09%) | 22 (23.91%) | 0 (0%) | |

| 4 | 47 (51.09%) | 1 (1.09%) | 48 (52.17%) | 0 (0%) | 44 (47.83%) | 4 (4.35%) | |

| SLC | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 86 (93.48%) | 6 (6.52%) | 91 (98.91%) | 1 (1.09%) | 88 (95.65%) | 4 (4.35%) | |

| SLR | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 86 (93.48%) | 6 (6.52%) | 91 (98.91%) | 1 (1.09%) | 88 (95.65%) | 4 (4.35%) | |

| UED | 1 | 7 (7.61%) | 2 (2.17%) | 9 (9.78%) | 0 (0%) | 5 (5.43%) | 4 (4.35%) |

| 0 | 79 (85.87%) | 4 (4.35%) | 82 (89.13%) | 1 (1.09%) | 83 (90.22%) | 0 (0%) | |

| Variable | Category | Accounts Access | Credit Access | Accounts Use | |||

|---|---|---|---|---|---|---|---|

| No | Yes | No | Yes | No | Yes | ||

| EL | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | |

| 3 | 3 (3.7%) | 4 (4.94%) | 5 (6.17%) | 2 (2.47%) | 6 (7.41%) | 1 (1.23%) | |

| 4 | 7 (8.64%) | 24 (29.63%) | 22 (27.16%) | 9 (11.11%) | 30 (37.04%) | 1 (1.23%) | |

| 5 | 2 (2.47%) | 13 (16.05%) | 12 (14.81%) | 3 (3.7%) | 13 (16.05%) | 2 (2.47%) | |

| 6 | 6 (7.41%) | 19 (23.46%) | 21 (25.93%) | 4 (4.94%) | 25 (30.86%) | 0 (0%) | |

| 7 | 0 (0%) | 2 (2.47%) | 1 (1.23%) | 1 (1.23%) | 2 (2.47%) | 0 (0%) | |

| WO | 0 | 0 (0%) | 2 (2.47%) | 1 (1.23%) | 1 (1.23%) | 2 (2.47%) | 0 (0%) |

| 1 | 1 (1.23%) | 5 (6.17%) | 6 (7.41%) | 0 (0%) | 6 (7.41%) | 0 (0%) | |

| 2 | 4 (4.94%) | 12 (14.81%) | 12 (14.81%) | 4 (4.94%) | 15 (18.52%) | 1 (1.23%) | |

| 3 | 7 (8.64%) | 28 (34.57%) | 23 (28.4%) | 12 (14.81%) | 33 (40.74%) | 2 (2.47%) | |

| 4 | 0 (0%) | 2 (2.47%) | 1 (1.23%) | 1 (1.23%) | 2 (2.47%) | 0 (0%) | |

| 5 | 1 (1.23%) | 1 (1.23%) | 2 (2.47%) | 0 (0%) | 2 (2.47%) | 0 (0%) | |

| 6 | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | |

| 7 | 0 (0%) | 1 (1.23%) | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 9 | 3 (3.7%) | 2 (2.47%) | 5 (6.17%) | 0 (0%) | 5 (6.17%) | 0 (0%) | |

| 10 | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | |

| 11 | 1 (1.23%) | 9 (11.11%) | 9 (11.11%) | 1 (1.23%) | 9 (11.11%) | 1 (1.23%) | |

| 12 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| I | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 1 (1.23%) | 1 (1.23%) | 0 (0%) | 1 (1.23%) | 0 (0%) | |

| 3 | 2 (2.47%) | 7 (8.64%) | 6 (7.41%) | 3 (3.7%) | 9 (11.11%) | 0 (0%) | |

| 4 | 16 (19.75%) | 29 (35.8%) | 34 (41.98%) | 11 (13.58%) | 43 (53.09%) | 2 (2.47%) | |

| 5 | 0 (0%) | 18 (22.22%) | 15 (18.52%) | 3 (3.7%) | 18 (22.22%) | 0 (0%) | |

| 6 | 0 (0%) | 5 (6.17%) | 3 (3.7%) | 2 (2.47%) | 4 (4.94%) | 1 (1.23%) | |

| G | 1 | 6 (7.41%) | 18 (22.22%) | 18 (22.22%) | 6 (7.41%) | 24 (29.63%) | 0 (0%) |

| 2 | 13 (16.05%) | 44 (54.32%) | 44 (54.32%) | 13 (16.05%) | 53 (65.43%) | 4 (4.94%) | |

| Z | 1 | 19 (23.46%) | 62 (76.54%) | 62 (76.54%) | 19 (23.46%) | 77 (95.06%) | 4 (4.94%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| A | 1 | 5 (6.17%) | 22 (27.16%) | 21 (25.93%) | 6 (7.41%) | 24 (29.63%) | 3 (3.7%) |

| 2 | 6 (7.41%) | 19 (23.46%) | 18 (22.22%) | 7 (8.64%) | 25 (30.86%) | 0 (0%) | |

| 3 | 3 (3.7%) | 12 (14.81%) | 11 (13.58%) | 4 (4.94%) | 15 (18.52%) | 0 (0%) | |

| 4 | 5 (6.17%) | 9 (11.11%) | 12 (14.81%) | 2 (2.47%) | 13 (16.05%) | 1 (1.23%) | |

| SLC | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 6 (7.41%) | 25 (30.86%) | 21 (25.93%) | 10 (12.35%) | 29 (35.8%) | 2 (2.47%) | |

| 4 | 13 (16.05%) | 37 (45.68%) | 41 (50.62%) | 9 (11.11%) | 48 (59.26%) | 2 (2.47%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| SLR | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 19 (23.46%) | 62 (76.54%) | 62 (76.54%) | 19 (23.46%) | 77 (95.06%) | 4 (4.94%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| UED | 1 | 10 (12.35%) | 49 (60.49%) | 45 (55.56%) | 14 (17.28%) | 55 (67.9%) | 4 (4.94%) |

| 0 | 9 (11.11%) | 13 (16.05%) | 17 (20.99%) | 5 (6.17%) | 22 (27.16%) | 0 (0%) | |

| Variable | Category | Accounts Access | Credit Access | Accounts Use | |||

|---|---|---|---|---|---|---|---|

| No | Yes | No | Yes | No | Yes | ||

| EL | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 3 (3.37%) | 1 (1.12%) | 4 (4.49%) | 0 (0%) | 4 (4.49%) | 0 (0%) | |

| 3 | 11 (12.36%) | 25 (28.09%) | 32 (35.96%) | 4 (4.49%) | 35 (39.33%) | 1 (1.12%) | |

| 4 | 7 (7.87%) | 12 (13.48%) | 16 (17.98%) | 3 (3.37%) | 19 (21.35%) | 0 (0%) | |

| 5 | 8 (8.99%) | 7 (7.87%) | 12 (13.48%) | 3 (3.37%) | 15 (16.85%) | 0 (0%) | |

| 6 | 1 (1.12%) | 13 (14.61%) | 13 (14.61%) | 1 (1.12%) | 14 (15.73%) | 0 (0%) | |

| 7 | 0 (0%) | 1 (1.12%) | 1 (1.12%) | 0 (0%) | 1 (1.12%) | 0 (0%) | |

| WO | 0 | 0 (0%) | 1 (1.12%) | 0 (0%) | 1 (1.12%) | 1 (1.12%) | 0 (0%) |

| 1 | 0 (0%) | 1 (1.12%) | 1 (1.12%) | 0 (0%) | 1 (1.12%) | 0 (0%) | |

| 2 | 20 (22.47%) | 31 (34.83%) | 46 (51.69%) | 5 (5.62%) | 50 (56.18%) | 1 (1.12%) | |

| 3 | 6 (6.74%) | 13 (14.61%) | 16 (17.98%) | 3 (3.37%) | 19 (21.35%) | 0 (0%) | |

| 4 | 0 (0%) | 3 (3.37%) | 3 (3.37%) | 0 (0%) | 3 (3.37%) | 0 (0%) | |

| 5 | 0 (0%) | 1 (1.12%) | 1 (1.12%) | 0 (0%) | 1 (1.12%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 9 | 1 (1.12%) | 3 (3.37%) | 4 (4.49%) | 0 (0%) | 4 (4.49%) | 0 (0%) | |

| 10 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 11 | 2 (2.25%) | 3 (3.37%) | 3 (3.37%) | 2 (2.25%) | 5 (5.62%) | 0 (0%) | |

| 12 | 1 (1.12%) | 3 (3.37%) | 4 (4.49%) | 0 (0%) | 4 (4.49%) | 0 (0%) | |

| I | 1 | 1 (1.12%) | 0 (0%) | 0 (0%) | 1 (1.12%) | 1 (1.12%) | 0 (0%) |

| 2 | 1 (1.12%) | 6 (6.74%) | 6 (6.74%) | 1 (1.12%) | 7 (7.87%) | 0 (0%) | |

| 3 | 12 (13.48%) | 11 (12.36%) | 19 (21.35%) | 4 (4.49%) | 22 (24.72%) | 1 (1.12%) | |

| 4 | 14 (15.73%) | 32 (35.96%) | 44 (49.44%) | 2 (2.25%) | 46 (51.69%) | 0 (0%) | |

| 5 | 0 (0%) | 5 (5.62%) | 4 (4.49%) | 1 (1.12%) | 5 (5.62%) | 0 (0%) | |

| 6 | 0 (0%) | 1 (1.12%) | 1 (1.12%) | 0 (0%) | 1 (1.12%) | 0 (0%) | |

| G | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 30 (33.71%) | 59 (66.29%) | 78 (87.64%) | 11 (12.36%) | 88 (98.88%) | 1 (1.12%) | |

| Z | 1 | 29 (32.58%) | 54 (60.67%) | 73 (82.02%) | 10 (11.24%) | 82 (92.13%) | 1 (1.12%) |

| 2 | 1 (1.12%) | 5 (5.62%) | 5 (5.62%) | 1 (1.12%) | 6 (6.74%) | 0 (0%) | |

| A | 1 | 4 (4.49%) | 12 (13.48%) | 13 (14.61%) | 3 (3.37%) | 16 (17.98%) | 0 (0%) |

| 2 | 18 (20.22%) | 37 (41.57%) | 50 (56.18%) | 5 (5.62%) | 54 (60.67%) | 1 (1.12%) | |

| 3 | 4 (4.49%) | 6 (6.74%) | 8 (8.99%) | 2 (2.25%) | 10 (11.24%) | 0 (0%) | |

| 4 | 4 (4.49%) | 4 (4.49%) | 7 (7.87%) | 1 (1.12%) | 8 (8.99%) | 0 (0%) | |

| SLC | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 29 (32.58%) | 58 (65.17%) | 76 (85.39%) | 11 (12.36%) | 86 (96.63%) | 1 (1.12%) | |

| 6 | 1 (1.12%) | 1 (1.12%) | 2 (2.25%) | 0 (0%) | 2 (2.25%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| SLR | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 30 (33.71%) | 59 (66.29%) | 78 (87.64%) | 11 (12.36%) | 88 (98.88%) | 1 (1.12%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| UED | 1 | 11 (12.36%) | 39 (43.82%) | 40 (44.94%) | 10 (11.24%) | 49 (55.06%) | 1 (1.12%) |

| 0 | 19 (21.35%) | 20 (22.47%) | 38 (42.7%) | 1 (1.12%) | 39 (43.82%) | 0 (0%) | |

| Variable | Category | Accounts Access | Credit Access | Accounts Use | |||

|---|---|---|---|---|---|---|---|

| No | Yes | No | Yes | No | Yes | ||

| EL | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 15 (20%) | 2 (2.67%) | 15 (20%) | 2 (2.67%) | 17 (22.67%) | 0 (0%) | |

| 3 | 42 (56%) | 12 (16%) | 51 (68%) | 3 (4%) | 54 (72%) | 0 (0%) | |

| 4 | 2 (2.67%) | 1 (1.33%) | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) | |

| 5 | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| WO | 0 | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) |

| 1 | 1 (1.33%) | 2 (2.67%) | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) | |

| 2 | 23 (30.67%) | 6 (8%) | 26 (34.67%) | 3 (4%) | 29 (38.67%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 1 (1.33%) | 2 (2.67%) | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) | |

| 5 | 2 (2.67%) | 0 (0%) | 1 (1.33%) | 1 (1.33%) | 2 (2.67%) | 0 (0%) | |

| 6 | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 9 | 24 (32%) | 3 (4%) | 26 (34.67%) | 1 (1.33%) | 27 (36%) | 0 (0%) | |

| 10 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 11 | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | |

| 12 | 0 (0%) | 1 (1.33%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) | |

| I | 1 | 6 (8%) | 0 (0%) | 6 (8%) | 0 (0%) | 6 (8%) | 0 (0%) |

| 2 | 13 (17.33%) | 1 (1.33%) | 14 (18.67%) | 0 (0%) | 14 (18.67%) | 0 (0%) | |

| 3 | 30 (40%) | 12 (16%) | 40 (53.33%) | 2 (2.67%) | 42 (56%) | 0 (0%) | |

| 4 | 4 (5.33%) | 1 (1.33%) | 4 (5.33%) | 1 (1.33%) | 5 (6.67%) | 0 (0%) | |

| 5 | 0 (0%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 1 (1.33%) | 0 (0%) | |

| 6 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| G | 1 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) |

| 2 | 60 (80%) | 15 (20%) | 70 (93.33%) | 5 (6.67%) | 75 (100%) | 0 (0%) | |

| Z | 1 | 56 (74.67%) | 13 (17.33%) | 64 (85.33%) | 5 (6.67%) | 69 (92%) | 0 (0%) |

| 2 | 4 (5.33%) | 2 (2.67%) | 6 (8%) | 0 (0%) | 6 (8%) | 0 (0%) | |

| A | 1 | 9 (12%) | 4 (5.33%) | 12 (16%) | 1 (1.33%) | 13 (17.33%) | 0 (0%) |

| 2 | 7 (9.33%) | 1 (1.33%) | 8 (10.67%) | 0 (0%) | 8 (10.67%) | 0 (0%) | |

| 3 | 18 (24%) | 5 (6.67%) | 19 (25.33%) | 4 (5.33%) | 23 (30.67%) | 0 (0%) | |

| 4 | 26 (34.67%) | 5 (6.67%) | 31 (41.33%) | 0 (0%) | 31 (41.33%) | 0 (0%) | |

| SLC | 1 | 0 (0%) | 1 (1.33%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 25 (33.33%) | 5 (6.67%) | 29 (38.67%) | 1 (1.33%) | 30 (40%) | 0 (0%) | |

| 6 | 35 (46.67%) | 9 (12%) | 40 (53.33%) | 4 (5.33%) | 44 (58.67%) | 0 (0%) | |

| 7 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 8 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| SLR | 1 | 0 (0%) | 1 (1.33%) | 1 (1.33%) | 0 (0%) | 1 (1.33%) | 0 (0%) |

| 2 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 3 | 60 (80%) | 14 (18.67%) | 69 (92%) | 5 (6.67%) | 74 (98.67%) | 0 (0%) | |

| 4 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| 5 | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | |

| UED | 1 | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) | 3 (4%) | 0 (0%) |

| 0 | 57 (76%) | 15 (20%) | 67 (89.33%) | 5 (6.67%) | 72 (96%) | 0 (0%) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Talavera, A.; Maehara, R.; Benites, L.; Arriaga, B.; Aybar-Flores, A. Evaluating Financial Inclusion in Peru: A Cluster Analysis Using Self-Organizing Maps. J. Risk Financial Manag. 2024, 17, 549. https://doi.org/10.3390/jrfm17120549

Talavera A, Maehara R, Benites L, Arriaga B, Aybar-Flores A. Evaluating Financial Inclusion in Peru: A Cluster Analysis Using Self-Organizing Maps. Journal of Risk and Financial Management. 2024; 17(12):549. https://doi.org/10.3390/jrfm17120549

Chicago/Turabian StyleTalavera, Alvaro, Rocío Maehara, Luis Benites, Benjamin Arriaga, and Alejandro Aybar-Flores. 2024. "Evaluating Financial Inclusion in Peru: A Cluster Analysis Using Self-Organizing Maps" Journal of Risk and Financial Management 17, no. 12: 549. https://doi.org/10.3390/jrfm17120549

APA StyleTalavera, A., Maehara, R., Benites, L., Arriaga, B., & Aybar-Flores, A. (2024). Evaluating Financial Inclusion in Peru: A Cluster Analysis Using Self-Organizing Maps. Journal of Risk and Financial Management, 17(12), 549. https://doi.org/10.3390/jrfm17120549