Interdependence between the BRICS Stock Markets and the Oil Price since the Onset of Financial and Economic Crises

Abstract

1. Introduction

2. Literature Review

3. Key Components That Form the Basis of Copulas

3.1. Copula Properties

3.1.1. The Normal Copula

3.1.2. The Student-t Copula

3.1.3. The Gumbel Copula

3.1.4. The Clayton Copula

3.1.5. The Frank Copula

3.1.6. The Survival Copulas

- Clayton copula of the survival copula

- Gumbel copula of the survival copula

3.2. Estimating the Parameters That Govern the Copula’s Behavior

3.3. Goodness-of-Fit Test

3.4. Exchange Point Testing Method

4. Empirical Results

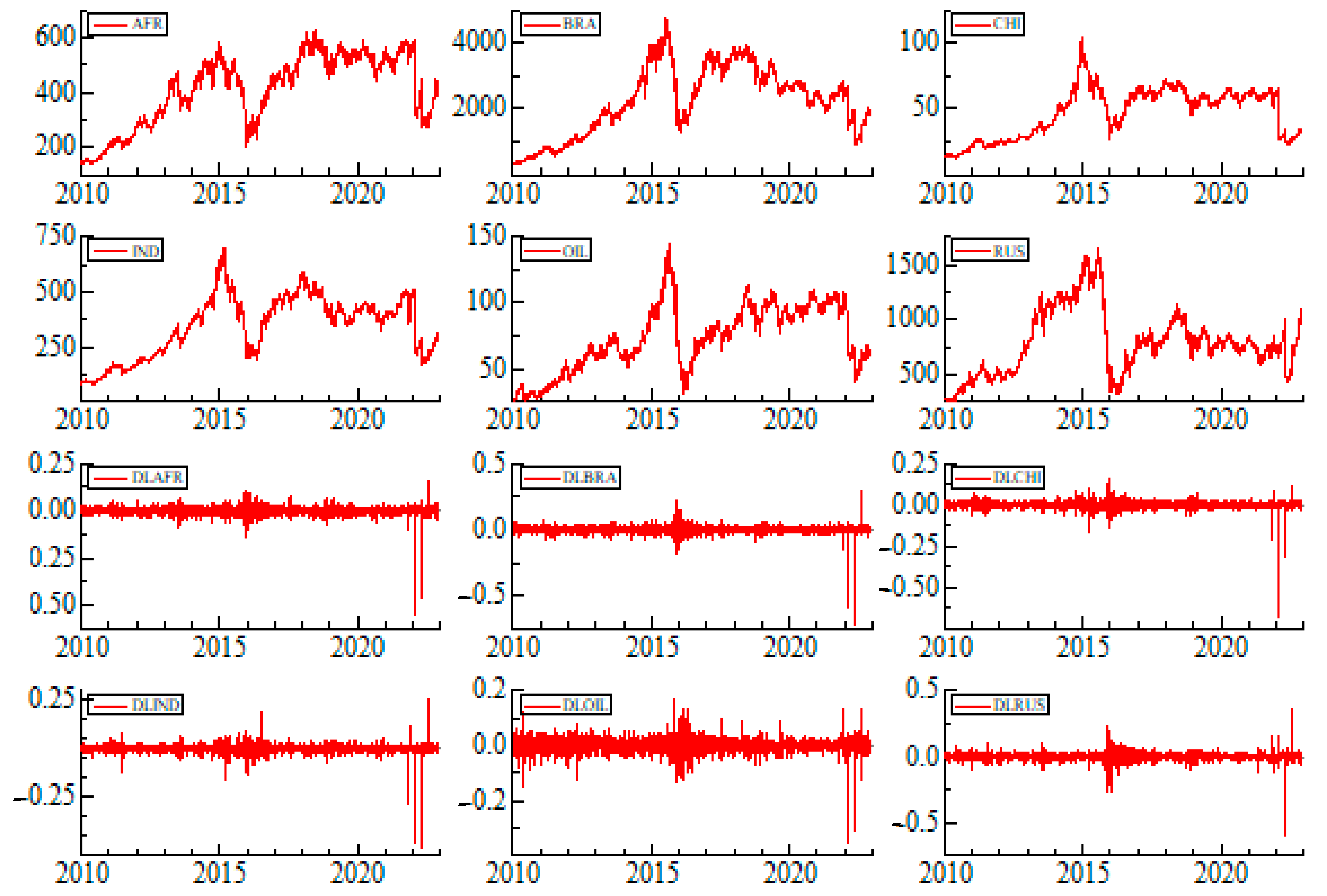

4.1. The Description of the Data

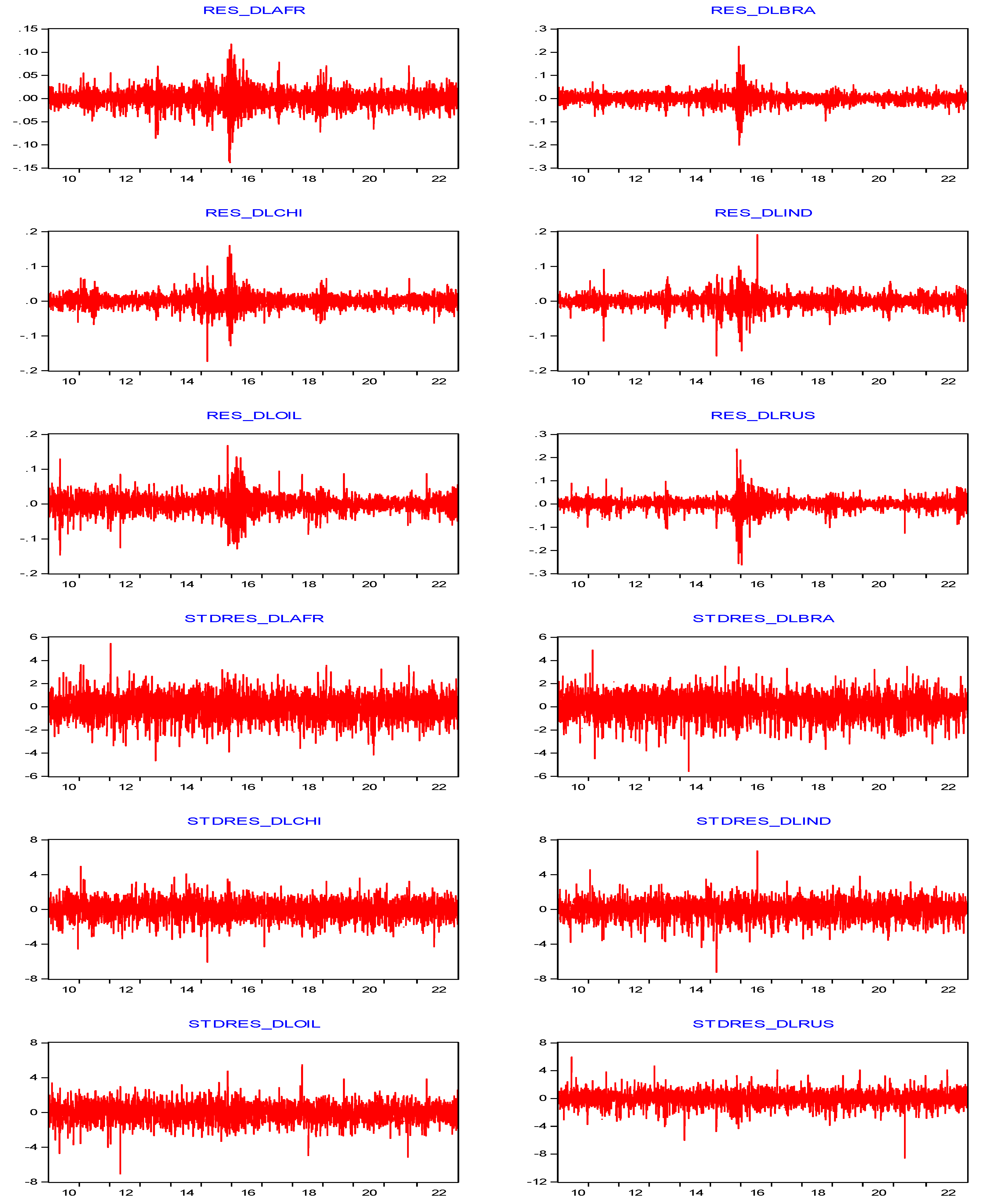

4.2. Marginal Distributions

4.3. Dependence Structure over the Entire Period

4.4. Testing the Change Point

4.5. An Analysis of the Dependency Structure over Different Sub-Periods

4.6. Value-at-Risk Study

- Begin by estimating the model using the first 1800 observations.

- Simulate 2000 values of the standardized residuals.

- Estimate the VaR and count the number of losses that exceed the estimated VaR values.

- Repeat this procedure until the last observation, comparing the estimated VaR with the actual next-day value change in the portfolio.

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | |

| 2 | The data for holidays and market closures have been excluded from our observations. |

| 3 | The autocorrelation functions and spectral densities are not included in the report. However, if you require these details, they can be provided upon request. |

| 4 | is the sample size. |

| 5 | The accent is put on the fact that the selected copula is the one with the lowest , as is mined instead of being exceeded in the estimate. |

| 6 | The critical values are chosen from Dias and Embrechts (2004). |

| 7 | The copulas mentioned earlier are re-estimated, and a goodness-of-fit test is conducted to determine the most suitable copula. Table 4 displays the selected copulas. The results are not presented here; they are available on request. |

References

- Agnieszka Cyndecka, Malgorzata. 2017. The Applicability and Application of the Market Economy Investor Principle: Lessons Learnt from the Financial Crisis. Eur. St. Aid LQ 16: 512. [Google Scholar] [CrossRef]

- Al-Awadhi, Abdullah M., Khaled Alsaifi, Ahmad Al-Awadhi, and Salah Alhammadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef]

- Alexakis, Panayotis D., Dimitris Kenourgios, and Dimitrios Dimitriou. 2016. On emerging stock market contagion: The Baltic region. Research in International Business and Finance 36: 312–21. [Google Scholar] [CrossRef]

- Alexander, Carol, and Elizabeth Sheedy. 2008. Developing a stress testing framework based on market risk models. Journal of Banking & Finance 32: 2220–36. [Google Scholar]

- Aloui, Riadh, Mohamed Safouane Ben Aïssa, and Duc Khuong Nguyen. 2011. Global financial crisis, extreme interdependences, and contagion effects: The role of economic structure? Journal of Banking & Finance 35: 130–41. [Google Scholar]

- Aloui, Riadh, Shawkat Hammoudeh, and Duc Khuong Nguyen. 2013. A time-varying copula approach to oil and stock market dependence: The case of transition economies. Energy Economics 39: 208–21. [Google Scholar] [CrossRef]

- Athari, Seyed Alireza, and Ngo Thai Hung. 2022. Time–frequency return co-movement among asset classes around the COVID-19 outbreak: Portfolio implications. Journal of Economics and Finance 46: 736–56. [Google Scholar] [CrossRef]

- Ayadi, Ahmed, Marjène Gana, Stéphane Goutte, and Khaled Guesmi. 2021. Equity-commodity contagion during four recent crises: Evidence from the USA, Europe and the BRICS. International Review of Economics & Finance 76: 376–423. [Google Scholar]

- Bachmeier, Lance, Qi Li, and Dandan Liu. 2008. Should oil prices receive so much attention? An evaluation of the predictive power of oil prices for the us economy. Economic Inquiry 46: 528–39. [Google Scholar] [CrossRef]

- Baillie, Richard T., and Tim Bollerslev. 1994. Cointegration, fractional cointegration, and exchange rate dynamics. The Journal of Finance 49: 737–45. [Google Scholar] [CrossRef]

- Beckmann, Joscha, Robert L. Czudaj, and Vipin Arora. 2020. The relationship between oil prices and exchange rates: Revisiting theory and evidence. Energy Economics 88: 104772. [Google Scholar] [CrossRef]

- Bekiros, Stelios, Rangan Gupta, and Alessia Paccagnini. 2015. Oil price forecastability and economic uncertainty. Economics Letters 132: 125–28. [Google Scholar] [CrossRef]

- Bernard, André, and Gérald Roy. 2003. Etude des distorsions de niveau des tests de Johansen pour la cointégration. Sherbrooke: Université de Sherbrooke, Faculté des lettres et sciences humaines, Département d’économique. [Google Scholar]

- Boubaker, Heni, and Syed Ali Raza. 2017. A wavelet analysis of mean and volatility spillovers between oil and BRICS stock markets. Energy Economics 64: 105–17. [Google Scholar] [CrossRef]

- Bouri, Elie, Chi Keung Marco Lau, Brian Lucey, and David Roubaud. 2019. Trading volume and the predictability of return and volatility in the cryptocurrency market. Finance Research Letters 29: 340–46. [Google Scholar] [CrossRef]

- Bu, Hui, Wenjin Tang, and Junjie Wu. 2019. Time-varying comovement and changes of comovement structure in the Chinese stock market: A causal network method. Economic Modelling 81: 181–204. [Google Scholar] [CrossRef]

- Burzala, Milda Maria. 2016. Contagion effects in selected European capital markets during the financial crisis of 2007–2009. Research in International Business and Finance 37: 556–71. [Google Scholar] [CrossRef]

- Büyükşahin, Bahattin, and Michel A. Robe. 2014. Speculators, commodities and cross-market linkages. Journal of International Money and Finance 42: 38–70. [Google Scholar] [CrossRef]

- Büyüksahin, Bahattin, Michael S. Haigh, and Michel A. Robe. 2009. Commodities and equities: Ever a market of one? The Journal of Alternative Investments 12: 76–95. [Google Scholar] [CrossRef]

- Canova, Fabio, and Matteo Ciccarelli. 2013. Panel Vector Autoregressive Models: A Survey☆ The views expressed in this article are those of the authors and do not necessarily reflect those of the ECB or the Eurosystem. In VAR models in Macroeconomics–New Developments and Applications: Essays in Honor of Christopher A. Sims. Bingley: Emerald Group Publishing Limited, vol. 32, pp. 205–46. [Google Scholar]

- Caporale, Guglielmo Maria, Faek Menla Ali, and Nicola Spagnolo. 2015. Oil price uncertainty and sectoral stock returns in China: A time-varying approach. China Economic Review 34: 311–21. [Google Scholar] [CrossRef]

- Charfeddine, Lanouar, and Karim Barkat. 2020. Short-and long-run asymmetric effect of oil prices and oil and gas revenues on the real GDP and economic diversification in oil-dependent economy. Energy Economics 86: 104680. [Google Scholar] [CrossRef]

- Chen, Yu, Zhicheng Wang, and Zhengjun Zhang. 2019. Mark to market value at risk. Journal of Econometrics 208: 299–321. [Google Scholar] [CrossRef]

- Chittedi, Krishna Reddy. 2010. Global stock markets development and integration: With special reference to BRIC countries. International Review of Applied Financial Issues and Economics, 18–36. [Google Scholar]

- Cong, Rong-Gang, Yi-Ming Wei, Jian-Lin Jiao, and Ying Fan. 2008. Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy 36: 3544–3553. [Google Scholar] [CrossRef]

- Corbet, Shaen, Yang Hou, Yang Hu, Brian Lucey, and Les Oxley. 2021. Aye Corona! The contagion effects of being named Corona during the COVID-19 pandemic. Finance Research Letters 38: 101591. [Google Scholar] [CrossRef] [PubMed]

- Crowder, William J. 1994. Foreign exchange market efficiency and common stochastic trends. Journal of International Money and Finance 13: 551–64. [Google Scholar] [CrossRef]

- Dash, Mihir, and Vikas Singh. 2019. A Comprehensive Study of Indian Financial Market. International Journal of Research and Analytical Reviews 6: 611–20. [Google Scholar]

- Demarzo, Peter M., David M. Frankel, and Yu Jin. 2021. Portfolio liquidity and security design with private information. The Review of Financial Studies 34: 5841–85. [Google Scholar] [CrossRef]

- Dias, Alexandra, and Paul Embrechts. 2004. Dynamic copula models for multivariate high-frequency data in finance. Manuscript, ETH Zurich 81: 1–42. [Google Scholar]

- Diaz, Elena Maria, Juan Carlos Molero, and Fernando Perez De Gracia. 2016. Oil price volatility and stock returns in the G7 economies. Energy Economics 54: 417–30. [Google Scholar] [CrossRef]

- Diebold, Francis X., Javier Gardeazabal, and Kamil Yilmaz. 1994. On cointegration and exchange rate dynamics. The Journal of Finance 49: 727–35. [Google Scholar] [CrossRef]

- Dimitriou, Dimitrios, Dimitris Kenourgios, and Theodore Simos. 2013. Global financial crisis and emerging stock market contagion: A multivariate FIAPARCH–DCC approach. International Review of Financial Analysis 30: 46–56. [Google Scholar] [CrossRef]

- Dupont, Louis. 2009. Cointégration et causalité entre développement touristique, croissance économique et réduction de la pauvreté: Cas de Haïti. Études Caribéennes, December 13–14. [Google Scholar] [CrossRef]

- Eleyan, Mohammed I. Abu, Abdurrahman Nazif Çatık, Mehmet Balcılar, and Esra Ballı. 2021. Are long-run income and price elasticities of oil demand time-varying? New evidence from BRICS countries. Energy 229: 120710. [Google Scholar] [CrossRef]

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society, 251–76. [Google Scholar] [CrossRef]

- Forbes, Kristin J., and Roberto Rigobon. 2002. No contagion, only interdependence: Measuring stock market comovements. The Journal of Finance 57: 2223–2261. [Google Scholar] [CrossRef]

- Gaye Gencer, Hatice, and Sercan Demiralay. 2016. Volatility modeling and value-at-risk (VaR) forecasting of emerging stock markets in the presence of long memory, asymmetry, and skewed heavy tails. Emerging Markets Finance and Trade 52: 639–57. [Google Scholar] [CrossRef]

- Genest, Christian, Bruno Rémillard, and David Beaudoin. 2009. Goodness-of-fit tests for copulas: A review and a power study. Insurance: Mathematics and Economics 44: 199–213. [Google Scholar] [CrossRef]

- Genest, Christian, Kilani Ghoudi, and L.-P. Rivest. 1995. A semiparametric estimation procedure of dependence parameters in multivariate families of distributions. Biometrika 82: 543–52. [Google Scholar] [CrossRef]

- Gjika, Dritan, and Roman Horvath. 2013. Stock market comovements in Central Europe: Evidence from the asymmetric DCC model. Economic Modelling 33: 55–64. [Google Scholar] [CrossRef]

- Goodell, John W. 2020. COVID-19 and finance: Agendas for future research. Finance Research Letters 35: 101512. [Google Scholar] [CrossRef] [PubMed]

- Grima, Simon, and Luca Caruana. 2017. The Effect of the Financial Crisis on Emerging Markets. A comparative analysis of the stock market situation before and after. Paper presented at DIEM: Dubrovnik International Economic Meeting, Sveučilište u Dubrovniku, Dubrovnik, Croatia, October 12–14; pp. 228–54. [Google Scholar]

- Gumbel, Emil J. 1960. Bivariate exponential distributions. Journal of the American Statistical Association 55: 698–707. [Google Scholar] [CrossRef]

- Hamilton, James D. 1983. Oil and the macroeconomy since World War II. Journal of Political Economy 91: 228–48. [Google Scholar] [CrossRef]

- Hamilton, James D. 2009. Causes and Consequences of the Oil Shock of 2007–2008. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Hamilton, James D. 2011. Nonlinearities and the macroeconomic effects of oil prices. Macroeconomic Dynamics 15: 364–78. [Google Scholar] [CrossRef]

- Hammoudeh, Shawkat, and Eisa Aleisa. 2004. Dynamic relationships among GCC stock markets and NYMEX oil futures. Contemporary Economic Policy 22: 250–69. [Google Scholar] [CrossRef]

- Hoese, Steffi, and Stefan Huschens. 2013. Stochastic orders and non-Gaussian risk factor models. Review of Managerial Science 7: 99–140. [Google Scholar] [CrossRef]

- Huang, Chiung-Ju. 2016. Is corruption bad for economic growth? Evidence from Asia-Pacific countries. The North American Journal of Economics and Finance 35: 247–56. [Google Scholar] [CrossRef]

- Huang, Yan, Haili Sun, Ke Xu, Songfeng Lu, Tongyang Wang, and Xinfang Zhang. 2021. CoRelatE: Learning the correlation in multi-fold relations for knowledge graph embedding. Knowledge-Based Systems 213: 106601. [Google Scholar] [CrossRef]

- Husain, Shaiara, Aviral Kumar Tiwari, Kazi Sohag, and Muhammad Shahbaz. 2019. Connectedness among crude oil prices, stock index and metal prices: An application of network approach in the USA. Resources Policy 62: 57–65. [Google Scholar] [CrossRef]

- Ji, Xiangfeng, Yusong Zhang, Nawazish Mirza, Muhammad Umar, and Syed Kumail Abbas Rizvi. 2020. The impact of carbon neutrality on the investment performance: Evidence from the equity mutual funds in BRICS. Journal of Environmental Management 297: 113228. [Google Scholar] [CrossRef]

- Joe, Harry. 1997. Multivariate Models and Multivariate Dependence Concepts. Boca Raton: CRC Press. [Google Scholar]

- Jorion, Philippe. 2007. Value at Risk: The New Benchmark for Managing Financial Risk. New York: The McGraw-Hill Companies, Inc. [Google Scholar]

- Karanasos, Antonios, Konstantinos Aznaouridis, George Latsios, Andreas Synetos, Stella Plitaria, Dimitrios Tousoulis, and Konstantinos Toutouzas. 2020. Impact of smoking status on disease severity and mortality of hospitalized patients with COVID-19 infection: A systematic review and meta-analysis. Nicotine and Tobacco Research 22: 1657–1659. [Google Scholar] [CrossRef] [PubMed]

- Kenourgios, Dimitris, Aristeidis Samitas, and Nikos Paltalidis. 2011. Financial crises and stock market contagion in a multivariate time-varying asymmetric framework. Journal of International Financial Markets, Institutions and Money 21: 92–106. [Google Scholar] [CrossRef]

- Khilar, Ruchi Priya, Shikta Singh, Sakti Ranjan Dash, and Maheswar Sethi. 2022. COVID-19 outbreak and stock market reaction: Evidence from emerging and advanced economies. Academy of Entrepreneurship Journal 28: 1–13. [Google Scholar]

- Kilian, Lutz, and Cheolbeom Park. 2009. The impact of oil price shocks on the US stock market. International Economic Review 50: 1267–1287. [Google Scholar] [CrossRef]

- Kojadinovic, Ivan, and Jun Yan. 2011. A goodness-of-fit test for multivariate multiparameter copulas based on multiplier central limit theorems. Statistics and Computing 21: 17–30. [Google Scholar] [CrossRef]

- Kollias, Christos, Catherine Kyrtsou, and Stephanos Papadamou. 2013. The effects of terrorism and war on the oil price–stock index relationshi. Energy Economics 40: 743–52. [Google Scholar] [CrossRef]

- Kristjanpoller, Werner, and Elie Bouri. 2019. Asymmetric multifractal cross-correlations between the main world currencies and the main cryptocurrencies. Physica A: Statistical Mechanics and Its Applications 523: 1057–1071. [Google Scholar] [CrossRef]

- Kumar, Satish, Ashis Kumar Pradhan, Aviral Kumar Tiwari, and Sang Hoon Kang. 2019. Correlations and volatility spillovers between oil, natural gas, and stock prices in India. Resources Policy 62: 282–91. [Google Scholar] [CrossRef]

- Lehkonen, Heikki, and Kari Heimonen. 2014. Timescale-dependent stock market comovement: BRICs vs. developed markets. Journal of Empirical Finance 28: 90–103. [Google Scholar] [CrossRef]

- Li, Youshu, and Junjie Guo. 2022. The asymmetric impacts of oil price and shocks on inflation in BRICS: A multiple threshold nonlinear ARDL model. Applied Economics 54: 1377–1395. [Google Scholar] [CrossRef]

- Liu, Chang, Haoming Shi, Liang Wu, and Min Guo. 2020. The short-term and long-term trade-off between risk and return: Chaos vs rationality. Journal of Business Economics and Management 21: 23–43. [Google Scholar] [CrossRef]

- Liu, Xuyi, Shun Zhang, and Junghan Bae. 2017. The nexus of renewable energy-agriculture-environment in BRICS. Applied Energy 204: 489–96. [Google Scholar] [CrossRef]

- Malik, Farooq, and Zaghum Umar. 2019. Dynamic connectedness of oil price shocks and exchange rates. Energy Economics 84: 104501. [Google Scholar] [CrossRef]

- Martín-Barragán, Belén, Sofia B. Ramos, and Helena Veiga. 2015. Correlations between oil and stock markets: A wavelet-based approach. Economic Modelling 50: 212–27. [Google Scholar] [CrossRef]

- Mensi, Walid, Besma Hkiri, Khamis H. Al-Yahyaee, and Sang Hoon Kang. 2018. Analyzing time–frequency co-movements across gold and oil prices with BRICS stock markets: A VaR based on wavelet approach. International Review of Economics & Finance 54: 74–102. [Google Scholar]

- Mensi, Walid, Shawkat Hammoudeh, Duc Khuong Nguyen, and Sang Hoon Kang. 2016. Global financial crisis and spillover effects among the US and BRICS stock markets. International Review of Economics & Finance 42: 257–76. [Google Scholar]

- Mollah, Sabur, A. M. M. Shahiduzzaman Quoreshi, and Goran Zafirov. 2016. Equity market contagion during global financial and Eurozone crises: Evidence from a dynamic correlation analysis. Journal of International Financial Markets, Institutions and Money 41: 151–67. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar, Ruipeng Liu, and Joakim Westerlund. 2016. A GARCH model for testing market efficiency. Journal of International Financial Markets, Institutions and Money 41: 121–38. [Google Scholar] [CrossRef]

- Nelsen, Roger B. 2006. Archimedean Copulas. An Introduction to Copulas. Berlin and Heidelberg: Springer Science & Business Media, pp. 109–55. [Google Scholar]

- Okere, Kingsley Ikechukwu, Favour Chidinma Onuoha, Obumneke Bob Muoneke, and Agbede Moses Oyeyemi. 2021. Towards sustainability path in Argentina: The role of finance, energy mix, and industrial value-added in low or high carbon emission—application of DARDL simulation. Environmental Science and Pollution Research 28: 55053–55071. [Google Scholar] [CrossRef]

- Qamar, Muhammad Ali Jibran, Umar Farooq, Hamayun Afzal, and Waheed Akhtar. 2016. Determinants of debt financing and their moderating role to leverage-performance relation: An emerging market review. International Journal of Economics and Finance 8: 300–11. [Google Scholar] [CrossRef]

- Raheem, Ibrahim D., Ajide Kazeem Bello, and Yusuf H. Agboola. 2020. A new insight into oil price-inflation nexus. Resources Policy 68: 101804. [Google Scholar] [CrossRef]

- Rajamani, K., N. Akbar Jan, A. K. Subramani, and A. Nirmal Raj. 2022. Access to Finance: Challenges Faced by Micro, Small, and Medium Enterprises in India. Engineering Economics 33: 73–85. [Google Scholar]

- RATTI, Ronald A., and Joaquin L. Vespignani. 2016. Oil prices and global factor macroeconomic variables. Energy Economics 59: 198–212. [Google Scholar] [CrossRef]

- Ready, Robert C. 2018. Oil consumption, economic growth, and oil futures: The impact of long-run oil supply uncertainty on asset prices. Journal of Monetary Economics 94: 1–26. [Google Scholar] [CrossRef]

- Ren, Shi-Yan, Rong-Ding Gao, and Ye-Lin Chen. 2020. Fear can be more harmful than the severe acute respiratory syndrome coronavirus 2 in controlling the corona virus disease 2019 epidemic. World Journal of Clinical Cases 8: 652. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1998. Initial public offerings. Contemporary Finance Digest 2: 5–30. [Google Scholar]

- Rouatbi, Wael, Ender Demir, Renatas Kizys, and Adam Zaremba. 2021. Immunizing markets against the pandemic: COVID-19 vaccinations and stock volatility around the world. International Review of Financial Analysis 77: 101819. [Google Scholar] [CrossRef]

- Sklar, M. 1959. Fonctions de répartition à n dimensions et leurs marges. Annales de l’ISUP 8: 229–31. [Google Scholar]

- Tse, Yiu Kuen. 1998. The conditional heteroscedasticity of the yen–dollar exchange rate. Journal of Applied Econometrics 13: 49–55. [Google Scholar] [CrossRef]

- Uebele, Martin, and Albrecht Ritschl. 2009. Stock markets and business cycle comovement in Germany before World War I: Evidence from spectral analysis. Journal of Macroeconomics 31: 35–57. [Google Scholar] [CrossRef]

- Yoon, Seong-Min, Md Al Mamun, Gazi Salah Uddin, and Sang Hoon Kang. 2019. Network connectedness and net spillover between financial and commodity markets. The North American Journal of Economics and Finance 48: 801–18. [Google Scholar] [CrossRef]

- Zarour, Bashar Abu. 2006. Wild oil prices, but brave stock markets! The case of GCC stock markets. Operational Research 6: 145–62. [Google Scholar] [CrossRef]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef] [PubMed]

| Countries | DLBRA | DLRUS | DLIND | DLCHI | DLAFR | DLOIL |

|---|---|---|---|---|---|---|

| Mean | 0.0008 | 0.0004 | 0.0006 | 0.0005 | 0.0007 | 0.0005 |

| Maximum | 0.2197 | 0.2410 | 0.2065 | 0.1909 | 0.0812 | 0.1758 |

| Minimum | −0.1865 | −0.2433 | −0.1565 | −0.1616 | −0.0360 | −0.1723 |

| Std. Dev. | 0.0222 | 0.0244 | 0.0168 | 0.01839 | 0.0199 | 0.0227 |

| Skewness | −0.1968 | −0.8368 | −0.301 | −0.0698 | −0.2904 | −0.1222 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Kurtosis | 13.7022 | 21.0023 | 15.1034 | 12.6939 | 9.4539 | 9.0567 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Jarque–Bera | 3157.7456 | 4879.5456 | 3023.5663 | 2851.9997 | 1118.0023 | 1307.0091 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| 17.9923 | 15.0232 | 14.0435 | 11.1728 | 14.0654 | 11.0962 | |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| 2568.5726 | 3578.5342 | 2867.3429 | 4582.8094 | 3578.5947 | 45,643.876 | |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| ARCH | 117.3457 | 157.9453 | 139.1563 | 217.0763 | 179.1523 | 217.9937 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| DLBRAZIL | DLRUSSIA | DLINDIA | DLCHINA | DLAFRICA | DLOIL | |

|---|---|---|---|---|---|---|

| 0.000 *** | 0.000 *** | 0.001 *** | 0.001 *** | 0.000 *** | 0.002 *** | |

| (3.462) | (3.983) | (4.455) | (3.982) | (4.323) | (3.764) | |

| 0.068 | 0.078 | 0.132 | 0.094 | 0.104 | 0.152 | |

| −0.758 | −0.549 | −0.645 | ||||

| 0.720 | 0.612 | 0.771 | ||||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.467 | 0.486 | 0.4830 | 0.532 | 0.463 | 0.482 | |

| 0.278 | 0.395 | 0.242 | 0.637 | |||

| 1.595 | 1.938 | 2.112 | 1.821 | |||

| 0.462 | 0.698 | 0.748 | 0.768 | 0.739 | 0.517 | |

| 0.192 | 0.338 | 0.095 | 0.169 | 0.259 | 0.238 | |

| Skw | 0.375 | −0.478 | −0.902 | 0.984 | 1.853 | −0.576 |

| Ex. Kurt | 2.325 | 2.478 | 4.351 | 3.568 | 1.467 | 0.789 |

| 11.458 | 17.356 | 17.341 | 11.342 | 14.458 | 16.734 | |

| 15.456 | 18.457 | 22.277 | 16.350 | 13.283 | 12.4564 |

| Selected Copula | LL | AIC | BIC | [p-Values] | ||||

|---|---|---|---|---|---|---|---|---|

| BRAZIL | Clayton | 0.0199 | 0.000 | 0 | −10.301 | −20.609 | −20.590 | 0.015 [0.251] |

| RUSSIA | Gumbel | 1.145 | 0 | 0.161 | −12.440 | −24.889 | −24.880 | 0.030 [0.390] |

| INDIA | Survival Gumbel | 1.131 | 0.150 | 0 | −16.790 | −33.590 | −33.581 | 0.024 [0.322] |

| CHINA | Survival Gumbel | 1.146 | 0.165 | 0 | −14.669 | −29.356 | −29.340 | 0.024 [0.360] |

| SOUTH AFRICA | Survival Gumbel | 1.170 | 0.194 | 0 | −16.253 | −32.471 | −32.475 | 0.034 [0.237] |

| Countries | |

|---|---|

| BRAZIL | 1 March 2020 |

| RUSSIA | 1 June 2020 |

| INDIA | 29 June 2020 |

| CHINA | 9 May 2020 |

| SOUTH AFRICA | 2 July 2020 |

| Countries | Quiet Period (Pre-Financial Crisis Period) | Crisis Period (Post-Financial Crisis Period) | ||||

|---|---|---|---|---|---|---|

| RUSSIA | 0.000 | 0.000 | 0 | 0.204 | 0.034 | 0 |

| INDIA | 0.071 | 0.000 | 0 | 0.107 | 0.003 | 0 |

| CHINA | 1.123 | 0 | 0.147 | 1.109 | 0 | 0.133 |

| SOUTH AFRICA | 1.112 | 0.135 | 0 | 1.131 | 0.154 | 0 |

| BRAZIL | 1.121 | 0.144 | 0 | 1.160 | 0.183 | 0 |

| Countries | |||||

|---|---|---|---|---|---|

| Backtest | Proportion | Number | Proportion | Number | |

| BRAZIL | Normal | 0.097 | 85 | 0.092 | 79 |

| Clayton | 0.089 | 78 | 0.085 | 70 | |

| RUSSIA | Normal | 0.105 | 98 | 0.098 | 92 |

| Gumbel | 0.096 | 89 | 0.087 | 82 | |

| INDIA | Normal | 0.114 | 103 | 0.103 | 97 |

| Survival Gumbel | 0.105 | 94 | 0.097 | 88 | |

| CHINA | Normal | 0.092 | 94 | 0.086 | 86 |

| Survival Gumbel | 0.087 | 86 | 0.080 | 78 | |

| AFRICA | Normal | 0.086 | 83 | 0.077 | 76 |

| Survival Gumbel | 0.078 | 75 | 0.071 | 69 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bouslama, N. Interdependence between the BRICS Stock Markets and the Oil Price since the Onset of Financial and Economic Crises. J. Risk Financial Manag. 2023, 16, 316. https://doi.org/10.3390/jrfm16070316

Bouslama N. Interdependence between the BRICS Stock Markets and the Oil Price since the Onset of Financial and Economic Crises. Journal of Risk and Financial Management. 2023; 16(7):316. https://doi.org/10.3390/jrfm16070316

Chicago/Turabian StyleBouslama, Narjess. 2023. "Interdependence between the BRICS Stock Markets and the Oil Price since the Onset of Financial and Economic Crises" Journal of Risk and Financial Management 16, no. 7: 316. https://doi.org/10.3390/jrfm16070316

APA StyleBouslama, N. (2023). Interdependence between the BRICS Stock Markets and the Oil Price since the Onset of Financial and Economic Crises. Journal of Risk and Financial Management, 16(7), 316. https://doi.org/10.3390/jrfm16070316