Abstract

In this study, we examined the influence of users’ experiences with the unified payments interface (UPI) system on the usage behavior of central bank digital currency (CBDC) in India. Our research developed a novel conceptual framework that investigated the relationships between technology, cognitive factors, and behavioral intentions towards CBDC use. The framework integrated UPI usage experience as a moderator within existing models of behavioral intentions and use behaviors. We collected data through a survey conducted in major Indian cities during the pilot launch of CBDC. By utilizing a partial least squares structural equation model (PLS-SEM), we analyzed the proposed model and the relationships between the constructs. Our findings revealed the significant impact of hedonic motivation and performance expectancy on users’ behavioral intentions towards CBDC. Social influence also played a significant role in CBDC usage. Furthermore, we identified that prior UPI usage negatively moderated the relationship between performance expectancy and behavioral intention, as well as the relationship between social influence and use behavior. However, prior UPI usage did not significantly moderate the relationships between perceived risk, hedonic motivation, behavioral intention, and use behavior. These findings contribute to our understanding of the factors influencing CBDC adoption and usage behavior in India.

1. Introduction

The central bank digital currency (CBDC) concept has sparked widespread interest, and all major central banks are currently looking into its implementation. CBDCs would need to be adopted and used on a large enough scale in the rapidly changing payment landscape to achieve the public policy goals they intend to accomplish. According to BIS (2021), central banks in 86% of countries surveyed were investigating the possibility of CBDCs, 60% were conducting experiments, and 14% were launching pilot projects. Investigating the importance of various factors in determining whether users would adopt and use CBDCs is crucial since users’ needs evolve rapidly, and innovation is reshaping their services.

CBDC and UPI are two distinct concepts related to the financial system’s digitalization. While they both deal with digital payments, their purposes are different, and they operate at different levels of the financial system. CBDCs are intended to be used as legal tender and would have the same status as physical currency. UPI, on the other hand, is a payment system created by the National Payments Corporation of India (NPCI) that enables instant fund transfers between bank accounts via a mobile phone. UPI allows users to make payments, transfer money, and pay bills without the use of physical currency. CBDC is a form of currency, whereas UPI is an interface where currency is used.

The Reserve Bank of India prefers a centrally controlled, conventional database infrastructure for CBDC instead of a DLT-based infrastructure due to the latter’s limitations. On the other hand, UPI is a payment system that operates on a real-time payment infrastructure developed by the NPCI. UPI enables instant fund transfers between bank accounts through a mobile phone. UPI uses a combination of technology solutions, such as Immediate Payment Service (IMPS) and USSD (Unstructured Supplementary Service Data) to facilitate payments. The motive behind the implementation of CBDC alongside the UPI payment system in India is to improve financial inclusion, reduce transaction costs, develop a secure payment system, and improve monetary policy. By utilizing CBDC, central banks can effectively implement and adjust monetary policy measures, including interest rate setting and liquidity management within the financial system. This heightened control enables a more precise and responsive implementation of monetary policy, potentially resulting in improved economic stability (Lukonga 2023).

Previous studies analyzing the factors that influence digital payment use and adoption behavior have utilized various theoretical models, such as the Technology Acceptance Model (TAM) (Dixit et al. 2022; Rodrigues et al. 2021) and the Unified Theories of Acceptance and Use of Technology (UTAUT and UTAUT2) (Manrai et al. 2021; Patil et al. 2020; Sharma and Sharma 2019). However, there are only a limited number of studies that have examined CBDC use behavior. For instance, Wu et al. (2022) employed an extended UTAUT model to investigate the factors affecting the adoption of China’s digital currency electronic payment (DCEP) by the Central Bank of China. China was the first major economy to pilot a CBDC in 2020, and the e-CNY is expected to be widely used in China by 2023 (Benzmiller 2022). In the meantime, the Reserve Bank of India launched CBDC pilot programs in the wholesale and retail sectors towards the end of 2022, with high hopes of success in the near future. Given that a CBDC must anticipate future user requirements and incorporate relevant innovations, this study aims to address the gaps in the literature by examining CBDC use behavior using original data from Indian regions where the government launched the e-rupee pilot test.

The study’s aim is to determine whether users’ experiences with unified payments interface systems would facilitate the adoption of central bank digital currency in a country such as India. In India, the UPI platform is already driving a digital payment revolution. Throughout the country, UPI-based payment is already a daily life activity for a variety of users, including retailers, service providers, small businesses, entrepreneurs, and suppliers, among others. Market potential, timing, and adoption rate are all critical factors to consider for digital payment apps that use the UPI system to expand their capacity. Shifting users’ preferences toward CBDC after the adoption of the UPI payment system is a significant challenge for the Reserve Bank of India.

To achieve the study’s aim, a theoretical framework based on a modified unified theory of acceptance and use of technology (UTAUT) model was developed. The proposed model incorporates UPI usage experience as a moderator in the existing behavioral intentions and adoption behaviors framework. The data sample consists of 517 survey responses collected from Mumbai, New Delhi, Bengaluru, and Bhubaneswar between November and December 2022. We discovered that performance expectancy and hedonic motivation both have a positive influence on CBDC behavior intention, whereas perceived risk has a negative influence. Furthermore, social influence has a positive impact on use behavior. Prior experience with UPI significantly moderates the relationship between performance expectancy and behavior intention, as well as the relationship between social influence and use behavior, according to the study.

The paper contributes to the existing literature in three significant ways. First, we employed modified versions of the Unified Theory of Acceptance and Use of Technology (UTAUT) and Technology Acceptance Model (TAM) to explain the variables influencing CBDC behavioral intention and usage behavior. This framework provides valuable insights that can inform the development of more effective strategies for encouraging CBDC usage.

Second, our study introduces a novel contribution by incorporating UPI usage experience as a moderator within the behavioral intention and usage behavior framework. This inclusion is the first of its kind and recognizes the impact of UPI usage experience on individuals’ familiarity with digital payment methods, their trust in the payment system, and their overall willingness to adopt a new form of currency. This addition enhances our understanding of the factors influencing CBDC usage and contributes to the existing literature on digital payment behavior.

Third, our findings reveal that behavioral intention has a strong influence on use behavior, with an explanatory power of 57.80%. This highlights the significant role of behavioral intention in usage and suggests that strategies to promote CBDC usage should focus on influencing users’ intentions. The insights gained from our research can assist central banks and policymakers in making more informed and successful decisions regarding CBDC implementation.

The paper is structured as follows. The introduction provides a clear overview of the research topic and sets the stage for the study. Section 2 provides an in-depth analysis of the CBDC as a means of payment, which is essential for understanding the research model and hypotheses formulated in the study. The data and methodology are presented in Section 3, which provides transparency regarding the research methods employed. The research findings are presented in Section 4, and a detailed discussion of the results is provided in Section 5. The paper concludes with Section 6, which draws conclusions and provides some final thoughts on the study.

2. Literature Review and Hypotheses Development

2.1. Central Bank Digital Currency (CBDC) as a Means of Payment

Central banks play a crucial role in the financial ecosystem of each country by providing reliable, efficient, and timely solutions for their national economies. Concurrently, digital currency is gaining popularity as a payment method and an alternative to traditional modes of payment such as cash, checks, and credit cards (Chaum et al. 2021; Zaidi and Rupeika-Apoga 2021). Digital currencies offer several benefits such as facilitating online transactions, money transfers, storage of value, and investment opportunities. Moreover, due to the increased expense and time required for printing money, individuals tend to prefer the convenience and ease of use of digital payment options (Ligon et al. 2019).

Several central banks across the globe, such as those in the United States, China, Russia, and the Bahamas, are actively involved in developing or researching CBDC projects (Alonso et al. 2021). The emergence of new financial transactions, financial technologies, and financial services, coupled with the upheaval caused by the COVID-19 pandemic, has heightened interest in CBDC (Adrian and Griffoli 2019). The Reserve Bank of India aims to launch CBDC pilots in both the wholesale and retail segments by the end of 2022, where individuals can use digital rupee-retail (e₹-R) to make payments to businesses, shops, or other individuals, while financial institutions can use digital rupee-wholesale (e₹-W) to settle financial market trades (Ray 2023). The successful implementation of the pilot project could enable CBDCs to ensure that the general public continues to use and access the most secure form of money, i.e., a central bank entitlement, even as economies become more digitalized (Babin et al. 2022). CBDC adoption could potentially expand the range of payment options available, reduce the time and cost involved in cross-border payments, widen access to financial services, and facilitate fiscal transfers during liquidity crises or economic recessions (Varma et al. 2022). A CBDC is a digital currency that has an equivalent value to fiat currency and can be exchanged for physical currency (Bordo et al. 2021). While CBDCs differ from decentralized and anonymous digital currencies such as Bitcoin, they can still use blockchain technology to produce both types of currency. The Chinese digital yuan has been in existence since 2020 but is currently in the pilot stage (Benzmiller 2022). China’s well-established digital and mobile payment infrastructure has led to the increased popularity of digital payments among Chinese consumers, displacing card payments. Central banks in developing countries are considering the potential of official digital currencies to reach the unbanked population (Blakstad and Allen 2018).

Several theoretical studies have been conducted to evaluate the potential of digital currency to appeal to a larger population. Lohana and Roy (2021) have highlighted that digital currency issued by central banks is still in its early stages, and as a result, smartphone users are not charged any transaction fees. Fahad and Shahid (2022) have examined the efficiency of digital payments by assessing the time taken to complete transactions, which requires only a single swipe, and the minimal involvement of middlemen. Additionally, Croxson et al. (2022) have demonstrated that the advantages of digital currency could contribute significantly to the expansion of India’s financial system. Although the adoption of new technology with digital payment systems has been researched in high- and upper-middle-income countries (Asongu et al. 2021; Lashitew et al. 2019), there are relatively few studies conducted for low- and middle-income countries (Li et al. 2021), and even fewer studies have been conducted for India (Handa 2020; Aggarwal et al. 2021).

Saha and Kiran (2022) and Gupta et al. (2019) conducted studies that demonstrate how users’ intention to use the unified payments interface is significantly affected by their expectations of the system’s performance, effort, and ease of use. In the context of studying the use behavior of CBDC, a novel theoretical framework, based on the unified theory of acceptance and use of technology (UTAUT), has been proposed by Wu et al. (2022). Abrahão et al. (2021) have reported that the UTAUT model’s prediction efficiency is 70% higher than that of the technology acceptance model (TAM) because it incorporates host and control variables. Recent studies have emphasized the importance of social influence in the widespread adoption of technologies such as digital payments and e-learning (Qu et al. 2022).

The Indian government has proposed the launch of a CBDC, and exploring the usage experience of the UPI may offer valuable insights into formulating effective policies for the adoption and implementation of CBDC. The success of UPI could potentially demonstrate the feasibility and advantages of digital payments, thereby facilitating the adoption of CBDC in India. However, it is possible that the success of UPI could lead to complacency or a lack of urgency in adopting CBDC, especially if users and businesses are already satisfied with existing digital payment mechanisms. Despite recent research on the factors that determine CBDC usage, there is no literature that specifically investigates the moderating influence of UPI usage experience on CBDC usage behaviors.

CBDC development represents a recent phenomenon that may trigger a fundamental shift in economic culture. Therefore, there is a pressing need to investigate the level of acceptance of CBDC as a payment system. This research aims to examine CBDC usage in relation to users’ prior experiences with the UPI by utilizing a conceptualized model that extracts some variables from the UTAUT model, the technology acceptance model, and the UTAUT 2 model. The UTAUT model has gained popularity in the technology adoption field as it integrates eight theories, including motivation theory, the technology acceptance model, the theory of reasoned action, the theory of planned behavior, social cognitive theory, the usage spread of advancement, and the combined technology acceptance model and theory of planned behavior. Despite its high explanatory capabilities for user intentions and usage behaviors, researchers continue to utilize the variables of the UTAUT model to better explain specific user behaviors in various research contexts. Our study’s findings have the potential to provide valuable insights into CBDC usage behavior and could be significant for policymakers, industry practitioners, and researchers. The UTAUT model proposes that the intention to use technology influences actual usage, with performance expectancy, effort expectancy, social influence, and facilitating conditions impacting the likelihood of technology adoption. However, in this study, the model has been conceptualized by including performance expectancy and social influence from UTAUT, hedonic motivation from UTAUT 2, and perceived risk from TAM. In addition, user experience with UPI has been used as a moderator.

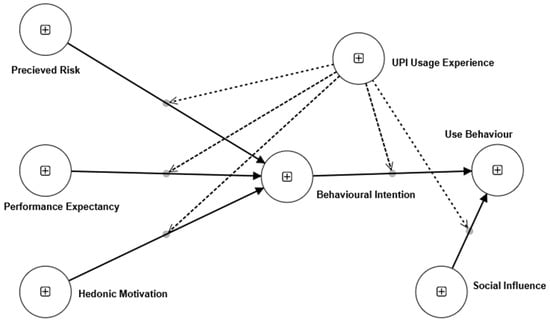

By investigating the usage of digital currency issued by central banks, this study presents a theoretical model. Figure 1 represents the paths of partial least squares structural equation modeling. In the model, seven different constructs are used. Perceived risk, performance expectancy, and hedonic motivation lead to behavioral intention, which in turn affects use behavior. Use behavior is the dependent variable in the model, with others being independent variables. Behavioral intention is a mediator in the model; it is affected by perceived risk, performance expectancy, and hedonic motivation, but it also affects use behavior. Use behavior is also affected by social influence. UPI usage experience is taken as a moderator in the path analysis, as it is hypothesized that it may affect the relationship between other constructs used in the model.

Figure 1.

Research model. Source: authors’ own work.

A research model (Figure 1) was developed to investigate the hypothesized relationship between technological effects and cognitive influence processes and their impact on behavioral intention. On the basis of the existing research gaps in the literature, we investigated the moderating effect of UPI use on factors affecting CBDC usage behavior. The following hypotheses were proposed.

2.2. Hypotheses

2.2.1. Perceived Risk

Perceived risk is a crucial factor that can impact the adoption and use of digital currency. This risk can manifest in several ways, including the possibility of financial loss due to fraud or hacking (Klobas et al. 2019), transaction errors (Khedmatgozar and Shahnazi 2018), and social risk associated with isolating oneself from their social circle (Maziriri and Chuchu 2017). Users’ perception of risk associated with digital currency can significantly affect their acceptance, usefulness, and satisfaction with the technology (Featherman and Pavlou 2003). Even a minor perceived risk can significantly impact user behavior and adoption of the technology. Studies utilizing TAM have shown that perceived risk has a significant explanatory power in the adoption and use of digital banking in rural areas (Abdul-Hamid et al. 2019). It has also been studied that perceived risk indirectly impacts intentions to use an online application under security threats (Lu et al. 2005).

The study by Jeon et al. (2020) validated the TAM model, which was expanded to include perceived risk and innovativeness as additional factors, in order to identify antecedents that influence customers’ intention to adopt self-service technology in restaurants. Lee et al. (2010) investigated the effect of trust and perceived risk in the context of certified electronic document authorities. Given the importance of understanding the potential risks associated with digital currency, we included a perceived risk factor and developed the following hypothesis.

H1:

Perceived Risk (PR) has a negative impact on Behavior Intention (BI).

2.2.2. Performance Expectancy

Performance expectancy refers to an individual’s belief that using a particular system will improve their job performance (Venkatesh et al. 2003). As a fundamental construct, it plays a significant role in determining the post-adoption use of relevant technology and is a strong predictor of behavioral intention (Nikolopoulou et al. 2021). Essentially, it measures the extent to which a person perceives that technology will enhance their efficiency and effectiveness (Diep et al. 2016). Studies have consistently shown that performance expectancy significantly influences an individual’s behavior intention towards adopting and using technology (Jangir et al. 2022). If individuals believe that technology will help them perform better and achieve their goals, they are more likely to use and adopt it. On the other hand, if they do not see any benefits or improvements, they are less likely to use and adopt it (Sharma et al. 2022). Therefore, technology designers and implementers must focus on improving performance expectancy as it is crucial in determining an individual’s behavior intention towards adopting and using new technology (Lakhwani et al. 2020). To determine the degree to which digital currency users perceive that using digital currency will benefit them in their daily lives, the following hypothesis was developed.

H2:

Performance Expectancy (PE) has a positive impact on Behavior Intention (BI).

2.2.3. Hedonic Motivation

The impact of hedonic perception on behavioral intention is the focus of the psychological field known as perceived enjoyment (Wang and Wang 2010). Perceived enjoyment refers to the pleasure or enjoyment that results from using digital currency to make or receive funds in digital form (Sarosa 2019). Hedonic motivation refers to emotional experiences such as joy, imagination, enlightenment, sensuality, and happiness (Berridge and Kringelbach 2011). Customers’ willingness to use certain online banking services is influenced by their perceived enjoyment (Curran and Meuter 2014). Hedonic motivation can also influence a person’s behavior and intention to use central bank digital currency. If users find CBDC enjoyable and positive, they are more likely to use it regularly and spread the word about it (Abbasi et al. 2021). Perceived risk can also influence the adoption of CBDCs, as factors such as security, privacy, trust, and uncertainty about new technology can all affect it. Users may be less likely to adopt CBDCs if they believe they pose significant risks, such as the possibility of hacking or loss of privacy. However, they may be more likely to use CBDCs if they perceive them to be secure and reliable (Salem and Ali 2019).

Hedonic motivation is regarded as the most significant theoretical addition to the UTAUT2 because it introduced a much-needed affective component into the primarily cognition-based UTAUT (Manrai et al. 2021). It shifted the emphasis from extrinsic organizational user motivation to intrinsic consumer technology motivation. Hedonic motivation was added to the research model because it is an important determinant of consumer technology acceptance and use.

The hypothesis presented here was developed to investigate how hedonic motivation influences user behavior when it comes to using and adopting digital currency.

H3:

Hedonic Motivation (HM) has a positive impact on Behavior Intention (BI).

2.2.4. Social Influence

Individuals are frequently influenced by the opinions, attitudes, and behaviors of those around them, so social influence plays a significant role in shaping behavior (Howard 2012). People tend to conform to their peers’ and social groups’ opinions and behaviors, especially when they perceive them as credible or trustworthy sources of information (Bakshy et al. 2012). If they believe that a product or behavior is widely used or accepted by others, they are more likely to adopt it. Word-of-mouth recommendations, user reviews, and public displays of use can all demonstrate social influence (Chevalier and Mayzlin 2018). Individuals are more likely to adopt a product or behavior if it comes from someone they know and trust (Komiak and Benbasat 2006). Because personal recommendations are more credible than other forms of advertising or marketing, a person who already uses UPI may not change their behavior after the introduction of CBDC, as they may consider both to be the same. However, if people around them start using CBDC, the user may be more likely to adopt the new technology to make transactions easier. Compatibility with the new technology, CBDC, can explain this behavior logically. People frequently model their actions after those they admire, including the products and brands they choose (Sharma et al. 2023a). Social influence has a powerful impact on user behavior and can drive the spread of products, behaviors, and ideas (Yang et al. 2012).

Akbar (2013) defines social influence as the degree to which an end-user is persuaded to adopt a technology on the basis of the recommendations or influence of others (a workgroup or friends). The subjective norm of one’s social circle may influence a user’s intention to use digital currency. Jasimuddin et al. (2017) found that societal factors influence the commons’ willingness to use new tools. The importance of social impact through word-of-mouth was emphasized by Baur et al. (2015), and it was argued that this was the catalyst for the use of digital currencies. The following hypothesis was developed to determine the effect of social influence on the use behavior of digital currency.

H4:

Social Influence (SI) has a positive impact on Use Behavior (UB).

2.2.5. Behavioral Intention

An individual’s attitude toward behavior (Vagnani and Volpe 2017), the subjective norm of an individual’s perceived risk (Amirtha et al. 2020), performance expectancy (Catherine et al. 2017), and hedonic motivation (Santo and Marques 2022) all influence the intention to adopt technology-based innovation. Understanding the user’s behavioral intention and anticipating what motivates them to adopt the innovation will most likely be critical to digital currency growth (Sobti 2019). The following hypothesis was developed to determine the impact of behavioral intention on use behavior.

H5:

Behavior Intention (BI) has a positive impact on Use Behavior (UB).

2.2.6. UPI Usage Experience

With the emergence of the digital revolution and the Indian government’s push for a cashless economy, along with ongoing demonetization efforts, many non-banking players have entered the payment space (Rupeika-Apoga et al. 2022). India’s UPI platform has proven highly advantageous for both consumers and financial institutions (Sivathanu 2019). However, UPI usage experience may serve as a moderator and impact the variables related to CBDC usage under investigation. Users who have had a positive experience with UPI may exhibit hesitancy in shifting to a new payment system such as CBDCs (Bijlsma et al. 2021). On the other hand, some users may have faced issues such as technical glitches, fraud, or customer service problems, such as slow processing times or frequent system failures, while using UPI. This could give rise to concerns about a CBDC’s reliability and functionality, leading people to be cautious in using new digital payment solutions, including CBDCs (Ma et al. 2022; Zhang and Huang 2022). No research has explored the use of UPI as a moderator for the adopted variables. This study investigates how UPI usage experience, as a moderating factor, impacts the relationship between adopted variables and digital currency use behavior. The study presents the following hypotheses developed for this purpose:

H6a:

UPI Usage Experience (UPI) moderates the in-between relationship of Perceived Risk (PR) and Behavioral Intention (BI).

H6b:

UPI Usage Experience (UPI) moderates the in-between relationship of Performance Expectancy (PE) and Behavioral Intention (BI).

H6c:

UPI Usage Experience (UPI) moderates the in-between relationship of Hedonic Motivation (HM) and Behavioral Intention (BI).

H6d:

UPI Usage Experience (UPI) moderates the in-between relationship of Behavioral Intention (BI) and Use Behavior (UB).

H6e:

UPI Usage Experience (UPI) moderates the in-between relationship of Social Influence (SI) and Use Behavior (UB).

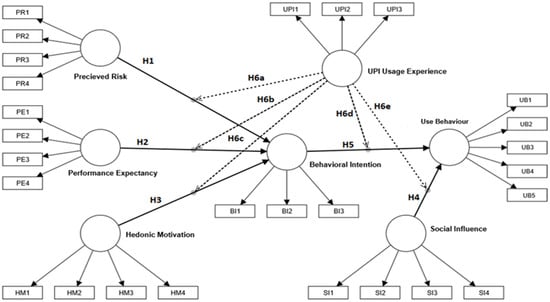

Figure 2 depicts a framework for the moderating effect of UPI usage experience on CBDC use behavior using theoretical model prism.

Figure 2.

A framework for the moderating effect of UPI usage experience on CBDC use behavior model prism. Source: authors’ own work.

3. Research Methodology

3.1. Sampling and Data Collection

The proposed study uses a reflective multi-indicator model to evaluate latent variables and develop scales for the constructs, aiming to investigate the impact of the variables under study on the use behavior for central bank digital currency. The scales used in this study were selected from the existing literature on the basis of their relevance to the current analysis. The survey was conducted between November and December 2022 and was distributed to 700 people in India, including Mumbai, New Delhi, Bengaluru, and Bhubaneswar, where the central bank digital currency was launched on a pilot basis. A total of 547 questionnaires were completed, resulting in a response rate of 78.14%. After discarding 30 (non-users), 517 responses were used for analysis. The collected data were analyzed using Structural Equation Modeling (SEM), which involves outlining the relationships between latent variables and observed indicators in a theoretical model as the initial step. PLS-SEM model validation requires ten times the number of answers as model paths, as per Cochran (1951) and Hair et al. (2019).

The model’s parameters were estimated using the statistical software Smart PLS 4.0. In the Smart PLS analysis process, the measurement model is evaluated first, which includes assessing the reliability and validity of the measures utilized in the study. Subsequently, the structural model is evaluated using path analysis to investigate the direction and strength of the relationships between the latent variables. Additionally, moderation analysis is carried out to examine the extent to which a moderator affects the relationship between two other variables.

The questionnaire utilized in this study consisted of two sections. The first section aimed to gather information on the respondents’ gender, age group, and annual income. Meanwhile, the second section evaluated the constructs under investigation. The data were collected using convenience and reference sampling methods. However, it should be noted that these methods may introduce sample selection bias, as they involve non-random selection of study participants. Consequently, the study’s sample may not be representative of the overall population, and the results may not be generalizable to other groups or contexts. Nonetheless, convenience and reference sampling can be beneficial in certain research contexts, such as when the focus is on specific subgroups within a population, such as the population that participated in this study’s pilot e-rupee use. To ensure that the sample consisted of CBDC users, a preliminary screening question was included, and respondents who answered “NO” were excluded. To expand the sample size, individuals known to the researchers were asked to provide references, both personally and through their networks. Participants were informed of the study’s objectives and guaranteed confidentiality and anonymity. The survey was conducted through various online channels, such as emails and social networking sites. Further, the survey form link was displayed through QR codes at various merchant locations. CBDC users were invited to fill out the survey form while making their purchases.

According to the study results, 60.35% of the respondents were men, and 39.65% were women. The majority of the participants (28.55%) were aged between 41 and 50 years. Moreover, 62.67% of the respondents reported an annual income of over Rs. 2.5 lacs. The sample characteristics are presented in Table 1, and descriptive statistics for the sample are provided in Appendix A in Table A1.

Table 1.

Sample characteristics.

3.2. Measures and Study Design

A seven-point Likert scale was used to evaluate participants’ responses to each question, with 1 indicating strongly disagree and 7 indicating strongly agree. The data were collected using a self-administered questionnaire containing 27 statements and 7 different constructs (as shown in Table 2). The purpose of the study was clearly stated at the beginning of the survey to inform respondents about the “use of CBDC as a digital payment system.” To test the questionnaire’s validity and reliability, a pilot study was conducted with 90 individuals, and the questionnaire’s Cronbach’s alpha was found to be 0.823, indicating its reliability. The Smart PLS 4-variance-based partial least squares method (PLS-SEM) was used to analyze and test the hypotheses. PLS-SEM is a nonparametric structural modeling method (Fornell and Larcker 1981) used to analyze causal relationships by combining quantitative data and qualitative causal assumptions.

Table 2.

Measurement objects.

Furthermore, the fact that some of the items in the data set are not normally distributed (as determined by the Kolmogorov–Smirnov test) led to the decision to use PLS, as well as the fact that Smart PLS can be used whether or not the data follow a normal distribution. PLS-SEM is a viable method for analyzing causal relationships in the theoretical framework of the social and behavioral sciences (Ghasemy et al. 2020; Saari et al. 2021). As a result, the relationships in the theoretical model were investigated using Smart PLS 4.

4. Results

4.1. Measurement Model Assessment

Table 3 displays the factor loadings.

Table 3.

Factor loadings.

The measurement model was used to evaluate convergent validity (Table 3), discriminant validity, and internal consistency reliability (Table 4) between the indicators and parent constructs. Cronbach’s alpha and composite reliability were used to test the indicators’ reliability for each construct. AVE values greater than 0.50 were considered indicative of convergent validity for all constructs (Hair et al. 2014). The results showed that the constructs accounted for at least 51% of the variance in their respective indicators (Henseler et al. 2009). Furthermore, the Cronbach’s alpha and composite reliability values for each construct were greater than 0.70 (Nunnally 1978; Hair et al. 2014), indicating a high level of reliability. The high Cronbach’s alpha, i.e., >0.90 for UB, BI, PR, SI, and UPI, suggests the items within each variable are a high inter-item correlation, indicating that they measure similar aspects of the construct. This homogeneity contributes to the overall reliability and internal consistency of the variables.

Table 4.

Construct validity and reliability.

The results for discriminant validity are presented in Table 5. To assess discriminant validity, the HTMT (Heterotrait–Monotrait) ratio, as suggested by Henseler et al. (2015), was used and found to be less than 0.85. The Fornell–Larcker criterion was also used to confirm discriminant validity, with AVE values shown below the diagonal. The criterion indicates that AVE values should be greater than the correlation coefficient (squared) between relevant factors (Fornell and Larcker 1981). The analysis revealed that the AVE values for each construct exceeded their corresponding correlation coefficients, thus confirming discriminant validity.

Table 5.

Discriminant validity (HTMT and Fornell–Lacker criterion).

Table 6 presents the variance explained in each of the endogenous constructs and models’ explanatory power, represented by R2 (Shmueli and Koppius 2011). R2 ranges from 0 to 1, with a higher value indicating greater explanatory power. According to Starnes et al. (2010) and Henseler et al. (2009), the squared value for endogenous latent variables falls within the range of 0.3 < R2 < 0.5 (low effect size), 0.5 < R2 < 0.7 (moderate effect size), and R2 > 0.7 (strong effect size). Table 6 shows that R2 values for the endogenous variables (UB = 0.578; BI = 0.625) fell within the range of 0.5 < R2 < 0.7, indicating a moderate effect of exogenous variables on endogenous variables. Even though the Cronbach’s alpha was high, the moderate R-squared value suggests that the items within each variable, while internally consistent, may not fully explain the variation in the outcome variable when considered collectively. This finding highlights the potential for future research to investigate additional factors that could enhance the explanatory power of the model. To estimate the explanatory power of each exogenous variable in the model, the change in R2 is calculated if a given exogenous construct is omitted, which is referred to as effect size f2. The impact of the predictor variable is considered high at the structural level if f2 < 0.35, medium if 0.15 < f2 < 0.35, and small if 0.02 < f2 < 0.15 (Cohen 1988). The f2 value in Table 6 indicates that the omission of performance expectancy had a high impact on behavioral intention, while the deletion of hedonic motivation, perceived risk, and UPI usage experience negligibly affected the model. Similarly, the omission of social influence moderately affected use behavior. Moreover, the Q2 values for endogenous constructs were above 0, which indicates predictive relevance.

Table 6.

Explanatory power of the model.

4.2. Structural Model Assessment

We tested the hypotheses using criteria from (Sarstedt et al. 2022) by examining the predictive and explanatory power of the structural model and tabulating the path coefficients on the basis of the magnitudes and significances reported by Ghasemy et al. (2020) and Saari et al. (2021). The beta coefficient (β) indicates the strength and direction of the relationship between the predictor and outcome variables, assuming all other factors remain constant (Venkatesh et al. 2016). The results of the model support hypothesis H1 (Table 7), as the negative effect of perceived risk on behavioral intention was statistically significant (β = −0.136, p ≤ 0.05). This finding suggests that for every unit increase in perceived risk, the behavioral intention to use CBDC decreases by 0.136 units, assuming all other factors remain constant. The negative coefficient indicates a negative relationship between the two variables, implying that as perceived risk increases, the intention to use CBDC decreases. Furthermore, both performance expectancy (β = 0.589, p ≤ 0.05) and hedonic motivation (β = 0.09, p ≤ 0.05) had a positive effect on behavioral intention, supporting hypotheses H2 and H3. The results indicated that both performance expectancy and hedonic motivation were positively associated with the intention to use CBDC.

Table 7.

Assessment of the structural model.

The beta coefficient of 0.589 for performance expectancy suggests that a one-unit increase in performance expectancy is associated with a 0.589-unit increase in the behavior intention to use CBDC. Similarly, the beta coefficient of 0.09 for hedonic motivation suggests that a one-unit increase in hedonic motivation is associated with a 0.09-unit increase in the behavior intention to use CBDC. However, the beta coefficient (β) of 0.09 for hedonic motivation may be considered low compared to the beta coefficient of 0.589 for performance expectancy. This suggests that performance expectancy may be a stronger predictor of behavior intention to use CBDC than hedonic motivation.

Furthermore, both SI (β = 0.453, p ≤ 0.05) and BI (β = 0.17, p ≤ 0.05) had a positive effect on UB, supporting the hypotheses H4 and H5. The results suggest that both social influence and behavior intention have a positive effect on the use behavior of CBDC as a digital payment system. The beta coefficient of 0.453 for social influence suggests that for every one-unit increase in social influence, the use behavior of CBDC as a digital payment system increases by 0.453 units. Similarly, the beta coefficient of 0.17 for behavior intention suggests that for every one-unit increase in behavior intention, the use behavior of CBDC as a digital payment system increases by 0.17 units.

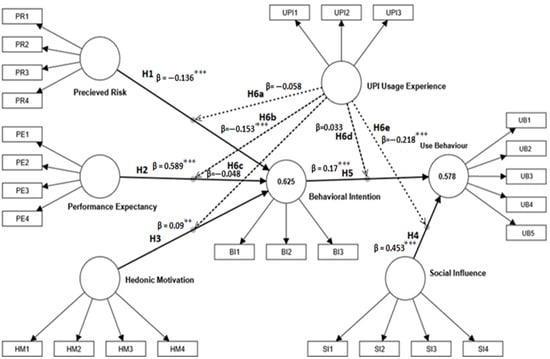

The hypotheses H6a, H6c, and H6d were rejected, indicating that there is no evidence of UPI usage experience moderating effect on the relationship between perceived risk and behavior intention (β = −0.053, p > 0.05) between hedonic motivation and behavior intention (β = −0.048, p > 0.05), and between behavior intention and use behavior (β = 0.033, p > 0.05). However, UPI has a negative influence on the relationship between PE and BI (β = −0.153, p ≤ 0.05) and the relationship between SI and UB (β = −0.218, p ≤ 0.05), supporting hypotheses H6b and H6e (see Figure 3). This means that UPI usage experience weakens the impact of performance expectancy and social influence on behavior intention and use behavior, respectively. In other words, individuals who have experience using UPI may have lower expectations of the performance of CBDC and may be less influenced by social pressures to use it.

Figure 3.

Structural model results. Source: authors’ computation. For significance level at 0.01 = ***, at 0.05 = **.

5. Discussion

This research paper focuses on the theoretical development of a model that analyzes the utilization of a CBDT in a digital payment system. The study proposes a new conceptual framework to test hypotheses and investigate the influence of technological and cognitive factors on use behavior. Moreover, the study includes the usage of UPI as a moderator in the behavioral intention and use behavior framework.

Performance Expectancy (PE) has a significant positive impact on the behavioral intention to use CBDC. Users are more likely to accept new technology if they believe it will improve their performance (Faqih and Jaradat 2015). In contrast, not meeting pre-adoption expectations can lead to cognitive dissonance or mental stress (Jangir et al. 2022). The study also explored the impact of Hedonic Motivation (HM) or perceived enjoyment on behavioral intention and found a weak positive effect. However, users prioritize the expected benefits and outcomes of using CBDC over the pleasure derived from it. Performance expectancy had a higher beta value (58.9%) than hedonic motivation (9%). This aligns with the idea that people are typically more motivated by the tangible benefits of a behavior rather than the hedonic aspects (Kiwanuka 2015). The findings suggest that while the perceived enjoyment of using CBDC can motivate users to use it, users are more concerned with the performance expectancy of digital currency.

The introduction of CBDC opens up many new possibilities, such as facilitating instant, secure, and transparent transactions. However, there are drawbacks such as inherent risk, high cost of use, and ambiguous societal perception associated with their possession (Arias-Oliva et al. 2019). Our study investigates the effect of perceived risk on users’ willingness to accept CBDC. The findings show that risks such as transaction failure and network issues have a negative impact on the intention to use crypto-based digital currency. Although the impact of perceived risk on behavior intention was found to be only 13.6% (β = −0.136), this can be attributed to improved network services and OTP-based secured transaction mechanisms that have increased user confidence in adopting digital currency (Chaimaa et al. 2021). The intention to use digital currency may also be influenced by the subjective norms of one’s social group. The study’s findings show that social influence has a significant positive effect on the use behavior of CBDC users. The social influence β value (0.453) indicates that people are influenced and encouraged by their peers to begin using the new digital currency and to use the currency delivered by a central bank in digital form in order to benefit from its features.

The research findings further provide evidence that frequent users of the UPI may exhibit lower performance expectancy and social influence towards the use of CBDC. This observation can be attributed to the possibility that UPI, as a specific payment system, may not optimally fulfill the expectations and requirements of all users, leading to negative experiences and subsequently reducing the intention to use CBDC. A plausible explanation for the reduction in performance expectancy is that users may perceive UPI as ineffective in facilitating their tasks due to challenges in system usability or technical issues, creating an adverse impact on their behavior. Similarly, negative social influence may emerge if users or their social network hold pessimistic attitudes towards UPI. Moreover, the perception of UPI being unsecure or untrustworthy could increase users’ perceived risk, thereby diminishing their inclination to use CBDC, especially among those who are unfamiliar with UPI or have had negative experiences with other payment systems. Additionally, users may harbor apprehensions about government-backed currencies and perceive CBDC as an instrument of government control over their financial transactions. Negative social influence can exacerbate these concerns, leading to reluctance or avoidance of CBDC adoption (Wenker 2022).

Interestingly, the impact of social influence on CBDC use behavior varies among high and low UPI users. Drawing on the theory of innovation diffusion (Rogers 2003), the usage of new technologies or innovations is a complex process influenced by multiple factors, including the innovation’s attributes, the adopter’s characteristics, and the social context in which the innovation is introduced. High UPI users, who are already accustomed to digital payment systems, may have developed a considerable level of trust and familiarity with the UPI system. Therefore, they may perceive CBDC as superfluous or redundant technology and may be less inclined to adopt it. In contrast, low UPI users may be more open to new digital payment technologies and more influenced by social factors, such as peer pressure or recommendations from trusted sources, which could potentially influence their CBDC use behavior. These findings suggest that social influence plays a differential role in shaping the usage of CBDC based on the level of UPI usage.

The relationship between a user’s perceived risk and behavior intention, as well as between hedonic motivation and behavior intention, appears to be unaffected by the usage experience of UPI, suggesting that these factors may be universal and not specific to UPI or any particular technology, consistent with prior research (Jamadar et al. 2022). It is important to note that digital currency transactions, such as all data-driven digital services, are vulnerable to privacy and security risks, such as weak encryption, ineffective cyber intelligence, and centralized data storage, regardless of a user’s length of time using the service (Acharya 2017). Finally, users are often excited about new technology, even when a substitute is already available (Jonas 1979).

5.1. Scientific Implications

The study aimed to determine whether users’ experiences with UPI systems would facilitate the use of CBDC. Firstly, the data analysis revealed that behavioral intention was significantly influenced by performance expectancy, perceived risk, and hedonic motivation. When these factors were combined with social influence, they had a significant positive impact on use behavior. When analyzing the behavioral intention and use behavior of technology in finance, hedonic motivation, perceived risk, and performance expectancy are of great importance, as demonstrated in previous research (Farah et al. 2018; Kaur and Arora 2021; Sharma et al. 2023b).

After analyzing the model, we found that behavioral intention had a strong influence on use behavior, explaining 57.80% of the variance in the data. These findings are consistent with prior research (Wu et al. 2022; Jung et al. 2019; Indrawati and Putri 2018), which have shown that hedonic motivation, perceived risk, and performance expectancy all significantly impact user behavior when adopting financial technology products or services. This suggests that a user’s decision to use digital currency is influenced by whether or not the product meets their expectations of improved performance, whether or not they find the product enjoyable to use, and whether or not the product can reduce the risk they are exposed to. Social pressure from peers to use the latest technology trends, combined with users’ desire to learn more about digital currency, can also drive use behavior.

Second, the research model was based on the moderator of prior experience with UPI, which was found to have a significant influence on the effects of performance expectancy on behavior intention and social influence on use behavior. This study used an underutilized construct of prior UPI usage experience as a moderator, and the moderation effect was found to be significant, demonstrating that prior experience with similar types of technology can influence a user’s intention to use new technology (Behal and Gupta 2022). The moderating effect can be explained by the fact that a user who has prior experience with UPI services may have seen a significant improvement in their day-to-day transaction performance and may have the same expectations when using new CBDC. Social influence, or the effect of technology on the user’s peer group, is also a significant factor. The UPI system and technology have created an environment in countries such as India where UPI payments are used for the majority of day-to-day petty transactions, which can make a user feel left out if they do not use the service and necessitate upgrading to a more recent version of the same technology. As such, a user who is already familiar with UPI may find it easy to switch to CBDC.

Third, we did not find evidence that prior UPI usage experience has a significant moderating effect on the relationship between perceived risk and hedonic motivation with behavioral intention, or between behavioral intention and use behavior. One possible explanation is that users who have previously used UPI or similar payment mechanisms have already accepted the inherent risks and acknowledge that such risks exist with new technologies as well. Additionally, continuous exposure to a particular technology may reduce its novelty and pleasure (Longstreet and Brooks 2017; Sharma et al. 2023c), so users may not experience the same level of hedonic motivation with a new technology that is similar to one they have used before. However, once a user has developed an intention to use a technology, it is generally easier for them to use a similar new technology.

5.2. Practical Implications

The study recommends that monetary authorities increase public awareness and acceptance of CBDC by improving its user-friendliness. Authorities should also consider users’ prior UPI experience and implement advanced and robust technology to attract more users. This can be achieved by enhancing safety features, creating a conducive environment, and offering incentives to encourage usage.

The concept of CBDC has yet to be thoroughly explored and implemented, with only a limited number of countries currently adopting or planning to adopt such systems. However, CBDC holds the potential to positively impact economies by increasing transaction volumes and generating new job opportunities, especially in contexts where cash liquidity may be a challenge. The widespread usage of CBDC in academia would necessitate the use and refinement of behavioral finance models to effectively implement various phases of digital currency usage, thereby opening up new avenues of inquiry within the field. As public awareness of key digital currency terms, such as blockchain, Bitcoin, and UPI, increases, there is a likelihood of a corresponding growth in the usage of digital currencies worldwide. This surge in adoption may also have the added advantage of reducing issues such as money laundering, the proliferation of black money, and counterfeiting.

6. Conclusions

This study aimed to investigate whether prior use of UPI systems would lead to the use of CBDC in countries such as India. Before exploring the motivating factors for the usage of CBDC, the researchers conceptualized the model by including performance expectancy and social influence from UTAUT, hedonic motivation from UTAUT 2, and perceived risk from TAM. Additionally, the study used user experience with UPI as a moderator. The findings suggest that, in the context of CBDC use, performance expectancy, perceived risk, and hedonic motivation play crucial roles in influencing behavioral intention, and that combining these factors with social influence has a positive impact on use behavior. Therefore, the conceptualized model may be helpful in comprehending and promoting the usage of CBDC.

The study found that prior experience with UPI has a negative impact on the relationship between performance expectation and behavior intention, as well as the relationship between social influence and use behavior for CBDC. These results suggest that individuals tend to favor things that they are familiar with and have prior experience using. For example, individuals accustomed to using UPI for digital payments may encounter difficulties when adapting to a new payment system such as CBDC, resulting in lower levels of performance expectancy. Users who are already accustomed to UPI may exhibit inertia and a preference for the existing system due to its convenience and reliability. The transition from UPI to CBDC can be perceived as disruptive, leading to resistance to change. Additionally, users may have already established trust in UPI’s security and reliability, making them hesitant to switch to an unfamiliar CBDC system. Moreover, users may not perceive significant benefits in adopting CBDC if UPI already effectively meets their payment needs. Compatibility and integration challenges may also hinder the adoption of CBDC. Additionally, the study reveals that social influence affects CBDC use behavior differently depending on an individual’s familiarity and use of UPI. High UPI users were negatively impacted by social influence because they perceived CBDC as a potential threat to their existing payment system, which they already trust and widely accept. In contrast, low UPI users were positively influenced by social influence as they were more open to new payment systems and viewed CBDC as a convenient and efficient alternative to existing methods. Thus, the impact of social influence on CBDC use behavior is contingent on an individual’s familiarity with and use of UPI.

Further, the study found that previous experience with UPI did not have a significant impact on the relationships between perceived risk, hedonic motivation, behavioral intention, and use behavior. The proposed model explained 57.80% of the variance in use behavior, indicating that behavioral intention strongly influenced usage behavior.

Overall, these findings suggest that UPI may not be an ideal moderator for all users and that its negative moderating effect on the relationships between performance expectancy and behavior intention, as well as between social influence and use behavior, should be taken into account when designing interventions to promote the adoption of new technologies. Further research is needed to explore the impact of UPI on technology adoption in more depth and identify potential strategies for mitigating its negative moderating effects.

The study has some limitations. Firstly, as the CBDC is still in the early stages of development in India, the government has only launched it in a few cities such as Mumbai, New Delhi, Bengaluru, and Bhubaneswar on a pilot basis. Therefore, the specific system design of the CBDC and its associated economic factors have not been determined yet and were not considered in this study. However, it is likely that the government is working with experts in the field to ensure that the user interface is intuitive, secure, and easy to use, as well as to make the CBDC accessible, affordable, and user-friendly. Secondly, because the CBDC has only been launched in a few cities covering a relatively small percentage of the total population of India (4.82%), the sample used in this study may not be representative of the broader population. However, the pilot project can help the Reserve Bank of India (RBI) to test the technology and infrastructure of the digital rupee before a full-scale rollout, as well as to identify and resolve any technical issues or challenges that may arise. Despite these limitations, the findings of this study may be useful to other countries planning to introduce CBDCs, as we focused on specific sub-groups within the Indian population. Further studies can be conducted in the future after the full-scale launching of CBDC in India to explore the impact of factors such as the final system design and economic factors on CBDC adoption.

To ensure successful implementation of digital currency, it is important to examine the factors that may influence its usage and adoption. Parameters such as gender, age, education, profession, and income should be analyzed through nationwide research to gain a better understanding of their impact. Additionally, as digital currency is likely to be an alternative to traditional currency, it is crucial to investigate the factors that may affect its usage compared to traditional currency. In-depth research should explore network effects, regulatory policies, individual preferences, and technological developments, as these factors may significantly affect the adoption and usage of central bank digital currency (CBDC) in the future.

Author Contributions

Conceptualization, M.G., V.S., S.T., A.S. and R.R.-A.; methodology, M.G., K.J., V.S. and S.T.; validation, M.G., V.S. and S.T.; formal analysis, K.J., V.S. and S.T.; data curation, K.J., V.S. and M.G.; writing—original draft preparation, M.G., V.S., S.T. and R.R.-A.; writing—review and editing, M.G., S.T. and R.R.-A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Ethical review and approval were waived for this study due to the aggregate nature of the survey, where respondents’ identities were not collected.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study through an online survey, where respondents participated anonymously.

Data Availability Statement

Data are available from the authors upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

Correction Statement

Due to an error by the Editorial Office, the Institutional Review Board Statement and Informed Consent Statement were not included in the originally published version of this article. These have now been added accordingly.

Appendix A

Table A1.

Descriptive statistics of survey data.

Table A1.

Descriptive statistics of survey data.

| Variable Name | N | Min. | Max | Mode | Std. Deviation | Skewness | Kurtosis | |||

|---|---|---|---|---|---|---|---|---|---|---|

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std. Error | Statistic | Std. Error | ||

| Perceived Risk | PR1 | 517 | 1 | 7 | 4 | 0.0650 | 0.054 | 0.107 | −0.242 | 0.214 |

| PR2 | 517 | 1 | 7 | 5 | 0.0557 | −0.314 | 0.107 | −0.896 | 0.214 | |

| PR3 | 517 | 1 | 7 | 5 | 0.0613 | −0.277 | 0.107 | −0.927 | 0.214 | |

| PR4 | 517 | 1 | 7 | 5 | 0.0634 | −0.252 | 0.107 | −0.885 | 0.214 | |

| Performance Expectancy | PE1 | 517 | 1 | 7 | 4 | 1.172 | −0.307 | 0.107 | 0.083 | 0.214 |

| PE2 | 517 | 1 | 7 | 4 | 1.227 | −0.071 | 0.107 | −0.309 | 0.214 | |

| PE3 | 517 | 1 | 7 | 5 | 1.166 | −0.365 | 0.107 | −0.529 | 0.214 | |

| PE4 | 517 | 1 | 7 | 4 | 1.150 | −0.401 | 0.107 | −0.378 | 0.214 | |

| Hedonic Motivation | HM1 | 517 | 1 | 7 | 4 | 1.224 | −0.284 | 0.107 | −0.628 | 0.214 |

| HM2 | 517 | 1 | 7 | 4 | 1.217 | 0.009 | 0.107 | −0.528 | 0.214 | |

| HM3 | 517 | 1 | 7 | 4 | 1.308 | −0.034 | 0.107 | −0.657 | 0.214 | |

| HM4 | 517 | 1 | 7 | 4 | 1.260 | −0.300 | 0.107 | −0.705 | 0.214 | |

| Social Influence | SI1 | 517 | 1 | 7 | 4 | 1.235 | −0.341 | 0.107 | −0.227 | 0.214 |

| SI2 | 517 | 1 | 7 | 5 | 1.254 | −0.382 | 0.107 | −0.255 | 0.214 | |

| SI3 | 517 | 1 | 7 | 5 | 1.259 | −0.335 | 0.107 | −0.404 | 0.214 | |

| SI4 | 517 | 1 | 7 | 5 | 1.207 | −0.550 | 0.107 | −0.122 | 0.214 | |

| UPI usage Experience | UPI1 | 517 | 1 | 7 | 4 | 1.278 | −0.132 | 0.107 | −0.587 | 0.214 |

| UPI2 | 517 | 1 | 7 | 4 | 1.356 | −0.149 | 0.107 | −0.331 | 0.214 | |

| UPI3 | 517 | 1 | 7 | 4 | 1.427 | −0.129 | 0.107 | −0.597 | 0.214 | |

| Behavioral Intention | BI1 | 517 | 1 | 7 | 4 | 1.213 | −0.281 | 0.107 | −0.056 | 0.214 |

| BI2 | 517 | 1 | 7 | 5 | 1.233 | −0.466 | 0.107 | −0.289 | 0.214 | |

| BI3 | 517 | 1 | 7 | 5 | 1.276 | −0.233 | 0.107 | 0.082 | 0.214 | |

| Use Behavior | UB1 | 517 | 1 | 7 | 4 | 1.233 | −0.389 | 0.107 | −0.709 | 0.214 |

| UB2 | 517 | 1 | 7 | 5 | 1.287 | −0.430 | 0.107 | −0.727 | 0.214 | |

| UB3 | 517 | 1 | 7 | 4 | 1.233 | −0.395 | 0.107 | −0.386 | 0.214 | |

| UB4 | 517 | 1 | 7 | 4 | 1.255 | −0.469 | 0.107 | −0.352 | 0.214 | |

| UB5 | 517 | 1 | 7 | 4 | 1.301 | −0.385 | 0.107 | −0.495 | 0.214 | |

References

- Abbasi, Ghazanfar Ali, Lee Yin Tiew, Jinquan Tang, Yen Nee Goh, and Ramayah Thurasamy. 2021. The Adoption of Cryptocurrency as a Disruptive Force: Deep Learning–Based Dual Stage Structural Equation Modelling and Artificial Neural Network Analysis. PLoS ONE 16: e0247582. [Google Scholar] [CrossRef] [PubMed]

- Abdul-Hamid, Ibn Kailan, Aijaz A. Shaikh, Henry Boateng, and Robert E. Hinson. 2019. Customers’ Perceived Risk and Trust in Using Mobile Money Services—An Empirical Study of Ghana. International Journal of E–Business Research 15: 1–19. [Google Scholar] [CrossRef]

- Abrahão, Ricardo de Sena, Stella Naomi Moriguchi, and Darly Fernando Andrade. 2021. Factors Influencing the Adoption of Mobile Payment Method among Generation Z: The Extended UTAUT Approach. RAI Revista de Administração e Inovação 13: 221–30. [Google Scholar] [CrossRef]

- Acharya, Bhairav. 2017. ORF_IssueBrief_177. Issue Briefs and Special Reports. Available online: https://www.orfonline.org/wp–content/uploads/2017/05/ORF_IssueBrief_177.pdf (accessed on 10 January 2023).

- Adrian, Tobias, and Tommaso Mancini Griffoli. 2019. The Rise of Digital Money. In FinTech Notes. Washington, DC: International Monetary Fund, vol. 19. [Google Scholar] [CrossRef]

- Aggarwal, Kartik, Sushant Malik, Dharmesh K. Mishra, and Dipen Paul. 2021. Moving from Cash to Cashless Economy: Toward Digital India. The Journal of Asian Finance, Economics and Business 8: 43–54. [Google Scholar] [CrossRef]

- Akbar, Fatema. 2013. What Affects Students’ Acceptance and Use of Technology? Pittsburgh: Carnegie Mellon University. [Google Scholar] [CrossRef]

- Alonso, Sergio Luis Náñez, Javier Jorge-Vazquez, and Ricardo Francisco ReierForradellas. 2021. Central Banks Digital Currency: Detection of Optimal Countries for the Implementation of a CBDC and the Implication for Payment Industry Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 72. [Google Scholar] [CrossRef]

- Amirtha, Raman, V. J. Sivakumar, and Yujong Hwang. 2020. Influence of Perceived Risk Dimensions on E–Shopping Behavioural Intention among Women—A Family Life Cycle Stage Perspective. Journal of Theoretical and Applied Electronic Commerce Research 16: 320–55. [Google Scholar] [CrossRef]

- Arias-Oliva, Mario, Jorge Pelegrín-Borondo, and Gustavo Matías-Clavero. 2019. Variables Influencing Cryptocurrency Use: A Technology Acceptance Model in Spain. Frontiers in Psychology 10: 475. [Google Scholar] [CrossRef]

- Asongu, Simplice, Mouna Amari, Anis Jarboui, and Khaireddine Mouakhar. 2021. ICT Dynamics for Gender Inclusive Intermediary Education: Minimum Poverty and Inequality Thresholds in Developing Countries. Telecommunications Policy 45: 102125. [Google Scholar] [CrossRef]

- Baabdullah, Abdullah M., Ali Abdallah Alalwan, Nripendra P. Rana, Hatice Kizgin, and Pushp Patil. 2018. Consumer Use of Mobile Banking (M–Banking) in Saudi Arabia: Towards an Integrated Model. International Journal of Information Management 44: 38–52. [Google Scholar] [CrossRef]

- Babin, Ron, Donna Smith, and Heli Shah. 2022. Central bank digital currency: Advising the financial services industry. Journal of Information Technology Teaching Cases. [Google Scholar] [CrossRef]

- Bakshy, Eytan, Itamar Rosenn, Cameron Marlow, and Lada Adamic. 2012. The Role of Social Networks in Information Diffusion. In WWW’12—Proceedings of the 21st Annual Conference on World Wide Web. New York: ACM, pp. 519–28. [Google Scholar] [CrossRef]

- Baur, Aaron W., Julian Bühler, Markus Bick, and Charlotte S. Bonorden. 2015. Cryptocurrencies as a Disruption? Empirical Findings on User Adoption and Future Potential of Bitcoin and Co. In Open and Big Data Management and Innovation: 14th IFIP WG 6.11 Conference on e-Business, e-Services, and e-Society, I3E 2015, Delft, The Netherlands, October 13–15, 2015, Proceedings 14. Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Berlin/Heidelberg: Springer International Publishing, pp. 63–80. [Google Scholar] [CrossRef]

- Behal, Vikas, and Munish Gupta. 2022. Reporting of Corporate Social Responsibility Practices: An Evidence from Indian BSE–Listed Companies. Prabandhan: Indian Journal of Management 15: 42–58. [Google Scholar] [CrossRef]

- Benzmiller, Theodore. 2022. China’s Progress Towards a Central Bank Digital Currency. April 19. Available online: https://www.csis.org/blogs/new-perspectives-asia/chinas-progress-towards-central-bank-digital-currency (accessed on 3 January 2023).

- Berridge, Kent C., and Morten L. Kringelbach. 2011. Building a Neuroscience of Pleasure and Well–Being. Psychology of Well–Being: Theory, Research and Practice 1: 3. [Google Scholar] [CrossRef] [PubMed]

- Bijlsma, Michiel, Carin van der Cruijsen, Nicole Jonker, and Jelmer Reijerink. 2021. What Triggers Consumer Adoption of CBDC? SSRN Electronic Journal 4: 1–33. [Google Scholar] [CrossRef]

- BIS Innovation Hub Work on Central Bank Digital Currency (CBDC). 2021. February. Available online: https://www.bis.org/about/bisih/topics/cbdc.htm (accessed on 10 January 2023).

- Blakstad, Sofie, and Robert Allen. 2018. Central Bank Digital Currencies and Cryptocurrencies. In FinTech Revolution. Cham: Palgrave Macmillan, pp. 87–112. [Google Scholar] [CrossRef]

- Bordo, Michael D, Harold James, Mickey Levy, Andy Levin, Will Roberds, and Warren Weber Humberto. 2021. Central Bank Digital Currency in Historical Perspective: Another Crossroad in Monetary History. Capitalism: A Journal of History and Economics 8: 1–28. [Google Scholar]

- Catherine, Nyesiga, Kituyi Mayoka Geofrey, Musa B. Moya, and Grace Aballo. 2017. Effort Expectancy, Performance Expectancy, Social Influence and Facilitating Conditions as Predictors of Behavioural Intentions to Use ATMs with Fingerprint Authentication in Ugandan Banks. Global Journal of Computer Science and Technology 17: 9–25. Available online: https://computerresearch.org/index.php/computer/article/view/101203 (accessed on 14 January 2023).

- Chaimaa, Belbergui, Elkamoun Najib, and Hilal Rachid. 2021. E-banking Overview: Concepts, Challenges and Solutions. Wireless Personal Communications 117: 1059–78. [Google Scholar] [CrossRef]

- Chaum, David, Christian Grothoff, and Thomas Moser. 2021. How to Issue a Central Bank Digital Currency. SSRN Electronic Journal, 1–38. [Google Scholar] [CrossRef]

- Chevalier, Judith A., and Dina Mayzlin. 2018. The Effect of Word of Mouth on Sales: Online Book Reviews. Journal of Marketing Research 43: 345–54. [Google Scholar] [CrossRef]

- Cochran, W.G. 1951. Improvement by Means of Selection. In Proceedings of the Second Berkeley Symposium on Mathematical Statistics and Probability. Berkeley: University of California Press, pp. 449–70. Available online: https://projecteuclid.org/euclid.bsmsp/1200500247 (accessed on 12 January 2023).

- Cohen, Jacob. 1988. Set Correlation and Contingency Tables. Applied Psychological Measurement 12: 425–34. [Google Scholar] [CrossRef]

- Croxson, Karen, Jon Frost, Leonardo Gambacorta, and Tommaso Valletti. 2022. Platform–Based Business Models and Financial Inclusion. BIS Working Papers. Available online: https://www.bis.org/publ/work986.htm (accessed on 14 January 2023).

- Curran, James M., and Matthew L. Meuter. 2014. Encouraging Existing Customers to Switch to Self–Service Technologies: Put a Little Fun in Their Lives. Journal of Marketing Theory and Practice 15: 283–98. [Google Scholar] [CrossRef]

- Diep, Nguyet A., Celine Cocquyt, Chang Zhu, and Tom Vanwing. 2016. Predicting Adult Learners’ Online Participation: Effects of Altruism, Performance Expectancy, and Social Capital. Computers & Education 101: 84–101. [Google Scholar] [CrossRef]

- Dixit, Sweta, Mohit Maurya, Neha Sharma, and Neha Zaidi. 2022. Payments Process Privilege: Leveraging Fintech with TAM. Paper presented at 8th International Conference on Advanced Computing and Communication Systems, ICACCS 2022, Coimbatore, India, March 25–26; pp. 1668–73. [Google Scholar] [CrossRef]

- Fahad, and Mohammad Shahid. 2022. Exploring the Determinants of Adoption of Unified Payment Interface (UPI) in India: A Study Based on Diffusion of Innovation Theory. Digital Business 2: 100040. [Google Scholar] [CrossRef]

- Faqih, Khaled M. S., and Mohammed Issa Riad Mousa Jaradat. 2015. Assessing the Moderating Effect of Gender Differences and Individualism–Collectivism at Individual–Level on the Adoption of Mobile Commerce Technology: TAM3 Perspective. Journal of Retailing and Consumer Services 22: 37–52. [Google Scholar] [CrossRef]

- Farah, Maya F., Muhammad Junaid Shahid Hasni, and Abbas Khan Abbas. 2018. Mobile–Banking Adoption: Empirical Evidence from the Banking Sector in Pakistan. International Journal of Bank Marketing 36: 1386–413. [Google Scholar] [CrossRef]

- Featherman, Mauricio S., and Paul A. Pavlou. 2003. Predicting E–Services Adoption: A Perceived Risk Facets Perspective. International Journal of Human–Computer Studies 59: 451–74. [Google Scholar] [CrossRef]

- Foon, Yeoh Sok, Benjamin Chan, and Yin Fah. 2011. Internet Banking Adoption in Kuala Lumpur: An Application of UTAUT Model. International Journal of Business and Management 6: 161. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Los Angeles: Sage Publications Sage. [Google Scholar]

- Ghasemy, Majid, Viraiyan Teeroovengadum, Jan Michael Becker, and Christian M. Ringle. 2020. This Fast Car Can Move Faster: A Review of PLS–SEM Application in Higher Education Research. Higher Education 80: 1121–52. [Google Scholar] [CrossRef]

- Gupta, Sahil, Ruchi Mittal, and Amit Mittal. 2019. Modelling the Intentions to Adopt UPIs: A PLS–SEM Approach. Paper presented at 2019 6th International Conference on Computing for Sustainable Global Development (INDIACom), New Delhi, India, March 13–15; pp. 246–50. [Google Scholar]

- Hair, Joe F., Marko Sarstedt, Lucas Hopkins, and Volker G. Kuppelwieser. 2014. Partial Least Squares Structural Equation Modeling (PLS–SEM): An Emerging Tool in Business Research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to Use and How to Report the Results of PLS–SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Handa, Shreya. 2020. Digital Currency—A Revolution in the Payment Landscape of India. Asian Journal of Research in Banking and Finance 10: 14. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2015. A New Criterion for Assessing Discriminant Validity in Variance–Based Structural Equation Modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Rudolf R. Sinkovics. 2009. The Use of Partial Least Squares Path Modeling in International Marketing. Advances in International Marketing 20: 277–319. [Google Scholar] [CrossRef]

- Howard, Daniel J. 2012. Introduction to Special Issue: Social Influence and Consumer Behavior. Social Influence 7: 131–33. [Google Scholar] [CrossRef]

- Indrawati, and Dianty Anggraini Putri. 2018. Analyzing Factors Influencing Continuance Intention of E–Payment Adoption Using Modified UTAUT 2 Model: (A Case Study of Go–Pay from Indonesia). Paper presented at 2018 6th International Conference on Information and Communication Technology, ICoICT 2018, Bandung, Indonesia, May 3–5; pp. 167–73. [Google Scholar] [CrossRef]

- Jamadar, Yasmin, Tze San Ong, Asna Atqa Abdullah, and Fakarudin Kamarudin. 2022. Earnings and discretionary accruals. Managerial and Decision Economics 43: 431–39. [Google Scholar] [CrossRef]

- Jangir, Kshitiz, Vikas Sharma, Sanjay Taneja, and Ramona Rupeika-Apoga. 2022. The Moderating Effect of Perceived Risk on Users’ Continuance Intention for FinTech Services. Journal of Risk and Financial Management 16: 21. [Google Scholar] [CrossRef]

- Jasimuddin, Sajjad M., Nishikant Mishra, and Nasser A. Saif Almuraqab. 2017. Modelling the Factors That Influence the Acceptance of Digital Technologies in E–Government Services in the UAE: A PLS–SEM Approach. Production Planning & Control 28: 1307–17. [Google Scholar] [CrossRef]

- Jeon, Hyeon Mo, Hye Jin Sung, and Hyun Young Kim. 2020. Customers’ Acceptance Intention of Self–Service Technology of Restaurant Industry: Expanding UTAUT with Perceived Risk and Innovativeness. Service Business 14: 533–51. [Google Scholar] [CrossRef]

- Jonas, Hans. 1979. Toward a Philosophy of Technology. The Hastings Center Report 9: 34. [Google Scholar] [CrossRef]

- Jung, Kyung Jin, Jung Boem Park, Nhu Quynh Phan, Chen Bo, and Gwang Yong Gim. 2019. An International Comparative Study on the Intension to Using Crypto–Currency. Studies in Computational Intelligence 788: 104–23. [Google Scholar] [CrossRef]

- Kaur, Puneet, Amandeep Dhir, Rahul Bodhi, Tripti Singh, and Mohammad Almotairi. 2020. Why Do People Use and Recommend M–Wallets? Journal of Retailing and Consumer Services 56: 102091. [Google Scholar] [CrossRef]

- Kaur, Simarpreet, and Sangeeta Arora. 2021. Role of Perceived Risk in Online Banking and Its Impact on Behavioral Intention: Trust as a Moderator. Journal of Asia Business Studies 15: 1–30. [Google Scholar] [CrossRef]

- Khedmatgozar, Hamid Reza, and Arezoo Shahnazi. 2018. The Role of Dimensions of Perceived Risk in Adoption of Corporate Internet Banking by Customers in Iran. Electronic Commerce Research 18: 389–412. [Google Scholar] [CrossRef]

- Kiwanuka, Achilles. 2015. Acceptance process: The missing link between UTAUT and diffusion of innovation theory. American Journal of Information Systems 3: 40–44. [Google Scholar]

- Klobas, Jane E., Tanya McGill, and Xuequn Wang. 2019. How Perceived Security Risk Affects Intention to Use Smart Home Devices: A Reasoned Action Explanation. Computers & Security 87: 101571. [Google Scholar] [CrossRef]

- Komiak, Sherrie Y. X., and Izak Benbasat. 2006. The Effects of Personalization and Familiarity on Trust and Adoption of Recommendation Agents. MIS Quarterly: Management Information Systems 30: 941–60. [Google Scholar] [CrossRef]

- Lakhwani, Monika, Omkar Dastane, Nurhizam Safie Mohd Satar, and Zainudin Johari. 2020. The Impact of Technology Adoption on Organizational Productivity. The Journal of Industrial Distribution & Business 11: 7–18. [Google Scholar] [CrossRef]

- Lashitew, Addisu A., Rob van Tulder, and Yann Liasse. 2019. Mobile Phones for Financial Inclusion: What Explains the Diffusion of Mobile Money Innovations? Research Policy 48: 1201–15. [Google Scholar] [CrossRef]

- Lee, Ji-Hwan, Soo Wook Kim, and Chi Hoon Song. 2010. The Effects of Trust and Perceived Risk on Users’ Acceptance of ICT Services. SSRN Electronic Journal 11: 1–37. [Google Scholar] [CrossRef]

- Li, Shanghai, Liming Chen, and Hao Dong. 2021. What Are Bitcoin Market Reactions to Its–Related Events? International Review of Economics & Finance 73: 1–10. [Google Scholar] [CrossRef]

- Ligon, Ethan, Badal Malick, Ketki Sheth, and Carly Trachtman. 2019. What explains low adoption of digital payment technologies? Evidence from small–scale merchants in Jaipur, India. PLoS ONE 14: e0219450. [Google Scholar] [CrossRef]

- Lohana, Sarika, and Deepankar Roy. 2021. Impact of Demographic Factors on Consumer’s Usage of Digital Payments. FIIB Business Review. [Google Scholar] [CrossRef]

- Longstreet, Phil, and Stoney Brooks. 2017. Life Satisfaction: A Key to Managing Internet & Social Media Addiction. Technology in Society 50: 73–77. [Google Scholar] [CrossRef]

- Lu, Hsi Peng, Chin Lung Hsu, and Hsiu Ying Hsu. 2005. An Empirical Study of the Effect of Perceived Risk upon Intention to Use Online Applications. Information Management and Computer Security 13: 106–20. [Google Scholar] [CrossRef]

- Lukonga, Inutu. 2023. Monetary Policy Implications of Central Bank Digital Currencies: Perspectives on Jurisdictions with Conventional and Islamic Banking Systems. IMF Working Papers. Washington, DC: International Monetary Fund. [Google Scholar] [CrossRef]

- Ma, Chao, Zhuang Jin, Ziwen Mei, Fei Zhou, Xinyu She, Jia Huang, and Da Liu. 2022. Internet of Things Background: An Em–pirical Study on the Payment Intention of Central Bank Digital Currency Design. Mobile Information Systems 2022: 4846372. [Google Scholar] [CrossRef]

- Manrai, Rishi, Utkarsh Goel, and Prashant Dev Yadav. 2021. Factors Affecting Adoption of Digital Payments by Semi–Rural Indian Women: Extension of UTAUT–2 with Self–Determination Theory and Perceived Credibility. Aslib Journal of Information Management 73: 814–38. [Google Scholar] [CrossRef]

- Maziriri, Eugine Tafadzwa, and Tinashe Chuchu. 2017. The Conception of Consumer Perceived Risk towards Online Purchases of Apparel and an Idiosyncratic Scrutiny of Perceived Social Risk: A Review of Literature. International Review of Management and Marketing 7: 257–65. Available online: https://dergipark.org.tr/en/pub/irmm/issue/32110/356013 (accessed on 14 January 2023).

- Nikolopoulou, Kleopatra, Vasilis Gialamas, and Konstantinos Lavidas. 2021. Habit, Hedonic Motivation, Performance Expectancy and Technological Pedagogical Knowledge Affect Teachers’ Intention to Use Mobile Internet. Computers and Education Open 2: 100041. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1978. An Overview of Psychological Measurement. In Clinical Diagnosis of Mental Disorders. Boston: Springer, pp. 97–146. [Google Scholar] [CrossRef]

- Patil, Pushp, Kuttimani Tamilmani, Nripendra P. Rana, and Vishnupriya Raghavan. 2020. Understanding Consumer Adoption of Mobile Payment in India: Extending Meta–UTAUT Model with Personal Innovativeness, Anxiety, Trust, and Grievance Redressal. International Journal of Information Management 54: 102144. [Google Scholar] [CrossRef]