Emerging Research Trends in Green Finance: A Bibliometric Overview

Abstract

1. Introduction

- What are the current trends in research publications on green finance?

- What publications and papers have the most impact on green finance research?

- Which organizations, nations, and authors most frequently contribute to the field of green finance?

- What are the primary subject areas and keywords for study in green finance?

- What are the recent issues and challenges in green finance?

- What areas of green finance research will be pursued in the future?

Objectives of the Study

2. Methodology

3. Analysis and Discussion

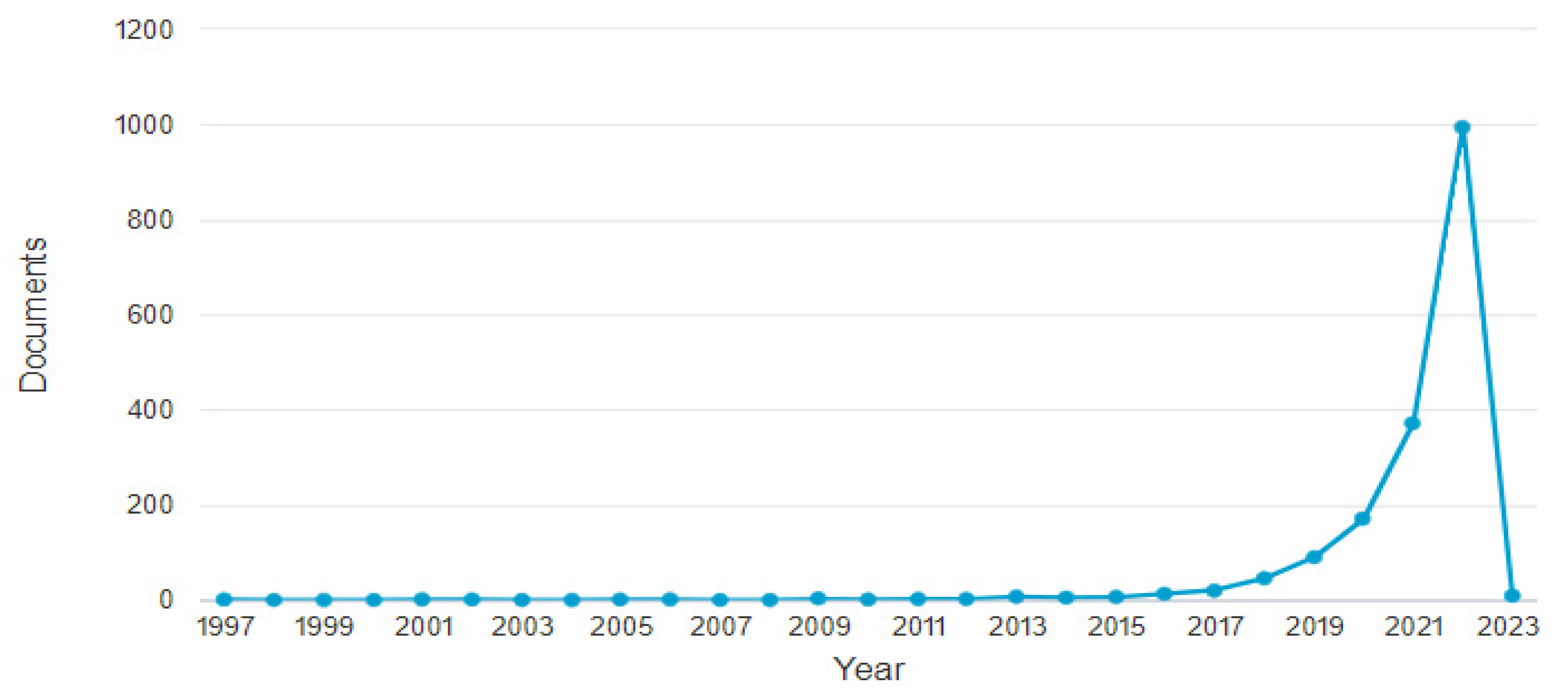

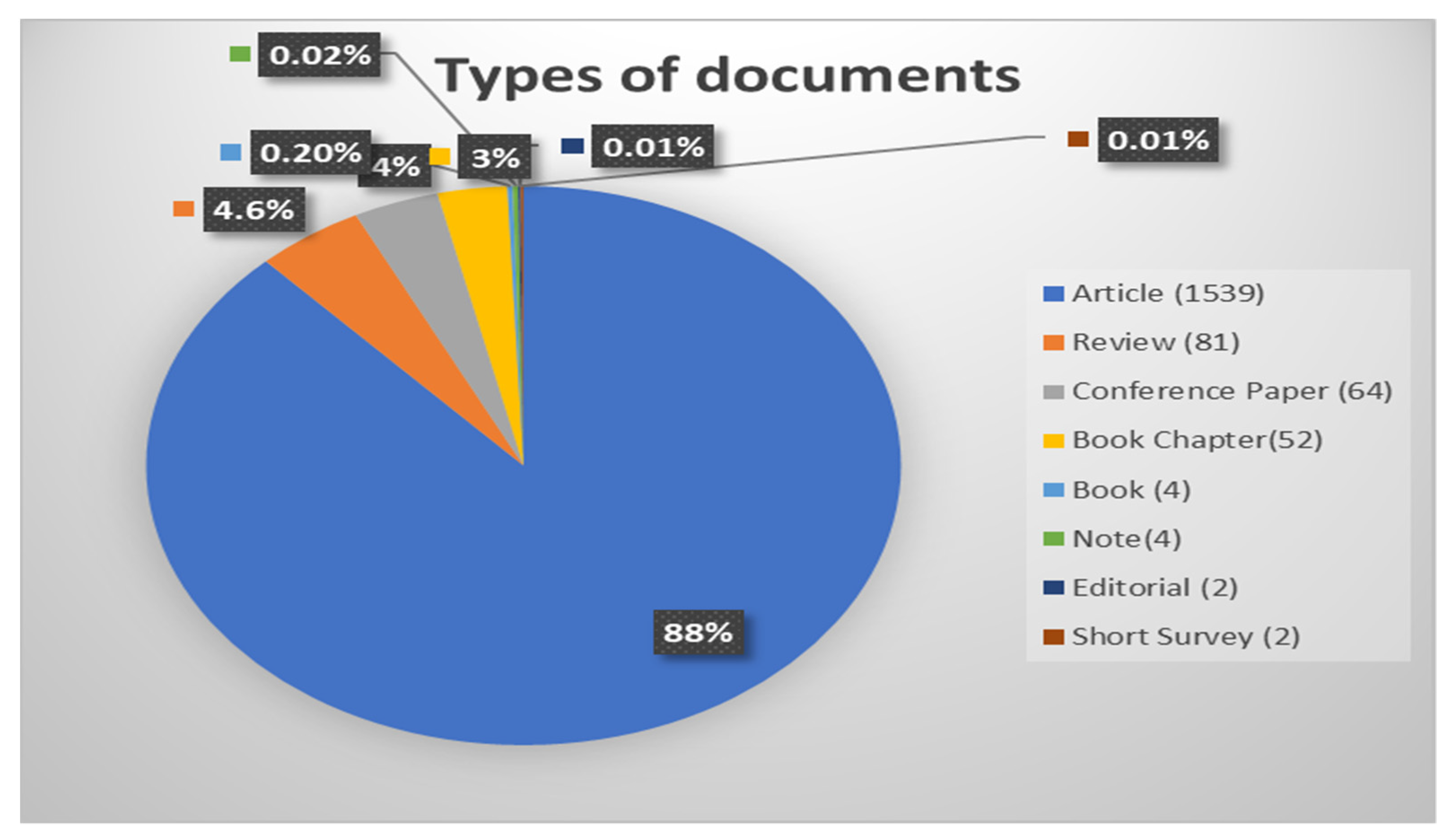

3.1. Analysis Based on Documents

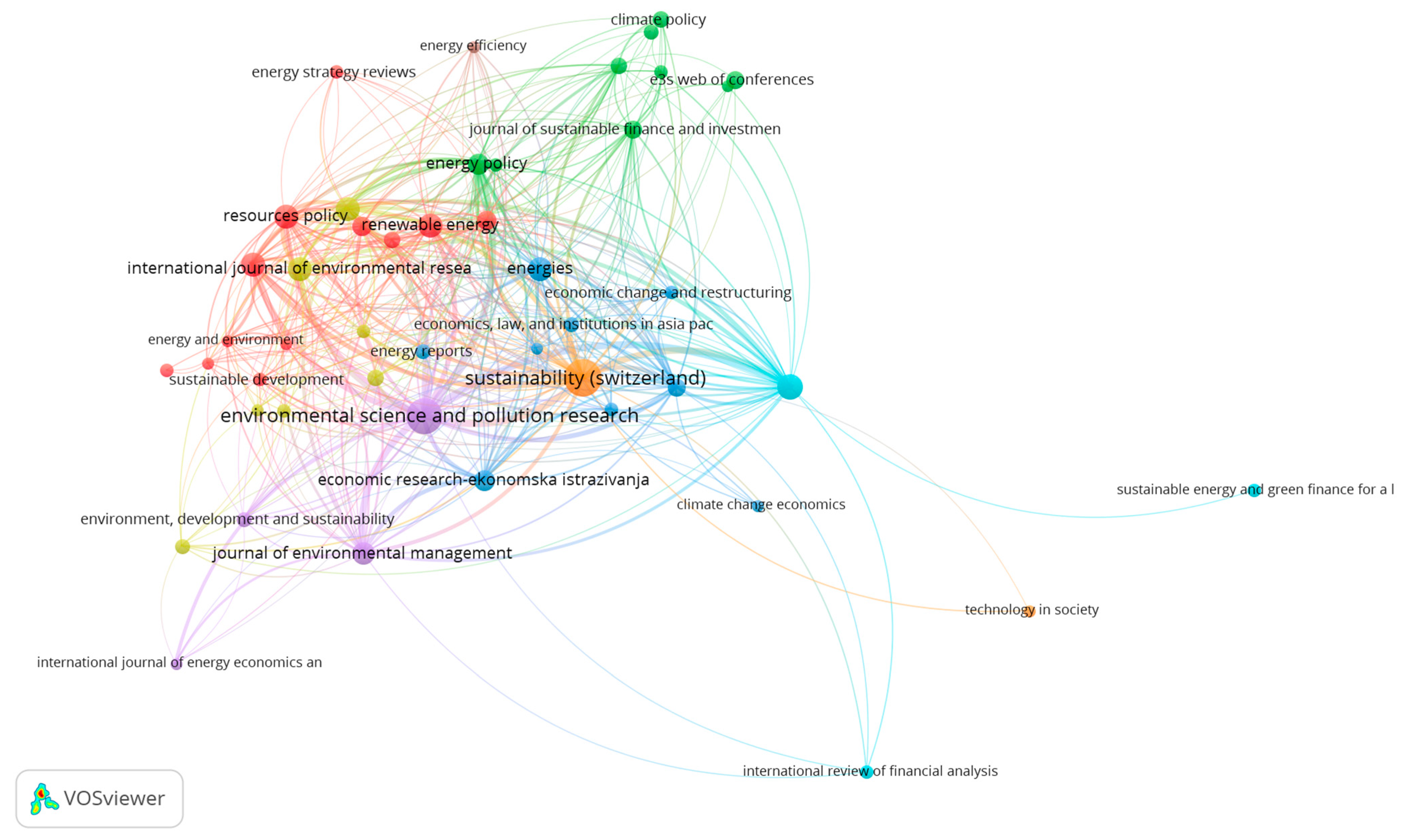

3.2. Analysis Based on Sources

3.3. Analysis Based on Country

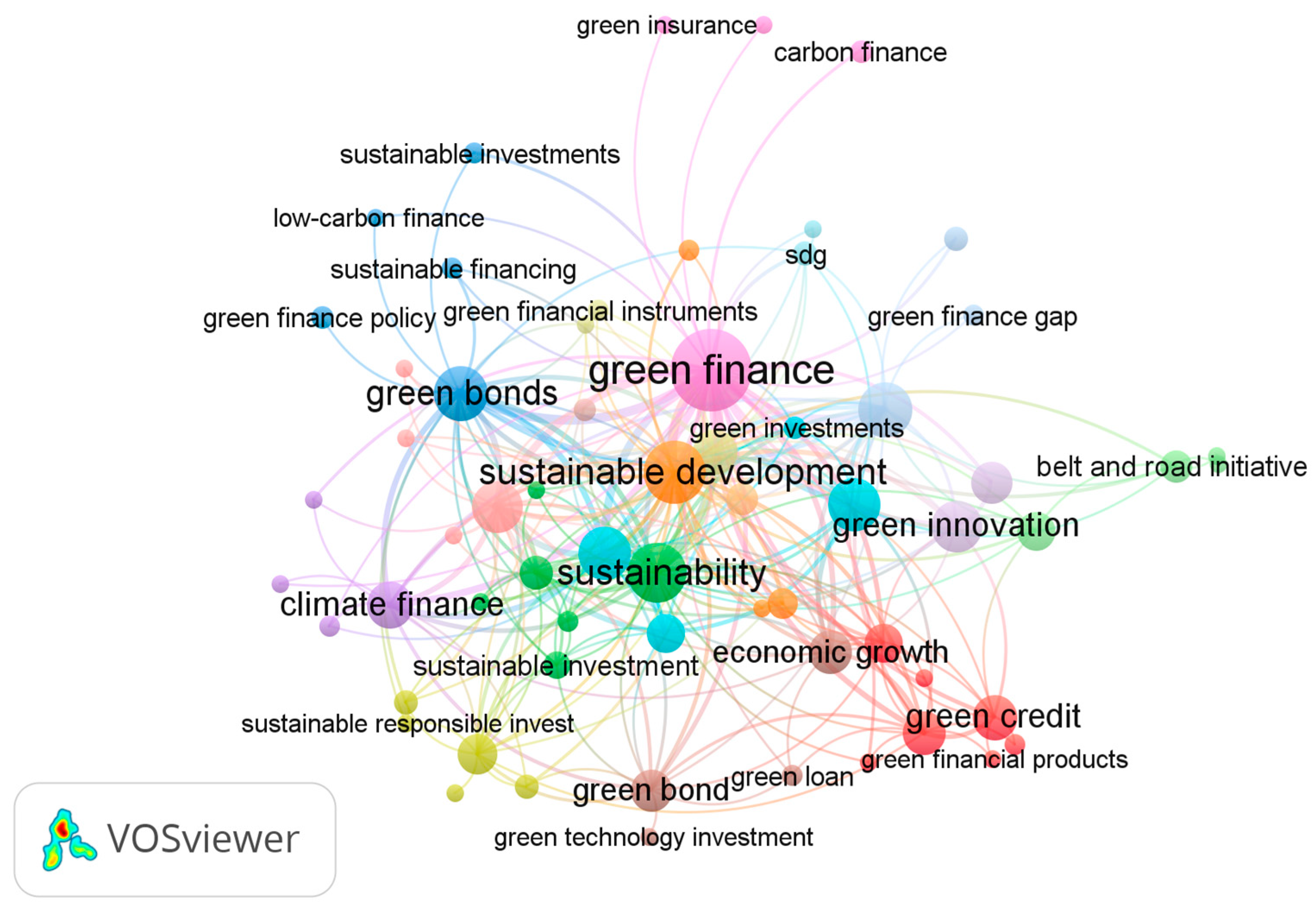

3.4. Analysis Based on Keywords

3.5. Analysis Based on Authors

3.6. Analysis Based on Issues and Challenges in Green Finance

4. Findings

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahmad, Mahmood, Zahoor Ahmed, Yang Bai, Guitao Qiao, József Popp, and Judit Oláh. 2022. Financial inclusion, technological innovations, and environmental quality: Analyzing the role of green openness. Frontiers in Environmental Science 10: 80. [Google Scholar] [CrossRef]

- Alshater, Muneer M., Osama F. Atayah, and Allam Hamdan. 2021. Journal of Sustainable Finance and Investment: A bibliometric analysis. Journal of Sustainable Finance & Investment, 1–22. [Google Scholar] [CrossRef]

- Amran, Azlan, Mehran Nejati, Say Keat Ooi, and Faizah Darus. 2018. Exploring Issues and Challenges of Green Financing in Malaysia: Perspectives of Financial Institutions. In Sustainability and Social Responsibility of Accountability Reporting Systems. Springer: Singapore, pp. 255–66. [Google Scholar]

- Baber, Hasnan, and Mina Fanea-Ivanovici. 2022. Fifteen years of crowdfunding—A bibliometric analysis. Technology Analysis & Strategic Management, 1–15. [Google Scholar] [CrossRef]

- Bernabé Argandoña, Lorena Carolina, Salvador Cruz Rambaud, and Joaquín López Pascual. 2022. The Impact of Sustainable Bond Issuances in the Economic Growth of the Latin American and Caribbean Countries. Sustainability 14: 4693. [Google Scholar] [CrossRef]

- Berrou, Romain, Philippe Dessertine, and Marco Migliorelli. 2019. An overview of green finance. The Rise of Green Finance in Europe, 3–29. [Google Scholar] [CrossRef]

- Chami, Ralph, Thomas F. Cosimano, and Connel Fullenkamp. 2002. Managing ethical risk: How investing in ethics adds value. Journal of Banking & Finance 26: 1697–718. [Google Scholar]

- Charfeddine, Lanouar, and Montassar Kahia. 2019. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renewable energy 139: 198–213. [Google Scholar] [CrossRef]

- Chen, Qiuping, Bo Ning, Yue Pan, and Jinli Xiao. 2022. Green finance and outward foreign direct investment: Evidence from a quasi-natural experiment of green insurance in China. Asia Pacific Journal of Management 39: 899–924. [Google Scholar] [CrossRef]

- Chen, Xiaoyan, and Yisheng Liu. 2020. Visualization analysis of high-speed railway research based on CiteSpace. Transport Policy 85: 1–17. [Google Scholar] [CrossRef]

- Chhaochharia, Megha. 2021. Green Finance in India: Progress and Challenges. Research Journal of Humanities and Social Sciences 12: 223–26. [Google Scholar] [CrossRef]

- Desalegn, Goshu, and Anita Tangl. 2022. Enhancing Green Finance for Inclusive Green Growth: A Systematic Approach. Sustainability 14: 7416. [Google Scholar] [CrossRef]

- Diener, Joel, and André Habisch. 2022. Developing an Impact-Focused Typology of Socially Responsible Fund Providers. Journal of Risk and Financial Management 15: 298. [Google Scholar] [CrossRef]

- Ding, Xue, Wei Li, Dujuan Huang, and Xinghong Qin. 2022. Does Innovation Climate Help to Effectiveness of Green Finance Product R&D Team? The Mediating Role of Knowledge Sharing and Moderating Effect of Knowledge Heterogeneity. Sustainability 14: 3926. [Google Scholar]

- Du, Mo, Ruirui Zhang, Shanglei Chai, Qiang Li, Ruixuan Sun, and Wenjun Chu. 2022. Can Green Finance Policies Stimulate Technological Innovation and Financial Performance? Evidence from Chinese Listed Green Enterprises. Sustainability 14: 9287. [Google Scholar] [CrossRef]

- Ehlers, Torsten, and Frank Packer. 2017. Green Bond Finance and Certification. BIS Quarterly Review September. Available online: https://ssrn.com/abstract=3042378 (accessed on 27 December 2022).

- Fedorova, Elena P. 2020. Role of the state in the resolution of green finance development issues. Finansovyj žhurnal—Financial Journal 4: 37–51. [Google Scholar] [CrossRef]

- Galletta, Simona, Sebastiano Mazzù, and Valeria Naciti. 2022. A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Research in International Business and Finance 62: 101684. [Google Scholar] [CrossRef]

- Ghosh, Bikramaditya, Spyros Papathanasiou, Vandita Dar, and Dimitrios Kenourgios. 2022. Deconstruction of the Green Bubble during COVID-19 International Evidence. Sustainability 14: 3466. [Google Scholar] [CrossRef]

- Gianfrate, Gianfranco, and Mattia Peri. 2019. The green advantage: Exploring the convenience of issuing green bonds. Journal of Cleaner Production 219: 127–35. [Google Scholar] [CrossRef]

- Giese, Guido, Linda-Eling Lee, Dimitris Melas, Zoltán Nagy, and Laura Nishikawa. 2019. Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. The Journal of Portfolio Management 45: 69–83. [Google Scholar] [CrossRef]

- Gillan, Stuart L., Andrew Koch, and Laura T. Starks. 2021. Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance 66: 101889. [Google Scholar] [CrossRef]

- Hadaś-Dyduch, Monika, Blandyna Puszer, Maria Czech, and Janusz Cichy. 2022. Green Bonds as an Instrument for Financing Ecological Investments in the V4 Countries. Sustainability 14: 12188. [Google Scholar] [CrossRef]

- He, Lingyun, Lihong Zhang, Zhangqi Zhong, Deqing Wang, and Feng Wang. 2019. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. Journal of Cleaner Production 208: 363–72. [Google Scholar] [CrossRef]

- Liu, Jingyu, Yan Xia, Shih-mo Lin, Jie Wu, and Ying Fan. 2015. Short-medium and long-term impact analysis of China’s green credit policy based on financial CGE model. Chinese Journal of Management Science 23: 46–52. [Google Scholar]

- Lee, Chi-Chuan, and Chien-Chiang Lee. 2022. How does green finance affect green total factor productivity? Evidence from China. Energy Economics 107: 105863. [Google Scholar] [CrossRef]

- Lee, Jung Wan. 2020. Green finance and sustainable development goals: The case of China. Journal of Asian Finance Economics and Business 7: 577–86. [Google Scholar] [CrossRef]

- Leichenko, Robin, Karen O’Brien, and William Solecki. 2009. Climate change and the global financial crisis. GECHS Synthesis Human Security in an Era of Global Change 25: 25–52. [Google Scholar]

- Lindenberg, Nannette. 2014. Definition of Green Finance (15 April 2014). DIE Mimeo. Available online: https://ssrn.com/abstract=2446496 (accessed on 27 December 2022).

- Lin, Lin, and Yanrong Hong. 2022. Developing a Green Bonds Market: Lessons from China. European Business Organization Law Review 23: 143–85. [Google Scholar] [CrossRef]

- Li, Yue, Ting Ding, and Wenzhong Zhu. 2022. Can Green Credit Contribute to Sustainable Economic Growth? An Empirical Study from China. Sustainability 14: 6661. [Google Scholar] [CrossRef]

- Martí-Ballester, Carmen Pilar. 2015. Investor reactions to socially responsible investment. Management Decision 53: 571–604. [Google Scholar] [CrossRef]

- Meher, Bharat Kumar, Iqbal Thonse Hawaldar, Latasha Mohapatra, Cristi Marcel Spulbar, and Felicia Ramona Birau. 2020. The effects of the environment, society and governance scores on investment returns and stock market volatility. International Journal of Energy Economics and Policy 10: 234–39. [Google Scholar] [CrossRef]

- Mehta, Pooja, Manjit Singh, and Manju Mittal. 2020. It is not an investment if it is destroying the planet: A literature review of socially responsible investments and proposed conceptual framework. Management of Environmental Quality: An International Journal 31: 307–29. [Google Scholar] [CrossRef]

- Mohsin, Muhammad, Hafiz Waqas Kamran, Muhammad Atif Nawaz, Muhammed Sajjad Hussain, and Abdul Samad Dahri. 2021. Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. Journal of Environmental Management 284: 111999. [Google Scholar] [CrossRef] [PubMed]

- Morano, Pierluigi, Francesco Tajani, and Debora Anelli. 2020. A decision support model for investment through the social impact bonds. The case of the city of Bari (Italy). Valori e Valutazioni 24: 163–78. [Google Scholar]

- Narayan, Paresh Kumar, Syed Aun R. Rizvi, and Ali Sakti. 2022. Did green debt instruments aid diversification during the COVID-19 pandemic? Financial Innovation 8: 1–15. [Google Scholar] [CrossRef]

- Naz, Farheen, Judit Oláh, Dinu Vasile, and Róbert Magda. 2020. Green purchase behavior of university students in Hungary: An empirical study. Sustainability 12: 10077. [Google Scholar] [CrossRef]

- Ngo, Quang-Thanh, Hoa Anh Tran, and Hai Thi Thanh Tran. 2021. The impact of green finance and COVID-19 on economic development: Capital formation and educational expenditure of ASEAN economies. China Finance Review International 12: 261–79. [Google Scholar] [CrossRef]

- Pizzi, Simone, Francesco Rosati, and Andrea Venturelli. 2021. The determinants of business contribution to the 2030 Agenda: Introducing the SDG Reporting Score. Business Strategy and the Environment 30: 404–21. [Google Scholar] [CrossRef]

- Prajapati, Dhaval, Dipen Paul, Sushant Malik, and Dharmesh K. Mishra. 2021. Understanding the preference of individual retail investors on green bond in India: An empirical study. Investment Management and Financial Innovations 18: 177–89. [Google Scholar] [CrossRef]

- Rizzello, Alessandro, Maria Cristina Migliazza, Rosella Carè, and Annarita Trotta. 2016. Social impact investing: A model and research agenda. In Routledge Handbook of Social and Sustainable Finance. London and New York: Routledge, pp. 102–24. [Google Scholar]

- Salazar, Jose. 1998. Environmental finance: Linking two world. Paper presented at A Workshop on Financial Innovations for Biodiversity Bratislava, Bratislava, Slovakia, May 1–3, vol. 1, pp. 2–18. [Google Scholar]

- Shahbaz, Muhammad, Qazi Muhammad Adnan Hye, Aviral Kumar Tiwari, and Nuno Carlos Leitão. 2013. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renewable and Sustainable Energy Reviews 25: 109–21. [Google Scholar] [CrossRef]

- Shen, Yijuan, Zhi-Wei Su, Muhammad Yousaf Malik, Muhammad Umar, Zeeshan Khan, and Mohsin Khan. 2021. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Science of the Total Environment 755: 142538. [Google Scholar] [CrossRef] [PubMed]

- Sibanda, Mabutho. 2013. Financialization of Green Capital: A Panacea? Mediterranean Journal of Social Sciences 4: 371–71. [Google Scholar] [CrossRef]

- Soundarrajan, Parvadavardini, and Nagarajan Vivek. 2016. Green finance for sustainable green economic growth in India. Agricultural Economics 62: 35–44. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, Farhad, and Naoyuki Yoshino. 2019. The way to induce private participation in green finance and investment. Finance Research Letters 31: 98–103. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, Farhad, and Naoyuki Yoshino. 2020. Sustainable solutions for green financing and investment in renewable energy projects. Energies 13: 788. [Google Scholar] [CrossRef]

- Talan, Gaurav, and Gagan Deep Sharma. 2019. Doing well by doing good: A systematic review and research agenda for sustainable investment. Sustainability 11: 353. [Google Scholar] [CrossRef]

- Van Duuren, Emiel, Auke Plantinga, and Bert Scholtens. 2016. ESG integration and the investment management process: Fundamental investing reinvented. Journal of Business Ethics 138: 525–33. [Google Scholar] [CrossRef]

- Wang, Xinxin, Zeshui Xu, and Marinko Škare. 2020. A bibliometric analysis of Economic Research-Ekonomska Istra zivanja (2007–2019). Economic research-Ekonomska istraživanja 33: 865–86. [Google Scholar] [CrossRef]

- Wang, Yao, and Qiang Zhi. 2016. The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia 104: 311–16. [Google Scholar] [CrossRef]

- Zhang, Bing, Yan Yang, and Jun Bi. 2011. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. Journal of Environmental Management 92: 1321–27. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Dongyang, Muhammad Mohsin, Abdul Khaliq Rasheed, Youngho Chang, and Farhad Taghizadeh-Hesary. 2021. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 153: 112256. [Google Scholar] [CrossRef]

- Zhang, Dayong, Zhiwei Zhang, and Shunsuke Managi. 2019. A bibliometric analysis on green finance: Current status, development, and future directions. Finance Research Letters 29: 425–30. [Google Scholar] [CrossRef]

- Zhang, Meihui, Chi Zhang, Fenghua Li, and Ziyu Liu. 2022. Green Finance as an Institutional Mechanism to Direct the Belt and Road Initiative towards Sustainability: The Case of China. Sustainability 14: 6164. [Google Scholar] [CrossRef]

- Zhang, Ning, Zhu Liu, Xuemei Zheng, and Jinjun Xue. 2017. The carbon footprint of China’s belt and road. Science 357: 1107–7. [Google Scholar] [CrossRef] [PubMed]

- Zheng, Guang-Wen, Abu Bakkar Siddik, Mohammad Masukujjaman, Nazneen Fatema, and Syed Shah Alam. 2021. Green finance development in Bangladesh: The role of private commercial banks (PCBs). Sustainability 13: 795. [Google Scholar] [CrossRef]

| Subject Areas | TP | TP% |

|---|---|---|

| Environmental Science | 1048 | 59.95% |

| Energy | 632 | 36.16% |

| Social Sciences | 549 | 31.40% |

| Economics, Econometrics and Finance | 487 | 27.86% |

| Business, Management and Accounting | 321 | 18.36% |

| Engineering | 281 | 16.08% |

| Computer Science | 134 | 7.67% |

| Earth and Planetary Sciences | 76 | 4.35% |

| Mathematical methods in social science | 69 | 3.95% |

| Arts and Humanities | 67 | 3.83% |

| Rank | Authors Name | Titles | Source Titles | Total Citation | Keywords | Methodology Applied |

|---|---|---|---|---|---|---|

| 1 | Taghizadeh-Hesary and Yoshino (2019) | The way to induce private participation in green finance and investment | Finance Research Letters (Netherlands) | 233 | Distributed ledger technology; Energy finance; Green credit guarantee scheme; Green finance; Sustainable development goals (SDGs) | Spillover tax revenue model and Credit guarantee premium scheme |

| 2 | Zhang et al. (2021) | Public spending and green economic growth in BRI region: Mediating role of green finance | Energy Policy (United Kingdom) | 186 | Belt and road initiative; Generalized method of moments; Green public finance; Radial direction distance function; Sustainable green finance | Generalized method of moments (GMM) method and data envelopment analysis (DEA) |

| 3 | Shen et al. (2021) | Do green investment, financial development, and natural resources rent limit carbon emissions? A provincial panel analysis of China | Science of the Total Environment (United Kingdom) | 160 | China; CS-ARDL; Financial development; Green investment; Natural resources rent | Cross-sectionally augmented autoregressive distributed lags (CS-ARDL) |

| 4 | Zhang et al. (2019) | A bibliometric analysis on green finance: Current status, development, and future directions | Finance Research Letters (Netherlands) | 151 | Bibliometric analysis; Climate change; Green finance | Bibliometric analysis |

| 5 | Zhang et al. (2011) | Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform | Journal of Environmental Management (United States) | 150 | Banking sector; Environmental responsibility; Environmental risk management; Green credit; Policy implementation | Theory of policy implementation |

| 6 | Mohsin et al. (2021) | Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies | Journal of Environmental Management (United States) | 147 | Asian economies; Econometric model; Environment management; Greenhouse gasses; Renewable energy; Sustainability | Random Effect (RE) approach and Hausman Taylor Regression (HTR) |

| 7 | He et al. (2019) | Green credit, renewable energy investment, and green economy development: Empirical analysis based on 150 listed companies in China | Journal of Cleaner Production (United Kingdom) | 145 | Green credit; Green economy development index; Renewable energy investment; Threshold effect | Green economy development index |

| 8 | Wang and Zhi (2016) | The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies | Energy Procedia (United Kingdom) | 145 | green finance; market mechanism; policies; renewable energy | Market mechanism approach |

| 9 | Taghizadeh-Hesary and Yoshino (2020) | Sustainable solutions for green financing and investment in renewable energy projects | Energies (Switzerland) | 129 | Community-based trust funds; Green credit guarantee scheme; Green finance; Green investment; Renewable energy | Spillover tax revenue model and Credit guarantee premium scheme |

| 10 | Gianfrate and Peri (2019) | The green advantage: Exploring the convenience of issuing green bonds | Journal of Cleaner Production (United Kingdom) | 121 | Climate change; Fixed income; Green bonds; Propensity score; Responsible investment; Sustainability | Propensity score matching approach |

| Rank | Source | Country | TP | TP% | TC | AC | h-Index | Total Link Strength |

|---|---|---|---|---|---|---|---|---|

| 1 | Sustainability (Switzerland) | Switzerland | 218 | 12.47 | 1670 | 7.66 | 109 | 537 |

| 2 | Environmental Science and Pollution Research | Germany | 180 | 10.29 | 1824 | 10.33 | 132 | 810 |

| 3 | Journal of Cleaner Production | United Kingdom | 58 | 3.31 | 1448 | 24.97 | 232 | 384 |

| 4 | Renewable Energy | United Kingdom | 50 | 2.86 | 487 | 9.74 | 210 | 192 |

| 5 | Energy Economics | Netherlands | 47 | 2.69 | 781 | 16.62 | 168 | 254 |

| 6 | Journal of Environmental Management | United States | 43 | 2.46 | 1347 | 31.33 | 196 | 278 |

| 7 | Energy Policy | United Kingdom | 32 | 1.83 | 1126 | 35.19 | 234 | 264 |

| 8 | Technological Forecasting and Social Change | United States | 28 | 1.6 | 431 | 15.39 | 134 | 94 |

| 9 | Finance Research Letters | Netherlands | 22 | 1.26 | 813 | 36.95 | 62 | 223 |

| 10 | Ecological Economics | Netherlands | 16 | 0.92 | 390 | 24.38 | 220 | 76 |

| Country Name | TP | TP% | TC | AC | Total Link Strength |

|---|---|---|---|---|---|

| China | 957 | 54.75 | 10,519 | 10.99 | 591 |

| United Kingdom | 155 | 8.87 | 2105 | 13.58 | 198 |

| Pakistan | 144 | 8.24 | 2541 | 17.65 | 300 |

| Malaysia | 98 | 5.61 | 1720 | 17.55 | 171 |

| United States | 91 | 5.21 | 1047 | 11.51 | 145 |

| India | 77 | 4.41 | 633 | 8.22 | 68 |

| Germany | 64 | 3.66 | 716 | 11.18 | 93 |

| Viet Nam | 64 | 3.66 | 1289 | 20.28 | 113 |

| Italy | 60 | 3.43 | 934 | 15.57 | 57 |

| Japan | 58 | 3.32 | 1484 | 25.59 | 82 |

| Rank | Keywords | Occurrences | Total Link Strength | Average Publication Years |

|---|---|---|---|---|

| 1 | Green Finance | 403 | 285 | 2021 |

| 2 | Sustainable Development | 157 | 136 | 2020.5 |

| 3 | Sustainability | 130 | 103 | 2020.5 |

| 4 | Renewable Energy | 92 | 80 | 2021 |

| 5 | Green Bonds | 91 | 106 | 2020.5 |

| 6 | Financial Development | 83 | 39 | 2021.5 |

| 7 | Climate Change | 82 | 107 | 2021.5 |

| 8 | Green Innovation | 75 | 36 | 2022 |

| 9 | Sustainable Finance | 74 | 97 | 2021 |

| 10 | Climate Finance | 52 | 62 | 2020 |

| 11 | Green Credit | 50 | 18 | 2021 |

| 12 | Green Economy | 50 | 52 | 2021 |

| 13 | Economic Growth | 45 | 38 | 2021.5 |

| 14 | Green Investment | 41 | 39 | 2020 |

| 15 | Green Credit Policy | 36 | 8 | 2021.5 |

| 16 | green bond | 35 | 29 | 2021 |

| 17 | green financing | 31 | 24 | 2021 |

| 18 | green development | 28 | 12 | 2020.5 |

| 19 | green growth | 27 | 20 | 2020.5 |

| 20 | sustainable development goals | 27 | 32 | 2021 |

| Author | Citations | Total Link Strength |

|---|---|---|

| Mohsin, M. | 1168 | 171,638 |

| Wang, y. | 1167 | 107,954 |

| Taghizadeh-hesary, F. | 1161 | 117,596 |

| Zhang, Y. | 875 | 99,030 |

| Lee, C.C. | 768 | 74,726 |

| Shahbaz, M. | 677 | 79,450 |

| Li, Y. | 639 | 63,731 |

| Zhang, J. | 634 | 75,145 |

| Chien, F. | 632 | 103,087 |

| Zhang, D. | 618 | 55,358 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohanty, S.; Nanda, S.S.; Soubhari, T.; S, V.N.; Biswal, S.; Patnaik, S. Emerging Research Trends in Green Finance: A Bibliometric Overview. J. Risk Financial Manag. 2023, 16, 108. https://doi.org/10.3390/jrfm16020108

Mohanty S, Nanda SS, Soubhari T, S VN, Biswal S, Patnaik S. Emerging Research Trends in Green Finance: A Bibliometric Overview. Journal of Risk and Financial Management. 2023; 16(2):108. https://doi.org/10.3390/jrfm16020108

Chicago/Turabian StyleMohanty, Sagarika, Sudhansu Sekhar Nanda, Tushar Soubhari, Vishnu N S, Sthitipragyan Biswal, and Shalini Patnaik. 2023. "Emerging Research Trends in Green Finance: A Bibliometric Overview" Journal of Risk and Financial Management 16, no. 2: 108. https://doi.org/10.3390/jrfm16020108

APA StyleMohanty, S., Nanda, S. S., Soubhari, T., S, V. N., Biswal, S., & Patnaik, S. (2023). Emerging Research Trends in Green Finance: A Bibliometric Overview. Journal of Risk and Financial Management, 16(2), 108. https://doi.org/10.3390/jrfm16020108