Abstract

The present study primarily examines the impact of financial distress (FD) on the dividend policy of 33 banks working in the Indian economy from 2010 to 2019. In addition, we further explore the association between financial distress and dividend policy under the influence of shareholder activism (SHA). Using the static panel data regression technique, it is revealed that financial distress is non-linearly associated with the dividend policy of banks in an inverted U-shape. In the initial phase of a distressing situation, banks tend to have a liberal dividend policy. However, after reaching the pressure point, the banks start to squeeze dividend distribution to the stakeholders. Furthermore, the significant impact of shareholder activism has been found in the association between financial distress and the dividend payout policy of banks. From the policy perspective, the study will provide the policymakers with a clear all-round perspective of distressing situations, as the current research involves exploring the impact of distress on the dividend policy that will help the experts in basically understanding the adverse effect of financial distress and the repercussions, respectively, on the earning of the shareholders.

1. Introduction

The world has seen several instances of corporations experiencing financially distressing situations (Bender 2013). Numerous globally renowned companies have turned into bait for distressed conditions. As observed by Ikpesu and Eboiyehi (2018), several leading businesses that once served as industry icons are now in financial trouble. All these adverse situations negatively impact the company’s image and value in the market. Stakeholders generally interpret that the distressing situations will eventually affect their gains and dividend share in the future. Thus, investors hesitate to consider such companies in their portfolios.

A distressing situation in a company always creates negative thoughts in the mind of the people attached to that company. Creditors, suppliers, investors, consumers, and staff are a few examples of stakeholders who are reluctant to cooperate with financially distressed organizations (Cornell and Shapiro 1987). A financially distressed company is generally the last choice for investors to invest in. A distressed situation is critical for a firm’s smooth business process and image (Outecheva 2007). Therefore, the role of management also becomes essential in this condition to fully satisfy each stakeholder and effectively manage all the firm’s operations.

According to Choy et al. (2011), a company is in financial distress when its operating cash flows are insufficient to cover its present obligations, forcing restructuring, loan agreement renegotiation, mergers and acquisitions, and the issuance of additional capital. Similarly, Wu et al. (2008) opined that when a company’s financial commitments are not paid or are only partially satisfied, it is said to be in financial distress. Beaver (1966) and Betker (1997) also maintained that a company’s operations and profitability are significantly impacted by financial distress due to cost implications or higher expenditures for debt payment and suppliers.

Financial difficulties such as distress, bankruptcy, or insolvency ultimately affect the company’s owners. The owners are, at last, responsible for handling all the losses or gains that occurred in the company’s books. Investors are expected to sacrifice their own gains and profits in the condition of financial trouble. This is the main reason investors avoid investing in companies that are not financially strong to pay dividends on a regular basis. Dividends are used as bait to attract prospective buyers to invest money in the companies.

In basic terms, a dividend policy is defined as a dividend per share divided by earnings per share before an extraordinary item (Gul 1999; Zeng 2003; Amidu and Abor 2006). Dividend distribution by firms is generally considered a compulsion by investors. Companies are not obligated to pay a dividend on a regular basis to their investors. Availability of enough profit is required for taking the decision to distribute it among the stakeholders. Sharing the profits in the form of dividends enhances the company’s image and value in the market, which can increase the market value of that company’s share. Thus, the dividend can be considered a company and investor reward.

Financial instability is an undesirable situation which may lead to the business failure of an organization. Banks in India or any other country are the backbone of the economy. Banks handle the majority of India’s financial system. If such a condition exists for financial firms—particularly banks—and if it leads to bank failure, this situation will not only affect the bank but can drastically impact the whole financial system of the economy (Kanoujiya et al. 2022). Moreover, the dividend policy of banks has a key importance for maintaining its reputation among investors. In addition, shareholder activism is shareholders’ participation in affecting the operation of an organization. SHA can influence both the operations of banks and the dividend distribution policy (Rastogi et al. 2022). However, the role of SHA in the association of FD and dividend policy is not yet investigated in the Indian context. Therefore, a connection between banks’ financial stability and dividend policy needs to be explored, particularly under the influence of SHA.

Though much literature is present explaining the conceptual meaning and association of dividends with other factors involving FD (Joshi 2012; Sanan 2019; Kim et al. 2007; Chughtai et al. 2014, and many more). All the existing studies conducted among different countries may have adopted different strategies, leading to different outcomes. However, the role of SHA in the association of FD and dividend policy is not yet investigated in the Indian context. Thus, it is necessary to conduct research by investigating the dividend distribution policy’s association with financial distress under the influence of SHA by involving the Indian banking sector. Nowadays the Indian economy is currently thought to be the one with the fastest rate of growth worldwide. However, India has witnessed several bank failures till now, for instance, the9 failure of “Punjab and Maharashtra bank”, “Yes bank”, and Laxmi Vilas Bank” recently (Kanoujiya et al. 2022). The Indian banking sector has also seen many reforms. In order to ensure that no gaps are left in enhancing the equal and efficient expansion of the Indian economy, we think it is high time to pay attention to each aspect of the Indian banking and corporate sector and to find fresh evidence on the association of FD and dividend policy.

With the aid of the current research work, we have primarily aimed to investigate the association between financial distress and dividend payout policy of banks working in the Indian banking sector. In addition, the study goes a step further by investigating the influence of shareholder activism on the association between financial distress and dividend. The banking industry is chosen explicitly in the current research work as it is considered a linkage to all the other sectors of the economy, depicting what is happening in the economy as a whole. In recent times, India has faced several bank failures. In addition, these days, the Indian banking sector is reforming at a fast pace, as the requirement for funds is rising each day. Thus, it is becoming necessary to analyze each external factor that can affect the efficient working of the banks.

The study contributes to the existing literature in several ways. Firstly, the study adds to the literature on financial distress by providing enough evidence on the association between financial distress and the dividend payout policy of Indian banks. Secondly, it looks for novel evidence on the association of FD and dividend policy under the moderating effect of SHA. Thirdly, the study will help investors understand the basic cause and repercussions of distressing situations in the banking sector.

The rest of the work has been arranged in the following manner. The following section includes a brief elaboration of the relevant literature related to the area of financial distress and dividends and the formulation of the hypothesis accordingly. Section 3 defines the data and methodology used in the study, followed by Section 4, which explains the empirical results obtained with the help of the analysis. Furthermore, Section 5 includes a discussion related to the results. Lastly, Section 6 sums up the research work with some concluding remarks.

2. Review of Literature

2.1. Financial Distress and Dividend Distribution

The occurrence of a financial distress condition is an unfavorable condition for any institution. Distressing conditions severely impact the firm’s crucial and day-to-day operations. According to Wruck (1990), financial distress is typically followed by significant organizational changes in management, governance, and structure. Many changes need to be made in how a company gets managed. Grinyer et al. (1988) find that one of the significant differences between recovering and non-recovering firms is that the former makes more management changes. In such difficult circumstances, a corporation must seriously consider making substantial adjustments. Such adjustments could be in the form of asset or financial restructuring.

Financial restructuring frequently entails negotiating with banks and other creditors, issuing new securities, cutting back on dividends, and switching debt for equity (Lasfer and Remer 2010). Dividend reduction or omission decisions are under the scope of financial restructuring for a firm; as a result, they naturally take on a significant amount of importance in company meetings. The major objective of company management should always be to persuade everyone to support the planned restructuring; otherwise, it may have a detrimental long-term influence on a company’s reputation.

There is vast literature available that focuses on dividend payout decisions, FD decisions, or a mix of both variables. In this study, we primarily concentrate on studies including associations of both variables. The findings of every study that has been conducted generally point to the same association between these two parameters. The findings of the studies by Aivazian et al. (2003a) and Amidu and Abor (2006) indicate that dividend payout has a negative relationship with financial risk. As per Lily et al. (2009), paying dividends also may increase the firm’s financial distress. Likewise, Zeng (2003) also proved that paying dividends can increase financial distress for firms when the leverage ratio is high. According to Coffinet et al. (2013), businesses facing financial difficulties may reduce their dividend payout ratio and payment. Many studies have investigated the relationship between FD and dividends (DeAngelo and DeAngelo 1990; Kazemian et al. 2017; Habib et al. 2020).

Malombe (2011) studies the dividend’s impact on a firm’s profitability in Kenyan firms and found an insignificant positive connection between dividend policy and a firm’s profitability. In other words, companies with financial problems will tend to reduce the dividend payout ratio and lessen the dividend payment (Coffinet et al. 2013). Hence, Malombe (2011) argues that a firm’s financial health might be an effective reason for dividend payouts.

However, the empirical evidence needs to be explored for the connection between dividend distribution and FD. Quite a few pieces of literature are available that involve the banking industry as the study’s focus area. Therefore, to investigate this issue and fill this significant research gap, we have framed a hypothesis in the current study for empirically testing the impact of FD on the dividend payout decision of banks in India.

Hypothesis 1 (H1).

Financial distress (FD) significantly impacts the dividend payout policy of Indian banks.

2.2. Interaction of Shareholder Activism on the Association of Financial Distress with Dividend Distribution Decision

Shareholder activism (SHA) is considered to be an effective instrument for effective supervision of the management of a company and its respective decisions related to the company. Pound (1992) claim that shareholder activism is no longer avoidable because investors are exploring various methods of exercising influence over the management to ensure the superior operation of the business. As per Şendur (2020), improvement in shareholder activism leads to greater involvement of shareholders in the decision-making of companies. The researcher further emphasizes that the main motive of activists is to alter certain strategic decisions of a firm, such as proper distribution of scarce resources, dividend distribution policy, and investing in a new business or amalgamating with existing businesses.

Further, we find several papers which investigate the association between shareholder activism and dividends (such as Barros et al. 2021; He et al. 2012; Jiraporn and Ning 2006; La Porta et al. 2000; Renneboog and Trojanowski 2007). Since we find coherent proof of a connection between shareholder activism and dividend, as well as between financial distress and dividend, there is good judgment to believe that shareholder activism can affect the relationship between financial distress and dividend.

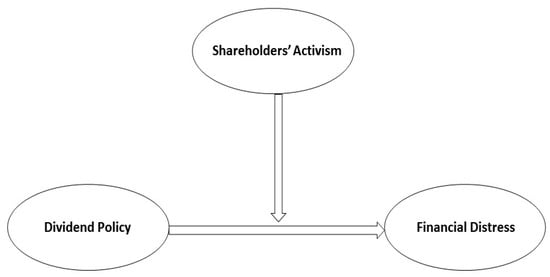

However, no such study has come to our knowledge as of now that has attempted to explore the influence of shareholder activism on the relationship existing between the distress condition and dividend policies formulated in the banking sector of the Indian Economy. Therefore, to fill this significant research gap present in the area of financial distress, a hypothesis has been formulated for empirically testing the moderating influence of shareholder activism on the relationship between financial distress and dividend payout policies of banks. The conceptual model of the research design is presented in Figure 1.

Figure 1.

Conceptual Model. Source: Author’s own analysis.

Hypothesis 2 (H2).

Shareholder activism significantly moderates the association between financial distress (FD) and dividend payout policy of Indian banks.

3. Data and Research Methodology

3.1. Data and Variables

The study aims to examine the impact of financial distress on banks’ dividends and how this relationship varies under the influence of shareholder activism. To do so, a sample of 33 Indian banks representing the majority share of the Indian banking sector has been considered. The time frame of the study is 2010–2019. The data is retrieved using CMIE Prowess and the official websites of respective banks. Panel data methodology is applied in the paper as it helps derive more meaningful insights from the data, which might not be possible by carrying out a time series or a cross-sectional analysis (Hsiao 2007). The variables used for the study are elaborated on in Table 1.

Table 1.

Description of Variables.

3.2. Methodology and Model Specifications

The paper analyzes the effects of financial distress on the dividends of Indian banks and how sha moderates the association between the two variables. The panel data regression (PDR) is adopted to test the farmed hypotheses. PDR models are incorporated to do regression analysis because it has the capability to deliver more comprehensive information than classical time series or cross-sectional studies (Kanoujiya et al. 2022; Wooldridge 2015; Hsiao 2007). PDR models involve time dimensions and cross-sectional units; therefore, their estimates are unbiased. In addition, PDR models are less susceptible to endogeneity issues. The study investigates this association under different conditions incorporating linear association (base model), non-linear association (Quadratic model), and moderating association (under sha) using interaction models. The quadratic model is an extension of a linear model, which exhibits a clearer picture to understand the relationship between two variables. Hence, we have also employed a quadratic model to ensure robust results. The models used in the study are developed as below:

where div is the dependent variable. Zscore1 and Zscore2 are the explanatory variables, and sha is the moderating variable. Furthermore, the interaction terms Zscore1Xsha and Zscore2Xsha, are also introduced to observe the interaction effect under moderating variables (MV). ‘X’ is the sign of multiplication in interaction variables. Demean values of main explanatory variables are taken to deal with inconsistencies due to extreme value issues (Wooldridge 2015). l_asset and ICR are taken as control variables for a good fit of models. Details of each variable are provided in Table 1. is considered an error term, and γ is the coefficient for control variables. is constant. are coefficients for explanatory variables. ‘it’ denotes the panel with ‘i’ as the cross-sectional unit (bank) and ‘t’ as the time dimension (year).

3.3. Descriptive Statistics

Table 2 depicts the outcome of the descriptive statistics of the sample. The 0.0183 mean value of div, which is closer to its minimum value of 0 than its maximum of 0.0644, exhibits that most of the sample banks do not have a high dividend distribution policy. Further, the mean values, 2.087472 and 2.619291 for Zscore1 and Zscore2, respectively, represent that most of the sample banks are free from financial distress issues, however at the same time, extreme minimum and maximum values for these variables exhibit that financial distress levels vary largely from one bank to another. The sha has an average score of 0.5245887 which is closer to its maximum of 0.7142, indicating that most of the banks have high shareholder activism prevalent.

Table 2.

Descriptive Analysis.

3.4. Correlation Matrix and Multicollinearity

There may exist multicollinearity problems if there is strong correlation between the independent variables (i.e., correlation coefficient > 0.800) (Wooldridge 2015). According to the values presented in Table 3, the correlation coefficients amongst some variables are high. The highest significant correlation is observed between Zscore1 and Zscore2, with a value of 0.9674 *, which is acceptable as both variables measure financial distress. Further, separate models have been prepared using Zscore1 and Zscore2 as the explanatory variables. The correlation between all other variables is lower than the value of 0.80. Hence, the multicollinearity issue in variables does not exist (Wooldridge 2015). Therefore, there exist no inconsistencies in model estimates due to multicollinearity.

Table 3.

Correlation Matrix.

4. Empirical Results

4.1. Outcomes of Regression Models

4.1.1. Regression Results for Linear and Quadratic Relationship

Table 4 elaborates on the results for Models 1, 2, 3 and 4. Models 1 and 2 examine the existence of a linear relationship between the dependent variable div and independent variables Zscore1 and Zscore 2, respectively. However, models 3 and 4 test the non-linear relationship between div and financial distress. All the models have a significant p-value for F-test (for fixed-effect) and the Breush-pagan test (for random-effect). Therefore, the Hausman test is applied to check the validity of fixed-effect or random effects. As the Hausman test exhibits a significant p-value (<0.05) for all the models, the fixed effect is found to be a valid approach for these models. Furthermore, the presence of autocorrelation (as revealed by the Wooldridge test with significant p-value < 0.05) and the heteroscedasticity (confirmed by the Wald test with p-value < 0.05) suggests that considering the robust standard error estimates to interpret results (Baltagi 2006).

Table 4.

Base and Quadratic Models Results (Static Panel Data Analysis).

The insignificant results for models 1 and 2 show that div has no linear relationship with the financial distress of banks. However, negative and significant coefficients of −0.000003 and −0.00000388 for Zscore1 and Zscore2, respectively, in models 3 and 4, suggest that financial stability is non-linearly connected to div in an inverted U-shape manner. It implies that in the initial stages of financial stability, banks follow a more liberal dividend payout policy beyond a point. In other words, financial distress is non-linearly connected to div in a U-shape manner. It means that initially, a distressed firm lowers the dividend to a threshold then it starts increasing dividends as the pressures of sustained distress increase. Additionally, the control variable l_assets is found negative and significant for div, whereas the ICR has no significant relationship with div.

4.1.2. Regression Results for Interaction Models

Interaction models 5 and 6 examine the impact of financial distress on div under sha. Analysis for models in Table 5 has been performed by applying the Fixed-effect model as the results for Hausman Test are significant with p-value < 0.05. Further, the presence of autocorrelation and heteroscedasticity necessitates the computation of robust estimates for better result interpretation.

Table 5.

Interaction Models Results for moderating effect.

In models 5 and 6, both Zscores (Zscore1 and Zscore2) are significant and positive with coefficient values of 0.000912 and 0.000880, respectively, at 5% significance. Hence, it indicates that Zscore has a positive impact on dividend distribution or that the FD has a negative impact on dividend distribution. The significant p-values for Zscore1Xsha and Zscore2Xsha in models 5 and 6, respectively, exhibit that shareholder activism has an important bearing on the association between div and financial distress. There are negative coefficients (i.e., −0.007817 in Model 5 and −0.005019 in Model 6) for Zscore1Xsha and Zscore2Xsha. This implies that shareholder activism has a detrimental impact on the affiliation of financial stability and div or a negative impact on FD and div. It further means that when sha is high, the increasing Zscore or financial health of the bank increases the dividend distribution and vice versa. Further, the insignificant sha coefficient in both models suggests that sha individually has no effect on div. However, the control variable l_asset is found to have a negative and significant relationship with div in model 5.

4.2. Endogeneity and Robustness

Table 6 reports the outcome of the endogeneity test. The Durbin_Chi2_ and Wu_Hausman tests are performed to check endogeneity issues (Baltagi 2006). The lag3 values of the variables are used as instruments to check endogeneity. Both tests reveal insignificant p-values supportive of the hypothesis null of no endogeneity. The results show that none of the explanatory variables are endogenous (Wooldridge 2015). Hence, models have no significant endogeneity problem. The robustness of the results should be ensured for reliable evidence (Kanoujiya et al. 2022; Rastogi et al. 2022). This study uses the multi-model approach to ensure robust results. Two variants of Altman’s Zscores (Zscore1 and Zscore2) are used to have different models. Furthermore, linear, non-linear, and interaction effects are observed to find the association of div and FD. In the majority of cases, similar results indicating a significant association between div and FD are found. Hence, the results are robust.

Table 6.

Endogeneity Test.

5. Discussion

5.1. Hypotheses Validation

The study includes two main hypotheses formulated based on the literature. The first one is that a significant relationship exists between financial distress and the dividend payout policy of Indian banks. The second is that shareholder activism significantly impacts the association between financial distress and the dividend policy of Indian banks. As per the analysis conducted in the previous section, the results reveal that the first hypothesis is partially not rejected as the relationship between financial distress and dividend is non-linearly significant in nature, as per model 3 and model 4. In contrast, the linear impact of distress on the dividend policy is insignificant (model 1 and model 2). Furthermore, the second hypothesis is not rejected as shareholder activism is proven to influence the association between financial distress and dividend, as per model 5 and model 6.

5.2. Comparison with Earlier Studies

While examining the previously conducted studies (DeAngelo and DeAngelo 1990; Kazemian et al. 2017; Habib et al. 2020; Aivazian et al. 2003b; Amidu and Abor 2006), an impact of financial distress on the dividend payout policies of firms or corporations working in different economies has been observed. The current paper focuses explicitly on India’s banking sector, which significantly differs between the already published work and the current study. The current findings also reveal a similar association between dividend and FD and support the previously conducted studies as mentioned above. However, the study’s findings further indicate through its non-linear estimates that the positive–negative relation between the FD and div exists to a certain limit. If a banks’s FD goes beyond its capabilities, then it increases its dividend. The positive connection between FD and div might be due to the bank’s bankruptcy condition. In this regard, the non-linear association also contradicts the findings of existing studies.

5.3. Contribution

The current study contributes to the existing literature by adding more novel contributions to the area. Firstly, the study has attempted to explore a new aspect of the relationship by adding a moderating variable in the study. This helps in investigating the possibility of the presence of any moderating influence by a variable, as the addition of such a moderation concept has not gained popularity among other researchers as of now. Secondly, the research has focused entirely on the banking sector of one of the world’s fastest-emerging economies. As it is becoming a significant requirement to increase basic knowledge related to all the factors that can affect the smooth functioning of the economy.

5.4. Implications

Our research in the area of financial distress has some implications as well. Firstly, the banking industry’s involvement in the study will significantly help policymakers. As the rising level of bankruptcy and insolvency situations are becoming a threat to economies worldwide. The study will provide a clear all-around perspective of such kind of distressing situations to the policymakers. The current research explores the impact of distress on the dividend policy, which will help the experts understand the adverse impact of financial distress and the repercussions on the shareholders’ earnings. Secondly, the inverted U-shaped relationship between financial distress and the dividend policy of the banks depicts that a rising level of distress leads to a squeeze in the dividend distribution that can negatively affect the image and value of the banking sector in the eyes of the investors, resulting in decreasing market value for a long time.

6. Conclusions

The financial distress of a firm, including banks, is an undesirable situation. It may influence business operations and may lead to business failure. Therefore, the association between dividend policy and FD needs to be explored from different angles. This paper investigates the impact financial distress has on the dividend payout policy of Indian banks in the ten years (2010–2019) sample period. The analysis was conducted using panel data regression and found linear, non-linear, and interaction effects. The findings suggest that the distressing situation non-linearly affects the dividend policy in banks. The results show that banks do not react much in the initial stage of distress and thus have a liberal dividend payout policy. However, with an increase in time and reaching the pressure point, the management of the banks start to reduce the distribution of dividends to the shareholders. At the same time, when analyzing the linear relationship between financial distress and dividend, the results suggest that no linearity exists between the variables (FD and dividend). Furthermore, the influence of shareholder activism is found to be significant in the association between financial distress and dividend. Thus, the negative coefficients of the interaction variable (Z-scoreXsha) imply that shareholder activism has a detrimental impact on the affiliation of financial distress and dividend. This study significantly contributes to the available literature on FD and dividend policy through its fresh evidence on the connection between the two. The study’s findings also provide substantial policy implications to all stakeholders to consider shareholders’ activism and financial stability as important factors for dividend policy decisions.

The study’s findings suggest how the banking sector will particularly act in a time of distress. Future researchers can concentrate their respective studies on other industries or sectors to investigate the relationship between FD and dividend payout policy. The outliers in the dependent variable may be the limitation of the study. However, proper care has been taken to obtain consistent results. In addition, due to the inherent limitations of the study, not many external factors have been included in the study as moderators, and the time span focused on the study is not very long either. This is considered to be the limitation in the current study, which needs further analysis in future works.

Author Contributions

All the respected authors have significantly contributed to the formulation of the current paper. The first author, A.R. and A.V.S. has handled the responsibility of writing the introduction, discussion and implications of the study, as well as the conclusion section of the paper. Secondly, S.R., P.J. and S.P.S. has effectively handled the analysis section. Lastly, A.R. has handled the literature review and the formatting of the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

CMIE Prowess and the official websites of respective banks.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Appendix A.1. Altman Zscore

The firm’s FD is proximated by Altman’s Zscore (Altman 1968; Kanoujiya et al. 2022) as this study utilizes the sample of financial firms (Banks) in India. Hence, the revised version of Altman Zscore for non-manufacturing firms is used (Pradhan 2014; Kanoujiya et al. 2022) to compute banks’ FD levels. Altman’s revised model for banks is given as follows:

where: ‘X’ is sign for multiplication.

E1 = “working capital/Total assets”

E2 = “Retained Earnings/Total assets”

E3 = “Operating income/total assets”

E4 = “market value of total equity/book value of total liabilities”

Classification:

If ZE > 2.6 then safe firm

If 1.1 < ZE < 2.6 then firm likely to be in FD

If ZE < 1.1 then distressed firm

This study considers the FD level for analysis. Therefore, we have considered the inverse relation of Altman Zscore and the bank’s FD level. It means that the higher the Zscore, the lower the FD.

This paper has also utilized the initially developed model by Altman (1968) for measuring FD. This Zscore (ZScore 1) is taken to ensure the results’ robustness. The original model is given as follows:

E1, E2, E3, E4 are the same as those used in the revised model

However, E5 = “sales/total assets”

Classification:

If ZScore1 > 2.67 then safe firm

If 1.81 < ZScore1 < 2.67 then firm likely to be in FD

If ZScore1 < 1.81 then distressed firm

Appendix A.2. Shareholders’ Activism

Shareholder activism refers to the involvement of shareholders who use their ownership position to affect the policies and practices of the firm. Six broad categories and 34 attributes are used to create a shareholder activism index, using corporate governance categories as the database. The SHAI has a number of characteristics that have gone unreported by researchers in the literature (Vargas et al. 2018; Shingade et al. 2022) but which would be very important to shareholders in the modern period. A score derived from the self-created shareholder activism index using a dichotomous approach (taking value 1 if activism does persist and 0 otherwise).

References

- Aivazian, Varouj, Laurence Booth, and Sean Cleary. 2003a. Dividend policy and the organization of capital markets. Journal of Multinational Financial Management 13: 101–21. [Google Scholar] [CrossRef]

- Aivazian, Varouj, Laurence Booth, and Sean Cleary. 2003b. Do emerging market firms follow different dividend policies from US firms? Journal of Financial Research 26: 371–87. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Amidu, Mohammed, and Joshua Abor. 2006. Determinants of dividend payout ratios in Ghana. The Journal of Risk Finance 7: 136–45. [Google Scholar] [CrossRef]

- Baltagi, Badi H., ed. 2006. Panel Data Econometrics: Theoretical Contributions and Empirical Applications. Bentley: Emerald Group Publishing. [Google Scholar]

- Barros, Victor, Pedro Verga Matos, Joaquim Miranda Sarmento, and Pedro Rino Vieira. 2021. Do activist shareholders influence a manager’s decisions on a firm’s dividend policy: A mixed-method study. Journal of Business Research 122: 387–97. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial ratios as predictors of failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Bender, Ruth. 2013. Corporate Financial Strategy. London: Routledge. [Google Scholar] [CrossRef]

- Betker, Brian L. 1997. The Administrative Costs of Debt Restructurings: Some Recent Evidence. Financial Management 26: 56–68. [Google Scholar] [CrossRef]

- Choy, Steven Liew Woon, Jayaraman Munusamy, Shankar Chelliah, and Ally Mandari. 2011. Effects of financial distress condition on the company performance: A Malaysian perspective. Review of Economics & Finance 1: 85–99. [Google Scholar]

- Chughtai, Asma Rafique, Aamir Azeem, and Shahid Ali. 2014. Determining the Impact of Dividends, Earnings, Invested Capital and Retained Earnings on Stock Prices in Pakistan: An Empirical Study. International Journal of Financial Management 4: 74–82. [Google Scholar]

- Coffinet, Jerome, Adrian Pop, and Muriel Tiesset. 2013. Monitoring financial distress in a high-stress financial world: The role of option prices as bank risk metrics. Journal of Financial Services Research 44: 229–57. [Google Scholar] [CrossRef]

- Cornell, Bradford, and Alan C. Shapiro. 1987. Corporate stakeholders and corporate finance. Financial Management 16: 5–14. [Google Scholar] [CrossRef]

- DeAngelo, Harry, and Linda DeAngelo. 1990. Dividend policy and financial distress: An empirical investigation of troubled NYSE firms. The Journal of Finance 45: 1415–31. [Google Scholar] [CrossRef]

- Goranova, Maria, and Lori Verstegen Ryan. 2014. Shareholder activism: A multidisciplinary review. Journal of Management 40: 1230–68. [Google Scholar] [CrossRef]

- Grinyer, Peter H., David G. Mayes, and Peter McKiernan. 1988. Sharpbenders: The Secrets of Unleashing Corporate Potential. Oxford: Basil Blackwell. [Google Scholar]

- Gul, Ferdinand A. 1999. Growth opportunities, capital structure and dividend policies in Japan. Journal of Corporate Finance 5: 141–68. [Google Scholar] [CrossRef]

- Habib, Ahsan, Mabel D. Costa, Hedy Jiaying Huang, Md. Borhan Uddin Bhuiyan, and Li Sun. 2020. Determinants and consequences of financial distress: Review of the empirical literature. Accounting & Finance 60: 1023–75. [Google Scholar]

- He, Tina T., Wilson X. B. Li, and Gordon Y. N. Tang. 2012. Dividends behavior in state-versus family-controlled firms: Evidence from Hong Kong. Journal of Business Ethics 110: 97–112. [Google Scholar] [CrossRef]

- Hsiao, Cheng. 2007. Panel data analysis—Advantages and challenges. Test 16: 1–22. [Google Scholar] [CrossRef]

- Ikpesu, Fredrick, and Osazemen C. Eboiyehi. 2018. Capital structure and corporate financial distress of manufacturing firms in Nigeria. Journal of Accounting and Taxation 10: 78–84. [Google Scholar] [CrossRef]

- Jayadev, M. 2013. Basel III implementation: Issues and challenges for Indian banks. IIMB Management Review 25: 115–30. [Google Scholar] [CrossRef]

- Ji, Hyunmi. 2017. The effect of cash based interest coverage ratio on the value relevance of accounting information. Global Business & Finance Review (GBFR) 22: 92–100. [Google Scholar]

- Jiraporn, Pornsit, and Yixi Ning. 2006. Dividend policy, shareholder rights, and corporate governance. Shareholder Rights, and Corporate Governance. September 18. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=931290 (accessed on 23 December 2022).

- Joshi, Rabindra. 2012. Effects of dividends on stock prices in Nepal. NRB Economic Review 24: 61–75. [Google Scholar]

- Kanoujiya, Jagjeevan, Shailesh Rastogi, and Venkata Mrudula Bhimavarapu. 2022. Competition and distress in banks in India: An application of panel data. Cogent Economics & Finance 10: 2122177. [Google Scholar]

- Kazemian, Soheil, Noor Azura Ahmad Shauri, Zuraidah Mohd Sanusi, Amrizah Kamaluddin, and Shuhaida Mohamed Shuhidan. 2017. Monitoring mechanisms and financial distress of public listed companies in Malaysia. Journal of International Studies 10: 92–109. [Google Scholar] [CrossRef]

- Kim, Yong H., Jong C. Rhim, and Daniel L. Friesner. 2007. Interrelationships among capital structure, dividends, and ownership: Evidence from South Korea. Multinational Business Review 15: 25–42. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 2000. Agency problems and dividend policies around the world. The Journal of Finance 55: 1–33. [Google Scholar] [CrossRef]

- Lasfer, Meziane, and Laxmi Remer. 2010. Corporate financial distress and recovery: The UK evidence. Corporate Financial Distress and Recovery. The UK Evidence, November 7. [Google Scholar]

- Lily, Jaratin, Sundar Venkatesh, and Thumwimon Sukserm. 2009. Determinants of dividend payout in Thailand. UBU Journal 11: 73–81. [Google Scholar]

- Malombe, Georgina M. 2011. The Effects of Dividend Policy on Profitability of Sacco’s with FOSAs in Kenya. Ph.D. dissertation, University of Nairobi, Nairobi, Kenya. [Google Scholar]

- Outecheva, Natalia. 2007. Corporate Financial Distress: An Empirical Analysis of Distress Risk. Unpublished doctoral dissertation, University of St. Gallen, St. Gallen, Switzerland. [Google Scholar]

- Pound, John. 1992. Raiders, targets, and politics: The history and future of American corporate control. Journal of Applied Corporate Finance 5: 6–18. [Google Scholar] [CrossRef]

- Pradhan, Roli. 2014. Z score estimation for Indian banking sector. International Journal of Trade, Economics, and Finance 5: 516. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, Jagjeevan Kanoujiya, and Kuldeep Singh. 2022. Shareholder Activism and Dividend Policy of the Firms: The Moderating Role of Financial Distress. Vision. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, Rajani Gupte, and R. Meenakshi. 2021. A holistic perspective on bank performance using regulation, profitability, and risk-taking with a view on ownership concentration. Journal of Risk and Financial Management 14: 111. [Google Scholar] [CrossRef]

- Renneboog, Luc, and Grzegorz Trojanowski. 2007. Control structures and payout policy. Managerial Finance 33: 43–64. [Google Scholar] [CrossRef]

- Sanan, Neeti Khetarpal. 2019. Impact of board characteristics on firm dividends: Evidence from India. Corporate Governance: International Journal of Business in Society 19: 1204–15. [Google Scholar] [CrossRef]

- Şendur, Yesim. 2020. Shareholder Activism: What Does It Refer to? In Uncertainty and Challenges in Contemporary Economic Behaviour. Bingley: Emerald Publishing Limited. [Google Scholar]

- Shingade, Sudam, Shailesh Rastogi, Venkata Mrudula Bhimavarapu, and Abhijit Chirputkar. 2022. Shareholder Activism and Its Impact on Profitability, Return, and Valuation of the Firms in India. Journal of Risk and Financial Management 15: 148. [Google Scholar] [CrossRef]

- Vargas, Luiz Henrique F., Patricia M. Bortolon, Lucas A. B. C. Barros, and Ricardo P. C. Leal. 2018. Recent activism initiatives in Brazil. International Journal of Disclosure and Governance 15: 40–50. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2015. Introductory Econometrics: A Modern Approach. Cengage Learning. Cambridge: MIT Press. [Google Scholar]

- Wruck, Karen Hopper. 1990. Financial distress, reorganisation and organisational efficiency. Journal of Financial Economics 27: 419–46. [Google Scholar] [CrossRef]

- Wu, Desheng Dash, Liang Liang, and Zijiang Yang. 2008. Analyzing the financial distress of Chinese public companies using probabilistic neural networks and multivariate discriminate analysis. Socio-Economic Planning Sciences 42: 206–20. [Google Scholar] [CrossRef]

- Zeng, Tao. 2003. What determines dividend policy. A comprehensive test. Journal of American Academy of Business 2: 304–30. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).