An Attempt to Understand Stock Market Investors’ Behaviour: The Case of Environmental, Social, and Governance (ESG) Forces in the Pakistani Stock Market

Abstract

1. Introduction

2. Review of Literature and Development of Hypotheses

Theoretical Underpinning

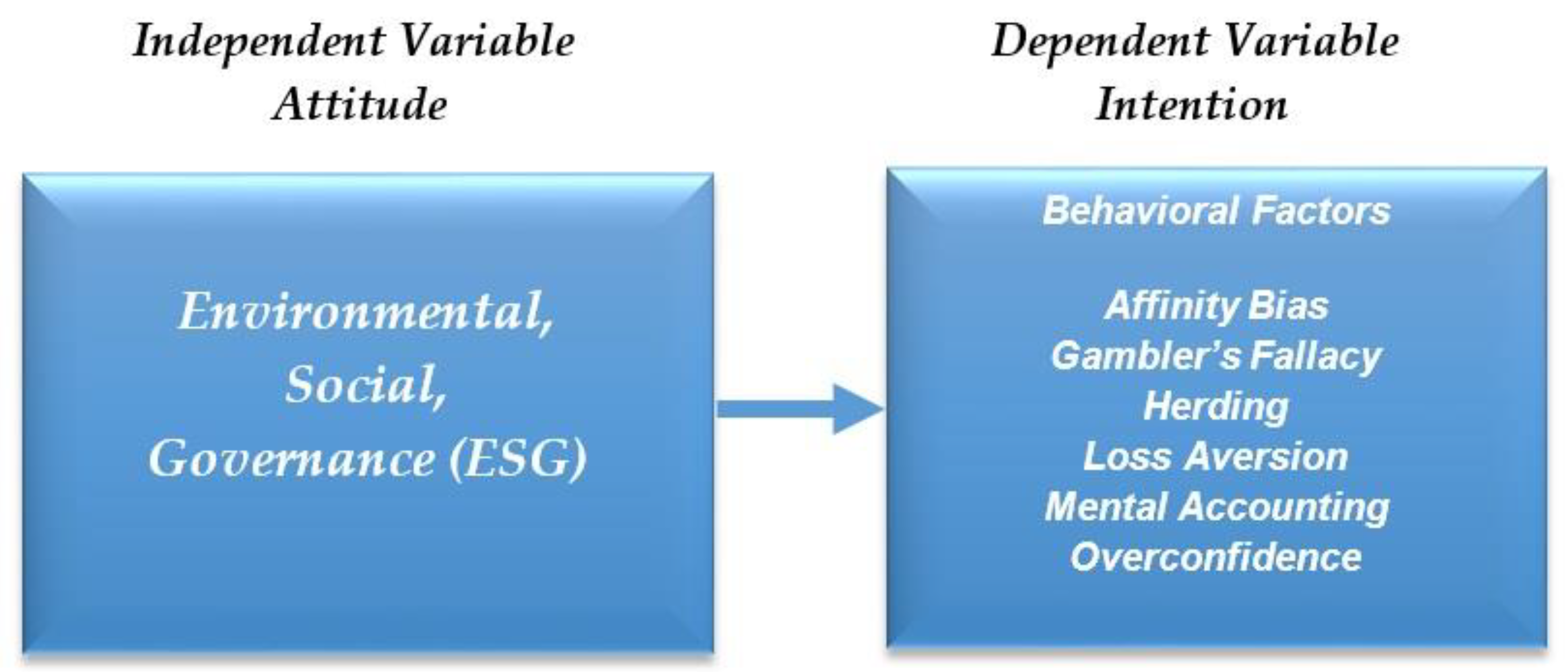

3. Independent Variables

4. Effect of Independent Variables on Dependent Variables

4.1. ESG and Affinity Bias

4.2. ESG and Gambler’s Fallacy

4.3. ESG and Herding Behaviour

4.4. ESG and Loss Aversion

4.5. ESG and Mental Accounting

4.6. ESG and Overconfidence

5. Research Methodology

6. Analysis and Results of the Study

Structural Model Assessment

7. Discussion

7.1. Theoretical Implications

7.2. Practical Implications

8. Conclusions and Recommendations

Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Correction Statement

Appendix A

| Demographic Variables | Age | Education Level | Place/Province of Residence | Duration of Residence |

| Gender: Male □ Female □ | Less than 30 y □ 31 to 40 y □ More than 40 y □ | Matriculation □ Intermediate □ Bachelors □ Masters □ Ph.D. □ Other □ | Khyber □ Pakhtunkhwa □ Punjab □ Sindh □ Balochistan □ Gilgit Baltistan □ | Less than 1 y □ 1 to 5 y □ More than 5 y □ |

| Variables | SD | D | N | A | SA |

| Variable: Environmental | |||||

| Items: I wish to invest in companies that care about: | |||||

| Climate Change | |||||

| During the time of investment, I address climate change as an investment risk. | |||||

| Carbon Emission | |||||

| Reducing harmful gases (carbon dioxide and chlorofluorocarbons) from the production process. | |||||

| I discourage those organizations who are involved in promoting this pollution. | |||||

| I am interested in investing in those organizations that reduce carbon emissions; policymakers provide incentives to achieve emission reduction. | |||||

| I invest under carbon emission regulation policies, and firms seek Cost-efficient methods to decrease emissions. | |||||

| Energy | |||||

| I want to invest in energy production projects because there are some areas in Pakistan where there is no electricity or gas. | |||||

| I would like to invest in projects that want to provide energy to the areas where there is a problem with energy. | |||||

| I prefer those investments that are working for renewable energy in Pakistan. | |||||

| Variable: Social | |||||

| Items: I wish to invest in companies that care about: | |||||

| Fair Trade Principles | |||||

| The organizations in Pakistan have fair trade rules. | |||||

| I prefer Investment in Community Development and environmentally Sustainable Projects. | |||||

| I invest in the project where I am given all the information withHonesty. | |||||

| I invest in those ventures that discourage forced labor and child labor. | |||||

| I invest in Workplace Non-Discrimination, Gender Equity, and Freedom of Association. | |||||

| Safety | |||||

| If the company is not safe for people, I do not invest. | |||||

| Pakistan has different safety issues so; I invest in the projects/organizations that are working for the safety of people. | |||||

| I also consider the health and safety of the people working in the organization as a major concern. | |||||

| I wish to invest in companies that care about the workplace health and safety of the employees and workers. | |||||

| Producing quality goods and services considering the customers’ health and safety, and providing correct product information. | |||||

| Philanthropy | |||||

| I prefer those investments which are for the benefit of people. | |||||

| I invest more in social causes than for my benefit. | |||||

| Pakistan endured the consequences of the war against terrorism in some areas; I would like to invest in rehabilitation. | |||||

| Pakistan is one of the hubs of refugees in some areas; I would like to invest in their betterment. | |||||

| I invest in a charitable organization. | |||||

| Variable: Governance | SD | D | N | A | SA |

| Corruption | |||||

| I would not like to be a part of corrupt management as an investor. | |||||

| I prefer private organizations because corruption is more common in government organizations than in private ones in Pakistan. | |||||

| Bribery | |||||

| Bribery is a problem in Pakistan that is affecting investments. | |||||

| I will refrain from investing in the projects if I doubt Bribery. | |||||

| I have witnessed certain cases of bribery in Pakistan organizations more often. | |||||

| Bribery is more common in government organizations than in private ones. | |||||

| Stakeholder Protection | |||||

| I prefer those organizations that prioritize stakeholder Protection. | |||||

| I expect that I will be communicated with all necessary actions done by the organization or project where I have invested in Pakistan. | |||||

| I wish to invest in those organizations to improve performance, transparency, and accountability among stakeholders. | |||||

| Variable: Trading Performance | |||||

| My current investment’s gains meet the expectations in Pakistan. | |||||

| I invest in riskier projects for high gains. | |||||

| I prefer a sufficiently high rate of returns on a project to the cause or attractiveness of the project. | |||||

| I always calculate my rate of return before investment and refrain from relying on intuitions. | |||||

| Generally, I am satisfied with my current investments due to satisfactory returns. | |||||

| If I invest in the future in Pakistan rather than in any other country, I will be satisfied. | |||||

| My trading experience motivates me to be a part of this region in the future. | |||||

| My level of satisfaction is linked with the level of safety of my investment. | |||||

| I consider the level of risk before investing in the stock market. | |||||

| I take high risks during my decision-making. | |||||

| If information is incomplete on an investment, I do not risk my money on that project. | |||||

| Investment in Pakistan is riskier than in any other country. | |||||

| I am satisfied with the way I am making investment decisions. | |||||

| My decision-making helps me to achieve my investment objectives. | |||||

| Variable: Behavioral Factors | SD | D | N | A | SA |

| Over-Confidence | |||||

| Sometimes I become overconfident in assuming returns. | |||||

| Initially, I was more confident in predicting returns, but with the experience, my overconfidence has reduced. | |||||

| I trade rapidly as I rely on my skills and knowledge. | |||||

| I tend to gather more and more information every time regarding Environmental, Social, and Governance (ESG) practicing firms. | |||||

| Confident in my ability to do better than others in stock picking during investment. | |||||

| I feel more confident in my own investment opinions than the opinions of my family, colleagues, or friends. | |||||

| Are Overconfident firm executives tending to exhibit superior ESG performance? | |||||

| Overconfident investors came to know that technical and fundamental analyses are not appropriate as investors are demanding ESG-oriented stock. | |||||

| Gambler’s Fallacy | |||||

| I have an opinion that if some things have been happening more in the past then it is less likely to occur in the future. | |||||

| I tend to predict the data-generating process of the returns of shares I have invested in. | |||||

| I make simpler investment decisions based on past experience rather than ESG experience. | |||||

| Will the investor keep an eye on the stock of companies that fully satisfy ESG criteria or past performance? | |||||

| Are the investors predicting or forecasting incorrectly and improperly that the trend will be inverted as an ESG trend? | |||||

| Loss Aversion | |||||

| I tend to make moves by predicting the loss I will be able to bear. | |||||

| I avoid loss more than focusing on attaining gains. | |||||

| I will be happier if I know I have safeguarded myself from a loss than if I gain from an investment. | |||||

| If I have endured a loss on investment in the past, I will not invest in the specific project/organization later. | |||||

| I will not increase my investment when the market performance is poor. | |||||

| I feel nervous when large losses (price drops) are in my invested stocks. | |||||

| Are the loss-averse investors trying to follow and invest in ESG-practicing firms? | |||||

| As a loss-averse investor, I would like to invest in an ESG-practicing firm. | |||||

| Mental Accounting | SD | D | N | A | SA |

| I focus on avoiding the pain of bearing losses in my Investments classification. | |||||

| I have found my decision-making irrational. | |||||

| I always presume different pools/projects in my mind to invest in ESG practicing firms. | |||||

| I invest only in a diversified portfolio and ESG-oriented stock. | |||||

| I always keep in mind the ESG orientation firms for investment. | |||||

| If the investors are aware of ESG then they do not stick within the loss-bearing stock. | |||||

| Affinity Bias | |||||

| I tend to prefer domestic equities. | |||||

| I tend to prefer to invest in the stock of companies I like to shop From. | |||||

| I invest in stocks that are socially and environmentally responsible. | |||||

| I like to invest in companies in Pakistan. | |||||

| I prefer to buy a stock that goes beyond profit maximization. | |||||

| I prefer some time to buy a stock that goes beyond profit maximization rather than ESG stock. | |||||

| Sometimes I would like to shop the ESG stock if they feel will have a positive impact on the world. | |||||

| Herding | |||||

| I sometimes try to follow the actions of my friends and acquaintances in the market. | |||||

| I rely more on collective information as compared to private Information. | |||||

| The speed of following the trading behavior of others is based on frequent coordination. | |||||

| I believe that others invest in more profitable ventures so, I tend to follow them immediately to safeguard my opportunity. | |||||

| I usually react quickly to changes in other investors’ decisions and follow their reactions to the stock market. | |||||

| I believe that information from relatives and colleagues has high reliability. | |||||

| Can ESG investment practices create a reputation & image of being more trustworthy among peers? | |||||

| I might keep on herding as well if I know that all the investors are focusing on the ESG-oriented stock, |

References

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Ani, Nuel Chinedu, and Çiğdem Özarı. 2020. Behavioral Finance: Investors Psychology. IOSR Journal of Economics and Finance 11. Available online: https://www.researchgate.net/profile/Nuel-Chinedu-Ani/project/The-Influence-of-Mental-Accounting-on-Windfall-Earning/attachment/5e36f95a3843b06506d69f9d/AS:854168642256904@1580661082182/download/Behavioral_Finance_Investors_Psychology+%281%29.pdf?context=ProjectUpdatesLog (accessed on 25 November 2023).

- Antony, Anu, and Ansted Iype Joseph. 2017. Influence of Behavioural Factors Affecting Investment Decision—An AHP Analysis. Metamorphosis: A Journal of Management Research 16: 107–14. [Google Scholar] [CrossRef]

- Aybars, Aslı, Levent Ataünal, and Ali Osman Gürbüz. 2019. ESG and financial performance: Impact of environmental, social, and governance issues on corporate performance. In Handbook of Research on Managerial Thinking in Global Business Economics. Hershey: IGI Global, pp. 520–36. [Google Scholar]

- Barberis, Nicholas, and Ming Huang. 2001. Mental Accounting, Loss Aversion, and Individual Stock Returns. The Journal of Finance 65: 1247–92. [Google Scholar] [CrossRef]

- Bilbao-Terol, Amelia, Mar Arenas-Parra, and Verónica Canal-Fernández. 2016. A Model Based on Copula Theory for Sustainable and Social Responsible Investments. Revista de Contabilidad 19: 55–76. [Google Scholar] [CrossRef][Green Version]

- Bloomfield, Robert, and Jeffrey Hales. 2002. Predicting the next Step of a Random Walk: Experimental Evidence of Re-gime-Shifting Beliefs. Journal of Financial Economics 65: 397–414. [Google Scholar] [CrossRef]

- Bollen, Nicolas P. B. 2007. Mutual fund attributes and investor behavior. Journal of Financial and Quantitative Analysis 42: 683–708. [Google Scholar] [CrossRef]

- Byrne, Michael. 2016. ‘Asset price urbanism’and financialization after the crisis: Ireland’s National Asset Management Agency. International Journal of Urban and Regional Research 40: 31–45. [Google Scholar] [CrossRef]

- Calvo, Clara, Carlos Ivorra, and Vicente Liern. 2016. Fuzzy Portfolio Selection with Non-Financial Goals: Exploring the Efficient Frontier. Annals of Operations Research 245: 31–46. [Google Scholar] [CrossRef]

- Chiromba, Vitalis. 2019. An Investigation of the Relationship between Signs and Faith in the Gospel According to John and its Application to the Zimbabwean Context. DARE: Holy Trinity College Journal 11: 23–38. [Google Scholar]

- Cohen, Gil, and Andrey Kudryavtsev. 2012. Investor rationality and financial decisions. Journal of Behavioral Finance 13: 11–16. [Google Scholar] [CrossRef]

- Crifo, Patricia, Vanina D. Forget, and Sabrina Teyssier. 2015. The price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. Journal of Corporate Finance 30: 168–94. [Google Scholar] [CrossRef]

- Dash, Gordon H., and Nina Kajiji. 2020. Multiobjective Behavioral Portfolio Selection with Efficient ESG Factors and Learning Network Estimation of Asset Returns. Paper presented at the 2nd Frontiers of Factor Investing Conference, Lancaster, UK, April 2–3; Available online: http://wp.lancs.ac.uk/fofi2020/files/2020/04/FoFI-2020-123-Gordon-Dash-Jr.pdf (accessed on 25 March 2023).

- Dick, Markus, Eva Wagner, and Helmut Pernsteiner. 2021. Founder-Controlled Family Firms, Overconfidence, and Corporate Social Responsibility Engagement: Evidence from Survey Data. Family Business Review 34: 71–92. [Google Scholar] [CrossRef]

- Esat, Robert. 1993. Investment Decisions and the Theory of Planned Behaviour. Journal of Economic Psychology 14: 337–75. [Google Scholar] [CrossRef]

- El-Gohary, Hatem. 2009. The Impact of E-Marketing Practices on Marketing Performance of Small Business Enterprises: An Empirical Investigation. Unpublished doctoral dissertation, Bradford University, Bradford, UK. [Google Scholar]

- El-Gohary, Hatem. 2012. Factors affecting E-Marketing adoption and implementation in tourism firms: An empirical investigation of Egyptian small tourism organizations. Tourism Management 33: 1256–69. [Google Scholar] [CrossRef]

- Ewens, Michael, and Richard R. Townsend. 2020. Are Early Stage Investors Biased against Women? Journal of Financial Economics 135: 653–77. [Google Scholar] [CrossRef]

- Fishbein, Martin, and Icek Ajzen. 2011. Predicting and Changing Behavior: The Reasoned Action Approach. London: Psychology Press. [Google Scholar]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Galbreath, Jeremy. 2012. Are Boards on Board? A Model of Corporate Board Influence on Sustainability Performance. Journal of Management & Organization 18: 445–60. [Google Scholar]

- Gasperini, Andrea. 2020. Principles for Responsible Investment (PRI) and ESG Factors. In Climate Action. Edited by Walter Leal Filho, Anabela Marisa Azul, Luciana Brandli, Pinar Gökcin Özuyar and Tony Wall. Encyclopedia of the UN Sustainable Development Goals. Cham: Springer International Publishing, pp. 737–49. [Google Scholar]

- Giannetti, Mariassunta, and Andrei Simonov. 2006. Which Investors Fear Expropriation? Evidence from Investors’ Portfolio Choices. The Journal of Finance 61: 1507–47. [Google Scholar] [CrossRef]

- Goel, Puneeta. 2018. Implications of corporate governance on financial performance: An analytical review of governance and social reporting reforms in India. Asian Journal of Sustainability and Social Responsibility 3: 1–21. [Google Scholar] [CrossRef]

- Guzavicius, Andrius, Rita Vilkė, and Vytautas Barkauskas. 2014. Behavioural finance: Corporate social responsibility approach. Procedia-Social and Behavioral Sciences 156: 518–23. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2012. Using partial least squares path modeling in advertising research: Basic concepts and recent issues. Handbook of Research on International Advertising 252. [Google Scholar] [CrossRef]

- Hirshleifer, David, Angie Low, and Siew Hong Teoh. 2012. Are overconfident CEOs better innovators? The Journal of Finance 67: 1457–98. [Google Scholar] [CrossRef]

- Hussain, Javed G., Navjot Sandhu, Hatem El-Gohary, and David J. Edwards. 2020. The Reality of Financing Small Tourism Firms: The case of Indian Tourism SMEs. International Journal of Customer Relationship Marketing and Management 11: 64–80. [Google Scholar] [CrossRef]

- Ivankova, Nataliya V., John W. Creswell, and Sheldon L. Stick. 2006. Using Mixed-Methods Sequential Explanatory Design: From Theory to Practice. Field Methods 18: 3–20. [Google Scholar] [CrossRef]

- Jafarkarimi, Hosein, Robab Saadatdoost, Alex Tze Hiang Sim, and Jee Mei Hee. 2016. Behavioral Intention in Social Networking Sites Ethical Dilemmas: An Extended Model Based on Theory of Planned Behavior. Computers in Human Behavior 62: 545–61. [Google Scholar] [CrossRef]

- Jain, Jinesh, Nidhi Walia, and Sanjay Gupta. 2019. Evaluation of behavioral biases affecting investment decision-making of individual equity investors by fuzzy analytic hierarchy process. Review of Behavioral Finance 12: 297–314. [Google Scholar] [CrossRef]

- Kline, Rex B. 2011. Convergence of structural equation modeling and multilevel modeling. The SAGE Handbook of Innovation in Social Research Methods 2011: 562–89. [Google Scholar]

- Kumar, Anil, Abdul Moktadir, Zahidur Rhaman Liman, Angappa Gunasekaran, Klaus Hegemann, and Syed Abdul Rehman Khan. 2020. Evaluating sustainable drivers for social responsibility in the context of ready-made garments supply chain. Journal of Cleaner Production 248: 119231. [Google Scholar] [CrossRef]

- Landi, Giovanni, and Mauro Sciarelli. 2019. Towards a more ethical market: The impact of ESG rating on corporate financial performance. Social Responsibility Journal 15: 11–27. [Google Scholar] [CrossRef]

- Lee, Ian. 2004. Corporate law, profit maximization, and the responsible shareholder. Stanford Journal of Law, Business & Finance 10: 31. [Google Scholar]

- Lungeanu, Razvan, and Klaus Weber. 2021. Social Responsibility Beyond the Corporate: Executive Mental Accounting Across Sectoral and Issue Domains. Organization Science 32: 1473–91. [Google Scholar] [CrossRef]

- Mahapatra, Mousumi Singha, Jayasree Raveendran, and Anupam De. 2016. Mental Proposing the Role of Accounting and Financial Cognition on Personal Financial Planning: A Study in Indian Context. Journal of Economic Policy and Research 12: 62–73. [Google Scholar]

- Metawa, Noura, M. Kabir Hassan, Saad Metawa, and M. Faisal Safa. 2019. Impact of behavioral factors on investors’ financial decisions: Case of the Egyptian stock market. International Journal of Islamic and Middle Eastern Finance and Management 12: 30–55. [Google Scholar] [CrossRef]

- Meyer, Julia, and Kelly Hess. 2018. Investments for Development in Switzerland: A Sub-type of Impact Investing with Strong Growth Dynamics. In Positive Impact Investing: A Sustainable Bridge between Strategy, Innovation, Change and Learning. Cham: Springer, pp. 177–95. [Google Scholar] [CrossRef]

- Mouna, Amari, and Jarboui Anis. 2015. A study on small investors’ sentiment, financial literacy and stock returns: Evidence for emerging market. International Journal of Accounting and Economics Studies 3: 10–19. [Google Scholar] [CrossRef]

- Ng, Artie W. 2018. From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial center. Journal of Cleaner Production 195: 585–92. [Google Scholar] [CrossRef]

- Nilsson, Jonas. 2008. Investment with a conscience: Examining the impact of pro-social attitudes and perceived financial performance on socially responsible investment behavior. Journal of Business Ethics 83: 307–25. [Google Scholar] [CrossRef]

- Nkwocha, Obinna Udodiri, Javed Hussain, Hatem El-Gohary, David J. Edwards, and Ernest Ovia. 2019. Dynamics of Group Lending Mechanism and the Role of Group Leaders in Developing Countries: Evidence from Nigeria. International Journal of Customer Relationship Marketing and Management 10: 54–71. [Google Scholar] [CrossRef]

- Omopariola, Emmanuel Dele, Abimbola Windapo, David John Edwards, and Hatem El-Gohary. 2021. Level of financial performance of selected construction companies in South Africa. Journal of Risk and Financial Management 14: 518. [Google Scholar] [CrossRef]

- Owusu-Manu, De-Graft, Prosper Babon-Ayeng, Ernest Kissi, David J. Edwards, Derek Okyere-Antwi, and Hatem Elgohary. 2023. Green construction and environmental performance: An assessment framework. Smart and Sustainable Built Environment 12: 565–83. [Google Scholar] [CrossRef]

- Parveen, Shagufta, Zoya Wajid Satti, Qazi Abdul Subhan, and Sana Jamil. 2020. Exploring market overreaction, investors’ sentiments, and investment decisions in an emerging stock market. Borsa Istanbul Review 20: 224–35. [Google Scholar] [CrossRef]

- Pellinen, Antti, Kari Törmäkangas, Outi Uusitalo, and Juha Munnukka. 2015. Beliefs Affecting Additional Investment Intentions of Mutual Fund Clients. Journal of Financial Services Marketing 20: 62–73. [Google Scholar] [CrossRef]

- Pompian, Michael M. 2017. Risk Tolerance and Behavioral Finance. Greenwood Village: Investment Management Consultants Association Inc., vol. 1, pp. 1–5. [Google Scholar]

- Przychodzen, Justyna, Fernando Gómez-Bezares, Wojciech Przychodzen, and Mikel Larreina. 2016. ESG Issues among Fund Managers—Factors and Motives. Sustainability 8: 1078. [Google Scholar] [CrossRef]

- Rehman, Mobeen Ur, and Xuan-Vinh Vo. 2020. Is a portfolio of socially responsible firms profitable for investors? Journal of Sustainable Finance and Investment 10: 191–212. [Google Scholar] [CrossRef]

- Riedl, Arno, and Paul Smeets. 2017. Why do investors hold socially responsible mutual funds? The Journal of Finance 72: 2505–50. [Google Scholar] [CrossRef]

- Ringle, Christian, Dirceu Da Silva, and Diógenes Bido. 2015. Structural equation modeling with the SmartPLS. Structural Equation Modeling with the Smartpls. Brazilian Journal of Marketing 13: 56–73. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2676422 (accessed on 25 November 2023).

- Rooh, Samina, and Arif Hussain. 2022. The Behavioral Factors and Individual Investor’s Trading Performance in Khyber Pakhtunkhwa: The mediating role of Environmental, Social, and Governance (ESG) Performance: Herding, Loss aversion, Mental Accounting, Overconfidence, and ESG Performance. City University Research Journal 12. Available online: http://www.cusitjournals.com/index.php/CURJ/article/view/746 (accessed on 25 March 2023).

- Rooh, Samina, Arif Hussain, and Muhammad Zahid. 2021. The impact of behavioral factors on environmental issues regarding individual investor’s decision making: Empirical evidence from Pakistan’s stock market. Sarhad Journal of Management Sciences 7: 65–82. [Google Scholar]

- Rubbaniy, Ghulame, Ali Awais Khalid, and Aristeidis Samitas. 2021. Are cryptos safe-haven assets during Covid-19? Evidence from wavelet coherence analysis. Emerging Markets Finance and Trade 57: 1741–56. [Google Scholar] [CrossRef]

- Sairally, Beebee Salma. 2015. Integrating Environmental, Social, and Governance (ESG) Factors in Islamic Finance: Towards the Realisation of Maqasid Al-Shari’Ah. ISRA International Journal of Islamic Finance 7: 145–54. Available online: http://search.proquest.com/openview/70dbf2bbb93fb0415e956ef5b9cbcd88/1?pq-origsite=gscholar&cbl=2031957 (accessed on 25 March 2023).

- Sandhu, Navjot, and Hatem El-Gohary. 2022. Unveiling the Impact of Psychological Traits on Innovative Financial Decision-Making in Small Tourism Businesses. Journal of the Knowledge Economy 14: 2284–317. [Google Scholar] [CrossRef]

- Saunders, Mark, Philip Lewis, and Adrian Thornhill. 2009. Research Methods for Business Students. London: Pearson education. [Google Scholar]

- Semmann, Dirk, Hans-J. Grgen Krambeck, and Manfred Milinski. 2005. Reputation is valuable within and outside one’s own social group. Behavioral Ecology and Sociobiology 57: 611–16. [Google Scholar] [CrossRef]

- Shefrin, Hersh, and Meir Statman. 2011. Behavioral Finance in the Financial Crisis: Market Efficiency, Minsky, and Keynes. Santa Clara: Santa Clara University. Available online: https://www.econbiz.de/Record/behavioral-finance-in-the-financial-crisis-market-efficiency-minsky-and-keynes-shefrin-hersh/10009741001 (accessed on 25 March 2023).

- Shiau, Wen-Lung, Ye Yuan, Xiaodie Pu, Soumya Ray, and Charlie C. Chen. 2020. Understanding fintech continuance: Perspectives from self-efficacy and ECT-IS theories. Industrial Management & Data Systems 120: 1659–89. [Google Scholar]

- Somathilake, Hmdn. 2020. Factors Influencing Individual Investment Decisions In Colombo Stock Exchange. International Journal of Scientific and Research Publications 10: 579–85. [Google Scholar] [CrossRef]

- Sreekumar Nair, Abhilash, and Rani Ladha. 2014. Determinants of Non-Economic Investment Goals among Indian Investors. Corporate Governance 14: 714–27. [Google Scholar] [CrossRef]

- Sultana, Sayema, Norhayah Zulkifli, and Dalilawati Zainal. 2018. Environmental, social and governance (ESG) and investment decision in Bangladesh. Sustainability 10: 1831. [Google Scholar] [CrossRef]

- Syed, Ali Murad. 2017. Environment, Social, and Governance (ESG) Criteria and Preference of Managers. Edited by Collins G. Ntim. Cogent Business & Management 4: 1340820. [Google Scholar] [CrossRef]

- Thaler, Richard H. 1992. The Winner’s Curse. Across the Board 29: 30. [Google Scholar]

- Tversky, Amos, and Daniel Kahneman. 1991. Loss Aversion in Riskless Choice: A Reference-Dependent Model. The Quarterly Journal of Economics 106: 1039–61. [Google Scholar] [CrossRef]

- Tversky, Amos, Paul Slovic, and Daniel Kahneman. 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5: 297–323. [Google Scholar] [CrossRef]

- Umar, Zaghum, Dimitris Kenourgios, and Sypros Papathanasiou. 2020. The static and dynamic connectedness of environmental, social, and governance investments: International evidence. Economic Modelling 93: 112–24. [Google Scholar] [CrossRef] [PubMed]

- UN Principles for Responsible Investment (UN PRI). 2015. Available online: http://www.unpri.org/about-pri/pri-governance/pri-financial-information/ (accessed on 25 March 2023).

- Wang, Haizhong, Hong Yuan, Xiaolin Li, and Huaxi Li. 2019. The Impact of Psychological Identification with Home-Name Stocks on Investor Behavior: An Empirical and Experimental Investigation. Journal of the Academy of Marketing Science 47: 1109–30. [Google Scholar] [CrossRef]

- Winegarden, Wayne. 2019. Environmental, Social, and Governance (Esg) Investing: An Evaluation of the Evidence. Pacific Research Institute. Available online: https://www.pacificresearch.org/wp-content/uploads/2019/05/ESG_Funds_F_web.pdf (accessed on 25 March 2023).

- Yadav, Rambalak, and Govind Swaroop Pathak. 2016. Young Consumers’ Intention towards Buying Green Products in a Developing Nation: Extending the Theory of Planned Behavior. Journal of Cleaner Production 135: 732–39. [Google Scholar] [CrossRef]

| ESG Factors | Factors |

|---|---|

| Environment | Climate change |

| Energy consumption Water Management | |

| Social | Fair Trade |

| Safety | |

| Philanthropy | |

| Governance | Corruption |

| Bribery |

| FL | Cronbach’s Alpha | rho_A | CR | AVE | VIF | |

|---|---|---|---|---|---|---|

| Affinity Bias | - | 0.891 | 0.916 | 0.909 | 0.590 | |

| AB-1 | 0.827 | 2.129 | ||||

| AB-2 | 0.798 | 1.920 | ||||

| AB-3 | 0.75 | 1.547 | ||||

| AB-4 | 0.739 | 2.055 | ||||

| AB-5 | 0.737 | 2.173 | ||||

| AB-6 | 0.742 | 2.045 | ||||

| AB-7 | 0.776 | 2.070 | ||||

| Anti-Bribery | 0.898 | 0.941 | 0.928 | 0.762 | ||

| BR-1 | 0.884 | 2.456 | ||||

| BR-2 | 0.906 | 2.640 | ||||

| BR-3 | 0.862 | 2.424 | ||||

| BR-4 | 0.838 | 2.462 | ||||

| Climate Change | 0.850 | 0.855 | 0.89 | 0.579 | ||

| CC-1 | 0.617 | 3.178 | ||||

| CC-2 | 0.647 | 3.278 | ||||

| CE-1 | 0.831 | 3.603 | ||||

| CE-2 | 0.8 | 2.811 | ||||

| CE-3 | 0.791 | 2.900 | ||||

| CE-4 | 0.847 | 3.612 | ||||

| Corruption | 0.907 | 1.063 | 0.927 | 0.762 | ||

| CO-1 | 0.937 | 2.697 | ||||

| CO-2 | 0.825 | 3.068 | ||||

| CO-3 | 0.893 | 2.742 | ||||

| CO-4 | 0.831 | 2.688 | ||||

| Energy Consumptions | 0.93 | 0.978 | 0.954 | 0.875 | ||

| EN-1 | 0.94 | 4.447 | ||||

| EN-2 | 0.945 | 3.349 | ||||

| EN-3 | 0.921 | 3.803 | ||||

| Fair Trade | 0.937 | 0.962 | 0.951 | 0.796 | ||

| FT-1 | 0.909 | 3.473 | ||||

| FT-2 | 0.89 | 3.112 | ||||

| FT-3 | 0.894 | 3.934 | ||||

| FT-4 | 0.871 | 3.141 | ||||

| FT-5 | 0.897 | 3.783 | ||||

| Gamblers Fallacy | 0.893 | 0.982 | 0.875 | 0.596 | ||

| GF-1 | 0.724 | 2.683 | ||||

| GF-2 | 0.642 | 2.561 | ||||

| GF-3 | 0.526 | 1.704 | ||||

| GF-4 | 0.969 | 3.211 | ||||

| GF-5 | 0.909 | 3.739 | ||||

| Herding | 0.901 | 0.906 | 0.920 | 0.590 | ||

| HE-1 | 0.76 | 2.137 | ||||

| HE-2 | 0.806 | 2.192 | ||||

| HE-3 | 0.779 | 2.038 | ||||

| HE-4 | 0.775 | 2.105 | ||||

| HE-5 | 0.749 | 1.900 | ||||

| HE-6 | 0.766 | 1.928 | ||||

| HE-7 | 0.727 | 1.762 | ||||

| HE-8 | 0.781 | 2.074 | ||||

| Loss Aversion | 0.898 | 0.883 | 0.907 | 0.586 | ||

| LA-1 | 0.86 | 2.299 | ||||

| LA-2 | 0.826 | 2.057 | ||||

| LA-3 | 0.791 | 2.252 | ||||

| LA-4 | 0.841 | 2.035 | ||||

| LA-5 | 0.584 | 1.775 | ||||

| LA-7 | 0.765 | 2.281 | ||||

| LA-8 | 0.65 | 2.066 | ||||

| Mental Accounting | 0.908 | 0.946 | 0.920 | 0.624 | ||

| MA-1 | 0.659 | 2.527 | ||||

| MA-2 | 0.737 | 2.762 | ||||

| MA-3 | 0.752 | 2.618 | ||||

| MA-4 | 0.862 | 2.598 | ||||

| MA-5 | 0.851 | 2.314 | ||||

| MA-6 | 0.871 | 2.893 | ||||

| MA-7 | 0.771 | 1.782 | ||||

| Over Confidence | 0.908 | 0.916 | 0.925 | 0.609 | ||

| OC-1 | 0.789 | 2.404 | ||||

| OC-2 | 0.851 | 2.967 | ||||

| OC-3 | 0.819 | 2.318 | ||||

| OC-4 | 0.827 | 2.492 | ||||

| OC-5 | 0.751 | 1.914 | ||||

| OC-6 | 0.664 | 1.615 | ||||

| OC-7 | 0.79 | 2.051 | ||||

| OC-8 | 0.734 | 1.843 | ||||

| Philanthropy | 0.927 | 1.030 | 0.943 | 0.767 | ||

| PH-1 | 0.819 | 2.583 | ||||

| PH-2 | 0.869 | 3.155 | ||||

| PH-3 | 0.875 | 3.112 | ||||

| PH-4 | 0.894 | 2.945 | ||||

| PH-5 | 0.919 | 3.279 | ||||

| Safety | 0.926 | 0.945 | 0.942 | 0.729 | ||

| SA-1 | 0.87 | 2.989 | ||||

| SA-2 | 0.816 | 2.435 | ||||

| SA-3 | 0.832 | 2.619 | ||||

| SA-4 | 0.871 | 2.741 | ||||

| SA-5 | 0.856 | 2.760 | ||||

| SA-6 | 0.875 | 2.768 | ||||

| Water Management | 0.919 | 1.547 | 0.933 | 0.778 | ||

| WM-1 | 0.872 | 3.789 | ||||

| WM-2 | 0.957 | 3.622 | ||||

| WM-3 | 0.821 | 3.834 | ||||

| WM-4 | 0.875 | 3.954 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Affinity Bias | 0.768 | |||||||||||||

| Anti-Bribery | 0.133 | 0.873 | ||||||||||||

| Climate Change | 0.188 | 0.109 | 0.761 | |||||||||||

| Corruption | −0.032 | 0.038 | 0.031 | 0.873 | ||||||||||

| Energy Consumptions | 0.128 | 0.112 | 0.390 | 0.058 | 0.935 | |||||||||

| Fair Trade | 0.225 | 0.166 | 0.422 | −0.001 | 0.289 | 0.892 | ||||||||

| Gamblers-Fallacy | −0.066 | −0.080 | −0.020 | 0.250 | −0.089 | −0.043 | 0.772 | |||||||

| Herding | 0.340 | 0.085 | 0.202 | −0.070 | 0.126 | 0.188 | −0.071 | 0.768 | ||||||

| Loss-Aversion | 0.093 | 0.066 | 0.203 | −0.028 | 0.217 | 0.220 | −0.034 | 0.014 | 0.766 | |||||

| Mental-Accounting | 0.242 | 0.124 | 0.287 | 0.007 | 0.168 | 0.141 | 0.001 | 0.186 | 0.165 | 0.790 | ||||

| Over-Confidence | 0.227 | 0.163 | 0.356 | −0.116 | 0.214 | 0.283 | −0.160 | 0.244 | 0.163 | 0.199 | 0.780 | |||

| Philanthropy | 0.007 | 0.081 | 0.121 | 0.099 | 0.059 | 0.146 | 0.046 | 0.076 | −0.076 | 0.044 | 0.118 | 0.876 | ||

| Safety | 0.093 | 0.144 | 0.406 | 0.096 | 0.390 | 0.420 | −0.105 | 0.108 | 0.084 | 0.180 | 0.163 | 0.050 | 0.854 | |

| Water Management | 0.044 | 0.166 | 0.221 | 0.144 | 0.160 | 0.194 | 0.086 | 0.004 | −0.044 | 0.129 | −0.018 | 0.127 | 0.259 | 0.882 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Affinity Bias | ||||||||||||||

| Anti-Bribery | 0.153 | |||||||||||||

| Climate Change | 0.188 | 0.135 | ||||||||||||

| Corruption | 0.051 | 0.062 | 0.06 | |||||||||||

| Energy Consumptions | 0.105 | 0.113 | 0.434 | 0.087 | ||||||||||

| Fair Trade | 0.212 | 0.188 | 0.463 | 0.053 | 0.3 | |||||||||

| Gamblers Fallacy | 0.050 | 0.047 | 0.051 | 0.196 | 0.145 | 0.054 | ||||||||

| Herding | 0.379 | 0.096 | 0.224 | 0.076 | 0.139 | 0.19 | 0.077 | |||||||

| Loss Aversion | 0.082 | 0.064 | 0.177 | 0.046 | 0.183 | 0.173 | 0.093 | 0.078 | ||||||

| Mental Accounting | 0.256 | 0.123 | 0.268 | 0.05 | 0.144 | 0.125 | 0.051 | 0.17 | 0.138 | |||||

| Over Confidence | 0.230 | 0.185 | 0.399 | 0.108 | 0.225 | 0.303 | 0.129 | 0.26 | 0.145 | 0.182 | ||||

| Philanthropy | 0.034 | 0.092 | 0.127 | 0.136 | 0.058 | 0.156 | 0.06 | 0.077 | 0.089 | 0.062 | 0.117 | |||

| Safety | 0.102 | 0.165 | 0.457 | 0.121 | 0.426 | 0.446 | 0.127 | 0.113 | 0.138 | 0.161 | 0.181 | 0.065 | ||

| Water Management | 0.065 | 0.184 | 0.246 | 0.192 | 0.166 | 0.208 | 0.085 | 0.036 | 0.057 | 0.127 | 0.066 | 0.127 | 0.289 | - |

| SM | EM | |

|---|---|---|

| SRMR | 0.053 | 0.07 |

| d_ULS | 8.985 | 15.454 |

| d_G | 3.115 | 3.222 |

| Chi-Square | 6209.9 | 6389.553 |

| NFI | 0.739 | 0.732 |

| Std. Beta | S.E | t-Values | p-Values | CILL | CIUL | Decision | |

|---|---|---|---|---|---|---|---|

| ESG → Affinity Bias | 0.235 | 0.076 | 3.007 | 0.003 | 0.130 | 0.348 | Supported |

| ESG → Gamblers Fallacy | −0.072 | 0.124 | 0.938 | 0.349 | −0.242 | 0.147 | Not Supported |

| ESG → Herding | 0.241 | 0.080 | 2.911 | 0.004 | 0.120 | 0.367 | Supported |

| ESG → Loss Aversion | 0.277 | 0.140 | 2.059 | 0.040 | −0.273 | 0.420 | Supported |

| ESG → Mental Accounting | 0.303 | 0.055 | 5.201 | 0.000 | 0.191 | 0.406 | Supported |

| ESG → Over Confidence | 0.386 | 0.047 | 8.125 | 0.000 | 0.285 | 0.473 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rooh, S.; El-Gohary, H.; Khan, I.; Alam, S.; Shah, S.M.A. An Attempt to Understand Stock Market Investors’ Behaviour: The Case of Environmental, Social, and Governance (ESG) Forces in the Pakistani Stock Market. J. Risk Financial Manag. 2023, 16, 500. https://doi.org/10.3390/jrfm16120500

Rooh S, El-Gohary H, Khan I, Alam S, Shah SMA. An Attempt to Understand Stock Market Investors’ Behaviour: The Case of Environmental, Social, and Governance (ESG) Forces in the Pakistani Stock Market. Journal of Risk and Financial Management. 2023; 16(12):500. https://doi.org/10.3390/jrfm16120500

Chicago/Turabian StyleRooh, Samina, Hatem El-Gohary, Imran Khan, Sayyam Alam, and Syed Mohsin Ali Shah. 2023. "An Attempt to Understand Stock Market Investors’ Behaviour: The Case of Environmental, Social, and Governance (ESG) Forces in the Pakistani Stock Market" Journal of Risk and Financial Management 16, no. 12: 500. https://doi.org/10.3390/jrfm16120500

APA StyleRooh, S., El-Gohary, H., Khan, I., Alam, S., & Shah, S. M. A. (2023). An Attempt to Understand Stock Market Investors’ Behaviour: The Case of Environmental, Social, and Governance (ESG) Forces in the Pakistani Stock Market. Journal of Risk and Financial Management, 16(12), 500. https://doi.org/10.3390/jrfm16120500