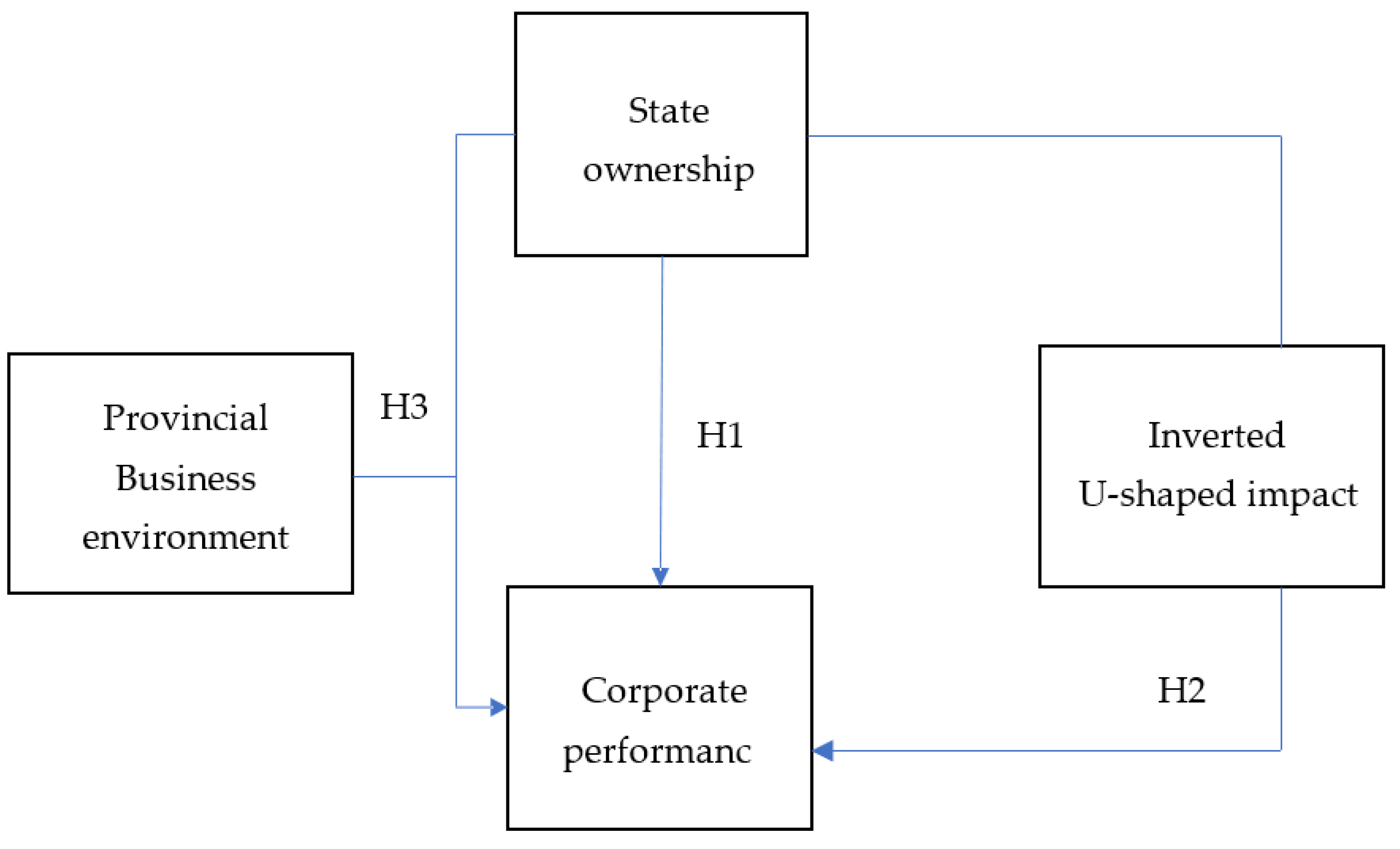

The Nexus between Corporate Performance and State Ownership in Vietnam: Evidence of State Ownership’s Inverted U-Shape and Provincial Business Environment Influences

Abstract

:1. Introduction

2. Literature Review

3. Data, Model, and Method

3.1. Data

3.2. Model

3.3. Estimating Method

4. Findings and Discussions

4.1. Empirical Findings

4.2. Discussions

5. Conclusions

6. Limitations

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abramov, Alexander, Alexander Radygin, Revold Entov, and Maria Chernova. 2017. State Ownership and Efficiency Characteristics. Russian Journal of Economics 3: 129–57. [Google Scholar] [CrossRef]

- Aguilera, Ruth V., and Gregory Jackson. 2010. Comparative and International Corporate Governance. Academy of Management Annals 4: 485–556. [Google Scholar] [CrossRef]

- Ahmad, Yahya Yeshua, Bambang Subroto, and Sari Atmini. 2022. The Role of Political Connections in the Relationship between Managerial Ability and Fraudulent Financial Statements. Journal of Accounting and Investment 23: 431–45. [Google Scholar] [CrossRef]

- Aljifri, Khaled, and Mohamed Moustafa. 2007. The Impact of Corporate Governance Mechanisms on the Performance of UAE Firms: An Empirical Analysis. Journal of Economic and Administrative Sciences 23: 71–93. [Google Scholar] [CrossRef]

- Alsamhi, Mohammed H., Fuad A. Al-Ofairi, Najib H. S. Farhan, Waleed M. Al-Ahdal, and Ayesha Siddiqui. 2022. Impact of Covid-19 on Firms’ Performance: Empirical Evidence from India. Cogent Business & Management 9: 2044593. [Google Scholar] [CrossRef]

- Ben-Nasr, Hamdi, Narjess Boubakri, and Jean Claude Cosset. 2015. Earnings Quality in Privatized Firms: The Role of State and Foreign Owners. Journal of Accounting and Public Policy 34: 392–416. [Google Scholar] [CrossRef]

- Ben Rejeb Attia, Mouna, Naima Lassoued, and Mohamed Chouikha. 2018. State Ownership and Firm Profitability in Emerging Markets. International Journal of Public Sector Management 31: 167–83. [Google Scholar] [CrossRef]

- Blundell, Richard, Stephen Bond, and Frank Windmeijer. 2001. Estimation in Dynamic Panel Data Models: Improving on the Performance of the Standard Gmm Estimator. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels. Edited by Badi H. Baltagi, Thomas B. Fomby and R. Carter Hill. Bradford: Emerald Group Publishing Limited, England, vol. 15, pp. 53–91. [Google Scholar]

- Borisova, Ginka, Veljko Fotak, Kateryna Holland, and William L. Megginson. 2015. Government Ownership and the Cost of Debt: Evidence from Government Investments in Publicly Traded Firms. Journal of Financial Economics 118: 168–91. [Google Scholar] [CrossRef]

- Boubakri, Narjess, Sadok El Ghoul, Omrane Guedhami, and William L. Megginson. 2018. The market value of government ownership. Journal of Corporate Finance 50: 44–65. [Google Scholar] [CrossRef]

- Boycko, Maxim, Andrei Shleifer, and Robert W. Vishny. 1996. A Theory of Privatization. The Economic Journal 106: 309–19. [Google Scholar] [CrossRef]

- Cao, Qingzi, Ming Fang, and Yuying Pan. 2022. Minority shareholders protection and corporate financial leverage: Evidence from a natural experiment in China. Pacific-Basin Finance Journal 73: 101742. [Google Scholar] [CrossRef]

- Chan, Kenny Ka Yin, Li Chen, and Norman Wong. 2016. New Zealand State-Owned Enterprises: Is State-Ownership Detrimental to Firm Performance? New Zealand Economic Papers 50: 1–15. [Google Scholar] [CrossRef]

- Chase, Kevin S., and Brian Murtha. 2019. Selling to Barricaded Buyers. Journal of Marketing 83: 2–20. [Google Scholar] [CrossRef]

- Chen, Ruiyuan, Sadok El Ghoul, Omrane Guedhami, and He Wang. 2017. Do State and Foreign Ownership Affect Investment Efficiency? Evidence from Privatizations. Journal of Corporate Finance 42: 408–21. [Google Scholar] [CrossRef]

- Chen, Ruiyuan, Sadok El Ghoul, Omrane Guedhami, Chuck C. Y. Kwok, and Robert Nash. 2021. International evidence on state ownership and trade credit: Opportunities and motivations. Journal of International Business Studies 52: 1121–58. [Google Scholar] [CrossRef] [PubMed]

- Cohen, Kalman J., Gabriel A. Hawawini, Steven F. Maier, Robert A. Schwartz, and David K. Whitcomb. 1983. Friction in the Trading Process and the Estimation of Systematic Risk. Journal of Financial Economics 12: 263–78. [Google Scholar] [CrossRef]

- Darsono, Susilo Nur Aji Cokro, Wing-Keung Wong, Nguyen Tran Thai Ha, Hafsah Fajar Jati, and Diah Setyawati Dewanti. 2022a. Good Governance and Sustainable Investment: The Effects of Governance Indicators on Stock Market Returns. Advances in Decision Sciences 26: 69–101. [Google Scholar] [CrossRef]

- Darsono, Susilo Nur Aji Cokro, Wing-Keung Wong, Tran Thai Ha Nguyen, and Dyah Titis Kusuma Wardani. 2022b. The Economic Policy Uncertainty and Its Effect on Sustainable Investment: A Panel Ardl Approach. Journal of Risk and Financial Management 15: 254. [Google Scholar] [CrossRef]

- Friedman, Milton. 1962. Capitalism and Freedom. Chicago: University of Chicago Press. [Google Scholar]

- Gan, Jie, Yan Guo, and Chenggang Xu. 2017. Decentralized Privatization and Change of Control Rights in China. The Review of Financial Studies 31: 3854–94. [Google Scholar] [CrossRef]

- Gao, Shang, Fanchen Meng, Wenshuai Wang, and Wenxin Chen. 2023. Does ESG always improve corporate performance? Evidence from firm life cycle perspective. Frontiers in Environmental Science 11: 1105077. [Google Scholar] [CrossRef]

- Gill, Amarjit, Nahum Biger, and Neil Mathur. 2011. The Effects of Capital Structure on Profitability: Evidence from United States. International Journal of Management 28: 3–15. [Google Scholar]

- Goodell, John W., Mingsheng Li, and Desheng Liu. 2021. Price informativeness and state-owned enterprises: Considering their heterogeneity. International Review of Financial Analysis 76: 101783. [Google Scholar] [CrossRef]

- Green, Stephen, and Guy S. Liu. 2005. Exit the Dragon? Privatization and State Control in China. London: Chatham House, Blackwell Publishing. [Google Scholar]

- Hai Yen, Tran Thi, Wing-Keung Wong, Mohammed Hasan Ali Al-Abyadh, Iskandar Muda, Felix Julca-Guerrero, Sanil S. Hishan, and Md Monirul Islam. 2023. The impact of ecological innovation and corporate social responsibilities on the sustainable development: Moderating role of environmental ethics. Economic Research-Ekonomska Istraživanja 36: 2153260. [Google Scholar] [CrossRef]

- Ho, Thomas S. Y., and Roni Michaely. 1988. Information Quality and Market Efficiency. The Journal of Financial and Quantitative Analysis 23: 53. [Google Scholar] [CrossRef]

- Hou, Tony Chieh-Tse. 2019. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corporate Social Responsibility and Environmental Management 26: 19–28. [Google Scholar] [CrossRef]

- Huang, Zhangkai, Lixing Li, Guangrong Ma, and Lixin Colin Xu. 2017. Hayek, Local Information, and Commanding Heights: Decentralizing State-Owned Enterprises in China. American Economic Review 107: 2455–78. [Google Scholar] [CrossRef]

- Iwasaki, Ichiro, Xinxin Ma, and Satoshi Mizobata. 2022. Ownership Structure and Firm Performance in Emerging Markets: A Comparative Meta-Analysis of East European Eu Member States, Russia and China. Economic Systems 46: 100945. [Google Scholar] [CrossRef]

- Jin, Xiankun, Liping Xu, Yu Xin, and Ajay Adhikari. 2022. Political governance in China’s state-owned enterprises. China Journal of Accounting Research 15: 100236. [Google Scholar] [CrossRef]

- Kang, Young-Sam, and Byung-Yeon Kim. 2012. Ownership Structure and Firm Performance: Evidence from the Chinese Corporate Reform. China Economic Review 23: 471–81. [Google Scholar] [CrossRef]

- Khan, Farman, Junrui Zhang, Muhammad Usman, Alina Badulescu, and Muhammad Sial. 2019. Ownership Reduction in State-Owned Enterprises and Corporate Social Responsibility: Perspective from Secondary Privatization in China. Sustainability 11: 1008. [Google Scholar] [CrossRef]

- Khatib, Saleh F. A., Dewi Fariha Abdullah, Ahmed Elamer, and Saddam A. Hazaea. 2022. The development of corporate governance literature in Malaysia: A systematic literature review and research agenda. Corporate Governance: The International Journal of Business in Society 22: 1026–53. [Google Scholar] [CrossRef]

- Kim, Younghwan, Jungwoo Lee, and Taeyong Yang. 2013. Corporate Transparency and Firm Performance: Evidence from Venture Firms Listed on the Korean Stock Market. Asia-Pacific Journal of Financial Studies 42: 653–88. [Google Scholar] [CrossRef]

- Kubo, Katsuyuki, and Huu Viet Phan. 2019. State ownership, sovereign wealth fund and their effects on firm performance: Empirical evidence from Vietnam. Pacific-Basin Finance Journal 58: 101220. [Google Scholar] [CrossRef]

- Kumar, Praveen, and Alessandro Zattoni. 2015. Ownership Structure, Corporate Governance and Firm Performance. Corporate Governance: An International Review 23: 469–71. [Google Scholar] [CrossRef]

- Kusnadi, Yuanto, Zhifeng Yang, and Yuxiao Zhou. 2015. Institutional Development, State Ownership, and Corporate Cash Holdings: Evidence from China. Journal of Business Research 68: 351–59. [Google Scholar] [CrossRef]

- Lazzarini, Sergio G., and Aldo Musacchio. 2018. State Ownership Reinvented? Explaining Performance Differences between State-Owned and Private Firms. Corporate Governance: An International Review 26: 255–72. [Google Scholar] [CrossRef]

- Le, Manh-Duc, Fabio Pieri, and Enrico Zaninotto. 2019. From Central Planning Towards a Market Economy: The Role of Ownership and Competition in Vietnamese Firms’ Productivity. Journal of Comparative Economics 47: 693–716. [Google Scholar] [CrossRef]

- Li, Yuan, Mike W. Peng, and Craig D. Macaulay. 2013. Market–Political Ambidexterity During Institutional Transitions. Strategic Organization 11: 205–13. [Google Scholar] [CrossRef]

- Liao, Jing, and Martin Young. 2012. The Impact of Residual Government Ownership in Privatized Firms: New Evidence from China. Emerging Markets Review 13: 338–51. [Google Scholar] [CrossRef]

- Liljeblom, Eva, Benjamin Maury, and Alexander Hörhammer. 2019. Complex State Ownership, Competition, and Firm Performance—Russian Evidence. International Journal of Emerging Markets 15: 189–221. [Google Scholar] [CrossRef]

- Lux, Sean, T. Russell Crook, and David J. Woehr. 2010. Mixing Business with Politics: A Meta-Analysis of the Antecedents and Outcomes of Corporate Political Activity. Journal of Management 37: 223–47. [Google Scholar] [CrossRef]

- Malesky, Edmund, Dau Anh Tuan, Ngoc Thach Pham, Le Thanh Ha, Tran Minh Thu, Phan Tuan Ngoc, Truong Duc Trong, Nguyen Thi Le Nghia, and Nguyen Le Ha. 2020. The Vietnam Provincial Competitiveness Index: Measuring Economic Governance for Private Sector Development. Hanoi: Vietnam Chamber of Commerce and Industry and United States Agency for International Development’s Vietnam Competitiveness Initiative. [Google Scholar]

- Merendino, Alessandro, and Rob Melville. 2019. The board of directors and firm performance: Empirical evidence from listed companies. Corporate Governance: The International Journal of Business in Society 19: 508–51. [Google Scholar] [CrossRef]

- Minh Ha, Nguyen, Pham Tuan Anh, Xiao-Guang Yue, and Nguyen Hoang Phi Nam. 2021. The impact of tax avoidance on the value of listed firms in Vietnam. Cogent Business & Management 8: 1930870. [Google Scholar] [CrossRef]

- Ng, Alex, Ayse Yuce, and Eason Chen. 2009. Determinants of State Equity Ownership, and Its Effect on Value/Performance: China’s Privatized Firms. Pacific Basin Finance Journal 17: 413–43. [Google Scholar] [CrossRef]

- Nguyen, Bach, Hoa Do, and Chau Le. 2021. How Much State Ownership Do Hybrid Firms Need for Better Performance? Small Business Economics, 1–27. [Google Scholar] [CrossRef]

- Nguyen, Manh Hoang, and Thi Quy Vo. 2022. Residual State Ownership and Firm Performance: A Case of Vietnam. Journal of Risk and Financial Management 15: 259. [Google Scholar] [CrossRef]

- Nguyen, Thuy Thu, and Mathijs A. Van Dijk. 2012. Corruption, Growth, and Governance: Private Vs. State-Owned Firms in Vietnam. Journal of Banking & Finance 36: 2935–48. [Google Scholar] [CrossRef]

- Nguyen, Tran Thai Ha, and Wing-Keung Wong. 2021. Do State Ownership and Business Environment Explain Corporate Cash Holdings? Empirical Evidence from an Emerging Country. Asian Academy of Management Journal of Accounting and Finance 17: 1–33. [Google Scholar] [CrossRef]

- Nguyen, Tran Thai Ha, Massoud Moslehpour, Thi Thuy Van Vo, and Wing-Keung Wong. 2020. State Ownership and Risk-Taking Behavior: An Empirical Approach to Get Better Profitability, Investment, and Trading Strategies for Listed Corporates in Vietnam. Economies 8: 46. [Google Scholar] [CrossRef]

- North, Douglass Cecil. 1990. Institutions, Institutional Change and Economic Performance. New York: Cambridge University Press. [Google Scholar]

- Pan, Yigang, Lefa Teng, Atipol Bhanich Supapol, Xiongwen Lu, Dan Huang, and Zhennan Wang. 2014. Firms’ FDI ownership: The influence of government ownership and legislative connections. Journal of International Business Studies 45: 1029–43. [Google Scholar] [CrossRef]

- Peng, Mike W., Garry D. Bruton, Ciprian V. Stan, and Yuanyuan Huang. 2016. Theories of the (State-Owned) Firm. Asia Pacific Journal of Management 33: 293–317. [Google Scholar] [CrossRef]

- Pfeffer, Jeffrey, and Gerald R. Salancik. 1978. The External Control of Organizations: A Resource Dependence Perspective. Academy of Management Review 4: 521–32. [Google Scholar]

- Quyen, Phan Gia, Nguyen Tran Thai Ha, Susilo Nur Aji Cokro Darsono, and Tran Dang Thanh Minh. 2021. Income Diversification and Financial Performance: The Mediating Effect of Banks’ Size, Ownership Structure and the Financial Crisis in Vietnam. Journal of Accounting and Investment 22: 296–309. [Google Scholar] [CrossRef]

- Sharma, Piyush, Louis T. W. Cheng, and Tak Yan Leung. 2020. Impact of Political Connections on Chinese Export Firms’ Performance—Lessons for Other Emerging Markets. Journal of Business Research 106: 24–34. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1998. The Grabbing Hand: Government Pathologies and Their Cures. Cambridge: Harvard University Press. [Google Scholar]

- Song, Zengji, Abraham Nahm, and Jun Yang. 2016. Institutional Environment, Political Connections of Partial State Ownership, and Performance. International Journal of Social Economics 43: 856–70. [Google Scholar] [CrossRef]

- Sun, Jide, Zhe Ji, Chen Wang, and Xincheng Wang. 2021. State ownership, institutional development, and corporate philanthropic giving: An integrated view of legitimacy–efficiency trade-offs. Economic Research-Ekonomska Istraživanja 34: 608–27. [Google Scholar] [CrossRef]

- Suu, Nguyen Duy, Ho Thuy Tien, and Wing-Keung Wong. 2021. The Impact of Capital Structure and Ownership on the Performance of State Enterprises after Equitization: Evidence from Vietnam. Annals of Financial Economics 16: 2150007. [Google Scholar] [CrossRef]

- Tee, Chwee Ming. 2018. Political Connections, Institutional Monitoring and the Cost of Debt: Evidence from Malaysian Firms. International Journal of Managerial Finance 14: 210–29. [Google Scholar] [CrossRef]

- Thanh, Su Dinh, Neil Hart, and Nguyen Phuc Canh. 2020. Public Spending, Public Governance and Economic Growth at the Vietnamese Provincial Level: A Disaggregate Analysis. Economic Systems 44: 100780. [Google Scholar] [CrossRef]

- Tihanyi, Laszlo, Ruth V. Aguilera, Pursey Heugens, Marc van Essen, Steve Sauerwald, Patricio Duran, and Roxana Turturea. 2019. State Ownership and Political Connections. Journal of Management 45: 2293–321. [Google Scholar] [CrossRef]

- Tran, Trung K., Minh T. Truong, Kim T. Bui, Phung D. Duong, Minh V. Huynh, and Tran T. Nguyen. 2023. Firm Risk and Tax Avoidance in Vietnam: Do Good Board Characteristics Interfere Effectively? Risks 11: 39. [Google Scholar] [CrossRef]

- Tran, Tuyen Quang, Anh Lan Tran, Thai Minh Pham, and Huong Van Vu. 2018. Local Governance and Occupational Choice among Young People: First Evidence from Vietnam. Children and Youth Services Review 86: 21–31. [Google Scholar] [CrossRef]

- Tseng, Ming-Lang, Chia-Hao Chang, Chun-Wei Lin, Tran Thai Ha Nguyen, and Ming K. Lim. 2020. Environmental responsibility drives board structure and financial and governance performance: A cause and effect model with qualitative information. Journal of Cleaner Production 258: 120668. [Google Scholar] [CrossRef]

- Tseng, Ming-Lang, Phan Tan, Shiou-Yun Jeng, Chun-Wei Lin, Yeneneh Negash, and Susilo Darsono. 2019. Sustainable Investment: Interrelated among Corporate Governance, Economic Performance and Market Risks Using Investor Preference Approach. Sustainability 11: 2108. [Google Scholar] [CrossRef]

- Tu, Wenjun, Xiaolan Zheng, Lei Li, and Zhiang Lin. 2021. Do Chinese firms benefit from government ownership following cross-border acquisitions? International Business Review 30: 101812. [Google Scholar] [CrossRef]

- Uddin, Md Hamid. 2016. Effect of Government Share Ownership on Corporate Risk Taking: Case of the United Arab Emirates. Research in International Business and Finance 36: 322–39. [Google Scholar] [CrossRef]

- Vo, Xuan Vinh. 2018. Do Firms with State Ownership in Transitional Economies Take More Risk? Evidence from Vietnam. Research in International Business and Finance 46: 251–56. [Google Scholar] [CrossRef]

- Vu, Kelly Anh, and Thanyawee Pratoomsuwan. 2019. Board Characteristics, State Ownership and Firm Performance: Evidence from Vietnam. International Journal of Managerial and Financial Accounting 11: 167–86. [Google Scholar] [CrossRef]

- Wehrheim, David, Hakkı Doğan Dalay, Andrea Fosfuri, and Christian Helmers. 2020. How Mixed Ownership Affects Decision Making in Turbulent Times: Evidence from the Digital Revolution in Telecommunications. Journal of Corporate Finance 64: 101626. [Google Scholar] [CrossRef]

- Wei, Gang. 2007. Ownership Structure, Corporate Governance and Company Performance in China. Asia Pacific Business Review 13: 519–45. [Google Scholar] [CrossRef]

- Yu, Mei. 2013. State Ownership and Firm Performance: Empirical Evidence from Chinese Listed Companies. China Journal of Accounting Research 6: 75–87. [Google Scholar] [CrossRef]

- Zhou, Wubiao. 2017. Institutional Environment, Public-Private Hybrid Forms, and Entrepreneurial Reinvestment in a Transition Economy. Journal of Business Venturing 32: 197–214. [Google Scholar] [CrossRef]

| Variable | Observations | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ROA | 4308 | 0.060 | 0.074 | −0.646 | 0.784 |

| ROE | 4308 | 0.111 | 0.158 | −3.674 | 0.982 |

| SOE | 4308 | 0.235 | 0.241 | 0.000 | 0.844 |

| PCI | 4308 | 0.623 | 0.041 | 0.493 | 0.751 |

| SIZE | 4308 | 27.294 | 1.584 | 23.330 | 33.691 |

| AGE | 4308 | 8.759 | 3.838 | 1.000 | 17.000 |

| PPE | 4308 | 0.189 | 0.191 | 0.000 | 0.962 |

| LEV | 4308 | 0.245 | 0.208 | 0.000 | 1.476 |

| NCFOTA | 4308 | 0.056 | 0.134 | −0.696 | 1.903 |

| CFP | CFP (ROA) | CFP (ROE) |

|---|---|---|

| Lag of CFP | 0.337 *** | 0.085 *** |

| (70.70) | (52.51) | |

| SOE | 0.010 *** | 0.047 *** |

| (3.03) | (8.18) | |

| SIZE | 0.008 *** | 0.030 *** |

| (10.72) | (24.41) | |

| AGE | −0.001 *** | −0.002 *** |

| (−5.59) | (−11.66) | |

| PPE | 0.015 ** | 0.079 *** |

| (2.00) | (9.47) | |

| LEV | −0.025 *** | −0.086 *** |

| (−8.21) | (−18.47) | |

| NCFOTA | 0.038 *** | 0.147 *** |

| (17.94) | (25.47) | |

| Const. | −0.181 *** | −0.713 *** |

| (−8.73) | (−21.43) | |

| Group | 359 | 359 |

| Obs | 3949 | 3949 |

| Number of IVs | 252 | 281 |

| Hansen test (p-value) | 0.250 | 0.179 |

| AR (1) (p-value) | 0.000 | 0.019 |

| AR (2) (p-value) | 0.195 | 0.856 |

| CFP | CFP (ROA) | CFP (ROE) |

|---|---|---|

| Lag of CFP | 0.335 *** | 0.077 *** |

| (70.86) | (44.97) | |

| SOE | 0.072 *** | 0.408 *** |

| (4.72) | (13.63) | |

| SOE2 | −0.110 *** | −0.632 *** |

| (−4.00) | (−12.50) | |

| SIZE | 0.009 *** | 0.034 *** |

| (12.21) | (25.86) | |

| AGE | −0.001 *** | −0.002 *** |

| (−4.02) | (−7.60) | |

| PPE | 0.138 * | 0.075 *** |

| (1.83) | (8.36) | |

| LEV | −0.028 *** | −0.099 *** |

| (−9.01) | (−19.58) | |

| NCFOTA | 0.037 *** | 0.111 *** |

| (16.79) | (18.90) | |

| Const. | −0.206 *** | −0.846 *** |

| (−10.24) | (−22.87) | |

| Group | 359 | 359 |

| Obs | 3949 | 3949 |

| Number of IVs | 252 | 281 |

| Hansen test (p-value) | 0.277 | 0.163 |

| AR (1) (p-value) | 0.000 | 0.021 |

| AR (2) (p-value) | 0.200 | 0.895 |

| Threshold | 32.72 | 32.27 |

| CFP | CFP (ROA) | CFP (ROE) |

|---|---|---|

| Lag of CFP | 0.349 *** | 0.083 *** |

| (221.80) | (78.79) | |

| PCI | 0.021 *** | 0.245 *** |

| (4.54) | (16.66) | |

| SOE∗PCI | 0.020 *** | 0.071 *** |

| (10.35) | (13.45) | |

| SIZE | 0.001 *** | 0.031 *** |

| (28.81) | (40.73) | |

| AGE | −0.001 *** | −0.004 |

| (−10.09) | (−25.97) | |

| PPE | 0.004 * | 0.072 |

| (1.83) | (14.27) | |

| LEV | −0.029 *** | −0.098 *** |

| (−27.65) | (−35.85) | |

| NCFOTA | 0.045 *** | 0.158 *** |

| (44.05) | (41.58) | |

| Const. | −0.186 *** | −0.870 *** |

| (−23.93) | (−40.19) | |

| Group | 359 | 359 |

| Obs | 3949 | 3949 |

| Number of IVs | 336 | 326 |

| Hansen test | 0.385 | 0.241 |

| AR (1) | 0.000 | 0.020 |

| AR (2) | 0.183 | 0.858 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, T.T.H.; Darsono, S.N.A.C.; Phan, G.Q.; Pham, T.H.V.; Bach Thi, H.; Johari, S.M. The Nexus between Corporate Performance and State Ownership in Vietnam: Evidence of State Ownership’s Inverted U-Shape and Provincial Business Environment Influences. J. Risk Financial Manag. 2023, 16, 499. https://doi.org/10.3390/jrfm16120499

Nguyen TTH, Darsono SNAC, Phan GQ, Pham THV, Bach Thi H, Johari SM. The Nexus between Corporate Performance and State Ownership in Vietnam: Evidence of State Ownership’s Inverted U-Shape and Provincial Business Environment Influences. Journal of Risk and Financial Management. 2023; 16(12):499. https://doi.org/10.3390/jrfm16120499

Chicago/Turabian StyleNguyen, Tran Thai Ha, Susilo Nur Aji Cokro Darsono, Gia Quyen Phan, Thi Hong Van Pham, Huyen Bach Thi, and Sobar M. Johari. 2023. "The Nexus between Corporate Performance and State Ownership in Vietnam: Evidence of State Ownership’s Inverted U-Shape and Provincial Business Environment Influences" Journal of Risk and Financial Management 16, no. 12: 499. https://doi.org/10.3390/jrfm16120499

APA StyleNguyen, T. T. H., Darsono, S. N. A. C., Phan, G. Q., Pham, T. H. V., Bach Thi, H., & Johari, S. M. (2023). The Nexus between Corporate Performance and State Ownership in Vietnam: Evidence of State Ownership’s Inverted U-Shape and Provincial Business Environment Influences. Journal of Risk and Financial Management, 16(12), 499. https://doi.org/10.3390/jrfm16120499