1. Introduction

Comprehending the causes and consequences of commodity price dynamics is an essential aspect of global finance. The relative income and well-being of countries engaged in the production and consumption of commodities are heavily reliant on the prices of these goods. Fluctuations in commodity prices also trigger unpredictable macroeconomic activity in emerging markets and developing economies (EMDEs).

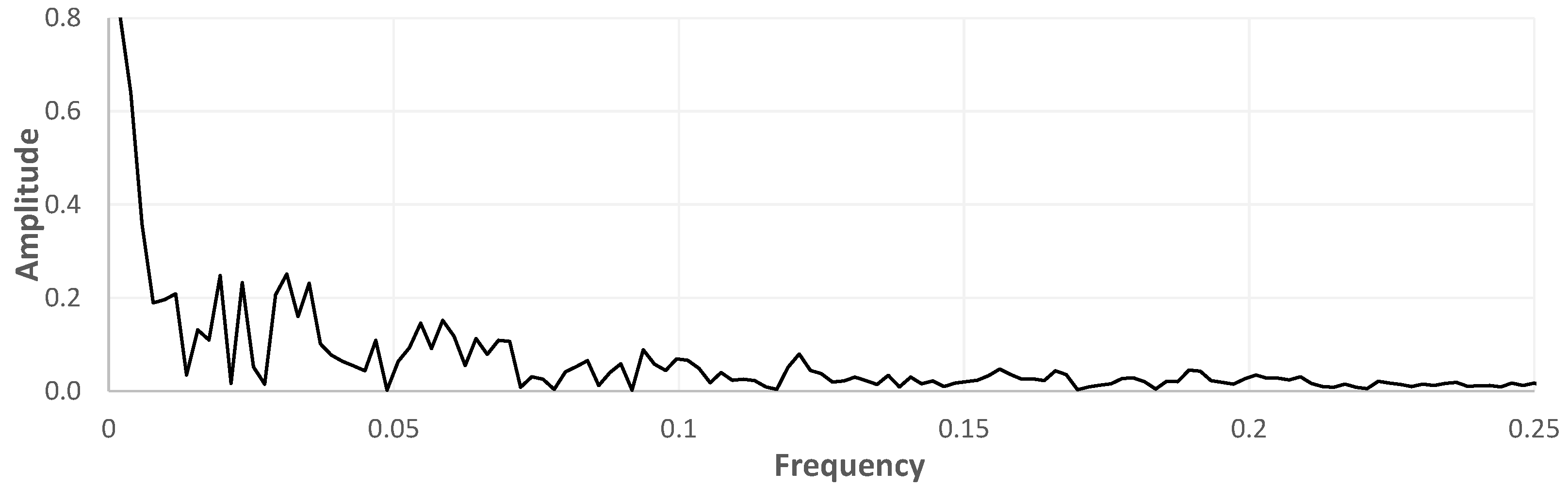

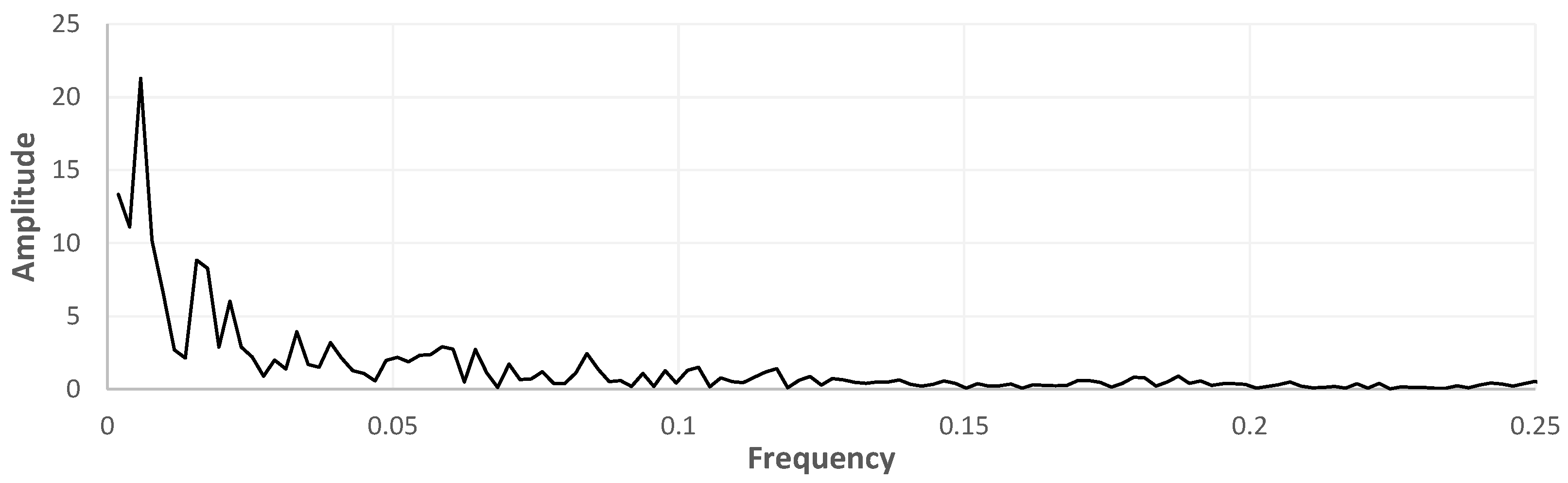

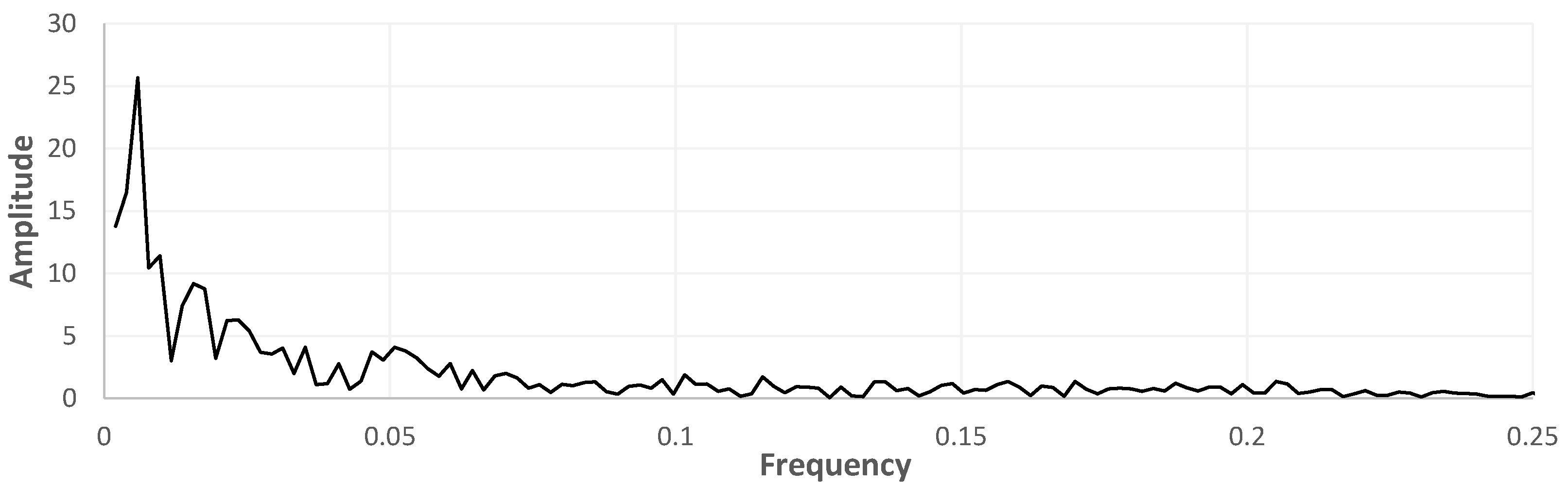

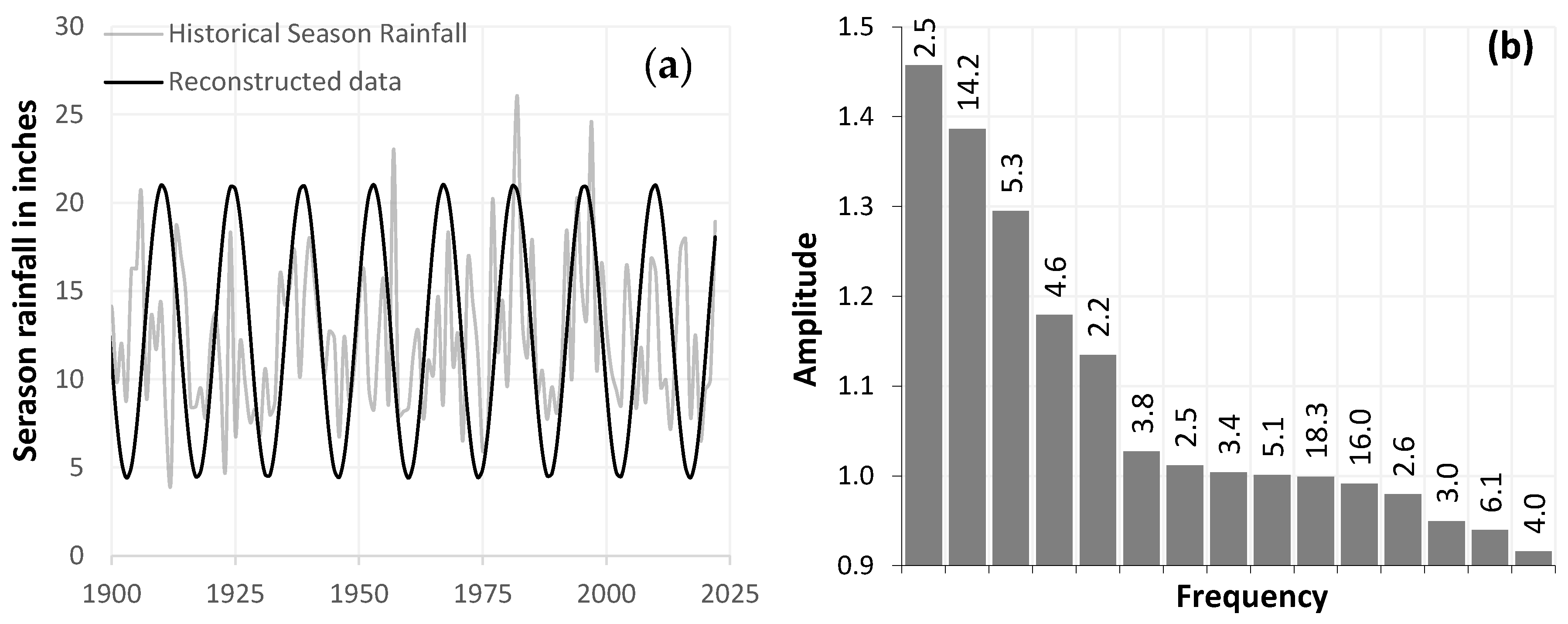

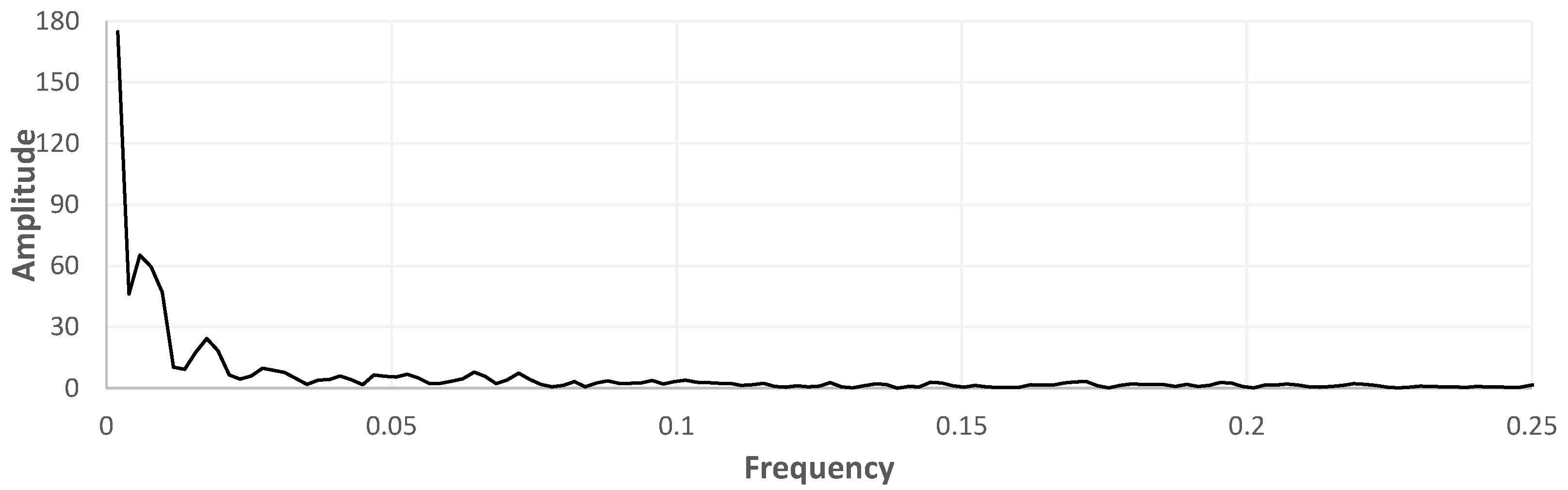

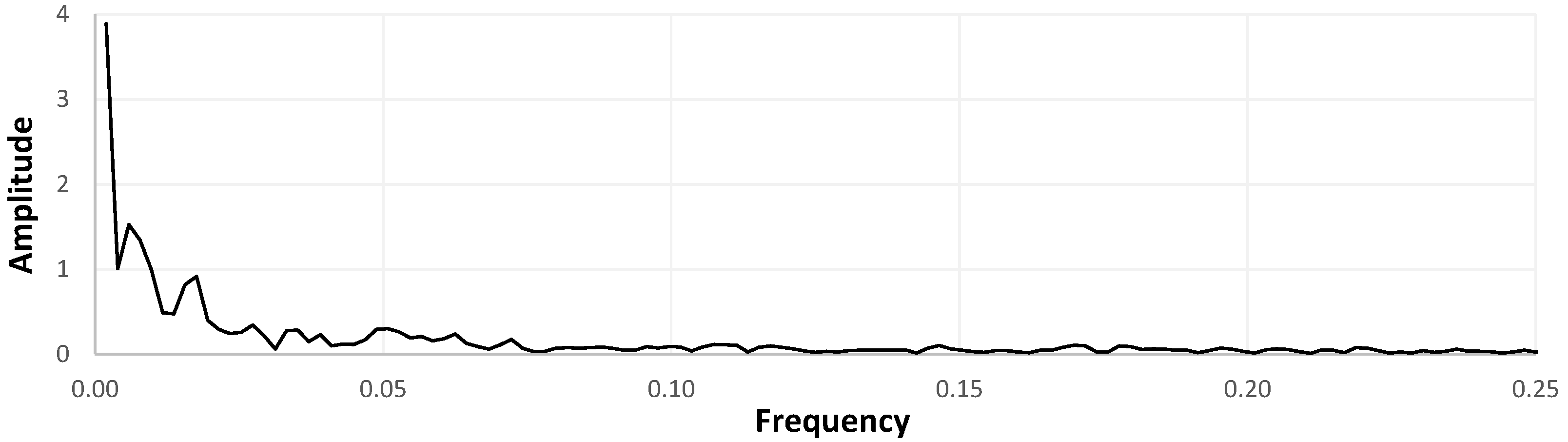

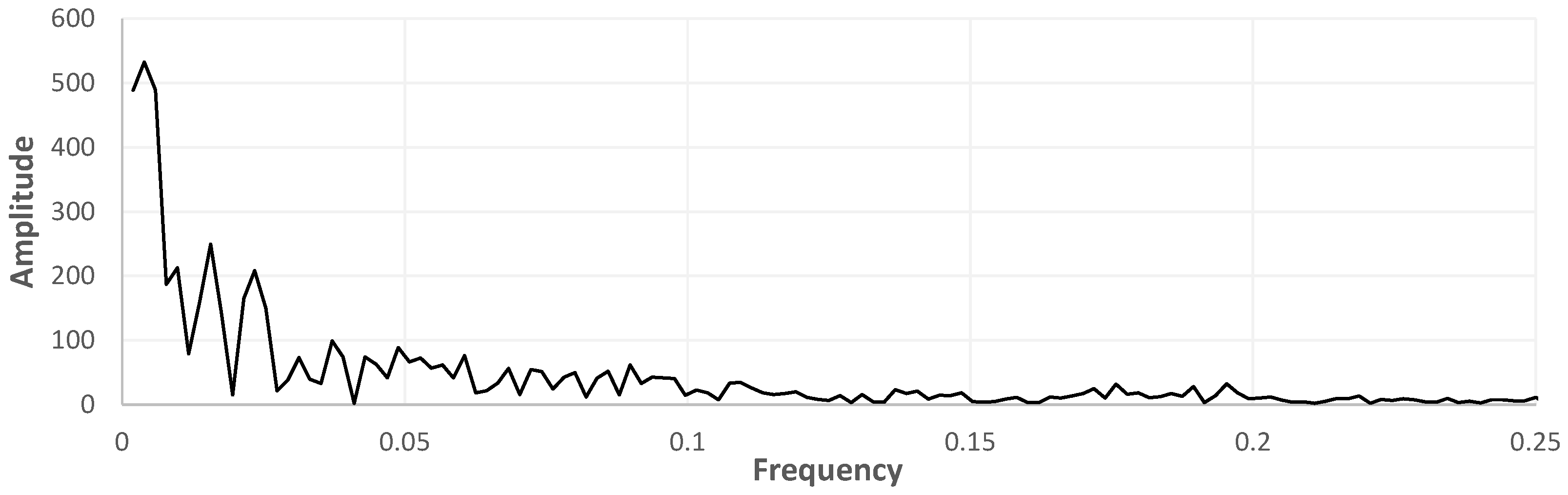

This research explores the dynamics and interplay between commodity price cycles and the broader economic conditions reflected in the United States (US) business cycle. It seeks to understand how changes in economic activity, consumer spending, and overall market conditions influence the demand for commodities and subsequently impact their prices. The empirical process will detail Fourier analyses of commodity price cycles as well as the US business cycle. In addition, the same empirical method will be used to examine historical rainfall patterns in the US to further the role of historical rainfall patterns in shaping agricultural productivity and subsequent price movements. The analysis of rainfall patterns exists as a supplementary feature that exclusively focuses on the agricultural commodities in this study. The study opens avenues to examine the cyclical patterns, correlations, and potential causal relationships between commodity price cycles, the US business cycle, and historical rainfall patterns in the agricultural sector.

The use of Fourier analysis has become increasingly popular in the fields of finance and economics as a tool for analysing time-series data. The complete concept is known as spectral analysis and is used in several fields as a tool to analyse complex signals and their frequency components (

Masset 2008). This method allows for the identification of cyclical patterns within a given dataset that may not be immediately apparent through other means of analysis. Fourier analysis is proficient in identifying underlying frequencies in time-series data; however, there are some limitations (e.g., Fourier methods may not be well suited to analysing datasets that contain irregular or non-periodic fluctuations) (

Fernández et al. 2020). The application of Fourier analysis in finance and economics has become increasingly important as researchers seek new ways to analyse complex time-series data. The nature of commodity price cycles and super-cycles lend themselves to the use of Fourier analysis. These cycles have been subject to widespread research, as they have significant implications for global economic growth and stability (see

Cuddington and Jerrett (

2008) and

Erten and Ocampo (

2013)).

The main objective of this research is to provide a detailed analysis of different commodity price cycles in relation to the US business cycle. Understanding the business cycle of a region and formulating an idea of its status (or phase in the cycle) allows participants in the economy to make informed decisions (

Thomson and van Vuuren 2016). Commodity price cycles cultivate capricious macroeconomic activity, and understanding the behaviour of these cycles offers valuable insight into numerous economic actors, such as commodity-producing emerging market economies. These are supplemented by the analysis of US historical rainfall patterns, and this exists as an exploration of one of many factors that has a profound impact on agricultural price cycles. This article uses Fourier analysis to examine US gross domestic product (GDP) time-series data, commodity price data and historical rainfall data. Significant cycles are detected in each of these datasets and the length of these cycles is quantified by examining the data in the frequency domain.

Fourier analysis, which

Walker (

1996) claimed was one of the greatest contributions to numerical analysis made in the 20th century, is the exploration of the processes wherein general periodical functions can be represented by the sum of trigonometric functions. Fourier analysis is underpinned by the work of Jean-Baptiste Fourier who asserted that any finite and time-ordered time series can be approximated by a decomposition of data into a set of sine and cosine waves wherein each respective wave has a specific cycle length, amplitude, and phase relationship with other waves (

Stádník et al. 2016). The complete Fourier analysis concept is known as spectral analysis and is widely used in many fields as a means of analysing and understanding complex signals and their underlying frequency components.

Stádník et al. (

2016) assessed whether Fourier analysis provides practical value for investors wishing to forecast stock market prices by exploring possible cyclical patterns embedded therein. Fourier analysis methods are frequently implemented within algorithmic trading as a technical analysis tool to determine directional forecasting for market price development. The Fast Fourier transform (FFT)—an abbreviated calculation of discrete Fourier transform (DFT)—describes an algorithm that significantly reduces the computation period of the DFT. DFT transforms a discrete signal or sequence of data from the time or spatial domain into the frequency domain (

Stádník et al. 2016).

Thomson and van Vuuren (

2016) used Fourier analysis to determine the contributing frequencies of the South African business cycle, which allowed them to forecast future values. The analysis calculated the duration and frequency of the business cycle using log changes in gross domestic product (GDP), and significant cycles were detected. The cycle frequencies were quantified by examining frequency-domain data rather than time-domain data. The combination of Fourier and periodogram analysis offers an alternative method, in terms of economic cycle analysis, to the traditional method used by the South African Reserve Bank (SARB). A log transformation is used in Fourier analysis methods, while the Hodrick–Prescott and Baxter–King filters are used to omit the prevalence of random ‘noise’ whilst maintaining the integrity of explanatory cycles within the data. The results indicate that a substantial cycle exists (about seven years) in the log monthly South African nominal GDP, comparable with previous studies (

Thomson and van Vuuren 2016).

Fourier methods are widely used in finance and economics as a tool to gather information about the frequency components of a time series. Time-domain analysis examines the evolution of an economic variable with respect to time, whereas frequency domain analysis shows at which frequencies the variable is active (

Masset 2008).

Masset’s (

2008) study focuses on spectral analysis, filtering methods and wavelets. To this end, Fourier analysis is deemed to be a useful tool in terms of identifying cycles and patterns in financial time-series data, owing to the decomposition of time series into sine and cosine waves comprising different frequencies that outline underlying patterns and trends (

Masset 2008;

Stádník et al. 2016). Wavelet analysis is also considered to be a more advanced technique that allows for the analysis of non-stationary time-series data. Time series are separated into a series of wavelets that are localised and may vary in frequency and amplitude: this approach can be particularly advantageous when analysing financial time-series data, where cycles and trends may not be stationary over time. Wavelet analysis is a means to overcome pitfalls of Fourier transform and filtering methods.

Masset (

2008) provides a useful introduction to Fourier and wavelet analysis, bolstered by several practical examples using real economic data.

Omekara et al. (

2013) investigate the behaviour of all-items monthly inflation rates in Nigeria from 2003 to 2011 using Fourier series analysis. A square root transformation is used to bolster the stability of the inflation rate data. The findings suggested that Nigeria exhibited both a short-term and a long-term cycle of 20 and 50 months, respectively.

Omekara et al. (

2013) also use a periodogram relationship to deduce the link between the inflation cycle and various government administrations within the sample period. Periodogram analysis, used to identify the dominant frequencies, is followed by Fourier series analysis that models the inflation rate data as a combination of harmonics with different periods. A harmonic series is thus indicated and underpinned by the fact that other frequencies are multiples of the fundamental, or initial, frequency.

Omekara et al. (

2013) compare the model’s predictions to actual inflation rate data and conclude that Fourier series models are effective in modelling inflation rates due to the advantage of identifying inflation cycles in conjunction with establishing a suitable model for the series. This research exemplifies the efficacy of Fourier series analysis in the context of the monthly inflation rates in Nigeria.

Some academic research has detailed the recommendation of wavelet analysis as a natural extension to the somewhat limited frequency-domain only methods, such as Fourier transforms (

Thomson and van Vuuren 2016).

Masset (

2008) outlines two important drawbacks regarding the use of spectral analysis and standard filtering methods, i.e., that these methods:

implement robust restrictions pertaining to the potential processes underlying the dynamics of the series

result in a pure frequency-domain representation of data (all information from the time-domain representation is lost in operation).

Kondratieff (

1926) and

Schumpeter (

1939) developed the major analytical frameworks that underpin commodity cycles (

van der Nest and van Vuuren 2023).

Kondratieff (

1926) observed long swings lasting 40–60 years using interest rates, commodity prices, industrial production, and foreign trade. Refuting the influence of external factors such as gold production, war or revolution,

Kondratieff (

1926) instead posited that technological advancement and capital accumulation were the main drivers behind these long swings.

Schumpeter (

1939) drew inspiration from Kondratieff’s ideas, especially in terms of endogeneity as the driving force, but he believed that entrepreneurial innovation was the key factor pertaining to the growth and contraction of these extensive cycles.

Multiple overlapping cycles of various durations were identified, including Kondratieff cycles lasting roughly 50 years, Juglar cycles lasting 9 years, and Kitchen cycles lasting 3 years.

Schumpeter (

1939) argued that Kondratieff cycles were based on the principles of his theory of creative destruction, which posits that dynamic investment opportunities in tandem with technological innovation stimulate economic growth in emerging sectors, while outdated sectors with antiquated methods of production are eroded (

van der Nest and van Vuuren 2023).

Periods of innovation in emerging sectors are characterised by prosperity phases, followed by stagnation phases where innovation and technology are assimilated and standardised across several industries (

Erten and Ocampo 2013).

Schumpeter (

1939) affirmed that commodity prices are inextricably linked to these periods of prosperity and stagnation, which in turn stimulate long cycles. During the prosperity phase, there is competition for productive inputs such as agricultural goods, metals, and minerals, resulting in rising commodity prices. As competing producers gradually imitate and innovation is numbed, the possibility of economic rent decreases, leading to a reduction in demand for commodities and hence falling prices during the stagnation phase (

Erten and Ocampo 2013).

Business cycle research in macroeconomics has given rise to the use of filtering techniques as a means of isolating specific frequencies in economic time series. The Hodrick–Prescott (HP) filter is the most popular; however, there are more flexible alternatives (

Cuddington and Jerrett 2008).

Baxter and King (

1999) postulate that there are challenges surrounding the selection of the smoothness parameter X in the HP filter when analysing cycles of different periodicities. Consequently, they develop and recommend the use of band-pass (BP) filters that are designed to extract stochastic cyclical components with a specified range of periodicities from individual time series (

Cuddington and Jerrett 2008).

The HP and BK filters are time-domain techniques that serve to decompose time-series data into trend and cycle components. The ‘ideal’ BP filter utilises an infinite number of leads and lags when determining the filter weights from the underlying spectral theory. In practice, using a significant number of leads and lags delivers precise results; however, this also renders more unusable observations at the beginning and the end of the sample.

Christiano and Fitzgerald (

2003) derive asymmetric filters that allow the computation of cyclical components for all observations at the beginning and end of a given data span, whilst the downside is minor phase shifting. The advantage of the theory of spectral analysis of time series is that it does not demand a commitment to any specific statistical model of the data. Spectral analysis relies on spectral representation theorem, whereby any time series within a broad class can be decomposed into different frequency components (

Christiano and Fitzgerald 2003).

Cuddington and Jerrett (

2008) asserted that super-cycles are cycles with a duration of 20–70 years that affect a plethora of commodities. Using an asymmetric BP filter to identify super-cycles in real metal prices to remove low-frequency and high-frequency components of the data, cycles are isolated within the specified frequency range. To this end,

Jerrett and Cuddington (

2008) pioneered the use of

Christiano and Fitzgerald’s (

2003) asymmetric band-pass filter as a means of identifying super-cycles in real metal prices. They use spectral analysis to examine the historical prices of six metals traded on the London Metal Exchange and investigate the potential drivers of super-cycles in real metal prices. The authors conclude that technological changes have the largest impact on super-cycles, followed by changes in supply disruptions and changes in demand (

Cuddington and Jerrett 2008). This research is one of the key references pertaining to the estimation of commodity price super-cycles using spectral analysis, but it is important to note some minor limitations. The article focuses exclusively on long-term cycles, creating scope for selection bias towards evidence of super-cycles. The authors acknowledge that shorter-term cycles may exist, but are not the focus of the research. Several drivers of super-cycles are also explored, but it is difficult to establish causality between these factors and metal prices, whilst the statistical analyses may not fully account for various other factors that could influence metal prices.

Erten and Ocampo (

2013) apply the same methodology (spectral analysis) in their bid to identify super-cycles in real non-oil commodity prices. The authors state that there have been four super-cycles in commodity prices since the mid-19th century. These cycles are further decomposed into three phases: a boom phase characterised by rising prices, a bust phase underpinned by falling prices and a stabilisation denoted by relatively stable prices. This notion is corroborated by

Jacks (

2019), who states, “Commodity price cycles are themselves punctuated by boom/bust episodes that are historically pervasive.”

Jacks and Stuermer (

2020) propose a framework that is designed to further the understanding of the long-term behaviour of commodity price cycles. The framework comprises a combination of structural factors that affect supply and demand throughout the global economy (in a process like that used by

Erten and Ocampo 2013). These are separated into four categories that shape commodity price movements:

Technological change: innovations in technology stimulate development in production methods, transportation, and distribution, which in turn affects the supply of and demand for commodities (e.g., the discovery of new oil extraction techniques that increased supply and falling oil prices).

Geopolitical events: wars and political instability, amongst other geopolitical factors, can disrupt supply chains and consequently stimulate price volatility. The inception of the Russia–Ukraine conflict had a dramatic effect on the price volatility of several metals (

van der Nest and van Vuuren 2023).

Climate and environmental factors: natural disasters, climate change and various other environmental factors can have a prominent impact on commodity production and supply (e.g., droughts can reduce agricultural output and therefore increase food prices).

Changes in global economic power: shifts in the balance of economic power between different countries and regions can affect the demand for commodities. China’s economic expansion in the early 2000s was accompanied by an insatiable demand for commodities, and much of the development of the post-2000 commodity super-cycle is attributed to China’s industrialisation (

Heap 2005).

Long-term commodity price movements are cultivated by a complex interplay of structural factors that affect supply and demand in the global economic milieu (

Erten and Ocampo 2013). To this end, the commodity sector is particularly vulnerable to a range of shocks that exert a palpable influence on overall supply and demand. The type and source of these shocks dictate whether they yield a transient or permanent impact on various commodities. Accordingly, price fluctuations can be classified into transitory and permanent components, with the latter having a more comprehensive effect on the entire sector, while the former causes a temporary effect on specific commodities (

Gubler and Hertweck 2013;

World Bank 2021).

Ahmed (

2022) uses wavelet analysis techniques to examine the time-frequency interdependencies between global equity and commodity markets based on the first four moments of their return distributions, revealing that these interdependencies are both time-dependent and frequency-dependent, with distinct patterns during different time periods, particularly during the 2010–2014 turmoil and after 2015, highlighting practical implications.

Focacci (

2023) explores the controversial theory of long economic cycles, proposed by Kondratieff, by analysing both the original Kondratieff data and GDP per capita data for various countries using wavelet and Fourier analysis to investigate the existence of periodic fluctuations, ultimately finding limited support for such cycles in both datasets.

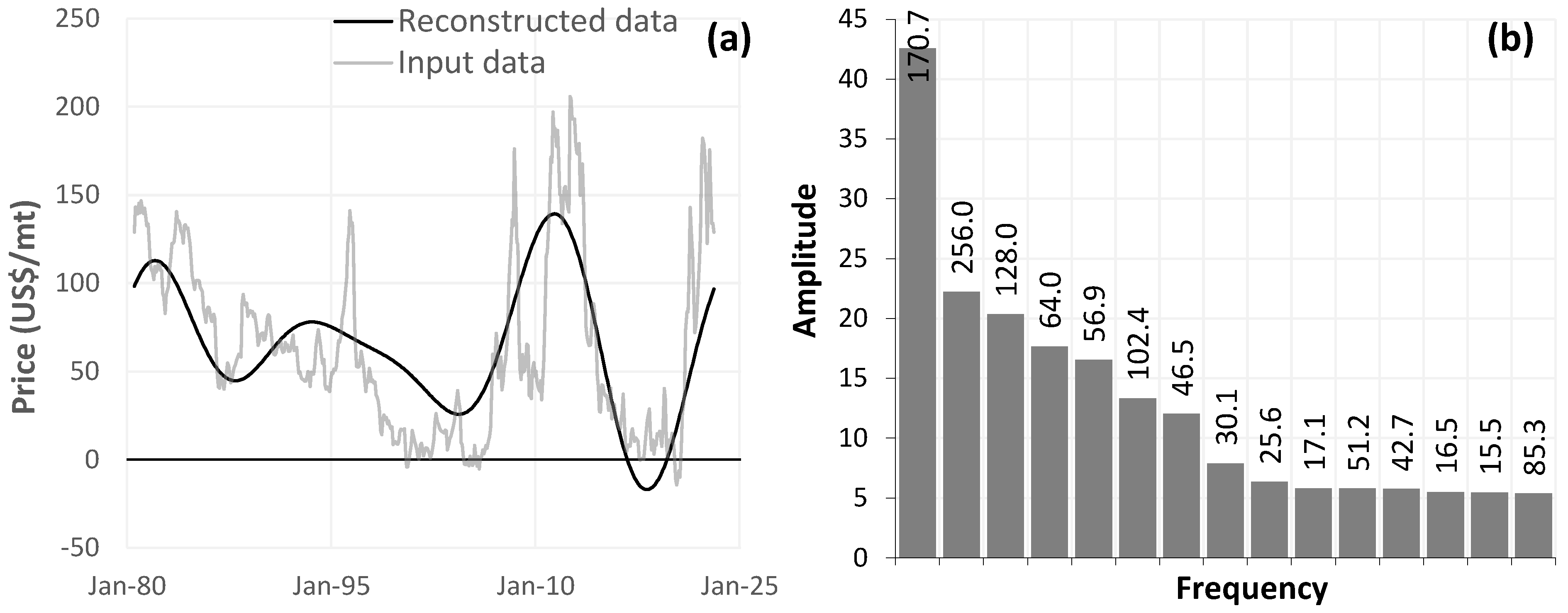

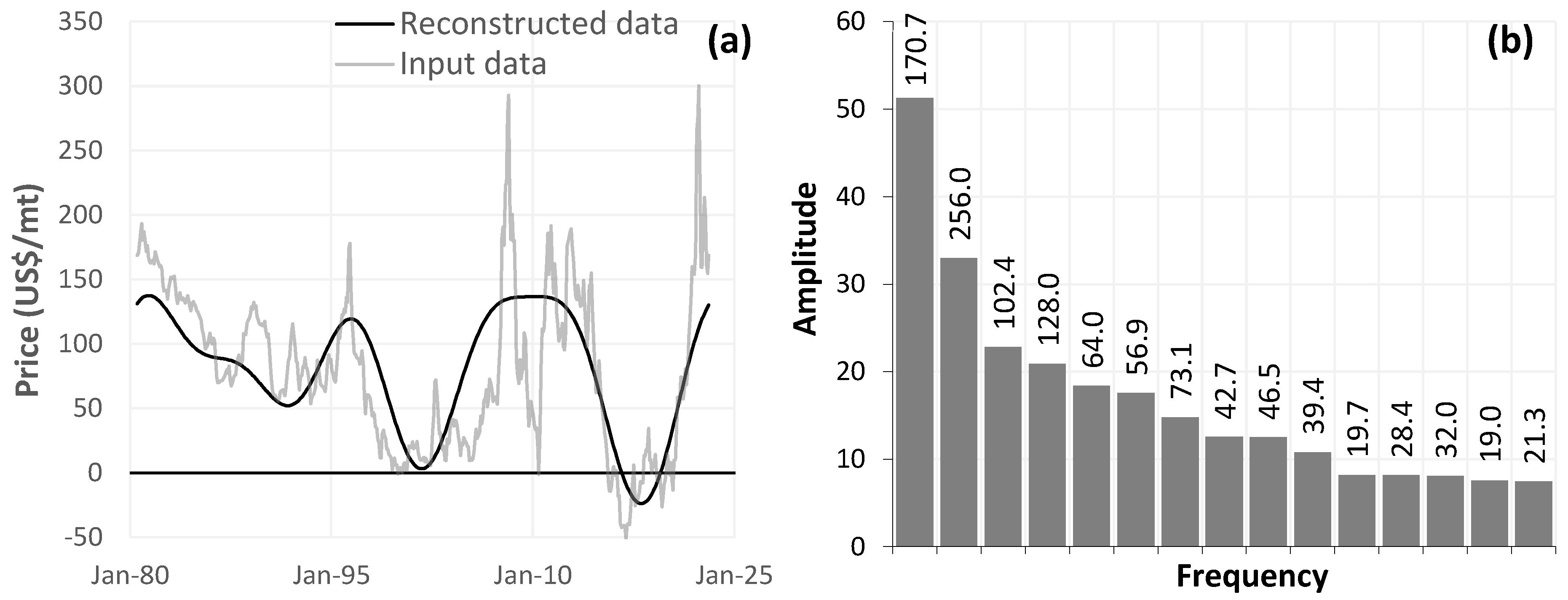

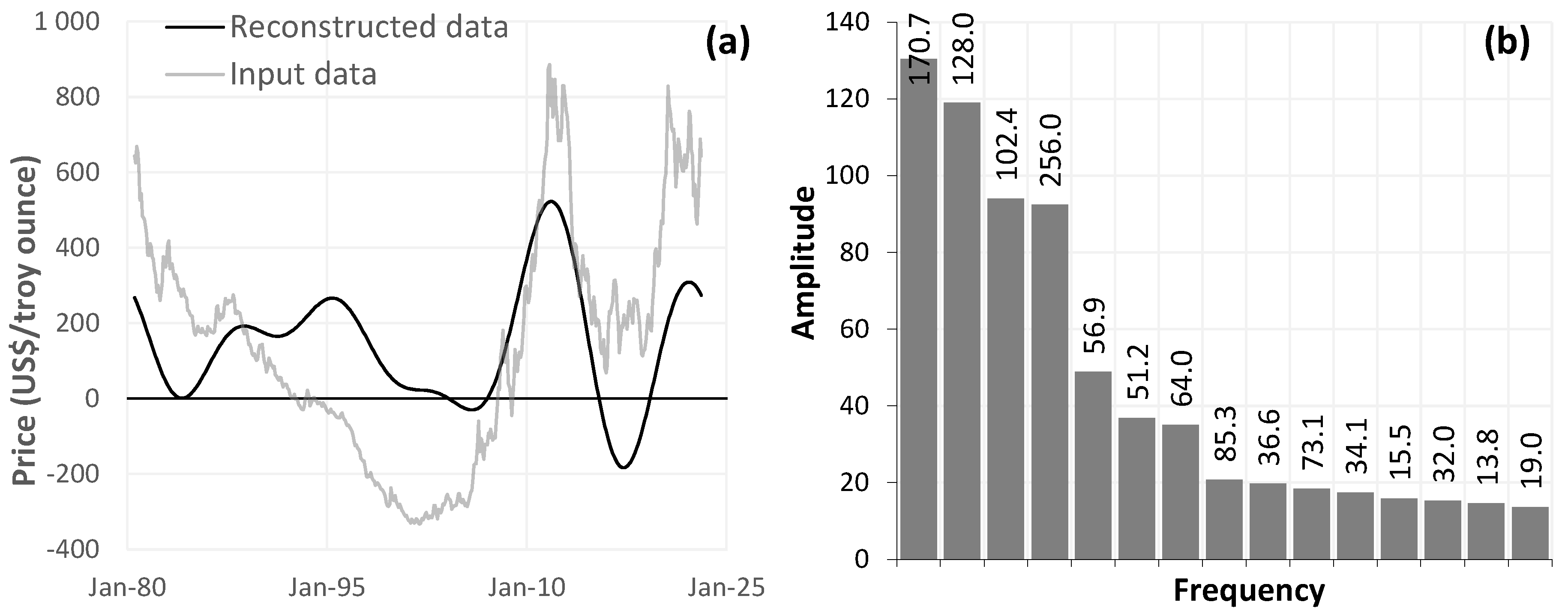

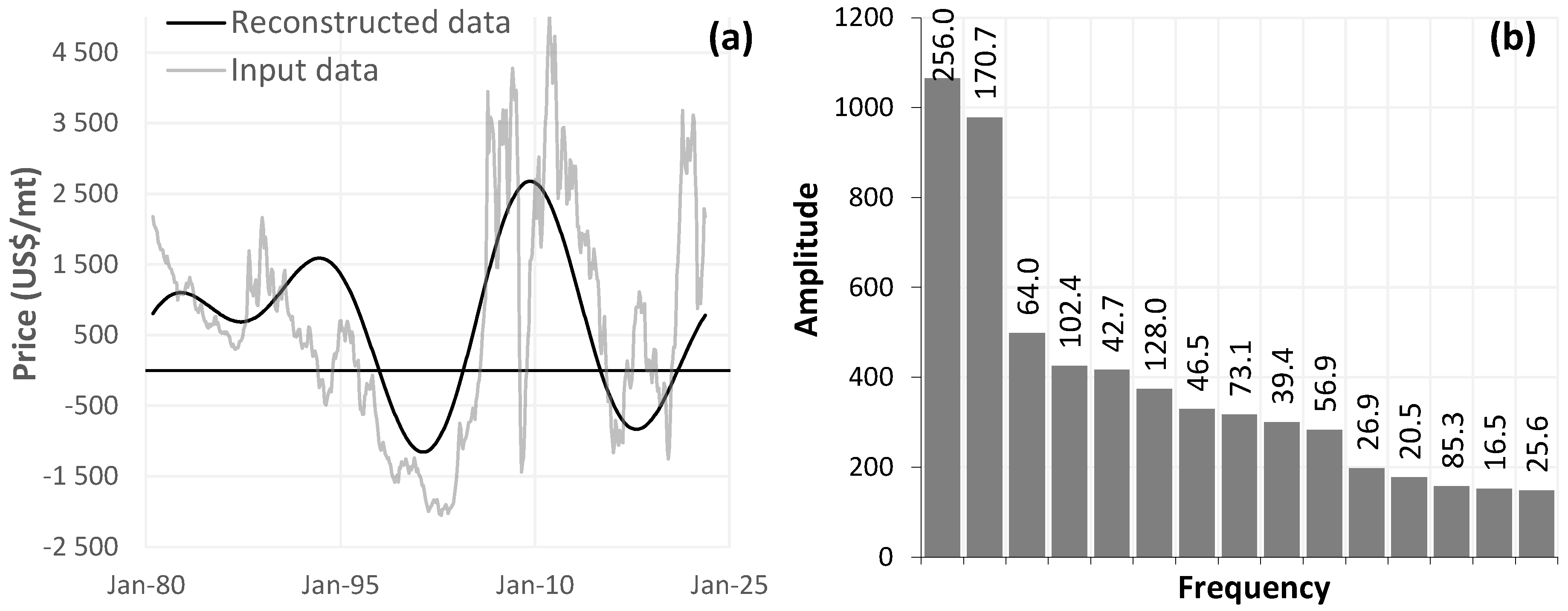

4. Conclusions

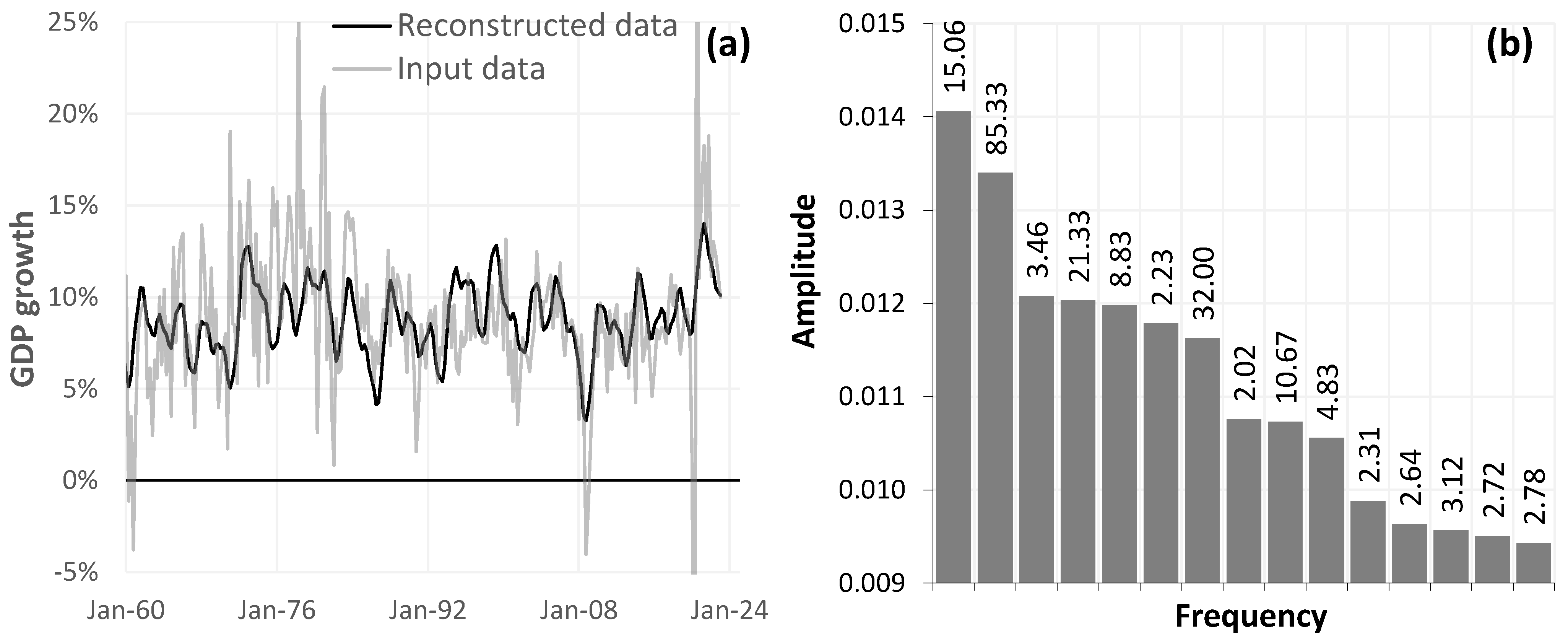

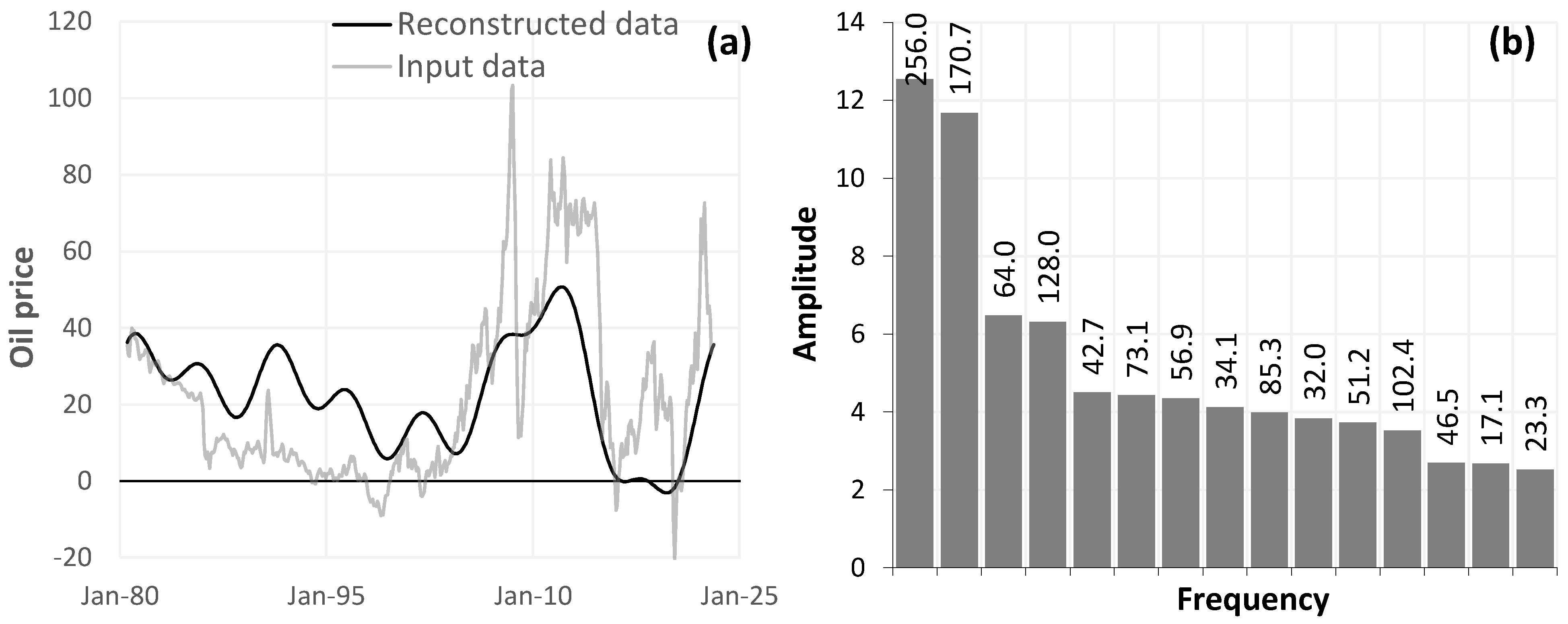

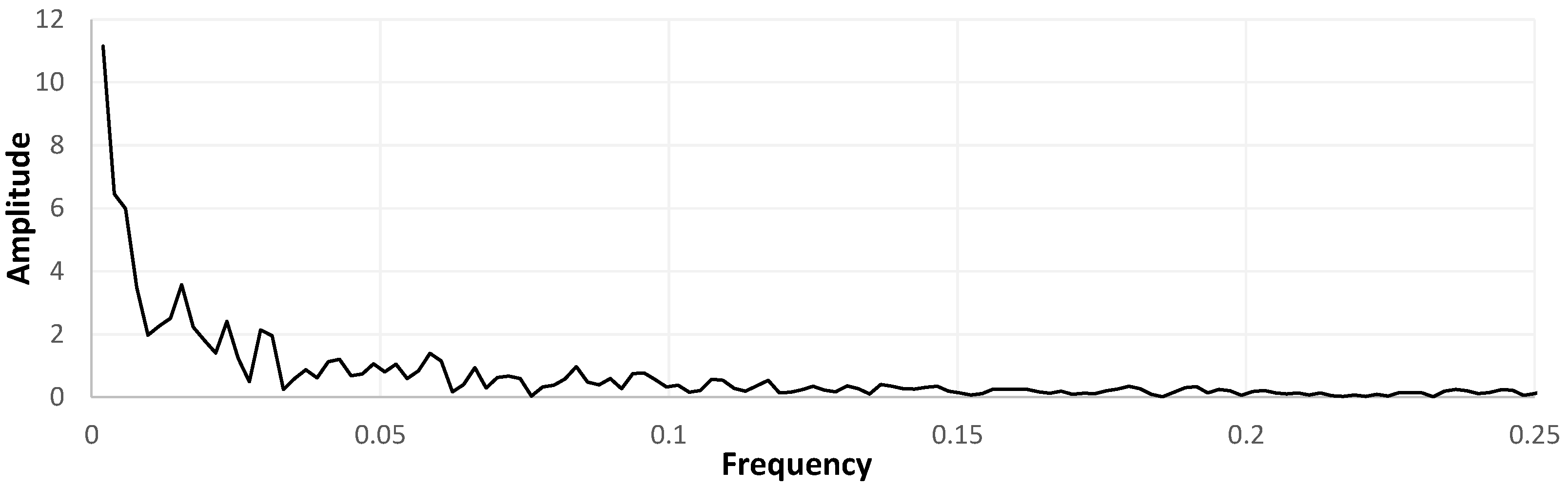

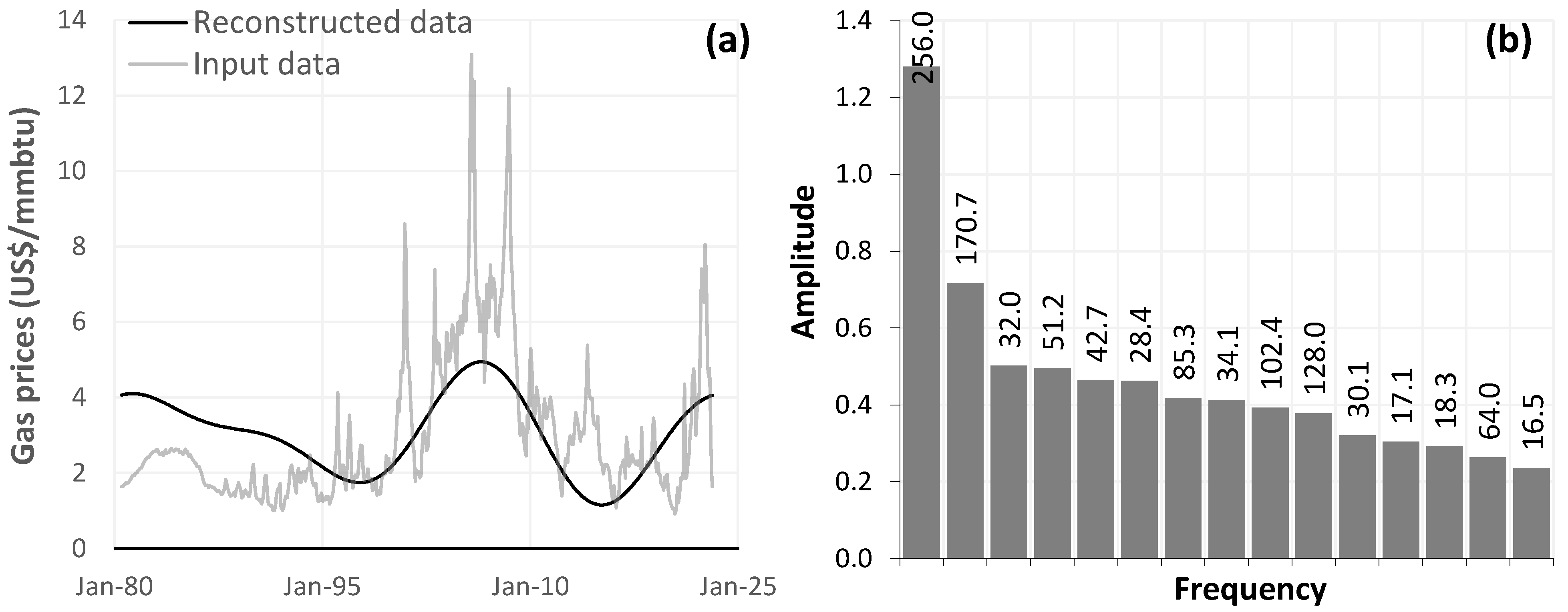

This article explores the connections between the US business cycle and various commodity price cycles, revealing significant insights. A notable discovery is the consistent presence of a roughly 14-year (170.7-month) medium-term cycle within the commodity dataset, albeit with varying prominence across commodities. This cycle aligns with the US business cycle, which exhibits a dominant 3.76-year cycle—around a quarter of the 14-year commodity cycle. These relationships are influenced by diverse factors specific to each commodity, adding complexity to the understanding of commodity price dynamics. The phases of these cycles, influenced by factors like demand shifts and oversupply, have direct effects on output and employment.

The implications of these findings are crucial for comprehending agricultural commodity price dynamics and broader economic influences. Economic activities, consumer spending, and market conditions all impact the demand for agricultural commodities, consequently affecting prices. The study’s spotlight on the synchronisation between commodity price, business, and historical rainfall cycles underscores the interplay between economic and climatic factors in shaping agricultural markets. Global demand changes, trade policies, and financial market fluctuations align with the broader business cycle, while weather patterns, especially rainfall, significantly influence agricultural productivity and prices.

The shale gas revolution’s impact on the US crude oil and natural gas industries is highlighted, with these sectors exhibiting cycles tied to the US business cycle. The presence of a roughly 14-year frequency in both industries, accompanied by procyclical behaviour, indicates a potential lead or lag relationship between these commodities and the US business cycle. The study also reinforces the cointegration of silver and gold prices, implying potential substitution between these assets due to their countercyclical nature.

This research’s practical applications extend to risk management and hedging strategies. Understanding the timing and phases of the business cycle and medium-term commodity cycles can aid market participants in anticipating and managing price volatility. Aligning production and marketing strategies with expected commodity price movements mitigates risk and optimises profitability. Investors and policymakers alike can benefit from this knowledge, informing portfolio management, risk mitigation strategies, and economic growth promotion.

The study underscores the need to consider both economic and climatic factors in analysing commodity price dynamics. The intricate interplay between the US business cycle, commodity cycles, and historical rainfall patterns highlights the complexity of agricultural commodity pricing. Policymakers must formulate comprehensive strategies considering economic policies, market conditions, climate change, and weather patterns to ensure the agricultural sector’s resilience in changing conditions. However, the relationship’s complexity and susceptibility to external factors necessitate ongoing research and analysis for a refined understanding of these interactions.

FFT has revolutionised many fields, including signal processing and data analysis (

Walker 1996). However, it has some noteworthy limitations. It requires a fixed number of samples, which limits the number of input data points to

, where

(

Cooley and Turkey 1965). This assumption has dictated the composition of all the datasets in this research. For example, the commodity price dataset was limited to 512 monthly data points between July 1980 and February 2023. The combination of the FFT constraint and limited data availability underpin the selection of the sample set. Other techniques, such as wavelet analysis, can use any amount of data and detect any frequency. In addition, this research assumes cyclicality, i.e., history mimics the future. This introduces its own limitations, as FFT does not effectively pick up once-off events such as COVID-19. The pandemic was a unique transitory shock independent of weather or financial causes, but it had an undeniable impact on frequency analyses.

Previous research conducted on super-cycles in different commodity markets incorporates the use of the HP and BK filters. These filters were not used; however, it is unlikely that the use of these methods would have had a dramatic effect on the results, as they would produce periodograms with less noise, but dominant frequencies would persist. Employing FFT resulted in inconclusive claims regarding the detection of long wave cycles. There was some evidence of these within the US natural gas and aluminium price cycles; however, the use of wavelet analysis in tandem with these filters would be a more suitable approach in terms of extracting noteworthy results relating to these potential long wave cycles.

Some limitations that have influenced this research include that FFT requires a fixed number of discrete samples, which limits the number of input data points to

, where

(

Cooley and Turkey 1965). For example, the commodity price dataset was limited to 512 monthly data points between July 1980 and February 2023. The combination of the FFT constraint and limited data availability underpin the selection of the sample set. Other techniques, such as wavelet analysis, can use any-sized data sample and detect any frequency. This research also assumes cyclicality, i.e., what happened in the past will mimic the future, which introduces its own limitations, as the FFT does not effectively identify once-off events such as COVID-19. The pandemic was a unique transitory shock that had nothing to do with weather or financial causes; however, it had an undeniable impact on frequency analyses.

Fourier analysis of price cycles for US natural gas and aluminium hints at the presence of extended cycles in these markets. However, Fourier transform might not be the most optimal approach for understanding longer cycles. A more promising avenue could involve wavelet analysis over a greater time span, which may yield more intriguing outcomes regarding potential long wave or super-cycles within these markets.

The findings indicate some level of interaction and synchronisation among rainfall patterns, the US economic cycle, and agricultural price cycles. It is worth considering that distinct weather phenomena could influence commodity prices across different geographical regions globally. For instance, analysing potential wildfire frequency trends in Northern Australia might offer valuable insights for farmers, policymakers, and other stakeholders seeking to make informed decisions.