Nexus between Intellectual Capital and Bank Productivity in India

Abstract

1. Introduction

2. Review of Related Studies

2.1. Theoretical Background

2.2. Relationship between Intellectual Capital and Firm Performance

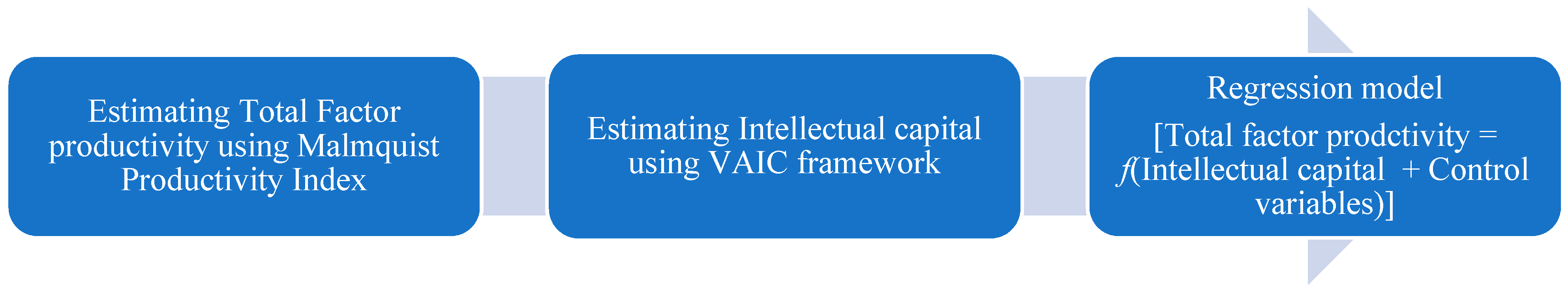

3. Methodology and Data

3.1. Dependent Variable: Estimating Malmquist Productivity Index (MPI)

3.2. Independent Variable: Measuring Intellectual Capital

3.3. Control Variables

3.4. Hypotheses Development

3.5. Regression Models

- Model 1:

- Model 2:

- Model 3:

- Model 4:

3.6. Data

4. Empirical Results and Discussions

4.1. Empirical Results

4.2. Discussions

4.3. Practical Implication of the Study

5. Conclusions

Limitations and Future Scope

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Details | Mean | Std. Dev. | TFPCH | TEFFCH | TECHCH | VAIC | MVAIC | VAHC | SCVA | VACE | RCVA | AHHI | Leverage | Size | Inflation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TFPCH | 0.9859 | 0.0716 | |||||||||||||

| TEFFCH | 0.9972 | 0.0455 | 0.6265 ** | ||||||||||||

| TECHCH | 0.9886 | 0.0562 | 0.7841 ** | 0.0092 | |||||||||||

| VAIC | 0.2399 | 0.0673 | 0.1012 ** | 0.1353 ** | 0.0265 | ||||||||||

| MVAIC | 2.8487 | 3.0522 | 0.0989 ** | 0.1340 ** | 0.0244 | 0.9996 ** | |||||||||

| VAHC | 2.887 | 2.9658 | −0.0207 | 0.0519 | −0.0683 | 0.5100 ** | 0.5273 ** | ||||||||

| SCVA | 2.148 | 1.2533 | 0.1299 ** | 0.1324 ** | 0.0666 | 0.8941 ** | 0.8845 ** | 0.0763 | |||||||

| VACE | 0.4179 | 2.6231 | −0.0263 | 0.0037 | −0.0367 | 0.3012 ** | 0.3111 ** | 0.4588 ** | 0.0455 | ||||||

| RCVA | 0.2827 | 0.2251 | −0.1268 ** | −0.1274 ** | −0.0687 | −0.7120 ** | −0.6912 ** | 0.0582 | −0.8587 ** | 0.0285 | |||||

| AHHI | 0.0383 | 0.1232 | −0.0209 | −0.0035 | −0.0244 | 0.0728 | 0.0803 | 0.0882 ** | 0.0369 | 0.0664 | 0.1295 ** | ||||

| Leverage | 0.932 | 0.0541 | 0.0019 | −0.0261 | 0.0231 | −0.1198 ** | −0.1253 ** | −0.2310 ** | −0.0227 | −0.0743 | −0.0486 | −0.0395 | |||

| Size | 13.5186 | 1.4938 | −0.038 | −0.0148 | −0.0363 | −0.0335 | −0.0344 | 0.0383 | −0.0532 | −0.0479 | 0.0017 | 0.0669 | 0.2010 ** | ||

| Inflation | 0.07 | 0.0279 | 0.1025 ** | 0.057 | 0.0832 | 0.0328 | 0.0324 | −0.021 | 0.0513 | −0.0357 | −0.0331 | 0.0777 | −0.0729 | 0.0232 | |

| GDP | 0.0705 | 0.0141 | −0.0407 | 0.0301 | −0.0754 | −0.0099 | −0.0089 | 0.0306 | −0.0238 | −0.0263 | 0.0294 | −0.0097 | 0.0048 | −0.0352 | −0.2613 ** |

References

- Ahangar, Reza Gharoie. 2011. The relationship between intellectual capital and financial performance: An empirical investigation in an Iranian company. African Journal of Business Management 5: 88–95. [Google Scholar]

- Akbar, Saeed, Jannine Poletti-Hughes, Ramadan El-Faitouri, and Syed Zulfiqar Ali Shah. 2016. More on the relationship between corporate governance and firm performance in the UK: Evidence from the application of generalized method of moments estimation. Research in International Business and Finance 38: 417–29. [Google Scholar] [CrossRef]

- Akin, Ahmet, Merve Kiliç, and Selim Zađm. 2009. Determinants of Bank Efficiency in Turkey: A Two Stage Data Envelopment Analysis. In International Symposium on Suistainable Development. pp. 32–41. Available online: https://omeka.ibu.edu.ba/files/original/51d77364b63243cd6420b482dbfaa0ca.pdf (accessed on 10 July 2022).

- Alhassan, Abdul Latif, and Nicholas Asare. 2016. Intellectual capital and bank productivity in emerging markets: Evidence from Ghana. Management Decision 54: 589–609. [Google Scholar] [CrossRef]

- Alhassan, Abdul Latif, and Nicholas Biekpe. 2016. Explaining bank productivity in Ghana. Managerial and Decision Economics 37: 563–73. [Google Scholar] [CrossRef]

- Alipour, Mohammad. 2012. The effect of intellectual capital on firm performance: An investigation of Iran insurance companies. Measuring Business Excellence 16: 53–66. [Google Scholar] [CrossRef]

- Amit, Raphael, and Paul J. H. Schoemaker. 1993. Strategic assets and organizational rent. Strategic Management Journal 14: 33–46. [Google Scholar]

- Anam, Ousama Abdulrahman, Abdul-Hamid Fatima, and Abdul Rashid Hafiz Majdi. 2012. Determinants of intellectual capital reporting: Evidence from annual reports of Malaysian listed companies. Journal of Accounting in Emerging Economies 2: 119–39. [Google Scholar] [CrossRef]

- Andriessen, Daniel. 2004. IC valuation and measurement: Classifying the state of the art. Journal of Intellectual Capital 5: 230–42. [Google Scholar] [CrossRef]

- Anghel, Ion. 2008. Intellectual capital and intangible assets analysis and valuation. Theoretical and Applied Economics 3: 75–84. [Google Scholar]

- Anifowose, Mutalib, Hafiz Mazdi Abdul Rashid, and Hairul Azlan Annuar. 2017. Intellectual capital disclosure and corporate market value: Does board diversity matter? Journal of Accounting in Emerging Economies 7: 369–98. [Google Scholar] [CrossRef]

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Berger, Allen N., and David B Humphrey. 1997. Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research 98: 175–212. [Google Scholar]

- Bollen, Laury, Philip Vergauwen, and Stephanie Schnieders. 2005. Linking intellectual capital and intellectual property to company Performance. Management Decision 43: 1161–85. [Google Scholar]

- Bontis, Nick. 1998. Intellectual capital: An exploratory study that develops measures and models. Management Decision 36: 63–76. [Google Scholar] [CrossRef]

- Bontis, Nick. 2002. World Congress of Intellectual Capital Readings. Boston: Elsevier Butterworth, Heinemann KMCI Press. [Google Scholar]

- Bontis, Nick, Willian Chua Chong Keow, and Stanley Richardson. 2000. Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital 1: 85–100. [Google Scholar] [CrossRef]

- Cabrilo, Sladjana, Zorica Uzelac, and Ilija Cosic. 2009. Researching indicators of organizational intellectual capital in Serbia. Journal of Intellectual Capital 10: 573–87. [Google Scholar] [CrossRef]

- Cabrita, Maria do Rosario, and Jorge Landeiro Vaz. 2006. Intellectual capital and value creation: Evidence from the Portuguese banking industry. Journal of Knowledge Management 4: 11–20. [Google Scholar]

- Chang, William S., and Jasper J Hsieh. 2011. Intellectual capital and value creation: Is innovation capital a missing link? International Journal of Business and Management 6: 3–12. [Google Scholar] [CrossRef]

- Chen, Fu-Chiang, Z-John Liu, and Qian Long Kweh. 2014. Intellectual capital and productivity of Malaysian general insurers. Economic Modelling 36: 413–20. [Google Scholar] [CrossRef]

- Chen, Lei. 2012. A Mixed Methods Study Investigating Intangibles in the Banking Sector. Ph.D. thesis, University of Glasgow, Glasgow, UK. [Google Scholar]

- Chen, Ming-Chin, Shu-Ju Cheng, and Yuhchang Hwang. 2005. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. Journal of Intellectual Capital 6: 159–76. [Google Scholar] [CrossRef]

- Chowdhury, Lina Afroz Mostofa, Tarek Rana, and Muhammad Istiaq Azim. 2019. Intellectual capital efficiency and organisational performance: In the context of the pharmaceutical industry in Bangladesh. Journal of Intellectual Capital 20: 784–806. [Google Scholar] [CrossRef]

- Chu, Samuel Kai Wah, Kin Hang Chan, Ka Yin Yu, Hing Tai Ng, and Wai Kwan Wong. 2011. An empirical study of the impact of intellectual capital on business performance. Journal of Information & Knowledge Management 10: 11–21. [Google Scholar]

- Clarke, Martin, Dyna Seng, and Rosalind H Whiting. 2011. Intellectual capital and firm performance in Australia. Journal of Intellectual Capital 12: 505–30. [Google Scholar] [CrossRef]

- Cummins, J. David, and Xiaoying Xie. 2013. Efficiency, productivity, and scale economies in the US property liability insurance industry. Journal of Productivity Analysis 39: 141–64. [Google Scholar] [CrossRef]

- Díez, Jose Maria, Magda Lizet Ochoa, M Begona Prieto, and Alicia Santidrián. 2010. Intellectual capital and value creation in Spanish firms. Journal of Intellectual Capital 11: 348–67. [Google Scholar] [CrossRef]

- Edvinsson, Leif, and M Malone. 1997. Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower. New York: Harper Collins. [Google Scholar]

- Edvinsson, Leif, and Patrick Sullivan. 1996. Developing a model for managing intellectual capital. European Management Journal 14: 356–64. [Google Scholar] [CrossRef]

- El-Bannany, Magdi. 2008. A study of determinants of intellectual capital performance in banks: The UK case. Journal of Intellectual Capital 9: 487–98. [Google Scholar] [CrossRef]

- Fare, Rolf, Shawna Grosskopf, and C. A. Knox Lovell. 1994. Production Frontiers. Cambridge: Cambridge University Press. [Google Scholar]

- Fiordelisi, Franco, and Phil Molyneux. 2010. The determinants of shareholder value in European banking. Journal of Banking & Finance 34: 1189–200. [Google Scholar]

- Firer, Steven, and S. Mitchell Williams. 2003. Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital 4: 348–60. [Google Scholar] [CrossRef]

- Galbreath, Jeremy. 2005. Which resources matter the most to firm success? An exploratory study of resource-based theory. Technovation 25: 979–87. [Google Scholar] [CrossRef]

- Ghosh, Santanu, and Amitava Mondal. 2009. Indian software and pharmaceutical sector IC and financial performance. Journal of Intellectual Capital 10: 369–88. [Google Scholar] [CrossRef]

- Goh, Pek Chen. 2005. Intellectual capital performance of commercial banks in Malaysia. Journal of Intellectual Capital 6: 385–96. [Google Scholar]

- Grigorian, David A., and Vlad Manole. 2002. Determinants of Commercial Bank Performance in Transition: An Application of Data Envelopment Analysis. World Bank Policy Research, Working paper No. 2850. Washington DC: World Bank. [Google Scholar]

- Gruian, Claudiu-Marian. 2011. The influence of intellectual capital on Romanian companies’ financial performance. Annales Universitatis Apulensis Series Oeconomica 2: 260–72. [Google Scholar] [CrossRef]

- Hamdan, Allam. 2018. Intellectual capital and firm performance. International Journal of Islamic and Middle Eastern Finance and Management 11: 139–51. [Google Scholar] [CrossRef]

- Hsu, Wen-Hsin, and Yao-Ling Chang. 2011. Intellectual capital and analyst forecast: Evidence from the high-tech industry in Taiwan. Applied Financial Economics 21: 1135–43. [Google Scholar] [CrossRef]

- Iazzolino, Gianpaolo, and Domenico Laise. 2013. Value added intellectual coefficient (VAIC). Journal of Intellectual Capital 14: 547–63. [Google Scholar] [CrossRef]

- Ilyas, Ashiq Mohd, and S Rajasekaran. 2019. An empirical investigation of efficiency and productivity in the Indian non life insurance market. Benchmarking: An International Journal 26: 2343–71. [Google Scholar] [CrossRef]

- Jaffry, Shabbar, Yaseen Ghulam, Sean Pascoe, and Joe Cox. 2007. Regulatory changes and productivity of the banking sector in the Indian sub-continent. Journal of Asian Economics 18: 415–38. [Google Scholar] [CrossRef]

- Joshi, Mahesh, Daryll Cahill, Jasvindar Sidhu, and Monika Kansal. 2013. Intellectual capital and financial performance: An evaluation of the Australian financial sector. Journal of Intellectual Capital 14: 264–85. [Google Scholar] [CrossRef]

- Kamukama, Nixon, Augustine Ahiauzu, and Joseph M Ntayi. 2010. Intellectual capital and performance: Testing interaction effects. Journal of Intellectual Capital 11: 554–74. [Google Scholar] [CrossRef]

- Kehelwalatenna, Sampath. 2016. Intellectual capital performance during financial crises. Measuring Business Excellence 20: 55–78. [Google Scholar] [CrossRef]

- Lu, Wen-Min, Wei-Kang Wang, and Qian Long Kweh. 2014. Intellectual capital and performance in the Chinese life insurance industry. Omega 42: 65–74. [Google Scholar] [CrossRef]

- Luhnen, Michael. 2009. Determinants of efficiency and productivity in German property-liability insurance: Evidence for 1995–2006. Geneva Papers on Risk and Insurance—Issues and Practice 34: 483–505. [Google Scholar] [CrossRef]

- Lynn, Bernadette E. 1998. Performance evaluation in the new economy: Bringing the measurement and evaluation of intellectual capital into the management planning and control system. International Journal of Technology Management 16: 162–76. [Google Scholar] [CrossRef]

- Maditinos, Dimitrios, Dimitrios Chatzoudes, Charalampos Tsairidis, and Georgios Theriou. 2011. The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital 12: 132–51. [Google Scholar] [CrossRef]

- Malmquist, Sten. 1953. Index numbers and indifference surfaces. Trabajos de estadística 4: 209–42. [Google Scholar] [CrossRef]

- Martí, Jose Maria Viedma. 2007. In search of an intellectual capital comprehensive theory. Electronic Journal of Knowledge Management 5: 245–56. [Google Scholar]

- Mavridis, Dimitrios G. 2004. The intellectual capital performance of the Japanese banking sector. Journal of Intellectual Capital 5: 92–115. [Google Scholar] [CrossRef]

- Mehralian, Gholamhossein, Ali Rajabzadeh, Mohammad Reza Sadeh, and Hamid Reza Rasekh. 2012. Intellectual capital and corporate performance in Iranian pharmaceutical industry. Journal of Intellectual Capital 13: 138–58. [Google Scholar] [CrossRef]

- Meles, Antonio, Claudio Porzio, Gabriele Sampagnaro, and Vincenzo Verdoliva. 2016. The impact of the intellectual capital efficiency on commercial banks performance: Evidence from the US. Journal of Multinational Financial Management 36: 64–74. [Google Scholar] [CrossRef]

- Mondal, Amitava, and Santanu Kumar Ghosh. 2012. Intellectual capital and financial performance of Indian banks. Journal of Intellectual Capital 13: 515–30. [Google Scholar] [CrossRef]

- Montequín, Vicente Rodriguez, Francisco Ortega Fernández, Valeriano Alvarez Cabal, and Nieves Roqueni Gutierrez. 2006. An integrated framework for intellectual capital measurement and knowledge management implementation in small and medium-sized enterprises. Journal of Information Science 32: 525–38. [Google Scholar] [CrossRef]

- Nadeem, Muhammad, Christopher Gan, and Cuong Nguyen. 2017. Does intellectual capital efficiency improve firm performance in BRICS economies? A dynamic panel estimation. Measuring Business Excellence 21: 65–85. [Google Scholar] [CrossRef]

- Nartey, Sarah Beatson, KofiA. Osei, and Emmanuel Sarpong-Kumankoma. 2019. Bank productivity in Africa. International Journal of Productivity and Performance Management 69: 1973–97. [Google Scholar] [CrossRef]

- OECD. 2005. The Measurement of Scientific and Technological Activities: Guidelines for Collecting and Interpreting Innovation Data: Oslo Manual, 3rd ed.; Prepared by the Working Party of National Experts on Scientific and Technology Indicators. Paris: OECD, p. 71.

- OECD. 2022. OECD Economic Outlook. 2022. Available online: https://issuu.com/oecd.publishing/docs/india-oecd-economic-outlook-projection-note-novemb (accessed on 18 December 2022).

- Oppong, Godfred Kesse, Jamini Kanta Pattanayak, and Mohd Irfan. 2019. Impact of intellectual capital on productivity of insurance companies in Ghana. Journal of Intellectual Capital 20: 763–83. [Google Scholar] [CrossRef]

- Ozkan, Nasif, Sinan Cakan, and Murad Kayacan. 2017. Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanbul Review 17: 190–98. [Google Scholar] [CrossRef]

- Pablos, Patricia. 2004. The nature of knowledge-based resources through the design of an architecture of human resource management systems: Implications for strategic management. International Journal of Technology Management 27: 23–45. [Google Scholar] [CrossRef]

- Penrose, Edith. 1980. The Theory of the Growth of the Firm, 2nd ed. New York: Basil Blackwell Publisher. [Google Scholar]

- Perry, Philip. 1992. Do banks gain or lose from inflation? Journal of Retail Banking 14: 25–31. [Google Scholar]

- Poh, Law Teck, Adem Kilicman, and Siti Nur Iqmal Ibrahim. 2018. On intellectual capital and financial performances of banks in Malaysia. Cogent Economics & Finance 6: 1–15. [Google Scholar]

- Pulic, Ante. 1998. Measuring the performance of intellectual potential in knowledge economy. Paper presented at 2nd McMaster Word Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential, Hamilton, ON, Canada. [Google Scholar]

- Pulic, Ante. 2000. VAICTM—An Accounting Tool for IC Management. International Journal Technology Management 20: 702–14. [Google Scholar]

- Riahi-Belkaoui, Ahmed. 2003. Intellectual capital and firm performance of US multinational firms. Journal of Intellectual Capital 4: 215. [Google Scholar] [CrossRef]

- Saengchan, Sarayuth. 2007. The role of intellectual capital in creating value in banking industry. Journal of Knowledge Management 3: 15–25. [Google Scholar]

- Santos-Rodrigues, Helena. 2013. Intellectual capital and innovation: A case study of a public healthcare organisation in Europe. Electronic Journal of Knowledge Management 11: 361–72. [Google Scholar]

- Sardo, Filipe, Zelia Serrasqueiro, and Helena Alves. 2018. On the relationship between intellectual capital and financial performance: A panel data analysis on SME hotels. International Journal of Hospitality Management 75: 67–74. [Google Scholar] [CrossRef]

- Scafarto, Vincenzo, Federica Ricci, and Francesco Scafarto. 2016. Intellectual capital and firm performance in the global agribusiness industry. Journal of Intellectual Capital 17: 530–52. [Google Scholar] [CrossRef]

- Sealey, Calvin W, Jr., and James T Lindley. 1977. Inputs, outputs, and a theory of production and cost at depository financial institutions. The Journal of Finance 32: 1251–66. [Google Scholar] [CrossRef]

- Sharma, Dipasha, and Anil Kumar Sharma. 2015. Influence of turbulent macroeconomic environment on productivity change of banking sector: Empirical evidence from India. Global Business Review 16: 439–62. [Google Scholar] [CrossRef]

- Singla, Harish Kumar. 2020. Does VAIC affect the profitability and value of real estate and infrastructure firms in India? A panel data investigation. Journal of Intellectual Capital 21: 309–31. [Google Scholar] [CrossRef]

- Smriti, Neha, and Niladri Das. 2018. The impact of intellectual capital on firm performance: A study of Indian firms listed in COSPI. Journal of Intellectual Capital 19: 935–64. [Google Scholar] [CrossRef]

- Ståhle, Pirjo, Sten Ståhle, and Samuli Aho. 2011. Value added intellectual coefficient (VAIC): A critical analysis. Journal of Intellectual Capital 12: 531–51. [Google Scholar] [CrossRef]

- Stewart, Thomas A. 1997. Intellectual Capital: The New Wealth of Organizations. New York: Currency Doubleday. [Google Scholar]

- Subramaniam, Mohan, and Mark A Youndt. 2005. The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal 48: 450–63. [Google Scholar] [CrossRef]

- Sufian, Fadzlan. 2011. Benchmarking the efficiency of the Korean banking sector: A DEA approach. Benchmarking: An International Journal 18: 107–27. [Google Scholar] [CrossRef]

- Tiwari, Ranjit. 2022. Nexus between intellectual capital and profitability with interaction effects: Panel data evidence from the Indian healthcare industry. Journal of Intellectual Capital 23: 588–616. [Google Scholar] [CrossRef]

- Tiwari, Ranjit, and Harishankar Vidyarthi. 2018. Intellectual capital and corporate performance: A case of Indian banks. Journal of Accounting in Emerging Economies 8: 84–105. [Google Scholar] [CrossRef]

- Tovstiga, George, and Ekatirina Tulugurova. 2007. Intellectual capital practices and performance in Russian enterprises. Journal of Intellectual Capital 8: 695–707. [Google Scholar] [CrossRef]

- Vidyarthi, Harishankar, and Ranjit Tiwari. 2020. Cost, revenue, and profit efficiency characteristics, and intellectual capital in Indian Banks. Journal of Intellectual Capital 21: 1–22. [Google Scholar] [CrossRef]

- Vishnu, Sriranga, and Vijay Kumar Gupta. 2014. Intellectual capital and performance of pharmaceutical firms in India. Journal of Intellectual Capital 15: 83–99. [Google Scholar] [CrossRef]

- Wang, Mao-Chang. 2013. Value relevance on intellectual capital valuation methods: The role of corporate governance. Quality & Quantity 47: 1213–23. [Google Scholar]

- Wang, Wen-Ying, and Chingfu Chang. 2005. Intellectual capital and performance in causal models: Evidence from the information technology industry in Taiwan. Journal of Intellectual Capital 6: 222–36. [Google Scholar] [CrossRef]

- Wernerfelt, Birger. 1984. A resource-based view of the firm. Strategic Management Journal 5: 171–80. [Google Scholar] [CrossRef]

- Williams, Jonathan, and Nghia Nguyen. 2005. Financial liberalisation, crisis, and restructuring: A comparative study of bank performance and bank governance in South East Asia. Journal of Banking and Finance 29: 2119–54. [Google Scholar] [CrossRef]

- Williams, S Mitchell. 2001. Is intellectual capital performance and disclosure practices related? Journal of Intellectual Capital 2: 192–203. [Google Scholar] [CrossRef]

- Xu, Jian, and Jingsuo Li. 2022. The interrelationship between intellectual capital and firm performance: Evidence from China’s manufacturing sector. Journal of Intellectual Capital 23: 313–41. [Google Scholar] [CrossRef]

- Yalama, Abdullah, and Metin Coskun. 2007. Intellectual capital performance of quoted banks on the Istanbul stock exchange market. Journal of Intellectual Capital 8: 256–71. [Google Scholar] [CrossRef]

- Young, Chaur-Shiuh, Hwan-Yann Su, Shih-Chieh Fang, and Shyh-Rong Fang. 2009. Cross-country comparison of intellectual capital performance of commercial banks in Asian economies. The Service Industries Journal 29: 1565–79. [Google Scholar] [CrossRef]

- Zack, Michael H. 1999. Developing a knowledge strategy. California Management Review 41: 125–45. [Google Scholar] [CrossRef]

- Zakery, Amir, and Abbas Afrazeh. 2015. Intellectual capital based performance improvement, study in insurance firms. Journal of Intellectual Capital 16: 619–38. [Google Scholar] [CrossRef]

- Zeghal, Daniel, and Anis Maaloul. 2010. Analysing value added as an indicator of intellectual capital and its consequences on company performance. Journal of Intellectual Capital 11: 39–60. [Google Scholar] [CrossRef]

| Variable | Definition | Purpose | Expected Sign (+/-) | Reference |

|---|---|---|---|---|

| AHHI | Adjusted Herfindahl–Hirshman Index. AHHI = 1 − [(Non-interest income/Total income)2 + (Net interest income/Total income)2] | The AHHI is used to evaluate the impact of revenue diversification on bank productivity. | +/- | Luhnen (2009); Cummins and Xie’s (2013); Alhassan and Biekpe (2016); Ilyas and Rajasekaran (2019); Sharma and Sharma (2015); Nartey et al. (2019) |

| Size | Natural logarithm of the bank’s total asset | Size is used to assess whether or not economies of scale exist in the Indian banking industry. | +/- | Grigorian and Manole (2002); Williams and Nguyen (2005); Akin et al. (2009); Sufian (2011); Sharma and Sharma (2015); Nartey et al. (2019) |

| Leverage | Ratio of debt to equity | The term leverage is used to describe the impact of leverage on bank productivity. | +/- | Alhassan and Asare (2016); Akbar et al. (2016); Nartey et al. (2019) |

| Inflation | Consumer price index | This study includes inflation to analyse the impact of price level changes on the efficiency and productivity growth of the Indian banking sector. | +/- | Perry (1992); Sufian (2011); Sharma and Sharma (2015) |

| GDP | GDP growth rate | GDP growth has been included in this study to measure the effect of volatile external conditions on the efficiency and productivity of Indian banks. | + | Fiordelisi and Molyneux (2010); Sharma and Sharma (2015) |

| Year | Technical Efficiency Change (TEFFCH) | Technical Change (TECHCH) | Change in Total Factor Productivity (TFPCH) |

|---|---|---|---|

| 2005 | 1 | 1 | 1 |

| 2006 | 1.011 | 0.949 | 0.96 |

| 2007 | 1.006 | 0.991 | 0.997 |

| 2008 | 1.004 | 0.984 | 0.988 |

| 2009 | 0.998 | 0.995 | 0.993 |

| 2010 | 0.998 | 1.013 | 1.011 |

| 2011 | 1.001 | 0.981 | 0.982 |

| 2012 | 0.999 | 1.001 | 1 |

| 2013 | 0.997 | 0.989 | 0.986 |

| 2014 | 0.988 | 0.989 | 0.977 |

| 2015 | 1.003 | 0.992 | 0.995 |

| 2016 | 0.975 | 0.964 | 0.94 |

| 2017 | 1.014 | 0.977 | 0.991 |

| 2018 | 0.945 | 0.987 | 0.933 |

| 2019 | 1.007 | 0.991 | 0.998 |

| Geometric Mean | 0.996 | 0.986 | 0.982 |

| Bank | Technical Efficiency Change (TEFFCH) | Technical Change (TECHCH) | Change in Total Factor Productivity (TFPCH) |

|---|---|---|---|

| Allahabad Bank | 0.985 | 1.007 | 0.992 |

| Andhra Bank | 0.986 | 0.995 | 0.98 |

| Axis Bank | 1.002 | 1.003 | 1.005 |

| Bank of Baroda | 0.999 | 0.991 | 0.99 |

| Bank of India | 0.986 | 1 | 0.986 |

| Bank of Maharashtra | 0.988 | 0.991 | 0.979 |

| Canara Bank | 0.997 | 0.99 | 0.988 |

| Catholic Syrian Bank | 0.996 | 0.967 | 0.964 |

| Central Bank of India | 0.987 | 0.988 | 0.975 |

| City Union Bank | 1 | 0.993 | 0.993 |

| Corporation Bank | 0.992 | 0.968 | 0.96 |

| D C B Bank | 1.011 | 0.983 | 0.994 |

| Dhanlaxmi Bank | 1.005 | 0.987 | 0.992 |

| Federal Bank | 1.006 | 1.004 | 1.01 |

| H D F C Bank | 1 | 0.989 | 0.989 |

| I C I C I Bank | 1 | 0.986 | 0.986 |

| I D B I Bank | 0.986 | 0.919 | 0.906 |

| Indian Bank | 0.997 | 0.988 | 0.985 |

| Indian Overseas Bank | 0.984 | 0.993 | 0.977 |

| Indusind Bank | 1 | 1.006 | 1.006 |

| Karnataka Bank | 1.002 | 0.978 | 0.981 |

| KarurVysya Bank | 0.992 | 0.996 | 0.988 |

| Kotak Mahindra Bank | 1 | 0.984 | 0.984 |

| Lakshmi Vilas Bank | 0.995 | 0.982 | 0.977 |

| Oriental Bank of Commerce | 1 | 1.002 | 1.002 |

| Punjab & Sind Bank | 0.995 | 0.979 | 0.974 |

| Punjab National Bank | 0.99 | 0.989 | 0.979 |

| R B L Bank | 1.009 | 0.992 | 1.001 |

| South Indian Bank | 1.008 | 0.999 | 1.007 |

| State Bank of India | 0.995 | 0.992 | 0.987 |

| Syndicate Bank | 0.992 | 0.995 | 0.987 |

| Tamilnadu Mercantile Bank | 0.997 | 0.967 | 0.965 |

| Uco Bank | 0.978 | 0.998 | 0.977 |

| Union Bank of India | 0.991 | 0.995 | 0.986 |

| United Bank of India | 1 | 0.963 | 0.963 |

| Yes Bank | 1 | 0.94 | 0.94 |

| Variables | TFPCH | TEFFCH | TECHCH | |||

|---|---|---|---|---|---|---|

| Model 1 | Model 3 | Model 1 | Model 3 | Model 1 | Model 3 | |

| Lagged DV | −0.0907 * | −0.0998 * | −0.282 * | −0.283 * | −0.0199 | −0.0304 *** |

| AHHI | −0.0924 * | −0.0848 * | −0.0181 | −0.0128 | −0.0961 * | −0.115 * |

| VAIC | 0.00429 * | 0.00304 * | 0.000919 * | |||

| VAHC | −0.00159 | 0.00503 * | −0.00770 * | |||

| SCVA | 0.00469 * | 0.00302 * | 0.00126 * | |||

| VACE | −0.0183 ** | −0.0018 | −0.00134 | |||

| Leverage | 0.0999 * | 0.0689 ** | −0.0227 | −0.0176 | 0.146 * | 0.128 * |

| Size | −0.00044 | −0.00402 *** | −0.00033 | 2.26E−05 | −0.00380 ** | −0.00533 ** |

| Inflation | 0.291 * | 0.304 * | 0.0908 * | 0.0922 * | 0.214 * | 0.211 * |

| GDP | −0.120 *** | −0.0923 | 0.0999 ** | 0.0919 ** | −0.269 * | −0.269 * |

| Constant | 0.986 * | 1.087 * | 1.286 * | 1.274 * | 0.947 * | 1.018 * |

| AR(1) | −4.3787 * | −4.4001 * | −3.0836 * | −3.087 * | −3.926 * | −3.9004 * |

| AR(2) | 0.62441 | 0.486 | −0.5393 | −0.5798 | 0.01734 | −0.1827 |

| Sargan | 0.4585 | 0.3405 | 0.2787 | 0.2752 | 0.3611 | 0.4259 |

| Variables | TFPCH | TEFFCH | TECHCH | |||

|---|---|---|---|---|---|---|

| Model 2 | Model 4 | Model 2 | Model 4 | Model 2 | Model 4 | |

| Lagged DV | −0.0902 * | −0.100 * | −0.282 * | −0.286 * | −0.0198 | −0.0257 |

| AHHI | −0.0946 * | −0.0819 ** | −0.0186 | −0.00278 | −0.0964 * | −0.124 * |

| MVAIC | 0.00445 * | 0.00317 * | 0.000961 * | |||

| VAHC | −0.00153 | 0.00534 * | −0.00797 * | |||

| SCVA | 0.00474 ** | 0.00216 ** | 0.00453 * | |||

| VACE | −0.0178 ** | −0.00066 | −0.00341 | |||

| RCVA | 0.00312 | −0.0217 | 0.0772 * | |||

| Leverage | 0.102 * | 0.0671 ** | −0.0222 | −0.0184 | 0.147 * | 0.139 * |

| Size | −0.00031 | −0.00378 | −0.00023 | −0.00046 | −0.00379 ** | −0.00487 *** |

| Inflation | 0.292 * | 0.305 * | 0.0911 * | 0.0934 * | 0.214 * | 0.195 * |

| GDP | −0.120 *** | −0.0873 | 0.0995 ** | 0.104 ** | −0.268 * | −0.269 * |

| Constant | 0.981 * | 1.084 * | 1.284 * | 1.281 * | 0.947 * | 0.997 * |

| AR(1) | −4.3793 * | −4.4059 * | −3.0854 * | −3.0751 * | −3.9255 | −3.879 * |

| AR(2) | 0.62338 | 0.4763 | −0.541 | −0.602 | 0.0167 | −0.2941 |

| Sargan | 0.46 | 0.3355 | 0.2763 | 0.2807 | 0.3618 | 0.4378 |

| Hypothesis | Details | Accept |

|---|---|---|

| Hypothesis 1 | VAIC has a significant positive impact on TFPCHa/TEFFCHb/TECHCHc. | H1a, H1b and H1c |

| Hypothesis 2 | VAHCa/SCVAb/VACEc has a significant positive impact on TFPCH. | H2b and H2c |

| Hypothesis 3 | VAHCa/SCVAb/VACEc has a significant positive impact on TEFFCH. | H3a and H3b |

| Hypothesis 4 | VAHCa/SCVAb/VACEc has a significant positive impact on TECHCH. | H4a and H4b |

| Hypothesis 5 | MVAIC has a significant positive impact on TFPCHa/TEFFCHb/TECHCHc. | H5a, H5b, and H5c |

| Hypothesis 6 | VAHCa/SCVAb/RCVAc/VACEd has a significant positive impact on TFPCH. | H6b and H6d |

| Hypothesis 7 | VAHCa/SCVAb/RCVAc/VACEd has a significant positive impact on TEFFCH. | H7a and H7b |

| Hypothesis 8 | VAHCa/SCVAb/RCVAc/VACEd has a significant positive impact on TECHCH. | H7a, H7b and H7c |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tiwari, R.; Vidyarthi, H.; Kumar, A. Nexus between Intellectual Capital and Bank Productivity in India. J. Risk Financial Manag. 2023, 16, 54. https://doi.org/10.3390/jrfm16010054

Tiwari R, Vidyarthi H, Kumar A. Nexus between Intellectual Capital and Bank Productivity in India. Journal of Risk and Financial Management. 2023; 16(1):54. https://doi.org/10.3390/jrfm16010054

Chicago/Turabian StyleTiwari, Ranjit, Harishankar Vidyarthi, and Anand Kumar. 2023. "Nexus between Intellectual Capital and Bank Productivity in India" Journal of Risk and Financial Management 16, no. 1: 54. https://doi.org/10.3390/jrfm16010054

APA StyleTiwari, R., Vidyarthi, H., & Kumar, A. (2023). Nexus between Intellectual Capital and Bank Productivity in India. Journal of Risk and Financial Management, 16(1), 54. https://doi.org/10.3390/jrfm16010054