1. Introduction

The promise of an alternative financial future was proposed by Satoshi Nakamoto, the mysterious creator of Bitcoin (

Nakamoto 2008). Trust normally reserved for governments and financial institutions was supposed to be replaced by a self-governing ecosystem of peer-to-peer transactions secured by cryptography. However, after a dozen years, while many people are aware of the most popular cryptocurrency (

Biggs 2018;

Schuh and Shy 2015) Bitcoin is relegated to a few use cases, particularly in the West. These “unintended consequences” include fraud (

Carlson 2019;

Christin 2012) and use of cryptocurrencies as a speculative investment (

Glaser et al. 2014;

Hileman 2014), among others. Neither Bitcoin, nor any other cryptocurrency is used as a general purpose and prevalent payment method by the mainstream consumer (

Catalini and Tucker 2016;

Henry et al. 2019). We have seen regional aberrations, where governments have introduced Bitcoin as legal tender, or where consumers use it as a reaction to hyperinflation in Venezuela, but consumers in the United States have not embraced it yet on a broad scale. Recent events including the ban of crypto in China, and possibly India, the bankruptcy of the FTX crypto exchange, crashes of stablecoins like Luna, crypto scams (

Binder 2022), and demonstrations against Bitcoin as legal tender in El Salvador have shaken consumer confidence in this otherwise revolutionary technology. The United States Secretary of the Treasury, Janet Yellen, recently said that digital asset markets “need careful regulation” following the FTX bankruptcy filing (

Condon 2022). While these pressures are concerning, the capitalization of these types of digital assets has reached USD 3 trillion, and 16% of Americans have purchased crypto, so there is still potential for them to become more reliable, stable, and for consumers to use it for actual purchases (

White House Fact Sheet 2022). This paper forms a hypothesis around factors related to brand and wanders what kind of entity would need to back a new, or evolved form of digital currency in order to increase usage of it as a general consumer payment method.

2. Source Materials for Hypothesis and Methods

The creation of the hypothesis about brand as a determinant for adoption of cryptocurrencies came from two distinct workstreams. First was a literature review identifying themes for adoption barriers and published in the proceedings of the IFABS 2022 conferences in Naples, Italy (

Kowalski et al. 2022). This scoping review identified 2000 matches, with highlighted themes around switching costs, awareness, speculative and even criminal uses of crypto, and it also identified two gaps in the research. First, most of the analysis surveyed focused on the technology, and not the human factor at play, with all the cultural and societal implications involved in digital currencies. The second issue was the focus of the studies on the early adopters, most of whom were already convinced about the promise of Bitcoin and other cryptocurrencies. It was clear from the research that digital money and its adoption could not be analyzed with simple Technology Adoption Models. Money also conveys cultural, social, and political dimensions, so any new uptake needs to introduce additional variables, beyond the purely technical ones. This also includes trust and brand.

The second workstream was a series of interviews with domain experts conducted in 2021. The experts were either proprietors of small to medium sized businesses with experience in cryptocurrencies, regulators and policy makers, or economists from academia and government agencies in the United States (

Kowalski 2021). The interviews have shown that the general consumer is not quite ready to give up cash, credit cards, banks, or their Venmo account and trade it in for a Bitcoin wallet to purchase their groceries or household appliances. The switching costs are too high, and the benefits are too intangible. The ideology of freedom and decentralization that was a reaction to the banking crisis (

Nakamoto 2008) did not translate into action or broader crypto adoption according to the experts interviewed for the study. Two of the respondents included an economist and a retailer of luxury goods. They had both commented on the fact that Bitcoin is quite efficient for high value, but infrequent transactions, particularly cross-border ones. However, credit card companies excel at low value and high frequency payments because transaction clearance is much faster than blockchain-based ledgers. This is not dissimilar from RTGS, or Real Time Gross Settlement systems used for inter-bank settlements. These are nearly instantaneous, as opposed to the ACH, or Automated Clearing House transactions which clear in batches and often take days to clear. In a two-sided marketplace neither merchants, nor customers are likely to accept the delay in everyday crypto transactions and settlements, stifling adoption.

We had taken these two sources and their conclusions, and then applied the classic Technology Adoption Model (

Davis 1989) to form a hypothesis model about brand as an external determinant factor. We had added demographic questions, general questions about exposure to cryptocurrencies, and then concluded with some “what if” scenarios to gauge the comfort level around the types of entities that could play a role in the future evolution of digital currencies. The focus is to find out if the brand, and what kind would provide enough assurance to the consumer in order to increase uptake. This could be focused on “Bitcoin 2.0”, and what it would look like, or the evolution of some of the new cryptocurrencies currently seeing significant uptake in the business-to-business world, like the Ethereum based governance tokens used to back smart contracts in supply chain and other domains.

3. Issues and Opportunities Identified in the Research

Our literature review found a lot of research focusing on crypto adoption barriers, but most were about the technology, regional societal and political drivers, usability, and switching costs, among other factors. Another, more recent comprehensive review of articles related to Bitcoin found that 33.4% of publications were related to computer science, 13.2% to Engineering, 11.2% to Mathematics, and only 5.9% were looking at social sciences, confirming the technical focus of the research to date (

Aysan et al. 2021). There was an ever bigger gap in the research, where few had looked at brand as an adoption barrier. We did find papers about how brand influences technology adoption, but it was focused on mobile, internet banking, and not cryptocurrencies. The sections below describe the findings, leads, and theories surfaced during our prior research, and how we had pivoted to focus on brand as an adoption factor. This will form the foundation for the hypothesis and the surveys we plan to administer later to confirm it.

3.1. Issue 1: Most Crypto Adoption Research Focuses on Early Adopters and Not on the General Consumer

Our literature review revealed that the analysis of adoption of crypto had focused on the only a few factors and a very narrow sector of the population (

Kowalski et al. 2022). First most of the studies had either looked at early adopters (

Walton and Johnston 2018), technologically savvy insiders (

Saiedi et al. 2020), or individuals who self-selected because of libertarian politics or severe economic constraints in their countries (

Walton and Johnston 2018;

Bashir et al. 2016). This makes it difficult to determine why this revolutionary financial instrument has not advanced from early adopter to the early majority stage of the innovation adoption lifecycle (

Rogers 2003). For example, one study looking at trust in Bitcoin referenced discussion fora, like Bitcointalk.org, and this site started as a forum for communication among developers (

Marella et al. 2020), so it probably does not reflect the average consumer sentiment.

Another study talks about adopter types when looking at new mobile services. They found that early adopters focused on perceived value. Late adopters were in contrast more reliant on brand satisfaction, and consumers were in general more dependent on trust and less on perceived value (

Lam and Shankar 2014). This might provide a hint as to why cryptocurrency adoption never moved beyond the early adoption phase, since Bitcoin, and other cryptocurrencies were brandless and did not need institutional trust by design, where one is supposed to trust in the cryptography and the math alone. More work needs to be done around perceptions held by the average consumer, instead of the early adopters.

3.2. Issue 2: Most Research Focuses on Predictable Adoption Barriers and Looks at Crypto through the Technology Lens, and Not as a Payment Method or Currency with All of Its Societal and Behavioral Elements

Several theories had emerged blaming slow adoption of crypto on a limited set of adoption factors like immature technologies (

Li 2019), poor usability (

Eshkandary et al. 2015), volatility (

Polasik et al. 2015), or lack of government regulations (

Comben 2018). There have been a number of advances over the last 14 years around more scalable technology platforms, like the Lightning Network protocol for Bitcoin, improvements around wallet usability, new government regulations, and attempts to create less volatile cryptocurrencies by tying them to existing fiat currencies, like Facebook’s Libra. Consumers and governments remained skeptical (

Dwoskin and De Vynck 2022). Most of the adoption barrier studies found in the literature review looked at crypto as a standalone technological instrument, and not as a broader phenomenon representing cultural, political, and societal drivers. Behavioral elements of this revolutionary blockchain-based technology are also seldom considered, with this study being one exception and underlining how governments and businesses can enhance trust, and thus increase acceptance (

Albayati et al. 2020).

We have also seen that mainstream consumers perceive the switching costs for cryptocurrencies to be too high, as compared to benefits and value offered by credit cards, PayPal, Venmo, cash, or other payment methods (

Presthus and O’Malley 2017;

Jonker 2019;

Alshamsi and Andras 2019;

Zeitler et al. 2019;

Folkinshteyn and Lennon 2016). Consumers also perceive crypto as their most precious asset, so many are not interested in spending it first. Specifically,

Luther (

2016) had employed a model developed by

Dowd and Greenaway (

1993), where he showed that agents will not adopt a theoretically better currency when network effects and switching costs are present. Only instability or government could alter this balance. We have seen this occurring with the decrees to make Bitcoin legal tender in El Salvador (

Sigalos 2022), albeit with mixed results. Digital money is multifaceted, so a more nuanced approach than a simple technology adoption model might be warranted that includes cultural, political, and human factor considerations of brands that represent digital currencies. One more aspect to consider is the fact that Bitcoin risk profile is more closely linked to stocks, bonds, and commodities, and not safe heaven assets like the United States dollar (

Wang et al. 2022). Right now, digital currencies like Bitcoin do not have any “branded” entities backing them, but consumers do have opinions about them, and we would like to explore these attitudes further, including possible ways for cryptocurrencies to evolve beyond their current configurations and stakeholders.

3.3. Opportunities for a New Approach: Focus on General Consumer and Adoption Factors Dealing with Trust and Brand as a Factor

Our literature review (

Kowalski et al. 2022) and subsequent interviews with domain experts (

Kowalski 2021) lead us to believe that the slow adoption is not due to the previously identified factors but is instead related to a paradox that is tied to both the technology and the societal and cultural aspects of money (

Parino et al. 2018;

Dodd 2017;

Yoo et al. 2020). We refer to it as the “missing human factor”. On one hand, many appreciate the lack of government control and anonymity inherent in the design of crypto based on the blockchain, yet they still want the assurances offered by federal entities, or at other times want a vendor phone number to call, if they encounter fraud or lose their password (

Gao et al. 2015;

Sas and Khairuddin 2017). Consumers are attracted to decentralized digital currencies as evidenced by the USD 3 trillion capitalization (

White House Fact Sheet 2022), but still desire the backing of governments, and/or businesses.

What sort of entity or brand could satisfy this paradox and ensure broader uptake? Could “Bitcoin 2.0” evolve to placate consumers, or is a new consortium or design necessary?

We would like to propose that Bitcoin and other crypto are not adopted by the general consumer as a payment method because of the absence of brand, the lack of trust and or security in the “system” and its inherent anonymity and lack of recourse, similar to what other studies had found (

Corritore et al. 2003;

Murko and Vrhovec 2019). These concepts are in turn tied to an entity or brand that consumers are familiar with. Previous studies on trust in the context of technology adoption have placed emphasis on the value of brand, be it a corporation, a government, or a hybrid alliance.

Alaeddin and Altounjy (

2018) has found that one must have awareness and trust in order to facilitate technology adoption. Yet, few researchers have posed direct questions, or attempted to measure the relationship of brand to cryptocurrency adoption, and none, to our knowledge have asked “what type” of brand would be best.

4. Technology Adoption Models, Trust and Brand

There are a number of studies showing that technology adoption, including internet banking and mobile applications are highly dependent on trust (

Alaeddin and Altounjy 2018;

Cheng and Yeung 2010). If people trust an entity, be it a corporation, government, or a bank they are more likely to try something, switch to it, or adapt it. Trust is usually viewed along two dimensions: Perceived Competence and Perceived Credibility (

Ganesan 1994). Individuals also tend to correlate trust with brand. This is partly why phishing attacks are successful. Someone masquerading as a trusted bank or online platform tricks users into signing into a similar looking website and they get the credentials for the real one.

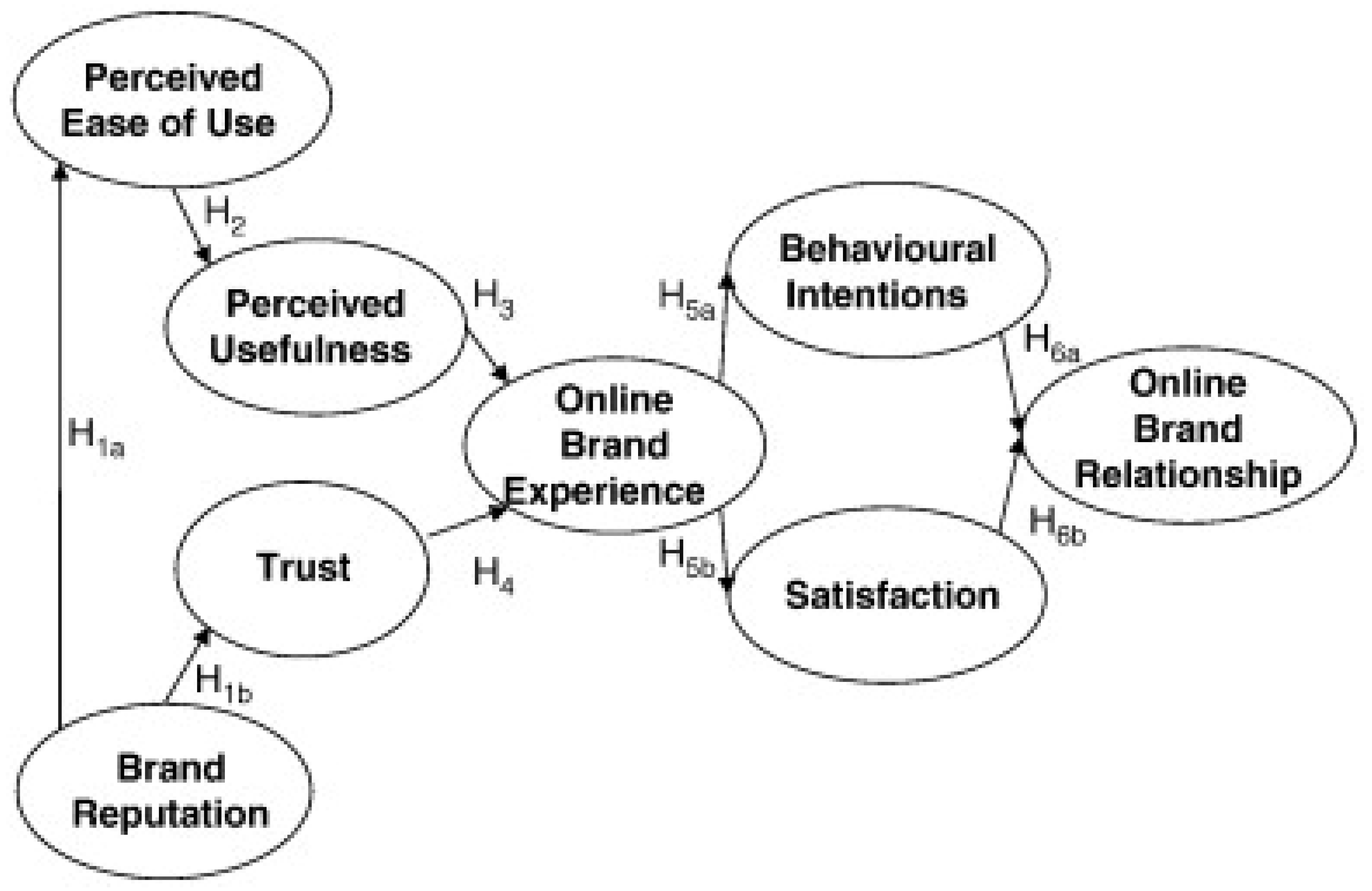

Morgan-Thomas and Veloutsou (

2013) ties trust and brand, stipulating that trust positively affects the online brand experience, and those positive experiences result in behavioral intentions that lead to users forming a relationship with a brand. We did find some new approaches in the literature, where marketing researchers focus on emotive factors (

Okazaki 2006), while older technology adoption literature based on

Davis’ (

1989) work zeros in on mostly functional outcomes, like usefulness or specific features. This contrast, or perhaps a symbioses of emotive and functional factors, is illustrated in

Figure 1, and it is useful for our hypothesis around brand as an adoption factor.

When researchers define trust in the context of technology adoption they analyze it in the context of three dimensions of security, product factors, and social influences (

AlHogail 2018). Most agree that trust is an acknowledged motivator in technology adoption (

Gefen et al. 2003). Additionally, trust is again often defined in terms of brand. One set of researchers looking at adoption of mobile services found another interrelation, where perceived reputation and corporate brand affected the consumers’ trust (

Gao and Yang 2014).

Blockchain’s nature and Bitcoin’s design focus on independence, decentralization, and democratic autonomy, but this also means no phone number to call, no familiar name to reference and trust, no vetted training and no recourse, if consumers need protections, support, or when disputes arise. The technology is also at an early stage and involves concepts and abstractions involving private and public keys, among others, and these are often not easily understood by the general consumer. Usability and lack of training and information affect adoption (

Alshamsi and Andras 2019). Additionally, it is not clear whom the consumer would trust to better understand these concepts and start using Bitcoin or others for payments. Mass adoption of Bitcoin or other crypto as a payment method has in part been thwarted because there is no legal, monetary, and institutional backing, just the theoretical concept of trust through technology (

Marella et al. 2020). A person has to trust an ideal or a system design, instead of an entity.

DeFilippi et al. (

2022) goes even further, and argues that blockchain is not a “trustless” technology but rather a confidence machine, where cryptography, mathematics, and game theory increase the confidence in the operation of a computational system. However, even those systems are not “pure math” and have governance and actors that involve tensions between confidence and trust.

4.1. Marketing Brand

There are a number of definitions of brand, but this one might be most appropriate and all-encompassing for the modern world: “A brand is a cluster of functional and emotional values which promise a particular experience” (

Ambler and Styles 1996), ‘creating a holistic experience that delivers an emotional fulfillment so that customer develops a special bond with and unique trust in the brand’ (

Kotler 2000).

A corporate brand is often defined in three dimensions. The first is about “Being Known” and collective perceptions and awareness. The second is “Being Known for Something” or relating to outcomes. The third is called “Generalized Favorability” and refers to judgment and perceptions of the observers (

Lange et al. 2011). What sort of a brand could help popularize a cryptocurrency, if brand affects product choice? Paradoxically a strong brand could also lull consumers into a false sense of security (

Hui 2010). This is again why phishing attacks are so successful. Brand name can also increase the perceived credibility and perceived quality, reducing the risk for the consumer and facilitating their purchase or switch (

Van Osselaer and Alba 2000).

Brand, trust, and technology adoption have all been studied, but seldom has anyone looked at a brand in the context of cryptocurrency adoption. Blockchain is the elegant and foundational concept behind crypto (

Nakamoto 2008). Our research indicated that this technical foundation and ideology might need to be bolstered by a trustworthy brand in order to gain wider adoption as a payment method. This study hopes to confirm this hypothesis when it comes to Bitcoin and also shed some light on what kind of brand the general consumer would trust, if they were to adopt an electronic currency, once it evolves beyond a pure decentralized model. Would it be a government, a technology company, a bank, or a hybrid alliance? While Bitcoin and other cryptocurrencies are currently decentralized and “brandless” they could evolve to include backing from certain types of institutions. This study aims to study “what if” scenarios.

4.2. Perceived Credibility and Quality

The classic definition of perceived credibility has 3 components, namely trustworthiness, attractiveness, and expertise (

McCroskey 1966), but this definition is grounded in marketing and credibility of the speaker. Other scholars who had had looked at perceived credibility in the world of banking or e-commerce had determined that security and privacy were even more important (

Wang et al. 2003;

Soleimani 2022).

A number of scandals involving crypto exchanges being hacked, electronic wallet credentials being stolen, and even information extortion incidents in the news highlight this concern (

Brezo and Bringas 2012). Consumers are reluctant to adopt Bitcoin or other crypto as a payment method out of fear that their personally identifiable information can be stolen, identity hijacked, or that they may become victims of theft, extortion, and fraud. Many also do not understand how it works, and it is becoming increasingly hard to know whom to trust. Brandless cryptocurrencies have understandably struggled to achieve credibility because bad actors can mostly remain anonymous, and there are no government protections, insurance, or regulations in this space.

Davis (

1989) had employed the technology adoption model to focus on intention to use a particular technology, and also showed that this is dependent on attitude. This concept, in turn consists of perceived ease of use and perceived usefulness. Traditional TAM models might be appropriate for simple technological advances and their adoption. However, money, or digital money in this case is more complex and includes societal and cultural elements, thus the need to augment TAM with external factors, namely perceived credibility and brand.

Brand name has been shown to augment perceived credibility and perceived quality and could therefore drive adoption (

Van Osselaer and Alba 2000). We intend to use this foundation to further study the impact of brand on digital currency uptake and learn more about the types of entities and consumer attitudes towards them.

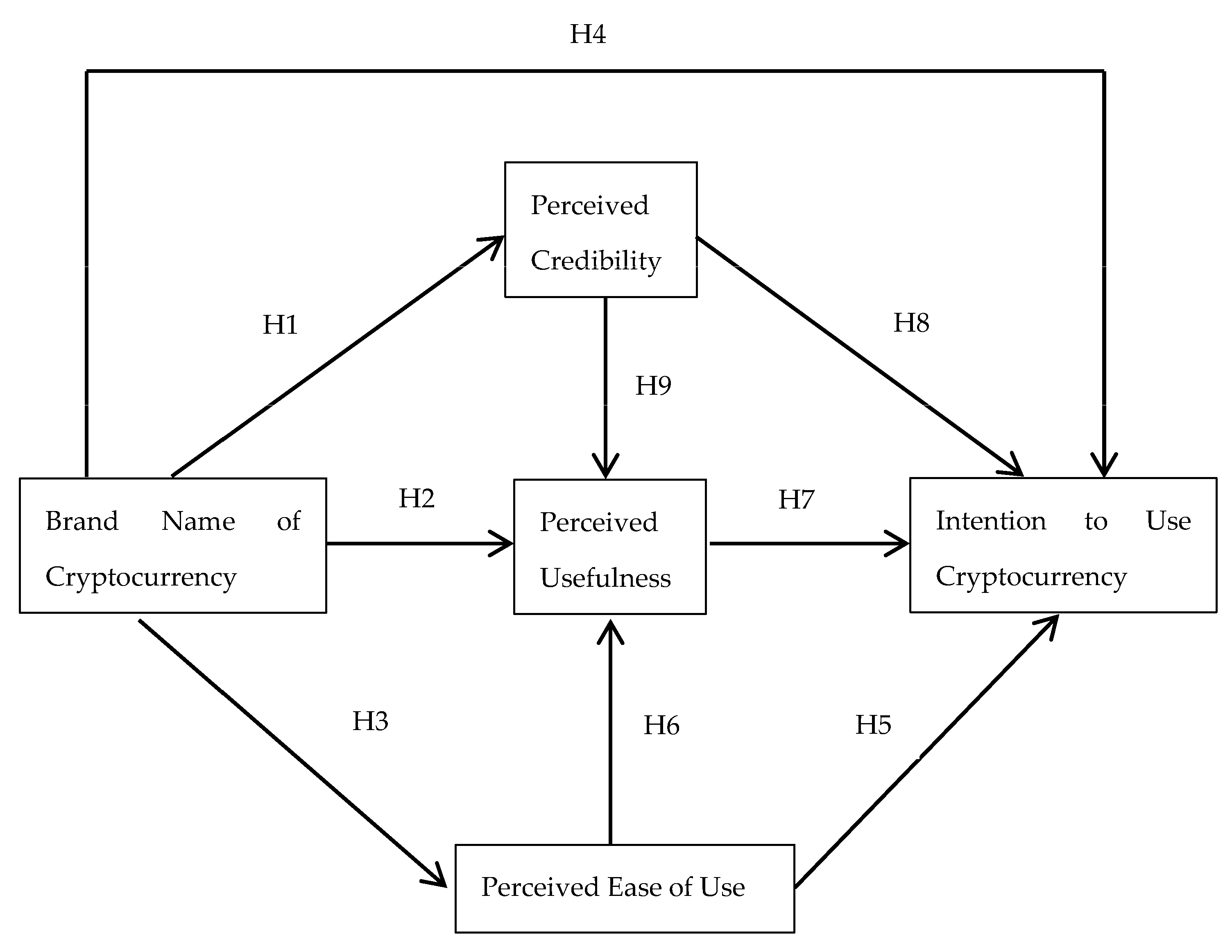

5. Model and Hypothesis Development

We would thus like to posit several hypotheses to better inform the path to broad consumer adoption of cryptocurrency and these will focus on the Impact of Brand on the Adoption of Cryptocurrency as a Payment Method by Consumers in the United States. This study will take a classical TAM approach of first identifying factors that affect general consumers’ desire to adopt cryptocurrencies as a payment method, and these will include brand name, perceived credibility, perceived usefulness, and perceived ease of use. We will then create a model for intention to use crypto based on TAM, where brand name is treated as an external factor. We will study Bitcoin, but also try to see what types of brands the survey respondents feel would be worth using and adopting.

Brand name literature and studies referencing the adoption of cryptocurrencies allowed us to formulate a model in

Figure 1. The nine hypotheses are listed in

Figure 2. We then add an element to further probe the attitudes of consumers about the type of brand they are likely to adopt (technology firm, banking, government, and hybrid). This will form the null hypothesis (

Table 1), where we state that brand type does not matter, as it pertains to digital currency adoption (

Table 2).

6. Research Methodology

We will conduct an empirical study in the form of a survey based on TAM, but with the modifications that include additional external factors, including brand. We will add a section with questions about the types of entities and test them using structural equation modeling. We are planning on a 300 plus sample size. Focus will be in the United States, and the user profile will focus on the general consumer. We will include some standard demographic questions, as well as some questions to gauge awareness and usage of cryptocurrencies. We will focus the majority of adoption barrier questions on Bitcoin as the most popular cryptocurrency. We will include an additional series of questions about stablecoins, country-issued crypto, and even smart contract-based government tokens in order to gauge consumer perceptions about the emerging trends. We intend to run a pilot test to refine the survey, and we will hire a firm to identify the sample, offering incentives to the participants. Technologists, blockchain experts, and academics studying blockchain and cryptocurrencies will be excluded based on the answers to the recruitment screener or the demographic section.

Once the data from the draft survey are collected, we intend to perform a Confirmatory Factor Analysis on the data, test for parameter reliability (C.R.), and look at bias.

7. Discussion

The collapse of the FTX cryptocurrency exchange and the preceding “crypto winter” have shaken consumer confidence in what is otherwise a promising technology and disruptive financial instrument based on the blockchain. Extensive advertising, sports stadium sponsorships, and Hollywood celebrity endorsements have marred the FTX brand, and the founder has been arrested. While Facebook was not a new brand their cryptocurrency effort had faltered likely because of lack of confidence in their ability to maintain data privacy, all in the context of other scandals in the background pertaining to the platform enabling election fraud and social media addiction in children (

Dwoskin and De Vynck 2022). None of the cryptocurrencies have been adopted as a general payment method in the United States despite a high degree of awareness and notoriety. Some pundits blame the technology, poor usability, criminal incidents, volatility, or lack of regulations. While these factors contribute to low adoption, very few researchers have looked at the role of brand and trust, as it pertains to crypto adoption and perceived risk for the general consumer.

The authors would like to submit a hypothesis, where we are looking to Instrument a future survey that focuses on the consumer and the human factor, and not the early adopters or speculators. It will examine perceptions of cryptocurrencies, including a hypothesis about how Bitcoin might evolve, if technology companies, nation states, regulators, and traditional banks collaborate to transform to create new blockchain-based instruments. A large percentage of the questions will be about Bitcoin as the most popular cryptocurrency, and where we can find out why people have not chosen it as a payment method. However, we will also ask some open-ended questions about the potential of other cryptocurrencies, including stablecoins, crypto issued by governments, or even some of the governance tokens tied to smart contracts. All forms have some potential to evolve as a payment method for consumers, business to business, cross-border, or even remittance transactions and payments.

We intend to get more information about how consumers perceive digital currencies. Current forms like Bitcoin, Doge, or Facebook’s Libra have not gained widespread adoption as a general-purpose payment method in the United States despite high awareness (

Biggs 2018). What type of entity would compel the average consumer to adopt it? Would it come from a technology firm, like Google or Twitter in Silicon Valley, a traditional bank, like Wells Fargo or Chase, a mobile payments processor like Venmo, or would it need to come with government backing? Or would it be a hybrid, backed by a public private consortium?

Perhaps there is a way to de-risk cryptographic transactions for the general consumer by introducing the element of a trusted or familiar brand. It seems that crypto’s design based on Lawrence Lessig’s “code is law”, or the fact that the technology itself provides the assurances is not enough, or we would have moved from the early adopter phases to general acceptance in almost 13 years. We hope to find out why, and how to increase adoption of cryptocurrencies as a general consumer payment method.

8. Limitations

There are several limitations we will monitor:

The collapse of the FTX crypto exchange is still developing, and we do not know what has transpired, and how it will affect consumer confidence in cryptocurrencies. We may need to revisit the literature review after the fallout.

Usability remains a challenge, and it may play a significant role as an adoption barrier.

Regulations are quickly evolving, and United States, European Community, and other regulators could radically alter the landscape and consumer perceptions of trust.

Research has shown that cryptocurrencies move together, where the values are correlated between six major ones (

Vaz de Melo Mendes and Carneiro 2020). It will be interesting to study how the co-dependent values correlate to perceptions of their respective “brands”.

Author Contributions

Conceptualization, L.K., W.G.; methodology, L.K., W.G., S.L., N.P.; investigation, L.K., S.L.; resources, L.K., W.G.; writing—original draft preparation, L.K.; writing—review and editing, L.K., W.G., S.L.; supervision, W.G., S.L., N.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alaeddin, Omar, and Rana Altounjy. 2018. Trust, Technology Awareness and Satisfaction Effect into the Intention to Use Cryptocurrency among Generation Z in Malaysia. International Journal of Engineering and Technology 7: 8–10. [Google Scholar] [CrossRef]

- Albayati, Hayder, Kyoung Suk Kim, and Jeung Jae Rho. 2020. Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technology in Society 20: 101320. [Google Scholar] [CrossRef]

- AlHogail, Areej. 2018. Improving IoT Technology Adoption through Improving Consumer Trust. Technologies 6: 64. [Google Scholar] [CrossRef]

- Alshamsi, Abdullah, and Peter Andras. 2019. User perception of Bitcoin usability and security across novice users. International Journal of Human-Computer Studies 126: 94–110. [Google Scholar] [CrossRef]

- Ambler, Tim, and Chris Styles. 1996. Brand development versus new product development: Towards a process model of extension decisions. Marketing Intelligence and Planning 14: 10–19. [Google Scholar] [CrossRef]

- Aysan, Ahmet Faruk, Huseyin Bedit Demirtaş, and Mustafa Saraç. 2021. The Ascent of Bitcoin: Bibliometric Analysis of Bitcoin Research. Journal of Risk and Financial Management 14: 427. [Google Scholar] [CrossRef]

- Bashir, Masooda, Beth Strickland, and Jeremiah Bohr. 2016. What Motivates People to Use Bitcoin? Edited by Emma Spiro and Yong-Yeol Ahn. Cham: Springer International Publishing, p. 347. [Google Scholar]

- Biggs, John. 2018. Study: 6 in 10 Americans Have Heard about Bitcoin. TechCrunch. Available online: https://social.techcrunch.com/2018/01/23/study-6-in-10-americans-have-heard-aboutbitcoin/ (accessed on 12 June 2021).

- Binder, Matt. 2022. The Biggest Crypto Scams of 2022 (So Far). Mashable, October 3. Available online: https://mashable.com/article/biggest-crypto-scams-2022 (accessed on 22 November 2022).

- Brezo, Felix, and Pablo Bringas. 2012. Issues and Risks Associated with Cryptocurrencies such as Bitcoin. The Second International Conference on Social Eco-Informatics. Available online: Thinkmind.org (accessed on 12 May 2020).

- Carlson, Jill. 2019. Cryptocurrency Is Most Useful for Breaking Laws and Social Constructs. Available online: https://www.coindesk.com/cryptocurrency-is-most-useful-for-breaking-laws-and-socialconstructs (accessed on 12 April 2020).

- Catalini, Christian, and Catherine Tucker. 2016. Seeding the S-Curve? The Role of Early Adopters in Diffusion. Rochester: National Bureau of Economic Research. [Google Scholar]

- Cheng, Edwin, and Wai-yeyng Yeung. 2010. An Empirical Study of the Impact of Brand Name on Personal Customers’ Adoption of Internet Banking in Hong Kong. International Journal of E-Business Research 6: 32–51. [Google Scholar] [CrossRef][Green Version]

- Christin, Nicolas. 2012. Traveling the Silk Road: A measurement analysis of a large anonymous online marketplace. Paper presented at the 22nd International World Wide Web Conference, Rio de Janeiro, Brazil, May 13–17. [Google Scholar]

- Comben, Christina. 2018. 9 Major Barriers to Widespread Cryptocurrency Adoption. Available online: https://coincentral.com/9-barriers-cryptocurrency-adoption/ (accessed on 4 February 2020).

- Condon, Christopher. 2022. FTX Debacle Shows Need for Crypto Regulation, Yellen Says, Bloomberg.com. November 12. Available online: https://www.bloomberg.com/news/articles/2022-11-12/yellen-says-ftx-debacle-shows-need-for-crypto-regulation?utm_source=google&utm_medium=bd&cmpId=google&leadSource=uverify%20wall (accessed on 5 December 2022).

- Corritore, Cynthia, Beverly Kracher, and Susan Wiedenbeck. 2003. On-line trust: Concepts, evolving themes, a model. International Journal of Human-Computer Studies 58: 737–58. [Google Scholar] [CrossRef]

- Davis, Fred. 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly 13: 319–40. [Google Scholar]

- DeFilippi, Primavera, Morshed Mannan, and Wessel Reijers. 2022. Blockchain as a confidence machine: The problem of trust & challenges of governance. Technology in Society 62: 101284. [Google Scholar]

- Dodd, Nigel. 2017. The Social Life of Bitcoin. Theory, Culture & Society 35: 35–56. [Google Scholar]

- Dowd, Kevin, and Sir David Greenaway. 1993. Currency Competition, Network Externalities and Switching Costs: Towards an Alternative View of Optimum Currency Areas. Economic Journal 103: 1180–89. [Google Scholar] [CrossRef]

- Dwoskin, Elizabeth, and Gerrit De Vynck. 2022. Facebook’s Cryptocurrency Failure Came after Internal Conflict and Regulatory Pushback. The Social Media Giant’s Shuttering of the Diem Project Followed Clashes over Its Direction and Sustained Opposition in Washington. Washington Post, January 28. Available online: https://www.washingtonpost.com/technology/2022/01/28/facebook-cryptocurrency-diem/ (accessed on 21 November 2022).

- Eshkandary, Shayan, David Barrera, Elizabeth Stobert, and Jeremy Clark. 2015. A First Look at the Usability of Bitcoin Key Management. San Diego: Internet Society. [Google Scholar]

- Folkinshteyn, Daniel, and Mark Lennon. 2016. Braving Bitcoin: A technology acceptance model (TAM) analysis. Journal of Information Technology Case and Application Research 18: 220–49. [Google Scholar] [CrossRef]

- Ganesan, Shankar. 1994. Determinants of Long-Term Orientation in Buyer-Seller Relationships. The Journal of Marketing 58: 1–19. [Google Scholar] [CrossRef]

- Gao, Shang, and Yuhao Yang. 2014. The Role of Trust towards the Adoption of Mobile Services in China: An Empirical Study. Paper presented at 13th Conference on e-Business, e-Services and e-Society (I3E), Sanya, China, November 28–30; pp. 46–57. [Google Scholar]

- Gao, Xianyi, Gradeigh Clark, and Janne Lindqvist. 2015. Of Two Minds, Multiple Addresses, and One History: Characterizing Opinions, Knowledge, and Perceptions of Bitcoin Across Groups. arXiv arXiv:1503.02377. [Google Scholar] [CrossRef][Green Version]

- Gefen, David, Elena Karahanna, and Detmar Straub. 2003. Trust and TAM in online shopping: An integrated model. MIS Quarterly 27: 51–90. [Google Scholar] [CrossRef]

- Glaser, Florian, Kai Zimmermann, Martin Haferkorn, Moritz Christian Weber, and Michael Siering. 2014. Bitcoin—Asset or Currency? Revealing Users’ Hidden Intentions. Available online: https://ssrn.com/abstract=2425247 (accessed on 14 October 2022).

- Henry, Christopher, Kim Huynh, and Gradon Nicholls. 2019. Bitcoin Awareness and Usage in Canada: An Update. The Journal of Investing 28: 21–31. [Google Scholar] [CrossRef]

- Hileman, Garrick. 2014. From Bitcoin to the Brixton Pound: History and Prospects for Alternative Currencies (Poster Abstract). In Financial Cryptography and Data, Security. Berlin and Heidelberg: Springer, p. 163. [Google Scholar]

- Hui, Wendy. 2010. Brand, knowledge, and false sense of security. Information Management & Computer Security 18: 162–72. [Google Scholar]

- Jonker, Nicole. 2019. What drives the adoption of crypto-payments by online retailers? Electronic Commerce Research and Applications 35: 100848. [Google Scholar] [CrossRef]

- Kotler, Philip. 2000. Marketing Management: The Millenium Edition. Upper Saddle River: Prentice Hall. [Google Scholar]

- Kowalski, Luke. 2021. Blog: Digital Currency Adoption Is More Closely Tied to Perceptions of Trust and Brand Than to Technology or Ideological Motivators, University of California, Berkeley Sutardja Center for Entrepreneurship and Technology. Available online: https://scet.berkeley.edu/digital-currency-adoption-is-more-closely-tied-to-perceptions-of-trust-and-brand-than-to-technology-or-ideological-motivators/ (accessed on 16 December 2022).

- Kowalski, Luke, William Green, and Simon Lilley. 2022. Perceived benefits and adoption barriers for Bitcoin following 12 years of research: The unintended consequences of the missing Human Factor. Paper presented at International Finance and Banking Society Conference, Naples, Italy, September 7–9. [Google Scholar]

- Lam, Shun Yin, and Venkatesh Shankar. 2014. Asymmetries in the Effects of Drivers of Brand Loyalty between Early and Late Adopters and Across Technology Generations. Journal of Interactive Marketing 28: 26–42. [Google Scholar] [CrossRef]

- Lange, Donald, Peggy Lee, and Ye Dai. 2011. Organizational reputation: A review. Journal of Management 37: 153–84. [Google Scholar] [CrossRef]

- Li, Kenny. 2019. The Blockchain Scalability Problem & the Race for Visa-Like Transaction Speed. Available online: https://towardsdatascience.com/the-blockchain-scalability-problem-therace-for-visa-like-transaction-speed-5cce48f9d44 (accessed on 13 March 2020).

- Luther, William J. 2016. Bitcoin and the future of digital payments. The Independent Review 20: 397–404. [Google Scholar] [CrossRef]

- Marella, Venkata, Bikesh Upreti, Jani Merikivi, and Virpi Kristiina Tuunainen. 2020. Understanding the creation of trust in cryptocurrencies: The case of Bitcoin. Electron Markets 30: 259–71. [Google Scholar] [CrossRef]

- McCroskey, James C. 1966. Scales for the measurement of ethos. Speech Monographs 33: 65–72. [Google Scholar] [CrossRef]

- Morgan-Thomas, Anna, and Cleopatra Veloutsou. 2013. Beyond technology acceptance: Brand relationships and online brand experience. Journal of Business Research 66: 21–27. [Google Scholar] [CrossRef]

- Murko, Aleksander, and Simon Vrhovec. 2019. Bitcoin adoption: Scams and anonymity may not matter but trust into Bitcoin security does. Paper presented at Third Central European Cybersecurity Conference, Munich, Germany, November 14–15; p. 1. [Google Scholar]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 14 January 2020).

- Okazaki, Shintaro. 2006. Excitement or sophistication? A preliminary exploration of online brand personality. International Marketing Review 23: 279–303. [Google Scholar] [CrossRef]

- Parino, Francesco, Mariano G. Beiro, and Laetitia Gauvin. 2018. Analysis of the Bitcoin blockchain: Socio-economic factors behind the adoption. EPJ Data Science 7: 1–23. [Google Scholar] [CrossRef]

- Polasik, Michal, Anna Iwona Piotrowska, Tomasz Piotr Wisniewski, Radoslaw Kotkowski, and Geoffrey Lightfoot. 2015. Price Fluctuations and the Use of Bitcoin: An Empirical Inquiry. International Journal of Electronic Commerce 20: 9–49. [Google Scholar] [CrossRef]

- Presthus, Wanda, and Nicholas Owen O’Malley. 2017. Motivations and Barriers for End-User Adoption of Bitcoin as Digital Currency. Procedia Computer Science 121: 89–97. [Google Scholar] [CrossRef]

- Rogers, Everett. 2003. Diffusion of Innovations, 5th ed. New York: Simon and Schuster. [Google Scholar]

- Saiedi, Ed, Anders Broström, and Felipe Ruiz. 2020. Global drivers of cryptocurrency infrastructure adoption. Small Business Economics 57: 353–406. [Google Scholar] [CrossRef]

- Sas, Corina, and Irni Khairuddin. 2017. Design for Trust: An Exploration of the Challenges and Opportunities of Bitcoin Users. Paper presented at 2017 CHI Conference on Human Factors in Computing Systems, Denver, CO, USA, May 6–11. [Google Scholar]

- Schuh, Scott, and Ozz Shy. 2015. U.S. Consumers’ Adoption and Use of Bitcoin and Other Virtual Currencies. Available online: https://www.banqueducanada.ca/wp-content/uploads/2015/12/us-consumers-adoption.pdf (accessed on 22 June 2021).

- Sigalos, MacKenzie. 2022. El Salvador Buys the Bitcoin Dip, Adding 500 Coins to Its Balance Sheet. CNBC, May 9. Available online: https://www.cnbc.com/2022/05/09/el-salvador-buys-500-bitcoin-as-crypto-market-sell-off-continues.html (accessed on 20 December 2022).

- Soleimani, Marzieh. 2022. Buyers’ trust and mistrust in e-commerce platforms: A synthesizing literature review. Information Systems and e-Business Management 20: 57–78. [Google Scholar] [CrossRef]

- Van Osselaer, Stijn, and Joseph W. Alba. 2000. Consumer learning and brand equity. The Journal of Consumer Research 27: 1–16. [Google Scholar] [CrossRef]

- Vaz de Melo Mendes, Beatriz, and André Fluminense Carneiro. 2020. A Comprehensive Statistical Analysis of the Six Major Crypto-Currencies from August 2015 through June 2020. Journal of Risk and Financial Management 13: 192. [Google Scholar] [CrossRef]

- Walton, Aiden, and Kevin Johnston. 2018. Exploring Perceptions of Bitcoin Adoption: The South African Virtual Community Perspective. Interdisciplinary Journal of Information, Knowledge, and Management 13: 165–82. [Google Scholar] [CrossRef]

- Wang, Panpan, Xiaoxing Liu, and Sixu Wu. 2022. Dynamic Linkage between Bitcoin and Traditional Financial Assets: A Comparative Analysis of Different Time Frequencies. Entropy 24: 1565. [Google Scholar] [CrossRef]

- Wang, Yi-Shun, You-Min Wang, Hsin-Hui Lin, and Tzung-I Tang. 2003. Determinants of user acceptance of Internet banking: An empirical study. International Journal of Service Industry Management 14: 501–18. [Google Scholar] [CrossRef]

- White House Fact Sheet. 2022. FACT SHEET: White House Releases First-Ever Comprehensive Framework for Responsible Development of Digital Assets. September 16. Available online: https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/16/fact-sheet-white-house-releases-first-ever-comprehensive-framework-for-responsible-development-of-digital-assets/ (accessed on 27 November 2022).

- Yoo, Kyeongsik, Kunwoo Bae, Eunil Park, and Taeyong Yang. 2020. Understanding the diffusion and adoption of Bitcoin transaction services: The integrated approach. Telematics and Informatics 53: 101302. [Google Scholar] [CrossRef]

- Zeitler, Peter, M. Harrison, Suzanne Baldwin, Robert Duncan, Tulloch Spell, and Jan Wijbrans. 2019. Ian McDougall (1935–2018). Washington, DC: Eos. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).