An Extended Fama-French Multi-Factor Model in Direct Real Estate Investing

Abstract

:1. Introduction

2. Literature Review

3. Research Design

3.1. Data

3.2. Model Setup

4. Empirical Results and Discussion

4.1. The Two Spatial-Temporal-Risk Factors

4.2. The Three Temporal-Risk Factors

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Alves, Paulo. 2013. The Fama French Model or the capital asset pricing model: International evidence. The International Journal of Business and Finance Research 7: 79–89. [Google Scholar]

- Baum, Andrew. 2020. Tokenisation—The Future of Real Estate Investment? The University of Oxford Research. Available online: https://www.sbs.ox.ac.uk/sites/default/files/2020-01/tokenisation.pdf (accessed on 2 July 2021).

- Brueggeman, William, Andrew Chen, and Thomas Thibodeau. 1984. Real estate investment funds: Performance and portfolio considerations. Real Estate Economics 12: 333–54. [Google Scholar] [CrossRef]

- Cannon, Susanne, Norman Miller, and Gurupdesh Pandher. 2006. Risk and Return in the U.S. Housing Market: A Cross-Sectional Asset-Pricing Approach. Real Estate Economics 34: 519–52. [Google Scholar] [CrossRef]

- Case, Karl, John Cotter, and Stuart Gabriel. 2011. Housing Risk and Return: Evidence from a Housing Asset-Pricing Model. Journal of Portfolio Management 37: 89–109. [Google Scholar] [CrossRef]

- Chambers, David, Christophe Spaenjers, and Eva Steiner. 2019. The rate of return on real estate: Long-run micro-level evidence. In HEC Paris Research Paper. No. FIN-2019-1342. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3407236# (accessed on 2 July 2021).

- Chen, Mark, Qinxi Wu, and Baozhong Yang. 2019. How Valuable Is FinTech Innovation? The Review of Financial Studies 32: 2062–106. [Google Scholar] [CrossRef]

- Cheung, Ka Shing, and Siu Kei Wong. 2019. Entry and exit affordability of shared equity homeownership: An international comparison. International Journal of Housing Markets and Analysis 13: 737–52. [Google Scholar] [CrossRef]

- Cheung, Ka Shing, Chung Yim Yiu, and Chuyi Xiong. 2021. Housing market in the time of pandemic: A price gradient analysis from the COVID-19 epicentre in China. Journal of Risk and Financial Management 14: 108. [Google Scholar] [CrossRef]

- Chong, James, Joëlle Miffre, and Simon Stevenson. 2009. Conditional Correlations and Real Estate Investment Trusts. Journal of Real Estate Portfolio Management 15: 173–84. [Google Scholar] [CrossRef]

- Chun, Gregory, Jarjisu Sa-Aadu, and James Shilling. 2004. The role of real estate in an institutional investor’s portfolio revisited. The Journal of Real Estate Finance and Economics 29: 295–320. [Google Scholar] [CrossRef]

- CoreLogic. 2020. Property Data & Analytics, Residential Real Estate, CoreLogic, New Zealand. Available online: https://www.corelogic.co.nz/industries/residential-real-estate/property-data-analytics (accessed on 2 July 2020).

- Coşkun, Yener, Sevtap Selcuk-Kestel, and Bilgi Yilmaz. 2017. Diversification benefit and return performance of REITs using CAPM and Fama-French: Evidence from Turkey. Borsa Istanbul Review 17: 199–215. [Google Scholar] [CrossRef]

- Datastream. 2020. Databases on Historical Financial and Economic Information. Available online: https://www.library.auckland.ac.nz/subject-guides/bus/infosources/datastream_faqs.htm (accessed on 2 July 2021).

- Deng, Kuang Kuang, Siu Kei Wong, Ka Shing Cheung, and Kwok Sang Tse. 2022. Do real estate investors trade on momentum? The North American Journal of Economics and Finance 62: 101746. [Google Scholar] [CrossRef]

- DoL. 2008. Housing Markets and Migration: Evidence from New Zealand: Economic Impacts of Immigration Working Paper Series, Department of Labour, New Zealand Government. Available online: https://www.lgnz.co.nz/assets/Housing-2030-Library-Resources/a18e59989e/housing-markets-and-immigration-evidence-from-nz_compressed.pdf?fbclid=IwAR2U5J12kzAjY8gNBA-Kn7Xl8bl4t4FDzCzi3KQcCz0-2ZWLny5r21ShoI8 (accessed on 2 July 2021).

- Domian, Dale, Rob Wolf, and Hsiao Fen Yang. 2015. An assessment of the risk and return of residential real estate. Managerial Finance 41: 591–99. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1992. The cross-section of expected stock returns. Journal of Finance 47: 427–65. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Finance Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1995. Size and book-to-market factors in earnings and returns. The Journal of Finance 50: 131–55. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 2015. A five-factor asset pricing model. Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef]

- Glascock, John, Chiuling Lu, and Raymond So. 2000. Further Evidence on the Integration of REIT, Bond and Stock Returns. Journal of Real Estate Finance and Economics 20: 1–9. [Google Scholar]

- Gounopoulos, Dimitrios, Kyriaki Kosmidou, Dimitrios Kousenidis, and Victoria Patsika. 2019. The investigation of the dynamic linkages between real estate market and stock market in Greece. The European Journal of Finance 25: 647–69. [Google Scholar] [CrossRef]

- Hu, Grace Xing, Can Chen, Yuan Shao, and Jiang Wang. 2019. Fama–French in China: Size and value factors in Chinese stock returns. International Review of Finance 19: 3–44. [Google Scholar] [CrossRef]

- Huang, MeiChi. 2021. Regime switches and permanent changes in impacts of housing risk factors on MSA-level housing returns. Journal of Finance Research 26: 310–42. [Google Scholar] [CrossRef]

- Jackson, Leonard. 2020. An application of the Fama–French three-factor model to lodging REITs: A 20-year analysis. Tourism and Hospitality Research 20: 31–40. [Google Scholar] [CrossRef]

- Jensen, Michael. 1968. The performance of mutual funds in the period 1945–1964. The Journal of Finance 23: 389–416. [Google Scholar] [CrossRef]

- Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor. 2019. The rate of return on everything, 1870–2015. The Quarterly Journal of Economics 134: 1225–98. [Google Scholar] [CrossRef]

- Kennedy, Simon. 2019. Canada and New Zealand Show Signs of Housing Bubble. Bloomberg Economics. July 13. Available online: https://www.bloomberg.com/news/articles/2019-07-12/canada-new-zealand-show-signs-of-housing-bubble-says-study (accessed on 1 August 2022).

- Liao, Hsien Hsing, and Jianping Mei. 1999. Institutional Factors and Real Estate Returns-A Cross Country Study. International Real Estate Review 2: 21–34. [Google Scholar] [CrossRef]

- Ling, David, and Andy Naranjo. 1999. The integration of commercial real estate markets and stock markets. Real Estate Economics 27: 483–515. [Google Scholar] [CrossRef]

- Lintner, John. 1965. The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. The Review of Economics and Statistics 51: 224–24. [Google Scholar] [CrossRef]

- Liu, Crocker, Terry Grissom, and David Hartzell. 1990. The impact of market imperfections on real estate returns and optimal investor portfolios. Real Estate Economics 18: 453–78. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. Portfolio selection. Journal of Finance 7: 77–99. [Google Scholar]

- MBIE. 2020. Rental Bond Data, Tenancy Services, New Zealand Government, New Zealand. Available online: https://www.tenancy.govt.nz/about-tenancy-services/data-and-statistics/rental-bond-data/ (accessed on 2 July 2021).

- Montgomery, Nicolle, Graham Squires, and Iqbal Syed. 2018. Disruptive potential of real estate crowdfunding in the real estate project finance industry. Property Management 36: 597–619. [Google Scholar] [CrossRef]

- Moro-Visconti, Roberto, Salvador Cruz Rambaud, and Joaquin López Pascual. 2020. Sustainability in FinTechs: An Explanation through Business Model Scalability and Market Valuation. Sustainability 12: 10316. [Google Scholar] [CrossRef]

- Neil Myer, F., and J. Webb. 1993. Return properties of equity REITs, common stocks, and commercial real estate: A comparison. Journal of Real Estate Research 8: 87–106. [Google Scholar] [CrossRef]

- Niskanen, J., and H. Falkenbach. 2010. REITs and Correlations with Other Asset Classes: A European Perspective. Journal of Real Estate Portfolio Management 16: 227–39. [Google Scholar] [CrossRef]

- Paliienko, Oleksandr, Svitlana Naumenkova, and Svitlana Mishchenko. 2020. An empirical investigation of the Fama-French five-factor model. Investment Management and Financial Innovations 17: 143–55. [Google Scholar] [CrossRef] [Green Version]

- Panwar, Vikrant. 2016. Testing the validity of capital asset pricing model (CAPM) in the Indian stock market. Indian Journal of Research in Capital Markets 3: 49–56. [Google Scholar]

- Peng, Liang. 2016. The risk and return of commercial real estate: A property level analysis. Real Estate Economics 44: 555–83. [Google Scholar] [CrossRef]

- Peterson, James, and Cheng Ho Hsieh. 1997. Do common risk factors in the returns on stocks and bonds explain returns on REITs? Real Estate Economics 25: 321–45. [Google Scholar] [CrossRef]

- RBNZ. 2020. Secondary Market Government Bond Yields, Wholesale Interest Rates, Reserve Bank of New Zealand, New Zealand. Available online: https://www.rbnz.govt.nz/statistics/b2 (accessed on 2 July 2021).

- Ross, Stephen, and Randall Zisler. 1991. Risk and return in real estate. The Journal of Real Estate Finance and Economics 4: 175–90. [Google Scholar] [CrossRef]

- Santhi, N. S., and K. Balanaga Gurunathan. 2014. Fama-French three factors model in the Indian mutual fund market. Asian Journal of Economics and Empirical Research 1: 1–5. [Google Scholar]

- Sehgal, Sanjay, and A. Balakrishnan. 2013. Robustness of Fama-French three-factor model: Further evidence for the Indian stock market. Vision 17: 119–27. [Google Scholar] [CrossRef]

- Sehrawat, Neeraj, Amit Kumar, Narander Kumar Nigam, Kirtivardhan Singh, and Khushi Goyal. 2020. Test of capital market integration using Fama-French three-factor model: Empirical evidence from India. Investment Management and Financial Innovations 17: 113–27. [Google Scholar] [CrossRef]

- Sharpe, William. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Taneja, Yash Pal. 2010. Revisiting Fama-French three-factor model in Indian stock market. Vision 14: 267–74. [Google Scholar] [CrossRef]

- Tang, Gordon, and Wai Shum. 2003. The conditional relationship between beta and returns: Recent evidence from international stock markets. International Business Review 12: 109–26. [Google Scholar] [CrossRef]

- The Economist. 2019. Global House Price Index. The Economist. June 27. Available online: https://www.economist.com/graphic-detail/2019/06/27/global-house-price-index?date=2000-03&index=income&places=NZL&places=AUS (accessed on 2 July 2021).

- Tobin, James. 1958. Liquidity preference as behaviour towards risk. The Review of Economic Studies 25: 65–86. [Google Scholar] [CrossRef]

- Watson, Elizabeth. 2012. Asset returns and the investment choice of New Zealanders. Reserve Bank of New Zealand 75: 26–34. [Google Scholar]

- Wong, Siu Kei, and Ka Shing Cheung. 2017. Renewing a Lease at a Discount or Premium? Journal of Real Estate Research 39: 215–34. [Google Scholar] [CrossRef]

- Wu, Mengyun, Muhammad Imran, Yanhua Feng, Linrong Zhang, and Muhammad Abbas. 2017. Review and validity of capital asset pricing model: Evidence from Pakistan stock exchange. International Research in Economics and Finance 1: 21. [Google Scholar] [CrossRef]

- Xiong, Chuyi, Ka Shing Cheung, DeborahSusan Levy, and Michael Allen. 2022. The effect of virtual reality on the marketing of residential property. Housing Studies, 1–24. [Google Scholar] [CrossRef]

- Yusof, Aida Yuzi, and Abdul Halim bin Mohd Nawawi. 2012. Does Malaysian REITs outperform the equity market? Paper presented at the 2012 International Conference on Statistics in Science, Business and Engineering (ICSSBE), Langkawi, Malaysia, September 10–12; pp. 1–5. [Google Scholar]

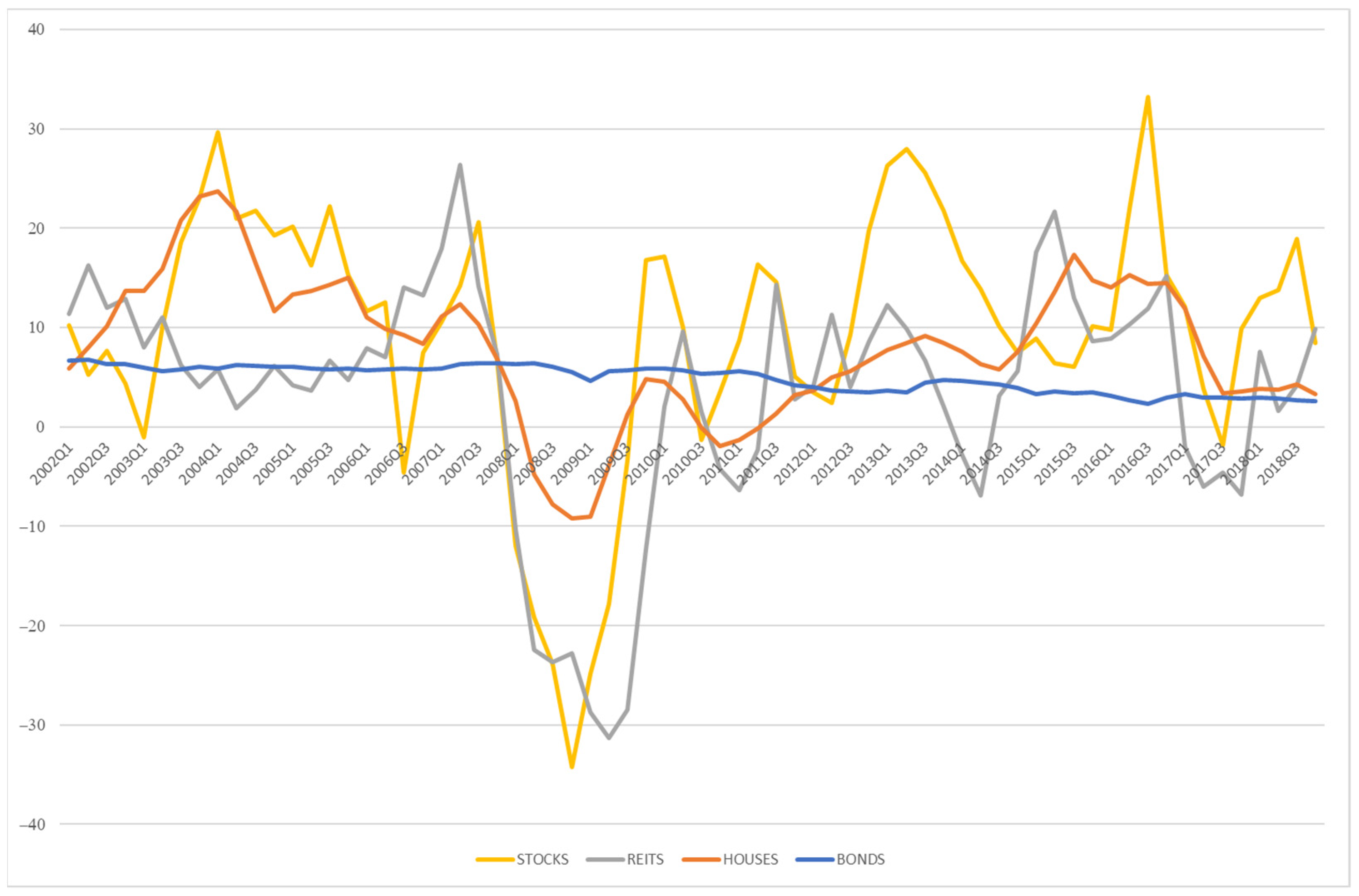

| Annual Returns (%) | Stocks | REITs | Bonds | Houses |

|---|---|---|---|---|

| Mean | 9.59 | 3.42 | 4.85 | 7.93 |

| Std. Dev. | 12.84 | 11.85 | 1.33 | 7.14 |

| Variable | Descriptions | Units | Sources |

|---|---|---|---|

| Price return of housing in New Zealand (Estimated by a hedonic pricing analysis on the transactions in Territory Authority i at time t) | % p.a. | See Appendix A | |

| National Price return of housing in New Zealand (average of all Territory Authorities at time t) | % p.a. | ||

| Total return of housing in New Zealand (Sum of price return and rental yield in Territory Authority i at time t) | % p.a. | See Appendix A | |

| Risk-free rates (i.e., 10-year government bond yield rate from the Reserve Bank of New Zealand) | % p.a. | RBNZ | |

| Market price return in year-on-year % change of the proxied index (Proxy 1: New Zealand Housing Price Return, ) (Proxy 2: New Zealand Stock Index, NZX 50) (Proxy 3: S&P New Zealand All REITs Return Index, NZ_REITs) | % p.a. | NZ_HTR = NZX 50—S&P (Datastream); NZ_REITs—S&P (Datastream) | |

| Market total return in year-on-year % change of the S&P New Zealand All REITs Total Return Index, NZ_REITs_TR) | % p.a. | NZ_REITs—S&P (Datastream) | |

| Liquidity risk (Small Minus Big): Smallest 1/3 Price Index—Biggest 1/3 Price Index | NA | ||

| Value risk (High Minus Low): Highest 1/3 CV/P—Lowest 1/3 CV/P | NA | CV—CoreLogic (2020), P (See Appendix A) | |

| Time risk (Short-term Minus Long-term): 2-year yield minus the 10-year yield of government bonds | % p.a. | Govt Bond Yield (RBNZ 2020) | |

| Default risk (Good-grade Minus Bad-grade): AA yield—BBB yield of corporate bond | % p.a. | S&P NZL AA & BBB Investment Grade Corporate B.D. Index (Datastream) | |

| Currency risk: NZD exchange rate against USD | NA | Datastream |

| Variables | Mean | Std. Dev. | Minimum | Maximum |

|---|---|---|---|---|

| 9.71 | 13.04 | −372.40 | 124.20 | |

| 14.17 | 13.01 | −32.45 | 129.19 | |

| 14.17 | 8.38 | −1.60 | 34.01 | |

| 4.94 | 1.33 | 2.29 | 6.77 | |

| (NZX50) | 11.24 | 13.13 | −33.01 | 30.60 |

| (NZ_REITS) | 3.42 | 11.76 | −31.32 | 26.33 |

| (NZ_REITS_TR) | 11.04 | 12.53 | −25.04 | 35.14 |

| −2.39 | 6.93 | −18.72 | 12.85 | |

| −1.18 | 5.47 | −11.45 | 10.13 | |

| −0.64 | 0.78 | −2.02 | 0.92 | |

| −0.83 | 0.57 | −2.70 | 0.53 | |

| 0.69 | 0.11 | 0.41 | 0.86 | |

| TA | 62 (Territorial Authorities of New Zealand) | |||

| Quarters | 68 (2002Q1–2018Q4) | |||

| Model 1a | Model 2a | Model 3a | Model 4a | |

|---|---|---|---|---|

| Dep. Var | (NZ_HCR) | (NZX50) | (NZ_REIT) | (NZ_REIT_TR) |

| 3.695 (18.21) *** | 6.618 (28.35) *** | 9.166 (49.00) *** | 12.710 (51.36) *** | |

| 0.777 (39.35) *** | 0.301 (17.77) *** | 0.124 (6.12) *** | 0.110 (5.83) *** | |

| F.E. | Yes | Yes | Yes | Yes |

| Adj R-sq | 0.36 | 0.14 | 0.07 | 0.07 |

| Observations | 72 × 62 | 68 × 62 | 68 × 62 | 68 × 62 |

| Model 1b | Model 2b | Model 3b | Model 4b | |

|---|---|---|---|---|

| Dep. Var | (NZ_HCR) | (NZX50) | (NZ_REIT) | (NZ_REIT_TR) |

| 2.673 (7.64) *** | 4.038 (10.69) *** | 4.950 (12.10) *** | 8.359 (17.38) *** | |

| 0.813 (31.21) *** | 0.308 (18.92) *** | 0.185 (8.57) *** | 0.148 (7.35) *** | |

| −0.007 (−0.15) | −0.206 (−4.25) *** | −0.336 (−6.65) *** | −0.315 (−6.26) *** | |

| −0.013 (−0.25) | −0.017 (−0.29) | −0.042 (−0.68) | −0.009 (−0.16) | |

| −0.780 (−2.80) *** | 3.28 (11.78) *** | 1.986 (6.61) *** | 2.201 (7.37) *** | |

| −0.489 (−1.41) | −4.759 (−13.41) *** | −5.098 (−13.34) *** | −5.191 (−13.70) *** | |

| −0.027 (−1.72) * | −0.057 (−3.36) *** | −0.021 (−1.20) | −0.015 (−0.85) | |

| F.E. | Yes | Yes | Yes | Yes |

| Adj R-sq | 0.36 | 0.24 | 0.18 | 0.18 |

| Obs. | 65 × 62 | 65 × 62 | 65 × 62 | 65 × 62 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yiu, C.-Y.; Xiong, C.; Cheung, K.-S. An Extended Fama-French Multi-Factor Model in Direct Real Estate Investing. J. Risk Financial Manag. 2022, 15, 390. https://doi.org/10.3390/jrfm15090390

Yiu C-Y, Xiong C, Cheung K-S. An Extended Fama-French Multi-Factor Model in Direct Real Estate Investing. Journal of Risk and Financial Management. 2022; 15(9):390. https://doi.org/10.3390/jrfm15090390

Chicago/Turabian StyleYiu, Chung-Yim, Chuyi Xiong, and Ka-Shing Cheung. 2022. "An Extended Fama-French Multi-Factor Model in Direct Real Estate Investing" Journal of Risk and Financial Management 15, no. 9: 390. https://doi.org/10.3390/jrfm15090390

APA StyleYiu, C.-Y., Xiong, C., & Cheung, K.-S. (2022). An Extended Fama-French Multi-Factor Model in Direct Real Estate Investing. Journal of Risk and Financial Management, 15(9), 390. https://doi.org/10.3390/jrfm15090390

_Cheung.jpeg)