The Effects of National Fundamental Factors on Regional House Prices: A Factor-Augmented VAR Analysis

Abstract

1. Introduction

2. Literature Review

3. Data

4. Methodology

5. Empirical Results

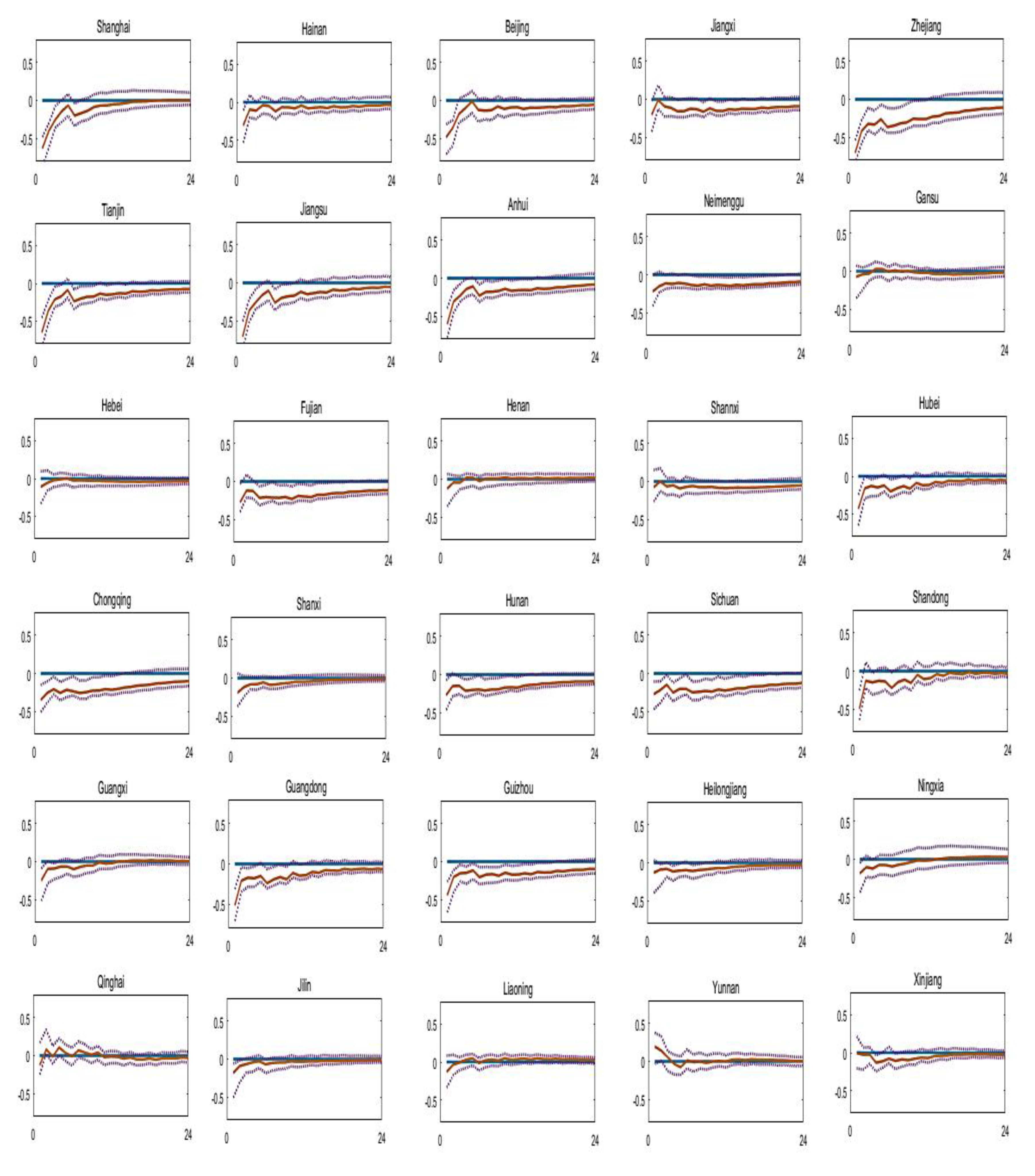

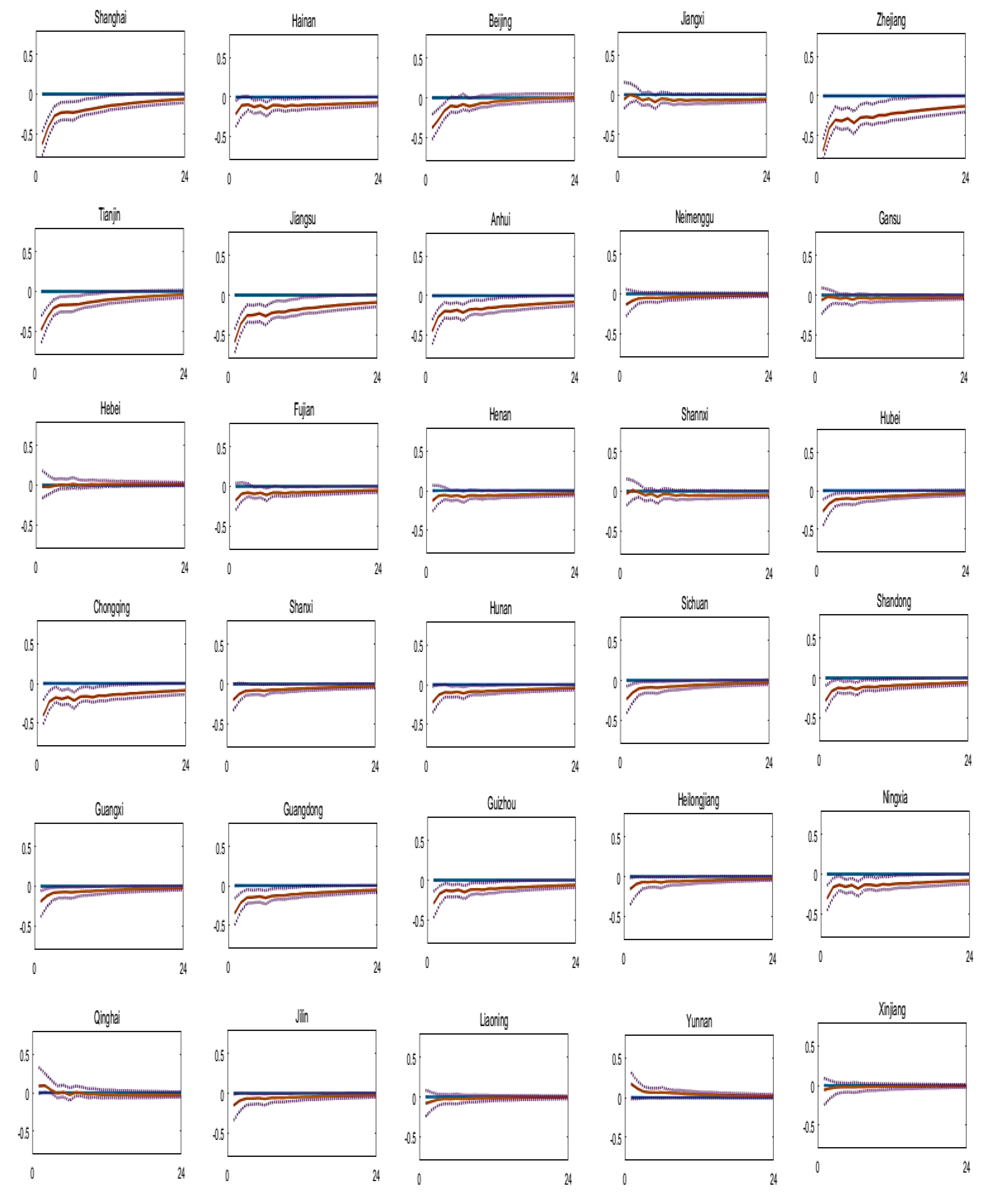

5.1. Effects of Monetary Shocks

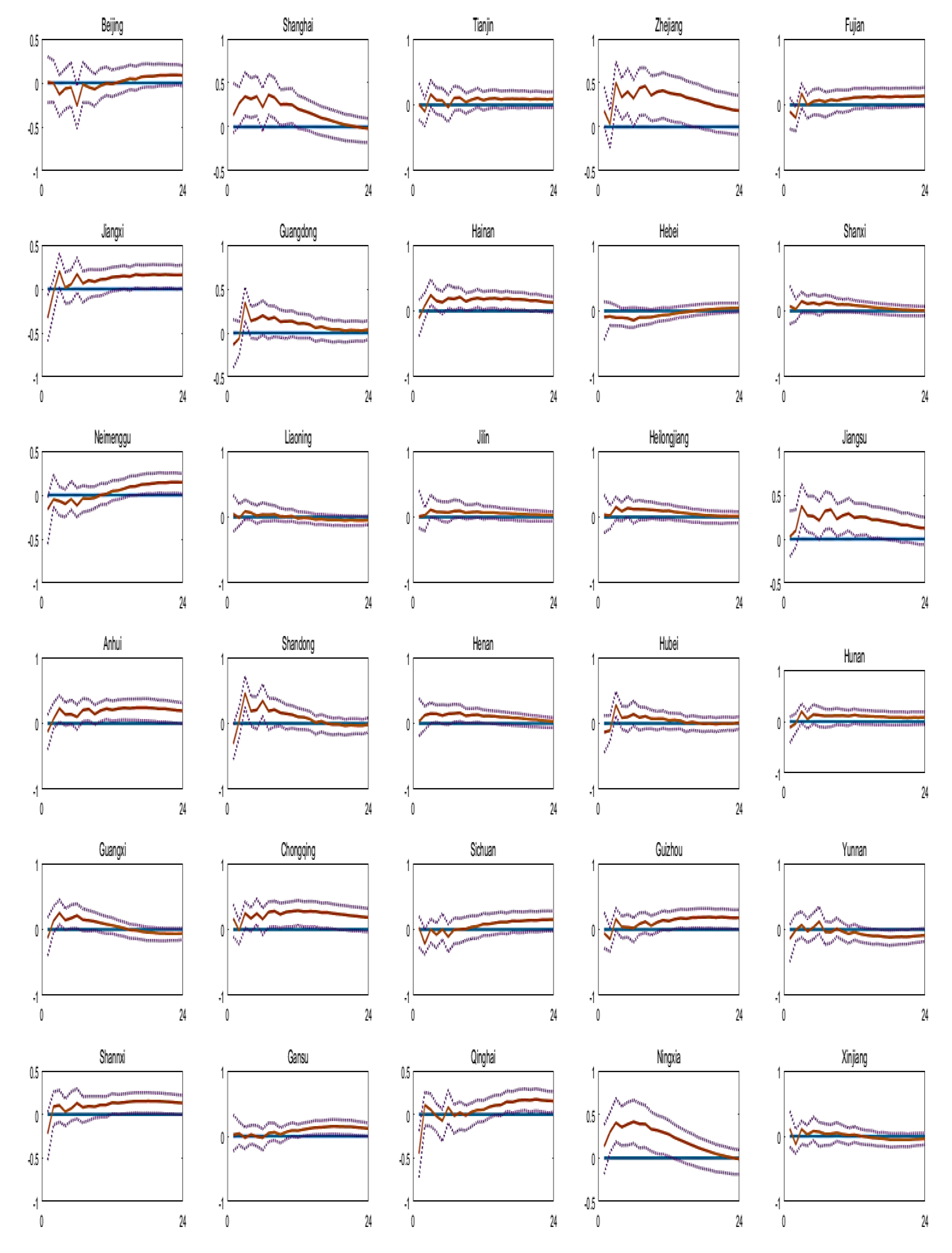

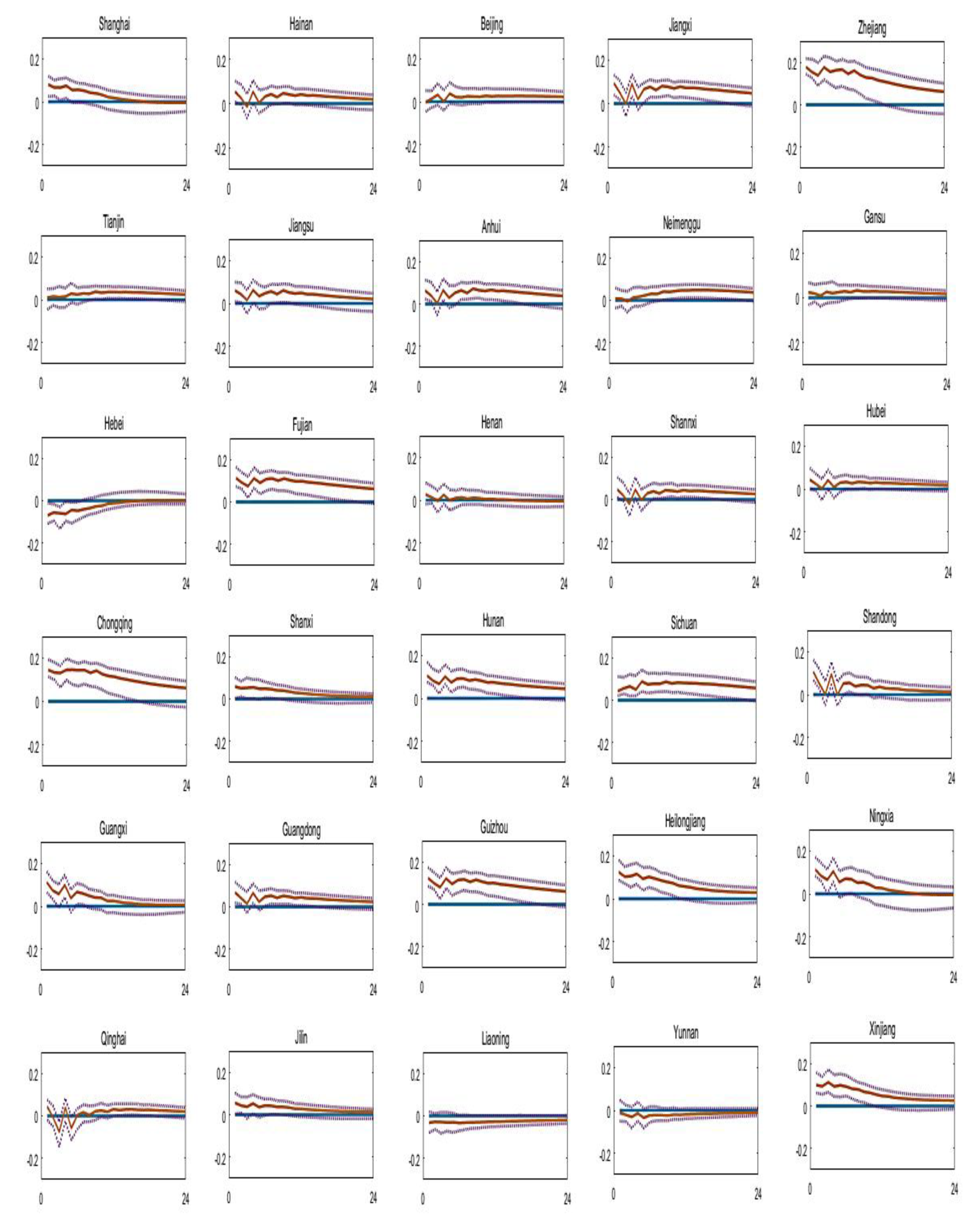

5.2. Effects of Real Output Shocks

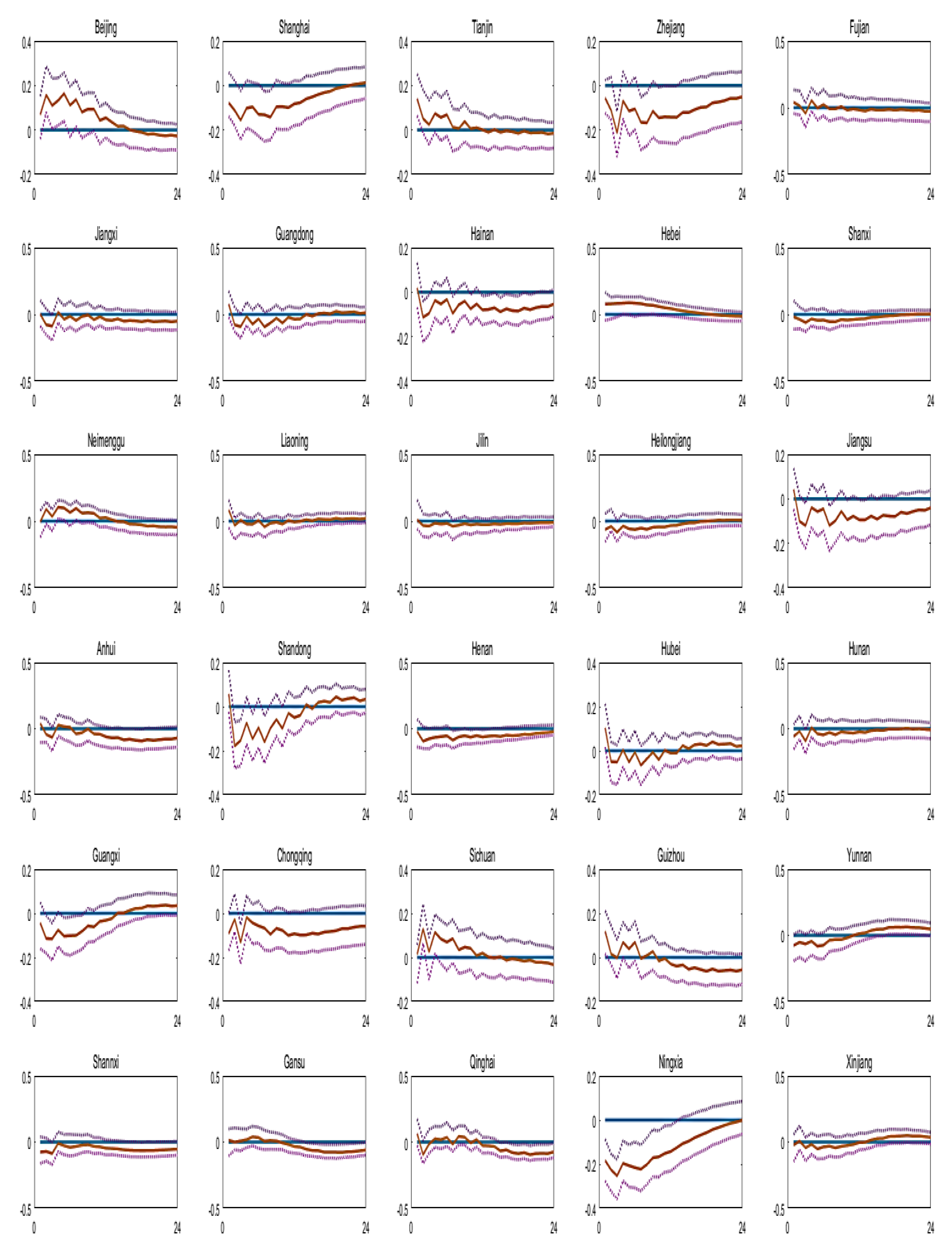

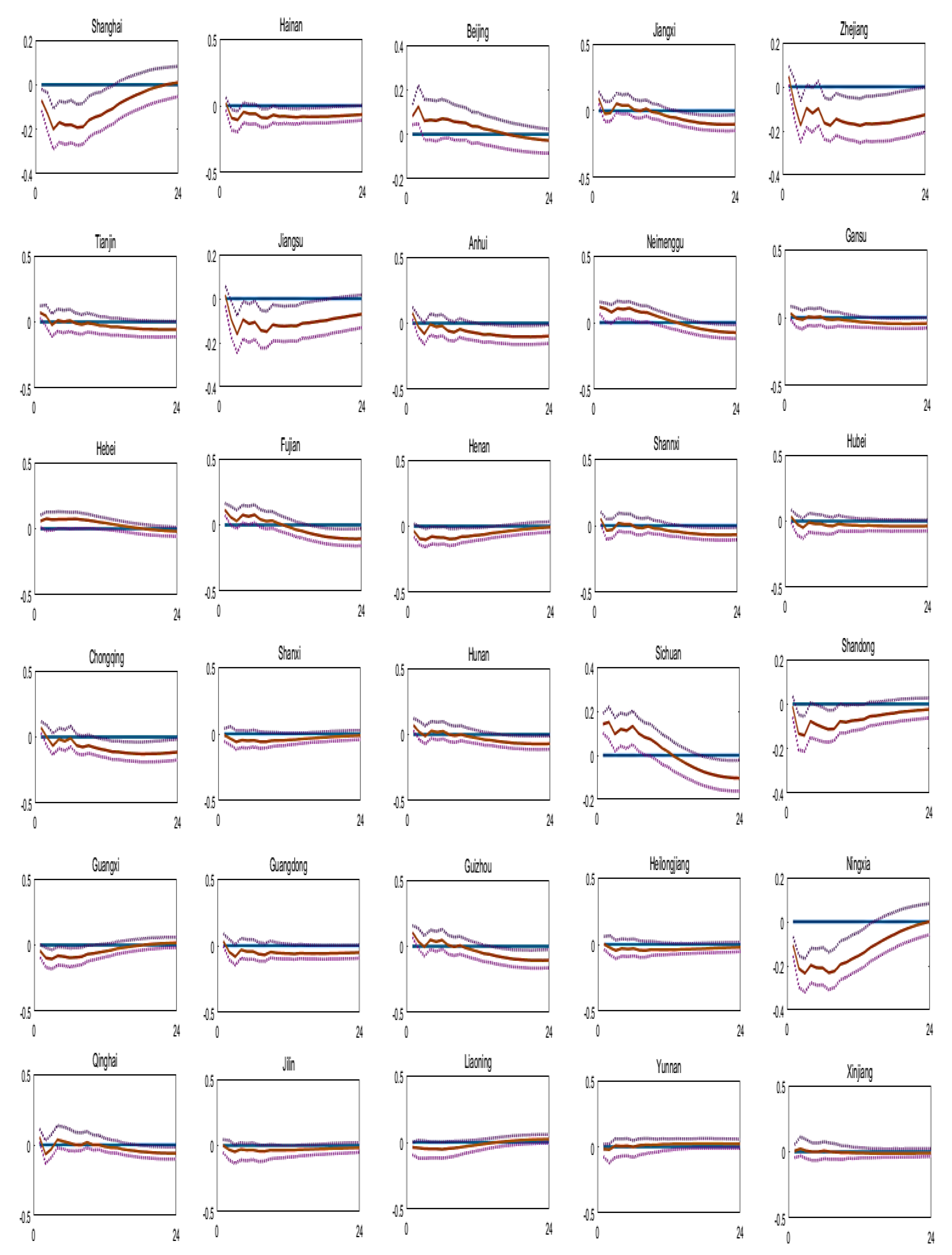

5.3. Effects of Inflation Shocks

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | In the case of the missing January data, we take the mean value of the previous month (December) and the next month (February). In the case of the missing February data, we take the mean value of the previous month (January) and the next month (March). In the case of the missing data from both months, firstly, we calculate the mean value of the next two months (March and April) to obtain the value of February; then, we take the mean values of December and February to obtain the value of January. |

| 2 | The Regional Coordinative Development Strategy is formulated on the Third Plenary Session of the 16th CPC Central Committee. It refers to actively promoting the development of the western region, revitalizing the old industrial bases such as the northeast region, promoting the rise of the central region, encouraging the eastern region to take the lead in development, continuing to give full play to the advantages and enthusiasm of each region, and gradually reversing the trend of widening the regional development gap by improving market mechanisms, cooperation mechanisms, mutual aid mechanisms, and support mechanisms so as to form a mutual promotion, complementary advantages, and a common ground between the east and the west. This is a new pattern of development. |

References

- Bai, Jushan, Kunpeng Li, and Lina Lu. 2016. Estimation and inference of FAVAR models. Journal of Business & Economic Statistics 34: 620–41. [Google Scholar]

- Bernanke, Ben S., and Alan S. Blinder. 1992. The federal funds rate and the channels of monetary transmission. The American Economic Review 82: 901–21. [Google Scholar]

- Bernanke, Ben S., Jean Boivin, and Piotr Eliasz. 2005. Measuring the effects of monetary policy: A factor-augmented vector autoregressive (FAVAR) approach. The Quarterly Journal of Economics 120: 387–422. [Google Scholar]

- Chen, Kaiji, and Yi Wen. 2017. The great housing boom of China. American Economic Journal: Macroeconomics 9: 73–114. [Google Scholar] [CrossRef]

- Chiang, Kevin. 2010. On the comovement of REIT prices. Journal of Real Estate Research 32: 187–200. [Google Scholar] [CrossRef]

- Dreger, Christian, and Yanqun Zhang. 2013. Is there a bubble in the Chinese housing market? Urban Policy and Research 31: 27–39. [Google Scholar] [CrossRef]

- Glindro, Eloisa T., Tientip Subhanij, Jessica Szeto, and Haibin Zhu. 2011. Determinants of house prices in nine Asia-Pacific economies. International Journal of Central Banking 7: 163–204. [Google Scholar] [CrossRef][Green Version]

- Goodhart, Charles, and Boris Hofmann. 2008. House prices, money, credit, and the macroeconomy. Oxford Review of Economic Policy 24: 180–205. [Google Scholar] [CrossRef]

- Gu, Yiyang. 2018. What are the most important factors that influence the changes in London Real Estate Prices? How to quantify them? arXiv arXiv:1802.08238. [Google Scholar]

- Hwang, Min, and John M. Quigley. 2006. Economic fundamentals in local housing markets: Evidence from US metropolitan regions. Journal of Regional Science 46: 425–53. [Google Scholar] [CrossRef]

- Iacoviello, Matteo, and Raoul Minetti. 2008. The credit channel of monetary policy: Evidence from the housing market. Journal of Macroeconomics 30: 69–96. [Google Scholar] [CrossRef]

- Iacoviello, Matteo. 2005. House prices, borrowing constraints, and monetary policy in the business cycle. American Economic Review 95: 739–64. [Google Scholar] [CrossRef]

- Kallberg, Jarl G., Crocker H. Liu, and Paolo Pasquariello. 2014. On the price comovement of US residential real estate markets. Real Estate Economics 42: 71–108. [Google Scholar] [CrossRef]

- Kamber, Güneş, and Madhusudan Mohanty. 2018. Do Interest Rates Play a Major Role in Monetary Policy Transmission in China? Working Paper No. 714. Basel: Bank for International Settlements. [Google Scholar]

- Kilian, Lutz. 1998. Small-sample confidence intervals for impulse response functions. Review of Economics and Statistics 80: 218–30. [Google Scholar] [CrossRef]

- Li, Jing, and Yat-Hung Chiang. 2012. What pushes up China’s real estate price? International Journal of Housing Markets and Analysis 5: 161–76. [Google Scholar] [CrossRef]

- Liang, Yunfang, and Tiemei Gao. 2007. Empirical Analysis on Real Estate Price Fluctuation in Different Provinces of China. Economic Research Journal 8: 133–42. [Google Scholar]

- Liao, Wei, and Sampawende J.-A. Tapsoba. 2014. China’s Monetary Policy and Interest Rate Liberalization: Lessons from International Experiences. No. 14–75. Washington, DC: International Monetary Fund. [Google Scholar]

- Merikas, Andreas G., Anna Merika, Nikiforos Laopodis, and Anna Triantafyllou. 2012. House Price Comovements in the Eurozone Economies. European Research Studies 15: 71. [Google Scholar] [CrossRef]

- Mian, Atif, Kamalesh Rao, and Amir Sufi. 2013. Household balance sheets, consumption, and the economic slump. The Quarterly Journal of Economics 128: 1687–726. [Google Scholar] [CrossRef]

- Negro, Marco, and Christopher Otrok. 2007. 99 Luftballons: Monetary policy and the house price boom across US states. Journal of Monetary Economics 54: 1962–85. [Google Scholar] [CrossRef]

- Otrok, Christopher, and Marco E. Terrones. 2005. House prices, interest rates and macroeconomic fluctuations: International evidence. Unpublished Manuscript. [Google Scholar]

- Sims, Christopher A. 1992. Interpreting the macroeconomic time series facts: The effects of monetary policy. European Economic Review 36: 975–1000. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 1989. New indexes of coincident and leading economic indicators. NBER Macroeconomics Annual 4: 351–94. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 2002. Forecasting using principal components from a large number of predictors. Journal of the American Statistical Association 97: 1167–79. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W. Watson. 2005. Implications of Dynamic Factor Models for VAR Analysis. No. w11467. Princeton: Princeton University, Economics Department. Available online: https://www.nber.org/papers/w11467 (accessed on 22 May 2022).

- Stock, James H., and Mark Watson. 2011. Dynamic factor models. The Oxford Handbook on Economic Forecasting. Available online: https://dash.harvard.edu/handle/1/28469541 (accessed on 22 May 2022).

- Wang, Zhi, and Qinghua Zhang. 2014. Fundamental factors in the housing markets of China. Journal of Housing Economics 25: 53–61. [Google Scholar] [CrossRef]

- Wei, Wei, and Hong-Wei Wang. 2010. Heterogeneity in the Response of Regional Housing Markets to Monetary Policies: Analysis on the Provincial Panel Data. Journal of Finance and Economics 6: 013. [Google Scholar]

- Weng, Yingliang, and Pu Gong. 2017. On price co-movement and volatility spillover effects in China’s housing markets. International Journal of Strategic Property Management 21: 240–55. [Google Scholar] [CrossRef]

- Xu, Yihong, Xu Kexiin, and Chen Youquan. 2016. A Study on the Influence Factors of Real Estate Prices Based on Econometric Model: A Case of Wuhan. Paper presented at the 2016 International Academic Conference on Human Society and Culture, Beijing, China, 30–31 December 2016; Available online: https://scholar.google.com.hk/scholar?hl=zh-CN&as_sdt=0%2C5&q=A+Study+on+the+Influence+Factors+of+Real+Estate+Prices+Based+on+Econometric+Model%3A+A+Case+of+Wuhan&btnG= (accessed on 22 May 2022).

- Yu, Huayi. 2010. China’s house price: Affected by economic fundamentals or real estate policy? Frontiers of Economics in China 5: 25–51. [Google Scholar] [CrossRef]

- Zhang, Yanbing, Xiuping Hua, and Liang Zhao. 2012. Exploring determinants of housing prices: A case study of Chinese experience in 1999–2010. Economic Modelling 29: 2349–61. [Google Scholar] [CrossRef]

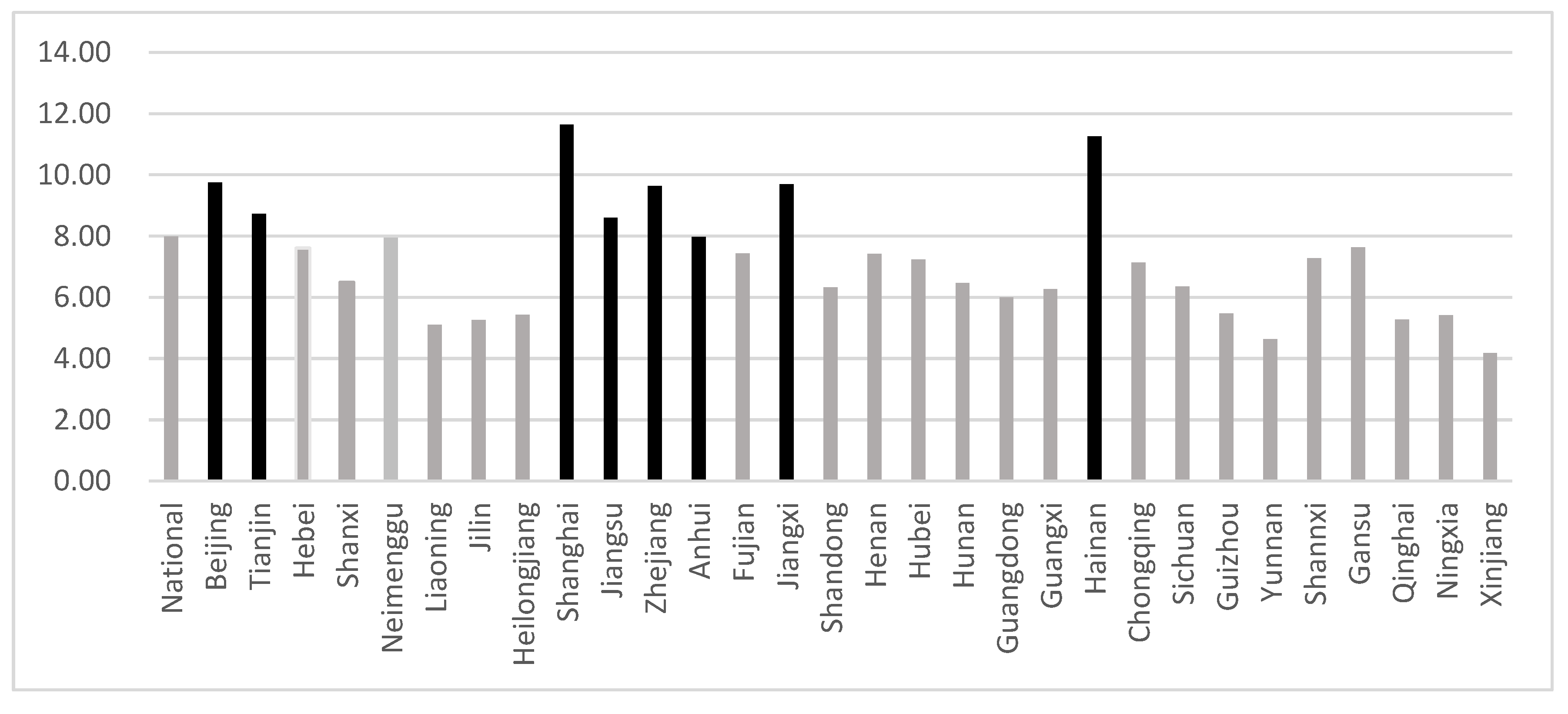

| Order | Region | Growth (%) | Order | Region | Growth (%) |

|---|---|---|---|---|---|

| 1 | Shanghai | 11.64 | 17 | Chongqing | 7.14 |

| 2 | Hainan | 11.25 | 18 | Shanxi | 6.49 |

| 3 | Beijing | 9.74 | 19 | Hunan | 6.46 |

| 4 | Jiangxi | 9.70 | 20 | Sichuan | 6.35 |

| 5 | Zhejiang | 9.64 | 21 | Shandong | 6.32 |

| 6 | Tianjin | 8.72 | 22 | Guangxi | 6.27 |

| 7 | Jiangsu | 8.59 | 23 | Guangdong | 6.00 |

| 8 | National | 7.99 | 24 | Guizhou | 5.47 |

| 9 | Anhui | 7.98 | 25 | Heilongjiang | 5.42 |

| 10 | Neimenggu | 7.95 | 26 | Ningxia | 5.42 |

| 11 | Gansu | 7.64 | 27 | Qinghai | 5.27 |

| 12 | Hebei | 7.61 | 28 | Jilin | 5.26 |

| 13 | Fujian | 7.44 | 29 | Liaoning | 5.10 |

| 14 | Henan | 7.42 | 30 | Yunnan | 4.64 |

| 15 | Shaanxi | 7.27 | 31 | Xinjiang | 4.18 |

| 16 | Hubei | 7.24 | - | - | - |

| Obs | Mean | Std. Dev. | Min | Max | |

|---|---|---|---|---|---|

| National | 252 | 3362.54 | 1062.87 | 1835.57 | 5435.28 |

| Beijing | 252 | 9723.48 | 5321.73 | 2698.28 | 23,247.34 |

| Tianjin | 252 | 4774.88 | 2119.66 | 1755.34 | 9639.42 |

| Hebei | 252 | 2400.84 | 971.12 | 991.80 | 4578.61 |

| Shanxi | 252 | 2026.91 | 804.49 | 811.77 | 3578.02 |

| Neimenggu | 252 | 1891.24 | 806.14 | 721.22 | 3252.92 |

| Liaoning | 252 | 3140.34 | 750.95 | 1496.37 | 4650.05 |

| Jilin | 252 | 2600.58 | 859.25 | 998.32 | 3984.60 |

| Heilongjiang | 252 | 2536.08 | 849.22 | 1429.78 | 4107.46 |

| Shanghai | 252 | 8048.22 | 4306.23 | 2066.87 | 18,696.78 |

| Jiangsu | 252 | 3463.54 | 1445.87 | 1385.82 | 6388.06 |

| Zhejiang | 252 | 5106.49 | 2725.78 | 1516.35 | 8970.48 |

| Anhui | 252 | 2407.20 | 1072.60 | 764.26 | 4130.95 |

| Fujian | 252 | 4098.95 | 1908.78 | 1629.91 | 7487.22 |

| Jiangxi | 252 | 2051.76 | 1153.49 | 663.53 | 4164.09 |

| Shandong | 252 | 2596.71 | 919.29 | 1331.48 | 4200.43 |

| Henan | 252 | 2020.14 | 737.93 | 622.26 | 3617.72 |

| Hubei | 252 | 2583.16 | 994.22 | 1198.35 | 4729.60 |

| Hunan | 252 | 1899.34 | 770.93 | 682.63 | 3147.67 |

| Guangdong | 252 | 4942.30 | 1645.54 | 2552.75 | 8580.75 |

| Guangxi | 252 | 2297.88 | 723.62 | 1170.22 | 3689.77 |

| Hainan | 252 | 4561.81 | 2491.89 | 893.20 | 8586.81 |

| Chongqing | 252 | 2529.28 | 1136.32 | 924.48 | 4292.71 |

| Sichuan | 252 | 2384.66 | 1014.75 | 974.71 | 3850.98 |

| Guizhou | 252 | 1854.02 | 713.03 | 894.43 | 3071.25 |

| Yunnan | 252 | 2280.36 | 617.93 | 1100.15 | 3698.02 |

| Shannxi | 252 | 2498.03 | 960.79 | 843.86 | 3976.28 |

| Gansu | 252 | 1951.29 | 767.03 | 757.09 | 3807.09 |

| Qinghai | 252 | 1872.00 | 583.77 | 929.30 | 3128.89 |

| Ningxia | 252 | 2011.21 | 567.11 | 913.37 | 3047.50 |

| Xinjiang | 252 | 1984.37 | 633.48 | 1066.01 | 3325.86 |

| Variables | Abbreviation | Time Series | |

|---|---|---|---|

| National | house price | NHP | 1999:01–2020:12 |

| industrial production index | IP | 1999:01–2020:12 | |

| consumer price index | P | 1999:01–2020:12 | |

| short-term interest rate | R | 1999:01–2020:12 | |

| monetary supply | M2 | 1999:01–2020:12 | |

| Regional | house price | HP | 1999:01–2020:12 |

| industry added value | IAV | 1999:01–2020:12 | |

| loans to real estate corporations | LOAN | 1999:01–2020:12 | |

| consumer consumption index | CPI | 1999:01–2020:12 | |

| export | EX | 1999:01–2020:12 | |

| Variable | Obs | Mean | Std. Dev. | Min | Max | |

|---|---|---|---|---|---|---|

| National | NHP | 252 | 0.41 | 3.48 | −13.61 | 13.05 |

| IP | 252 | 9.41 | 4.27 | −3.26 | 23.54 | |

| P | 252 | 2.19 | 2.06 | −1.81 | 8.34 | |

| R | 252 | 2.22 | 0.72 | 0.81 | 6.43 | |

| M2 | 252 | 15.20 | 3.25 | 9.14 | 25.96 | |

| Beijing | HP | 252 | 9.70 | 17.43 | −45.21 | 50.42 |

| IAV | 252 | 1.81 | 2.70 | −4.74 | 10.46 | |

| LOAN | 252 | 12.98 | 30.91 | −84.84 | 101.95 | |

| CPI | 252 | 6.36 | 18.40 | −41.47 | 69.11 | |

| EX | 252 | 7.62 | 7.40 | −15.49 | 26.79 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, X.; Kong, W.; Hu, Z. The Effects of National Fundamental Factors on Regional House Prices: A Factor-Augmented VAR Analysis. J. Risk Financial Manag. 2022, 15, 309. https://doi.org/10.3390/jrfm15070309

Gao X, Kong W, Hu Z. The Effects of National Fundamental Factors on Regional House Prices: A Factor-Augmented VAR Analysis. Journal of Risk and Financial Management. 2022; 15(7):309. https://doi.org/10.3390/jrfm15070309

Chicago/Turabian StyleGao, Xiang, Wen Kong, and Zhijun Hu. 2022. "The Effects of National Fundamental Factors on Regional House Prices: A Factor-Augmented VAR Analysis" Journal of Risk and Financial Management 15, no. 7: 309. https://doi.org/10.3390/jrfm15070309

APA StyleGao, X., Kong, W., & Hu, Z. (2022). The Effects of National Fundamental Factors on Regional House Prices: A Factor-Augmented VAR Analysis. Journal of Risk and Financial Management, 15(7), 309. https://doi.org/10.3390/jrfm15070309