Market Quality and Short-Selling Ban during the COVID-19 Pandemic: A High-Frequency Data Approach

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

4. Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ali, Mohsin, Nafis Alam, and Syed Aun R. Rizvi. 2020. Coronavirus (COVID-19)—An Epidemic or Pandemic for Financial Markets. Journal of Behavioral and Experimental Finance 27: S2214635020301350. [Google Scholar] [CrossRef] [PubMed]

- Alzyadat, Jumah, Alaa Adden Abuhommous, and Huthaifa Alqaralleh. 2021. Testing the conditional volatility of saudi arabia stock market: Symmetric and asymmetric autoregressive conditional heteroskedasticity (garch) approach. Academy of Accounting and Financial Studies Journal 25: 1–9. [Google Scholar]

- Amihud, Yakov. 2002. Illiquidity and Stock Returns: Cross-Section and Time-Series Effects. Journal of Financial Markets 5: 31–56. [Google Scholar] [CrossRef]

- Andersen, Torben G., and Oleg Bondarenko. 2014a. Reflecting on the VPIN Dispute. Journal of Financial Markets 17: 53–64. [Google Scholar] [CrossRef]

- Andersen, Torben G., and Oleg Bondarenko. 2014b. VPIN and the Flash Crash. Journal of Financial Markets 17: 1–46. [Google Scholar] [CrossRef]

- Andersen, Torben G., and Oleg Bondarenko. 2015. Assessing Measures of Order Flow Toxicity and Early Warning Signals for Market Turbulence*. Review of Finance 19: 1–54. [Google Scholar] [CrossRef]

- Anggraini, Puspita Ghaniy, Evy Rahman Utami, and Eva Wulandari. 2022. What Happens to the Stock Market during the COVID-19 Pandemic? A Systematic Literature Review. Pacific Accounting Review 34: 406–25. [Google Scholar] [CrossRef]

- Arce, Óscar, and Sergio Mayordomo. 2016. The Impact of the 2011 Short-Sale Ban on Financial Stability: Evidence from the Spanish Stock Market. European Financial Management 22: 1001–22. [Google Scholar] [CrossRef]

- Barardehi, Yashar H, Dan Bernhardt, Thomas Ruchti, and Marc Weidenmier. 2020. The Night and Day of Amihud’s (2002) Liquidity Measure. The Review of Asset Pricing Studies 11: 269–308. [Google Scholar] [CrossRef]

- Baron, Matthew, Jonathan Brogaard, Björn Hagströmer, and Andrei Kirilenko. 2019. Risk and Return in High-Frequency Trading. Journal of Financial and Quantitative Analysis 54: 993–1024. [Google Scholar] [CrossRef]

- Barro, Robert J., José F. Ursúa, and Joanna Weng. 2022. Macroeconomics of the Great Influenza Pandemic, 1918–1920. Research in Economics 76: 21–29. [Google Scholar] [CrossRef] [PubMed]

- Benos, Evangelos, and Satchit Sagade. 2016. Price Discovery and the Cross-Section of High-Frequency Trading. Journal of Financial Markets 30: 54–77. [Google Scholar] [CrossRef]

- Bińkowski, Mikołaj, and Charles-Albert Lehalle. 2018. Endogeneous Dynamics of Intraday Liquidity. arXiv arXiv:1811.03766. [Google Scholar]

- Boehmer, Ekkehart, and Juan (Julie) Wu. 2013. Short Selling and the Price Discovery Process. The Review of Financial Studies 26: 287–322. [Google Scholar] [CrossRef]

- Boehmer, Ekkehart, Kingsley Y. L. Fong, and Juan (Julie) Wu. 2018. Algorithmic Trading And Market Quality: International Evidence. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Borch, Christian. 2016. High-Frequency Trading, Algorithmic Finance and the Flash Crash: Reflections on Eventalization. Economy and Society 45: 350–78. [Google Scholar] [CrossRef]

- Bouveret, Antoine, Cyrille Guillaumie, Carlos Aparicio Roqueiro, Christian Winkler, and Steffen Nauhaus. 2014. Economic Report. Available online: https://www.esma.europa.eu/sites/default/files/library/2015/11/esma20141_-_hft_activity_in_eu_equity_markets.pdf (accessed on 10 September 2021).

- Brogaard, J. 2011. High Frequency Trading and Market Quality. Capital Markets: Market Microstructure eJournal, 66. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, Björn Hagströmer, Lars Nordén, and Ryan Riordan. 2015. Trading Fast and Slow: Colocation and Liquidity. Review of Financial Studies 28: 3407–43. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, Terrence Hendershott, and Ryan Riordan. 2013. High Frequency Trading and Price Discovery. Review of Financial Studies 27: 2267–306. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, Terrence Hendershott, and Ryan Riordan. 2017. High Frequency Trading and the 2008 Short-Sale Ban. Journal of Financial Economics 124: 22–42. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, Terrence Hendershott, and Ryan Riordan. 2019. Price Discovery without Trading: Evidence from Limit Orders. The Journal of Finance 74: 1621–58. [Google Scholar] [CrossRef]

- Chakrabarty, Bidisha, and Roberto Pascual. 2022. Stock Liquidity and Algorithmic Market Making during the COVID-19 Crisis. Journal of Banking & Finance 2022: 106415. [Google Scholar] [CrossRef]

- Chowdhury, Emon Kalyan, Iffat Ishrat Khan, and Bablu Kumar Dhar. 2021. Catastrophic impact of Covid-19 on the global stock markets and economic activities. Business and Society Review 127: 437–60. [Google Scholar] [CrossRef]

- Cvitanic, Jaksa, and Andrei A. Kirilenko. 2012. High Frequency Traders and Asset Prices. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- D’Souza, Chris. 2007. Where Does Price Discovery Occur in FX Markets? Working paper. York: Bank of Canada. Available online: https://www.bankofcanada.ca/wp-content/uploads/2010/02/wp07-52.pdf (accessed on 10 September 2021).

- Dall’Amico, Lorenzo, A. Fosset, J.-P. Bouchaud, and M. Benzaquen. 2019. How does latent liquidity get revealed in the limit order book? Journal of Statistical Mechanics: Theory and Experiment 2019: 013404. [Google Scholar] [CrossRef]

- Damien, Kunjal. 2021. The Impact of COVID-19 on Stock Market Liquidity: Evidence from the Johannesburg Stock Exchange. African Review of Economics and Finance 13: 104–23. [Google Scholar] [CrossRef]

- David, S., Claudio Inacio, and José Tenreiro Machado. 2020. The Recovery of Global Stock Markets Indices after Impacts Due to Pandemics. Research in International Business and Finance 55: 101335. [Google Scholar] [CrossRef] [PubMed]

- Diamond, Douglas W., and Robert E. Verrecchia. 1987. Constraints on Short-Selling and Asset Price Adjustment to Private Information. Journal of Financial Economics 18: 277–311. [Google Scholar] [CrossRef]

- Dias, Rui, Paula Heliodoro, Nuno Teixeira, and Teresa Godinho. 2020. Testing the Weak Form of Efficient Market Hypothesis: Empirical Evidence from Equity Markets. International Journal of Accounting, Finance and Risk Management 5: 40. [Google Scholar] [CrossRef]

- Dumitrescu, Elena-Ivona, and Christophe Hurlin. 2012. Testing for Granger Non-Causality in Heterogeneous Panels. Economic Modelling 29: 1450–60. [Google Scholar] [CrossRef]

- Duong, Huu Nhan, and Petko S. Kalev. 2007. Order Book Slope and Price Volatility. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Easley, David, Marcos de Prado, and Maureen O’Hara. 2012. Flow Toxicity and Liquidity in a High Frequency World. Review of Financial Studies 25: 1457–93. [Google Scholar] [CrossRef]

- Easley, David, Marcos M. López de Prado, and Maureen O’Hara. 2014. VPIN and the Flash Crash: A Rejoinder. Journal of Financial Markets 17: 47–52. [Google Scholar] [CrossRef]

- Eaves, James, and Jeffrey Williams. 2010. Are Intraday Volume and Volatility U-Shaped After Accounting for Public Information? American Journal of Agricultural Economics 92: 212–27. [Google Scholar] [CrossRef]

- Egger, Peter H., and Jiaqing Zhu. 2021. Dynamic Network and Own Effects on Abnormal Returns: Evidence from China’s Stock Market. Empirical Economics 60: 487–512. [Google Scholar] [CrossRef]

- Elaut, Gert, Michael Frömmel, and Kevin Lampaert. 2018. Intraday Momentum in FX Markets: Disentangling Informed Trading from Liquidity Provision. Journal of Financial Markets 37: 35–51. [Google Scholar] [CrossRef]

- Engelhardt, Nils, Miguel Krause, Daniel Neukirchen, and Peter Posch. 2020. Trust and Stock Market Volatility during the COVID-19 Crisis. Finance Research Letters 38: 101873. [Google Scholar] [CrossRef]

- European Securities and Markets Authority. 2022. TRV, ESMA Report on Trends, Risks and Vulnerabilities. No 1. Available online: https://www.esma.europa.eu/document/esma-report-trends-risks-and-vulnerabilities-no1-2022 (accessed on 10 September 2021).

- Feng, Xunan, and Kam C. Chan. 2016. Information Advantage, Short Sales, and Stock Returns: Evidence from Short Selling Reform in China. Economic Modelling 59: 131–42. [Google Scholar] [CrossRef]

- Foley, Sean, Amy Kwan, Richard Philip, and Bernt Arne Ødegaard. 2022. Contagious Margin Calls: How COVID-19 Threatened Global Stock Market Liquidity. Journal of Financial Markets 59: 100689. [Google Scholar] [CrossRef]

- Friederich, Sylvain, and Richard Payne. 2012. Computer Based Trading, Liquidity and Trading Costs. (Foresight: DR5) 2012: 1–39. [Google Scholar]

- Friederich, Sylvain, and Richard Payne. 2015. Order-to-Trade Ratios and Market Liquidity. Journal of Banking and Finance 50: 214–23. [Google Scholar] [CrossRef]

- Ftiti, Zied, Hachmi Ben Ameur, and Waël Louhichi. 2021. Does non-fundamental news related to COVID-19 matter for stock returns? Evidence from Shanghai stock market. Economic Modelling 99: 105484. Available online: https://EconPapers.repec.org/RePEc:eee:ecmode:v:99:y:2021:i:c:s0264999321000675 (accessed on 10 September 2021). [CrossRef]

- Gao, Lei, Yu Han, Sophia Zhengzi Li, and Guofu Zhou. 2018. Market intraday momentum. Journal of Financial Economics 129: 394–414. [Google Scholar] [CrossRef]

- Gao, Xue, Yixin Ren, and Muhammad Umar. 2021. To what extent does COVID-19 drive stock market volatility? A comparison between the U.S. and China. Economic Research-Ekonomska Istraživanja 2021: 1–21. [Google Scholar] [CrossRef]

- Gençay, Ramazan, and Nikola Gradojevic. 2013. Private Information and Its Origins in an Electronic Foreign Exchange Market. Economic Modelling 33: 86–93. [Google Scholar] [CrossRef]

- Gençay, Ramazan, Nikola Gradojevic, Richard Olsen, and Faruk Selçuk. 2015. Informed Traders’ Arrival in Foreign Exchange Markets: Does Geography Matter? Empirical Economics 49: 1431–62. [Google Scholar] [CrossRef]

- Goldstein, Michael A., and Kenneth A. Kavajecz. 2004. Trading Strategies during Circuit Breakers and Extreme Market Movements. Journal of Financial Markets 7: 301–33. [Google Scholar] [CrossRef]

- Golub, Anton, John Keane, and Ser-Huang Poon. 2012. High Frequency Trading and Mini Flash Crashes. SSRN Electronic Journal, 1–22. [Google Scholar] [CrossRef]

- Hadri, Kaddour. 2000. Testing for Stationarity in Heterogeneous Panel Data. The Econometrics Journal 3: 148–61. [Google Scholar] [CrossRef]

- Haroon, Omair, and Syed Aun R. Rizvi. 2020. COVID-19: Media Coverage and Financial Markets Behavior—A Sectoral Inquiry. Journal of Behavioral and Experimental Finance 27: 100343. [Google Scholar] [CrossRef]

- Hasbrouck, Joel, and Gideon Saar. 2013. Low-Latency Trading. Journal of Financial Markets 16: 646–79. [Google Scholar] [CrossRef]

- Helmes, Uwe, Julia Henker, and Thomas Henker. 2010. The Effect of the Ban on Short Selling on Market Efficiency and Volatility. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1688135 (accessed on 10 September 2021).

- Hendershott, Terrence, Charles M. Jones, and Albert J. Menkveld. 2011. Does Algorithmic Trading Improve Liquidity? Spreads for the Long Run. Journal of Finance 66: 1–33. [Google Scholar] [CrossRef]

- Hong, Hui, Zhicun Bian, and Chien-Chiang Lee. 2021. COVID-19 and Instability of Stock Market Performance: Evidence from the U.S. Financial Innovation 7: 12. [Google Scholar] [CrossRef]

- Hossain, Saddam, Beáta Gavurová, Xianghui Yuan, Morshadul Hasan, and Judit Oláh. 2021. The impact of intraday momentum on stock returns: Evidence from s&p500 and csi300. E a M: Ekonomie a Management 24: 121–44. [Google Scholar] [CrossRef]

- Hua, Mingshu, and Chen-Yu Li. 2011. The Intraday Bid–Ask Spread Behaviour of the JPY/USD Exchange Rate in the EBS Electronic Brokerage System. Applied Economics 43: 2003–13. [Google Scholar] [CrossRef]

- Huhtilainen, Matias. 2017. European Journal of Government and Economics The Short Selling Regulation in the European Union: Assessing the Authorization Granted for the European Securities and Markets Authority to Prohibit Short Selling. European Journal of Government and Economics 6: 5–23. [Google Scholar] [CrossRef]

- Hunjra, Ahmed Imran, Ploypailin Kijkasiwat, Murugesh Arunachalam, and Helmi Hammami. 2021. COVID-19 health policy intervention and volatility of Asian capital markets. Technological Forecasting and Social Change 169: 120840. [Google Scholar] [CrossRef]

- Jovanovic, Boyan, and Albert J. Menkveld. 2012. Middlemen in Limit-Order Markets. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Kottaridi, Constantina, Emmanouil Skarmeas, and Vasileios Pappas. 2020a. Intraday Stock Returns Patterns Revisited. A Day of the Week and Market Trend Approach. A Day of the Week and Market Trend Approach. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3482450 (accessed on 10 September 2021).

- Kubiczek, Jakub, and Marcin Tuszkiewicz. 2022. Intraday Patterns of Liquidity on the Warsaw Stock Exchange before and after the Outbreak of the COVID-19 Pandemic. International Journal of Financial Studies 10: 13. [Google Scholar] [CrossRef]

- Li, Weiqing, Fengsheng Chien, Hafiz Waqas Kamran, Talla M. Aldeehani, Muhammad Sadiq, Van Chien Nguyen, and Farhad Taghizadeh-Hesary. 2021. The Nexus between COVID-19 Fear and Stock Market Volatility. Economic Research-Ekonomska Istraživanja, 1–22. [Google Scholar] [CrossRef]

- Losada López, Ramiro, and Albert Martínez. 2020. Analysis of the Effect of Restrictions on Net Short Positions on Spanish Shares between March and May 2020. Madrid: Comisión Nacional del Mercado de Valores. [Google Scholar]

- Ma, Rui, Hamish D. Anderson, and Ben R. Marshall. 2018. Market Volatility, Liquidity Shocks, and Stock Returns: Worldwide Evidence. Pacific-Basin Finance Journal 49: 164–99. [Google Scholar] [CrossRef]

- MacKinnon, James G., Alfred A. Haug, and Leo Michelis. 1999. Numerical distribution functions of likelihood ratio tests for cointegration. Journal of Applied Econometrics 14: 563–77. [Google Scholar] [CrossRef]

- Marozva, Godfrey, and Margaret Rutendo Magwedere. 2021. COVID-19 and Stock Market Liquidity: An Analysis of Emerging and Developed Markets. Scientific Annals of Economics and Business 68: 129–44. [Google Scholar] [CrossRef]

- Marsh, Ian W., and Richard Payne. 2012. Banning Short Sales and Market Quality: The UK’s Experience. Journal of Banking and Finance 36: 1975–86. [Google Scholar] [CrossRef]

- Martens, Martin, Yuan-Chen Chang, and Stephen J. Taylor. 2002. A Comparison of seasonal adjustment methods when forecasting intraday volatility. Journal of Financial Research XXV: 283–99. [Google Scholar]

- Massa, Massimo, Bohui Zhang, and Hong Zhang. 2015. The Invisible Hand of Short Selling: Does Short Selling Discipline Earnings Management? The Review of Financial Studies 28: 1701–36. [Google Scholar] [CrossRef]

- Menkveld, Albert J. 2013. High Frequency Trading and the New Market Makers. Journal of Financial Markets 16: 712–40. [Google Scholar] [CrossRef]

- Mishra, P. K., and S. K. Mishra. 2021. Do Banking and Financial Services Sectors Show Herding Behaviour in Indian Stock Market Amid COVID-19 Pandemic? Insights from Quantile Regression Approach. Millennial Asia, 09763996211032356. [Google Scholar] [CrossRef]

- Næs, Randi, and Johannes A. Skjeltorp. 2006. Order Book Characteristics and the Volume-Volatility Relation: Empirical Evidence from a Limit Order Market. Journal of Financial Markets 9: 408–32. [Google Scholar] [CrossRef]

- O’Hara, Maureen. 2015. High Frequency Market Microstructure. Journal of Financial Economics 116: 257–70. [Google Scholar] [CrossRef]

- Ozenbas, Deniz. 2008. Intra-Day Trading Volume Patterns Of Equity Markets: A Study Of US And European Stock Markets. International Business & Economics Research Journal (IBER) 2008: 7. [Google Scholar] [CrossRef][Green Version]

- Ozkan, Oktay. 2021. Impact of COVID-19 on stock market efficiency: Evidence from developed countries. Research in International Business and Finance 58: 101445. [Google Scholar] [CrossRef]

- Pascual, Roberto, and David Veredas. 2006. Does the Open Limit Order Book Matter in Explaining Long Run Volatility? Louvain: Université catholique de Louvain, Center for Operations Research and Econometrics (CORE). [Google Scholar]

- Priscilla, Sherin, Saarce Hatane, and Josua Tarigan. 2022. COVID-19 Catastrophes and Stock Market Liquidity: Evidence from Technology Industry of Four Biggest ASEAN Capital Market. Asia-Pacific Journal of Business Administration. [Google Scholar] [CrossRef]

- Prodromou, Tina, and P. Joakim Westerholm. 2022. Are High Frequency Traders Responsible for Extreme Price Movements? Economic Analysis and Policy 73: 94–111. [Google Scholar] [CrossRef]

- Roll, Richard. 1984. A Simple Implicit Measure of the Effective Bid-Ask Spread in an Efficient Market. The Journal of Finance 39: 1127–39. [Google Scholar] [CrossRef]

- Sheraz, Muhammad, and Imran Nasir. 2021. Information-Theoretic Measures and Modeling Stock Market Volatility: A Comparative Approach. Risks 9: 89. [Google Scholar] [CrossRef]

- Siciliano, Gianfranco, and Marco Ventoruzzo. 2020. Banning Cassandra from the Market? An Empirical Analysis of Short-Selling Bans during the COVID-19 Crisis. European Company and Financial Law Review 17: 386–418. [Google Scholar] [CrossRef]

- Sobaci, Cihat, Ahmet Sensoy, and Mutahhar Erturk. 2014. Impact of Short Selling Activity on Market Dynamics: Evidence from an Emerging Market. Journal of Financial Stability 15: 53–62. [Google Scholar] [CrossRef]

- Tian, Gary Gang, and Mingyuan Guo. 2007. Interday and Intraday Volatility: Additional Evidence from the Shanghai Stock Exchange. Review of Quantitative Finance and Accounting 28: 287–306. [Google Scholar] [CrossRef]

- Tilfani, Oussama, Paulo Ferreira, and My Youssef El Boukfaoui. 2021. Dynamic cross-correlation and dynamic contagion of stock markets: A sliding windows approach with the DCCA correlation coefficient. Empirical Economics 60: 1127–56. [Google Scholar] [CrossRef]

- Tissaoui, Kais, Besma Hkiri, Mariem Talbi, Waleed Alghassab, and Khaled Issa Alfreahat. 2021. Market Volatility and Illiquidity during the COVID-19 Outbreak: Evidence from the Saudi Stock Exchange through the Wavelet Coherence Approaches. The North American Journal of Economics and Finance 58: 101521. [Google Scholar] [CrossRef]

- Uddin, Moshfique, Anup Chowdhury, Keith Anderson, and Kausik Chaudhuri. 2021. The Effect of COVID-19 Pandemic on Global Stock Market Volatility: Can Economic Strength Help to Manage the Uncertainty? Journal of Business Research 128: 31–44. [Google Scholar] [CrossRef]

- Virgilio, Gianluca Piero Maria. 2019. High-Frequency Trading: A Literature Review. Financial Markets and Portfolio Management 33: 183–208. [Google Scholar] [CrossRef]

- Wang, Shu-Feng, Kuan-Hui Lee, and Min-Cheol Woo. 2017. Do Individual Short-Sellers Make Money? Evidence from Korea. Journal of Banking & Finance 79: 159–72. [Google Scholar] [CrossRef]

- Wilcoxon, Frank. 1945. Individual Comparisons by Ranking Methods. Biometrics Bulletin 1: 80–83. [Google Scholar] [CrossRef]

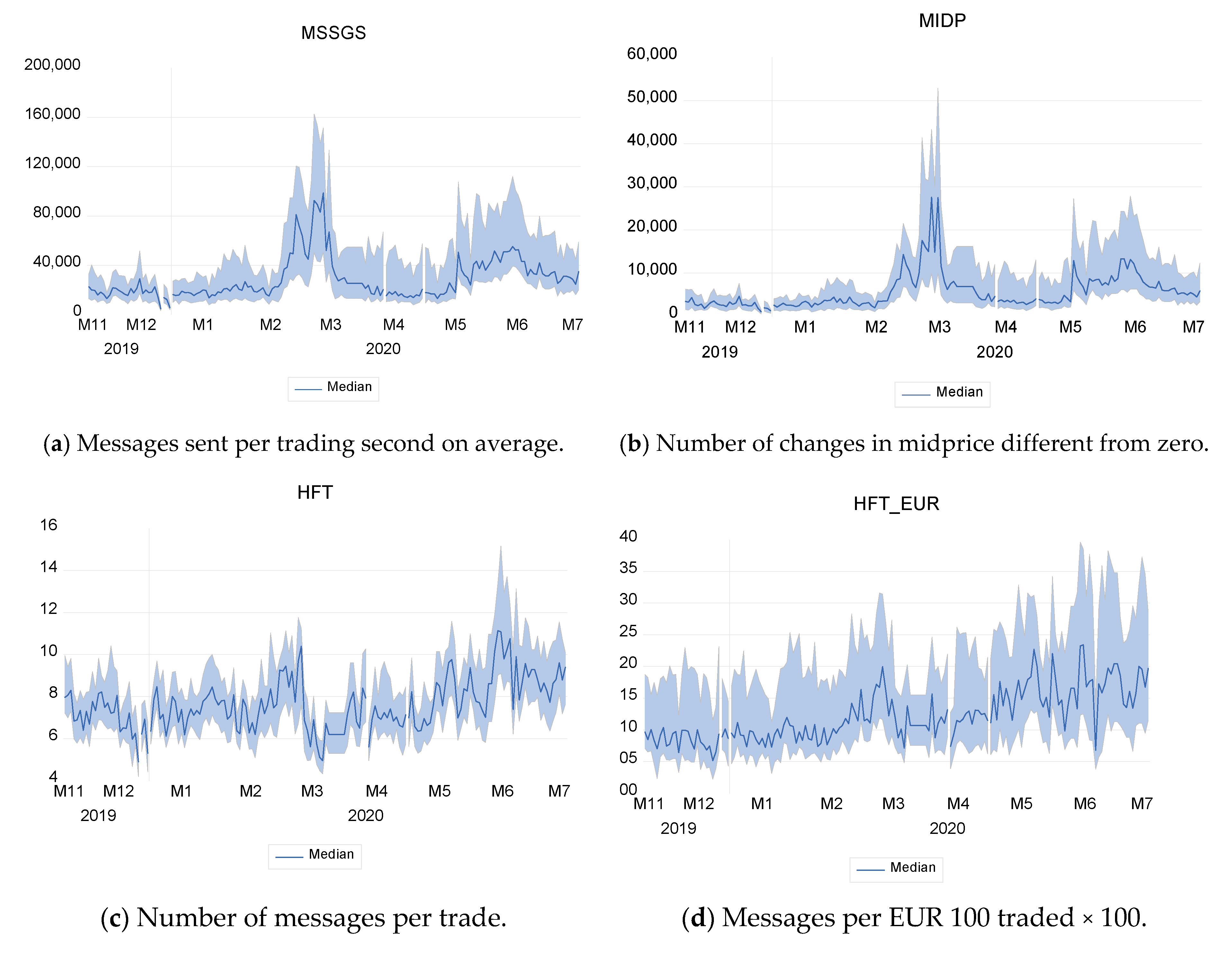

| Panel A. | ||||||||

| Measures | Algo Tr % | Avg Size | Messages Sec | Messages Trade (HFT) | Midprice Changes | #_trades | Messages_€100 | |

| Pre-COVID W0 | IB | 71.892 | 441.986 | 0.571 | 7.100 | 2505.000 | 2255.000 | 0.087 |

| COVID Crash W1 | 73.028 | 402.232 | 1.004 | 7.529 | 5076.000 | 3804.000 | 0.112 | |

| Short-Selling Ban W2 | 72.454 | 502.345 | 0.616 | 6.767 | 4181.000 | 2737.000 | 0.117 | |

| De-escalation W3 | 68.377 | 408.680 | 1.225 | 8.801 | 7293.000 | 4115.000 | 0.167 | |

| Pre-COVID W0 | Q4 | 75.841 | 539.405 | 0.998 | 6.710 | 3958.000 | 4375.000 | 0.045 |

| COVID Crash W1 | 77.023 | 458.254 | 1.788 | 6.948 | 9724.000 | 7368.000 | 0.064 | |

| Short-Selling Ban W2 | 76.574 | 529.740 | 1.653 | 6.322 | 11,229.000 | 7403.000 | 0.064 | |

| De-escalation W3 | 73.369 | 430.040 | 2.296 | 8.613 | 11,772.000 | 7852.000 | 0.091 | |

| Pre-COVID W0 | Q3 | 69.867 | 383.641 | 0.796 | 7.456 | 3622.500 | 2676.500 | 0.075 |

| COVID Crash W1 | 70.909 | 351.761 | 1.694 | 8.097 | 8388.000 | 5314.500 | 0.099 | |

| Short-Selling Ban W2 | 70.092 | 519.319 | 1.435 | 7.546 | 10,156.000 | 4765.500 | 0.097 | |

| De-escalation W3 | 68.243 | 406.606 | 2.092 | 9.485 | 13,566.500 | 5990.000 | 0.155 | |

| Pre-COVID W0 | Q2 | 73.010 | 561.486 | 0.521 | 6.855 | 2224.000 | 2145.000 | 0.099 |

| COVID Crash W1 | 74.229 | 516.710 | 0.857 | 7.512 | 4123.000 | 3332.000 | 0.117 | |

| Short-Selling Ban W2 | 71.618 | 562.891 | 0.542 | 6.699 | 3354.000 | 2537.000 | 0.143 | |

| De-escalation W3 | 66.501 | 413.067 | 1.096 | 8.681 | 6399.000 | 3888.000 | 0.197 | |

| Pre-COVID W0 | Q1 | 67.857 | 338.089 | 0.288 | 7.390 | 1232.000 | 1123.000 | 0.205 |

| COVID Crash W1 | 68.379 | 330.296 | 0.418 | 7.549 | 2214.000 | 1841.000 | 0.229 | |

| Short-Selling Ban W2 | 67.384 | 409.503 | 0.263 | 6.910 | 1512.000 | 1135.000 | 0.210 | |

| De-escalation W3 | 61.832 | 391.942 | 0.564 | 8.658 | 3364.000 | 1922.000 | 0.324 | |

| Panel B. | ||||||||

| Changes % | Algo tr | AvgSize | Messages sec | Messages trade (HFT) | Midprice changes | #_trades | Messages_€100 | |

| W1-W0 | IB | 1.58 *** | −8.99 *** | 75.90 *** | 6.04 *** | 102.63 *** | 68.69 *** | 28.13 *** |

| W2-W0 | 0.78 | 13.66 *** | 7.91 *** | −4.69 *** | 66.91 *** | 21.37 *** | 33.66 *** | |

| W3-W0 | −4.89 | −7.54 | 114.57 *** | 23.96 | 191.14 *** | 82.48 *** | 91.71 *** | |

| W2-W1 | −0.79 *** | 24.89 *** | −38.65 *** | −10.12 *** | −17.63 *** | −28.05 *** | 4.31 ** | |

| W3-W1 | −6.37 *** | 1.60 *** | 21.99 *** | 16.90 *** | 43.68 *** | 8.18 *** | 49.62 *** | |

| W3-W2 | −5.63 *** | −18.65 *** | 98.84 *** | 30.06 *** | 74.43 *** | 50.35 *** | 43.43 *** | |

| W1-W0 | Q4 | 1.56 *** | −15.04 *** | 79.08 *** | 3.53 *** | 145.68 *** | 68.41 *** | 42.59 *** |

| W2-W0 | 0.97 *** | −1.79 *** | 65.57 *** | −5.79 * | 183.70 *** | 69.21 *** | 43.40 *** | |

| W3-W0 | −3.26 *** | −20.28 *** | 130.03 *** | 28.36 *** | 197.42 *** | 79.47 *** | 105.01 *** | |

| W2-W1 | −0.58 | 15.60 *** | −7.54 *** | −9.01 *** | 15.48 | 0.48 *** | 0.57 * | |

| W3-W1 | −4.74 *** | −6.16 ** | 25.45 | 23.98 *** | 21.06 | 6.57 | 43.78 *** | |

| W3-W2 | −4.19 *** | −18.82 *** | 38.93 *** | 36.25 *** | 4.84 *** | 6.07 *** | 42.97 *** | |

| W1-W0 | Q3 | 1.49 ** | −8.31 *** | 112.76 *** | 8.58 *** | 131.55 *** | 98.56 *** | 32.96 *** |

| W2-W0 | 0.32 | 35.37 *** | 80.24 *** | 1.20 | 180.36 *** | 78.05 *** | 29.66 *** | |

| W3-W0 | −2.33 *** | 5.99 ** | 162.65 *** | 27.21 *** | 274.51 *** | 123.80 *** | 107.56 *** | |

| W2-W1 | −1.15 ** | 47.63 *** | −15.28 *** | −6.80 *** | 21.08 *** | −10.33 * | −2.48 | |

| W3-W1 | −3.76 *** | 15.59 | 23.45 *** | 17.15 *** | 61.74 *** | 12.71 ** | 56.11 *** | |

| W3-W2 | −2.64 *** | −21.70 *** | 45.72 *** | 25.70 *** | 33.58 *** | 25.70 *** | 60.07 *** | |

| W1-W0 | Q2 | 1.67 *** | −7.97 *** | 64.39 *** | 9.58 *** | 85.39 *** | 55.34 *** | 18.13 *** |

| W2-W0 | −1.91 *** | 0.25 *** | 3.93 *** | −2.28 ** | 50.81 *** | 18.28 *** | 44.48 *** | |

| W3-W0 | −8.92 *** | −26.43 | 110.19 *** | 26.64 *** | 187.72 *** | 81.26 *** | 22.31 *** | |

| W2-W1 | −3.52 *** | 8.94 *** | −36.78 *** | −10.82 *** | −18.65 *** | −23.86 *** | 22.31 *** | |

| W3-W1 | −10.41 *** | −20.06 | 27.87 *** | 15.57 *** | 55.20 *** | 16.69 ** | 69.33 *** | |

| W3-W2 | −7.15 *** | −26.62 *** | 102.26 *** | 29.59 *** | 90.79 *** | 53.25 *** | 38.45 *** | |

| W1-W0 | Q1 | 0.77 * | −2.31 | 44.87 *** | 2.15 * | 79.71 *** | 63.94 *** | 11.93 *** |

| W2-W0 | −0.70 | 21.12 *** | −8.60 *** | −6.49 | 22.73 *** | 1.07 ** | 2.68 *** | |

| W3-W0 | −8.88 *** | 15.93 *** | 95.69 *** | 17.16 *** | 173.05 *** | 71.15 *** | 58.09 *** | |

| W2-W1 | −1.45 | 23.98 *** | −36.91 *** | 8.46 ** | −31.71 *** | −38.35 *** | −8.26 | |

| W3-W1 | −9.57 *** | 18.66 *** | 35.08 ** | 14.69 *** | 51.94 *** | 4.40 | 41.24 *** | |

| W3-W2 | −8.24 *** | −4.29 *** | 114.09 *** | 25.29 *** | 122.49 *** | 69.34 *** | 53.96 *** | |

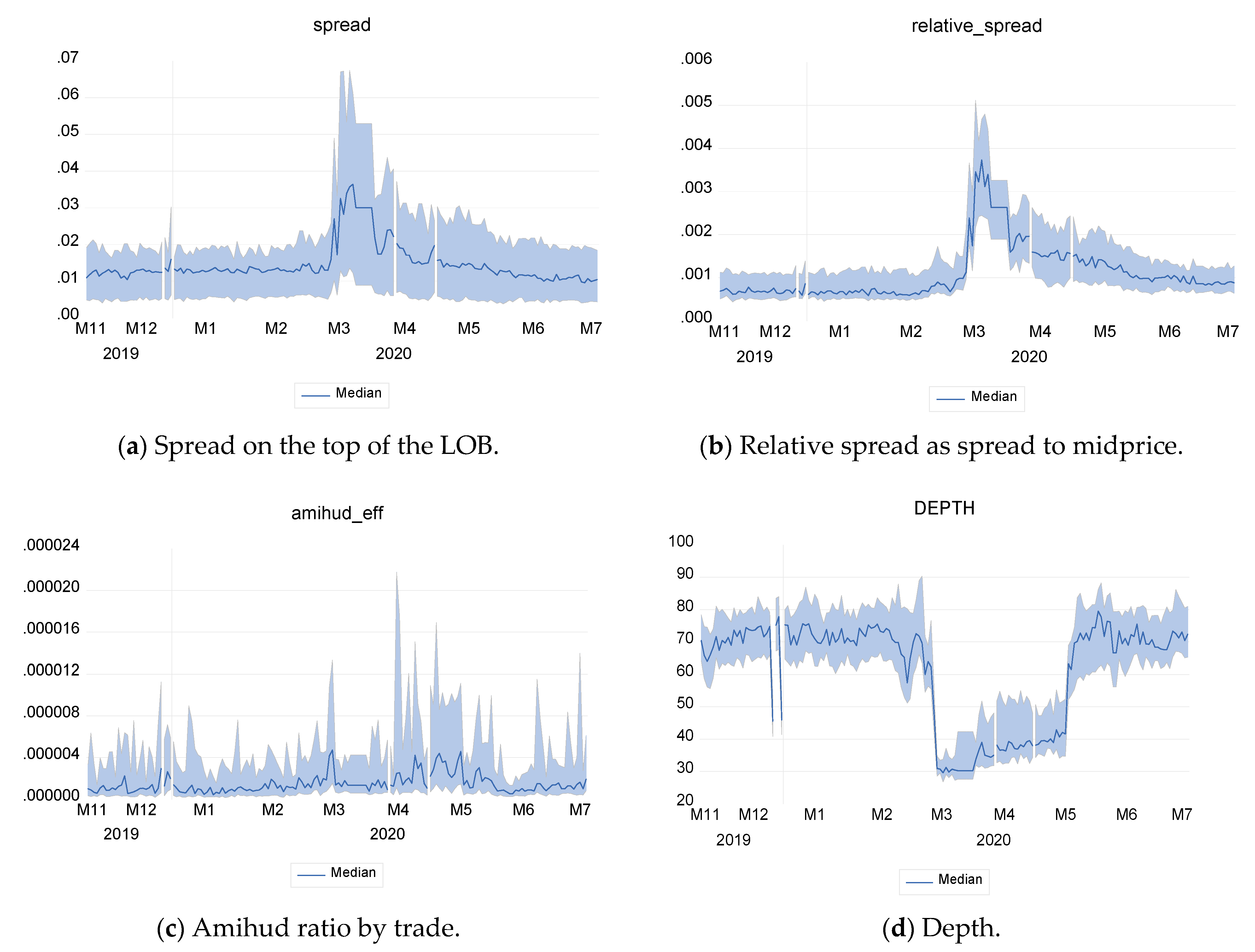

| Panel A. | ||||||

| Liquidity | AvgVol | Spread | Relative Spread | Depth | Amihud (Trades) | |

| Median | % | ×1,000,000 | ||||

| Pre-COVID W0 | IB | 894,028.000 | 0.013 | 0.068 | 70.736 | 1.010 |

| COVID Crash W1 | 1,461,954.000 | 0.013 | 0.077 | 68.555 | 1.110 | |

| Short-Selling Ban W2 | 1,205,918.000 | 0.018 | 0.183 | 36.819 | 1.890 | |

| De-escalation W3 | 1,382,215.000 | 0.011 | 0.099 | 70.598 | 1.130 | |

| Pre-COVID W0 | Q4 | 2,335,742.000 | 0.013 | 0.042 | 78.601 | 0.378 |

| COVID Crash W1 | 3,482,542.000 | 0.013 | 0.051 | 79.911 | 0.459 | |

| Short-Selling Ban W2 | 3,658,708.000 | 0.014 | 0.091 | 48.341 | 0.879 | |

| De-escalation W3 | 3,217,618.000 | 0.012 | 0.064 | 81.125 | 0.688 | |

| Pre-COVID W0 | Q3 | 937,541.500 | 0.014 | 0.058 | 70.576 | 0.378 |

| COVID Crash W1 | 1,749,269.500 | 0.015 | 0.062 | 69.189 | 0.482 | |

| Short-Selling Ban W2 | 1,664,479.500 | 0.019 | 0.144 | 40.510 | 0.743 | |

| De-escalation W3 | 1,626,919.500 | 0.013 | 0.078 | 73.550 | 0.484 | |

| Pre-COVID W0 | Q2 | 1,245,738.000 | 0.010 | 0.078 | 71.835 | 1.680 |

| COVID Crash W1 | 1,666,171.000 | 0.010 | 0.091 | 68.891 | 1.650 | |

| Short-Selling Ban W2 | 1,445,547.000 | 0.020 | 0.192 | 35.091 | 3.100 | |

| De-escalation W3 | 1,540,680.000 | 0.010 | 0.111 | 67.870 | 1.930 | |

| Pre-COVID W0 | Q1 | 392,815.000 | 0.013 | 0.133 | 63.480 | 2.980 |

| COVID Crash W1 | 572,274.000 | 0.016 | 0.148 | 60.694 | 4.400 | |

| Short-Selling Ban W2 | 463,558.000 | 0.022 | 0.308 | 32.986 | 6.290 | |

| De-escalation W3 | 755,178.000 | 0.014 | 0.176 | 61.047 | 3.120 | |

| Panel B. | ||||||

| % | AvgVol | Spread | Relative Spread | Depth | Amihud (trades) | |

| W1-W0 | IB | 63.52 *** | 6.27 *** | 13.66 *** | −3.08 *** | 9.90 |

| W2-W0 | 34.89 *** | 43.42 *** | 168.14 *** | −47.95 *** | 87.13 *** | |

| W3-W0 | 54.61 *** | −9.47 *** | 44.93 *** | −0.20 | 11.88 * | |

| W2-W1 | −17.51 | 34.96 *** | 135.92 *** | −46.29 *** | 70.27 *** | |

| W3-W1 | −5.45 *** | −14.81 | 27.52 *** | 2.98 *** | 1.80 ** | |

| W3-W2 | 14.62 *** | −36.88 *** | −45.95 *** | 91.75 *** | −40.21 *** | |

| W1-W0 | Q4 | 49.10 *** | 3.49 *** | 20.52 *** | 1.67 | 21.43 |

| W2-W0 | 56.64 *** | 12.77 *** | 114.15 *** | −38.68 *** | 132.54 *** | |

| W3-W0 | 37.76 *** | −5.84 *** | 49.76 *** | 3.21 *** | 82.01 *** | |

| W2-W1 | 5.06 | 8.97 *** | 77.69 *** | −39.69 *** | 91.50 *** | |

| W3-W1 | −7.61 | −9.01 ** | 24.27 *** | 1.52 *** | 49.89 *** | |

| W3-W2 | −12.06 | −16.50 *** | −30.07 *** | 68.32 *** | −21.73 *** | |

| W1-W0 | Q3 | 86.58 *** | 4.53 ** | 5.65 *** | −1.97 | 27.51 |

| W2-W0 | 77.54 *** | 36.52 *** | 146.19 *** | −42.60 *** | 96.43 *** | |

| W3-W0 | 73.53 *** | −4.47 *** | 32.85 *** | 4.21 | 28.04 | |

| W2-W1 | −4.85 *** | 30.60 *** | 133.04 *** | −41.45 | 54.05 *** | |

| W3-W1 | −6.99 *** | −8.61 | 25.75 *** | 6.30 | 0.41 | |

| W3-W2 | −2.26 * | −30.02 | −46.04 *** | 81.56 *** | 34.81 *** | |

| W1-W0 | Q2 | 33.75 *** | 0.00 *** | 16.45 *** | −4.10 *** | −1.79 |

| W2-W0 | 16.04 *** | 100.00 *** | 145.15 *** | −51.15 *** | 84.52 *** | |

| W3-W0 | 23.68 *** | 0.00 *** | 41.58 *** | −5.52 *** | 14.88 ** | |

| W2-W1 | −13.24 *** | 100.00 *** | 110.51 *** | −49.06 *** | 87.88 *** | |

| W3-W1 | −7.53 *** | 0.00 *** | 21.58 *** | −1.48 *** | 16.97 ** | |

| W3-W2 | 6.58 *** | −50.00 *** | −42.25 *** | 93.41 *** | −34.74 *** | |

| W1-W0 | Q1 | 45.69 *** | 24.47 *** | 11.30 *** | −4.39 *** | 47.65 |

| W2-W0 | 18.01 *** | 74.05 *** | 131.55 *** | −48.04 *** | 111.07 *** | |

| W3-W0 | 92.25 *** | 6.71 *** | 32.30 *** | −3.83 | 4.70 | |

| W2-W1 | −19.00 *** | 39.84 *** | 108.05 *** | −45.65 *** | 42.945 *** | |

| W3-W1 | 31.96 * | −14.27 | 18.88 *** | 0.58 *** | −29.09 | |

| W3-W2 | 62.91 *** | −38.69 *** | −42.86 *** | 85.07 *** | −50.40 *** | |

| 1 min Volatility Measures | No SSR Period | SSR Period W2 |

|---|---|---|

| VDAX (1 min scaled) | 0.002026 | 0.04199 |

| (RVol_1m) | 0.000957 | 0.001184 |

| (RVol_1m) without SSR * | 0.000957 | 0.003130 |

| Panel A. | ||

| Volatility | Realized_vol_1min | |

| Pre-COVID W0 | IB | 0.001 |

| COVID Crash W1 | 0.001 | |

| Short-Selling Ban W2 | 0.001 | |

| De-escalation W3 | 0.001 | |

| Pre-COVID W0 | Q4 | 0.000 |

| COVID Crash W1 | 0.001 | |

| Short-Selling Ban W2 | 0.001 | |

| De-escalation W3 | 0.001 | |

| Pre-COVID W0 | Q3 | 0.001 |

| COVID Crash W1 | 0.001 | |

| Short-Selling Ban W2 | 0.002 | |

| De-escalation W3 | 0.001 | |

| Pre-COVID W0 | Q2 | 0.001 |

| COVID Crash W1 | 0.001 | |

| Short-Selling Ban W2 | 0.001 | |

| De-escalation W3 | 0.001 | |

| Pre-COVID W0 | Q1 | 0.001 |

| COVID Crash W1 | 0.001 | |

| Short-Selling Ban W2 | 0.002 | |

| De-escalation W3 | 0.001 | |

| Panel B. | ||

| % | Median change | |

| W1-W0 | IB | 47.67 *** |

| W2-W0 | 165.41 *** | |

| W3-W0 | 106.27 *** | |

| W2-W1 | 79.73 *** | |

| W3-W1 | 39.68 *** | |

| W3-W2 | −22.28 *** | |

| W1-W0 | Q4 | 41.39 *** |

| W2-W0 | 187.92 *** | |

| W3-W0 | 117.90 *** | |

| W2-W1 | 103.64 *** | |

| W3-W1 | 54.11 *** | |

| W3-W2 | −24.32 *** | |

| W1-W0 | Q3 | 48.27 *** |

| W2-W0 | 191.97 *** | |

| W3-W0 | 110.13 *** | |

| W2-W1 | 96.92 *** | |

| W3-W1 | 41.72 *** | |

| W3-W2 | −28.03 | |

| W1-W0 | Q2 | 42.81 *** |

| W2-W0 | 159.68 *** | |

| W3-W0 | 106.93 *** | |

| W2-W1 | 81.84 *** | |

| W3-W1 | 44.90 *** | |

| W3-W2 | −20.31 *** | |

| W1-W0 | Q1 | 43.74 *** |

| W2-W0 | 123.11 *** | |

| W3-W0 | 92.71 *** | |

| W2-W1 | 55.22 *** | |

| W3-W1 | 34.07 *** | |

| W3-W2 | −13.63 *** | |

| Panel A. | |||||

| Price Efficiency | Autocorrelation 1 min | Slope | ELOB | Vol_coef_1m_30m | |

| Pre-COVID W0 | IB | −0.061 | 1282.29 | 1.023 | 1.28 |

| COVID Crash W1 | −0.053 | 1120.38 | 1.032 | 1.26 | |

| Short-Selling Ban W2 | −0.103 | 583.50 | 1.063 | 1.32 | |

| De-escalation W3 | −0.035 | 916.34 | 1.024 | 1.28 | |

| Pre-COVID W0 | Q4 | −0.086 | 1740.22 | 1.018 | 1.23 |

| COVID Crash W1 | −0.067 | 1529.51 | 1.023 | 1.20 | |

| Short-Selling Ban W2 | −0.093 | 1059.28 | 1.046 | 1.21 | |

| De-escalation W3 | −0.044 | 1329.84 | 1.019 | 1.19 | |

| Pre-COVID W0 | Q3 | −0.049 | 1454.90 | 1.024 | 1.28 |

| COVID Crash W1 | −0.047 | 1308.47 | 1.033 | 1.27 | |

| Short-Selling Ban W2 | −0.100 | 723.95 | 1.044 | 1.34 | |

| De-escalation W3 | 0.000 | 1021.12 | 1.026 | 1.28 | |

| Pre-COVID W0 | Q2 | −0.058 | 1198.12 | 1.025 | 1.23 |

| COVID Crash W1 | −0.048 | 1052.86 | 1.032 | 1.20 | |

| Short-Selling Ban W2 | −0.105 | 597.96 | 1.079 | 1.21 | |

| De-escalation W3 | −0.025 | 889.31 | 1.024 | 1.19 | |

| Pre-COVID W0 | Q1 | −0.057 | 685.33 | 1.028 | 1.35 |

| COVID Crash W1 | −0.057 | 622.41 | 1.053 | 1.34 | |

| Short-Selling Ban W2 | −0.117 | 352.44 | 1.107 | 1.42 | |

| De-escalation W3 | −0.039 | 514.22 | 1.026 | 1.39 | |

| Panel B. | |||||

| % | Median change | Median change | Median change | Median change | |

| W1-W0 | IB | −12.77 *** | −12.63 *** | 0.82 | −1.61 *** |

| W2-W0 | 68.28 *** | −54.50 *** | 3.90 *** | 3.42 *** | |

| W3-W0 | −42.17 *** | −28.54 *** | 0.06 ** | −0.10 ** | |

| W2-W1 | 92.92 *** | −47.92 *** | 3.05 *** | 5.11 *** | |

| W3-W1 | −33.70 *** | −18.21 *** | −0.76 *** | 1.53 ** | |

| W3-W2 | −65.64 *** | 57.04 *** | −3.69 *** | −3.40 *** | |

| W1-W0 | Q4 | −21.71 *** | −12.11 *** | 0.46 *** | −2.88 ** |

| W2-W0 | 8.71 *** | −39.13 *** | 2.73 *** | −1.84 * | |

| W3-W0 | −48.09 *** | −23.58 *** | 0.05 | −3.45 ** | |

| W2-W1 | 38.86 *** | −30.74 *** | 2.27 *** | 1.08 | |

| W3-W1 | −33.70 *** | −13.05 *** | −0.41 ** | −0.58 | |

| W3-W2 | −52.25 *** | 25.54 *** | −2.61 *** | −1.64 | |

| W1-W0 | Q3 | −5.63 | −10.06 *** | 0.90 *** | −0.60 ** |

| W2-W0 | 101.76 *** | −50.24 *** | 1.94 *** | 4.33 | |

| W3-W0 | −100 *** | −29.82 *** | 0.25 *** | −0.18 * | |

| W2-W1 | 113.80 *** | −44.67 *** | 1.03 *** | 4.96 *** | |

| W3-W1 | −100 *** | −21.96 *** | −0.65 *** | 0.43 | |

| W3-W2 | −100 *** | 41.05 *** | −1.66 *** | −4.32 ** | |

| W1-W0 | Q2 | −17.58 * | −12.12 *** | 0.69 *** | −2.72 * |

| W2-W0 | 81.21 *** | −50.09 *** | 5.29 *** | −1.68 | |

| W3-W0 | −57.35 *** | 25.77 *** | −0.05 | −3.29 ** | |

| W2-W1 | 119.87 *** | −43.21 *** | 4.58 *** | 1.08 | |

| W3-W1 | −48.25 *** | −15.53 *** | −0.73 *** | −0.58 | |

| W3-W2 | −76.46 *** | 48.72 *** | −5.08 *** | −1.64 | |

| W1-W0 | Q1 | 0.05 | 9.18 *** | 2.45 *** | −0.62 |

| W2-W0 | 106.29 *** | −48.57 *** | 7.74 *** | 5.35 *** | |

| W3-W0 | −31.72 ** | −21.97 *** | −0.18 | 2.81 *** | |

| W2-W1 | 106.18 *** | −43.38 *** | 5.17 *** | 6.01 *** | |

| W3-W1 | −31.75 | −17.38 *** | −2.56 *** | 3.44 *** | |

| W3-W2 | −66.90 *** | 45.91 *** | −7.35 *** | −2.42 | |

| Coefficients | SPREAD | RELATIVE SPREAD % | DEPTH | AMIHUD 106 |

| Intercept | 0.005 (0.002) ** | −0.028 (0.009) *** | 79.849 (1.534) *** | 13.181 (9.909) |

| Pre-COVID W0 | 0.014 (0.002) *** | 0.121 (0.010) *** | −8.374 (1.566) *** | −3.535 (10.121) |

| COVID Crisis W1 | 0.017 (0.002) *** | 0.136 (0.009) *** | −9.346 (1.498) *** | −6.150 (9.682) |

| Ban Period W2 | 0.031 (0.002) *** | 0.252 (0.009) *** | −39.038 (1.500) *** | 0.040 (9.693) |

| De-escalation W3 | 0.017 (0.002) *** | 0.155 (0.010) *** | −8.723 (1.566) *** | 2.110 (10.121) |

| Adjusted R | 0.810 | 0.765 | 0.707 | 0.057 |

| Coefficients | ELOB | SLOPE | ||

| Intercept | 0.867 (0.066) *** | 1480.501 (35.364) *** | ||

| Pre-COVID W0 | 0.158 (0.067) ** | −99.918 (36.119) *** | ||

| COVID Crisis W1 | 0.193 (0.064) *** | −241.908 (34.550) *** | ||

| Ban Period W2 | 0.165 (0.064) ** | −763.373 (36.119) *** | ||

| De-escalation W3 | 0.167 (0.067) ** | −516.373 (36.119) *** | ||

| Adjusted R | 0.024 | 0.812 | ||

| Coefficients | REALIZED_VOL % | VOLCOEF | AUTOCORR | |

| Intercept | −0.124 (0.009) *** | 1.389 (0.045) *** | −0.031 (0.008) *** | |

| Pre-COVID W0 | 0.185 (0.009) *** | −0.040 (0.046) | −0.036 (0.008) *** | |

| COVID Crisis W1 | 0.230 (0.008) *** | −0.0797 (0.044) | −0.026 (0.008) *** | |

| Ban Period W2 | 0.305 (0.008) *** | −0.0103 (0.044) | −0.076 (0.008) *** | |

| De-escalation W3 | 0.252 (0.009) *** | −0.048 (0.046) | −0.015 (0.008) ** | |

| Adjusted R | 0.263 | 0.053 | 0.436 | |

| Coefficients | MIDPRICE CHANGES | MSSG_SEC | MSSG_TRADE | MSSG_EUR |

| Intercept | 986.828 (1.277.187) | 0.793 (0.094) *** | 9.443 (0.544) *** | 0.174 (0.016) *** |

| Pre-COVID W0 | 3.136.770 (1.304.473) ** | −0.046 (0.096) | −0.905 (0555) | −0.038 (0.016) ** |

| COVID Crisis W1 | 9.687.549 (1.247.859) *** | 0.736 (0.09) *** | −0.356 (0.531) | −0.003 (0.015) |

| Ban Period W2 | 8.461.500 (1.249.336) *** | 0.234 (0.09) ** | −1.050 (0.532) ** | −0.001 (0.015) |

| De-escalation W3 | 12.046.030 (1.304.473) *** | 0.923 (0.10) *** | 1.477 (0.555) *** | 0.074 (0.016) *** |

| Adjusted R | 0.589 | 0.652 | 0.786 | 0.231 |

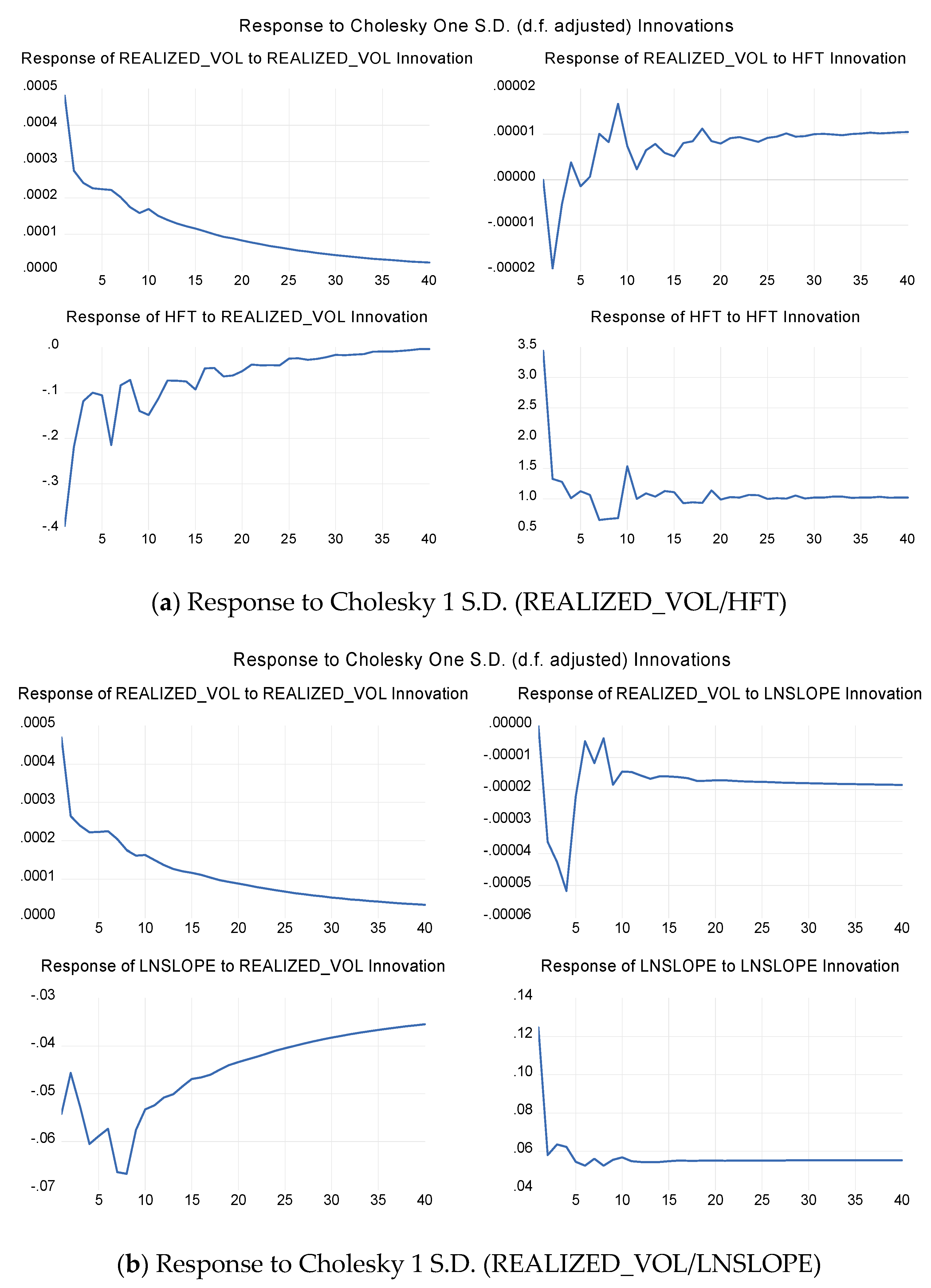

| Panel A. | ||||||||

| VECM and Panel Granger Causality | ||||||||

| Realized Volatility and HFT | Chi-sq | p-value | ||||||

| Long-run cointegrating equation ECTt−1 * | −1.08 × 10−5 | −0.001158 | ||||||

| VECM equation | −0.1016 | 3.27 × 10−6 | ||||||

| Lag (1) | −0.33295 | −6.76 × 10−6 | ||||||

| Lag (2) | −0.15369 | −2.93 × 10−6 | ||||||

| Lag (3) | −0.06585 | 6.91 × 10−7 | ||||||

| Lag (4) | −0.00661 | −7.23 × 10−7 | ||||||

| Lag (5) | 0.02862 | −8.91 × 10−8 | ||||||

| Lag (6) | 0.01534 | 2.72 × 10−6 | ||||||

| Lag (7) | −0.01898 | 1.18 × 10−6 | ||||||

| Lag (8) | −0.02616 | 2.98 × 10−6 | ||||||

| Lag (9) | 0.02010 | 6.00 × 10−7 | ||||||

| HFT Granger causes 1 min realized volatility | 20.0095 | 0.0179 | ||||||

| 1 min realized volatility does not Granger cause HFT | 14.5797 | 0.1031 | ||||||

| Panel B. | ||||||||

| VECM and Granger Panel Causality | ||||||||

| Realized Volatility and LNSLOPE | Chi-sq | p-value | ||||||

| Long-run cointegrating equation ECTt−1 | 0.000346 | −0.003593 | ||||||

| VECM equation | −0.1095 | 2.64 × 10−6 | ||||||

| Lag (1) | −0.36147 | −0.00025 | ||||||

| Lag (2) | −0.18476 | −0.00031 | ||||||

| Lag (3) | −0.12068 | −0.00032 | ||||||

| Lag (4) | −0.03289 | −1.68 × 10−5 | ||||||

| Lag (5) | 0.03733 | 0.00018 | ||||||

| Lag (6) | 0.02358 | 0.00012 | ||||||

| Lag (7) | −0.00789 | 0.00015 | ||||||

| Lag (8) | −0.02764 | 5.72 × 10−6 | ||||||

| LNSLOPE Granger causes 1 min realized volatility | 74.0635 | 0.0000 | ||||||

| 1 min realized volatility Granger causes LNSLOPE | 236.823 | 0.0000 | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ferreruela, S.; Martín, D. Market Quality and Short-Selling Ban during the COVID-19 Pandemic: A High-Frequency Data Approach. J. Risk Financial Manag. 2022, 15, 308. https://doi.org/10.3390/jrfm15070308

Ferreruela S, Martín D. Market Quality and Short-Selling Ban during the COVID-19 Pandemic: A High-Frequency Data Approach. Journal of Risk and Financial Management. 2022; 15(7):308. https://doi.org/10.3390/jrfm15070308

Chicago/Turabian StyleFerreruela, Sandra, and Daniel Martín. 2022. "Market Quality and Short-Selling Ban during the COVID-19 Pandemic: A High-Frequency Data Approach" Journal of Risk and Financial Management 15, no. 7: 308. https://doi.org/10.3390/jrfm15070308

APA StyleFerreruela, S., & Martín, D. (2022). Market Quality and Short-Selling Ban during the COVID-19 Pandemic: A High-Frequency Data Approach. Journal of Risk and Financial Management, 15(7), 308. https://doi.org/10.3390/jrfm15070308