Tourism Activity as an Engine of Growth: Lessons Learned from the European Union

Abstract

:1. Introduction

2. Literature Review

3. Research Hypothesis

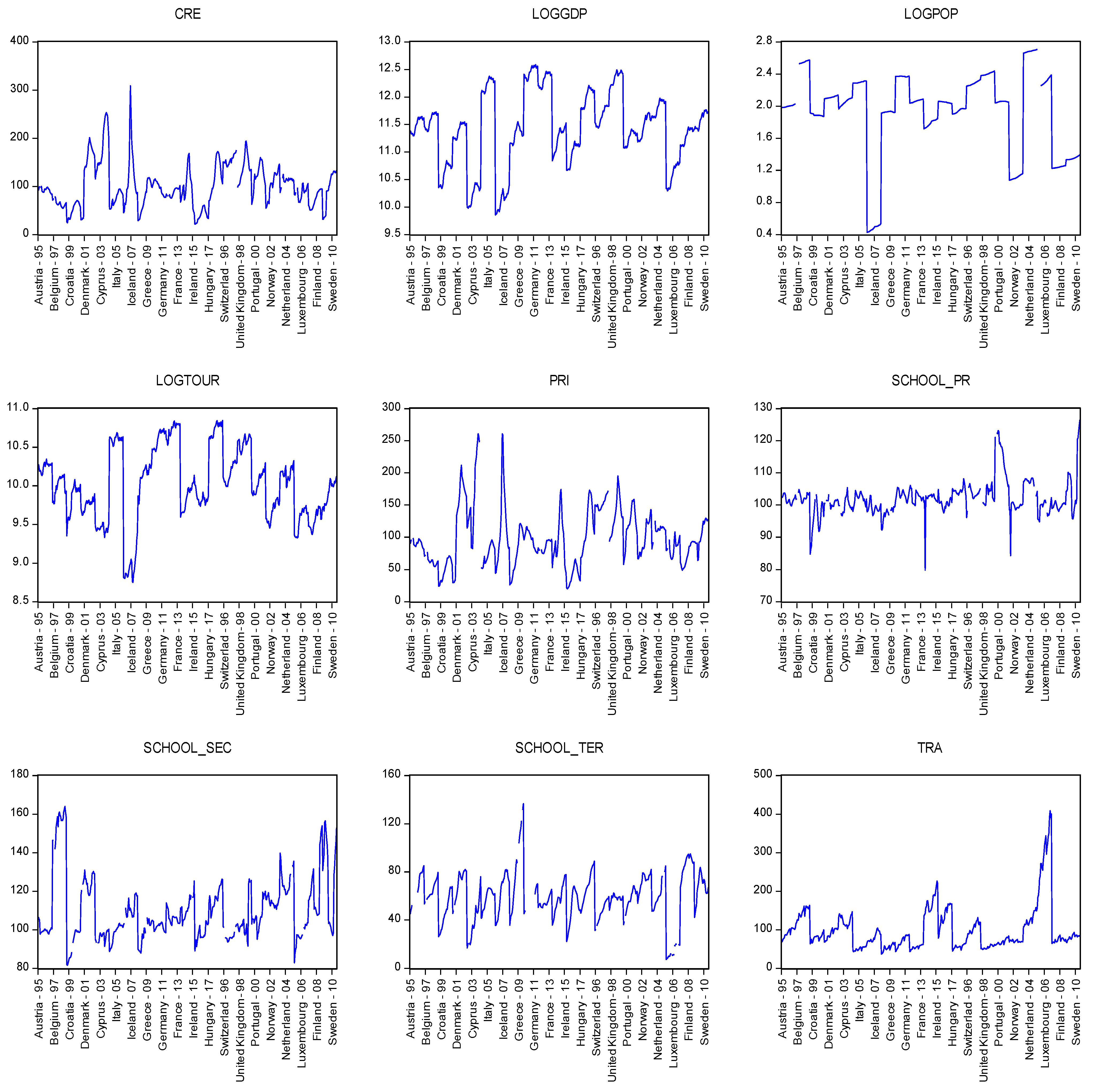

4. Data and Methodology

4.1. Panel Unit Root Test

4.2. Cointegration Tests

4.3. Panel Data Regression Analysis

4.4. Generalized Methods of Moments (GMM) Analysis

4.5. Granger Causality Test

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Our primary goal was to include only the European countries that constitute the European Economic Area (EEA). However, due to severe data limitations, we had to include only the pre-selected 21 countries. It is noteworthy that most of the sample countries belong to the European Monetary Union (Eurozone) turning thus our analysis focuses on the countries that have adopted a (strong) common currency (e.g., the euro). |

References

- Akinboade, Oludele A., and Lydia A. Braimoh. 2010. International tourism and economic development in South Africa: A Granger causality test. International Journal of Tourism Research 12: 149–63. [Google Scholar] [CrossRef]

- Albalate, Daniel, and Germà Bel. 2010. Tourism and urban public transport: Holding demand pressure under supply constraints. Tourism Management 31: 425–33. [Google Scholar] [CrossRef]

- Apergis, Nicholas, and James E. Payne. 2012. Tourism and growth in the Caribbean—Evidence from a panel error correction model. Tourism Economics 18: 449–56. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef] [Green Version]

- Aslan, Alper. 2013. Tourism development and economic growth in the Mediterranean countries: Evidence from panel Granger causality tests. Current Issues in Tourism 17: 363–72. [Google Scholar] [CrossRef]

- Balaguer, Jacint, and Manuel Cantavella-Jordá. 2002. Tourism as a long-run Economic Growth factor: The Spanish case. Applied Economics 34: 877–84. [Google Scholar] [CrossRef] [Green Version]

- Barro, Robert J., and Sala-i-X Martin. 1997. Technological diffusion, convergence, and growth. Journal of Economic Growth 2: 1–26. [Google Scholar] [CrossRef]

- Becker, Brian, and Barry Gerhart. 1996. The impact of human resource management on organizational performance: Progress and prospects. Academy of Management Journal 39: 779–801. [Google Scholar] [CrossRef]

- Belloumi, Mounir. 2010. The relationship between tourism receipts, real effective exchange rate and economic growth in Tunisia. International Journal of Tourism Research 12: 550–60. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef] [Green Version]

- Breitung, Jörg. 2000. The local power of some unit root tests for panel data. In Advances in Econometrics. Non-Stationary Panels, Panel Cointegration, and Dynamic Panels. Edited by Badi Baltagi. Amsterdam: JAI Press, pp. 161–78. [Google Scholar]

- Bruno, Giovanni. 2005. Estimation and inference in dynamic unbalanced panel-data models with a small number of individuals. Stata Journal 5: 473–500. [Google Scholar] [CrossRef] [Green Version]

- Cárdenas-García, Pablo Juan, Marcelino Sánchez-Rivero, and J. I. Pulido-Fernández. 2015. Does Tourism Growth Influence Economic Development? Journal of Travel Research 54: 206–21. [Google Scholar] [CrossRef]

- Carter, Simon. 1998. Tourists’ and travellers’ social construction of Africa and Asia as risky locations. Tourism Management 19: 349–58. [Google Scholar] [CrossRef]

- Choi, In. 2011. Unit root tests for panel data. Journal of International Money and Finance 20: 249–72. [Google Scholar] [CrossRef]

- Cihak, Martin, Asli Demirguc-Kunt, Erik Feyenm, and Ross Levine. 2013. Financial development in 205 economies, 1960 to 2010. Journal of Financial Perspectives 1: 17–36. [Google Scholar]

- Cortés-Jiménez, Isabel, Manuela Pulina, Carme Riera Prunera, and Manuel Artis. 2009. Tourism and Exports as a Means of Growth. Working Papers 2009/10. Barcelona: University of Barcelona, Research Institute of Applied Economics. [Google Scholar]

- Deller, Steven. 2010. Rural poverty, Tourism and spatial heterogeneity. Annals of Tourism Research 37: 180–205. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distributions of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Dritsakis, Nikolaos. 2004a. Cointegration analysis of German and British tourism demand for Greece. Tourism Management 25: 111–19. [Google Scholar] [CrossRef]

- Dritsakis, Nikolaos. 2004b. Tourism as a long-run economic growth factor: An empirical investigation for Greece using causality analysis. Tourism Economics 10: 305–16. [Google Scholar] [CrossRef]

- Dumitrescu, Elena Ivona, and Christophe Hurlin. 2012. Testing for Granger non-causality in heterogeneous panels. Economic Modelling 29: 1450–60. [Google Scholar] [CrossRef] [Green Version]

- Durbarry, Ramesh. 2002. The economic contribution of Tourism in Mauritious. Annals of Tourism Research 29: 862–65. [Google Scholar] [CrossRef]

- Falk, Martin. 2010. A dynamic panel data analysis of snow depth and winter tourism. Tourism Management 31: 912–24. [Google Scholar] [CrossRef]

- Fereidouni, Hassan G., and Usama Al-mulali. 2014. The interaction between tourism and FDI in real estate in OECD countries. Current Issues in Tourism 17: 105–13. [Google Scholar] [CrossRef]

- Gokovali, Um, and Oz Bahar. 2006. Contribution of Tourism to Economic Growth: A Panel Data Approach. Anatolia: An International Journal of Tourism and Hospitality Research 17: 155–67. [Google Scholar] [CrossRef]

- Granger, Clive W. J. 1969. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Hadri, Kaddour. 2000. Testing for stationarity in heterogeneous panel data. Econometric Journal 8: 55–69. [Google Scholar] [CrossRef]

- Hajiyeva, Leyla A., and Vusala Teymurova. 2019. Analysis of the impact of the human capital on tourism development in Azerbaijan. Paper presented at 37th International Scientific Conference on Economic and Social Development—“Socio-Economic Problems of Sustainable Development”, Baku, Azerbaijan, February 14–15; pp. 1579–89. [Google Scholar]

- Hausman, Jerry. 1978. Specification Tests in Econometrics. Econometrica 46: 1251–71. [Google Scholar] [CrossRef] [Green Version]

- Holzner, Mario. 2011. Tourism and economic growth: The beach disease? Tourism Management 32: 922–33. [Google Scholar] [CrossRef] [Green Version]

- Im, Kyung S., M. Hasmem Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar]

- Kao, Chihwa. 1999. Spurious regression and residual-based test for cointegration in panel data. Journal of Econometrics 90: 1–44. [Google Scholar] [CrossRef]

- Kasimati, Evangelia. 2011. Economic Impact of Tourism on Greece’s Economy: Cointegration and Causality Analysis. International Research Journal of Finance and Economics 79: 79–85. [Google Scholar]

- Katircioglu, Salih. 2009. Revisiting the Tourism-led-growth Hypothesis for Turkey Using the Bounds Test and Johansen Approach for Cointegration. Tourism Management 30: 17–20. [Google Scholar] [CrossRef]

- Kim, Hyun J., Ming H. Chen, and SooCheong S. Jang. 2006. Tourism expansion and economic development: The case of Taiwan. Tourism Management 29: 180–92. [Google Scholar] [CrossRef] [PubMed]

- Lanza, Alessandro, Paul Temple, and Giovanni Urga. 2003. The implications of tourism specialization in the long run: An econometric analysis for 13 OCDE economies. Tourism Management 24: 315–21. [Google Scholar] [CrossRef]

- Lee, Sangkwon. 2009. Income inequality in tourism services-dependent countries. Current Issues in Tourism 12: 33–45. [Google Scholar] [CrossRef]

- Lee, Chien C., and Chun P. Chang. 2008. Tourism development and economic growth: A closer look to panels. Tourism Management 29: 80–192. [Google Scholar] [CrossRef]

- Lee, Chien C., and Mei S. Chien. 2008. Structural breaks, tourism development and economic growth: Evidence for Taiwan. Mathematics and Computers in Simulation 77: 358–68. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien F. Lin, and James Chu. 2002. Unit root test in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Li, Kevin X., Mengjie Jin, and Wenming Shi. 2018. Tourism as an important impetus to promoting economic growth: A critical review. Tourism Management Perspectives 26: 135–42. [Google Scholar] [CrossRef]

- Lucas, Robert E. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Maddala, Gangadharrao S., and Shaowen Wu. 1999. A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61: 631–52. [Google Scholar] [CrossRef]

- Mankiw, Gregory N., David Romer, and David N. Weil. 1992. A Contribution to the Empirics Growth. Quarterly Journal of Economics 107: 407–37. [Google Scholar] [CrossRef]

- Nissan, Edward, Miguel A. Galindo, and Maria T. Mendez. 2011. Relationship between tourism and economic growth. The Servic Industries Journal 31: 1567–72. [Google Scholar] [CrossRef]

- Oh, Chi. 2005. The contribution of tourism development to economic growth in the Korean economy. Tourism Managemen 26: 39–44. [Google Scholar] [CrossRef]

- Payne, James E., and Andrea Mervar. 2010. The tourism–growth nexus in Croatia. Tourism Economics 16: 1089–94. [Google Scholar] [CrossRef]

- Pedroni, Peter. 1999. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics 61: 653–69. [Google Scholar] [CrossRef]

- Po, Wan C., and B. Nung Huang. 2008. Tourism development and economic growth—A nonlinear approach. Physica A: Statistical Mechanics and Its Applications 387: 5535–42. [Google Scholar] [CrossRef]

- Ricardo, David. 1951. On the Principles of Political Economy and Taxation. Edited by Piero Sraffa. Works and Correspondence of David Ricardo. Cambridge: Cambridge University Press, Volume I, p. 47. First published 1817. [Google Scholar]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef] [Green Version]

- Sahli, Mondher, and Jean J. Nowak. 2007. Does inbound tourism benefit developing countries? A trade theoretic approach. Journal of Travel Research 45: 426–34. [Google Scholar] [CrossRef]

- Scheyvens, Regina. 2007. Exploring the tourism-poverty nexus. Current Issues in Tourism 10: 231–54. [Google Scholar] [CrossRef]

- Scheyvens, Regina, and Mat Russell. 2012. Tourism, land tenure and poverty alleviation in Fiji. Tourism Geographies 14: 1–25. [Google Scholar] [CrossRef]

- Seetanah, Boopen. 2011. Assessing the dynamic economic impact of tourism for island economies. Annals of Tourism Research 38: 291–308. [Google Scholar] [CrossRef]

- Seghir, Guellil M., Belmokaddem Mostefa, Sahraoui M. Abbes, and Ghouali Y. Zakarya. 2015. Tourism Spending-Economic Growth Causality in 49 Countries: A Dynamic Panel Data Approach. Procedia Economics and Finance 23: 1613–23. [Google Scholar] [CrossRef] [Green Version]

- Sequeira, Tiago N., and Paulo M. Nunes. 2008. Does tourism influence economic growth? A dynamic panel data approach. Applied Economics 40: 2431–41. [Google Scholar] [CrossRef]

- Sequira, Tiago, and Carla Campos. 2005. International tourism and economic growth. Natural Resources Management 14: 1–25. [Google Scholar]

- Tang, Chor H., and SooCheong S. Jang. 2009. The tourism-economy causality in the United States: A sub–industry level examination. Tourism Management 30: 553–58. [Google Scholar] [CrossRef]

- Tang, Chor F., and Eu C. Tan. 2013. How stable is the tourism-led growth hypothesis Malaysia? Evidence from disaggregated tourism markets. Tourism Management 37: 52–57. [Google Scholar] [CrossRef]

- Tugcu, Can. 2014. Tourism and Economic Growth nexus revisited: A panel causality analysis for the case of the Mediterranean Region. Tourism Management 42: 207–12. [Google Scholar] [CrossRef]

| Variables | Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| lnGDP | 11.425 | 11.439 | 12.589 | 9.853 | 0.666 | −0.343 | 2.515 |

| lnPOP | 1.940 | 2.046 | 2.706 | 0.426 | 0.512 | −1.211 | 4.233 |

| lnTOUR | 10.01 | 9.997 | 10.845 | 8.749 | 0.470 | −0.226 | 2.699 |

| CRE | 101.980 | 95.371 | 308.978 | 21.360 | 45.629 | 0.858 | 4.249 |

| SCHOOL_PR | 102.115 | 101.456 | 126.575 | 79.857 | 5.269 | 1.315 | 8.999 |

| SCHOOL_SEC | 109.708 | 104.496 | 163.934 | 81.650 | 16.466 | 1.352 | 4.646 |

| SCHOOL_TER | 59.639 | 59.895 | 136.602 | 7.380 | 19.301 | −0.041 | 4.209 |

| TRA | 99.354 | 80.881 | 408.362 | 37.107 | 58.970 | 2.511 | 10.885 |

| Pedroni Residual Cointegration Tests | ||

|---|---|---|

| Panel Statistics | ||

| Panel v-Statistic | −499.492 (1.000) | −1.247 (0.894) |

| Panel rho-Statistic | 4.294 (1.000) | 3.190 (0.999) |

| Panel pp-Statistic | 2.063 (0.981) | −1.519 (0.064) |

| Panel ADF-Statistic | 0.845 (0.801) | −2.050 * (0.020) |

| Group Statistics | ||

| Group rho-Statistic | 4.890 (1.000) | |

| Group pp-Statistic | −3.368 * (0.000) | |

| Group ADF-Statistic | −3.112 * (0.001) | |

| Kao Residual Cointegration Tests | ||

| ADF-Statistic | −4.575 * (0.000) | |

| Johansen Fisher Panel Cointegration Tests | ||

| Fisher Statistic from the trace test | None 86.16 * (0.000) | |

| At most 1 330.1 * (0.000) | ||

| At most 2 262.4 * (0.000) | ||

| At most 3 269.7 * (0.000) | ||

| At most 4 263.4 * (0.000) | ||

| At most 5 154.8 * (0.000) | ||

| At most 6 92.22 * (0.000) | ||

| Fisher Statistic from the maximum eigenvalue test | None 86.16 * (0.000) | |

| At most 1 203.0 * (0.000) | ||

| At most 2 208.2 * (0.000) | ||

| At most 3 199.2 * (0.000) | ||

| At most 4 195.0 * (0.000) | ||

| At most 5 116.9 * (0.000) | ||

| At most 6 92.22 * (0.000) | ||

| Pooled OLS Model | Fixed Effect Model | Random Effect Model | |

|---|---|---|---|

| ln(GDP) | −1.704 * (0.0000) | 3.144 * (0.0000) | 4.314 * (0.0000) |

| ln(POP) | −0.040 (0.307) | 1.724 * (0.000) | 0.607 * (0.000) |

| ln(TOUR) | 1.215 * (0.000) | 0.465 * (0.000) | 0.552 * (0.000) |

| PRI | 0.001 * (0.009) | 0.001 * (0.000) | 0.001 * (0.000) |

| SCHOOL_sec | 0.007 * (0.000) | −0.000 (0.357) | −0.000 (0.744) |

| SCHOOL_ter | 0.004 * (0.000) | 0.002 * (0.000) | 0.003 * (0.000) |

| TRA | −0.000 (0.145) | 0.001 * (0.000) | 0.001 * (0.000) |

| Hausman test | 77.923 * (0.000) | ||

| Two-Step Difference GMM | ||||

|---|---|---|---|---|

| Variable | Coefficient | Standard Error | T Statistic | p-Value |

| lnGDP(−1) | 0.713 * | 0.094 | 7.562 | (0.000) |

| lnPOP | 0.571 | 0.848 | 0.674 | (0.501) |

| lnTOUR | 0.414 * | 0.073 | 5.676 | (0.000) |

| PRI | −0.000 | 0.000 | −0.896 | (0.371) |

| SCHOOL_SEC | 5.7 × 105 | 0.001 | 0.034 | (0.972) |

| SCHOOL_TER | 0.002 * | 0.000 | 5.773 | (0.000) |

| TRA | −0.001 * | 0.000 | −2.238 | (0.026) |

| Sargan’s Test of Overidentifying Restrictions | 15.655 (0.405) | |||

| Arellano Bond Tests | ||||

| Test order | m-Statistic | rho | SE(rho) | Prob. |

| 1st order autocorrelation AR(1) | NA | −0.083 | NA | NA |

| 2nd order autocorrelation AR(2) | −0.000 | −0.119 | 140.812 | 0.999 |

| Sample: 1995–2017, Lags: 2 | ||

|---|---|---|

| Null Hypothesis | F-Statistic | p-Value |

| D(lnPOP) does not Granger Cause D(lnGDP) | 1.840 | (0.160) |

| D(lnGDP) does not Granger Cause D(lnPOP) | 7.754 * | (0.005) |

| D(lnTOUR) does not Granger Cause D(lnGDP) | 5.891 * | (0.003) |

| D(lnGDP) does not Granger Cause D(lnTOUR) | 6.247 * | (0.002) |

| D(PRI) does not Granger Cause D(lnGDP) | 0.861 | (0.423) |

| D(lnGDP) does not Granger Cause D(PRI) | 13.752 * | (2 × 10−6) |

| D(SCHOOL_sec) does not Granger Cause D(lnGDP) | 1.759 | (0.174) |

| D(lnGDP) does not Granger Cause D(SCHOOL_sec) | 8.076 * | (0.000) |

| D(SCHOOL_ter) does not Granger Cause D(lnGDP) | 3.811 * | (0.023) |

| D(lnGDP) does not Granger Cause D(SCHOOL_ter) | 4.442 * | (0.012) |

| D(TRA) does not Granger Cause D(lnGDP) | 2.026 | (0.133) |

| D(lnGDP) does not Granger Cause D(TRA) | 0.798 | (0.450) |

| D(lnTOUR) does not Granger Cause D(lnPOP) | 6.371 * | (0.002) |

| D(lnPOP) does not Granger Cause D(lnTOUR) | 5.222 * | (0.006) |

| D(PRI) does not Granger Cause D(lnPOP) | 5.681 * | (0.004) |

| D(lnPOP) does not Granger Cause D(PRI) | 1.103 | (0.332) |

| D(SCHOOL_sec) does not Granger CauseD(lnPOP) | 0.105 | (0.899) |

| D(lnPOP) does not Granger Cause D(SCHOOL_sec) | 0.387 | (0.678) |

| D(SCHOOL_ter) does not Granger Cause D(lnPOP) | 0.058 | (0.943) |

| D(lnPOP) does not Granger Cause D(SCHOOL_ter) | 1.361 | (0.258) |

| D(TRA) does not Granger Cause D(lnPOP) | 0.271 | (0.762) |

| D(lnPOP) does not Granger Cause D(TRA) | 2.064 | (0.128) |

| D(PRI) does not Granger Cause D(lnTOUR) | 1.989 | (0.138) |

| D(lnTOUR) does not Granger Cause D(PRI) | 3.213 * | (0.041) |

| D(SCHOOL_sec) does not Granger Cause D(lnTOUR) | 2.869 | (0.058) |

| D(lnTOUR) does not Granger Cause D(SCHOOL_sec) | 2.465 | (0.086) |

| D(SCHOOL_ter) does not Granger Cause D(lnTOUR) | 0.626 | (0.535) |

| D(lnTOUR) does not Granger Cause D(SCHOOL_ter) | 1.213 | (0.298) |

| D(TRA) does not Granger Cause D(lnTOUR) | 0.642 | (0.526) |

| D(lnTOUR) does not Granger Cause D(TRA) | 0.987 | (0.373) |

| D(SCHOOL_sec) does not Granger Cause D(PRI) | 2.152 | (0.118) |

| D(PRI) does not Granger Cause D(SCHOOL_sec) | 3.025 * | (0.049) |

| D(SCHOOL_ter) does not Granger Cause D(PRI) | 10.015 * | (6 × 10−5) |

| D(PRI) does not Granger Cause D(SCHOOL_ter) | 0.502 | (0.605) |

| D(TRA) does not Granger Cause D(PRI) | 3.335 * | (0.036) |

| D(PRI) does not Granger Cause D(TRA) | 1.462 | (0.233) |

| D(SCHOOL_ter) does not Granger Cause D(SCHOOL_sec) | 4.713 * | (0.009) |

| D(SCHOOL_sec) does not Granger Cause D(SCHOOL_ter) | 1.622 | (0.199) |

| D(TRA) does not Granger Cause D(SCHOOL_sec) | 0.975 | (0.378) |

| D(SCHOOL_sec) does not Granger Cause D(TRA) | 1.385 | (0.251) |

| D(TRA) does not Granger Cause D(SCHOOL_ter) | 0.600 | (0.549) |

| D(SCHOOL_ter) does not Granger Cause D(TRA) | 2.754 | (0.065) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Matzana, V.; Oikonomou, A.; Polemis, M. Tourism Activity as an Engine of Growth: Lessons Learned from the European Union. J. Risk Financial Manag. 2022, 15, 177. https://doi.org/10.3390/jrfm15040177

Matzana V, Oikonomou A, Polemis M. Tourism Activity as an Engine of Growth: Lessons Learned from the European Union. Journal of Risk and Financial Management. 2022; 15(4):177. https://doi.org/10.3390/jrfm15040177

Chicago/Turabian StyleMatzana, Velisaria, Aikaterina Oikonomou, and Michael Polemis. 2022. "Tourism Activity as an Engine of Growth: Lessons Learned from the European Union" Journal of Risk and Financial Management 15, no. 4: 177. https://doi.org/10.3390/jrfm15040177

APA StyleMatzana, V., Oikonomou, A., & Polemis, M. (2022). Tourism Activity as an Engine of Growth: Lessons Learned from the European Union. Journal of Risk and Financial Management, 15(4), 177. https://doi.org/10.3390/jrfm15040177