1. Introduction

Since the inception of the concept of price, inflation has been a major concern to people looking to store value, engage in trade and maximize their wealth. Since the earliest attempts by kings to broaden the money base in ancient times by diluting the degree of gold, bronze, or silver coins through the addition of copper, governments have always been tempted to finance economic stimuli or their political programs through a prolonged and indirect way of taxation by creating inflation. Nowadays, central banks create money electronically to finance fiscal policies by purchasing government bonds and to provide a low-interest rate environment. One of the core concerns that comes along with this kind of monetary policy is the degree to which inflation is being generated. Recent increases in inflation rates globally have their root causes in a broad range of factors. First, the global pandemic has been causing severe supply chain disruptions, which lead to supply shock, thus triggering inflation. Second, government-induced lock down and subsequent financial aid programs are causing an artificial excess demand, which encounters limited supply, thus creating another inflation-triggering factor. The central banks-induced purchases of government bonds are another potential factor in the excess money supply. However, the money provided to banks has not entered the business cycle yet, since the economy prevails in Keynes’ famous liquidity trap.

The combination of these factors leads to uncertainty in markets regarding inflation expectation. There exist several theoretical models of inflation that provide estimates about the potential impacts of economic factor changes.

Amongst the most important ones are univariate models, such as the model by

Stock and Watson (

1999), and the Phillips curve.

Stock and Watson (

1999) evaluated the performance of a wide array of inflation forecasting models using monthly data on inflation as measured by the implicit price deflator for personal consumption expenditures (the PCE deflator) and the consumer price index (CPI).

Atkeson and Ohanian (

2001) found that

Stock and Watson’s (

1999) model has not been substantially more accurate than the naive forecast by

Atkeson and Ohanian (

2001).

Another important inflation model is the model by

Mishkin (

1990), who conducted an empirical analysis and found that for maturities of six months or less, the term structure of nominal interest rates provides almost no information about the future path of inflation, but does provide information about the term structure of real interest rates. However, as maturities lengthen to nine and twelve months, the nominal term structure begins to contain information about future inflation, but ceases to provide information about the real term structure.

Fama (

1975) was concerned about the efficiency of the market, and analyzed one- to six-month U.S. Treasury bills. He found a relationship between nominal interest rates and rates of inflation subsequently observed.

Nelson and Schwert (

1977) argued that the relative magnitude of the measurement errors is such that the tests carried out by

Fama (

1975) were not powerful enough to reject the joint hypothesis that the ex-ante real rate is a constant and expectations are rational.

Anari and Kolari (

2017) investigated how monetary policy rates impact interest and inflation rates. They developed a model comprising joint Fisher–Wicksell effects augmented with the federal funds rate, and found that dual Fisher and Wicksell effects are important channels of monetary policy rate transmission to interest and inflation rates.

The Quantity Theory of Money was developed by Simon Newcomb, Alfred de Foville, Irving Fisher, and Ludwig von Mises around 1900. The quantity equation is a widely used concept to explain the relationship between the quantity of money available for investment and production purposes. Moreover, it explains the velocity at which this money is circulating and is therefore available to secondary market participants, as well as the value of all goods and services produced and offered in an economy, where the value of the aggregated consumption is a function of the amount of goods and services available, and thus of their price.

The equation basically states that in an equilibrated market, the amount of money available to purchase goods and services equals the produced goods and services, subject to the price at which they are offered. In other words, demand for goods and services equals the available supply of money.

In this paper, we infer inflation from a holistic estimation of the quantity equation.

The quantity equation has already been widely debated for more than century by many researchers, such as

Lucas (

1980), who found that a change in the rate of change in the quantity of money induces an equal change in the rate of price inflation. His results were confirmed by

Sargent and Surico (

2011), who estimated a DSGE model over a subsample of Luca’s data.

Moroney (

2002) found long-term evidence for the quantity equation by investigating 81 countries from 1980 to 1993. Nevertheless, he stressed that the quantity theory offers a less complete explanation of inflation, and while it is a reliable model of inflation for most countries, it is not for those experiencing slow long-term money growth.

Duck (

1993) found empirical evidence for the quantity theory by combining the quantity theory and Fisher’s hypothesis on the relationship between the nominal interest rate and inflation.

Friedman (

1956) was a central figure in the discussion of quantity theory. In 1970,

Friedman (

1970) stated that “inflation is always and everywhere a monetary phenomenon”.

Teles et al. (

2016) explored whether the quantity theory is still alive, and found evidence for a one-to-one close relationship between long term inflation and money growth when excluding countries with moderate inflation. Nevertheless, they were able to reconstruct the one-to-one relationship even for countries with moderate inflation when taking into account the effect of long-term movements in nominal interest rates. For countries with low inflation rates, they found an overwhelming relationship between average inflation and the growth rate of money.

One of the main criticisms of the quantity theory is that by applying the quantity equation, monetarists fail to account for the dynamics of money growth and inflation. Another main criticism is that the quantity theory assumes full employment as well as a static velocity. In our model, we consider the dynamics of money growth and inflation. Moreover, we apply the quantity equation at a time of full employment in the United States, considering the broad monetary expansion prevailing during full employment prior to the COVID-19 crisis, and assume velocity to be dynamic, and independent of the other components in the quantity equation. The independence of velocity is a very important feature in our model, since central banks around the world are discussing the possible implementation of digital currencies, which would increase the velocity of money.

Based on a study by

Sargent (

1982),

Sauer (

2019) tackled the problem of the occurrence of inflation from a different point of view. He found that hyperinflations can be better explained by taking the central bank’s asset side into account. In his opinion, inflation is not a quantity of money phenomenon, but depends on the solvency of a central bank. As long as we are dealing with the central bank of a reserve currency, he argued that the central bank cannot become insolvent, since it can print money if necessary. However,

Sauer (

2019) argued that the printing of the money does not create inflation; rather, it is the solvency deterioration of the central bank, as the liabilities increase while the market value of its assets does not change. In fact, what triggers hyperinflation is the situation when a central bank issues more and more unbacked money by granting credit to its broken government, and the market participants start losing confidence in the value of the central bank’s claims, characterized by a deterioration of the government’s bond prices as well as a devaluation of the exchange rate.

In times of increasing money stock, as well as emerging discussions about theories that effectively approve the unlimited supply of money, such as stated by the modern monetary theory (MMT) (

Wray (

2015);

Real-World Economics Review (

2019);

Fullwiler et al. (

2012);

Fullwiler and Kelton (

2013);

Fullwiler and Wray (

2010)), the question arises as to what effect an increase in money supply would have on an economy according to the quantity equation. MMT suggests that deficit financing can be used without harmful economic effects in circumstances of low inflation rates and low interest rates—conditions that currently exist despite indications that the country is at full employment (

Driessen and Gravelle 2019).

In this article, we conduct various ceteris paribus simulations for all components of the quantity equation, and analyze their effects on the price level. Since the level of price depends on the relationship to three factors, quantity, velocity, and demand for money, we estimate the parameters that allow us to effectively link the supply side with the demand side, and thus run a predictive analysis for various changes in these levels.

The question we are concerned about is related to the fact that the quantity theory implies a ceteris paribus unitary relationship between inflation and money growth. However, as indicated by Keynes’ liquidity trap, the increase in money supply does not necessarily have to cause inflation instantaneously, and in fact, it does not constitute a sufficient condition to spark inflation. What we know is that if inflation is set into motion, then the cause is likely to be found in the relatively higher growth rate of the monetary base compared to the growth rate of productivity. Keynes believed that the ratio of cash balance to the total money value of all transactions in the economy (what we understand as the monetary base), as well as the velocity of money, is highly unstable and volatile. In his view, increasing the money supply reduces the need to economize on the use of money, thus also reducing velocity and encouraging larger cash balances. However, his assumption requires that the demand side remains constant. Since the quantity equation posits an identity, it allows us to substitute and replace variables from one side to the other. This characteristic allows us to conduct a ceteris paribus analysis, which in turn allows us to infer the relative contribution of each parameter to the other input variables, i.e., by estimating the parameters on the supply side, we are able to infer the relative contribution of productivity to price levels. Therefore, our research question concerns the ceteris paribus contribution of GDP to the price level, while taking into account the money stock and velocity. The analysis of the relative contribution of GDP to price levels in comparison to money stock and velocity provides a holistic view of the quantity equation.

The most recent literature on the quantity equation and inflation uses Markov switching models to describe inflation.

Bojanic (

2021) analyzed the Bolivian inflation process by utilizing a time-varying univariate and multivariate Markov switching model, and found that the results generally fall in line with what the quantity theory of money predicts. He further found that by partitioning the sources of inflation, he can demonstrate that, from a long-term perspective and in a high-inflation regime, differences in inflation are mostly explained by GDP growth. This finding is in line with our findings. However, in contrast to

Bojanic (

2021), we further determine the relative explanatory contribution of GDP growth to money and velocity by estimating the parameters holistically.

Marchiori (

2021) developed a monetary model that applies monetary theory to the level of virtual reality. He studied a model featuring virtual goods, sold against virtual currency, and agents providing payment services (miners), remunerated with newly issued virtual currency. His hypothesis is that virtual money growth may have effects opposite to those predicted by monetary theory, since declining virtual currency issuance, such as in Bitcoin, raises the price of virtual goods, which counteracts the traditional impact of a reduced inflation tax. He found that welfare improves as virtual currency issuance decreases, but only if the virtual currency growth rate is sufficiently larger than the fiat money growth rate. While

Marchiori (

2021) found that effects may be opposite to those predicted by monetary theory, his approach did not take into account economic productivity, and only linked inflation to the money stock, either issued in the virtual setting or in the real world fiat money setting. Thus, while his approach is very novel and insightful in the emergence of virtual reality, a question about the sustainability of a virtual reality in which no economic productivity is being achieved has to be raised.

The classic assumption, that changes in commodity prices such as those of oil, or changes in exchange rates, lead to changes in inflation, was investigated by

Abatcha (

2021), who conducted an empirical analysis of the effects of oil price changes on inflation in Nigeria. He found that in the long run, oil price as well as exchange rate changes exert positive influences on the rate of inflation.

Gumata and Ndou (

2021) found that money demand shortfall shock dampens the pass-through of the rand exchange rate deprecation shocks to inflation. In contrast to their approaches, we have focused on productivity level and its effect on inflation in relation to money stock and velocity.

Kuhle (

2021) studied inflation in a game setting, wherein households converted paper assets, such as money, into consumption goods, in order to preempt inflation. He found that for intermediate levels of money supply, there exist multiple equilibria with either high or low inflation, and that equilibria with moderate inflation do not exist, and can thus cannot be targeted by a central bank. His approach again only tackles the effect of the money stock on inflation, while we analyze the effect of the productivity of an economy on inflation.

Pinter (

2021) focused in his research on the velocity of money, and found that velocity should be seen as a variable derived from a system of parameters and variables related to money demand. Furthermore, he concluded that the high money growth rates seen since the pandemic outbreak are unlikely to translate into higher inflation rates. This insight conforms to our results, as we found economic productivity to be the main explaining factor for inflation.

We contribute to the literature by showing evidence for the ability of the quantity equation to estimate the GDP deflator through a holistic approach. By estimating the parameters of general economic demand, we confirm that the price level is a functional of the supply and circulation speed of money, as well as the demand for goods and services offered in an economy.

Moreover, we are probably among the first to investigate the behavior and validity of the quantity equation in times of a global pandemic, and its effects on exploding budget deficits and an unprecedented expansion of the monetary base, a breakdown of global supply chains, as well as impositions of global lockdowns on the economy, which lead to an unprecedented crash in global productivity. Our goal is to estimate the expected inflation following these unprecedented events and measures; thus, this paper could also be entitled “testing the quantity equation under stress”.

We further contribute to the inflation literature by providing inflation forecasts that can outperform forecasts of inflation generated from existing published models, such as the univariate naive model of

Atkeson and Ohanian (

2001).

Atkeson and Ohanian (

2001) compared the accuracy of the inflation forecasts derived from the textbook NAIRU Phillips curve model to their naive forecast by comparing the root mean squared error (RMSE) of these two sets of forecasts. In a NAIRU Phillips curve, unemployment or some other measure of economic activity is used to forecast future changes in the inflation rate, rather than the inflation rate itself.

Gordon (

1997) found that the forecasts derived from the textbook NAIRU Phillips curve model are considerably less accurate than those from the naive model. The ratio of the NAIRU RMSE to the naive model RMSE is 1.88. This indicates that the forecast error is 88% higher for the NAIRU model than for the naive model. We conclude from this evidence that the textbook NAIRU Phillips curve model has not been a useful inflation forecasting tool.

For the estimation of the true inflation, it is more accurate to estimate the GDP deflator than the CPI index, because the CPI index only encompasses a basket of selected goods, while the GDP deflator accounts for the total economic productivity of an economy.

Another point is that the velocity of money is usually worked out backwards from a certain quantity of money, a realized real GDP, and a price level. In our holistic approach, this is not the case. We assume that the velocity of money is actually an independent variable that is influenced by consumer behavior and policy measures. Even though Keynesians are right in arguing that velocity is negatively correlated with the money stock through interest rates, we are interested in controlling for each variable in order to conduct a ceteris paribus analysis. Moreover, we find a negative correlation of −0.68 between the quarterly USD M3 money stock and USD velocity from 01/01/1960 to 07/01/2021, which leaves room for a ceteris paribus analysis.

We will present our holistic approach for the estimation of parameters of the money supply side in the next chapter, and conduct a ceteris paribus analysis in

Section 3. In

Section 4, we perform a robustness check by benchmarking our inflation forecasting results against the naive model provided by

Atkeson and Ohanian (

2001), and in

Section 5 we conclude.

3. Ceteris Paribus Analysis

We use quarterly data from Fred St. Louis for the implicit price deflator (

FRED 2020) of the U.S. GDP, M3 (

FRED 2021a) of the USD, the U.S. real gross domestic product (

FRED 2021b), and the Velocity of M1V money stock (

FRED 2021c) of the USD from 1 January 1960 to 1 July 2021.

Table 3 provides an overview of the descriptive statistics of the variables in use. In order to be able to interpret the results better, we scale all four parameters by a factor of 100. To avoid misleading judgements of the regression output, we adjust the time series seasonally using an ARIMA X-12 model.

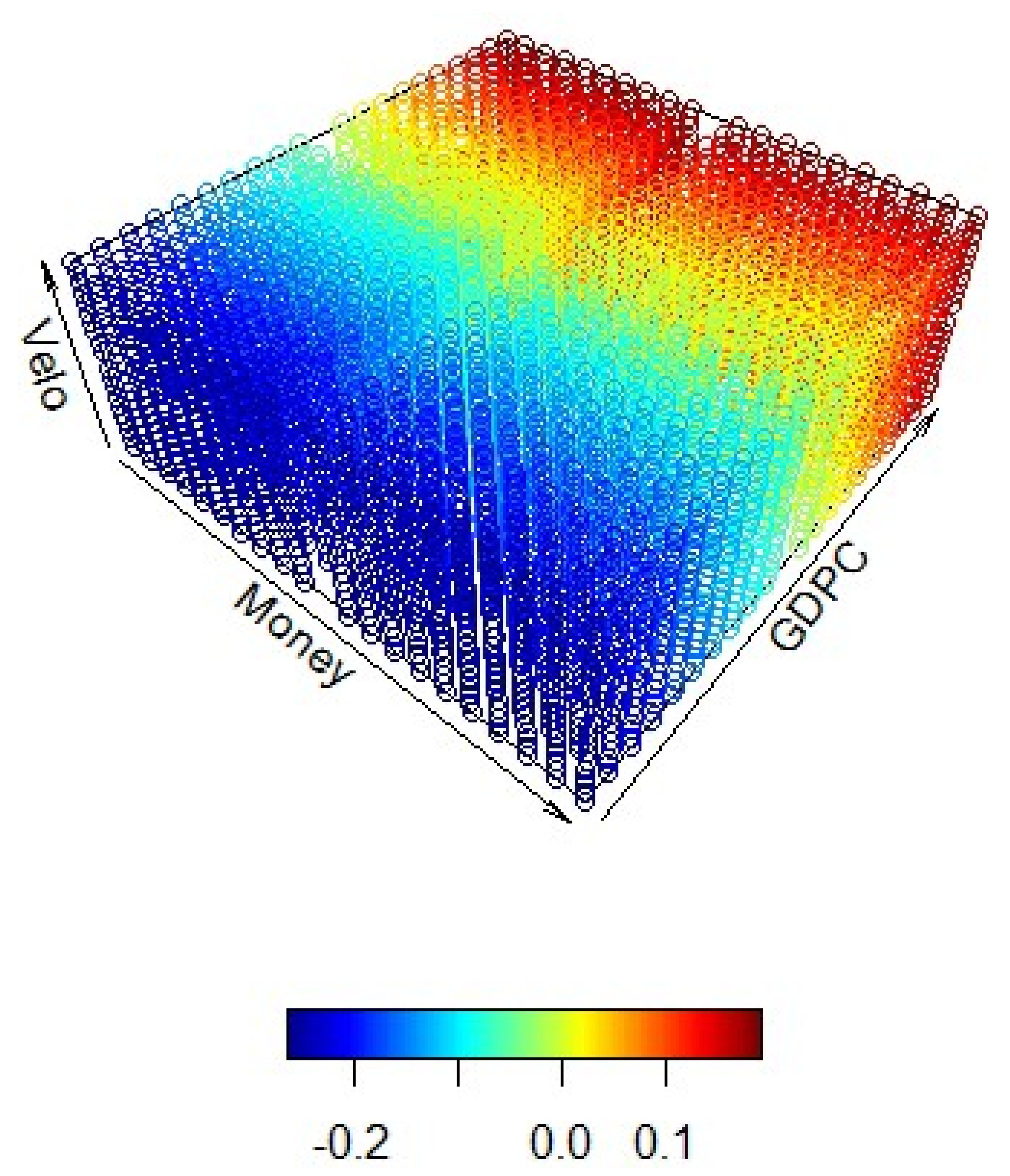

The ceteris paribus analysis we conduct comprises four different models. In our first model, we estimate the parameters for the aggregate supply side, M*V, by regressing the aggregated supply side on the aggregated demand side. The second model focuses on the estimation of the singular parameters of money and velocity by regressing them on inflation, measured through the GDP deflator. In the third model, we regress the same parameters, money and velocity, on the GDP, and in the fourth model we regress inflation on money, velocity, and GDP. The main focus of this analysis lies in the comparison of the regression results of inflation regressed on the supply side without GDP vs. the supply side including GDP, to extract the marginal explanatory power of GDP compared to money and velocity.

Further, we test the predictors of all models for multicollinearity, and find a small VIF statistic for all regressions, which implies that the predictors are not correlated, and thus together contribute a significant explanation of the response variable.

The standard assumption of a regression is that the residuals follow a normal distribution. To investigate this, we perform a residual normality test.

Table 4 shows that the null hypothesis (the residuals are not normally distributed) can be rejected with a very high confidence level.

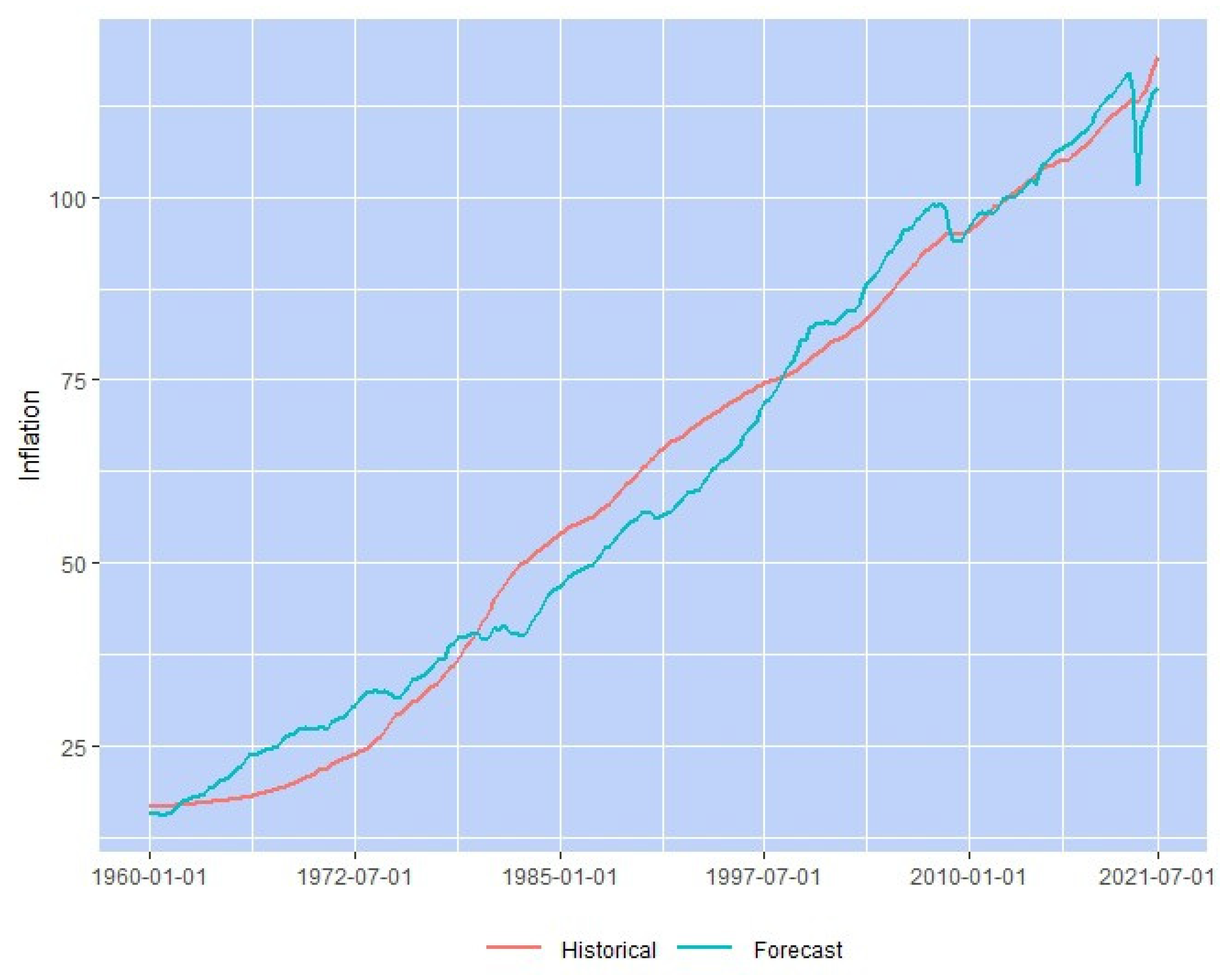

Figure 1 shows the quarterly GDP deflator as a functional of money stock, velocity, and GDP.

Table 5 highlights some scenarios that we consider as realistic developments, including a stress scenario with a fluctuation in the size of the latest impact due to COVID-19. It is interesting to see that, according to a holistic model, the level of inflation primarily depends on the productivity level of an economy. Secondly, the quantity of money represents the second most important factor affecting the level of inflation. However, even high levels of money creation do not necessarily yield higher levels of inflation. One reason for this might be Keynes’ liquidity trap. Only in combination with higher levels of productivity does inflation materialize.

This makes sense, as the created money only enters the circular business flow when its demand matches its supply. Interestingly, when taking into account the interaction between the cross terms, the velocity of money, thus consumer confidence or the willingness of the consumers to spend their money, play subordinate roles. As long as consumers are not confident about the future, even high levels of money stock creation will usually not lead to inflation, as consumer confidence alone barely influences the level of inflation. As long as the general economic productivity does not overheat over a longer period of time, the risk of creating inflation is pretty moderate. The combination of excessive economic growth, expansionary money stock and an increasing velocity of money will usually lead to inflation. Generally, we find more deflationary pressure in the holistic approach than increased pressure in price levels. This might be partly attributed to the recent deflationary shock of the pandemic, which sent GDP levels and money velocity to war-time lows.

One can also interpret the results from a different perspective: in order to create economic growth, prices do not necessarily have to increase. Even under deflationary conditions, the economy can grow if the money stock increases sufficiently. Interestingly, even a shrinking money stock can lead to inflation if economic productivity prevails.

Figure 1 and

Table 2 indicate that inflation can be estimated very accurately by estimating the parameters of the money supply side holistically. Even excluding the GDP, we can still see in

Figure 2 and

Table 6 that the money stock and the velocity of money alone predict inflation fairly accurately.

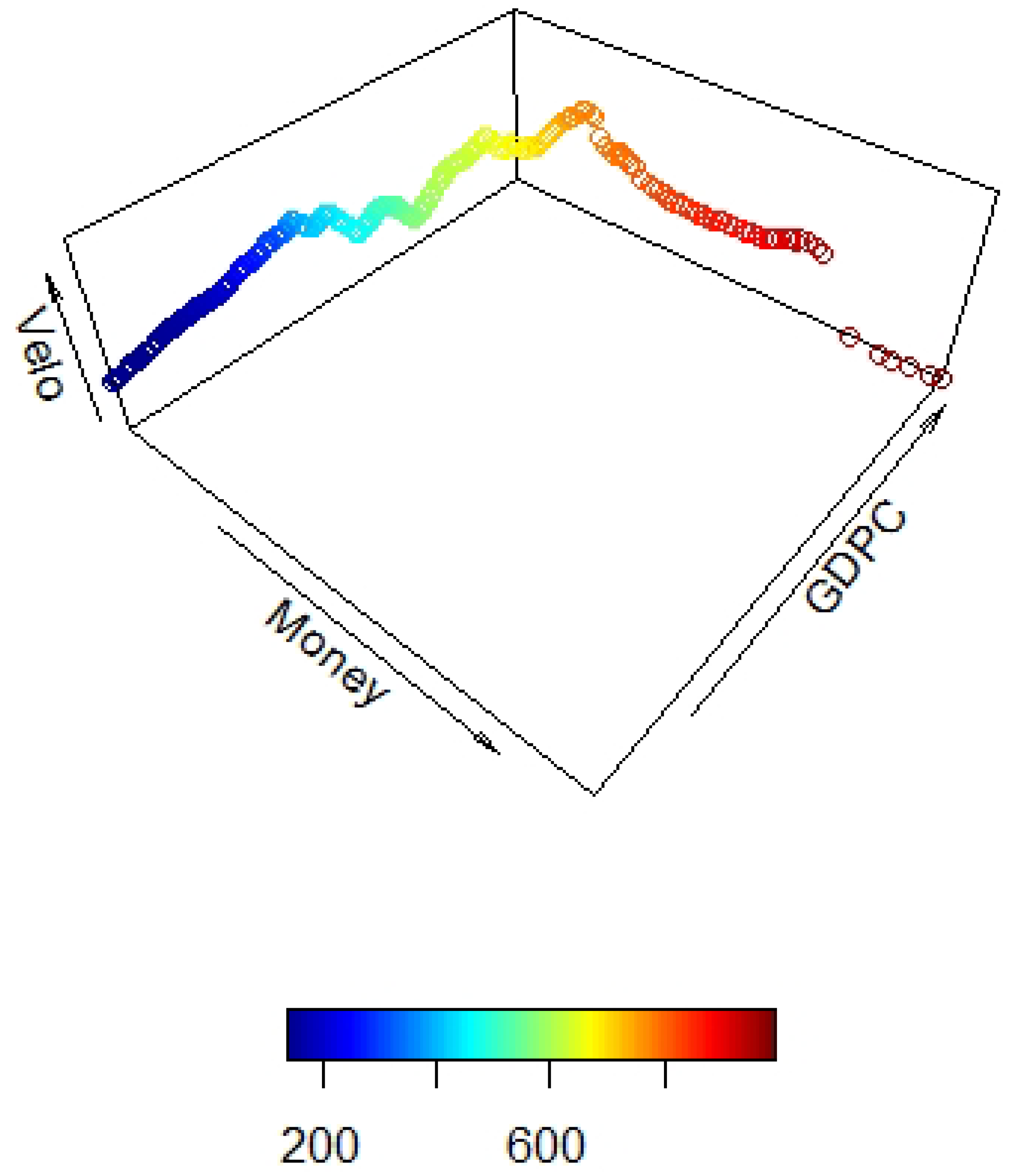

The plot of historic data of the quantity of money, the velocity of money, GDP and GDP deflator shown in

Figure 3, as well as the three-dimensional graph in

Figure 4, illustrating the results of our ceteris paribus analysis, show how the GDP primarily drives the level of inflation. An increase in the quantity of money historically supports the creation of inflation, but fails to gain support in general when holding a holistic inflation perspective.

Table 7 reports the regression of the supply side on the demand side. We can see that the production and price changes explain the changes in money stock and velocity. When holding GDP and velocity constant and increasing money, stock we can see that inflation increases, depending on the level of productivity. At low levels of GDP, we actually encounter a deflation. Holding the money stock and GDP constant, we can see that inflation increases with increasing velocity. This effect can also be inferred from

Table 8, where we regress the GDP deflator on all three components of money stock, velocity, and GDP. From

Table 8, we can see that GDP is one of the main explanatory factors in inflation due to the highly positive correlation. Since the money stock as well as velocity explain GDP, we can normalize the money supply side through GDP, as reported in

Table 2, which confirms the validity of our holistic approach to model inflation by considering the cross-combination of the supply and demand side factors.

Table 9 reports the Variance inflation factor. We can see that the predictors don’t exhibit any multi-collinearity and thus allow us to conduct our holistic regression.

The most extreme effect can be seen when money supply increases, as well as velocity and GDP. The values displayed in the color scale represent actual changes in the components, so they can be used for the calculation of the inflation based upon the latest inflation level.

The results indicate the strong marginal explanatory power of the economic productivity as regards inflation. When relating economic productivity to money supply and velocity, we can see that the explanatory effects of the money stock and velocity dissipate. In contrast to most of the existing literature, which stipulates that the supply side factors of money and velocity are mostly responsible for explaining inflation, we find evidence for Keynes’ liquidity trap in the sense that created money only affects prices when it is being used for productive purposes. Without the utilization of money in productive processes, as measured through the GDP, the level of money creation and the velocity of circulation still explain the level of inflation, but on a much smaller relative scale than when including productivity levels in the estimation process.