2.1. The Concept of Financial Security

Discussions about the role of the financial system in the process of the creation of modern economies reveal that its impact can be both positive and negative. Therefore, the question of how the financial system must be defined in order to have a positive impact remains unanswered. Likewise, there is no answer as to the nature of the most desirable scenario for the development of the financial system itself to enable the sustainable development of society. The intention of society and politicians to make the financial system reliable, secure, and efficient, thereby supporting the sustainable development of society, is clearly expressed, but it is unclear how the concept of a financial security should be defined.

Many authors analyse various aspects of financial security.

Hryhoruk et al. (

2019) associated financial security with the protection of financial interests.

Franchuk et al. (

2020) argued that the main task of a financial security system is not only to maintain financial resources but also to create a secure environment for continuous business development.

Munyon et al. (

2020) defined financial security as a subjective state that reflects the adequacy and stability of monetary assets relative to liabilities. Therefore,

Guryanova et al. (

2017) described financial security as a phenomenon of a high degree of complexity and multidimensionality. In support of this view,

Vergun and Topenko (

2016) argued that the integration of the existing theoretical approaches leads to the conclusion that there is no generally accepted definition of financial security: all of the above formulations reflect only certain aspects of this category and do not represent its unambiguous interpretation.

Zwolak (

2017) pointed out the difficulties that occur when it comes to determining financial security, as this category proves to be unsettled, dynamic, and difficult to quantify. There are also attempts to define the concept of financial insecurity. According to

Osberg (

2015), the term financial insecurity (which is potentially very broad) has been commonly restricted to the context of retirement and/or old age, and this is often done without any accompanying explicit definition. These reasons increase the need to formulate a universal definition of financial security for households, enterprises, and the state.

In 1950, Hertz wrote of security as the absence of fear of being ‘attacked, subjected, dominated or annihilated by other groups and individuals’ (

Retter et al. 2020).

Engerer (

2009) stated that security is often described as the absence of threats or risks and, in his view, security is often considered to be a public good, meaning a stable society and a strong government.

Engerer (

2009) pointed out that economists describe security as an economic good.

Mura et al. (

2017) argued that, historically, security expresses the ability of the state to secure its autonomy and stability and, according to European mercantilists, security is closely connected with the establishment of conditions for economic growth. In the opinion of

Brück (

2004), insecurity is defined as an aggregate and unquantifiable form of risk.

It is worth noting that the concept of security has changed over time. For example,

Retter et al. (

2020) expressed the opinion that after the collapse of the Soviet Union, the focus on military security decreased and the need to review the concept of security arose as the priority of military security grew into a broader context, including the dimension of economic security. As the concept of security changes, other elements of security—environmental, social, financial, etc.—become more important.

Abu Bakar et al. (

2015) supported this idea, and argued that the emergence of welfare is influenced by the satisfaction of basic needs and the provision of certain conditions, which include maintaining interpersonal relationships, community empowerment, financial security, remunerated employment, good health, and an attractive environment. In the context of shaping economic welfare, the need to ensure the financial security of households, enterprises, and the state becomes important. This means that in this multi-dimensional environment the financial security interests of individual entities (households, enterprises, the state) need to be harmonised.

Financial security is analysed at different levels of the economy (micro and macro). Historical events, public needs, and other trends also lead to different interpretations of financial security. Some authors use the term financial security to analyse the financial situation of households or companies. For example,

Piotrowska (

2017) defined financial security as the ability to achieve the income necessary for covering household needs at a sufficient level and to create financial reserves that are available in case of emergencies (sickness, job loss, family breakdown).

Ahmad and Sabri (

2014) described financial security as the state of having constant income or other resources to maintain a standard of living now and in the foreseeable future. Such an approach by these authors implies that the state of financial security exists at the time when there is a steady income that allows for the maintenance of a decent standard of living now and in the near future.

Delas et al. (

2015) stated that one of the main tasks of a company’s system of ensuring financial security is to protect its own financial interests from the influence of internal and external threats in order to ensure the efficiency of the enterprise.

Blakyta and Ganushchak (

2018) defined the financial security of undertakings as a constituent part of the economic security of an enterprise, which defines the process of development of the enterprise on the basis of: certain financial resources; the sufficient structure of capital which is used by the company; compliance with the targets and missions on the basis of the level of internal and external threats; and the influences of certain factors in unstable periods of development.

Ermakova (

2017) defined financial security as the preparation of a country’s financial system for timely and reliable financial support, to the extent sufficient to maintain the economy at a level that would ensure the country’s economic security.

Reznik et al. (

2020) understood the financial security of the state as protection of the financial and economic interests against internal and external unlawful threats.

Burkaltseva et al. (

2017) presented financial security as sustainable, high-quality economic growth in the absence of internal and external threats.

The analysis of the views of a number of authors on financial security allows for the formulation of a universal definition of financial security, which would be appropriate to describe the financial security of entities at different levels (households, enterprises, and the state). Financial security shall mean a level of financial standing maintained by legal regulatory, managerial, economic, and other means, enabling protection against risks that might have significant negative impacts and ensuring satisfaction of the most important needs while maintaining financial independence.

A variety of instruments can be used to address financial insecurity.

Brown et al. (

2020) revealed that social security policies have an impact on future financial well-being and financial security.

Zimon et al. (

2020) revealed that proper management of stocks, receivables, and liabilities is crucial to increase the financial security of renewable energy companies.

Poltorak et al. (

2019) associated the financial security of the state with favourable financial conditions for the sustainable development of the financial system.

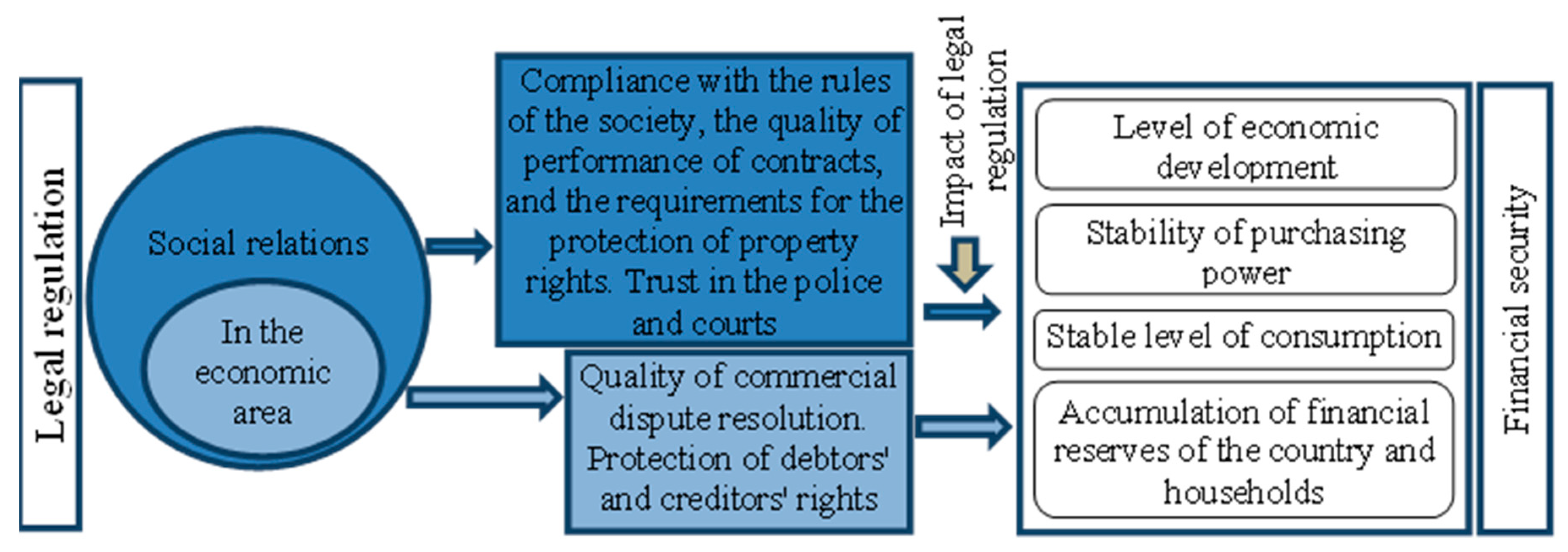

Vaitkus and Vasiliauskaitė (

2021) proposed a set of tools to address financial insecurity, incorporating instruments and models of financial security assurance. The legal regulation measures contained in this set of financial security tools are designated as an integral part of the process of the creation of sustainable economic development. The importance of legal regulation is confirmed by many authors (

De Serres et al. 2006;

Lehmann 2017;

Schultz et al. 2019). The OECD is considered to be a key player in shaping regulatory policy in the international field (

Jakobi 2012). It is therefore appropriate to disclose the specificities of the OECD’s legal regulation in the field of financial security.

2.2. OECD Legal Regulation in the Field of Financial Security

The OECD promotes policies aimed at achieving the highest sustainable levels of economic growth and employment and raising living standards in the Member States, while maintaining financial stability and thus contributing to the development of the global economy.

Osberg (

2015) argued that economic insecurity is an important determinant of individual wellbeing, and that it is now expensive in all OECD countries to mitigate the extent of economic insecurity. These reasons lead to the fact that in OECD countries not only funds but also various recommendations are allocated to reducing economic insecurity, especially in cases of unemployment, sickness, widowhood, and old age. The first of the OECD’s international documents on regulatory quality was the 1995 recommendation on improving the quality of government regulation (

Bublienė et al. 2017). The OECD’s recommendations include the review, maintenance, and implementation of regulatory procedures and targets, regulatory review, and reporting on regulatory policies and the implementation of reforms. Regulatory coherence is also promoted in order to avoid duplication or conflict (

OECD 2012). As regards financial security, the OECD recommends ensuring that regulatory decisions are taken objectively, impartially, and consistently, without conflict of interest, bias, or undue influence in the implementation of risk assessment and management.

The documents adopted by the OECD in the field of regulation fall within the group of soft law instruments (

Bublienė et al. 2017). Thus, the OECD is constantly making recommendations

1 to improve regulation in order to contribute to financial stability and economic development. However,

De Serres et al. (

2006) considered that the main regulatory objectives in OECD countries tend to be to narrower, with a focus on market integrity (conduct rules), consumer/investor protection (disclosure rules), and crisis prevention—in particular limiting systemic risks in the event of one or more institutions experiencing unexpected problems (prudential regulation).

The search for appropriate legal regulation raises problems in maintaining a balance between the liberalisation of the financial market and excessive constraints, which may hinder effective economic development.

De Serres et al. (

2006) indicated that in order to strike the right balance between the protection of the rights of various stakeholders (shareholders, creditors, entrepreneurs/managers, and employees) and allowing firms and markets to function effectively, a complex compromise is needed across different regulatory areas. For these reasons, public policy makers must address the dilemma of maintaining proportionality between increasing the regulation of financial security and its efficiency, and the principles of justice and freedom.

The OECD’s recommendations focus on consumer protection through measures for reducing risks and vulnerabilities.

De Serres et al. (

2006) pointed out that, to a certain extent, rules aimed at consumer protection may contribute to reinforced competition; as an example, helping consumers to make better informed decisions raises their willingness to switch between institutions. However, in many cases, regulation is aimed at stability or consumer protection.

Lyons et al. (

2018) revealed that households do not have sufficient opportunities to ensure security, primarily due to a lack of financial planning, savings options, and financial knowledge. To address these and other problems, the OECD established the International Network on Financial Education (OECD/INFE) in 2008, which promotes and activates international cooperation between policy makers and other stakeholders in the field of financial literacy. The OECD Core Competences Framework for Financial Literacy highlights the various results of financial literacy, which can be considered important for owners and managers of micro-, small-, and medium-sized enterprises and potential entrepreneurs, as well as for the development of financial literacy systems for young people and adults.

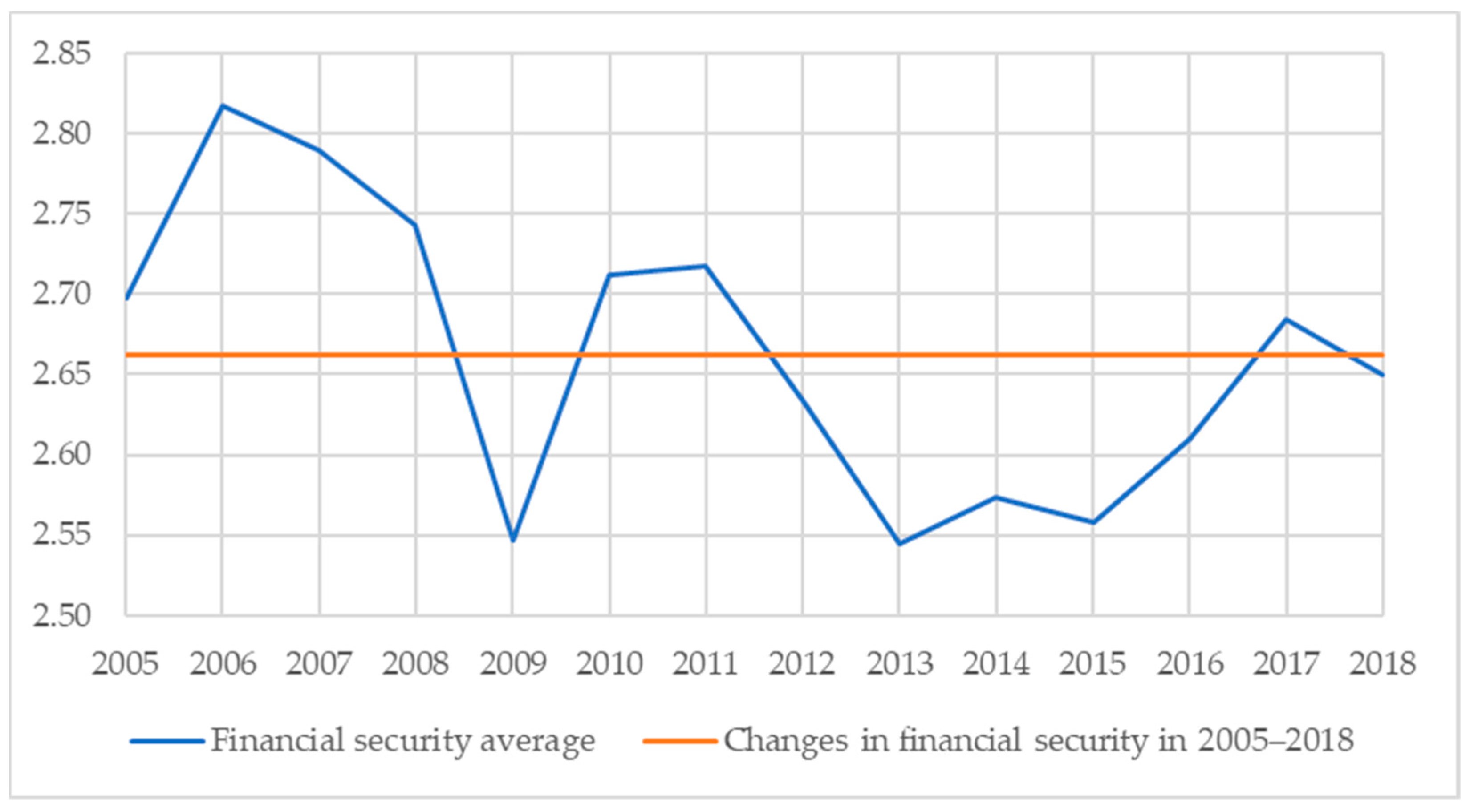

2One way to choose effective financial security measures is the monitoring and evaluation of the current state of financial security regulation in individual OECD countries. This is perhaps why

Brück (

2004) argued that the key policy focus should be the monitoring of security spending, the security situation, the security policy, and its impact on the economy, and that measures should be adjusted over time as appropriate. Monitoring of the current situation makes it possible to understand which regulatory measures best achieve the intended objectives in terms of improving financial position. Thus, various indicators reflecting the state of regulation are being developed.

Schultz et al. (

2019) noted that the OECD regulatory and governance indicators (iREGs) are among the main indicators for better regulation in the world. These indicators are an integral part of OECD flagship products and reflect the importance of an appropriate regulatory policy for achieving the priority economic and social objectives. The disclosure of the best performing countries is an important incentive to initiate closer cooperation and the sharing of regulatory best practices from the countries that have achieved more in this field to those where it is appropriate to improve the existing regulatory frameworks.

In summary, as regards the legal regulation of the OECD in the field of financial security it can be noted that, despite the fact that economic security or individual financial security measures are given a lot of attention, the issue of financial security is not sufficiently reflected in OECD recommendations and other documents. The conceptual aspects of financial security are not highlighted. Generally, these regulations are limited to general recommendations for the whole economic sector or its individual areas (e.g., banks, risk management, and the improvement of management processes).

The theoretical assessment of legal regulation does not demonstrate and is not sufficient for the selection and development of the necessary measures for the formulation of financial security policy. An assessment of the financial security situation of individual entities (households, enterprises, the state) is also insufficient to identify the problems of sustainable and high-quality economic growth. The assessment of the financial situation requires a holistic approach and an assessment to be carried out in a broader context. This will help to answer the question of whether the legal regulation has an impact on financial security and whether this impact, if it exists, is positive or negative. To address this problem, an econometric assessment of the impact of legal regulation on financial security in OECD countries was carried out.