Abstract

We provide a fresh look at the performance of the stock prices of firms that launched an IPO between 2009 and 2019 and assess the role of their size, age and sector in affecting future performance. We utilize data about 1611 IPOs spanning 11 economic sectors using the event study method. We provide evidence that a firm’s size and age do act as predictors for its price evolution in the future. In addition, there is a significant variation in the long-term performance between sectors and between small and large firms within each sector. Furthermore, there is a clear tendency of firms from sectors such as healthcare and technology to go public at a relatively younger age than other sectors. The results have implications for asset pricing and are useful for investors involved in IPOs.

JEL Classification:

G11; G14; G17

1. Introduction

The literature on initial public offerings (IPOs) has established that investors earn significant negative abnormal returns in the few years following their issuance. Early evidence confirming this phenomenon has been detected in the US (Ritter 1991; Loughran and Ritter 1995), the UK (Espenlaub et al. 2000; Chambers and Dimson 2009), Australia (Lee et al. 1996), Germany (Ljungqvist 1997) and France (Chahine 2008).

Despite this evidence, parallel studies raise doubts regarding this phenomenon. They claim that it does not really exist in the US and highlight its sensitivity to the method applied (Brav and Gompers 1997; Stehle et al. 2000). Moreover, other studies report contradictory results and show the overperformance of IPOs in South Korea (Kim et al. 1995), China (Chan et al. 2004; Gao et al. 2015), Canada (Kooli and Suret 2004), Greece (Thomadakis et al. 2012) and India (Dutta 2016).

Given the cumulative evidence challenging the long-term underperformance of firms executing IPOs, we extend the literature by reexamining the near- and long-term performance of IPOs. We contribute to the literature in three ways. First, we use a fresh and large dataset consisting of 1611 firms categorized into 11 economic sectors between January 2009 and May 2019 to examine the robustness of earlier findings on the performance of US IPOs. Second, we construct cross-sector portfolios sorted by firms’ size and age and track their performance in the near and long term. Third, we compare the long-term performance of IPOs of large and small firms at the sector level.

An interseting finding that emerges is the large variability in the average age of firms going public at the sectoral level (Table 1 Panel F). For example, on average, healthcare (technology) companies go public at 10 (13) years, while those in basic materials (industrials) do so at 30 (34) years. We suggest that firms in healthcare and technology issue IPOs earlier in their lifecycle due to their need for financial resources to develop a drug or technology.1 Maksimovic and Pichler (2001) assert that going public is a strategic choice to gain a first-mover advantage in the product market. In turn, going public increases investor recognition, a firm’s visibility, reputation, and credibility, reducing a firm’s cost of equity and increasing its value (e.g., Merton 1987).

Table 1.

Sample Descriptive Statistics.

Our findings indicate that, while firms generally underperform the market portfolio, smaller IPOs underperform more than bigger IPOs. For example, tracking the performance of small firms indicates a negative cumulative average abnormal return (CAAR) of −42.77% one-year post IPO, −89.26% two years after the IPO and −113.91% three years after the IPO. In contrast, large firms have a CAAR of only −14.59% for one-year, −27.74% two years post IPO and −25.57% three years after the IPO (Table 2 Panel A). These findings produce a difference between the large and small portfolios of 28.17% for one year, 61.52% for two years and 88.33% for three years post IPO. The role of the firm’s size is also evident at the sector level when dividing firms into small and large firms within each sector.

Table 2.

Size (MV before the IPO)-Ranked Portfolios and the Performance of IPOs.

Our results also show that there is a strong positive correlation between a firm’s size and age (Table 1 Panel E). In line with Engelen and Van Essen (2010), we suggest that older firms are more likely to generate more profits, reducing uncertainty about them and increasing their value (e.g., Su and Fleisher 1999; Loughran and Ritter 2004; Chahine 2008). Mitigating uncertainty about a firm’s prospects is also evident in the positive correlation between a firm’s age and size and the funds raised (Table 1 Panel G).

Our study has several practical implications, particularly given the change in regulations that accompanied the passage of the Jumpstart Our Business Startups (JOBS 2012) Act, which has dramatically altered investors’ approach to small-sized firms. Indeed, firms are issuing IPOs at a much younger age. For example, 2 sectors out of 11 are responsible for 47% of the firms going public: healthcare (505 firms) and technology (261 firms) with an average age of 10 and 13 years, respectively. Our findings emphasize that size is a key factor predicting underperformance in the near term for small firms after issuing IPOs. Hence, such firms and their consulting underwriters might consider postponing their going public until they are more mature. Second, investors can benefit from the patterns detected here by using a simple trading strategy that guarantees reaping abnormal profits: longing large-size IPO firms and shorting small-size IPO ones (Table 2). Similarly, longing mature IPO firms and shorting younger IPO ones will also yield positive abnormal returns as shown below for Age-Ranked Portfolios.

Issuing stocks to the public has major economic outcomes not only for the issuing firm, but also for owners, stockholders, managers, potential investors, and other market participants. In the literature review, we discuss the documented motivations for and benefits of going public. In addition, issuing stock to the public has important implications for the economy. The literature has established that IPOs boost the economy by increasing aggregate demand for local consumption goods, which increases the demand for labor and creates jobs in the industries that sell these goods. In line with this idea, IPOs help increase the price of houses in their surrounding areas (e.g., Nguyen et al. 2022; Butler et al. 2019). Furthermore, IPOs can also prompt issuing firms to increase their investments in the local economy, which, in turn, has positive effects on neighboring businesses (e.g., Matray 2021) and an uptick in the vibrancy of the local area (Dougal et al. 2015).

As previously stated, 47% of the firms that went public in our sample came from the healthcare and technology sectors. Their value (in average terms) when they went public was USD 1033 M and USD 1292 M for healthcare and technology, respectively, which is smaller than the average of the entire sample (USD 1561 M). In addition, firms in both sectors went public at relatively young ages: 10 and 13, respectively. Hence, raising funds is crucial for small and young businesses, particularly given the importance of these two sectors to the US economy.

According to the Centers for Medicare & Medicaid Services (CMS)2, healthcare expenditures in the US were responsible for an average of 17.3% of the US GDP in 2009 to 2019. During this period, healthcare jobs in the United States grew by more than 20%, significantly outpacing the job growth of 3% in all other employment sectors. In addition, the healthcare sector added 2.8 million jobs between 2006 and 2016, which was nearly seven times faster than the overall economy (e.g., Martiniano and Moore 2018). According to the Bureau of Labor Statistics, this industry created 3 million jobs in 2011 to 2021.3 Globally, North America alone accounts for almost half of the pharmaceutical market globally. For example, in 2016, pharmaceutical companies in the US generated more than USD 440 billion total in revenue. In 2019, five out of the 10 top pharma companies in the world by revenue were in the US and 14% of American adults were employed in the healthcare industry.4 The technology sector, on the other hand, is the second largest industry in the US and was responsible for 10.2–10.5% of the US GDP between 2018 and 2020.5 According to the 2019 Computing Technology Industry Association report, between 2010 and 2018, this sector created 1.9 million jobs. The impact of the tech industry has affected nearly every state, and the industry is ranked in the top five economic contributors in 23 states and in the top 10 of 28 states.6

2. Literature Review

When firms go public, a well-documented phenomenon is the underpricing of their IPOs, meaning the initial offering price tends to be less than the market price. One of the leading explanations for this phenomenon is information asymmetry. It implies that some investors such as a firm’s insiders, owners and managers have better information about the value of the firm than outside investors (Rock 1986). Carter et al. (1998), as well as many subsequent studies, have suggested that the reputation of the underwriter could mitigate the problem of asymmetric information; the better the reputation of the underwriter, the less likely the underpricing.

On the other hand, if we measure the performance of IPO firms over longer periods, say for one, two or three years following the listing, their returns generally perform poorly relative to a given market benchmark. Early on, Aggarwal and Rivoli (1990) used 1598 US IPOs for 1977–1987 and reported an abnormal market-adjusted return of −13.73% for a period of one year. Ritter (1991) refined and extended the tests to 1526 IPOs for 1975–1984. The study documented that IPOs underperformed by 10.23% by the end of first year, 16.89% by the end of second year and 29.13% by the end of third year. Using US IPOs in 1935–1972, Gompers and Lerner (2003) reported underperformance ranging from 8.4% to 16.7%. Goergen et al. (2007) explored this issue using a sample of 228 UK IPOs and demonstrated consistent, negative, abnormal performance using various methodologies. Gregory et al. (2010) conducted an analysis of the main and second boards of the UK and documented their long-term underperformance across different benchmarks used to calculate abnormal returns. Consistent with the literature, Agathee et al. (2014) demonstrated the long-term underperformance in the US regardless of the benchmarks used.

Other works attempt to provide more in-depth analysis and link the performance of IPO firms after their launch to the company’s management transparency, ownership structure and advertising. For example, Amor and Kooli (2017) analyzed the performance of US issuers between 2000 and 2010 regarding how they used the money they raised through the IPO: sales and marketing promotions, investments, debt repayment and vague statements about their intended use of the proceeds. The researchers hypothesized that firms that disclose such information reduce ex-ante uncertainty about their true value and hence are less likely to be underpriced. They reported that all the issuers had a negative CAAR of −16.32% in the three years following the IPO. However, firms that announced that they were using the proceeds to repay debt underperformed the worst at −21.09%. In contrast, those who intended to invest the proceeds underperformed much less poorly at −9.55%. Wang et al. (2015) examined the long-term performance of 636 non-state-owned enterprises in China from 2002 to 2010. They reported an overall negative CAAR of −15.13% in the three years after an IPO. They also observed that firms with excess control rights underperformed much more (−23.83%) than firms without excess control rights (−7.83%). Chemmanur and Yan (2017) explored whether firms that advertise heavily prior to their IPO outperform those that do less advertising. Using a sample of 647 US firms that launched an IPO from 1990 to 2007, they found a negative CAAR of −15.8% three years after the IPO. Firms that advertised heavily had a much lower average CAAR of −24.5% than those who did less advertising (−7.4%).

As previously stated, despite this evidence, recent studies raise doubts regarding this phenomenon mainly in countries other than the US. Kim et al. (1995) analyzed the performance of 169 Korean IPOs between 1985 and 1989 and provided evidence that Korean IPOs outperform seasoned firms with similar characteristics. A similar pattern is also evident in Thomadakis et al. (2012) who reported the overperformance of 254 Greek IPOs during 1994–2002. Kooli and Suret (2004) examined data on 445 Canadian IPOs from 1991 to 1998, but did not find significant patterns of underperformance. Using a sample of 76 firms from the healthcare and biopharmaceutical sectors that launched an IPO between 1986 and 2014 in Asian stock exchanges, Komenkul and Kiranand (2017) reported a positive significant CAAR of 2.83%. However, the results varied depending on the country. For example, Singaporean firms performed the worse with a negative CAAR of −36.54%, whereas the IPOs of Malaysian and Thai companies performed better in the three years after the IPO with CAARs of 33.34% and 28.94%, respectively. Zhang and Zhang’s (2020) study of Chinese IPOs between 2003 and 2013 reported that VC-backed firms with patent growth during the investment period of the VCs exhibited a 36-month buy and hold market-adjusted return of 14.78%. In contrast, the returns were 10.55% for other VC-backed firms without patent growth and 5.23% for non-VC-backed firms. The authors highlighted the role of technological innovation in the long-term performance of VC-backed IPOs.

The decision to issue stock and go public has major consequences not only for the firm, but also for stockholders, potential investors, and the economy. IPOs are one of the most popular methods for raising funds from the public. Nevertheless, it seems that it is not the only benefit of going public. The literature provides theories and hypotheses about the motivations and expected benefits for a company when it becomes public.

Ritter and Welch (2002) claimed that most firms go public primarily to raise funds for growth opportunities. Many studies support this unsurprising view and argue that new capital raised through IPOs fuels the firm’s internal growth, allowing it to explore new investment opportunities and develop new initiatives (e.g., Bancel and Mittoo 2009).

The literature also shows that new funds raised from IPOs are used for other purposes in addition to financing growth. Going public enhances a firm’s prestige, increases its visibility, and attracts shareholders. Merton (1987), as well as Bancel and Mittoo (2001), argued that broadening the shareholder base and increasing investors’ recognition help reduce the firm’s cost of equity, and thus increase its value. In this spirit, Maksimovic and Pichler (2001) highlighted that going public is a strategic decision to attract attention in the marketplace and provides the firm with a great deal of publicity. Hence, going public enhances the firm’s visibility, reputation and credibility and allows it to raise capital for growth.

Another view suggests that companies go public mainly to promote an efficient merger and acquisition strategy (e.g., Hsieh et al. 2011). The underlying assumption supporting this view is that private firms are uncertain about their precise equity value. To remove this valuation uncertainty, firms go public and allow market participants to value their equity. Celikyurt et al. (2010) supported this view and reported that newly public US firms are often involved in mergers and acquisitions. They also indicated that the number of post-IPO acquisitions is positively related to the degree of valuation uncertainty.

Another benefit of launching an IPO is the resulting financial flexibility and the increased bargaining power with financial creditors (Rajan 1992). The underlying assumption is that creating additional sources of capital to finance a firm’s investments provides financial flexibility and reduces the dependence on other sources, which in turn, reduces the firm’s cost of debt (e.g., Huyghebaert and Van Hulle 2006). In this respect, Amihud and Mendelson (1986), as well as Amihud and Levi (2022), suggested that listing the firm’s shares on capital exchange enhances the liquidity of its stock, which, in turn, increases investment in the firm and its production.

Other studies relate the decision to launch an IPO to external monitoring issues. While some IPO models view external monitoring as beneficial, others view it as a cost. Early on, Jensen and Meckling (1976) contended that a company’s commitment to meeting the disclosure and regulatory requirements of financial exchanges reduces the agency costs between managers and shareholders, promotes better corporate governance and increases transparency. On the other hand, external monitoring can be a kind of cost for managers and controlling shareholders. The increased attention of market participants and analysts may make managers much more cautious, limiting their willingness to take the risks needed to succeed. However, firms construct managerial incentive plans that generally align with the interests of shareholders (Banerjee and Homroy 2018). In addition, greater transparency may lead firms to disclose critical information that may appear as very advantageous to competitors (Maksimovic and Pichler 2001).

While the benefits described above mainly affect corporate growth opportunities and profits, other theories maintain that IPOs are a first step in the founders’ or owners’ exit strategy (e.g., Zingales 1995; Dambra et al. 2015). Black and Gilson (1998) described the IPO decision as an opportunity for owners such as founders, angels and venture capitalists to cash out their investments.

Finally, one of the most important ways to promote economic growth in a country is to create an environment where small companies can go public. Relatively recent legislation relevant to this study is the US JOBS Act (April 2012). This act eases the regulations on emerging growth companies. According to SEC regulations, an emerging growth company is one that first sold stock in a registered offering after 8 December 2011 and had a total gross annual revenue of less than USD 1 billion during its most recently completed fiscal year. The JOBS Act was designed to boost job creation by giving smaller companies access to the capital needed to expand their businesses. According to Dambra et al. (2015), during the years following its passage, the volume and proportion of small firms issuing IPOS was the largest since 2000.

3. Data and Method

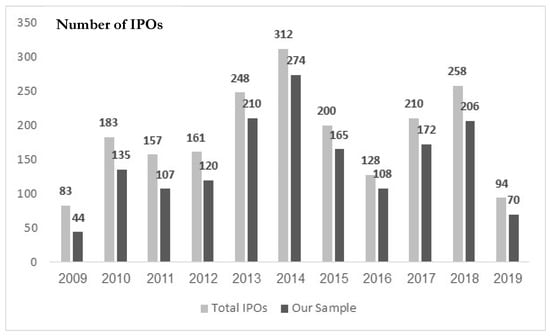

Our sample includes data about 1611 US firms that executed IPOs between April 2009 and May 2019. We purchased the trading data and financial reports from gurufocus.com. We excluded the IPOs of SPACs, trust funds and firms that were traded for less than one year. We divided the sample into 11 economic sectors using Standard & Poor’s (S&P) and Morgan Stanley Capital International’s (MSCI) categories. Figure 1 plots the evolution of the total IPOs and those used in our sample across the sample period.7

Figure 1.

The evolution of IPOs in the US: April 2009 to May 2019.

Table 1 presents the sample descriptive statistic from a variety of aspects. Panels A and B report the statistics of the market value (MV) of the sampled firms. MV is calculated as the number of shares pre-IPO multiplied by the offer price (e.g., Alavi et al. 2008; Abrahamson and De Ridder 2015). According to Panel A, the average size of the lowest quintile (Q1) is USD 36M, and the highest is USD 6400M. The highest market value is USD 320,213M, belonging to Benitec Biopharma LTD. In Panel B, firms are divided into 11 sectors. The highest average market value of USD 3657M belongs to the communication services sector. The lowest average MV of USD 790M belongs to the utilities sector. We also extracted the pre-IPO total asset value of the sampled companies. These values are listed in Panels C and D. Panels E and F present the firms’ age across quintiles and sectors, respectively. The overall picture in Panel E demonstrates that a firm’s age increases gradually across quintiles. For example, while the average firm age in Q1 is 10.3 years, it rises to 28.2 years in Q5. Naturally, older firms have had more time to establish and expand their business, as reflected in their value. Finally, Panel G indicates that larger firms can raise more money, an average of USD 70.7M in Q1 versus USD 834.3M in Q5. In a sectoral look (Panel H), the healthcare sector raised the smallest average amount of USD 96.6M, while the communication sector raised the largest average amount of USD 631.6M.

We used the event-study methodology to analyze the long-term performance of IPO events. This methodology is the most used approach in finance research in general and in IPO research in particular. We followed the literature and used the event study analysis to explore the issue of interest (e.g., Gompers and Lerner 2003; Thomadakis et al. 2012). Equation (1) calculates the Abnormal Return ( for firm “i” on day t.

denotes the return of firm “i” on trading day t, and is the benchmark index return on day t. For each firm we aggregated the abnormal returns from day 1 to day T for each of the 750 trading days post IPO to obtain the cumulative abnormal return (). That is,

The cumulative average abnormal return () across a subsample of n firms is calculated as follows:

The cross-sector standard deviation t-test is expressed in Equation (4).

where is estimated as follows:

Finally, we analyzed the CAAR using five size portfolios ranked according to the firms’ market value, five portfolios constructed according to the firms’ book asset value, and three portfolios constructed according to the firms’ age and across sectors.

4. Empirical Findings

4.1. Portfolio View

Table 2 lists the cumulative average abnormal return (CAAR) for selected time windows following the IPO. In line with the literature, we set the IPO day as t = 0, and calculated the CAAR from day 1 on (e.g., Ritter 1991; Espenlaub et al. 2000; Zhang and Zhang 2020). We constructed five cross-sector portfolios (Q1 to Q5) sorted according to the market value (MV) of the underlying assets. “Q1” denotes the portfolio consisting of firms with the lowest MV, whereas “Q5” refers to firms with the highest MV.

For robustness and given that the selection of benchmarks might affect the scale of the abnormal returns obtained (e.g., Fama and French 1996; Espenlaub et al. 2000), we calculated the CAAR using three different benchmarks: the S&P 500 (Panel A); Russell 2000 (Panel B) and sector indices (Panel C).8 By sector indices we mean that for each company we used the relevant sector index as a benchmark. For example, for companies from the technology sector, we utilized the S&P technology index.

As Table 2 indicates, the results are very similar across these three benchmarks. Hence, we refer to the results relative to the S&P 500 benchmark in Panel A. Overall, small firms underperform large firms. For example, for the first 150 days following the IPO, Q1 CAAR equals −26.18% (t-stat. = −8.92) and Q5 CAAR equals −9.15% (t-stat. −3.85). For the first 250 days (one year following the IPO), Q1 CAAR equals −42.77% (t-stat. = −10.28) and Q5 CAAR equals −14.59% (t-stat. −4.72). For 550 days (two years post IPO), Q1 CAAR equals −89.26% (t-stat. = −12.66) and Q5 CAAR equals −27.74% (t-stat. −5.87). Finally, for three years post IPO (the first 750 trading days), Q1 CAAR equals −113.91% (t-stat. = −13.39) and Q5 CAAR equals −25.57% (t-stat. −4.41).

The last column of Table 2 presents the results of a simple trading strategy that investors can utilize to take advantage of the pattern detected here. The strategy suggests buying a portfolio of large size IPOs (Q5) and shorting a portfolio of small size IPOs (Q1). We tracked the results of this strategy across time and found that it produced abnormal returns. For example, the first 100 days following the IPO, the trading rule yielded a 14.21% return. After 250 days, this trading strategy yielded 28.17% and after 550 trading days, 61.52%.

Our results are in line with earlier works confirming the long-term underperformance of IPOs in the US (e.g., Chen and Zheng 2021) and the different premiums associated with portfolios based on the size of the companies involved (e.g., Qadan and Aharon 2019). More specifically, our findings accord with the empirical works of Brav and Gompers (1997), Stehle et al. (2000), Goergen et al. (2007), and Agathee et al. (2014). These studies reported that corporate characteristics such as the firm’s book-to-market ratio or its size have a significant effect on the long-term underperformance of IPOs. They also indicated that small firms do worse in the long run than large firms. Similarly, our results contradict those claiming that IPOs overperform or do not underperform in the long run (da Silva Rosa et al. 2003; Thomadakis et al. 2012).

4.2. Sector View

In addition to creating portfolios, we examined the sectors. Thus, we divided each sector into two subsamples using a MV separator of USD 500M to differentiate between small and large firms. We chose USD 500M as it was close to the USD 496M average of the median market value of the sectors. We recalculated the CAAR (versus the S&P500 index as a benchmark) for each sector and for each sector’s subsamples as presented in Table 3. In most sectors, the subsample of large firms outperforms the subsample of small firms. For example, in the healthcare sector small firms had a CAAR of −23.22% (t = −6.93), −32.57 (t = −7.81), and −63.49% (t = −9.38) versus the CAAR of −16.37% (t = −2.8), −22.12% (t = −3.47) and −16.54% (t = −1.75) for 200, 300 and 550 days post IPO, respectively. In the technology sector, the differences between small and large firms are even more pronounced, with small firms having a CAAR of −21.31 (t = −3.6), −31.66% (t = −4.28) and −47.66% (t = −4.7) versus large firms with a CAAR of −1.45% (t = −0.42), −6.24% (t = −1.32) and −5.7% (t = −0.71) for 200, 300 and 500 trading days, respectively.

Table 3.

CAAR by Sector.

We repeated the calculations in Table 3 for the other two benchmarks. In addition, we recalculated the CAAR using asset value to distinguish small and large firms. We chose an asset value of USD 500M as a separator because it is close to the average of the medians for the Q1 to Q5 portfolios (USD 680M) and to the average of the sector medians (USD 418M). These results are like those in Table 3, so we did not display them in detail.9 Instead, Table 4 summarizes and maps the results of the CAAR calculations within the sectors for each of the three benchmarks and for the two factors that distinguish small firms from large ones: market value and asset value. As the table indicates, in 86% of the sectors large firms outperform small ones regardless of the benchmark and regardless of the separator between small and large firms.

Table 4.

CAAR Results by Sector.

Given the clear positive correlation between the size portfolios and the firms’ age (Table 1 Panel E), we recalculated the CAAR in three age-based portfolios. The results appear in Table 5. In this table, Portfolio A1 consists of very young firms between 1 and 6 years old, Portfolio A2 consists of slightly more mature firms between 7 and 13 years old, and Portfolio A3 consists of the most mature firms that are 14+ years old. We calculated the CAAR for different time windows using our three benchmarks. We present only the results related to the S&P500 benchmark (Table 5 Panel A) considering the similarity between them. Overall, older firms perform better than younger ones regardless of the time window. For example, Portfolio A1′s CAAR is −7.44% (t = −4.28), −20.5% (t = −8.2), −30.81% (t = −9.96) and −45.99% (t = −10.5) compared to Portfolio A3′s CAAR of −3.82% (t = −2.42), −10.39% (t = −4.51), −17.58% (t = −6.19) and −28.81% (t = −6.44) for 100, 200, 300, and 550 days post IPO, respectively (Table 5 Panel A). This finding accords with Ritter (1984) who suggested using age as a proxy for risk.

Table 5.

Age-Ranked Portfolios and the Performance of IPOs.

Many studies link a firm’s age to the underpricing of its IPO, meaning its market price is higher than the price of the IPO when it is launched. They document that there is less underpricing for older firms (e.g., Ritter 1984, 1991; Engelen and Van Essen 2010). One popular explanation is related to the assumption that older companies have a longer history and more information available to the public. Thus, analysts, the financial press and potential investors are less uncertain about the firm’s value. As a result, the IPO is likely to be less underpriced. While much attention has been devoted to studying the link between age and the underpricing of IPOs, less attention has been devoted to the link between a firm’s age and the long-term underperformance of those that launch IPOs. Kim et al. (1995), for example, maintained that age is not a significant factor explaining future returns. Conversely, Spiess and Affleck-Graves (1995), as well as Brau et al. (2012), reported that age negatively affects long-term performance. Based on our findings, we conclude that younger firms who launch IPOs do much worse in the long-term than older firms that go public do.

5. Robustness Checks

For robustness, we repeated the calculations presented in Table 2 and Table 3 using asset value instead of market value as a proxy for a firm’s size. Table 6 presents the CAAR calculation across the five size portfolios (Q1 to Q5) using three different benchmarks. For example, the Q1 CAAR results in −11.34% (t-stat. = −4.42), −31.51% (t-stat. = −8.21), −43.26% (t-stat. = −9.01) for 100, 200 and 300 days, respectively, post IPO. The corresponding values for Q5 are 1.21% (t-stat. = 0.71), −3.08% (t-stat. = −1.42) and −10% (t-stat. = −3.65), respectively. As in Table 2, large firms have a lower negative CAAR than small firms. These findings produce a difference between the portfolios of large and small companies of 29.84% for one year, 57.42% for two years and 88.45% for three years post IPO.

Table 6.

Size (Assets before the IPO)-Ranked Portfolios and the Performance of IPOs.

As Table 7 indicates, the role of the firm’s size is also evident at the sector level. For each sampled sector, and based on book asset values, we divided the companies into two groups—small and large—with book asset values pre-IPO less than (small) and greater than (large) USD 500M. The overall picture is maintained.

Table 7.

Sectors and their Subsample CAARs divided by Asset Value Pre IPO.

Finally, the literature suggests several possible explanations for the poor subsequent stock performance of IPO-issuing firms including the divergence of opinion hypothesis (Miller 1977), the “impresario” hypothesis (Aggarwal and Rivoli 1990), and the “windows of opportunity” hypothesis (Ritter 1991; Loughran and Ritter 1995).

6. Conclusions

Using a large US dataset, we reassessed the near- and long-term performance of IPOs based on economic sector, and a firm’s size and age. We revealed significant negative cumulative abnormal returns that vary across economic sectors. However, the IPOs of smaller companies underperform more than those of larger companies. The difference in this performance after one year is 28% and leaps to 62% and 88% after two and three years, respectively. This finding is also evident across economic sectors. One possible explanation is that there is more information available publicly about older and larger firms regarding their past performance and prospects than for smaller and younger firms. In addition, large cap and older firms are regarded as less risky, due to their larger number and amount of capital resources, and managerial and organizational experience. Thus, investors in larger and older firms suffer less from asymmetric information.

We also found significant variation in the age of firms going public across sectors. Healthcare and technology companies go public at a relatively younger age (~10–13 years) than those in the industrial, basic materials and cyclical consumer sectors (~30+ years). Our finding accords with the theory suggested by Merton (1987) and others, which emphasizes financial and strategic considerations, such as improved reputation, visibility, credibility, and financial flexibility as major advantages of going public early on.

Our results have direct implications for firms and their underwriters regarding the optimal timing for issuing IPOs. Investors, on the other hand, must be aware that over time investing in young or small firms is likely to yield smaller returns than investing in mature or large firms. However, for young and small firms that face an acute shortage of cash, raising funds is a matter of survival, prompting them to issue IPOs early in their lifecycle. Future research may focus on the performance of IPOs across economic sectors, particularly unprofitable firms, and firms without revenues. These studies can also investigate such companies in other developed and developing countries, with an eye to determining whether regulatory reforms that grant young companies exemptions from reporting requirements and relax regulations on them improve their performance if they issue IPOs.

Author Contributions

The authors have an equivalent contribution. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data will be provided upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | For example, Zoom Video Communications IPO was in April 2019 at the young age of 8. It raised USD 750M, which enabled it to improve its online products early before the pandemic outbreak. Zoom has become the leading platform used internationally, leaving its competitors far behind. |

| 2 | https://www.cms.gov/ (accessed on 19 November 2022). |

| 3 | https://www.bls.gov/emp/industry-employment/industry.xlsx (accessed on 19 November 2022). |

| 4 | https://www.zippia.com/advice/us-healthcare-industry-statistics/ (accessed on 19 November 2022). |

| 5 | https://www.statista.com/statistics/1239480/united-states-leading-states-by-tech-contribution-to-gross-product/ (accessed on 19 November 2022). |

| 6 | https://nhtechalliance.org/wp-content/uploads/2019/10/CompTIA_Cyberstates_2019.pdf?x84255 (accessed on 19 November 2022). |

| 7 | According to Stockanalysis.com, there were 232,480 and 1058 IPOs in 2019, 2020 and 2021 respectively. |

| 8 | S&P500 Healthcare for the healthcare sector, S&P500 Real Estate for the real estate sector and so on. |

| 9 | These results are available upon request. |

References

- Abrahamson, Martin, and Adri De Ridder. 2015. Allocation of shares to foreign and domestic investors: Firm and ownership characteristics in Swedish IPOs. Research in International Business and Finance 34: 52–65. [Google Scholar] [CrossRef]

- Agathee, Ushad Subadar, Raja Vinesh Sannassee, and Chris Brooks. 2014. The long-run performance of IPOs: The case of the Stock Exchange of Mauritius. Applied Financial Economics 24: 1123–45. [Google Scholar] [CrossRef]

- Aggarwal, Reena, and Pietra Rivoli. 1990. Fads in the initial public offering market? Financial Management 19: 45–57. [Google Scholar] [CrossRef]

- Alavi, Arash, Peter Kien Pham, and Toan My Pham. 2008. Pre-IPO ownership structure and its impact on the IPO process. Journal of Banking & Finance 32: 2361–75. [Google Scholar]

- Amihud, Yakov, and Haim Mendelson. 1986. Asset pricing and the bid-ask spread. Journal of Financial Economics 17: 223–49. [Google Scholar] [CrossRef]

- Amihud, Yakov, and Shai Levi. 2022. The effect of stock liquidity on the firm’s investment and production. Review of Financial Studies. forthcoming. [Google Scholar] [CrossRef]

- Amor, Salma Ben, and Maher Kooli. 2017. Intended use of proceeds and post-IPO performance. Quarterly Review of Economics and Finance 65: 168–81. [Google Scholar] [CrossRef]

- Bancel, Franck, and Cusha Mittoo. 2001. European managerial perceptions of the net benefits of foreign stock listings. European Financial Management 7: 213–36. [Google Scholar] [CrossRef]

- Bancel, Franck, and Usha Mittoo. 2009. Why do European firms go public? European Financial Management 15: 844–84. [Google Scholar] [CrossRef]

- Banerjee, Shantanu, and Swarnodeep Homroy. 2018. Managerial incentives and strategic choices of firms with different ownership structures. Journal of Corporate Finance 48: 314–30. [Google Scholar] [CrossRef]

- Black, Bernard S., and Ronald J. Gilson. 1998. Venture capital and the structure of capital markets: Banks versus stock markets. Journal of Financial Economics 47: 243–77. [Google Scholar] [CrossRef]

- Brau, James C., Robert B. Couch, and Ninon K. Sutton. 2012. The desire to acquire and IPO long-run underperformance. Journal of Financial and Quantitative Analysis 47: 493–510. [Google Scholar] [CrossRef]

- Brav, Alon, and Paul A. Gompers. 1997. Myth or reality? The long-run underperformance of initial public offerings: Evidence from venture and nonventure capital-backed companies. Journal of Finance 52: 1791–821. [Google Scholar] [CrossRef]

- Butler, Alexander W., Larry Fauver, and Ioannis Spyridopoulos. 2019. Local economic spillover effects of stock market listings. Journal of Financial and Quantitative Analysis 54: 1025–50. [Google Scholar] [CrossRef]

- Carter, Richard B., Frederick H. Dark, and Ajai K. Singh. 1998. Underwriter reputation, initial returns, and the long-run performance of IPO stocks. Journal of Finance 53: 285–311. [Google Scholar] [CrossRef]

- Celikyurt, Ugur, Merih Sevilir, and Anil Shivdasani. 2010. Going public to acquire? The acquisition motive in IPOs. Journal of Financial Economics 96: 345–63. [Google Scholar] [CrossRef]

- Chahine, Chahine. 2008. Underpricing versus gross spread: New evidence on the effect of sold shares at the time of IPOs. Journal of Multinational Financial Management 18: 180–96. [Google Scholar] [CrossRef]

- Chambers, David, and Elroy Dimson. 2009. IPO underpricing over the very long run. Journal of Finance 64: 1407–43. [Google Scholar] [CrossRef]

- Chan, Kalok, Junbo Wang, and K. John Wei. 2004. Underpricing and long-term performance of IPOs in China. Journal of Corporate Finance 10: 409–30. [Google Scholar] [CrossRef]

- Chemmanur, Thomas, and An Yan. 2017. Product market advertising, heterogeneous beliefs, and the long-run performance of initial public offerings. Journal of Corporate Finance 46: 1–24. [Google Scholar] [CrossRef]

- Chen, Honghui, and Minrong Zheng. 2021. IPO underperformance and the idiosyncratic risk puzzle. Journal of Banking & Finance 131: 106190. [Google Scholar]

- da Silva Rosa, Ray, Gerard Velayuthen, and Terry Walter. 2003. The sharemarket performance of Australian venture capital-backed and non-venture capital-backed IPOs. Pacific-Basin Finance Journal 11: 197–218. [Google Scholar] [CrossRef]

- Dambra, Michael, Laura C. Field, and Matthew T. Gustafson. 2015. The JOBS Act and IPO volume: Evidence that disclosure costs affect the IPO decision. Journal of Financial Economics 116: 121–43. [Google Scholar] [CrossRef]

- Dougal, Casey, Christopher A. Parsons, and Sheridan Titman. 2015. Urban vibrancy and corporate growth. The Journal of Finance 70: 163–210. [Google Scholar] [CrossRef]

- Dutta, Anupam. 2016. Reassessing the long-term performance of Indian IPOs. Journal of Statistics and Management Systems 19: 141–50. [Google Scholar] [CrossRef]

- Engelen, Peter-Jan, and Marc Van Essen. 2010. Underpricing of IPOs: Firm-, issue-and country-specific characteristics. Journal of Banking & Finance 34: 1958–69. [Google Scholar]

- Espenlaub, Susanne, Alan Gregory, and Ian Tonks. 2000. Re-assessing the long-term underperformance of UK Initial Public Offerings. European Financial Management 6: 319–42. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1996. Multifactor explanations of asset pricing anomalies. Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Gao, Jing, Ling Mei Cong, and John Evans. 2015. Earnings management, IPO underpricing, and post-issue stock performance of Chinese SMEs. The Chinese Economy 48: 351–71. [Google Scholar] [CrossRef]

- Goergen, Marc, Arif Khurshed, and Ram Mudambi. 2007. The long-run performance of UK IPOs: Can it be predicted? Managerial Finance 33: 401–19. [Google Scholar] [CrossRef]

- Gompers, Paul A., and Josh Lerner. 2003. The really long-run performance of initial public offerings: The pre-Nasdaq evidence. Journal of Finance 58: 1355–92. [Google Scholar] [CrossRef]

- Gregory, Alan, Guermat Cherif, and Al-Fawaz Shawawreh. 2010. UK IPOs: Long run returns, behavioural timing and pseudo timing. Journal of Business Finance & Accounting 37: 612–47. [Google Scholar]

- Hsieh, Jim, Evgeny Lyandres, and Alexei Zhdanov. 2011. A theory of merger-driven IPOs. Journal of Financial and Quantitative Analysis 46: 1367–405. [Google Scholar] [CrossRef]

- Huyghebaert, Nancy, and Cynthia Van Hulle. 2006. Structuring the IPO: Empirical evidence on the portions of primary and secondary shares. Journal of Corporate Finance 12: 296–320. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Itzhak Krinsky, and Jason Lee. 1995. The aftermarket performance of initial public offerings in Korea. Pacific-Basin Finance Journal 3: 429–48. [Google Scholar] [CrossRef]

- Komenkul, Kulabutr, and Santi Kiranand. 2017. Aftermarket performance of health care and biopharmaceutical IPOs: Evidence from ASEAN countries. INQUIRY: The Journal of Health Care Organization, Provision, and Financing 54: 0046958017727105. [Google Scholar] [CrossRef]

- Kooli, Maher, and Jean-Marc Suret. 2004. The aftermarket performance of initial public offerings in Canada. Journal of Multinational Financial Management 14: 47–66. [Google Scholar] [CrossRef]

- Lee, Philip J., Stephen L. Taylor, and Terry S. Walter. 1996. Australian IPO pricing in the short and long run. Journal of Banking & Finance 20: 1189–210. [Google Scholar]

- Ljungqvist, Alexander P. 1997. Pricing initial public offerings: Further evidence from Germany. European Economic Review 41: 1309–20. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay R. Ritter. 1995. The new issues puzzle. Journal of Finance 50: 23–51. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay Ritter. 2004. Why has IPO underpricing changed over time? Financial Management 33: 35–37. [Google Scholar] [CrossRef]

- Maksimovic, Vojislav, and Pegaret Pichler. 2001. Technological innovation and initial public offerings. Review of Financial Studies 14: 459–94. [Google Scholar] [CrossRef]

- Martiniano, Rui, and Jean Moore. 2018. Health Care Employment Projections, 2016–2026: An Analysis of Bureau of Labor Statistics Projections by Setting and by Occupation. Rensselaer: Center for Health Workforce Studies, School of Public Health, SUNY Albany. [Google Scholar]

- Matray, Adrien. 2021. The local innovation spillovers of listed firms. Journal of Financial Economics 141: 395–412. [Google Scholar] [CrossRef]

- Merton, Robert C. 1987. A Simple Model of Capital Market Equilibrium with Incomplete Information. Journal of Finance 42: 483–510. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, uncertainty, and divergence of opinion. The Journal of Finance 32: 1151–68. [Google Scholar] [CrossRef]

- Nguyen, Thanh, Arsenio Staer, and Jing Yang. 2022. Initial Public Offerings and Local Housing Markets. Journal of Real Estate Research 44: 184–218. [Google Scholar] [CrossRef]

- Qadan, Mahmoud, and David Yehiam Aharon. 2019. Can investor sentiment predict the size premium? International Review of Financial Analysis 63: 10–26. [Google Scholar] [CrossRef]

- Rajan, Raghuram G. 1992. Insiders and outsiders: The choice between informed and arm’s-length debt. Journal of Finance 47: 1367–400. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1984. The “hot issue” market of 1980. Journal of Business 57: 215–40. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1991. The long-run performance of initial public offerings. Journal of Finance 46: 3–27. [Google Scholar] [CrossRef]

- Ritter, Jay R., and Ivo Welch. 2002. A review of IPO activity, pricing, and allocations. Journal of Finance 57: 1795–828. [Google Scholar] [CrossRef]

- Rock, Kevin. 1986. Why new issues are underpriced. Journal of Financial Economics 15: 187–212. [Google Scholar] [CrossRef]

- Spiess, D. Katherine, and John Affleck-Graves. 1995. Underperformance in long-run stock returns following seasoned equity offerings. Journal of Financial Economics 38: 243–67. [Google Scholar] [CrossRef]

- Stehle, Richard, Olaf Ehrhardt, and René Przyborowsky. 2000. Long-run stock performance of German initial public offerings and seasoned equity issues. European Financial Management 6: 173–96. [Google Scholar] [CrossRef]

- Su, Dongwei, and Belton M. Fleisher. 1999. An empirical investigation of underpricing in Chinese IPOs. Pacific-Basin Finance Journal 7: 173–202. [Google Scholar] [CrossRef]

- Thomadakis, Stavros, Christos Nounis, and Dimitrios Gounopoulos. 2012. Long-term performance of Greek IPOs. European Financial Management 18: 117–41. [Google Scholar] [CrossRef]

- Wang, Xiaoming, Jerry Cao, Qigui Liu, J. Tang, and Gary Tian. 2015. Disproportionate ownership structure and IPO long-run performance of non-SOEs in China. China Economic Review 32: 27–42. [Google Scholar] [CrossRef]

- Zhang, Yeqing, and Xueyong Zhang. 2020. Patent growth and the long-run performance of VC-backed IPOs. International Review of Economics & Finance 69: 33–47. [Google Scholar]

- Zingales, Luigi. 1995. Insider ownership and the decision to go public. Review of Economic Studies 62: 425–48. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).