What Do We Know about Crowdfunding and P2P Lending Research? A Bibliometric Review and Meta-Analysis

Abstract

1. Introduction

2. Data and Methods

3. Descriptive Analysis

3.1. Main Information about Data

3.2. Production Trends

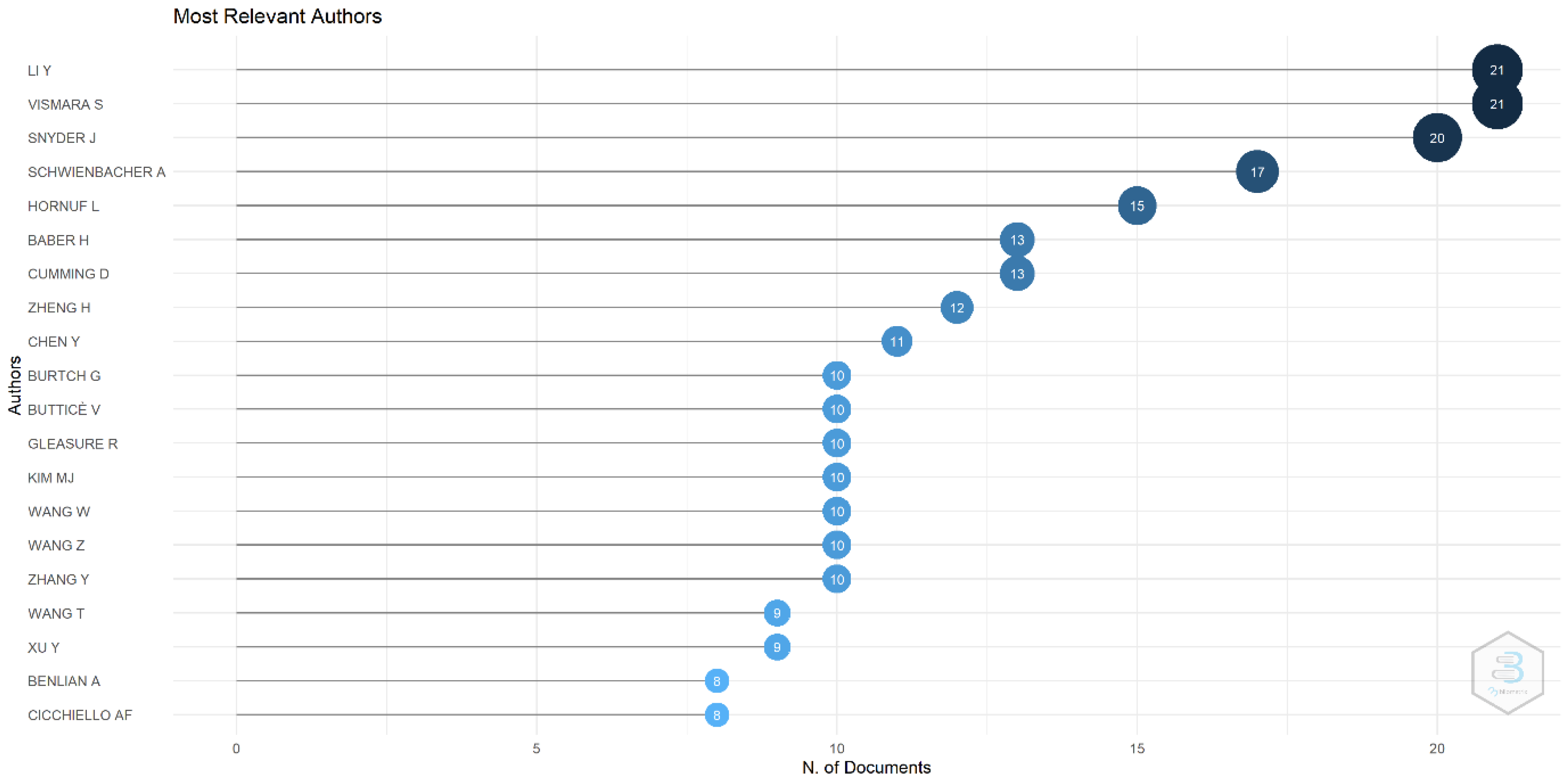

3.3. Prolific Authors

3.4. Most Significant Papers

3.5. Prominent Sources of Publication

3.6. Countries Publishing on Crowdfunding and P2P Lending

3.7. Key Affiliations Publishing on Crowdfunding and P2P Lending

4. Network Analysis and Visualisation

4.1. Citation Analysis

4.2. Co-Citations Analysis of Authors

4.3. Co-Citation Analysis of Sources

4.4. Co-Citation Analysis of Institutions

4.5. Analysis of Co-Occurrence of Keywords

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abdullah, Ahmad-Ridhuwan, Nthati Rametse, Siti Salwani Abdullah, Aziz Hassan, and Muhammad Naqib Mat Yunoh. 2019. Mapping crowdfunding research on the web of science database: A bibliometric analysis approach. International Journal of Innovation, Creativity and Change 6: 1–34. [Google Scholar]

- Alaeddin, Omar Mohanad Al Dakash, and Tawfik Azrak. 2021. Implementing the Blockchain Technology in Islamic Financial Industry: Opportunities and Challenges. Journal of Information Technology Management 13: 99–115. [Google Scholar] [CrossRef]

- Astrauskaitė,Ieva, Arvydas Paškevičius. 2018. An analysis of crowdfunded projects: Kpi’s to success. Entrepreneurship and Sustainability Issues 6: 23–34. [Google Scholar] [CrossRef]

- Attuel-Mendes, Laurence, Djamchid Assadi, and Silsa Raymond. 2021. Investors’ motivations in different types of crowdfunding. In Multidisciplinary Approaches to Crowdfunding Platforms. Hershey: IGI Global, pp. 21–54. [Google Scholar] [CrossRef]

- Ballesteros-Ruiz, Mauricio, and Felix Florencio Cardenas-del Castillo. 2019. Startup capital. In Innovation and Entrepreneurship: A New Mindset for Emerging Markets. Bingley: Emerald Group Publishing Ltd., pp. 199–230. [Google Scholar] [CrossRef]

- Basha, Shabeen Afsar, Mohammed M. Elgammal, and Bana M. Abuzayed. 2021. Online peer-to-peer lending: A review of the literature. Electronic Commerce Research and Applications 48: 101069. [Google Scholar] [CrossRef]

- Bashar, Abu. 2014. The Impact of Perceived CSR Initiatives on Consumer’s Buying Behaviour: An Empirical Study. Dehradun: Institute of Management Studies, p. 22. [Google Scholar]

- Bashar, Abu, Mustafa Raza Rabbani, Shahnawaz Khan, and Mahmood Asad Moh’d Ali. 2021a. Data driven finance: A bibliometric review and scientific mapping. Paper presented at the 2021 International Conference on Data Analytics for Business and Industry (ICDABI 2021), Sakhir, Bahrain, October 25–26; pp. 161–66. [Google Scholar] [CrossRef]

- Bashar, Abu, Shalini Singh, and Vivek Kumar Pathak. 2021b. A Bibliometric Review of Online Impulse Buying Behavior Literature. International Journal of Electronic Business 17: 162–83. [Google Scholar] [CrossRef]

- Baucus, Melissa S., and Cheryl R. Mitteness. 2016. Crowdfrauding: Avoiding Ponzi entrepreneurs when investing in new ventures. Business Horizons 59: 37–50. [Google Scholar] [CrossRef]

- Bernardino, Susana, and J. Freitas Santos. 2018. Unleashing the Intelligence of Cities by Social Innovation and Civic Crowdfunding: An Exploratory Study. International Journal of Technology and Human Interaction 14: 54–68. [Google Scholar] [CrossRef]

- Bernardino, Susana, JoséFreitas Santos, and J. Cadima Ribeiro. 2016. Social crowdfunding: A new model for financing regional development? Journal of Urban and Regional Analysis 8: 97–116. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.085016092166&partnerID=40&md5=786c9c6cf408c454d91cb32cb2b6d282 (accessed on 20 August 2022).

- Bessière, Véronique, Eric Stéphany, and Peter Wirtz. 2020. Crowdfunding, business angels, and venture capital: An exploratory study of the concept of the funding trajectory. Venture Capital 22: 135–60. [Google Scholar] [CrossRef]

- Borst, Irma, Christine Moser, and Julie Ferguson. 2018. From friendfunding to crowdfunding: Relevance of relationships, social media, and platform activities to crowdfunding performance. New Media and Society 20: 1396–414. [Google Scholar] [CrossRef]

- Bringmann, Katja, Thomas Vanoutrive, and Ann Verhetsel. 2018. Venture capital: The effect of local and global social ties on firm performance. Papers in Regional Science 97: 737–55. [Google Scholar] [CrossRef]

- Brown, Ross, Suzanne Mawson, Alexander Rowe, and Colin Mason. 2018. Working the crowd: Improvisational entrepreneurship and equity crowdfunding in nascent entrepreneurial ventures. International Small Business Journal: Researching Entrepreneurship 36: 169–93. [Google Scholar] [CrossRef]

- Butticè, Vincenzo, Massimo G. Colombo, Elena Fumagalli, and Carlotta Orsenigo. 2019. Green oriented crowdfunding campaigns: Their characteristics and diffusion in different institutional settings. Technological Forecasting and Social Change 141: 85–97. [Google Scholar] [CrossRef]

- Calic, Goran, and Anton Shevchenko. 2020. How signal intensity of behavioral orientations affects crowdfunding performance: The role of entrepreneurial orientation in crowdfunding business ventures. Journal of Business Research 115: 204–20. [Google Scholar] [CrossRef]

- Campillo-Artero, Carlos, Jaume Puig-Junoy, José Luis Segú-Tolsa, and Marta Trapero-Bertran. 2020. Price Models for Multi-indication Drugs: A Systematic Review. Applied Health Economics and Health Policy 18: 47–56. [Google Scholar] [CrossRef] [PubMed]

- Chen, Wendy D. 2022. Crowdfunding: Different types of legitimacy. Small Business Economics. [Google Scholar] [CrossRef]

- Colombo, Oska. 2021. The Use of Signals in New-Venture Financing: A Review and Research Agenda. Journal of Management 47: 237–59. [Google Scholar] [CrossRef]

- Cummings, Michael E., Hans Rawhouser, Silvio Vismara, and Erin L. Hamilton. 2020. An equity crowdfunding research agenda: Evidence from stakeholder participation in the rulemaking process. Small Business Economics 54: 907–32. [Google Scholar] [CrossRef]

- Devigne, David, Sophie Manigart, Tom Vanacker, and Klaas Mulier. 2018. Venture capital internationalization: Synthesis and future research directions. Journal of Economic Surveys 32: 1414–45. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debidutta Pattnaik, and Neeraj Pandey. 2021. A bibliometric review of International Marketing Review (IMR): Past, present, and future. International Marketing Review 38: 840–78. [Google Scholar] [CrossRef]

- Dressler, Gabrielle, and Sarah A. Kelly. 2018. Ethical implications of medical crowdfunding: The case of Charlie Gard. Journal of Medical Ethics 44: 453–57. [Google Scholar] [CrossRef]

- Ellman, Matthew, and Sjaak Hurkens. 2019. Optimal crowdfunding design. Journal of Economic Theory 184: 104939. [Google Scholar] [CrossRef]

- Elsaid, Haitham Mohamed. 2021. A review of literature directions regarding the impact of fintech firms on the banking industry. Qualitative Research in Financial Markets. [Google Scholar] [CrossRef]

- Fabus, Juraj, Iveta Kremenova, and Terezia Kvasnicova. 2015. Crowdfunding development in Slovakia. Paper presented at the International Conferences on e-Health 2015,EH 2015, e-Commerce and Digital Marketing 2015, EC 2015 and Information Systems Post-Implementation and Change Management 2015, ISPCM 2015, Gran Canaria, Spain, July 21–24; pp. 235–36. [Google Scholar]

- Farhoud, Mohamed, Sheeza Shah, Pekka Stenholm, Ewald Kibler, Maija Renko, and Siri Terjesen. 2021. Social enterprise crowdfunding in an acute crisis. Journal of Business Venturing Insights 15: e00211. [Google Scholar] [CrossRef]

- Farooq, Omar, and Amal Alahkam. 2016. Performance of shariah-compliant firms and non-shariah-compliant firms in the MENA region: Which is better? Journal of Islamic Accounting and Business Research 7: 268–81. [Google Scholar] [CrossRef]

- Flögel, Franz, and Marius Beckamp. 2020. Will FinTech make regional banks superfluous for small firm finance? Observations from soft information-based lending in Germany. Economic Notes 49: e12159. [Google Scholar] [CrossRef]

- Forgione, Antonio Fabio, and Carlo Migliardo. 2020. CSR engagement and market structure: Evidence from listed banks. Finance Research Letters 35: 101592. [Google Scholar] [CrossRef]

- Freund, Robert. 2010. Freund, Robert 2010. How to overcome the barriers between economy and sociology with open innovation, open evaluation and crowdfunding. International Journal of Industrial Engineering and Management 1: 105–9. [Google Scholar]

- Giudici, Giancarlo, Massimiliano Guerini, and Cristina Rossi-Lamastra. 2018. Reward-based crowdfunding of entrepreneurial projects: The effect of local altruism and localized social capital on proponents’ success. Small Business Economics 50: 307–24. [Google Scholar] [CrossRef]

- Goergen, Marc, and Laura Rondi. 2019. Grand challenges and new avenues for corporate governance research: Introduction to the special issue. Journal of Industrial and Business Economics 46: 137–46. [Google Scholar] [CrossRef]

- Gu, Jinmo, Jinhyuk Na, Jeongeun Park, and Hayoung Kim. 2021. Predicting success of outbound telemarketing in insurance policy loans using an explainable multiple-filter convolutional neural network. Applied Sciences 11: 7147. [Google Scholar] [CrossRef]

- Guo, Lihuan, Wei Wang, Yenchun Jim Wu, and Mark Goh. 2021. How much do social connections matter in fundraising outcomes? Financial Innovation 7: 79. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, Mustafa Raza Rabbani, Jennifer Brodmann, Abu Bashar, and Himani Grewal. 2022. Bibliometric and Scientometric analysis on CSR practices in the banking sector. Review of Financial Economics. [Google Scholar] [CrossRef]

- Hassani, Hossein, Xu Huang, Emmanuel Silva, and Mansi Ghodsi. 2020. Deep Learning and Implementations in Banking. Annals of Data Science 7: 433–46. [Google Scholar] [CrossRef]

- Hörisch, Jacob. 2019. Take the money and run? Implementation and disclosure of environmentally-oriented crowdfunding projects. Journal of Cleaner Production 223: 127–35. [Google Scholar] [CrossRef]

- Hornuf, Lars, and Armin Schwienbacher. 2017. Should securities regulation promote equity crowdfunding? Small Business Economics 49: 579–93. [Google Scholar] [CrossRef]

- Hornuf, Lars, Matthias Schmitt, and Eliza Stenzhorn. 2018. Equity crowdfunding in Germany and the United Kingdom: Follow-up funding and firm failure. Corporate Governance: An International Review 26: 331–54. [Google Scholar] [CrossRef]

- Hsu, Sara, Jianjun Li, and Hong Bao. 2021. P2P lending in China: Role and prospects for the future. Manchester School 89: 526–40. [Google Scholar] [CrossRef]

- Hui, Julie S., and Elizabeth M. Gerber. Crowdfunding science: Sharing research with an extended audience. Proceedings of the 18th ACM International Conference on Computer-Supported Cooperative Work and Social Computing (CSCW), Vancouver, BC, Canada, March 14–18; pp. 31–43. [CrossRef]

- Iman, Abdul Hamid Mar, and Mohammad Tahir Sabit Haji H. Mohammad. 2017. Waqf as a framework for entrepreneurship. Humanomics 33: 419–40. [Google Scholar] [CrossRef]

- Jo, Koren M., and Shuo Yang. 2021. Is There Crowd Wisdom in Accounting? Evidence From Forecasts in Equity-Based Crowdfunding. Journal of Accounting, Auditing and Finance 36: 723–49. [Google Scholar] [CrossRef]

- Jünger, Moritz, and Mark Mietzner. 2020. Banking goes digital: The adoption of FinTech services by German households. Finance Research Letters 34: 101260. [Google Scholar] [CrossRef]

- Kaiser, Manuel, and Elisabeth S. C. Berger. 2021. Trust in the investor relationship marketing of startups: A systematic literature review and research agenda. Management Review Quarterly 71: 491–517. [Google Scholar] [CrossRef]

- Katzenmeier, Stefan, David Bendig, Steffen Strese, and Malte Brettel. 2019. The supply side: Profiling crowdfunders. In Handbook of Research on Crowdfunding. Cheltenham: Edward Elgar Publishing Ltd., pp. 122–64. [Google Scholar] [CrossRef]

- Khan, Ashraf, John W. Goodell, M. Kabir Hassan, and Andrea Paltrinieri. 2021. A bibliometric review of finance bibliometric papers. Finance Research Letters 47: 102520. [Google Scholar] [CrossRef]

- Khan, Mohammad Shahfaraz, Mustafa Raza Rabbani, Iqbal Thonse Hawaldar, and Abu Bashar. 2022. Determinants of Behavioral Intentions to Use Islamic Financial Technology: An Empirical Assessment. Risks 10: 114. [Google Scholar] [CrossRef]

- Khan, Shahnawaz, and Mustafa Raza Rabbani. 2021. Artificial Intelligence and NLP based Chatbot as Islamic Banking and Finance Expert. International Journal of Information Retrieval Research (IJIRR) 11: 65–77. [Google Scholar] [CrossRef]

- Kim, Myung Ja, and C. Michael Hall. 2019. Can Co-Creation and Crowdfunding Types Predict Funder Behavior? An Extended Model of Goal-Directed Behavior. Sustainability 11: 7061. [Google Scholar] [CrossRef]

- Kim, Taekyung, Meng Hong Por, and Sung-Byung Yang. 2017. Winning the crowd in online fundraising platforms: The roles of founder and project features. Electronic Commerce Research and Applications 25: 86–94. [Google Scholar] [CrossRef]

- Klein, Galit, Zeev Shtudiner, and Moti Zwilling. 2021. Why do peer-to-peer (P2P) lending platforms fail? The gap between P2P lenders’ preferences and the platforms’ intentions. Electronic Commerce Research. [Google Scholar] [CrossRef]

- Konhäusner, Peter, Marius Thielmann, Veronica Câmpian, and Dan-Cristian Dabija. 2021. Crowdfunding for independent print media: E-commerce, marketing, and business development. Sustainability 13: 11100. [Google Scholar] [CrossRef]

- Kranz, Johann, Esther Nagel, and Youngjin Yoo. 2019. Blockchain Token Sale: Economic and Technological Foundations. Business and Information Systems Engineering 61: 745–53. [Google Scholar] [CrossRef]

- Kuanova, Laura Aibolovna, Rimma Sagiyeva, and Nasim Shah Shirazi. 2021. Islamic social finance: A literature review and future research directions. Journal of Islamic Accounting and Business Research 12: 707–28. [Google Scholar] [CrossRef]

- Kuo, Ying-Feng, Cathy S. Lin, and Chung-Hsien Wu. 2020. Why do people intend to back crowdfunding projects? A perspective on social cognitive theory. Journal of Electronic Commerce Research 21: 180–96. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85091378892&partnerID=40&md5=dddf24b28c4913b66b460f6c3e78aab1 (accessed on 20 August 2022).

- Kuppuswamy, Venkat, and Barry L. Bayus. 2018. Crowdfunding Creative Ideas: The dynamics of project backers. In The Economics of Crowdfunding: Startups, Portals and Investor Behavior. Cham: Springer International Publishing, pp. 151–82. [Google Scholar] [CrossRef]

- Lau, Keng Liang, and Boon Cheong Chew. 2016. Crowdfunding for research: A case study in research management centre in Malaysia. International Journal of Industrial Engineering and Management 7: 117–24. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85026380923&partnerID=40&md5=564355032814f041aca86265e77f2c41 (accessed on 11 August 2022).

- Leboeuf, Gaël, and Armin Schwienbacher. 2018. Crowdfunding as a new financing tool. In The Economics of Crowdfunding: Startups, Portals and Investor Behavior. Cham: Springer International Publishing, pp. 11–28. [Google Scholar] [CrossRef]

- Lehner, Othmar M. 2014. The formation and interplay of social capital in crowdfunded social ventures. Entrepreneurship and Regional Development 26: 478–99. [Google Scholar] [CrossRef]

- Li, Yijing, Wenjie Fan, Fei Liu, Eric T. K. Lim, Yong Liu, and Chee-Wee Tan. 2018. Exploring the nudging and counter-nudging effects of campaign updates in crowdfunding. Paper presented at the 22nd Pacific Asia Conference on Information Systems—Opportunities and Challenges for the Digitized Society: Are We Ready?, PACIS 2018, Yokohama, Japan, June 26–30. [Google Scholar]

- Maier, Lukas, Christian V. Baccarella, Jörn H. Block, Timm F. Wagner, and K.-I. Voigt. 2021. The Legitimization Effect of Crowdfunding Success: A Consumer Perspective. Entrepreneurship: Theory and Practice. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2020. Entrepreneurial Finance and Moral Hazard: Evidence from Token Offerings. Journal of Business Venturing 36: 106001. [Google Scholar] [CrossRef]

- Morse, Adair. 2015. Peer-to-Peer Crowdfunding: Information and the Potential for Disruption in Consumer Lending. Annual Review of Financial Economics 7: 463–82. [Google Scholar] [CrossRef]

- Moss, Todd W., Maija Renko, Emily Block, and Moriah Meyskens. 2018. Funding the story of hybrid ventures: Crowdfunder lending preferences and linguistic hybridity. Journal of Business Venturing 33: 643–59. [Google Scholar] [CrossRef]

- Motylska-Kuźma, Anna. 2020. The Equity Crowdfunding and Family Firms—A Fuzzy Linguistic Approach. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics): Vol. 12330 LNCS. Berlin: Springer, pp. 99–115. [Google Scholar] [CrossRef]

- Mubarrok, Ujang Syahrul, Izzani Ulfi, Raditya Sukmana, and Badri Munir Sukoco. 2020. A bibliometric analysis of Islamic marketing studies in the “journal of Islamic marketing”. Journal of Islamic Marketing. [Google Scholar] [CrossRef]

- Muhammad, Rifqi, Faaza Fakhrunnas, and Amalia Khairina Hanun. 2021. The Determinants of Potential Failure of Islamic Peer-to-Peer Lending: Perceptions of Stakeholders in Indonesia. Journal of Asian Finance, Economics and Business 8: 981–92. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Sitara Karim, Mustafa Raza Rabbani, Abu Bashar, and Satish Kumar. 2022. Current State and Future Directions of Green and Sustainable Finance: A Bibliometric Analysis. Qualitative Research in Financial Markets. [Google Scholar]

- Nobanee, Haitham, Mehroz Nida Dilshad, Mona Al Dhanhani, Maitha Al Neyadi, Sultan Al Qubaisi, and Saeed Al Shamsi. 2021. Big Data Applications the Banking Sector: A Bibliometric Analysis Approach. SAGE Open 11: 21582440211. [Google Scholar] [CrossRef]

- Oberoi, Swati, Smita Srivastava, Vishal K. Gupta, Rohit Joshi, and Atul Mehta. 2022. Crowd Reactions to Entrepreneurial Failure in Rewards-Based Crowdfunding: A Psychological Contract Theory Perspective. Journal of Risk and Financial Management 15: 300. [Google Scholar] [CrossRef]

- Oladapo, Ibrahim Abiodun, Manal Mohammed Hamoudah, Md. Mahmudul Alam, Olawale Rafiu Olaopa, and Ruhaini Muda. 2021. Customers’ perceptions of FinTech adaptability in the Islamic banking sector: Comparative study on Malaysia and Saudi Arabia. Journal of Modelling in Management. [Google Scholar] [CrossRef]

- Ortiz Zezzatti, Carlos Alberto Ochoa, Darwin Young, Camelia Chira, Daniel Azpeitia, and Alán Calvillo. 2012. Mass media strategies: Hybrid approach using a bioinspired algorithm and social data mining. In Logistics Management and Optimization through Hybrid Artificial Intelligence Systems. Hershey: IGI Global, pp. 327–54. [Google Scholar] [CrossRef][Green Version]

- Palladino, Lenore. 2019. Democratizing Investment. Politics and Society 47: 573–91. [Google Scholar] [CrossRef]

- Pan, Chung-Lien, Lin Yu, Zhuoshan Lin, Jialong Li, and Yu-Chun Pan. 2020. Scientometric analysis of corporate social responsibility, corporate social performance and financial performance based on corporate governance. Paper presented at the 2020 International Conference on Energy Big Data and Low-Carbon Development Management (EBLDM 2020), Nanjing, China, December 18–20; Ulis: EDP Science, vol. 214. [Google Scholar]

- Payne, Elizabeth Manser, James. W. Peltier, and Victor A. Barger. 2018. Mobile banking and AI-enabled mobile banking: The differential effects of technological and non-technological factors on digital natives’ perceptions and behavior. Journal of Research in Interactive Marketing. [Google Scholar]

- Perez, Charles, Karina Sokolova, and Malick Konate. 2020. Digital social capital and performance of initial coin offerings. Technological Forecasting and Social Change 152: 119888. [Google Scholar] [CrossRef]

- Popescul, Daniela, Laura Diana Radu, Vasile Daniel Păvăloaia, and Mircea Radu Georgescu. 2020. Psychological Determinants of Investor Motivation in Social Media-Based Crowdfunding Projects: A Systematic Review. Frontiers in Psychology 11: 588121. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza. 2022. Fintech innovations, scope, challenges, and implications in Islamic Finance: A systematic analysis. International Journal of Computing and Digital Systems 11: 1–28. [Google Scholar]

- Rabbani, Mustafa Raza, Abu Bashar, Mohd Atif, Ammar Jreisat, Zehra Zulfikar, and Yusra Naseem. 2021a. Text mining and visual analytics in research: Exploring the innovative tools. Paper presented at the 2021 International Conference on Decision Aid Sciences and Application (DASA),University of Bahrain, Zallaq, Bahrain, December 7–8; pp. 1087–91. [Google Scholar]

- Rabbani, Mustafa Raza, Abu Bashar, Nishad Nawaz, Sitara Karim, Mahmood Asad Mohd Ali, Habeeb Ur Rahiman, and Md. Shabbir Alam. 2021b. Exploring the role of islamic fintech in combating the aftershocks of COVID-19: The open social innovation of the islamic financial system. Journal of Open Innovation: Technology, Market, and Complexity 7: 136. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Adel Mohammed Sarea, Shahnawaz Khan, and Yomna Abdullah. 2021c. Ethical concerns in Artificial Intelligence (AI) implementation: The role of RegTech and Islamic finance. Paper presented at the International Conference On Global Economic Revolutions, Online, September 15–16; pp. 381–90. [Google Scholar]

- Rabbani, Mustafa Raza, Amani Alshaikh, Ammar Jreisat, Abu Bashar, and Mahmood Asad Mohd Ali ’. 2021d. Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective. Paper presented at the 2021 International Conference on Sustainable Islamic Business and Finance, Zallaq, Bahrain, December 5–6; pp. 103–8. [Google Scholar]

- Rabbani, Mustafa Raza, Shahnawaz Khan, M. Kabir Hassan, and Mahmood Asad Mohd’d Ali. 2021e. Artificial intelligence and Natural language processing (NLP) based FinTech model of Zakat for poverty alleviation and sustainable development for Muslims in India. In ICOVID-19 and Islamic Social Finance. London, UK: Routledge. [Google Scholar]

- Radu, Valentin, Florin Radu, Alina Iuliana Tabirca, Silviu Ilie Saplacan, and Ramona Lile. 2021. Bibliometric Analysis of Fuzzy Logic Research in International Scientific Databases. International Journal of Computers, Communications & Control 16: 1–20. [Google Scholar]

- Rosavina, Monica, Raden Aswin Rahadi, Mandra Lazuardi Kitri, Shimaditya Nuraeni, and Lidia Mayangsari. 2019. P2P lending adoption by SMEs in Indonesia. Qualitative Research in Financial Markets 11: 260–79. [Google Scholar] [CrossRef]

- Rose, Stefan, Daniel Wentzel, Christian Hopp, and Jermain Kaminski. 2021. Launching for success: The effects of psychological distance and mental simulation on funding decisions and crowdfunding performance. Journal of Business Venturing 36: 106021. [Google Scholar] [CrossRef]

- Rossi, Alice, and Silvio Vismara. 2018. What do crowdfunding platforms do? A comparison between investment-based platforms in Europe. Eurasian Business Review 8: 93–118. [Google Scholar] [CrossRef]

- Rusydiana, Aam Slamet, Sri Rahardjo, and Wahyu Sugeng Soeparno. 2021. Mapping Research on Halal Logistics using VoSviewer. Library Philosophy and Practice 2021: 1–14. [Google Scholar]

- Sannajust, Aurelie, Fabien Roux, and Anissa Chaibi. 2014. Crowdfunding in France: A new revolution? Journal of Applied Business Research 30: 1909–18. [Google Scholar] [CrossRef][Green Version]

- Schwienbacher, Armin. 2019. Equity crowdfunding: Anything to celebrate? Venture Capital 21: 65–74. [Google Scholar] [CrossRef]

- Shen, Wen, Jacob W. Crandall, Ke Yan, and Cristina V. Lopes. 2018. Information design in crowdfunding under thresholding policies. Proceedings of the 17th International Conference on Autonomous Agents and Multiagent Systems (AAMAS), Stockholm, Sweden, July 10–15, vol. 1, pp. 632–40. [Google Scholar]

- Shulin, Zhou, and Kuo Chienliang. 2018. How social media are changing nonprofit advocacy: Evidence from the crowdfunding platform in Taiwan. China Nonprofit Review 10: 349–70. [Google Scholar] [CrossRef]

- Singh, Shalini, and Abu Bashar. 2021. A bibliometric review on the development in e-tourism research. International Hospitality Review. ahead-of-print. [Google Scholar] [CrossRef]

- Sousa, Cristina, and Mónica Azevedo. 2018. The impact of crowdfunding on entrepreneurial value creation: Differences between social, cultural and commercial-oriented projects. Paper presented at the 13th European Conference on Innovation and Entrepreneurship (ECIE 2018), Aveiro, Portugal, September 20–21; Reading: Academic Conferences and Publishing International Limited, pp. 789–97. [Google Scholar]

- Steininger, Dennis M., Mark Lorch, and Daniel Veit. 2014. The bandwagon effect in digital environments: An experimental study on Kickstarter.com. In Multikonferenz Wirtschaftsinformatik, MKWI 2014—Multi-Conference on Business Informatics, MKWI 2014. Edited by Dennis Kundisch, Lars Beckmann and Leena Suhl. Paderborn: University of Paderborn, pp. 546–56. [Google Scholar]

- Sun, Huidong, Mustafa Raza Rabbani, Muhammad Safdar Sial, Siming Yu, José António Filipe, and Jacob Cherian. 2020. Identifying big data’s opportunities, challenges, and implications in finance. Mathematics 8: 1738. [Google Scholar] [CrossRef]

- Suri, Tavneet, Prashant Bharadwaj, and William Jack. 2021. Fintech and household resilience to shocks: Evidence from digital loans in Kenya. Journal of Development Economics 102697: 153. [Google Scholar] [CrossRef]

- Tenca, Francesca, Annalisa Croce, and Elisa Ughetto. 2019. Business angels research in entrepreneurial finance: A literature review and a research agenda. In Contemporary Topics in Finance: A Collection of Literature Surveys. Hoboken: Wiley, pp. 183–214. [Google Scholar] [CrossRef]

- Tenner, Isabell. 2021. The potential of crowdfunding for sustainable development: A comparison of sustainable and conventional crowdfunding projects. International Journal of Entrepreneurial Venturing 13: 508–27. [Google Scholar] [CrossRef]

- Walther, Martin, and Marco Bade. 2020. Observational learning and willingness to pay in equity crowdfunding. Business Research 13: 639–61. [Google Scholar] [CrossRef]

- Walthoff-Borm, Xavier, Tom Vanacker, and Veroniek Collewaert. 2018. Equity crowdfunding, shareholder structures, and firm performance. Corporate Governance: An International Review 26: 314–30. [Google Scholar] [CrossRef]

- Wehnert, Peter, Christian V. Baccarella, and Markus Beckmann. 2019. In crowdfunding we trust? Investigating crowdfunding success as a signal for enhancing trust in sustainable product features. Technological Forecasting and Social Change 141: 128–37. [Google Scholar] [CrossRef]

- Xu, Duoqi, and Mingyu Ge. 2017. Equity-Based Crowdfunding in China: Beginning with the First Crowdfunding Financing Case. Asian Journal of Law and Society 4: 81–107. [Google Scholar] [CrossRef]

- Xu, Fasheng, Xiaomeng Guo, Guang Xiao, and Fuqiang Zhang. 2022. Crowdfunding Adoption in the Presence of Word-of-Mouth Communication. Foundations and Trends in Technology, Information and Operations Management 15: 247–65. [Google Scholar] [CrossRef]

- Yeh, Tsai-Lien, Tser-Yieth Chen, and Cheng-Chun Lee. 2019. Investigating the funding success factors affecting reward-based crowdfunding projects. Innovation: Management, Policy and Practice 21: 466–86. [Google Scholar] [CrossRef]

- Zhao, Ying, Phil Harris, and Wing Lam. 2019. Crowdfunding industry—History, development, policies, and potential issues. Journal of Public Affairs 19: e1921. [Google Scholar] [CrossRef]

- Zheng, Haichao, Zihao Qi, Xin Luo, Liting Li, and Bo Xu. 2020. The value of backers’ word-of-mouth in crowdfunding projects filtering: An empirical investigation. Electronic Commerce Research 20: 757–82. [Google Scholar] [CrossRef]

| Description | Results |

|---|---|

| Timespan | 2010:2021 |

| Sources (journals, books, etc.) | 851 |

| Documents | 1742 |

| Average citations per document | 18.49 |

| Average citations per year per doc | 3.349 |

| References | 83,817 |

| Article | 1655 |

| Review | 87 |

| Keywords plus (ID) | 3430 |

| Author’s keywords (DE) | 4118 |

| Authors | 3504 |

| Authors of single-authored documents | 292 |

| Authors of multiauthored documents | 3212 |

| Single-authored documents | 327 |

| Documents per author | 0.497 |

| Authors per document | 2.01 |

| Co-authors per document | 2.77 |

| Collaboration index | 2.27 |

| Year | No. of Papers | Mean Total Citations per Articles | Mean Total Citations per Year | Citable Years |

|---|---|---|---|---|

| 2010 | 1 | 3 | 0 | 12 |

| 2011 | 2 | 82 | 7 | 11 |

| 2012 | 3 | 42 | 4 | 10 |

| 2013 | 25 | 65 | 7 | 9 |

| 2014 | 55 | 91 | 11 | 8 |

| 2015 | 72 | 59 | 8 | 7 |

| 2016 | 127 | 36 | 6 | 6 |

| 2017 | 160 | 32 | 6 | 5 |

| 2018 | 206 | 23 | 6 | 4 |

| 2019 | 304 | 11 | 4 | 3 |

| 2020 | 328 | 6 | 3 | 2 |

| 2021 | 459 | 2 | 2 | 1 |

| Element | h_index | g_index | m_index | TC | NP | PY_start |

|---|---|---|---|---|---|---|

| MOLLICK E | 4 | 4 | 0.4 | 2188 | 4 | 2014 |

| SCHWIENBACHER A | 11 | 16 | 1.1 | 1853 | 16 | 2013 |

| BELLEFLAMME P | 3 | 3 | 0.3 | 1488 | 3 | 2013 |

| VISMARA S | 15 | 20 | 2.1 | 1285 | 20 | 2016 |

| LAMBERT T | 2 | 2 | 0.2 | 1277 | 2 | 2013 |

| BURTCH G | 9 | 10 | 0.9 | 1145 | 10 | 2013 |

| CUMMING D | 10 | 11 | 1.0 | 1069 | 11 | 2013 |

| GHOSE A | 5 | 5 | 0.5 | 928 | 5 | 2013 |

| GOLDFARB A | 5 | 5 | 0.6 | 910 | 5 | 2014 |

| WATTAL S | 4 | 4 | 0.4 | 887 | 4 | 2013 |

| AGRAWAL A | 4 | 4 | 0.4 | 869 | 4 | 2014 |

| CATALINI C | 4 | 4 | 0.4 | 869 | 4 | 2014 |

| COLOMBO MG | 5 | 5 | 0.6 | 861 | 5 | 2015 |

| SCHWEIZER D | 3 | 3 | 0.4 | 784 | 3 | 2015 |

| ROSSI-LAMASTRA C | 6 | 7 | 0.6 | 764 | 7 | 2013 |

| AHLERS GKC | 1 | 1 | 0.1 | 709 | 1 | 2015 |

| GÜNTHER C | 1 | 1 | 0.1 | 709 | 1 | 2015 |

| DAVIS BC | 4 | 4 | 0.5 | 704 | 4 | 2015 |

| WEBB JW | 4 | 4 | 0.5 | 704 | 4 | 2015 |

| SHORT JC | 6 | 8 | 0.75 | 670 | 8 | 2015 |

| Author | Tittle | Source | Year | Local Citations | Global Citations | LC/GC Ratio (%) |

|---|---|---|---|---|---|---|

| MOLLICK E | A systematic literature review of crowdfunding and sustainability: highlighting what really matters | Journal of Business Venturing | 2014 | 825 | 1675 | 49.25 |

| BELLEFLAMME P | Crowdfunding: tapping the right crowd | Journal of Business Venturing | 2014 | 574 | 1055 | 54.41 |

| AHLERS GKC | Signalling in equity crowdfunding | Entrepreneurship Theory and Practice | 2015 | 410 | 709 | 57.83 |

| COLOMBO MG | Internal Social Capital and the Attraction of Early Contributions in Crowdfunding | Entrepreneurship Theory and Practice | 2015 | 273 | 480 | 56.88 |

| AGRAWAL A | The geography of crowdfunding | Journal of Economic Management and Strategy | 2015 | 250 | 422 | 59.24 |

| BURTCH G | An empirical examination of the antecedents and consequences of contribution patterns in crowd-funded markets | Information Systems Research | 2013 | 218 | 462 | 47.19 |

| AGRAWAL A | Some simple economics of crowdfunding | Innovation Policy and the Economics | 2014 | 200 | 367 | 54.50 |

| GERBER EM | Motivations for crowdfunding: what drives the crowd to invest in start-ups? | Computer Human Interaction (Con) | 2013 | 192 | 388 | 49.48 |

| ZHENG H | The role of multidimensional social capital in crowdfunding: A comparative study in China and US | Information & management | 2014 | 176 | 292 | 60.27 |

| VISMARA S | Equity retention and social network theory in equity crowdfunding | Small Business Economics | 2016 | 170 | 277 | 61.37 |

| Journals | h_index | g_index | m_index | TC | NP | PY_start |

|---|---|---|---|---|---|---|

| JOURNAL OF BUSINESS VENTURING | 18 | 20 | 2.0 | 4144 | 20 | 2014 |

| ENTREPRENEURSHIP: THEORY AND PRACTICE | 11 | 23 | 1.4 | 2799 | 23 | 2015 |

| SMALL BUSINESS ECONOMICS | 20 | 35 | 2.9 | 1600 | 35 | 2016 |

| MANAGEMENT SCIENCE | 12 | 17 | 1.5 | 1263 | 17 | 2015 |

| VENTURE CAPITAL | 13 | 21 | 1.3 | 1203 | 21 | 2013 |

| JOURNAL OF BUSINESS RESEARCH | 12 | 18 | 1.7 | 688 | 18 | 2016 |

| INFORMATION SYSTEMS RESEARCH | 7 | 12 | 0.7 | 638 | 12 | 2013 |

| TECHNOLOGICAL FORECASTING AND SOCIAL CHANGE | 15 | 23 | 3.0 | 595 | 31 | 2018 |

| DECISION SUPPORT SYSTEMS | 9 | 15 | 1.3 | 567 | 15 | 2016 |

| CALIFORNIA MANAGEMENT REVIEW | 9 | 9 | 1.3 | 530 | 9 | 2016 |

| INFORMATION AND MANAGEMENT | 6 | 9 | 0.7 | 516 | 9 | 2014 |

| RESEARCH POLICY | 7 | 10 | 1.2 | 432 | 10 | 2017 |

| JOURNAL OF ECONOMICS AND MANAGEMENT STRATEGY | 2 | 2 | 0.3 | 425 | 2 | 2015 |

| NEW MEDIA AND SOCIETY | 12 | 13 | 1.5 | 415 | 13 | 2015 |

| ACM TRANSACTIONS ON COMPUTER–HUMAN INTERACTION | 2 | 2 | 0.2 | 394 | 2 | 2013 |

| Country | Number of Papers | Total Citations | Average Article Citations |

|---|---|---|---|

| USA | 239 | 6363 | 26.62 |

| ITALY | 89 | 2430 | 27.30 |

| FRANCE | 41 | 1735 | 42.32 |

| CHINA | 190 | 1701 | 8.95 |

| CANADA | 48 | 1665 | 34.69 |

| GERMANY | 76 | 1574 | 20.71 |

| UNITED KINGDOM | 76 | 1543 | 20.30 |

| SPAIN | 47 | 606 | 12.89 |

| NETHERLANDS | 25 | 386 | 15.44 |

| FINLAND | 9 | 382 | 42.44 |

| BELGIUM | 7 | 319 | 45.57 |

| KOREA | 46 | 312 | 6.78 |

| IRELAND | 21 | 298 | 14.19 |

| AUSTRIA | 4 | 243 | 60.75 |

| AUSTRALIA | 19 | 216 | 11.37 |

| INDIA | 17 | 183 | 10.77 |

| ISRAEL | 11 | 172 | 15.64 |

| SWEDEN | 9 | 164 | 18.22 |

| LIECHTENSTEIN | 7 | 135 | 19.29 |

| BRAZIL | 10 | 123 | 12.30 |

| Country | Articles | SCP | MCP |

|---|---|---|---|

| USA | 239 | 197 | 42 |

| CHINA | 190 | 129 | 61 |

| ITALY | 89 | 65 | 24 |

| GERMANY | 76 | 54 | 22 |

| UNITED KINGDOM | 76 | 49 | 27 |

| CANADA | 48 | 28 | 20 |

| SPAIN | 47 | 39 | 8 |

| KOREA | 46 | 32 | 14 |

| FRANCE | 41 | 23 | 18 |

| MALAYSIA | 26 | 21 | 5 |

| NETHERLANDS | 25 | 15 | 10 |

| IRELAND | 21 | 12 | 9 |

| AUSTRALIA | 19 | 11 | 8 |

| INDONESIA | 19 | 16 | 3 |

| INDIA | 17 | 13 | 4 |

| HONG KONG | 13 | 7 | 6 |

| POLAND | 13 | 11 | 2 |

| NORWAY | 12 | 4 | 8 |

| DENMARK | 11 | 4 | 7 |

| ISRAEL | 11 | 4 | 7 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rabbani, M.R.; Bashar, A.; Hawaldar, I.T.; Shaik, M.; Selim, M. What Do We Know about Crowdfunding and P2P Lending Research? A Bibliometric Review and Meta-Analysis. J. Risk Financial Manag. 2022, 15, 451. https://doi.org/10.3390/jrfm15100451

Rabbani MR, Bashar A, Hawaldar IT, Shaik M, Selim M. What Do We Know about Crowdfunding and P2P Lending Research? A Bibliometric Review and Meta-Analysis. Journal of Risk and Financial Management. 2022; 15(10):451. https://doi.org/10.3390/jrfm15100451

Chicago/Turabian StyleRabbani, Mustafa Raza, Abu Bashar, Iqbal Thonse Hawaldar, Muneer Shaik, and Mohammed Selim. 2022. "What Do We Know about Crowdfunding and P2P Lending Research? A Bibliometric Review and Meta-Analysis" Journal of Risk and Financial Management 15, no. 10: 451. https://doi.org/10.3390/jrfm15100451

APA StyleRabbani, M. R., Bashar, A., Hawaldar, I. T., Shaik, M., & Selim, M. (2022). What Do We Know about Crowdfunding and P2P Lending Research? A Bibliometric Review and Meta-Analysis. Journal of Risk and Financial Management, 15(10), 451. https://doi.org/10.3390/jrfm15100451