Abstract

One of the main trends in the development of the financial sector around the world is digitalization. The purpose of this study is to analyze the interdependence between the level of digitalization and the key performance indicators of commercial banks, as well as the prospects for further development of digital technologies and their implementation in the activities of commercial banks. Based on the analysis of statistical data, it was confirmed that the digitalization of the Russian banking sector has significant potential. A correlation analysis of the data of 100 Russian commercial banks for 2021, grouped by assets, was performed. The presence of the influence of the level of digitalization on the individuals’ transactions and on the net commission income was confirmed. Hypotheses about the existence of a close relationship between the level of digitalization and the volume of transactions with legal entities, as well as profitability, have not been confirmed. According to the results of the study, it was noted that digitalization currently has the greatest impact on large Russian banks. It was concluded that currently, for the largest and big banks, a high level of digital maturity is a competitive advantage. This research contributes to the development of the theory of modern banking. The results obtained will be useful for researchers of the impact of digitalization on various aspects of banks’ activities, for banks, and for public authorities.

1. Introduction

Digitalization is one of the main trends in the development of the financial industry (Yadgarov et al. 2019). During the countries’ transition to a digital economy, it is important that financial institutions and governments develop digital identification systems, cybersecurity strategies and data protection (Artemenko and Zenchenko 2021).

The digitalization of the banking sector has a positive impact on the digitalization of society in general. It increases the possibility of the population switching to digital channels for financial transactions (Carbó-Valverde et al. 2020).

Digital competencies are significant predictors of competitiveness (Georgescu and Kinnunen 2021; Zhao et al. 2019), and the digitalization of the financial sector contributes to its achievement of sustainable development goals (Úbeda et al. 2022). Improving the technological efficiency of banking processes can lead to simplification and optimization of traditional operations, fraud prevention, the creation of new and more personalized offers to meet customer needs, serve remote areas, and reduce operating costs (Artemenko and Zenchenko 2021; Kitsios et al. 2021).

Digitalization helps banks to reduce the direct impact on the environment. The bank uses less paper, and uses vehicles and aviation less often, as it conducts some operations remotely. It was found that an increase in energy consumption due to the development of modern technologies can lead to an increase in energy efficiency (Zakari et al. 2021). Digitalization helps to increase the transparency of banking activities. Transparency is necessary to improve management practices and corporate culture. The creation of new products and services and the transfer of some operations to a remote format allows banks to build their business strategy in accordance with the needs of modern society. Digitalization increases the inclusiveness and accessibility of the bank. The authors of the study note that the financial system could become part of the regulations aimed at protecting the environment (Barrios et al. 2019). According to Khan et al., the quality of the environment can be improved by increasing investments in environmental technologies (Khan et al. 2021).

The creation of an innovative financial framework will promote the use of alternative energy sources, for example, biomass energy (Irfan et al. 2022). In turn, the acceleration of the transition to clean energy has a positive effect on economic growth (Khan et al. 2022). Despite the availability of efficient natural resources and fossil fuel energy, countries need to develop policies that promote the conservation of the forest sector and develop a culture of respect for the environment in order to maintain economic growth in the long term (Xie et al. 2022).

Russia is a country that significantly contributes to the economy through mining. To overcome the resource curse, according to the recommendations developed in the study, it is necessary to ensure a higher level of investment in industries unrelated to mining, so that a diversified portfolio provides more income (Tang et al. 2022). The development of green financial instruments contributes to the achievement of this goal. Digitalization of banks contributes to the development of green financing. Digitalization helps to improve the quality of assessment of borrowers, including from the position of compliance of their activities with ESG principles. However, the bank will engage in digitalization only if it has a positive commercial effect. The contribution of this article to the solution of environmental, social, and managerial problems lies in the fact that it can be used as an additional justification for the expediency of digitalization, which is one of the tools for faster achievement of sustainable development goals.

Traditional banks around the world are facing increased competition due to financial technology companies in the market and the implementation of technological innovations by existing banks. Innovative actions can lead to success in a hyper-competitive environment (Lee et al. 2021). Rapid changes in consumer behavior are forcing banks to develop digital marketing (Sawhney and Ahuja 2021). Rapid digitalization and cost reduction efforts are driving record bank branch closures in many countries (e.g., 2414 branch closures in the USA in 2020 only) (S&P Global Market Intelligence 2022).

The COVID-19 pandemic has become a powerful motivator for the digitalization of various sectors of the economy around the world. In the banking sector, in addition to the pandemic, digitalization was driven by the steady growth of cashless transactions around the world and the global digital banking market, increased competition in the retail banking market, and a significant margin decrease for traditional banking products (Dudin et al. 2021).

Digitalization of commercial banks in Russia has growth potential. According to one study (Digital Economy 2022), in 2020, only 49% of the Russian population aged 15 to 74 used the Internet for financial transactions, while in Finland, Sweden, Great Britain, and Estonia, the same figure exceeded 80%. In the United States, where the level of Internet accessibility for households is comparable to Russia (80% in 2020), the share of the population that performs financial transactions online was 60%.

Digitalization can stimulate the financial performance of the banking sector (Kanungo and Gupta 2021). However, the level of digitalization of the bank itself may not directly affect profitability (Niemand et al. 2021) but may affect other indicators of banking activity. One of the reasons why banking companies fail to get the desired benefits from technological progress is the inefficient management of resources (Cao et al. 2022).

Digitalization is a complex phenomenon that has a multidirectional impact on various aspects of the activities of credit institutions. At the same time, it is itself formed and transformed under the influence of environmental conditions. Even the cultural features of the organization can become an obstacle to the successful implementation of modern technologies (de Almeida and de Souza Ramos 2022).

An overview of the main changes taking place in the banking sector after digitalization is implemented shows that while acting as the driving force behind the development of the bank as a financial supermarket, digitalization is simultaneously associated with negative consequences such as higher costs for the implementation of technologies by the bank, as well as the dismission of labor that can negatively affect the level of employment in the country (Starodubtseva et al. 2021).

All of the factors mentioned above determine the relevance of studying the impact of digitalization on key performance indicators of commercial banks and the prospects for the further development of digital technologies and their implementation by commercial banks.

Thus, this study is relevant. Despite the obvious advantages of introducing digital technologies into the activities of a commercial bank for the economy and society, not all banks are actively doing this in the Russian Federation. The reason for this behavior may be a weak correlation between the level of digitalization and the key performance indicators of the bank. In addition, differences in the level of digitalization can be caused by significant differences in the size of different banks and their market share. The purpose of this study is to analyze the interdependence between the level of digitalization and the key performance indicators of commercial banks, as well as the prospects for further development of digital technologies and their implementation in their activities by commercial banks. The scientific novelty of this study lies in the fact that the authors performed a correlation analysis of the impact of digitalization on key areas of income generation, taking into account the heterogeneity of competition in a total of 100 banks in the banking sector of the Russian Federation.

2. Literature Review

The relevance of the digitalization of the banking sector increases the interest of scientists. Authors from different countries explore various aspects of this process.

One study (Fiapshev and Afanasyeva 2021) is devoted to assessing the possibility of turning digitalization into a significant factor in the development of the banking system and the entire Russian economy, as a result of which it was revealed that structural, institutional, and external factors are currently the limitations of digitalization. The article discusses the political and legal aspects and prudential rules for regulating the banking sector under the conditions of digital technologies, including the tendency of the country to achieve sustainable development goals. There is a study devoted only to barriers that slow down the development of interaction between banks and the premium segment (Timokhina et al. 2021).

A large number of studies are devoted to assessing the impact of digitalization on choice, customer satisfaction, and loyalty. Chauhan et al. revealed that there is a link between impulse purchases, sales promotion, and positive emotions by performing a simulation of the desire of buyers to make purchases in the conditions of COVID-19 in India (Chauhan et al. 2021). Through digitalization, banks can conduct more sales promotion activities (loyalty programs, cashback, promotions, and bonuses in applications, etc.). Accordingly, the probability that digitalization affects the number of customers and the volume of their transactions is high. For example, Seiler V, Fanenbruck K.M. analyze the impact on customer choice of individual technological innovations, such as automated consultants (Seiler and Fanenbruck 2021). Another paper (Dehnert and Schumann 2022) evaluates the factors that influence the choice of a banking services provider by customers in the German market. The authors conclude that, currently, the choice is most influenced by the existing work experience, scope of services, and professionalism, while digital innovations have little effect on the choice of customers in general. At the same time, a study of customer satisfaction with the quality of service in Tunisia showed that digitalization is one of the aspects that affect the quality of service (Zouari and Abdelhedi 2020) and the choice of a bank accordingly.

Busby (2017) notes that the choice of a digitalization strategy contributes to increased customer loyalty.

Amin (2016) (Malaysia), Raza et al. (2015) (Pakistan) and others study the influence of the quality of Internet banking services on the satisfaction and loyalty of bank customers in different countries. The articles show a direct dependence of the degree of satisfaction on the quality of banking Internet services; however, this quality affects loyalty less or indirectly.

A number of studies are devoted to mobile banking and its impact on the development of commercial banks, as well as the impact on customer satisfaction and financial behavior (AlSoufi and Al 2014; Silva Bidarra et al. 2013; Jun and Palacios 2016).

The study highlights the importance of banks using social networks to increase the perceived value of banking products, the quality of interaction, and customer loyalty (Dootson et al. 2016).

One paper (Katsiampa et al. 2022) devoted to the study of the Chinese financial market draws an interesting conclusion that those banks owned by central regulators outperform financial technical companies in the competition due to access to large resources, financing, and technologies. In turn, Cheng M, Qu Y point out that Chinese state-owned banks also have a first-mover advantage in deploying financial technologies (Cheng and Qu 2020).

Another work (Kothari and Seetharaman 2020) aims to study the impact of digital transformation on the retail banking industry in the United Arab Emirates and identify variables that stimulate digital transformation.

The issue of the impact of digitalization on the key performance indicators of individual banks and the entire banking sector as a whole is also of research interest.

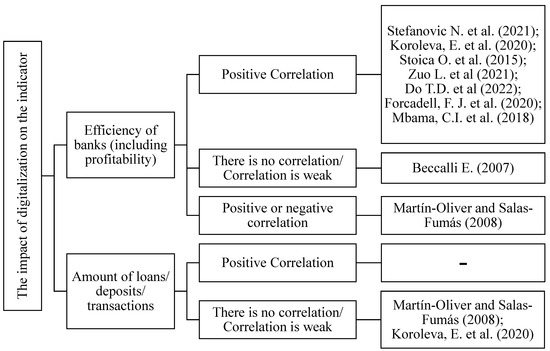

Researchers are obtaining controversial results for this topic. A generalized overview of the results of research on the impact of digitalization on the performance of banks is presented in Figure 1.

Figure 1.

A generalized overview of the results of research on the impact of digitalization on the performance of banks. Source: (Stefanovic et al. 2021; Koroleva and Kudryavtseva 2020; Stoica et al. 2015; Zuo et al. 2021; Do et al. 2022; Forcadell et al. 2020; Mbama et al. 2018; Beccalli 2007; Martín-Oliver and Salas-Fumás 2008).

Beccalli found a weak relationship between total IT investments and increased profitability or efficiency of banks, using a sample of 737 European banks for the period 1995–2000 (Beccalli 2007). V. Martín-Oliver A. found no evidence that investments in IT increase the demand for loans or the supply of deposits (Martín-Oliver and Salas-Fumás 2008). Investments in IT development in a bank can affect the amount of profit, both positively and negatively, due to the effects of competition (Xin and Choudhary 2019)

In turn, a study of the Romanian banking sector shows that banks can effectively use Internet banking services to increase their overall efficiency (Stoica et al. 2015). At the same time, the digitalization of the Romanian banking sector is limited by both the low level of trust in modern financial technologies and the development disparity of the regions of the country (Sbarcea 2019).

A study by Mbama et al. (2018) looked at the links between digitalization, customer loyalty, and the financial performance of banks in the UK, and concluded that digitalization could improve financial ratios and its positive impact on customer loyalty.

Digitalization does not directly improve workforce performance but has the potential to improve productivity in companies with relatively small assets, according to a study of Chinese banks (Zhou et al. 2021). At the same time, as a result of the analysis of the Chinese banking sector, it was revealed that investments in digitalization contributed to a significant increase in the integrated production efficiency of commercial banks; however, there was diversity between banks (Zuo et al. 2021).

A study of the relationship between digitalization and sustainable development in the Serbian banking sector showed that digitalization has a positive effect on the return on equity of banks and helps banks remain profitable even under the conditions of the global COVID-19 pandemic (Stefanovic et al. 2021).

Do et al. (2022) found out that digital transformation has a positive effect on the work of Vietnamese commercial banks, and the strength of the positive influence is directly proportional to the scale of the bank.

Based on the results of a study (Koroleva and Kudryavtseva 2020) of 16 Russian digital banks, it is concluded that digital banks with more transactions through digital channels have a higher return on assets, while a significant impact of digitalization on the share of loans and deposits is not confirmed. This indicates the need for further research in this area.

Empirical results obtained on a sample of 112 global banks for the period 2003–2016 showed that the higher the reputation of a bank, the more it can benefit from digital strategies (Forcadell et al. 2020).

The number of empirical studies devoted to the impact of digitalization on the key performance indicators of banks is relatively small. The available studies are usually devoted to banks in one country. In our opinion, the impact of digitalization on the key performance indicators of commercial banks in the Russian Federation has not been sufficiently investigated.

So, there are a significant number of works devoted to the digitalization of commercial banks. Despite this, the relevance and rapid variability of this process lead to a large number of unexplored aspects. To our opinion, the impact of digitalization on the key performance indicators of commercial banks in the Russian Federation has not been sufficiently studied. The banking sector of this country is quite large and differentiated, both in terms of the scale of activities of individual banks and the current state of digitalization. This makes it interesting to study the prospects for further digitalization of the entire banking sector as a whole, as well as to carry out a more detailed study of its impact on the performance of different banks.

Within this research, the following hypotheses have been developed:

Hypothesis 1 (H1).

The banking sector of the Russian Federation is better to increase the number of digital and other services.

Hypothesis 2 (H2).

The level of digitalization of a commercial bank affects the volume of transactions of individuals.

Hypothesis 3 (H3).

The level of digitalization of a commercial bank affects the volume of transactions with legal entities.

Hypothesis 4 (H4).

The level of digitalization of a commercial bank affects the size of its net commission income.

Hypothesis 5 (H5).

The level of digitalization affects the profitability of a commercial bank.

3. Materials and Methods

The framework of the study is the dialectical method, which reveals the possibilities of studying economic phenomena in their development, interconnection, and interdependence. General scientific methods were also applied: scientific abstraction, analysis, and synthesis; grouping and comparison; as well as the evaluation method using absolute and relative indicators.

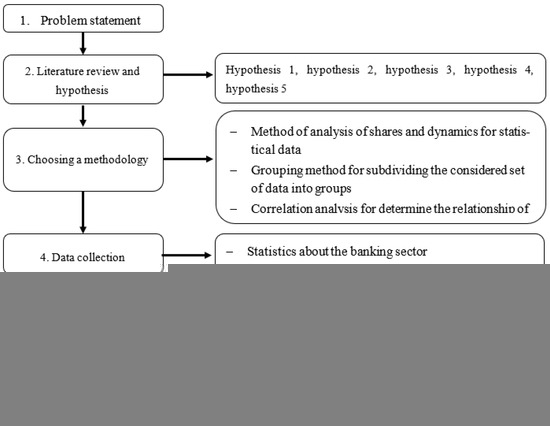

This study was conducted according to the procedure shown in Figure 2.

Figure 2.

Research methodology scheme.

3.1. The Data

Correlation analysis was performed to test the hypotheses. Key indicators were collected that characterize the activities of 100 commercial banks operating in Russia as of 01.01.2022. The sources of data were turnover balance reports by accounting invoices (Form 101), statements of financial results (Form 102), consolidated balance statements (Form 802), and consolidated statements of financial results (Form 803), posted for each of the considered banks on the official Bank of Russia website (List of credit institutions n.d.).

Based on the results of a logical analysis, the authors have selected factors that may depend on the level of digitalization of a commercial bank. These factors include quantitative indicators such as: the volume of loans issued to legal entities and individual entrepreneurs; the volume of loans issued to individuals; the amount of funds of legal entities; the amount of private deposits; net interest margin; net commission income; after-tax income; general and management costs; labor costs.

Table 1 provides details and the source of the variables.

Table 1.

Description of variables and data sources.

To ensure the comparability of data in the simulation, relative indicators were found. To estimate the level of digitalization of banks, the final ratings assigned to banks by SDI 360 were used based on the results of a study of the digital maturity of banks according to three criteria: “availability in the Internet”, “promotion and communications”, and “online sales” (X) (Sdi360 2021).

3.2. Grouping of Banks

The complexity of the analysis of the Russian banking sector is due to the fact that according to the data of the Bank of Russia, the level of competition in the banking sector is lower than in other sectors of the financial market. At the same time, competition is heterogeneous. The historically significant state participation in the capital of a number of banks leads to the dominance of individual leaders in the market and a disbalance in the perception of competition by consumers (Competition in the financial market 2018). Therefore, structurally, the Russian banking market can be represented by several groups, within which there are banks with similar characteristics, and accordingly they compete mainly with similar market participants.

As part of this research, banks were divided into four groups depending on the amount of assets (Appendix A).

The first group includes banks whose assets exceed RUB 1 trillion, including 12 systemically important banks, as well as JSC “JSB Rossiya”, JSC “RRDB” Bank. These are the largest banks represented in a large number of regions. They have leading positions in the market, demonstrated by a number of indicators (the volume of loans granted, the volume of funds raised, the amount of profit, etc.).

The second group includes banks with assets ranging from RUB 300 billion to 1 trillion. They are also large, with a wide range of services and usually an extensive regional network.

The third group consists of banks with assets ranging from RUB 100 to 300 billion. It includes medium-sized banks with strong positions in certain regions or certain products.

The fourth group includes banks with assets less than RUB 100 billion. From the point of view of competition, as a rule, these are follower banks at the regional level.

3.3. The Correlation Analysis

To define the degree of relationship between the indicators, the correlation coefficient (r) was calculated using the Pearson formula (1):

where

- n—number of indicators;

- —values of indicators;

- —an average value of indicators.

The values of the coefficient can be interpreted as the following:

- −0.5 < r < 0.5—the relation is weak or absent;

- −0.7 < r < −0.5 or 0.5 < r < 0.7—the relation is average;

- −1 < r < −0.7 or 0.7 < r < 1—the relation is strong.

4. Results

The results of this study may be useful for commercial banks that are developing a system of indicators for evaluating the effectiveness of digitalization. In addition, the study may be of interest to public authorities. The revealed dependencies between the level of digital maturity and banking performance indicators for different groups of banks in terms of assets can be taken into account when developing programs for the development of the banking system of the Russian Federation. Thus, the chosen research topic is socially significant.

4.1. Digitalization Prospects of Commercial Banks in the Russian Federation

The COVID-19 pandemic has accelerated the digital transformation of various industries around the world and forced banks to hasten their digital transformation (Miklaszewska et al. 2021). For example, total financial technologies investment in France, Germany and the UK increased to USD 15 billion in 2021 from USD 5 billion in 2020 (Wadhwani et al. 2022).

The further development of digital competencies by the banks of the Russian Federation is seen as promising from the perspective of changing the behavior patterns of existing and potential customers. The data of the Federal State Statistics Service confirm the growth of digitalization of Russian society. The COVID-19 pandemic was the powerful trigger, which affected the attitude of the population towards modern technologies. As Table 2 shows, over the past two years, the share of the population that used personal computers and mobile devices, including outdoors, has significantly increased; the number of people ordering goods or services online increased by 53.5%; the share of people with an electronic signature increased by 50%.

Table 2.

Statistics on information technologies and information and telecommunication networks usage by the population.

The statistics on the number of funds raised from clients by location of banks and their internal structural divisions confirms the thesis about the prospects for further digitalization of commercial banks (Table 3).

Table 3.

The relative share of raised funds of legal entities and individuals, in credit institutions of other regions that do not have internal structural units in this region.

As Table 3 shows, every year, due to remote channels, an increasing number of funds of individuals and legal entities are placed in credit institutions that do not have branches or internal structural units in the client’s region. As Table 4 shows, the number of remote access accounts opened with credit institutions increased by 12.47% in 2021. This fact increases competition in the banking sector, as the client has the opportunity to choose from a larger number of credit institutions and, as already mentioned, the level of digitalization of the bank plays an important role in his choice.

Table 4.

Dynamics of performance indicators of credit institutions in Russia.

An analysis of the performance indicators dynamics of credit institutions of the Russian Federation showed that at the end of 2021, the volume of intangible assets was significantly increased, which indicates the effect of the trend on computerization and the development of digital services and platforms. Statistical data confirm that Russia has a global trend towards a reduction in the number of branches and internal structural divisions of banks. In 2021 their number decreased by 6.41%. So, Russian banks are actively increasing intangible assets. At the same time, they are replacing some of the banking services previously provided offline with digital ones.

The rationality of such a strategy is confirmed by the growth rate of the banking sector’s profits. After falling by 3.11% in 2020 under the influence of the COVID-19 pandemic, and related sanitary and epidemiological measures that negatively affected economic growth worldwide, banks were able to quickly reshape their activities. As a result, their profit increased by 46.8% in 2021, significantly exceeding the values at the beginning of 2020.

However, there is a factor that negatively affects the further increase in the number of users of digital services. The growing interest in online services and mobile applications of the population and businesses inevitably leads to increased cybercriminal activity.

According to the Bank of Russia, twice as many fake banking websites were detected in 2020, and the population’s resistance to social engineering methods remains at a low level (The Main Types of Computer Attacks 2021).

However, the loss of personal data or money due to the mistakes of the individual or legal entity leads to a negative attitude of this person towards the bank, which services he used, and with a high probability of refusing to use them further.

To achieve a sustainable increase in users of digital services and retain them, banks need to pay attention not only to internal information security systems, but also to the development of measures to improve the information literacy of their customers. However, this thesis is disputed. A number of studies (Liao and Chen 2020, 2021; Lusardi et al. 2017; Scheresberg et al. 2020; Heo et al. 2021) have shown that people with a lower level of financial well-being, caused by both low financial literacy and irrational behavior, are more likely to use modern technologies, which in turn can worsen their financial situation. At the same time, the study did not find a strong link between financial vulnerability and the use of mobile payments or other digital payment methods (Seldal and Nyhus 2022).

To partially eliminate the threats that arise in the process of digitalization of the banking sector, it is necessary to update the banking business environment considering the trends in the development of the digital economy; strengthen the control of the reliability of bank customers in terms of transaction thresholds; and launch programs to improve the financial literacy of the population (Ivanova et al. 2019).

So, the H1 hypothesis about the viability of further increasing the number of digital services and services by the banking sector of the Russian Federation can be considered to be confirmed. However, it is not clear whether digitalization has a significant positive impact on all commercial banks.

4.2. The Impact of Digitalization on the Performance of Commercial Banks

Due to the fact that the banking sector of the Russian Federation is represented by a large number of banks that differ significantly in the scale of their activities, a grouping was set according to the criterion of the volume of assets.

Correlation analysis was performed within each group: the authors calculated correlation coefficients and created correlation matrices. The calculated coefficients presented in Table 5 allowed the authors to identify whether there is a relationship between the level of digital maturity of the bank and its performance indicators and the strength of such a relationship.

Table 5.

Correlation coefficients of performance indicators of commercial banks and the level of digital maturity of the bank by groups of banks.

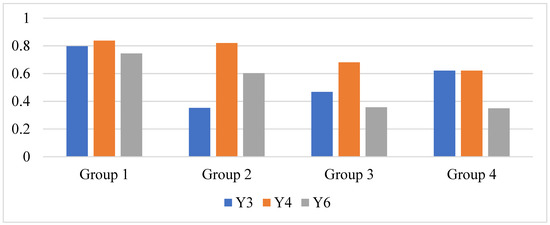

Based on the results of the correlation analysis, the following conclusions were drawn. To the greatest extent, the level of digital maturity affects the key performance indicators of the largest banks. Factors Y3, Y4, Y6 showed a strong connection; four more factors showed a normal connection (Y2, Y7, Y8, Y9).

The graphical representation of the highest values of the correlation coefficients between the level of digitalization and the key indicators of banks is shown in Figure 3.

Figure 3.

The highest values of correlation coefficients between the level of digitalization and key indicators of banks (absolute value of a number).

In the second group, a strong connection with the level of digitalization is observed only in the Y4 factor, while Y1, Y2, Y5, Y6, and Y9 have a normal connection.

In the third group, the normal connection was found only between the level of digital maturity and factors Y4 and Y9.

In the fourth group, the normal connection was observed only for factor Y4.

So, the dependence of the level of digital maturity and the share of deposits of individuals in the banking passives was revealed for all groups of banks.

4.3. Discussion

According to calculated data, the level of digitalization has the most significant impact on the market leaders—the largest banks. They have great opportunities for development and promotion, occupying a special place in the Russian financial market, both due to their scale and due to special attention and support from the state (systemically important banks). These banks offer similar services, are widely represented in the information field and, due to their recognition, have a similar level of customer trust. In this regard, the choice factors for the consumer are prices (interest rates, commissions, etc.) and ease of interaction.

A strong connection between the level of digital maturity and the share of accounts of legal entities was revealed only for the first group of banks. This may also be due to the fact that the largest banks have sufficient opportunities for the active development of digital services not only for individuals, but also for legal entities.

This corresponds with the conclusions made by the authors of the study SDI360, who found that banks with a wide range of retail products are more actively involved in the development of digital competencies, while banks focusing on corporate investment business are less interested in the development of digital services. Meanwhile, in other industries, such as insurance, DIY retail, and private medicine, digitalization is relevant for all market participants.

Medium-sized banks are focusing on the development of information technologies in cybersecurity, business continuity, and the development of remote service channels, partially reducing investments in other projects, while large banks are acting within the previously developed strategies, confirming the trend of hyperautomation (Lanitbpm 2021).

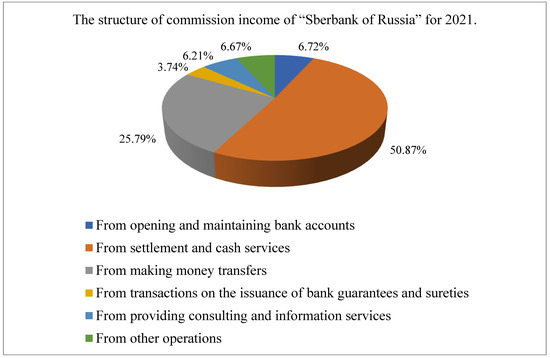

So, hypothesis H3 was not confirmed; however, hypothesis H2 was confirmed for all groups of banks.

For groups of large banks, the analysis confirmed hypothesis H4, which states that the level of digitalization affects the share of bank commission income. The development of digital services allows additional commercial services to be offered. The analysis of 30 Russian banks (from groups 1 and 2) showed that the commission income is generated by charging fees for settlement service and cash banking and money transfers (for example, Figure 4 shows the structure of fee income of PJSC “Sberbank of Russia”). The possibility to remotely open and manage accounts attracts customers and encourages them to make more transactions that bring commissions to the bank.

Figure 4.

The structure of commission income of “Sberbank of Russia” for 2021 (Sberbank of Russia Financial Results Report for 2021 n.d.).

Research into the financial results reports of 30 Russian banks confirmed this thesis. So, for example, Figure 1 shows the structure of commission income of “Sberbank of Russia” for 2021.

According to the consulting company Deloitte, on average, high-tech banks have a higher return on equity and in order to accelerate digitalization, banks need to pay special attention to analyzing customer demand in terms of preferred channels of interaction and digital services, the level of competition and trends in the banking industry of the region or country of operation (Deloitte 2020). Similar conclusions were made in a study (Accenture 2019), which found a connection between the level of digitalization and the return on equity of a bank and predicted a further increase in the gap between digital leaders and banks that are not engaged in digitalization, according to this indicator.

A tight connection between profitability indicators and the level of digitalization was not confirmed by the results of the analysis. This may happen due to three factors. First, due to the nature of competition in the market, the level of digitalization affects profit margins to a lesser extent than other indicators. Secondly, when assigning a score for the level of digital maturity, its aspects were considered on the part of the client; internal positive effects from the introduction of digital processes were not considered (for example, a reduction in the number of errors and failures in the banking internal systems). Thirdly, since the acceleration of digitalization processes has occurred relatively recently, banks have not yet fully felt its effect on profits, being engaged in the introduction and scaling of new digital services, which is the subject of discussion. Further study of this issue is required.

5. Conclusions

5.1. Main Conclusions

In the last few years, the financial sector has undergone significant changes due to the active development of IT technologies around the world. The COVID-19 pandemic has made it necessary to accelerate the introduction of digital technologies in all spheres of people’s lives. The activities of commercial banks were no exception. Despite the fact that the digitalization of banks began quite a long time ago, it has accelerated significantly in the last two years. Commercial banks introduced new digital products and services under the influence of customer requests, competition, and regulatory requirements. However, there was a problem. Some banks engaged in digitalization much less actively than others, despite the obvious advantages of technological development. This hindered the development of the banking sector as a whole. The authors tried to find out whether it is true that digitalization is associated with key performance indicators of commercial banks or not. The purpose of the study was to assess the impact of digitalization on the key performance indicators of Russian commercial banks, as well as the prospects for further development of digital technologies and their implementation in their activities by commercial banks.

The authors faced a number of limitations when conducting this study. One of the key limitations was the insufficient amount of information in open databases. Most of the banks in the Russian Federation do not post detailed information about how exactly they carry out digitalization and how much money they spend on this process. In addition, the information that banks publish about digitalization, as a rule, does not include quantitative data. There are no generally accepted quantitative indicators for assessing the level of digitalization. Unified reporting on digitalization does not exist. This complicates the comparison of banks among themselves and the construction of high-quality econometric models.

The authors used the digital maturity rating compiled by SDI 360 to overcome this limitation. This rating was chosen due to the fact that it includes a larger number of commercial banks than other ratings available to the authors. The selected rating included the leaders of digitalization, as well as banks that pay less attention to digitalization issues. The choice of this rating made it possible to perform a correlation analysis in total for one hundred commercial banks.

The heterogeneity of competition in the banking sector of the Russian Federation has become another limitation that influenced the course of this study. In order not to get distortions caused by different scales of banks’ activities when analyzing the relationship between the level of digitalization and key performance indicators, the authors performed a grouping and identified four groups. The members of each group have similar characteristics and pursue similar goals. This allows us to compare them with each other and look for the presence of dependencies within the group.

We put forward five hypotheses at the beginning of the study.

Hypothesis 1, that it is advisable for the banking sector to increase the number of digital services and services, has been confirmed. According to the analyzed statistical data (Table 1, Table 2 and Table 3), there was an increase in the number of users of personal computers and the Internet, an increase in the share of client funds attracted through remote channels, and an increase in the volume of intangible assets in the banking system. The expediency of further digitalization has been confirmed both on the demand side and on the supply side. Thus, the study revealed that the digitalization of the Russian banking sector has significant potential.

Correlation analysis of data from 100 commercial banks for 2021 was performed to test the remaining hypotheses (Table 4).

Hypothesis 2 about the impact of the level of digitalization on the volume of transactions of individuals was confirmed for all groups of banks, regardless of their size.

Hypothesis 3 about the relationship between the level of digitalization and the volume of transactions with legal entities has not been confirmed.

Hypothesis 4 about the impact of the level of digitalization on the amount of net commission income was confirmed only for large banks.

Hypothesis 5 about the existence of a link between the profitability of the bank and the level of its digitalization has not been confirmed.

According to the results of the study, it was noted that digitalization currently has the greatest impact on large Russian banks.

For the largest banks, a high level of digital maturity is a competitive advantage in the market. Meanwhile, small banks are not significantly affected by online presence, online sales, and active online promotion and communication with customers. This can be caused both by the insufficient involvement of small banks in digitalization processes due to the limited number of available resources, small client database, narrow specialization in certain operations, and the heterogeneity of competition in the Russian banking sector. These areas require further research.

At the same time, the dependence of the level of digital maturity and the share of deposits of individuals in the banking passives was revealed for all groups of banks. The functioning of the deposit insurance system reduces the risks for individuals of investing money in banks, regardless of their size and reliability. Consequently, an important consumer property of a bank for individuals is the convenience of managing their funds, which includes a feasible online bank and mobile application, the ability to remotely open an account and transfer funds, the availability of additional services where you can see the structure of your expenses and arrival of funds, set purpose of savings, and much more. The online customer support on the website and on social networks, as well as the number of online references, also have a significant impact on the choice of a bank by individuals for depositing their funds.

One of the main problems in the development of digital channels of interaction with customers, which slows down their widespread implementation, is cybersecurity issues. Despite the fact that commercial banks and the mega-regulator pay attention to these increasing issues, banking services and systems remain attractive to hackers, as they contain a large number of customers’ personal data and also provide access to various financial transactions.

The theoretical significance of the research is that it contributes to the development of the theory of modern banking. The results may be useful for researchers in constructing regression models for the banking sector and in further studying the impact of digitalization on various aspects of commercial banks.

5.2. Policy Recommendations and Future Research

From a practical point of view, the results of this study can be used by commercial banks for choosing key indicators used to evaluate the effectiveness of digitalization. In addition, the study may be of interest to public authorities. The revealed dependencies between the level of digital maturity and banking performance indicators for different groups of banks in terms of assets can be taken into account when developing programs for the development of the banking system of the Russian Federation.

Firstly, the prospects for further digitalization of the Russian banking sector were confirmed in the study. In this regard, it is advisable to encourage the further development of banking IT technologies to state authorities and the Central Bank. Despite the fact that a number of documents on cybersecurity of banks have already been adopted, the regulator should continue monitoring new risks. In addition, work on improving information literacy and financial literacy should be carried out regularly for the population. This is necessary to protect the population from fraudsters.

Secondly, a stronger impact of digitalization on large banks was revealed by the authors of the study. A close relationship between digitalization and profitability has not been identified. Together, these facts suggest that medium and small banks are currently less interested in the development of digital products and services, which in the long term may slow down the development of the entire banking sector as a whole. The financial system significantly affects the country’s economy; therefore, its development is very important. Regulators should pay attention to the heterogeneity of digitalization and consider measures to further stimulate small banks. They do not have as many resources and first-class personnel as large banks. Special programs of financial and non-financial state support will have a positive impact.

Targeted interaction between the central bank and commercial banks will ensure an increase in the level of digitalization of the banking sector as a whole. This will help to achieve the Sustainable Development Goals faster.

This study was aimed at analyzing enlarged groups of banks. The value of assets was chosen as a criterion for grouping banks by size. This grouping helped to identify patterns common to the groups. Further research may be devoted to a more detailed study of each of the groups of banks to identify other dependencies within the groups. Digitalization covers different areas of activity of a commercial bank, so it is difficult to unambiguously assess its level. The digital maturity rating was used in the construction of correlation models in this study to overcome the existing limitations. However, the rating did not include all banks that are currently operating in the Russian Federation. In addition, ratings can be subjective. The search for other criteria for assessing the level of digitalization of banks in the Russian Federation is another area for further research.

Author Contributions

Conceptualization, M.O.I.; methodology, E.A.P. and N.V.M.; software, M.O.I.; validation, E.A.P. and M.O.I.; formal analysis, E.A.P.; investigation, E.A.P.; resources, N.V.M.; data curation, E.A.P.; writing—original draft preparation, E.A.P.; writing—review and editing, M.O.I.; visualization, M.O.I.; supervision, M.O.I.; project administration, E.A.P.; funding acquisition, N.V.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was done by Peter the Great St. Petersburg Polytechnic University and supported under the strategic academic leadership program ‘Priority 2030’ of the Russian Federation (Agreement 075-15-2021-1333 dated 30 September 2021).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Grouping of Banks by Assets

| № | Group Name | Size of Assets, Billion Rubles | Name of Banks |

| 1. | The largest banks | Over RUB 1 billion | PJSC Sberbank, VTB Bank (PJSC), Bank GPB (JSC), JSC “ALFA-BANK”, JSC “Russian Agricultural Bank”, PJSC “MOSCOW CREDIT BANK”, Otkrytie FC Bank, PJSC “Sovcombank”, JSC Raiffeisenbank, PJSC ROSBANK, JSC “Bank “Rossiya”, JSC Tinkoff Bank, JSC UniCredit Bank, Bank RRDB (JSC) |

| 2. | Large banks | RUB 300–1000 billion | JSC Bank DOM.RF, PJSC Bank Saint-Petersburg, JSC SMP Bank, JSC CB Citibank, PJSC AK BARS BANK, JSCB NOVIKOMBANK, PJSC BANK URALSIB, JSC “Post Bank”, JSC MOSOBLBANK, JSCB Peresvet, RNCB Bank (PJSC), JSC MinBank, PJSC CB UBRD, Home Credit & Finance Bank LLC, PJSC “MTS Bank”, JSC Russian Standard Bank |

| 3. | Medium banks | RUB 100–300 billion | JSCB Absolut Bank (CJSC), PJSC Bank ZENIT, TKB BANK PJSC, INVESTTORGBANK JSC, Cetelem Bank LLC, JSC VUZ Bank, JSC Expobank, JSC “OTP Bank”, CB “Renaissance Credit” (LLC), RGS Bank PJSC, PJSC JSCB Metallinvestbank, Tauride Bank (OJSC), JSCB AVANGARD, LLC Bank Avers, JSC CB “LOKO-Bank”, JSC Gazenergobank, Asia-Pacific Bank (JSC), JSC Credit Europe Bank (Russia), CB Kuban Credit LLC, Deutsche Bank LLC, CB Center-Invest PJSC, JSC SME Bank, PJSC Bank Sinara, PJSC CB Vostochny, RN Bank JSC, Bank Finservice JSC, ING BANK (EURASIA) JSC, BBR Bank (JSC), Bank SOYUZ (JSC), JSCB BANK OF CHINA (JSC), JSC “SMBSR Bank” |

| 4. | Small banks | under RUB 100 billion | JSC Bank SNGB, Bank Intesa JSC, Bank ICBC (JSC), SKB Primorye Primsotsbank PJSC, HSBC Bank (RR) LLC, Bank Levoberezhny (PJSC), PJSC METCOMBANK, JSC Mizuho Bank (Moscow), SDM-Bank (PJSC), JSC Toyota Bank, JSCB CentroCredit, JSC CB “Solidarity”, JSCB “INTERNATIONAL FINANCIAL CLUB”, JSC “BCS Bank”, BMW Bank LLC, LLC CB ARESBANK, JSC BANK SGB, COMMERZBANK (EURASIJA) JSC, JSCB FORA-BANK (JSC), BNP PARIBAS BANK JSC, PJSC CHELYABINVESTBANK, JSC GENBANK, PJSC CHELINDBANK, SEB Bank JSC, United Capital Bank JSC, QIWI Bank (JSC), Credit Agricole CIB AO, CB J.P. Morgan Bank International (LLC), Far Eastern Bank JSC, KEB HNB Bank LLC, Derzhava JSCB PJSC, CB ENERGOTRANSBANK (JSC), Goldman Sachs Bank LLC, PJSC “BALTINVESTBANK”, “CUB” JSC, Volkswagen Bank RUS LLC, Bank IPB (JSC), JSC “Bank Credit Suisse (Moscow)”, PJSC “Zapsibcombank” |

| Source: created by the author based on the Bank of Russia data (List of credit institutions n.d.) | |||

References

- Accenture. 2019. Available online: https://www.accenture.com/_acnmedia/PDF-102/Accenture-Banking-Does-Digital-Leadership-Matter.pdf (accessed on 1 March 2022).

- AlSoufi, Ali, and Hayat Al. 2014. Customers perception of mbanking adoption in Kingdom of Bahrain: An empirical assessment of an extended tam model. arXiv arXiv:1403.2828. [Google Scholar]

- Amin, Muslim. 2016. Internet banking service quality and its implication on e-customer satisfaction and e-customer loyalty. International Journal of Bank Marketing 34: 280–306. [Google Scholar] [CrossRef]

- Artemenko, Dmitry Anatolyevich, and Svetlana Vyacheslavovna Zenchenko. 2021. Digital Technologies in the Financial sector: Evolution and Major Development Trends in Russia and Abroad. Finance: Theory and Practice 25: 90–101. [Google Scholar] [CrossRef]

- Barrios, Candelaria, Esther Flores, and M. Ángeles Martínez. 2019. Convergence clubs in Latin America. Applied Economics Letters 26: 16–20. [Google Scholar] [CrossRef]

- Beccalli, Elena. 2007. Does It Investment Improve Bank Performance? Evidence from Europe. Journal of Banking and Finance 31: 2205–30. [Google Scholar] [CrossRef]

- Busby, Darren. 2017. Adopting the best approach for a digital banking solution: Combine the benefits of the ‘build’, ‘buy’ or ‘outsource’ options. Journal of Digital Banking 2: 43–50. [Google Scholar]

- Cao, Ting, Wade D. Cook, and M. Murat Kristal. 2022. Has the technological investment been worth it? Assessing the aggregate efficiency of non-homogeneous bank holding companies in the digital age. Technological Forecasting and Social Change 178: 121576. [Google Scholar] [CrossRef]

- Carbó-Valverde, Santiago, Pedro J. Cuadros-Solas, and Francisco Rodríguez-Fernández. 2020. The Effect of Banks’ IT Investments on the Digitalization of their Customers. Global Policy 11: 9–17. [Google Scholar] [CrossRef]

- Chauhan, Shaifali, Richa Banerjee, and Vishal Dagar. 2021. Analysis of Impulse Buying Behaviour of Consumer During COVID-19: An Empirical Study. Millennial Asia. [Google Scholar] [CrossRef]

- Cheng, Maoyong, and Yang Qu. 2020. Does bank FinTech reduce credit risk? Evidence from China. Pacific-Basin Finance Journal 63: 101398. [Google Scholar] [CrossRef]

- Competition in the financial market. 2018. The analytical report was prepared by the Bank of Russia. Paper presented at the XXVII International Financial Congress, St. Petersburg, Russia, June 6–8; Available online: https://cbr.ru/StaticHtml/File/41186/20180607_report.pdf (accessed on 1 March 2022).

- de Almeida, Helena Tenorio Veiga, and Ricardo Luiz de Souza Ramos. 2022. The case of digitalisation in the brazilian development bank (BNDES): How brazilian culture and the institutional values influence the process. In Resilience in a Digital Age. Contributions to Management Science. Berlin/Heidelberg: Springer, pp. 285–308. [Google Scholar]

- Dehnert, Maik, and Josephine Schumann. 2022. Uncovering the digitalization impact on consumer decision-making for checking accounts in banking. Electronic Markets, 1–26. [Google Scholar] [CrossRef]

- Deloitte. 2020. Available online: https://www2.deloitte.com/ce/en/pages/financial-services/articles/digital-banking-maturity-2020.html (accessed on 1 March 2022).

- Digital Economy. 2022. A Brief Statistical Collection/G. I. Abdrakhmanova, S. A. Vasilkovsky, K. O. Vishnevsky, etc. National Research. un-t “Higher School of Economics”. Available online: https://publications.hse.ru/pubs/share/direct/553808040.pdf (accessed on 1 May 2022).

- Do, Trang Doan, Ha An Thi Pham, Eleftherios I. Thalassinos, and Hoang Anh Le. 2022. The Impact of Digital Transformation on Performance: Evidence from Vietnamese Commercial Banks. Journal of Risk and Financial Management 15: 21. [Google Scholar] [CrossRef]

- Dootson, Paula, Amanda Beatson, and Judy Drennan. 2016. Financial institutions using social media—Do consumers perceive value? International Journal of Bank Marketing 34: 9–36. [Google Scholar] [CrossRef]

- Dudin, M. N., S. V. Shkodinskii, and D. I. Usmanov. 2021. Key trends and regulations of the development of digital business models of banking services in industry 4.0. Finance: Theory and Practice 25: 59–78. [Google Scholar] [CrossRef]

- Federal State Statistics Service. n.d. Available online: https://gks.ru/free_doc/new_site/business/it/ikt21/index.html (accessed on 1 May 2022).

- Fiapshev, Alim Borisovich, and Oksana Nikolaevna Afanasyeva. 2021. Digitalization as a factor of development of Russia’s banking system. In Meta-Scientific Study of Artificial Intelligence. Charlotte: IAP (Information Age Publishing, INC), pp. 461–68. [Google Scholar]

- Forcadell, Francisco Javier, Elisa Aracil, and Fernando Ubeda Mellina. 2020. The Impact of Corporate Sustainability and Digitalization on International Banks’ Performance. Global Policy 11: 18–27. [Google Scholar] [CrossRef]

- Georgescu, Irina, and Jani Kinnunen. 2021. The Digital Effectiveness on Economic Inequality: A Computational Approach. In Business Revolution in a Digital Era. Edited by Alina Mihaela Dima and Fabrizio D’Ascenzo. Springer Proceedings in Business and Economics. Cham: Springer, p. 23. [Google Scholar]

- Heo, Wookjae, Jae Min Lee, and Abed G. Rabbani. 2021. Mediation effect of financial education between financial stress and use of financial technology. Journal of Family and Economic Issues 42: 413–28. [Google Scholar] [CrossRef]

- Information about the Placed and Attracted Funds. Central Bank of the Russian Federation n.d. Available online: https://cbr.ru/statistics/bank_sector/sors/ (accessed on 1 May 2022).

- Irfan, Muhammad, Rajvikram Madurai Elavarasan, Munir Ahmad, Muhammad Mohsin, Vishal Dagar, and Yu Hao. 2022. Prioritizing and overcoming biomass energy barriers: Application of AHP and G-TOPSIS approaches. Technological Forecasting and Social Change 177: 121524. [Google Scholar] [CrossRef]

- Ivanova, Olga V., Larisa S. Korobeinikova, Igor E. Risin, and Elena F. Sysoeva. 2019. The Main Directions and Tools of Banking Digitalization. In Digital Economy: Complexity and Variety vs. Rationality. Cham: Springer, pp. 510–16. [Google Scholar]

- Jun, Minjoon, and Sergio Palacios. 2016. Examining the Key Dimensions of Mobile Banking Service Quality: An Exploratory Study. International Journal of Bank Marketing 34: 307–26. [Google Scholar] [CrossRef]

- Kanungo, Rama Prasad, and Suraksha Gupta. 2021. Financial inclusion through digitalisation of services for well-being. Technological Forecasting and Social Change 167: 120721. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Paul B. McGuinness, Jean-Philippe Serbera, and Kun Zhao. 2022. The financial and prudential performance of Chinese banks and Fintech lenders in the era of digitalization. Review of Quantitative Finance and Accounting 58: 1451–503. [Google Scholar] [CrossRef]

- Khan, Irfan, Abdulrasheed Zakari, Jinjun Zhang, Vishal Dagar, and Sanjeet Singh. 2022. A study of trilemma energy balance, clean energy transitions, and economic expansion in the midst of environmental sustainability: New insights from three trilemma leadership. Energy 248: 123619. [Google Scholar] [CrossRef]

- Khan, Muhammad Kamran, Samreen Fahim Babar, Bahareh Oryani, Vishal Dagar, Abdul Rehman, Abdulrasheed Zakari, and Muhammad Owais Khan. 2021. Role of financial development, environmental-related technologies, research and development, energy intensity, natural resource depletion, and temperature in sustainable environment in Canada. Environmental Science and Pollution Research 29: 622–38. [Google Scholar] [CrossRef]

- Kitsios, Fotis, Ioannis Giatsidis, and Maria Kamariotou. 2021. Digital Transformation and Strategy in the Banking Sector: Evaluating the Acceptance Rate of E-Services. Journal of Open Innovation: Technology, Market, and Complexity 7: 204. [Google Scholar] [CrossRef]

- Koroleva, Ekaterina V., and Tatiana Kudryavtseva. 2020. Factors Influencing Digital Bank Performance. Paper presented at the 2018 International Conference on Digital Science, Budva, Montenegro, October 19–21; pp. 325–33. [Google Scholar]

- Kothari, Umesh, and A. Seetharaman. 2020. Impact of digital transformation on retail banking industry in the UAE. IFIP Advances in Information and Communication Technology 617: 425–38. [Google Scholar]

- Lanitbpm. 2021. Available online: https://lanitbpm.ru/banksautomationresearch2021?utm_source=tadvizer2021&utm_medium=research&utm_campaign=newslanitbpm (accessed on 1 May 2022).

- Lee, Seungju, Yona Kwon, Nam Nguyen Quoc, Cynthia Danon, Maren Mehler, Karoline Elm, Raphael Bauret, and Seungho Choi. 2021. Red queen effect in german bank industry: Implication of banking digitalization for open innovation dynamics. Journal of Open Innovation: Technology, Market, and Complexity 7: 90. [Google Scholar] [CrossRef]

- Liao, Chih-Feng, and Chun-Da Chen. 2020. Financial literacy and mobile payment behaviors. Journal of Accounting & Finance 20: 2158–3625. [Google Scholar]

- Liao, Chih-Feng, and Chun-Da Chen. 2021. Influences of mobile payment usage on financial behaviors. International Review of Accounting, Banking & Finance 13: 1–16. [Google Scholar]

- List of Credit Institutions Registered in the Territory of the Russian Federation. Central Bank of the Russian Federation n.d. Available online: https://cbr.ru/banking_sector/credit/FullCoList/ (accessed on 1 May 2022).

- Lusardi, Annamaria, Carlo de Bassa Scheresberg, and Hasler Andrea. 2017. Millennial Mobile Payment Users: A Look into Their Personal Finances and Financial Behaviors. GFLEC Insights Report. Washington, DC: Global Finance Literary Excellence Center, The George Washington University School of Business. [Google Scholar]

- Martín-Oliver, Alfredo, and Vicente Salas-Fumás. 2008. The Output and Profit Contribution of Information Technology and Advertising Investments in Banks. Journal of Financial Intermediation 17: 229–55. [Google Scholar] [CrossRef]

- Mbama, Cajetan Ikechukwu, Patrick Ezepue, Lyuba Alboul, and Martin Beer. 2018. Digital banking, customer experience and financial performance: UK bank managers’ perceptions. Journal of Research in Interactive Marketing 12: 432–51. [Google Scholar] [CrossRef]

- Miklaszewska, Ewa, Krzysztof Kil, and Marcin Idzik. 2021. How the COVID-19 pandemic affects bank risks and returns: Evidence from EU members in central, eastern, and northern Europe. Risks 9: 180. [Google Scholar] [CrossRef]

- Niemand, Thomas, J. P. Coen Rigtering, Andreas Kallmünzer, Sascha Kraus, and Adnane Maalaoui. 2021. Digitalization in the financial industry: A contingency approach of entrepreneurial orientation and strategic vision on digitalization. European Management Journal 39: 317–26. [Google Scholar] [CrossRef]

- Raza, Syed Ali, Syed Tehseen Jawaid, and Ayesha Hassan. 2015. Internet Banking and Customer Satisfaction in Pakistan. Qualitative Research in Financial Markets 7: 24–36. [Google Scholar] [CrossRef]

- S&P Global Market Intelligence. 2022. Banking Industry Outlook Says Pandemic Response Proves Double-Edged Sword for U.S. Banks. New York: PRNewswire. Available online: https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2022-banking-industry-outlook-says-pandemic-response-proves-double-edged-sword-for-us-banks-301418321.html (accessed on 1 May 2022).

- Sawhney, Aastha, and Vandana Ahuja. 2021. Drivers of social media content marketing in the banking sector: A literature review. International Journal of Service Science, Management, Engineering, and Technology 12: 54–72. [Google Scholar] [CrossRef]

- Sbarcea, Ioana Raluca. 2019. Banks digitalization—A challenge for the romanian banking sector. Studies in Business and Economics 14: 221–30. [Google Scholar] [CrossRef]

- Sberbank of Russia Financial Results Report for 2021. Central Bank of the Russian Federation n.d. Available online: https://cbr.ru/banking_sector/credit/coinfo/f102/?regnum=1481&dt=2022-01-01 (accessed on 1 May 2022).

- Scheresberg, Carlo de Bassa, Andrea Hasler, and Annamaria Lusardi. 2020. Millennial Mobile Payment Users: A Look into Their Personal Finances and Financial Behavior. ADBI Working Paper. Tokyo: Asian Development Bank Institute, 1074. [Google Scholar]

- Sdi360. 2021. Available online: https://sdi360.ru/banks (accessed on 1 May 2022).

- Seiler, Volker, and Katharina Maria Fanenbruck. 2021. Acceptance of digital investment solutions: The case of robo advisory in Germany. Research in International Business and Finance 58: 101490. [Google Scholar] [CrossRef]

- Seldal, M. M., and Ellen K. Nyhus. 2022. Financial Vulnerability, Financial Literacy, and the Use of Digital Payment Technologies. Journal of Consumer Policy 45: 281–306. [Google Scholar] [CrossRef]

- Silva Bidarra, Samuel Henrique, Francisco Muñoz-Leiva, and Francisco Liébana-Cabanillas. 2013. Analysis and modeling of the determinants of mobile banking acceptance. The International Journal of Management Science and Information Technology (IJMSIT) 8: 1–27. [Google Scholar]

- Starodubtseva, Elena B., Marina V. Grachyova, and Marina B. Trachenko. 2021. Digitalization as a driver of the banking sector. StudSystDecisControl 314: 607–13. [Google Scholar]

- Statistical Indicators of the Banking Sector of the Russian Federation. Central Bank of the Russian Federation n.d. Available online: https://cbr.ru/statistics/bank_sector/review/ (accessed on 1 May 2022).

- Stefanovic, Nikola, Lidija Barjaktarovic, and Alexey Bataev. 2021. Digitainability and Financial Performance: Evidence from the Serbian Banking Sector. Sustainability 13: 13461. [Google Scholar] [CrossRef]

- Stoica, Ovidiu, Seyed Mehdian, and Alina Sargu. 2015. The impact of internet banking on the performance of Romanian banks: DEA and PCA approach. Procedia Economics and Finance 20: 610–22. [Google Scholar] [CrossRef]

- Tang, Chang, Muhammad Irfan, Asif Razzaq, and Vishal Dagar. 2022. Natural resources and financial development: Role of business regulations in testing the resource-curse hypothesis in ASEAN countries. Resources Policy 76. [Google Scholar] [CrossRef]

- The Main Types of Computer Attacks in the Credit and Financial Sphere in 2019–2020. 2021. Central Bank of the Russian Federation. Available online: https://cbr.ru/Collection/Collection/File/32122/Attack_2019-2020.pdf (accessed on 1 May 2022).

- Timokhina, Galina, Lyubov Prokopova, Yuri Gribanov, Stanislav Zaitsev, Natalia Ivashkova, Roman Sidorchuk, Irina Skorobogatykh, Anatoly Shishkin, and Zhanna Musatova. 2021. Digital customer experience mapping in russian premium banking. Economies 9: 108. [Google Scholar] [CrossRef]

- Úbeda, Fernando, Francisco Javier Forcadell, Elisa Aracil, and Alvaro Mendez. 2022. How sustainable banking fosters the SDG 10 in weak institutional environments. Journal of Business Research 146: 277–87. [Google Scholar]

- Wadhwani Preeti, Smriti Loomba Neobanking Market Size, By Account Type (Business Account, Savings Account), By Service (Mobile Banking, Payments & Money Transfer, Checking/Savings Account, Loans), By Application (Enterprises, Personal), COVID-19 Impact Analysis, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2022–2028. Gminsights 2022. Available online: https://www.gminsights.com/industry-analysis/neobanking-market (accessed on 1 May 2022).

- Xie, Mingting, Muhammad Irfan, Asif Razzaq, and Vishal Dagar. 2022. Forest and mineral volatility and economic performance: Evidence from frequency domain causality approach for global data. Resources Policy 76: 102685. [Google Scholar] [CrossRef]

- Xin, Mingdi, and Vidyanand Choudhary. 2019. IT Investment Under Competition: The Role of Implementation Failure. Management Science 65: 1909–25. [Google Scholar] [CrossRef]

- Yadgarov, Y. S., V. A. Sidorov, and E. V. Obolev. 2019. Credit and banking component of the market economy phenomenon: Methdological approach transformation to the development of digitalization and capital fictivization. Finance: Theory and Practice 23: 115–25. [Google Scholar] [CrossRef]

- Zakari, Abdulrasheed, Jurij Toplak, Missaoui Ibtissem, Vishal Dagar, and Muhammad Kamran Khan. 2021. Impact of Nigeria’s industrial sector on level of inefficiency for energy consumption: Fisher Ideal index decomposition analysis. Heliyon 7: e06952. [Google Scholar] [CrossRef]

- Zhao, Qun, Pei-Hsuan Tsai, and Jin-Long Wang. 2019. Improving Financial Service Innovation Strategies for Enhancing China’s Banking Industry Competitive Advantage during the Fintech Revolution: A Hybrid MCDM Model. Sustainability 11: 1419. [Google Scholar] [CrossRef]

- Zhou, Dan, Mika Kautonen, Weiqi Dai, and Hui Zhang. 2021. Exploring how digitalization influences incumbents in financial services: The role of entrepreneurial orientation, firm assets, and organizational legitimacy. Technological Forecasting and Social Change 173: 121120. [Google Scholar] [CrossRef]

- Zouari, Ghazi, and Marwa Abdelhedi. 2020. Customer satisfaction in the digital era: Evidence from Islamic banking. Journal of Innovation and Entrepreneurship 10: 1–18. [Google Scholar] [CrossRef]

- Zuo, Lihua, Jack Strauss, and Lijuan Zuo. 2021. The Digitalization Transformation of Commercial Banks and Its Impact on Sustainable Efficiency Improvements through Investment in Science and Technology. Sustainability 13: 1028. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).