1. Introduction

Since the reform and opening up, the housing system has abolished welfare housing, the market-oriented reform of China’s cities and towns has been basically completed, and real estate has entered the fast lane of development. Subsequently, the market has gradually matured through two financial crises and many rounds of policy regulation and cleansing.

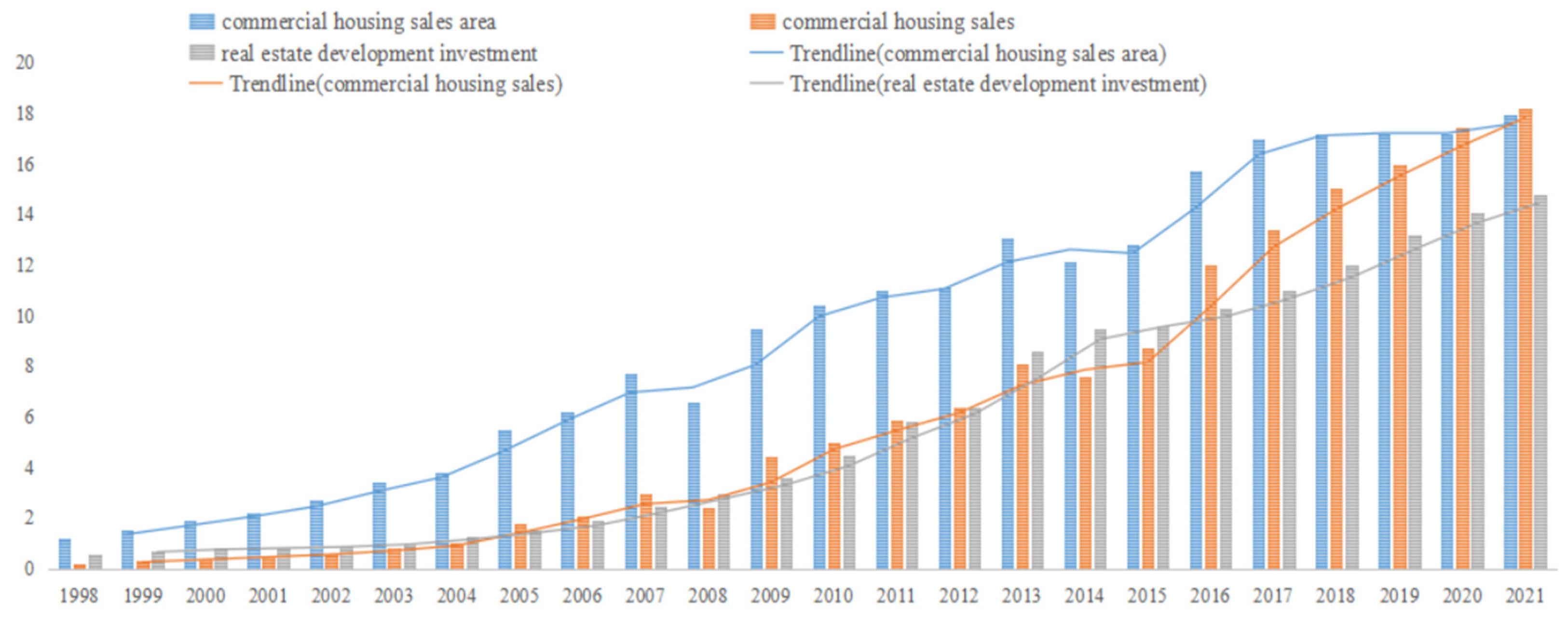

Figure 1 summarizes the commercial housing sales area, commercial housing sales and development investment in real estate development from 1998 to 2020. Compared to 1998, the domestic commercial housing sales area has increased about 15 times to reach 1.79 billion square meters, in 2021, commercial housing sales have increased 90 times to reach 18.2 trillion yuan, in 2021, and real estate development investment has increased nearly 25 times to reach 14.8 trillion yuan, in 2021. During the period of 1998 to the present, China’s real estate market has gone through three clearly characterized development phases, including the rapid development phase, the boom phase, and the adjustment and maintenance of stability phase.

The first phase was from 1998 to 2008. After the “housing reform” in 1998, the operating environment of the real estate market was improved, housing demand exploded centrally, the sales area of commercial houses grew rapidly, and the house price index climbed rapidly from 2001. After a smooth transition, real estate enterprises entered the era of rapid capitalization, and personal housing credit developed rapidly. As a result, the government introduced corresponding policies to adjust housing prices, such as “eight real estate market regulation measures” and a policy of guaranteed housing.

The second phase was from 2009 to 2013. After the financial crisis in 2008, the government launched a stimulus plan and an easy monetary environment, which led to the rapid activation of domestic real estate investment and prosperity. In major Chinese cities, such as Beijing, Shanghai, and Shenzhen, house prices have approached Western levels (D.

Zhang et al. 2017). Government regulation and control policies were intensively introduced, and the game with the market became more frequent. The urban pattern of the real estate market has also changed significantly, and the real estate market in many small and medium-sized cities has achieved rapid development during this period.

The third phase is from 2014 to the present. This phase can also be called the de-stocking and high market size consolidation phase. After the rapid expansion of the previous period, the national commercial housing construction area of 11.3 billion square meters in the period 2008–2014, the sales area totaled 7.4 billion square meters during the same period based on

Figure 1. From this set of data, it is easy to find that the real estate market has a huge backlog of inventory, the market supply and demand structure has changed, real estate enterprises promote capital recovery by reducing prices because of their tightening funds, and the price of housing appears to be trending down. At the same time, the market differentiation of different cities is obvious, the supply of houses in first-tier and hot second-tier cities still exceeds demand, and house prices remains high, while the situation in third- and fourth-tier cities is quite the opposite (Y.

Huang 2020). After 2014, the real estate market showed a rapid rise in quantity and price in 2016 with the implementation of the “de-stocking” policy and the large-scale squatter policy. Therefore, the central government re-emphasized that “houses are for living, not for speculation” to maintain stability, making it clear that housing construction must return to the purpose of living. The long-term mechanism is also accelerating, and the real estate market is performing more steadily, with the sales area of commercial properties nationwide stabilizing at around 1.7 billion square meters in

Figure 1. In summary, the overall trend of China’s real estate market development over the past two decades has shown a cycle pattern of rise-fall-rise, from the previous period of rapid expansion into a period of stable development. Such a trend is closely related to the intervention of various government policies. Whenever there is excessive volume and price growth in the real estate market, it is often accompanied by various types of stringent regulation and control policies, and when the real estate market is in the doldrums, the policies will also be relaxed.

However, demand for houses is more complicated than demand for ordinary consumer goods, because houses have a dual nature consisting of consumption demand and investment demand. In China’s urban real estate market, it is easy to have an excessive “speculation room” phenomenon (J.

Chen et al. 2017). Looking back on the development of China’s urban housing market in the past 20 years, one of its characteristics is the rapid rise in housing prices (

Kuang and Li 2012), and there are obvious signs of hyperinflation. According to statistics from the National Bureau of Statistics, the average sale price of residential housing increased by approximately 232% from 2000 to 2015, and the sale price rise in the major cities is closer to 400%. Another feature of China’s real estate market is that the inhabitance demand, the investment demand, and speculative demand have become completely imbalanced, with the speculative demand becoming dominant (

Yang et al. 2014). A high percentage of house buyers buy houses neither for dwelling nor for investment, but for reselling them to make a huge profit from the rapid rising prices. In general, the housing market in Chinese cities can be explained by an upward spiral: expectations of high housing prices have led to higher demand for sales, while higher demand has further led to higher housing prices. Is there a bubble at the high price level? The existence of bubbles in the real estate market has been extensively researched by foreign scholars (e.g.,

Evans 1989;

Stiglitz 1990;

Topol 1991;

Cuñado et al. 2005) and empirically verified by quantifying house price bubbles (e.g.,

Abraham and Hendershott 1994;

Sornette 2008;

Mikhed and Zemčík 2009;

Ahuja et al. 2010;

Bangura and Lee 2022). Although China’s real estate market started later than Western countries, due to its rapid development, more and more scholars in China have focused on the existence of house price bubbles in China based on the studies of foreign scholars (e.g.,

Hui and Yue 2006;

Gao et al. 2014; W.

Zhang 2017) and have used the indicator method (H.

Liu and Shen 2004), modeling method (J.

Lv 2010) and other methods to measure the house price bubble to affirm the existence of house price bubbles in China. Therefore, the issue of how to ensure that “the houses are built to be inhabited but not for speculation” is extremely important.

Based on the above observations, we conduct a micro-economics analysis of China’s urban housing market and make policy suggestions to the Chinese authorities. The rest of the paper is organized as follows.

Section 2 provides a literature review of the relevant topics and describes the motivation of our paper.

Section 3 constructs the market demand model of real estate based on the Cobb–Douglas production function, and distinguishes the price discrimination of the housing market supply on the condition of complete and incomplete information. In

Section 4, we point out the alienation of dwelling demand and speculative demand, the single housing supply mode, and the danger of the bubble bursting in the Chinese urban housing market. In

Section 5 we put forward a policy scheme to achieve “houses built for inhabitance” in China’s cities from the perspectives of “speculation limitation” and “price control”. In

Section 6, we apply numerical analysis to consider the macroeconomic effects of these two policy solutions on the housing market and offer reference for the healthy development of the housing market in China’s cities.

Section 7 concludes the paper by discussing the implications of our findings.

2. Literature Review and Motivation of Our Paper

Marx’s demand theory (

Marx and Engels 1958) holds that housing, as a natural demand and survival need, is not only one of the most basic human needs but is also the basis of other needs. While residential prices are important information reflecting the residential development, the importance of residential issues and the sensitivity of residential prices have attracted extensive attention from a large number of scholars and the public. A review of the existing literature at home and abroad reveals that economic fundamentals including population, income, interest rate, inflation rate, financial system, and land policy can better explain housing price changes.

Mankiw and Weil (

1989),

Stuart et al. (

1999);

Saiz (

2007);

Lu et al. (

2014); X.

Liu et al. (

2016) analyze the impact on housing prices in terms of birth rate, migration, and urban migration, and population growth tends to be positively correlated with housing price growth.

Case and Shiller (

1990);

Otto (

2007), Y.

Zhang et al. (

2011); S.

Zhang and Fan (

2015) find that both domestic and foreign real income have a significant effect on housing prices.

Brueggeman et al. (

1984);

Kostas and Zhu (

2004); F.

Lv (

2016) point out that the effect of real estate price fluctuations on inflation is positive. In addition to the analysis of housing prices with individual factors, as research continues, more and more studies have included some or all of the above-mentioned macroeconomic factors in a framework for comprehensive research and analysis; for example,

Pagés and Maza (

2003);

Kostas and Zhu (

2004) combined income, population, interest rate and inflation rate to analyze their effects on housing prices, respectively.

Not only do population, income, interest rates, and inflation rates have significant effects on housing prices, but financial systems and land policies are also critical to housing price effects. By constructing a commodity hierarchy model,

Sweeney (

1974) shows that although the government cannot control rental prices by providing subsidies to developers, it can lower rents by increasing public housing construction programs. Based on Sweeney’s model,

Ohls (

1975) developed a general equilibrium housing market filtering model considering the formulation of housing policies for the low-income class. Their study shows that direct monetary subsidies for housing for low-income households are more efficient in terms of government costs than building subsidized housing.

Galster (

1997) further extends Ohls’ argument by stating that when housing supply is sufficient and housing demand is sufficiently elastic, “capitation subsidies” are better than “brick subsidies” because “capitation subsidies” are more effective in transferring policy benefits to low-income and moderate-income households.

O’Sullivan (

2000) argues that the in-kind housing security approach is an effective way to quickly alleviate the housing hardship of low-income groups in a housing supply shortage, although it may lead to inefficiencies. In addition,

Gyourko and Linneman (

1989) explore the effectiveness of rent pricing and related government regulations in solving housing problems. Their study shows that “rent control” policies have led to greater heterogeneity in the distribution of welfare among different income groups, with low-income households generally more able to benefit from these policies at the expense of landlords. This may lead landlords to reduce funding for housing maintenance, which can ultimately affect housing quality.

Disney (

2007) further builds on

Gyourko and Linneman’s (

1990) argument that the implementation of a “national paid rental incentive program” can not only meet the housing needs of low-income groups, but also meet landlords’ higher rental return requirements.

Based on a qualitative analysis of the impact of financial systems and land policies on housing prices, in recent years,

Iacoviello (

2005);

Iacoviello and Neri (

2010) applied the theory of dynamic stochastic general equilibrium (DSGE) to an analysis of the housing market, and they developed a four-sector DSGE model consisting of representative families, intermediate production enterprises, final product manufacturers, and the government. This is a pioneering quantitative study, laying down a solid theoretical and empirical analysis foundation for people to evaluate the impacts of the government’s financial and monetary policy on housing prices. Following Iacoviello and Neri’s DSGE approach,

Walentin (

2014) ran a Bayesian estimation of a DSGE model, finding that the government’s monetary policy affected the housing price through the transmission effect of the nominal interest rate; he also found that the strength of monetary policy and the ratio of housing loan amount to housing value were positively correlated. On the other hand,

Kannan et al. (

2012) used a DSGE model to study the effect of macro-prudential policies on economic stability against the background of rising housing prices. His simulation results show that these policies would be able to hedge the financial risks and stabilize the economy when the economy faces either financial sector or housing demand shocks. In addition,

Carstensen et al. (

2009), using data from 12 European countries during the period 1995–2006, applied a panel vector auto-regression (VAR) model to explore the importance of the heterogeneity of the housing loan market on monetary policy transmission. He divided 12 European countries into two separate groups according to the sizes of the impacts of monetary policy shocks on real house prices; his results show that the effect of monetary policy on macroeconomic fluctuations has been magnified in countries where real house prices are more reactive.

Gupta et al. (

2010) used a large data set from South Africa for the first quarter of 1980 to the fourth quarter of 2006, employing the factor extension VAR model to measure the effects of monetary policy on the growth of real estate prices; the results, based on the impulse response function, show that, in general, money supply shocks have positive impacts on housing prices, although there is significant heterogeneity in the impacts upon different types of housing.

Based on this, many Chinese scholars have conducted a series of studies on housing prices and housing bubbles from a perspective of monetary policy, fiscal policy, and land policy in the context of the rapid growth of housing prices, the dominance of speculative demand, and the existence of housing bubbles in the Chinese real estate market. However, most of these studies are empirical.

Liang and Gao (

2007) made use of the 1999–2006 panel data from China’s 28 provinces and autonomous regions, applying an error correction model to discuss regional differences in the effects of monetary policy on housing prices. They found that the credit quota has greater effects on both the short-term fluctuation of housing prices and their long-term trend in China’s east and west regional areas than it has in China’s central area. Additionally, there is no significant difference in the effects of the real interest rate on housing prices in the eastern, central, and western regions, and the impacts are small. Based on Liang and Gao’s research,

Dai and Zhang (

2009) used a structural VAR model to analyze the monetary policy transmission mechanism of real estate prices in China, and they found that monetary policy has a smooth transmission path to real estate prices, whereas the transmission path from real estate prices to housing consumption and investment is usually jammed. This shows that in urban areas in China, the transmission of monetary policy to housing consumption and investment is not smooth, and it is likely to lead to real estate market risk aggregation.

Huo (

2013),

Dreger and Zhang (

2013) also argued that the low interest rate policy introduced by the government has greatly boosted real estate investment and massive credit expansion, while the excess capital gathered in the real estate market will further lead to the creation of a market bubble. Then, D.

Zhang et al. (

2017) used time series of house prices and rents for 33 cities and argued that bubbles exist in the housing markets of most of the Chinese sample cities and also argued that irrational expectations may play an important role in generating these bubbles by taking into account deterministic time trends with breakpoints in a unit root test of the house price-to-rent ratio. Although these bubbles can be largely mitigated by strong government intervention, government policies should be formulated differently from city to city because of their variability.

Kuang (

2005) and

Zheng and Shi (

2011), respectively, studied China’s housing market by analyzing the data of real estate sale price indices and residential land price indices in the first quarters of 1999 through 2005, and the data in China’s 35 large and medium-sized cities; these researchers concluded that “land finance (finance by selling land)”, as the local government’s policy, is the main reason for the rapid rise of real estate prices in China. Further, X.

Wang and Yang (

2012) constructed a real estate market equilibrium model under the land supply restriction; their research shows that “land finance” has led local governments to rely increasingly heavily on the real estate markets. Additionally, the local governments all have an incentive to create various policies to support high housing prices, eventually encouraging speculative behaviors in the property market and pushing up the housing prices. Through international comparison and analysis, X. Wang and Yang also found that China’s real estate speculation is significantly more dependent on the land finance than that of the other developed countries. A study by S.

Huang et al. (

2012), based on an empirical test of the “tax substitution” mechanism by using the survey data of industrial enterprises in China from 1998 to 2008, reveals the reasons why local governments are keen to promote the development of real estate. S.

Guo (

2016) and C.

Guo and Wang (

2018) argued that the aggressive monetary policy and land finance adopted by the state can also increase the extent of real estate bubbles except for the presence of faster urbanization and the influence of expanding speculative demand.

In addition, some scholars have analyzed the impact of the “deleveraging” policy on housing prices and housing bubbles. The government’s determination to reduce the indebtedness of the real estate market and force capital out of the real estate industry is reflected in the “three deleveraging policies” and the “three red lines” policy in 2021. In order to achieve the goal of the “de-stocking” of real estate, the government stimulated the demand for housing through various preferential policies for housing purchases, which made the loans for housing purchases rise rapidly. As home purchase loans account for the majority of the residential sector’s debt, “de-stocking” has led to a further increase in residential sector leverage and a new round of house price increases. At present, China’s residential sector leverage is already high, and excessive residential sector leverage can trigger the risk of a real estate bubble (

Li and Zhao 2019). By constructing a dynamic general equilibrium model containing high leverage characteristics, R.

Liu et al. (

2018) also emphasized that China should make efforts to control the trend of excessively high residential sector leverage in recent years and keep the residential sector leverage stable in the process of promoting structural deleveraging. Later,

Lin et al. (

2021) theoretically analyzed the pricing relationship between asset price bubbles and financial leverage and found that under the premise of positive default probability, the rise in financial leverage leads to an increase in positive asset price bubbles. The NARDL model is also used to empirically analyze the long- and short-term asymmetric effects of subsectoral macro-leverage on China’s real estate price bubbles. The empirical results show that the negative adjustment of leverage in both the real economy and the financial sector will effectively suppress the continuous expansion of real estate price bubbles in the long run, but the “one-size-fits-all” counter-cyclical leverage adjustment is not conducive to the long-term stable operation of the real estate market, so a differentiated leverage regulation policy should be implemented. Based on this, F.

Zhang et al. (

2022) developed a DSGE model to investigate how monetary policy and macroprudential policy can coordinate to cope with the real estate market bubble and ensure the stable development of the real economy in the context of high corporate leverage. The study finds that although rising leverage can promote the growth of consumption, investment and output, it also brings deflation and rising housing prices, which are not conducive to the healthy development of the real economy in the long run. Therefore, when promoting economic deleveraging, the macro-prudential policy of using macro-leverage to peg house prices should be withdrawn in a timely manner, together with the price-based monetary policy of pegging inflation and house prices to achieve the purpose of promoting real economy investment and output growth while steadily reducing the real estate bubble.

Finally, since the air pollution problem is one of the common concerns of all human beings, more and more scholars at home and abroad have started to analyze its impact on the real estate market from the perspective of air quality prices. Based on the HPM model implementation that includes consumer theory (

Lancaster 1966) and implicit market theory (

Rosen 1974) to quantify air quality, some scholars (

Chasco and Gallo 2013; S.

Chen and Jin 2019) analyze the relationship between it and air quality from the housing sales market, stating that air quality data have a significant negative correlation with house prices. A small number of other scholars have focused on the rental market, such as

Hitaj et al. (

2018), who analyzed exploring the responses of renters to air quality. Based on the study by Hitaj et al., R.

Liu et al. (

2018) analyze which market is more affected by air quality by comparing the housing sales market and the rental market, using Chengdu as an example. Later, J.

Wang and Lee (

2021) build on previous studies to include consumer preferences for air quality in both markets and combine panel data from 283 Chinese prefecture-level cities to provide a more comprehensive understanding of residents’ preferences for air quality, noting that both the housing sales market and the rental market have a negative relationship with air quality, and that cleaner air can bring benefits to all residents, differences in air quality preferences across city tiers may be determined by local air quality conditions and socioeconomic status.

To sum up, the existing studies have, to some extent, provided a good analysis of the connection between economic fundamentals and the performance of the housing market, especially the relationship between government’s housing policy and housing market performance (

Ye and Wu 2008;

Chiu 2008). Their empirical results suggest that any improvement of fiscal and monetary policies could restrict speculative behavior in the real estate markets, stabilizing housing prices and leading to a more efficient allocation of national resources.

Our study contributes to the existing literature in the following aspects. First, this study constructs a mathematical model to study China’s urban real estate markets, in which there are different types of demands from house buyers and housing suppliers adopt the strategy of quality differentiation second-degree price discrimination. Previous literature regarding the China’s housing market is generally either quantitative analysis or case study; few published studies have provided a theoretical analysis of China’s housing market from the demand side and supply side. Second, this study introduces a policy scheme to achieve “houses built for inhabitance” in China’s cities from the perspectives of “speculation limitation” and “price control”. We also conduct a numerical analysis to consider the macroeconomic effects of these two policy solutions on the housing market. Such findings help to enrich the literature of both housing market regulation specifically, and housing market in general.

5. Policy Suggestion

As analyzed in the last section, the main problem in China’s real estate markets is caused by a lack of speculation control. As speculative behavior becomes increasingly dominant in the real estate market in large cities, the developers (supported by local governments) expend more economic resources on real property speculation without giving back any real returns to society. The misallocation of economic resources is an important cause of China’s economy slowing down over the last few years.

In terms of macroeconomic theory, to ensure China’s economic growth and economic development and create harmony in Chinese society, responsible policy makers must introduce effective measures to restrict speculative behavior in the real property markets.

5.1. Restriction on Speculation

As mentioned above, the speculation activity in the real estate markets is rooted in the expectation of rocketing prices leading to great profit from reselling. When the prices are under a degree of control, the expectation for high profit from reselling will no longer be realistic, and the speculative behavior will be under control. As a result, buying an apartment, whether high end or low end, will be primarily for dwelling.

We now revisit the case of second-degree price discrimination, but with government policy implementation added.

There are several available options from which the policy maker can choose. No matter which option is chosen, it must be implemented with taxation upon reselling. For simplicity, we assume that the taxation policy means that the reseller makes zero profit, and, therefore, buying for dwelling purposes dominates in the real property market.

Option 1. No other intervention other than the reselling tax.

In this case, the government imposes a higher amount of reselling-tax, i.e.,

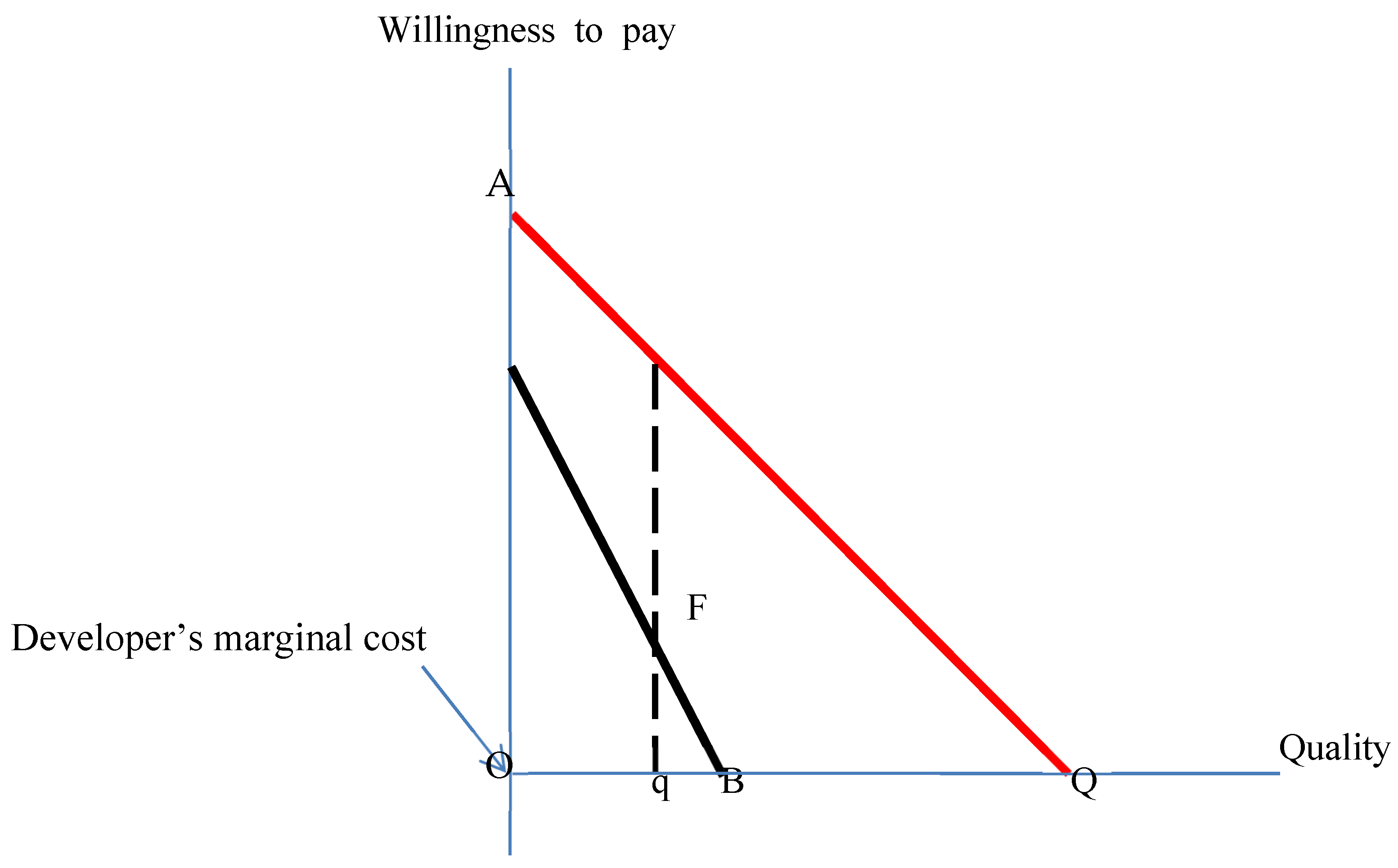

, for real estate so that speculators cannot make excessive profits. The market is very much the same as in

Section 3.3. The developers offer different quality apartments to meet the different types of demand. As shown in the graph below, lower-end customers will purchase lower-end apartments for dwelling, paying a price equal to the area of the quadrilateral

AOqF, enjoying zero economic surplus; higher-end customers will purchase higher-end apartments for dwelling, paying a price equal to the sum of the area of the quadrilateral

AOqF and that of the triangle

EqQ, enjoying an economic surplus equal to the area of the quadrilateral

CAFE. (Refer to

Figure 3 above).

From the graph, one can check that the pricing is consistent with the self-selection criterion: by buying the higher-end apartments, the high-end customers do not enjoy less of an economic surplus than they would if they bought the lower-end apartments.

That the decision of the developer is profit-maximized can be verified by the marginal condition, as explained below. Imagine that the developer, instead of building the lower-end apartments with a quality of

q, builds these apartments with quality

q+dq. Then, his additional surplus becomes:

This equals to zero if and only if the producer surplus is maximized.

5.2. Price Control

We assume that the government can distinguish a poorer buyer from a richer one through knowledge of their family income (and wealth). There will be an available option from which the policy maker can choose, ensuring that the goal that “houses are built to be inhabited” can be reached.

Option 2. The government builds the lower-end houses, either selling or renting to the poorer with subsidies (S), and leaves the supply of higher-end houses to the developers in the private sector, while charging selling taxes,

In this option, the government builds the lower-end apartments according to the low-income buyer’s demand for quality (as represented by |OB| in the graph) and sells at a price just equal to the building costs, leaving the supply of high-end apartments to the private developers. As is shown in

Figure 6, a government supplier develops apartments with a quality equal to that at point C, selling them at a price equal to the building costs

, leaving the low-income buyer with an economic surplus equal to the triangle

OAC. A private sector developer develops apartments with a quality equal to that at point C’, charging a price equal to the triangle

A’

O’

C’ plus the building costs

, leaving no surplus at all to the buyer. In addition, in the case in which the government notices that the quality of the low-end apartments is too low compared to the high-end ones, the government could build higher quality apartments for those poorer families by charging a price below the building costs (subsidizing the poorer) while levying a specific tax upon the private developer. We will explain this option in more detail in

Section 6.

5.3. A Comparison between the Two Options

It is clear that option 1 is more favorable to those who can afford higher-end apartments, because they enjoy a positive economic surplus; at the same time, the lower-end apartment buyers have zero surpluses, and, usually, the apartments they can purchase do not meet the quality that they demanded. Therefore, we may refer to this option as pro-rich, as is the case in the real estate markets in Hong Kong that we already mentioned.

Option 2, on the other hand, is based on a pro-poor policy. In this option, higher-end apartment buyers end up with zero surpluses, yet lower-end buyers can buy an apartment that satisfies their demand for quality. Furthermore, those with incomes below the threshold can enjoy government subsidies. This is the situation, to some extent, in Singapore. Actually, most of the lower-income families own their apartments, of which the quality and space are comparable, if not better than, those owned by the middle-income class in Hong Kong.

6. A Numerical Analysis

To explain the above-mentioned two schemes, we consider a simple example in this section. Let us assume that there are two types of house buyers, the poorer and the richer, and their demands for housing quality are given by the demand equations below:

Here, the variable y represents the “price of quality” marked up above the supplier’s marginal cost. Assume that a speculator expects the annual inflation rate in the housing market to be = 10%, and the consumer price index to be = 105%. So, as mentioned above, in the absence of government intervention, the property speculation market will dominate, and the low-end housing market will eventually collapse.

If the government levies a resale tax in the high-end housing market, any seller who sells their own high-end housing after the K-year purchase must pay a tax that is equivalent to the following fees:

Therefore, in this case, all speculators will find that speculation on real estate will not generate excess profits. In turn, the housing speculation will be well limited, which could ensure that “houses are built to be inhabited but not for speculation”.

Suppose the demand side of the real estate market consists of 300 low-end buyers and 100 high-end buyers. In option 1, note that the quality for a high-end apartment or house is 2000, and the important step is to compute the quality

q of apartments designed by the developer. With the help of

Figure 5, we can compute:

Let us also assume the MC = 1000 in this example. Thus, we can calculate that the price for a low-end apartment (the area of quadrilateral OqFA plus the developer’s costs) is USD 367,339 + USD 571.4*(1000) = USD 938,739, and that the price for a high-end apartment (the area of the triangle OQC minus the area of the quadrilateral AFEC plus developer’s costs) is USD 1,183,698 + USD 2000*(1000) = USD 3,183,698.

In option 2, as the private sector’s real estate developer is the sole seller of high-end housing, he/she will charge a price equal to the area of the triangle A’O’C’ plus the costs, thereby exploiting the full economic surplus. The sale price of high-end apartments is 0.5*(2000)*(1600) + 2000*(1000) = USD 3,600,000.

On the other hand, the government supplier builds low-end apartments with a quality equal to 800, selling to the poorer buyers at a price equal to a building cost of 800*($1000) = USD 800,000.

Suppose that the government regards the low-end apartment quality of 800 is too low compared with the high-end apartment quality of 2000; if so, the government may, for example, build low-end apartments of quality 1200 but sell to the poorer family at a price of USD 800,000. As a result, the total subsidy given up in the low-end market is 300 * (1200 − 800) * (USD 1000) = USD 120,000,000. At the same time, the government can levy a specific tax upon the private developer, which equals to USD 1,200,000. As a result, the actual price received by the private developer for a high-end apartment is USD 2,400,000. Please note that, this actual price is still higher than the developer’s building cost of USD 2,000,000, leaving a net profit of USD 400,000 to him/her from each of the high-end apartments sold.

A comparison of two options shows that in option 2, poorer low-end housing consumers will pay lower prices for better quality housing, while the quality of the housing available to wealthier high-end housing consumers will not be reduced (although no surplus is left to them). Thus, for society, option 2 leads to better distribution of social welfare than does option 1. As mentioned above, we may call option 1 a pro-rich option, and option 2 a pro-poor option.

7. Conclusions and Discussion

The main findings of this paper are that the real property developer, as the monopolist, can choose first-degree price discrimination in the case of complete information, or, in the case of all potential buyers having the same demand, exploit the entire consumer surplus from each of his/her customers. Meanwhile, on the premise of incomplete information, where the real estate developer does not know the exact demands of a buyer, the real estate developer can introduce second-degree price discrimination. As shown in the results of the supply for real properties in the Chinese market, at some early stage, even in large cities, both low-end and high-end houses are available; however, as observed, the land prices grow, as do the prices of construction materials and labor costs. As a result, the variable costs of low-end houses will also rocket, and the equilibrium quality demanded for low-end houses will shrink; at some point, the developer will discover that profit is maximized by constructing only high-end houses, and the low-end market will disappear.

Furthermore, we present evidence that, for the same quality of housing, richer families may have a higher rating than poor families and be willing to pay higher prices. As illustrated by the results of characteristics of the demands for real properties in the Chinese market, as time passes, demands for high-end houses for speculation purposes increase; the speculators will buy the house with a zero surplus at the current stage because they expect the real price to grow at the next stage, and they will then earn a real profit in the future. This process continues repeatedly for any stage in which the speculators expect that the house price will grow; these have been the dominant patterns in China’s real estate markets in the large cities, where the dwelling demands are almost completely neglected.

It is also demonstrated in this paper that the speculative market can remain active and the prices of houses can keep growing only when the current buyer expects the inflation rate of the real property price to be always higher than the CPI of the economy; this situation cannot be sustained forever because otherwise increasing percentages of national income and wealth will be expended in real estate speculation; another consequence of a long-term evolution of real estate speculation is that the speculators (the rich) become increasingly rich, and those who cannot afford to speculate become increasingly poor.

Last but not least, we emphasize that regulations such as resale tax and other measures of speculation restriction must be introduced in the housing market to redirect the housing market back to “building houses mainly for dwelling purposes”. We also suggest that the Chinese authorities should learn from Singapore’s experience in regulating the urban housing market so that most ordinary families can afford better quality housing.

In this paper, there are still some limitations that can be improved in future research. We mainly use numerical simulations to examine the impact of speculation restriction and price control schemes on housing market supply and demand, assuming that other influencing factors remain unchanged. It is difficult to test this empirically using market data, as subsidies for low-end housing and charging selling taxes for high-end housing (price control) and resale taxes (speculation restriction) have not yet been extended to relevant cities in China. We will continue to monitor the introduction of relevant policies and conduct further studies in the future.