The Behavioural Aspects of Financial Literacy

Abstract

1. Introduction

2. Literature Review

2.1. Financial Literacy

2.2. Behavioural Biases

3. Research Design

3.1. Questionnaire

3.2. Construction of Financial Literacy Scores

4. Empirical Results and Discussion

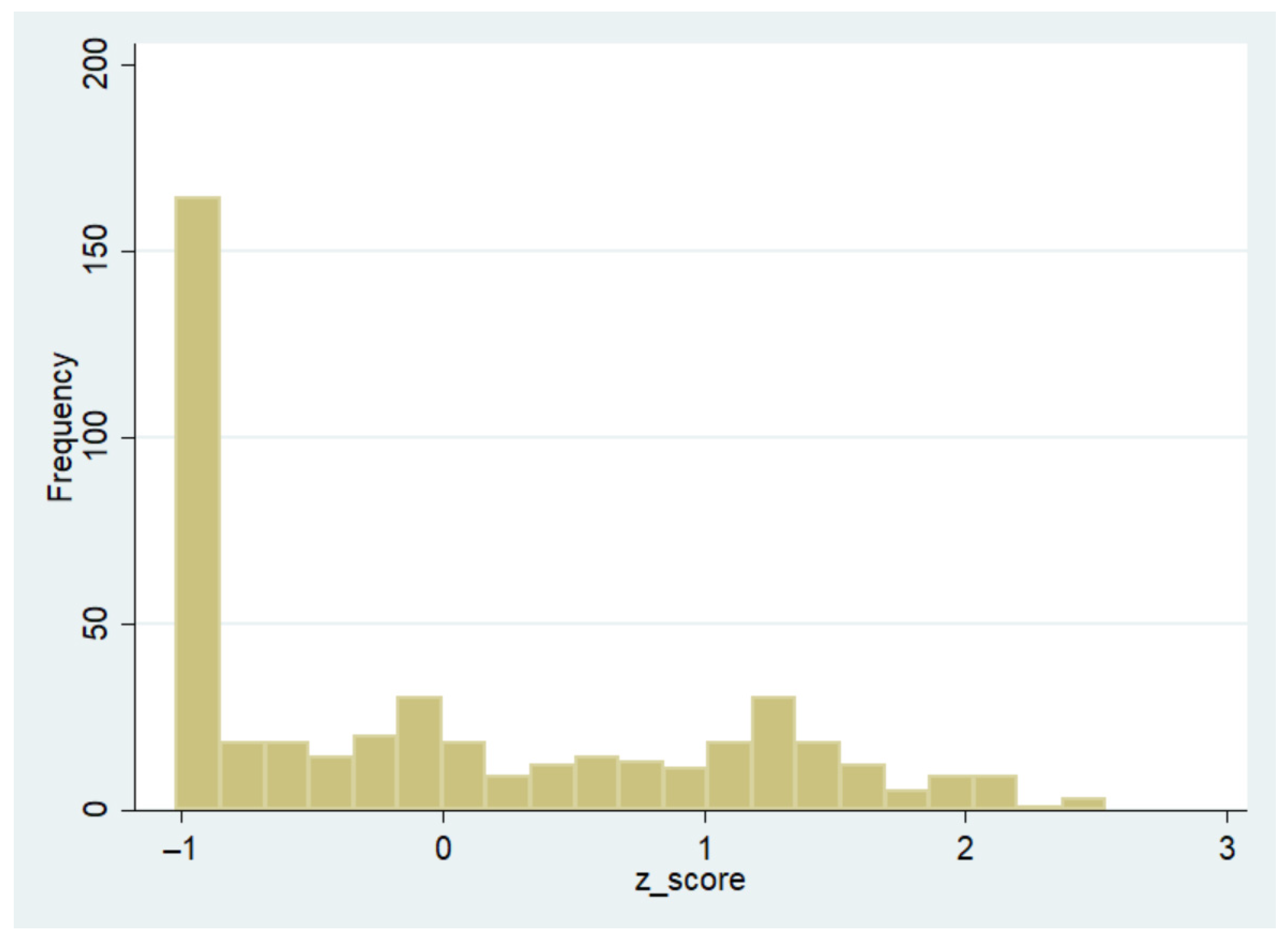

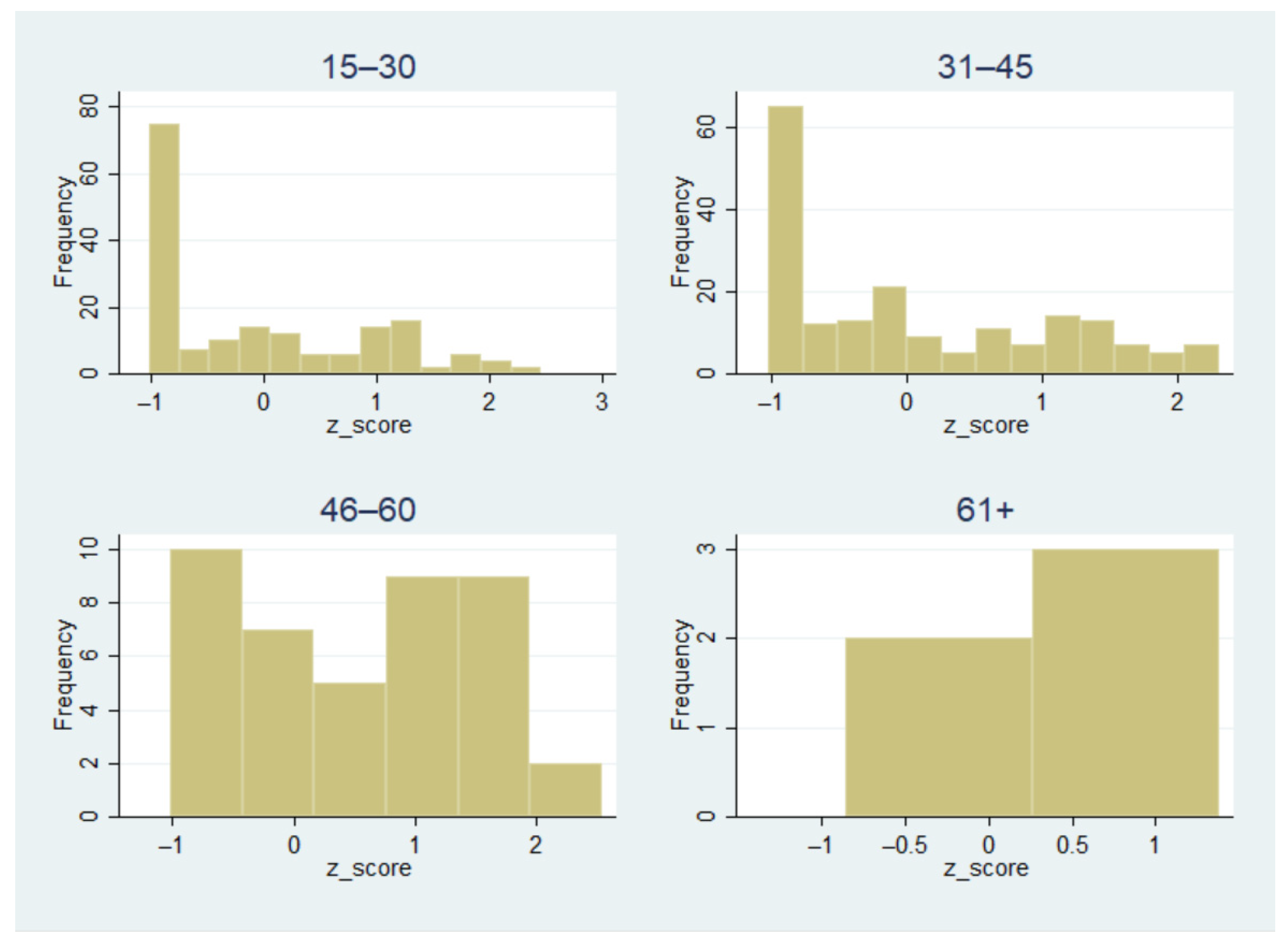

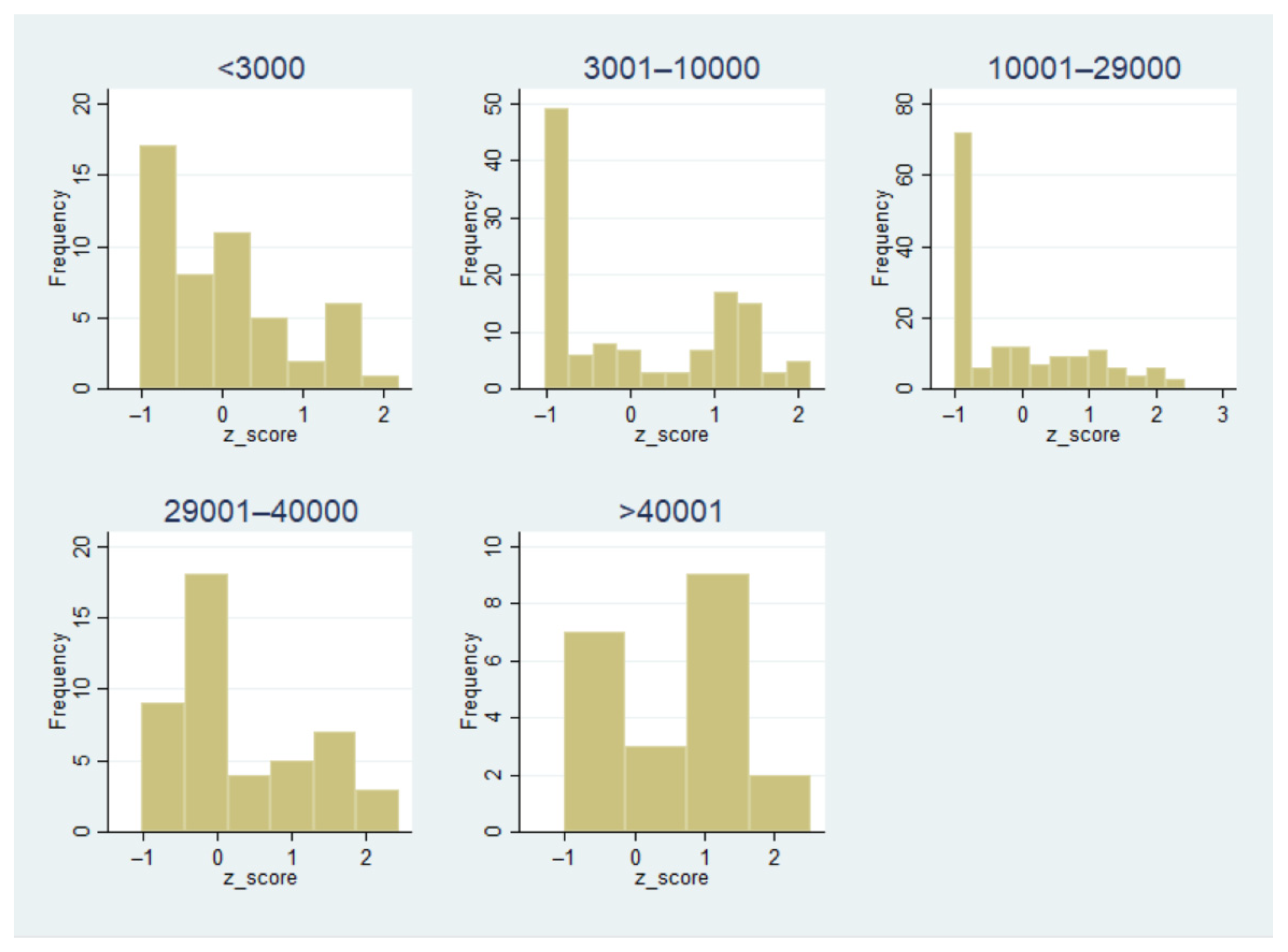

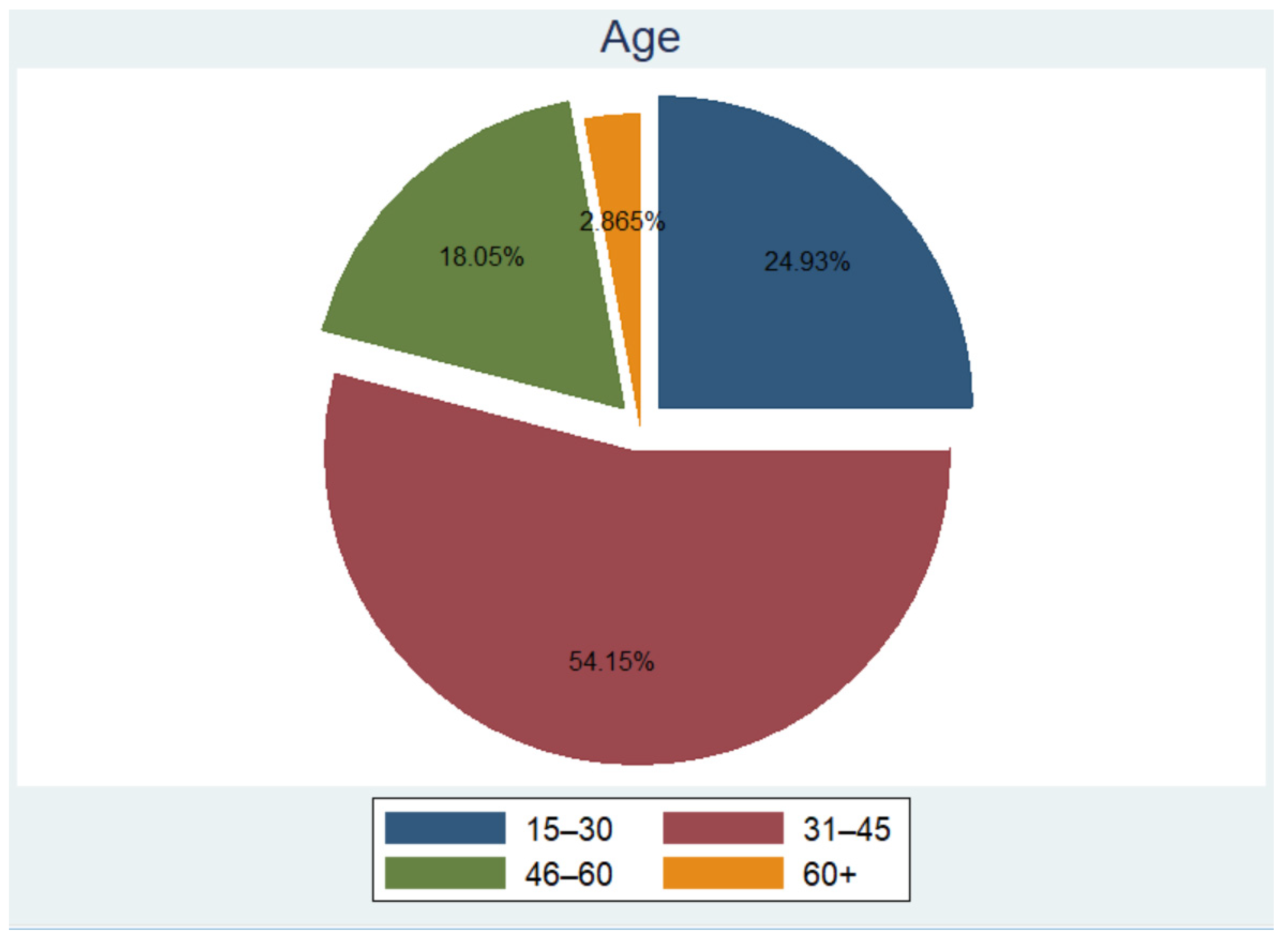

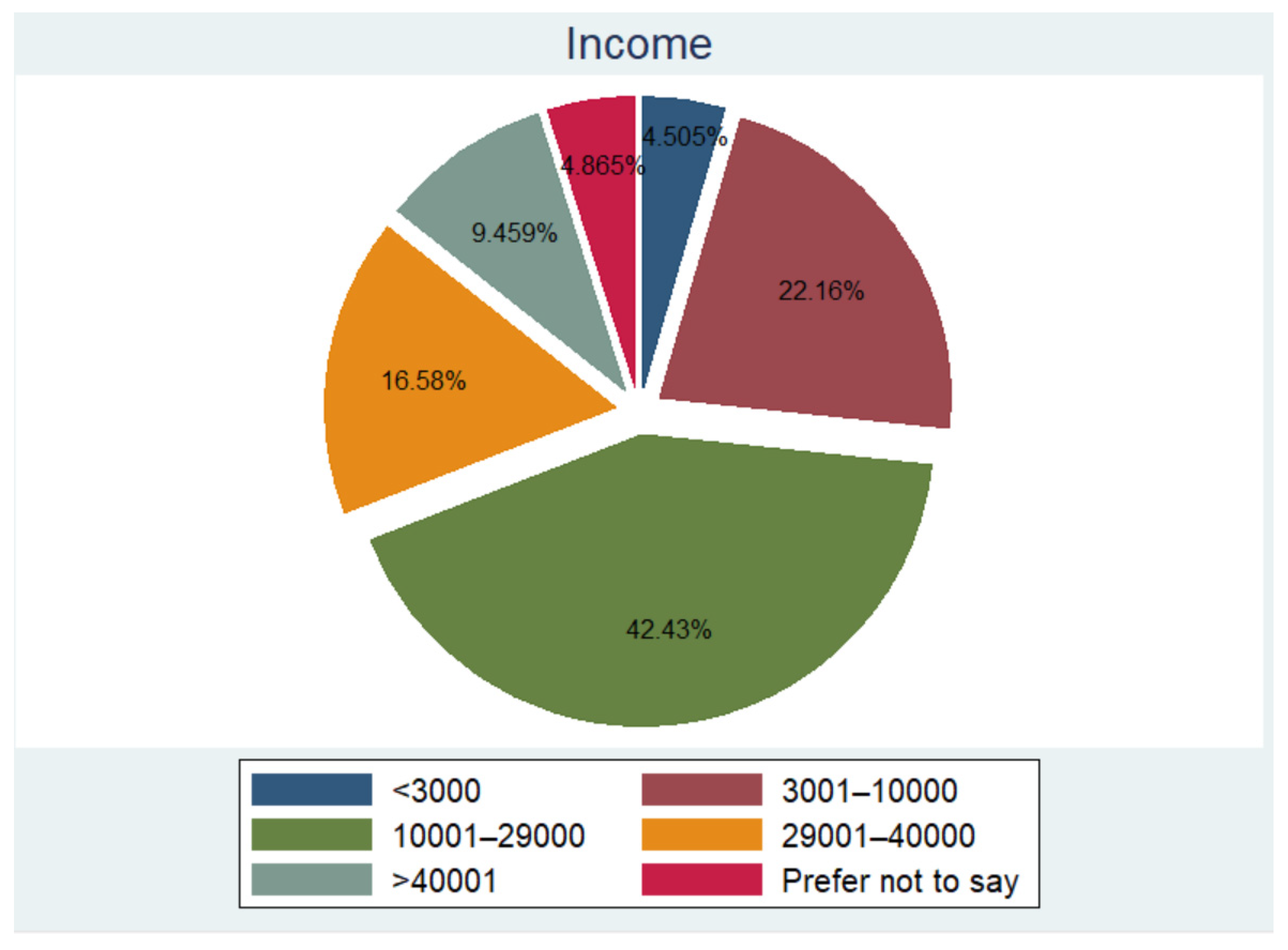

4.1. Descriptive Statistics

4.2. Empirical Evidence

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Coefficient | t-Statistics |

|---|---|---|

| Constant | −0.5629 *** | −4.92 |

| Hindsight bias | 0.7134 *** | 5.48 |

| Self-serving bias | 0.5527 ** | 2.47 |

| Overconfidence bias I | 0.1803 | 0.56 |

| Overconfidence bias II | 0.0495 | 0.19 |

| Loss aversion bias | 0.4569 *** | 3.72 |

| Representativeness bias | 0.5299 *** | 4.30 |

| GenderFemale | 0.0073 | 0.09 |

| Age31–45 | 0.0459 | 0.49 |

| Age46–60 | 0.3786 *** | 2.76 |

| Age60+ | 0.1822 | 0.47 |

| Income3001–10,000 | 0.0623 | 0.49 |

| Income10,001–29,000 | −0.0870 | −0.67 |

| Income29,001–40,000 | 0.0209 | 0.13 |

| Income+40,001 | −0.0773 | −0.31 |

| IncomePrefer not to say | 0.6349 * | 1.78 |

| 1 | Financial shock refers to any expense or loss of income that individuals or households do not plan for when budgeting (Pew Trust 2015). |

| 2 | For brevity, the questionnaire questions have not been included; however, they are available upon request from the authors. |

| 3 | Another paper that follows this method is the work by Morgan and Trinh (2019). The authors apply these calculations in order to find the determinants of financial literacy in Cambodia and Vietnam. |

| 4 | To construct the financial literacy score, the total sum of the questions for each category is added up. Consequently, the score might range from 0 (total financial ignorance) to 105 (total financial literacy). |

| 5 | Note that we have five different behavioural biases, but six different bias variables. The reason is that overconfidence can be captured through two different behavioural patterns. Therefore, we assign two different variables to it. |

| 6 | The regression model under Equation (1) might potentially suffer from reverse-causality. That is, there might be feedback effects coming from the independent to the dependent variable and back. In order to avoid such a problem, instrumental variable estimation might be used. The data obtained, unfortunately, do not allow us to construct instruments to control for such an issue. We leave this shortcoming to further research. |

| 7 | The reader should be cautious about the interpretation of the results. Regression modelling in its present form solely means a statistically robust relationship between variables. It does not refer to causality. We leave the issue of causality between the variables for further research. |

| 8 | To not duplicate the information given, we refrain from discussing the results represented by Table 2 and encourage the reader to study Section 4.2: Empirical Evidence. Furthermore, the control variable gender is not presented. The reason is that the variable is a dummy variable, and therefore numerical analysis as shown in Table 2 is meaningless. |

| 9 | For ease of interpretation and display, the control variables have been omitted from Table 3. They were, nonetheless, included in the model, Equation (1). Furthermore, the results have been estimated considering a heteroscedasticity-consistent variance-covariance matrix. |

| 10 | As a robustness test, the same model was estimated using the method-of-moments estimation technique. In order to do so, we assumed predeterminedness and the moment condition of non-stochastic covariates. The quantitative and qualitative results remain the same. |

References

- Agarwal, Sumit, Gene Amromin, Itzhak Ben-David, Souphala Chomsisengphet, and Douglas D. Evanoff. 2015. Financial literacy and financial planning: Evidence from India. Journal of Housing Economics 27: 4–21. [Google Scholar] [CrossRef]

- Agnew, Julie R., Hazel Bateman, and Susan Thorp. 2012. Financial Literacy and Retirement Planning in Australia. UNSW Australian School of Business Research Paper No. 2012ACTL16. Available online: https://ssrn.com/abstract=2198641 (accessed on 20 June 2021).

- Ameliawati, Meli, and Redianna Setiyani. 2018. The Influence of Financial Attitude, Financial Socialization, and Financial Experience to Financial Management Behavior with Financial Literacy as the Mediation Variable. Paper presented at the International Conference on Economics, Business and Economic Education 2018, Semarang, Indonesia, July 17–18; Dubai: KnE Publishing, pp. 811–32. [Google Scholar]

- ANZ Survey of Adult Financial Literacy in Australia. 2008. The Social Research Centre. Available online: https://www.anz.com/Documents/AU/Aboutanz/AN_5654_Adult_Fin_Lit_Report_08_Web_Report_full.pdf (accessed on 20 June 2021).

- Asbi, Ammar, Vikash Ramiah, Xi Yu, Damien Wallace, Nisreen Moosa, and Krishna Reddy. 2020. The determinants of recovery from the Black Saturday bushfire: Demographic factors, behavioural characteristics and financial literacy. Accounting and Finance 60: 15–46. [Google Scholar] [CrossRef]

- Atkinson, Adele, and Flore-Anne Messy. 2012. Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study. In OECD Working Papers on Finance, Insurance and Private Pensions Measuring Financial Literacy. Paris: OECD. [Google Scholar] [CrossRef]

- Babiarz, Patryk, and Cliff A. Robb. 2014. Financial Literacy and Emergency Saving. Journal of Family and Economic Issues 35: 40–50. [Google Scholar] [CrossRef]

- Baker, Kent H., Satish Kumar, Nisha Goyal, and Vidhu Gaur. 2019. How financial literacy and demographic variables relate to behavioral biases. Managerial Finance 45: 124–46. [Google Scholar] [CrossRef]

- Barber, Brad M., and Terrance Odean. 2000. Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. Journal of Finance LV: 772–806. [Google Scholar]

- Barberis, Nicholas, Andrei Shleifer, and Robert Vishny. 1998. A model of investor sentiment. Journal of Financial Economics 49: 307–43. [Google Scholar] [CrossRef]

- Bernasek, Alexandra, and Stephanie Shwiff. 2001. Gender, risk, and retirement. Journal of Economic Issues 35: 345–56. [Google Scholar] [CrossRef]

- Bernheim, B. Douglas, and Daniel M. Garrett. 2003. The effects of financial education in the workplace: Evidence from a survey of households. Journal of Public Economics 87: 1487–519. [Google Scholar] [CrossRef]

- Bezhani, Ivoni. 2010. Intellectual capital reporting at UK universities. Journal of Intellectual Capital 11: 179–207. [Google Scholar] [CrossRef]

- Bianchi, Milo. 2018. Financial literacy and portfolio dynamics. Journal of Finance 73: 831–59. [Google Scholar] [CrossRef]

- Bryce, Mitchell, Muhammad Jahangir Ali, and Paul R. Mather. 2021. Director expectations gap and hindsight bias. Accounting and Finance 61: 2965–96. [Google Scholar] [CrossRef]

- Bucher-Koenen, Tabea, and Michael Ziegelmeyer. 2014. Once burned, twice shy? Financial literacy and wealth losses during the financial crisis. European Finance Review 18: 2215–46. [Google Scholar] [CrossRef]

- Camerer, Colin, Geroge Loewenstein, and Martin Weber. 1989. The Curse of Knowledge in Economic Settings: An Experimental Analysis. Journal of Political Economy 97: 1232–54. [Google Scholar] [CrossRef]

- Carpena, Fenella, Shawn Cole, Jeremy Shapiro, and Bilal Zia. 2019. The ABCs of financial education: Experimental evidence on attitudes, behavior, and cognitive biases. Management Science 65: 346–69. [Google Scholar] [CrossRef]

- Chelley-Steeley, Patricia L., Brian D. Kluger, and James M. Steeley. 2015. Earnings and hindsight bias: An experimental study. Economics Letters 134: 130–32. [Google Scholar] [CrossRef][Green Version]

- Chen, Gongmeng, Kenneth A. Kim, John R. Nofsinger, and Oliver M. Rui. 2007. Trading Performance, Disposition Effect, Overconfidence, Representativeness Bias, and Experience of Emerging Market Investors. Journal of Behavioral Decision Making 20: 425–51. [Google Scholar] [CrossRef]

- Chowk, Girija, Vikash Ramiah, and Imad Moosa. 2016. Behavioural biases of Australian financial planners. Paper presented at 23rd Annual Conference of the Multinational Finance Society, Stockholm, Sweden, June 26–29. [Google Scholar]

- Clare, Ross. 2013. Equity and Superannuation—The Real Issues. Canberra: Association of Superannuation Funds of Australia. [Google Scholar]

- Clark, Gordon L., Maurizio Fiaschetti, and Paul Gerrans. 2019. Determinants of seeking advice within defined contribution retirement savings schemes. Accounting and Finance 59: 563–91. [Google Scholar] [CrossRef]

- Daniel, Kent, David Hirshleifer, and Avanidhar Subrahmanyam. 1998. Investor psychology and security market under- and overreactions. Journal of Finance 53: 1839–86. [Google Scholar] [CrossRef]

- Delpachitra, Sarath, and Diana Beal. 2002. Factors influencing planning for retirement. Economic Papers: A Journal of Applied Economics and Policy 21: 1–13. [Google Scholar] [CrossRef]

- Fernandez, Prafula. 2007. The benefits of simplified superannuation reform. The Agricultural Industry 9: 1–9. [Google Scholar]

- Finch, Nigel. 2005. The trouble with MER: The disclosure of fees and charges in Australian superannuation and investment funds. Journal of Law and Financial Management 4: 32–50. [Google Scholar]

- Fischhoff, Baruch. 1975. Hindsight is not equal to foresight: The effect of outcome knowledge on judgment under uncertainty. Journal of Experimental Psychology: Human Perception and Performance 1: 288–99. [Google Scholar] [CrossRef]

- Fischhoff, Baruch, and Ruth Beyth. 1975. I knew it would happen: Remembered probabilities of once-future things. Organizational Behavior and Human Performance 13: 1–16. [Google Scholar] [CrossRef]

- Frank, Jerome D. 1935. Some psychological determinants of the level of aspiration. American Journal of Psychology 47: 285–93. [Google Scholar] [CrossRef]

- Fry, Tim, Richard Heaney, and Warren McKeown. 2007. Will investors change their superannuation fund given the choice? Accounting and Finance 47: 267–83. [Google Scholar] [CrossRef]

- Gallery, Natalie. 2002. Superannuation fund choice: Opening Pandora’s Box. Australian Review of Public Affairs, September 5. [Google Scholar]

- Gerth, Florian, Vikash Ramiah, Elissar Toufaily, and Glenn Muschert. 2021. Assessing the effectiveness of Covid-19 financial product innovations in supporting financially distressed firms and households in the UAE. Journal of Financial Services Marketing, 1–11. [Google Scholar] [CrossRef]

- Grable, John E., and So-Hyun Joo. 2001. A further examination of financial help-seeking behaviour. Journal of Financial Counselling and Planning 12: 55–66. [Google Scholar]

- Greer, Thomas V., Nuchai Chuchinprakarn, and Sudhindra Seshadri. 2000. Likelihood of participating in mail survey research: Business respondents’ perspectives. Industrial Marketing Management 29: 97–109. [Google Scholar] [CrossRef]

- Grether, David M. 1980. Bayes rule as a descriptive model: The representativeness heuristic. Quarterly Journal of Economics 95: 537–57. [Google Scholar] [CrossRef]

- Guthrie, Chris. 2003. Prospect Theory, Risk Preference, and the Law. Northwestern University Law Review 97: 1115–63. [Google Scholar] [CrossRef]

- Ingles, David. 2009. The Great Superannuation Tax Concession Rort. The Australia Institute for a Just, Sustainable, Peaceful Future. Available online: https://www.tai.org.au/sites/default/files/super_tax_concessions_final_7.pdf (accessed on 5 June 2021).

- Jefferson, Therese. 2005. Women and retirement incomes in Australia: A review. Economic Record 81: 273–91. [Google Scholar] [CrossRef]

- Jonsson, Sara, Inga-Lill Söderberg, and Mats Wilhelmsson. 2017. An investigation of the impact of financial literacy, risk attitude, and saving motives on the attenuation of mutual fund investors’ disposition bias. Managerial Finance 43: 282–98. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Amos Tversky. 1972. Subjective probability: A judgment of representativeness. Cognitive Psychology 3: 430–54. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Amos Tversky. 1979. Prospect theory: An analysis of decision under risk. Econometrica 47: 263–91. [Google Scholar] [CrossRef]

- Kiymaz, Halil, Belma Öztürkkal, and K. Ali Akkemik. 2016. Behavioral biases of finance professionals: Turkish evidence. Journal of Behavioral and Experimental Finance 12: 101–11. [Google Scholar] [CrossRef]

- Klapper, Leora, Annamaria Lusardi, and Georgios A. Panos. 2013. Financial literacy and its consequences: Evidence from Russia during the financial crisis. Journal of Banking and Finance 37: 3904–23. [Google Scholar] [CrossRef]

- Lin, Xi, Aaron Bruhn, and Jananie William. 2019. Extending financial literacy to insurance literacy: A survey approach. Accounting and Finance 59: 685–713. [Google Scholar] [CrossRef]

- Linsky, Arnold S. 1975. Stimulating responses to mailed questionnaires: A review. Public Opinion Quarterly 39: 82–101. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2007. Financial literacy and retirement preparedness: Evidence and implications for financial education. Business Economics 42: 35–44. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011. Financial literacy and retirement planning in the United States. Journal of Pension Economics and Finance 10: 509–25. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, and Geoffrey Tate. 2008. Who makes acquisitions? CEO overconfidence and the market’s reaction. Journal of Financial Economics 89: 20–43. [Google Scholar] [CrossRef]

- Mezulis, Amy H., Lyn Y. Abramson, Janet Hyde, and Benjamin L. Hankin. 2004. Is there a universal positivity bias in attributions? A meta-analytic review of individual, developmental, and cultural differences in the self-serving attributional bias. Psychological Bulletin 130: 711–47. [Google Scholar] [CrossRef]

- Miller, Dale T., and Michael Ross. 1975. Self-serving biases in the attribution of causality: Fact or fiction? Psychological Bulletin 82: 213–25. [Google Scholar] [CrossRef]

- Mitchell, Olivia S., and Stephen P. Utkus, eds. 2004. Lessons from behavioural finance for retirement plan design. In Pension Design and Structure: New Lessons from Behavioural Finance. Oxford: Oxford University Press, pp. 3–42. [Google Scholar]

- MLC. 2012. Federal Budget Analysis. May 8, pp. 1–5. Available online: https://www.abc.net.au/news/specials/federal-budget-2012/2012-05-08/businesses-sidelined-in-federal-budget/3998986 (accessed on 1 July 2021).

- Morgan, Peter J., and Long Q. Trinh. 2019. Determinants and impacts of financial literacy in Cambodia and Viet Nam. Journal of Risk and Financial Management 12: 19. [Google Scholar] [CrossRef]

- Morling, Steven, and Robert Subbaraman. 1995. Superannuation and Saving. Research Discussion Paper RDP 9511. Sydney: Reserve Bank of Australia, Economic Research Department. [Google Scholar]

- Newell, Graeme. 2006. The Significance of the Property in Industry-Based Superannuation Funds in Australia. Paper presented at Pacific Rim Real Estate Society Conference, Auckland, New Zealand, January 22–26. [Google Scholar]

- Ng, Tuan-Hock, Woan-Ying Tay, Nya-Ling Tan, and Ying-San Lim. 2011. Influence of investment experience and demographic factors on retirement planning intention. International Journal of Business and Management 6: 196–203. [Google Scholar] [CrossRef]

- Noctor, Michael, Sheila Stoney, and Robert Stradling. 1992. Financial Literacy: A Discussion of Concepts and Competencies of Financial Literacy and Opportunities for Its Introduction into Young People’s Learning. Report prepared for the National Westminster Bank. London: National Foundation for Education Research. [Google Scholar]

- Noone, Jack, Fiona Alpass, and Christine Stephens. 2010. Do men and women differ in their retirement planning? Testing a theoretical model of gendered pathways to retirement preparation. Research on Aging 32: 715–38. [Google Scholar] [CrossRef]

- OECD. 2013. OECD/Info Toolkit to Measure Financial Literacy and Financial Inclusion: Guidance, Core Questionnaire and Supplementary Questions. Available online: http://www.oecd.org/finance/financial-education/Toolkit-to-measure-fin-lit-2013.pdf (accessed on 12 May 2021).

- OECD/INFE. 2015. OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion. Available online: https://www.oecd.org/daf/fin/financial-education/2015_OECD_INFE_Toolkit_Measuring_Financial_Literacy.pdf (accessed on 28 May 2021).

- The Pew Charitable Trust. 2015. The Role of Emergency Savings in Family Financial Security How Do Families Cope with Financial Shocks? Available online: https://www.pewtrusts.org/~/media/assets/2015/10/emergency-savings-report-1_artfinal.pdf (accessed on 10 July 2021).

- Pompian, Michael. 2006. Behavioral Finance and Wealth Management—How to Build Optimal Portfolios That Account for Investor Biases. Hoboken: John Wiley & Sons. [Google Scholar]

- Rabin, Matthew. 1998. Psychology and economics. Journal of Economic Literature 36: 11–46. [Google Scholar]

- Ramiah, Vikash. 2013. The impact of the Boxing Day tsunami on the world capital markets. Review of Quantitative Finance and Accounting 40: 383–401. [Google Scholar] [CrossRef]

- Ramiah, Vikash, Yilang Zhao, and Imad Moosa. 2014. Working capital management during the global financial crisis: The Australian experience. Qualitative Research in Financial Markets 6: 332–51. [Google Scholar] [CrossRef]

- Ramiah, Vikash, Yilang Zhao, Imad Moosa, and Michael Graham. 2016. A behavioural finance approach to working capital management. European Journal of Finance 22: 662–68. [Google Scholar] [CrossRef]

- Rice, Michael, and Ian McEwin. 2002. Superannuation Fees and Competition. Sydney: Phillips Fox Actuaries and Consultants, pp. 1–35. [Google Scholar]

- Rothman, George. 2003. Tax Advantages of Investment in Superannuation—In Bad Times as Well as Good. Paper presented at the Eleventh Annual Colloquium of Superannuation Researchers, Sydney, Australia, July 7–8. [Google Scholar]

- Rothman, George P. 2011. Projecting the adequacy of Australian retirement incomes. Paper presented at the Nineteenth Colloquium of Superannuation Researchers, Sydney, Australia, July 14–15. [Google Scholar]

- Shalev, Jonathan. 1997. Loss Aversion in a Multi-Period Model. Mathematical Social Sciences 33: 203–26. [Google Scholar] [CrossRef]

- Statista. 2021. United Arab Emirates 2021: Statista Country Report. Available online: https://www.statista.com/study/48490/united-arab-emirates/ (accessed on 25 May 2021).

- Sudman, Seymour, Norman M. Bradburn, and Norbert Schwarz. 1996. Thinking about Answers: The Application of Cognitive Processes to Survey Methodology. San Francisco: Jossey-Bass Publishers. [Google Scholar]

- Truell, Allen D., James E. Bartlett, and Melody W. Alexander. 2002. Response rate, speed, and completeness: A comparison of Internet-based and mail surveys. Behaviour Research Methods, Instruments, and Computers 34: 46–49. [Google Scholar] [CrossRef] [PubMed]

- Tversky, Amos, and Daniel Kahneman. 1974. Judgment under uncertainty: Heuristics and biases. Science 185: 1124–31. [Google Scholar] [CrossRef]

- van Rooij, Maarten C. J., Clemens J. M. Kool, and Menriette H. Prast. 2007. Risk-return preferences in the pension domain: Are people able to choose? Journal of Public Economics 91: 701–22. [Google Scholar] [CrossRef]

- van Rooij, Maarten C. J., Annamarie Lusardi, and Rob Alessie. 2011. Financial literacy and stock market participation. Journal of Financial Economics 101: 449–72. [Google Scholar] [CrossRef]

- Wood, Gordon. 1978. The knew-it-all-along effect. Journal of Experimental Psychology: Human Perception and Performance 4: 345–53. [Google Scholar] [CrossRef]

- Xue, Rui, Adrian Gepp, Terry J. O’Neill, Steven Stern, and Bruce J. Vanstone. 2019. Financial literacy amongst elderly Australians. Accounting and Finance 59: 887–918. [Google Scholar] [CrossRef]

- Yoong, Joanne, and Vera R. D. M. Ferreira. 2013. Improving Financial Education Effectiveness through Behavioural Economics: OECD Key Findings and Way Forward. Paris: OECD Publishing, vol. 1, pp. 1926–82. [Google Scholar]

- Zuckerman, Miron. 1979. Attribution of success and failure revisited, or: The motivational bias is alive and well in attribution theory. Journal of Personality 47: 245–87. [Google Scholar] [CrossRef]

| Gender | Income | Age | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bias | N | Male | Female | >3000 | 3000–10,000 | 10,001–29,000 | 29,001–40,000 | >40,000 | Prefer Not to Say | 15–30 | 31–45 | 46–60 | 61+ |

| Hindsight bias | 60 | 47 | 13 | 4 | 24 | 13 | 11 | 3 | 5 | 22 | 26 | 12 | 0 |

| Self-serving bias | 30 | 20 | 10 | 4 | 4 | 7 | 5 | 8 | 2 | 12 | 13 | 4 | 1 |

| Overconfidence bias I | 14 | 11 | 3 | 5 | 2 | 3 | 2 | 1 | 1 | 4 | 9 | 0 | 1 |

| Overconfidence bias II | 14 | 13 | 1 | 4 | 4 | 2 | 2 | 1 | 1 | 5 | 9 | 0 | 0 |

| Loss aversion bias | 180 | 113 | 67 | 20 | 51 | 65 | 25 | 12 | 7 | 66 | 87 | 22 | 5 |

| Representativeness bias | 177 | 110 | 67 | 22 | 55 | 62 | 22 | 12 | 4 | 65 | 86 | 23 | 3 |

| Variable | N | Mean | Median | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| score | 446 | 26.3 | 19.0 | 25.9 | 0 | 92 |

| scorez | 446 | 0 | −0.28 | 1.0 | −1.07 | 2.54 |

| Age | 446 | 33 | 38 | 10.5 | 29 | 65 |

| Income | 428 | 16,562 | 20,000 | 12,247 | 2000 | 55,000 |

| Hindsight Bias | Self-Serving Bias | Overconfidence Bias I | Overconfidence Bias II | Loss Aversion Bias | Representativeness Bias |

|---|---|---|---|---|---|

| 0.7134 | 0.5527 | 0.1803 | 0.0495 | 0.4569 | 0.5299 |

| (5.48 ***) | (2.47 **) | (0.56) | (0.19) | (3.72 ***) | (4.30 ***) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gerth, F.; Lopez, K.; Reddy, K.; Ramiah, V.; Wallace, D.; Muschert, G.; Frino, A.; Jooste, L. The Behavioural Aspects of Financial Literacy. J. Risk Financial Manag. 2021, 14, 395. https://doi.org/10.3390/jrfm14090395

Gerth F, Lopez K, Reddy K, Ramiah V, Wallace D, Muschert G, Frino A, Jooste L. The Behavioural Aspects of Financial Literacy. Journal of Risk and Financial Management. 2021; 14(9):395. https://doi.org/10.3390/jrfm14090395

Chicago/Turabian StyleGerth, Florian, Katia Lopez, Krishna Reddy, Vikash Ramiah, Damien Wallace, Glenn Muschert, Alex Frino, and Leonie Jooste. 2021. "The Behavioural Aspects of Financial Literacy" Journal of Risk and Financial Management 14, no. 9: 395. https://doi.org/10.3390/jrfm14090395

APA StyleGerth, F., Lopez, K., Reddy, K., Ramiah, V., Wallace, D., Muschert, G., Frino, A., & Jooste, L. (2021). The Behavioural Aspects of Financial Literacy. Journal of Risk and Financial Management, 14(9), 395. https://doi.org/10.3390/jrfm14090395