The Slow Death of Capital Protection

Abstract

1. Introduction

2. Data on Structured Products and Financial Markets

3. Results

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | This also explains why academic research in this field is often at a disadvantage, given the well-documented US bias regarding data in publications in top finance journals (Karolyi 2016). |

| 2 | Warrants have the same payoff as plain vanilla options, however, they are not traded on an option market, but instead on markets for structured products or over the counter. This means that they—like all other structured products—include an issuer risk: if the issuing company (usually bank) goes bankrupt, the invested money is usually lost, regardless of the development of the underlying asset. Warrants also have on average a longer time to expiration than options. |

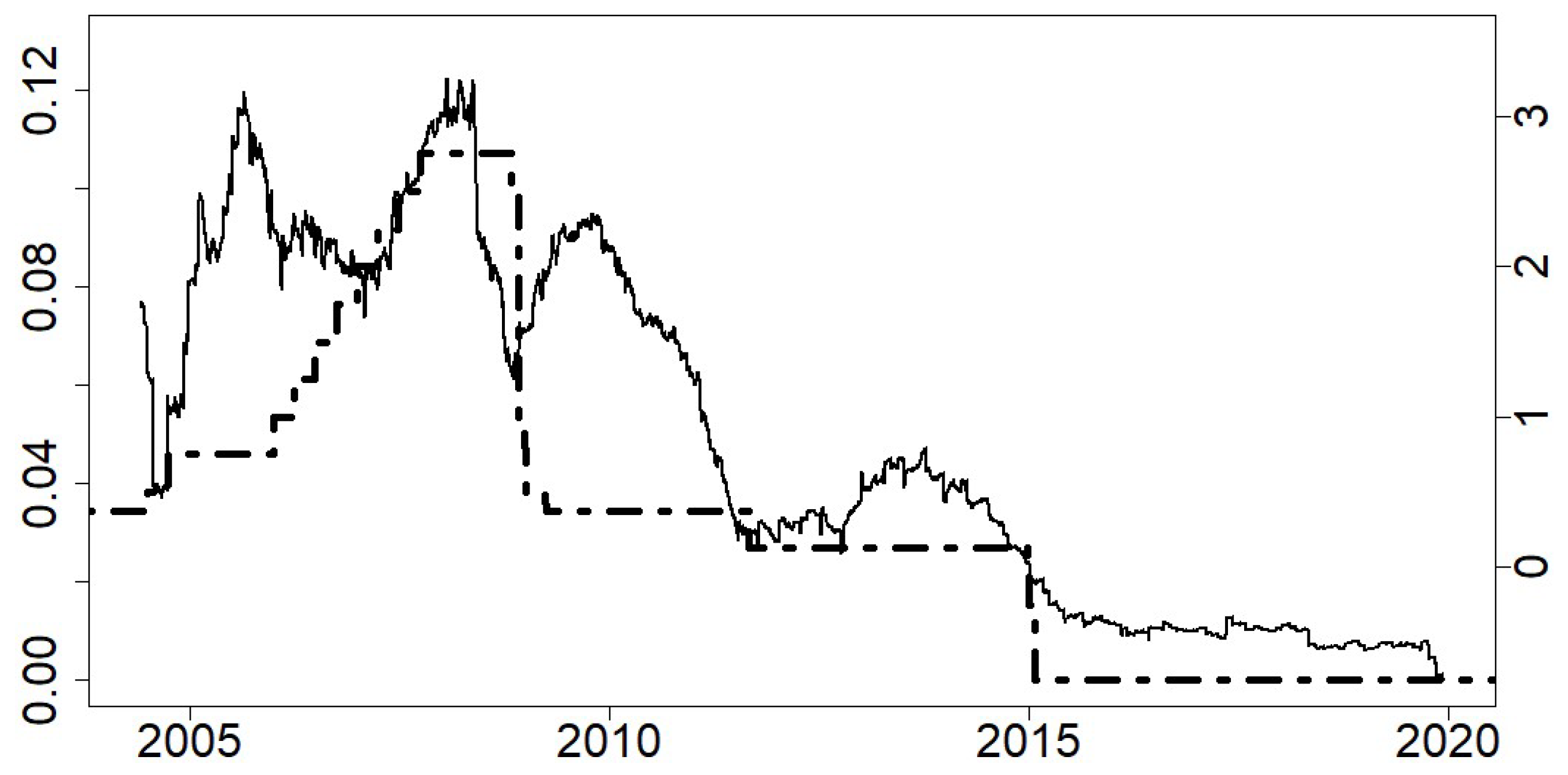

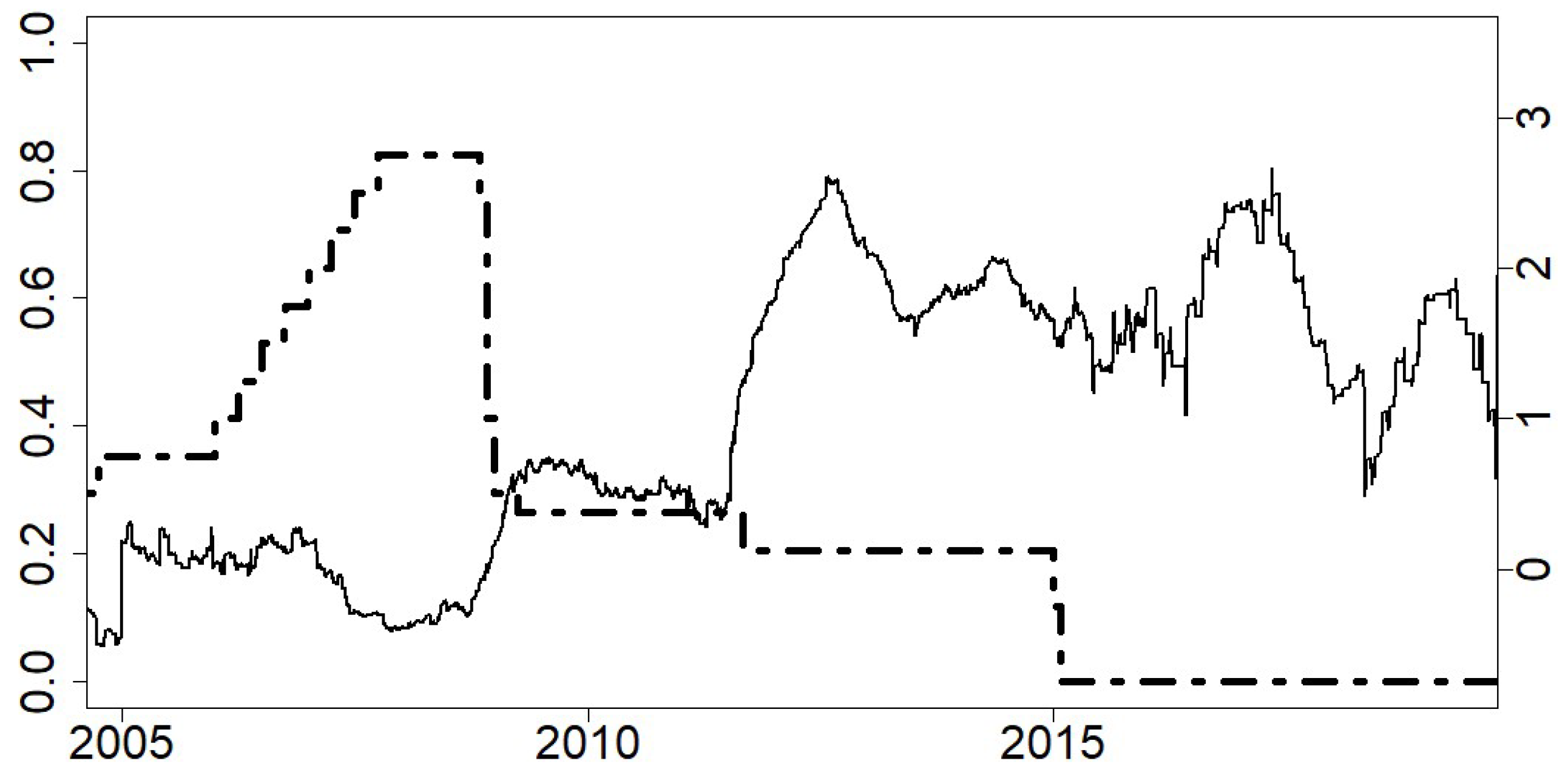

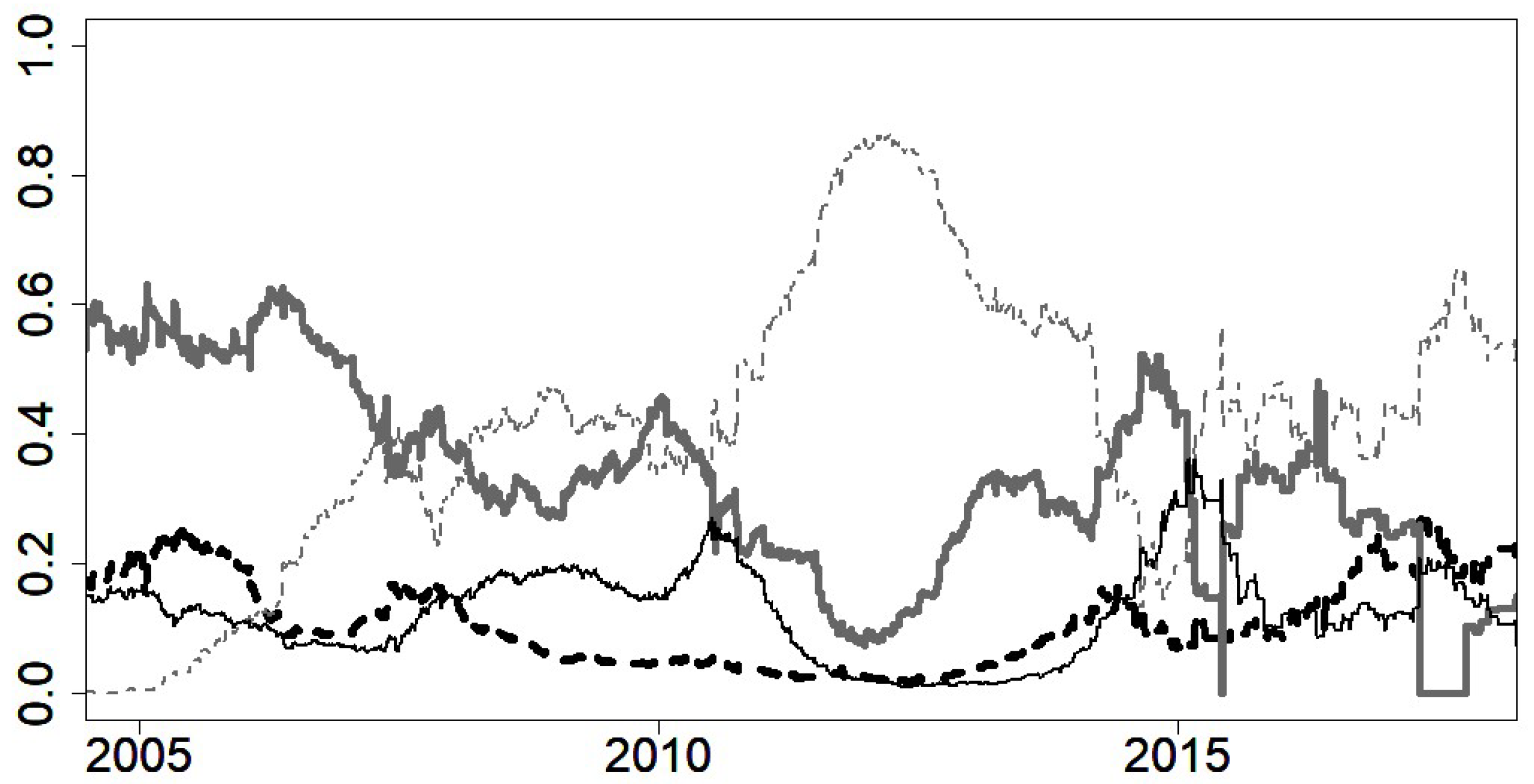

| 3 | Neither the interest rate nor the VIX have significant influence on the share of any of the subgroups of all structured products, except for the subgroup of capital protected products. Detailed results available from the authors. |

| 4 | The residuals for the OLS regressions showed leptokurtosis of 1.5 to 3.5 and excess kurtosis of 7 to 30 in 7 of 11 models presented in the results section. The Jarque–Bera test for normal distributed data yielded p-values below in 8 and the Breusch–Pagan test for heteroscedasticity p-values below 0.001 in 7 of the 11 models. |

References

- Abreu, Margarida, and Victor Mendes. 2018. The investor in structured retail products: Advice driven or gambling oriented? Journal of Behavioral and Experimental Finance 17: 1–9. [Google Scholar] [CrossRef]

- Anic, Vladimir, and Martin Wallmeier. 2020. Perceived attractiveness of structured financial products: The role of presentation format and reference instruments. Journal of Behavioral Finance 21: 78–102. [Google Scholar] [CrossRef]

- Benet, Bruce A., Antoine Giannetti, and Seema Pissaris. 2006. Gains from structured product markets: The case of reverse-exchangeable securities (RES). Journal of Banking and Finance 30: 111–32. [Google Scholar] [CrossRef]

- Branger, Nicole, and Beate Breuer. 2007. The Optimal Demand for Retail Derivatives. Working Paper. Münster: University of Münster. [Google Scholar]

- Breuer, Wolfgang, and Achim Perst. 2007. Retail banking and behavioral financial engineering: The case of structured products. Journal of Banking and Finance 31: 827–44. [Google Scholar] [CrossRef]

- Grünbichler, Andreas, and Hanspeter Wohlwend. 2005. The valuation of structured products: Empirical findings for the Swiss market. Financial Markets and Portfolio Management 19: 361–80. [Google Scholar] [CrossRef]

- Henderson, Brian J., and Neil D. Pearson. 2011. The dark side of financial innovation: A case study of the pricing of a retail financial product. Journal of Financial Economics 100: 227–47. [Google Scholar] [CrossRef]

- Hens, Thorsten, and Marc Oliver Rieger. 2014. Can utility optimization explain the demand for structured investment products? Quantitative Finance 14: 673–81. [Google Scholar] [CrossRef]

- Holzmeister, Felix, Jürgen Huber, Michael Kirchler, Florian Lindner, Utz Weitzel, and Stefan Zeisberger. 2020. What drives risk perception? A global survey with financial professionals and laypeople. Management Science 66: 3977–4002. [Google Scholar] [CrossRef]

- Karolyi, George Andrew. 2016. Home bias, an academic puzzle. Review of Finance 20: 2049–78. [Google Scholar] [CrossRef]

- Kunz, Alexis H., Claude Messner, and Martin Wallmeier. 2017. Investors’ risk perceptions of structured financial products with worst-of payout characteristics. Journal of Behavioral and Experimental Finance 15: 66–73. [Google Scholar] [CrossRef]

- Rieger, Marc Oliver. 2009. Optionen, Derivate und Strukturierte Produkte (Options, Derivatives and Structured Products). Stuttgart: Schäffer-Poeschel. [Google Scholar]

- Rieger, Marc Oliver. 2011. Co-monotonicity of optimal investments and the design of structural financial products. Finance and Stochastics 15: 27–55. [Google Scholar] [CrossRef]

- Rieger, Marc Oliver. 2012. Why do investors buy bad financial products? Probability misestimation and preferences in financial investment decision. Journal of Behavioral Finance 13: 108–18. [Google Scholar] [CrossRef]

- Rieger, Marc Oliver, and Thorsten Hens. 2012. Explaining the demand for structured financial products: Survey and field experiment evidence. Zeitschrift für Betriebswirtschaftslehre 82: 491–508. [Google Scholar] [CrossRef]

- Shefrin, Hersh, and Meir Statman. 1993. Behavioral aspects of the design and marketing of financial products. Financial Management 22: 123–34. [Google Scholar] [CrossRef]

- Shefrin, Hersh, and Meir Statman. 2000. Behavioral portfolio theory. Journal of Financial and Quantitative Analysis 35: 127–151. [Google Scholar] [CrossRef]

- Stoimenov, Pavel A., and Sascha Wilkens. 2005. Are structured products “fairly” priced? An analysis of the German market for equity-linked instruments. Journal of Banking and Finance 29: 2971–93. [Google Scholar] [CrossRef]

- Szymanowska, Marta, Jenke Ter Horst, and Chris Veld. 2009. Reverse convertible bonds analyzed. Journal of Futures Markets: Futures, Options, and Other Derivative Products 29: 895–919. [Google Scholar] [CrossRef]

- Tversky, Amos, and Daniel Kahneman. 1992. Advances in Prospect Theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5: 297–323. [Google Scholar] [CrossRef]

- Wallmeier, Martin, and Martin Diethelm. 2009. Market pricing of exotic structured products: The case of multi-asset barrier reverse convertibles in switzerland. The Journal of Derivatives 17: 59–72. [Google Scholar] [CrossRef][Green Version]

- Wilkens, Sascha, Carsten Erner, and Klaus Röder. 2003. The pricing of structured products—An empirical investigation of the German market. The Journal of Derivatives 11: 55–69. [Google Scholar] [CrossRef]

- Wilkens, Sascha, and Pavel A. Stoimenov. 2007. The pricing of leverage products: An empirical investigation of the German market for ‘long’ and ‘short’ stock index certificates. Journal of Banking and Finance 31: 735–50. [Google Scholar] [CrossRef]

- Zeisberger, Stefan. 2020. Do People Care about Loss Probabilities? Available at SSRN 2169394. Available online: https://ssrn.com/abstract=2169394 (accessed on 30 June 2021).

| Year | Number of Investment Products | Number of Capital Protected Products | Share in % |

|---|---|---|---|

| 2004 | 828 | 63 | 7.6% |

| 2005 | 3056 | 248 | 8.1% |

| 2006 | 6951 | 633 | 9.1% |

| 2007 | 17,394 | 1428 | 8.2% |

| 2008 | 22,845 | 2622 | 11.5% |

| 2009 | 17,891 | 1275 | 7.1% |

| 2010 | 30,203 | 2636 | 9.7% |

| 2011 | 23,587 | 1448 | 6.1% |

| 2012 | 20,899 | 590 | 2.8% |

| 2013 | 22,575 | 958 | 4.2% |

| 2014 | 22,790 | 820 | 3.6% |

| 2015 | 22,626 | 538 | 2.4% |

| 2016 | 7495 | 87 | 1.2% |

| 2017 | 11,010 | 109 | 1.0% |

| 2018 | 11,982 | 125 | 1.0% |

| 2019 | 13,179 | 91 | 0.7% |

| Dependent Variable: | |||

|---|---|---|---|

| CPP Share on All SP | Shares of Different Protection Levels among All CPPs | ||

| Full prot. | Partial prot. | ||

| (1) | (2) | (3) | |

| Swiss policy rate | 0.022 *** | 0.026 | −0.011 |

| (0.006) | (0.023) | (0.021) | |

| VIX | 0.001 | 0.006 *** | −0.005 *** |

| (0.001) | (0.002) | (0.002) | |

| Time | −0.00000 | −0.0001 *** | 0.0001 *** |

| (0.00000) | (0.00003) | (0.00003) | |

| Constant | 0.080 | 1.711 *** | −0.813 ** |

| (0.069) | (0.454) | (0.386) | |

| Observations | 188 | 183 | 183 |

| R | 0.537 | 0.289 | 0.244 |

| Adjusted R | 0.529 | 0.277 | 0.231 |

| Resid. Std. Error | 0.025 | 0.235 | 0.242 |

| (df = 184) | (df = 179) | (df = 179) | |

| Dependent Variable: | ||||

|---|---|---|---|---|

| Single | Index | Basket | Multi Asset | |

| (1) | (2) | (3) | (4) | |

| Swiss policy rate | 0.145 *** | 0.049 | 0.230 * | 0.228 *** |

| (0.021) | (0.042) | (0.135) | (0.065) | |

| VIX | 0.002 | 0.001 | −0.005 * | 0.016 *** |

| (0.003) | (0.001) | (0.003) | (0.003) | |

| Time | 0.00003 *** | 0.00002 ** | 0.0001 * | 0.0001 *** |

| (0.00001) | (0.00001) | (0.00004) | (0.00003) | |

| Constant | −0.441 ** | −0.329 * | −0.752 | −1.758 *** |

| (0.187) | (0.172) | (0.497) | (0.386) | |

| Observations | 188 | 226 | 207 | 188 |

| R | 0.499 | 0.132 | 0.196 | 0.330 |

| Adjusted R | 0.491 | 0.120 | 0.184 | 0.319 |

| Resid. Std. Error | 0.115 | 0.080 | 0.253 | 0.328 |

| (df = 184) | (df = 222) | (df = 203) | (df = 184) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bauer, C.; Rieger, M.O. The Slow Death of Capital Protection. J. Risk Financial Manag. 2021, 14, 303. https://doi.org/10.3390/jrfm14070303

Bauer C, Rieger MO. The Slow Death of Capital Protection. Journal of Risk and Financial Management. 2021; 14(7):303. https://doi.org/10.3390/jrfm14070303

Chicago/Turabian StyleBauer, Christian, and Marc Oliver Rieger. 2021. "The Slow Death of Capital Protection" Journal of Risk and Financial Management 14, no. 7: 303. https://doi.org/10.3390/jrfm14070303

APA StyleBauer, C., & Rieger, M. O. (2021). The Slow Death of Capital Protection. Journal of Risk and Financial Management, 14(7), 303. https://doi.org/10.3390/jrfm14070303