Volatility Spillover and International Contagion of Housing Bubbles

Abstract

1. Introduction

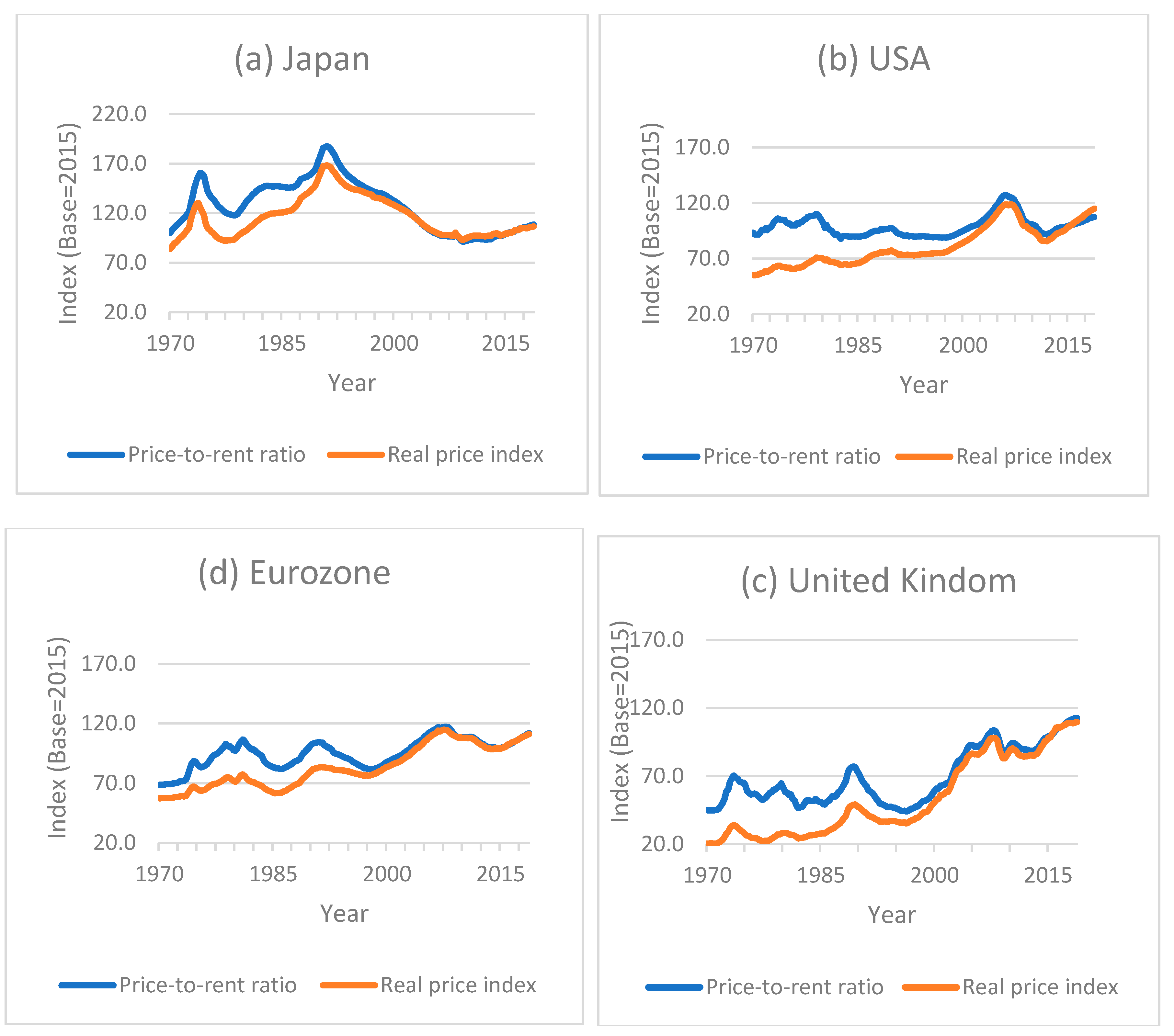

2. Data

3. Methodology

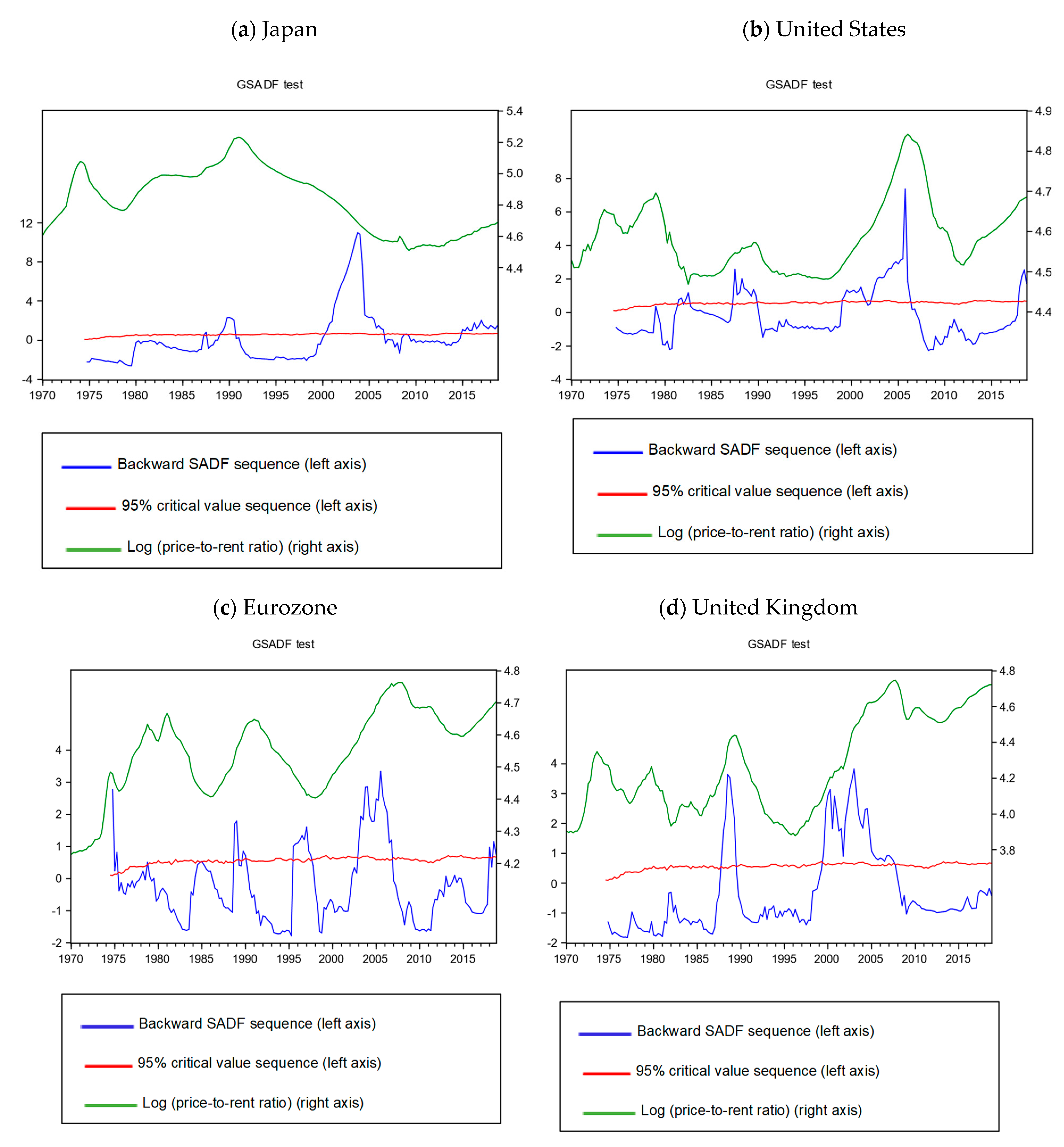

3.1. Test for Explosive Behavior and Bubble Episodes

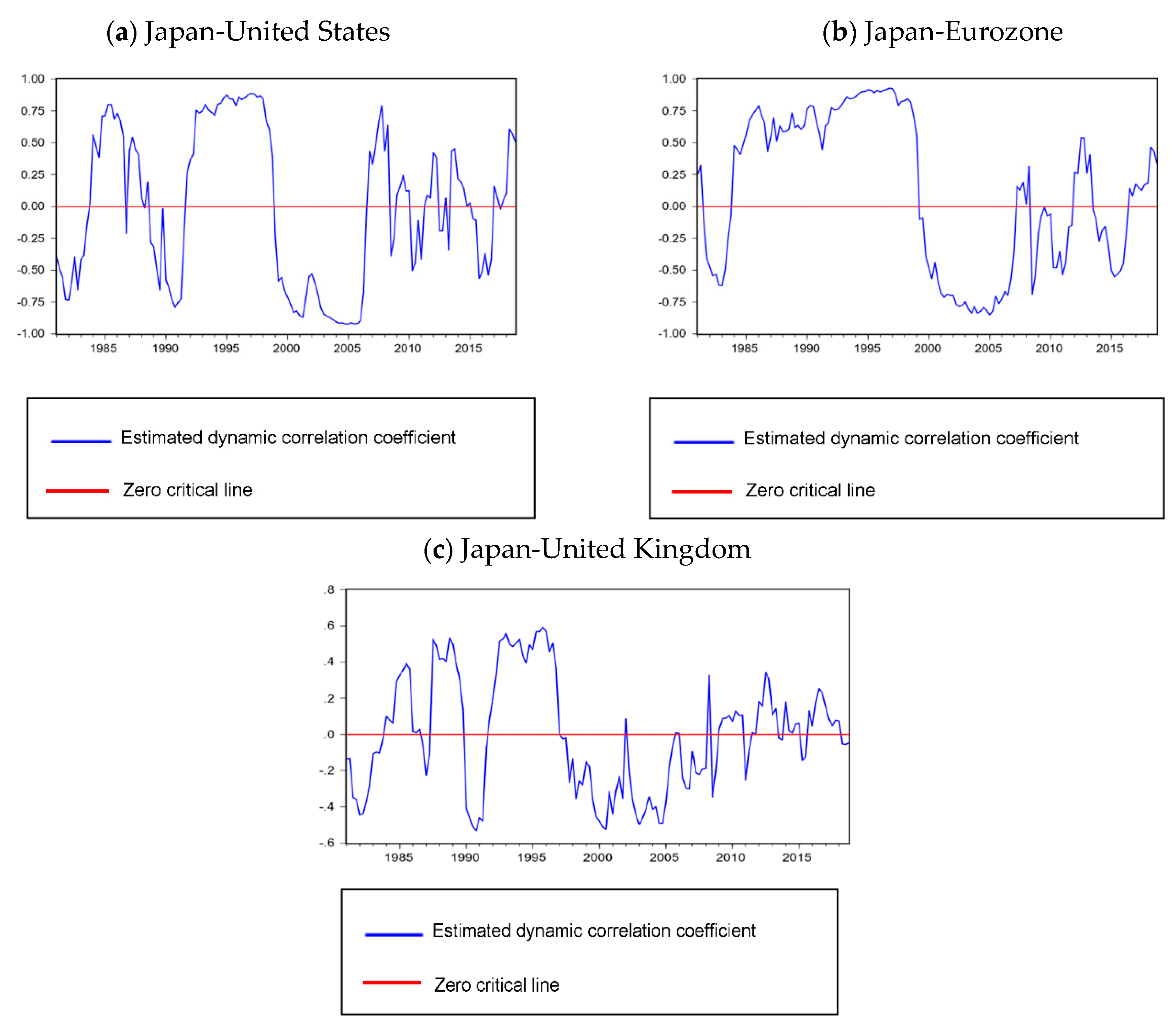

3.2. Multivariate DCC-GARCH Model for Volatility Spillover

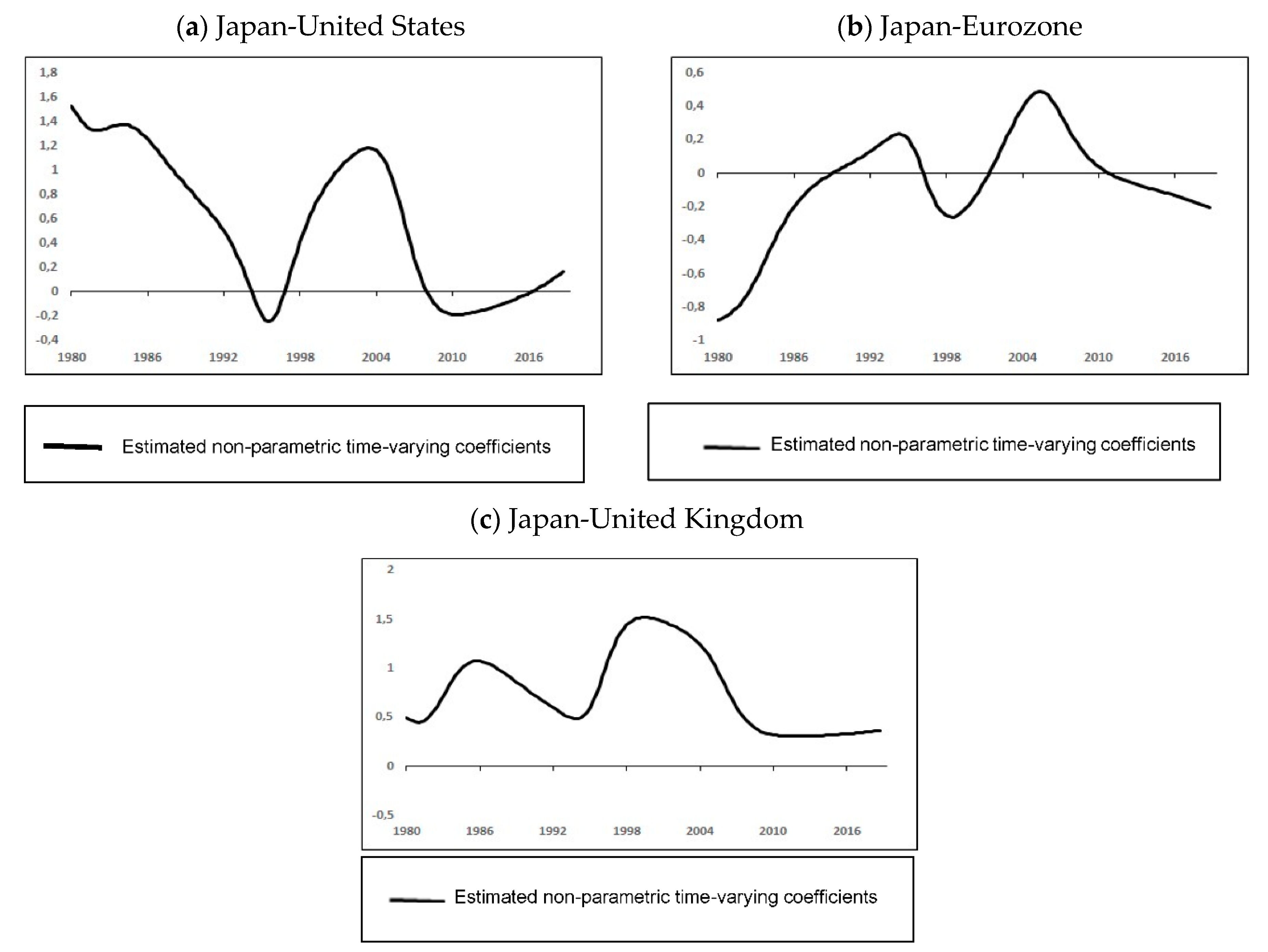

3.3. Non-Parametric Model with Time-Varying Coefficient for Bubble Contagion

4. Empirical Results

4.1. Bubble Detection

4.2. Price Volatility Spillover Effects

4.3. Bubble Contagion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

| 1 | |

| 2 | China is not included in our analysis because of insufficient data. |

| 3 | The OECD real estate price indexes measure the rate at which the prices of residential properties (flats, detached houses, terraced houses, etc.) purchased by households are changing over time. The data cover both new and existing dwellings, independently of their final use and their previous owners. Only market prices are considered. OECD also includes the price of the land on which residential buildings are located in the housing price index. |

References

- Agnello, Luca, and Ludger Schuknecht. 2011. Booms and busts in housing markets: Determinants and implications. Journal of Housing Economics 20: 171–90. [Google Scholar] [CrossRef]

- Akkoc, Ugur, and Irfan Civcir. 2019. Dynamic linkages between strategic commodities and stock market in Turkey: Evidence from SVAR-DCC-GARCH model. Resources Policy 62: 231–39. [Google Scholar] [CrossRef]

- Alter, Adrian, Jane Dokko, Mitsuru Katagiri, Romain Lafarguette, and Dulani Seneviratne. 2018. House Price Synchronization: What Role for Financial Factors. IMF Global Financial Stability Report. Washington: IMF. [Google Scholar]

- An, Jaehyung, Alexey Mikhaylov, and Ulf H. Richter. 2020. Trade War Effects: Evidence from Sectors of Energy and Resources in Africa. Heliyon 6: e05693. [Google Scholar]

- Bago, Jean-Louis, Imad Rherrad, Koffi Akakpo, and Ernest Ouédraogo. 2021. Real Estate Bubbles and Contagion: Evidence from Selected European Countries. Forthcoming. Review of Economic Analysis 13. Available online: https://openjournals.uwaterloo.ca/index.php/rofea/article/view/1823 (accessed on 10 March 2021).

- Bala, Dahiru A., and Taro Takimoto. 2017. Stock markets volatility spillovers during financial crises: A DCC-MGARCH with skewed-t density approach. Borsa Istanbul Review 17: 25–48. [Google Scholar] [CrossRef]

- Bloomberg. 2019. Global Insight: Where Is the Next Housing Bubble Brewing? Bloomberg Economics Report. New York: Bloomberg, July 15. [Google Scholar]

- Bollerslev, Tim, Robert F. Engle, and Jeffrey M. Wooldridge. 1988. A capital asset pricing model with time series varying covariance. Journal of Political Economy 96: 116–31. [Google Scholar] [CrossRef]

- Case, Karl E., and Robert J. Shiller. 2003. Is there a bubble in the housing market? Brookings Papers on Economic Activity 2003: 299–342. [Google Scholar] [CrossRef]

- Caspi, Itamar. 2017. Rtadf: Testing for bubbles with EViews. Journal of Statistical Software 81: 1–16. [Google Scholar]

- Celık, Sibel. 2012. The more contagion effect on emerging markets: The evidence of DCC-GARCH model. Economic Modelling 29: 1946–59. [Google Scholar] [CrossRef]

- Chen, Chien-Fu, and Shu-Hen Chiang. 2020. Time-varying spillovers among first-tier housing markets in China. Urban Studies 57: 844–64. [Google Scholar] [CrossRef]

- Chen, Shyh-Wei, and Zixiong Xie. 2017. Detecting speculative bubbles under considerations of the sign asymmetry and size non-linearity: New international evidence. International Review of Economics & Finance 52: 188–209. [Google Scholar]

- Cohen, Jeffrey P., and Jeffrey Zabel. 2020. Local house price diffusion. Real Estate Economics 48: 710–43. [Google Scholar] [CrossRef]

- Conrad, Christian, and Menelaos Karanasos. 2010. Negative volatility spillovers in the unrestricted ECCC-GARCH model. Econometric Theory 26: 838–62. [Google Scholar] [CrossRef]

- Corbet, Shaen, Charles James Larkin, Brian Lucey, and Larisa Yarovaya. 2019. KODAKCoin: A blockchain revolution or exploiting a potential cryptocurrency bubble? Applied Economics Letters 27: 518–24. [Google Scholar] [CrossRef]

- Deng, Yongheng, Eric Girardin, Roselyne Joyeux, and Shuping Shi. 2017. Did bubbles migrate from the stock to the housing market in China between 2005 and 2010? Pacific Economic Review 22: 276–92. [Google Scholar] [CrossRef]

- Dreger, Christian, and Yanqun Zhang. 2013. Is there a bubble in the Chinese housing market? Urban Policy and Research 31: 27–39. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Engsted, Tom, and Thomas Q. Pedersen. 2015. Predicting returns and rent growth in the housing market using the rent-price ratio: Evidence from the OECD countries. Journal of International Money and Finance 53: 257–75. [Google Scholar] [CrossRef]

- Engsted, Tom, Simon J. Hviid, and Thomas Q. Pedersen. 2016. Explosive bubbles in house prices? Evidence from the OECD countries. Journal of International Financial Markets, Institutions and Money 40: 14–25. [Google Scholar] [CrossRef]

- Flood, Robert P., and Robert J. Hodrick. 1990. On testing for speculative bubbles. Journal of Economic Perspectives 4: 85–101. [Google Scholar] [CrossRef]

- Fraser, Patricia, Martin Hoesli, and Lynn McAlevey. 2008. House prices and bubbles in New Zealand. The Journal of Real Estate Finance and Economics 37: 71–91. [Google Scholar] [CrossRef][Green Version]

- Garber, Peter M. 1990. Famous first bubbles. Journal of Economic Perspectives 4: 35–54. [Google Scholar] [CrossRef]

- Gelain, Paolo, and Kevin J. Lansing. 2014. House prices, expectations, and time-varying fundamentals. Journal of Empirical Finance 29: 3–25. [Google Scholar] [CrossRef]

- Gomez-Gonzalez, Jose Eduardo, Jair N. Ojeda-Joya, Catalina Rey-Guerra, and Natalia Sicard. 2015. Testing for bubbles in the Colombian housing market: A new approach. Desarrollo y Sociedad 75: 197–222. [Google Scholar] [CrossRef]

- Gomez-Gonzalez, Jose Eduardo, Juliana Gamboa-Arbeláez, Jorge Hirs-Garzón, and Andrés Pinchao-Rosero. 2018. When bubble meets bubble: Contagion in OECD countries. The Journal of Real Estate Finance and Economics 56: 546–66. [Google Scholar] [CrossRef]

- Greenaway-McGrevy, Ryan, and Peter C. B. Phillips. 2016. Hot property in New Zealand: Empirical evidence of housing bubbles in the metropolitan centres. New Zealand Economic Papers 50: 88–113. [Google Scholar] [CrossRef]

- Gürkaynak, Refet S. 2008. Econometric tests of asset price bubbles: Taking stock. Journal of Economic Surveys 22: 166–86. [Google Scholar] [CrossRef]

- Hafner, Christian M. 2020. Testing for bubbles in cryptocurrencies with time-varying volatility. Journal of Financial Econometrics 18: 233–49. [Google Scholar]

- Harvey, David I., Stephen J. Leybourne, and Yang Zu. 2020. Sign-based unit root tests for explosive financial bubbles in the presence of deterministically time-varying volatility. Economic Theory 36: 122–69. [Google Scholar] [CrossRef]

- Harvey, David I., Stephen J. Leybourne, Robert Sollis, and Robert A. M. Taylor. 2016. Tests for explosive financial bubbles in the presence of non-stationary volatility. Journal of Empirical Finance 38: 548–74. [Google Scholar] [CrossRef]

- Hirata, Hideaki, Ayhan Kose, Christopher Otrok, and Marco Terrones. 2013. Global House Price Fluctuations; Synchronization and Determinants (No. 2013/038). Washington: International Monetary Fund. [Google Scholar]

- Hu, Yang, and Les Oxley. 2018. Bubble contagion: Evidence from Japan’s asset price bubble of the 1980–90s. Journal of the Japanese and International Economies 50: 89–95. [Google Scholar] [CrossRef]

- Ito, Takatoshi, and Tokuo Iwaisako. 1995. Explaining Asset Bubbles in Japan. Technical report. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Katagiri, Mitsuru. 2018. House Price Synchronization and Financial Openness: A Dynamic Factor Model Approach. Washington: International Monetary Fund. [Google Scholar]

- Kholodilin, Konstantin A., Claus Michelsen, and Dirk Ulbricht. 2014. Speculative Price Bubbles in Urban Housing Markets in Germany. DIW Berlin Discussion Paper No. 1417. Berlin: German Institute for Economic Research. [Google Scholar]

- Kindleberger, Charles, and Robert Aliber. 2005. Manias, Panics, and Crashes, 5th ed. Hoboken: John Wiley & Sons. [Google Scholar]

- Kobayashi, Masahiro. 2016. The Housing Market and Housing Policies in Japan. Technical report. Tokyo: Asian Development Bank Institute. [Google Scholar]

- Kohn, Maximilian-Benedikt Herwarth, and Pedro L. Valls Pereira. 2017. Speculative bubbles and contagion: Analysis of volatility’s clusters during the DotCom bubble based on the dynamic conditional correlation model. Cogent Economics & Finance 5: 1411453. [Google Scholar]

- Lee, Bong-Soo. 1995. Fundamentals and bubbles in asset prices: Evidence from us and Japanese asset prices. Financial Engineering and the Japanese Markets 2: 89–122. [Google Scholar] [CrossRef]

- Mikhaylov, Alexey Yurievich. 2018. Pricing in Oil Market and Using Probit Model for Analysis of Stock Market Effects. International Journal of Energy Economics and Policy 8: 69–73. [Google Scholar]

- Monschang, Verena, and Bernd Wilfling. 2020. Sup-ADF-style bubble-detection methods under test. Empirical Economics, 1–28. [Google Scholar] [CrossRef]

- Nyangarika, Anthony Msafiri, Alexey Yurievich Mikhaylov, and Bao-jun Tang. 2018. Correlation of Oil Prices and Gross Domestic Product in Oil Producing Countries. International Journal of Energy Economics and Policy 8: 42–48. [Google Scholar]

- OECD. 2019. Housing Prices (Indicator). Available online: https://data.oecd.org/price/housing-prices.htm (accessed on 27 June 2019).

- Omrane, Walid Ben, and Christian M. Hafner. 2009. Information spillover, volatility and the currency markets. International Econometric Review 1: 47–59. [Google Scholar]

- Orskaug, Elisabeth. 2009. Multivariate DCC-GARCH Model with Various Error Distributions. Norway: Norwegian University of Science and Technology, Department of Mathematical Sciences. [Google Scholar]

- Panda, Ajaya Kumar, and Swagatika Nanda. 2018. Time-varying synchronization and dynamic conditional correlation among the stock market returns of leading South American economies. International Journal of Managerial Finance 14: 245–62. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Jun Yu. 2011. Dating the timeline of financial bubbles during the subprime crisis. Quantitative Economics 2: 455–91. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Shuping Shi, and Jun Yu. 2015. Testing for multiple bubbles: Historical episodes of exuberance and collapse in the S&P 500. International Economic Review 56: 1043–78. [Google Scholar]

- Phillips, Peter C. B., Yangru Wu, and Jun Yu. 2011. Explosive behavior in the 1990s Nasdaq: When did exuberance escalate asset values? International Economic Review 52: 201–26. [Google Scholar] [CrossRef]

- Rherrad, Imad, Jean-Louis Bago, and Mardochée Mokengoy. 2020. Real estate bubbles and contagion: New empirical evidence from Canada. New Zealand Economic Papers 58: 38–51. [Google Scholar] [CrossRef]

- Rherrad, Imad, Mardochér Mokengoy, and Landry Kuate Fotue. 2019. Is the Canadian Housing Market ‘Really’exuberant? Evidence from Vancouver, Toronto and Montreal. Applied Economics Letters 26: 1597–602. [Google Scholar] [CrossRef]

- Richter, Michael, and Johannes-Gabriel Werner. 2016. Conceptualising the Role of International Capital Flows for Housing Markets. Intereconomics 51: 146–54. [Google Scholar] [CrossRef][Green Version]

- Saita, Yumi, Chihiro Shimizu, and Tsutomu Watanabe. 2016. Aging and real estate prices: Evidence from Japanese and US regional data. International Journal of Housing Markets and Analysis 9: 66–87. [Google Scholar] [CrossRef]

- Schwartz, Herman M. 2009. Subprime Nation: American Power, Global Capital, and the Housing Bubble. New York: Cornell University Press. [Google Scholar]

- Shi, Shuping, Abbas Valadkhani, Russell Smyth, and Farshid Vahid. 2016. Dating the timeline of house price bubbles in Australian capital cities. Economic Record 92: 590–605. [Google Scholar] [CrossRef]

- Shiller, Robert J. 2015. Irrational Exuberance: Revised and Expanded, 3rd ed. Princeton: Princeton University Press. [Google Scholar]

- Steeley, James M. 2006. Volatility transmission between stock and bond markets. Journal of International Financial Markets, Institutions and Money 16: 71–86. [Google Scholar] [CrossRef]

- Teuben, Bert, and Razia Neshat. 2020. Real Estate Market Size 2019: Annual Update on the Size of the Professionally Managed Global Real Estate Investment Market. New York: Morgan Stanley Capital International (MSCI). [Google Scholar]

- UBS. 2018. UBS Global Real Estate Bubble Index. Latest Index Scores for the Housing Markets of Select Cities. Zurich: UBS Chief Investment Office, Investment Research. [Google Scholar]

- Wong, Swee-Kee, Kwok Wing Chau, and Chung Yim Edward Yiu. 2007. Volatility Transmission in the Real Estate Spot and Forward Markets. Journal of Real Estate Finance and Economics 35: 281–93. [Google Scholar] [CrossRef]

- Xie, Zixiong, and Shyh-Wei Chen. 2015. Are there periodically collapsing bubbles in the REIT markets? Newevidence from the US. Research in International Business and Finance 33: 17–31. [Google Scholar] [CrossRef]

- Yiu, Matthew S., Jun Yu, and Lu Jin. 2013. Detecting bubbles in Hong Kong residential property market. Journal of Asian Economics 28: 115–24. [Google Scholar] [CrossRef]

- Zhou, Wei-Xing, and Didier Sornette. 2003. 2000–2003 real estate bubble in the UK but not in the USA. Physica A: Statistical Mechanics and Its Applications 329: 249–63. [Google Scholar] [CrossRef]

| Country | Mean | Sd | Min | Max | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| Japan | 128.2 | 25.7 | 91.1 | 187.7 | 0.27 | 2.08 |

| United States | 99.02 | 9.1 | 87.9 | 127.4 | 1.24 | 4.29 |

| Eurozone | 95.11 | 11.9 | 68.5 | 117.1 | −0.33 | 2.53 |

| United Kingdom | 69.13 | 20.4 | 44.0 | 112.5 | 0.57 | 1.92 |

| ADF | PP | KPSS | ||||

|---|---|---|---|---|---|---|

| Country | Stat | pv | Stat | pv | Stat | pv |

| Japan | −1.716 | 0.418 | −2.468 | 0.379 | 0.638 | 0.01 |

| United States | −0.756 | 0.774 | −2.263 | 0.465 | 0.248 | 0.1 |

| Eurozone | −1.780 | 0.390 | −1.911 | 0.327 | 0.786 | 0.00 |

| United Kingdom | 0.054 | 0.959 | −1.969 | 0.588 | 0.935 | 0.01 |

| Country | Period | Optimal Lags | GSADF | Interpretation |

|---|---|---|---|---|

| Japan | 1970Q1–2018Q4 | 1 | 10.98 *** | Presence of bubble |

| United States | 1970Q1–2018Q4 | 3 | 7.37 *** | Presence of bubble |

| Eurozone | 1970Q1–2018Q4 | 5 | 3.34 *** | Presence of bubble |

| United Kingdom | 1970Q1–2018Q4 | 1 | 3.83 *** | Presence of bubble |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bago, J.-L.; Akakpo, K.; Rherrad, I.; Ouédraogo, E. Volatility Spillover and International Contagion of Housing Bubbles. J. Risk Financial Manag. 2021, 14, 287. https://doi.org/10.3390/jrfm14070287

Bago J-L, Akakpo K, Rherrad I, Ouédraogo E. Volatility Spillover and International Contagion of Housing Bubbles. Journal of Risk and Financial Management. 2021; 14(7):287. https://doi.org/10.3390/jrfm14070287

Chicago/Turabian StyleBago, Jean-Louis, Koffi Akakpo, Imad Rherrad, and Ernest Ouédraogo. 2021. "Volatility Spillover and International Contagion of Housing Bubbles" Journal of Risk and Financial Management 14, no. 7: 287. https://doi.org/10.3390/jrfm14070287

APA StyleBago, J.-L., Akakpo, K., Rherrad, I., & Ouédraogo, E. (2021). Volatility Spillover and International Contagion of Housing Bubbles. Journal of Risk and Financial Management, 14(7), 287. https://doi.org/10.3390/jrfm14070287