The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe

Abstract

1. Introduction

2. Brief Literature Review

3. Materials and Methods

3.1. Data

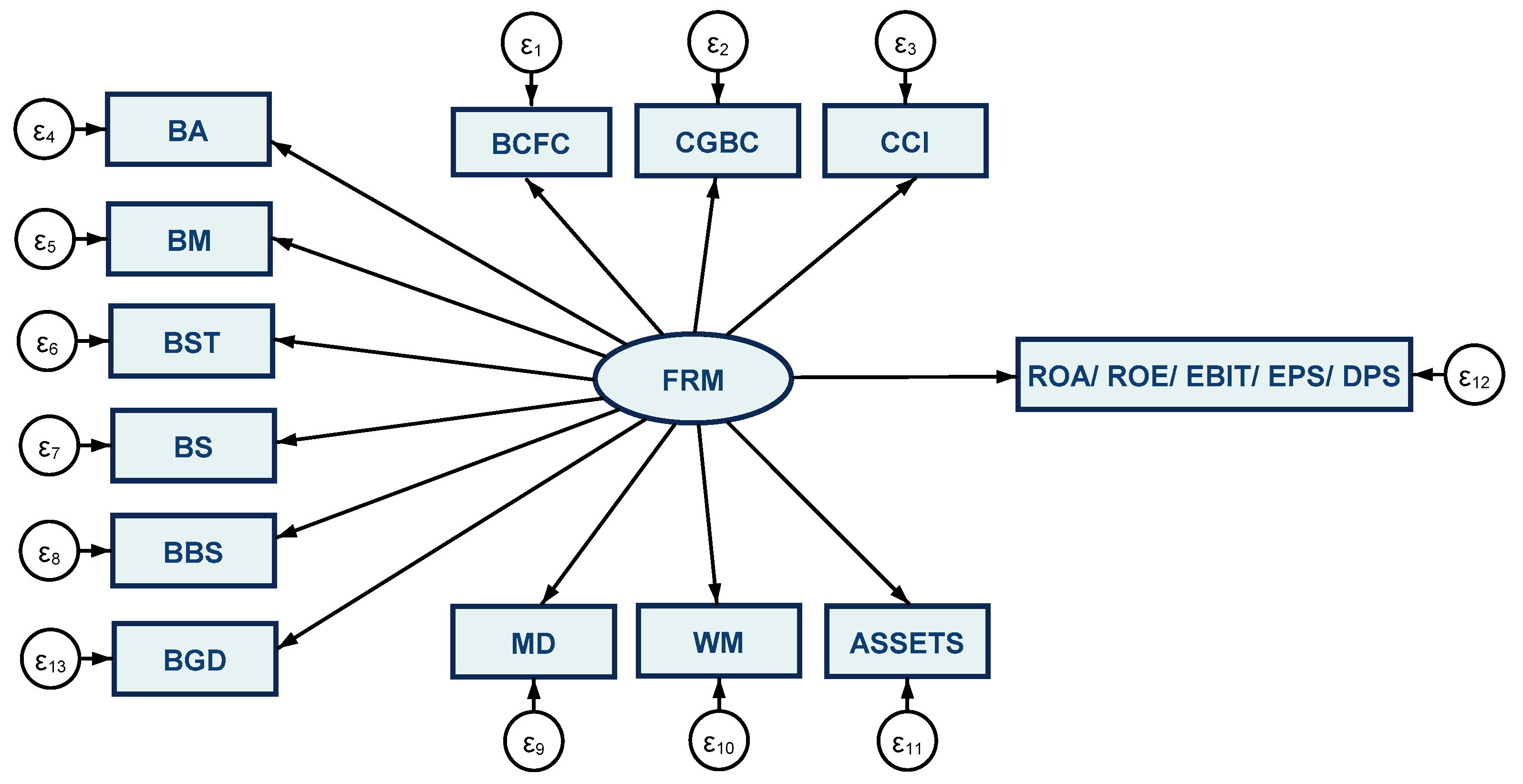

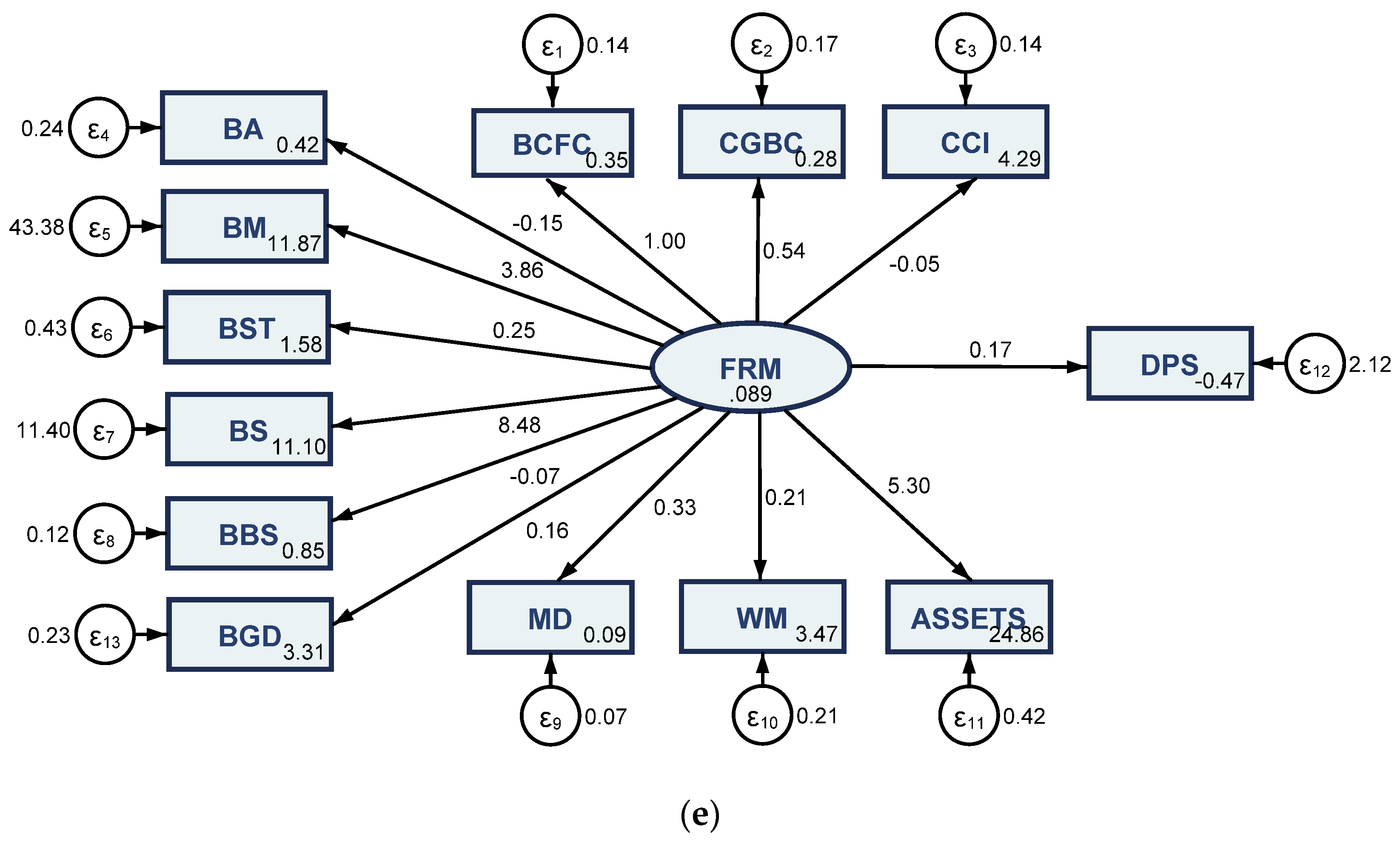

- Corporate governance and board characteristics (FY0): “Corporate Governance Board Committee” (CGBC), binary data, 0—No, 1—Yes; “Board Attendance” (BA), binary data, 0—No, 1—Yes; “Number of Board Meetings” (BM), number (median); “Board Structure Type” (BST), multi-category variable, 1—unitary (a single board), 2—two-tier (two boards, one management board and another supervisory board), 3—mixed; “Board Size” (BS), number (median); “Board Background and Skills” (BBS), binary data, 0—No, 1—Yes; “Board Gender Diversity” (BGD), % (median); “Management Departures” (MD), binary data, 0—No, 1—Yes; “Women Managers” (WM), % (median); “Bribery, Corruption and Fraud Controversies” (BCFC), binary data, 0—No, 1—Yes; “Compensation Committee Independence” (CCI), % (median);

- Financial performance and firm profitability indicators (FY1): “Return on Assets” (ROA), %; “Return on Equity” (ROE), %; “Earnings before interest and taxes” (EBIT) (mean, USD); “Earnings per share” (EPS), (mean, USD); “Dividend per share” (DPS) (mean, USD);

- Sustainable development indicators (FY0): “Environmental, Social and Governance (ESG) reporting scope” (ESG_RS), % (median); “Corporate Social Responsibility (CSR), sustainability committee” (CSR_SC), binary data, 0—No, 1—Yes;

- “ASSETS” (FY1): As a control measure for the size of the company, capturing the total value of the assets (USD).

3.2. Methodology

4. Results

4.1. Results of Structural Equation Modelling (SEM)

4.2. Results of Gaussian Graphical Models (GGMs)

- Positive synergies with ROA related to the size of the board (BS), departures of management (MD), the skills of board and its background (BBS), the type of structure of board (BST) (a single board, two-tier—one management board and another supervisory board, or mixed structure), and the existence of a (CG) board and committee (CGBC), on the one hand, and negative ones in regards to the connections with the independence of compensation committee (CCI) and CSR sustainability committee (CSR_SC);

- Favorable linkages with ROE in regards to the CSR sustainability committee (CSR_SC), women’s involvement in board management (WM), the ESG policies (ESG_RS), and the independence of compensation committee (CCI), and unfavorable ones with the size of the board (BS) and departures of management (MD);

- Positive influence on EBIT in relations to "Bribery, Corruption and Fraud Controversies” (BCFC) and the size of the board (BS), and negative ones in regards to the type structure of board (BST) (a single board, two-tier—one management board and another supervisory board, or mixed), and the diversity of board by gender (BGD);

- Earnings per share (EPS) is positively associated with women’s involvement in board management (WM), the independence of compensation committee (CCI) and sustainable development indicators, namely CSR committee (CSR_SC) and ESG reporting actions (ESG_RS), on the one hand, and negatively related with size (BS) and skills of board and its background (BBS), board meetings (BM), and attendance (BA), and the existence of (CG) board (CGBC), on the other hand;

- Dividend per share (DPS) is favorably linked with size (BS) and board attendance (BA), but also with skills of board and its background (BBS) and the existence of (CG) board (CGBC), and unfavorably connected with women’s involvement in board management (WM), sustainable development indicators, namely CSR committee (CSR_SC) and ESG reporting actions (ESG_RS), and the independence of compensation committee (CCI).

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| ROA | ROE | EBIT | EPS | DPS | |

| BCFC | |||||

| FRM | 1 (.) | 1 (.) | 1 (.) | 1 (.) | 1 (.) |

| _cons | 0.354 *** (0.0399) | 0.354 *** (0.0399) | 0.354 *** (0.0399) | 0.354 *** (0.0399) | 0.354 *** (0.0399) |

| CGBC | |||||

| FRM | 0.518 *** (0.139) | 0.519 *** (0.138) | 0.549 *** (0.139) | 0.536 *** (0.139) | 0.536 *** (0.138) |

| _cons | 0.278 *** (0.0373) | 0.278 *** (0.0373) | 0.278 *** (0.0373) | 0.278 *** (0.0373) | 0.278 *** (0.0373) |

| CCI | |||||

| FRM | −0.0621 (0.124) | −0.0581 (0.124) | −0.0652 (0.123) | −0.0552 (0.125) | −0.0526 (0.125) |

| _cons | 4.286 *** (0.0343) | 4.286 *** (0.0343) | 4.286 *** (0.0343) | 4.286 *** (0.0343) | 4.286 *** (0.0343) |

| BA | |||||

| FRM | −0.167 (0.152) | −0.184 (0.154) | −0.156 (0.151) | −0.154 (0.152) | −0.154 (0.152) |

| _cons | 0.424 *** (0.0412) | 0.424 *** (0.0412) | 0.424 *** (0.0412) | 0.424 *** (0.0412) | 0.424 *** (0.0412) |

| BM | |||||

| FRM | 4.389 * (2.229) | 4.271 (2.216) | 3.380 (2.204) | 3.828 (2.198) | 3.865 (2.186) |

| _cons | 11.87 *** (0.604) | 11.88 *** (0.604) | 11.87 *** (0.605) | 11.87 *** (0.604) | 11.87 *** (0.604) |

| BST | |||||

| FRM | 0.232 (0.209) | 0.213 (0.206) | 0.265 (0.202) | 0.259 (0.215) | 0.246 (0.211) |

| _cons | 1.583 *** (0.0551) | 1.583 *** (0.0551) | 1.583 *** (0.0551) | 1.583 *** (0.0551) | 1.583 *** (0.0551) |

| BS | |||||

| FRM | 8.633 *** (1.440) | 8.720 *** (1.461) | 8.450 *** (1.429) | 8.502 *** (1.452) | 8.479 *** (1.443) |

| _cons | 11.10 *** (0.352) | 11.10 *** (0.352) | 11.10 *** (0.352) | 11.10 *** (0.352) | 11.10 *** (0.352) |

| BBS | |||||

| FRM | −0.0878 (0.112) | −0.111 (0.112) | −0.0428 (0.108) | −0.0653 (0.111) | −0.0691 (0.110) |

| _cons | 0.854 *** (0.0294) | 0.854 *** (0.0294) | 0.854 *** (0.0294) | 0.854 *** (0.0294) | 0.854 *** (0.0294) |

| MD | |||||

| FRM | 0.329 *** (0.0891) | 0.331 *** (0.0888) | 0.315 *** (0.0893) | 0.331 *** (0.0893) | 0.330 *** (0.0888) |

| _cons | 0.0903 *** (0.0239) | 0.0903 *** (0.0239) | 0.0903 *** (0.0239) | 0.0903 *** (0.0239) | 0.0903 *** (0.0239) |

| WM | |||||

| FRM | 0.192 (0.178) | 0.189 (0.179) | 0.226 (0.173) | 0.211 (0.177) | 0.210 (0.176) |

| _cons | 3.469 *** (0.0476) | 3.469 *** (0.0475) | 3.467 *** (0.0474) | 3.468 *** (0.0475) | 3.468 *** (0.0475) |

| ASSETS | |||||

| FRM | 5.360 *** (0.840) | 4.962 *** (0.785) | 5.754 *** (0.728) | 5.429 *** (1.102) | 5.298 *** (0.993) |

| _cons | 24.86 *** (0.148) | 24.87 *** (0.148) | 24.85 *** (0.148) | 24.86 *** (0.149) | 24.86 *** (0.149) |

| BGD | |||||

| FRM | 0.164 (0.158) | 0.113 (0.159) | 0.206 (0.150) | 0.175 (0.173) | 0.162 (0.167) |

| _cons | 3.313 *** (0.0408) | 3.313 *** (0.0408) | 3.313 *** (0.0408) | 3.313 *** (0.0408) | 3.313 *** (0.0408) |

| / | |||||

| var(e.BCFC) | 0.141 *** (0.0195) | 0.136 *** (0.0194) | 0.146 *** (0.0181) | 0.142 *** (0.0223) | 0.140 *** (0.0213) |

| var(e.CGBC) | 0.177 *** (0.0213) | 0.176 *** (0.0214) | 0.176 *** (0.0210) | 0.176 *** (0.0215) | 0.175 *** (0.0214) |

| var(e.CCI) | 0.142 *** (0.0182) | 0.142 *** (0.0182) | 0.142 *** (0.0182) | 0.142 *** (0.0182) | 0.142 *** (0.0182) |

| var(e.BA) | 0.242 *** (0.0285) | 0.241 *** (0.0285) | 0.242 *** (0.0286) | 0.242 *** (0.0286) | 0.242 *** (0.0286) |

| var(e.BM) | 43.02 *** (5.558) | 43.04 *** (5.563) | 43.77 *** (5.617) | 43.44 *** (5.592) | 43.38 *** (5.587) |

| var(e.BST) | 0.433 *** (0.0511) | 0.433 *** (0.0512) | 0.432 *** (0.0509) | 0.432 *** (0.0510) | 0.432 *** (0.0511) |

| var(e.BS) | 11.27 *** (1.555) | 10.77 *** (1.584) | 11.88 *** (1.483) | 11.51 *** (1.619) | 11.40 *** (1.585) |

| var(e.BBS) | 0.124 *** (0.0146) | 0.123 *** (0.0146) | 0.124 *** (0.0147) | 0.124 *** (0.0146) | 0.124 *** (0.0146) |

| var(e.MD) | 0.0726 *** (0.00875) | 0.0720 *** (0.00876) | 0.0739 *** (0.00878) | 0.0726 *** (0.00880) | 0.0724 *** (0.00878) |

| var(e.WM) | 0.207 *** (0.0298) | 0.207 *** (0.0298) | 0.206 *** (0.0296) | 0.206 *** (0.0297) | 0.206 *** (0.0297) |

| var(e.ASSETS) | 0.404 (0.275) | 0.618 * (0.285) | 0.181 (0.122) | 0.355 (0.412) | 0.416 (0.363) |

| var(e.ROA) | 0.438 *** (0.0618) | ||||

| var(e.BGD) | 0.229 *** (0.0276) | 0.231 *** (0.0277) | 0.228 *** (0.0274) | 0.229 *** (0.0276) | 0.229 *** (0.0276) |

| var(FRM) | 0.0878 *** (0.0235) | 0.0927 *** (0.0243) | 0.0832 *** (0.0216) | 0.0872 *** (0.0258) | 0.0892 *** (0.0253) |

| var(e.ROE) | 0.494 *** (0.0647) | ||||

| var(e.EBIT) | 0.444 *** (0.103) | ||||

| var(e.EPS) | 2.513 *** (0.317) | ||||

| var(e.DPS) | 2.123 *** (0.282) | ||||

| ROA | |||||

| FRM | −1.414 *** (0.297) | ||||

| _cons | −0.225 ** (0.0722) | ||||

| ROE | |||||

| FRM | −0.931 *** (0.264) | ||||

| _cons | 2.164 *** (0.0670) | ||||

| EBIT | |||||

| FRM | 4.897 *** (0.616) | ||||

| _cons | 20.47 *** (0.136) | ||||

| EPS | |||||

| FRM | 0.297 (0.607) | ||||

| _cons | −0.00555 (0.142) | ||||

| DPS | |||||

| FRM | 0.168 (0.521) | ||||

| _cons | −0.471 *** (0.138) | ||||

| N | 144 | 144 | 144 | 144 | 144 |

| Items | SEM-1 | SEM-2 | SEM-3 | SEM-4 | SEM-5 |

|---|---|---|---|---|---|

| BCFC | 0.4440 | 0.4548 | 0.5258 | 0.4719 | 0.4480 |

| CGBC | 0.5288 | 0.5343 | 0.5112 | 0.4223 | 0.4718 |

| CCI | 0.5475 | 0.6458 | 0.6360 | 0.5088 | 0.6952 |

| BA | 0.5425 | 0.5398 | 0.6433 | 0.6213 | 0.4378 |

| BM | 0.5157 | 0.5194 | 0.5543 | 0.4384 | 0.4072 |

| BST | 0.5692 | 0.6730 | 0.5064 | 0.4621 | 0.6547 |

| BS | 0.4203 | 0.5210 | 0.450 | 0.4747 | 0.4017 |

| BBS | 0.5324 | 0.5316 | 0.5499 | 0.5867 | 0.6801 |

| MD | 0.5150 | 0.5149 | 0.5806 | 0.4256 | 0.4598 |

| WM | 0.5431 | 0.5454 | 0.5004 | 0.6704 | 0.4295 |

| ASSETS | 0.6608 | 0.6724 | 0.5658 | 0.4085 | 0.4385 |

| BGD | 0.5485 | 0.6477 | 0.5540 | 0.6956 | 0.6668 |

| ROA | 0.6830 | ||||

| ROE | 0.6830 | ||||

| EBIT | 0.5772 | ||||

| EPS | 0.4271 | ||||

| DPS | 0.4385 | ||||

| Total scale | 0.6348 | 0.6370 | 0.6150 | 0.6705 | 0.6411 |

| Variables | SEM-1 | SEM-2 | SEM-3 | SEM-4 | SEM-5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Chi2 | p | Chi2 | p | Chi2 | p | Chi2 | p | Chi2 | p | |

| BCFC | 0 | - | 0 | - | 0 | - | 0 | - | 0 | - |

| CGBC | 14.00 | 0.000 | 14.15 | 0.000 | 15.50 | 0.000 | 14.87 | 0.000 | 15.08 | 0.000 |

| CCI | 1.25 | 0.115 | 1.22 | 0.338 | 1.28 | 0.296 | 1.19 | 0.259 | 1.18 | 0.272 |

| BA | 1.19 | 0.274 | 1.44 | 0.230 | 1.07 | 0.302 | 1.02 | 0.311 | 1.03 | 0.310 |

| BM | 3.88 | 0.049 | 3.72 | 0.053 | 2.35 | 0.125 | 3.03 | 0.081 | 3.12 | 0.077 |

| BST | 1.23 | 0.267 | 1.06 | 0.302 | 1.72 | 0.189 | 1.46 | 0.227 | 1.36 | 0.243 |

| BS | 35.92 | 0.000 | 35.61 | 0.000 | 34.96 | 0.000 | 34.27 | 0.000 | 34.54 | 0.000 |

| BBS | 1.62 | 0.032 | 0.98 | 0.321 | 1.16 | 0.292 | 1.35 | 0.256 | 1.39 | 0.231 |

| MD | 13.64 | 0.000 | 13.93 | 0.000 | 12.46 | 0.000 | 13.75 | 0.000 | 13.82 | 0.000 |

| WM | 1.15 | 0.283 | 1.12 | 0.290 | 1.71 | 0.191 | 1.42 | 0.233 | 1.42 | 0.233 |

| ASSETS | 40.72 | 0.000 | 39.99 | 0.000 | 62.46 | 0.000 | 24.26 | 0.000 | 28.45 | 0.000 |

| BGD | 1.08 | 0.299 | 1.50 | 0.2774 | 1.89 | 0.168 | 1.03 | 0.310 | 1.94 | 0.212 |

| ROA | 22.69 | 0.000 | ||||||||

| ROE | 12.42 | 0.000 | ||||||||

| EBIT | 63.13 | 0.000 | ||||||||

| EPS | 3.24 | 0.024 | ||||||||

| DPS | 3.10 | 0.097 | ||||||||

| Explanations | SEM-1 | SEM-2 | SEM-3 | SEM-4 | SEM-5 |

|---|---|---|---|---|---|

| “Likelihood ratio” | |||||

| “Model vs. saturated chi2_ms (15)” | 163.732 | 170.003 | 153.322 | 181.727 | 167.931 |

| p > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| “Baseline vs. saturated chi2_bs (24)” | 326.941 | 318.609 | 455.538 | 316.227 | 302.292 |

| p > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| “Information criteria” | |||||

| “AIC (Akaike’s information criterion)” | 3750.401 | 3788.584 | 3789.857 | 3985.453 | 3917.438 |

| “BIC (Bayesian information criterion)” | 3866.224 | 3904.407 | 3905.680 | 4101.276 | 4033.261 |

| “Baseline comparison” | |||||

| “CFI (Comparative fit index)” | 0.603 | 0.564 | 0.766 | 0.510 | 0.541 |

| “TLI (Tucker–Lewis index)” | 0.524 | 0.476 | 0.719 | 0.412 | 0.449 |

| “Size of residuals” | |||||

| “CD (Coefficient of determination)” | 0.891 | 0.848 | 0.955 | 0.898 | 0.883 |

References

- Abdullah, Shamsul Nahar. 2004. Board composition, CEO duality and performance among Malaysian listed companies. Corporate Governance 4: 47–61. [Google Scholar] [CrossRef]

- Abdullah, Maizatulakma, Zaleha Abdul Shukor, Zakiah Muhammadun Mohamed, and Azlina Ahmad. 2015. Risk management disclosure: A study on the effect of voluntary risk management disclosure toward firm value. Journal of Applied Accounting Research 16: 400–32. [Google Scholar] [CrossRef]

- Al-Matari, Ebrahim Mohammmed, Abdullah Kaid Al-Swidi, Faudziah Hanim Bt Fadzil, and Yahya Ali Al-Matari. 2012. The impact of board characteristics on firm performance: Evidence from nonfinancial listed companies in Kuwaiti Stock Exchange. International Journal of Accounting and Financial Reporting 2: 310–32. [Google Scholar] [CrossRef]

- Anton, Sorin Gabriel, and Anca Elena Afloarei Nucu. 2020. Enterprise Risk Management: A Literature Review and Agenda for Future Research. Journal of Risk and Financial Management 13: 281. [Google Scholar] [CrossRef]

- Băndoi, Anca, Claudiu George Bocean, Mara Del Baldo, Lucian Mandache, Leonardo Geo Mănescu, and Cătălina Soriana Sitnikov. 2021. Including Sustainable Reporting Practices in Corporate Management Reports: Assessing the Impact of Transparency on Economic Performance. Sustainability 13: 940. [Google Scholar] [CrossRef]

- Beran, Tanya, and Claudio Violato. 2010. Structural equation modeling in medical research. BMC Research Notes 3: 267. [Google Scholar] [CrossRef]

- Berrone, Pascual, and Luis Gomez-Mejia. 2009. Environmental Performance and Executive Compensation: An Integrated Agency-Institutional Perspective. Academy of Management Journal 52: 103–26. [Google Scholar] [CrossRef]

- Bonn, Ingrid. 2004. Board Structure and Firm Performance: Evidence from Australia. Journal of Management & Organization 10: 14–24. [Google Scholar]

- Brannick, T. Michael. 1995. Critical comments on applying covariance structure modeling. Journal of Organizational Behavior 16: 201–13. [Google Scholar] [CrossRef]

- Brannick, T. Michael. 2020. Structural Equation Modeling (SEM). Available online: http://faculty.cas.usf.edu/mbrannick/regression/SEM.html (accessed on 12 January 2021).

- Bunea, Mariana, and Vasile Dinu. 2020. The relationship between the boards characteristics and the risk management of the Romanian banking sector. Journal of Business Economics and Management 21: 1248–68. [Google Scholar] [CrossRef]

- Cho, Sang Jun, Chune Young Chung, and Jason Young. 2019. Study on the Relationship between CSR and Financial Performance. Sustainability 11: 343. [Google Scholar] [CrossRef]

- Coffey, Betty, and Jia Wang. 1998. Board Diversity and Managerial Control as Predictors of Corporate Social Performance. Journal of Business Ethics 17: 1595–1603. [Google Scholar] [CrossRef]

- Coles, Jerilyn, Victoria McWilliams, and Nilanjan Sen. 2001. An examination of the relationship of governance mechanisms to performance. Journal of Management 27: 23–50. [Google Scholar] [CrossRef]

- De Villiers, Charl, Vic Naiker, and Chris J. van Staden. 2011. The Effect of Board Characteristics on Firm Environmental Performance. Journal of Management 37: 1636–63. [Google Scholar] [CrossRef]

- Dehaene, Alexander, Veerle De Vuyst, and Hubert Ooghe. 2001. Corporate Performance and Board Structure in Belgian Companies. Long Range Planning 34: 383–98. [Google Scholar] [CrossRef]

- Du Rietz, Anita, and Magnus Henrekson. 2000. Testing the Female Underperformance Hypothesis. Small Business Economics 14: 1–10. [Google Scholar] [CrossRef]

- Eckles, David L., Robert E. Hoyt, and Steve M. Miller. 2014. The impact of enterprise risk management on the marginal cost of reducing risk: Evidence from the insurance industry. Journal of Banking & Finance 49: 409–23. [Google Scholar]

- Epskamp, Sacha, Lourens J. Waldorp, René Mõttus, and Denny Borsboom. 2018. The Gaussian Graphical Model in Cross-Sectional and Time-Series Data. Multivariate Behavioral Research 53: 453–80. [Google Scholar] [CrossRef]

- Florio, Cristina, and Giulia Leoni. 2017. Enterprise risk management and firm performance: The Italian case. British Accounting Review 49: 56–74. [Google Scholar] [CrossRef]

- Gujarati, Damodar. 2003. Basic econometrics, 4th ed. Boston: McGraw Hill. [Google Scholar]

- Haque, Faizul. 2017. The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. The British Accounting Review 49: 347–64. [Google Scholar] [CrossRef]

- Hosny, Amr. 2017. Political stability, firm characteristics and performance: Evidence from 6,083 private firms in the Middle East. Review of Middle East Economics and Finance 13: 1–21. [Google Scholar] [CrossRef]

- Huse, Morten, and Anne Grethe Solberg. 2006. Gender-related boardroom dynamics: How Scandinavian women make and can make contributions on corporate boards. Women in Management Review 21: 113–30. [Google Scholar] [CrossRef]

- Jia, Ming, and Zhe Zhang. 2013. Critical Mass of Women on BODs, Multiple Identities, and Corporate Philanthropic Disaster Response: Evidence from Privately Owned Chinese Firms. Journal of Business Ethics 118: 303–17. [Google Scholar] [CrossRef]

- Kakanda, Mohammed Mahmud, and Basariah Salim. 2017. Corporate governance, risk management disclosure, and firm performance: A theoretical and empirical review perspective. Asian Economic and Financial Review 7: 836–45. [Google Scholar] [CrossRef]

- Kiel, C. Geoffrey, and Gavin J. Nicholson. 2003. Board Composition and Corporate Performance: How the Australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review 11: 189–205. [Google Scholar] [CrossRef]

- Lechner, Philipp, and Nadine Gatzert. 2018. Determinants and value of enterprise risk management: Empirical evidence from Germany. European Journal of Finance 24: 867–87. [Google Scholar] [CrossRef]

- Liao, Lin, Le Luo, and Qingliang Tang. 2015. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47: 409–24. [Google Scholar] [CrossRef]

- Liu, Yu, Mihail K. Miletknov, Zuobao Wei, and Tina Yang. 2015. Board Independence and Firm Performance in China. Journal of Corporate Finance 30: 223–44. [Google Scholar] [CrossRef]

- Millet-Reyes, Benedicte, and Ronald Zhao. 2010. A Comparison Between One-Tier and Two-Tier Board Structures in France. Journal of International Financial Management & Accounting 21: 279–310. [Google Scholar]

- Murphy, Steven, and Michael McIntyre. 2007. Board of director performance: A group dynamics perspective. Corporate Governance. 7: 209–24. [Google Scholar] [CrossRef]

- Muturi, Willy, and Maleya M. Omondi. 2013. Factors Affecting the Financial Performance of Listed Companies at the Nairobi Securities Exchange in Kenya. Research Journal of Finance and Accounting 4: 99–105. [Google Scholar]

- Noja, Gratiela Georgiana, Mirela Cristea, Cecilia Nicoleta Jurcut, Alexandru Buglea, and Ioan Lala Popa. 2020. Management financial incentives and firm performance in a sustainable development framework: Empirical evidence from European companies. Sustainability 12: 7247. [Google Scholar] [CrossRef]

- Nunkoo, Robin, and Haywantee Ramkissoon. 2012. Structural equation modelling and regression analysis in tourism research. Current Issues in Tourism 15: 777–802. [Google Scholar] [CrossRef]

- Abu, Odudu Seini, Arumona James Okpeh, and Uchenna James Okpe. 2016. Board Characteristics and Financial Performance of Deposit Money Banks in Nigeria. International Journal of Business and Social Science 7: 159–73. [Google Scholar]

- Ozen, Ercan, Eser Yesildag, and Mustafa Soba. 2015. TOPSIS performance evaluation measures and relation between financial ratios and stock returns. Journal of Economics Finance and Accounting 2: 482–500. [Google Scholar] [CrossRef]

- Pirtea, Marilen, Cristina Nicolescu, and Claudiu Botoc. 2014. Do Romanian Companies Follow Pecking Order Financing? Economic Computation and Economic Cybernetics Studies and Research 48: 1–15. [Google Scholar]

- Pucheta-Martínez, Maria Consuelo, and Isabel Gallego-Álvarez. 2020. Do board characteristics drive firm performance? An international perspective. Review of Managerial Science 14: 1251–97. [Google Scholar] [CrossRef]

- Randöy, Trond, Steen Thomsen, and Lars Oxelheim. 2006. A Nordic Perspective on Corporate Board Diversity. Copenhagen: Nordic Council of Ministers, Nordic Innovation Centre, pp. 2–28. [Google Scholar]

- Refinitiv. 2020. Thomson Reuters Eikon Database. New Yrok: Refinitiv. [Google Scholar]

- Rose, Caspar. 2005. The composition of semi-two-tier corporate boards and firm performance. Corporate Governance: An International Review 13: 691–701. [Google Scholar] [CrossRef]

- Sichigea, Mirela, Marian Ilie Siminica, Daniel Circiumaru, Silviu Carstina, and Nela Loredana Caraba-Meita. 2020. A comparative approach of the environmental performance between periods with positive and negative accounting returns of EEA companies. Sustainability 12: 7382. [Google Scholar] [CrossRef]

- Skandalis, Konstantinos, Panagiotis Liargovas, and Anna A. Merika. 2008. Firm management competence: Does it Matter? International Journal of Business and Economics 7: 167–80. [Google Scholar]

- Solomon, Jill Frances, Aris Solomon, Simon D. Norton, and Nathan L. Joseph. 2000. A conceptual framework for corporate risk disclosure emerging from the agenda for corporate governance reform. British Accounting Review 32: 447–78. [Google Scholar] [CrossRef]

- Suciu, Marta-Christina, Gratiela Georgiana Noja, and Mirela Cristea. 2020. Diversity, social inclusion and human capital development as fundamentals of financial performance and risk mitigation. Amfiteatru Economic 22: 742–57. [Google Scholar]

- Swartz, N. P., and Steven Firer. 2005. Board structure and intellectual capital performance in South Africa. Meditari Accountancy Research 13: 145–66. [Google Scholar] [CrossRef]

- Ujunwa, Augustine. 2012. Board characteristics and the financial performance of Nigerian quoted firms. Corporate Governance 12: 656–74. [Google Scholar] [CrossRef]

- Yermack, David. 1996. Higher market valuation of companies with a small board of directors, Journal of Financial Economics 40: 185–211. Journal of Financial Economics 40: 185–211. [Google Scholar] [CrossRef]

| Variables | N | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| BCFC | 144 | 0.3541667 | 0.4799293 | 0 | 1 |

| CGBC | 144 | 0.2777778 | 0.4494666 | 0 | 1 |

| CCI | 129 | 72.94589 | 29.00742 | 0 | 100 |

| BA | 144 | 0.4236111 | 0.495855 | 0 | 1 |

| BM | 122 | 11.89344 | 6.71597 | 3 | 43 |

| BST | 144 | 1.583333 | 0.6637465 | 1 | 3 |

| BS | 144 | 11.10417 | 4.235578 | 3 | 29 |

| BBS | 144 | 0.8541667 | 0.354171 | 0 | 1 |

| BGD | 144 | 29.28736 | 13.08738 | 0 | 57.14 |

| MD | 144 | 0.0902778 | 0.2875796 | 0 | 1 |

| WM | 97 | 35.35351 | 12.94517 | 5.56 | 72.07 |

| CSR_SC | 144 | 0.5555556 | 0.4986384 | 0 | 1 |

| ESG_RS | 113 | 91.06681 | 18.537 | 2.22 | 100 |

| ROA | 144 | 0.8188958 | 0.9709631 | −0.7 | 7.3 |

| ROE | 144 | 9.013201 | 7.831185 | −17.3 | 62.358 |

| EBIT | 124 | 2,600,000,000 | 4,560,000,000 | −10,100,000 | 29,400,000,000 |

| EPS | 129 | 3.04031 | 5.95377 | −0.09 | 41.9 |

| DPS | 132 | 1.62303 | 4.178183 | 0 | 36.69 |

| ASSETS | 126 | 262,000,000,000 | 482,000,000,000 | 441,000,000 | 2,760,000,000,000 |

| N total | 144 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Noja, G.G.; Thalassinos, E.; Cristea, M.; Grecu, I.M. The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe. J. Risk Financial Manag. 2021, 14, 79. https://doi.org/10.3390/jrfm14020079

Noja GG, Thalassinos E, Cristea M, Grecu IM. The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe. Journal of Risk and Financial Management. 2021; 14(2):79. https://doi.org/10.3390/jrfm14020079

Chicago/Turabian StyleNoja, Gratiela Georgiana, Eleftherios Thalassinos, Mirela Cristea, and Irina Maria Grecu. 2021. "The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe" Journal of Risk and Financial Management 14, no. 2: 79. https://doi.org/10.3390/jrfm14020079

APA StyleNoja, G. G., Thalassinos, E., Cristea, M., & Grecu, I. M. (2021). The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe. Journal of Risk and Financial Management, 14(2), 79. https://doi.org/10.3390/jrfm14020079