Dynamic Effects of Material Production and Environmental Sustainability on Economic Vitality Indicators: A Panel VAR Approach

Abstract

1. Introduction

2. Theoretical Framework, Evidence and Hypothesis Development

3. Methodology

3.1. Econometric Model

3.2. Data, Variables, and Specification of the Model

4. Results and Discussion

4.1. Empirical Evidence

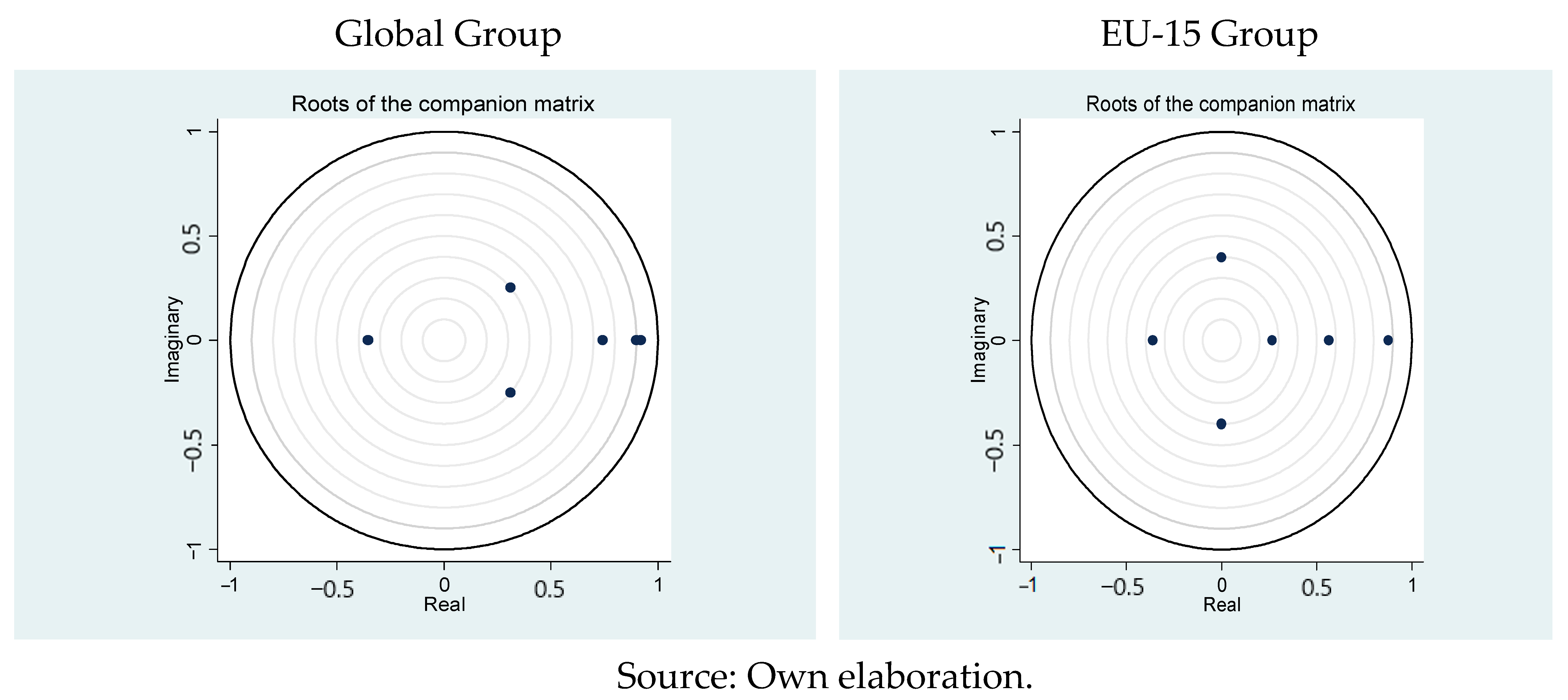

4.2. Robustness of the Model

4.3. Discussion

5. Conclusions

5.1. Empirical Findings and Implications

5.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abrigo, Michael R. M., and Inessa Love. 2016. Estimation of Panel Vector Autoregression in Stata. Stata Journal 16: 778–804. [Google Scholar] [CrossRef]

- Agbloyor, Elikplimi Komla, Joshua Abor, Charles Komla Delali Adjasi, and Alfred Yawson. 2013. Exploring the Causality Links between Financial Markets and Foreign Direct Investment in Africa. Research in International Business and Finance 28: 118–34. [Google Scholar] [CrossRef]

- Agnolucci, Paolo, Florian Flachenecker, and Magnus Söderberg. 2017. The Causal Impact of Economic Growth on Material Use in Europe. Journal of Environmental Economics and Policy 6: 415–32. [Google Scholar] [CrossRef]

- Aleluia, João, and João Leitão. 2011. International Entrepreneurship and Technology Transfer: The CDM Situation in China. In Handbook of Research on Energy Entrepreneurship. Edited by Rolf Wüstenhagen and Robert Wuebker. Northampton: Edward Elgar Publishing, Inc. [Google Scholar] [CrossRef]

- Alfaro, Laura, Areendam Chanda, Sebnem Kalemli-Ozcan, and Selin Sayek. 2004. FDI and Economic Growth: The Role of Local Financial Markets. Journal of International Economics 64: 89–112. [Google Scholar] [CrossRef]

- Andrews, Donald W. K., and Biao Lu. 2001. Consistent Model and Moment Selection Procedures for GMM Estimation with Application to Dynamic Panel Data Models. Journal of Econometrics 101: 123–64. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another Look at the Instrumental Variable Estimation of Error-Components Models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Ayres, Robert U., and Jeroen C. J. M. Van Den Bergh. 2005. A Theory of Economic Growth with Material/Energy Resources and Dematerialization: Interaction of Three Growth Mechanisms. Ecological Economics 55: 96–118. [Google Scholar] [CrossRef]

- Azman-Saini, W. N. W., Siong Hook Law, and Abd Halim Ahmad. 2010. FDI and Economic Growth: New Evidence on the Role of Financial Markets. Economics Letters 107: 211–13. [Google Scholar] [CrossRef]

- Balasubramanyam, Vudayagiri N., Mohammed Salisu, and David Sapsford. 1996. Foreign Direct Investment and Growth in EP and IS Countries. Economic Journal 106: 92–105. [Google Scholar] [CrossRef]

- Batten, Jonathan A., Cetin Ciner, and Brian M. Lucey. 2010. The Macroeconomic Determinants of Volatility in Precious Metals Markets. Resources Policy 35: 65–71. [Google Scholar] [CrossRef]

- Bernardini, Oliviero, and Riccardo Galli. 1993. Dematerialization: Long-Term Trends in the Intensity of Use of Materials and Energy. Futures 25: 431–48. [Google Scholar] [CrossRef]

- Boyer, Brian, and Lu Zheng. 2009. Investor Flows and Stock Market Returns. Journal of Empirical Finance 16: 87–100. [Google Scholar] [CrossRef]

- Cai, Yifei, Chung Yan Sam, and Tsangyao Chang. 2018. Nexus between Clean Energy Consumption, Economic Growth and CO2 Emissions. Journal of Cleaner Production 182: 1001–11. [Google Scholar] [CrossRef]

- Canas, Ângela, Paulo Ferrão, and Pedro Conceição. 2003. A New Environmental Kuznets Curve? Relationship between Direct Material Input and Income per Capita: Evidence from Industrialised Countries. Ecological Economics 46: 217–29. [Google Scholar] [CrossRef]

- Chen, Jiandong, Ping Wang, Lianbiao Cui, Shuo Huang, and Malin Song. 2018. Decomposition and Decoupling Analysis of CO2 Emissions in OECD. Applied Energy 231: 937–50. [Google Scholar] [CrossRef]

- Cheng, Cheng, Xiaohang Ren, Zhen Wang, and Cheng Yan. 2019. Heterogeneous Impacts of Renewable Energy and Environmental Patents on CO2 Emission—Evidence from the BRIICS. Science of the Total Environment 668: 1328–38. [Google Scholar] [CrossRef]

- Choi, Jongmoo Jay, Shmuel Hauser, and Kenneth J. Kopecky. 1999. Does the Stock Market Predict Real Activity? Time Series Evidence from the G-7 Countries. Journal of Banking and Finance 23: 1771–92. [Google Scholar] [CrossRef]

- Claessens, Stijn, Daniela Klingebiel, and Sergio L. Schmukler. 2001. FDI and Stock Market Development: Complements or Substitutes? New York: Mimeo (World Bank). [Google Scholar]

- Cleveland, Curler J., and Matthias Ruth. 1998. Indicators of Dematerialization and the Materials Intensity of Use. Journal of Industrial Ecology 2: 15–50. [Google Scholar] [CrossRef]

- da Silva, Patricia Pereira, Blanca Moreno, and Nuno Carvalho Figueiredo. 2016. Firm-Specific Impacts of CO2 Prices on the Stock Market Value of the Spanish Power Industry. Energy Policy 94: 492–501. [Google Scholar] [CrossRef]

- Dai, Tiejun, and Rui Liu. 2018. Dematerialization in Beijing from the Perspective of Material Metabolism. Journal of Cleaner Production 201: 792–801. [Google Scholar] [CrossRef]

- Dasgupta, Susmita, Benoit Laplante, Hua Wang, and David Wheeler. 2002. Confronting the Environmental Kuznets Curve. Journal of Economic Perspectives 16: 147–68. [Google Scholar] [CrossRef]

- De Gregorio, José. 1992. Economic Growth in Latin America. Journal of Development Economics 39: 59–84. [Google Scholar] [CrossRef]

- Dinda, Soumyananda. 2004. Environmental Kuznets Curve Hypothesis: A Survey. Ecological Economics 49: 431–55. [Google Scholar] [CrossRef]

- Dong, Liang, Ming Dai, Hanwei Liang, Ning Zhang, Nabeel Mancheri, Jingzheng Ren, Yi Dou, and Mingming Hu. 2017. Material Flows and Resource Productivity in China, South Korea and Japan from 1970 to 2008: A Transitional Perspective. Journal of Cleaner Production 141: 1164–77. [Google Scholar] [CrossRef]

- Dungey, Mardi, Renée Fry, Brenda González-Hermosillo, and Vance L. Martin. 2007. Contagion in Global Equity Markets in 1998: The Effects of the Russian and LTCM Crises. North American Journal of Economics and Finance 18: 155–74. [Google Scholar] [CrossRef]

- Dungey, Mardi, Renée Fry, Brenda González-Hermosillo, and Vance Martin. 2006. Contagion in International Bond Markets during the Russian and the LTCM Crises. Journal of Financial Stability 2: 1–27. [Google Scholar] [CrossRef]

- Dungey, Mardi, Renee Fry, Brenda González-Hermosillo, Vance Martin, and Chrismin Tang. 2010. Are Financial Crises Alike? IMF Working Papers 10: 1. [Google Scholar] [CrossRef]

- Dutta, Anupam, Elie Bouri, and Md Hasib Noor. 2018. Return and Volatility Linkages between CO2 Emission and Clean Energy Stock Prices. Energy 164: 803–10. [Google Scholar] [CrossRef]

- Fernández, Y. Fernández, M. A. Fernández López, and B. Olmedillas Blanco. 2018. Innovation for Sustainability: The Impact of R&D Spending on CO2 Emissions. Journal of Cleaner Production 172: 3459–67. [Google Scholar] [CrossRef]

- Froot, Kenneth A., and Jeremy C. Stein. 1991. Exchange Rates and Foreign Direct Investment: An Imperfect Capital Markets Approach. The Quarterly Journal of Economics 106: 1191–217. [Google Scholar] [CrossRef]

- Goux, Jean-François. 1996. Le Canal Étroit Du Crédit En France: Essai de Vérification Macroéconomique 1970–1994. Revue d’économie Politique 106: 655–81. [Google Scholar]

- Grossman, Gene M., and Alan B. Krueger. 1991. Environmental Impacts of a North American Free Trade Agreement. 3914. NBER Working Papers. Cambridge: NBER. [Google Scholar] [CrossRef]

- Guzmán, Juan Ignacio, Takashi Nishiyama, and John E. Tilton. 2005. Trends in the Intensity of Copper Use in Japan since 1960. Resources Policy 30: 21–27. [Google Scholar] [CrossRef]

- Hansen, Lars P. 1982. Large Sample Properties of Generalized Method of Moments Estimators. Econometrica 50: 1029–54. [Google Scholar] [CrossRef]

- Hassapis, Christis, and Sarantis Kalyvitis. 2002. Investigating the Links between Growth and Real Stock Price Changes with Empirical Evidence from the G-7 Economies. Quarterly Review of Economics and Finance 42: 543–75. [Google Scholar] [CrossRef]

- Herman, Robert, Siamak A. Ardekani, and Jesse H. Ausubel. 1990. Dematerialization. Technological Forecasting and Social Change 38: 333–47. [Google Scholar] [CrossRef]

- Herzer, Dierk. 2012. How Does Foreign Direct Investment Really Affect Developing Countries’ Growth? Review of International Economics 20: 396–414. [Google Scholar] [CrossRef]

- Holtz-Eakin, Douglas, Whitney Newey, and Harvey Rosen. 1988. Estimating Vector Autoregressions with Panel Data. Econometrica 56: 1371–95. [Google Scholar] [CrossRef]

- Huang, Roger D., Ronald W. Masulis, and Hans R. Stoll. 1996. Energy Shocks and Financial Markets. Journal of Futures Markets 16: 1–27. [Google Scholar] [CrossRef]

- Iamsiraroj, Sasi, and Mehmet Ali Ulubaşoğlu. 2015. Foreign Direct Investment and Economic Growth: A Real Relationship or Wishful Thinking? Economic Modelling 51: 200–13. [Google Scholar] [CrossRef]

- Irandoust, Manuchehr. 2017. Metal Prices and Stock Market Performance: Is There an Empirical Link? Resources Policy 52: 389–92. [Google Scholar] [CrossRef]

- Jain, Anshul, and Pratap Chandra Biswal. 2016. Dynamic Linkages among Oil Price, Gold Price, Exchange Rate, and Stock Market in India. Resources Policy 49: 179–85. [Google Scholar] [CrossRef]

- Jänicke, Martin, Manfred Binder, and Harald Mönch. 1997. ‘Dirty Industries’: Patterns of Change in Industrial Countries. Environmental and Resource Economics 9: 467–91. [Google Scholar] [CrossRef]

- Javorcik, Beata Smarzynska. 2004. Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers through Backward Linkages. American Economic Review 94: 605–27. [Google Scholar] [CrossRef]

- Kalaitzidakis, Pantelis, Theofanis Mamuneas, and Thanasis Stengos. 2018. Greenhouse Emissions and Productivity Growth. Journal of Risk and Financial Management 11: 38. [Google Scholar] [CrossRef]

- Kemp-Benedict, Eric. 2018. Dematerialization, Decoupling, and Productivity Change. Ecological Economics 150: 204–16. [Google Scholar] [CrossRef]

- Korhonen, Jouni, Antero Honkasalo, and Jyri Seppälä. 2018. Circular Economy: The Concept and Its Limitations. Ecological Economics 143: 37–46. [Google Scholar] [CrossRef]

- Krausmann, Fridolin, Simone Gingrich, Nina Eisenmenger, Karl Heinz Erb, Helmut Haberl, and Marina Fischer-Kowalski. 2009. Growth in Global Materials Use, GDP and Population during the 20th Century. Ecological Economics 68: 2696–705. [Google Scholar] [CrossRef]

- Laplante, Benoit, and Paul Lanoie. 1994. The Market Response to Environmental Incidents in Canada: A Theoretical and Empirical Analysis. Southern Economic Journal 60: 657–72. [Google Scholar] [CrossRef]

- Lau, Lin Sea, Chee Keong Choong, and Yoke Kee Eng. 2014. Investigation of the Environmental Kuznets Curve for Carbon Emissions in Malaysia: DO Foreign Direct Investment and Trade Matter? Energy Policy 68: 490–97. [Google Scholar] [CrossRef]

- Lee, Chien Chiang, and Chun Ping Chang. 2009. FDI, Financial Development, and Economic Growth: International Evidence. Journal of Applied Economics 12: 249–71. [Google Scholar] [CrossRef]

- Leitão, Joao, and Rui Baptista. 2011. Inward FDI and ICT: Are They a Joint Technological Driver of Entrepreneurship? International Journal of Technology Transfer and Commercialisation 10: 268–88. [Google Scholar] [CrossRef]

- Levine, Ross, and Sara Zervos. 1998. Stock Markets, Banks, and Economic Growth. American Economic Review 88: 537–58. [Google Scholar] [CrossRef]

- Li, Xiaoying, and Xiaming Liu. 2005. Foreign Direct Investment and Economic Growth: An Increasingly Endogenous Relationship. World Development 33: 393–407. [Google Scholar] [CrossRef]

- Lizardo, Radhamés A., and André V. Mollick. 2009. Do Foreign Purchases of U.S. Stocks Help the U.S. Stock Market? Journal of International Financial Markets, Institutions and Money 19: 969–86. [Google Scholar] [CrossRef]

- Love, Inessa, and Lea Zicchino. 2006. Financial Development and Dynamic Investment Behavior: Evidence from Panel VAR. Quarterly Review of Economics and Finance 46: 190–210. [Google Scholar] [CrossRef]

- Luo, Cuicui, and Desheng Wu. 2016. Environment and Economic Risk: An Analysis of Carbon Emission Market and Portfolio Management. Environmental Research 149: 297–301. [Google Scholar] [CrossRef]

- Lütkepohl, Helmut. 2005. New Introduction to Multiple Time Series Analysis. Berlin: Springer. [Google Scholar] [CrossRef]

- Magee, Christopher L., and Tessaleno C. Devezas. 2017. A Simple Extension of Dematerialization Theory: Incorporation of Technical Progress and the Rebound Effect. Technological Forecasting and Social Change 117: 196–205. [Google Scholar] [CrossRef]

- Makiela, Kamil, and Bazoumana Ouattara. 2018. Foreign Direct Investment and Economic Growth: Exploring the Transmission Channels. Economic Modelling 72: 296–305. [Google Scholar] [CrossRef]

- Mamun, Md Al, Kazi Sohag, Muhammad Shahbaz, and Shawkat Hammoudeh. 2018. Financial Markets, Innovations and Cleaner Energy Production in OECD Countries. Energy Economics 72: 236–54. [Google Scholar] [CrossRef]

- Mensah, Claudia Nyarko, Xingle Long, Kofi Baah Boamah, Isaac Asare Bediako, Lamini Dauda, and Muhammed Salman. 2018. The Effect of Innovation on CO2 Emissions of OCED Countries from 1990 to 2014. Environmental Science and Pollution Research 25: 29678–98. [Google Scholar] [CrossRef] [PubMed]

- Mimouni, Karim, and Akram Temimi. 2018. What Drives Energy Efficiency? New Evidence from Financial Crises. Energy Policy 122: 332–48. [Google Scholar] [CrossRef]

- Muoghalu, Michael I., H. David Robison, and John L. Glascock. 1990. Hazardous Waste Lawsuits, Stockholder Returns, and Deterrence. Southern Economic Journal 57: 357–70. [Google Scholar] [CrossRef]

- Nickell, Stephen. 1981. Biases in Dynamic Models with Fixed Effects. Econometrica 49: 1417–26. [Google Scholar] [CrossRef]

- Pacca, Lucia, Alexander Antonarakis, Patrick Schröder, and Andreas Antoniades. 2020. The Effect of Financial Crises on Air Pollutant Emissions: An Assessment of the Short vs. Medium-Term Effects. Science of the Total Environment 698: 133614. [Google Scholar] [CrossRef] [PubMed]

- Panayotou, Theodore. 1993. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development. ILO Working Papers 992927783402676. Available online: https://ideas.repec.org/p/ilo/ilowps/992927783402676.html (accessed on 2 October 2020).

- Panayotou, Theodore. 1997. Demystifying the Environmental Kuznets Curve: Turning a Black Box into a Policy Tool. Environment and Development Economics 2: 465–84. [Google Scholar] [CrossRef]

- Paramati, Sudharshan Reddy, Di Mo, and Rakesh Gupta. 2017. The Effects of Stock Market Growth and Renewable Energy Use on CO2 Emissions: Evidence from G20 Countries. Energy Economics 66: 360–71. [Google Scholar] [CrossRef]

- Paramati, Sudharshan Reddy, Mallesh Ummalla, and Nicholas Apergis. 2016. The Effect of Foreign Direct Investment and Stock Market Growth on Clean Energy Use across a Panel of Emerging Market Economies. Energy Economics 56: 29–41. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2007. A Simple Panel Unit Root Test in the Presence of Cross Section Dependence. Journal of Applied Econometrics 3: 265–312. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2015. Testing Weak Cross-Sectional Dependence in Large Panels. Econometric Reviews 34: 1089–117. [Google Scholar] [CrossRef]

- Pothen, Frank, and Heinz Welsch. 2019. Economic Development and Material Use. Evidence from International Panel Data. World Development 115: 107–19. [Google Scholar] [CrossRef]

- Reckling, Dennis. 2016. Variance Risk Premia in CO2 Markets: A Political Perspective. Energy Policy 94: 345–54. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2014. Modeling Volatility and Correlations between Emerging Market Stock Prices and the Prices of Copper, Oil and Wheat. Energy Economics 43: 72–81. [Google Scholar] [CrossRef]

- Samargandi, Nahla. 2017. Sector Value Addition, Technology and CO2 Emissions in Saudi Arabia. Renewable and Sustainable Energy Reviews 78: 868–77. [Google Scholar] [CrossRef]

- Schwert, G. William. 1990. Stock Return and Real Activity: A Century of Evidence. Journal of Finance 45: 1237–57. [Google Scholar] [CrossRef]

- Seker, Fahri, Hasan Murat Ertugrul, and Murat Cetin. 2015. The Impact of Foreign Direct Investment on Environmental Quality: A Bounds Testing and Causality Analysis for Turkey. Renewable and Sustainable Energy Reviews 52: 347–56. [Google Scholar] [CrossRef]

- Shao, Qinglong, Anke Schaffartzik, Andreas Mayer, and Fridolin Krausmann. 2017. The High ‘Price’ of Dematerialization: A Dynamic Panel Data Analysis of Material Use and Economic Recession. Journal of Cleaner Production 167: 120–32. [Google Scholar] [CrossRef]

- Singhal, Shelly, and Sajal Ghosh. 2016. Returns and Volatility Linkages between International Crude Oil Price, Metal and Other Stock Indices in India: Evidence from VAR-DCC-GARCH Models. Resources Policy 50: 276–88. [Google Scholar] [CrossRef]

- Steinberger, Julia K., and Fridolin Krausmann. 2011. Material and Energy Productivity. Environmental Science and Technology 45: 1169–76. [Google Scholar] [CrossRef]

- Stern, David I. 1998. Progress on the Environmental Kuznets Curve? Environment and Development Economics 3: 173–96. [Google Scholar] [CrossRef]

- Su, Hsin Ning, and Igam M. Moaniba. 2017. Does Innovation Respond to Climate Change? Empirical Evidence from Patents and Greenhouse Gas Emissions. Technological Forecasting and Social Change 122: 49–62. [Google Scholar] [CrossRef]

- Tavares, José. 2009. Economic Integration and the Comovement of Stock Returns. Economics Letters 103: 65–67. [Google Scholar] [CrossRef]

- Tilton, John E. 1991. Material Substitution. The Role of New Technology. Technological Forecasting and Social Change 39: 127–44. [Google Scholar] [CrossRef]

- Vehmas, Jarmo, Jyrki Luukkanen, and Jari Kaivo-oja. 2007. Linking Analyses and Environmental Kuznets Curves for Aggregated Material Flows in the EU. Journal of Cleaner Production 15: 1662–73. [Google Scholar] [CrossRef]

- Vo, Anh, Duc Vo, and Quan Le. 2019. CO2 Emissions, Energy Consumption, and Cconomic Growth: New Evidence in the ASEAN Countries. Journal of Risk and Financial Management 12: 145. [Google Scholar] [CrossRef]

- Wang, Shaojian, Jingyuan Zeng, and Xiaoping Liu. 2019. Examining the Multiple Impacts of Technological Progress on CO2 Emissions in China: A Panel Quantile Regression Approach. Renewable and Sustainable Energy Reviews 103: 140–50. [Google Scholar] [CrossRef]

- Wu, Ya, Qianwen Zhu, and Bangzhu Zhu. 2018. Decoupling Analysis of World Economic Growth and CO2 Emissions: A Study Comparing Developed and Developing Countries. Journal of Cleaner Production 190: 94–103. [Google Scholar] [CrossRef]

- Zhang, Chao, Wei Qiang Chen, Gang Liu, and Da Jian Zhu. 2017. Economic Growth and the Evolution of Material Cycles: An Analytical Framework Integrating Material Flow and Stock Indicators. Ecological Economics 140: 265–74. [Google Scholar] [CrossRef]

| 1 | The instrumental variables are specified according to the procedures proposed by Holtz-Eakin et al. (1988). |

| 2 | Given the limited access to data, these were collected referring to the group of metals and the group of minerals. Concerning the group of metals, the materials included in the study variable are: aluminium, steel, cadmium, bismuth, lead, cobalt, copper, tin, iron, pig iron, lithium, magnesium, manganese, nickel, gold, silver, platinum and its derivatives and zinc. The group of minerals includes the following materials: asbestos, alumina, barite, feldspar, rock phosphate, gypsum, graphite, mica, salt and zirconia. |

| 3 | For the European Union, only Luxembourg was not included due to the unavailability of data. |

| 4 | The dummy variable has the value of 1 in the annual periods of 1991, 1994, 1995, 1997–2000, 2002, and the value of zero in the remaining periods. The periods under analysis correspond to different international crises, such as: the oil crisis (1991); the Mexican economic crisis (1994/1995); the Asian monetary crisis (1997); the Russian monetary crisis (1998); the Brazilian monetary crisis (1999); the Argentinian economic crisis (1999–2000); and the South American economic crisis (2002). The dummy variable equals to 1 in the annual periods of 2001 and 2007–2010, and 0 in other periods .These periods correspond to the dotcom bubble (2001), the subprime crisis (2007–2008) and the European debt crisis (2009–2010). |

| 5 | The Kitchin cycles are classified as short-term cycles, i.e., cycles lasting 4 years. Therefore, the Kitchin cycles found in the period of analysis correspond to the periods 1997–2000 and 2007–2010. |

| 6 | The dummy variable represents economic recession in the USA and People’s Republic of China, having the value of 1 in the annual periods of 2008 and 2009 and the value of zero in the other periods. The dummy variable corresponds to economic recession in Germany, France and the United Kingdom, having the value of 1 in the annual periods of 1991–1992, 2002–2003 and 2008–2009 and the value of zero in the other periods analysed. |

| 7 | In the Global Group, the FDI, SMKT and ENV_TECH variables appear as stationary at levels, whereas in the EU-15 Group only FDI is stationary, at levels. |

| 8 | The tables of the tests applied can be obtained upon request to the authors. |

| 9 | The PVAR Granger causality Wald test results, for the sake of brevity, can be obtained on request from the authors. |

| Variables | Associated Concepts | Description | Units | Statistical Sources |

|---|---|---|---|---|

| Material Production (MAT_PR) | Aggregate Material Production | Production of minerals commodities | Tons | British Geological Survey |

| Foreign Direct Investment (FDI) | Foreign Direct Investment or FDI | Inward and outward flows and stock | US Millions deflated by GDP deflator | UNCTAD |

| Gross Domestic Product (GDP_PC) | Economic Activity | Total of GDP per capita | US Millions in constant prices | UNCTAD |

| CO2 productivity (CO2_PR) | Carbon productivity | GDP per units of energy-related CO2 emissions | US dollar per kilogram | OECD |

| Stock Markets (SMKT) | Stock Markets | Major domestic stock markets indexes | Index points | investing.com |

| Environment-related technologies (ENV_TECH) | Green Tech | Patents related with environmental management, water adaptation and climate change mitigation | Units of patents | OECD |

| Models | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Dependent Variable | MAT_PR | FDI | GDP_PC | CO2_PR | SMKT | ENV_TECH |

| MAT_PR | 0.4120 ** | 1.9798 * | 0.0719 *** | −0.0941 | 0.3907 | 1.0105 ** |

| [2.5700] | [1.9000] | [3.0400] | [−1.2700] | [1.3500] | [2.3700] | |

| FDI | −0.0136 | 0.8452 *** | −0.0030 | 0.0038 | 0.0235 | −0.0048 |

| [−1.3000] | [8.8300] | [−1.5500] | [0.8000] | [0.7900] | [−0.1700] | |

| GDP_PC | −1.0465 ** | 0.0254 | 0.3489 *** | 0.8836 *** | −1.1130 | −0.6140 |

| [−1.9700] | [0.0100] | [3.4100] | [3.3700] | [−0.7500] | [−0.4000] | |

| CO2_PR | 0.5478 | −5.2331 * | −0.0535 | −0.5501 *** | 1.7834 ** | 0.5847 |

| [1.4300] | [−1.7200] | [−0.7800] | [−3.1900] | [2.3000] | [0.6500] | |

| SMKT | −0.0147 | 0.1931 ** | −0.0033 | −0.0058 | 0.8226 *** | 0.0146 |

| [−1.3500] | [2.0900] | [−1.6200] | [−1.1800] | [23.0100] | [0.4500] | |

| ENV_TECH | −0.0231 | 0.0671 | 0.0030 | 0.0209 *** | 0.0335 | 0.9463 *** |

| [−1.6400] | [0.5400] | [0.9700] | [2.8400] | [0.7400] | [20.0700] | |

| Dummy Crises EM | −0.0069 | 0.2746 ** | 0.0110 *** | 0.0080 | −0.0589 | 0.0054 |

| [−0.4700] | [1.6100] | [4.6200] | [1.2600] | [−1.6400] | [0.1300] | |

| Dummy Crises DM | 0.0560 ** | 0.0575 | 0.0189 *** | −0.0010 | −0.0146 | 0.1384 ** |

| [2.3300] | [0.3200] | [5.3600] | [−0.1100] | [−0.3300] | [2.4800] | |

| Dummy Global | −0.1571 *** | −0.3331 * | −0.0514 *** | −0.0037 | −0.3125 *** | −0.1140 * |

| [−4.7100] | [−1.9600] | [−9.3300] | [−0.3800] | [−4.7100] | [−1.9100] |

| Models | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Dependent Variable | MAT_PR | FDI | GDP_PC | CO2_PR | SMKT | ENV_TECH |

| MAT_PR | 0.0980 | 0.9915 | 0.0075 | 0.1032 ** | −0.2974 | 0.4450 * |

| [0.7700] | [1.0300] | [0.3200] | [2.4100] | [−0.9400] | [1.8600] | |

| FDI | 0.0129 | 0.9471 *** | −0.0049 | 0.0165 ** | −0.0058 | 0.0396 |

| [0.5900] | [5.9600] | [−1.3600] | [2.0600] | [−0.1000] | [1.1500] | |

| GDP_PC | −2.3522 *** | −1.6165 | 0.2052 *** | 0.1862 | −2.4965 ** | −0.3280 |

| [−4.7900] | [−0.4900] | [2.7900] | [1.1400] | [−1.9700] | [−0.3900] | |

| CO2_PR | 0.3538 | −1.8769 | 0.0410 | −0.2540 *** | 2.1104 *** | 0.2990 |

| [1.4800] | [−1.0600] | [0.9300] | [−2.9000] | [3.0000] | [0.7600] | |

| SMKT | 0.2345 *** | −0.7736 * | 0.0153 | 0.0249 | 0.3182 * | 0.0170 |

| [3.5100] | [−1.6900] | [1.4800] | [1.0300] | [1.8600] | [0.1700] | |

| ENV_TECH | −0.1162 | −0.2358 | −0.0172 | 0.0509 ** | 0.0798 | 0.0259 |

| [−1.4600] | [−0.5200] | [−1.4400] | [2.3700] | [0.4900] | [0.1800] | |

| Dummy Crises EM | 0.0383 ** | 0.4088 *** | 0.0135 *** | −0.0075 | −0.0205 | 0.0475 * |

| [2.0800] | [3.1600] | [4.7500] | [−1.1900] | [−0.4600] | [1.7600] | |

| Dummy Crises DM | −0.0195 | 0.0029 | 0.0039 | −0.0103 | −0.2392 *** | 0.0553 |

| [−0.8000] | [0.0100] | [1.0000] | [−1.1900] | [−4.2400] | [1.6200] | |

| Dummy EU | 0.0247 | −0.6449 *** | −0.0190 *** | −0.0114 | −0.0030 | 0.0339 |

| [0.8800] | [−3.1200] | [−4.4800] | [−1.1600] | [−0.0300] | [0.7400] |

| Equantion Variable | Excluded Variable | Dynamic Analysis | 4 Years | 8 Years | 10 Years | Sign |

|---|---|---|---|---|---|---|

| MAT_PR | ||||||

| GDP_PC | FEVD | 0.0312 | 0.0307 | 0.0306 | - | |

| COIRF | −0.0289 | −0.0241 | −0.0228 | |||

| FDI | ||||||

| MAT_PR | FEVD | 0.0842 | 0.0834 | 0.0825 | + | |

| COIRF | 0.8485 | 1.1720 | 1.2737 | |||

| CO2_PR | FEVD | 0.0289 | 0.0238 | 0.0229 | - | |

| COIRF | −0.3221 | −0.3905 | −0.4071 | |||

| SMKT | FEVD | 0.0122 | 0.0318 | 0.0390 | + | |

| COIRF | 0.3957 | 0.8743 | 1.0787 | |||

| GDP_PC | ||||||

| MAT_PR | FEVD | 0.2924 | 0.2821 | 0.2799 | + | |

| COIRF | 0.0263 | 0.0219 | 0.0206 | |||

| CO2_PR | ||||||

| GDP_PC | FEVD | 0.0903 | 0.0894 | 0.0891 | + | |

| COIRF | 0.0226 | 0.0222 | 0.0222 | |||

| ENV_TECH | FEVD | 0.0153 | 0.0229 | 0.0251 | + | |

| COIRF | 0.0152 | 0.0248 | 0.0285 | |||

| SMKT | ||||||

| CO2_PR | FEVD | 0.0192 | 0.0165 | 0.0160 | + | |

| COIRF | 0.0838 | 0.1271 | 0.1410 | |||

| ENV_TECH | ||||||

| MAT_PR | FEVD | 0.1988 | 0.2155 | 0.2152 | + | |

| COIRF | 0.5593 | 0.9260 | 1.0637 |

| Equation Variable | Excluded Variable | Dynamic Analysis | 4 Years | 8 Years | 10 Years | Sign |

|---|---|---|---|---|---|---|

| MAT_PR | ||||||

| GDP_PC | FEVD | 0.1047 | 0.0852 | 0.081 | - | |

| COIRF | −0.0722 | −0.0080 | −0.0816 | |||

| SMKT | FEVD | 0.1940 | 0.1702 | 0.1672 | + | |

| COIRF | 0.0657 | 0.0265 | 0.010 | |||

| FDI | ||||||

| SMKT | FEVD | 0.0485 | 0.0691 | 0.0728 | - | |

| COIRF | −1.0312 | −1.8847 | −2.1822 | |||

| CO2_PR | ||||||

| MAT_PR | FEVD | 0.0855 | 0.0715 | 0.0685 | + | |

| COIRF | 0.0074 | 0.0149 | 0.0175 | |||

| FDI | FEVD | 0.2088 | 0.3415 | 0.3666 | - | |

| COIRF | 0.0745 | 0.1285 | 0.1474 | |||

| ENV_TECH | FEVD | 0.0411 | 0.0347 | 0.0338 | - | |

| COIRF | 0.0058 | −0.0008 | −0.0036 | |||

| SMKT | ||||||

| GDP_PC | FEVD | 0.0181 | 0.0176 | 0.0172 | - | |

| COIRF | −0.0621 | −0.0759 | −0.0783 | |||

| CO2_PR | FEVD | 0.0913 | 0.0847 | 0.0832 | + | |

| COIRF | 0.1068 | 0.0800 | 0.0675 | |||

| ENV_TECH | ||||||

| MAT_PR | FEVD | 0.0311 | 0.0286 | 0.0280 | + | |

| COIRF | 0.0633 | 0.0899 | 0.0992 |

| Equation Variable | Excluded Variable | Dynamic Analysis | 4 Years | 8 Years | 10 Years | Sign |

|---|---|---|---|---|---|---|

| MAT_PR | ||||||

| GDP_PC | FEVD | 0.0365 | 0.0369 | 0.0370 | - | |

| COIRF | −0.0272 | −0.0182 | −0.0154 | |||

| FDI | ||||||

| MAT_PR | FEVD | 0.0724 | 0.0735 | 0.0730 | + | |

| COIRF | 0.8137 | 1.1337 | 1.2359 | |||

| CO2_PR | FEVD | 0.0474 | 0.0418 | 0.0406 | - | |

| COIRF | −0.5433 | −0.7033 | −0.7446 | |||

| SMKT | FEVD | 0.0083 | 0.0231 | 0.0292 | + | |

| COIRF | 0.2945 | 0.7175 | 0.9048 | |||

| GDP_PC | ||||||

| MAT_PR | FEVD | 0.2862 | 0.2757 | 0.2735 | + | |

| COIRF | 0.0265 | 0.0223 | 0.0209 | |||

| CO2_PR | ||||||

| GDP_PC | FEVD | 0.1096 | 0.1087 | 0.1084 | + | |

| COIRF | 0.0166 | 0.0156 | 0.0155 | |||

| ENV_TECH | FEVD | 0.0355 | 0.0426 | 0.0447 | + | |

| COIRF | 0.0159 | 0.0254 | 0.0291 | |||

| SMKT | ||||||

| CO2_PR | FEVD | 0.0261 | 0.0218 | 0.0208 | + | |

| COIRF | 0.1404 | 0.1790 | 0.1882 | |||

| ENV_TECH | ||||||

| MAT_PR | FEVD | 0.1397 | 0.1531 | 0.1527 | + | |

| COIRF | 0.4489 | 0.7584 | 0.8735 |

| Equation Variable | Excluded Variable | Dynamic Analysis | 4 Years | 8 Years | 10 Years | Sign |

|---|---|---|---|---|---|---|

| MAT_PR | ||||||

| GDP_PC | FEVD | 0.1197 | 0.0971 | 0.0920 | - | |

| COIRF | −0.0748 | −0.0822 | −0.0835 | |||

| SMKT | FEVD | 0.1769 | 0.1677 | 0.1683 | - | |

| COIRF | 0.0536 | 0.0025 | −0.0181 | |||

| FDI | ||||||

| SMKT | FEVD | 0.0911 | 0.1194 | 0.1244 | - | |

| COIRF | −1.4795 | −2.5512 | −2.9221 | |||

| CO2_PR | ||||||

| MAT_PR | FEVD | 0.0340 | 0.0281 | 0.0268 | + | |

| COIRF | 0.0122 | 0.0161 | 0.0174 | |||

| FDI | FEVD | 0.2106 | 0.3342 | 0.3573 | + | |

| COIRF | 0.0741 | 0.1267 | 0.1451 | |||

| ENV_TECH | FEVD | 0.0459 | 0.0369 | 0.0351 | + | |

| COIRF | 0.0153 | 0.0132 | 0.0120 | |||

| SMKT | ||||||

| GDP_PC | FEVD | 0.0202 | 0.0195 | 0.0190 | - | |

| COIRF | −0.0716 | −0.0845 | −0.0866 | |||

| CO2_PR | FEVD | 0.1093 | 0.1014 | 0.0996 | + | |

| COIRF | 0.1090 | 0.0800 | 0.0667 | |||

| ENV_TECH | ||||||

| MAT_PR | FEVD | 0.0297 | 0.0254 | 0.0245 | + | |

| COIRF | 0.0472 | 0.0612 | 0.0659 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leitão, J.; Ferreira, J. Dynamic Effects of Material Production and Environmental Sustainability on Economic Vitality Indicators: A Panel VAR Approach. J. Risk Financial Manag. 2021, 14, 74. https://doi.org/10.3390/jrfm14020074

Leitão J, Ferreira J. Dynamic Effects of Material Production and Environmental Sustainability on Economic Vitality Indicators: A Panel VAR Approach. Journal of Risk and Financial Management. 2021; 14(2):74. https://doi.org/10.3390/jrfm14020074

Chicago/Turabian StyleLeitão, João, and Joaquim Ferreira. 2021. "Dynamic Effects of Material Production and Environmental Sustainability on Economic Vitality Indicators: A Panel VAR Approach" Journal of Risk and Financial Management 14, no. 2: 74. https://doi.org/10.3390/jrfm14020074

APA StyleLeitão, J., & Ferreira, J. (2021). Dynamic Effects of Material Production and Environmental Sustainability on Economic Vitality Indicators: A Panel VAR Approach. Journal of Risk and Financial Management, 14(2), 74. https://doi.org/10.3390/jrfm14020074