COVID 19 and Bank Profitability in Low Income Countries: The Case of Uganda

Abstract

1. Introduction

2. Bank Profitability and the COVID-19 Pandemic

3. An Overview of Uganda’s Banking Sector

4. Methodology

4.1. Model Specification

4.2. Data and Measurement of Key Variables

5. Results and Discussion

5.1. Unit Root and Cointegration Tests Results

5.2. Discussion of Results

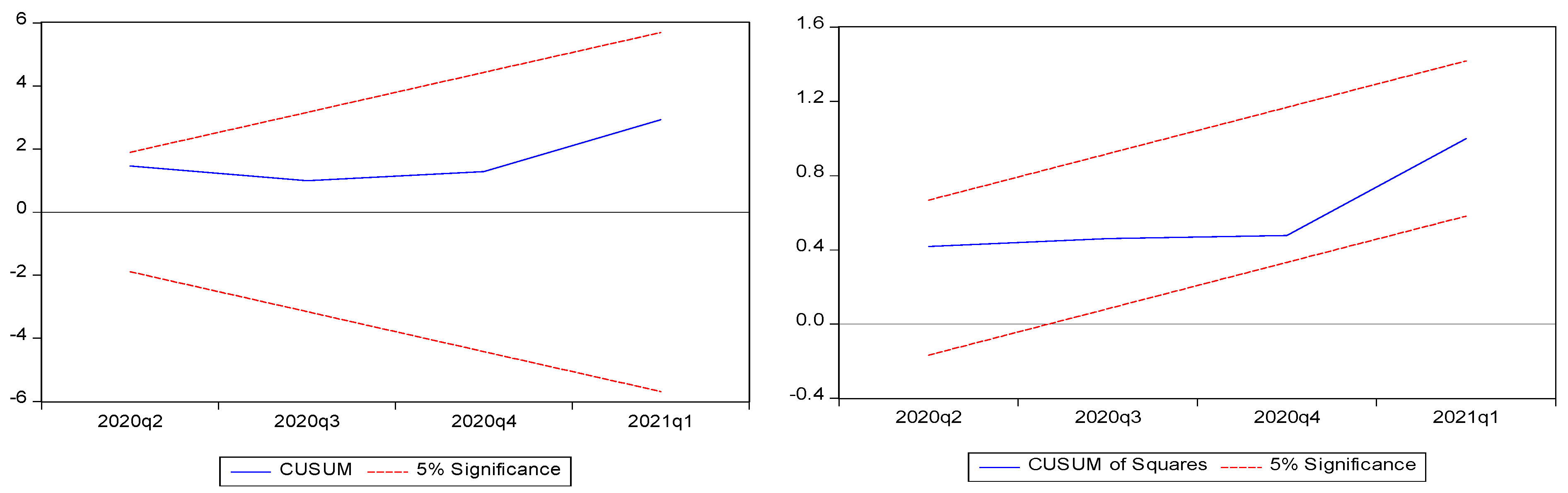

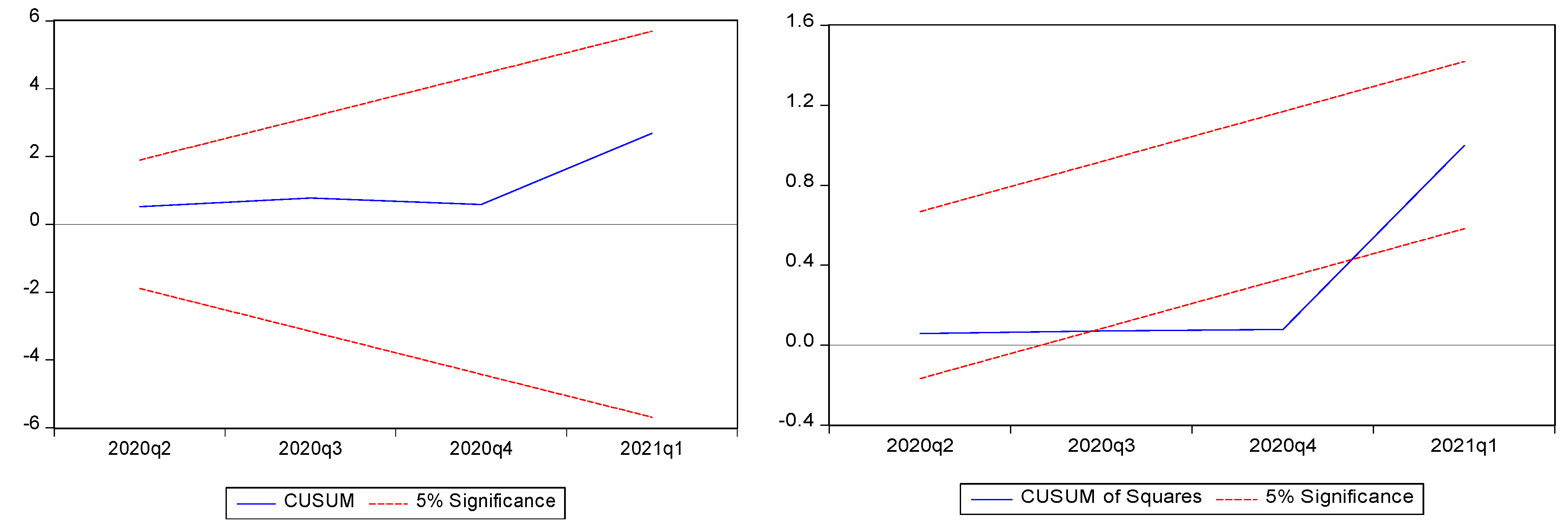

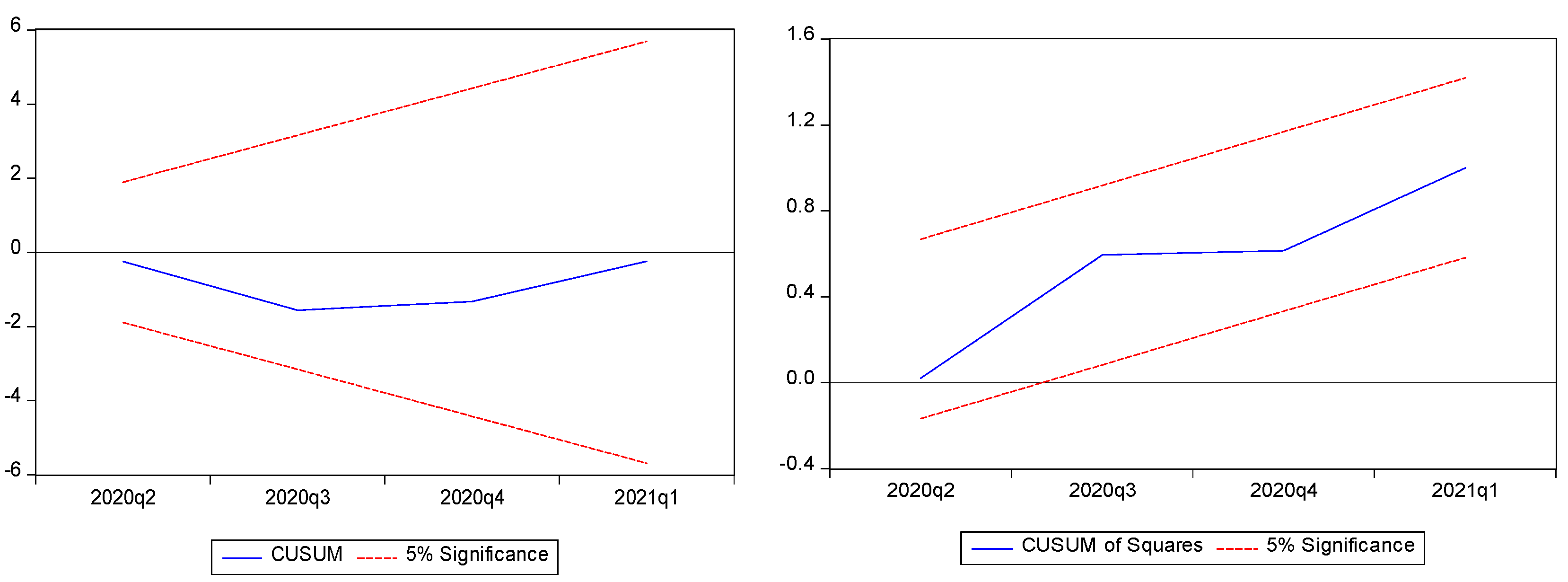

5.3. Model Specification and Robustness Test Results

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | For a summary of some of the recent studies see (Al-Homaidi et al. 2018). |

| 2 | As a precaution we apply the Heteroscedasticity and Autocorrelation Consistent Covariance (HAC) estimators in the ARDL model estimations to ensure that our results are robust in the presence of heteroscedasticity and serial correlation. Note that the HAC approach alters the estimates of the coefficient standard errors of an equation but not the point estimates themselves. |

| 3 | These results are available from the author upon request. |

References

- Abdelaziz, Hakimi, Boussaada Rim, and Hamdi Helmi. 2020. The Interactional Relationships Between Credit Risk, Liquidity Risk and Bank Profitability in MENA Region. Global Business Review. [Google Scholar] [CrossRef]

- Adelopo, Ismail, Robert Lloydking, and Venancio Tauringana. 2018. Determinants of Bank Profitability before, during, and after the Financial Crisis. International Journal of Managerial Finance 14: 378–98. [Google Scholar] [CrossRef]

- African Development Bank. 2021. African Economic Outlook 2021—From Debt Resolution to Growth: The Road Ahead for Africa. Abidjan: African Development Bank Group. [Google Scholar]

- Al-Homaidi, Eissa A., Mosab I. Tabash, Najib H. S. Farhan, and Faozi A. Almaqtari. 2018. Bank-Specific and Macro-Economic Determinants of Profitability of Indian Commercial Banks: A Panel Data Approach. Cogent Economics & Finance 6: 1548072. [Google Scholar]

- Almaqtari, Faozi A., Eissa A. Al-Homaidi, Mosab I. Tabash, and Najib H. Farhan. 2019. The Determinants of Profitability of Indian Commercial Banks: A Panel Data Approach. International Journal of Finance & Economics 24: 168–85. [Google Scholar] [CrossRef]

- Alshatti, Ali Sulieman. 2015. The Effect of Credit Risk Management on Financial Performance of the Jordanian Commercial Banks. Investment Management and Financial Innovations 12: 338–45. [Google Scholar]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimis, and Matthaios D. Delis. 2008. Bank-Specific, Industry-Specific and Macroeconomic Determinants of Bank Profitability. Journal of International Financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, Marzieh Bolhassani, and Scott W. Hegerty. 2010. The Effects of Currency Fluctuations and Trade Integration on Industry Trade between Canada and Mexico. Research in Economics 64: 212–23. [Google Scholar] [CrossRef]

- Bank of Uganda. 2020a. Annual Supervision Report. Kampala: Bank of Uganda. [Google Scholar]

- Bank of Uganda. 2020b. Financial Stability Report. Kampala: Bank of Uganda. [Google Scholar]

- Bank of Uganda. 2020c. Licensed Commercial Banks as at July 01, 2020. Kampala: Supervised Institutions. [Google Scholar]

- Barua, Bipasha, and Suborna Barua. 2020. COVID-19 Implications for Banks: Evidence from an Emerging Economy. SN Business & Economics 1: 19. [Google Scholar] [CrossRef]

- Bhattarai, Yuga Raj. 2016. Effect of Credit Risk on the Performance of Nepalese Commercial Banks. NRB Economic Review 28: 41–64. [Google Scholar]

- Bigsten, Arne, and Steve Kayizzi-Mugerwa. 2001. Is Uganda an Emerging Economy?: A Report for the OECD Project “Emerging Africa”. Uppsala: Nordiska Afrikainstitutet. [Google Scholar]

- Boateng, Kwadwo. 2018. Determinants of Bank Profitability: A Comparative Study of Indian and Ghanaian Banks. Journal of Emerging Technology and Innovative Research 5: 1–12. [Google Scholar]

- Damak, Mohamed, Cynthia Cohen Freue, Geeta Chugh, Natalia Yalovskaya, Ming Tan, Ivan Tan, Sergio Garibian, Tatiana Lysenko, and Elijah Oliveros Rosen. 2020. Banks in Emerging Markets. New York: Standard & Poor’s Financial Services. [Google Scholar]

- De Zoysa, Hema R., Robert L. Sharer, and Calvin A. McDonald. 1995. Monetary Policy and Financial Sector Reform. In Uganda Adjustment with Growth, 1987–94, Occasional. Washington: International Monetary Fund, pp. 31–38. [Google Scholar] [CrossRef]

- Elnahass, Marwa, Vu Quang Trinh, and Teng Li. 2021. Global Banking Stability in the Shadow of Covid-19 Outbreak. Journal of International Financial Markets, Institutions and Money 72: 101322. [Google Scholar] [CrossRef]

- Harris, Richard, and Robert Sollis. 2003. Applied Time Series Modelling and Forecasting. Chichester: Wiley. [Google Scholar]

- Jurd de Girancourt, François, Aalind Gupta, Shikha Gupta, and Uzayr Jeenah. 2021. African Banking in the New Reality. Chicago: McKinsey & Company. [Google Scholar]

- Katusiime, Lorna. 2021. Mobile Money Use: The Impact of Macroeconomic Policy and Regulation. Economies 9: 51. [Google Scholar] [CrossRef]

- Kohlscheen, Emanuel, Andrés Murcia, and Juan Contreras. 2018. Determinants of Bank Profitability in Emerging Markets. Basel: Bank for International Settlements. [Google Scholar]

- Kremers, Jeroen J. M., Neil R. Ericsson, and Juan J. Dolado. 1992. The Power of Cointegration Tests. Oxford Bulletin of Economics and Statistics 54: 325–48. [Google Scholar] [CrossRef]

- Kumar, Vijay, Sanjeev Acharya, and Ly T. H. Ho. 2020. Does Monetary Policy Influence the Profitability of Banks in New Zealand? International Journal of Financial Studies 8: 35. [Google Scholar] [CrossRef]

- Kutan, Ali M., Emre Ozsoz, and Erick W. Rengifo. 2012. Cross-Sectional Determinants of Bank Performance under Deposit Dollarization in Emerging Markets. Emerging Markets Review 13: 478–92. [Google Scholar] [CrossRef]

- Kuteesa, Florence, Emmanuel Tumusiime-Mutebile, Alan Whitworth, and Tim Williamson. 2010. Uganda’s Economic Reforms: Insider Accounts. Edited by Florence Kuteesa, Emmanuel Tumusiime-Mutebile, Alan Whitworth and Tim Williamson. New York: Oxford University Press. [Google Scholar]

- Lartey, Victor Curtis, Samuel Antwi, and Eric Kofi Boadi. 2013. The Relationship between Liquidity and Profitability of Listed Banks in Ghana. International Journal of Business and Social Science 4: 1–9. [Google Scholar]

- Le, Tu D. Q., and Thanh Ngo. 2020. The Determinants of Bank Profitability: A Cross-Country Analysis. Central Bank Review 20: 65–73. [Google Scholar] [CrossRef]

- Lwanga Mayanja, Musa, and Annet Adong. 2016. A Pathway to Financial Inclusion: Mobile Money and Individual Savings in Uganda. Research Series; Kampala: Economic Policy Research Centre. [Google Scholar]

- Mawejje, Joseph, and E. C. Lakuma. 2017. Macroeconomic Effects of Mobile Money in Uganda. Kampala: Economic Policy Research Centre. [Google Scholar] [CrossRef]

- Minney, Tom. 2020. Can Africa’s Banks Emerge Stronger after Covid-19? African Business, November 3. [Google Scholar]

- Morley, Bruce. 2006. Causality between Economic Growth and Immigration: An ARDL Bounds Testing Approach. Economics Letters 90: 72–76. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar. 2005. The Saving and Investment Nexus for China: Evidence from Cointegration Tests. Applied Economics 37: 1979–90. [Google Scholar] [CrossRef]

- OECD. 2020. OECD Economic Outlook, Volume 2020 Issue 1: Vol. Issue 1, No. 107. Paris: OECD. [Google Scholar] [CrossRef]

- OECD. n.d. Focus on the Global Economy. Paris: Organisation for Economic Co-Operation and Development (OECD).

- Ogunbiyi, S. Samuel. 2014. Interest Rates and Deposit Money Banks’profitability Nexus: The Nigerian Experience. Arabian Journal of Business and Management Review (OMAN Chapter) 3: 133. [Google Scholar] [CrossRef]

- Oino, Isaiah. 2015. Competitiveness and Determinants of Bank Profitability in Sub-Saharan Africa. International Journal of Economics and Finance 7: 151–62. [Google Scholar] [CrossRef][Green Version]

- Owolabi, Adesegun. 2020. Effect of Lending Rate on the Performance of Nigerian Deposit Money Bank. Journal of Asian Economics 1: 163–80. [Google Scholar]

- Ozili, Peterson K. 2021. Bank Profitability Determinants: Comparing the United States, Nigeria and South Africa. International Journal of Banking and Finance 16: 55–78. [Google Scholar] [CrossRef]

- Ozurumba, Benedict Anayochukwu. 2016. Impact of Non-Performing Loans on the Performance of Selected Commercial Banks in Nigeria. Research Journal of Finance and Accounting 7: 95–109. [Google Scholar]

- Pesaran, M. Hashem, and Yongcheol Shin. 1998. An Autoregressive Distributed-Lag Modelling Approach to Cointegration Analysis. Econometric Society Monographs 31: 371–413. [Google Scholar]

- Pesaran, M. Hashem, and Yongcheol Shin. 1999. An Autoregressive Distributed-Lag Modelling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. Edited by Steinar Strøm. Econometric Society Monographs. Cambridge: Cambridge University Press, pp. 371–413. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Rahman, Mohammad Morshedur, Md Kowsar Hamid, and Md Abdul Mannan Khan. 2015. Determinants of Bank Profitability: Empirical Evidence from Bangladesh. International Journal of Business and Management 10: 135. [Google Scholar] [CrossRef]

- Sufian, Fadzlan, and Muzafar Shah Habibullah. 2009. Determinants of Bank Profitability in a Developing Economy: Empirical Evidence from Bangladesh. Journal of Business Economics and Management 10: 207–17. [Google Scholar] [CrossRef]

- The East African. 2020. Half of Ugandan Banks Fail Pandemic Liquidity Test. The East African, June 29. [Google Scholar]

- Titko, Jelena, Viktorija Skvarciany, and Daiva Jurevičienė. 2015. Drivers of Bank Profitability: Case of Latvia and Lithuania. Intellectual Economics 9: 120–29. [Google Scholar] [CrossRef]

- Twaha, Ali. 2021. Bank Deposit Accounts Hit 17 Million—New Vision Official. New Vision, February 25. [Google Scholar]

- Tyson, Judith. 2020. The Impact of COVID-19 on Africa’s Banking System|ODI: Think Change. London: Overseas Development Institute (ODI). [Google Scholar]

- World Bank. 2021. Global Economic Prospects: The Global Economy: On Track for Strong but Uneven Growth as COVID-19 Still Weighs. Feature Story, June 8. [Google Scholar]

- Yao, Hongxing, Muhammad Haris, and Gulzara Tariq. 2018. Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan. International Journal of Financial Studies 6: 53. [Google Scholar] [CrossRef]

| Year | Number of Banks | Total Assets (UGX Trillions) | ROA (%) | ROE (%) | NPL Ratio (%) |

|---|---|---|---|---|---|

| 1999 | 20 | 1.352 | 1.02 | 24.5 | 26 |

| 2005 | 15 | 3.689 | 3.4 | 28.6 | 2.3 |

| 2018 | 24 | 28.1 | 2.5 | 14.4 | 3.4 |

| 2019 | 26 | 32.8 | 2.5 | 13.8 | 4.9 |

| 2020 | 25 | 38.3 | 1.8 | 10.3 | 5.3 |

| Variable | Description | Mean | Median | Maximum | Minimum | Std. Dev. | Observations |

|---|---|---|---|---|---|---|---|

| ROE | Return on Equity (%) | 25.197 | 22.432 | 58.933 | 8.327 | 12.042 | 85 |

| ROA | Return on Assets (%) | 3.298 | 3.289 | 6.025 | 1.330 | 0.966 | 85 |

| NIM | Net Interest Margin (%) | 10.835 | 10.951 | 13.548 | 7.979 | 1.159 | 85 |

| NPLS | Non Performing Loans (%) | 4.891 | 4.131 | 15.149 | 1.606 | 2.561 | 85 |

| LIQ | Liquidity (%) | 44.808 | 45.466 | 69.166 | 17.647 | 11.288 | 85 |

| SEN | Market Sensitivity (%) | 57.148 | 60.057 | 89.784 | 23.308 | 19.031 | 85 |

| LRGDP | Natural Log of Economic Activity | 9.850 | 9.929 | 10.397 | 9.157 | 0.378 | 85 |

| LINF | Natural Log of Inflation | 5.898 | 4.970 | 21.579 | −4.418 | 4.559 | 85 |

| LEX | Natural Log of Exchange rate | 7.772 | 7.717 | 8.235 | 7.326 | 0.301 | 85 |

| LEND | Lending rate (%) | 21.068 | 20.482 | 27.218 | 17.727 | 2.160 | 85 |

| TB | Treasury Bill Rate (%) | 10.625 | 9.617 | 22.120 | 3.756 | 4.025 | 85 |

| Unit Root Tests | Augmented Dicky–Fuller (ADF) | Phillips Peron (PP) | |||

|---|---|---|---|---|---|

| Levels | 1st Difference | Levels | 1st Difference | Inference | |

| Return on Equity (ROE) | −3.783 *** | −2.333 | −8.1896 *** | I(1)/I(0) | |

| Return on Assets (ROA) | −2.721 | −7.243 *** | −2.498 | −7.5766 *** | I(1) |

| Net Interest Margin (NIM) | −3.919 *** | −3.392 ** | I(0) | ||

| Non Performing Loans (NPLS) | −4.468 *** | −4.457 *** | I(0) | ||

| Liquidity (LIQ) | −2.799 | −6.660 *** | −2.912 ** | I(1)/I(0) | |

| Market Sensitivity (SEN) | −1.817 | −9.981 *** | −1.790 | −10.0577 *** | I(1) |

| Economic Activity (LRGDP) | −0.116 | −2.851 *** | −3.134 ** | I(1)/I(0) | |

| Inflation (LINF) | −2.693 | −5.482 *** | −2.550 | −5.0948 *** | I(1) |

| Exchange rate (LER) | −0.666 | −7.120 *** | −0.688 | −6.9013 *** | I(1) |

| Lending rate (LEND) | −2.458 | −9.609 *** | −2.610 | −9.609 *** | I(1) |

| Treasury Bill Rate (TB) | −3.476 ** | −3.600 *** | I(0) | ||

| Dependent Variable a | F-Statistic for Case III Intercept No Trend b | Conclusion |

|---|---|---|

| MODEL 1: ROE | ||

| P | 7.159 | Cointegration |

| NPLS | 4.760 | No cointegration |

| LIQ | 4.334 | No cointegration |

| SEN | 3.915 | No cointegration |

| MODEL 2:ROA | ||

| P | 6.873 | Cointegration |

| NPLS | 3.420 | No cointegration |

| LIQ | 3.331 | No cointegration |

| SEN | 3.912 | No cointegration |

| MODEL 3:NIM | ||

| P | 10.483 | Cointegration |

| NPLS | 5.475 | No cointegration |

| LIQ | 3.034 | No cointegration |

| SEN | 3.631 | No cointegration |

| MODEL 1: ROE | MODEL 2: ROA | MODEL 3: NIM | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Regressors | ARDL (1,4,2,0) | LONG RUN | SHORT RUN | ARDL (3,4,0,0) | LONG RUN | SHORT RUN | ARDL (2,0,0,0) | LONG RUN | SHORT RUN |

| Intercept | 13.994 | 14.944 *** | 5.075 * | 5.554 *** | −5.280 *** | −6.269 *** | |||

| (0.62) | (7.01) | (1.79) | (6.86) | (−2.63) | (−7.36) | ||||

| Bank Profitability (−1) | 0.705 *** | 0.891 *** | 1.103 *** | ||||||

| (11.84) | (11.44) | (13.00) | |||||||

| Δ Bank Profitability (−1) | 0.261 *** | 0.331 *** | |||||||

| (3.13) | (4.12) | ||||||||

| Bank Profitability (−2) | 0.082 | −0.415 *** | |||||||

| (0.80) | (−5.41) | ||||||||

| Δ Bank Profitability (−2) | 0.362 *** | ||||||||

| (4.02) | |||||||||

| Bank Profitability (−3) | −0.375 *** | ||||||||

| (−5.40) | |||||||||

| Non Performing Loans | −0.912 *** | 0.655 | −0.108 *** | −0.027 | 0.045 ** | 0.144 ** | |||

| (−4.01) | (0.67) | (−3.86) | (−0.30) | (2.34) | (2.17) | ||||

| Δ Non Performing Loans | −0.927 *** | −0.100 *** | 0.029 | ||||||

| (−3.99) | (−3.63) | (0.94) | |||||||

| Non Performing Loans (−1) | 0.658 * | 0.078 ** | |||||||

| (1.92) | (2.26) | ||||||||

| Δ Non Performing Loans (−1) | −0.507 ** | −0.029 | |||||||

| (−2.15) | (−1.08) | ||||||||

| Non Performing Loans (−2) | 0.347 | 0.035 | |||||||

| (1.35) | (1.11) | ||||||||

| Δ Non Performing Loans (−2) | −0.171 | −0.001 | |||||||

| (−0.69) | (−0.02) | ||||||||

| Non Performing Loans (−3) | −0.683 *** | −0.110 | |||||||

| (−3.19) | (−2.75) | ||||||||

| Δ Non Performing Loans (−3) | −0.834 *** | −0.105 *** | |||||||

| (−3.69) | (−4.02) | ||||||||

| Non Performing Loans (−4) | 0.782 ** | 0.094 *** | |||||||

| (2.45) | (2.35) | ||||||||

| Liquidity | −0.163 ** | 0.103 | −0.007 | −0.016 | 0.002 | 0.005 | |||

| (−2.72) | (0.53) | (−1.48) | (−1.58) | (0.47) | (0.46) | ||||

| Δ Liquidity | −0.171 *** | −0.016 ** | −0.010 | ||||||

| (−3.09) | (−2.40) | (−1.35) | |||||||

| Liquidity (−1) | 0.011 | ||||||||

| (0.16) | |||||||||

| Δ Liquidity (−1) | −0.188 *** | ||||||||

| (−3.37) | |||||||||

| Liquidity (−2) | 0.182 *** | ||||||||

| (3.26) | |||||||||

| Market Sensitivity | −0.150 *** | −0.511 *** | −0.008 | −0.019 | −0.005 | −0.017 | |||

| (3.06) | (3.44) | (−1.20) | (−1.24) | (−1.26) | (−1.17) | ||||

| Δ Market Sensitivity | −0.110 * | −0.005 | 0.001 | ||||||

| (−190) | (−0.79) | (0.10) | |||||||

| Economic Activity | 8.321 * | 28.249 | 0.178 | 0.442 | 1.070 ** | 3.427 ** | |||

| (1.76) | (1.71) | (0.33) | (0.33) | (2.38) | (2.20) | ||||

| Δ Economic Activity | −26.736 | −1.956 | −3.146 | ||||||

| (−0.56) | (−0.35) | (−0.49) | |||||||

| Inflation | −0.107 | −0.362 | 0.004 | 0.010 | 0.009 | 0.028 | |||

| (−1.21) | (−1.17) | (0.41) | (0.41) | (0.73) | (0.74) | ||||

| Δ Inflation | −0.164 | −0.011 | −0.004 | ||||||

| (−1.29) | (−0.73) | (−0.23) | |||||||

| Exchange rate | −12.20 ** | −41.416 *** | −0.730 | −1.813 * | −0.482 | −1.543 | |||

| (−2.64) | (−2.80) | (−1.66) | (−1.80) | (−1.15) | (−1.08) | ||||

| Δ Exchange rate | −9.500 | −1.033 | −1.145 | ||||||

| (−1.44) | (−1.35) | (−1.31) | |||||||

| Lending rate | 0.303 | 1.027 | 0.028 | 0.069 | 0.081 ** | 0.259 *** | |||

| (1.24) | (1.33) | (1.39) | (1.46) | (2.60) | (2.86) | ||||

| Δ Lending rate | 0.324 | 0.009 | 0.075 ** | ||||||

| (1.32) | (0.30) | (2.35) | |||||||

| Interest rate | 0.598 *** | 2.030 *** | 0.030 * | 0.074 * | 0.014 | 0.046 | |||

| (4.14) | (3.52) | (1.94) | (1.88) | (0.78) | (0.75) | ||||

| Δ Interest rate | 0.605 *** | 0.031 ** | 0.005 | ||||||

| (4.52) | (2.03) | (0.30) | |||||||

| Covid19 pandemic crisis | 0.941 | 3.194 | 0.226 | 0.562 | −0.285 *** | −0.914 *** | |||

| (0.68) | (0.70) | (1.13) | (1.23) | (−3.35) | (3.20) | ||||

| Δ (Covid19 pandemic crisis) | −0.416 | 0.109 | −0.180 | ||||||

| (−0.18) | (0.41) | (−0.58) | |||||||

| ECT (−1) | −0.304 *** | −0.438 *** | −0.375 *** | ||||||

| (−7.00) | (−6.88) | (−7.45) | |||||||

| Model Diagnostics | MODEL 1 | MODEL 2 | MODEL 3 |

|---|---|---|---|

| Adjusted R-squared | 0.95 | 0.92 | 0.92 |

| S.E. of regression | 2.30 | 0.27 | 0.32 |

| Schwarz Bayesian Criterion | 5.19 | 0.89 | 1.05 |

| DW-statistic | 1.54 | 1.85 | 2.24 |

| Residual Diagnostics | |||

| Serial Correlation 1 | 1.69 [0.193] | 1.03 [0.363] | 1.66 [0.197] |

| F-statistic 2 | 99.77 [0.00] | 55.25 [0.000] | 82.47 [0.000] |

| Heteroscedasticity 3 | 0.009 [0.92] | 0.111[0.740] | 0.693[0.408] |

| Functional Form 4 | 2.43 [0.018] | 0.59 [0.559] | 0.92 [0.360] |

| Normality 5 | 0.114 [0.945] | 1.331 [0.514] | 2.84 [0.241] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Katusiime, L. COVID 19 and Bank Profitability in Low Income Countries: The Case of Uganda. J. Risk Financial Manag. 2021, 14, 588. https://doi.org/10.3390/jrfm14120588

Katusiime L. COVID 19 and Bank Profitability in Low Income Countries: The Case of Uganda. Journal of Risk and Financial Management. 2021; 14(12):588. https://doi.org/10.3390/jrfm14120588

Chicago/Turabian StyleKatusiime, Lorna. 2021. "COVID 19 and Bank Profitability in Low Income Countries: The Case of Uganda" Journal of Risk and Financial Management 14, no. 12: 588. https://doi.org/10.3390/jrfm14120588

APA StyleKatusiime, L. (2021). COVID 19 and Bank Profitability in Low Income Countries: The Case of Uganda. Journal of Risk and Financial Management, 14(12), 588. https://doi.org/10.3390/jrfm14120588