The Impact of Unsystematic Factors on Bitcoin Value

Abstract

:1. Introduction

2. Theoretical Framework

2.1. Efficient Market

2.2. Overview of the Previous Research

Phase A means stopping the previous downward trend. Up to this point, the offer was dominant. This signals preliminary support (PS) and sales peak (SC). Automatic purchase and active purchase then cause an automatic increase (AR). SC and AR denote the trading range of the accumulation phase.

Phase B—The period in which the assets are accumulated.

Phase C—The stock price goes through a decisive test of the remaining offer.

Phase D—This is a passing phase and is the last opportunity for investors and traders to buy at lower prices, and finally, there is last point support (LPS). This is the highest low before the market breaks through the resistance levels. Signs of support (SOS) occur where resistance prices used to be.

Following the decline in the Bitcoin price in May 2021, the Wyckoff Market Cycle graph explains the evolution of the Bitcoin prices, that is, that Bitcoin then entered phase C (Figure 1). After the price correction and its increase in line with Wyckoff’s graph, Bitcoin entered phase D, where it is expected to grow further, but also undergo certain price corrections. Legend: Phase A—Stopping the previous downward trend. Phase B—The period in which the assets are accumulated. Phase C—The stock price goes through a decisive test of the remaining offer. Phase D—This is a passing phase and is the last opportunity for investors to buy at lower prices. Phase E—Indicates an increase in market demand and an upward trend. PS—Signals preliminary support. SC—Sales peak. AC—Automatic purchase and active purchase. AR—Automatic increase. LPS—Last point support (LPS). SOS—Signs of support.Phase E—Indicates an increase in market demand and an upward trend.

3. Methods and Research

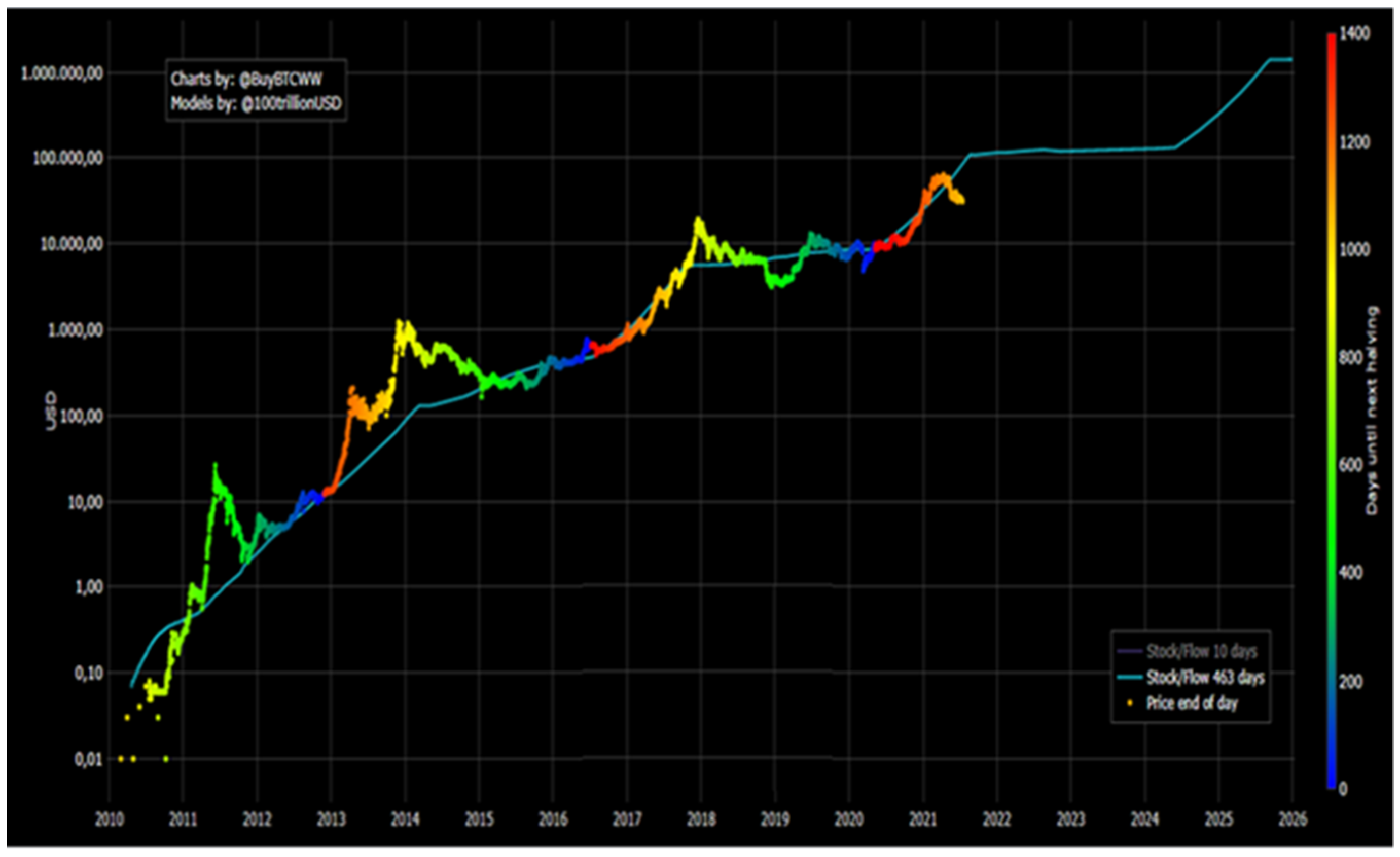

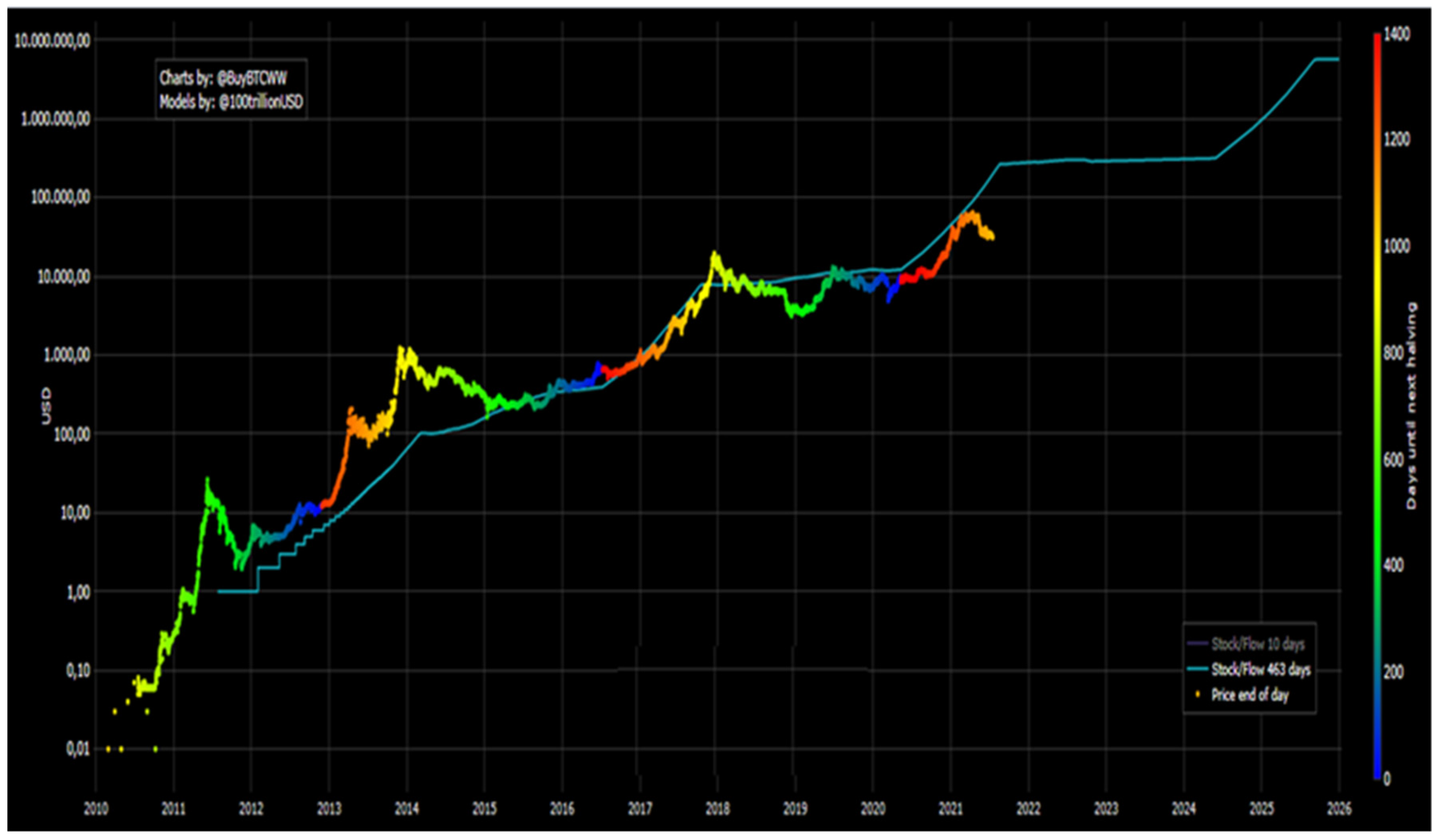

BTC “Concept Confirmation” (S2F index value—1.3 and market value of $1M);

BTC “Payment” (S2F index value—3.3 market value of $58M);

BTC “E-Gold” (S2F index value—10.2 market value of $5.6B);

BTC “Financial Assets” (S2F index value—25.1 market value of $114B).

To compare S2F values of precious metals:

Silver S2F 33.3 (900,000/27,000 tones) with market capitalisation of $561B;

Gold S2F 58.3 (190,000/3260 tons) with market capitalisation of $10,088B.

4. Results and Discussion

- S = number of coins in a period of time;

- F = remaining number of coins for mining;

- S/F—stock-to-flow index;

- PV (estimated value) BTC = exp (14.6) * SF ^ 3.3;

- Square root RV (difference in value) = (PV—TV (market value) BTC) ^ 2;

- SV (sum of RV in a period in which (half) information caused oscillations about the value) marks the significance that the information left on the BTC value.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adizes, Ichak. 2006. Životni Ciklusi Tvrtke. Zagreb: M. E. P. Consult. [Google Scholar]

- Arnerić, Josip, and Mladen Mateljan. 2019. Analiza međuovisnosti tržišta kapitala i tržišta kriptovaluta. Ekonomska Misao i Praksa 2: 449–65. [Google Scholar]

- Alajbeg, Denis, Zoran Bubaš, and Velimir Šonje. 2012. The efficient market hypothesis: Problems with interpretations of empirical tests. Financial Theory and Practice 36: 53–72. [Google Scholar] [CrossRef]

- Allen, Franklin, and Elena Carlleti. 2010. An Overview of the Crisis: Causes, Consequences and Solutions. Urban Economics & Regional Studies eJournal 10: 1–26. [Google Scholar] [CrossRef]

- Apopo, Natalya, and Andrew Phiri. 2021. On the (in)efficiency of cryptocurrencies: Have they taken daily or weekly random walks? Heliyon 7. [Google Scholar]

- Balcilar, Mehmet, Bouri Elie, Gupta Rangan, and David Roubaud. 2017. Can Volume Predict Bitcoin Returns and Volatility? A Quantiles-Based Approach. Economic Modelling 64: 74–81. [Google Scholar] [CrossRef] [Green Version]

- Barbić, Tajana. 2010. Pregled razvoja hipoteze efikasnog tržišta. Privredna Kretanja i Ekonomska Politika 20: 29–61. [Google Scholar]

- Baur, Dirk G., Thomas Dimpfl, and Konstantin Kuck. 2017. Bitcoin, gold and the US dollar–A replication and extension. Finance Research Letters 25: 103–10. [Google Scholar] [CrossRef]

- Bjerg, Ole. 2016. How is Bitcoin Money? Theory, Culture & Society 33: 53–72. [Google Scholar]

- Bodie, Zvi, Alex Kane, and Alan J. Marcus. 2008. Investments, 7th ed. New York: McGraw-Hill. [Google Scholar]

- Böhme, Rainer, Christin Nicolas, Edelman Benjamin, and Moore Tyler. 2015. Bitcoin: Economics, Technology, and Governance. Journal of Economic Perspectives 29: 213–38. Available online: http://dx.doi.org/10.1257/jep (accessed on 12 September 2021).

- Bouoiyour, Jamal, and Refk Selmi. 2014. What Bitcoin looks like? MPRA Paper No. 58091. Available online: http://mpra.ub.uni-muenchen.de/58091/ (accessed on 18 September 2021).

- Bouoiyour, Jamal, Selmi Refk, and Tiwari Aviral. 2014. Is Bitcoin Business Income or Speculative Bubble? Unconditional vs. Conditional Frequency Domain Analysis. MPRA Paper. Munich: University Library of Munich, Available online: https://mpra.ub.uni-muenchen.de/59595/1/MPRA_paper_59595.pdf (accessed on 18 September 2021).

- Bouri, Elie, Peter Molnár, Georges Azzi, David Roubaud, and Lars Ivar Hagfors. 2017. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters 20: 192–98. Available online: https://isiarticles.com/bundles/Article/pre/pdf/100961.pdf (accessed on 14 September 2021).

- Bursztynsky, Jessica. 2020. Warren Buffett: Cryptocurrency ‘Has No Value’—‘I Don’t Own Any and Never Will’. Available online: https://www.cnbc.com/2020/02/24/warren-buffett-cryptocurrency-has-no-value.html (accessed on 14 September 2021).

- Buterin, Denis, Ribarić Eda, and Suzana Savić. 2015. Bitcoin-nova globalna valuta, investicijska prilika ili nešto treće? Zbornik Veleučilišta u Rijeci 3: 145–58. [Google Scholar]

- Buybit. 2021a. Available online: https://stats.buyBitcoinworldwide.com/stock-to-flow/ (accessed on 14 September 2021).

- Buybit. 2021b. Available online: https://stats.buyBitcoinworldwide.com/s2fx/ (accessed on 14 September 2021).

- Caporale, Guglielmo Maria, Gil-Alana Luis, and Plastun Alex. 2019. Long-term price overreactions: Are markets inefficient? Journal of Economics and Finance 43: 657–80. [Google Scholar] [CrossRef] [Green Version]

- Cardero, Niko. 2020. Why the Stock-to-Flow Bitcoin Valuation Model Is Wrong. Available online: https://www.coindesk.com/markets/2020/06/30/why-the-stock-to-flow-Bitcoin-valuation-model-is-wrong/ (accessed on 14 September 2021).

- Chaum, David. 1983. Blind Signatures for Untraceable Payments. Santa Barbara: University of California, Available online: http://www.hit.bme.hu/~buttyan/courses/BMEVIHIM219/2009/Chaum.BlindSigForPayment.1982.PDF (accessed on 14 September 2021).

- Cheah, Eng-Tuck, and John Fry. 2015. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Economic Letters 130: 32–36. [Google Scholar] [CrossRef] [Green Version]

- Carney, Mark. 2021. Finding Value in Values. Available online: https://www.bnymellon.com/content/dam/bnymellon/documents/pdf/perspectives/mark_carney-finding_value_in_values.pdf.coredownload.pdf (accessed on 14 September 2021).

- Ding, Wenzhi, Ross Levine, Chen Lin, and Wensi Xie. 2020. Corporate Immunity to the COVID-19 Pandemic, Working Paper 27055. Available online: https://www.nber.org/papers/w27055 (accessed on 14 September 2021).

- Dyhrberg, Anne Haubo. 2015. Bitcoin, Gold and the Dollar—A GARCH Volatility Analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef] [Green Version]

- Dziadkowiec, Jakub. 2021. Bitcoin (BTC) Peak: Wyckoff Distribution. 2013 Bull Run and Pi Cycle. May 20. Available online: https://finance.yahoo.com/news/Bitcoin-btc-peak-wyckoff-distribution-173000176.html (accessed on 14 September 2021).

- Fama, Eugene F. 1965. The behavior of stock-market prices. The Journal of Business 38: 34–105. [Google Scholar] [CrossRef]

- Financial Times. 2019. Bitcoin Is the 10-Year Treasury of Our Time. Available online: https://www.ft.com/content/b4d55f00-a8e6-3355-ae5c-8d7b6972e666 (accessed on 14 September 2021).

- Frisby, Dominic. 2015. Bitcoin: The Future of Money? 1st ed.London: Unbound. [Google Scholar]

- Fučkan, Đurđica, and Adrija Sabol. 2013. Planiranje Poslovnih Dometa. Zagreb: Hum Naklada d.o.o. [Google Scholar]

- Garcia, David, Tessone Claudio, J. Mavrodiev Pavlin, and Perony Nicolas. 2014. The digital traces of bubbles: Feedback cycles between socio-economic signals in the Bitcoin economy. Journal of the Royal Society Interface 11: 20140623. [Google Scholar] [CrossRef]

- Gibbs, Samuel. 2015. Man Buys $27 of Bitcoin, Forgets about Them, Finds They’re Now Worth $886. The Guardian. Available online: https://www.theguardian.com/technology/2015/dec/09/Bitcoin-forgotten-currency-norway-oslo-home (accessed on 14 September 2021).

- Glaser, Florian, Kai Zimmermann, Haferkorn Kai, Weber Martin, and Michael Moritz Christianand Siering. 2014. Bitcoin—Asset or Currency? Revealing Users’ Hidden Intentions. ECIS 2014 (Tel Aviv). Available online: https://ssrn.com/abstract=2425247 (accessed on 14 September 2021).

- Hammoudeh, Shawkat, and Yuan Yuan. 2008. Metal volatility in presence of oil and interest rate shocks. Energy Economics 30: 606–20. [Google Scholar] [CrossRef]

- Hawkins, Amy. 2017. Meet the Millennials Making Big Money Riding China’s Bitcoin Wave. Available online: https://www.theguardian.com/technology/2017/apr/11/meet-the-millennials-making-big-money-riding-chinas-Bitcoin-wave (accessed on 14 September 2021).

- Hayes, Adam. 2015. Cryptocurrency value formation: An empirical analysis leading to a cost of production model for valuing Bitcoin. Telematics and Informatics 34: 1308–21. [Google Scholar] [CrossRef]

- Hileman, Garrich, and Michel Rauch. 2017. Global Cryptocurrency Benchmarking Study; University of Cambridge. Available online: https://cdn.crowdfundinsider.com/wp-content/uploads/2017/04/Global-Cryptocurrency-Benchmarking-Study.pdf (accessed on 14 September 2021).

- Hunter, Gregor Stuart, and Chao Deng. 2016. China Buying Sparks Bitcoin Surge. The Wall Street Journal. Available online: https://www.wsj.com/articles/china-buying-sparks-Bitcoin-surge-1464608221 (accessed on 14 September 2021).

- Jenssen, Torbjørn Bull. 2014. Why Bitcoins Have Value, and Why Governments Are Sceptical. Master’s thesis, University of Oslo, Oslo, Norway. Available online: https://core.ac.uk/download/pdf/30902945.pdf (accessed on 14 September 2021).

- Kavvadias, Gerasimos. 2017. What Drives the Value of Cryptocurrencies? A Time Series Analysis of Bitcoin. Master’s thesis, Tilburg University, Tilburg, The Netherlands. Available online: http://arno.uvt.nl/show.cgi?fid=145139 (accessed on 14 September 2021).

- Kim, Young Bin, Jun Gi Kim, Wook Kim, Jae Ho Im, Tae Hyeong Kim, Shin Jin Kang, and Chang Hun Kim. 2016. Predicting fluctuations in cryptocurrency transactions based on user comments and replies. PLoS ONE 11: e0161197. [Google Scholar] [CrossRef] [Green Version]

- Kolodny, Lora. 2021. Elon Musk Says Tesla Will Stop Accepting Bitcoin for Car Purchases. Available online: https://www.cnbc.com/2021/05/12/elon-musk-says-tesla-will-stop-accepting-Bitcoin-for-car-purchases.html (accessed on 14 September 2021).

- Kraus, Sascha, Thomas Claus, Matthiasm Breier, Johannson Gast, Allessandro Zardinin, and Tiberius Victor. 2020. The economics of COVID-19: Initial empirical evidence on how family firms in five European countries cope with the corona crisis. International Journal of Entrepreneurial Behaviour & Research 26: 1067–92. [Google Scholar]

- Kristoufek, Ladislav. 2014. What Are the Main Drivers of the Bitcoin Price? Evidence from Wavelet Coherence Analysis. Available online: https://arxiv.org/pdf/1406.0268.pdf (accessed on 14 September 2021).

- Kyriazis, Nikolaos A. 2020. Is Bitcoin Similar to Gold? An Integrated Overview of Empirical Findings. Journal of Risk and Financial Management 13: 1–19. [Google Scholar] [CrossRef]

- Letra, Ivo. 2016. What Drives Cryptocurrency Value? A Volatility and Predictability Analysis. Master’s thesis, Lisbon School of Economics & Management, Lisboa, Portugal. Available online: https://www.repository.utl.pt/bitstream/10400.5/12556/1/DM-IJSL-2016.pdf (accessed on 14 September 2021).

- Lu, Hsin-Ke, Li-wei Yang, Peng-Chun Lin, Tzu-Han Yang, and Alexander N. Chen. 2017. A study on adoption of Bitcoin in Taiwan: Using big data analysis of social media. Paper presented at the 3rd International Conference on Communication and Information Processing, Tokyo Japan, November 24–26; pp. 32–38. [Google Scholar] [CrossRef]

- Mackintosh, James. 2017. Let’s Be Real: Bitcoin is a Useless Investment. The Wall Street Journal. Available online: https://www.wsj.com/articles/BL-MBB-58585 (accessed on 14 September 2021).

- Malini, Helma. 2019. Efficient Market Hypothesis and Market Anomalies of LQ 45 Index in Indonesia Stock Exchange. Sriwijaya International Journal of Dynamic Economics and Business 3: 107. [Google Scholar] [CrossRef]

- Masafumi, Nakano, Takahashi Akihiko, and Takahashi Soichiro. 2018. Bitcoin technical trading with artificial neural network. Physica A: Statistical Mechanics and its Applications 510: 587–609. [Google Scholar]

- Matta, Martina, Ilaria Lunesu, and Marchesi Michele. 2015. Bitcoin Spread Prediction Using Social and Web Search Media. Available online: http://ceur-ws.org/Vol-1388/DeCat2015-paper3.pdf (accessed on 14 September 2021).

- McKinnon, John D., and Ryan Tracy. 2014. IRS Says Bitcoin Is Property, Not Currency. The Wall Street Journal. Available online: https://www.wsj.com/articles/SB10001424052702303949704579461502538024502 (accessed on 16 September 2021).

- Medium. 2021. Available online: https://medium.com/coinmonks/the-Bitcoin-price-crash-smart-money-manipulation-of-the-market-217c4ada6b41 (accessed on 14 September 2021).

- Mishkin, Frederic S., and Stanly G. Eakins. 2003. Financijska Tržišta + Institucije. 4 izdanje. Zagreb: Mate d.o.o. [Google Scholar]

- Mora, Camilo, L. Rollins Randi, Katie Taladay, Michael B. Kantar, Mason K. Chock, Shimada Mia, and Erik C. Franklin. 2018. Bitcoin emissions alone could push global warming above 2 °C. Nature Climate Change 8: 931–33. [Google Scholar] [CrossRef]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic System. Available online: https://fimaplus.com/wp-content/uploads/2018/03/Bitcoin-Whitepaper.pdf (accessed on 12 September 2021).

- Nurdina, Nurdina, R. Yudi sidharta, and Mochamad Mochklas. 2021. Inefficient Markets, Anomalies, And Investor Behavior: A Literature Review. International Journal of Economics, Business and Accounting Research (IJEBAR) 5: 354–74. [Google Scholar] [CrossRef]

- O’Brien, Matt. 2015. Bitcoin Is Not the Future of Money Its Either a Ponzi Scheme or a Pyramid Scheme. The Washington Post. Available online: https://www.washingtonpost.com/gdpr-consent/?next_url=https%3a%2f%2fwww.washingtonpost.com%2fnews%2fwonk%2fwp%2f2015%2f06%2f08%2fBitcoin-isnt-the-future-of-money-its-either-a-ponzi-scheme-or-a-pyramid-scheme%2f (accessed on 14 September 2021).

- Ozili, Peterson, and Thankom Arun. 2020. Spillover of COVID-19: Impact on the Global Economy. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562570 (accessed on 14 September 2021).

- Park, Han Woo, and Youngjoo Lee. 2019. How Are Twitter Activities Related to Top Cryptocurrencies’ Performance? Evidence from Social Media Network and Sentiment Analysis. Društvena istraživanja 28: 435–60. [Google Scholar] [CrossRef]

- Peck, Morgen. 2012. Years in, Bitcoin Digital Money Gains Momentum. Scientific American. Available online: https://www.scientificamerican.com/article/3-years-in-Bitcoin-digital-money-gains-momentum/ (accessed on 20 September 2021).

- Panagiotidis, Theodore, Stengos Thanasis, and Vravosinos Orestis. 2019. A Principal Component-Guided Sparse Regression Approach for the Determination of Bitcoin Returns. Journal of Risk and Financial Management 13. [Google Scholar] [CrossRef] [Green Version]

- Pandey, Asheesh, Anand Mittal, and Arjun Mittal. 2021. Size effect alive or dead: Evidence from European markets. Cogent Economics & Finance 9: 1897224. [Google Scholar] [CrossRef]

- Parveen, Shagufta, Zoya Wajid Satti, Qazi Abdul Subhan, and Sana Jamil. 2020. Exploring market overreaction, investors’ sentiments and investment decisions in an emerging stock market. Borsa Istanbul Review 20: 224–35. [Google Scholar] [CrossRef]

- Polasik, Michal, Anna Iwona Piotrowska, Tomasz Piotr Wisniewski, Radoslaw Kotkowski, and Geoffrey Lightfoot. 2014. Price Fluctuations and the Use of Bitcoin: An Empirical Inquiry. Available online: https://www.ecb.europa.eu/pub/conferences/shared/pdf/retpaym_150604/polasik_paper.pdf (accessed on 20 September 2021).

- Poyser, Obryan. 2017. Exploring the Determinants of Bitcoin’s Price: An Application of Bayesian Structural Time Series. Available online: https://arxiv.org/ftp/arxiv/papers/1706/1706.01437.pdf (accessed on 20 September 2021).

- Priem, Randy. 2021. An Exploratory Study on the Impact of the COVID-19 Confinement on the Financial Behavior of Individual Investors. Economics, Management, and Financial Markets 16: 9–40. [Google Scholar] [CrossRef]

- Seys, Jens, and Kjartan Decaestecker. 2016. The Evolution of Bitcoin Price Drivers: Moving Towards Stability? Master’s thesis, University of Ghent, Ghent, Belgium. Available online: https://libstore.ugent.be/fulltxt/RUG01/002/273/510/RUG01-002273510_2016_0001_AC.pdf (accessed on 14 September 2021).

- Simser, Jeffrey. 2015. Bitcoin and modern alchemy: In code we trust. Journal of Financial Crime 22: 155–69. [Google Scholar] [CrossRef]

- Stöferle, Ronald Peter, and Mark J. Valek. 2021. In Gold We Trust. Report; Monetary Climate Change; Incrementum AG. Available online: https://ingoldwetrust.report/igwt/?lang=en (accessed on 14 September 2021).

- Stöferle, Ronald Peter, and Mark J. Valek. 2020. In Gold We Trust. Report: The Dawning of a Golden Decade; Incrementum AG. Available online: https://ingoldwetrust.report/wp-content/uploads/2020/05/In-Gold-We-Trust-report-2020-Extended-Version-english.pdf (accessed on 14 September 2021).

- Šonje, Velimir, and Kristijan Kotarski. 2020. Korona Ekonomika: Pet Jahača Apokalipse. Zagreb: Arhivanalitika. [Google Scholar]

- Thelwall, Mike. 2017. Can social news websites pay for content and curation? The SteemIt cryptocurrency model. Journal of Information Science, 1–24. [Google Scholar] [CrossRef]

- Urquhart, Andrew, and Hanxiong Zhang. 2019. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. International Review of Financial Analysis 63: 49–57. [Google Scholar] [CrossRef]

- Van Horne, Jemes C., and John M. Wachowicz. 2008. Fundamentals of Financial Management, 13th ed. Harlow: Prentice-Hall, Inc., Pearson Education Limited. [Google Scholar]

- Wang, Pengfei, Wei Zhang, Xiao Li, and Dehua Shen. 2019. Is Cryptocurrency a Hedge or a Safe Haven for International Indices? A Comprehensive and Dynamic Perspective. Finance Research Letters 31: 1–18. [Google Scholar] [CrossRef]

- Weiss Crypto Rating. 2021a. The World’s First Ratings of Bitcoin, Ethereum, Ripple, Dash and 100+ Cryptocurrencies by a Financial Rating Agency. Available online: https://weisscryptocurrencyratings.com/reports/WCY/ext/468y/?ec=EWCYUA01&sc=WCAEZ&campid=WCY2018-10 (accessed on 16 September 2021).

- Weiss Crypto Rating. 2021b. Top Coins by Rating. Available online: https://weisscrypto.com/ (accessed on 14 September 2021).

- Wisniewska, Anna. 2016. Bitcoin as a Virtual Currency, Working Papers 1/2016. Institute of Economic Research revised Feb. Available online: https://econpapers.repec.org/scripts/redir.pf?u=http%3A%2F%2Fwww.badania-gospodarcze.pl%2Fimages%2FWorking_Papers%2F2016_No_1.pdf;h=repec:pes:wpaper:2016:no1 (accessed on 14 September 2021).

- Yoo, Soonduck. 2021. How to Design Cryptocurrency Value and How to Secure Its Sustainability in the Market. Journal of Risk and Financial Management 14. [Google Scholar] [CrossRef]

| Ord. No. | Date | Prices According to S2F Model | Market Value | Relative Deviation from Market Value | Source | Short Description |

|---|---|---|---|---|---|---|

| 1. | 10 April 2013 | 20.45 | 201.52 | 885% | (Peck 2012) | Increase in acceptance of Bitcoin, second serious separation from S2F. The first is hard to explain with the news because the market was very small and not much capital is needed for it to move to the price above S2F. |

| 2. | 02 December 2013 | 71.77 | 1022.95 | 1325% | (Gibbs 2015) | People start to realise thst it is possible to earn exceptional amounts of money through Bitcoin and that this is just the beginning of this revolutionary technology. |

| 3. | 06 June 2014 | 134.77 | 650.41 | 383% | (McKinnon and Tracy 2014) | The IRS had classsified Bitcoin into the assets class, after which the investors realised that cryptocurrency has earning potential although they are obligated to pay taxes. |

| 4. | 25 August 2015 | 343.29 | 220.36 | −36% | (O’Brien 2015) | Because of this FUD, Bitcoin fell under the S2F level for the first time after 2012. |

| 5. | 16 June 2016 | 460.11 | 762.17 | 66% | (Hunter and Deng 2016) | China had a great influence on the cryptomarket at the time, and the news of adding a billion dollars to market capitalisation at the time stirred excitement among investors. |

| 6. | 28 March 2017 | 1562.87 | 1044.25 | −33% | (Mackintosh 2017) | The Winklevoss brothers wanted to report the BTC to ETF, but they were rejected, and that is when the Bitcoin value became questionable in the public. |

| 7. | 17 December 2017 | 5875.96 | 19,065.00 | 224% | (Hawkins 2017) | Bitcoin was moving below the S2F curve and this news sparked a bullish sentiment and pushed Bitcoin from the price of 1044$ to approximately 20,089$, which means that it grew almost 20x in approximately 9 months. |

| 8. | 14 December 2018 | 6784.32 | 3253.46 | −52% | (Mora et al. 2018) | The drop below the S2F line instigated a research according to which Bitcoin mining could increase global warming by 2 °C. |

| 9. | 10 July 2019 | 7867.50 | 12,099.12 | 54% | (Financial Times 2019) | The Financial Times promotes Bitcoin as a bond of our age. |

| 10. | 12 March 2020 | 8600.12 | 4106.00 | −52% | (Bursztynsky 2020) | The COVID-19 crisis has affected the prices of everything, including Bitcoin. When Warren Buffet additionally depreciated Bitcoin, it created an exceptionally negative sentiment in the market and pushed Bitcoin again below the S2F curve by more than 50%. |

| 11. | 12 May 2021 | 81,112.68 | 33,804.20 | −58% | (Kolodny 2021) | Elon Musk initiated the bear market by announcing that Tesla will not be accepting Bitcoin transactions because they are not eco-friendly, which was complemented by the situation with Chinese miners, which together led to the lowest point in relation to S2F (excluding the situation before 2012). |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Merkaš, Z.; Roška, V. The Impact of Unsystematic Factors on Bitcoin Value. J. Risk Financial Manag. 2021, 14, 546. https://doi.org/10.3390/jrfm14110546

Merkaš Z, Roška V. The Impact of Unsystematic Factors on Bitcoin Value. Journal of Risk and Financial Management. 2021; 14(11):546. https://doi.org/10.3390/jrfm14110546

Chicago/Turabian StyleMerkaš, Zvonko, and Vlasta Roška. 2021. "The Impact of Unsystematic Factors on Bitcoin Value" Journal of Risk and Financial Management 14, no. 11: 546. https://doi.org/10.3390/jrfm14110546

APA StyleMerkaš, Z., & Roška, V. (2021). The Impact of Unsystematic Factors on Bitcoin Value. Journal of Risk and Financial Management, 14(11), 546. https://doi.org/10.3390/jrfm14110546