An Assessment of the Efficiency of Canadian Power Generation Companies with Bootstrap DEA

Abstract

:1. Introduction

- -

- What are the most efficient power generation companies across the country?

- -

- Does the efficiency of the power generation companies vary across the provinces and the territories?

- -

- Does the type of ownership affect the overall technical efficiency of the Canadian power generation companies?

- -

- Did the 2007–2009 crisis negatively affect the overall technical efficiency of the Canadian power sector?

- the main sources of operational inefficiency in the Canadian power generation companies;

- the potential strategies to improve the operational efficiency of the inefficient companies;

- the potential strategies to reduce the impact of future economic cyclical variations on the Canadian power generation companies; and

- the understanding of the best practices in the power generation energy sector, and potential strategies for the inefficient companies to improve their overall technical and managerial efficiencies.

2. Literature Review

2.1. The Canadian Energy Industry

2.2. Efficiency Measurement of Power Generation Companies

3. Methodology

3.1. Data Envelopment Analysis and Bootstrapping

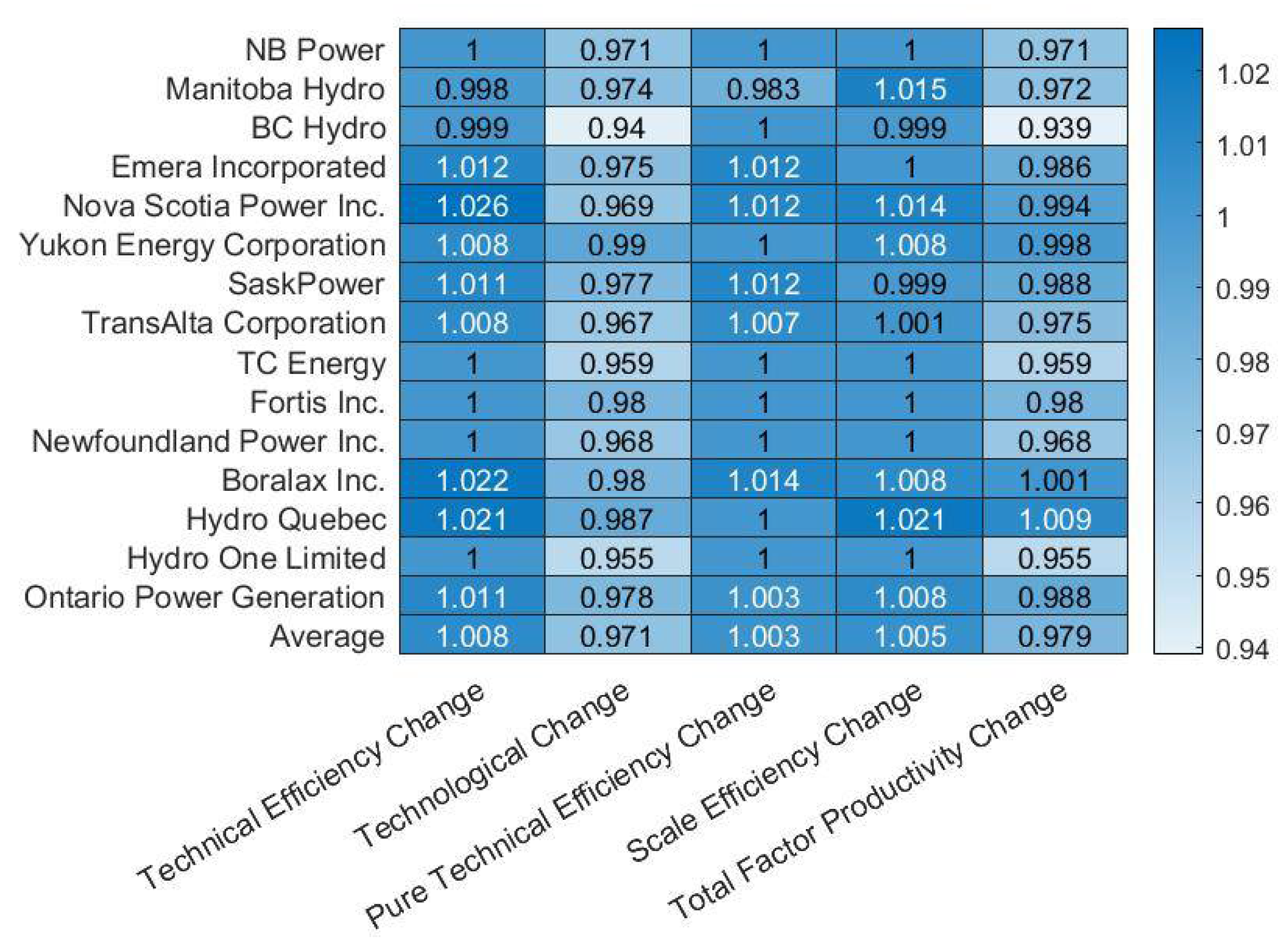

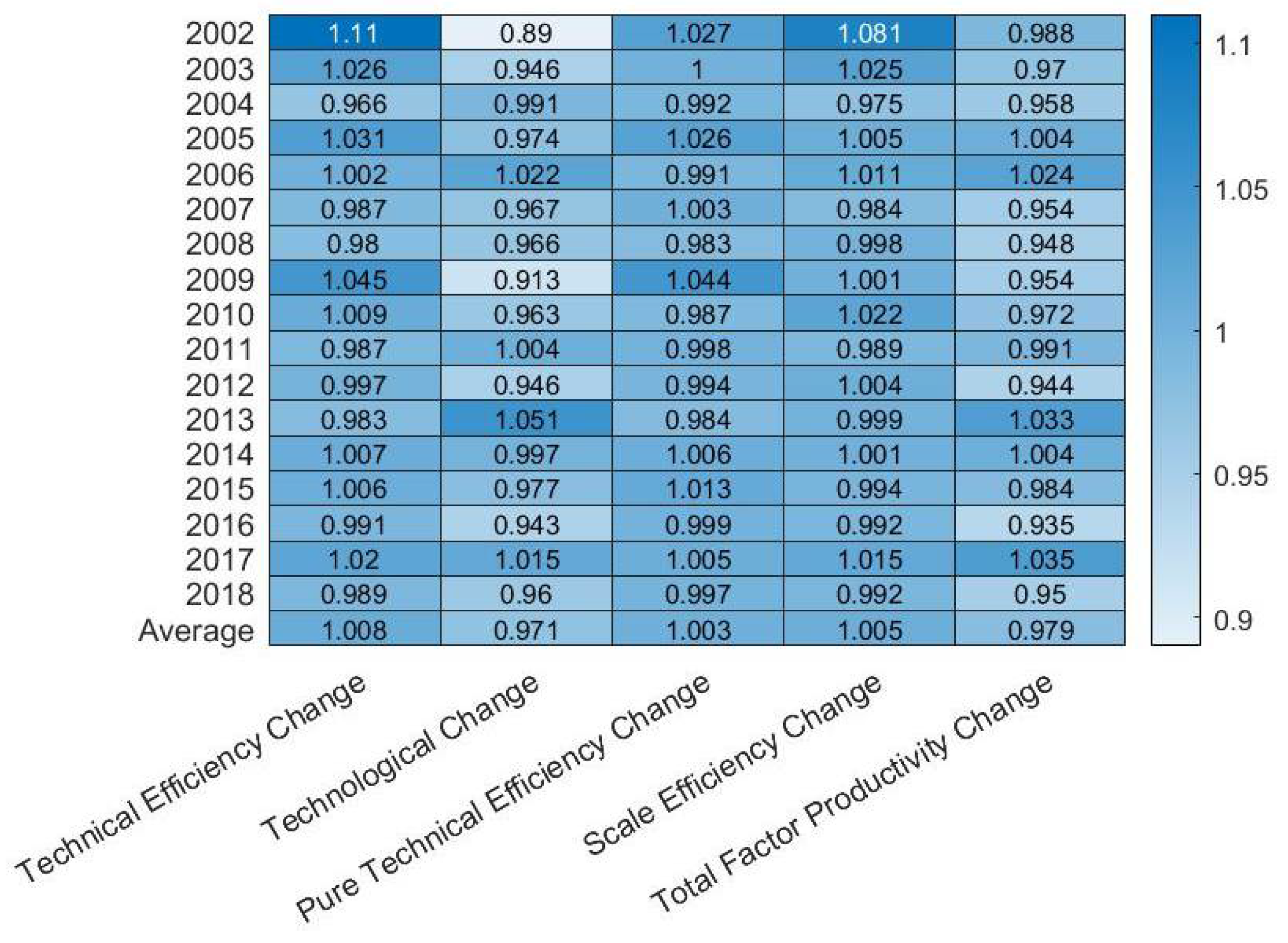

3.2. Efficiency Variation over Time

3.3. Selection of the Inputs and Outputs

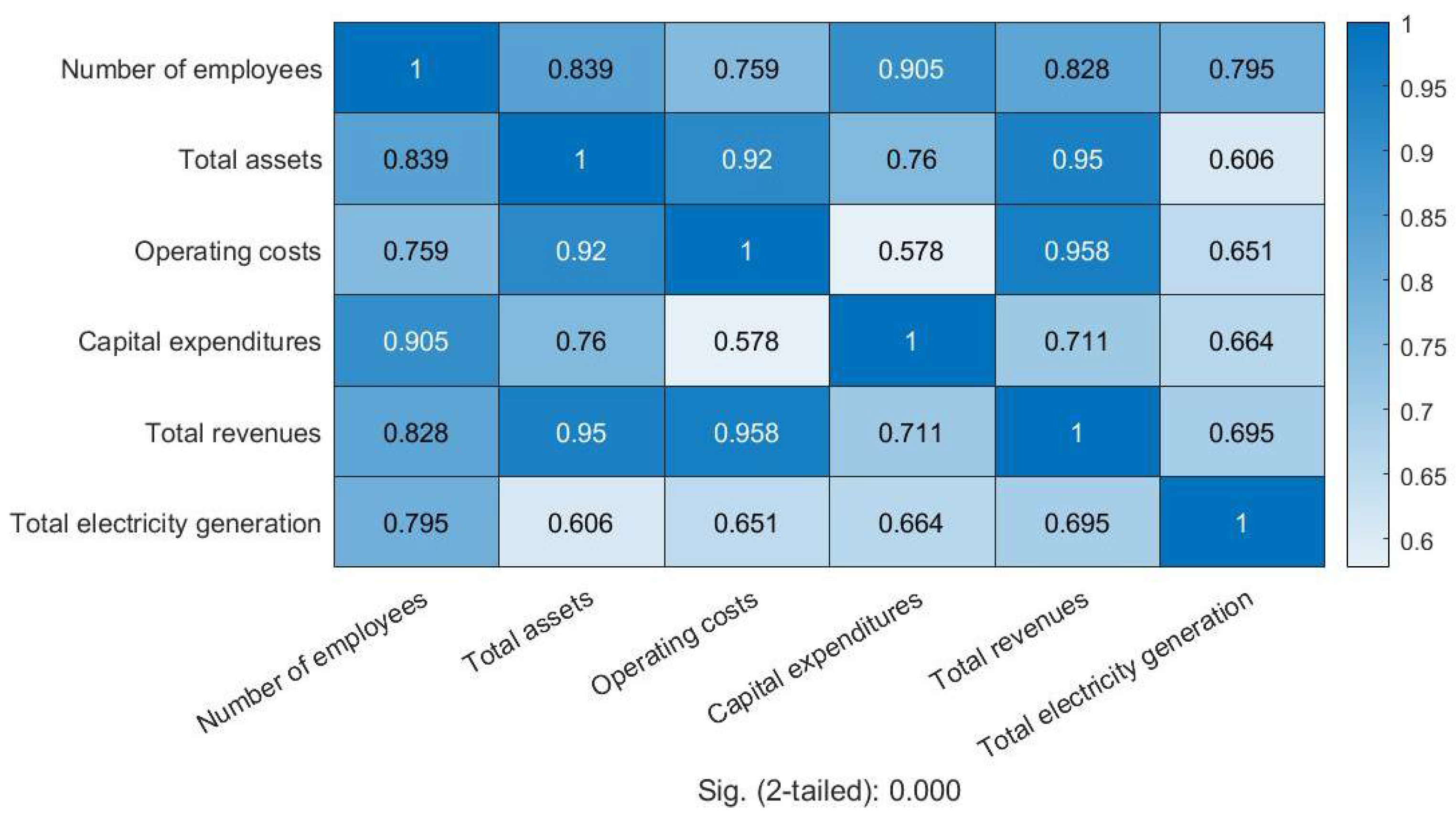

4. Empirical Study

4.1. Sample and Data

4.2. Results Analysis

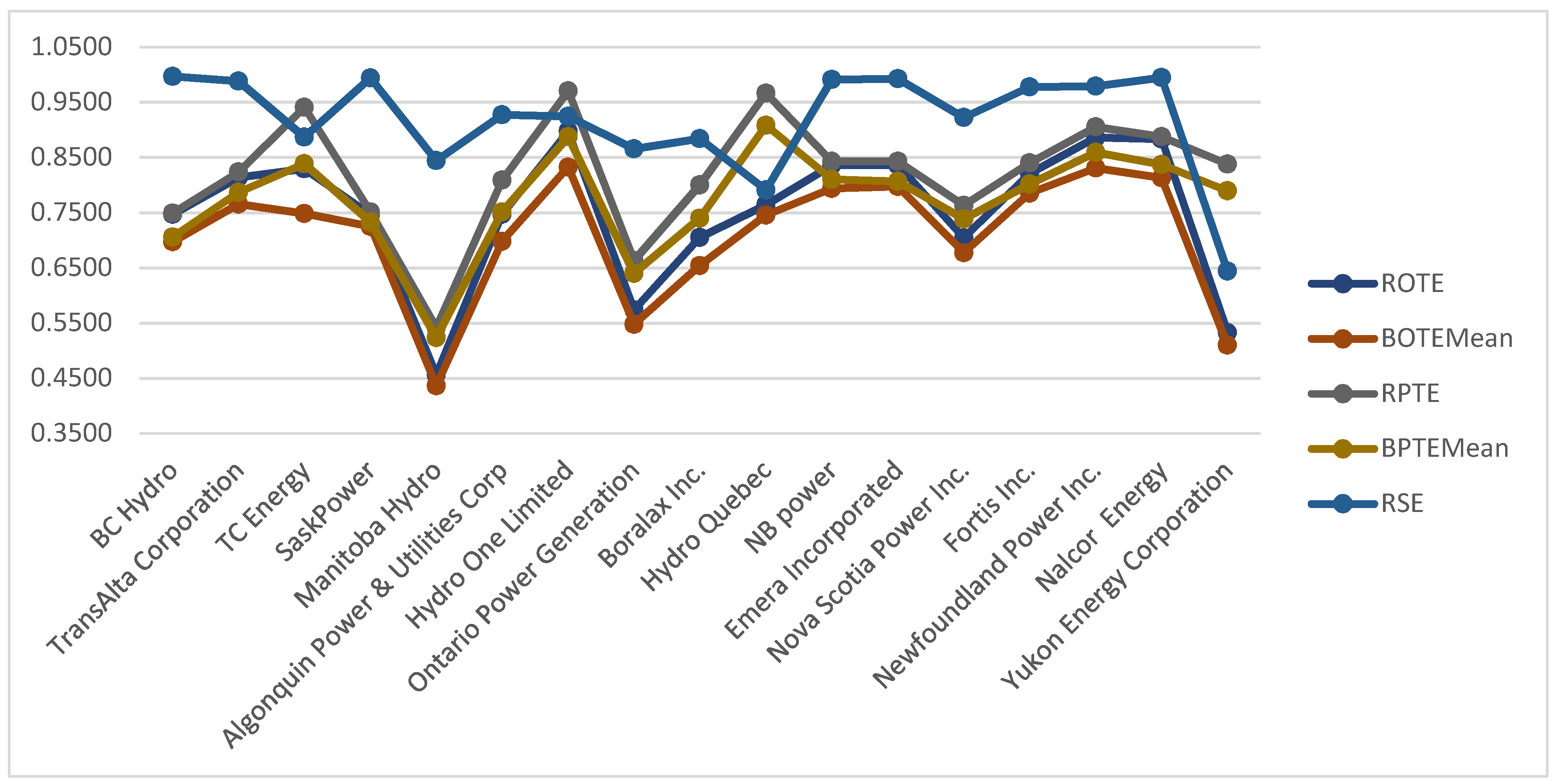

4.2.1. Benchmarking of the Power Generation Companies across the Country

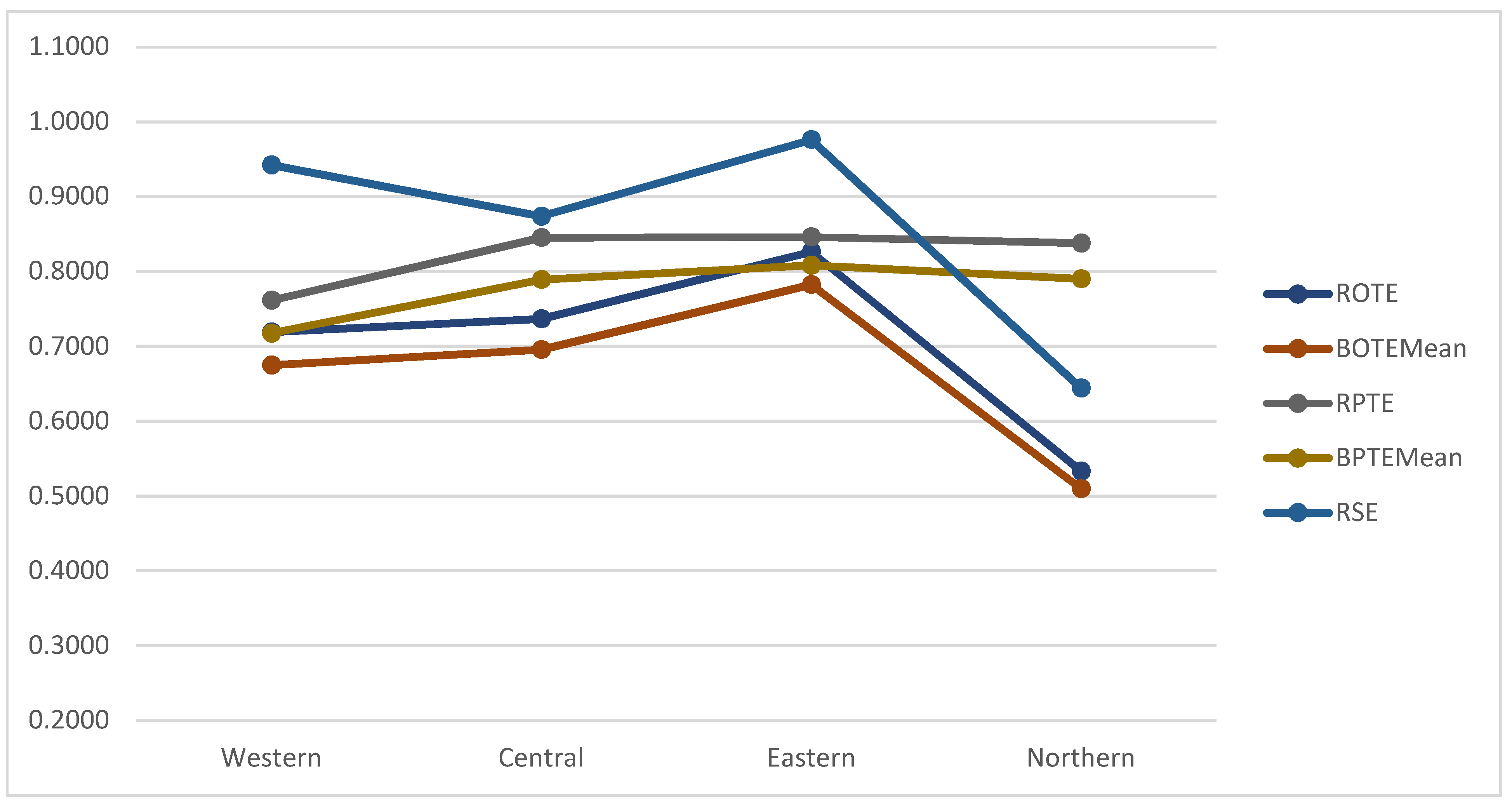

4.2.2. Benchmarking of the Power Generation Companies across the Regions

4.2.3. Benchmarking of the Power Generation Companies across the Provinces and Territories

4.2.4. Benchmarking of the Power Generation Companies Based on the Type of Ownership

4.2.5. Annual Efficiencies of the Power Generation Companies over the Period of 2001–2018

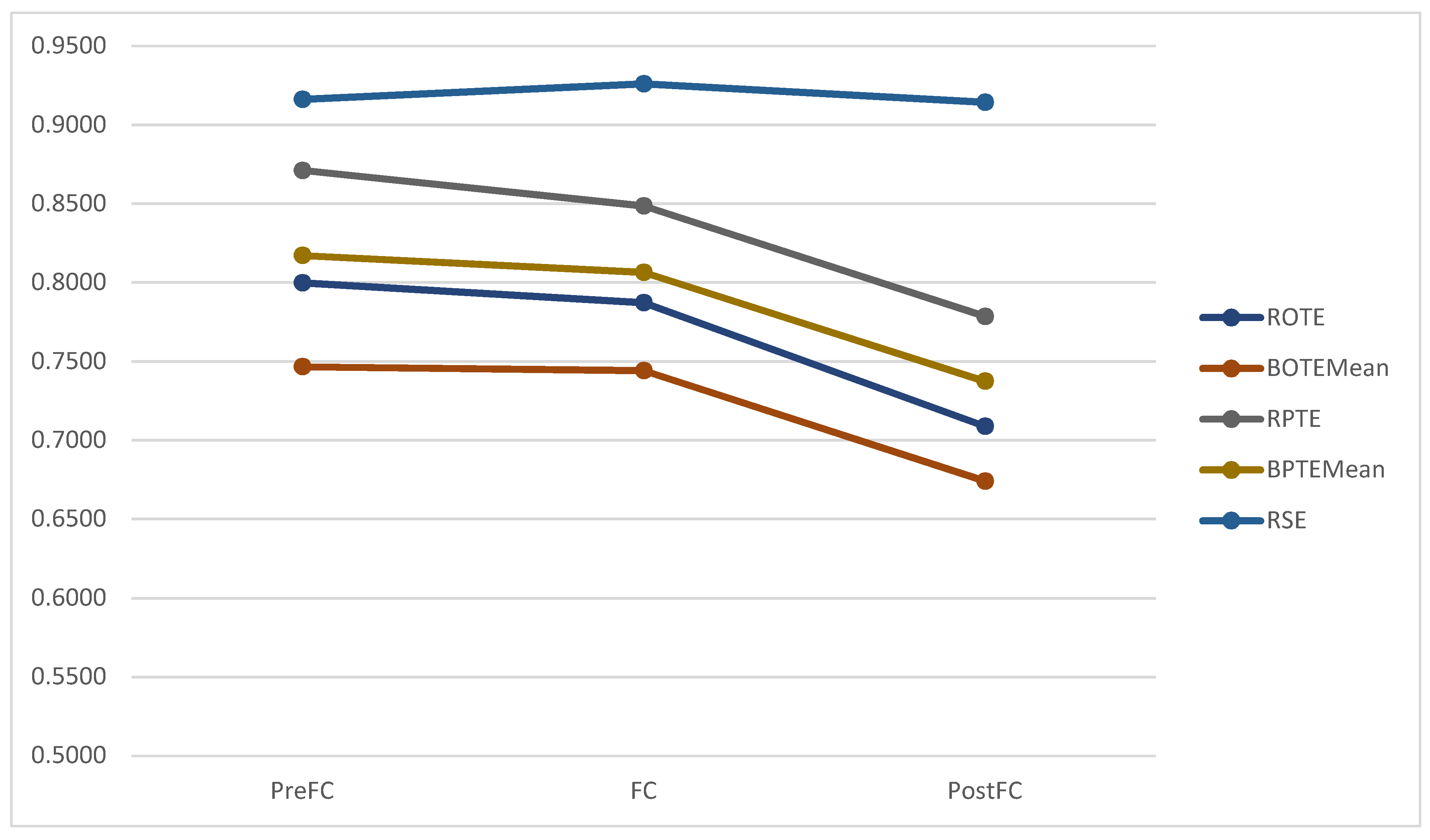

4.2.6. Impact of the 2007–2009 Financial Crisis on the Power Generation Companies

5. Managerial Insights

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

| 1 | |

| 2 | https://www.nrcan.gc.ca/science-and-data/data-and-analysis/energy-data-and-analysis/energy-facts/electricity-facts/20068 (accessed on 3 October 2021). |

| 3 | https://www.nrcan.gc.ca/science-and-data/data-and-analysis/energy-data-and-analysis/energy-facts/electricity-facts/20068 (accessed on 3 October 2021). |

| 4 | https://www.nrcan.gc.ca/science-and-data/data-and-analysis/energy-data-and-analysis/energy-facts/electricity-facts/20068 (accessed on 3 October 2021). |

| 5 | https://www.nrcan.gc.ca/science-and-data/data-and-analysis/energy-data-and-analysis/energy-facts/electricity-facts/20068 (accessed on 3 October 2021). |

References

- Al-Refaie, Abbas, Mohammad Hammad, and Ming-Hsien Li. 2016. DEA window analysis and Malmquist index to assess energy efficiency and productivity in Jordanian industrial sector. Energy Efficiency 9: 1299–313. [Google Scholar] [CrossRef]

- Asmild, Mette, Joseph C. Paradi, Vanita Aggarwall, and Claire Schaffnit. 2004. Combining DEA window analysis with the Malmquist index approach in a study of the Canadian banking industry. Journal of Productivity Analysis 21: 67–89. [Google Scholar] [CrossRef]

- Banker, Rajiv D., Abraham Charnes, and William Wager Cooper. 1984. Some models for estimating technical and scale efficiencies in data envelopment analysis. Management Science 30: 1078–92. [Google Scholar] [CrossRef] [Green Version]

- Banker, Rajiv D., Abraham Charnes, and William Wager Cooper. 1989. Constrained game formulations and interpretations for data envelopment analysis. European Journal of Operational Research 40: 299–308. [Google Scholar] [CrossRef]

- Barros, Carlos Pestana. 2008. Efficiency analysis of hydroelectric generating plants: A case study for portugal. Energy Economics 30: 59–75. [Google Scholar] [CrossRef]

- Barros, Carlos P., and Nicolas Peypoch. 2007. The determinants of cost efficiency of hydroelectric generating plants: A random frontier approach. Energy Policy 35: 4463–70. [Google Scholar] [CrossRef]

- BP Statistical Review of World Energy. 2018. Available online: https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf (accessed on 17 July 2019).

- Çelen, Aydın. 2013. Efficiency and productivity (TFP) of the Turkish electricity distribution companies: An application of two-stage (DEA & Tobit) analysis. Energy Policy 63: 300–10. [Google Scholar]

- Charnes, Abraham, Charles T. Clark, William W. Cooper, and Boaz Golany. 1985. A Developmental Study of Data Envelopment Analysis in Measuring the Efficiency of Maintenance Units in the US Air Forces. Annals of Operations Research 2: 95–112. [Google Scholar] [CrossRef]

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision-making units. European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Chung, Shu-Hsing, Amy Hsin-I. Lee, He-Yau Kang, and Chih-Wei Lai. 2008. A DEA window analysis on the product family mix selection for a semiconductor fabricator. Expert Systems with Applications 35: 379–88. [Google Scholar] [CrossRef]

- Emrouznejad, Ali, and Guo-liang Yang. 2018. A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio-Economic Planning Sciences 61: 4–8. [Google Scholar] [CrossRef]

- Färe, Rolf, Shawna Grosskopf, and James Logan. 1983. The relative efficiency of Illinois electric utilities. Resources and Energy 5: 349–67. [Google Scholar] [CrossRef]

- Fare, Rolf, Shawna Grosskopf, and C.A. Lovell. 1994. Production Frontiers. Cambridge: Cambridge University Press. [Google Scholar]

- Goto, Mika, and Toshiyuki Sueyoshi. 2014. DEA efficiency analysis of solar photovoltaic power stations in Germany and the United States. Paper presented at 37th IAEE International Conference on Energy & the Economy, New York City, NY, USA, June 15–18. [Google Scholar]

- Government of Canada. 2020. Canada Energy Regular. Canada’s Energy Future. CER—Canada’s Energy Future. Available online: cer-rec.gc.ca (accessed on 3 October 2021).

- Jamasb, Tooraj, and Michael Pollitt. 2001. Benchmarking and regulation: International electric experience. Utilities Policy 9: 107–30. [Google Scholar] [CrossRef]

- Jebali, Eya, Hédi Essid, and Naceur Khraief. 2017. The analysis of energy efficiency of the Mediterranean countries: A two-stage double bootstrap DEA approach. Energy 134: 991–1000. [Google Scholar] [CrossRef]

- Jha, Deependra Kumar, and Rabin Shrestha. 2006. Measuring efficiency of hydropower plants in Nepal using data envelopment analysis. IEEE Transactions on Power Systems 21: 1502–11. [Google Scholar] [CrossRef]

- Lovell, Knox. 1993. Production frontiers and productive efficiency. In The Measurement of Productive Efficiency: Techniques and Applications. Edited by Harold O. Fried, Knox Lovell and Shelton Schmidt. Oxford: Oxford University Press, pp. 3–67. [Google Scholar]

- Lyu, Xiaohuan, and Anna Shi. 2018. Research on the renewable energy industry financing efficiency assessment and mode selection. Sustainability 10: 222. [Google Scholar] [CrossRef] [Green Version]

- Mahmoudi, Reza, Ali Emrouznejad, Hossein Khosroshahi, Mehdi Khashei, and Parisa Rajabi. 2019. Performance evaluation of thermal power plants considering CO2 emission: A multistage PCA, clustering, game theory and data envelopment analysis. Journal of Cleaner Production 223: 641–50. [Google Scholar] [CrossRef] [Green Version]

- Malmquist, Sten. 1953. Index numbers and indifference surfaces. Trabajos de Estadística 4: 209–42. [Google Scholar] [CrossRef]

- Mirnezami, Seyed Reza. 2014. Electricity inequality in Canada: Should pricing reforms eliminate subsidies to encourage efficient usage? Utilities Policy 31: 36–43. [Google Scholar] [CrossRef]

- Moeini, Ramtin, and Mohammad H. Afshar. 2011. Arc-based constrained ant colony optimization algorithms for the optimal solution of hydropower reservoir operation problems. Canandian Journal of Civil Engineering 38: 811–24. [Google Scholar]

- Natural Resources Canada. 2019. Electricity Facts. Available online: https://www.nrcan.gc.ca/science-and-data/data-and-analysis/energy-data-and-analysis/energy-facts/electricity-facts/20068 (accessed on 3 October 2021).

- Ng, Thiam Hee, and Jacqueline Yujia Tao. 2016. Bond financing for renewable energy in Asia. Energy Policy 95: 509–17. [Google Scholar] [CrossRef] [Green Version]

- Qudrat-Ullah, Hassan. 2013. Understanding the dynamics of electricity generation capacity in Canada: A system dynamics approach. Energy 59: 285–94. [Google Scholar] [CrossRef]

- Shi, Guang-Ming, Jun Bi, and Jin-Nan Wang. 2010. Chinese regional industrial energy efficiency evaluation based on a DEA model of fixing non-energy inputs. Energy Policy 38: 6172–79. [Google Scholar] [CrossRef]

- Simar, Leopold, and Paul W. Wilson. 1998. Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Management Science 44: 49–61. [Google Scholar] [CrossRef] [Green Version]

- Song, Ma-Lin, Lin-Ling Zhang, Wei Liu, and Ron Fisher. 2013. Bootstrap-DEA analysis of BRICS’ energy efficiency based on small sample data. Applied Energy 112: 1049–55. [Google Scholar] [CrossRef]

- Sozen, Adnan, İhsan Alp, and Cuma Kilinc. 2012. Efficiency assessment of the hydro-power plants in Turkey by using data envelopment analysis. Renewable Energy 46: 192–202. [Google Scholar] [CrossRef]

- Sueyoshi, Toshiyuki, Aijun Li, and Xiaohong Liu. 2019. Exploring sources of china’s CO2 emission: Decomposition analysis under different technology changes. European Journal of Operational Research 279: 984–95. [Google Scholar] [CrossRef]

- Tavana, Madjid, Kaveh Khalili-Damghani, Francisco J. Santos Arteaga, and Arousha Hashemi. 2019. A Malmquist productivity index for network production systems in the energy sector. Annals of Operations Research 284: 415–45. [Google Scholar] [CrossRef]

- The Conference Board of Canada. 2012. Infrastructure Investments. Available online: https://www.conferenceboard.ca/e-library/abstract.aspx?did=4673 (accessed on 17 July 2019).

- The Conference Board of Canada. 2018. Climate Change and Infrastructure. Available online: https://www.conferenceboard.ca/e-library/abstract.aspx?did=9535 (accessed on 17 July 2019).

- Toma, Pierluigi, Pier Paolo Miglietta, Giovanni Zurlini, Donatella Valente, and Irene Petrosillo. 2017. A non-parametric bootstrap-data envelopment analysis approach for environmental policy planning and management of agricultural efficiency in EU countries. Ecological Indicators 83: 132–43. [Google Scholar] [CrossRef]

- Wang, Bing, Ioan Nistor, Tad Murty, and Yi-Ming Wei. 2014. Efficiency assessment of hydroelectric power plants in Canada: A multi criteria decision making approach. Energy Economics 46: 112–21. [Google Scholar] [CrossRef]

- Wang, Zhaohua, and Chao Feng. 2015. A performance evaluation of the energy, environmental, and economic efficiency and productivity in China: An application of global data envelopment analysis. Applied Energy 147: 617–26. [Google Scholar] [CrossRef]

- Wegener, Matthew, and Gholam R. Amin. 2019. Minimizing greenhouse gas emissions using inverse dea with an application in oil and gas. Expert Systems with Applications 122: 369–75. [Google Scholar] [CrossRef]

- Zha, Yong, Linlin Zhao, and Yiwen Bian. 2016. Measuring regional efficiency of energy and carbon dioxide emissions in china: A chance constrained DEA approach. Computers & Operations Research 66: 351–61. [Google Scholar]

- Zhang, Shanshan, Tommy Lundgren, and Wenchao Zhou. 2016. Energy efficiency in Swedish industry: A firm-level data envelopment analysis. Energy Economics 55: 42–51. [Google Scholar] [CrossRef]

- Zhou, Peng, Beng Wah Ang, and Kim-Leng Poh. 2008. A survey of data envelopment analysis in energy and environmental studies. European Journal of Operations Research 189: 1–18. [Google Scholar] [CrossRef]

| Energy Efficiency Analysis | Model Used | Inputs | Outputs | Reference |

|---|---|---|---|---|

| Energy efficiency of thermal power plants | Shanon entropy Game theory | Generation capacity Hours of operation Fuel consumption Number of employees Cost of power generation Cost of training | Total revenue Electricity generated CO2 emissions | Mahmoudi et al. (2019) |

| Energy efficiency of power plants in China | DEA Production decomposition analysis (PDA) Index decomposition analysis | Energy consumption Capital Labor | GDP CO2 emissions | Sueyoshi et al. (2019) |

| Energy efficiency of oil and gas companies | Directional distance DEA | Number of employees Capital expenditure Total assets | Production Greenhouse gas emissions | Wegener and Amin (2019) |

| Energy efficiency of Iranian oil refineries | Network DEA Malmquist index | Consumption of oil Consumption of fuel Actual capacity Complexity index Number of employees Consumption of Super gasoline | LPG Gasoline Kerosene Gas oil, fuel oil | Tavana et al. (2019) |

| Renewable energy financing efficiency in different parts of the globe | DEA and Malmquist index | R&D investment Development of the stock market Project financing Venture capital | Renewable energy generation | Lyu and Shi (2018) |

| Energy efficiency in Mediterranean countries | DEA and double bootstrap | Energy consumption Labor force Gross fixed capital | GDP | Jebali et al. (2017) |

| Energy efficiency and productivity growth in Jordanian power generation | DEA and Malmquist index | Number of employees Number of establishments Energy consumption Employee compensation Intermediate consumption | Gross value added CO2 emissions | Al-Refaie et al. (2016) |

| Energy regional efficiency of power plants in China | Radial distance DEA | Labor Capital Coal Natural gas | GDP CO2 | Zha et al. (2016) |

| Energy efficiency of power plants in Sweden | DEA Regression | Labor Capital Fossil fuel Non-fossil fuel | Sales SO2 NOx | Zhang et al. (2016) |

| Energy, environmental, and economic efficiency of power plants in China | DEA and Malmquist index | Capital stock Labor Energy consumption | GDP SO2 Chemical oxygen demand | Wang and Feng (2015) |

| Energy Efficiency Of Photovoltaic Power Stations In Germany And The United States | Radial distance DEA | Insolation Average sunshine Photovoltaic land area | Annual modules | Goto and Sueyoshi (2014) |

| Energy efficiency among BRICS countries | Bootstrap DEA Super-SBM model | Economically active population Capital formation rate Energy consumption | GDP | Song et al. (2013) |

| Energy efficiency of power plants in Turkey | DEA | Capacity usage factor (%) Installed capacity Water collection Unit cost Operations cost | Net generation Gross generation | Sozen et al. (2012) |

| Energy efficiency of 28 administrative regions of China | DEA | Fixed assets Energy consumption Labor | Industrial added value Volume of industrial waste gas | Shi et al. (2010) |

| Investigation of best practices toward improved performance in the energy market | DEA and Malmquist index | Labor Capital Operational cost Investment | Energy Production Capacity utilization in % | Barros (2008) |

| Region | Province/Territory | Company Name | N | Statistics | Number of Employees | Total Assets (CAD Millions) | Operating Costs (CAD Millions) | Capital Expenditures (CAD Millions) | Total Revenues (CAD Millions) | Total Electricity Generation (GWh) |

|---|---|---|---|---|---|---|---|---|---|---|

| Western | BC | BC Hydro | 18 | Mean | 5470.00 | 19,317.06 | 4515.83 | 1436.94 | 4925.72 | 83,348.28 |

| Median | 5740.00 | 17,211.00 | 4365.50 | 1458.00 | 4792.50 | 83,388.00 | ||||

| Std. deviation | 634.60 | 7680.23 | 1115.13 | 779.62 | 1207.25 | 5853.36 | ||||

| AB | TransAlta Corporation | 18 | Mean | 2415.72 | 8990.89 | 2172.22 | 580.72 | 2519.67 | 44,647.83 | |

| Median | 2384.50 | 9465.50 | 2175.00 | 529.50 | 2589.00 | 45,369.00 | ||||

| Std. deviation | 251.49 | 1241.12 | 234.70 | 232.68 | 298.09 | 6596.80 | ||||

| AB | TC Energy | 18 | Mean | 4238.44 | 46,706.94 | 6134.00 | 4212.61 | 8642.61 | 16,638.83 | |

| Median | 4100.00 | 45,215.00 | 4737.00 | 3800.00 | 8341.50 | 15,728.00 | ||||

| Std. deviation | 1884.58 | 24,741.47 | 3446.80 | 2845.38 | 2702.84 | 3202.53 | ||||

| SK | SaskPower | 18 | Mean | 2720.61 | 6603.61 | 1627.89 | 643.00 | 1753.78 | 21,840.22 | |

| Median | 2677.00 | 5303.50 | 1446.50 | 581.50 | 1602.50 | 21,618.00 | ||||

| Std. deviation | 325.51 | 3028.25 | 505.06 | 355.58 | 509.06 | 2097.15 | ||||

| MN | Manitoba Hydro | 18 | Mean | 5926.83 | 13,851.22 | 2017.11 | 11,308.67 | 2108.33 | 23,363.72 | |

| Median | 6039.00 | 12,102.00 | 1959.50 | 9755.00 | 2104.00 | 23,426.00 | ||||

| Std. deviation | 573.65 | 4576.88 | 287.55 | 4609.61 | 209.03 | 1545.14 | ||||

| Central | ON | Algonquin Power & Utilities Corp | 10 | Mean | 1441.80 | 4467.00 | 636.90 | 240.20 | 792.30 | 2875.60 |

| Median | 1230.00 | 3795.00 | 688.00 | 181.00 | 809.50 | 3031.00 | ||||

| Std. deviation | 575.01 | 3204.65 | 408.64 | 207.59 | 541.12 | 1171.34 | ||||

| ON | Hydro One Limited | 18 | Mean | 5624.33 | 17,452.11 | 4092.11 | 1206.78 | 5157.78 | 172,977.78 | |

| Median | 5572.00 | 16,478.50 | 4027.50 | 1417.00 | 4934.00 | 170,600.00 | ||||

| Std. deviation | 1417.78 | 5657.48 | 857.70 | 421.85 | 992.25 | 7555.64 | ||||

| ON | Ontario Power Generation | 18 | Mean | 10,720.72 | 31,362.06 | 3728.06 | 15,479.44 | 4342.56 | 95,455.56 | |

| Median | 10,950.00 | 28,580.50 | 3677.00 | 13,268.00 | 4428.00 | 88,600.00 | ||||

| Std. deviation | 1035.59 | 11,413.68 | 284.91 | 4001.13 | 414.23 | 18,407.49 | ||||

| QC | Boralax Inc. | 18 | Mean | 276.67 | 1372.56 | 135.61 | 780.67 | 197.50 | 1777.83 | |

| Median | 280.00 | 920.50 | 104.00 | 528.50 | 184.50 | 1559.50 | ||||

| Std. deviation | 62.31 | 1315.42 | 97.58 | 634.85 | 109.67 | 710.51 | ||||

| QC | Hydro Quebec | 18 | Mean | 20,164.06 | 67,034.06 | 7016.22 | 56,231.78 | 11,851.39 | 192,614.72 | |

| Median | 19,790.00 | 65,363.50 | 7041.00 | 55,920.00 | 12,257.00 | 192,237.50 | ||||

| Std. deviation | 1745.99 | 6705.20 | 878.67 | 5003.29 | 1843.13 | 9656.30 | ||||

| Eastern | NB | NB power | 18 | Mean | 2581.28 | 5414.61 | 1393.61 | 283.72 | 1578.67 | 18,799.72 |

| Median | 2597.00 | 5505.50 | 1487.00 | 279.00 | 1625.50 | 18,692.00 | ||||

| Std. deviation | 128.93 | 1502.81 | 210.28 | 104.23 | 189.80 | 1480.49 | ||||

| NS | Emera Incorporated | 18 | Mean | 3540.28 | 10,009.72 | 1836.33 | 560.17 | 2328.94 | 16,932.78 | |

| Median | 2819.00 | 5686.00 | 1206.50 | 470.50 | 1545.00 | 15,603.50 | ||||

| Std. deviation | 1856.11 | 9561.92 | 1365.34 | 529.26 | 1691.98 | 3092.87 | ||||

| NS | Nova Scotia Power Inc. | 18 | Mean | 1806.39 | 3778.72 | 888.72 | 2907.06 | 1157.00 | 11,686.22 | |

| Median | 1805.00 | 3694.00 | 944.50 | 2733.00 | 1192.50 | 11,781.50 | ||||

| Std. deviation | 110.78 | 769.94 | 198.70 | 587.25 | 198.27 | 711.99 | ||||

| NFL | Fortis Inc. | 18 | Mean | 4448.78 | 17,614.33 | 2879.06 | 1187.56 | 3737.78 | 32,369.00 | |

| Median | 2950.50 | 12,775.00 | 2900.50 | 1047.50 | 3650.50 | 27,732.50 | ||||

| Std. deviation | 2450.83 | 16562.14 | 1879.50 | 931.06 | 2537.49 | 10,539.50 | ||||

| NFL | Newfoundland Power Inc. | 18 | Mean | 669.72 | 1165.78 | 409.17 | 920.94 | 527.89 | 5678.39 | |

| Median | 640.50 | 1222.50 | 383.00 | 863.00 | 541.00 | 5673.50 | ||||

| Std. deviation | 105.90 | 325.74 | 161.45 | 299.98 | 111.58 | 459.78 | ||||

| NFL | Nalcor Energy | 15 | Mean | 1311.27 | 3020.60 | 611.13 | 1039.33 | 697.13 | 39,313.93 | |

| Median | 1290.00 | 2712.00 | 585.00 | 254.00 | 714.00 | 39,242.00 | ||||

| Std. deviation | 145.75 | 846.78 | 147.42 | 1244.89 | 151.19 | 1583.63 | ||||

| Northern | YK | Yukon Energy Corporation | 18 | Mean | 81.11 | 326.83 | 26.94 | 287.39 | 33.89 | 373.56 |

| Median | 85.00 | 325.50 | 23.00 | 250.00 | 32.50 | 379.00 | ||||

| Std. deviation | 15.58 | 145.24 | 9.83 | 131.13 | 8.18 | 67.59 | ||||

| All samples | All companies | 295 | Mean | 4428.53 | 15,620.30 | 2424.57 | 6042.33 | 3165.84 | 47,157.78 | |

| Median | 2657.00 | 7878.00 | 1746.00 | 949.00 | 1869.00 | 21,875.00 | ||||

| Std. deviation | 4902.14 | 19,709.69 | 2316.89 | 13,634.64 | 3326.82 | 57,366.17 |

| Region | Province/Territory | Company Name | N | Statistics | ROTE | BOTEMean | RPTE | BPTEMean | RSE |

|---|---|---|---|---|---|---|---|---|---|

| Western | BC | BC Hydro | 18 | Mean | 0.7473 | 0.6972 | 0.7495 | 0.7062 | 0.9967 |

| Median | 0.6963 | 0.6721 | 0.6984 | 0.6756 | 0.9988 | ||||

| Std. deviation | 0.1059 | 0.0751 | 0.1047 | 0.0819 | 0.0057 | ||||

| AB | TransAlta Corporation | 18 | Mean | 0.8141 | 0.7656 | 0.8237 | 0.7869 | 0.9882 | |

| Median | 0.8321 | 0.7794 | 0.8392 | 0.8059 | 0.9890 | ||||

| Std. deviation | 0.0943 | 0.0866 | 0.0944 | 0.0901 | 0.0083 | ||||

| AB | TC Energy | 18 | Mean | 0.8297 | 0.7488 | 0.9409 | 0.8384 | 0.8866 | |

| Median | 0.8248 | 0.7564 | 1.0000 | 0.8573 | 0.9808 | ||||

| Std. deviation | 0.1462 | 0.1201 | 0.0741 | 0.0469 | 0.1604 | ||||

| SK | SaskPower | 18 | Mean | 0.7467 | 0.7253 | 0.7512 | 0.7332 | 0.9943 | |

| Median | 0.7821 | 0.7620 | 0.7857 | 0.7696 | 0.9947 | ||||

| Std. deviation | 0.0721 | 0.0706 | 0.0748 | 0.0737 | 0.0042 | ||||

| MN | Manitoba Hydro | 18 | Mean | 0.4558 | 0.4362 | 0.5415 | 0.5233 | 0.8443 | |

| Median | 0.4535 | 0.4329 | 0.5363 | 0.5155 | 0.8476 | ||||

| Std. deviation | 0.0372 | 0.0323 | 0.0574 | 0.0549 | 0.0307 | ||||

| Central | ON | Algonquin Power & Utilities Corp | 10 | Mean | 0.7473 | 0.6983 | 0.8087 | 0.7515 | 0.9271 |

| Median | 0.7157 | 0.6761 | 0.7729 | 0.7254 | 0.9537 | ||||

| Std. deviation | 0.0950 | 0.0655 | 0.1062 | 0.0701 | 0.0646 | ||||

| ON | Hydro One Limited | 18 | Mean | 0.8972 | 0.8325 | 0.9708 | 0.8878 | 0.9246 | |

| Median | 0.8576 | 0.8152 | 0.9816 | 0.8926 | 0.9549 | ||||

| Std. deviation | 0.0791 | 0.0526 | 0.0375 | 0.0312 | 0.0761 | ||||

| ON | Ontario Power Generation | 18 | Mean | 0.5741 | 0.5476 | 0.6637 | 0.6398 | 0.8655 | |

| Median | 0.5684 | 0.5469 | 0.6542 | 0.6353 | 0.8632 | ||||

| Std. deviation | 0.0340 | 0.0287 | 0.0437 | 0.0409 | 0.0145 | ||||

| QC | Boralax Inc. | 18 | Mean | 0.7049 | 0.6544 | 0.8006 | 0.7402 | 0.8837 | |

| Median | 0.6642 | 0.6317 | 0.7526 | 0.7034 | 0.9056 | ||||

| Std. deviation | 0.1308 | 0.1154 | 0.1421 | 0.1150 | 0.0817 | ||||

| QC | Hydro Quebec | 18 | Mean | 0.7643 | 0.7454 | 0.9661 | 0.9084 | 0.7914 | |

| Median | 0.7719 | 0.7541 | 0.9844 | 0.9213 | 0.7926 | ||||

| Std. deviation | 0.0361 | 0.0377 | 0.0494 | 0.0447 | 0.0130 | ||||

| Eastern | NB | NB power | 18 | Mean | 0.8359 | 0.7941 | 0.8429 | 0.8103 | 0.9913 |

| Median | 0.8332 | 0.7836 | 0.8366 | 0.8027 | 0.9915 | ||||

| Std. deviation | 0.0892 | 0.0797 | 0.0866 | 0.0768 | 0.0054 | ||||

| NS | Emera Incorporated | 18 | Mean | 0.8366 | 0.7978 | 0.8426 | 0.8065 | 0.9930 | |

| Median | 0.8140 | 0.7814 | 0.8179 | 0.7912 | 0.9940 | ||||

| Std. deviation | 0.0926 | 0.0846 | 0.0938 | 0.0904 | 0.0055 | ||||

| NS | Nova Scotia Power Inc. | 18 | Mean | 0.7043 | 0.6773 | 0.7637 | 0.7387 | 0.9226 | |

| Median | 0.7038 | 0.6827 | 0.7589 | 0.7328 | 0.9273 | ||||

| Std. deviation | 0.0316 | 0.0365 | 0.0315 | 0.0315 | 0.0332 | ||||

| NFL | Fortis Inc. | 18 | Mean | 0.8208 | 0.7854 | 0.8404 | 0.8021 | 0.9777 | |

| Median | 0.7971 | 0.7695 | 0.8246 | 0.7983 | 0.9976 | ||||

| Std. deviation | 0.0866 | 0.0816 | 0.0853 | 0.0777 | 0.0487 | ||||

| NFL | Newfoundland Power Inc. | 18 | Mean | 0.8861 | 0.8306 | 0.9051 | 0.8594 | 0.9790 | |

| Median | 0.8996 | 0.8489 | 0.9219 | 0.8787 | 0.9776 | ||||

| Std. deviation | 0.0713 | 0.0632 | 0.0714 | 0.0636 | 0.0084 | ||||

| NFL | Nalcor Energy | 15 | Mean | 0.8832 | 0.8133 | 0.8876 | 0.8371 | 0.9946 | |

| Median | 0.9044 | 0.8403 | 0.9080 | 0.8655 | 0.9957 | ||||

| Std. deviation | 0.0962 | 0.0700 | 0.0936 | 0.0737 | 0.0043 | ||||

| Northern | YK | Yukon Energy Corporation | 18 | Mean | 0.5329 | 0.5097 | 0.8376 | 0.7898 | 0.6439 |

| Median | 0.5395 | 0.5127 | 0.8609 | 0.8280 | 0.6438 | ||||

| Std. deviation | 0.0511 | 0.0476 | 0.1334 | 0.1183 | 0.0588 | ||||

| All samples | All companies | 295 | Mean | 0.7506 | 0.7086 | 0.8194 | 0.7741 | 0.9169 | |

| Median | 0.7679 | 0.7334 | 0.8250 | 0.7855 | 0.9767 | ||||

| Std. deviation | 0.1498 | 0.1337 | 0.1357 | 0.1170 | 0.1073 | ||||

| One-way | F | 39.307 | 45.118 | 28.445 | 28.576 | 53.338 | |||

| ANOVA | p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Ownership | N | Statistics | ROTE | BOTEMean | RPTE | BPTEMean | RSE |

|---|---|---|---|---|---|---|---|

| Government | 177 | Mean | 0.7102 | 0.6754 | 0.7893 | 0.7532 | 0.9008 |

| Std. deviation | 0.1547 | 0.1405 | 0.1423 | 0.1279 | 0.1145 | ||

| Public | 118 | Mean | 0.8113 | 0.7585 | 0.8646 | 0.8053 | 0.9410 |

| Std. deviation | 0.1192 | 0.1051 | 0.1113 | 0.0904 | 0.0906 | ||

| Total | 295 | Mean | 0.7506 | 0.7086 | 0.8194 | 0.7741 | 0.9169 |

| Std. deviation | 0.1498 | 0.1337 | 0.1357 | 0.1170 | 0.1073 | ||

| One-way | F | 36.088 | 30.067 | 23.509 | 14.678 | 10.261 | |

| ANOVA | p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.002 |

| Year | N | Statistics | ROTE | BOTEMean | RPTE | BPTEMean | RSE |

|---|---|---|---|---|---|---|---|

| 2001 | 15 | Mean | 0.7993 | 0.7337 | 0.8732 | 0.8027 | 0.9125 |

| Median | 0.7856 | 0.7644 | 0.8437 | 0.8165 | 0.9921 | ||

| Std. deviation | 0.1909 | 0.1557 | 0.1360 | 0.1021 | 0.1361 | ||

| 2002 | 15 | Mean | 0.8087 | 0.7477 | 0.8828 | 0.8214 | 0.9151 |

| Median | 0.8422 | 0.8148 | 0.9422 | 0.8750 | 0.9911 | ||

| Std. deviation | 0.1736 | 0.1466 | 0.1415 | 0.1179 | 0.1174 | ||

| 2003 | 15 | Mean | 0.7975 | 0.7467 | 0.8779 | 0.8263 | 0.9069 |

| Median | 0.8162 | 0.7856 | 0.9006 | 0.8666 | 0.9889 | ||

| Std. deviation | 0.1774 | 0.1542 | 0.1390 | 0.1182 | 0.1273 | ||

| 2004 | 16 | Mean | 0.7989 | 0.7494 | 0.8615 | 0.8121 | 0.9266 |

| Median | 0.8384 | 0.7787 | 0.9053 | 0.8631 | 0.9869 | ||

| Std. deviation | 0.1668 | 0.1457 | 0.1457 | 0.1264 | 0.1100 | ||

| 2005 | 16 | Mean | 0.7964 | 0.7507 | 0.8642 | 0.8181 | 0.9178 |

| Median | 0.8541 | 0.7915 | 0.8849 | 0.8546 | 0.9873 | ||

| Std. deviation | 0.1631 | 0.1472 | 0.1149 | 0.1001 | 0.1194 | ||

| 2006 | 16 | Mean | 0.7988 | 0.7508 | 0.8685 | 0.8222 | 0.9173 |

| Median | 0.8162 | 0.7900 | 0.8778 | 0.8370 | 0.9837 | ||

| Std. deviation | 0.1543 | 0.1399 | 0.1116 | 0.0985 | 0.1142 | ||

| 2007 | 16 | Mean | 0.8144 | 0.7698 | 0.8800 | 0.8362 | 0.9227 |

| Median | 0.8285 | 0.7969 | 0.9302 | 0.8712 | 0.9864 | ||

| Std. deviation | 0.1620 | 0.1471 | 0.1235 | 0.1080 | 0.1114 | ||

| 2008 | 16 | Mean | 0.7784 | 0.7357 | 0.8382 | 0.7967 | 0.9279 |

| Median | 0.7827 | 0.7586 | 0.8561 | 0.8099 | 0.9845 | ||

| Std. deviation | 0.1496 | 0.1337 | 0.1235 | 0.1110 | 0.1082 | ||

| 2009 | 17 | Mean | 0.7702 | 0.7281 | 0.8290 | 0.7878 | 0.9274 |

| Median | 0.7658 | 0.7400 | 0.8347 | 0.7968 | 0.9854 | ||

| Std. deviation | 0.1428 | 0.1266 | 0.1132 | 0.0974 | 0.1040 | ||

| 2010 | 17 | Mean | 0.7390 | 0.7039 | 0.8032 | 0.7676 | 0.9219 |

| Median | 0.7772 | 0.7320 | 0.7962 | 0.7775 | 0.9786 | ||

| Std. deviation | 0.1252 | 0.1178 | 0.1176 | 0.1090 | 0.1017 | ||

| 2011 | 17 | Mean | 0.7383 | 0.7042 | 0.8040 | 0.7705 | 0.9170 |

| Median | 0.7785 | 0.7453 | 0.7954 | 0.7738 | 0.9463 | ||

| Std. deviation | 0.1377 | 0.1297 | 0.1211 | 0.1140 | 0.0958 | ||

| 2012 | 17 | Mean | 0.7026 | 0.6696 | 0.7684 | 0.7360 | 0.9150 |

| Median | 0.7001 | 0.6795 | 0.7555 | 0.7302 | 0.9329 | ||

| Std. deviation | 0.1216 | 0.1153 | 0.1202 | 0.1116 | 0.0889 | ||

| 2013 | 17 | Mean | 0.7288 | 0.6928 | 0.7884 | 0.7474 | 0.9252 |

| Median | 0.7474 | 0.7183 | 0.7796 | 0.7550 | 0.9541 | ||

| Std. deviation | 0.1346 | 0.1213 | 0.1360 | 0.1152 | 0.0865 | ||

| 2014 | 17 | Mean | 0.7306 | 0.6960 | 0.7953 | 0.7493 | 0.9229 |

| Median | 0.7759 | 0.7146 | 0.7917 | 0.7731 | 0.9719 | ||

| Std. deviation | 0.1237 | 0.1134 | 0.1363 | 0.1084 | 0.0958 | ||

| 2015 | 17 | Mean | 0.7195 | 0.6801 | 0.7829 | 0.7330 | 0.9234 |

| Median | 0.7389 | 0.6995 | 0.7519 | 0.7227 | 0.9754 | ||

| Std. deviation | 0.1312 | 0.1161 | 0.1418 | 0.1134 | 0.1008 | ||

| 2016 | 17 | Mean | 0.6745 | 0.6423 | 0.7518 | 0.7113 | 0.9046 |

| Median | 0.6834 | 0.6519 | 0.7256 | 0.7007 | 0.9525 | ||

| Std. deviation | 0.1241 | 0.1180 | 0.1406 | 0.1199 | 0.1220 | ||

| 2017 | 17 | Mean | 0.6786 | 0.6434 | 0.7602 | 0.7175 | 0.9011 |

| Median | 0.6965 | 0.6619 | 0.7132 | 0.6858 | 0.9529 | ||

| Std. deviation | 0.1171 | 0.1076 | 0.1401 | 0.1180 | 0.1150 | ||

| 2018 | 17 | Mean | 0.6685 | 0.6348 | 0.7531 | 0.7048 | 0.8982 |

| Median | 0.6941 | 0.6647 | 0.7282 | 0.7052 | 0.9427 | ||

| Std. deviation | 0.1236 | 0.1190 | 0.1535 | 0.1266 | 0.1216 | ||

| Total | 195 | Mean | 0.7506 | 0.7086 | 0.8194 | 0.7741 | 0.9169 |

| Median | 0.7679 | 0.7334 | 0.8250 | 0.7855 | 0.9767 | ||

| Std. deviation | 0.1498 | 0.1337 | 0.1357 | 0.1170 | 0.1073 | ||

| One-way | F | 1.894 | 1.721 | 2.158 | 2.474 | 0.114 | |

| ANOVA | p-value | 0.018 | 0.039 | 0.006 | 0.001 | 1.000 |

| PreFCPost | N | Statistics | ROTE | BOTEMean | RPTE | BPTEMean | RSE |

|---|---|---|---|---|---|---|---|

| PreFC | 93 | Mean | 0.7999 | 0.7466 | 0.8711 | 0.8171 | 0.9162 |

| Median | 0.8301 | 0.7880 | 0.8918 | 0.8557 | 0.9883 | ||

| Std. deviation | 0.1664 | 0.1442 | 0.1284 | 0.1082 | 0.1176 | ||

| FC | 49 | Mean | 0.7873 | 0.7442 | 0.8487 | 0.8065 | 0.9261 |

| Median | 0.8059 | 0.7693 | 0.8500 | 0.8179 | 0.9854 | ||

| Std. deviation | 0.1495 | 0.1342 | 0.1196 | 0.1054 | 0.1056 | ||

| PostFC | 153 | Mean | 0.7089 | 0.6741 | 0.7786 | 0.7375 | 0.9144 |

| Median | 0.7295 | 0.6983 | 0.7668 | 0.7353 | 0.9622 | ||

| Std. deviation | 0.1262 | 0.1175 | 0.1325 | 0.1143 | 0.1016 | ||

| Total | 295 | Mean | 0.7506 | 0.7086 | 0.8194 | 0.7741 | 0.9169 |

| Median | 0.7679 | 0.7334 | 0.8250 | 0.7855 | 0.9767 | ||

| Std. deviation | 0.1498 | 0.1337 | 0.1357 | 0.1170 | 0.1073 | ||

| One-way | F | 13.464 | 11.313 | 16.349 | 17.397 | 0.222 | |

| ANOVA | p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.801 |

| Efficiencies | Period Comparison | Difference | p-Value |

|---|---|---|---|

| ROTE | PreFC vs. FC | 0.0126 | 0.873 |

| PreFC vs. PostFC | 0.0909 | 0.000 | |

| FC vs. PostFC | 0.0783 | 0.003 | |

| BOTEMean | PreFC vs. FC | 0.0024 | 0.994 |

| PreFC vs. PostFC | 0.0725 | 0.000 | |

| FC vs. PostFC | 0.0700 | 0.003 | |

| RPTE | PreFC vs. FC | 0.0225 | 0.587 |

| PreFC vs. PostFC | 0.0925 | 0.000 | |

| FC vs. PostFC | 0.0701 | 0.003 | |

| BPTEMean | PreFC vs. FC | 0.0106 | 0.850 |

| PreFC vs. PostFC | 0.0796 | 0.000 | |

| FC vs. PostFC | 0.0690 | 0.001 | |

| RSE | PreFC vs. FC | −0.0099 | 0.862 |

| PreFC vs. PostFC | 0.0018 | 0.991 | |

| FC vs. PostFC | 0.0117 | 0.785 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dia, M.; Shahi, S.K.; Zéphyr, L. An Assessment of the Efficiency of Canadian Power Generation Companies with Bootstrap DEA. J. Risk Financial Manag. 2021, 14, 498. https://doi.org/10.3390/jrfm14100498

Dia M, Shahi SK, Zéphyr L. An Assessment of the Efficiency of Canadian Power Generation Companies with Bootstrap DEA. Journal of Risk and Financial Management. 2021; 14(10):498. https://doi.org/10.3390/jrfm14100498

Chicago/Turabian StyleDia, Mohamed, Shashi K. Shahi, and Luckny Zéphyr. 2021. "An Assessment of the Efficiency of Canadian Power Generation Companies with Bootstrap DEA" Journal of Risk and Financial Management 14, no. 10: 498. https://doi.org/10.3390/jrfm14100498

APA StyleDia, M., Shahi, S. K., & Zéphyr, L. (2021). An Assessment of the Efficiency of Canadian Power Generation Companies with Bootstrap DEA. Journal of Risk and Financial Management, 14(10), 498. https://doi.org/10.3390/jrfm14100498