Consumer Behaviour during Crises: Preliminary Research on How Coronavirus Has Manifested Consumer Panic Buying, Herd Mentality, Changing Discretionary Spending and the Role of the Media in Influencing Behaviour

Abstract

:1. Introduction

2. Theoretical Development

2.1. Panic Buying

2.2. Herd Mentality

2.3. Maslow’s Hierarchy of Needs Model

2.4. Role of the Media in Influencing Consumer Behaviour

3. Methodology

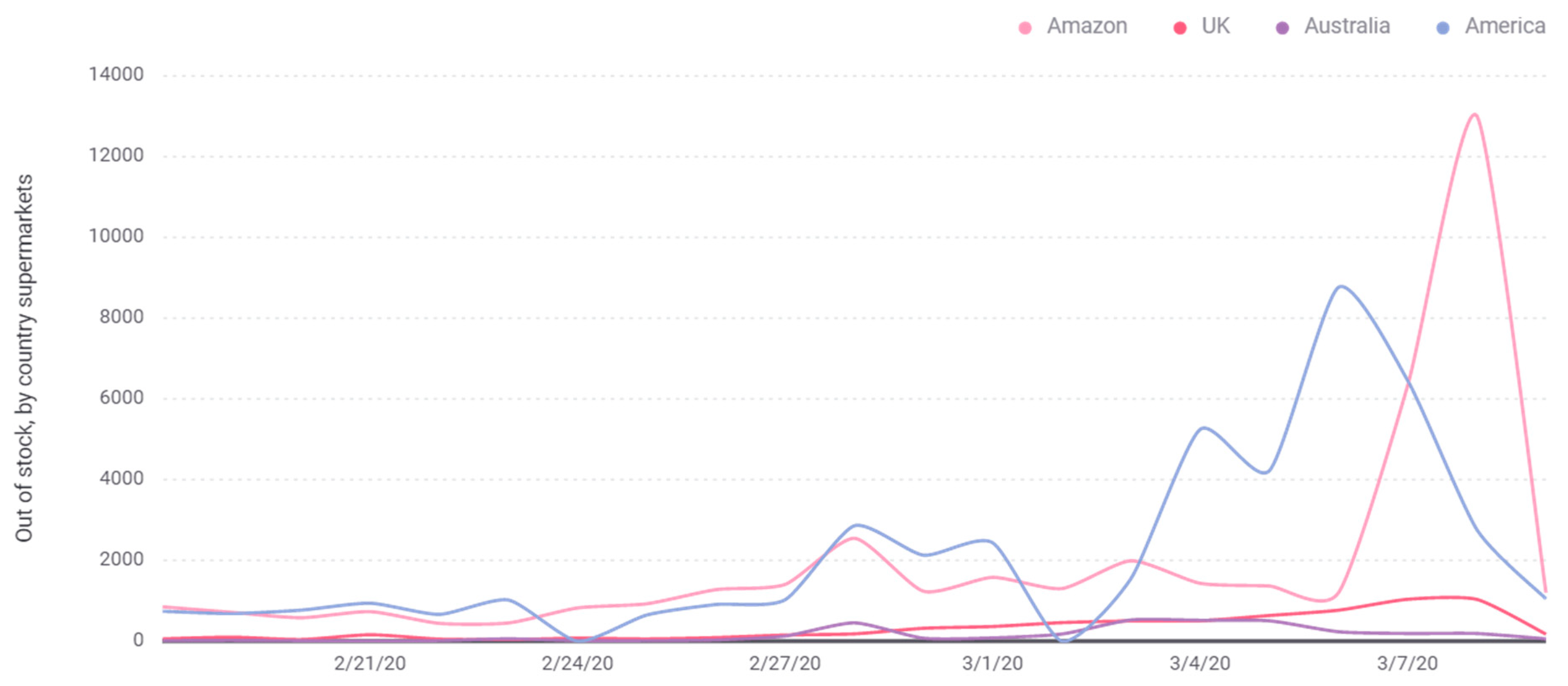

3.1. Panic Buying

3.2. Herd Mentality

3.3. Maslow’s Hierarchy of Needs

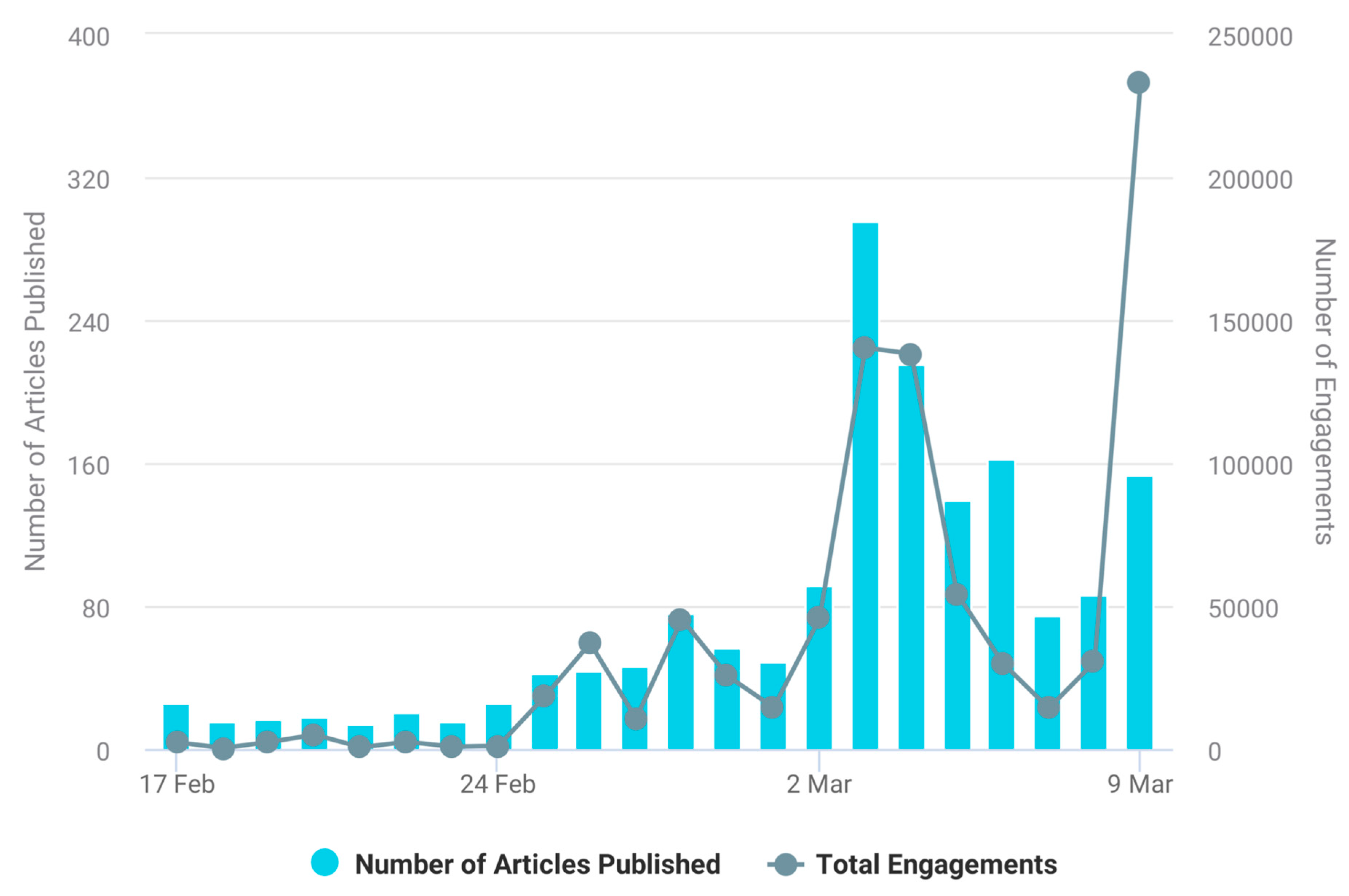

3.4. Role of the Media in Influencing Consumer Behaviour

4. Results

5. Discussion

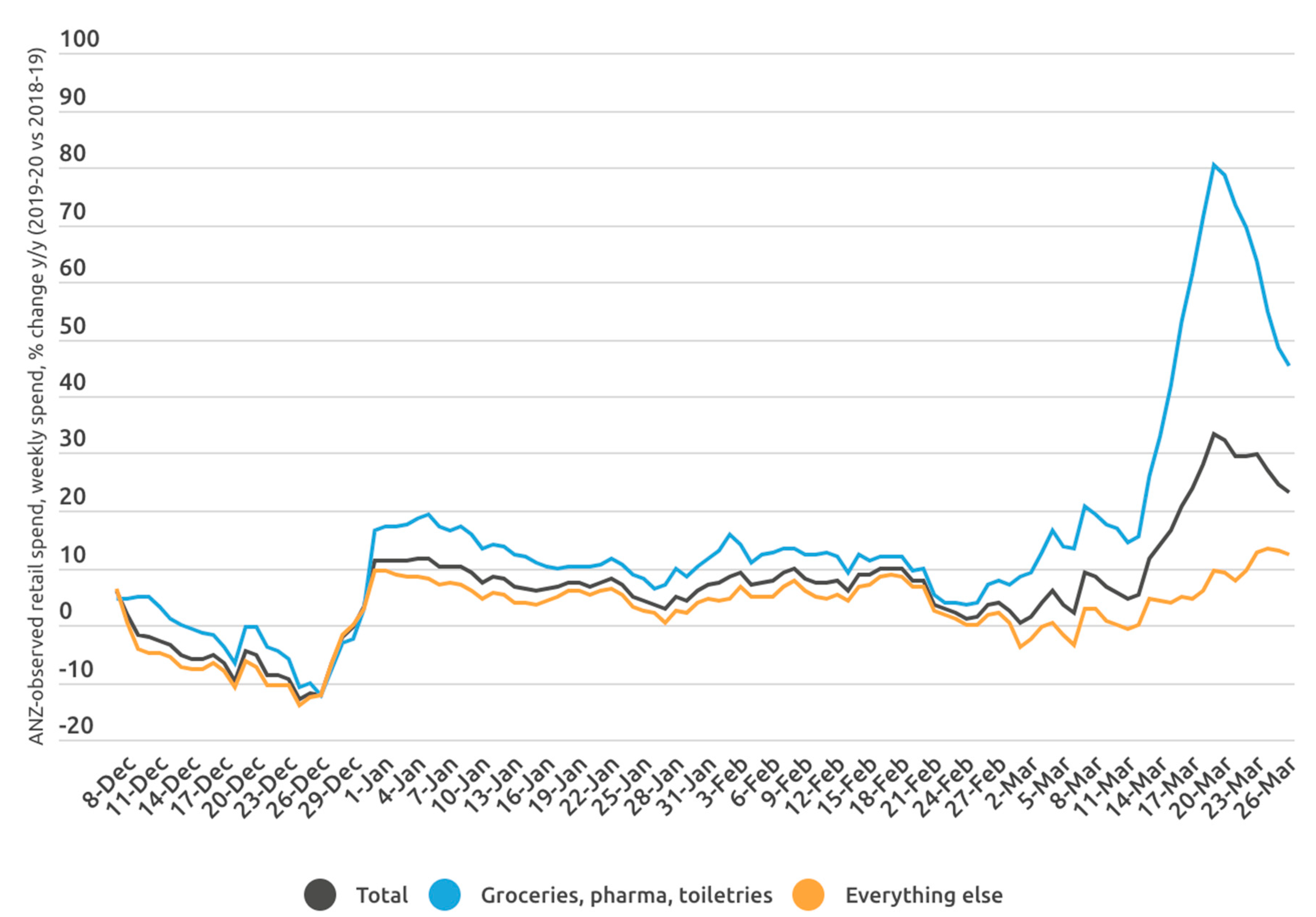

5.1. Discussion on Panic Buying

5.2. Discussion on Herd Mentality

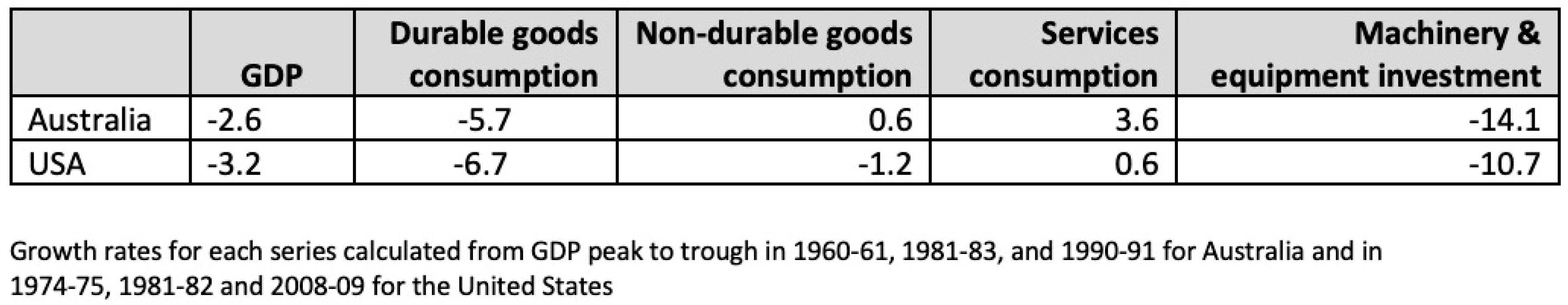

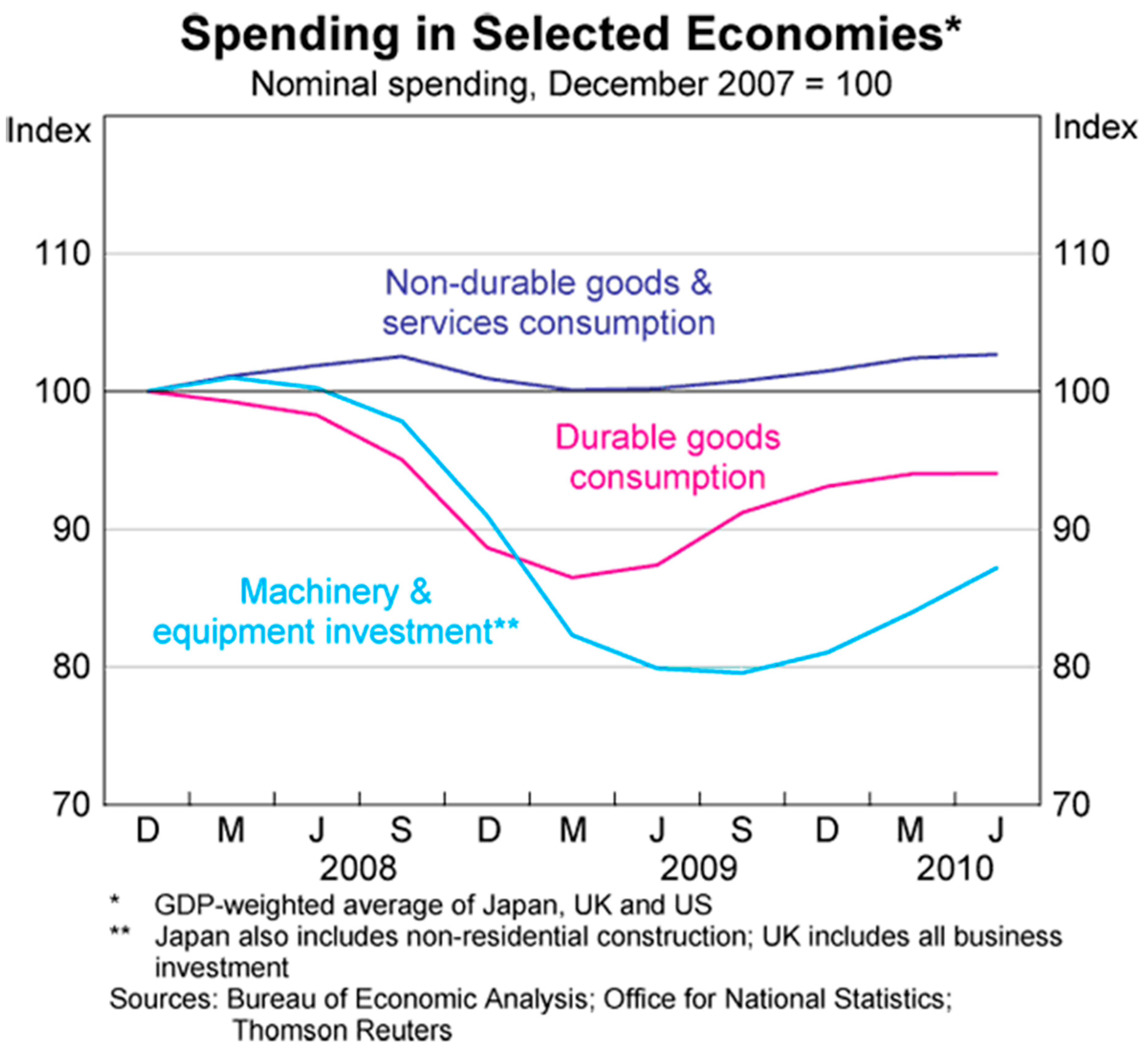

5.3. Discussion on Maslow’s Hierarchy of Needs

5.4. Discussion on the Influence of the Media

5.5. Limitations and Future Research Directive

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Accardi, Nicolette. 2020. These Retailers Are Using Their Manufacturing Facilities to Make Masks and Hospital Equipment. Available online: https://www.nj.com/business/2020/03/these-retailers-are-using-their-manufacturing-facilities-to-make-masks-and-equipment.html (accessed on 2 June 2020).

- Anderson, Timothy. 2020. Woolworths Group Ltd.: March Quarter 2020 Sales Report. Australian Stock Report. Available online: https://www.australianstockreport.com.au/insights/woolworths-group-ltd-march-quarter-2020-sales-report (accessed on 10 June 2020).

- Asch, Solomon. 1955. Opinions and social pressure. Scientific American 193: 31–35. [Google Scholar] [CrossRef]

- Ballantine, Paul W. 2013. Changes in retail shopping behaviour in the aftermath of an earthquake. The International Review of Retail, Distribution and Consumer Research 1: 28–42. [Google Scholar] [CrossRef]

- Ball-Rokeach, Sandra, and Melvin DeFleur. 1976. A dependency model of mass-media effects. Communication Research 3: 3–21. [Google Scholar] [CrossRef]

- Besson, Emilie K. 2020. COVID-19 (Coronavirus): Panic Buying and Its Impact on Global Health Supply Chains. World Bank. Available online: https://blogs.worldbank.org/health/covid-19-coronavirus-panic-buying-and-its-impact-global-health-supply-chains (accessed on 14 June 2020).

- Black, Susan, and Tom Cusbert. 2012. Durable Goods and the Business Cycle. Reserve Bank of Australia. Available online: http://www.rba.gov.au/publications/bulletin/2010/sep/pdf/bu-0910-2.pdf (accessed on 29 July 2020).

- Brooks, Andrew, Monica Capra, and Gregory Berns. 2012. Neural insensitivity to upticks in value is associated with the disposition effect. NeuroImage 59: 4086–93. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Buchholz, Katharina. 2020. Toilet Paper Producers Roll’ing in the Dough. Available online: https://www.statista.com/chart/21327/rise-in-revenue-toilet-paper-selected-countries/ (accessed on 17 June 2020).

- CDC. 2016. Lessons of Risk Communication and Health Promotion—West Africa and United States. Atlanta: Centres for Disease Control and Prevention. [Google Scholar]

- Cheung, Tracy, Floor Kroese, Bob Fennis, and Denise De Ridder. 2015. Put a limit on it: The protective effects of scarcity heuristics when self-control is low. Health Psychology Open 2: 1–11. [Google Scholar] [CrossRef] [Green Version]

- Clee, Mona, and Robert Wicklund. 1980. Consumer behaviour and psychological reactance. Journal of Consumer Research 6: 389–405. [Google Scholar] [CrossRef]

- Dang, Ha, and Mi Lin. 2016. Herd mentality in the stock market: On the role of idiosyncratic participants with heterogeneous information. International Review of Financial Analysis 48: 247–60. [Google Scholar] [CrossRef]

- Dry, Sarah, and Melissa Leach. 2010. Epidemics: Science, Governance and Social Justice. London: Routledge. [Google Scholar]

- Easley, David, and Jon Kleinberg. 2010. Networks, Crowds, and Markets: Reasoning about a Highly Connected World. Cambridge: Cambridge International Press. [Google Scholar]

- Elmore, Charles. 2017. Irma: Frenzied buying in Palm Beach, St. Lucie regions led state. The Palm Beach Post. Available online: https://www.palmbeachpost.com/business/data-firm-tracked-how-hurricane-irma-store-sales-boomed-went-bust/LIDVXIL3qlqJGLlaosfSiL/ (accessed on 30 June 2020).

- Forbes, Kristin. 2012. The “Big C”: Identifying and mitigating contagion. NBER Working Paper 18465. MIT Sloan School Working Paper, 1–42. [Google Scholar] [CrossRef]

- Forbes, Sharon L. 2017. Post-disaster consumption: analysis from the 2011 Christchurch earthquake. The International Review of Retail, Distribution and Consumer Research 27: 28–42. [Google Scholar] [CrossRef]

- Freestone, Owen, Danial Gaudry, Anthony Obeyesekere, and Matthew Sedgwick. 2011. The Rise in Household Saving and Its Implication for the Australian Economy. Economic Round-up. pp. 61–79. Available online: https://www.nber.org/papers/w18465 (accessed on 29 July 2020).

- Frost, Randy O., and Tobias Hartl. 1996. A cognitive-behavioural model of compulsive hoarding. Behaviour Research and Therapy 34: 341–50. [Google Scholar] [CrossRef]

- Garfin, Dana, Roxanne Silver, and Alison Holdman. 2020. The Novel Coronavirus Outbreak: Amplification of Public Health Consequences by Media Exposure. Worcester: American Psychological Association. [Google Scholar]

- Ghassabi, Fateme, and Firoozeh Zare-Farashbandi. 2015. The role of media in crisis management: A case study of Azerbaijan earthquake. International Journal of Health System & Disaster Management 3: 95–102. [Google Scholar]

- Haghani, Milani, Emiliano Cristiani, Nikolai W.F. Bode, Maik Boltes, and Alessandro Corbetta. 2019. Panic, irrationality, and herding: Three ambiguous terms in crowd dynamics research. Journal of Advanced Transportation 2019: 1–58. [Google Scholar] [CrossRef] [Green Version]

- Hardin, Garrett. 1968. The tragedy of the commons. Science 162: 1243–48. [Google Scholar]

- Hirschman, Elizabeth, and Craig Thompson. 1997. Why media matter: Toward a richer understanding of consumers’ relationships with advertising and mass media. Journal of Advertising 26: 43–60. [Google Scholar] [CrossRef]

- IBISWorld. 2020. Global Car & Automobile Manufacturing Industry—Market Research Report. Available online: https://www.ibisworld.com/global/market-research-reports/global-car-automobile-manufacturing-industry/ (accessed on 2 June 2020).

- Jeffrey, Joel, and Anthony Putman. 2013. The irrationality illusion: A new paradigm for economics and behavioural economics. Journal of Behavioural Finance 14: 161–94. [Google Scholar] [CrossRef]

- Johnston, Eric. 2020. Panic-buying of ‘made in China’ tissues and toilet paper erupts in Japanese cities. Japan Times. Available online: https://www.japantimes.co.jp/news/2020/02/29/national/toilet-paper-tissue-coronavirus/#.XuXloWozZE4 (accessed on 14 June 2020).

- Jones, Katie. 2020. The Pandemic Economy: What Are Shoppers Buying Online during COVID-19? Available online: https://www.visualcapitalist.com/shoppers-buying-online-ecommerce-covid-19/ (accessed on 1 June 2020).

- Kaigo, Munego. 2012. Social media usage during disasters and social capital: Twitter and the Great East Japan earthquake. Keio Communication Review 34: 19–35. [Google Scholar]

- Kameda, Tatsuya, and Reid Hastie. 2015. Herd behaviour. In Emerging Trends in the Social and Behavioural Sciences. Hoboken: John Wiley & Sons. [Google Scholar]

- Keane, Michael, and Timothy Neal. 2020. Consumer panic in the COVID-19 pandemic. ARC Centre of Excellence in Population Ageing Research & University of New South Wales. CEPAR Working Paper 12: 1–34. [Google Scholar]

- Kennett-Hensel, Pamela, Julie Sneath, and Russell Lacey. 2012. Liminality and consumption in the aftermath of a natural disaster. The Journal of Consumer Marketing 29: 52–63. [Google Scholar] [CrossRef]

- Kilgo, Danielle K., Joseph Yoo, and Thomas J. Johnson. 2019. Spreading Ebola panic: newspaper and social media coverage of the 2014 Ebola health crisis. Health Communication 34: 811–17. [Google Scholar] [CrossRef]

- Knaus, Christopher. 2020. More than 130 Australian companies ready to boost PPE stock of coronavirus masks, gowns and gloves. The Guardian. March 23. Available online: https://www.theguardian.com/world/2020/mar/23/more-than-100-australian-companies-ready-to-boost-ppe-stock-of-coronavirus-masks-gowns-and-gloves (accessed on 3 June 2020).

- Kulemeka, Owen. 2010. US consumers and disaster: Observing “panic buying” during the winter storm and hurricane seasons. Advances in Consumer Research 37: 837–38. [Google Scholar]

- Le Grand, Chip. 2020. ‘Carpetbaggers and Snake Oil Sellers’ Hike Prices on COVID-19 Essentials. Available online: https://www.smh.com.au/national/carpetbaggers-and-snake-oil-sellers-hike-prices-on-covid-19-essentials-20200526-p54wgc.html (accessed on 5 June 2020).

- Lester, David. 2013. Measuring Maslow’s hierarchy of needs. Psychological Reports: Mental & Physical Health 113: 15–17. [Google Scholar]

- Li, Guangdi, and Erik De Clercq. 2020. Therapeutic options for the 2019 novel coronavirus (2019-nCoV). Nature Reviews Drug Discovery 19: 149–50. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Liu, Wei, Xiao-Guang Yue, and Paul B. Tchounwou. 2020. Response to the COVID-19 Epidemic: The Chinese Experience and Implications for Other Countries. International Journal of Environmental Research and Public Health 17: 2304. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Loewenstein, George F., Elke U. Weber, Christopher K. Hsee, and Ned Welch. 2001. Risk as feelings. Psychological Bulletin 127: 267–86. [Google Scholar] [CrossRef]

- Mannix, Liam. 2020. The Perfect Virus: Two Gene Tweaks That Turned COVID-19 into a Killer. Sydney Morning Herald. Available online: https://www.smh.com.au/national/the-perfect-virus-two-gene-tweaks-that-turned-covid-19-into-a-killer-20200327-p54elo.html (accessed on 8 June 2020).

- Maslow, Abraham. 1954. Motivation and Personality. New York: Harper and Row Publishers Inc. [Google Scholar]

- Mathes, Brittany, Mary Oglesby, Nicole Short, Amberly Portero, Amanda Raines, and Norman Schmidt. 2017. An examination of the role of intolerance of distress and uncertainty in hoarding symptoms. Comprehensive Psychiatry 72: 121–29. [Google Scholar] [CrossRef]

- McCombs, Maxwell. 2018. Influencing public opinion. In Setting the Agenda: Mass media and Public Opinion. Edited by Maxwell McCombs. Hoboken: Wiley, pp. 1–13. [Google Scholar]

- McKeever, Amy. 2020. Coronavirus is Spreading Panic. Here’s the Science behind Why. Washington: National Geographic, Available online: https://www.nationalgeographic.com/history/reference/modern-history/why-we-evolved-to-feel-panic-anxiety/ (accessed on 8 June 2020).

- McLeod, Saul A. 2007. Maslow’s hierarchy of needs. Simply Psychology. Available online: http://www.simplypsychology.org/maslow.html (accessed on 28 July 2020).

- McQuail, Denis. 1977. The influence and effects of mass media. In Mass Communication and Society. London: Edward Arnold, pp. 70–94. [Google Scholar]

- Murphy, Katharine. 2020. Unemployment rate in Australia jumps to 6.2% due to Covid-19 as 600,000 jobs lost. The Guardian. May 14. Available online: https://www.theguardian.com/business/2020/may/14/unemployment-rate-in-australia-jumps-to-62-due-to-covid-19-as-600000-jobs-lost (accessed on 14 June 2020).

- Myer, Robert, Jay Baker, Kenneth Broad, Jeff Czajkowski, and Ben Orlove. 2014. The dynamics of hurricane risk perception: real-time evidence from the 2012 Atlantic hurricane season: Surveys of coastal residents conducted in 2012 as hurricanes were approaching reveal widespread misunderstanding of the extent and nature of threats posed by tropical cyclones. Bulletin of the American Meteorological Society 95: 1389–404. [Google Scholar]

- Natividad, Ivan. 2020. COVID-19 and the media: The role of journalism in a global pandemic. Berkeley, May 6. [Google Scholar]

- NC Solutions. 2020a. Top Categories on March 12. Available online: https://www.ncsolutions.com/covid/top-cpg-categories-on-march-12/ (accessed on 14 June 2020).

- NC Solutions. 2020b. “A Bulk Buying Tipping Point.” In NCS COVID-19 Resources. Available online: https://www.ncsolutions.com/covid/a-bulk-buying-tipping-point/ (accessed on 14 June 2020).

- NC Solutions. 2020c. COVID-19 Shopping Stages. Available online: https://www.ncsolutions.com/covid/covid-19-shopping-stages/ (accessed on 14 June 2020).

- Norman, Freya. 2020. Australia tops coronavirus consumer panic. UNSW News Room. Available online: https://newsroom.unsw.edu.au/news/business-law/australia-tops-coronavirus-consumer-panic (accessed on 16 June 2020).

- Parse.ly. 2020. Coronavirus Viewership. New York: Parse.ly. [Google Scholar]

- Pieri, Elisa. 2018. Media framing and the threat of global pandemics: the Ebola crisis in UK media and policy response. Sociological Research Online 24: 73–92. [Google Scholar] [CrossRef] [Green Version]

- Rapoport, Anatol, and Albert Chammah. 1965. Sex differences in factors contributing to the level of cooperation in the prisoner’s dilemma game. Journal of Personality and Social Psychology 2: 831–38. [Google Scholar] [CrossRef]

- Raymond, Adam K. 2020. Due to coronavirus, these products are suddenly impossible to find. NY Magazine. Available online: https://nymag.com/intelligencer/2020/05/coronavirus-made-these-products-impossible-to-find.html (accessed on 5 June 2020).

- Reid, Leia. 2020. Coronavirus: Looking Back at How Panic Buying Went Viral. Brighton: Brandwatch, Available online: https://www.brandwatch.com/blog/react-coronavirus-panic-buying/ (accessed on 8 June 2020).

- Russell, Cally. 2020. What retail categories are booming due to coronavirus? Available online: https://www.forbes.com/sites/callyrussell/2020/04/15/what-retail-categories-are-booming-due-to-coronavirus/#7963c0c42e93 (accessed on 12 June 2020).

- Samli, Coskun. 2012. International Consumer Behaviour in the 21st Century: Impact on Marketing Strategy Development. New York: Springer. [Google Scholar]

- Siddiqui, Huma. 2020. Fight against COVID-19: All Hands on Board! Rajnath Singh Urges all Organizations to Assist Civilian Authorities. Available online: https://www.financialexpress.com/defence/fight-against-covid-19-all-hands-on-board-rajnath-singh-urges-all-organizations-to-assist-civilian-authorities/1916134/ (accessed on 16 June 2020).

- Slovic, Paul, Melissa L. Finucane, Ellen Peters, and Donald G. Macgregor. 2004. Risk as analysis and risk as feelings: Some thoughts about affect, reason, risk, and rationality. Risk Analysis 24: 311–22. [Google Scholar] [CrossRef]

- Smiedt, David. 2020. 5 Aussie Booze Companies Who Are Now Making Hand Sanitiser. GQ. Available online: https://www.gq.com.au/lifestyle/food-wine/5-aussie-booze-companies-who-are-now-making-hand-sanitiser/image-gallery/7d958fd349291385449319d0c48f6ec1 (accessed on 1 June 2020).

- Smith, Erica. 2020. Behold: The LVMH hand sanitizer. The Cut. Available online: https://www.thecut.com/2020/03/lvmh-hand-sanitizer-dior-soap-bottle.html (accessed on 1 June 2020).

- Swain, Sarah. 2020. Coronavirus: Woolworths and Coles’ strict new shopping limits as PM calls to stop panic buying. 9News. Available online: https://www.9news.com.au/national/coronavirus-woolworths-coles-shopping-hour/83669f0d-664d-47a8-bc72-963c94a93e42 (accessed on 5 June 2020).

- Thomas, Jeff. A. 2014. Community resilience, latent resources and resource scarcity after an earthquake: Is society really three meals away from anarchy? Natural Hazards 74: 477–90. [Google Scholar] [CrossRef]

- Timbrell, Adelaide, and David Plank. 2020. Aus Retail: Stockpiling Peaks. BlueNotes. Available online: https://bluenotes.anz.com/posts/2020/04/anz-research-coronavirus-australian-retail-spend (accessed on 13 June 2020).

- Trading Economics. 2020a. U.S. Retail Sales 1992–2020 Data. Available online: https://tradingeconomics.com/united-states/retail-sales (accessed on 14 June 2020).

- Trading Economics. 2020b. United States—Advance Retail Sales: Grocery Stores. Available online: https://tradingeconomics.com/united-states/advance-retail-sales-grocery-stores-fed-data.html (accessed on 14 June 2020).

- United Nations. 2014. Ebola Disruption could Spark New Food Crisis. United Nations. Available online: https://www.un.org/africarenewal/magazine/december-2014/ebola-disruption-could-spark-new-food-crisis (accessed on 9 June 2020).

- Vitorovich, Lilly. 2020. The Australian online readership doubles during coronavirus. The Australian, April 14. [Google Scholar]

- World Health Organisation (WHO). 2020. WHO Coronavirus Disease (COVID-19) Dashboard. Geneva: WHO. [Google Scholar]

- Wray, Meaghan. 2020. Hand sanitiser hoarder under investigation after trying to sell bottles for $70 each. Global News. Available online: https://globalnews.ca/news/6683642/hand-sanitizer-hoarder-coronavirus/ (accessed on 5 June 2020).

- Wright, Shane. 2020. Consumer confidence falls to lowest level since last recession. Sydney Morning Herald. Available online: https://www.smh.com.au/politics/federal/consumer-confidence-falls-to-lowest-level-since-last-recession-20200324-p54d9a.html (accessed on 10 June 2020).

- Yang, Jingyu, Yi Li, Wei Liu, and Liang Wen. 2019. Does fdi presence make domestic firms greener in an emerging economy? The effect of media attention. Academy of Management Proceedings 1: 16388–92. [Google Scholar] [CrossRef]

- Yoon, Jiho, Ram Narasimhan, and Myung K. Kim. 2017. Retailer’s sourcing strategy under consumer stockpiling in anticipation of supply disruptions. International Journal of Production Research 56: 3615–35. [Google Scholar] [CrossRef]

- Yuen, Kum F., Xueqin Wang, Fei Ma, and Kevin X. Li. 2020. The psychological causes of panic buying following a health crisis. International Journal of Environmental Research and Public Health 17: 3513. [Google Scholar] [CrossRef]

- Zhang, Xaoling, Shibo Li, Raymond R. Burke, and Alex Leykin. 2014. An examination of social influence on Shopper behaviour using video tracking data. Journal of Marketing 78: 24–41. [Google Scholar] [CrossRef] [Green Version]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Loxton, M.; Truskett, R.; Scarf, B.; Sindone, L.; Baldry, G.; Zhao, Y. Consumer Behaviour during Crises: Preliminary Research on How Coronavirus Has Manifested Consumer Panic Buying, Herd Mentality, Changing Discretionary Spending and the Role of the Media in Influencing Behaviour. J. Risk Financial Manag. 2020, 13, 166. https://doi.org/10.3390/jrfm13080166

Loxton M, Truskett R, Scarf B, Sindone L, Baldry G, Zhao Y. Consumer Behaviour during Crises: Preliminary Research on How Coronavirus Has Manifested Consumer Panic Buying, Herd Mentality, Changing Discretionary Spending and the Role of the Media in Influencing Behaviour. Journal of Risk and Financial Management. 2020; 13(8):166. https://doi.org/10.3390/jrfm13080166

Chicago/Turabian StyleLoxton, Mary, Robert Truskett, Brigitte Scarf, Laura Sindone, George Baldry, and Yinong Zhao. 2020. "Consumer Behaviour during Crises: Preliminary Research on How Coronavirus Has Manifested Consumer Panic Buying, Herd Mentality, Changing Discretionary Spending and the Role of the Media in Influencing Behaviour" Journal of Risk and Financial Management 13, no. 8: 166. https://doi.org/10.3390/jrfm13080166

APA StyleLoxton, M., Truskett, R., Scarf, B., Sindone, L., Baldry, G., & Zhao, Y. (2020). Consumer Behaviour during Crises: Preliminary Research on How Coronavirus Has Manifested Consumer Panic Buying, Herd Mentality, Changing Discretionary Spending and the Role of the Media in Influencing Behaviour. Journal of Risk and Financial Management, 13(8), 166. https://doi.org/10.3390/jrfm13080166