Industrial Life-Cycle and the Development of the Russian Tourism Industry

Abstract

1. Introduction

2. Materials and Methods

3. Emergence and Development of Contemporary Tourism Industry in Russia

4. The Russian Tourism Industry Dynamics: Results and Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

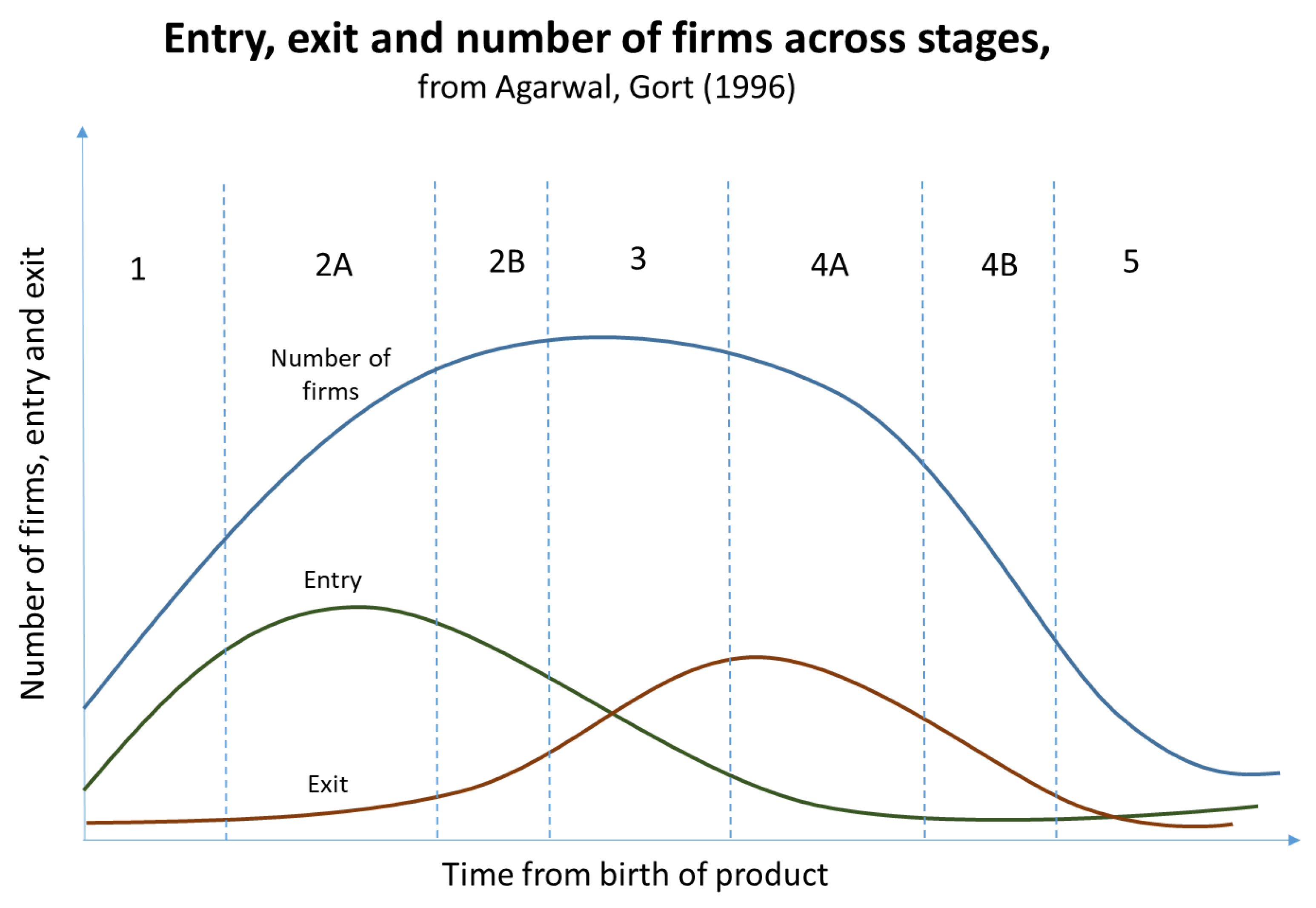

- Agarwal, Rajshree, and Michael Gort. 1996. The Evolution of Markets and Entry, Exit and Survival of Firms. The Review of Economics and Statistics 3: 489–98. Available online: https://pdfs.semanticscholar.org/be77/465aafcb967d57b7142211efea8edcedc0ac.pdf (accessed on 30 March 2020). [CrossRef]

- Algieri, Bernardina. 2006. An econometric estimation of the demand for tourism: The case of Russia. Tourism Economics 1: 5–20. [Google Scholar] [CrossRef]

- Amir, Rabah, and Natalia Lazzati. 2011. Network effects, market structure and industry performance. Journal of Economic Theory 6: 2389–419. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1499909 (accessed on 30 March 2020). [CrossRef]

- Andrades, Lidia, and Frederic Dimanche. 2017. Destination competitiveness and tourism development in Russia: Issues and challenges. Tourism Management 62: 360–76. [Google Scholar] [CrossRef]

- Armstrong, Mark, and Robert H. Porter, eds. 2007. Handbook of Industrial Organization. Amsterdam: Elsevier. Available online: https://www.elsevier.com/books/handbook-of-industrial-organization/armstrong/978-0-444-82435-6 (accessed on 30 March 2020).

- Balaeva, Olga, Ella Burnatseva, Marina Predvoditeleva, Marina Sheresheva, and Olga Tretyak. 2012. Network strategies of hospitality companies in emerging and transitory economies: Evidence from Russia. In Service Science Research, Strategy and Innovation: Dynamic Knowledge Management Methods. Hershey: IGI Global, pp. 519–46. Available online: https://www.igi-global.com/gateway/chapter/61893 (accessed on 30 March 2020).

- Baum, Tom. 1998. Taking the exit route: Extending the tourism area life cycle model. Current Issues in Tourism 1: 167–75. [Google Scholar] [CrossRef]

- Brock, William, and Anastasios Xepapadeas. 2002. Optimal ecosystem management when species compete for limiting resources. Journal of Environmental Economics and Management 2: 189–220. Available online: https://econpapers.repec.org/paper/attwimass/200027.htm (accessed on 30 March 2020). [CrossRef]

- Brouder, Patrick, and Rikard H. Eriksson. 2013. Staying power: What influences micro-firm survival in tourism? Tourism Geographies 1: 125–44. Available online: https://link.springer.com/article/10.1007/s12132-014-9239-z (accessed on 30 March 2020). [CrossRef]

- Burns, Peter. 1998. Tourism in Russia: Background and structure. Tourism Management 6: 555–65. [Google Scholar] [CrossRef]

- Butler, Richard W. 1980. The concept of a tourist area cycle of evolution: Implications for management of resources. Canadian Geographer/Le Géographe Canadien 24: 5–12. [Google Scholar] [CrossRef]

- Butler, Richard W. 2006. The Tourism Area Life Cycle. Bristol: Channel View Publications, vols. 1 and 2. [Google Scholar]

- Chemakin, I. M. 1984. Codification of Legislation on Physical Culture, Sports, and Tourism. Soviet Law and Government 3: 73–89. [Google Scholar] [CrossRef]

- Chkalova, Olga, Marina Efremova, Vladimir Lezhnin, Anna Polukhina, and Marina Sheresheva. 2019. Innovative mechanism for local tourism system management: A case study. Entrepreneurship and Sustainability Issues 4: 2052–67. Available online: https://www.jssidoi.org/jesi/uploads/articles/24/Chkalova_Innovative_mechanism_for_local_tourism_system_management_a_case_study.pdf (accessed on 30 March 2020). [CrossRef]

- Clementi, Gian Luca, and Berardino Palazzo. 2016. Entry, exit, firm dynamics, and aggregate fluctuations. American Economic Journal: Macroeconomics 3: 1–41. Available online: http://pages.stern.nyu.edu/~gclement/Papers/Entry_exit.pdf (accessed on 30 March 2020). [CrossRef]

- Dimanche, Frédéric, and Lidia Andrades, eds. 2015. Tourism in Russia: A Management Handbook. Bingley: Emerald Group Publishing. Available online: https://www.researchgate.net/publication/280094297_Tourism_in_Russia_A_Management_Handbook (accessed on 30 March 2020).

- Dosi, Giovanni, and Richard R. Nelson. 2010. Technical change and industrial dynamics as evolutionary processes. In Handbook of the Economics of Innovation. North-Holland: Elsevier, vol. 1, pp. 51–127. [Google Scholar] [CrossRef]

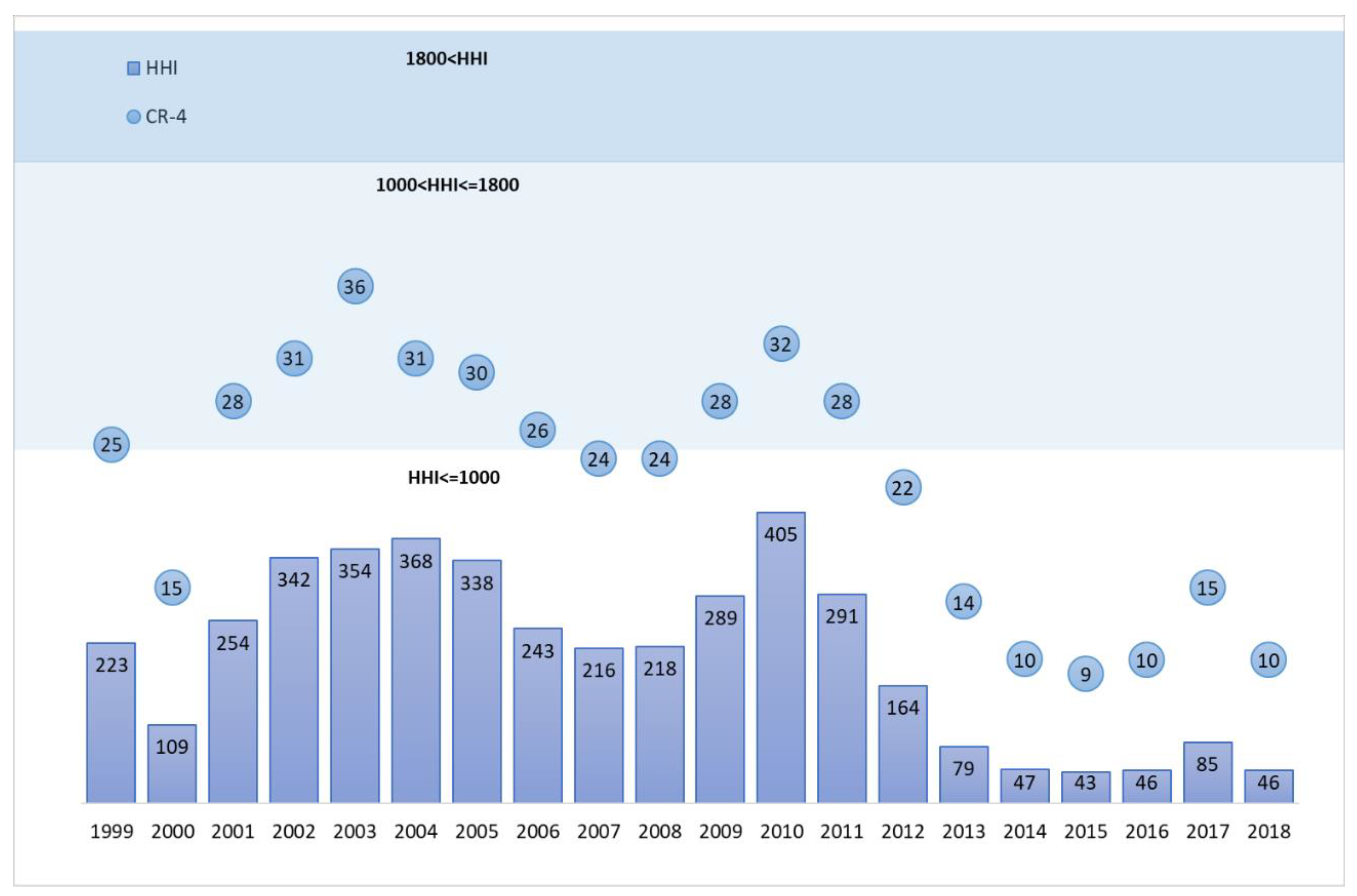

- Fernandes, Paula Odete, Alcina Maria Nunes, Cláudia Miranda Veloso, Eleonora Santos, Fernanda A. Ferreira, and Manuel José Fonseca. 2020. Spatial and temporal concentration of tourism supply and demand in Northern Portugal. Application of the Herfindahl-Hirschman index. In Advances in Tourism, Technology and Smart Systems. Singapore: Springer, pp. 263–73. [Google Scholar]

- Foster, Richard, and Sarah Kaplan. 2001. Creative Destruction: Why Companies That Are Built to Last Underperform the Market—and How to Successfully Transform Them. New York: Currency/Doubleday. Available online: https://www.pdfdrive.com/creative-destruction-why-companies-that-are-built-to-last-underperform-the-market-and-how-to-successfully-transform-them-e194520467.html (accessed on 30 March 2020).

- Freiling, Jörg, and Thomas Baron. 2017. A resource-based view of entrepreneurial ecosystems. In Technologie, Strategie und Organisation. Wiesbaden: Springer Gabler, pp. 65–84. Available online: https://link.springer.com/chapter/10.1007%2F978-3-658-16042-5_4 (accessed on 30 March 2020).

- Frenken, Koen, Elena Cefis, and Erik Stam. 2015. Industrial dynamics and clusters: A survey. Regional Studies 1: 10–27. [Google Scholar] [CrossRef]

- Frolova, Elena Victorovna, Tatyana Mikhailovna Ryabova, Elena Evgen’evna Kabanova, Olga Vladimirovna Rogach, and Ekaterina Alexandrovna Vetrova. 2017. Domestic tourism in Russian Federation: Population estimations, resources and development constraints. Journal of Environmental Management and Tourism 2: 436–45. Available online: https://www.elibrary.ru/item.asp?id=29402213 (accessed on 30 March 2020).

- Garay, Luis, and Gemma Cánoves. 2011. Life cycles, stages and tourism history: The Catalonia (Spain) experience. Annals of Tourism Research 2: 651–71. [Google Scholar] [CrossRef]

- Gorsuch, Anne E. 2003. “There’s No Place Like Home”: Soviet Tourism in Late Stalinism. Slavic Review 4: 760–85. [Google Scholar] [CrossRef]

- Gorsuch, Anne E. 2011. All This Is Your World: Soviet Tourism at Home and Abroad after Stalin. Oxford: OUP. Available online: https://www.cambridge.org/core/journals/annales-histoire-sciences-sociales/article/anne-e-gorsuch-all-this-is-your-world-soviet-tourism-at-home-and-abroad-after-stalin-oxford-oxford-university-press-2011-222-p/640287C3382B91CD3647F19945CFB4C0 (accessed on 30 March 2020).

- Gort, Michael, and Steven Klepper. 1982. Time paths in the diffusion of product innovations. The Economic Journal 92: 630–53. Available online: https://ideas.repec.org/a/ecj/econjl/v92y1982i367p630-53.html (accessed on 30 March 2020). [CrossRef]

- Gudkov, Alexander, Elena Dedkova, and Kristina Dudina. 2018. The Main Trends in the Russian Tourism and Hospitality Market from the Point of View of Russian Travel Agencies. Worldwide Hospitality and Tourism Themes. [Google Scholar] [CrossRef]

- Javid, Elyeh, and Salih Katircioglu. 2017. The globalization indicators-tourism development nexus: A dynamic panel-data analysis. Asia Pacific Journal of Tourism Research 11: 1194–205. [Google Scholar] [CrossRef]

- Jawahar, I. M., and Gary L. McLaughlin. 2001. Toward a descriptive stakeholder theory: An organizational life cycle approach. Academy of Management Review 3: 397–414. Available online: https://www.jstor.org/stable/259184 (accessed on 30 March 2020). [CrossRef]

- Jelili, Riadh Ben, and Mohamed Goaied. 2010. Entry, exit, and productivity in Tunisian manufacturing industries. In Market Dynamics and Productivity in Developing Countries. New York: Springer, pp. 73–108. Available online: https://link.springer.com/chapter/10.1007/978-1-4419-1037-0_4 (accessed on 30 March 2020).

- Klepper, Steven. 1997. Industry life cycles. Industrial and Corporate Change 1: 145–82. Available online: https://ideas.repec.org/a/oup/indcch/v6y1997i1p145-81.html (accessed on 30 March 2020). [CrossRef]

- Koenker, Diane P. 2003. Travel to work, travel to play: On Russian tourism, travel, and leisure. Slavic Review 4: 657–65. Available online: https://www.cambridge.org/core/journals/slavic-review/article/travel-to-work-travel-to-play-on-russian-tourism-travel-and-leisure/35AE05321649AFB83C202868F1B617EF (accessed on 30 March 2020). [CrossRef][Green Version]

- Lábaj, Martin, Karol Morvay, Peter Silanič, Christoph Weiss, and Biliana Yontcheva. 2018. Market structure and competition in transition: results from a spatial analysis. Applied Economics 15: 1694–715. [Google Scholar] [CrossRef]

- Lagiewski, Rchard M. 2006. The application of the TALC model: A literature survey. The Tourism Area Life Cycle 1: 27–50. [Google Scholar]

- Lester, Donald L., John Alan Parnell, and Shawn M. Carraher. 2003. Organizational life cycle: A five-stage empirical scale. The International Journal of Organizational Analysis 4: 339–54. [Google Scholar] [CrossRef]

- Massidda, Carla, and Ivan Etzo. 2012. The determinants of Italian domestic tourism: A panel data analysis. Tourism Management 3: 603–10. [Google Scholar] [CrossRef]

- Morley, Clive, Jaume Rosselló, and Maria Santana-Gallego. 2014. Gravity models for tourism demand: theory and use. Annals of Tourism Research 48: 1–10. [Google Scholar] [CrossRef]

- Peltoniemi, Mirva. 2011. Reviewing industry life-cycle theory: Avenues for future research. International Journal of Management Reviews 4: 349–75. [Google Scholar] [CrossRef]

- Petković, Goran, Stipe Lovreta, Renata Pindžo, and Saša Pešić. 2016. Evaluating the concentration in Serbian tourism and FMCG retail sector. Ekonomika Preduzeća 1–2: 187–98. [Google Scholar] [CrossRef]

- Quinn, Robert E., and Kim Cameron. 1983. Organizational life cycles and shifting criteria of effectiveness: Some preliminary evidence. Management Science 1: 33–51. [Google Scholar] [CrossRef]

- Scott, Anthony D., Patrick S. Viguerie, Evan I. Schwartz, and John Van Landeghem. 2018. Corporate Longevity Forecast: Creative Destruction Is Accelerating. Lexington: Innosight. Available online: https://www.innosight.com/wp-content/uploads/2017/11/Innosight-Corporate-Longevity-2018.pdf (accessed on 30 March 2020).

- Seyfi, Siamak, and Michael C. Hall. 2019. International sanctions, tourism destinations and resistive economy. Journal of Policy Research in Tourism, Leisure and Events 11: 159–69. [Google Scholar] [CrossRef]

- Seyfi, Siamak, and Michael C. Hall. 2020. Sanctions and tourism: conceptualisation and implications for destination marketing and management. Journal of Destination Marketing Management 15. [Google Scholar] [CrossRef]

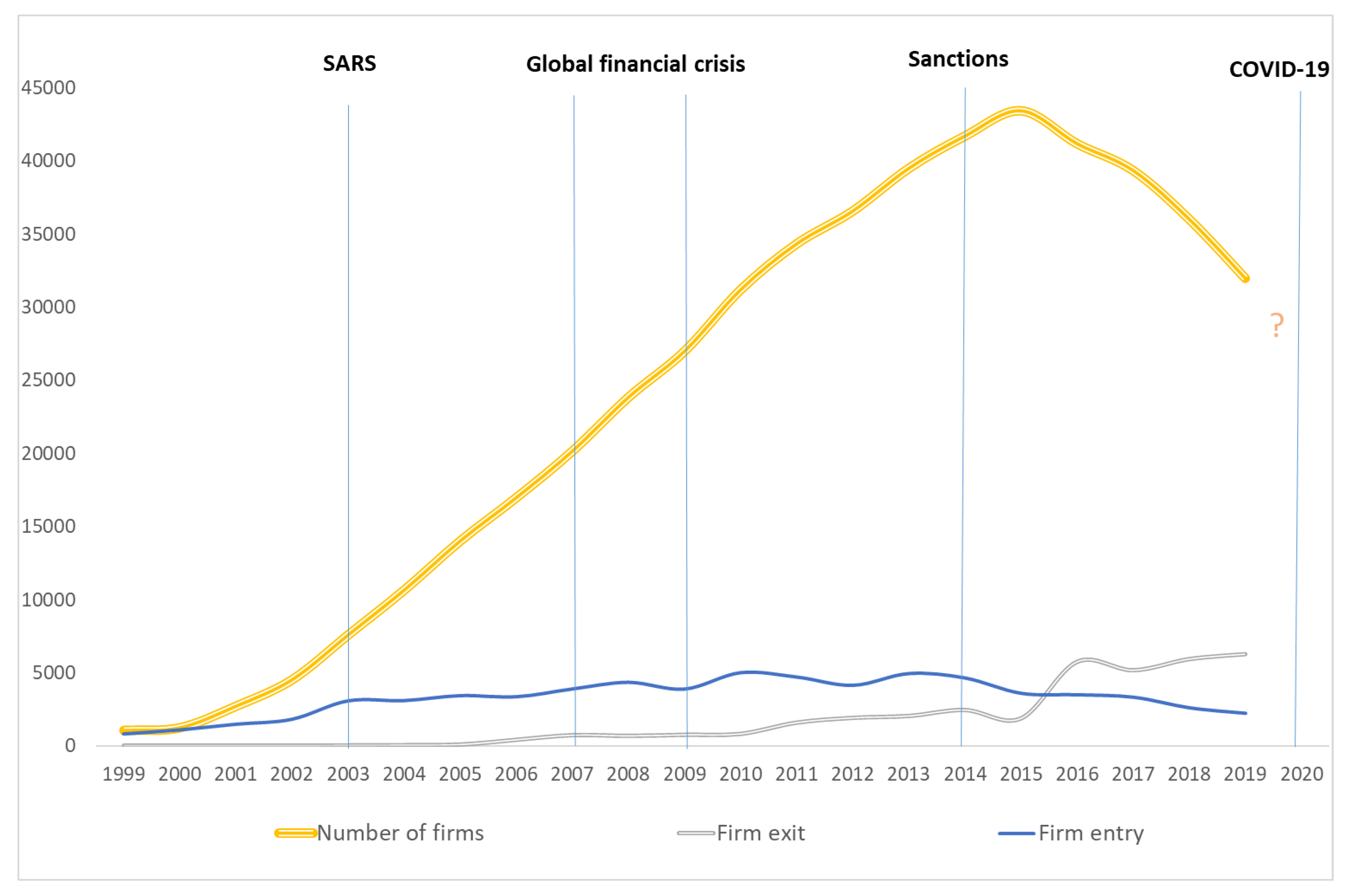

- Sheresheva, Marina Y. 2018. The Russian tourism and hospitality market: New challenges and destinations. Worldwide Hospitality and Tourism Themes 4: 400–11. [Google Scholar] [CrossRef]

- Sheresheva, Marina Y. 2020. Coronavirus and tourism. Population and Economics 2: 72–76. [Google Scholar] [CrossRef]

- Sheresheva, Marina Y., and John Kopiski. 2016. The main trends, challenges and success factors in the Russian hospitality and tourism market. Worldwide Hospitality and Tourism Themes 3: 260–72. [Google Scholar] [CrossRef]

- Sheresheva, Marina Y., Matvey S. Oborin, and Elena E. Polyanskaya. 2018. International hotel chains in Russia: The prospects and challenges of movement from megacities to smaller cities in Russian regions. Worldwide Hospitality and Tourism Themes 4: 421–35. [Google Scholar] [CrossRef]

- Soh, Ann-Ni, Chin-Hong Puah, and Arip Mohammad Affendy. 2019. Construction of tourism cycle indicator: A signalling tool for tourism market dynamics. Electronic Journal of Applied Statistical Analysis 2: 477–90. Available online: http://siba-ese.unisalento.it/index.php/ejasa/article/view/20164 (accessed on 30 March 2020).

- Song, Haiyan, Larry Dwyer, Gang Li, and Zheng Cao. 2012. Tourism economics research: A review and assessment. Annals of Tourism Research 3: 1653–82. [Google Scholar] [CrossRef]

- Stabler, Mike J., Andreas Papatheodorou, and M. Thea Sinclair. 2009. The Economics of Tourism. London: Taylor & Francis. [Google Scholar]

- Zaitseva, Natalia A., Elena G. Kropinova, Valentin S. Korneevets, Irina I. Dragileva, and Alexey D. Chudnovskiy. 2016. The long-term forecast of the Russian tourism development. International Review of Management and Marketing 6: 103–10. Available online: https://www.researchgate.net/publication/306229903_The_Long-Term_Forecast_of_the_Russian_Tourism_Development (accessed on 30 March 2020).

- Ziganshin, Irek I., Anton O. Ovcharov, and Marina A. Rysayeva. 2015. Influence of economic sanctions on the development of Russian tourism. Aktual’niye Problemy Ekonomiki i Prava 1: 17–25. Available online: https://www.researchgate.net/publication/307770542_Influence_of_economic_sanctions_on_the_development_of_Russian_tourism (accessed on 30 March 2020).

| 1 | SPARK is an abbreviation for System of Professional Analysis of Markets and Companies [Sistema Professional’nogo Analiza Rynkov i Kompaniy = SPARK]. |

| Number of Firms | Number of Tourist Packages, Thousand | Firm Exit | Firm Entry (Calculated) | Number of Firms | Firm Entry | Firm Exit | HHI | CR-4 | |

|---|---|---|---|---|---|---|---|---|---|

| Source/Year | Rostourism | Industrial Enterprises Register | |||||||

| 1999 | 1052 | 807 | 0 | 223 | 25 | ||||

| 2000 | 1236 | 1085 | 0 | 109 | 15 | ||||

| 2001 | 2710 | 1476 | 2 | 254 | 28 | ||||

| 2002 | 3345 | 1639 | 4519 | 1811 | 2 | 342 | 31 | ||

| 2003 | 3678 | 1836 | 7581 | 3078 | 16 | 354 | 36 | ||

| 2004 | 4010 | 2034 | 10,646 | 3097 | 32 | 368 | 31 | ||

| 2005 | 5079 | 4326 | 14,008 | 3439 | 77 | 338 | 30 | ||

| 2006 | 5842 | 4641 | 16,966 | 3360 | 402 | 243 | 26 | ||

| 2007 | 6639 | 5819 | 20,146 | 3896 | 716 | 216 | 24 | ||

| 2008 | 6477 | 4305 | 23,828 | 4351 | 669 | 218 | 24 | ||

| 2009 | 6897 | 3666 | 26,974 | 3889 | 743 | 289 | 28 | ||

| 2010 | 9133 | 4358 | 2276 | 4512 | 31,179 | 5012 | 807 | 405 | 32 |

| 2011 | 10,266 | 4427 | 1872 | 3005 | 34,315 | 4714 | 1578 | 291 | 28 |

| 2012 | 10,773 | 4763 | 1832 | 2339 | 36,554 | 4145 | 1906 | 164 | 22 |

| 2013 | 11,324 | 5384 | 3178 | 3729 | 39,474 | 4953 | 2033 | 79 | 14 |

| 2014 | 11,614 | 4384 | 2383 | 2673 | 41,679 | 4649 | 2444 | 47 | 10 |

| 2015 | 11,893 | 4024 | 2790 | 3069 | 43,407 | 3596 | 1868 | 43 | 9 |

| 2016 | 12,395 | 3352 | 2160 | 2662 | 41,160 | 3495 | 5742 | 46 | 10 |

| 2017 | 13,579 | 4390 | 1228 | 2412 | 39,325 | 3330 | 5165 | 85 | 15 |

| 2018 | 13,674 | 4586 | 1448 | 1543 | 35,999 | 2602 | 5928 | 46 | 10 |

| 2019 | 13,770 | 4790 | 1148 | 1244 | 31,959 | 2227 | 6267 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheresheva, M.; Valitova, L.; Tsenzharik, M.; Oborin, M. Industrial Life-Cycle and the Development of the Russian Tourism Industry. J. Risk Financial Manag. 2020, 13, 113. https://doi.org/10.3390/jrfm13060113

Sheresheva M, Valitova L, Tsenzharik M, Oborin M. Industrial Life-Cycle and the Development of the Russian Tourism Industry. Journal of Risk and Financial Management. 2020; 13(6):113. https://doi.org/10.3390/jrfm13060113

Chicago/Turabian StyleSheresheva, Marina, Lilia Valitova, Maria Tsenzharik, and Matvey Oborin. 2020. "Industrial Life-Cycle and the Development of the Russian Tourism Industry" Journal of Risk and Financial Management 13, no. 6: 113. https://doi.org/10.3390/jrfm13060113

APA StyleSheresheva, M., Valitova, L., Tsenzharik, M., & Oborin, M. (2020). Industrial Life-Cycle and the Development of the Russian Tourism Industry. Journal of Risk and Financial Management, 13(6), 113. https://doi.org/10.3390/jrfm13060113