Comparison of Prediction Models Applied in Economic Recession and Expansion

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Materials

3.2. Methods

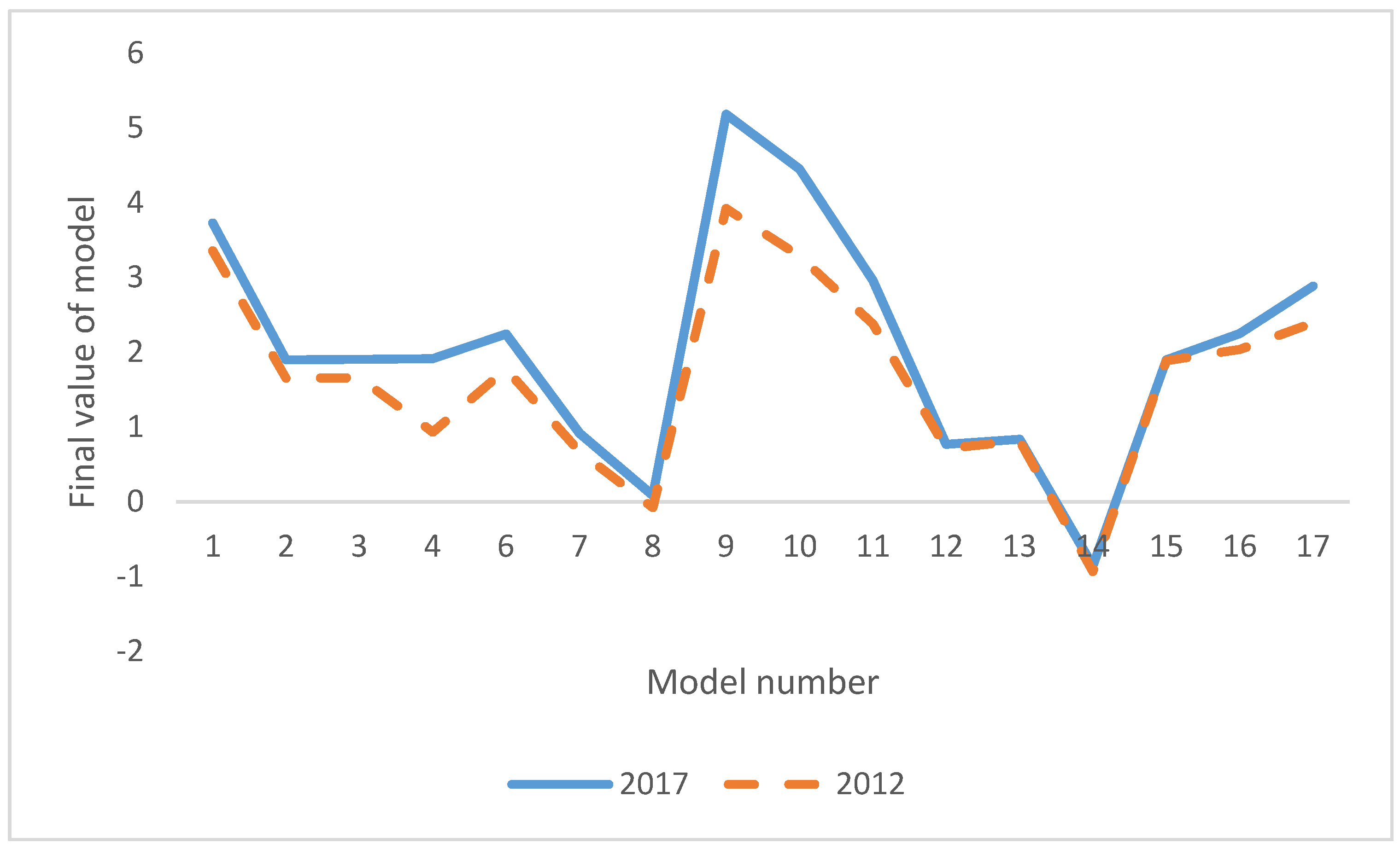

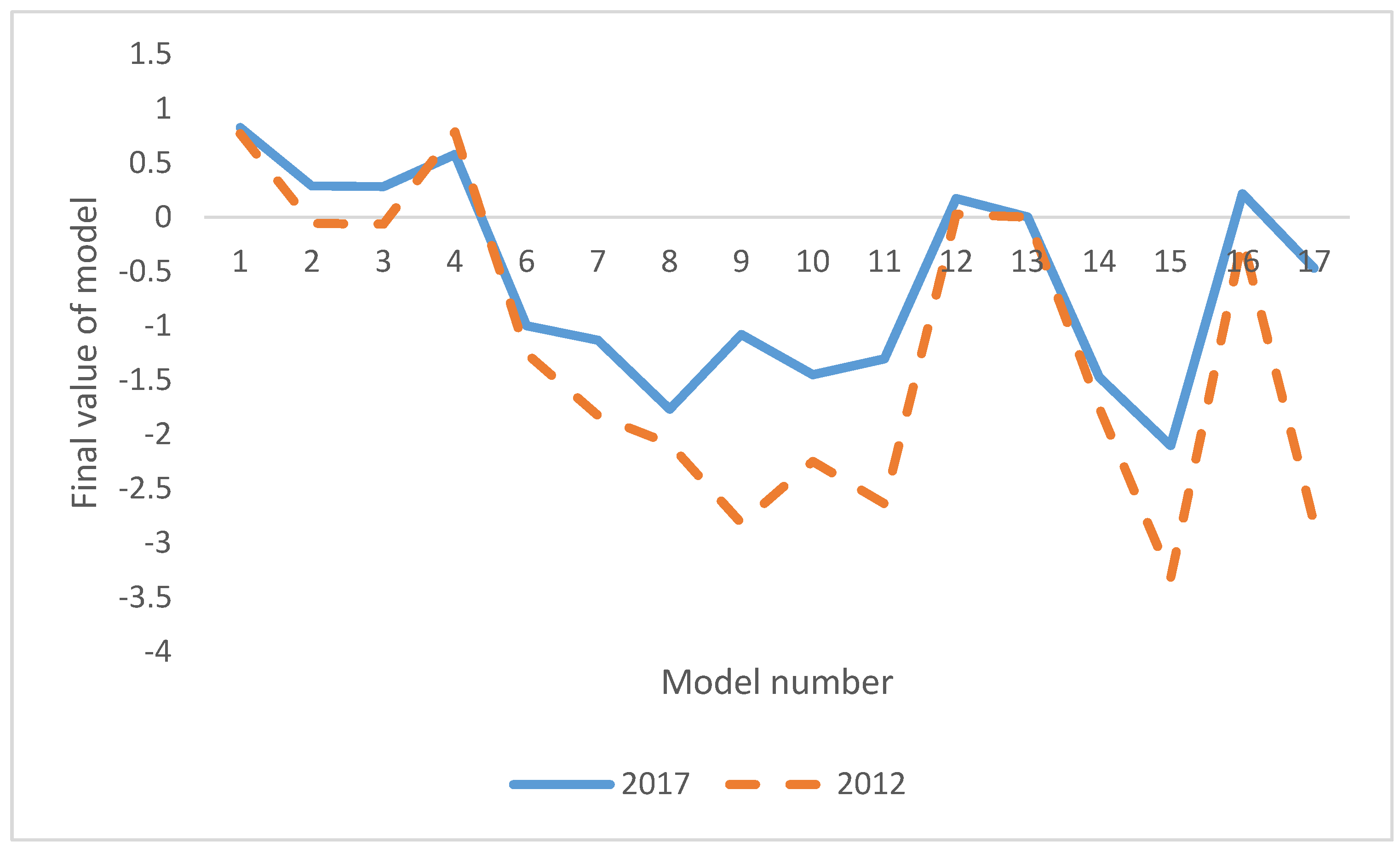

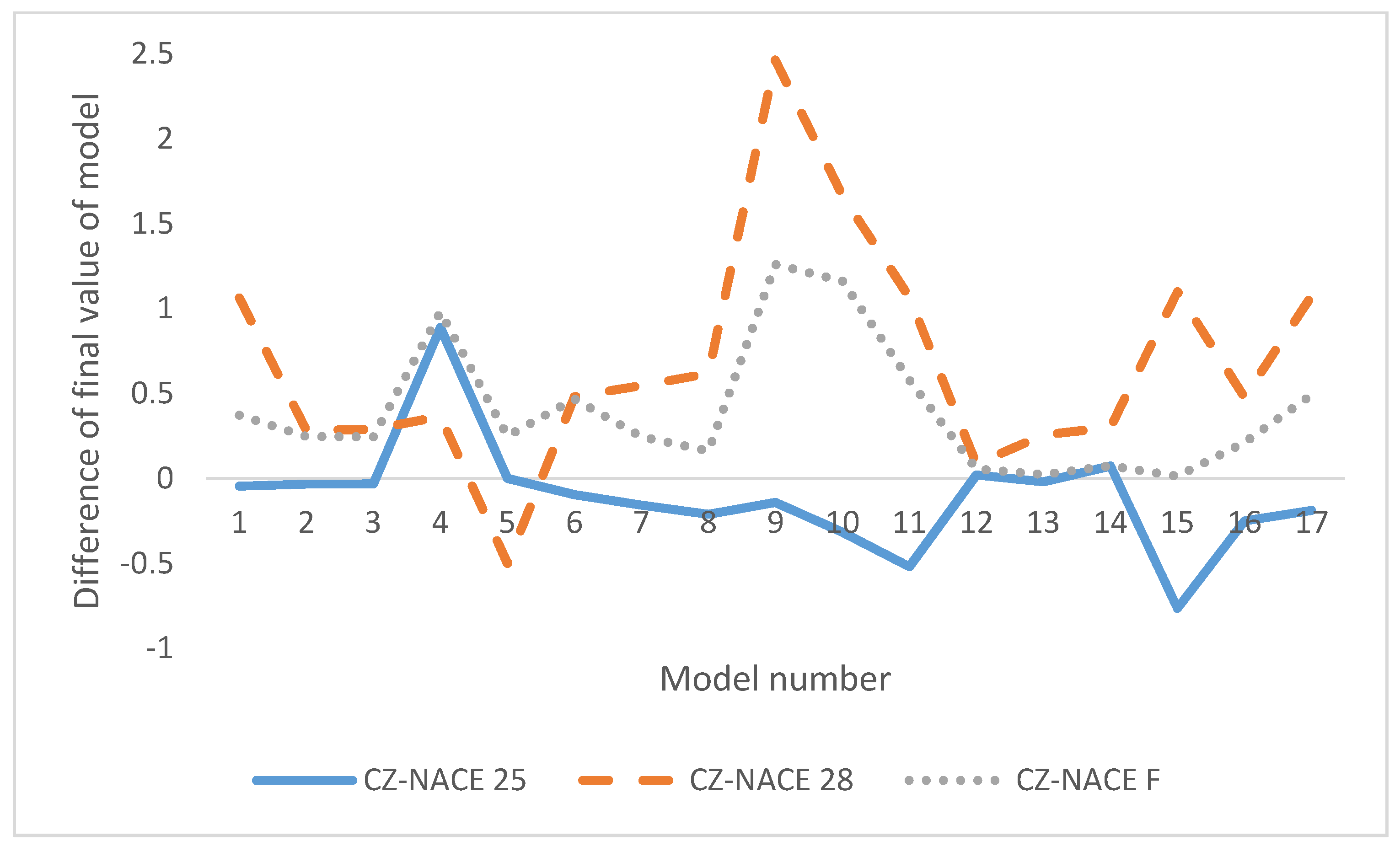

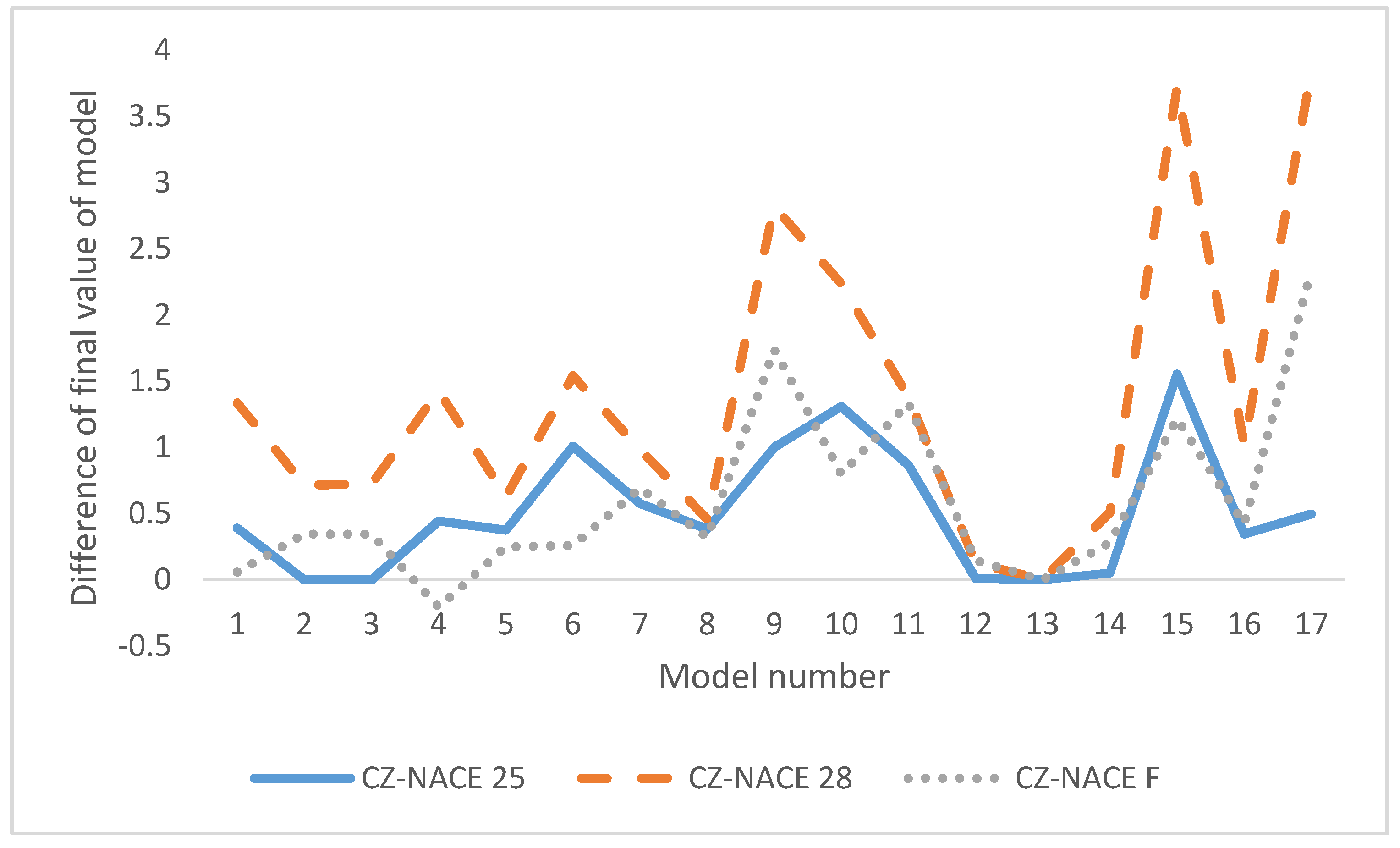

4. Results

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Achim, Monica Violeta, Codruta Mare, and Sorin Nicolae Borlea. 2012. A statistical model of financial risk bankruptcy applied for Romanian manufacturing industry. Procedia Economics and Finance 3: 132–37. [Google Scholar] [CrossRef][Green Version]

- Acosta-González, Eduardo, and Fernando Fernández-Rodríguez. 2014. Forecasting financial failure of firms via genetic algorithms. Computational Economics 43: 133–57. [Google Scholar] [CrossRef]

- Agarwal, Vineet, and Richard Taffler. 2007. Twenty-five years of the Taffler z-score model: does it really have predictive ability? Accounting and Business Research 37: 285–300. [Google Scholar] [CrossRef]

- Ahn, Byeong, Sung Cho, and Chang Kim. 2000. The integrated methodology of rough set theory and artificial neural network for business failure prediction. Expert Systems with Applications 18: 65–74. [Google Scholar] [CrossRef]

- Alaka, Hafiz A., Lukumon O. Oyedele, Hakeem A. Owolabi, Vikas Kumar, Saheed O. Ajayi, Olungbenga O. Akinade, and Muhammad Bilal. 2018. Systematic review of bankruptcy prediction models: Towards a framework for tool selection. Expert Systems with Applications 94: 164–84. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I. 1993. Corporate Financial Distress and Bankruptcy, 2nd ed. New York: John Wiley & Sons. ISBN 978-0-471-55253-6. [Google Scholar]

- Altman, Edward I. 2004. Predicting corporate distress in a turbulent economic and regulatory environment. Rassegna Economica 68: 483–524. [Google Scholar]

- Balcaen, Sofie, and Hubert Ooghe. 2006. 35 years of studies on business failure: an overview of the classic statistical methodologies and their related problems. The British Accounting Review 38: 63–93. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial Ratios as Predictors of Failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Belás, Jaroslav, Luboš Smrčka, Beata Gavurova, and Jan Dvorský. 2018. The impact of social and economic factors in the credit risk management of SME. Technological and Economic Development of Economy 24: 1215–30. [Google Scholar] [CrossRef]

- Bokšová, Jiřina, and Monika Randáková. 2013. Zveřejňují podniky, které procházejí insolvenčním řízením, své účetní závěrky (Do Firms in Insolvency Proceedings Publish Their Financial Statements?)? Český finanční a účetní časopis 8: 164–71. [Google Scholar] [CrossRef]

- Bruneau, Catherine, Olivier de Bandt, and Widad El Amri. 2012. Macroeconomic fluctuations and corporate financial fragility. Journal of Financial Stability 8: 219–35. [Google Scholar] [CrossRef]

- Čámská, Dagmar. 2015. Models Predicting Financial Distress and their Accuracy in the Case of Construction Industry in the Czech Republic. Paper presented at 7th International Scientific Conference Finance and Performance of Firms in Science, Education and Practice, Zlín, Czech Republic, April 23–24; Edited by Eliška Pastuszková, Zuzana Crhová, Jana Vychytilová, Blanka Vytrhlíková and Adriana Knápková. Zlín: Tomas Bata University in Zlin, pp. 178–90. [Google Scholar]

- Čámská, Dagmar. 2016. Accuracy of Models Predicting Corporate Bankruptcy in a Selected Industry Branch. Ekonomický časopis 64: 353–66. [Google Scholar]

- Čámská, Dagmar. 2019. Models predicting corporate financial distress and industry specifics. Paper presented at International Conference on Time Series and Forecasting (ITISE 2019), Universidad de Granada, Granada, Spain, September 25–27; Edited by Olga Valenzuela, Fernando Rojas, Hector Pomares and Ignacio Rojas. Granada: Godel Impresiones Digitales S.L., pp. 647–56. [Google Scholar]

- Chava, Sudheer, and Robert Jarrow. 2004. Bankruptcy Prediction with Industry Effects. Review of Finance 8: 537–69. [Google Scholar] [CrossRef]

- Crone, Sven, and Steven Finlay. 2012. Instance Sampling in Credit Scoring: An Empirical Study of Sample Size and Balancing. International Journal of Forecasting 28: 224–38. [Google Scholar] [CrossRef]

- Davidova, G. 1999. Quantity method of bankruptcy risk evaluation. Journal of Risk Management 3: 13–20. [Google Scholar]

- De Laurentis, Giacomo, Renato Maino, and Luca Molteni. 2010. Developing, Validating and Using Internal Ratings: Methodologies and Case Studies, 1st ed. Singapore: John Wiley & Sons. ISBN 978-0-470-71149-1. [Google Scholar]

- Deakin, Edward B. 1972. A Discriminant Analysis of Prediction of Business Failure. Journal of Accounting Research 10: 167–69. [Google Scholar] [CrossRef]

- Doucha, Rudolf. 1996. Finanční Analýza Podniku: Praktické Aplikace (Corporate Financial Analysis: Practical Applications), 1st ed. Prague: Vox Consult. ISBN 80-902111-2-7. [Google Scholar]

- Du Jardin, Philippe. 2017. Dynamics of Firm Financial Evolution and Bankruptcy Prediction. Expert Systems with Application 75: 25–43. [Google Scholar] [CrossRef]

- Du Jardin, Philippe. 2018. Failure pattern-based ensembles applied to bankruptcy forecasting. Decision Support Systems 107: 64–77. [Google Scholar] [CrossRef]

- European Commission. 2012. Communication from the Commission to the European Parliament, The Council, The European Economic and Social Committee and The Committee of the Regions Entrepreneurship 2020 Action Plan, Reigniting the entrepreneurial spirit in Europe. Brussels: European Communities. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52012DC0795 (accessed on 15 December 2019).

- Fairfield, Patricia M, Sundaresh Rammath, and Teri Lombardi Yohn. 2009. Do Industry-Level Analyses Improve Forecasts of Financial Performance? Journal of Accounting Research 47: 147–78. [Google Scholar] [CrossRef]

- Foster, George. 1986. Financial Statement Analysis, 2nd ed. New York: Prentice Hall. ISBN 978-0133163179. [Google Scholar]

- Frank, Murray Z., and Vidhan K. Goyal. 2009. Capital Structure Decisions: Which Factors Are Reliably Important? Financial Management 38: 1–37. [Google Scholar] [CrossRef]

- Ganguin, Blaise, and John Bilardello. 2004. Standard & Poor’s Fundamentals of Corporate Credit Analysis. New York: McGrew-Hill Professional. ISBN 978-0071441636. [Google Scholar]

- Hajdu, Ottó, and Miklós Virág. 2001. Hungarian Model for Predicting Financial Bankruptcy. Society and Economy in Central and Eastern Europe 23: 28–46. [Google Scholar]

- Hamilton, David T., Greg M. Gupton, and A. Berthault. 2001. Default and Recovery Rates of Corporate Bond Issuers: 2000. Moody’s Investor Service, New York, USA. Available online: http://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID277999_code010803670.pdf?abstractid=277999&mirid=1 (accessed on 12 December 2019).

- Hol, Suzan. 2007. The influence of the business cycle on bankruptcy probability. International Transactions in Operational Research 14: 75–90. [Google Scholar] [CrossRef]

- Jackson, Andrew B, Marlene A. Plumlee, and Brian R. Rountree. 2018. Decomposing the market, industry, and firm components of profitability: implications for forecasts of profitability. Review of Accounting Studies 23: 1071–95. [Google Scholar] [CrossRef]

- Jansone, Inga, Viktors Nespors, and Irina Voronova. 2010. Finanšu un ekonomisko risku ietekme uz Latvijas partikas mazumtirdzniecibas nozares attistibu (Impact of Financial and Economic Risks to Extension of Food Retail Industry of Latvia). Scientific Journal of Riga Technical University Economics and Business Economy: Theory and Practice 20: 59–64. [Google Scholar]

- Jordan, Bradford, Randolph Westerfield, and Stephen Ross. 2011. Corporate Finance Essentials. New York: McGraw-Hill. ISBN 978-0-07-122115-3. [Google Scholar]

- Karas, Michal, and Mária Režňáková. 2013. Bankruptcy Prediction Model of Industrial Enterprises in the Czech Republic. International Journal of Mathematical Models and Methods in Applied Sciences 7: 519–31. [Google Scholar]

- Kisielińska, Joanna, and Adam Waszkowski. 2010. Polskie modele do prognozowania bankructwa przedsiębiorstw i ich weryfikacja (Polish Models to Predict Bankruptcy and Its Verification). Ekonomika i Organizacja Gospodarki Żywnościowej 82: 17–31. [Google Scholar]

- Klečka, Jiří, and Hana Scholleová. 2010. Bankruptcy models enunciation for Czech glass making firms. Economics and Management 15: 954–59. [Google Scholar]

- Klieštik, Tomáš, Jana Klieštiková, Mária Kováčová, Lucia Švábová, Katarína Valášková, Marek Vochozka, and Judit Oláh. 2018. Prediction of Financial Health of Business Entities in Transition Economies. New York: Addleton Academic Publishers. ISBN 978-1-942585-39-8. [Google Scholar]

- Korol, Tomasz, and Adrian Korodi. 2010. Predicting Bankruptcy with the Use of Macroeconomic Variables. Economic Computation and Economic Cybernetics Studies and Research 44: 201–19. [Google Scholar]

- Kralicek, Peter. 2007. Ertrags- und Vermögensanalyse (Quicktest) (Earnings and Wealth Analysis (Quicktest)). Available online: http://www.kralicek.at/pdf/qr_druck.pdf (accessed on 15 May 2019).

- Kumar, P. Ravi, and Vadlamani Ravi. 2007. Bankruptcy prediction in banks and firms via statistical and intelligent techniques—A review. European Journal of Operational Research 180: 1–28. [Google Scholar] [CrossRef]

- Lee, Gwendolyn K., and Mishari Alnahedh. 2016. Industries’ Potential for Interdependency and Profitability: A Panel of 135 Industries, 1988–1996. Strategy Science 1: 285–308. [Google Scholar] [CrossRef]

- Lee, Seung-Hyun, Yasuhiro Yamakawa, Mike W. Peng, and Jay B. Barney. 2011. How do bankruptcy laws affect entrepreneurship development around the world? Journal of Business Venturing 26: 505–20. [Google Scholar] [CrossRef]

- Lensberg, Terje, Aasmund Eilifsen, and Thomas E. McKee. 2006. Bankruptcy theory development and classification via genetic programming. European Journal of Operational Research 169: 677–97. [Google Scholar] [CrossRef]

- Lessmann, Stefan, Bart Baesens, Hsin-Vonn Seow, and Lyn C. Thomas. 2015. Benchmarking state-of-the-art classification algorithms for credit scoring: An update of research. European Journal of Operational Research 247: 124–36. [Google Scholar] [CrossRef]

- Li, Leon, and Robert Faff. 2019. Predicting corporate bankruptcy: What matters? International Review of Economics & Finance 62: 1–19. [Google Scholar] [CrossRef]

- Liou, Dah-Kwei, and MalcolmMalcolm Smith Malcolm Smith. 2007. Macroeconomic Variables and Financial Distress. Journal of Accounting, Business & Management 14: 17–31. [Google Scholar]

- Machek, Ondřej. 2014. Long-term Predictive Ability of Bankruptcy Models in the Czech Republic: Evidence from 2007–2012. Central European Business Review 3: 14–17. [Google Scholar] [CrossRef]

- Merkevicius, Egidijus, Gintautas Garšva, and Stasys Girdzijauskas. 2006. A Hybrid SOM-Altman Model for Bankruptcy Prediction. Paper presented at 6th International Conference Computational Science–ICCS 2006, Reading, UK, May 28–31; Berlin and Heidelberg: Springer, pp. 364–371, Part II. [Google Scholar] [CrossRef]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance 29: 449–70. [Google Scholar] [CrossRef]

- Min, Jae H., and Young-Chan Lee. 2005. Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert Systems with Applications 28: 603–14. [Google Scholar] [CrossRef]

- Ministry of Industry and Trade. 2013. Finanční analýza podnikové sféry se zaměřením na konkurenceschopnost sledovaných odvětví za rok 2012 (Financial Analysis of the Business Sphere with a Focus on the Competitiveness of the Monitred Sectors in 2012). Available online: https://www.mpo.cz/assets/dokumenty/48519/55958/605530/priloha001.xls (accessed on 10 April 2014).

- Ministry of Industry and Trade. 2018. Finanční analýza podnikové sféry za rok 2017 (Financial Analysis of the Business Sphere in 2017). Available online: https://www.mpo.cz/assets/cz/rozcestnik/analyticke-materialy-a-statistiky/analyticke-materialy/2018/6/Tabulky2017.xlsx (accessed on 20 June 2019).

- Moyer, Stephen G. 2005. Distressed Debt Analysis: Strategies for Speculative Investors. Boca Raton: J. Ross Publishing. ISBN 1-932159-18-5. [Google Scholar]

- Neumaierová, Inka, and Ivan Neumaier. 2002. Výkonnost a Tržní Hodnota Firmy (Performance and Company Market Value), 1st ed. Prague: Grada. ISBN 9788024701257. [Google Scholar]

- Neumaierová, Inka, and Ivan Neumaier. 2005. Index IN05 (Index IN05). Paper presented at Evropské Finanční Systémy, Masarykova Univerzita, Brno, Czech Republic, June 21–23; Brno: Masarykova Univerzita, pp. 143–48. [Google Scholar]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef]

- Öztekin, Özde. 2015. Capital structure decisions around the world: which factors are reliably important? Journal of Financial and Quantitative Analysis 50: 301–23. [Google Scholar] [CrossRef]

- Peng, Mike W., Yasuhiro Yamakawa, and Seung-Hyun Lee. 2010. Bankruptcy Laws and Entrepreneur–Friendliness. Entrepreneurship Theory and Practice 34: 517–30. [Google Scholar] [CrossRef]

- Pitrová, Kateřina. 2011. Possibilities of the Altman Zeta Model Application to Czech Firms. EM Ekonomika a Management 14: 66–76. [Google Scholar]

- Prusak, Błażej. 2018. Review of research into enterprise bankruptcy prediction in selected central and eastern European countries. International Journal of Financial Studies 6: 60. [Google Scholar] [CrossRef]

- Ravisankar, Pediredla, and Vadlamani Ravi. 2010. Financial distress prediction in banks using Group Method of Data Handling neural network, counter propagation neural network and fuzzy ARTMAP. Knowledge-Based Systems 23: 823–31. [Google Scholar] [CrossRef]

- Schönfeld, Jaroslav, Michal Kuděj, and Luboš Smrčka. 2018. Financial Health of Enterprises Introducing Safeguard Procedure Based on Bankruptcy Models. Journal of Business Economics and Management 19: 692–705. [Google Scholar] [CrossRef]

- Smrčka, Luboš, Markéta Arltová, and Jaroslav Schönfeld. 2013. Reasons for the failure to implement financial rehabilitation procedures in insolvent reality. Politická Ekonomie 61: 188–208. [Google Scholar] [CrossRef]

- Strouhal, Jiří, Natalja Gurtviš, Monika Nikitina-Kalamäe, Tsz Wan Li, Anna-Lena Lochman, and Kathrin Born. 2014. Are Companies Willing to Publicly Present their Financial Statements on Time? Case of Czech and Estonian TOP100 Companies. Paper presented at 7th International Scientific Conference on Managing and Modelling of Financial Risks Modelling of Financial Risks, VSB Tech Univ Ostrava, Ostrava, Czech Republic, September 8–9; pp. 731–38. [Google Scholar]

- Svobodová, Libuše. 2013. Trends in the number of bankruptcies in the Czech Republic. Paper presented at Hradecké ekonomické dny (Hradec Economic Days), Hradec Králové, Czech Republic, February 19–20; pp. 393–99. [Google Scholar]

- Topaloglu, Zeynep. 2012. A multi-period logistic model of bankruptcies in the manufacturing industry. International Journal of Finance and Accounting 1: 28–37. [Google Scholar] [CrossRef]

- Vlachý, Jan. 2018. Corporate Finance. Prague: Leges. ISBN 978-80-7502-291-2. [Google Scholar]

- Wöber, André, and Oliver Siebenlist. 2009. Sanierungsberatung für Mittel- und Kleinbetriebe, Erfolgreiches Consolting in der Unternehmenkrise (Restructuring Advice for Medium and Small Businesses, Successful Consulting in the Corporate Crisis). Berlin: Erich Schmidt Verlag GmbH. ISBN 978-3503112456. [Google Scholar]

- Wu, Desheng Dash, Yidong Zhang, Dexiang Wu, and David L. Olson. 2010. Fuzzy multi-objective programming for supplier selection and risk modeling: A possibility approach. European Journal of Operational Research 200: 774–87. [Google Scholar] [CrossRef]

- Zellner, Arnold. 1992. Statistics, Science and Public Policy. Journal of the American Statistical Association 87: 1–6. [Google Scholar] [CrossRef]

- Zhou, Ligang, Kin Keung Lai, and Jerome Yen. 2010. Bankruptcy prediction incorporating macroeconomic variables using Neural Network. Paper presented at International Conference on Technologies and Applications of Artificial Intelligence, TAAI 2010, Hsinchu, Taiwan, November 18–20; pp. 80–85. [Google Scholar] [CrossRef]

| Industry Branch | Healthy 2012 | Insolvent 2012 | Healthy 2017 | Insolvent 2017 |

|---|---|---|---|---|

| CZ-NACE 25 | 383 | 36 | 786 | 25 |

| CZ-NACE 28 | 33 | 10 | 321 | 11 |

| CZ-NACE F | 229 | 33 | 1997 | 105 |

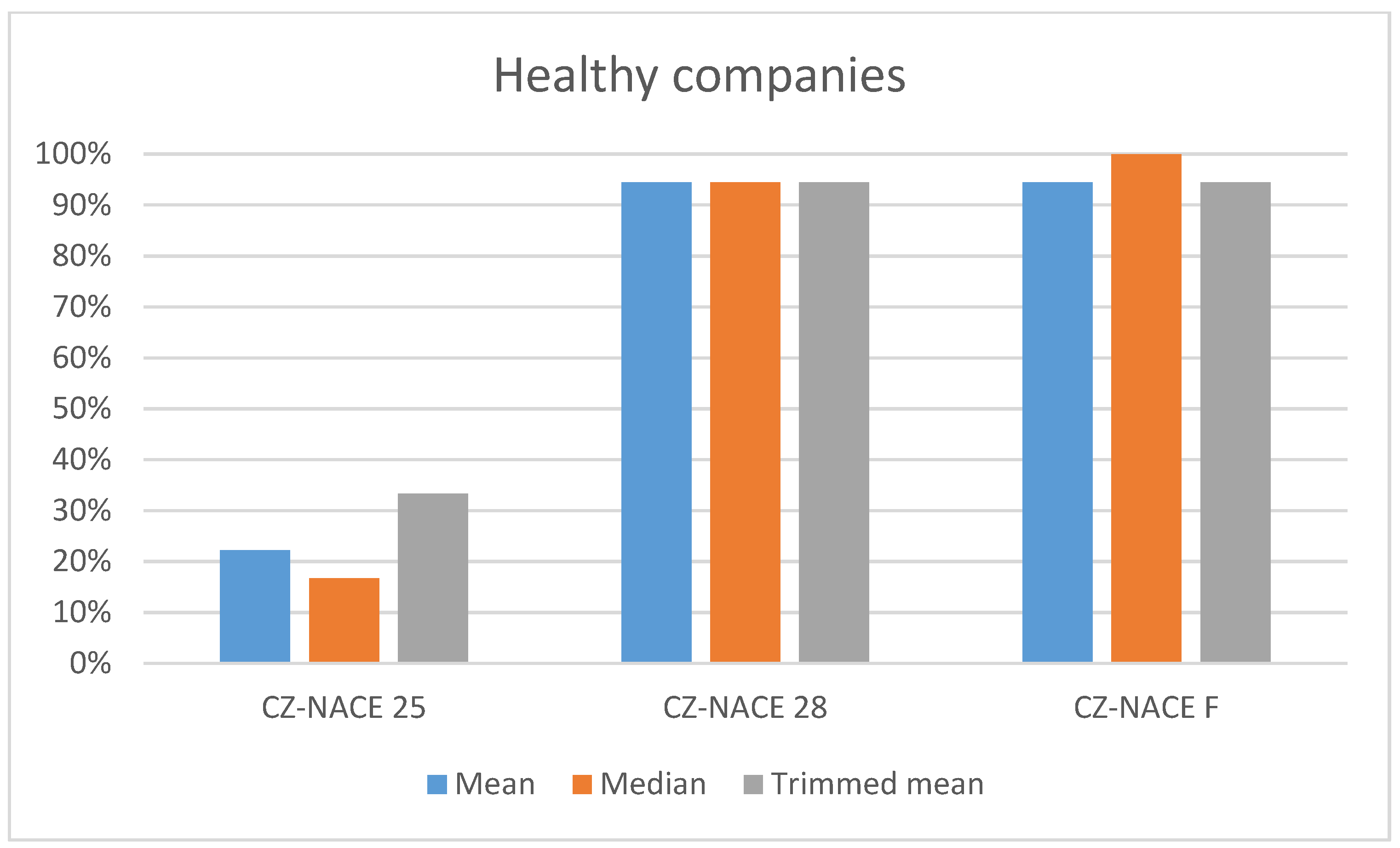

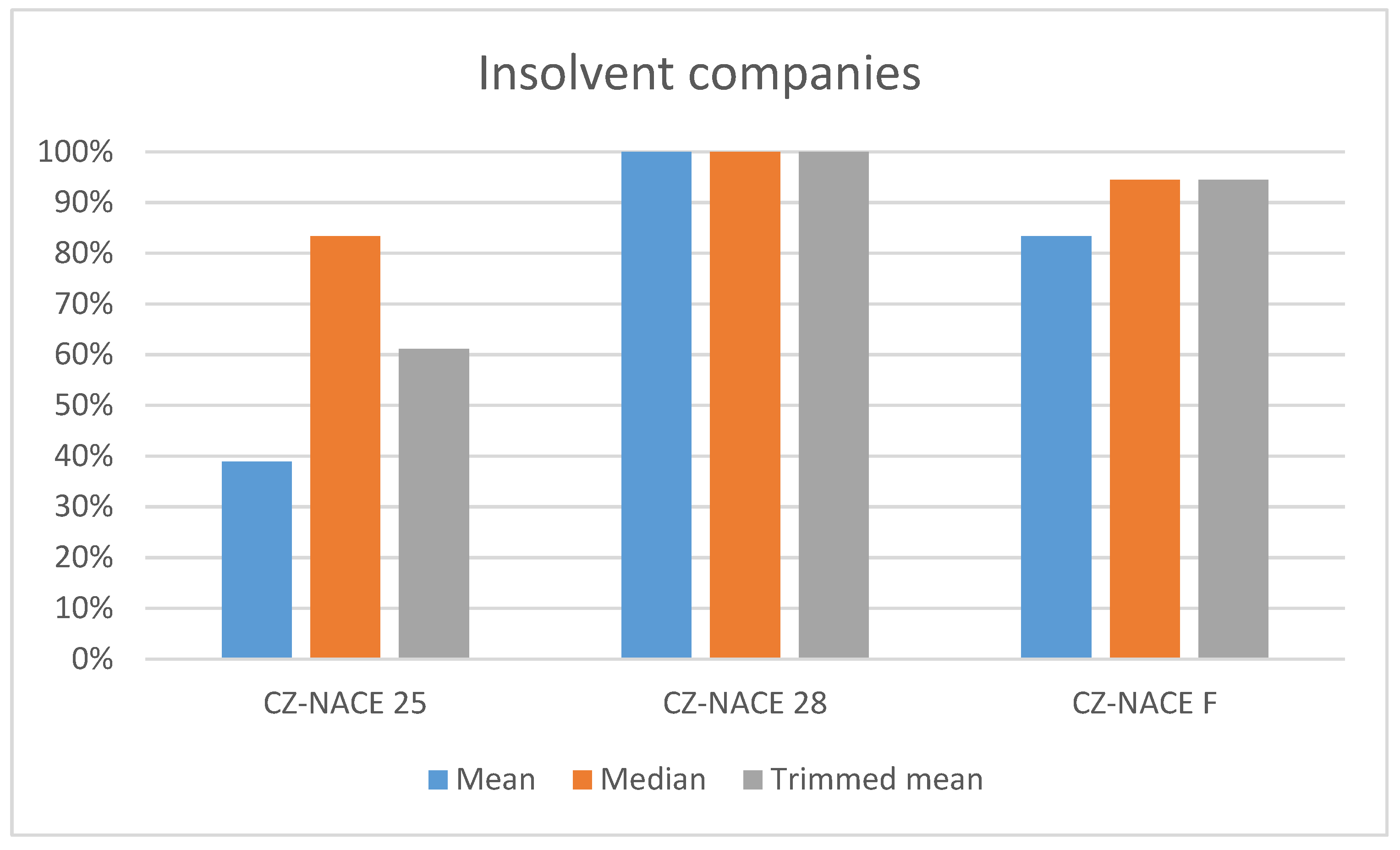

| Statistics | Healthy | Healthy | Healthy | Insolvent | Insolvent | Insolvent |

|---|---|---|---|---|---|---|

| Mean | Median | Trimmed Mean | Mean | Median | Trimmed Mean | |

| CZ-NACE 25 | 4.17 | 3.71 | 3.98 | −1.23 | 0.74 | −0.04 |

| CZ-NACE 28 | 4.27 | 3.70 | 4.09 | 1.55 | 1.68 | 1.52 |

| CZ-NACE F | 4.22 | 3.73 | 4.04 | 0.72 | 0.83 | 0.76 |

| Company Type | Healthy | Healthy | Healthy | Insolvent | Insolvent | Insolvent |

|---|---|---|---|---|---|---|

| Model | CZ-NACE 25 | CZ-NACE 28 | CZ-NACE F | CZ-NACE 25 | CZ-NACE 28 | CZ-NACE F |

| Model 1 | 0.1246 | 0.0094 | 0.0177 | 0.3556 | 0.0167 | 0.4495 |

| Model 2 | 0.9158 | 0.0219 | 0.0003 | 0.2126 | 0.1213 | 0.2582 |

| Model 3 | 0.9118 | 0.0220 | 0.0003 | 0.2072 | 0.1213 | 0.2541 |

| Model 4 | 0.0000 | 0.0039 | 0.0000 | 0.2467 | 0.2908 | 0.4406 |

| Model 5 | 0.0219 | 0.2928 | 0.0001 | 0.0455 | 0.1329 | 0.0390 |

| Model 6 | 0.8835 | 0.1783 | 0.0002 | 0.1236 | 0.0573 | 0.0666 |

| Model 7 | 0.3279 | 0.0582 | 0.0921 | 0.1347 | 0.0573 | 0.0768 |

| Model 8 | 0.1380 | 0.0418 | 0.2294 | 0.0889 | 0.1213 | 0.1336 |

| Model 9 | 0.4733 | 0.0083 | 0.0037 | 0.1309 | 0.0039 | 0.0811 |

| Model 10 | 0.4938 | 0.0361 | 0.0007 | 0.1549 | 0.0290 | 0.0864 |

| Model 11 | 0.2264 | 0.1174 | 0.0231 | 0.1347 | 0.0573 | 0.0156 |

| Model 12 | 0.1269 | 0.0070 | 0.0002 | 0.2180 | 0.2599 | 0.3074 |

| Model 13 | 0.9997 | 0.0262 | 0.3491 | 0.5379 | 0.1392 | 0.6407 |

| Model 14 | 0.9026 | 0.0926 | 0.5013 | 0.9415 | 0.9439 | 0.4031 |

| Model 15 | 0.0000 | 0.0465 | 0.5648 | 0.2910 | 0.0112 | 0.0245 |

| Model 16 | 0.0084 | 0.0440 | 0.2563 | 0.2292 | 0.0060 | 0.0673 |

| Model 17 | 0.4545 | 0.0397 | 0.0635 | 0.2292 | 0.0137 | 0.0029 |

| Model 18 | 0.5437 | 0.1081 | 0.1799 | 0.2778 | 0.0167 | 0.0158 |

| Company Type | Healthy | Insolvent |

|---|---|---|

| CZ-NACE 25 | −1.03 | 2.47 |

| CZ-NACE 28 | 3.78 | 9.57 |

| CZ-NACE F | 2.08 | 5.94 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Camska, D.; Klecka, J. Comparison of Prediction Models Applied in Economic Recession and Expansion. J. Risk Financial Manag. 2020, 13, 52. https://doi.org/10.3390/jrfm13030052

Camska D, Klecka J. Comparison of Prediction Models Applied in Economic Recession and Expansion. Journal of Risk and Financial Management. 2020; 13(3):52. https://doi.org/10.3390/jrfm13030052

Chicago/Turabian StyleCamska, Dagmar, and Jiri Klecka. 2020. "Comparison of Prediction Models Applied in Economic Recession and Expansion" Journal of Risk and Financial Management 13, no. 3: 52. https://doi.org/10.3390/jrfm13030052

APA StyleCamska, D., & Klecka, J. (2020). Comparison of Prediction Models Applied in Economic Recession and Expansion. Journal of Risk and Financial Management, 13(3), 52. https://doi.org/10.3390/jrfm13030052