Self-Assessment of Driving Style and the Willingness to Share Personal Information

Abstract

1. Introduction

1.1. Customer Data in Insurance

1.2. Willingness to Share Personal Information

1.3. Self-Assessment of Driving Style

1.4. Insights and Research Focus

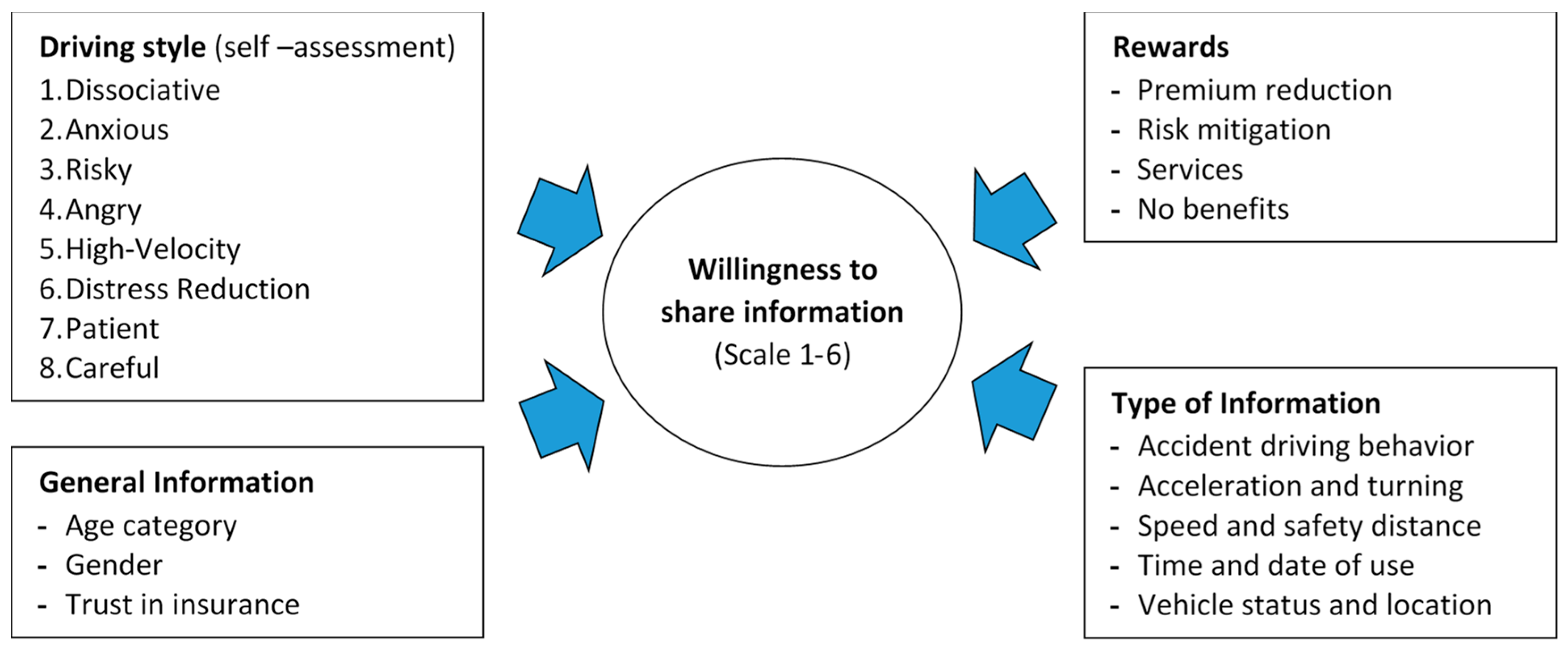

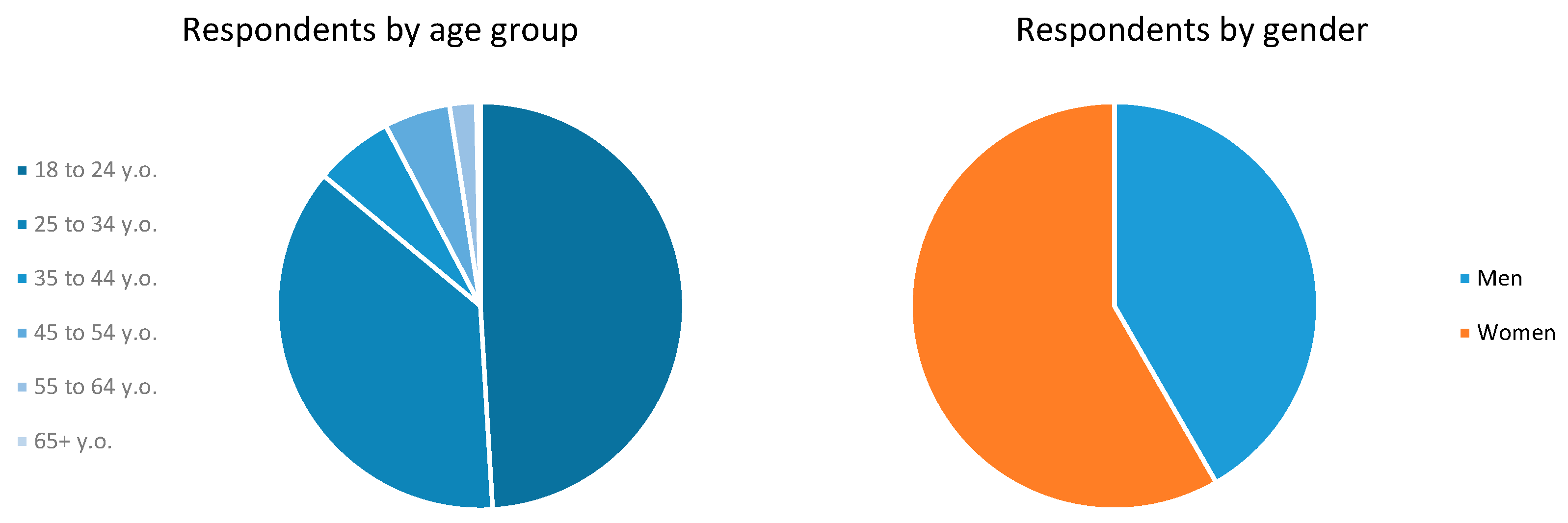

2. Materials and Methods

3. Results

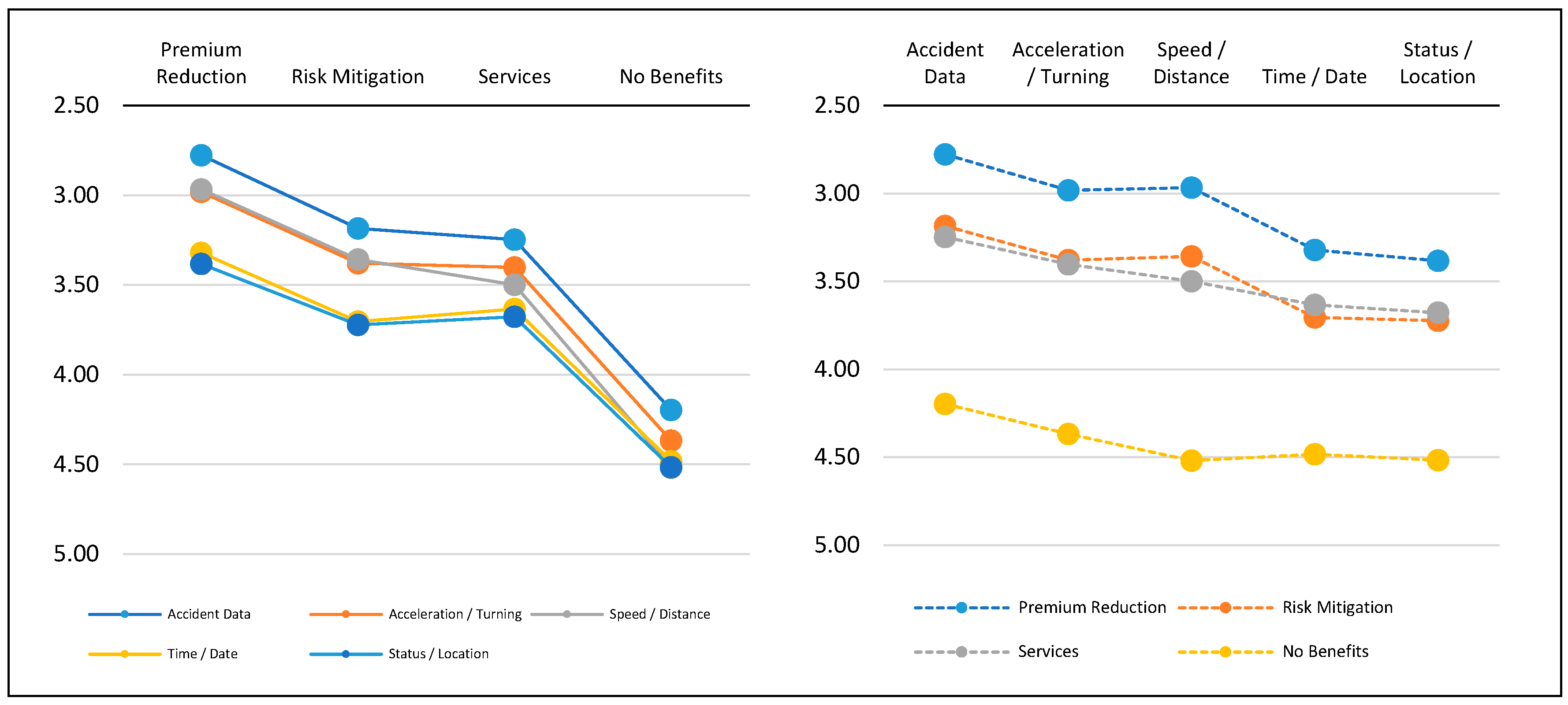

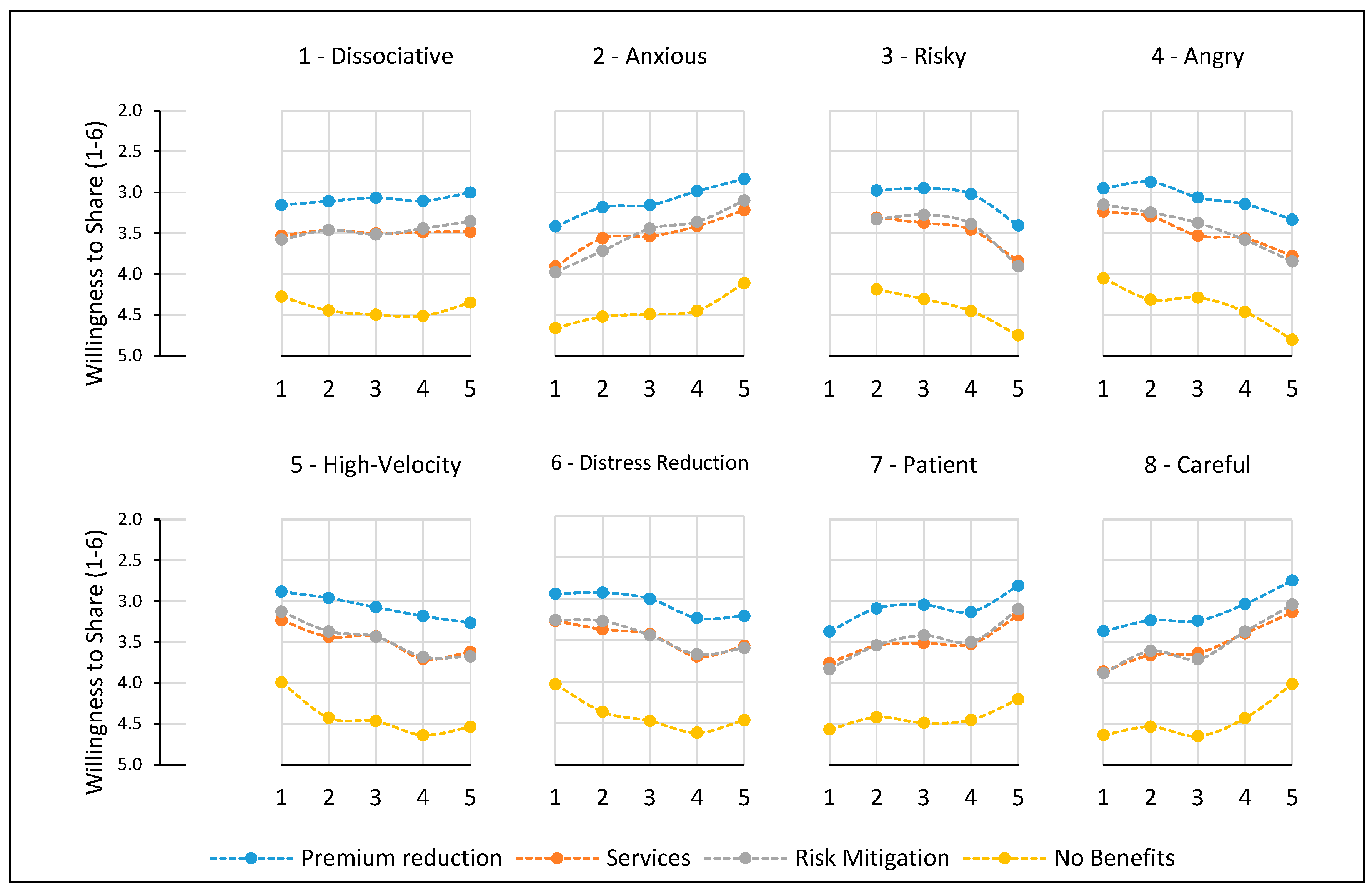

3.1. Overall Willingness to Share

- The overall value of 3.62 (on a scale of 1–6) shows a somewhat restrained willingness to share information with insurance companies.

- The type of benefit offered has the highest impact on the willingness to share, with the offer of premium reduction providing an impact of some 1.3 vs. offering no benefits (3.09 for premium reduction vs. 4.42 for no benefits).

- Risk mitigation and other services also impact the willingness to share significantly, but not as much as a financial incentive. The difference between these two factors is not statistically significant.

- The type of information requested also impacts willingness to share significantly. The more the information is relevant for current insurance purposes (e.g., adjusting a claim), the higher the willingness to share it. By contrast, customers are more reluctant to share general personal information, such as vehicle location and usage patterns.

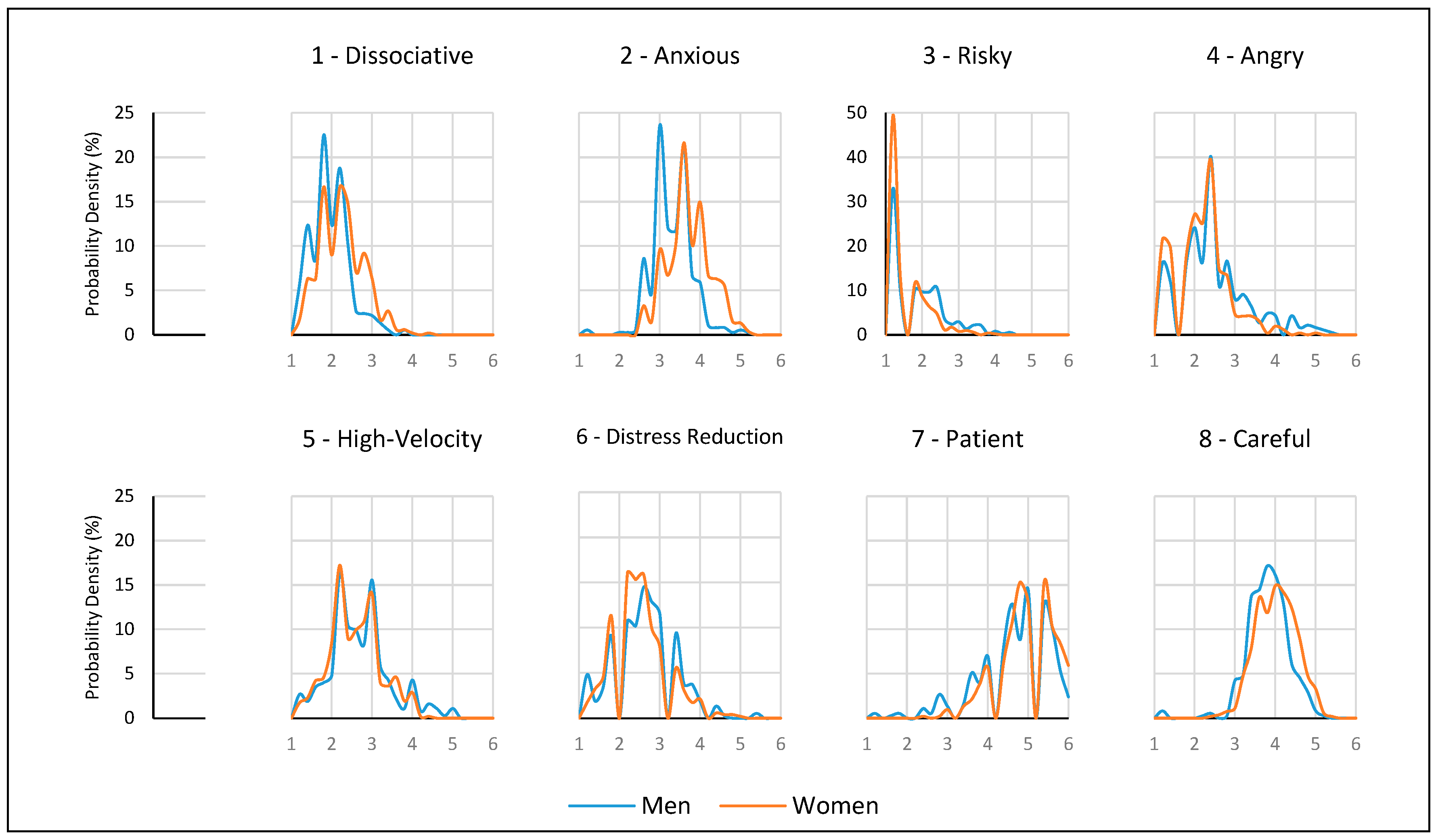

3.2. Self-Assessment of Driving Style

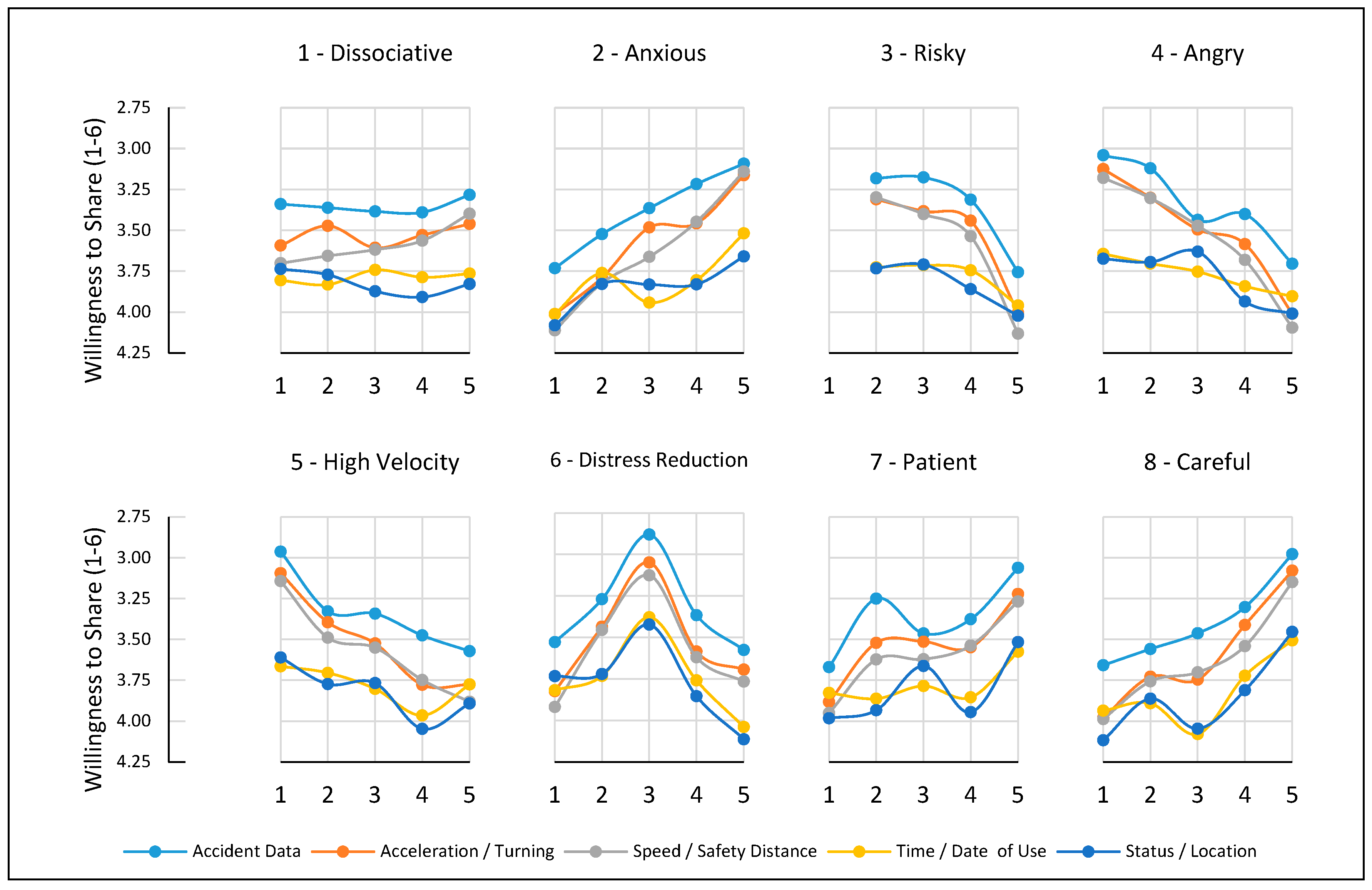

3.3. Impact of Self-Assessment on Willingness to Share

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Acquisti, Alessandro, Leslie K. John, and George Loewenstein. 2013. What is Privacy Worth? The Journal of Legal Studies 42: 249–74. [Google Scholar] [CrossRef]

- Amado, Sonia, Elvan Arikan, Gülin Kaça, Mehmet Koyuncu, and B. Nilay Turkan. 2014. How Accurately Do Drivers Evaluate Their Own Driving Behavior? An on-Road Observational Study. Accident Analysis and Prevention 63: 65–73. [Google Scholar] [CrossRef] [PubMed]

- Barth, Susanne, and Menno D. T. de Jong. 2017. The Privacy Paradox—Investigating Discrepancies Between Expressed Privacy Concerns and Actual Online Behavior—A Systematic Literature Review. Telematics and Informatics 34: 1038–58. [Google Scholar] [CrossRef]

- Cather, David A. 2018. Cream Skimming: Innovations in Insurance Risk Classification and Adverse Selection. Risk Management and Insurance Review 21: 335–66. [Google Scholar] [CrossRef]

- Cohen, Alma, and Peter Siegelman. 2010. Testing for Adverse Selection in Insurance Markets. Journal of Risk and Insurance 77: 39–84. [Google Scholar] [CrossRef]

- Culnan, Mary J., and Pamela K. Armstrong. 1999. Information Privacy Concerns, Procedural Fairness, and Impersonal Trust: An Empirical Investigation. Organization Science 10: 104–15. [Google Scholar] [CrossRef]

- De Craen, Saskia, Divera A. M. Twisk, Marjan P. Hagenzieker, Henk Elffers, and Karel A. Brookhuis. 2011. Do Young Novice Drivers Overestimate Their Drivng Skills More Than Experienced Drivers? Different Methods Lead to Different Conclusions. Accident Analysis and Prevention 43: 1660–65. [Google Scholar] [CrossRef]

- De Winter, J. C. F., and Dimitra Dodou. 2010. The Driver Behavior Questionnaire as a Predictor of Accidents: A Meta-Analysis. Journal of Safety Research 41: 463–70. [Google Scholar] [CrossRef]

- Dunning, David, Judith A. Meyerowitz, and Amy D. Holzberg. 1989. Ambiguity and Self-Evaluation: The Role of Idiosyncratic Trait Definitions in Self-Serving Assessent of Ability. Journal of Personality and Social Psychology 57: 1082–90. [Google Scholar] [CrossRef]

- Dunning, David, Chip Heath, and Jerry M. Suls. 2004. Flawed Self-Assessment. Implications for Health, Education and the Workplace. Psychological Science in the Public Interest 5: 69–106. [Google Scholar] [CrossRef]

- Eling, Martin, and Martin Lehmann. 2017. The Impact of Digitalization on the Insurance Value Chain and the Insurability of Risk. The Geneva Papers 43: 359–96. [Google Scholar] [CrossRef]

- Federal Trade Commission. 2007. Credit-Based Insurance Scores: Impacts on Consumers of Automobile Insurance. Available online: https://www.ftc.gov/sites/default/files/documents/reports/credit-based-insurance-scores-impacts-consumers-automobile-insurance-report-congress-federal-trade/p044804facta_report_credit-based_insurance_scores.pdf (accessed on 28 December 2019).

- French, D. J., R. J. West, J. Elander, and J. M. Widing. 1993. Decision-Making Style, Driving Style, and Self-Reported Involvement in Road Traffic Accidents. Ergonomics 36: 627–44. [Google Scholar] [CrossRef] [PubMed]

- Groeger, John A., and Gunn E. Grande. 1996. Self-Preserving Assessment of Skill? British Journal of Psychology 87: 61–79. [Google Scholar] [CrossRef]

- Harrison, Warren. 2009. Reliability of the Driver Behaviors Questionnaire in a Sample of Novice Drivers. Paper presented at Australian Road Safety Research, Policing and Education Conference, Sydney, NSW, Australia, November 10–13. [Google Scholar]

- Jai, Tun-Min, and Nancy J. King. 2016. Privacy Versus Reward: Do Loyalty Programs Increase Consumers’ Willingness to Share Personal Information with Third-Party Advertisers and Data Brokers? Journal of Retailing and Consumer Services 28: 296–303. [Google Scholar] [CrossRef]

- Kontogiannis, Tom, Zoe Kossiavelou, and Nicolas Marmaras. 2002. Self-Reports of Aberrant Behaviour on the Road: Errors and Violations in a Sample of Greek Drivers. Accident Analysis and Prevention 34: 381–99. [Google Scholar] [CrossRef]

- Kruger, Justin, and David Dunning. 1999. Unskilled and Unaware of It: How Difficulties in Recognizing One’s Own Incompetence Lead to Inflated Self-Assessments. Journal of Personality and Social Psychology 77: 1121–34. [Google Scholar] [CrossRef]

- Lajunen, Timo, Dianne Parker, and Heikki Summala. 2004. The Manchester Driver Behaviour Questionnaire: A Cross-Cultural Study. Accident Analysis and Prevention 36: 231–38. [Google Scholar] [CrossRef]

- Leppäniemi, Matti, Heikki Karjaluoto, and Hannu Saarijärvi. 2017. Customer Perceived Value, Satisfaction, and Loyalty: The Role of Willingness to Share Information. The International Review of Retail, Distribution and Consumer Research 27: 164–88. [Google Scholar] [CrossRef]

- Lo, Janice, and Cindy Riemenschneider. 2010. An Examination of Privacy Concerns and Trust Entities in Determining Willingness to Disclose Personal Information on a Social Networking Site. Paper presented at the 16th Americas Conference on Information Systems, Lima, Peru, August 12–15. [Google Scholar]

- Martinussen, Laila M., Liisa Hakamies-Blomqvist, Mette Møller, Türker Özkan, and Timo Lajunen. 2013. Age, Gender, Mileage and the DBQ: The Validity of the Driver Behavior Questionnaire in Different Driver Groups. Accident Analysis & Prevention 52: 228–36. [Google Scholar] [CrossRef]

- Martinussen, Laila M., Mette Møller, and Carlo G. Prato. 2014. Assessing the Relationship between the Driver Behavior Questionnaire and the Driver Skill Inventory: Revealing Sub-groups of Drivers. Transportation Research Part F: Traffic Psychology and Behaviour 26: 82–91. [Google Scholar] [CrossRef]

- Maurstad, Hugo, Johan Riddergard, and Coenraad Vrolijk. 2001. Insuring Profits. McKinsey Quarterly, 12–15. [Google Scholar]

- McKenna, Frank P., Robert A. Stanier, and Clive Lewis. 1991. Factors Underlying Illusory Self-Assessment of Driving Skill in Males and Females. Accident Analysis and Prevention 23: 45–52. [Google Scholar] [CrossRef]

- Miesler, Linda, and Angela Bearth. 2016. “Willingness to share” im Kontext Big Data: Wie entscheiden Kunden, ob Sie ihre persönlichen Daten mit Unternehmen teilen? In Dialogmarketing Perspektiven 2015/2016. München: Springer Fachmedien, pp. 49–66. [Google Scholar] [CrossRef]

- Özkan, Türker, Timo Lajunen, and Heikki Summala. 2006. Driver Behaviour Questionnaire: A Follow-Up Study. Accident Analysis and Prevention 38: 386–95. [Google Scholar] [CrossRef] [PubMed]

- Özkan, Türker, and Timo Lajunen. 2006. What Causes the Differences in Driving Between Young Men and Women? The Effects of Gender Roles and Sex on Young Drivers’ Driving Behaviour and Self-Assessment of Skills. Transportation Research Part F 9: 269–77. [Google Scholar] [CrossRef]

- Paefgen, Johannes, Thorsten Staake, and Frédéric Thiesse. 2013. Evaluation and Aggregation of Pay-As-You-Drive Insurance Rate Factors: A Classification Analysis Approach. Decision Support Systems 56: 192–201. [Google Scholar] [CrossRef]

- Parker, Dianne, James T. Reason, Antony R. Manstead, and Stephen G. Stradling. 1995. Driving Errors, Driving Violations and Accident Involvement. Ergonomics 38: 1036–48. [Google Scholar] [CrossRef]

- Reason, James, Antony Manstead, Stephen Stradling, James Baxter, and Karen Campbell. 1990. Errors and Violations on the Roads: A real Distinction? Ergonomics 33: 1315–32. [Google Scholar] [CrossRef]

- Ross, John. A. 2006. The Reliability, Validity and Utility of Self-Assessment. Practical Assessment Research and Evaluation 11: 10. [Google Scholar]

- Rothschild, Michael, and Joseph Stiglitz. 1976. Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information. Quarterly Journal of Economics 90: 629–49. [Google Scholar] [CrossRef]

- Schoenbachler, Denise D., and Geoffrey L. Gordon. 2002. Trust and Customer Willingness to Provide Information in Database-Driven Relationship Marketing. Journal of Interactive Marketing 16. [Google Scholar] [CrossRef]

- Schudy, Simeon, and Verena Utikal. 2017. You Must Not Know About Me—On the Willingness to Share Personal Data. Journal of Economic Behavior and Organization 141: 1–13. [Google Scholar] [CrossRef]

- Sivak, Michael, José Soler, and Ulrich Tränkle. 1989. Cross-Cultural Differences in Driver Self-Assessment. Accident Analysis and Prevention 21: 371–75. [Google Scholar] [CrossRef]

- Stone, Eugene F., and Dianna L. Stone. 1990. Privacy in Organizations: Theoretical Issues, Research Findings, and Protection Mechanisms. Research in Personnel an Human Resources Management 8: 349–411. [Google Scholar]

- Sundström, Anna. 2008. Self-Assessment of Driving Skill—A Review from a Measurement Perspective. Transportation Research Part F 11: 1–9. [Google Scholar] [CrossRef]

- Sundström, Anna. 2011. The Validity of Self-Reported Driver Competence: Relations between Measures of Perceived Driver Competence and Actual Driving Skill. Transportation Research Part F 14: 155–63. [Google Scholar] [CrossRef]

- Taubman-Ben-Ari, Orit, Mario Mikulincer, and Omri Gillath. 2004. The Multidimensional Driving Style Inventory—Scale Construct and Validation. Accident Analysis and Prevention 36: 323–32. [Google Scholar] [CrossRef]

- Taubman-Ben-Ari, Orit, and Vera Skvirsky. 2016. The Multidimensional Driving Style Inventory a Decade Later: Reviewof the Literature and Re-evaluation of the Scale. Accident Analysis and Prevention 93: 179–88. [Google Scholar] [CrossRef]

- Taubman-Ben-Ari, Orit, Ahinoam Eherenfreund-Hager, and Carlo G. Prato. 2016. The Value of Self-Report Measures as Indicators of driving Behaviors among Young Drivers. Transportation Research Part F 39: 33–42. [Google Scholar] [CrossRef]

- Thomas, R. Guy. 2017. Loss Coverage: Why Insurance Works Better with Some Adverse Selection. Cambridge: Cambridge University Press. [Google Scholar]

- Tsai, Janice Y., Serge Egelman, Lorrie Cranor, and Alessandro Acquisti. 2011. The Effect of Online Privacy Information on the Purchasing Behavior: An Experimental Study. Information Systems Research 22: 254–68. [Google Scholar] [CrossRef]

- West, Robert, Davina French, Richard Kemp, and James Elander. 1993. Direct Observation of Driving, Self Reports of Driver Behaviour, and Accident Involvement. Ergonomics 36: 557–67. [Google Scholar] [CrossRef]

| Answer | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Willingness to share information | Yes | Yes, conditional | Rather yes | Rather no | Unlikely | Never |

| Driving Style | Questions |

|---|---|

| 1—Dissociative Tendency to be easily distracted during driving, to commit driving errors due to this distraction, and to display cognitive gaps and dissociations during driving. | [30] misjudge the speed of an oncoming vehicle when passing [34] intend to switch on the windscreen wipers, but switch on the lights instead [27] forget that my lights are on full beam until flashed by another motorist [39] nearly hit something due to misjudging my gap in a parking lot [36] plan my route badly, so that I hit traffic that I could have avoided [35] attempt to drive away from traffic lights in third gear (or on the neutral mode in automatic cars) [15] lost in thoughts or distracted, I fail to notice someone at the pedestrian crossings [11] I daydream to pass the time while driving |

| 2—Anxious Tendency to feel distress during driving, to display signs of anxiety due to the driving situation, and to express doubts and lack of confidence about his or her driving skills. | [31] feel nervous while driving [33] feel distressed while driving [10] driving makes me feel frustrated [25] it worries me when driving in bad weather [7] on a clear freeway, I usually drive at or a little below the speed limit [4] feel I have control over driving [40] feel comfortable while driving |

| 3—Risky A person’s seeking for stimulation, sensation, and risk during driving and his or her tendency to take risky driving decisions and to engage in risky driving. | [44] enjoy the excitement of dangerous driving [6] enjoy the sensation of driving on the limit [22] like to take risks while driving [24] like the thrill of flirting with death or disaster [20] fix my hair/ makeup while driving |

| 4—Angry Tendency to be hostile towards other drivers as well as behave aggressively and feel intense anger while driving. | [12] swear at other drivers [3] blow my horn or “flash” the car in front as a way of expressing frustrations [28] when someone does something on the road that annoys me, I flash them with the high beam [43] honk my horn at others [19] when someone tries to skirt in front of me on the road, I drive in an assertive way in order to prevent it |

| 5—High-Velocity Tendency to drive fast, to display signs of time pressure while driving, and to be oriented towards high velocity driving. | [16] in a traffic jam, I think about ways to get through the traffic faster [9] when in a traffic jam and the lane next to me starts to move, I try to move into that lane as soon as possible [17] when a traffic light turns green and the car in front of me doesn’t get going immediately, I try to urge the driver to move on [2] purposely tailgate other drivers [32] get impatient during rush hours [5] drive through traffic lights that have just turned red |

| 6—Distress Reduction Tendency to engage in relaxing activities during driving aimed at reducing distress while driving. | [37] use muscle relaxation techniques while driving [8] while driving, I try to relax myself [1] do relaxing activities while driving [26] meditate while driving |

| 7—Patient Tendency to be polite towards other drivers, to feel no time pressure during driving, and to display patience while driving. | [18] at an intersection where I have to give right-of-way to oncoming traffic, I wait patiently for cross-traffic to pass [23] base my behavior on the motto “better safe than sorry” [13] when a traffic light turns green and the car in front of me doesn’t get going, I just wait for a while until it moves [38] plan long journeys in advance |

| 8—Careful Tendency to be careful during driving, to effectively plan his or her driving trajectory, and to adopt a problem-solving attitude towards driving-related problems and obstacles. | [42] tend to drive cautiously [14] drive cautiously [41] always ready to react to unexpected maneuvers by other drivers [21] distracted or preoccupied, and suddenly realize the vehicle ahead has slowed down, and have to slam on the breaks to avoid a collision [29] get a thrill out of breaking the law |

| Premium Reduction | Risk Mitigation | Services | No Benefits | Mean | |

|---|---|---|---|---|---|

| Driving Behavior Before and After an Accident | 2.78 | 3.18 | 3.25 | 4.20 | 3.35 |

| Acceleration, Turning and Braking | 2.98 | 3.38 | 3.40 | 4.37 | 3.53 |

| Speed and Safety Distance | 2.97 | 3.36 | 3.50 | 4.52 | 3.59 |

| Time and Date of Vehicle Use | 3.32 | 3.70 | 3.63 | 4.48 | 3.79 |

| Vehicle Status and Location | 3.38 | 3.72 | 3.68 | 4.52 | 3.82 |

| Mean | 3.09 | 3.47 | 3.49 | 4.42 | 3.62 |

| Dimension | N | Mean | Std. Dev. | Significant (α < 0.01) | |

|---|---|---|---|---|---|

| Type of Information | Yes (p < 0.0002 ***) Three groups: (a)/(b) (c)/(d) (e) | ||||

| (a) | Driving Behavior Before and After an Accident | 3.35 | 1.74 | ||

| (b) | Acceleration, Turning and Braking | 3.53 | 1.77 | ||

| (c) | Speed and Safety Distance | 3.59 | 1.75 | ||

| (d) | Time and Date of Vehicle Use | 3.79 | 1.95 | ||

| (e) | Vehicle Status and Location | 3.82 | 1.81 | ||

| Type of Benefit | Yes (p < 0.00025 ***) Three groups: (f)/(g) (h)/(i) | ||||

| (f) | Premium Reduction | 3.09 | 1.77 | ||

| (g) | Risk Mitigation | 3.47 | 1.74 | ||

| (h) | Services | 3.49 | 1.74 | ||

| (i) | No Benefit | 4.42 | 1.64 | ||

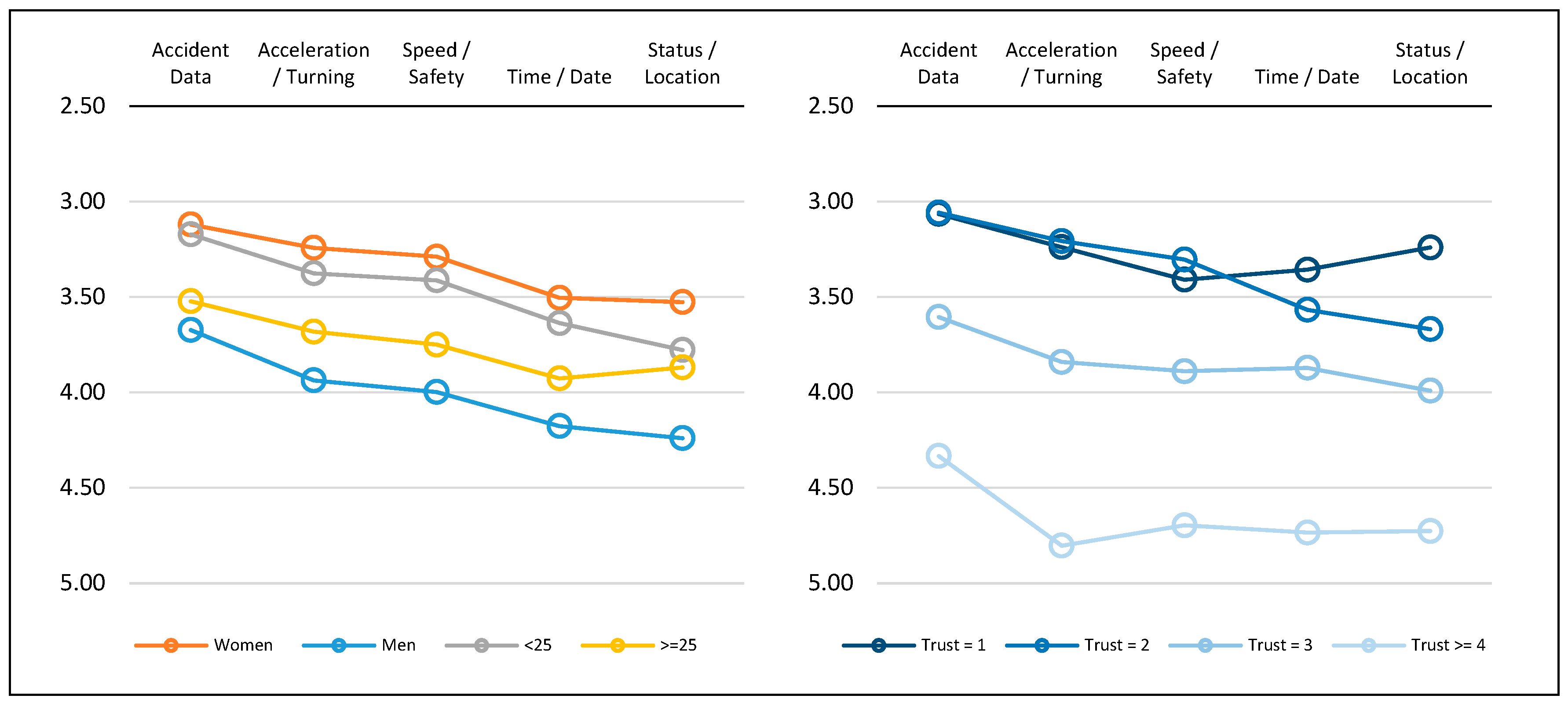

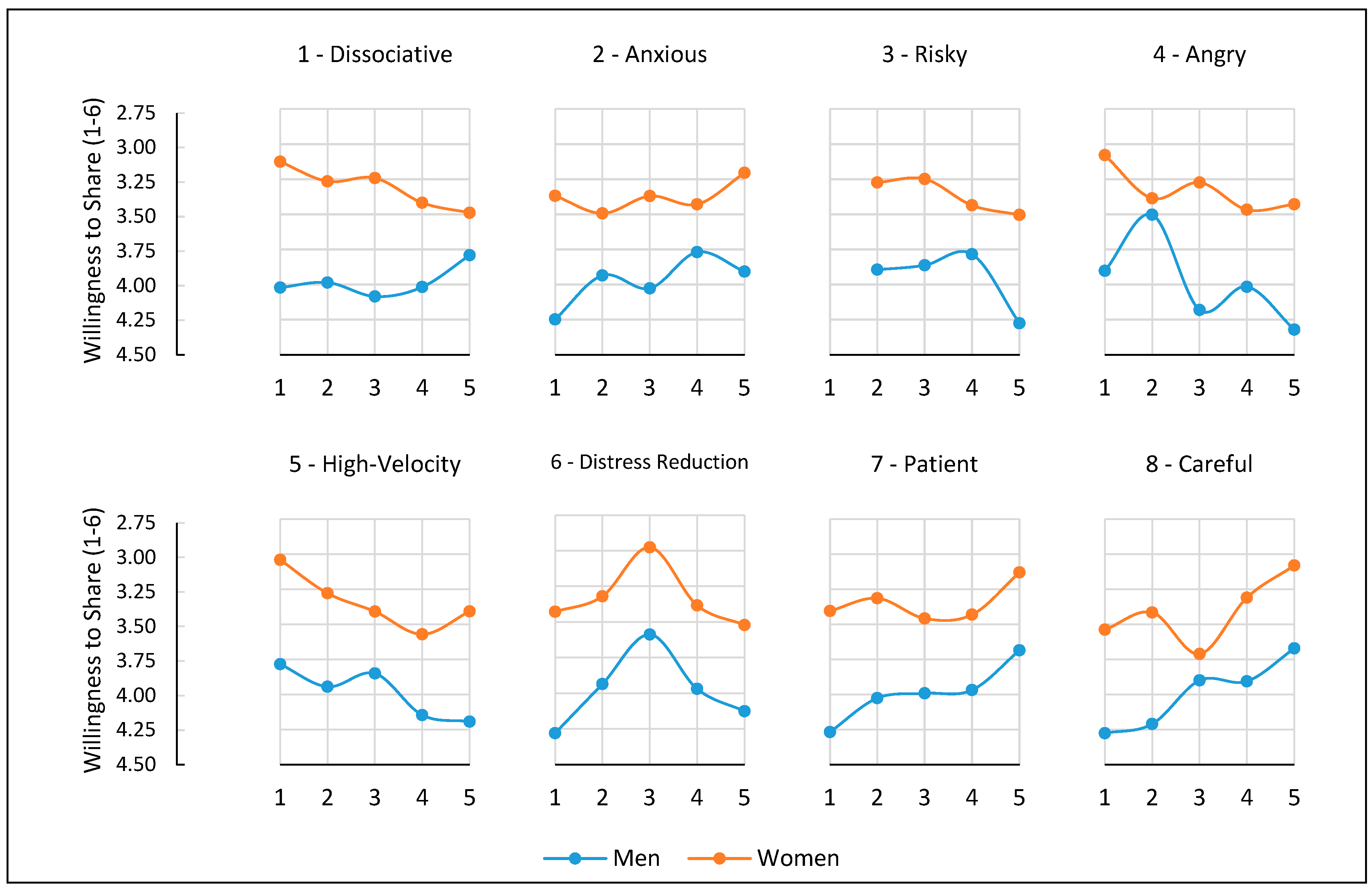

| Gender | Yes (p < 0.0001 ***) | ||||

| (j) | Men | 373 | 4.00 | 1.32 | |

| (k) | Women | 522 | 3.34 | 1.30 | |

| Age | Yes (p = 0.0023 ***) | ||||

| (l) | <25 years old | 439 | 3.48 | 1.27 | |

| (m) | 25+ years old | 456 | 3.75 | 1.40 | |

| Trust in Insurance | Yes (p < 0.00025 ***) Among all four levels of trust | ||||

| (n) | 1 | 142 | 3.26 | 1.39 | |

| (o) | 2 | 335 | 3.36 | 1.24 | |

| (p) | 3 | 170 | 3.84 | 1.26 | |

| (q) | 4-6 | 33 | 4.67 | 1.28 |

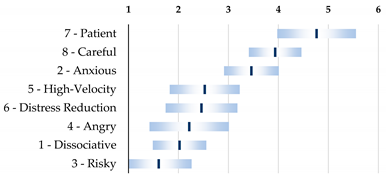

| Factor | Mean | Std. Dev. |  |

| 1—Dissociative | 2.02 | 0.54 | |

| 2—Anxious | 3.46 | 0.55 | |

| 3—Risky | 1.61 | 0.66 | |

| 4—Angry | 2.22 | 0.79 | |

| 5—High-Velocity | 2.53 | 0.70 | |

| 6—Distress Reduction | 2.46 | 0.72 | |

| 7—Patient | 4.76 | 0.79 | |

| 8—Careful | 3.93 | 0.53 |

| Dissociative | Anxious | Risky | Angry | High-Velocity | Distress Reduction | Patient | Careful | |

|---|---|---|---|---|---|---|---|---|

| 1—Dissociative | - | |||||||

| 2—Anxious | 0.369 | - | ||||||

| 3—Risky | 0.042 | −0.287 | - | |||||

| 4—Angry | 0.057 | −0.196 | 0.541 | - | ||||

| 5—High-Velocity | 0.175 | −0.061 | 0.470 | 0.626 | - | |||

| 6—Distress Reduction | 0.150 | −0.022 | 0.158 | 0.066 | 0.081 | - | ||

| 7—Patient | −0.010 | 0.328 | −0.378 | −0.470 | −0.421 | 0.038 | - | |

| 8—Careful | 0.108 | 0.388 | −0.188 | −0.190 | −0.062 | 0.049 | 0.371 | - |

| Driving Style | Mean | Male | Female | Significant (α < 0.01) | <25 y.o. | 25+ y.o. | Significant (α < 0.01) |

|---|---|---|---|---|---|---|---|

| 895 | 373 | 522 | 439 | 456 | |||

| 1—Dissociative | 2.02 | 1.85 | 2.14 | Yes (p < 0.001 ***) | 2.06 | 1.97 | No (p = 0.048 *) |

| 2—Anxious | 3.46 | 3.22 | 3.63 | Yes (p < 0.001 ***) | 3.50 | 3.42 | No (p = 0.032 *) |

| 3—Risky | 1.61 | 1.80 | 1.47 | Yes (p < 0.001 ***) | 1.60 | 1.61 | No (p = 0.94) |

| 4—Angry | 2.22 | 2.39 | 2.09 | Yes (p < 0.001 ***) | 2.19 | 2.24 | No (p = 0.29) |

| 5—High-Velocity | 2.53 | 2.60 | 2.47 | Yes (p = 0.009 **) | 2.47 | 2.58 | No (p = 0.032 *) |

| 6—Distress Reduction | 2.46 | 2.54 | 2.40 | Yes (p = 0.006 **) | 2.40 | 2.52 | No (p = 0.018 *) |

| 7—Patient | 4.76 | 4.60 | 4.88 | Yes (p < 0.001 ***) | 4.80 | 4.71 | No (p = 0.13) |

| 8—Careful | 3.93 | 3.82 | 4.02 | Yes (p < 0.001 ***) | 3.96 | 3.91 | No (p = 0.20) |

| Driving Style | Driving Behavior before and after an Accident | Acceleration, Turning and Braking | Speed and Safety Distance | Time and Date of Vehicle Use | Vehicle Status and Location |

|---|---|---|---|---|---|

| 1—Dissociative | 0.044 | 0.058 | 0.106 | 0.030 | 0.000 |

| 2—Anxious | 0.151 | 0.182 | 0.219 | 0.086 | 0.075 |

| 3—Risky | −0.203 | −0.214 | −0.256 | −0.070 | −0.090 |

| 4—Angry | −0.183 | −0.213 | −0.237 | −0.057 | −0.087 |

| 5—High-Velocity | −0.166 | −0.191 | −0.199 | −0.043 | −0.084 |

| 6—Distress Reduction | −0.033 | −0.011 | −0.019 | −0.066 | −0.091 |

| 7—Patient | 0.162 | 0.176 | 0.193 | 0.073 | 0.110 |

| 8—Careful | 0.187 | 0.223 | 0.206 | 0.115 | 0.148 |

| Driving Style | Range | Quintile 1 | Quintile 2 | Quintile 3 | Quintile 4 | Quintile 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| from | N | from | N | from | N | from | N | from | N | ||

| 1—Dissociative | 1.000–4.375 | min | 174 | 0.162 | 171 | 1.875 | 186 | 2.125 | 179 | 2.500 | 185 |

| 2—Anxious | 1.000–5.143 | min | 135 | 3.000 | 164 | 3.286 | 197 | 3.571 | 171 | 3.857 | 228 |

| 3—Risky | 1.000–4.400 | - | - | min | 236 | 1.200 | 253 | 1.600 | 180 | 2.000 | 226 |

| 4—Angry | 1.000–5.400 | min | 159 | 1.600 | 195 | 2.000 | 97 | 2.200 | 238 | 2.800 | 206 |

| 5—High-Velocity | 1.000–5.000 | min | 175 | 2.000 | 151 | 2.333 | 175 | 2.666 | 160 | 3.000 | 234 |

| 6—Distress Reduction | 1.000–5.250 | min | 88 | 1.750 | 217 | 2.250 | 118 | 2.500 | 237 | 3.000 | 235 |

| 7—Patient | 1.000–6.000 | min | 167 | 4.250 | 169 | 4.750 | 113 | 5.000 | 250 | 5.500 | 196 |

| 8—Careful | 1.000–5.400 | min | 171 | 3.600 | 125 | 3.800 | 126 | 4.000 | 260 | 4.400 | 213 |

| Driving Style | Driving Behavior before and after an Accident | Acceleration, Turning and Braking | Speed and Safety Distance | Time and Date of Vehicle Use | Vehicle Status and Location | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Q1 | Q5 | Q1 | Q5 | Q1 | Q5 | Q1 | Q5 | Q1 | Q5 | |

| 1—Dissociative | 3.34 | 3.28 | 3.59 | 3.46 | 3.70 | 3.40 | 3.81 | 3.76 | 3.73 | 3.83 |

| 2—Anxious | 3.73 | 3.09 | 4.01 | 3.16 | 4.11 | 3.14 | 4.01 | 3.52 | 4.08 | 3.66 |

| 3—Risky | 3.18 | 3.76 | 3.31 | 4.00 | 3.30 | 4.13 | 3.73 | 3.96 | 3.73 | 4.02 |

| 4—Angry | 3.04 | 3.70 | 3.13 | 4.01 | 3.18 | 4.10 | 3.64 | 3.90 | 3.67 | 4.01 |

| 5—High-Velocity | 2.96 | 3.57 | 3.10 | 3.78 | 3.14 | 3.88 | 3.66 | 3.78 | 3.61 | 3.89 |

| 6—Distress Reduction | 3.53 | 3.58 | 3.82 | 3.69 | 3.92 | 3.76 | 3.82 | 4.04 | 3.73 | 4.11 |

| 7—Patient | 3.67 | 3.06 | 3.88 | 3.22 | 3.95 | 3.27 | 3.83 | 3.57 | 3.98 | 3.52 |

| 8—Careful | 3.66 | 2.98 | 3.98 | 3.08 | 3.97 | 3.15 | 3.94 | 3.51 | 4.17 | 3.45 |

| Driving Style | Driving Behavior Before and After an Accident | Acceleration, Turning and Braking | Speed and Safety Distance | Time and Date of Vehicle Use | Vehicle Status and Location |

|---|---|---|---|---|---|

| Significant (α < 0.01) | Significant (α < 0.01) | Significant (α < 0.01) | Significant (α < 0.01) | Significant (α < 0.01) | |

| 1—Dissociative | No (p = 0.96) | No (p = 0.85) | No (p = 0.32) | No (p = 0.99) | No (p = 0.85) |

| 2—Anxious | Yes (p = 0.0005 **) | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | No (p = 0.03) | No (p = 0.21) |

| 3—Risky | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | No (p = 0.47) | No (p = 0.24) |

| 4—Angry | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | No (p = 0.78) | No (p = 0.09) |

| 5—High-Velocity | Yes (p = 0.0008 **) | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | No (p = 0.51) | No (p = 0.14) |

| 6—Distress Reduction | Yes (p < 0.0005 **) | Yes (p < 0.0007 **) | Yes (p = 0.0002 **) | No (p = 0.009 *) | No (p = 0.0027 *) |

| 7—Patient | Yes (p = 0.0018 **) | Yes (p = 0.0017 **) | Yes (p = 0.0004 **) | No (p = 0.38) | No (p = 0.016 *) |

| 8—Careful | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | Yes (p < 0.0002 ***) | No (p = 0.012 *) | Yes (p = 0.0006 **) |

| Driving Style | All | Men | Women | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Q1 | Q5 | Impact | Q1 | Q5 | Impact | Q1 | Q5 | Impact | |

| 1—Dissociative | 3.63 | 3.55 | 0.09 | 4.02 | 3.79 | 0.23 | 3.12 | 3.49 | −0.36 |

| 2—Anxious | 3.99 | 3.31 | 0.67 | 4.25 | 3.91 | 0.34 | 3.37 | 3.20 | 0.16 |

| 3—Risky | 3.45 | 3.97 | −0.53 | 3.89 | 4.28 | −0.38 | 3.27 | 3.50 | −0.23 |

| 4—Angry | 3.35 | 3.94 | −0.59 | 3.90 | 4.32 | −0.42 | 3.08 | 3.43 | −0.35 |

| 5—High-Velocity | 3.31 | 3.77 | −0.47 | 3.78 | 4.19 | −0.41 | 3.04 | 3.41 | −0.37 |

| 6—Distress Reduction | 3.80 | 3.83 | −0.04 | 4.28 | 4.23 | 0.15 | 3.43 | 3.52 | −0.09 |

| 7—Patient | 3.88 | 3.32 | −0.56 | 4.27 | 3.69 | 0.58 | 3.40 | 3.13 | 0.27 |

| 8—Careful | 3.94 | 3.23 | 0.70 | 4.28 | 3.67 | 0.61 | 3.54 | 3.08 | 0.46 |

| Dimension | Impact | Impact net of Gender | Comments | |

|---|---|---|---|---|

| (a) | Trust (full range) | 1.40 | - | Customers are more willing to share information if they trust their insurance company |

| (b) | Trust (1 to 3) | 0.58 | - | A range excluding the customers distrusting of the company may be more appropriate when targeting own or potential customers |

| (c) | Gender | 0.67 | - | Women more open to sharing information than men |

| (d) | Age | 0.28 | - | Younger people (<25 y.o.) more willing to share information than older people |

| (e) | Type of Information | 0.47 | - | Customers are more willing to share accident-relevant information than vehicle location and usage |

| Benefit | ||||

| (f) | Premium reduction vs. no benefit | 1.33 | - | Premium reduction has a larger impact than services of risk mitigation |

| (g) | Premium reduction vs. Services | 0.40 | - | Premium reduction has a larger impact than services of risk mitigation |

| (h) | Services vs. no benefit | 0.94 | - | Offering benefits significantly impacts the willingness to share information |

| Self-Assessment | ||||

| (i) | 1—Dissociative | 0.09 | 0.07 | Not statistically significant at α < 0.01 |

| (j) | 2—Anxious | 0.67 | 0.25 | |

| (k) | 3—Risky | 0.52 | 0.31 | |

| (l) | 4—Angry | 0.59 | 0.38 | |

| (m) | 5—High-Velocity | 0.46 | 0.39 | |

| (n) | 6—Distress Reduction | 0.04 | 0.03 | Not statistically significant at α < 0.01. Impact improves to 0.64/0.50 (net of gender) if measured mid-range vs. extremes |

| (o) | 7—Patient | 0.56 | 0.43 | |

| (p) | 8—Careful | 0.70 | 0.53 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pugnetti, C.; Elmer, S. Self-Assessment of Driving Style and the Willingness to Share Personal Information. J. Risk Financial Manag. 2020, 13, 53. https://doi.org/10.3390/jrfm13030053

Pugnetti C, Elmer S. Self-Assessment of Driving Style and the Willingness to Share Personal Information. Journal of Risk and Financial Management. 2020; 13(3):53. https://doi.org/10.3390/jrfm13030053

Chicago/Turabian StylePugnetti, Carlo, and Sandra Elmer. 2020. "Self-Assessment of Driving Style and the Willingness to Share Personal Information" Journal of Risk and Financial Management 13, no. 3: 53. https://doi.org/10.3390/jrfm13030053

APA StylePugnetti, C., & Elmer, S. (2020). Self-Assessment of Driving Style and the Willingness to Share Personal Information. Journal of Risk and Financial Management, 13(3), 53. https://doi.org/10.3390/jrfm13030053